funding

Auto Added by WPeMatico

Auto Added by WPeMatico

The flow of venture capital in 2020 has been surprisingly strong given the year’s general uncertainty, but while investors have showered plenty of dough on growth-stage companies, seed-stage startups are down 32% last quarter compared to the year before.

There have been plenty of recent conversations about alternative funding routes for founders, and one of those oft-overlooked paths has been equity crowdfunding. While crowdfunding platforms like Kickstarter push consumers to back unrealized projects in exchange for products or other services, equity crowdfunding allows consumers to actually invest cash and receive a piece of the company. It’s not a conventional path, but it can be a viable option for companies that have a close relationship with an engaged customer base.

The Security and Exchange Commission’s Regulation Crowdfunding guidelines were adopted under Title III of the JOBS Act back in 2016, but because many entrepreneurs were unfamiliar with how to participate, many of the startups that have taken advantage of it haven’t been the highest quality. The tide could be turning: This week, the SEC updated some of its guidance on crowdfunding, eliminating some ambiguities and increasing the amount of capital companies can raise from both accredited and nonaccredited investors. Additionally, companies can now raise $5 million per year using equity crowdfunding, compared to the previous limit of $1.07 million.

But life has gotten easier in other ways as well for founders pursuing this fundraising type and the platforms that seek to simplify it.

Wefunder is one of a handful of equity crowdfunding platforms that have popped up in the last few years. Before a company can raise on its platform, Wefunder vets them before allowing them to tap into their network of amateur investors who can invest as little as $100 with the median investment sitting at $250. Last month, 40 companies launched on Wefunder and collectively raised $12 million, according to Wefunder CEO Nicholas Tommarello.

Powered by WPeMatico

Online education tools continue to see a surge of interest boosted by major changes in work and learning practices in the midst of a global health pandemic. And today, one of the early pioneers of the medium is announcing some funding as it tips into profitability on the back of a pivot to enterprise services, targeting businesses and governments that are looking to upskill workers to give them tech expertise more relevant to modern demands.

Udacity, which provides online courses and popularized the concept of “Nanodegrees” in tech-related subjects like artificial intelligence, programming, autonomous driving and cloud computing, has secured $75 million in the form of a debt facility. The funding will be used to continue investing in its platform to target more business customers.

Udacity said that part of the business is growing fast, with Q3 bookings up by 120% year-over-year and average run rates up 260% in H1 2020.

Udacity said that customers in the segment include “five of the world’s top seven aerospace companies, three of the Big Four professional services firms, the world’s leading pharmaceutical company, Egypt’s Information Technology Industry Development Agency, and three of the four branches of the United States Department of Defense”, which work with Udacity to build tailor-made courses for their specific needs, as well as use off-the-shelf content from its catalogue.

Udacity also works with companies to build programs as part of their CSR remits, and with tech companies like Microsoft to build programs to get more developers using their tools.

“We’re seeing tremendous demand on the enterprise and government side,” said Gabe Dalporto, Udacity’s CEO who joined the company in 2019. “But to date it’s mostly been inbound, with enterprises, Fortune 500 companies and government organizations coming in and wanting to work with us. Now it’s time to build out a sales team to go after them.”

The news today is a welcome turn of events for a company that has been in the spotlight over the years for less rosy reasons, partly because it found it challenging to land on a profitable business model.

Founded nearly a decade ago by three robotics specialists, including Sebastian Thrun, the Stanford professor who at the time was instrumental in building and running Google’s self-driving car and larger moonshot programs, Udacity initially saw an opportunity to partner with colleges and universities to build online tech courses (Thrun’s academic standing, and the vogue for MOOCs, were possibly two fillips for that strategy).

After that proved to be too challenging and costly, Udacity pivoted to positioning itself as a vocational learning provider targeting adults, specifically those who didn’t have the hours or money to embark on full-time courses but wanted to learn tech skills that could help them land better jobs.

That resulted in some substantial user growth, but still no profit. Eventually, the company faced multiple rounds of layoffs as it restructured and gravitated closer to its current form.

