funding

Auto Added by WPeMatico

Auto Added by WPeMatico

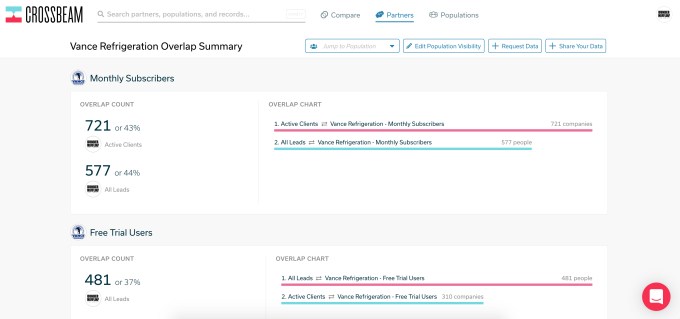

As sales teams partner with other companies, they go through a process called account mapping to find common customers and prospects. This is usually a highly manual activity tracked in spreadsheets. Crossbeam, a Philadelphia startup, has come up with a way to automate partnership data integration. Today the company announced a $25 million Series B investment.

Redpoint Ventures led the round with help from existing investors FirstMark Capital, Salesforce Ventures, Slack Fund and Uncork Capital, along with new investors Okta Ventures and Partnership Leaders, a partnership industry association. All in all, an interesting mix of traditional VCs and strategic investors that Crossbeam could potentially partner with as they grow the business.

The funding comes on the heels of a $3.5 million seed round in 2018 and a $12.5 million Series A a year ago. The startup has now raised a total of $41 million.

Crossbeam has been growing steadily, and that attracted the attention of investors, whom CEO and co-founder Bob Moore says approached him. He was actually not thinking about fundraising until next year, but when the opportunity presented itself, he decided to seize it.

The platform has a natural networking effect built into it with over 900 companies using it so far. As new companies come on, they invite partners, who can join and invite more partners, and that creates a constant sales motion for them without much effort at all.

“We didn’t go out fundraising. We caught the eye of Redpoint because they could see the virality of the product and the extent to which it was being used by many of their portfolio companies and companies out in the market […],” Moore told TechCrunch.

Image Credits: Crossbeam

To accelerate interest in the product, the company also announced a new free tier, which replaces the limited free trial and a starter level that previously cost $500 per month. Prior to this move, if you didn’t move to the starter tier, you would lose your data when the trial was over.

“The idea here is what we’ve seen in the data is that we can create a whole lot of value for people and demonstrate really strong ROI once they get in the door and actually have access to that data, and they don’t have to worry about a free trial where the data is going away,” Moore explained.

Moore says they currently have 28 employees and have ambitious plans to add new people to the mix in the coming months, expecting to reach 50 employees by early 2021. As the company revs up on the personnel side, Moore says diversity is front and center of their plans.

“As far as Crossbeam specifically goes, we’ve made sure that diversity, equity and inclusion is part of our entire recruiting process and also the cultural experience that we create for people that are at the company,” he said. Although he didn’t discuss specific numbers, he said the company was making progress, particularly in the latest round of hires.

While the company has an office in Philly, even before COVID hit, it was a remote first organization with about half of the employees working from home. “I think a lot of our culture was kind of built to make sure that remote team members are first-class citizens in every respect in the company. So we already had all the controls, technology and practices in place, and when we shut the office, it was about as smooth as could be,” he said.

Powered by WPeMatico

Krisp’s smart noise suppression tech, which silences ambient sounds and isolates your voice for calls, arrived just in time. The company got out in front of the global shift to virtual presence, turning early niche traction into real customers and attracting a shiny new $5 million Series A funding round to expand and diversify its timely offering.

We first met Krisp back in 2018 when it emerged from UC Berkeley’s Skydeck accelerator. The company was an early one in the big surge of AI startups, but with a straightforward use case and obviously effective tech it was hard to be skeptical about.

