funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Applications based on artificial intelligence — whether they are systems running autonomous services, platforms being used in drug development or to predict the spread of a virus, traffic management for 5G networks or something else altogether — require an unprecedented amount of computing power to run. And today, one of the big names in the world of designing and building processors fit for the task has closed a major round of funding as it takes its business to the next level.

Graphcore, the Bristol, U.K.-based AI chipmaker, has raised $222 million, a Series E that CEO and co-founder Nigel Toon said in an interview will be used for a couple of key purposes.

First, Graphcore will use the money to continue expanding its technology, based around an architecture it calls “IPU” (intelligence processing unit), which competes against chips from the likes of Nvidia and Intel also optimized for AI applications. And second, Graphcore will use the funding to shore up its finances ahead of a possible public listing.

The funding, Toon said, gives Graphcore $440 million in cash on the balance sheet and a post-money, $2.77 billion valuation to start 2021.

“We’re in a strong position to double down and grow fast and take advantage of the opportunity in front of us,” he added. He said it could be “premature” to describe this Series E as a “pre-IPO” round. “We have enough cash and this puts us in a position to take that next step,” he added. The company has in recent weeks been rumored to be eyeing up a listing not in the U.K. but on Nasdaq in the U.S.

This latest round of funding is coming from a roster of financial investors. Led by the Ontario Teachers’ Pension Plan, it also includes participation from Fidelity International and Schroders, as well as previous investors Baillie Gifford and Draper Esprit. Graphcore has now raised some $710 million to date.

This Series E gives Graphcore a definite step up in its valuation — the company last raised money back in February of this year, a $150 million extension to its Series D that valued the company at $1.95 billion — but all the same, it closes off what Toon described as a “challenging” year for the company (and indeed, the world at large).

“I view this year as a speed bump,” he said. “It has been challenging and we’ve realigned to speed things up.”

As it has been for many companies, the year came in different parts.

On one side, Graphcore’s hardware and software product development continued apace with ever-faster processors in ever-smaller packages. In July, Graphcore launched the second generation of its flagship chip, the GC200, and a new IPU Machine that runs on it, the M2000, which the company described at the time as the first AI computer to achieve a petaflop of processing power “in the size of a pizza box.”

But on the other side, the building and launch of those products was largely done with a remote workforce, with employees sent to work from home to help slow down the spread of the coronavirus that has gripped the world and rewritten how much of it operates.

Indeed, the industry at large, and how companies are spending and investing during a period of uncertainty, has also likely shifted. Some companies like Amazon, Apple and Google are all getting more serious about their own chipmaking efforts. Others are caught up in a wave of consolidation: Witness Nvidia’s efforts to acquire ARM in a $40 billion deal.

All of these spell challenges for an upstart like Graphcore. Toon said Graphcore doesn’t have any plans to make acquisitions: Its strategy is based around organic growth.

And, no great surprises here, he is not excited about Nvidia’s acquisition of ARM: “If we’re not careful, things will consolidate too much and that could kill off innovation,” he said. “We have made our position clear to the U.K. government. We don’t think the Nvidia ARM deal is a good thing.” (Somewhat ironic, considering he and Graphcore co-founder Simon Knowles sold a previous startup to none other than Nvidia.)

He also declined to talk about new customers for Graphcore, but he said that there has been interest from financial services companies, and some from the world of healthcare, automotive and internet companies, “large hyperscalers” in his words, that require the kind of technology that Graphcore is building either to run their systems, or to complement processors that they are potentially also building themselves. (Strategic backers of the company include the likes of Microsoft, BMW, Bosch and Dell.)

Graphcore said that the company is shipping its newest products “in production volume” to customers, and Toon said that a couple of big names are likely to be announced in the coming year, one that some believe might actually be calmer overall for the chip industry compared to 2020.

It’s that pull of technology, and specifically the processing demands of the next generation of computing, that investors believe will continue to drive business to Graphcore as the dust settles on this year.

“The market for purpose-built AI processors is expected to be significant in the coming years because of computing megatrends like cloud technology and 5G and increased AI adoption, and we believe Graphcore is poised to be a leader in this space,” said Olivia Steedman, senior managing director, Teachers’ Innovation Platform (TIP) at Ontario Teachers’. “TIP focuses on investing in tech-enabled businesses like Graphcore that are at the forefront of innovation in their sector. We are excited to partner with Nigel and the strong management team to support the company’s continued growth and product development.”