Currently, the company still provides direct-to-consumer (direct-to-learner?) courses, but it won’t be long, Dalporto said, before enterprise and government customers account for about 80% of the company’s business.

Previously, Udacity had raised nearly $170 million from a pretty illustrious group of investors that include Andreessen Horowitz, Ballie Gifford, CRV, Emerson Collective and more. This latest tranche is coming in the form of a debt facility from a single company, Hercules Capital.

Dalporto said the decision to take the debt route came after initially getting a number of term sheets for an equity round.

“We had multiple term sheets on the equity side, but then we received an unsolicited debt term sheet,” he said. That led to the company modelling out the cost of capital and dilution, he said, and “it turned out it was the better option.” For now, he added, equity was “off the table” but it may consider revisiting the idea en route to a public listing. “For the foreseeable future, we are cash flow positive so there is no compelling reason right now, but we might do something closer to an IPO.”

Being a debt facility, this funding does not mean a revisiting of Udacity’s valuation. The company was last capitalized five years ago at $1 billion, but Dalporto would not comment on how that had changed in the (uncompleted) equity term sheets it had received.

The interest Udacity is seeing — both from investors and as a company — is part of the bigger spotlight that online education companies have had in the last year. In K-12 and university education, the focus has been on building better technology and content to help students stay engaged and continue learning even when they cannot be in their normal physical classrooms as schools, districts, governments and public health officials implement social distancing to slow the spread of COVID-19.

But that’s not the only classroom where online education is getting called on. In the world of business, organizations that have also gone remote because of the pandemic are facing a matrix of challenges. How can they keep employees productive and feeling like part of a team when they no longer work next to each other? How do they make sure their workforces have the skills they need to work in the new environment? How do they make sure their own businesses are equipped with the right technology, and the expertise of people to run it, for this latest and future iterations of “work”? And how can governments make sure their economies don’t fall off a cliff as a result of the pandemic?

Online education has been seen as something of a panacea for all of these questions, and that has spelled a lot of opportunity for tech companies building online learning tools and other infrastructure — with others including the likes of Coursera, LinkedIn, Pluralsight, Treehouse and Springboard in the area of tech-related courses and learning platforms for workers.

As with other market segments like e-commerce, this isn’t about a trend emerging out of the blue, but about it accelerating much faster than people projected it would.

“Given Udacity’s growth, focus on sustainable business practices, and expanding reach across multiple industries, we are excited to provide this investment. We look forward to working with the company to help them sustain their impressive global growth, and continued innovation in upskilling and reskilling,” said Steve Kuo, senior MD and Technology Group head at Hercules Capital, in a statement.

In the areas of enterprise and government, Dalporto described a number of scenarios where Udacity is already active, which are natural progressions of the kind of vocational learning it was already offering.

They include, for example, the energy company Shell retraining structural and geological engineers “who had good math skills but no machine learning expertise” to be able to work in data science, needed as the company builds more automation into its operation and moves into new kinds of energy technology.

And he said that Egypt and other nations — looking to the success that India has had — have been providing technology expertise training to residents to help them find jobs in the “outsourcing economy.” He said that the program in Egypt has seen an 80% graduation rate and 70% “positive outcomes” (resulting in jobs).

“If you take just AI and machine learning, demand for these skills is growing at a rate of 70% year-over-year, but there is a shortage of talent to fill those roles,” Dalporto said.

Udacity is for now not looking at any acquisitions, he added, for another 6-12 months. “We have so much demand and work to do internally that there is no compelling reason to do that. At some point we will look at that but it needs to be linked to our strategy.”

Powered by WPeMatico

Stensul, a startup aiming to streamline the process of building marketing emails, has raised $16 million in Series B funding.

When the company raised its $7 million Series A two years ago, founder and CEO Noah Dinkin told me about how it spun out of his previous startup, FanBridge. And while there are many products focused on email delivery, he said Stensul is focused on the email creation process.

