funding

Auto Added by WPeMatico

Auto Added by WPeMatico

It’s been an eventful fall for Perigee CEO and founder Mollie Breen. The former NSA employee participated in the TechCrunch Disrupt Startup Battlefield in September, and she just closed her first seed round on Thanksgiving, giving her a $1.5 million runway to begin building the company.

Outsiders Fund led the round, with participation from Westport, Contour Venture Partners, BBG Ventures, Innospark Ventures and a couple of individual investors.

Perigee wants to secure areas of the company like HVAC systems or elevators that may interact with the company’s network, but which often fall outside the typical network security monitoring purview. Breen says the company’s value proposition is about bridging the gap between network security and operations security. She said this has been a security blind spot for companies, often caught between these two teams. Perigee provides a set of analytics that gives the security team visibility into this vulnerable area.

As Breen explained when we spoke in September around her Battlefield turn, the solution learns normal behavior from the operations systems as it interacts with the network, collecting data like which systems and individuals normally access it. It can then determine when something seems off and cut off an anomalous act, which may be indicative of hacker activity, before it reaches the network.

She says that as a female founder getting funding, she is acutely aware how rare that is, and part of the reason she wanted to publicize this funding round was to show other women who are thinking about starting a company that it’s possible, even if it remains difficult.

She plans to grow the company to about six people in the next 12 months, and Breen says that she thinks deeply about how to build a diverse organization. She says that starts with her investors, and includes considering diversity in terms of gender, race and age. She believes that it’s crucial to start with the earliest employees, and she actively recruits diverse candidates.

“I write a lot of cold emails, particularly around hiring and that’s partly because with job listings it’s all inbound and you can’t necessarily guarantee that that is going to be diverse. And so by writing cold emails and really following up with those people and having those conversations, I have found a way of actually making sure that I’m talking to people from different perspectives,” she said.

As she looks ahead to 2021, she’s thinking about the best approach to office versus remote and she says it will probably be mostly remote with some in-person. “I’m really balancing at this point in time, how do we really make the connections, and make them strong and genuine with a lot of trust and do that with balancing some elements of remote, knowing that is where the industry is going and if you’re going to be a company and in a post-2020 world, you probably need to adopt to some element of remote working,” she said.

Powered by WPeMatico

BigID has been on the investment fast track, raising $94 million over three rounds that started in January 2018. Today, that investment train kept rolling as the company announced a $70 million Series D on a valuation of $1 billion.

Salesforce Ventures and Tiger Global co-led the round with participation Glynn Capital and existing investors Bessemer Venture Partners, Scale Venture Partners and Boldstart Ventures. The company has raised almost $165 million in just over two years.

BigID is attracting this kind of investment by building a security and privacy platform. When I first spoke to CEO and co-founder Dimitri Sirota in 2018, he was developing a data discovery product aimed at helping companies coping with GDPR find the most sensitive data, but since then the startup has greatly expanded the vision and the mission.

“We started shifting I think when we spoke back in September from being this kind of best of breed data discovery privacy to being a platform anchored in data intelligence through our kind of unique approach to discovery and insight,” he said.

That includes the ability for BigID and third parties to build applications on top of the platform they have built, something that might have attracted investor Salesforce Ventures. Salesforce was the first cloud company to offer the ability for third parties to build applications on its platform and sell them in a marketplace. Sirota says that so far their marketplace includes just apps built by BigID, but the plan is to expand it to third-party developers in 2021.

While he wasn’t ready to talk about specific revenue growth, he said he expects a material uplift in revenue for this year, and he believes that his investors are looking at the vast market potential here.

He has 235 employees today with plans to boost it to 300 next year. While he stopped hiring for a time in Q2 this year as the pandemic took hold, he says that he never had to resort to layoffs. As he continues hiring in 2021, he is looking at diversity at all levels from the makeup of his board to the executive level to the general staff.

He says that the ability to use the early investments to expand internationally has given them the opportunity to build a more diverse workforce. “We have staff around the world and we did very early […] so we do have diversity within our broader company. But clearly not enough when it came to the board of directors and the executives. So we realized that, and we are trying to change that,” he said.

