funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Michael Waxman, co-founder and CEO of dog food startup Sundays, acknowledged that dog owners have no shortage of options when it comes to feeding their beloved pets — but he still thinks there’s room for something new.

“There’s a sort of ‘Water everywhere, but not a drop to drink’ phenomenon,” Waxman said. “There are over 3,000 dog foods, and yet I think there isn’t really one that is the no-brainer, compelling answer.”

Sundays “soft launched” its first product in February and now has around 1,000 paying customers. It’s launching more broadly today and is also announcing that it has raised $2.27 million in funding from Red Sea Ventures, Box Group, Great Oaks Ventures, Matt Salzberg, Zach Klein and others.

Waxman’s past startups include dating app Grouper, while his wife/co-founder Tory Waxman is a veterinarian (and serves as the startup’s chief veterinary officer). He told me that the two of them became interested in pet food a couple years ago when one of their dogs started to have stomach issues, and they “went down this rabbit hole of trying to find the best dog food.”

The market can be divided two broad categories, Waxman said. There’s kibble, which is relatively cheap and affordable but not as healthy. Then there’s refrigerated food, including direct-to-consumer options like The Farmer’s Dog, which are healthier but also pricier and require more preparation.

“Those are so unbelievably inconvenient,” Waxman argued. “You’re not going to find too many people crazier about their dogs than we are, and we would do literally anything for our dogs — except prepare their food for an hour a day.”

Image Credits: Sundays

So he’s pitching Sundays as a “new, third category of dog food between kibble and refrigerated.” It’s supposed to be human-grade dog food that’s 90% fresh meat, organs and bones, created through a unique air drying process.

For dog owners who rely on kibble, Waxman said the startup offers “a much higher-quality product that tastes much better and doesn’t compromise on the convenience that you’re used to,” while for owners who currently pay for refrigerated options, he promised “an all-around unbelievable increase in convenience, without any compromise in quality and taste.”

Several early customers compared the food to beef jerky in their reviews. Waxman added that in taste tests, dogs preferred Sundays to premium kibble 40-to-0.

The food is available for both one-time and subscription purchase. A single 40-ounce box currently costs $75, while the same box costs $59 via subscription.

Waxman suggested that it hasn’t been easy getting to this point — with a new process for creating dog food, “there were no supply chains set up for this.” Ultimately, he said Sundays selected a “USDA-monitored jerky kitchen in the U.S. to create this new form factor.”

“It took us much longer than we expected,” he admitted. “However, the short-term headache is a long-term feature that we’re really excited about. Ultimately, it should serve as a pretty deep moat to prevent would-be competitors from offering similarly high quality and differentiated products.”

Powered by WPeMatico

Stacklet co-founders Travis Stanfield and Kapil Thangavelu met while both were working at Capital One several years ago. Thangavelu helped create the Cloud Custodian open-source cloud governance project. The two eventually got together and decided to build a startup based on that project and today the company launched out of stealth with a $4 million seed investment from Foundation Capital and Addition.

Stanfield, who is CEO at the young startup, says that Cloud Custodian came about as Capital One was moving to a fully cloud approach in around 2013. As the company looked for ways to deal with compliance and governance, it found that organizations like theirs were forced to do one-off scripts and they were looking for a way that could be repeatable and scale.

“Cloud Custodian was developed as a way of understanding what all those one-off scripts were doing, looking at the cloud control plane, finding the interesting set of resources, and then taking sensitive actions on them,” he explained.

After leaving Capital One, and going off in different directions for a time, the two came together this year to start Stacklet as a way to nurture the underlying open-source project Thangavelu helped build, and build a commercial company to add some functionality to make it easier for enterprises to implement and understand.

While cloud administrators can download and figure out how to use the raw open source, Stacklet is attempting to make that easier by providing an administrative layer to manage usage across thousands of cloud accounts along with pre-packaged sets of common kinds of compliance requirements out of the box, analytics to understand how the tool is doing and what it’s finding in terms of issues, and finally a resources database to understand all of the cloud resources under management.