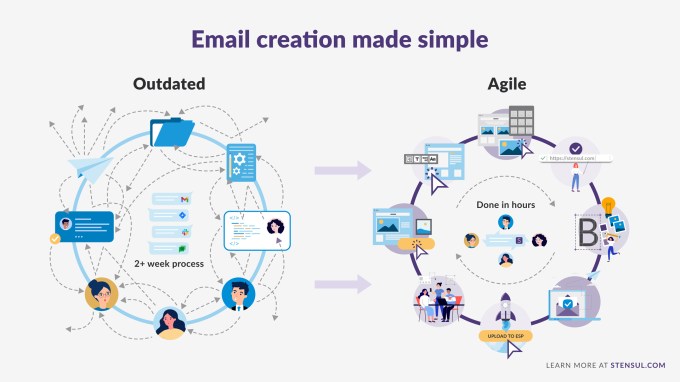

Dinkin made many similar points when we discussed the Series B last week. He said that for many teams, creating a marketing email can take weeks. With Stensul, that process can be reduced to just two hours, with marketers able to create the email on their own, without asking developers for help. Things like brand guidelines are already built in, and it’s easy to get feedback and approval from executives and other teams.

Dinkin also noted that while the big marketing clouds all include “some kind of email builder, it’s not their center of gravity.”

He added, “What we tell folks [is that] literally over half the company is engineers, and they are only working on email creation.”

Image Credits: Stensul

The team has recently grown to more than 100 employees, with new customers like Capital One, ASICS Digital, Greenhouse, Samsung, AppDynamics, Kroger and Clover Health. New features include an integration with work management platform Workfront.

Plus, with other marketing channels paused or diminished during the pandemic, Dinkin said that email has only become more important, with the old, time-intensive process becoming more and more of a burden.

“We need more emails — whether that’s more versions or more segments or more languages, the requests are through the roof,” he said. “The teams are the same size … and so that’s where especially the leaders of these organizations have looked inward a lot more. The ways that they have been doing it for years or decades just doesn’t work anymore and prevents them from being competitive in the marketplace.”

The new round was led by USVP, with participation from Capital One Ventures, Peak State Ventures, plus existing investors Javelin Venture Partners, Uncork Capital, First Round Capital and Lowercase Capital . Individual investors include Okta co-founder and COO Frederic Kerrest, Okta CMO Ryan Carlson, former Marketo/Adobe executive Aaron Bird, Avid Larizadeh Duggan, Gary Swart and Talend CMO Lauren Vaccarello.

Dinkin said the money will allow Stensul to expand its marketing, product, engineering and sales teams.

“We originally thought: Everybody who sends email should have an email creation platform,” he said. “And ‘everyone who sends email’ is synonymous with ‘every company in the world.’ We’ve just seen that accelerate in that last few years.”

Powered by WPeMatico

When we covered Leena AI as a member of the Y Combinator Summer 2018 cohort, the young startup was firmly focused on building HR chatbots, but in the intervening years it has expanded the vision to a broader HR policy platform. Today, the company announced an $8 million Series A led by Greycroft with help from several individual industry investors.

Company CEO and co-founder Adit Jain says that in 2018 the company was concentrating on building an intelligent virtual assistant for HR-related questions. It allowed employees to ask the bot questions like how many vacation days they have left or what holidays they have off this year.

Over the last couple of years since leaving Y Combinator, the company has moved into broader HR service delivery. “So I’m talking about having an intelligent case management, knowledge management and document management system, which is backing the virtual assistant as well,” Jain explained.

He says that users should think of it as an entire system where the chatbot is the user interface for employees to interact with the HR information on the back end. For example, he says that the knowledge management component is where the chatbots find the answers to questions, and as employees interact with the chatbot, it grows more intelligent based on the feedback from them.

The document management piece enables HR to write or import HR policies and the case management system comes into play when the situation is too complex for the chatbot to handle and it has to be escalated to a human HR representative.

When we spoke to Jain in September 2018 at the time of his startup’s $2 million seed round, he had 16 customers and hoped to have 50 in the next 12-18 months. Today the company has 100 enterprise customers with 300,000 employees using the platform worldwide.

In fact, the pandemic has fueled business with more than half of those customers coming on board this year. He says this is because companies are looking for ways to digitize processes like HR as employees are working from home more.