As for this round, Sirota says like his previous rounds in this cycle he wasn’t necessarily looking for additional money, but with the pandemic economy still precarious, he took it to keep building out the BigID platform. “We actually have not purposely gone out to raise money since our seed. Every round we’ve done has been preemptive. So it’s been fairly easy,” he told me. In fact, he reports that he now has five years of runway and a much more fully developed platform. He is aiming to accelerate sales and marketing in 2021.

The company’s previous rounds included a $14 million Series A in January 2018, a $30 million B in June that year and a $50 million C in September 2019.

Powered by WPeMatico

Technical manuals and other product content may not be the first things that come to mind when you are thinking of software. But if you’ve ever found yourself in a pickle or just need some help getting something to work correctly, you know how vital they can be, and also how frustrating it can be if you cannot find what you are looking for.

Today, a startup called Zoomin, which has built a platform that uses AI to help companies get their technical documentation in order, and natural language to help better understand what answers people are looking for, so that those content troves can be used better and across more environments, is announcing that it has raised $21 million, and picked up a strategic investor, as it comes out of stealth.

“We are focused on product content assets — manuals, guides, and so on — the most boring assets at every company,” Gal Oron, the CEO and co-founder, joked. “To us, it’s all gold because this is actually the information customers are looking for.”

Bessemer Venture Partners, strategic backer Salesforce Ventures and Viola Growth are leading the funding, which actually came in two parts while Zoomin — founded in Israel but now with operations and its CEO also in New York — was still under the radar.

“We have done no PR for the last four years,” said Gal Oron, who co-founded the company with Joe Gelb and Hannan Saltzman. “It’s because we’ve been very busy developing product and signing our first customers. Now, after having dozens of very big customers and nice traction, we felt like this was the time to go.”

The startup now counts Imperva, Dell, Automation Anywhere and McAfee among its customers, with the companies using the Zoomin platform to better organise their content into something that can be used by both customer service agents helping people with issues, and by customers themselves if they opt to try the DIY option, wherever they might be seeing information: be it on a website, in a customer forum, over email or chat, or in a piece of software or an app itself.

The challenge that Zoomin is going after goes a little something like this: technical content is a boring yet necessary component for using software and hardware, especially when a user comes up against any kind of hitch.

The issue is that a lot of it has been written in fits and spurts, and often in a way that might not be easy for the average user to access or understand, with no easy and quick way of drilling into the content to find what you are specifically looking for. And a lot of it exists in disparate places and these days, the entry points for where a user might be looking for that information might also be as fragmented as the places where the content lives.

“Dell has no way of controlling where you might engage with a product,” Oron explained. It might be on Dell’s site, in its software, on a forum, on social media, and so on.

Zoomin aims to provide what Oron describes as a personalised experience for users wherever they may be searching. By that, he means that Zoomin learns what a user is working with, and what that user typically searching for, in order to connect them more quickly with the right answers. In an app, this might take the form of a widget that appears for help. On a forum, it might more likely be by way of an agent who is participating, using Zoomin’s engine to find the right answers to respond to questions.

For Zoomin, this has so far applied primarily to the world of B2B customer service: its product is used to organise and “orchestrate” knowledge for its customers to in turn provide to business/enterprise customers. But Oron notes that it could be just as applicable, and may well see traction over time, with non-business consumers, too, since at the end of the day they are all consumers, he noted.

“We like to think of ourselves as consumerizing the experience,” he said. “We want to make it as easy as buying on Amazon or browsing Netflix.”

The wider area of “knowledge base management” or knowledge orchestration is often part of a larger customer service play, an unsurprisingly the companies that have products in a similar area include the likes of Zendesk and Hubspot. Other tech companies building solutions to help organise knowledge bases include companies like ProProfs, Helpjuice and Instrktiv.

Salesforce is an interesting strategic investor in that regard: it hasn’t build something like this itself in its community and service clouds, so Zoomin is a close partner to provide that option. (The startup also integrates with a number of other platforms like Oracle’s service cloud, Zendesk, Jira, SharePoint and more.)