Krisp applies a machine learning system to audio in real time that has been trained on what is and isn’t the human voice. What isn’t a voice gets carefully removed even during speech, and what remains sounds clearer. That’s pretty much it! There’s very little latency (15 milliseconds is the claim) and a modest computational overhead, meaning it can work on practically any device, especially ones with AI acceleration units like most modern smartphones.

The company began by offering its standalone software for free, with a paid tier that removed time limits. It also shipped integrated into popular social chat app Discord. But the real business is, unsurprisingly, in enterprise.

“Early on our revenue was all pro, but in December we started onboarding enterprises. COVID has really accelerated that plan,” explained Davit Baghdasaryan, co-founder and CEO of Krisp. “In March, our biggest customer was a large tech company with 2,000 employees — and they bought 2,000 licenses, because everyone is remote. Gradually enterprise is taking over, because we’re signing up banks, call centers and so on. But we think Krisp will still be consumer-first, because everyone needs that, right?”

Now even more large companies have signed on, including one call center with some 40,000 employees. Baghdasaryan says the company went from 0 to 600 paying enterprises, and $0 to $4 million annual recurring revenue, in a single year, which probably makes the investment — by Storm Ventures, Sierra Ventures, TechNexus and Hive Ventures — look like a pretty safe one.

It’s a big win for the Krisp team, which is split between the U.S. and Armenia, where the company was founded, and a validation of a global approach to staffing — world-class talent isn’t just to be found in California, New York, Berlin and other tech centers, but in smaller countries that don’t have the benefit of local hype and investment infrastructure.

Funding is another story, of course, but having raised money the company is now working to expand its products and team. Krisp’s next move is essentially to monitor and present the metadata of conversation.

“The next iteration will tell you not just about noise, but give you real time feedback on how you are performing as a speaker,” Baghdasaryan explained. Not in the toastmasters sense, exactly, but haven’t you ever wondered about how much you actually spoke during some call, or whether you interrupted or were interrupted by others, and so on?

“Speaking is a skill that people can improve. Think Grammar.ly for voice and video,” Baghdasaryan ventured. “It’s going to be subtle about how it gives that feedback to you. When someone is speaking they may not necessarily want to see that. But over time we’ll analyze what you say, give you hints about vocabulary, how to improve your speaking abilities.”

Since architecturally Krisp is privy to all audio going in and out, it can fairly easily collect this data. But don’t worry — like the company’s other products, this will be entirely private and on-device. No cloud required.

“We’re very opinionated here: Ours is a company that never sends data to its servers,” said Baghdasaryan. “We’re never exposed to it. We take extra steps to create and optimize our tech so the audio never leaves the device.”

That should be reassuring for privacy wonks who are suspicious of sending all their conversations through a third party to be analyzed. But after all, the type of advice Krisp is considering can be done without really “understanding” what is said, which also limits its scope. It won’t be coaching you into a modern Cicero, but it might help you speak more consistently or let you know when you’re taking up too much time.

For the immediate future, though, Krisp is still focused on improving its noise-suppression software, which you can download for free here.

Powered by WPeMatico

While a handful of tech companies like Zoom and Shopify are enjoying massive gains as a result of COVID-19, that’s obviously not the case for most. Weaker demand, slower sales cycles, and customer insistence on pricing concessions and payment deferrals have conspired to cloud the outlook for many tech companies’ growth.

Compounding these challenges, a lot of tech companies are struggling to raise capital just when they need it most. The data so far suggests that investors, particularly those focused on earlier stage financings, are taking a more cautious approach to new deals and valuations while they wait to see how individual companies perform and which way the economy will go. With the outcome of their planned equity financings uncertain, some tech companies are revisiting their funding strategies and exploring alternative sources of capital to fuel their continued growth.

For certain businesses, COVID-19’s impact on revenue was immediate. For others, the effects of slower economic activity and tighter budgets surfaced more gradually with deals in the funnel before the pandemic closing in April and May. Either way, in the second half of 2020, technology CFOs face a common challenge: How do you accurately forecast sales when there’s very little consensus around key issues such as when business activity will return to pre-COVID levels and what the long-term effects of the crisis might be?

