funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Online education has been one of the hotspots in the tech world this year, as people turn to e-learning tools to fill in the gaps variously arising from closed schools, closed offices, social distancing and more time on our hands at home because of the COVID-19 pandemic. And that is giving a big bump to education startups, which are raising money to capitalise on the growth opportunity.

In one of the latest developments, Udemy — which provides a marketplace currently numbering some 130,000 video-based courses across 65 languages, ranging from learning Python or how to photograph better, through to mastering mindfulness and business analytics — is raising up to $100 million in a Series F round of funding that would value the company at up to $3.32 billion.

The company has filed paperwork for the fundraise in Delaware, first discovered by Justin Byers and the team at Prime Unicorn Index. It’s not clear if the round has closed, and whether the full amount was raised (or indeed, more).

Contacted for a response, Udemy didn’t deny the report but also declined to say anything for the moment. “We have a company policy where we don’t comment on speculations,” a spokesperson said to me via email. “We don’t have a comment at this time but I’ll reach out if anything changes.”

The fundraise would be a strong move for Udemy, which only closed its Series E earlier this year — a $50 million round that catapulted the company to a $2 billion+ post-money valuation.

But that was in February, before the novel coronavirus really took hold of the world. Since then, startups focused on education have been seeing a surge of business starting in the spring of this year, and as a result, also a surge of attention from investors who see a good moment to back rising stars.

Just looking at some of the most recent deals, last week, Udacity announced a $75 million debt round and said it was finally profitable. In October, Kahoot announced a $215 million round from SoftBank. And in September, Outschool raised $45 million (and is now profitable); Homer raised $50 million (from an impressive group of strategic backers); Unacademy raised $150 million and the juggernaut that is Byju’s picked up $500 million from Silver Lake.

And these are just some of the bigger deals; there have been many smaller fundraises, new edtech startup launches and other signs of momentum alongside this. (And Prime Unicorn, incidentally, also noted that Duolingo is also raising money, up to $35 million at a valuation of $2.21 billion if all shares are issued. We’re still digging on that lead.)

When Udemy last raised money, earlier this year, the president of the business division told me it had clocked up 50 million students that purchase courses in an à la carte format, while enterprise customers — which include Adidas, General Mills, Toyota, Wipro, Pinterest and Lyft in a list of some 5,000 in all — use a subscription model.

It looks like its business users have grown and now number over 7,000, according to figures on its site, with total course enrollments now totalling 400 million to date. That could point to the opportunity that Udemy is now exploring with more capital.

But to be clear, the filing does not detail who is in this latest round, nor what the purpose of the fundraising is.

As we wrote at the time of the round in February, that fundraise came from a single, strategic investor, the Japanese educational publisher Benesse Holdings, which partners with Udemy in Japan. Benesse’s bigger business includes developing educational content for children and courses for adults, both online and in-person, and for other educational brands that it owns, such as Berlitz, and Udemy helps Benesse develop content for those various efforts.

Other investors in the company include Stripes, Naspers (now Prosus), Learn Capital, Insight Partners and Norwest Venture Partners, among others.

Prime Unicorn Index notes that the terms surrounding this latest Series F include a “pari passu liquidation preference with all other preferred, and conventional convertible, meaning they will not participate with common stock if there are remaining proceeds.” It also noted that Udemy’s most recent price per share is $24.13, an up round from the Series E, which priced shares at $15.57.

We’ll update this post as we learn more.

Powered by WPeMatico

Kyklo, a startup that helps wholesale distributors of electrical and automation products launch e-commerce stores, is announcing that it has raised $8.5 million in seed funding.

The industry may sound a bit arcane, but it’s one that founders Remi Ducrocq (Kyklo’s CEO) and Fabien Legouic (CTO) know from having worked at Schneider Electric. Ducrocq said that the process of selling these products to manufacturers and electricians remains cumbersome, relying largely on PDF catalogs.

Shifting these businesses to digital is a much bigger challenge than creating your standard online store, both because of the number of products being sold and the needs for accurate listings.

“Even the small folks sell 100,000 SKUs [distinct products], up to 1 million SKUs,” Ducrocq told me. “If you choose the wrong product, your factory gets shut down. [It’s essential] to have accurate information present on the web store to have a transaction happen.”

