funding

Auto Added by WPeMatico

Auto Added by WPeMatico

When you launch an application in the public cloud, you usually put everything on one provider, but what if you could choose the components based on cost and technology and have your database one place and your storage another?

That’s what Cast.ai says that it can provide, and today it announced a healthy $7.7 million seed round from TA Ventures, DNX, Florida Funders and other unnamed angels to keep building on that idea. The round closed in June.

Company CEO and co-founder Yuri Frayman says that they started the company with the idea that developers should be able to get the best of each of the public clouds without being locked in. They do this by creating Kubernetes clusters that are able to span multiple clouds.

“Cast does not require you to do anything except for launching your application. You don’t need to know […] what cloud you are using [at any given time]. You don’t need to know anything except to identify the application, identify which [public] cloud providers you would like to use, the percentage of each [cloud provider’s] use and launch the application,” Frayman explained.

This means that you could use Amazon’s RDS database and Google’s ML engine, and the solution decides how to make that work based on your requirements and price. You set the policies when you are ready to launch and Cast will take care of distributing it for you in the location and providers that you desire, or that makes most sense for your application.

The company takes advantage of cloud-native technologies, containerization and Kubernetes to break the proprietary barriers that exist between clouds, says company co-founder Laurent Gil. “We break these barriers of cloud providers so that an application does not need to sit in one place anymore. It can sit in several [providers] at the same time. And this is great for the Kubernetes application because they’re kind of designed with this [flexibility] in mind,” Gil said.

Developers use the policy engine to decide how much they want to control this process. They can simply set location and let Cast optimize the application across clouds automatically, or they can select at a granular level exactly the resources they want to use on which cloud. Regardless of how they do it, Cast will continually monitor the installation and optimize based on cost to give them the cheapest options available for their configuration.

The company currently has 25 employees with four new hires in the pipeline, and plans to double to 50 by the end of 2021. As they grow, the company is trying keep diversity and inclusion front and center in its hiring approach; they currently have women in charge of HR, marketing and sales at the company.

“We have very robust processes on the continuous education inside of our organization on diversity training. And a lot of us came from organizations where this was very visible and we took a lot of those processes [and lessons] and brought them here,” Frayman said.

Frayman has been involved with multiple startups, including Cujo.ai, a consumer firewall startup that participated in TechCrunch Disrupt Battlefield in New York in 2016.

Powered by WPeMatico

U.S. challenger bank Current, which has doubled its member base in less than six months, announced this morning it raised $131 million in Series C funding, led by Tiger Global Management. The additional financing brings Current to over $180 million in total funding to date, and gives the company a valuation of $750 million.

The round also brought in new investors Sapphire Ventures and Avenir. Existing investors returned for the Series C, as well, including Foundation Capital, Wellington Management Company and QED.

Current began as a teen debit card controlled by parents, but expanded to offer personal checking accounts last year, using the same underlying banking technology. The service today competes with a range of mobile banking apps, offering features like free overdrafts, no minimum balance requirements, faster direct deposits, instant spending notifications, banking insights, check deposits using your phone’s camera and other now-standard baseline features for challenger banks.

In August 2020, Current debuted a points rewards program in an effort to better differentiate its service from the competition, which as of this month now includes Google Pay.

When Current raised its Series B last fall, it had over 500,000 accounts on its service. Today, it touts over 2 million members. Revenue has also grown, increasing by 500% year-over-year, the company noted today.

“We have seen a demonstrated need for access to affordable banking with a best-in-class mobile solution that Current is uniquely suited to provide,” said Current founder and CEO Stuart Sopp, in a statement about the fundraise. “We are committed to building products specifically to improve the financial outcomes of the millions of hard-working Americans who live paycheck to paycheck, and whose needs are not being properly served by traditional banks. With this new round of funding we will continue to expand on our mission, growth and innovation to find more ways to get members their money faster, help them spend it smarter and help close the financial inequality gap,” he added.

The additional funds will be used to further develop and expand Current’s mobile banking offerings, the company says.

Powered by WPeMatico

Supply chains used to be one of those magical elements of capitalism that seemed to be designed by Apple: they just worked. Minus the occasional salmonella outbreak in your vegetable aisle, we could go about our daily consumer lives never really questioning how our fast-fashion clothes, tech gadgets and medical supplies actually got to our shelves or homes.