Unfortunately, navigating this uncertainty is just as daunting a challenge for investors. These days, equity investors’ assessment of a company’s growth potential, and the value they are willing to pay for that growth, aren’t just impacted by their view of the company itself. Equally important is their assumptions about when the economy will recover and what the new normal might look like. This uncertainty can lead to situations where companies and their potential investors have materially different views on valuation.

While the full impact of COVID was felt too late to have a material impact on Q1 deal volumes, recently released data from Pitchbook and the NVCA suggest that 2020 will see a significant decrease in the number of companies funded, possibly by as much 30 percent compared to 2019 among early stage companies. And, while it often takes several months to see evidence of broad trends in investment terms, anecdotal evidence indicates investors are seeking to mitigate risk by demanding additional protective provisions.

Powered by WPeMatico

PandaDoc, the startup that provides a fully digital sales document workflow from proposal to electronic signature to collecting payment, announced a $30 million Series B extension today, making it the second such extension the company has taken since taking its original $15 million Series B in 2017. The total for the three B investments is $50 million.

Company co-founder and CEO Mikita Mikado says that he took this approach — taking the original money in 2017, then $5 million last year along with the money announced today — because it made more sense financially for the company than taking a huge chunk of money all at once.

“Basically when we do little chunks of cash frequently, [we found that] you dilute yourself less,” Mikado told TechCrunch. He said that they’ve grown comfortable with this approach because the business became more predictable once it passed 10,000 customers. In fact today it has 20,000.

“With a high-velocity in-bound sales model, you can predict what’s going to happen next month or [say] six months out. So you kind of have this luxury of raising as much money as you need when you need it, minimizing dilution just like public companies do,” he said.

While he wouldn’t discuss specifics in terms of valuations, he did say that the B1 had 2x the valuation of the original B round and the B2 had double the valuation of the B1.

For this round, One Peak led the investment, with participation from Microsoft’s Venture Fund (M12), Savano Capital Partners, Rembrandt Venture Partners and EBRD Venture Capital Investment Programme.

Part of the company’s growth strategy is using their eSignature tool to move people to the platform. They made that tool free in March just as the pandemic was hitting hard in the U.S., and it has proven to be what Mikado called “a lead magnet” to get more people familiar with the company.

Once they do that he says, they start to look at the broader set of tools and they can become paying customers. “This launch helped us validate that businesses need a broader workflow solution. Businesses used to think of the eSignature as the Holy Grail in getting a deal done. Now they are realizing that eSignature is just a moment in time. The full value is what happens before, during and after the eSignature in order to get deals done,” Mikado said.

The company currently has 334 employees with plans to hit 380 by year’s end and is aiming for 470 by next year. With the office in San Francisco, Belarus and Manila, it has geographic diversity built in, but Mikado says it’s something they are still working at and includes anti-bias programs and training and leadership programs to give more people a chance to be hired or promoted into management.

When it came to shutting down offices and working from home, Mikado admits it was a challenge, especially as some of the geographies they operate in might not have access to a good internet connection at home or face other challenges, but overall he says it has worked out in terms of maintaining productivity across the company. And he points out being geographically diverse, they have had to deal with online communications for some time.

Powered by WPeMatico

Electric vehicles (EVs) are spreading throughout the world. While Tesla has drawn the most attention in the United States with its luxurious and cutting-edge cars, EVs are becoming a mainstay in markets far away from the environs of California.

Take India for instance. In the local mobility market, two- and three-wheel vehicles are starting to emerge as a popular option for a rapidly expanding middle class looking for more affordable options. EV versions are popular thanks to their reduced maintenance costs and higher reliability compared to gasoline alternatives.

Two-wheeled electric scooters are a fast-growing segment of India’s mobility market.

There’s just one problem, and it’s the same one faced by every country which has attempted to convert from gasoline to electric: how do you build out the charging station network to make these vehicles usable outside a small range from their garage?

