funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Pula, a Kenyan insurtech startup that specialises in digital and agricultural insurance to derisk millions of smallholder farmers across Africa, has closed a Series A investment of $6 million.

The round was led by Pan-African early-stage venture capital firm, TLcom Capital, with participation from nonprofit Women’s World Banking. The raise comes after Pula closed $1 million in seed investment from Rocher Participations with support from Accion Venture Lab, Omidyar Network and several angel investors in 2018.

Founded by Rose Goslinga and Thomas Njeru in 2015, Pula delivers agricultural insurance and digital products to help smallholder farmers navigate climate risks, improve their farming practices and bolster their incomes over time.

Agriculture insurance has traditionally relied on farm business. In the U.S. or Europe with typically large farms, an average insurance premium is $1,000. But in Africa, where smallholding or small-scale farms are the norm, the number stands at an average of $4.

It is particularly telling that the value of agricultural insurance premiums in Africa represents less than 1% of the world’s total when the continent has 17% of the world’s arable land.

This disparity stems from the fact that the traditional method of calculating insurance through farm visits is often unaffordable for these smallholder farmers. Thus, they are often neglected from financial protection against climate risks like flood, drought, pestilence and hail.

Pula is solving this problem by using technology and data. Through its Area Yield Index Insurance product, the insurtech startup leverages machine learning, crop-cut experiments and data points relating to weather patterns and farmer losses, to build products that cater to various risks.

But getting farmers on board has never been easy, Goslinga told TechCrunch. According to her, Pula has understood not to sell insurance directly to small-scale farmers, because they can suffer from optimism bias. “Some think a climate disaster wouldn’t hit their farms for a particular season; hence, they don’t ask for insurance initially. But if they witness any of these climate risks during the season, they would want to get insurance, which is counterproductive to Pula,” said the founder in a phone call.

Image Credits: Pula

So the startup instead partners with banks. Banks provide loans to farmers and make it compulsory for them to have insurance. With the loan, banks can pay the insurance on behalf of the farmers at the start of the season. But at the end of the season, the farmer has to repay the loan with interest.

“The unit economics doesn’t work for us to work with farmers directly. But with banks, we know they provide loans to farmers with much better margins to pay for insurance. Also, we work together with government subsidy programs since they’re also interested in protecting their farmers.”

Through its partnerships with banks, governments and agricultural input companies, Pula is at the center of an ecosystem that provides insurance to smallholder farmers and has amassed 50 insurance partners and six reinsurance partners.

Its clientele includes the likes of the World Food Programme and Central Bank of Nigeria, as well as the Zambian and Kenyan governments. Social enterprises like One Acre Fund, startups like Apollo Agriculture and agribusiness giants like Flour Mills and Export Trading Group are also among Pula’s clients.

When Goslinga met Njeru in 2008, she worked for Syngenta Foundation for Sustainable Agriculture (SFSA). There, she started Kilimo Salama as a micro-insurance program for more than 200,000 farmers in Kenya and Rwanda. She met Njeru, who was the lead actuary at UAP Insurance, a partner to the Kilimo Salama program, at the time.

After staying with Syngenta for six years and recognising the need to provide standard insurance products for smallholder farmers, Goslinga left to start Pula with Njeru in 2015. However, it wasn’t until two years later that Njeru joined fulltime as he had a six-year engagement with Deloitte South Africa from 2012 as a consultant actuary. The pair both act as co-CEOs.

“When Thomas and I launched Pula in 2015, we had one goal in mind: to build and deliver scalable insurance solutions for Africa’s 700 million smallholder farmers,” Goslinga said. “With our latest funding, now is the time to break into new ground. In our five years since launching, we’ve built strong traction for our products. However, the fact remains that across Africa and other emerging markets, there are still millions of smallholder farmers with risks to their livelihoods that have not been covered.”

According to Goslinga, the COVID-19 pandemic helped Pula double its footprint and size as rural farming activities and operations continued despite pandemic-induced lockdowns.

Pula co-founders and Co-CEOs (Rose Goslinga and Thomas Njeru)

Therefore, the new financing will scale up operations in its existing 13 markets across Africa, where it has insured over 4.3 million farmers. They include Senegal, Ghana, Mali, Nigeria, Ethiopia, Madagascar, Tanzania, Kenya, Rwanda, Uganda, Zambia, Malawi and Mozambique. Likewise, the Kenyan startup hopes to propel its expansion for smallholder farmers in Asia and Latin America.

Pula is one of the few African startups disrupting the farming industry with technology. Its Series A investment attests that investors’ appetite for agritech startups is still on the rise.

A week ago, Aerobotics, a South African startup that uses artificial intelligence to help farmers protect their trees and fruits from risks, raised a Series B round of $17 million. Last month, SunCulture, a Kenyan startup that provides solar power systems, water pumps and irrigation systems for small-scale farmers, raised $14 million.