Of course, a lot has changed over the past few years. Anti-globalization sentiment has grown as a political force, driving governments like the United States and the United Kingdom to renegotiate free trade agreements and attempt to onshore manufacturing while disrupting the trade status quo. Meanwhile, the COVID-19 pandemic placed huge stress on supply chains — with some entirely breaking in the process.

In short, supply chain managers suddenly went from one of those key functions that no one wants to think about, to one of those key functions that everyone thinks about all the time.

While these specialists have access to huge platforms from companies like Oracle and SAP, they need additional intelligence to understand where these supply chains could potentially break. Are there links in the supply chain that might be more brittle than at first glance? Are there factories in the supply chain that are on alert lists for child labor or environmental violations? What if government trade policy shifts — are we at risk of watching products sit in a cargo container at a port?

New York-headquartered Altana wants to be that intelligence layer for supply chain management, bringing data and machine learning to bear against the complexity of modern capitalism. Today, the company announced that it has raised $7 million in seed financing led by Anne Glover of London-based Amadeus Capital Partners.

The three founders of the startup, CEO Evan Smith, CTO Peter Swartz and COO Raphael Tehranian, all worked together on Panjiva, a global supply chain platform that was founded in 2006, funded by Battery Ventures a decade ago, and sold to S&P Global in early 2018. Panjiva’s goal was to build a “graph” of supply chains that would offer intelligence to managers.

That direct experience informs Altana’s vision, which in many ways is the same as Panjiva’s but perhaps revamped using newer technology and data science. Again, Altana wants to build a supply chain knowledge graph, provide intelligence to managers and create better resilience.

The difference has to do with data. “What we continually found when we were in the data sales business was that you are kind of stuck in that place in the value chain,” Smith said. “Your customers won’t let you touch their data, because they don’t trust you with it, and other proprietary data companies don’t let you work on and manage and transform their data.”

Instead of trying to be the central repository for all data, Altana is “operating downstream” from all of these data sources, allowing companies to build their own supply chain graphs using their own data and whatever other data sources to which they have access.

The company sells into procurement offices, which are typically managed in the CFO’s office. Today, the majority of customers for Altana are government clients such as border control, where “the task is to pick the needles out of the haystack as the ship arrives and you’ve got to pick the illicit shipments from the safe ones and actually facilitate the lawful trade,” Smith said.

The company’s executive chairman is Alan Bersin, who is a former commissioner of the U.S. Customs and Border Protection agency currently working as a policy consultant for Covington & Burling, which has been one of the premier law firms on trade issues like CFIUS during the Trump administration.

Altana allows one-off investigations and simulations, but its major product goal is to offer real-time alerts that give supply chain managers substantive visibility into changes that affect their business. For instance, rather than waiting for an annual labor or environmental audit to find issues, Altana hopes to provide predictive capabilities that allow companies to solve problems much faster than before.

In addition to Amadeus, Schematic Ventures, AlleyCorp and the Working Capital – The Supply Chain Investment Fund also participated.

Powered by WPeMatico

Consumer drones have over the years struggled with an image of being no more than expensive and delicate toys. But applications in industrial, military and enterprise scenarios have shown that there is indeed a market for unmanned aerial vehicles, and today, a startup that makes drones for some of those latter purposes is announcing a large round of funding and a partnership that provides a picture of how the drone industry will look in years to come.

Percepto, which makes drones — both the hardware and software — to monitor and analyze industrial sites and other physical work areas largely unattended by people, has raised $45 million in a Series B round of funding.

Alongside this, it is now working with Boston Dynamics and has integrated its Spot robots with Percepto’s Sparrow drones, with the aim being better infrastructure assessments, and potentially more as Spot’s agility improves.

The funding is being led by a strategic backer, Koch Disruptive Technologies, the investment arm of industrial giant Koch Industries (which has interests in energy, minerals, chemicals and related areas), with participation also from new investors State of Mind Ventures, Atento Capital, Summit Peak Investments and Delek-US. Previous investors U.S. Venture Partners, Spider Capital and Arkin Holdings also participated. (It appears that Boston Dynamics and SoftBank are not part of this investment.)

Israel-based Percepto has now raised $72.5 million since it was founded in 2014, and it’s not disclosing its valuation, but CEO and founder Dor Abuhasira described as “a very good round.”

“It gives us the ability to create a category leader,” Abuhasira said in an interview. It has customers in around 10 countries, with the list including ENEL, Florida Power and Light and Verizon.