“Salesforce Ventures supports bold ideas put forward by enterprise cloud companies, so we are thrilled to support Zoomin on their journey to improve how product content is experienced. We believe in the innovative team at Zoomin and their vision of increasing content accessibility,” added Alex Kayyal, partner and head of Salesforce Ventures International.

Investors are especially interested in the role that a company like Zoomin might be playing these days in particular: with customer service enquiries higher than ever before as more of us are working remotely, it puts a big strain on systems to triage and answer questions. This presents an opportunity.

“The era of digital transformation has clearly reached product content,” said Amit Karp, Partner at Bessemer Venture Partners in a statement. “As technical product content continues to grow exponentially, Zoomin allows enterprises to leverage this content as a strategic asset.”

Zoomin is not disclosing valuation at this stage.

Powered by WPeMatico

BoxCast, a Cleveland-based company aiming to make it easy to live stream any event, has raised $20 million in Series A funding.

Co-founder and CEO Gordon Daily said that when the company first launched in 2013, “streaming wasn’t something that everyone understood,” and you needed professional help to live stream anything. BoxCast is supposed to make that process accessible to anyone.

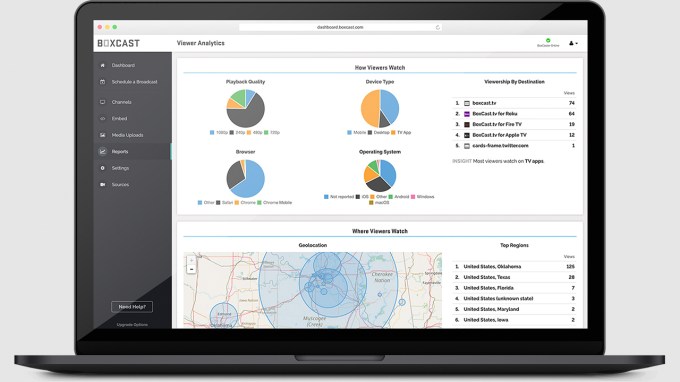

The company has created several different video encoder devices, but Daily said the “small box” is just a one piece of BoxCast platform, which is designed to cover all your live-streaming needs, with support for 1080p broadcasting; streaming to Facebook Live, YouTube and your own website; analytics and more — plus there are add-ons like automatic scoreboard displays and event ticketing.

Pricing starts at $99 per month for the “essential” streaming plan, plus $399 for a BoxCast encoder. (You can also just stream from an iOS device.)

And it’s no surprise that 2020 has been a “watershed moment” for the company, as Daily put it, with BoxCast now live streaming millions of events per year — everything from sports to religious services to virtual safaris offered by Sri Lanka’s tourism board.

BoxCast dashboard

“When you can’t even meet in-person … we knew that there was going to be higher usage,” he said. “What caught me off-guard was the volume increase — it’s new customers, it’s existing customers, at peak times there’s a 10x increase [from pre-pandemic usage].”

And while in-person events will hopefully become more common next year, Daily said live streams will still be a valuable tool to reach audiences who can’t attend, and to promote your business or organization with new kinds of programming.

COO Sam Brenner added that while BoxCast employed fewer than 40 people before the pandemic, the team has grown to 56, and will likely double within the next 12 months.

The Series A was led by Updata Partners, with participation from audio equipment manufacturer Shure.

“The live streaming video market has grown dramatically over the last decade, and COVID-19 has accelerated adoption in recent months. BoxCast offers a unique end-to-end platform that makes live streaming easy,” said Updata’s Carter Griffin in a statement. “We’re excited to partner with Gordon and his team, and look forward to contributing to their vision of making live events accessible to all.”

Powered by WPeMatico

Parsec, a startup that’s built streaming technology for both work and play, is announcing that it has raised $25 million in Series B funding.

This brings Parsec’s total funding to $33 million, according to Crunchbase. The round was led by Andreessen Horowitz, with the firm’s general partner Martin Casado joining the board. Previous investors Lerer Hippeau, Makers Fund, NextView Ventures and Notation Capital also participated.