Powered by WPeMatico

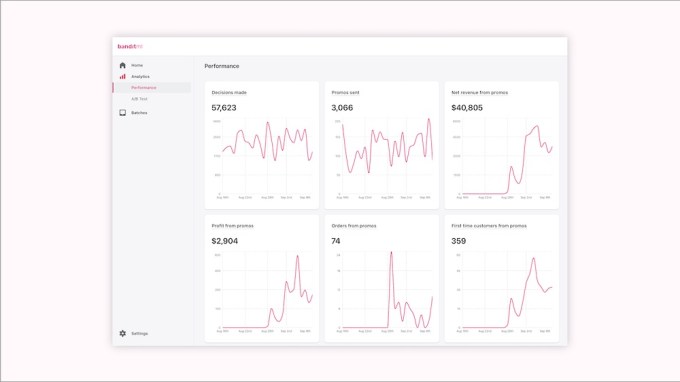

Bandit ML aims to optimize and automate the process of presenting the right offer to the right customer.

The startup was part of the summer 2020 class at accelerator Y Combinator . It also raised a $1.32 million seed round in September from YC, Haystack Fund, Webb Investment Network, Liquid 2 Ventures, Jigsaw Ventures, Basecamp Fund, Pathbreaker Ventures and various angels — including what CEO Edoardo Conti said are 10 current and former Uber employees.

Conti (who founded the company with Lionel Vital and Joseph Gilley) is a former Uber software engineer and researcher himself.

The idea, as he explained via email, is that one customer might be more excited about a $5 discount, while another might be more effectively enticed by free shipping, and a third might be completely uninterested because they just made a large purchase. Using a merchant’s order history and website activity data, Bandit ML is supposed to help them determine which offer will be most effective with which shopper.

Image Credits: Bandit ML

Conti acknowledged that there’s other discount-optimizing software out there, but he suggested none of them offers what Bandit ML does: “off the shelf tools that use machine learning the way giants like Uber, Amazon and Walmart do.”

He added that Bandit ML’s technology is unique in its support for full automation (“some stores sent their first batch of offers within 10 minutes of signing up”) and its ability to optimize for longer-term metrics, like purchases over a 120-day period, rather than focusing on one-off redemptions. In fact, Conti said the technology the startup uses to make these decisions is similar to the ReAgent project that he worked on at Facebook.

Bandit ML is currently focused on merchants with Shopify stores, though it also supports other stores not on Shopify, like Calii. Conti said the platform has been used to send millions of dollars’ worth of promotions since July, with one clothing company seeing a 20% increase in net revenue.

“Starting with an always-on incentive engine for every online business, we aim to build functioning out-of-the-box machine learning tools that a small online business needs to compete with the Walmarts and Amazons of the world,” he said.

Powered by WPeMatico

StepZen, a new startup from the crew who gave you Apigee (which was sold to Google in 2016 for $625 million) had a different vision for their latest company. They are building a single API that pulls data from disparate sources to help developers deliver more complex customer experiences online.

Today, the startup emerged from stealth and announced an $8 million seed investment from Neotribe Ventures and Wing Venture Capital .

With years of experience working with APIs, the founders wanted to take that a step further, says CEO and co-founder Anant Jhingran. “StepZen is a product that lets front end developers easily create and consume one API for all the data they need from the back end,” he explained.

This is all in the service of providing a smoother, more consistent customer experience. That means whether you are on an e-commerce site accessing your order history or a banking app grabbing your current balance, these scenarios require pulling data from various back-end data resources. Connecting to those resources is a time-consuming task, and StepZen wants to simplify that for developers.

“Developers spend an enormous amount of time deploying and managing code that accesses the back end, and what StepZen wants to do is to give them that time back,” he said.

Instead of manually writing code to pull this data, StepZen enables developers to simply provide configuration information and credentials to connect to these back-end data sources, and then it builds a single API that handles all of the heavy lifting of pulling that data and presenting it when needed.

Jhingran uses the example of presenting a list of open orders for a customer. It sounds simple enough, but once you consider that the data could live in several places, including the CRM system, the order system or with your courier, that means accessing at least three separate and highly disparate systems. StepZen will help pull this all together via its API and present it smoothly to the user.