It’s the classic chicken-and-egg problem. You need EVs in order to make money on charging stations, but you can’t afford to build charging stations until EVs are popular. Some startups have attempted to build out these networks themselves first. Perhaps the most famous example was Better Place, an Israeli startup that raised $800 million in venture capital before dying from negative cash flow back in 2013. Tesla has attempted to solve the problem by being both the chicken and egg by creating a network of Superchargers.

That’s what makes Statiq so interesting. The company, based in the New Delhi suburb of Gurugram, is bootstrapping an EV charging network using a multi-revenue model that it hopes will allow it to avoid the financial challenges that other charging networks have faced. It’s in the current Y Combinator batch and will be presenting at Demo Day later this month.

Akshit Bansal and Raghav Arora, the company’s co-founders, worked together previously as consultants and built a company for buying photos online, eventually reaching 50,000 monthly actives. They decided to make a pivot — a hard pivot really — into EVs and specifically charging equipment.

Statiq founders Raghav Arora and Akshit Bansal. Photos via Statiq

“We felt the need to do something about the climate because we were living in Delhi and Delhi is one of the most polluted cities in the world, and India is home to a lot of the polluted cities in the world. So we wanted to do something about it,” Bansal said. As they researched the causes of pollution, they learned that automobile exhaust represented a large part of the problem locally. They looked at alternatives, but EV charging stations remain basically non-existent across the country.

Thus, they founded Statiq in October 2019 and officially launched this past May. They have installed more than 150 charging stations in Delhi, Bangalore, and Mumbai and the surrounding environs.

Let’s get to the economics though, since that to me is the most fascinating part of their story. Statiq as I noted has a multi-revenue model. First, end users buy a subscription from Statiq to use the network, and then users pay a fee per charging session. That session fee is split between Statiq and the property owner, giving landlords who install the stations an incremental revenue boost.

A Statiq charging station. Photo via Statiq

When it comes to installation, Statiq has a couple of tricks up its sleeves. First, the company’s charging equipment — according to Bansal — costs roughly a third of the equivalent cost of U.S. equipment. That makes the base technology cheaper to acquire. From there, the company negotiates installations with landlords where the landlords will pay the fixed costs of installation in exchange for that continuing session charge fee.

On top of all that, the charging stations have advertising on them, offering another income stream particularly in high-visibility locations like shopping malls which are critical for a successful EV charging network.

In short, Statiq hasn’t had to outlay capital in order to put in place their charging equipment — and they were able to bootstrap before applying to YC earlier this year. Bansal said the company had dozens of charging stations and thousands of paid sessions on its platform before joining their YC batch, and “we are now growing 20% week-over-week.”

What’s next? It’s all about deliberate scaling. The EV market is turning on in India, and Statiq wants to be where those cars are. Bansal and his co-founder are hoping to ride the wave, continuing to build out critical infrastructure along the way. India’s government will likely continue to help: its approved billions of dollars in incentives for EVs and for charging stations, tipping the economics even further in the direction of a clean car future.

Powered by WPeMatico

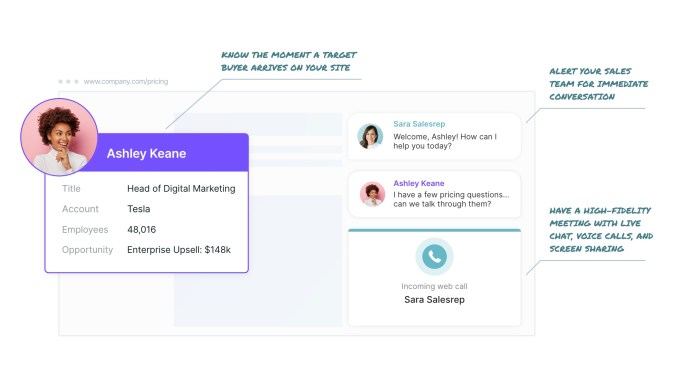

Qualified, a startup co-founded by former Salesforce executives Kraig Swensrud and Sean Whiteley, has raised $12 million in Series A funding.

Swensrud (Qualified’s CEO) said the startup is meant to solve a problem that he faced when he was CMO at Salesforce. Apparently he’d complain about being “blind,” because he knew so little about who was visiting the Salesforce website.