Another startup is Apollo Agriculture which raised $6 million Series A, akin to Pula. Not only did the pair raise the same round, Apollo Agriculture and Pula both deal with providing financial resources to smallholder farmers. But while both companies might look like competitors, even to the admission of Goslinga, she argues that the startups are partners and complement each other.

As part of the new fundraise, TLcom’s senior partner Omobola Johnson will join Pula’s board. However, it was her colleague, Maurizio Caio, the firm’s managing partner, who had something to say about the round.

“The potential for the insurance market for smallholder farmers in Africa is huge, and under the leadership of Rose and Thomas, Pula has rapidly established a strong presence throughout the continent and has several high-profile clients on their books. We are confident of Pula’s potential for growth in spite of the pandemic and look forward to partnering with them as they execute the next phase of their journey,” he said in a statement.

For the lead investor, Pula’s investment marks the culmination of its busiest run of investments having led and co-led rounds in Okra, Shara, Autochek and Ilara Health within the past year.

Christina Juhasz, CIO at Women’s World Banking, the other investor in the round, explained that the organisation cut a check for Pula “given the legions of women engaged in small-hold farming and securing the food supply for communities around the globe.”

Powered by WPeMatico

When Stripe-subsidiary Paystack raised its seed round of $1.3 million in 2016, it was one of the largest disclosed rounds at that stage in Nigeria.

At the time, seven-figure seed investments in African startups were a rarity. But over the years, those same seed-stage rounds have become more common, with some very early-stage startups even raising eight-figure sums. Nigerian fintech startup, Kuda, which bagged $10 million last year, comes to mind, for example.

Also notable amidst the growth in seven and eight-figure African seed deals have been gains in pre-seed fundraising. Typically, pre-seed rounds are raised when the startup is still in the product development phase, yet to make revenue or discover product-market fit. These investments are usually made by third-party investors (friends and family), and range between $25,000-$150,000.

But the narrative as to how much an early-stage African startup can raise as pre-seed has changed.

Last year, African VCs who usually fund seed and Series A rounds began partaking in pre-seed rounds, and they don’t seem to be slowing down. Just a month into 2021, Egyptian fintech startup Cassbana raised a $1 million pre-seed investment led by VC firm Disruptech in a bid to drive expansion within the country.

So why the sudden change in appetite from investors?

Andreata Muforo is a partner at TLcom Capital, a pan-African early-stage VC firm. She told TechCrunch that last year’s run of 23 pre-seed rounds (10 of which were $150,000+ deals) per Briter Bridges data, was due to the confidence investors had in the market, especially fintech.

While most African pre-seed investments in 2020 went to fintech, there were exceptions, including Egyptian edtech startup Zedny, which raised $1.2 million; Nigerian automotive tech startup Autochek Africa, which raised $3.4 million; and Nigerian talent startup TalentQL, which raised $300,000.

Just as Paystack and Flutterwave built payment infrastructure for thousands of African businesses, these fintech startups are trying to make their mark in the sweet spots of credit and banking.

“Fintech is compelling. But while most fintech startups play around the commodities side of fintech, it’s the companies building infrastructure around the market that got most of the pre-seed validation last year,” Muforo said. Her firm, TLcom, led the $1 million pre-seed investment in Okra.

Okra is an API fintech startup. So are Mono, OnePipe and Pngme. They are building Africa’s API infrastructure that connects bank accounts with financial institutions and third-party companies for different purposes. Within the past 18 months, Mono and Pngme raised $500,000, while OnePipe raised $950,000 in pre-seed.

It is noteworthy that while these startups are clamoring to solve Africa’s open API banking issues, three of the four deals came after Visa’s $5.3 billion acquisition of Plaid last year in January.

Although the Visa-Plaid acquisition has now been called off, it is safe to say some African investors developed FOMO, handing out sizable checks to fund “Africa’s Plaid” in the process.

Digital lenders remain one of their most important customers for fintech API startups. They can access customers’ financial accounts to understand their spending patterns and know who to loan to.

Egypt’s Shahry and Nigeria’s Evolve Credit are fintech startups building credit infrastructure for their markets. Evolve Credit connects digital lenders to those who need loan services in Nigeria via its online loan marketplace. Shahry, on the other hand, employs an AI-based credit scoring engine so users in Egypt can apply for credit. The pair also secured impressive pre-seed funding — Evolve Credit, $325,000, and Shahry, $650,000.

Muforo points out that aside from startups building fintech infrastructure, the caliber of founders was another reason pre-seed funding peaked last year.

Adewale Yusuf, co-founder and CEO of TalentQL, a startup that hires, manages and outsources talent for Nigerian and global companies, seemed to agree. He told TechCrunch that trust between the VCs and founders involved played a major role in most pre-seed rounds last year.

“It wasn’t surprising that a lot of investors put money in pre-seed rounds. I say this because we also saw existing founders and serial entrepreneurs coming back to the market. To me, these founders’ credibility was a major part of why those rounds were large,” he said.