Today the company has 11 employees, including the three founders, with plans to add another eight or so in 2021. As they do that, CBO and co-founder Helen Whelan says they are working to build a diverse and inclusive company. While the founding team is itself diverse, they want to hire employees with diverse backgrounds and ways of thinking to build the most complete product and company.

“For the first 10 or so employees, we tapped into the networks of the people who we’ve worked with, people who you know can do a great job. Then I think it’s about deliberately expanding from there and deliberately taking the time that you need to explore and expand your pipeline of candidates,” she said.

The company is just nine months old and has been spending most of this year building the solution and working with pre-alpha users. Today the product is in alpha, with plans to release it as a software service early next year.

As the company emerges from stealth, it’s looking to continue building the product and looking for ways to remove as much complexity as possible. “We know how to do the hard things on the back end. We’ve got the database technologies and the API technologies down, and it’s now about finding how to make all of that simple on the outside and easy for developers to use, ” Whelan said.

Powered by WPeMatico

Google said on Tuesday it is investing in two Indian startups, Glance and DailyHunt, as the Android-maker makes a further push into the world’s second-largest internet market.

Two-year-old Indian startup Glance, which serves news, media content and games on the lock screen of more than 100 million smartphones, has raised $145 million in a new financing round from Google and existing investor Mithril Partners.

Glance, which is part of advertising giant InMobi Group, uses AI to offer personalized experience to its users. The service replaces the otherwise empty lock screen with locally relevant news, stories and casual games. Late last year, InMobi acquired Roposo, a Gurgaon-headquartered startup, that has enabled it to introduce short-form videos on the platform. Google is also investing in Roposo.

Roposo is a short-video platform with more than 33 million monthly active users. These users spend about 20 minutes consuming content across multiple genres in more than 10 languages on the app everyday.

Glance ships pre-installed on several smartphone models. The subsidiary maintains tie-ups with nearly every top Android smartphone vendor, including Xiaomi and Samsung, the two largest smartphone vendors in India. The service has amassed over 115 million daily active users.

“Glance is a great example of innovation solving for mobile-first and mobile-only consumption, serving content across many of India’s local languages,” said Caesar Sengupta, VP, Google, in a statement. “Still too many Indians have trouble finding content to read or services they can use confidently, in their own language. And this significantly limits the value of the internet for them, particularly at a time like this when the internet is the lifeline of so many people. This investment underlines our strong belief in working with India’s innovative startups and work towards the shared goal of building a truly inclusive digital economy that will benefit everyone.”

Naveen Tewari, founder and chief executive of Glance and InMobi Group, said the investment will pave the way for “deeper partnership between Google and Glance across product development, infrastructure, and global market expansion.” The startup plans to deploy the fresh capital to expand in the U.S.

Google said on Tuesday that it is also investing in VerSe Innovation, the parent firm of Indian startup DailyHunt. Across its apps including eponymous service and short-video platform Josh, DailyHunt claims to serve over 300 million users news and entertainment content in 14 Indian languages. The startup said it has completed a round of over $100 million from Google, Microsoft and AlphaWave among other investors, and this new round values it at over $1 billion, making it a unicorn.

DailyHunt — which is co-run by Umang Bedi, former Facebook India head — plans to deploy the fresh capital to scale the Josh app, the augmentation of local language content offerings, the development of content creator ecosystem, innovation in AI and ML and the growth of its truly “made-in-Bharat-for-Bharat short-video platform,” it said.

Josh and Roposo are among over a dozen apps in India that are attempting to fill the void New Delhi created after banning TikTok in late June in the country. TikTok identified India as its biggest overseas market prior to the ban.

Google is writing both these checks from India Digitization Fund that it unveiled this year. Google has committed to invest $10 billion in India over the course of the next few years. Prior to today, the company invested $4.5 billion from this fund in Indian telecom giant Jio Platforms.

Powered by WPeMatico

OneTrust, the four-year-old privacy platform startup from the folks who brought you AirWatch (which was acquired by VMmare for $1.5 billion in 2014), announced a $300 million Series C on an impressive $5.1 billion valuation today.