CEO Benjy Boxer told me that since he and CTO Chris Dickson founded the company in 2016, the vision has always been “to make it easier for people to connect to their technology, software and content from anywhere, on any device.”

They started out by helping gamers access their gaming PCs from other devices (the Parsec app is currently available for Windows, Mac, Linux, Android, Raspberry Pi and the web).

“From the beginning, we thought that if we could build something that is great for gaming, it will be great for everything,” Boxer said.

But it was a natural transition to other use cases, since some of the people using Parsec to play games in their free time also turned out to work at TV production companies, video game companies or in other jobs where they need access to high-end workstations. That’s why the company launched Parsec for Teams this year, which offers the same low-latency remote experience, while also adding features like encryption, group permissions and collaboration on the same file.

Image Credits: Parsec

“The performance of Parsec is just way above everything else,” Boxer said. “People forget they’re using Parsec.”

Parsec works with major gaming clients like EA, Ubisoft, Blizzard Entertainment and Square Enix, and it’s also being used in industries like architecture, engineering and video broadcast/production/post-production.

And as you might imagine, the need for something like this has only increased during the pandemic. Boxer said customers have found that the platform is saving their employees more than an hour a day by eliminating the commute and giving them high-speed access to their workstations — rather than, say, having to wait an hour for a 100 gigabyte file to download.

And most of those clients anticipate that after the pandemic, their employees will continue for work from home for part of the time.

“So in that scenario, people are bringing their computers back to the office, and they can use Parsec to make sure it’s always accessible to them,” Boxer said.

On the consumer side, he said that where usage was previously heaviest during the weekends, during the pandemic “there’s no spike anymore on the weekends, people are playing all the time.”

Boxer added that the company will continue developing the core platform, leading to improvements for both gaming and enterprise users, while there’s a separate team focused on building administrative and collaborative features.

Powered by WPeMatico

Tive, a Boston-based startup, is building a hardware and software platform to help track the conditions of a shipment like say food or medicine to make sure it is stored under the proper conditions as it moves from farm or factory to market. Today, the company announced a $12 million Series A.

RRE Ventures led the round with help from new investor Two Sigma Ventures and existing investors NextView Ventures, Hyperplane Ventures, One Way Ventures, Fathom Ventures and other unnamed individuals. The company has now raised close to $17 million, according to Crunchbase data.

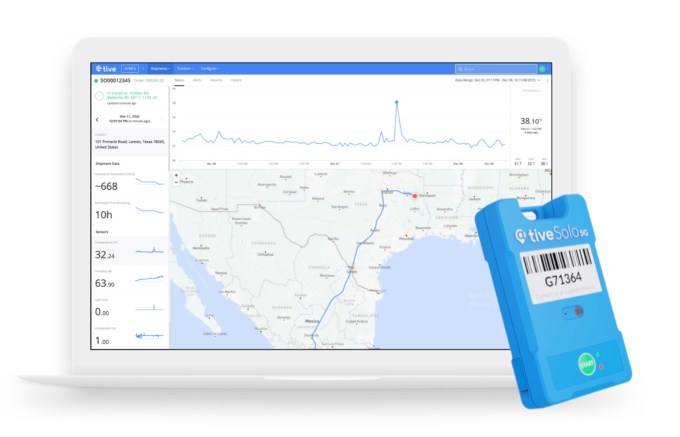

“Tive helps companies all over the world track their shipments in a very specific way,” company co-founder and CEO Krenar Komoni told me. Using a tracking device the company created, customers can press a button, place the tracker on a palette or in a container, and it begins transmitting shipment data like temperature, shock, light exposure, humidity and location data in real time to ensure that the shipment is moving safely to market under proper conditions.

He said that they are the first company to create single-use 5G trackers, meaning the shipping company doesn’t have to worry about managing, maintaining, recharging or returning them (although they encourage that by giving a discount for future orders on returned items).

Tive hardware tracker and data tracking software. Image Credit: Tive

The approach seems to be working. Komoni reports that revenue has grown 570% in 2020 as the product-market fit has become more acute with digitization hitting the supply chain in a big way. He says that in particular customers and investors like the company’s full-stack approach.