While some drone makers have focused on building hardware, and others are working specifically on the analytics, computer vision and other critical technology that needs to be in place on the software side for drones to work correctly and safely, Percepto has taken what I referred to, and Abuhasira confirmed, as the “Apple approach”: vertical integration as far as Percepto can take it on its own.

That has included hiring teams with specializations in AI, computer vision, navigation and analytics as well as those strong in industrial hardware — all strong areas in the Israel tech landscape, by virtue of it being so closely tied with its military investments. (Note: Percepto does not make its own chips: these are currently acquired from Nvidia, he confirmed to me.)

“The Apple approach is the only one that works in drones,” he said. “That’s because it is all still too complicated. For those offering an Android-style approach, there are cracks in the complete flow.”

It presents the product as a “drone-in-a-box”, which means in part that those buying it have little work to do to set it up to work, but also refers to how it works: its drones leave the box to make a flight to collect data, and then return to the box to recharge and transfer more information, alongside the data that is picked up in real time.

The drones themselves operate on an on-demand basis: they fly in part for regular monitoring, to detect changes that could point to issues; and they can also be launched to collect data as a result of engineers requesting information. The product is marketed by Percepto as “AIM”, short for autonomous site inspection and monitoring.

News broke last week that Amazon has been reorganising its Prime Air efforts — one sign of how some more consumer-facing business applications — despite many developments — may still have some turbulence ahead before they are commercially viable. Businesses like Percepto’s stand in contrast to that, with their focus specifically on flying over, and collecting data, in areas where there are precisely no people present.

It has dovetailed with a bigger focus from industries on the efficiencies (and cost savings) you can get with automation, which in turn has become the centerpiece of how industry is investing in the buzz phrase of the moment, “digital transformation.”

“We believe Percepto AIM addresses a multi-billion-dollar issue for numerous industries and will change the way manufacturing sites are managed in the IoT, Industry 4.0 era,” said Chase Koch, president of Koch Disruptive Technologies, in a statement. “Percepto’s track record in autonomous technology and data analytics is impressive, and we believe it is uniquely positioned to deliver the remote operations center of the future. We look forward to partnering with the Percepto team to make this happen.”

The partnership with Boston Dynamics is notable for a couple of reasons: it speaks to how various robotics hardware will work together in tandem in an automated, unmanned world, and it speaks to how Boston Dynamics is pulling up its socks.

On the latter front, the company has been making waves in the world of robotics for years, specifically with its agile and strong dog-like (with names like “Spot” and “Big Dog”) robots that can cover rugged terrain and handle tussles without falling apart.

That led it into the arms of Google, which acquired it as part of its own secretive moonshot efforts, in 2013. That never panned out into a business, and probably gave Google more complicated optics at a time when it was already being seen as too powerful. Then, SoftBank stepped in to pick it up, along with other robotics assets, in 2017. That hasn’t really gone anywhere either, it seems, and just this month it was reported that Boston Dynamics was reportedly facing yet another suitor, Hyundai.

All of this is to say that partnerships with third parties that are going places (quite literally) become strong signs of how Boston Dynamics’ extensive R&D investments might finally pay off with enterprising dividends.

Indeed, while Percepto has focused on its own vertical integration, longer term and more generally there is an argument to be made for more interoperability and collaboration between the various companies building “connected” and smart hardware for industrial, physical applications.

It means that specific industries can focus on the special equipment and expertise they require, while at the same time complementing that with hardware and software that are recognised as best-in-class. Abuhasira said that he expects the Boston Dynamics partnership to be the first of many.

That makes this first one an interesting template. The partnership will see Spot carrying Percepto’s payloads for high-resolution imaging and thermal vision “to detect issues including hot spots on machines or electrical conductors, water and steam leaks around plants and equipment with degraded performance, with the data relayed via AIM.” It will also mean a more thorough picture, beyond what you get from the air. And, potentially, you might imagine a time in the future when the data that the combined devices source results even in Spot (or perhaps a third piece of autonomous hardware) carrying out repairs or other assistance.

“Combining Percepto’s Sparrow drone with Spot creates a unique solution for remote inspection,” said Michael Perry, VP of Business Development at Boston Dynamics, in a statement. “This partnership demonstrates the value of harnessing robotic collaborations and the insurmountable benefits to worker safety and cost savings that robotics can bring to industries that involve hazardous or remote work.”