Kyklo doesn’t automate the process completely, Ducrocq added, because “you can’t just create content or apply AI to something that is so unstructured.” Creating these stores remains a manual process for the Kylo team, but the company has built “technology to make that manual process as easy as possible.”

That includes standardized data structures and a variety of scripts to create these product listings more quickly. Ultimately, Ducrocq said Kyklo can get distributors up and running with an online store within 30 days, and sometimes as quickly as two weeks.

In total, Kyklo has created a catalog of more than 2.5 million products for more than 35 distributors. It’s also been endorsed by manufacturers like Schneider Electric, Wago, Festo US and Mitsubishi Electric Automation as their preferred e-commerce partner.

Ducrocq suggested that going digital with Kyklo helps these businesses both by allowing them to reach new customers with improved SEO and by giving them tools to expand their sales with existing customers. For example, IEC Supply says that its online sales increased 500% for the first six months after launching with Kyklo, while new customer interactions tripled.

“Market maturity accelerated because of the pandemic,” he added. “These B2B traditional businesses were reluctant to go towards digitization, with only visionaries embarking on the journey. But during the pandemic, salespeople haven’t been able to see their customers in person for six months, so many distributors are reassessing how they should effectively go to market.”

Kyklo has now raised a total of $10.2 million. The new funding was led by Felicis Ventures and IA Ventures, with participation from Jungle Ventures, partners at Wavemaker, Seedplus and strategic angel investors.

“With 80% of the $640 billion electrical, industrial and automation distribution industry still relying on PDF catalogs and phone and emails for its operations, distributors face a challenge in the market,” said Felicis Managing Director Sundeep Peechu in a statement. “KYKLO’s platform helps these companies keep pace with crucial industry needs and reassess how digital tools can transform their sales force.”

Powered by WPeMatico

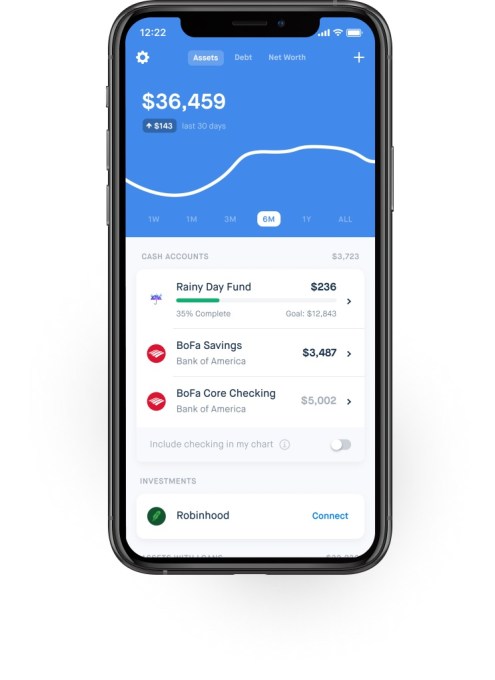

Truebill, a startup offering a variety of tools to help users take control of their finances, announced today that it has raised $17 million in Series C funding.

When I first wrote about the startup in 2016, it was focused on helping users track and cancel unwanted subscriptions. Since then, it’s expanded into other financial products, like reports on your personal expenses and the ability to negotiate lower bills.

This week, Chief Revenue Officer Yahya Mokhtarzada told me that with the pandemic leading to a dramatic reduction in ad costs, Truebill was able to make TV advertising a key channel for reaching new users.

And of course, the financial uncertainty has made the product more appealing too — particularly its smart savings tool, where users can automatically set aside money for their goals.

“People became aware of the need to have some cushion,” Mokhtarzada said. “You should start saving when things are going well, before you need it, but [saving during the pandemic] is better than not doing it at all. We’ve seen a big bump in smart savings adoption, which is at an all-time high.”

Image Credits: Truebill

The new round brings Truebill’s total funding to $40 million. It was led by Bessemer Venture Partners, with participation from Eldridge Capital, Cota Capital, Firebolt Ventures and Day One Ventures.

The startup says the round will allow it to develop new products and features, including net worth tracking, automated debt payments and shared accounts.

Mokhtarzada added that the company will be making big investments in data science to help follow its “north star” of financial health, where he said, “The data challenge is significant.”