The company has attracted considerable attention from investors in a remarkably short time. It came out of the box with a $200 million Series A on a $1.3 billion valuation in July 2019. Those are not typical A round numbers, but this has never been a typical startup. The Series B was more of the same — $210 million on a $2.7 billion valuation this past February.

That brings us to today’s Series C. Consider that the company has almost doubled its valuation again, and has raised $710 million in a mere 18 months, some of it during a pandemic. TCV led today’s round joining existing investors Insight Partners and Coatue.

So what are they doing to attract all this cash? In a world where privacy laws like GDPR and CCPA are already in play, with others in the works in the U.S. and around the world, companies need to be sure they are compliant with local laws wherever they operate. That’s where OneTrust comes in.

“We help companies ensure that they can be trusted, and that they make sure that they’re compliant to all laws around privacy, trust and risk,” OneTrust Chairman Alan Dabbiere told me.

That involves a suite of products that the company has already built or acquired, moving very quickly to offer a privacy platform to cover all aspects of a customer’s privacy requirements, including privacy management, discovery, third-party risk assessment, risk management, ethics and compliance and consent management.

The company has already attracted 7,500 customers to the platform — and is adding1,000 additional customers per quarter. Dabbiere says that the products are helping them be compliant without adding a lot of friction to the building or buying process. “The goal is that we don’t slow the process down, we speed it up. And there’s a new philosophy called privacy by design,” he said. That means building privacy transparency into products, while making sure they are compliant with all of the legal and regulatory requirements.

The startup hasn’t been shy about using its investments to buy pieces of the platform, having made four acquisitions already in just four years since it was founded. It already has 1,500 employees and plans to add around 900 more in 2021.

As they build this workforce, Dabbiere says being based in a highly diverse city like Atlanta has helped in terms of building a diverse group of employees. “By finding the best employees and doing it in an area like Atlanta, we are finding the diversity comes naturally,” he said, adding, “We are thoughtful about it.” CEO Kabir Barday also launched a diversity, equity and inclusion council internally this past summer in response to the Black Lives Matter movement happening in the Atlanta community and around the country.

OneTrust had relied heavily on trade shows before the pandemic hit. In fact, Dabbiere says that they attended as many as 700 a year. When that avenue closed as the pandemic hit, they initially lowered their revenue guidance, but as they moved to digital channels along with their customers, they found that revenue didn’t drop as they expected.

He says that OneTrust has money in the bank from its prior investments, but they had reasons for taking on more cash now anyway. “The number one reason for doing this was the currency of our stock. We needed to revalue it for employees, for acquisitions, and the next steps of our growth,” he said.

Powered by WPeMatico

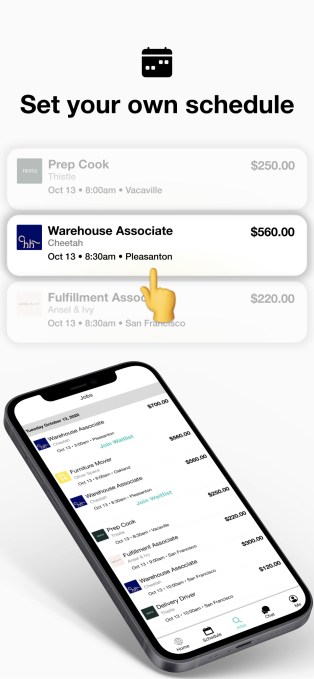

While there’s been plenty of recent debate around the gig economy, Jarah Euston argued that it’s time to rethink a bigger part of the workforce — hourly workers.

Euston, who was previously an executive at mobile advertising startup Flurry and a co-founder at data operations startup Nexla, told me that although 80 million Americans are paid on an hourly basis, the current system doesn’t work particular well for either employers or workers.

On the employer side, there are usually high rates of turnover and absenteeism, while workers have to deal with unpredictable schedules and often struggle to get assigned all the hours they want. So Euston has launched WorkWhile to create a better system, and she’s also raised $3.5 million in seed funding.

WorkWhile, she explained, is a marketplace that matches hourly workers with open shifts — employers identify the shifts that they want filled, while workers say which hours they want to work. That means employers can grow or shrink their workforce as needed, while the workers only work when they want.

“By pooling the labor force … we can provide the flexibility that both sides want,” Euston said.