The company has just three employees, including the two founders, but will be adding a couple of more shortly with a goal of having a team of 10 by year’s end. The open-source project has 270 contributors from around the world. The startup is looking to build diversity through being fully remote. Not being limited by geography means they can hire from anywhere, and that can help lead to a more diverse group of employees.

The founders admit that it’s a tough time to start a company and to be fundraising, but on the bright side, they didn’t have to be on a plane to San Francisco every week during the process.

In fact, Sid Trivedi, partner at Foundation Capital, said that this was his first investment where he never met the founders in person, but he said through long discussions he learned “their passion for the opportunity at hand, experience of the market dynamics and vision for how they would solve the problem of meeting the needs of both IT/security admins and developers.”

Powered by WPeMatico

For the third time since last February, Gong has raised a significant sum. In February, the company scored $40 million. In December, it grabbed another $65 million. And today, it was $200 million on a $2.2 billion valuation. That’s a total of $305 million in less than 18 months.

Coatue led today’s cash infusion, with help from new investors Index Ventures, Salesforce Ventures and Thrive Capital, and existing investors Battery Ventures, NextWorld Capital, Norwest Venture Partners, Sequoia Capital and Wing Venture Capital. It has now raised a total of $334 million, according to the company.

What is attracting this kind of investor attention? When we spoke to Gong about its Series B round, it had 300 customers. Today it has around 1,300, representing substantial growth in that time period. The company reports revenue has grown 2.5x this year alone.

Gong CEO Amit Bendov says his company is trying to create a category they have dubbed “revenue intelligence.” As he explains it, today sales data is stored in a CRM database consisting of descriptions of customer interactions as described by the salesperson or CSR. Gong is trying to transform that process by capturing both sides of the interaction, then, using artificial intelligence, it transcribes and analyzes those interactions.

Bendov says the pandemic and economic malaise has created a situation where there is a lot of liquidity in the market and investors have been looking for companies like his to invest some of it.

“There’s a lot of liquidity in the market. There are very few investment opportunities. I think the investment community was waiting a little bit to see how the market shakes out […] and they are betting on companies that could benefit long-term from the new normal, and I think we’re one of them,” Bendov told TechCrunch.

He says that he wasn’t looking for money, and in fact still is operating off the Series B investment, but when firms come knocking with checkbooks open and favorable terms, he wasn’t about to turn them down. “There are CEOs schools [of thought] that tell you to raise money when you can, not when you need to. It’s not very diluted at this kind of valuation and it was a very easy process. […] The whole deal closed in 14 days from term sheet to money in the bank,” he said.

Bendov said that taking the money was “pretty much a no-brainer.” In fact, he says the money gives them the freedom to operate and further legitimacy in the marketplace. “It gives us the ability to buy companies, make strategic investment, accelerate plans, and it also, especially since we cater to large enterprise customers, it gives them confidence that this company is here to stay,” he said.

With around 350 employees today, it hopes to add 100 people by the end of the year. Bendov says diversity and inclusion is a “massive priority” for the company. Among the steps they’ve taken recently is opening a recruiting hub in Atlanta to bring more diverse candidates into the company, working with a company called FlockJay to train and hire underrepresented groups in customer success roles, and in Israel where the company’s R&D center is located, helping members of the Arab community with computer science backgrounds to learn interview skills. Some of those folks will end up working for Gong, and some at other places.

While the company has grown remarkably quickly and has shown great promise, Bendov is not thinking ahead to an IPO just yet. He says he wants to grow the company to at least a couple of hundred million dollars in sales, and that’s two to three years away at this point. He certainly has plenty of cash to operate until then.