Sure, it’s pretty straightforward to recognize whether someone’s doing well or poorly financially, but the real goal is to “recognize trends and shortfalls before they happen.”

For example, instead of simply alerting users when they’ve been charged an overdraft fee on their account, Mokhtarzada said, “What is helpful is to have predictive models analyze data to anticipate a cashflow shortage and have the right tools in place that prevent it.”

Powered by WPeMatico

A Y Combinator-backed startup that is helping major companies efficiently listen to how happy — or unhappy — their employees are and resolve their issues on time to retain talent just raised a new financing round from several high-profile executives.

InFeedo, a four-year-old people analytics SaaS startup with headquarters in Gurgaon, said on Thursday it has raised $3.2 million in its Series A funding round. Bling Capital led the round and its founder, Benjamin Ling, who previously served as a general partner at Khosla Ventures and executive roles at Google and Facebook, has assumed a board seat at InFeedo.

Simon Yoo of Green Visor Capital, Maninder Gulati, chief strategy officer at budget lodging startup Oyo, Munish Varma, managing director for EMEA region at SoftBank and Girish Mathrubootham, founder of SaaS giant Freshworks, are among those who participated in the round.

As a business grows up and the headcount balloons over thousand, ten thousand, and tens of thousands, it becomes impossible for the chief executive to engage meaningfully with employees to gauge their morale and understand if there is anything they wish the company changed.

InFeedo is tackling this challenge through Amber, a chatbot it has built that touches base with employees periodically to quickly check how things are going, explained Tanmaya Jain, founder and chief executive of the four-year-old startup.

On the backend, executives can check the status of their employees across the company and how likely some individuals — especially the top talent — are at leaving the firm. They can check exactly what issues these employees have raised in the past, and whether their concerns were resolved.

Amber is able to track the progress because it remembers what an employee has previously shared. So each future conversation begins with it asking whether anything has meaningfully changed since the last time it spoke to the employee.

“Almost three years ago, we started using Amber at OYO and I was amazed by the product. We were using this for executive decision-making, to get an accurate pulse of our employees across geographies, functions as we were expanding across the world. I actually reached out to Tanmaya and am excited to be part of this journey,” said Oyo’s Gulati in a statement.

InFeedo has amassed more than 100 customers — including GE Healthcare, Puma, steel-to-salt conglomerate Tata Group, telecom firm Airtel, computer vendor Lenovo, Oyo, Indian internet conglomerate Times Internet and edtech giant Byju’s — across over 50 countries. More than 300,000 users today use InFeedo’s service. The startup today is clocking an annual revenue run rate of $1.6 million, something Jain said he is working to get to $10 million.

For Jain, 26, InFeedo’s current avatar is the third pivot he has made at the startup. InFeedo started as an edtech platform to create a feedback loop between students and their teachers. The startup then explored building a social network for companies. Neither of those ideas gained much traction, he explained. During the third attempt, Jain said he spent days at his early customers to understand exactly what features they needed.

As part of the new financing round, InFeedo, which has raised $4 million to date, said it has delivered partial exits of $1.1 million to early investors and early employees or those who left. “Helping people around me make so much money has been one of the most fulfilling things for me,” he said, adding that this liquidity at the time of a pandemic has been immensely useful to many.

The startup plans to deploy the new funding to make Amber understand multiple languages, a key aspect that Jain said would help the startup better serve clients in adjacent markets to India. InFeedo also wants to expand the use cases of Amber and experiment with new technologies such as GPT-3. It is also hiring for product, engineering and marketing leadership roles.

Powered by WPeMatico

A lot of the focus in online education — and, let’s face it, education overall — has been about professional development for knowledge workers, education for K-12 and how best to deliver cost-effective, engaging higher learning to those in college and beyond. But in what might be a sign of the times, today a startup that’s focused on e-learning and the subsequent job market for a completely different end of the spectrum — home services — is announcing some funding to continue building out its business in earnest.

Nana, which runs a free academy to teach people how to fix appliances, and then gives students the option of becoming a part of its own marketplace to connect them to people needing repairs — has picked up $6 million.

The seed round is being led by Shripriya Mahesh of Spero Ventures; Next Play Ventures (ex-LinkedIn CEO Jeff Weiner’s new fund), Lachy Groom, Scott Belsky, Geoff Donaker of Burst Capital and Michael Staton of Learn Capital are among those also participating.