A second-time founder himself, Yusuf is the co-founder of Nigerian tech media publication Techpoint Africa. His partner at TalentQL, Opeyemi Awoyemi, is also a serial entrepreneur. He co-founded Ringier One Africa Media-owned Jobberman, one of Africa’s most popular recruitment platforms.

According to Adedayo Amzat, founder of Zedcrest Capital, which is the lead investor in TalentQL’s round, the founders’ experience proved vital in closing the deal.

He says investors are more comfortable backing experienced founders in pre-seed rounds because they have a more mature understanding of the problems they’re trying to solve. So, in essence, they tend to raise more capital.

“If you look at pre-seed sizes, experienced founders can demand a significant premium over first-time founders,” Amzat said. “Pre-seed valuation cap for first-time founders will typically be between 400K to $1 million while we frequently see up to $5 million for experienced founders.”

It was a recurring theme last year. Yele Bademosi, who runs Microtraction, a West African early-stage VC firm, is the CEO of Bundle Africa, a Nigerian-based crypto-exchange startup that raised $450,000 in April 2020.

Shahry co-founders Sherif ElRakabawy and Mohamed Ewis also run Egypt’s largest shopping engine and price comparison website, Yaoota.

Mono co-founder and CEO Abdulhamid Hassan was the co-founder of Nigerian fintech startup OyaPay and data science startup Voyance. Also, Etop Ikpe, the co-founder and CEO of Autochek Africa, was CEO of DealDey and Cars45.

That said, Fara Ashiru Jituboh of Okra and Akan Nelson of Evolve Credit as first-time founders got investments that most of their counterparts would only dream of. For Jituboh, her solid tech background spoke for her — boasting a senior software engineering job at Pexels and engineering consultant role at Canva before founding Okra.

“We backed Fara because she’s a strong tech founder. When you look at the core of what Okra does as a tech-heavy company, you see how important it was to make the decision,” Muforo said about backing Okra’s CEO and CTO.

Nelson also told TechCrunch that his finance background helped Evolve Credit raise its six-figure sum. The team’s bullishness on finding product-market fit and the potential of Africa’s loan marketplace was also enough to bring foreign and local VCs like Samurai Incubate, Future Africa, Ingressive Capital and Microtraction on board.

While early-stage investments in African startups haven’t reached full speed, the explosion in the number of angel investors has lowered entry barriers into early-stage investing.

Now investors are beginning to show readiness toward African startups that have promise as they continue to search for the next Paystack.

“More people are willing to take risks now in the market, especially angel investors. They can easily let go of $10K-$50K because of success stories like Paystack,” Yusuf said about the $200 million acquisition by U.S. payments startup Stripe.

For all of its significance to the African tech ecosystem, what particularly stands out about Paystack’s exit is the return on investment made for early investors.

By the time it exited in October 2020, some angel investors had an ROI of more than 1,400% according to Jason Njoku in his blog post. Njoku, who took part in the round as an angel investor, is the CEO of IROKO, a Nigerian VOD internet company.

For Muforo, witnessing more early-stage investments is a big deal, one the African tech ecosystem should savor regardless of the round in question.

“Pre-seed or seed are just names investors and founders give,” she said. “What I think is most important is the fact that we’re getting more early-stage capital into Africa, and startups are getting more attention from investors, which is fantastic.”

Powered by WPeMatico

As the global agricultural industry stretches to meet expected population growth and food demand, and food security becomes more of a pressing issue with global warming, a startup out of South Africa is using artificial intelligence to help farmers manage their farms, trees and fruits.

Aerobotics, a South African startup that provides intelligent tools to the world’s agriculture industry, has raised $17 million in an oversubscribed Series B round.

South African consumer internet giant Naspers led the round through its investment arm, Naspers Foundry, investing $5.6 million, according to Aerobotics. Cathay AfricInvest Innovation, FMO: Entrepreneurial Development Bank and Platform Investment Partners also participated.

Founded in 2014 by James Paterson and Benji Meltzer, Aerobotics is currently focused on building tools for fruit and tree farmers. Using artificial intelligence, drones and other robotics, its technology helps track and assess the health of these crops, including identifying when trees are sick, tracking pests and diseases, and analytics for better yield management.

The company has progressed its technology and provides to farmers independent and reliable yield estimations and harvest schedules by collecting and processing both tree and fruit imagery from citrus growers early in the season. In turn, farmers can prepare their stock, predict demand and ensure their customers have the best quality of produce.

Aerobotics has experienced record growth in the last few years. For one, it claims to have the largest proprietary data set of trees and citrus fruit in the world, having processed 81 million trees and more than a million citrus fruit.

