funding

Auto Added by WPeMatico

Auto Added by WPeMatico

GitLab has confirmed with TechCrunch that it raised a $195 million secondary round on a $6 billion valuation. CNBC broke the story earlier today.

The company’s impressive valuation comes after its most recent 2019 Series E in which it raised $268 million on a 2.75 billion valuation, an increase of $3.25 billion in under 18 months. Company co-founder and CEO Sid Sijbrandij believes the increase is due to his company’s progress adding functionality to the platform.

“We believe the increase in valuation over the past year reflects the progress of our complete DevOps platform towards realizing a greater share of the growing, multi-billion dollar software development market,” he told TechCrunch.

While the startup has raised over $434 million, this round involved buying employee stock options, a move that allows the company’s workers to cash in some of their equity prior to going public. CNBC reported that the firms buying the stock included Alta Park, HMI Capital, OMERS Growth Equity, TCV and Verition.

The next logical step would appear to be IPO, something the company has never shied away from. In fact, it actually at one point included the proposed date of November 18, 2020 as a target IPO date on the company wiki. While they didn’t quite make that goal, Sijbrandij still sees the company going public at some point. He’s just not being so specific as in the past, suggesting that the company has plenty of runway left from the last funding round and can go public when the timing is right.

“We continue to believe that being a public company is an integral part of realizing our mission. As a public company, GitLab would benefit from enhanced brand awareness, access to capital, shareholder liquidity, autonomy and transparency,” he said.

He added, “That said, we want to maximize the outcome by selecting an opportune time. Our most recent capital raise was in 2019 and contributed to an already healthy balance sheet. A strong balance sheet and business model enables us to select a period that works best for realizing our long-term goals.”

GitLab has not only published IPO goals on its Wiki, but its entire company philosophy, goals and OKRs for everyone to see. Sijbrandij told TechCrunch’s Alex Wilhelm at a TechCrunch Disrupt panel in September that he believes that transparency helps attract and keep employees. It doesn’t hurt that the company was and remains a fully remote organization, even pre-COVID.

“We started [this level of] transparency to connect with the wider community around GitLab, but it turned out to be super beneficial for attracting great talent as well,” Sijbrandij told Wilhelm in September.

The company, which launched in 2014, offers a DevOps platform to help move applications through the programming lifecycle.

Powered by WPeMatico

Harness, the startup that wants to create a suite of engineering tools to give every company the kind of technological reach that the biggest companies have, announced an $85 million Series C today on a $1.7 billion valuation.

Today’s round comes after 2019’s $60 million Series B, which had a $500 million valuation, showing a company rapidly increasing in value. For a company that launched just three years ago, this is a fairly remarkable trajectory.

Alkeon Capital led the round with help from new investors Battery Ventures, Citi Ventures, Norwest Venture Partners, Sorenson Capital and Thomvest Ventures. The startup also revealed a previously unannounced $30 million B-1 round raised after the $60 million round, bringing the total raised to date to $195 million.

Company founder and CEO Jyoti Bansal previously founded AppDynamics, which he sold to Cisco in 2017 for $3.7 billion. With his track record, investors came looking for him this round. It didn’t hurt that revenue grew almost 3x last year.

“The business is doing very well, so the investor community has been proactively reaching out and trying to invest in us. We were not actually planning to raise a round until later this year. We had enough capital to get through that, but there were a lot of people wanting to invest,” Bansal told me.

In fact, he said there is so much investor interest that he could have raised twice as much, but didn’t feel a need to take on that much capital at this time. “Overall, the investor community sees the value in developer tools and the DevOps market. There are so many big public companies now in that space that have gone out in the last three to five years and that has definitely created even more validation of this space,” he said.

Bansal says that he started the company with the goal of making every company as good as Google or Facebook when it comes to engineering efficiency. Since most companies lack the engineering resources of these large companies, that’s a tall task, but one he thinks he can solve through software.

The company started by building a continuous delivery module. A cloud cost-efficiency module followed. Last year the company bought open-source continuous integration company Drone.io and they are working on building that into the platform now, with it currently in beta. There are additional modules on the product roadmap coming this year, according to Bansal.