Image Credits: WorkWhile

WorkWhile screens workers with one-on-one interviews, background checks and tests based on cognitive science, with the goal of identifying applicants who are qualified and reliable.

Employers pay WorkWhile a service fee, while the platform is free for users. And because the startup aims to build a long-term relationship with its workforce, Euston said it will also invest by providing additional benefits, starting with sick leave credits earned when you work and next-day payments to your debit cards.

“It’s hard to find a job that works with you and doesn’t give you a take it or leave it schedule,” said Michael Zavala, one of the workers on the platform, in a statement. “WorkWhile was exactly what I was looking for with the ability to create your own schedule for full time.”

The startup is launching in the San Francisco Bay Area, Los Angeles, Orange County and Dallas-Forth Worth.

Given the broader economic and employment trends during the pandemic, there should plenty of people looking for more work, while Euston said she’s seen a “feast or famine” situation on the employer side — yes, some companies have had to freeze or cut staff, but others have grown rapidly, including WorkWhile customers including restaurant supplier Cheetah, meal delivery service Thistle and horticultural e-commerce company Ansel & Ivy.

The funding, meanwhile, was led by Khosla Ventures, with participation from Stitch Fix founder and CEO Katrina Lake, Jennifer Fonstad, F7, Siqi Chen, Philipp Brenner, Zouhair Belkoura and Nicholas Pilkington.

“The majority of hourly workers are honest and reliable but some have difficult personal circumstances they need help with,” Vinod Khosla said in a statement. “Companies treat these employees as high turnover and expendable but, if given respect and appropriate support, they can become longer-term, model employees. WorkWhile wants to help solve this problem.”

Powered by WPeMatico

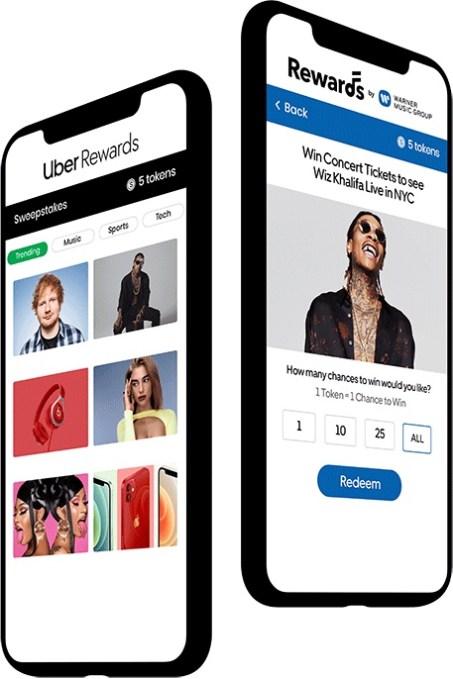

Tap Network is providing a new approach to loyalty rewards programs that it describes as “rewards as a service.”

You may recognize the Tap Network name, as well as its co-founder and CEO Lin Dai, from Hooch, a startup that offered a drink-a-day subscription service before shifting focus to a broader rewards program. Dai told me he “learned a lot from the Hooch experience” but ultimately “decided that Tap is a much bigger opportunity, we’re really looking at rewards in general.”

So Tap Network is a new startup, one that recently raised $4 million in funding from investors including Revelis Capital, Nima Capital, the Forbes family office, Warner Music Group, Access Industries, Bill Tai, Bob Hurst, Edward Devlin and others.

Dai said that normal rewards programs are only accessible to the top 10% or 20% of a company’s customers. So in his view, businesses have an opportunity to “super serve the average customers who 40 years ago might not have been considered important customers, but who today could be building a loyalty behavior pattern.”

Image Credits: Tap Network

He added that making rewards programs accessible to more customers has an added benefit for many businesses, because “whether it’s a major bank or major travel company, they are starting to accrue billions of dollars that are locked up in these wallets.” Those points might never be redeemed, but they’re still considered liabilities from an accounting perspective.

Tap Network aims to solve this problem by allowing customers to spend those points through a broader network of rewards, which can usually be redeemed at a lower point level. It’s offered as a white-label addition to an existing rewards program, with each program choosing the rewards that might be the best fit for their customers.