Nana has now raised $10.7 million, with past backers including Alpha Bridge Ventures, Bob Lee and the Uber Syndicate, an investment vehicle to back Uber alums in new ventures. Founder and CEO David Zamir is not actually an Uber alum, but one of his first employees, VP of Engineering Oliver Nicholas is an early Uber engineer and the company has also found a lot of traction of Uber drivers this year, after many found themselves out of work after the chilling effect that the pandemic had on ridesharing.

Nana — full name Nana Technologies (and not to be confused with Nana Technology, tech built for older adults) — is partly a labor/future of work play, partly an educational play, partly a tech/IoT play and partly an ecological play, in the eyes of Zamir, who himself trained as an appliance repairperson, running his own successful business in the Bay Area before pivoting it into a training platform and marketplace.

“There are 5.9 million tons of municipal solid waste [which includes lots of electronics like washing machines, blenders and everything in between] in the U.S.,” he said in an interview, “and only 50% of that is capable of getting recycled. We’re in a vicious cycle with appliances, and it’s partly because there aren’t enough people with the knowledge to repair them. But what if you had the liquidity to do that? We’re talking about creating jobs, but also saving the environment.”

Nana’s proposition starts with free lessons to fix a range of appliances — currently dishwashers, refrigerators, ovens, stoves, washers and dryers — and their typical breakdown/poor performance issues to anyone who wants to know how to repair them. These classes are available to anyone — an individual simply interested in learning how to fix a machine, but more likely someone looking to pick up a skill and then use it to make some money.

Once you take and pass a course — currently remote — you have the option (but not requirement) to register on Nana’s platform to become a repair person who picks up jobs through it to get jobs fixing that particular issue. Nana already has partnerships with major appliance and warranty companies, including GE, Miele, Samsung, Assurant, Cinch and First American Home Warranty, so this is how it gets most of its work in, but it also accepts direct requests from consumers for repair of dishwashers, refrigerators, ovens, stoves, washers and dryers.

Over time, Zamir said, the plan is not just to take in jobs and send out technicians to fix things in an Uber-style dispatch service — but to expand it to fit the kinds of next-generation appliances that are being built today, with IoT diagnostic monitoring and helping also to integrate these appliances into connected homes. It also seems to be slowly expanding into other home services too, alongside appliance repair (which remains its main business).

Nana has to date registered hundreds of technicians in 12 markets across the U.S. and said it expects to expand to 20 markets by the end of 2021.

Nana has an unlikely founder story that speaks to how so much of the tech world is still about hustle and finding opportunities in the margins.

Founder and CEO David Zamir hails from Israel, but unlike many of the transplants you may come across from there to the Bay Area tech world, he’s not a tech guy by education, training or work experience. He used to run clothing stores in Tel Aviv and vaguely liked the idea of being involved in a tech business at some point — Israel loves to call itself “startup nation,” so that bug is bound to bite even those who don’t study computer science or engineering — but he didn’t know what to do or where to begin.

“The clothing business didn’t make much money,” he said. So after a period Zamir and his American wife decided to move to the U.S. and try their luck there.

While initially based on the east coast near her family and wondering about what kind of job to pursue, Zamir spoke with a friend of his in Toronto who was working as an independent tradesperson fixing appliances, and the friend suggested this as an option, at least for a while.

“So I hopped on an airplane to shadow my friend,” he recalled. “The lightbulb went off. I thought, I should do this in San Francisco,” where he had been wanting to move to crack in to the tech world, somehow. “I thought that I’d start with fixing appliances while I figured out how to find my way into tech.”

That turned into more than a temporary income stopgap, of course. After finding that his business was taking off, Zamir saw that technology would be the avenue to growing it.

He was helped in part to build the idea and the business through his grit. Josh Elman, the famous tech investor, complained about a broken dryer back in April, and asked the Twitter hive mind whether he should get a new one or go through the pain of fixing it. Someone flagged the question to Zamir, who reached out and connected Elman with one of Nana’s online teaching technicians. Twelve hours later, Elman’s drier was diagnosed (by Elman), on its way to getting fixed, and Elman signed on as an advisor to the company.

