funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Pinecone, a new startup from the folks who helped launch Amazon SageMaker, has built a vector database that generates data in a specialized format to help build machine learning applications faster, something that was previously only accessible to the largest organizations. Today the company came out of stealth with a new product and announced a $10 million seed investment led by Wing Venture Capital.

Company co-founder Edo Liberty says that he started the company because of this fundamental belief that the industry was being held back by the lack of wider access to this type of database. “The data that a machine learning model expects isn’t a JSON record, it’s a high dimensional vector that is either a list of features or what’s called an embedding that’s a numerical representation of the items or the objects in the world. This [format] is much more semantically rich and actionable for machine learning,” he explained.

He says that this is a concept that is widely understood by data scientists, and supported by research, but up until now only the biggest and technically superior companies like Google or Pinterest could take advantage of this difference. Liberty and his team created Pinecone to put that kind of technology in reach of any company.

The startup spent the last couple of years building the solution, which consists of three main components. The main piece is a vector engine to convert the data into this machine-learning ingestible format. Liberty says that this is the piece of technology that contains all the data structures and algorithms that allow them to index very large amounts of high dimensional vector data, and search through it in an efficient and accurate way.

The second is a cloud hosted system to apply all of that converted data to the machine learning model, while handling things like index lookups along with the pre- and post-processing — everything a data science team needs to run a machine learning project at scale with very large workloads and throughputs. Finally, there is a management layer to track all of this and manage data transfer between source locations.

One classic example Liberty uses is an eCommerce recommendation engine. While this has been a standard part of online selling for years, he believes using a vectorized data approach will result in much more accurate recommendations and he says the data science research data bears him out.

“It used to be that deploying [something like a recommendation engine] was actually incredibly complex, and […] if you have access to a production grade database, 90% of the difficulty and heavy lifting in creating those solutions goes away, and that’s why we’re building this. We believe it’s the new standard,” he said.

The company currently has 10 people including the founders, but the plan is to double or even triple that number, depending on how the year goes. As he builds his company as an immigrant founder — Liberty is from Israel — he says that diversity is top of mind. He adds that it’s something he worked hard on at his previous positions at Yahoo and Amazon as he was building his teams at those two organizations. One way he is doing that is in the recruitment process. “We have instructed our recruiters to be proactive [in finding more diverse applicants], making sure they don’t miss out on great candidates, and that they bring us a diverse set of candidates,” he said.

Looking ahead to post-pandemic, Liberty says he is a bit more traditional in terms of office versus home, and that he hopes to have more in-person interactions. “Maybe I’m old fashioned but I like offices and I like people and I like to see who I work with and hang out with them and laugh and enjoy each other’s company, and so I’m not jumping on the bandwagon of ‘let’s all be remote and work from home’.”

Powered by WPeMatico

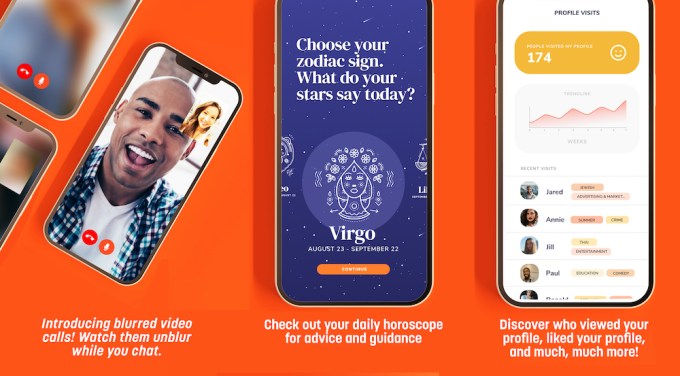

S’More, a dating app that’s focused on helping users find more meaningful relationships, announced today that it has raised $2.1 million in seed funding.

S’More (short for “something more”) ensures that users can’t focus on physical appearance, because photos are initally blurred — they gradually un-blur as you interact with someone. The startup has introduced new features like video chat (also blurred initially), and it launched a redesigned app of the beginning of this month — CEO Adam Cohen-Aslatei said it’s a “completely rebuilt product” with new features like real-time conversation prompts and the ability to pay to promote your profile.

Cohen-Aslatei also said that S’More’s focus on “anti-superficial relationships” is attracting a real audience, with 160,000 downloads in its first year and “thousands” of paying users, including a 50% increase in subscriptions after launching the new app in January.

Looking at how dating will evolve after the pandemic, Cohen-Aslatei suggested, “I don’t think we’re going back to the way things were.” He pointed to a recent survey of S’More users in which 80% of respondents said they hadn’t gone on a single live, in-person date in 2020.

“Do you want to meet for casual encounter on Tinder, or do you have to want to have a conversation get to know a real person on S’More?” he said. Assuming that many people will choose the latter, the next question is: “How do you make discovery fun? There’s got to be multimedia, video, audio, games, all of those features are part of our product roadmap … S’More will feel like Hinge meets Nextdoor.” (Apparently, there’s “a huge cohort” of users on Nextdoor who are single and looking for relationships.)