As the company continued to grow revenue and build out the platform in 2020, it also added a slew of new employees, growing from 200 to 300 during the pandemic. Bansal says that he has plans to add another 200 by the end of this year. Harness has a reputation of being a good place to work, recently landing on Glassdoor’s best companies list.

As an experienced entrepreneur, Bansal takes building a diverse company with a welcoming culture very seriously. “Yes, you have to provide equal opportunity and make sure that you are open to hiring people from diverse backgrounds, but you have to be more proactive about it in the sense that you have to make sure that your company environment and company culture feels very welcoming to everyone,” he said.

It’s been a difficult time building a company during the pandemic, adding so many new employees, and finding a way to make everyone feel welcome and included. Bansal says he has actually seen productivity increase during the pandemic, but now has to guard against employee burnout.

He says that people didn’t know how to draw boundaries when working at home. One thing he did was introduce a program to give everyone one Friday a month off to recharge. The company also recently announced it would be a “work from anywhere” company post-COVID, but Bansal still plans on having regional offices where people can meet when needed.

Powered by WPeMatico

Small enterprises remain one of the most underserved segments of the business market, but the growth of cloud-based services — easier to buy, easier to provision — has helped that change in recent years. Today, one of the more promising startups out of Europe building software to help SMEs run online businesses is announcing some funding to better tap into both the opportunity to build these services, and to meet a growing demand from the SME segment.

Xentral, a German startup that develops enterprise resource planning software covering a variety of back-office functions for the average online small business, has picked up a Series A of $20 million.

The company’s platform today covers services like order and warehouse management, packaging, fulfillment, accounting and sales management, and the majority of its 1,000 customers are in Germany — they include the likes of direct-to-consumer brands like YFood, KoRo, the Nu Company and Flyeralarm.

But Benedikt Sauter, the co-founder and CEO of Xentral, said the ambition is to expand into the rest of Europe, and eventually other geographies, and to fold in more services to its ERP platform, such as a more powerful API to allow customers to integrate more services — for example in cases where a business might be selling on their own site, but also Amazon, eBay, social platforms and more — to bring their businesses to a wider market.

Mainly, he said, the startup wants “to build a better ecosystem to help our customers run their own businesses better.”

The funding is being led by Sequoia Capital, with Visionaires Club (a B2B-focused VC out of Berlin) also participating.

The deal is notable for being the prolific, high-profile VC’s first investment in Europe since officially opening for business in the region. (Sequoia has backed a number of startups in Europe before this, including Graphcore, Klarna, Tessian, Unity, UiPath, n8n and Evervault — but all of those deals were done from afar.)

Augsburg-based Xentral has been around as a startup since 2018, and “as a startup” is the operative phrase here.

Sauter and his co-founder Claudia Sauter (who is also his co-founder in life: she is his wife) built the early prototype for the service originally for themselves.

The pair were running a business of their own — a hardware company they founded in 2008, selling not nails, hammers and wood, but circuit boards they designed, along with other hardware to build computers and other connected objects. Around 2013, as the business was starting to pick up steam, they decided that they really needed better tools to manage everything at the backend so that they would have more time to build their actual products.

But Bene Sauter quickly discovered a problem in the process: smaller businesses may have Shopify and its various competitors to help manage e-commerce at the front end, but when it came to the many parts of the process at the backend, there really wasn’t a single, easy solution (remember this was eight years ago, at a time before the Shopifys of the world were yet to expand into these kinds of tools). Being of a DIY and technical persuasion — Sauter had studied hardware engineering at university — he decided that he’d try to build the tools that he wanted to use.

The Sauters used those tools for years, until without much outbound effort, they started to get some inbound interest from other online businesses to use the software, too. That led to the Sauters balancing both their own hardware business and selling the software on the side, until around 2017/2018 when they decided to wind down the hardware operation and focus on the software full time. And from then, Xentral was born. It now has, in addition to 1,000 customers, some 65 employees working on developing the platform.

The focus with Xentral is to have a platform that is easy to implement and use, regardless of what kind of SME you might be as long as you are selling online. But even so, Sauter pointed out that the other common thread is that you need at least one person at the business who champions and understands the value of ERP. “It’s really a mindset,” he said.

The challenge with Xentral in that regard will be to see how and if they can bring more businesses to the table and tap into the kinds of tools that it provides, at the same time that a number of other players also eye up the same market. (Others in the same general category of building ERP for small businesses include online payments provider Sage, NetSuite and Acumatica.) ERP overall is forecast to become a $49.5 billion market by 2025.