“There could be 10 or 100 or 100,000 people on my website right now, and I don’t know who they are, I don’t know what they’re interested in, my sales team has no idea that they’re even there,” he said.

Apparently, this is a big problem in business-to-business sales, where waiting five minutes after a lead leaves your website can result in a 10x decrease in the odds of making contact. But the solution currently adopted by many websites is just a chatbot that treats every visitor similarly.

Qualified, meanwhile, connects real-time website visitor information with a company’s Salesforce customer database. That means it can identify visitors from high-value accounts and route them to the correct salesperson while they’re still on the website, turning into a full-on sales meeting that can also include a phone call and screensharing.

Image Credits: Qualified

Of course, the amount of data Qualified has access to will differ from visitor to visitor. Some visitors may be purely incognito, while in other cases, the platform might simply know your city or where you work. In still others (say if you click on a link from marketing email), it can identify you individually.

That’s something I experienced myself, when I decided to take a look at the Qualified website this morning and was quickly greeted with a message that read, “ Welcome TechCrunch! We’re excited about our funding announcement…” It was a little creepy, but also much more effective than my visits to other marketing technology websites, where someone usually sends me a generic sales message.

Welcome TechCrunch! We’re excited about our funding announcement…” It was a little creepy, but also much more effective than my visits to other marketing technology websites, where someone usually sends me a generic sales message.

Swensrud acknowledged that using Qualified represents “a change to people’s selling processes,” as it requires sales to respond in real time to website visitors (as a last resort, Qualified can also use chatbots and schedule future calls), but he argued that it’s a necessary change.

“If you email them later, some percentage of those people, they ghost you, they get bored, they moved on to the competition,” he said. “This real-time approach, it forces organizations to think differently in terms of their process.”

And it’s an approach that seems to be working. Among Qualified’s customers, the company says ThoughtSpot increased conversations with its target accounts by 10x, Bitly grew its enterprise sales pipeline by 6x and Gamma drove over $2.5 million in new business pipeline.

The Series A brings Qualified’s total funding to $17 million. It was led by Norwest Venture Partners, with participation from existing investors including Redpoint Ventures and Salesforce Ventures. Norwest’s Scott Beechuk is joining Qualified’s board of directors.

“The conversational model is simply a better way to connect with new customers,” Beechuk said in a statement. “Buyers love the real-time engagement, sellers love the instant connections, and marketers have the confidence that every dollar spent on demand generation is maximized. The multi-billion-dollar market for Salesforce automation software is going to adopt this new model, and Qualified is perfectly positioned to capture that demand.”

Powered by WPeMatico

Radish is announcing that it has raised $63.2 million in new funding.

Breaking up book-length stories into smaller chapters that are released over days or weeks is an idea that was popularized in the 19th century, and startups have been trying to revive it for at least the past decade. Still, this round represents a major step up in funding, not just for Radish (which only raised around $5 million previously), but also compared to other startups in a relatively nascent market. (Digital fiction startup Wattpad is the notable exception.)

When I first wrote about Radish at the beginning of 2017, the startup was focused on user-generated content. Last year, however, the company launched the Radish Originals program, where Radish is able to produce more content using teams of writers lead by a “showrunner,” and where the startup owns the resulting intellectual property.

“Instead of becoming YouTube or Wattpad for serial fiction, we want to be more like Netflix and create our own originals,” founder and CEO Seungyoon Lee told me. “I got a lot of inspiration from platforms in Korea, China and Japan, where serial fiction is huge and established on mobile.”

One of the ideas Radish took from the Asian markets is rapidly updating its stories. For example, its most popular title, “Torn Between Alphas” (a romance story with werewolves) has released 10 seasons in less than a year, with each season consisting of more than 50 chapters — later seasons have more than 100 chapters — that are released multiple times a day.

“On Netflix, you can binge-watch three seasons of a show at once,” Lee said. “On Radish, you can binge-read a thousand episodes.”