“This is a trend that’s going to continue as organizations have realized the value of doing things with more and more digital applications taking care of your processes […] especially mundane, repeatable tasks being handed over to technology more and more,” Jain said.

As the business has grown this year, the company has expanded from 30 to 75 employees and he hopes to double that number in the next year. As he does, he has discussed with his lead investor how to build a diverse and inclusive culture at Leena AI .

One thing he is trying to do is raise some money from a diverse group of investors, approximately $400,000, and his hope is that these diverse investors can help him build solid diversity programs as he adds employees to his growing company.

That the startup hasn’t only grown during these turbulent times, but thrived, shows that companies are looking to modernize every part of the enterprise technology stack, and that includes HR.

Powered by WPeMatico

The world of enterprise software and cybersecurity has taken multiple body blows since COVID-19 demolished the in-person office, flinging employees across the world and forcing companies to adapt to an all-remote productivity model. The shift has required companies to rethink not only collaboration software, but also the infrastructure that powers it and the best way to protect assets once their security perimeters have been destroyed.

The pandemic has also dramatically increased the usage of digital services, forcing cloud providers to keep up with crushing demands for performance and reliability.

In short — it’s never been a better time to be an enterprise investor (or, possibly, a founder).

So I’m excited to announce our next guest in our Extra Crunch Live interview series: Asheem Chandna from Greylock, one of the top enterprise investors of the past two decades who has worked with multiple important founding teams from whiteboard to IPO. We’re scheduled for Thursday, November 5 at noon PST/3 p.m. EST/8 p.m. GMT (check that daylight savings time math!)

Login details are below the fold for EC members, and if you don’t have an Extra Crunch membership, click through to sign up.

For nearly two decades, Asheem Chandna has invested in enterprise and security startups at Greylock, with massive investment wins in Palo Alto Networks, AppDynamics and Sumo Logic. These days, he continues to invest in cybersecurity with companies like Awake Security and Abnormal Security, data platforms like Rubrik and Delphix, and the stealthy search engine company Neeva. As a leading early-stage investor and mentor in the space, he’s seen a multitude of companies transition from inception to product-market fit to IPO.

We’ll talk about what all the turbulence in enterprise means for the future of startups in the space, how cybersecurity is evolving given the new threat landscape and also discuss a bit about how the public markets and their aggressive multiples for Silicon Valley enterprise startups is changing the strategy of venture capitalists. Plus, we’ll talk about company building, developing founders as leaders and more.

Join us next week with Asheem on Thursday, November 5 at noon PST/3 p.m. EST/8 p.m. GMT. Login details and calendar invite are below.

Powered by WPeMatico

Nestlé USA just announced that it has acquired Freshly for $1.5 billion — $950 million plus potential earnouts of up to $550 million based on future growth.

Founded in 2015, Freshly is a New York City-based startup that offers healthy meals delivered to your home in weekly orders, which can then be prepared in a few minutes in your microwave or oven. So you get the benefit of fresh, healthy meals but — unlike signing up with a meal kit startup — you don’t have to spend a lot of time cooking them yourself.

If anything, this sounds even more appealing now, as so many of us are spending most of our time at home, doing our best to cook for ourselves. According to Nestlé’s press release, Freshly is now shipping more than 1 million meals per week across 48 states, with forecasted sales of $430 million for 2020.

The startup raised a total of $107 million from investors, including Highland Capital Partners, White Star Capital, Insight Venture Partners and Nestlé itself, which led the Series C in 2017. Today’s announcement describes the earlier investment as giving the food and beverage giant a 16% stake in Freshly and serving as “a strategic move to evaluate and test the burgeoning market.”

“Consumers are embracing ecommerce and eating at home like never before,” said Nestlé USA Chairman and CEO Steve Presley in a statement. “It’s an evolution brought on by the pandemic but taking hold for the long term. Freshly is an innovative, fast-growing, food-tech startup, and adding them to the portfolio accelerates our ability to capitalize on the new realities in the U.S. food market and further positions Nestlé to win in the future.”