Sequoia and its new partner in Europe, Luciana Lixandru — who is joining Xentral’s board along with Visionaries’ Robert Lacher — believe however that there remains a golden opportunity to build a new kind of provider from the ground up and out of Europe specifically to target the opportunity in that region.

“I see Xentral becoming the de facto platform for any SMEs to run their businesses online,” she said in an interview. “ERP sounds a bit scary especially because it makes one think of companies like SAP, long implementation cycles, and so on. But here it’s the opposite.” She describes Xentral as “very lean and easy to use because you an start with one module and then add more. For SMEs it has to be super simple. I see this becoming like the Shopify for ERP.”

Powered by WPeMatico

After launching in October, Tradeswell is announcing today that it has raised $15.5 million in Series A funding.

Co-founder and CEO Paul Palmieri previously led digital ad company Millennial Media (now owned by TechCrunch’s parent company Verizon Media), and he said the e-commerce market today is similar to the online ad market when he was leading Millennial — ready for more optimization and automation.

Tradeswell focuses on six components of e-commerce businesses — marketing, retail, inventory, logistics, forecasting, lifetime value and financials — with the key goal of allowing those businesses to improve their net margins, rather than simply driving more clicks or purchases. The platform can fully automate some processes, such as buying online ads.

To illustrate what it can accomplish, Tradeswell pointed to the work it did with a personal care brand on Amazon Prime Day, with total sales doubling versus the previous Prime Day and profits increasing 67%.

The startup has now raised a total of $18.8 million. The Series A was led by SignalFire, which also led Tradeswell’s seed round, while Construct Capital, Allen & Company and The Emerson Group also participated.

“With the explosion of ecommerce over the past year, Tradeswell is perfectly positioned to help brands manage the complexity of online sales across an ever-increasing number of platforms and marketplaces,” said SignalFire founder and CEO Chris Farmer in a statement. “Paul and his team bring together a unique blend of experience in data, marketing and logistics to address the challenges of today and a rapidly evolving market in the years ahead with a central command center to optimize profitable growth.”

Palmieri said the new funding will allow Tradeswell to continue investing in the product, which will also mean building more integrations so that more types of data become “more liquid,” which in turn means that the platform can “make much more real-time decisions.”

When Tradeswell launched publicly last fall, it already had 100 customers, and Palmieri told me that number has subsequently grown past 150. Nor does he expect the consumer shift in e-commerce to disappear once the pandemic ends.

“Some of it probably goes back to the way it was, some of it stays online,” he said. “I do think it’s important to point out there’s something in the middle — that something is this notion of high convenience, that is semi-brick-and-mortar with [elements of e-commerce], whether that’s mobile ordering or something like an Instacart.”

Naturally, he sees Tradeswell as the key platform to help businesses navigate that shift.

Powered by WPeMatico

Openbase founder Lior Grossman started his company the way that many founders do — to solve a problem he was having. In this case, it was finding the right open-source components to build his software. He decided to build something to solve the problem, and Openbase was born.

Today, the company announced a $3.65 million seed round led by Zeev Ventures with participation from Y Combinator and 20 individual tech industry investors. Openbase was a member of the YC 2020 cohort.

Grossman says that being part of YC helped him meet investors, especially on Demo Day when hundreds of investors listened in. “I would say that being part of YC definitely gave us a higher profile, and exposed us to some investors that I didn’t know before. It definitely opened doors for us,” he said.

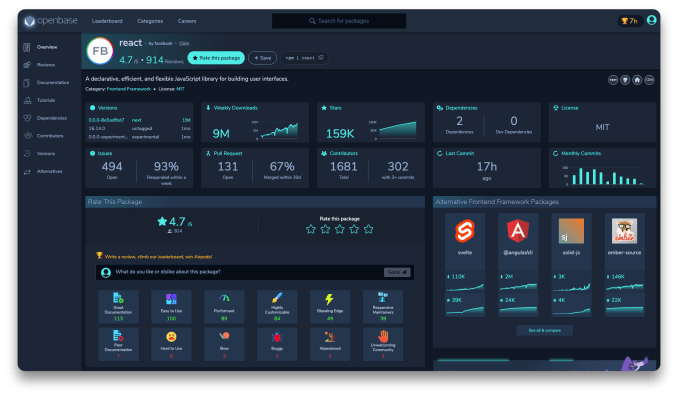

As developers build modern software, they often use open-source components to help build the application, and Openbase helps them find the best one for their purposes. “Openbase basically helps developers choose from among millions of open-source packages,” Grossman told me.