The world of tech is all about building new things and solving problems, with “breaking” being more synonymous with disruption (= “good”) and fearlessness (see: Facebook’s old mantra to its early employees to move fast and break things). But behind that, there is an interesting disconnect between the tech version of “broken” and objects that are actually “broken” in the real world.

Many of us these days find using apps and other digital interfaces second-nature, but most of us would have no idea how to repair or work with much more basic electronic systems. And nor do most of us want to. More often than not, we give up on it, decide it’s not worth fixing and click on Amazon et al. to get a new shiny object.

Looked at on a wider scale, this is actually a big problem.

Electronics can be recycled, but in reality only about half the materials can be usefully reused. Meanwhile, Nana estimates that the appliance repair market is a $4 billion opportunity, with some 80 million appliances in need of being serviced annually in the U.S. But currently there are only some 31,000 trained technicians in the market. Nana estimates that to meet the demand of growing numbers, an additional 28,000 new technicians will be needed by 2025.

At the same time, the move to automation in many skilled labor jobs is putting people out of work: research from the Brookings Institution estimates that some 30 million people will lose their jobs in coming years because of it.

The idea here is that a platform like Nana can help some of those people retrain to fill the gap for appliance technicians, while at the same time extending the life of people’s appliances in a less painful way — putting less stuff into landfill — while at the same time expanding knowledge for anyone who cares for it.

Zamir said that Nana was named after his mother, who raised David as a single parent after his father passed away, a reference to working hard and being practical.

That sentimentality seems to motivate him in a bigger way, too: Zamir himself is a guy with a lot of heart and emotion vested into the concept of his startup. When I told him an anecdote of how our dishwasher broke down earlier this year and both a customer service rep from the maker (Siemens) and a separate repair person advised me to replace it, he got visibly agitated over our video call, as if the subject was something political or significantly more grave than a story about a dishwasher.

“I am not a supporter of what they told you,” he said in an angry voice. “It’s really upsetting me.” (I calmed him down a little, I think, when I told him that I myself uninstalled the broken dishwasher and installed the new one myself, because COVID.)

Zamir said that there are no plans to charge for its academy courses, nor to tie people into signing up with Nana to work once they take the courses. The fact that it provides a lot of inbound jobs attracts enough turnover — between 40% and 60% of those taking courses stay on to work when they took in-person classes, and for now the online figures are between 15% and 35%.

“It’s still early days,” he said, “but we’re finding the take up impressive… Most want to participate in the marketplace.” He says that there are other call-out services where they could register, but the tech that Nana has built makes its system more efficient, and that means better returns.

All of this has played well with those who have become Nana’s investors. People like Jeff Weiner — who in his time as CEO of LinkedIn led the company to acquire Lynda as part of a bigger emphasis on the importance of skills training and education — see the opportunity and need to provide an equivalent platform not just for knowledge workers but those who have more manual jobs, too.

“We are excited by Nana’s vision of providing training, access and opportunity for rewarding, satisfying work while also filling a critical gap in our economy,” said Shripriya Mahesh of Spero Ventures, in a statement. “Nana has created a new, scalable approach to giving people the agency, tools and support systems they need to build new skills and pursue fulfilling work opportunities.”

The round was oversubscribed in the end, and Nana shouldn’t find it too hard to raise again if it sticks to its plan and the market continues to grow as it has. That does not seem to be the motivation for Zamir, though.

“We just think it’s super important to build Nana for the people,” he said.

Powered by WPeMatico

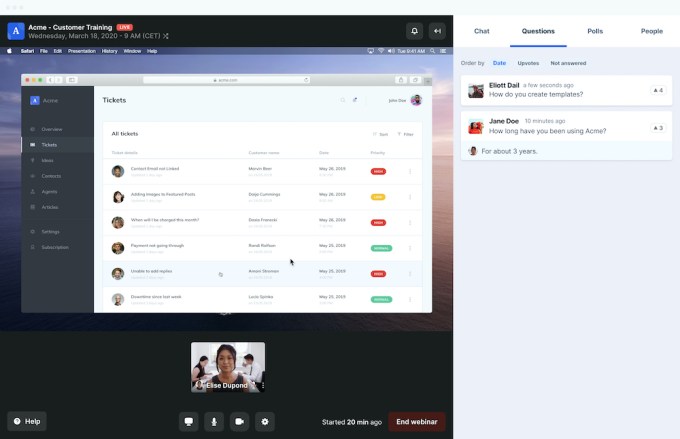

Video communication startup Livestorm announced today that it has raised $30 million in Series B funding.