Powered by WPeMatico

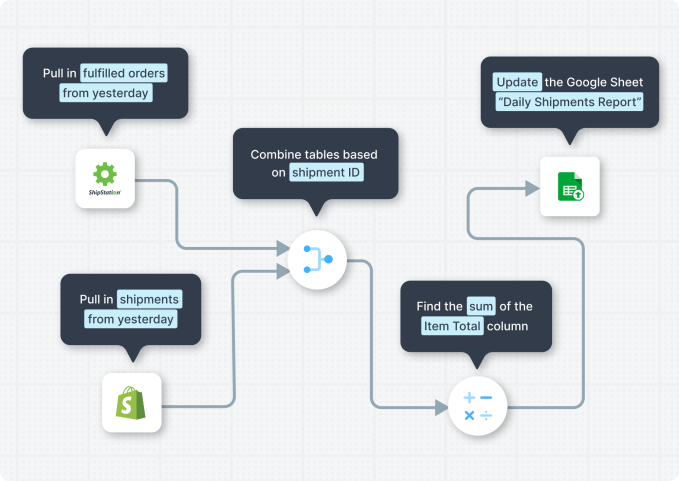

Many workers today are still stuck doing a bushel of manual tasks, copying and pasting data into spreadsheets, sending out the same emails every morning and generally lacking any kind of automation because they lack coding skills. Parabola wants to change that with a simple drag and drop workflow setup, and today the startup announced an $8 million Series A investment.

Matrix Partners led the round with participation from Thrive Capital and various individual investors. Ilya Sukhar from Matrix will be joining the Parabola board under the terms of the agreement. The company has now raised $10.2 million, including a $2.2 million seed round in 2018.

At the same time, the company also announced a new Shopify connector. As COVID has forced a dramatic increase in online shopping, Parabola has seen a corresponding increase in demand for its workflow automation services from e-commerce vendors, and they have added functionality to support that.

Company founder and CEO Alex Yaseen sees the tool as a way to bring programming-like automation to anyone who deals with data tasks on a regular basis, particularly in a spreadsheet. “We’re a drag and drop productivity tool, and we like to say we bring the power of programming to everybody,” Yaseen told TechCrunch.

They do this by providing a library of pre-built steps that you can drag and drop onto a workflow canvas. Each of those steps helps you automate what was previously a manual, repetitive data task in Excel or Google Sheets.

Image Credits: Parabola

Lead investor Sukhar says that while low code is becoming more popular right now, he and Yaseen have always seen it as a way to bring programming-level productivity enhancing skills to a much broader set of users, and to bring that focus to e-commerce in particular.

“The real trick is finding the right set of users, the right abstraction, the right niche to start with and that’s where I think this goes back to the e-commerce focus. I think that’s what’s super exciting about the approach Parabola has taken, and what got me excited,” he said.

As e-commerce in general surges during the pandemic, Yaseen says he has seen a corresponding increase in usage on the platform over the last couple of months as retail companies move online or increase their online presence and need to find ways to automate more of their internal processes to keep up.

While the company is still in its early stages of development with around 20 employees, it is actively hiring and looking to build a diverse workforce as it does. Yaseen sees this tied to the company’s overall mission of bringing programming level skills to a larger group of people who don’t know how to code, and they need a diverse set of workers that reflects society at large to build that effectively.

“We talk about this as a core authentic value, and I think we’ve done a pretty good job so far. I think we have a lot of room for improvement, as does the tech industry as a whole, but we are pushing very hard,” he said.

The company wants to use the money from this round to keep refining the design of the platform to make it even easier for non-technical users. “This round is very much for product and design work to make it increasingly comfortable for these users who are today really familiar with doing their tasks in spreadsheets […] and increasingly working towards a less and less technical user, as we make products easier and more approachable,” he said.

Powered by WPeMatico

It seems the pandemic has forced the business world to digitize faster, and the industrial sector is no different. Parsable, a San Francisco startup that is helping digitize industrial front-line workers, announced a $60 million Series D today.

Activate Capital and Glade Brook Capital Partners co-led the round. They got help from new investors Alumni Ventures Group, Cisco Investments, Downing Ventures, Evolv Ventures and Princeville Capital, along with existing investors Lightspeed Venture Partners, Future Fund, B37 Ventures, Honeywell and Saudi Aramco. Today’s money brings the total raised to more than $133 million, according to the company.