Powered by WPeMatico

The Chinese Uber for trucks Manbang announced Tuesday that it has raised $1.7 billion in its latest funding round, two years after it hauled in $1.9 billion from investors including SoftBank Group and Alphabet Inc.’s venture capital fund CapitalG.

The news came fresh off a Wall Street Journal report two weeks ago that Manbang was seeking $1 billion ahead of an initial public offering next year. The company declined to comment on the matter, though its CEO Zhang Hui said in May 2019 that the firm was “not in a rush” to go public.

Manbang said it achieved profitability this year. Its valuation was reportedly on course to reach $10 billion in 2018.

The company, which runs an app matching truck drivers and merchants transporting cargo and provides financial services to truckers, was formed from a merger between rivals Yunmanman and Huochebang in 2017. It was a time when China’s “sharing economy” craze began to see consolidation and shakeup.

The latest financing again attracted high-profile backers, including returning investors SoftBank Vision Fund and Sequoia Capital China, Permira and Fidelity, a consortium that co-led the round. Other participants were Hillhouse Capital, GGV Capital, Lightspeed China Partners, Tencent, Jack Ma’s YF Capital and more.

The company has other Alibaba ties. Its CEO Zhang, who founded Yunmanman, hailed from Alibaba’s famed B2B department where Manbang chairman Wang Gang also worked before he went on to fund ride-hailing giant Didi’s angel round.

Manbang claims its platform has more than 10 million verified drivers and 5 million cargo owners. The latest funding will allow it to further invest in research and development, upgrade its matching system and expand its service capacity to functions like door-to-door transportation.

Sequoia is quite bullish about truck-hailing as it made its sixth investment in Manbang. For Permira, a European private equity fund, the Manbang investment marked the China debut of its Growth Opportunities Fund.

Powered by WPeMatico

Cashfree, an Indian startup that offers a wide-range of payments services to businesses, has raised $35.3 million in a new financing round as the profitable firm looks to broaden its offering.

The Bangalore-based startup’s Series B was led by London-headquartered private equity firm Apis Partners (which invested through its Growth Fund II), with participation from existing investors Y Combinator and Smilegate Investments. The new round brings the startup’s to-date raise to $42 million.

Cashfree kickstarted its journey in 2015 as a solution for restaurants in Bangalore that needed an efficient way for their delivery personnel to collect cash from customers.

Akash Sinha and Reeju Datta, the founders of Cashfree, did not have any prior experience with payments. When their merchants asked if they could build a service to accept payments online, the founders quickly realized that Cashfree could serve a wider purpose.

In the early days, Cashfree also struggled to court investors, many of whom did not think a payments processing firm could grow big — and do so fast enough. But the startup’s fate changed after Y Combinator accepted its application, even though the founders had missed the deadline and couldn’t arrive to join the batch on time. Y Combinator later financed Cashfree’s seed round.

Fast-forward five years, Cashfree today offers more than a dozen products and services and helps over 55,000 businesses disburse salary to employees, accept payments online, set up recurring payments and settle marketplace commissions.

Some of its customers include financial services startup Cred, online grocer BigBasket, food delivery platform Zomato, insurers HDFC Ergo and Acko and travel ticketing service provider Ixigo. The startup works with several banks and also offers integrations with platforms such as Shopify, PayPal and Amazon Pay.

Based on its offerings, Cashfree today competes with scores of startups, but it has an edge — if not many. Cashfree has been profitable for the past three years, Sinha, who serves as the startup’s chief executive, told TechCrunch in an interview.

“Cashfree has maintained a leadership position in this space and is now going through a period of rapid growth fuelled by the development of unique and innovative products that serve the needs of its customers,” Udayan Goyal, co-founder and a managing partner at Apis, said in a statement.

The startup processed over $12 billion in payments volumes in the financial year that ended in March. Sinha said part of the fresh fund will be deployed in R&D so that Cashfree can scale its technology stack and build more services, including those that can digitize more offline payments for its clients.

Cashfree is also working on building cross-border payments solutions to explore opportunities in emerging markets, he said.

“We still see payments as an evolving industry with its own challenges and we would be investing in next-gen payments as well as banking tech to make payments processing easier and more reliable. With the solid foundation of in-house technologies, tech-driven processes and in-depth industry knowledge, we are confident of growing Cashfree to be the leader in the payments space in India and internationally,” he said.