For example, Uber recently worked with Tap Network to expand its Uber Rewards program, offering new Tap Network-powered rewards like free Apple Music or HBO Max, as well as the option to donate to causes like World Central Kitchen. And the minimum number of points needed to claim a reward fell from 500 points to 100 points.

Other companies using Tap Network include Warner Music Group (which, as previously mentioned, is also an investor) and privacy-focused browser company Brave.

Dai said that in the future, Tap could even allow consumers to combine rewards points from different programs: “If I want to redeem something, I might be able to take a little bit of my Uber points, a little bit of my Warner points, a little bit of points from another program,” and combine them.

Powered by WPeMatico

Zomato has raised $660 million in a financing round that it kicked off last year as the Indian food delivery startup prepares to go public next year.

The Indian startup said Tiger Global, Kora, Luxor, Fidelity (FMR), D1 Capital, Baillie Gifford, Mirae and Steadview participated in the round — a Series J — which gives Zomato a post-money valuation of $3.9 billion. Zomato had previously disclosed a fundraise of about $212 million as part of a Series J round from Ant Financial, Tiger Global, Baillie Gifford and Temasek.

Deepinder Goyal, the co-founder and chief executive of Zomato, said the 12-year-old startup is also in the process of closing a $140 million secondary transaction. “As part of this transaction, we have already provided liquidity worth $30m to our ex-employees,” he tweeted.

The startup originally anticipated to close a round of about $600 million by January this year, but several obstacles, including the current pandemic, delayed the fundraise effort. Additionally, Ant Financial, which had originally committed to invest $150 million in this round, only delivered a third of it, Zomato’s investor Info Edge disclosed earlier this year.

The Gurgaon-headquartered startup, which acquired the Indian food delivery business of Uber early this year, competes with Prosus Ventures-backed Swiggy in India. A third player, Amazon, has also emerged in the market, though it currently offers its food delivery service in only parts of Bangalore.

At stake is India’s food delivery market, which analysts at Bernstein expect to balloon to be worth $12 billion by 2022, they wrote in a report to clients — accessed by TechCrunch. With about 50% of the market share, Zomato is the current leader among the three, Bernstein analysts wrote.

Zomato eliminated hundreds of jobs this year to improve its finances and navigate the coronavirus pandemic, which significantly hurt the food delivery business in India in the early months. Goyal said the food delivery market is “rapidly coming out of COVID-19 shadows. December 2020 is expected to be the highest ever GMV month in our history. We are now clocking ~25% higher GMV than our previous peaks in February 2020.” He added, “I am supremely excited about what lies ahead and the impact that we will create for our customers, delivery partners, and restaurant partners.”

In September, Goyal told employees that Zomato was working for its IPO for “sometime in the first half of next year” and was raising money to build a war-chest for “future M&A, and fighting off any mischief or price wars from our competition in various areas of our business.”

Making money with food delivery has been especially challenging in India. Unlike Western markets such as the U.S., where the value of each delivery item is about $33, in India, a similar item carries the price tag of $4, according to estimates by Bangalore-based research firm RedSeer.

“The problem is that there are very few people in India who can afford to place an order from a food delivery firm each day,” said Anand Lunia, a venture capitalist at India Quotient, in an interview with TechCrunch earlier this year.

Powered by WPeMatico

We’ve seen a big wave of proptech startups emerge to reimagine how houses are bought and sold, with some tapping into the opportunity with distressed property, and others exploring the “iBuyer” model where houses are bought and fixed up by a single startup and resold to homeowners who don’t want to invest in a fixer-upper. But the vast majority of homes are still sold the traditional way, by way of a real estate agent working via a broker.

Today, a startup is announcing that it has raised seed funding not to disrupt, but improve that basic model with a more flexible approach that can help agents work in a more modern way, and to ultimately scale out the number of people working as agents in the market.

Avenue 8, which describes itself as a “mobile-first residential real estate brokerage” — providing a new set of tools for agents to source, list and sell homes, and handle the other aspects of the process that fall between those — has raised $4 million. This is a seed round, and Avenue 8 plans to use it to expand further in the cities where it is already active — it’s been in beta thus far in the San Francisco and Los Angeles areas — as well as grow to several more.

The funding is notable because of the backers that the startup has attracted early on. It’s being led by Craft Ventures — the firm co-founded by David Sacks and Bill Lee that has amassed a prolific and impressive portfolio of companies — with Zigg Capital and Good Friends (an early-stage fund from the founders of Warby Parker, Harry’s and Allbirds) also participating.