The seven-year-old startup is based in Cape Town, South Africa. At a time when many of the startups out of the African continent have focused their attention primarily on identifying and fixing challenges at home, Aerobotics has found a lot of traction for its services abroad, too. It has offices in the U.S., Australia and Portugal — like Africa, home to other major, global agricultural economies — and operates in 18 countries across Africa, the Americas, Europe and Australia.

Image Credits: Aerobotics

Within that, the U.S. is the company’s primary market, and Aerobotics says it has two provisional patents pending in the country, one for systems and methods for estimating tree age and another for systems and methods for predicting yield.

The company said it plans to use this Series B investment to continue developing more technology and product delivery, both for the U.S. and other markets.

“We’re committed to providing intelligent tools to optimize automation, minimize inputs and maximize production. We look forward to further co-developing our products with the agricultural industry leaders,” said Paterson, the CEO in a statement.

Once heralded as a frontier for technology centuries ago, the agriculture industry has stalled in that aspect for a long while. However, agritech companies like Aerobotics that support climate-smart agriculture and help farmers have sprung forth trying to take the industry back to its past glory. Investors have taken notice and over the past five years, investments have flowed with breathtaking pace.

For Aerobotics, it raised $600,000 from 4Di Capital and Savannah Fund as part of its seed round in September 2017. The company then raised a further $4 million in Series A funding in February 2019, led by Nedbank Capital and Paper Plane Ventures.

Naspers Foundry, the lead investor in this Series B round, was launched by Naspers in 2019 as a 1.4 billion rand (~$100 million) fund for tech startups in South Africa.

Phuthi Mahanyele-Dabengwa, CEO of Naspers South Africa, said of the investment, “Food security is of paramount importance in South Africa and the Aerobotics platform provides a positive contribution towards helping to sustain it. This type of tech innovation addresses societal challenges and is exactly the type of early-stage company that Naspers Foundry looks to back.”

Besides Aerobotics, Naspers Foundry has invested in online cleaning service SweepSouth, and food service platform Food Supply Network.

Powered by WPeMatico

Soci, a startup focused on what it calls “localized marketing,” is announcing that it has raised $80 million in Series D funding.

National and global companies like Ace Hardware, Anytime Fitness, The Hertz Corporation and Nekter Juice Bar use Soci (pronounced soh-shee) to coordinate individual stores as they promote themselves through search, social media, review platforms and ad campaigns. Soci said that in 2020, it brought on more than 100 new customers, representing nearly 30,000 new locations.

Co-founder and CEO Afif Khoury told me that the pandemic was a crucial moment for the platform, with so many businesses “scrambling to find a real solution to connect with local audiences.”

One of the key advantages to Soci’s approach, Khoury said, is to allow the national marketing team to share content and assets so that each location stays true to the “national corporate personality,” while also allowing each location to express a “local personality.” During the pandemic, businesses could share basic information about “who’s open, who’s not” while also “commiserating and expressing the humanity that’s often missing element from marketing nationally.”

“The result there was businesses that had to close, when they had their grand reopenings, people wanted to support that business,” he said. “It created a sort of bond that hopefully lasts forever.”

Khoury also emphasized that Soci has built a comprehensive platform that businesses can use to manage all their localized marketing, because “nobody wants to have seven different logins to seven different systems, especially at the local level.”

The new funding, he said, will allow Soci to make the platform even more comprehensive, both through acquisitions and integrations: “We want to connect into the CRM, the point-of-sale, the rewards program and take all that data and marry that to our search, social, reviews data to start to build a profile on a customer.”

Soci has now raised a total of $110 million. The Series D was led by JMI Equity, with participation from Ankona Capital, Seismic CEO Doug Winter and Khoury himself.

“All signs point to an equally difficult first few months of this year for restaurants and other businesses dependent on their communities,” said JMI’s Suken Vakil in a statement. “This means there will be a continued need for localized marketing campaigns that align with national brand values but also provide for community-specific messaging. SOCi’s multi-location functionality positions it as a market leader that currently stands far beyond its competitors as the must-have platform solution for multi-location franchises/brands.”

Powered by WPeMatico

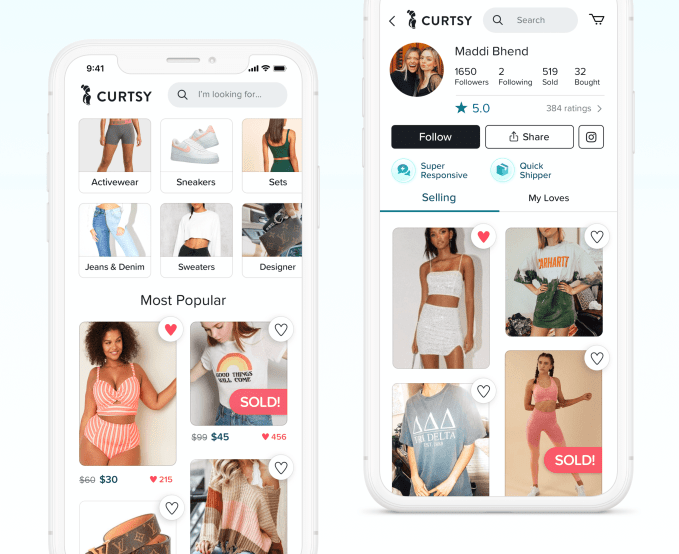

Curtsy, a clothing resale app and competitor to recently IPO’d Poshmark, announced today it has raised $11 million in Series A funding for its startup focused on the Gen Z market. The app, which evolved out of an earlier effort for renting dresses, now allows women to list their clothes, shoes and accessories for resale, while also reducing many of the frictions involved with the typical resale process.