In a note to customers, Freshly co-founder and CEO Michael Wystrach said that as a result of the acquisition, his team has plans to triple the number of menu items offered each week. Beyond that, however, he suggested that things won’t change too dramatically:

I can assure you that your meals, pricing, and subscription will remain just as you know them. Freshly will continue to operate as a standalone business to accomplish our core mission to remove the barriers to healthy eating with convenient, nutritious and delicious meal solutions, backed by the power of Nestlé to open new doors for a fresher, faster food delivery to your door. We will continue to maintain our own strict standards and maintain complete control of our products. Our meals will not be changing, and there are no plans to change ingredients or integrate Nestlé products into Freshly meals, but we are excited about potential opportunities for the future.

Powered by WPeMatico

Despite e-commerce firms Amazon and Walmart and others pouring billions of dollars into India, offline retail still commands more than 95% of all sales in the world’s second largest internet market.

The giants have acknowledged the strong hold neighborhood stores (mom and pop shops) have in the country, and in recent quarters scrambled for ways to work with them. Mukesh Ambani, India’s richest man, has made the dynamics more interesting in the past year as he works to help these neighborhood stores sell online.

But the market opportunity is still too large, and there are many aspects of the old retail business that could use some tech. That’s the bet WareIQ, a Bangalore-headquartered, Y Combinator-backed startup is making. And it has just raised a $1.65 million seed financing round from YC, FundersClub, Pioneer Fund, Soma Capital, Emles Venture Advisors and founders of Flexport.

The one-year-old startup operates a platform to leverage the warehouses across the country. It has built a management system for these warehouses, most of which largely engage in offline business-to-business commerce and have had little to no prior e-commerce exposure.

“We connect these warehouses across India to our platform and utilize their infrastructure for e-commerce order processing,” said Harsh Vaidya, co-founder and chief executive of WareIQ, in an interview with TechCrunch. The company offers this as a service to retail businesses.

Who are these businesses? Third-party sellers (some of whom sell to Amazon and Flipkart and use WareIQ to speed up their delivery), e-commerce firms, social commerce platforms, as well as neighborhood stores and social media influencers.

Any online store, for instance, can send its products to WareIQ, which has integrations with several popular e-commerce platforms and marketplaces. It works with courier partners to move items from one warehouse to another to offer the fastest delivery, explained Vaidya.

The infrastructure stitched together by WareIQ also enables an online seller to set up their own store and engage with customers directly, thereby saving fees they would have paid to Amazon and other established e-commerce players.

“The sellers were not able do this on their own before because it required them to talk directly to warehousing companies that maintain their own rigid contracts, and high-security deposits, and they still needed to work with multiple technology providers to complete the tech-stack,” he said. WareIQ also offers these sellers last-mile delivery, cash collection and fraud detection among several other services.

“In a way, we are building an open-source Amazon fulfilment service, where any seller can send their goods to any of our warehouses and we fulfil their Amazon orders, Myntra orders, Flipkart orders or their own website orders. We also comply with the standard of these individual marketplaces, so our sellers get a Prime tag on Amazon,” he said.

WareIQ is free for anyone to sign up with any charge and it takes a cut by the volume of orders it processes. The startup today works with more than 40 fulfilment centres and plans to deploy the fresh capital to expand its network to tier 2 and tier 3 cities, he said. It’s also hiring for a number of tech roles.

Powered by WPeMatico

If you miss hanging out with your co-workers but don’t want to spend a single second more on Zoom, the latest product from Donut might be the answer.

The startup is launching its new Watercooler product today while also announcing that it has raised $12 million in total funding, led by Accel and with participation from Bloomberg Beta, FirstMark, Slack Fund and various angel investors.

Co-founder and CEO Dan Manian told me that this is actually money that the startup raised before the pandemic, across multiple rounds. It just didn’t announce the fundraising until now.

The startup’s vision, Manian said, is “to create human connection between people at work.” Its first product, Intros, connects via Slack teammates who didn’t already know each other, often with the goal of setting up quick coffee meetings (originally in-person and now virtual).

Donut says it has facilitated 4 million connections across 12,000 companies (including The New York Times, Toyota and InVision), with 1 million of those connections made since the beginning of the pandemic.