Co-founder and CEO Gilles Bertaux told me that the company started out with a focus on webinars before launching a video meeting product as well (which we used for our interview).

“The way we think about it is, webinars and meetings are not use cases,” Bertaux said.

He argued that it’s more meaningful to talk about whether you’re having a team meeting or a training demo or whatever else, and then how many people you want to attend, with Livestorm supporting all of those use cases and meeting sizes through different templates: “We’re trying to remove the semantic distinction of meeting and webinar out of the equation.”

Among other things, Livestorm is distinguished from other video conferencing tools because it’s purely browser based, without requiring presenters or attendees to install any software. The company says it has grown revenue 8x since it raised its €4.6 million Series A last fall, with a customer base that now includes 3,500 customers such as Shopify, Honda and Sephora.

Image Credits: Livestorm

Of course, you’d expect a video communication product to do well in 2020. At the same time, Zoom has dominated the remote work conversation this year — in fact, Bertaux acknowledged that Zoom may have built “the best video meeting technology.”

But he also suggested that the landscape is changing: “The thing is, we’re entering a period where video is becoming a commodity.”

So the Livestorm team is less focused on the core video technology and more on the experience around the video, with in-meeting features like screen sharing and virtual background, as well as a broader suite of marketing tools that allow customers to continue delivering targeted messages to event attendees.

Bertaux compared Livestorm to HubSpot, which he said “didn’t reinvent landing pages,” but put the different pieces of the marketing stack together around those landing pages.

The Livestorm executive team. Image Credits: Livestorm

“In 2021, we want to have the biggest ecosystem of integrations on a video product,” he said.

The round was led by Aglaé Ventures and Bpifrance Digital Venture, with participation from Raise Ventures and IDInvest.

In a statement, Aglaé Ventures partner Cyril Guenoun similarly described Livestorm “the HubSpot for video communications,” adding, “Video and online events have become essential in 2020, and are here to stay. The Livestorm platform thrives in this environment, providing a seamless solution for meetings and events with all the connectors that marketing, sales, customer service and HR pros need to make video a tightly integrated part of their communications strategies.”

Bertaux said the new funding will allow Paris-headquartered Livestorm to continue expanding into North America — apparently, the U.S. already represents one-third of its customer base and is the company’s fastest-growing region.

Powered by WPeMatico

Menlo Security, a malware and phishing prevention startup, announced a $100 million Series E today on an $800 million valuation. The round was led by Vista Equity Partners with help from Neuberger Berman, General Catalyst, JP Morgan and other unnamed existing investors. The company has now raised approximately $250 million.

CEO and co-founder Amir Ben-Efraim says that while the platform has expanded over the years, the company stays mostly focused on web and email as major attack vectors for customers. “We really focused on a better kind of security outcome relative to the major threat factors of web and email. So web and email is really how most of the world or the enterprise world at least does its work, and these channels remain forever vulnerable to the latest attack,” Ben-Efraim explained.

He says that to protect those attack surfaces, the company pioneered a technology called web isolation to disconnect the user from the content and send only safe visuals. “When they click a link or engage with a website, the safe visuals are guaranteed to be malware-free, no matter where you go or you end up,” Ben-Efraim said.

With a valuation of $800 million, he’s proud having built his company from the ground up to this point. He’s not quite ready to discuss an IPO yet, but he expects to take this large influx of cash and continue to grow an independent company with an IPO perhaps three years out.

With an increase in business and the new capital, the company, which has 270 employees of which around 70 came on board this year, hopes to continue to grow at that pace in 2021. He says that as that happens the security startup has been paying close attention to the social justice movements.

“As a management team and for myself as a CEO, it’s an important topic. So we were paying close attention to our own diversification goals. We want Menlo to become a more diversified company,” Ben-Efraim said. He believes the way to get there is to prioritize recruiting channels where they can tap into a wider variety of potential recruits for the company.