The new round was led by Index Ventures, and included participation from Y Combinator, prior investors FJ Labs and 1984 Ventures, and angel investor Josh Breinlinger (who left Jackson Square Ventures to start his own fund).

To date, Curtsy has raised $14.5 million, including over two prior rounds, which also included investors CRV, SV Angel, Kevin Durant, Priscilla Scala and other angels.

Like other online clothing resale businesses, Curtsy aims to address the needs of a younger generation of consumers who are looking for a more sustainable alternative when shopping for clothing. Instead of constantly buying new, many Gen Z consumers will rotate their wardrobes over time, often by leveraging resale apps.

Image Credits: Curtsy

However, the current process for listing your own clothes on resale apps can be time-consuming. A recent report by Wired, for example, detailed how many women were spinning their wheels engaging with Poshmark in the hopes of making money from their closets, to little avail. The Poshmark sellers complained they had to do more than just list, sell, package and ship their items — they also had to participate in the community in order to have their items discovered.

Curtsy has an entirely different take. It wants to make it easier and faster for casual sellers to list items by reducing the amount of work involved to sell. It also doesn’t matter how many followers a seller has, which makes its marketplace more welcoming to first-time sellers.

“The big gap in the market is really for casual sellers — people who are not interested in selling professionally,” explains Curtsy CEO David Oates. “In pretty much every other app that you’ve heard about, pro sellers really crowd out everyday women. Part of that is the friction of the whole process,” he says.

On Curtsy, the listing process is far more streamlined.

The app uses a combination of machine learning and human review to help the sellers merchandise their items, which increase their chances of selling. When sellers first list their item in the app, Curtsy will recommend a price, then fill in details like the brand, category, subcategory, shipping weight and the suggested selling price, using machine learning systems training on the previous items sold on its marketplace. Human review fixes any errors in that process.

Also before items are posted, Curtsy improves and crops the images, as well as fixes any other issues with the listing, and moderates listings for spam. This process helps to standardize the listings on the app across all sellers, giving everyone a fair shot at having their items discovered and purchased.

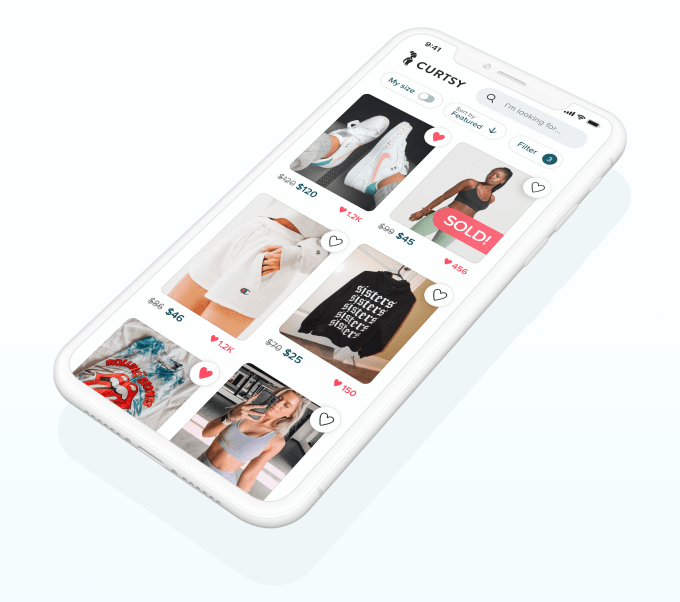

Another unique feature is how Curtsy caters to the Gen Z to young Millennial user base (ages 15-30), who are often without shipping supplies or even a printer for producing a shipping label.

Image Credit: Curtsy / Photo credit: Brooke Ray

First-time sellers receive a free starter kit with Curtsy-branded supplies for packaging their items at home, like poly mailers in multiple sizes. As they need more supplies, the cost of those is built into the selling flow, so you don’t have to explicitly pay for it — it’s just deducted from your earnings. Curtsy also helps sellers to schedule a free USPS pickup to save a trip to the post office, and it will even send sellers a shipping label, if need be.

“One of the things we realized quickly is Gen Z does not really have printers. So we actually have a label service and we’ll send you the label in the mail for free from centers across the country,” says Oates.