As I wrote at the time of the company’s $40 million Series C in 2018, “Parsable has developed a Connected Worker platform to help bring high tech solutions to deskless industrial workers who have been working mostly with paper-based processes.”

CEO Lawrence Whittle says that while the pandemic has shut some factories, and reduced overall worker headcount, it has still led to increased usage on the platform of companies whose products are considered essential services. What’s more, Parsable’s ability to deal with information on an individual mobile device or laptop means that in many cases, workers can stay separated and not share computers on the factory floor, making the process safer.

“Fortunately, the majority of our focus is in what’s often deemed as essential industries — so consumer packaged goods (CPG), food, beverage, agriculture and related industries such as paper and packaging. Those markets, interestingly enough, predominantly because of consumer demand continue to operate pretty successfully from a demand perspective during this COVID period,” Whittle told TechCrunch.

While the company would not give specific growth numbers, they shared that registered users grew 11x and the number of deployed sites tripled year over year. What’s more, they have users in more than 100 countries encompassing 14 languages.

With the money, the company wants to expand internationally into Asia, EMEA and Latin America. The startup has 120 employees, but plans to hire for essential needs over the next several months, preferring to be conservative and seeing where the pandemic takes the economy in the coming months.

Whittle points out that the diversity of its user base, and the desire to expand into other regions demands that they have a more diverse employee base, even while it’s a clear ethical consideration, as well.

“When you’re serving customers in over 100 countries, and you provide a product in in 14 languages, [having] diversity and inclusion is to some extent a given. What we’re doing as a company […] is taking every opportunity to further lean into that and that’s one of the leading lights of our of our business,” Whittle said.

Parsable launched in 2013. It took a few years to build the product. Today, customers include Georgia-Pacific, Henkel and Shell.

Powered by WPeMatico

Entrepreneurial creators have to do a lot with limited time. They need to, well, create, but then they also need to build their marketing funnels, convert users to their paid products and manage business operations. Yet, perhaps the most important task they face is keeping their existing fans engaged, because ultimately, that engagement ties directly to the health of their brand long-term.

Social tools are abysmal on platforms like YouTube and Instagram, particularly when it comes to creators owning their own communities and building deeper relationships with them. Other products like Discord have been used to some success, although Discord was built with a different focus in mind and is being hammered in to fix the problem.

Circle believes there is a better way. The New York City-based startup officially launched today for creators (following eight months of product beta testing). The platform is designed from the bottom-up to offer better community building and engagement tools for creators, while also integrating with other software typical in the creator toolkit.

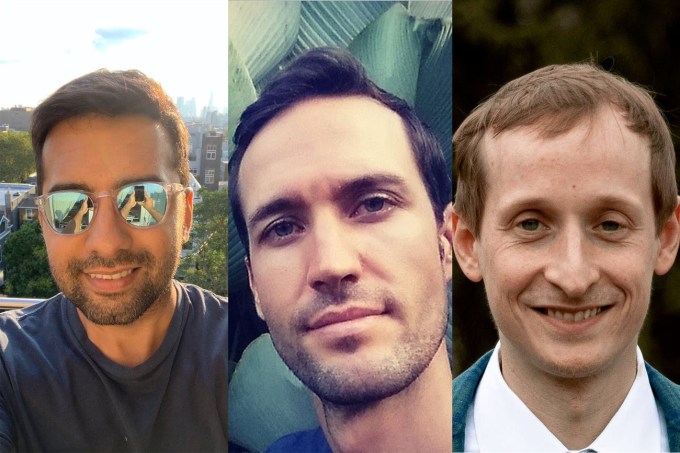

Circle co-founders Sid Yadav, Rudy Santino and Andrew Guttormsen. Photo via Circle.

The key DNA for the company is another NYC-based startup called Teachable. Two of Circle’s three founders, Sid Yadav and Andrew Guttormsen, hail from the edtech platform, which helps entrepreneurial teachers setup online storefronts for their classes. Teachable was sold to Hotmart earlier this year for what was reported to be a quarter of a billion dollars. Yadav was VP of Product there, and Guttormsen was VP of Growth and Marketing. Their third co-founder, Rudy Santino, knew Yadav from previous work.