Image Credits: S’More

The new funding comes from a long list of investors: Benson Oak Ventures, Mark Pincus’ Workplay Ventures, Gaingels VC, Loud Capital/Pride Fund

SideCar Angels, AppLovin Chairman Rafael Vivas, Joshua Black of Apollo Management, Plus Grade CEO Ken Harris, Harvard geneticist George Church, former Meet Group CEO John Abbott, former IMAX CEO Brad Weschler, Aaron and Sharon Stern, Justen Stepka/Enterprise Fund, Boston Harbor Angels, Grit Daily CEO Jordan French, Kind.Fund founder Marty Isaac, Craig Mullett and Dating Group.

Cohen-Asletai told me the funding has already allowed him to hire what he’s calling a “founding team,” including chief architect Long Nguyen, head of operations Sneha Ramanchandran, head of product and design Regina Guinto and senior developer David Lichy.

S’More is also announcing that it has signed a production deal with producers Elvia Van Es Oliva and Jack Tarantino, who have worked on shows like “90 Day Fiancé.” Cohen-Asletai said the startup will work with them to create “anti-superficial” dating content for digital platforms and TV networks.

This deal builds on the success of S’More Live, the startup’s celebrity dating show on Instagram Live, which has aired 60 episodes so far.

“We’re using that show to build our brand, to gain awareness and then … we’re actually able to leverage all of the viewers and retarget them with content from S’More, which has made our cost to acquire a user [very affordable],” Cohen-Asletai said.

Powered by WPeMatico

One big theme in tech right now is the rise of services to help us keep working through lockdowns, office closures, and other Covid-19 restrictions. The “future of work” — cloud services, communications, productivity apps — has become “the way we work now.” And companies that have identified ways to help with this are seeing a boom.

Today comes news from a startup that has been a part of that trend: Calendly, a popular cloud-based service that people use to set up and confirm meeting times with others, has closed an investment of $350 million from OpenView Venture Partners and Iconiq.

The funding round includes both primary and secondary money (slightly more of the latter than the former, from what I understand) and values the Atlanta-based startup at over $3 billion.

Not bad for a company that before now had raised just $550,000, including the life savings of the founder and CEO, Tope Awotona, to initially get off the ground.

Calendly is a freemium software-as-a-service, built around what is essentially a very simple piece of functionality.

It’s a platform that provides a quick way to manage open spaces in your calendar for people to book appointments with you in those spaces, which then also books out the time in calendars like Google’s or Microsoft Outlook — with a growing number of tools to enhance that experience, including the ability to pay for a service in the event that your appointment is not a business meeting but, say, a yoga class. Pricing ranges from free (one calendar/one user/one event) to premium ($8/month) and pro ($12/month) for more calendars, events, integrations and features, with bigger packages for enterprises also available.

Its growth, meanwhile, has to date been based mostly around a very organic strategy: Calendly invites become links to Calendly itself, so people who use it and like it can (and do) start to use it, too.

The wide range of its use cases, and the virality of that growth strategy, have been winners. Calendly is already profitable, and it has been for years. And more recently, it has seen a boost, specifically in the last twelve months, as new Calendly users have emerged, as a result of how we are living.

We may not be doing more traditional “business meetings” per week, but the number of meetings we now need to set up, has gone up.

All of the serendipitous and impromptu encounters we used to have around an office, or a neighborhood coffee shop, or the park? Those are now scheduled. Teachers and students meeting for a remote lesson? Those also need invitations for online meetings.

And so do sessions with therapists, virtual dinner parties, and even (where they can still happen) in-person meetings, which are often now happening with more timed precision and more record-keeping, to keep social distancing and potential contact tracing in better order.

Currently, some 10 million of us are using Calendly for all of this on a monthly basis, with that number growing 1,180% last year. The army of business users from companies like Twilio, Zoom, and UCSF has been joined by teachers, contractors, entrepreneurs, and freelancers, the company says.

The company last year made about $70 million annually in subscription revenues from its SaaS-based business model and seems confident that its aggregated revenues will not long from now get to $1 billion.

So while the secondary funding is going towards giving liquidity to existing investors and early employees, Awotona said the plan will be to use the primary capital to invest in the company’s business.

That will include building out its platform with more tools and integrations — it started with and still has a substantial R&D operation in Kiev, Ukraine — expanding its operations with more talent (it currently has around 200 employees and plans to double headcount), further business development and more.

Two notable moves on that front are also being announced with the funding: Jeff Diana is coming on as chief people officer with a mission to double the company’s employee base. And Patrick Moran — formerly of Quip and New Relic — is joing as Calendly’s first chief revenue officer. Notably, both are based in San Francisco — not Atlanta.

That focus for building in San Francisco is already a big change for Calendly. The startup, which is going on eight years old, has been somewhat off the radar for years.

That is in part due to the fact that it raised very little money up to now (just $550,000 from a handful of investors that include OpenView, Atlanta Ventures, IncWell and Greenspring Associates).

It’s also based in Atlanta, an increasingly notable city for technology startups and other companies but more often than not short on being credited for its heft in that department (SalesLoft, Amex-acquired Kabbage, OneTrust, Bakkt, and many others are based there, with others like Mailchimp also not too far away).

And perhaps most of all, proactively courting publicity did not appear to be part of Calendly’s growth playbook.

In fact, Calendly might have closed this big round quietly and continued to get on with business, were it not for a short Tweet last autumn that signaled the company raising money and shaping up to be a quiet giant.