“What’s interesting […] and why we are resonating with customers and also why investors like it, is because we’re providing the full stack, meaning the hardware, the software, the platform and the APIs to major transportation management systems,” Komoni explained.

The company has 22 employees and expects to double that number in 2021. As he grows the company, Komoni says that as an immigrant founder, he’s particularly sensitive to diversity and inclusion.

“I’m an immigrant myself. I grew up in Kosovo, came to the U.S. when I was 17 years old, went to high school here in Vermont. I’m a U.S. citizen, but part of who I am is being open to different cultures and different nationalities. It’s just part of my nature,” he says.

The company was founded in 2015 and its facilities are in Boston. It has continued shipping devices throughout the pandemic, and that has meant figuring out how to operate in a safe way with some employees in the building. He expects the company will have more employees operating out of the office as we move past the pandemic. He also has an engineering operation in Kosovo.

Powered by WPeMatico

Only about a third of the yields Indian farmers produce reaches the big markets. Those whose produce makes it there today are able to leverage post-harvest services. Everyone else is missing out.

A Noida-based startup is working with all the stakeholders — farmers, food processors, traders and financial institutions — to bridge this post-harvest services gap — and it just secured new funds to continue its journey.

Seven-year-old Arya said on Tuesday it has raised $21 million in its Series B financing round. The round was led by Quona Capital, a venture firm that focuses on fintech in emerging markets. Existing investors LGT Lightstone Aspada and Omnivore also participated in the round, while multiple unnamed lenders are providing additional debt financing to the startup, Arya said.

Nearly all post-harvest interventions that exist in India today are focused largely toward major agriculture centres such as Kota in the northern Indian state of Rajasthan and Azadpur Mandi in capital New Delhi, explained Prasanna Rao, co-founder and chief executive of Arya, in an interview with TechCrunch.

This uneven concentration has deprived millions of farmers in the country of reasonable options to efficiently store and sell their produce and of financing options to maintain their cash flow, he said.

“Our belief is that we should cater to the two-thirds of the market that are currently underserved. The Kota mandi (market), for instance, has 35 bank branches in a kilometre of radius. But if you travel 70 to 80 kilometres away from Kota, this really declines,” said Rao, who previously worked at a bank.

Arya is solving all the aforementioned challenges: It operates a network of more than 1,500 warehouses in 20 Indian states where it stores over $1 billion worth of commodities. This network allows farmers to store their produce at a centre that is much nearer to their farms, avoiding any spillage and exorbitant real estate costs of the big markets. On the credit side, Arya has disbursed over $36.5 million to farmers and its banking partners have disbursed more than $95 million.

“Arya is addressing a vastly underserved market of farmers in India, half of whom previously had little access to post-harvest finance,” said Ganesh Rengaswamy, co-founder and partner at Quona Capital, in a statement. “We believe Arya’s unique approach, providing a full-service digital platform with embedded finance and differentiated efficiencies for small farmholders, will drive the future of farming in India.”

The startup’s offerings have proven even more useful during the coronavirus pandemic, which saw New Delhi enforce one of the world’s strictest lockdowns earlier this year. The lockdown broke the supply chain network, and prices of agricultural commodities dropped by over 20%.

To navigate this, Arya connected farmer produce organizers, or FPOs, with buyers through its own digital marketplace a2zgodaam.com. “The need for immediate liquidity saw demand increase for credit against these warehouse receipts. Arya’s credit portfolio saw a 3x jump year-on-year,” wrote Prashanth Prakash, a founding partner at Accel in India, and Mark Kahn, managing partner at Omnivore in an industry report last week.

Rao said Arya will deploy the fresh capital to scale its fintech platform in a “big way” as the startup broadens its network of warehouses across the country. Additionally, the startup plans to fuel the growth of a2zgodaam.com, which also aggregates unorganized warehouses, and supercharge them with their own set of financiers and insurers and ways to allow farmers to sell directly through these warehouses if they need.