While he wouldn’t discuss revenue, he did say in spite of the pandemic, the business is growing rapidly and sales are up 155% in terms of net new sales over last year. “The momentum for that being customers specifically in critical infrastructure, financial services, government and the like are seeing an uptick in attacks associated with COVID, and are looking at security as essential in an area that they need to double down on. So despite the financial difficulties, that’s created a bit of a tailwind for us strangely in 2020, even though the world economy as a whole is clearly being challenged by this epidemic,” he said.

Powered by WPeMatico

PUBG Mobile plans to return in India in a new avatar, parent company PUBG Corporation said on Thursday. TechCrunch reported last week that the South Korean gaming firm was plotting its return to the world’s second largest internet market two months after its marquee title was banned by the country.

The new game, called PUBG Mobile India, has been specially created for users in India, PUBG Corporation said. It did not share when it plans to release the title.

Additionally, the company — and its parent firm, KRAFTON — said they plan to make an investment worth $100 million in India, one of the largest markets of PUBG Mobile, to cultivate the local video game, esports, entertainment and IT industries ecosystems. It also plans for more than 100 employees in the country.

“Thanks to overwhelming community enthusiasm for PUBG esports in India, the company also plans to make investments by hosting India-exclusive esports events, which will feature the biggest tournaments, the largest prize pools, and the best tournament productions,” it said in a statement.

New Delhi has banned more than 200 apps with links to China — including PUBG Mobile and TikTok — in recent months because of cybersecurity concerns. The ban was enforced as tensions escalated on the nations’ disputed border.

To allay concerns of the Indian government, PUBG Mobile cut ties with Chinese internet giant Tencent — which is its publisher in many markets — in India days after the order. Last week it inked a global deal with Microsoft to move all PUBG Mobile data — as well as data from its other properties — to Azure. Microsoft operates three cloud regions in India.

In a statement today, PUBG Corporation said, “privacy and security of Indian player data being a top priority for PUBG Corporation, the company will conduct regular audits and verifications on the storage systems holding Indian users’ personally identifiable information to reinforce security and ensure that their data is safely managed.”

Prior to the ban in early September, PUBG Mobile had amassed over 50 million monthly active users in India, more than any other mobile game in the country. It helped establish an entire ecosystem of esports organisations and even a cottage industry of streamers that made the most of its spectator sport-friendly gameplay, said Rishi Alwani, a longtime analyst of the Indian gaming market and publisher of news outlet The Mako Reactor.

PUBG Corporation’s move today could also set a precedence for other impacted apps to chart their returns to the country. One thing — and perhaps the most crucial element in all of this — that remains unclear for now is whether the Indian government has approved PUBG Corporation’s move.

Powered by WPeMatico

Mozart Data founders Peter Fishman and Dan Silberman have been friends for over 20 years, working at various startups, and even launching a hot sauce company together along the way. As technologists, they saw companies building a data stack over and over. They decided to provide one for them and Mozart Data was born.

The company graduated from the Y Combinator Summer 2020 cohort in August and announced a $4 million seed round today led by Craft Ventures and Array Ventures with participation from Coelius Capital, Jigsaw VC, Signia VC, Taurus VC and various angel investors.

In spite of the detour into hot sauce, the two founders were mostly involved in data over the years and they formed strong opinions about what a data stack should look like. “We wanted to bring the same stack that we’ve been building at all these different startups, and make it available more broadly,” Fishman told TechCrunch.

They see a modern data stack as one that has different databases, SaaS tools and data sources. They pull it together, process it and make it ready for whatever business intelligence tool you use. “We do all of the parts before the BI tool. So we extract and load the data. We manage a data warehouse for you under the hood in Snowflake, and we provide a layer for you to do transformations,” he said.

The service is aimed mostly at technical people who know some SQL like data analysts, data scientists and sales and marketing operations. They founded the company earlier this year with their own money, and joined Y Combinator in June. Today, they have about a dozen customers and six employees. They expect to add 10-12 more in the next year.

Fishman says they have mostly hired from their networks, but have begun looking outward as they make their next hires with a goal of building a diverse company. In fact, they have made offers to several diverse candidates, who didn’t ultimately take the job, but he believes if you start looking at the top of the funnel, you will get good results. “I think if you spend a lot of energy in terms of top of funnel recruiting, you end up getting a good, diverse set at the bottom,” he said.