“The company’s capital efficiency and what @TopeAwotona has built deserve way more credit than they get,” it read. “Perhaps this will start to change that recognition.”

After that short note on Twitter — flagged on TechCrunch’s internal message board — I made a guess at Awotona’s email, sent a note introducing myself, and waited to see if I would get a reply.

I eventually did get a response, in the form of a short note agreeing to chat, with a Calendly link (naturally) to choose a time.

(Thanks, unnamed TC writer, for never writing about Calendly when Tope originally pitched you years ago: you may have whet his appetite to respond to me.)

In that first chat over Zoom, Awotona was nothing short of wary.

In that first chat over Zoom, Awotona was nothing short of wary.

After years of little or no attention, he was getting cold-contacted by me and it seems others, all of us suddenly interested in him and his company.

“It’s been the bane of my life,” he said to me with a laugh about the calls he’s been getting.

Part of me thinks it’s because it can be hard and distracting to balance responding to people, but it’s also because he works hard, and has always worked hard, so doesn’t understand what the new fuss is about.

A lot of those calls have been from would-be investors.

“It’s been exorbitant, the amount of interest Calendly has been getting, from backers of all shapes and sizes,” Blake Bartlett, a partner at OpenView, said to me in an interview.

From what I understand, it’s had inbound interest from a number of strategic tech companies, as well as a long list of financial investors. That process eventually whittled down to just two backers, OpenView and Iconiq.

Yet even putting the rumors of the funding to one side, Calendly and Awotona himself have been a remarkable story up to now, one that champions immigrants as well as startup grit.

Tope comes from Lagos, Nigeria, part of a large, middle class household. His mother had been the chief pharmacist for the Nigerian Central Bank, his father worked for Unilever.

The family may have been comfortable, but growing up in Lagos, a city riven by economic disparity and crime, brought its share of tragedies. When he was 12, Awotona’s father was murdered in front of him during a carjacking. The family moved to the U.S. some time after that, and since then his mother has also passed away.

A bright student who actually finished high school at 15, Awotona cut his teeth in the world of business first by studying it — his major at the University of Georgia was management information systems — and then working in it, with jobs after college including periods at IBM and EMC.

But it seems Awotona was also an entrepreneur at heart — if one that initially was not prepared for the steps he needed to take to get something off the ground.

He told me a story about what he describes as his “first foray into business” at age 18, which involved devising and patenting a new feature for cash registers, so that they could use optical character recognition recognize which bills and change were being used for, and dispense the right amount a customer might need in return after paying.

At the time, he was working at a pharmacy while studying and saw how often the change in the cash registers didn’t add up correctly, and his was his idea for how to fix it.

He cold-contacted the leading cash register company at the time, NCR, with his idea. NCR was interested, offering to send him up to Ohio, where it was headquartered then, to pitch the idea to the company directly, and maybe sell the patent in the process. Awotona, however, froze.

“I was blown away,” he said, but also too surprised at how quickly things escalated. He turned down the offer, and ultimately let his patent application lapse. (Computer-vision-based scanning systems and automatic dispensers are, of course, a basic part nowadays of self-checkout systems, for those times when people pay in cash.)

There were several other entrepreneurial attempts, none particularly successful and at times quite frustrating because of the grunt work involved just to speak to people, before his businesses themselves could even be considered.

Eventually, it was the grunt work that then started to catch Awotona’s attention.

“What led me to create a scheduling product” — Awotona said, clear not to describe it as a calendaring service — “was my personal need. At the time wasn’t looking to start a business. I just was trying to schedule a meeting, but it took way too many emails to get it done, and I became frustrated.

“I decided that I was going to look for scheduling products that existed on the market that I could sign up for,” he continued, “but the problem I was facing at the time was I was trying to arrange a meeting with, you know, 10 or 20 people. I was just looking for an easy way for us to easily share our availability and, you know, easily find a time that works for everybody.”

He said he couldn’t really see anything that worked the way he wanted — the products either needed you to commit to a subscription right away (Calendly is freemium) or were geared at specific verticals such as beauty salons. All that eventually led to a recognition, he said, “that there was a big opportunity to solve that problem.”

The building of the startup was partly done with engineers in Kiev — a drama in itself that pivoted at times on the political situation at times in Ukraine (you can read a great unfolding of that story here).

Awotona says that he admired the new guard of cloud-based services like Dropbox and decided that he wanted Calendly to be built using “the Dropbox approach” — something that could be adopted and adapted by different kinds of users and usages.

On the surface, there is a simplicity to the company’s product: it’s basically about finding a time for two parties to meet. Awotona notes that behind the scenes the scheduling help Calendly provides is the key to what it might develop next.

For example, there are now tools to help people prepare for meetings — specifically features like being able to, say, pay for something that’s been scheduled on Calendly in order to register. A future focus could well be more tools for following up on those meetings, and more ways to help people plan recurring individual or group events.

One area where it seems Calendly does not want to dabble are those meetings themselves — that is, hosting meetings and videoconferencing itself.

“What you don’t want is to start a world war three with Zoom,” Awotona joked. (In addition to becoming the very verb-ified definition of video conferencing, Zoom is also a customer of Calendly’s.)