There has been at least $18 billion in funding raised by proptech companies in the last decade, and with that no shortage of efforts to take the lessons of tech — from cloud computing and mobile technology, through to artificial intelligence, data science and innovations in e-commerce — and apply them to the real estate market.

Michael Martin, who co-founded Avenue 8 with Justin Fichelson, believes that this pace of change, in fact, means that one has to continually consider new approaches.

“It’s important to remember that Compass’s growth strategy was to roll out its technology to traditional brokerages,” he said of one of the big juggernauts in the space (which itself has seen its own challenges). “But if you built it today, it would be fundamentally different.”

And he believes that “different” would look not unlike Avenue 8.

The startup is based around a subscription model for a start, rather than a classic 30/70 split on the sales commissions that respectively (and typically) exist between brokers and agents.

Around that basic model, Avenue 8 has built a set of tools that provides agents with an intuitive way to use newer kinds of marketing and analytics tools both to get the word out about their properties across multiple channels; analytics to measure how their efforts are doing, in order to improve future listings; and access to wider market data to help them make more informed decisions on valuations and sales. It also provides a marketplace of people — valets — who can help stage and photograph properties for listing, and Avenue 8 doesn’t require payments to be made to those partners unless a home sells.

It also provides all of this via a mobile platform — key for people in a profession that often has them on the move.

Targeting agents that have in the past relied essentially on using whatever tools the brokers use — which often were simply their own sites plus some aggregating portals — Avenue 8’s pitch is not just better returns but a better process to get there.

“We’ve heard time and time again that agents struggle to identify and leverage the technology and tools to successfully manage their relationships and properties. Changing buyer/seller expectations have accelerated the digital transformation of most agents’ workflows,” said Ryan Orley, partner at Zigg Capital, in a statement. “Avenue 8 is building and integrating the right software and resources for our new reality.”

What’s also interesting about Avenue 8 is how it can open the door to a wider pool of agents in the longer run.

The real estate market has been noticeably resilient throughout the pandemic, with lower interest rates, a generally lower overall home inventory and people spending more time at home (and wanting a better space) creating a high level of demand. With a number of other industries feeling the pinch, a flexible platform like Avenue 8’s creates a way for people — who have taken and passed the certifications needed to become agents — to register and flexibly work as an agent as much or as little as they choose, creating a kind of “Uber for real estate agents,” as it were.

That scaling opportunity is likely one of the reasons why this has potentially caught the eye of investors.

“Avenue 8’s organic growth is clear evidence that the market demands a mobile-first, digital platform,” said Jeff Fluhr, general partner at Craft Ventures, in a statement. “Michael and Justin have a clear vision for modernizing real estate while keeping agents at the center. Avenue 8’s model helps agents take home more even in today’s environment where commissions are compressing.”

Interestingly, just as Uber’s changed the way that on-demand transportation is ordered and delivered, Avenue 8 is starting to see some interesting traction in terms of its place in the real estate market. Although it was originally targeted at agents with the pitch of being like “a better broker” — providing the services brokers are regulated to provide, but with a more modern wrapper around it — it’s also in some cases attracting brokerages, too. Martin said that it’s already working with a few smaller ones, and ultimately might consider ways of providing its tools to larger ones to manage their businesses better.

Powered by WPeMatico

The world of virtual communications continues to hold a central place in our socially-distanced lives, and today it looks like one of the companies reaping some of the spoils is also reaping some funding out of it. Discord, the chat and communications platform wildly popular with gamers and, increasingly, many others, has confirmed to us today that it has raised $100 million more in funding as it hits 140 million monthly active users, double the number it had a year ago.

“We are humbled and honored by the growth we’ve seen among so many incredible and diverse communities that have made Discord their place to hang out,” said co-founder and CEO Jason Citron in a statement. “As we look to 2021, we are excited about what we have in store and plan to use this funding to help make Discord even better – both for our free service and our Nitro subscribers.”

Greenoaks Capital is leading this round, and we’ve confirmed with sources that Index Ventures is also participating.