Later, when a buyer of an item purchased from Curtsy is ready to resell it, they can do so with one tap — they don’t have to photograph it and describe it again. This also speeds up the selling process.

Overall, the use of technology, outsourced teams who improve listings and extra features like supplies and labels can be expensive. But Curtsy believes the end result is that they can bring more casual sellers to the resale market.

“Whatever costs we have, they should be in service of increased liquidity, so we can grow faster and add more people,” Oates says. “In case of the label service, those are people who otherwise wouldn’t be able to participate in selling online. There’s no other app that would allow them to sell without a printer.”

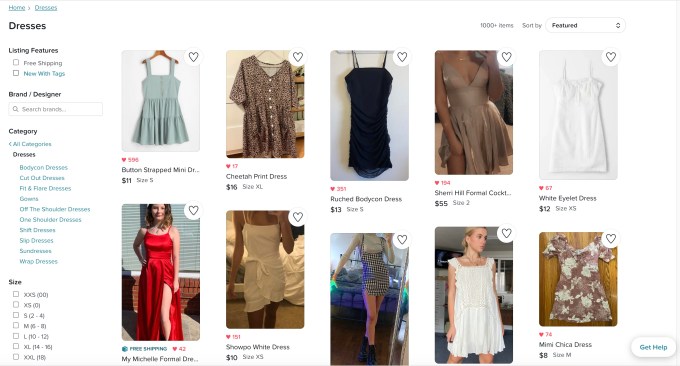

Image Credits: Curtsy

This system, so far, appears to be working. Curtsy now has several hundred thousand people who buy and sell on its iOS-only app, with an average transaction rates of three items bought or sold per month. When the new round closed late in 2020, the company was reporting a $25 million GMV revenue run rate, and average monthly growth of around 30%. Today, Curtsy generates revenue by taking a 20% commission on sales (or $3 for items under $15).

The team, until recently, was only five people — including co-founders David Oates, William Ault, Clara Agnes Ault and Eli Allen, plus a contract workforce. With the Series A, Curtsy will be expanding, specifically by investing in new roles within product and marketing to help it scale. It will also be focused on developing an Android version of its app in the first quarter of 2021 and further building out its web presence.

“Never before have we seen such a strong overlap between buyers and sellers on a consumer-to-consumer marketplace,” said Damir Becirovic of Index Ventures, about the firm’s investment. “We believe the incredible love for Curtsy is indicative of a large marketplace in the making,” he added.

Powered by WPeMatico

Podchaser, a startup building what it calls “IMDB for podcasts,” recently announced that it has raised $4 million in a funding round led by Greycroft.

In other words, it’s a site where — similar to the Amazon-owned Internet Movie Database — users can look up who’s appeared in which podcasts, rate and review those podcasts and add them to lists. In fact, CEO Bradley Davis told me that the startup’s “vibrant, exciting community of podcast nerds” have already created 8.5 million podcast credits in the database.

Davis said this is something he simply wanted to exist and was, in fact, convinced that it had to exist already. When he realized that it didn’t, he posted on Reddit asking whether anyone was willing to build the company with him — which is how he connected with his eventual co-founder and CTO Ben Slinger in Australia. (Podchaser is a fully distributed company, with Davis currently based in Oklahoma City.)

To be clear, Davis doesn’t think podcast nerds are the only ones taking advantage of the listings. Instead, he suggested that it’s useful for anyone looking to learn more about podcasts and discover new ones, with Podchaser’s monthly active users quintupling over the past year.

For example, he said that one of the most popular pages is politician Pete Buttigieg’s profile, where visitors don’t just learn about Buttigieg’s own podcast but see others on which he’s appeared. (You can also use Podchaser to learn more about TechCrunch’s Equity, Mixtape and Original Content podcasts, though those profiles could stand to be filled out a bit more.)

There has been endless discussion about how to fix podcast discovery, and while Davis isn’t claiming that Podchaser will solve it wholesale, he thinks it can be part of the solution — not just through its own database, but through the broader Podcast Taxonomy project that it’s organizing.

“I think if we are successful at standardizing a lot of the terminology, and if we do an analysis of all podcasts, of how popular they are, that [will help many listeners] to cull and find the good stuff,” he said.

Podchaser plans to add new features that will further encourage user contributions, like a gamification system and a discussion system.

While the consumer site is free, the startup recently launched a paid product called Podchaser Pro, which provides reach and demographic data across 1.8 million podcasts. It also monetizes by providing podcast players with access to its credits through an API.

Davis said the startup was “lucky” that it decided to build a database that’s “agnostic” from any specific podcast player.

“So we had a lot of latitude to work with those platforms, we integrate with many of those platforms and you’re going to see a lot of our credits showing up [in podcast players],” he said.