While Radish borrowed the writing room model from TV — and hired Emmy-winning TV writers, particularly those with a background in soap operas — Lee said it’s also taken inspiration from gaming. For one thing, it relies on micro-payments to make money, with users buying coins that allow them to unlock later chapters of a story (chapters usually cost 20 or 30 cents, and more chapters get moved out from behind the paywall over time). In addition, the company can allow reader taste to determine the direction of stories by A/B testing different versions of the same chapter.

Lee pointed to the fall of 2019 as Radish’s “inflection point,” where the model really started to work. Now, the company says its most popular story has made more than $4 million and has received more than 50 million “reads.” Radish stories are mostly in the genres of romance, paranormal/sci-fi, LGBTQ, young adult, horror, mystery and thriller, and Lee said the audience is largely female and based in the United States.

By raising a big round led by SoftBank Ventures Asia (the early-stage investment arm of troubled SoftBank Group) and Kakao Pages (which publishes webtoons, web novels and more, and is part of Korean internet giant Kakao), Lee said he can take advantage of their expertise in the Asian market to grow Radish’s audience in the U.S. That will mean accelerating content production in the hopes of creating more hit titles, and also spending more on performance marketing.

“With its own fast-paced original content production, Radish is best positioned to become a leading player in the global online fiction market,” said SoftBank Ventures Asia CEO JP Lee in a statement. “Radish has proven that its serialized novel platform can change the way people consume online content, and we are excited to support the company’s continued disruption in the mobile fiction space. Leveraging our global SoftBank ecosystem, we hope to support and accelerate Radish’s expansion across different regions worldwide.”

Powered by WPeMatico

Financial services companies like banks and insurance tend to be heavily regulated. As such, they require a special level of security and auditability. Hearsay, which makes compliant communications tools for these types of companies, announced a new partnership with Salesforce today, enabling smooth integration with Salesforce CRM and marketing automation tools.

The company also announced that Salesforce would be taking a minority stake in Hearsay, although company co-founder and CEO Clara Shih, did not provide any details on that part of the announcement.

Shih says the company created the social selling category when it launched 10 years ago. Today, it provides a set of tools like email, messaging and websites along with a governance layer to help financial services companies interact with customers in a compliant way. Their customers are primarily in banking, insurance, wealth management and mortgages.

She said that they realized if they could find a way to share the data they were collecting with the Hearsay tool set with CRM and marketing automation software in an automated way, it would make greater use of this information than it could on its own. To that end, they have created a set of APIs to enable that with some built-in connectors. The first one will be to connect Hearsay to Salesforce, with plans to add other vendors in the future.

“It’s about being able to connect [data from Hearsay] with the CRM system of record, and then analyzing it across thousands, if not tens of thousands of advisors or bankers in a single company, to uncover best practices. You could then use that information like GPS driving directions that help every advisor behave in the moment and reach out in the moment like the very best advisor would,” Shih explained.

In practice, this means sharing the information with the customer data platform (CDP), the CRM and marketing automation tooling to deliver more intelligent targeting based on a richer body of information. So the advisor can use information gleaned from everything he or she knows about the client across the set of tools to deliver a more meaningful personal message instead of a targeted ad or an email blast. As Shih points out, the ad might even make sense, but could be tone deaf depending on the circumstances.

“What we focus on is this human-client experience, and that can only be delivered in the last mile because it’s only with the advisor that many clients will confide in these very important life events and life decisions, and then conversely, it’s only in the last mile that the trusted advisor can deliver relationship advice,” she said.

She says what they are trying to do by combining streams of data about the customer is build loyalty in a way that pure technology solutions just aren’t capable of doing. As she says, nobody says they are switching banks because it has the best chat bot.

Hearsay was founded in 2009 and has raised $51 million, as well as whatever other money Salesforce will be adding to the mix with today’s investment. Other investors include Sequoia and NEA Associates. Its last raise was way back in 2013, a $30 million Series C.

Powered by WPeMatico

Low-code is a hot category these days. It helps companies build workflows or simple applications without coding skills, freeing up valuable engineering resources for more important projects. Paragon, a member of the Y Combinator Winter 2020 cohort, announced a $2.5 million seed round today for its low-code application integration platform.