Powered by WPeMatico

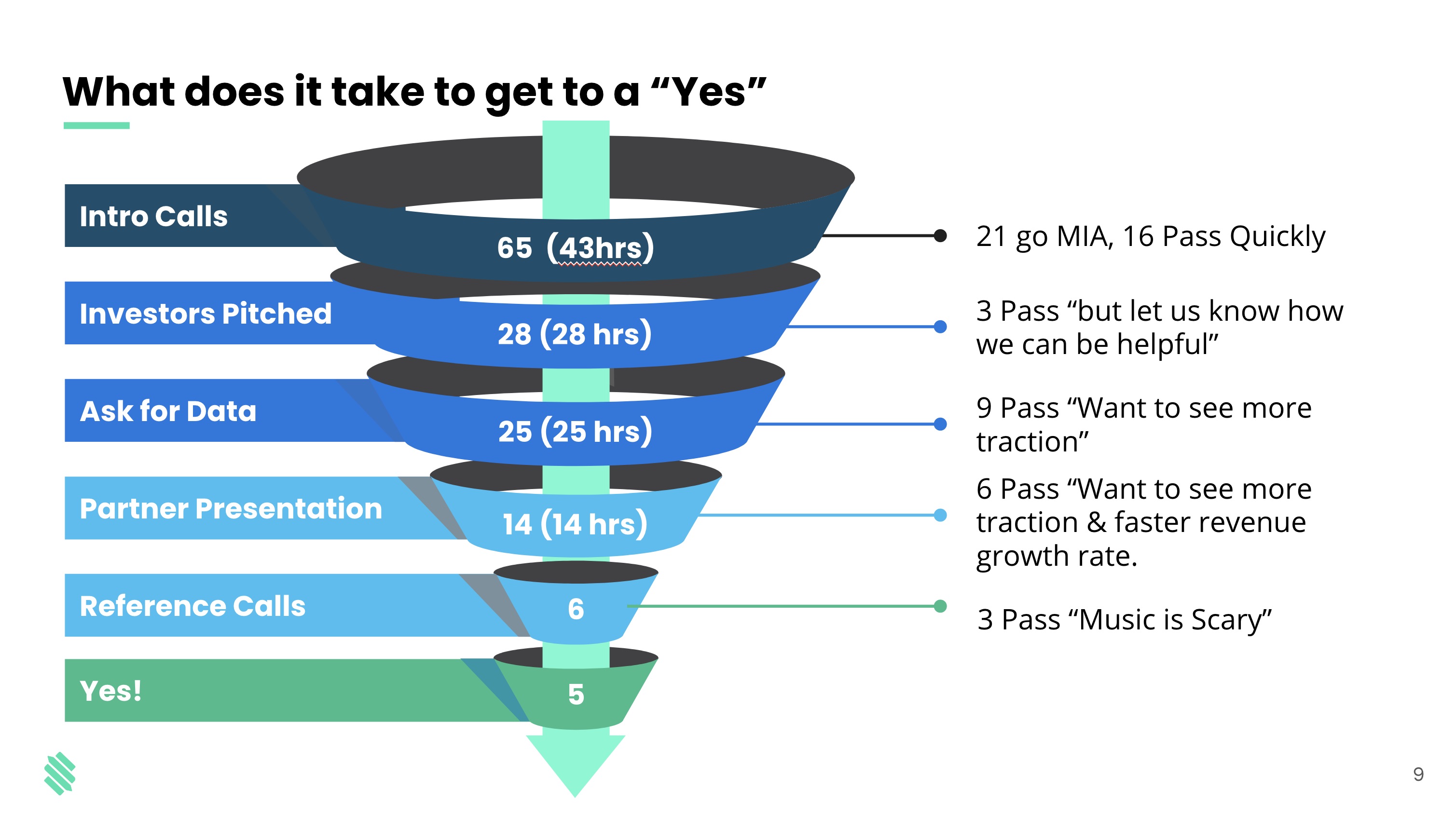

Milana Lewis, CEO and co-founder of music tech startup Stem, started the fundraising process long before she actually asked any investors for money (dig the well before you’re thirsty — it’s the best way). She recommends that other founders do the same.

Ten years ago, Milana started working at United Talent Agency (UTA), one of the world’s leading talent agencies. When tasked with finding the best tools and technologies that UTA’s clients could use to self-distribute their work, she discovered a glaring gap.