In addition to Greycroft, Advancit Capital, LightShed Ventures, Powerhouse Capital, High Alpha, Hyde Park Venture Partners and Poplar Ventures also participated in the round, as did TrendKite founder A.J. Bruno, Ad Results Media CEO Marshall Williams and Shamrock Capital Partner Mike LaSalle.

“Even in the face of a pandemic, the podcast market continues to grow at a breakneck pace,” said Greycroft co-founder and chairman Alan Patricof in a statement. “The demand from consumers and brands is insatiable. Podchaser’s data and discovery tools are crucial to taking podcasting to new heights.”

Powered by WPeMatico

Bay Area-based construction startup TraceAir today announced a $3.5 million Series A. Led by London-based XTX Ventures, this round brings the company’s total funding up to $7 million. The raise includes existing investor Metropolis VC, along with new additions Liquid 2 Ventures, GEM Capital, GPS Ventures and Andrew Filev.

We first noted the company back in 2016, when it pitched a method for using drones to spot construction errors before they become too expense. It’s a pretty massive field that various technology companies are attempting to solve through a variety of different means, ranging from quadrupedal robots to site-scanning hard hats.

Last February, TraceAir announced a new drone management tool. “Haul Router provides the best mathematically objective hauls for each given drone scan,” the company noted at the time. “Any employee can use the tool to design a haul road and export the results to feed into grading equipment.”

The pandemic has thrown the construction industry for a loop (along with countless others). But unlike other sectors, demand still remains high in many places. TraceAir is hoping its solution will prove beneficial as many outfits seek a way to continue the process in spite of uncertainty.

“The Covid-19 pandemic created new challenges for the U.S. and worldwide construction industries, resulting in delayed projects and growing unemployment rates,” CEO Dmitry Korolev said in a release tied to the news. “Our platform allows industry leaders to manage projects more efficiently and collaborate with their teams remotely, minimizing the need for a physical presence on-site.”

TraceAir says the additional funding will go toward its sales and marketing, along with future product developments, including an unnamed product set for release this quarter.

Powered by WPeMatico

When a system outage happens, chaos can ensue as the team tries to figure out what’s happening and how to fix it. StackPulse, a new startup that wants to help developers manage these crisis situations more efficiently, emerged from stealth today with a $28 million investment.

The round actually breaks down to a previously unannounced $8 million seed investment and a new $20 million Series A. GGV led the A round, while Bessemer Venture Partners led the seed and also participated in the A. Glenn Solomon at GGV and Amit Karp at Bessemer will join the StackPulse board.

Nobody is immune to these outages. We’ve seen incidents from companies as varied as Amazon and Slack in recent months. The biggest companies like Google, Facebook and Amazon employ site reliability engineers and build customized platforms to help remediate these kinds of situations. StackPulse hopes to put this kind of capability within reach of companies, whose only defense is the on-call developers.

Company co-founder and CEO Ofer Smadari says that in the midst of a crisis with signals coming at you from Slack and PagerDuty and other sources, it’s hard to figure out what’s happening. StackPulse is designed to help sort out the details to get you back to equilibrium as quickly as possible.

First off, it helps identify the severity of the incident. Is it a false alarm or something that requires your team’s immediate attention or something that can be put off for a later maintenance cycle? If there is something going wrong that needs to be fixed right now, StackPulse can not only identify the source of the problem, but also help fix it automatically, Smadari explained.

After the incident has been resolved, it can also help with a post-mortem to figure out what exactly went wrong by pulling in all of the alert communications and incident data into the platform.

As the company emerges from stealth, it has some early customers, and 35 employees based in Portland, Oregon and Tel Aviv. Smadari says that he hopes to have 100 employees by the end of this year. As he builds the organization, he is thinking about how to build a diverse team for a diverse customer base. He believes that people with diverse backgrounds build a better product. He adds that diversity is a top level goal for the company, which already has an HR leader in place to help.

Glenn Solomon from GGV, who will be joining the company board, saw a strong founding team solving a big problem for companies and wanted to invest. “When they described the vision for the product they wanted to build, it made sense to us,” he said.

Customers are impatient with down time and Solomon sees developers on the front line trying to solve these issues. “Performance is more important than ever. When there is downtime, it’s damaging to companies,” he said. He believes StackPulse can help.

Powered by WPeMatico

Darwinbox, which operates a cloud-based human resource management platform, has raised $15 million in a new financing round as the Indian startup looks to expand beyond the country and Southeast Asian markets.

The new round, a Series C, for the Hyderabad-based startup was led by Salesforce Ventures, the venture arm of the American software giant. This is Salesforce Ventures’ one of rare investments in India. Existing investors including Lightspeed India and Sequoia Capital India also participated in the round, which brings the five-year old startup’s total raise to date to $35 million.