Yadav spun out of Teachable and actually got his start as a contractor for Sahil Lavingia, the founder of Gumroad we were just talking about last week because he launched a new seed fund. He worked part-time as a product and design consultant, allowing him the flexibility to begin spending time thinking about new product ideas.

“I always knew that my next startup was going to be in [the creator] space,” Yadav said. “I just loved what they’re all about, which is about making an income from what they love doing.”

Teachable’s rapid growth in a small slice of the creator space taught Yadav some of the key challenges that creators face, and what a new product needed to solve in order to help them. With his co-founders, he enlisted a group of creators — including Pat Flynn at Smart Passive Income and Anne-Laure Le Cunff, who operates a newsletter called Ness Labs — to actively build communities on Circle to prove out their various design and product decisions.

The growth of the platform and the engagement of potential customers attracted the attention of Notation Capital, a NYC-based pre-seed fund that just announced its third fund late last month. Notation led a $1.5 million seed round into Circle, which also included Lavingia, Ankur Nagpal (the founder and CEO of Teachable), Dave Ambrose and Matthew Ziskie, among others.

There is a growing movement of software designed to help creators start their businesses. Substack of course has gotten the most attention in Silicon Valley, with a platform designed mostly around email newsletter subscriptions. Pico, meanwhile, has focused on building out more of the infrastructure of the creator business through a CRM that integrates with most other platforms. Patreon handles more of the payments and revenue engagement of fans.

Circle may end up touching on those areas, but today, wants to be the destination where you send all your creators in between newsletters or blog posts or Instragrams. It’s a smart part of the creator stack to play in, and with strong early customer enthusiasm and a chunk of funding, seems ready to make a mark in this burgeoning market.

Powered by WPeMatico

Skillshare CEO Matt Cooper said 2020 has been a year of rapid growth — even before the pandemic forced large swaths of the population to stay home and turn to online learning for entertainment and enrichment.

Cooper (who became CEO in 2017) told me that the company decided last year to “focus on our strength,” leading to a “brand relaunch” in January 2020 to emphasize the richness of its creativity-themed content. At the same time, Cooper said the company defines creativity very broadly, with classes divided into categories like animation, design, illustration, photography, filmmaking and writing.

“It’s not Bob Ross,” he said. “And I love Bob Ross, but that’s a very narrow definition of creativity. Creativity can come in lots of different forms — art, design, journaling, creative writing, it can be culinary, it can be crafts.”

Cooper added that daily usage was already up significantly by mid-March, when the pandemic led to widespread social distancing orders across the United States. That created some challenges, particularly for the more polished Skillshare Originals that the company offers alongside its user-taught classes. (For example, Originals include a color masterclass taught by Victo Ngai, a class on “discovering your creative voice” taught by Shantell Martin and a creative nonfiction class by Susan Orlean.)

But of course the pandemic also meant that, as Cooper put it, “A lot more people had a lot more free time at home and were looking for a constructive way to spend it.” In fact, the company said that since its rebranding, new membership sign-ups have tripled, with existing members watching three times the number of lessons.

And Skillshare has continued producing Originals by sending instructors “a huge box of gear” and then supervising the shoot remotely. In fact, Cooper suggested that this has “opened up a whole new world” for the Originals team, allowing them to “look at parts of the world where we probably weren’t going to fly a camera crew to go shoot.”

The company now has 12 million registered members, 8,000 teachers and 30,000 classes — all accessible for $99 a year or $19 a month. And it’s announcing that it has raised $66 million in new funding led by OMERS Growth Equity, with managing director Saar Pikar joining the board of directors. Previous investors Union Square Ventures, Amasia, Burda Principal Investments and Spero Ventures also participated.

“Skillshare serves the needs of professional creatives and everyday creative hobbyists alike, which presents a highly-innovative value proposition for the online learning market,” Pikar said in a statement. “We look forward to deepening our partnership with Skillshare, and our fellow investors, in order to help Matt Cooper and his team scale up the company’s international reach – and help Skillshare achieve the full potential of its unique approach to online learning.”