However, Manian said customers have been asking Donut to facilitate more frequent interactions, especially since most people aren’t going to have these coffee meetings every day. At the same time, people face the dueling issues of isolation and Zoom fatigue, where “the antidote to one thing makes the other pain worse.” And he suggested that one of the hardest things to recreate while so many of us are working remotely are “all the little microinteractions that you have while you’re working.”

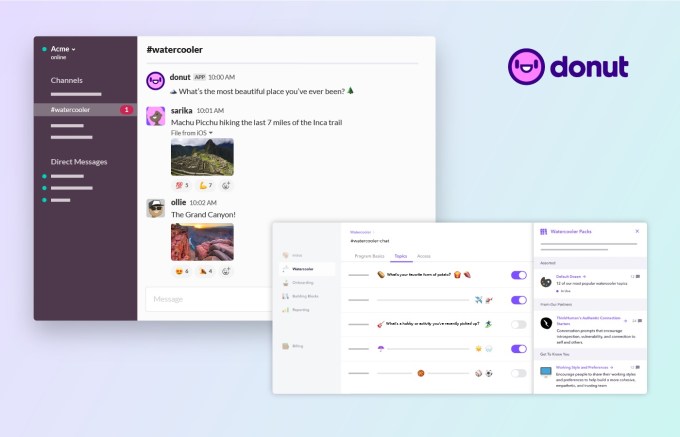

That’s where Watercooler comes in — as the name suggests, it’s designed to replicate the feeling of hanging out at the office watercooler, having brief, low-key conversations. Like Intros, it integrates with Slack, creating a new channel where Watercooler will post fun, conversation-starting questions like “‘What’s your favorite form of potato?” or “What’s one thing you’ve learned in your career that you wish you knew sooner?”

Talking about these topics shouldn’t take much time, but Manian argued that brief conversations are important: “Those things add up to friendship over time, they’re what actually transform you from co-worker to friend.” And those friendships are important for employers too, because they help with team cohesion and retention.

I fully endorse the idea of a Slack watercooler — in fact, the TechCrunch editorial team has a very active “watercooler” channel and I’m always happy to waste time there. My big question was: Why do companies need to purchase a product for this?

Donut Watercooler. Image Credits: Donut

Manian said that there were “a bunch of our early adopters” who had tried doing this manually, but it was always in the “past tense”: “It got too hard to come up with the questions, or it took real work coming up with them, whoever was doing it already had a it full time job.”

With Watercooler, on the other hand, the company can choose from pre-selected topics and questions, set the frequency with which those questions are posted and then everything happens automatically.

Manian also noted that different organizations will focus on different types of questions. There are no divisive political questions included, but while some teams will stick to easy questions about things like potatoes and breakfast foods, others will get into more substantive topics like the ways that people prefer to receive feedback.

And yes, Manian thinks companies will still need these tools after the pandemic is over.

“Work has fundamentally changed,” he said. “I don’t think we’ll put remote work back in the bottle. I think it’s here to stay.”

At the same time, he described the past few months as “training wheels” for a hybrid model, where some team members go back to the office while others continue working remotely. In his view, teams will face an even bigger challenge then: To keep their remote members feeling like they’re connected and in-the-loop.

Powered by WPeMatico

Code is the lifeblood of the modern world, yet the tooling for some programming environments can be remarkably spartan. While developers have long had access to graphical programming environments (IDEs) and performance profilers and debuggers, advanced products to analyze and improve lines of code have been harder to find.

These days, the most typical tool in the kit is a linter, which scans through code pointing out flaws that might cause issues. For instance, there might be too many spaces on a line, or a particular line might have a well-known ambiguity that could cause bugs that are hard to diagnose and would best be avoided.

What if we could expand the power of linters to do a lot more though? What if programmers had an assistant that could analyze their code and actively point out new security issues, erroneous code, style problems and bad logic?

Static code analysis is a whole interesting branch of computer science, and some of those ideas have trickled into the real-world with tools like semgrep, which was developed at Facebook to add more robust code-checking tools to its developer workflow. Semgrep is an open-source project, and it’s being commercialized through r2c, a startup that wants to bring the power of this tool to the developer masses.