“We really see ourselves as a leading orchestration platform. What that means is that we really want to remain extensible and flexible. We want our users to bring their own best in class products,” he said. “We think about this in an agnostic way.”

But in a technology world that usually defaults back to the power of platforms, that position is not without its challenges.

“Calendly has a vision increasingly to be a central part of the meeting life cycle. What happens before, during and after the meeting. Historically, the obvious was before the meeting, but now it’s looking at integrations, automations and other things, so that it all magically happens. But moving into the rest of the lifecycle is a lot of opportunity but also many players,” admitted Bartlett, with others including older startups like X.ai and Doodle (owned by Swiss-based Tamedia) or newer entrants like Undock but also biggies like Google and Microsoft.

“It will be an interesting task to see where there are opportunities to partner or build or buy to build out its competitive position.”

You’ll notice that throughout this story I didn’t refer to Awotona’s position as a black founder — still very much a rarity among startups, and especially those valued at over $1 billion.

That is partly because in my conversations with him, it emerged that he saw it as just another detail. Still, it is one that is brought up a lot, he said, and so he understands it is important for others.

“I don’t spend a lot of time thinking about being black or not black,” he said. “It doesn’t change how I approach or built Calendly. I’m not incredibly conscious of my race or color, except for the last few years through he growth of Calendly. I find that more people approach me as a black tech founder, and that there is young black people who are inspired by the story.”

That is something he hopes to build on in the near future, including in his home country.

Pending pandemic chaos, he has plans to try to visit Nigeria later this year and to get more involved in the ecosystem in that country, I’m guessing as a mentor if not more.

“I just know the country that produced me,” he said. “There are a million Topes in Nigeria. The difference for me was my parents. But I’m not a diamond in the rough, and I want to get involved in some way to help with that full potential.”

Powered by WPeMatico

Streaming data is not new. Kafka has existed as an open source tool for a decade. Vectorized was founded on the premise that the existing tools were too complex and not designed for today’s streaming requirements. Today the company released its first product, Redpanda, an open source tool designed to make it easier for developers to build streaming data applications.

While it was at it, the startup announced a $15.5 million funding round, which is actually a combination of a previously unannounced $3 million seed round led by Lightspeed Venture Partners and a $12.5 million Series A, which was also from Lightspeed with help from Google Ventures.

Redpanda is an open source tool that is delivered as an “intelligent API” to help “turn data streams into products,” company founder and CEO Alexander Gallego explained. It’s built to be a Kafka replacement, while remaining Kafka-compatible to help deal with backwards compatibility.

At the same time, it takes a more modern approach. Gallego points out that teams building data streaming applications have been getting lost in the complexity and he recognized an opportunity to build a company to simplify that.

“People are drowning in complexity today managing Kafka, ZooKeeper (an open source configuration management tool) and the data lake,” he said, adding “We enable new things that couldn’t be done before for several reasons: one is performance, one is simplicity and the other one is this store procedures.”

He says that the key to developer adoption is making the product free through open source, and having Kafka compatibility so that developers don’t feel like they have to just dump existing projects and start from scratch. While the company is launching with an open source tool, it plans to use the funding to build a hosted version of Redpanda to put it within reach of more organizations. “This funding round in particular is to power our cloud,” he said.

Arif Janmohamed, a partner at Lightspeed Ventures who is leading the investment in Vectorized sees a company looking to improve upon an existing technology with a better approach. “With a simple, elegant solution that doesn’t require any changes to an existing application’s code, Vectorized delivers 10x better performance, a much simpler management paradigm, and new functionality that will unleash the next set of real-time applications for the next decade,” Janmohamed said.

The company has 22 employees today with plans to add another 8 in the first half of this year, mostly engineers to help build the hosted version. As a Latino founder, Gallego is acutely aware of the need for a diverse and inclusive workforce. “What I have found is that being a [Latino] CEO, it attracts more people that look like me, and so that’s been a big thing, and it’s made a difference [in attracting diverse candidates],” he said.

One concrete thing he has done is start a scholarship to encourage under represented groups to become developers. “I started a scholarship where we just give money and mentorship to communities of Latino, Black and female developers, or people that want to transition to software engineering,” he said. While he says he does it without strings attached, he does hope that some of these folks could become part of the tech industry eventually, and perhaps even work at his company.

Powered by WPeMatico

This week, Latch becomes the latest company to join the SPAC parade. Founded in 2014, the New York-based company came out of stealth two years later, launching a smart lock system. Though, like many companies primarily known for hardware solutions, Latch says it’s more, offering a connected security software platform for owners of apartment buildings.

The company is set to go public courtesy of a merger with blank check company TS Innovation Acquisitions Corp. As far as partners go, Tishman Speyer Properties makes strategic sense here. The New York-based commercial real estate firm is a logical partner for a company whose technology is currently deployed exclusively in residential apartment buildings.

“With a standard IPO, you have all of the banks take you out to all of the big investors,” Latch founder and CEO Luke Schoenfelder tells TechCrunch. “We felt like there was an opportunity here to have an extra level of strategic partnership and an extra level of product expansion that came as part of the process. Our ability to go into Europe and commercial offices is now accelerated meaningfully because of this partnership.