“There were all these tools built for the distribution of content, monetization of content and audience development,” she says. “The last piece missing was the financial aspect.” The entertainment industry desperately needed a platform that would help artists manage the financial side of their business — and that’s how the idea for Stem was born.

Because UTA had its own investment branch, called UTA Ventures, Milana’s job also introduced her to some brilliant investors. Years later, when it was time to fundraise for Stem, those connections played a pretty big role.

In an episode of How I Raised It, Milana shared how Stem has landed some superstar investors and raised a little under $22 million.

Milana’s involvement with UTA Ventures exposed her to the investor experience and put her in the same room as people like Gary Vaynerchuk, Jonathon Triest from Ludlow Ventures, Anthony Saleh from Wndrco and Scooter Braun.

After meeting them the first time, she made sure to nurture those relationships, and she was “honest and vulnerable” about the fact that she wanted to be an entrepreneur one day.

“It’s amazing how much people will help and support you along in that journey,” Milana says. Investors “get excited about making early-stage investments because they want to identify that person before anyone else does.”

As her idea for Stem came together, she shared that with them, too. Over the course of a year, she provided regular updates on her vision, like how she was building out her team, and she also called them for occasional advice.

By the time she approached some of them for funding, she didn’t even need to present a full pitch. By then, they already knew enough about Stem, and about Milana as a businesswoman. Her pitch meeting with Gary Vaynerchuk — the first person to invest — ended up being just 15 minutes long.

“I brought people on my entrepreneurial journey in the beginning,” Milana says. “The biggest piece of advice I could give is to start raising a year before you start raising. Start building relationships and data points.”

Image Credits: Nathan Beckord (opens in a new window)

For each round, Milana put together a lead list — a list of potential investors who she either met socially or through business. Each time, she wanted to have at least 100 names on this list.

Powered by WPeMatico

Superpeer, a startup that helps experts share and monetize their knowledge online, is announcing that it has raised $8 million in additional funding.

As I wrote in March, the Superpeer platform allows experts to promote, schedule and charge for one-on-one video calls with anyone who might want to ask for their advice.

In addition to announcing funding, the startup is also moving beyond one-on-one sessions by launching paid channels, where experts can charge a subscription fee for access to larger group sessions with video and chat. Co-founder and CEO Devrim Yasar suggested that channels allow Superpeer experts to be more accessible, reaching a larger audience by hosting sessions that cost less money to watch.

“It can be hard to say, ‘Hi, I’m Anthony Ha, if you want to talk to me, my hourly rate is $500,’ ” Yasar said. (To be clear: I would never say that.) “But if you have a channel where anyone can subscribe for $1 or $5, that makes you feel better that you are accessible.”

Plus, you can still offer (and charge more for) one-on-one meetings, say for subscribers who still have “burning questions” after a channel session.

In the midst of the pandemic, we’re seeing a widespread embrace of online mentoring and content as a new source of revenue. Last week, for example, Squarespace launched a new paywall feature called Member Areas, and I’ve also written about another video mentoring platform called Prox.

Yasar acknowledged that things are getting pretty competitive, but he said that Superpeer is trying to build the most attractive brand for public intellectuals and thought leaders — he described the vision (half-jokingly, half-proudly) as “OnlyFans for brains.”

“If you are an intellectual, if you have an audience, if you are a TED speaker with 30 million views on your video, you’ve never had a platform to really monetize that audience,” Yasar said. “All you could do is maybe write a book and sell that, you could be a guest at someone else’s event [but not much else]. Those people don’t want to go to YouTube or Instagram, that’s not the brand that they associate themselves with.”

Beyond branding, Yasar said that Superpeer has also worked hard on the technology side to create a lightweight video experience in the browser.

The new round comes from Acrew Capital, Audacious Ventures, Homebrew, Moxxie Ventures, Brianne Kimmel, Scott Belsky and OnDeck, and it brings Superpeer’s total funding to $10 million.

Yasar said the startup will be expanding its growth, partnership and revenue teams. It also will be offering financial support for experts through a brand ambassador program, though the company is still working out the details.

And if you’d like to see the platform in action, I’ll also be talking to Yasar and his investors at Eniac Ventures tomorrow in a free session at noon Eastern.

Powered by WPeMatico

Friday, an app looking to make remote work more efficient, has announced the close of a $2.1 million seed round led by Bessemer Venture Partners. Active Capital, Underscore, El Cap Holdings, TLC Collective and New York Venture Partners also participated in the round, among others.