The database includes 1.5 million JavaScript packages today, with support for additional languages including Python and Go in beta. The way it works is that users search for a package based on their requirements and get a set of results. From there, they can compare components and judge them based on user reviews and other detailed insights.

Image Credits: Openbase

Grossman found that his idea began resonating with developers shortly after he launched in 2019. In fact, he reports that he went from zero to half a million users in the first year without any marketing beyond word of mouth. That’s when he decided to apply to Y Combinator and got into the Summer 2020 class.

The database is free for developers, and that has helped build the user base so quickly. Eventually he hopes to monetize by allowing certain companies to promote their packages on the system. He says that these will be clearly marked and that the plan is to have only one promoted package per category. What’s more, they will retain all their user reviews and other associated data, regardless of whether it’s being promoted or not.

Grossman started the company on his own, but has added five employees, with plans to hire more people this year to keep growing the startup. As an immigrant founder, he is sensitive to diversity and sees building a diverse company as a key goal. “I built this company as an immigrant myself […] and I want to build an inclusive culture with people from different backgrounds because I think that will produce the best environment to foster innovation,” he explained.

So far the company has been fully remote, but the plan is to open an office post-pandemic. He says he sees a highly flexible approach to work, though, with people spending some days in the office and some at home. “I think for our culture this hybrid approach will work. Whenever we expand further I obviously imagine having more offices and not only our office in San Francisco.”

Powered by WPeMatico

The last we heard from Luther.ai, the startup was participating in the TechCrunch Disrupt Battlefield in September. The company got a lot of attention from that appearance, which culminated in a $3.2 million seed round it announced today. While they were at it, the founders decided to change the company name to Human AI, which they believe better reflects their mission.

Differential VC led the round, joined by Village Global VC, Good Friends VC, Beni VC and Keshif Ventures. David Magerman from Differential will join the startup’s board.

The investors were attracted to Human AI’s personalized kind of artificial intelligence, and co-founder and CEO Suman Kanuganti says the Battlefield appearance led directly to investor interest, which quickly resulted in a deal four weeks later.

“I think overall the messaging of what we delivered at TechCrunch Disrupt regarding an individual personal AI that is secured by blockchain to retain and recall [information] really set the stage for what the company is all about, both from a user standpoint as well as from an investor standpoint,” Kanuganti told me.

As for the name change, he reported that there was some confusion in the market that Luther was an AI assistant like Alexa or a chatbot, and the founders wanted the name to better reflect the personalized nature of the product.

“We are creating AI for the individual and there is so much emphasis on the authenticity and the voice and the thoughts of an individual, and how we also use blockchain to secure ownership of the data. So most of the principle lies in creating this AI for an individual human. So we thought, let’s call it Human AI,” he explained.

As Kanuganti described it in September, the tool allows individuals to search for nuggets of information from past events using a variety of AI technologies:

It’s made possible through a convergence of neuroscience, NLP and blockchain to deliver seamless in-the-moment recall. GPT-3 is built on the memories of the public internet, while Luther is built on the memories of your private self.

The company is still in the process of refining the product and finding its audience, but reports that so far they have found interest from creative people such as writers, professionals such as therapists, high-tech workers interested in AI, students looking to track school work and seniors looking for a way to track their memories for memoir purposes. All of these groups have the common theme of having to find nuggets of information from a ton of signals, and that’s where Human AI’s strength lies.

The company’s diverse founding team includes two women, CTO Sharon Zhang and designer Kristie Kaiser, along with Kanuganti, who is himself an immigrant. The founders want to continue building a diverse organization as they add employees. “I think in general we just want to attract a diverse kind of talent, especially because we are also Human AI and we believe that everyone should have the same opportunity,” Zhang told me.

The company currently has seven full-time employees and a dozen consultants, but with the new funding is looking to hire engineers and AI talent and a head of marketing to push the notion of consumer AI. While the company is remote today and has employees around the world, it will look to build a headquarters at some point post-COVID where some percentage of the employees can work in the same space together.