The number of SPAC deals has increased substantially over the past several months, including recent examples like Taboola. According to Crunchbase, Latch has raised $152 million, to date. And the company has seen solid growth over the past year — not something every hardware or hardware adjacent company can say about the pandemic.

As my colleague Alex noted on Extra Crunch today, “Doing some quick match, Latch grew booked revenues 50.5% from 2019 to 2020. Its booked software revenues grew 37.1%, while its booked hardware top line expanded over 70% during the same period.”

“We’ve been a customer and investor in Latch for years,” Tishman Speyer President and CEO Rob Speyer tells TechCrunch. “Our customers — the people who live in our buildings — love the Latch product. So we’ve rolled it out across our residential portfolio […] I hope we can act as both a thought partner and product incubator for them.”

While the company plans to expand to commercial offices, apartment buildings have been a nice vertical thus far — meaning the company doesn’t have to compete as directly in the crowded smart home lock category. Among other things, it’s probably a net positive if you’re going head to head against, say Amazon. That the company has built in partners in real estate firms like Tishman Speyer is also a net positive.

Schoenfelder says the company is looking toward such partnerships as test beds for its technology. “Our products have been in the field for many years in multifamily. The usage patterns are going to be slightly different in commercial offices. We think we know how they’re going to be different, but being able to get them up and running and observe the interaction with products in the wild is going to be really important.”

The deal values Latch at $1.56 billion and is expected to close in Q2.

Powered by WPeMatico

Goalsetter, a platform that helps parents teach their kids financial literacy, announced the raise of a $3.9 million seed round this morning, led by Astia.

PNC Bank, Mastercard, U.S. Bank, Northwestern Mutual Future Ventures, Elevate Capital, Portfolia’s First Step and Rising America Fund and Pipeline Angels also participated in the round. The round also saw participation from a handful of individual investors including Robert F. Smith, Kevin Durant, Chris Paul, Baron Davis, Sterling K. Brown, Ryan Bathe, CC Sabathia and Amber Sabathia.

Goalsetter launched in 2019 out of the Entrepreneurs Roundtable Accelerator. Founded by Tanya Van Court, who lost over $1 million in the 2001 bubble burst, the platform teaches financial literacy to children of all ages, helping them learn economic concepts, lingo and the principles of financial health.

After long stints at Nickelodeon and ESPN, Van Court understands deeply how kids learn and what keeps their attention. She vowed to make sure that her children were never ignorant of what it takes to protect their wealth and create more.

The app also allows parents to give allowances through the app, and even pay out their own specified amount for every quiz question the kid gets right in the app. Plus, family and friends can give “goal cards” instead of gift cards, helping kids save for the things they really want in the future.

The company recently launched a debit card for kids, as well, letting parents control the way the card is used and even lock it until their kids have passed the week’s financial literacy quiz.

Families save an average of $120 a month on the platform, and Van Court says that two families saved over $10,000 in the last year.

The company is also launching a massive campaign next week for Black History Month with the goal of closing the wealth gap among Black children and kids of color through financial education.

“It’s one thing to put a debit card into your teenager’s hands,” said Van Court. “That’s great. That teaches them how to spend money. It’s another thing to teach kids the core concepts about how to build wealth, or to know the difference between putting your money into an investment account, or putting your money into a CD versus a mutual fund versus a savings account. We teach what interest rates are, and what compound interest means. Our focus is on financial education because it’s not enough to teach kids how to spend.”

Goalsetter raised $2.1 million in 2019 and now adds this latest round to that for a total of $6 million raised. This latest round was oversubscribed, giving Van Court the opportunity to be super selective about her investors.

“Every single one of these investors has a demonstrated commitment prior to people marching in the streets in April, to social justice and to investing in diversity and inclusion initiatives and people,” said Van Court. “Every single one of them. That was really important because we were oversubscribed and we had the luxury of being able to pick who our investors were. Every one of the investors that we invited to our table were investors who we knew invited folks who look like us in 2019 and 2018 and 2017 to their table.”