The whole project has found enough traction among developers that Satish Dharmaraj at Redpoint and Jim Goetz at Sequoia teamed up to pour $13 million into the company for its Series A round, and also backed the company in an earlier, unannounced seed round.

The company was founded by three MIT grads — CEO Isaac Evans and Drew Dennison were roommates in college, and they joined up with head of product Luke O’Malley. Across their various experiences, they have worked at Palantir, the intelligence community, and Fortune 500 companies, and when Evans and Dennison were EIRs at Redpoint, they explored ideas based on what they had seen in their wide-ranging coding experiences.

The r2c team, which I assume only writes bug-free code. Image by r2c.

“Facebook, Apple, and Amazon are so far ahead when it comes to what they do at the code level to bake security [into their products compared to] other companies, it’s really not even funny,” Evans explained. The big tech companies have massively scaled their coding infrastructure to ensure uniform coding standards, but few others have access to the talent or technology to be on an equal playing field. Through r2c and semgrep, the founders want to close the gap.

With r2c’s technology, developers can scan their codebases on-demand or enforce a regular code check through their continuous integration platform. The company provides its own template rulesets (“rule packs”) to check for issues like security holes, complicated errors and other potential bugs, and developers and companies can add their own custom rulesets to enforce their own standards. Currently, r2c supports eight programming languages, including JavaScript and Python, and a variety of frameworks, and it is actively working on more compatibility.

One unique focus for r2c has been getting developers onboard with the model. The core technology remains open-sourced. Evans said that “if you actually want something that’s going to get broad developer adoption, it has to be predominantly open source so that developers can actually mess with it and hack on it and see whether or not it’s valuable without having to worry about some kind of super restrictive license.”

Beyond its model, the key has been getting developers to actually use the tool. No one likes bugs, and no developer wants to find more bugs that they have to fix. With semgrep and r2c though, developers can get much more immediate and comprehensive feedback — helping them fix tricky errors before they move on and forget the context of what they were engineering.

“I think one of the coolest things for us is that none of the existing tools in the space have ever been adopted by developers, but for us, it’s about 50/50 developer teams who are getting excited about it versus security teams getting excited about it,” Evans said. Developers hate finding more bugs, but they also hate writing them in the first place. Evans notes that the company’s key metric is the number of bugs found that are actually fixed by developers, indicating that they are offering “good, actionable results” through the product. One area that r2c has explored is actively patching obvious bugs, saving developers time.

Breaches, errors and downtime are a bedrock of software, but it doesn’t have to be that way. With more than a dozen employees and a hefty pool of capital, r2c hopes to improve the reliability of all the experiences we enjoy — and save developers time in the process.

Powered by WPeMatico

Robust.AI today announced that it has raised a $15 million Series A, led by Jazz Venture Partners. Existing partners Playground Global, Liquid2, Fontinalis, Jaan Tallinn and Mark Leslie also participated in the round, which brings the Bay Area-based robotics AI startup’s funding up to $22.5 million.

Founded mid-2019, the company counts Rodney Brooks among its C-level executives. The iRobot co-founder serves as the startup’s CTO, following the unexpected closure of the promising (but financially untenable) Rethink, which gave the world the Baxter and Sawyer robots. (Fellow iRobot co-founder Helen Greiner also notably landed at a new venture in recent months). CEO Gary Marcus, meanwhile, is also the co-founder of Geometric Intelligence, which was acquired by Uber, back in 2016.

At the core of Robust.AI are plans to build “the world’s first industrial-grade cognitive engine for robots,” essentially providing collaborative robots sufficient problem-solving capacity to effectively work alongside humans.

The company is still quite new, but many robotics and automation investments have seemingly been fast-tracked by a pandemic that has hamstrung much of the human workforce. Robust’s stated mission is to overhaul the software stack that runs many of these machines, in order to to make them function better in often complex environments.

“Finding market fit is as important in robots and AI systems as any other product,” Brooks said in a statement. “We are building something we believe most robotics companies will find irresistible, taking solutions from single-purpose tools that today function in defined environments, to highly useful systems that can work within our world and all its intricacies.”

Powered by WPeMatico