Powered by WPeMatico

It’s estimated that there were some 50 billion connected devices globally in 2020, and while that really says a lot about how far we’ve come in tech, for many it also speaks to a big issue: security vulnerabilities, with the devices themselves, plus all the components and services running on them, all potential targets for anything from malicious hackers to not-so-intentional data leaks.

Today, Israeli startup Vdoo — which has been developing AI-based services to detect and fix those kinds of vulnerabilities in IoT devices — is announcing $25 million in funding, money that it plans to use to help it better address the wider issue as it applies to all connected objects. With its initial focus on large industrial deployments, medical systems, communications infrastructure and automotive, Vdoo also is looking more deeply now at the wider network of devices that use communications chips, providing quick (as in minutes) assessments to identify and remediate or directly fix various issues: it cites zero-day vulnerabilities, CVEs, configuration and hardening issues, and standard incompliances among them.

The funding — an extension to the $32 million round that Vdoo announced in April 2019 — is coming from two investors, Israel’s Qumra Capital and Verizon Ventures (the investing arm of Verizon, which — by way of its acquisition of Aol many years ago — also owns TechCrunch).

Verizon’s interest in Vdoo is strategic and speaks to the opportunity in the market. As CEO Netanel Davidi (who co-founded the company with Uri Alter and Asaf Karas) describes it, operators like Verizon are interested because of their role as a distributer and reseller of hardware as part of their wider services play, be it for broadband access, or a telematics service or something for the connected home or connected office.

“They sell connected devices to enterprises and home users that are not made by them, yet the carriers are responsible for the security,” he said, “so the solution is to bake that into devices” to make it work more seamlessly, he said.

Verizon is not the startup’s only strategic backer. Others in the first tranche of this round included another carrier, Japan’s NTT Docomo, MS&AD Ventures (the venture arm of the global cyber insurance firm) and Dell Technology Capital, the VC arm of Dell.

The company has now raised around $70 million, and while it’s not disclosing valuation, Davidi confirmed that it has more than doubled this year.

(In April 2019, PitchBook estimated that it was just under $100 million, which would make it now at over $200 million if that figure is accurate.)

Davidi said that the decision to raise this money as an extension to the previous round rather than a new round was strategic: it gave the company the chance to raise funding more quickly, and to take more time to prepare for a bigger funding round in the near future.

And the reason for raising quickly was to address what was a quickly moving target: One of the by-products of the COVID-19 pandemic has been a dramatic shift to people working from home, buying new devices to enable that and in general using their communications networks much more heavily than before.

Connected-device security typically focuses on monitoring activity on the hardware, how data is moving in and out of it. Vdoo’s approach has been to build a platform that monitors the behavior of the devices themselves, using AI to compare that behavior to identify when something is not working as it should.

“For any kind of vulnerability, using deep binary analysis capabilities, we try to understand the broader idea, to figure out how a similar vulnerability can emerge,” is how Davidi described the process when we talked about the first part of this round back in 2019.

Vdoo generates specific “tailor-made on-device micro-agents” to continue the detection and repair process, which Davidi likens to a modern approach to some cancer care: preventive measures such as periodic monitoring checks, followed by a “tailored immunotherapy” based on prior analysis of DNA.

Vdoo is a play on the Hebrew word that sounds like “vee-doo” and means “making sure”, and points to the basic idea of how it approaches the verification around its device monitoring. It also feels somewhat like the next step in endpoint security, which was the focus of Davidi and Alter’s previous startup, Cyvera, which was eventually acquired by Palo Alto Networks.

The focus on devices, in some ways, is a significantly more complex approach, given that it’s not just about the device, but the many components that go into them. As we have seen with Meltdown and Spectre, vulnerabilities might exist at the processor level.

And as Davidi pointed out to me this week, at times those issues aren’t even intentional but still mean data can leak out, and at worst that can be exploitable by bad actors.

“Backdoors are being built into many devices, and some are not even intentional,” he said. “It may be that the developer wanted to create a shortcut to make something else easier in the future. Some will see that as a back door, and some will not.”

The fractal-like nature of the issue is what Vdoo is digging into with its widening approach.