Powered by WPeMatico

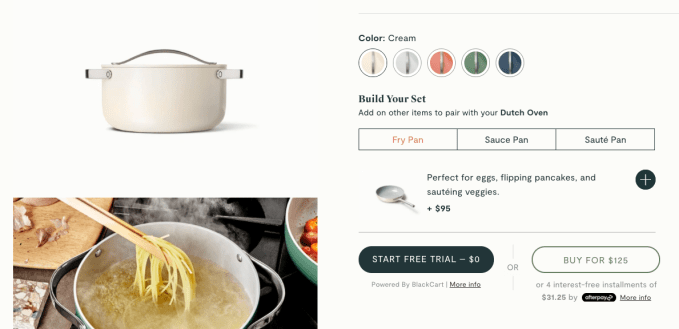

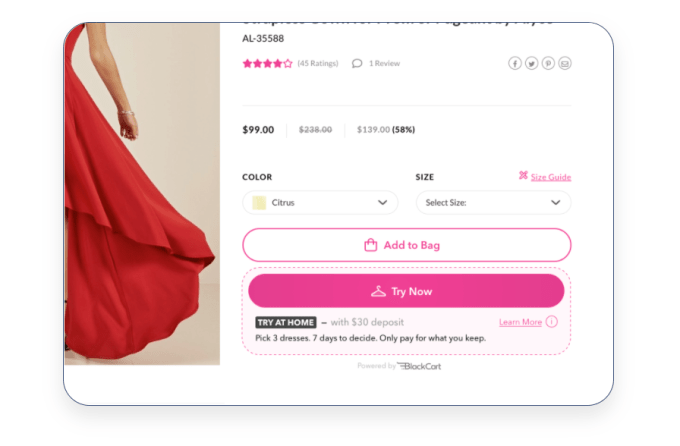

A startup called BlackCart is tackling one of the key challenges with online shopping: an inability to try on or test out the merchandise before making a purchase. That company, which has now closed on $8.8 million in Series A funding, has built a try-before-you-buy platform that integrates with e-commerce storefronts, allowing customers to ship items to their home for free and only pay if they choose to keep the item after a “try on” period has lapsed.

The new round of financing was led by Origin Ventures and Hyde Park Ventures Partners, and saw participation from Struck Capital, Citi Ventures, 500 Startups and several other angel investors, including Christian Sullivan of Republic Labs, Dean Bakes of M3 Ventures, Greg Rudin of Menlo Ventures, Jordan Nathan of Caraway Cookware and First National Bank CFO Nick Pirollo, among others.

The Toronto-based company last year had raised a $2 million seed.

Image Credits: BlackCart

BlackCart founder Donny Ouyang had previously founded online tutoring marketplace Rayku before joining a seed-stage VC fund, Caravan Ventures. But he was inspired to return to entrepreneurship, he says, after experiencing a personal problem with trying to order shoes online.

Realizing the opportunity for a “try before you buy” type of service, Ouyang first built BlackCart in 2017 as a business-to-consumer (B2C) platform that worked by way of a Chrome extension with some 50 different online merchants, largely in apparel.

This MVP of sorts proved there was consumer demand for something like this in online shopping.

Ouyang credits the earlier version of BlackCart with helping the team to understand what sort of products work best for this service.

“I think, in general, for try-before-you-buy, anything that’s moderate to higher price points, lower frequency of purchase, where the customer makes a considered purchase decision — those perform really well,” he says.

Two years later, Ouyang took BlackCart to 500 Startups in San Francisco, where he then pivoted the business to the B2B offering it is today.

Image Credits: BlackCart

The startup now provides a try-before-you-buy platform that integrates with online storefronts, including those from Shopify, Magento, WooCommerce, Big Commerce, SalesForce Commerce Cloud, WordPress and even custom storefronts. The system is designed to be turnkey for online retailers and takes around 48 hours to set up on Shopify and around a week on Magento, for example.

BlackCart has also developed its own proprietary technology around fraud detection, payments, returns and the overall user experience, which includes a button for retailers’ websites.

Because the online shoppers aren’t paying upfront for the merchandise they’re being shipped, BlackCart has to rely on an expanded array of behavioral signals and data in order to make a determination about whether the customer represents a fraud risk. As one example, if the customer had read a lot of helpdesk articles about fraud before placing their order, that could be flagged as a negative signal.

BlackCart also verifies the user’s phone number at checkout and matches it to telco and government data sets to see if their historical addresses match their shipping and billing addresses.

Image Credits: BlackCart

After the customer receives the item, they are able to keep it for a period of time (as designated by the retailer) before being charged. BlackCart covers any fraud as part of its value proposition to retailers.

BlackCart makes money by way of a rev share model, where it charges retailers a percentage of the sales where the customers have kept the products. This amount can vary based on a number of factors, like the fraud multiplier, average order value, the type of product and others. At the low end, it’s around 4% and around 10% on the high end, Ouyang says.

The company has also expanded beyond home try-on to include try-before-you-buy for electronics, jewelry, home goods and more. It can even ship out makeup samples for home try-on, as another option.

Once integrated on a website, BlackCart claims its merchants typically see conversion increases of 24%, average order values climb by 51% and bottom-line sales growth of 27%.

To date, the platform has been adopted by more than 50 medium-to-large retailers, as well as e-commerce startups, like luxury sneaker brand Koio, clothing startup Dia&Co, online mattress startup Helix Sleep and cookware startup Caraway, among others. It’s also under NDA now with a top-50 retailer it can’t yet name publicly, and has contracts signed with 13 others that are waiting to be onboarded.

Soon, BlackCart aims to offer a self-serve onboarding process, Ouyang notes.

“This would be later, end of Q2 or early Q3,” he says. “But I think for us, it will still be probably 80% self-serve, and then larger enterprises will want to be handheld.”

With the additional funding, BlackCart aims to shift to paying the merchant immediately for the items at checkout, then reconciling afterwards in order to be more efficient. This has been one of merchants’ biggest feature requests, as well.