The company has been able to start from scratch in the midst of a pandemic and add employees and customers because the founders had a good network to pitch the product to, but they understand that moving forward they will have to move outside of that. They plan to use their experience as users to drive their message.

“I think talking about some of the whys and the rationale is our strategy for adding value to customers […], it’s about basically how would we set up a data stack if we were at this type of startup,” he said.

Powered by WPeMatico

This year, more than ever before because of the COVID-19 pandemic, huge droves of workers and consumers have been turning to the internet to communicate, get things done and entertain themselves. That has created a huge bonanza for cybercriminals, but also companies that are building tools to combat them.

In the latest development, an Israel-hatched, Mountain View-based enterprise startup called SentinelOne — which has built a machine learning-based solution that it sells under the brand Singularity that works across the entire edge of the network to monitor and secure laptops, phones, containerised applications and the many other devices and services connected to a network — has closed $267 million in funding to continue expanding its business to meet demand, which has seen business boom this year. Its valuation is now over $3 billion.

Given the large sums the company has now raised — $430 million to date — the funding will likely be used for acquisitions (cyber is a very crowded market and will likely see some strong consolidation in the coming years), as well as more in-house development and sales and marketing. Earlier this year, CEO and founder Tomer Weingarten told me that an IPO “would be the next logical step” for the company. “But we’re not in any rush,” he said at the time. “We have one to two years of growth left as a private company.”

SentinelOne contacted TechCrunch with the above details but said that an official press release was due only to be released at 3 p.m. U.K. time. We’ll update with more details if they’re available when they are published. In the meantime, other outlets such as Calcalist in Israel (in Hebrew) have also published these details. And it should be noted that the round was rumored for almost a month ahead of this, although the sums raised were off by quite a bit: the reports had said $150-200 million.

(Side note: Why the pointless games with timings and exclusives? Who knows — I certainly don’t. )

This round included Tiger Global, Sequoia, Insight Partners, Third Point Ventures and Qualcomm Ventures . It looks like Sequoia — which is currently building up a new European operation to look more closely at opportunities on this side of the globe — is the only new name in that list. The others have all backed SentinelOne in previous rounds.

It was only in February of this year that SentinelOne had raised $200 million at a $1.1 billion valuation.

The rapid fundraising, from a top-shelf list of firms, is a notable aspect of this story.

In the world of startups, we are firmly living in a time when investors are looking for strong opportunities to back companies that are shining in a market that is particularly challenging. COVID-19 has all but decimated the travel industry and live in-person event industry, among others.

But services that are helping people continue to live their lives, and those that are helping find a cure or at least solutions to minimise the impact, are very much in demand.

The cybersecurity market — in particular companies that are providing solutions that can immediately prove to be effective in what is an increasingly sophisticated threat landscape — is incredibly active right now, even more than it already was.

“Around 450 cybersecurity companies are operating in Israel, constituting 5% of the global cybersecurity market, in some cyber segments the two world leaders are by Israeli founders like CheckPoint and Palo Alto,” noted Avihai Michaeli, an advisor who scouts startups for corporate VCs.

Within that, endpoint security, the area where SentinelOne concentrates its efforts, is particularly strong. Last year, endpoint security solutions was estimated to be around an $8 billion market, and analysts project that it could be worth as much as $18.4 billion by 2024.

While SentinelOne has a lot of competitors — they include Microsoft, CrowdStrike, Kaspersky, McAfee and Symantec — it is also a strong player in the market. Relying on the advances of AI and with roots in the Israeli cyberintelligence community, its platform is built around the idea of working automatically not just to detect endpoints and their vulnerabilities, but to apply behavioral models, and various modes of protection, detection and response in one go.

“We are seeing more automated and real-time attacks that themselves are using more machine learning,” Weingarten said to me this year. “That translates to the fact that you need defence that moves in real time as with as much automation as possible.”

As of February, it had 3,500 customers, including three of the biggest companies in the world, and “hundreds” from the global 2,000 enterprises, with 113% year-on-year new bookings growth, revenue growth of 104% year-on-year and 150% growth year-on-year in transactions over $2 million. Those numbers will have likely grown significantly since then. (We’ll update as and when we learn more.)

Powered by WPeMatico