Over 500 firms including — Tokopedia, Indorama, JG Summit Group, Zilingo, Zalora, Fave, Adani, Mahindra, Kotak, TVS, NSE, Ujjivan Small Finance Bank, Dr.Reddy’s, Nivea, Puma, Swiggy, Bigbasket — use Darwinbox’s HR platform to provide more than a million employees of theirs with a range of features including insurance and early salary as loans in 60 nations, up from about 200 firms across 50 nations in 2019, said Chaitanya Peddi, co-founder of Darwinbo, in an interview with TechCrunch.

Peddi said the startup has always looked up to Salesforce, and investment from the enterprise giant is “nothing sort of a child receiving validation from their father,” he said.

The fundraise caps the most successful year for the startup that started with uncertainty as the coronavirus spread across Asian nations. The startup took a hit as its customers scrambled to navigate through the global pandemic, but the last two quarters have been its best to date, said Peddi. Overall, the startup’s revenue has ballooned by 300% since September 2019, when it last raised money, he said.

Image Credits: Darwinbox

Darwinbox’s platform is built to take care of the entire “hiring to retiring” cycle needs for employees. It handles onboarding of new hires, keeps a tap on their performance, monitors attrition rate, and provides an ongoing feedback loop.

It also provides its customers with a social network for their employees to remain connected with one another and an AI assistant to apply for a leave or set up meetings with quick voice commands from their phones.

Peddi said the startup will deploy the fresh capital to expand to several more countries, especially in the Middle East, and broaden its offerings.

“India is home to one of the world’s youngest population, and by 2050, it is expected to account for over 18% of the global working age population,” said Arundhati Bhattacharya, Chairperson and CEO, Salesforce India, in a statement. “This makes technology platforms like Darwinbox, that focuses on workforces, incredibly important. I’m proud that Salesforce is supporting Darwinbox on their journey as they continue to grow and innovate in this space.”

More to follow…

Powered by WPeMatico

With the last year changing how (and where) many of us work, organizations have started to rethink how well they manage their employees, and what tools they use to do that. Today, one of the startups that is building technology to address this challenge is announcing a major round of funding that underscores its traction to date.

Personio — the German startup that targets small- and medium-sized businesses (10-2,000 employees) with an all-in-one HR platform covering recruiting and onboarding, payroll, absence tracking and other major HR functions — has picked up $125 million in funding at a $1.7 billion post-money valuation.

The Series D is being co-led by Index Ventures and Meritech, with previous backers Accel, Lightspeed Venture Partners, Northzone, Global Founders Capital and Picus all participating.

The $1.7 billion valuation is a big jump on the company’s $500 million valuation a year ago, and it comes after a year where the startup has doubled its revenues and was not on the hunt to raise, with much of its previous fundraising still in the bank.

Personio currently counts some 3,000 SMEs in Europe as customers.

In an interview, Hanno Renner, the co-founder and CEO of Personio, said that the startup would be using the funding to continue building out the product — which operates a little like Workday, but built for much smaller organizations — as well as expanding its presence in Europe.

Although SMEs can be a notoriously challenging customer segment, Renner said that a new opportunity has emerged: A new wave of people in the SME sector have started to realise the value of having a modern and integrated HR platform.

“We started Personio in 2016 wanting to become the leading HR platform for midmarket companies, and we knew it could be a great company, but we realize it can be hard to grasp what HR really means,” he said. “But I think what has driven our business in the past year has been the realization that HR is not just an important part, but maybe the most important part, of any business.”

It may take one magic turn to convert users, he said, by providing (as one example) tools to recruit, sign contracts and onboard new employees remotely. Still, he acknowledges that the midmarket — especially those companies not built around technology — has been “lagging for years,” with many still working off Excel spreadsheets, or even more surprisingly, pen and paper. “Supporting them by helping them to digitize in a more efficient way has been driving our business.”

Personio is not the only startup hopeful that the shift in how we work will bring a new appreciation (and appetite) for purchasing HR tools. Others like Hibob have also seen a big boost in their business and have also been raising money to tap into the opportunity more aggressively.

Hibob is looking to build in more training tools, underscoring the feature race that Personio will also have to run to keep up.

But given the sheer numbers of SMBs in the European market — more than 25 million, and accounting for more than 99% of all enterprises, according to research from the European Union — the fact that many of them have yet to adopt any kind of HR platform at all, there remains a lot of growth for a number of players.

“SMEs are the backbone of the European economy, employing 100 million people across the continent, but it is also a sector that has been neglected by software companies focused predominantly on large enterprises,” Martin Mignot, a partner at Index who sits on Personio’s board, said in a statement. “Personio changes that, having created a set of powerful tools tailored to address the needs of small businesses.”

“We have had the pleasure of working with some of the most successful SaaS companies in the world, and given Personio’s success over the past five years and the immense market potential, we strongly believe in Personio’s ability to build an equally successful and impactful business,” added Alex Clayton, general partner at Meritech Capital, in his own statement. “After many great discussions with Hanno over recent years, we are now excited to be joining the journey.” Clayton is also joining the board with this round.

Powered by WPeMatico