Founded by Luke Thomas, Friday sits on top of the tools that teams already use — GitHub, Trello, Asana, Slack, etc. — to surface information that workers need when they need it and keep them on top of what others in the organization are doing.

The platform offers a Daily Planner feature, so users can roadmap their day and share it with others, as well as a Work Routines feature, giving users the ability to customize and even automate routine updates. For example, weekly updates or daily standups done via Slack or Google Hangouts can be done via Friday app, eliminating the time spent by managers, or others, jotting down these updates or copying that info over from Slack.

Friday also lets users set goals across the organization or team so that users’ daily and weekly work aligns with the broader OKRs of the company.

Plus, Friday users can track their time spent in meetings, as well as team morale and productivity, using the Analytics dashboard of the platform.

Friday has a free-forever model, which allows individual users or even organizations to use the app for free for as long as they want. More advanced features like Goals, Analytics and the ability to see past three weeks of history within the app are paywalled for a price of $6/seat/month.

Thomas says that one of the biggest challenges for Friday is that people automatically assume it’s competing with an Asana or Trello, as opposed to being a layer on top of these products that brings all that information into one place.

“The number one problem is that we’re in a noisy space,” said Thomas. “There are a lot of tools that are saying they’re a remote work tool when they’re really just a layer on top of Zoom or a video conferencing tool. There is certainly increased amount of interest in the space in a good and positive way, but it also means that we have to work harder to cut through the noise.”

The Friday team is small for now — four full-time staff members — and Thomas says that he plans to double the size of the team following the seed round. Thomas declined to share any information around the diversity breakdown of the team.

Following a beta launch at the beginning of 2020, Friday says it is used by employees at organizations such as Twitter, LinkedIn, Quizlet, Red Hat and EA, among others.

This latest round brings the company’s total funding to $2.5 million.

Powered by WPeMatico

Kea is a new startup giving restaurants an opportunity to upgrade one of the more old-fashioned ways that they take orders — over the phone.

Today, Kea is announcing that it has raised a $10 million Series A led by Marbruck, with participation from Streamlined Ventures, Xfund, Heartland Ventures, DEEPCORE, Barrel Ventures and AVG Funds, as well as angel investors Raj Kapoor (chief strategy officer at Lyft), Craig Flom (who was on the founding team at Panera Bread), Wingstop franchisee Tony Lam and Five Guys franchisee Jonathan Kelly.

Founder and CEO Adam Ahmad said that with restaurants perpetually understaffed, they usually don’t have someone who can devote their attention to answering the phone. (Many of you, after all, are probably pretty familiar with the experience of calling a restaurant and being immediately placed on hold.)

At the same time, he suggested it remains an important ordering channel — especially during the pandemic, as takeout and delivery has become the biggest source of revenue for many restaurants. The New Yorker’s Helen Rosner put it succinctly when she suggested that anyone who wants to support restaurants should “pick up the damn phone.”

Similarly, Ahmad said that for restaurants, paying substantial third-party ordering fees on all of their orders is “not a sustainable long-term strategy.” So Kea is offering technology that should help restaurants handle more orders over the phone, creating what Ahmad called a “virtual cashier” who can do the initial intake with customers, process most routine orders and bring in a human employee when needed.

The idea of an automated voice assistant may bring back unpleasant memories of trying to call your bank or another Byzantine customer service department. But Ahmad said that while most existing phone systems are “not smart,” Kea’s AI is very different, because it’s just focused on restaurant ordering.

“We’re doing a very closed domain,” he said. “In the pizza world, there are only a couple thousand permutations. We’re not innovating for the whole dictionary — it’s a constrained model, it’s a menu.”

In fact, the Kea team gave me a number to dial where I could try out the system for myself. It was a pretty straightforward and easy process, where I provided my address and then the details of my pizza order. And again, you can transfer to a human employee at any time. (In fact, I was accidentally transferred during my demo, leading me to quickly hang up in embarrassment.)

Kea is already live in more than 250 restaurants, including Papa John’s, Donatos and Primanti Brothers, and it says it’s saving them an average of 10 hours of labor per week, with a 23% increase in average order size. With the new funding, Ahmad’s goal is to bring Kea to 1,000 restaurants across 37 states in 2021.

Powered by WPeMatico