Cooper added that the company (which had previously raised $42 million) was cash-flow positive for the first half of 2020, so it raised the new round to invest in growth — particularly in the Skillshare for Teams enterprise product, which allows customers like GM Financial, Vice, AWS, Lululemon, American Crafts and Benefit to offer Skillshare as a perk for their employees.

Cooper is also hoping to expand internationally. Apparently two-thirds of new member sign-ups are coming from outside the United States, with India as Skillshare’s fastest growing market, and that’s with “no local language content, no local language teachers.” While Cooper plans to remain focused on English content for the near future, he noted there are other steps Skillshare can take to encourage global viewership, like accepting payments in different currencies and supporting subtitles in different languages.

“Just by making it a little easier for those international users to get value from the platform, we expect to see dramatic growth in these international markets,” he said.

Powered by WPeMatico

The media landscape is changing rapidly. Even before COVID, media companies were looking at new revenue models beyond your standard banner ad, all the while trying to navigate the oft-changing world of social media and search, where a minor algorithm change can boost or tank traffic.

Anytime an industry is in the midst of a transformation is a great time for startups to capitalize. That’s why we’re amped to have Lerer Hippeau’s managing partner Eric Hippeau join us for an episode of Extra Crunch Live.

The episode will air at 2 p.m. ET/11 a.m. PT on August 13. Folks in the audience can ask their own questions, but you must be an Extra Crunch member to access the chat. If you still haven’t signed up, now’s your chance!

Eric Hippeau served as CEO for the Huffington Post before co-founding Lerer Hippeau. He also served as chairman and CEO at Ziff-Davis, a former top publisher of computer magazines. He sits on the boards of BuzzFeed and Marriott International.

Lerer Hippeau portfolio companies include Axios, BuzzFeed, Genius, Chartbeat and Giphy. And while the firm has experience in media, that doesn’t mean the portfolio is squarely focused on it. Other portfolio companies include Casper, WayUp, Warby Parker, Mirror, HungryRoot, Glossier, Everlane, Brit + Co. and AllBirds, to name just a few.

As an early-stage investor, Hippeau knows what it takes for companies to get the attention of VCs and take the deal across the finish line. We’ll chat with Hippeau about some of the dos and don’ts of fundraising, his expectation for the next-generation of startups born in this pandemic world and which sectors he’s most excited to invest in.

As previously mentioned, Extra Crunch members are encouraged to bring their own questions to this discussion. Come prepared!

Hippeau joins an all-star cast of guests on Extra Crunch Live, including Mark Cuban, Roelof Botha, Kirsten Green, Aileen Lee and Charles Hudson. You can check out the full slate of episodes here.

You can find the full details of the conversation below.

Powered by WPeMatico

Clean.io, a startup that helps digital publishers protect themselves from malicious ads, recently announced that it has raised $5 million in Series A funding.

The Baltimore-based company isn’t the only organization promising to fight malvertising (such as ads that force visitors to redirect to another website). But as co-founder Seth Demsey told me last year, Clean.io provides “granular control over who gets to load JavaScript.”

CEO Matt Gillis told me via email this week that the challenge will “always” be evolving.”

“Just like an antivirus company needs to constantly be updating their definitions and improving their protections, we always need to be alert to the fact that bad actors will constantly try to evade detection and get over and around the walls that you put in front of them,” Gillis wrote.

The company says its technology is now used on more than 7 million websites for customers including WarnerMedia’s Xandr (formerly AppNexus), The Boston Globe and Imgur.

Image Credits: Clean.io

Clean.io has now raised a total of $7.5 million. The Series A was led by Tribeca Venture Partners, with participation from Real Ventures, Inner Loop Capital and Grit Capital Partners.