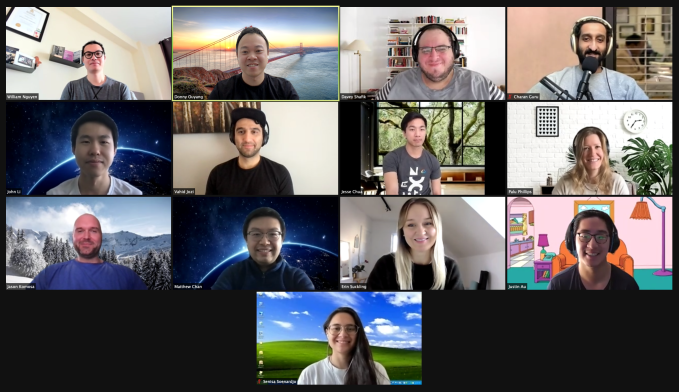

Image Credits: BlackCart; team photo

The funding will also allow BlackCart to expand its remotely distributed 10-person team to around 50 by year-end, including engineers, product specialists, customer support staff and sales.

More broadly, it aims to quickly capitalize on the growth in the e-commerce market, driven by the COVID-19 pandemic.

“[We want to] take advantage of the favorable macroeconomic situation to scale as quickly as possible,” Ouyang explains. “We’re hoping to get to around $250 million in transactions through our platform by the end of 2021. And this would be driven by both engineering and sales hires, and just pushing it up,” he says.

Longer-term, Ouyang envisions adding more consumer-facing features to BlackCart’s platform, like on-demand returns where a courier comes to the house to pick up your return, for example.

“Our firm is excited to partner with BlackCart as it makes try-before-you-buy the standard in online shopping,” said Prashant Shukla of Origin Ventures, who now sits on BlackCart’s board, as result of the new financing. “Its underwriting technology provides merchants with peace of mind, and its best-in-class consumer experience delivers significant sales and conversion lifts. Digital Native generations expect to be able to shop online exactly as they would in a retail store, and BlackCart is the only company providing this experience,” he adds.

Powered by WPeMatico

Payments for consumers have made a huge shift to the online world in the last year, a time when they have moved more of their purchasing to the internet to minimize in-person transactions in the midst of a virus-based health pandemic. Today, a startup that has built a similar kind of payments infrastructure — but specifically targeting small businesses and the payments they need to make — has raised a big round of funding to double down on its own slice of the market.

Melio, which provides a platform for SMBs to pay other companies electronically using bank transfers, debit cards or credit — along with the option of cutting paper checks for recipients if that is what the recipients request — has closed $110 million in funding at a valuation that the company said was now $1.3 billion.

The company’s focus to date has been building and growing a system to replace the paper invoices, snail mail and bank transfers that might take multiple days to clear and still dominate payments for small and medium enterprises. The company was founded in Israel but has to date focused a lot of its attention on the U.S. market, where it saw growth of 2,000% last year (it doesn’t disclose the actual number of customers that it has). CEO Matan Bar said that this is where the company will continue to focus for now.

This latest round was led by Coatue and also included participation from previous backers Accel, Aleph, Bessemer Venture Partners, Corner Ventures, General Catalyst and Latitude. It caps off a huge year for the company, which raised $130 million in 2020 (and $256 million overall), with other recent backers including others like American Express and Salesforce.

The latter two are strategic backers: AmEx is one of the options given to customers paying other businesses through Melio’s rails.

Salesforce, meanwhile, is not yet an integration partner, but Bar — who co-founded the company with Ilan Atias and Ziv Paz (respectively CTO and COO) — described its interest as similar to that of Intuit-owned accounting giant QuickBooks. QuickBooks connects with Melio so that users of one can seamlessly import activity from one platform into the other, and Bar hinted that there is an interest from the CRM giant, which provides a number of other business and productivity tools, to work together in a similar fashion.

Bar came to found Melio on the heels of years of experience in peer-to-peer payments focused on the consumer market. He previously ran PayPal’s business unit focused on peer-to-peer payments, which included Venmo in the U.S. and equivalent services (not branded Venmo) outside of it. He came to PayPal, which at the time was a part of eBay, through eBay’s acquisition of his previous startup, a social gifting platform called The Gifts Project.

As Bar describes it, PayPal “was the first time I experienced what the digitization of payments looked like as they were shifting from cash to mobile payments. Consumers were buying online instead of at brick-and-mortar stores, and even when they were getting physical items, they were paying online.” What he quickly realized, though, was that the same was not applying to the businesses themselves.

“There are still trillions being transferred via paper checks in the B2B space,” he said, with paper invoices and paper checks dominating the market. “The space is way behind other payment areas. I would be talking with SMB owners who would be using fancy Square or PayPal point of sale devices, but when they had to pay, say, a coffee bean supplier, they stuffed checks in envelopes. That’s very intriguing obviously, and it triggered our interest.”

Interestingly this isn’t a problem that hasn’t been identified before, but many of the solutions, such as Bill.com or Tipalti, are really designed for larger enterprises. “They are too overwhelming for SMBs,” he said. “Even their names say it all: Accounts Payable Automation Solutions. It’s about tens of thousands of payments, and accounting departments, not an order from a wine shop.”

That formed the basis of what the startup started to build, which has been, in essence, a very pared-down version of these other payments platforms with SMB needs in mind.

The first of these is a focus on cashflow, Bar said. Specifically, the Melio platform lets payments be made automatically but businesses themselves can delay the timing on when money actually leaves their accounts: “Buyers keep cash longer, vendors get paid faster,” is how Bar describes it.

This is in part enabled by the tech that Melio has built, which builds in risk assessment, as well as fraud management, and balances payments across the whole of its platform to send money in and out without the need for the company to raise debt to back up those payments.