“Initially we wanted to serve the ecosystem of manufacturers, since they are the cause of the problem and the origin of the security issues,” he said. “We started there with Fortune 500 customers in areas like automotive and industrial and medical and telco and aviation. The idea was to make a platform that could serve and protect security stakeholders. But then we saw that this was a big unserved market.”

Indeed, Vdoo quotes figures from research firm MarketsandMarkets that forecast that the global device security market will grow to $36.6 billion by 2025 from $12.5 billion in 2020.

“The number of connected IoT devices is rapidly growing, creating greater opportunities for security breaches,” said Boaz Dinte, managing partner of Qumra Capital, in a statement. “Vdoo’s unique device-centric, deep technology automated approach has already brought immediate value to vendors in a very short period of time. We believe the market opportunity is huge, and with newly infused growth capital, Vdoo is well-positioned to become the leading global player for securing connected devices.”

“With the expansion of 5G networks and mobile edge compute, there’s a need for an end-to-end, device-centric security approach to IoT,” added Verizon Ventures MD Tammy Mahn in a statement. “As the venture arm of a leading telco, Verizon Ventures is proud to invest in Vdoo and its world-class team on their journey to solve this global need, while ushering in a new era of security by design in our increasingly connected world.”

Powered by WPeMatico

You & Mr. Jones announced today that it has added $60 million in new funding from Merian Chrysalis, bringing the Series B round announced in December to a total of $260 million.

The round values the company at $1.36 billion, post-money.

You & Mr. Jones takes its name from CEO David Jones, who founded the company in 2015. After having served as the CEO of ad giant Havas, Jones told me that his goal in starting what he called “a brand tech group” was to provide marketers with something that neither traditional agencies nor technology companies could give them.

“At that moment, the choices were to go work with an agency group, which is great at brand and marketing, but they don’t understand tech, or with a tech company, which will only ever recommend their platform and don’t have the same [brand and marketing] expertise,” he said.

So You & Mr. Jones has built its own technology platform to help marketers with their digital, mobile and e-commerce needs, while also investing in companies like Pinterest and Niantic. And it makes acquisitions — last year, for example, it bought influencer marketing company Collectively.

You & Mr. Jones has grown to 3,000 employees, and its clients include Unilever, Accenture, Google, Adidas, Marriott and Microsoft. In fact, Jones said that as of the third quarter of 2020, its net revenue had grown 27% year over year.

That’s particularly impressive given the impact of the pandemic on ad spending, but Jones said that’s one of the key distinctions between digital advertising and the broader brand tech category, which he said has grown steadily, even during the pandemic, and which also sets the company apart from agencies that are “digital and tech in press release only.”

“We’re not an ad agency, we’ll never acquire agencies,” he said. “We have the technology platform, process and people to deliver all of your end-to-end, always-on content — social, digital, e-commerce and community management.”

In addition to the funding, the company is announcing that it has hired Paulette Forte, who was previously senior director of human services at the NBA, as its first chief people officer.

“The brand tech category didn’t even exist before You & Mr Jones was established,” Forte said in a statement. “The company became a true industry disruptor in short order, and growth has been swift. In order to keep up with the momentum, it’s critical to have systems in place that help talent develop their skills, encourage diversity and creativity, and find pathways to improving workflow. I am excited to join the leadership team to drive this crucial work forward.”

Powered by WPeMatico

As ride-hailing companies like Uber and Lyft continue to find their feet in a new landscape for transportation services — where unessential travel is being actively discouraged in many markets and people remain concerned about catching the coronavirus in restricted, shared spaces — a smaller player that has carved out a place for itself targeting business users is announcing more funding.

Gett, which started out as a more direct competitor to the likes of Uber and Lyft but now focuses mainly on ground transportation services for business clients in major cities around the world, said in a short statement that it has closed a round of $115 million. The company — co-headquartered in London and Israel — also said it is now “operationally profitable” and is hitting its budget targets.

The funding is being led by new backer Pelham Capital Investments Ltd. and also included participation from unnamed existing investors.

Including this round, Gett has now raised $865 million, with past investors including VW, Access and its founder Len Blavatnik, Kreos, MCI and more. Gett’s last confirmed valuation was $1.5 billion, pegged to a $200 million fundraise in May 2019. It’s not talking about current valuation, or any recent customer numbers, today.