Powered by WPeMatico

Exoskeleton technology has been one of the more interesting developments in the world of robotics: Instead of building machines that replace humans altogether, build hardware that humans can wear to supercharge their abilities. Today, German Bionic, one of the startups designing exoskeletons specifically aimed at industrial and physical applications — it describes its Cray X robot as “the world’s first connected exoskeleton for industrial use,” that is, to help people lifting and working with heavy objects, providing more power, precision and safety — is announcing a funding round that underscores the opportunity ahead.

The Augsburg, Germany-based company has raised $20 million, funding that it plans to use to continue building out its business, as well as its technology, both in terms of the hardware and the cloud-based software platform, German Bionic IO, that works with the exoskeletons to optimize them and help them “learn” to work better.

The Cray X currently can compensate up to 30 kg for each lifting movement, the company says.

“With our groundbreaking robotic technology that combines human work with the industrial Internet of Things (IIoT), we literally strengthen the shop floor workers’ backs in an immediate and sustainable way. Measurable data underscores that this ultimately increases productivity and the efficiency of the work done,” says Armin G. Schmidt, CEO of German Bionic, in a statement. “The market for smart human-machine systems is huge and we are now perfectly positioned to take a major share and substantially improve numerous working lives.”

The Series A is being co-led by Samsung Catalyst Fund, a strategic investment arm from the hardware giant, and German investor MIG AG, one of the original backers of BioNtech, the breakthrough company that’s developed the first COVID-19 vaccine to be rolled out globally.

Storm Ventures, Benhamou Global Ventures (founded and led by Eric Benhamou, who was the founding CEO of Palm and before that the CEO of 3com) and IT Farm also participated. Previously, German Bionic had only raised $3.5 million in seed funding (with IT Farm, Atlantic Labs and individual investors participating).

German Bionic’s rise comes at an interesting moment in terms of how automation and cloud technology are sweeping the world of work. When people talk about the next generation of industrial work, the focus is usually on more automation and the rise of robots to replace humans in different stages of production.

But at the same time, some robotics technologists have worked on another idea. Because we’re probably still a long way away from being able to make robots that are just like humans, but better in terms of cognition and all movements, instead, create hardware that doesn’t replace, but augments, live laborers, to help make them stronger while still being able to retain the reliable and fine-tuned expertise of those humans.

The argument for more automation in industrial settings has taken on a more pointed urgency in recent times, with the rise of the COVID-19 health pandemic: Factories have been one of the focus points for outbreaks, and the tendency has been to reduce physical contact and proximity to reduce the spread of the virus.

Exoskeletons don’t really address that aspect of COVID-19 — even if you might require less of them as a result of using exoskeletons, you still require humans to wear them, after all — but the general focus that automation has had has brought more attention to the opportunity of using them.

And in any case, even putting the pandemic to one side, we are still a long way away from cost-effective robots that completely replace humans in all situations. So, as we roll out vaccinations and develop a better understanding of how the virus operates, this still means a strong market for the exoskeleton concept, which analysts (quoted by German Bionic) predict could be worth as much as $20 billion by 2030.

In that context, it’s interesting to consider Samsung as an investor: The company itself, as one of the world’s leading consumer electronics and industrial electronics providers, is a manufacturing powerhouse in its own right. But it also makes equipment for others to use in their industrial work, both as a direct brand and through subsidiaries like Harman. It’s not clear which of these use cases interests Samsung: whether to use the Cray X in its own manufacturing and logistics work, or whether to become a strategic partner in manufacturing these for others. It could easily be both.

“We are pleased to support German Bionic in its continued development of world-leading exoskeleton technology,” says Young Sohn, corporate president and chief strategy officer for Samsung Electronics and chairman of the board, Harman, in a statement. “Exoskeleton technologies have great promise in enhancing human’s health, wellbeing and productivity. We believe that it can be a transformative technology with mass market potential.”

German Bionic describes its Cray X as a “self-learning power suit” aimed primarily at reinforcing lifting movements and to safeguard the wearer from making bad calls that could cause injuries. That could apply both to those in factories, or those in warehouses, or even sole trader mechanics working in your local garage. The company is not disclosing a list of customers, except to note that it includes, in the words of a spokesperson, “a big logistics player, industrial producers and infrastructure hubs.” One of these, the Stuttgart Airport, is highlighted on its site.