Investors include Y Combinator, Village Global, Global Founders Capital, Soma Capital and FundersClub.

“Paragon makes it easier for non-technical people to be able to build out integrations using our visual workflow editor. We essentially provide building blocks for things like API requests, interactions with third party APIs and conditional logic. And so users can drag and drop these building blocks to create workflows that describe business logic in their application,” says company co-founder Brandon Foo.

Foo acknowledges there are a lot of low-code workflow tools out there, but many like UIPath, Blue Prism and Automation Anywhere concentrate on robotic process automation (RPA) to automate certain tasks. He says he and co-founder Ishmael Samuel wanted to focus on developers.

“We’re really focused on how can we improve developer efficiency, and how can we bring the benefits of low code to product and engineering teams and make it easier to build products without writing manual code for every single integration, and really be able to streamline the product development process,” Foo told TechCrunch.

The way it works is you can drag and drop one of 1,200 predefined connectors for tools like Stripe, Slack and Google Drive into a workflow template, and build connectors very quickly to trigger some sort of action. The company is built on AWS serverless architecture, so you define the trigger action and subsequent actions, and Paragon handles all of the back-end infrastructure requirements for you.

It’s early days for the company. After launching in private beta in January, the company has 80 customers. It currently has six employees, including Foo, who previously co-founded Polymail, and Samuel, who was previously lead engineer at Uber. They plan to hire four more employees this year.

With both founders people of color, they definitely are looking to build a diverse team around them. “I think it’s already sort of built into our DNA. As a diverse founding team we have perhaps a broader viewpoint and perspective in terms of hiring the kind of people that we seek to work with. Of course, I think there’s always room for improvement, and so we’re always looking for new ways that we can be more inclusive in our hiring recruiting process [as we grow],” he said.

As far as raising during a pandemic, he says it’s been a crazy time, but he believes they are solving a real problem and that they can succeed in spite of the macro economic conditions of the moment.

Powered by WPeMatico

In a world with growing amounts of data, finding the right set for a particular machine learning model can be a challenge. Explorium has created a platform to make that an easier task, and today the startup announced a $31 million Series B.

The round was led by Zeev Ventures, with help from Dynamic Loop, Emerge, 01 Advisors and F2 Capital. Today’s investment brings the total raised to $50 million, according to the company.

CEO and co-founder Maor Shlomo says the company’s platform is designed to help people find the right data for their model. “The next frontier in analytics will not be about how you fine tune or improve a certain algorithm, it will be how do you find the right data to fit into those algorithms to make them as useful and impactful as possible,” he said.

He says that companies need this more than ever during the pandemic because this can help customers find more relevant data at a time when their historical data might not be useful to help build predictive models. For instance, if you’re a retailer, your historical shopping data won’t be relevant if you are in an area where you can no longer open your store, he says.

“There are so many environmental factors that are now influencing every business problem that organizations are trying to solve that Explorium is becoming this […] layer where you search for data to solve your business problems to fuel your predictive models,” he said.

When the pandemic hit in March, he worried about how it would affect his company, and he put a hold on hiring, but as he saw business increasing in April and May, he decided to accelerate again. The company currently has 87 employees between offices in Israel and the United States and he plans to be at 100 in the next couple of months.

When it comes to hiring, he says he doesn’t try to have hard and fast hiring rules like you have a certain degree or have gone to a certain school. “The only thing that’s important is getting good people hungry to succeed. The more diverse the culture is, the more diverse the group is, we find the more fun it is for people to discover each other and to discover different cultures,” Shlomo explained.

In terms of fundraising, while the company needs money to fuel its growth, at the same time it still had plenty of money in the bank from last year’s round. “We got into the pandemic and we didn’t know how long it’s going to last, and [early on] we didn’t yet know how it would impact the business. Existing investors were always bullish about the company. We decided to just go with that,” he said.

The company was founded in 2017 and previously raised a $19.1 million Series A round last year.

Powered by WPeMatico