Dave Waiser, Gett’s founder and CEO, described the funding earlier today in a note to me as an extension to the company’s previous round, a $100 million equity investment that it announced in July last year.

Chairman Amos Genish, said in a statement that the funding round was oversubscribed, “which shows the market’s interest in our platform and long-term vision. Gett is disrupting and transforming a fragmented market delivering ever-critical cost optimisation and client satisfaction.”

The company has been building out a focus on the B2B market for several years now — a smart way of avoiding the expensive and painful race to compete like-for-like against the Ubers of the world — and this most recent round is focused on doubling down on that.

The Gett of the past — it was originally founded in 2010 under the name GetTaxi — did indeed try to build a business around both consumers and higher-end users, but the idea behind Gett today is to focus on corporate accounts.

Gett provides those businesses’ employees with a predictable and reliable app-based platform to make it easier to order car services wherever they happen to be traveling, and those businesses — which in the past would have used a fragmented mix of local services — then have a consolidated way of managing, accounting for and analysing those travel expenses. It claims to be able to save companies some 25%-40% in costs.

The company previously said that its network covered some 1,500 cities. In certain metropolitan areas like London and Moscow, Gett provides transportation services directly. In markets where it does not have direct operations (such as anywhere in the U.S., including New York), it partners with third parties, such as Lyft.

“We are on a journey to transform corporate ground travel and I’m delighted that investors find our model attractive,” Waiser said in a statement today. “This investment will allow us to further develop our SaaS technology and deepen our proposition within the corporate ground travel market.”

Updated to correct that this is an extension of the $100 million round.

Powered by WPeMatico

We are more than seven years into the notion of modern containerization, and it still requires a complex set of tools and a high level of knowledge on how containers work. The DockerSlim open-source project developed several years ago from a desire to remove some of that complexity for developers.

Slim.ai, a new startup that wants to build a commercial product on top of the open-source project, announced a $6.6 million seed round today from Boldstart Ventures, Decibel Partners, FXP Ventures and TechAviv Founder Partners.

Company co-founder and CEO John Amaral says he and fellow co-founder and CTO Kyle Quest have worked together for years, but it was Quest who started and nurtured DockerSlim. “We started coming together around a project that Kyle built called DockerSlim. He’s the primary author, inventor and up until we started doing this company, the sole proprietor of that community,” Amaral explained.

At the time Quest built DockerSlim in 2015, he was working with Docker containers and he wanted a way to automate some of the lower-level tasks involved in dealing with them. “I wanted to solve my own pain points and problems that I had to deal with, and my team had to deal with dealing with containers. Containers were an exciting new technology, but there was a lot of domain knowledge you needed to build production-grade applications and not everybody had that kind of domain expertise on the team, which is pretty common in almost every team,” he said.

He originally built the tool to optimize container images, but he began looking at other aspects of the DevOps lifecycle. including the author, build, deploy and run phases. He found as he looked at that, he saw the possibility of building a commercial company on top of the open-source project.

Quest says that while the open-source project is a starting point, he and Amaral see a lot of areas to expand. “You need to integrate it into your developer workflow and then you have different systems you deal with, different container registries, different cloud environments and all of that. […] You need a solution that can address those needs and doing that through an open source tool is challenging, and that’s where there’s a lot of opportunity to provide premium value and have a commercial product offering,” Quest explained.

Ed Sim, founder and general partner at Boldstart Ventures, one of the seed investors, sees a company bringing innovation to an area of technology where it has been lacking, while putting some more control in the hands of developers. “Slim can shift that all left and give developers the power through the Slim tools to answer all those questions, and then, boom, they can develop containers, push them into production and then DevOps can do their thing,” he said.

They are just 15 people right now including the founders, but Amaral says building a diverse and inclusive company is important to him, and that’s why one of his early hires was head of culture. “One of the first two or three people we brought into the company was our head of culture. We actually have that role in our company now, and she is a rock star and a highly competent and focused person on building a great culture. Culture and diversity to me are two sides of the same coin,” he said.

The company is still in the very early stages of developing that product. In the meantime, they continue to nurture the open-source project and to build a community around that. They hope to use that as a springboard to build interest in the commercial product, which should be available some time later this year.

Powered by WPeMatico