“Previously, efficiency gains and health promotion in manual labor were often at odds with one another. German Bionic Systems managed to not only break through this paradigm, but also to make manual labor a part of the digital transformation and elegantly integrate it into the smart factory,” says Michael Motschmann, managing partner with MIG in a statement. “We see immense potential with the company and are particularly happy to be working together with a first-class team of experienced entrepreneurs and engineers.”

Exoskeletons as a concept have been around for over a decade already — MIT developed its first exoskeleton, aimed to help soldiers carrying heavy loads — back in 2007, but advancements in cloud computing, smaller processors for the hardware itself and artificial intelligence have really opened up the idea of where and how these might augment humans. In addition to industry, some of the other applications have included helping people with knee injuries (or looking to avoid knee injuries!) ski better, and for medical purposes, although the recent pandemic has put a strain on some of these use cases, leading to indefinite pauses in production.

Powered by WPeMatico

Open banking platforms, where services that might not have previously lived next to each other are now joined up by way of APIs, has been one of the emerging trends of the last couple of years, and today one of the leaders in the space out of Europe has closed a round of funding to expand its business.

Tink, a startup out of Stockholm, Sweden that aggregates a number of banks and financial services by way of an API so that those can in turn be accessed via new channels, has raised €85 million (or $103 million at current rates), at a post-money valuation of €680 million (or around $825 million). It plans to use the capital to double down on expanding its network of banks and payment services in Europe. Tink already links up 3,400 banks, covering some 250 million people, with partners including PayPal, NatWest, ABN AMRO, BNP Paribas, Nordea and SEB, some of which are also strategic investors. On the other side, it has some 8,000 developers using its APIs.

This latest tranche of funding is being co-led by new investor Eurazeo Growth and Dawn Capital, with PayPal Ventures, HMI Capital, Heartcore, ABN AMRO Ventures, Poste Italiane and BNP Paribas’ venture arm, Opera Tech Ventures, also participating.

The funding comes less than a year after it announced a round of €90 million ($105 million) in January 2020, and is more specifically an extension of that round. For context, that previous round was at a €415 million ($503 million) valuation, and the company has definitely grown since then: in January it said it had 2,500 banking partners in its network. It has now raised €175 million in total.

The last year — shaped by a global health pandemic — has been all about bringing more services online and into the cloud, so people and businesses that can no longer do things like banking or selling/shopping in person can still get things done. That has most definitely played out strongly in the world of financial services, with banks, bank competitors and their tech partners seeing a surge in demand for more flexible, digital channels.

“Despite the difficulties of 2020, it was a year of great growth for Tink,” said Daniel Kjellén, co-founder and CEO of Tink, in a statement. “2020 has seen payments powered by open banking take-off, and in 2021 we expect to see this scale – most prominently in the UK, followed by Europe. This funding extension will further facilitate the development of our payment initiation services across Europe, while continuing to deliver new data-products built on open banking technology to our customers.”

Tink is not the only company that is looking to capitalize on this. Just earlier this week, another startup, Unit, came out of stealth with $18.6 million in funding. It also has ambitions to provide a way to integrate banking features, and banks, into environments where they might have not previously existed. Others also linking up financial services and helping them integrate into other platforms and apps include Plaid and Rapyd.

Plaid is in the process of getting acquired by Visa for $5.3 billion, although that deal is currently under antitrust scrutiny. Rapyd remains VC-backed and was last valued at $1.3 billion. The proliferation and growth of these might prove to be a strong argument in favor of the market not being sewn up by Plaid (no pun intended), although having one owned by a single payments giant would definitely shift how the market is evolving.

“The open banking movement continues to pick up pace, with 2021 showing every sign that it will bring increased collaboration between fintechs and large enterprises, who want to take digitally enabled services to their customers with a tried and trusted partner,” said Zoé Fabian, MD of Eurazeo Growth, in a statement. “Since its inception eight years ago, Tink has proven itself to be the leading open banking platform in Europe, and our investment underlines the confidence we and the industry have in Tink and open banking. We look forward to supporting them on their continued journey.”