“Discord is the best place to gather with your communities, whether to play video games, swap recipes, or collaborate on a project,” said Neil Mehta, founder and managing partner at Greenoaks Capital, in a statement. “We believe Discord will evolve and grow alongside the endless innovation in the ways people interact, ultimately connecting billions of people around the world. We are lucky to continue our long-term partnership with Jason, Stan and the entire Discord team.”

Earlier today, we reported that the company was in the process of raising up to $140 million in a Series H round, at a valuation that could be as high as $7 billion, according to paperwork filed by the company and unearthed by Prime Unicorn Index.

We have attached the documentation at the end of this article. Given the discrepancy between how much it’s announcing today, and how much it’s filed to raise, we have asked to see if the round is still open.

The analysts’ report appears to confirm our own reporting from some weeks ago. At the end of November, sources had confirmed to us that the company was raising at a valuation of up to $7 billion.

We also are trying to confirm if that is indeed the valuation with this round.

This latest fundraising had been rumored for a while, and some have described it as a “pre-IPO round” for the privately-backed startup. Prime Unicorn notes that Discord’s most recent price per share in the documentation is $280.2487, with the Series G priced at $144.1809.

Previous investors in the company have included Greylock, IVP, Spark Capital, Tencent and Benchmark, among others. With an extra $140 million, the total amount raised by the startup would stand at $420 million.

The fundraise, and the size of it, is a testament not just to how virtual communications tools continue to be an important part of our lives these days; but to the growth of Discord itself.

Discord made its name originally as a communications channel that could exist in an easy way alongside popular online games — a byproduct, perhaps, of how it first came into existence. Discord was started by Jason Citron and Stanislav Vishnevskiy as part of their Hammer & Chisel gaming studio as a way for them and their teams to communicate tactics and other details to each other while playing games (their own games, other people’s games, all games).

It proceeded to get lots of traction on Twitch and with e-sports players, environments where it might be especially interesting for both players and spectators to have a place to provide running commentary on what is going on.

But just as the biggest games and gameplay has mass-market, even casual, appeal, so can the platforms that gamers use to communicate. Discord’s growth has exploded in recent years, with monthly active users doubling to 140 million this year with 800,000 downloads a day.

That’s in part down to Discord’s use alongside newly, virally popular games like Among Us; but also because it’s being used for more than just games.

The company had already raised $100 million on a $3.5 billion valuation earlier this year, and at the time Citron and Vishnevskiy noted that the platform had already outgrown — or at least made room for much more than — its gaming roots:

“It turns out that, for a lot of you, it wasn’t just about video games anymore,” they noted, describing Discord as “a place designed to hang out and talk in the comfort of your own communities and friends… a place to have genuine conversations and spend quality time with people, whether catching up, learning something or sharing ideas.”

That growth among “communities” hasn’t been without its teething pains. Discord has had a high profile, ongoing battle with unsavory elements like white supremacism on its platform. The company claims that this is on the wane, and that the platform is also a home for Black Lives Matter organizers, less politicised social media influencers, and more. Some are not so convinced, so perhaps it’s a problem that not a finished story and will continue to need to be tackled, much as it is on any social platform.

“Discord is always on and always present among these groups on the far-right,” Joan Donovan, the lead researcher on media manipulation at the Data & Society Research Institute, told Slate some years ago. “It’s the place where they do most of the organizing of doxing and harassment campaigns.”

It’s interesting that this latest $140 million of funding — that is if it closes — is coming so swiftly on the heels of the last round, just six months later. The company and its investors have some clear ambitions to build out not just more, better and efficient tools for gamers, but for people online at large, and that’s not cheap.

Some of that is happening already: witness yesterday’s news of Discord’s screen share functionality getting extended finally beyond desktop to iOS and Android (an interesting area, considering Twitter’s recent acquisition of Squad).

“Rather than throwing raw content at you, like Facebook, [Discord] provides a shared experience for you and your friends,” said Danny Rimer of Index Ventures, which led the $100 million round earlier this year. “We’ll come to appreciate that Discord does for social conversation what Slack has done for professional conversation.”

Prime Unicorn note that the terms in the Series H include “a pari passu liquidation preference with all other preferred, and conventional convertible meaning they will not participate with common stock if there are remaining proceeds.”

PrimeUnicornIndex_Discord_COI_12112020

Updated with confirmation from Discord

Powered by WPeMatico