Gillis said he’d initially planned to fundraise at the end of February, but he had to put those plans on hold due to COVID-19. He ended up doing all his pitching via Zoom (“I saw more than my fair share of small NY apartments”) and he praised Tribeca’s Chip Meakem (whose previous investments include AppNexus) as “a world-class partner.”

Of course, the pandemic’s impact on digital advertising goes far beyond pausing Gillis’ fundraising process. And when it comes to malicious ads, he said that with the cost of digital advertising declining precipitously in late March, “bad actors capitalized on this opportunity.”

“We saw a pretty constant surge in threat levels from mid-March until early May,” Gillis continued. “Demand for our solutions have remained strong due to the increased level of attacks brought on by the pandemic. Now more than ever, publishers need to protect their user experience and their revenue.”

Powered by WPeMatico

Special is a new startup offering online video creators a way to move beyond advertising for their income.

The service was created by the team behind tech consulting and development firm Triple Tree Software. Special’s co-founder and CEO Sam Lucas told me that the team had already “scrapped our way from nothing to a seven-figure annual revenue,” but when the founders met with Next Frontier Capital (Next Frontier, like Special, is based in Bozeman, Montana) they pitched a bigger idea — an app where creators charge a subscription fee for access to premium content.

While Triple Tree started in the service business, Lucas explained the goal was always to create “a product company that we could sell for $100 million.” Now Special is announcing it has raised $2.26 million in seed funding from Next Frontier and other investors.

It’s also built an initial version of the product that’s being tested by friends, family and a handful of creators, with plans for a broader beta release in October.

With online advertising slowing dramatically during the COVID-19 pandemic, YouTube recently highlighted the fact that 80,000 of its channels are earning money from non-ad sources, and that the number of creators who receive the majority of their income from those sources grew 40% between January and May.

One of the main ways that creators can ask their viewers for money is through Patreon. Lucas acknowledged Patreon as a “very big inspiration” for Special, but he said that conversations with creators pointed to a few key ways that the service falls short.

Image Credits: Special

For one thing, he argued while contributions on Patreon are framed as “donations” or “support,” Special allows creators to emphasize the value of their premium content by putting it behind a subscription paywall. Patreon supports paywalls as well, but that leads to Lucas’ next point — it was built for creators of all kinds, while Special is focused specifically on video, and it has built a high-quality video player into the experience.

In fact, Lucas described Special’s spin on the idea of a white-labeled product as “silver label.” The goal is to create “the perfect balance between a platform and a custom app” — creators get their own customizable channels that emphasize their brand identity (rather than Special’s), while still getting the distribution and exposure benefits of being part of a larger platform, with their content searchable and viewable on web, mobile and smart TVs.

Creators also retain ownership of their content, and they get to decide how much they want to charge subscribers — Lucas said it can be anywhere between “$1 or $999” per month, with Special taking a 10% fee. He added that the team has plans to build a bundling option that would allow creators to team up and offer a joint subscription.

Lucas’ pitch reminded me of startups like Vessel (acquired and shut down by TechCrunch’s parent company Verizon in 2016), which previously hoped to bring online creators together for a subscription offering. In Lucas’ view, Vessel was similar to newer apps like Quibi, in that they directly funded creators to produce exclusive content.

“It’s a billion-dollar arms race, with what used to be a technology play but is now a production studio play,” he said. Special doesn’t have the funding to compete at that level, but Lucas suggested that a studio model also provides the wrong incentives to creators, who say “Hell yeah, keep those checks coming in,” but disappear “the moment the checks stop.”

“I almost think it’s an egotistical play,” Lucas added. “The company thinks they know best what a creator should produce for an audience that doesn’t exist yet. We say: Let them do it on Special. Do whatever you want, as long as you follow our terms of service, and own your creative vision.”

It might also seem like a big challenge to recruit creators while based in Montana, but Lucas replied that Special has more access than you might think, especially since the town has become “such a hotspot for extremely wealthy people to buy their third home.”

More broadly, he suggested that the distance from Hollywood and Silicon Valley “allows us to not follow the trends of every new streaming platform and [instead] truly find those independent creators underneath the woodworks.”

Powered by WPeMatico