Tink’s business is based around payment initiation technology, providing easy integrations into existing banking services, and then making a commission on transactions that subsequently take place. The company said that it currently processes around 1 million payment transactions per month in five markets.

Although it doesn’t specify the value of those transactions, or how much it makes itself, it notes that current customers include Kivra, a digital mailbox provider with 4 million adults in Sweden; and, as of earlier this year, payment fintech Lydia, with over 5 million customers. It is live in Sweden, U.K., France, Spain, Germany, Italy, Portugal, Denmark, Finland, Norway, Belgium, Austria and the Netherlands and the plan is to expand to 10 markets in 2021.

While the company will be using the funding to expand partnerships and its footprint, it’s also not shying away from inorganic growth. This year it made no less than three acquisitions to expand its business — a sign also of how there is likely more consolidation to come as not every company can find the scale and funding to grow in the current market. Tink’s acquisitions included Swedish credit decisioning firm Instantor, to expand in credit risk products; Spanish account aggregation provider Eurobits; and U.K. aggregation platform OpenWrks.

“Tink has truly emerged as Europe’s leading open banking platform and is quickly becoming a key strategic piece of financial technology infrastructure,” said Josh Bell, general partner of Dawn, in a statement. “We have seen activity across Tink’s network rapidly accelerate this year, with increasing adoption and implementation of open banking products and services across their platform. We are delighted to support Tink’s latest funding round, and look forward to working with the team across 2021 to expand the breadth and depth of its already considerable network of banks, accelerate the rollout of its account-to-account payments initiation solutions, and continue to deliver exceptional value to its fast-growing customer base.”

Powered by WPeMatico

Swell Energy, an installer and manager of residential renewable energy, energy efficiency and storage technologies, is raising $450 million to finance the construction of four virtual power plants representing a massive amount of energy storage capacity paired with solar power generation.

It’s a sign of the distributed nature of renewable energy development and a transition from large-scale power generation projects feeding into utility grids at their edge to smaller, point solutions distributed at the actual points of consumption.

The project will pair 200 megawatt hours of distributed energy storage with 100 megawatts of solar photovoltaic capacity, the company said.

Los Angeles-based Swell was commissioned by utilities across three states to establish the dispatchable energy storage capacity, which will be made available through the construction and aggregation of approximately 14,000 solar energy generation and storage systems. The goal is to make local grids more efficient.

To finance these projects — and others the company expects to land — Swell has cut a deal with Ares Management Corp. and Aligned Climate Capital to create a virtual power plant financing vehicle with a target of $450 million.

That financing entity will support the development of power projects like the combined solar and battery agreement nationwide.

Over the next 20 years, Swell is targeting the development of over 3,000 gigawatt hours of clean solar energy production, with customers storing 1,000 gigawatt hours for later use, and dispatching 200 gigawatt hours of this stored energy back to the utility grid.

It has the potential to create a more resilient grid less susceptible to the kinds of power outages and rolling blackouts that have plagued states like California.

“Utilities are increasingly looking to distributed energy resources as valuable ‘grid edge’ assets,” said Suleman Khan, CEO of Swell Energy, in a statement. “By networking these individual homes and businesses into virtual power plants, Swell is able to bring down the cost of ownership for its customers and help utilities manage demand across their electric grids,” said Khan. “By receiving GridRevenue from Swell, customers participating in our VPP programs pay less for their solar energy generation and storage systems, while potentially reducing the risk of a local power outage, and keeping their homes and businesses securely powered through any outages.”

Along with the launch of the virtual power plant financing vehicle, Swell is also giving homeowners a way to finance their home energy systems through Swell. They need the buy-in from homeowners to get these power plants off the ground, and for homeowners, there’s a way to get some money back by feeding power into the grid.

It’s a win-win for the company, customers and early investors like Urban.us, which was seed investor in the company.

Powered by WPeMatico