“We leverage data to assess risk,” said Bar. “Every dollar in this round is going towards R&D and sales and marketing. We don’t need the capital in our model.” It also works with the likes of AmEx and its own credit system in cases where people are paying on credit, but Bar also noted that currently most of the transactions that happen on its platform are not credit based. Most are bank transfers.

While others like Stripe have also built B2B payment services to pay out suppliers, Bar points out that what it has created is unique in that it is a standalone service: no need to be a part of Stripe’s wider ecosystem of services to use this if you already use another payments provider you are happy with.

Given that focus on cashflow for SMBs, what’s also interesting is the low bar to entry that Melio has built into its platform. Specifically, the service is completely free for businesses to use — that is, no fee is charged — as long as companies are making bank transfers or using debit cards. It takes a 2.9% fee when a business elects to use a credit card for a transaction (and even then Melio says that the fee is tax deductible in the U.S.).

He noted that one of the reasons that Melio has to date targeted the U.S. market is because of how antiquated it still is. “The average bank transfer still takes three to four business days, if you don’t want to take any risk,” he said. “We have developed models to do it same day. We take the risk that the buyer might not have the funds in that account but think about how that impacts cash flows. With Melio you still pay in three days, but money will be delivered the same day. That is how you can keep cash longer, without a payments risk.”

Targeting a market that remains very underserved at a time when so much has gone virtual in payments is why investors are also interested.

“Melio has identified both the opportunity and duty to help small businesses manage their finance remotely and improve cash flow, in normal times as well as during this crisis, as physical payments supply chains are interrupted and overwhelmed,” said Michael Gilroy, a general partner at Coatue, in a statement. “Going digital is the only way small businesses can compete against larger rivals and stay ahead of the curve.”

In terms of more product development, Bar said that the company has received “a lot of incoming interest from partners to enable B2B payments within their products on their product,” similar to what QuickBooks is doing and Salesforce is likely to do. “Payments are contextual and they want to enable a quicker way to get there. The SMB is underserved. And yes, from a unit economics it’s much better to go after Nike. But this is also to really create some financial inclusion. We want to enable services for the small shop that the big guys already have.”

Powered by WPeMatico

In a year marred by the coronavirus pandemic, it seems that early-stage startups on the African continent are continuing to see some notable growth, both in terms of their business and from investors looking to back them.

Microtraction, an early-stage venture capital firm based in Lagos, Nigeria, saw funding nearly quadruple for its portfolio.

In a review of the year published last week, the firm noted that 21 companies in its portfolio have raised more than $33 million in funding. This represents nearly four-fold growth over a year ago, when its portfolio raised $6 million (and just $3 million in 2018). The companies’ combined valuation stands at more than $147 million, according to the firm.

Founded by Yele Bademosi in 2017, Microtraction arrived on the continent’s early-stage investment scene with all intent to be “the most accessible and preferred source of pre-seed funding for African tech entrepreneurs.”

Bademosi, who returned to Nigeria from the U.K. in 2015, worked as the general manager for Starta Africa, an online community for African tech entrepreneurs. After his stint there, he saw the need to plug the gap of early-stage funding in Nigeria and the continent at large with Microtraction.

Microtraction does not specify the size of its fund, but what is more clear is that it has attracted a great deal of attention and has built a strong network in part because of who backs it.

Michael Seibel, the CEO of Y Combinator, is a global advisor and an investor in the firm, and so is Andy Volk, the head of ecosystem for Google Sub-Saharan Africa. Other investors include Pave Investments and U.S.-based angel investor Chris Schultz.

Being entrepreneurs in the past, some of these investors know what it takes to build a startup in the U.S. But it’s completely different in Africa. With no on the ground knowledge as to which startups to fund but an interest to do so, for portfolio diversification and other personal reasons, Microtraction and a few other early-stage investors present the best bets to accomplish this goal.

At first, Microtraction’s standard deal was to offer portfolio startups $15,000 in exchange for a 7.5% equity. But as a sign of how the market is firming up, that changed last year, and now the firm invests $25,000 for 7% equity.

Microtraction revealed that it accepted more than 500 applications from startups in Nigeria, Ghana, Zambia and Mauritius in its first full year of operation (though, just eight of those companies got investments).

The introductory batch was all Nigerian: four fintech startups — Cowrywise, Riby, Wallets Africa and ThankUCash; a crypto-exchange startup, BuyCoins; a SaaS platform, Accounteer; an edtech startup, Schoolable; and healthtech startup, 54gene.

2019 saw the local VC firm invest in six companies. This time there was a representative outside Nigeria — Ghanaian fintech startup Bitsika. The Nigerian startups included social commerce startup Sendbox; events startup Festival Coins; and communications-as-a-service platform Termii. The rest were unannounced.

Last year (the one this latest review covers), Microtraction announced seven startups. The latest selection includes Nigerian fintech startups Evolve Credit and Chaka; edtech startup Gradely; bus-hailing platform PlentyWaka; and Kenyan credit data marketplace CARMA.

Of the total investments raised in 2019 and 2020, 54gene contributed more than half of those numbers by raising $4.5 million in seed and a $15 million Series A investment. With an ingenious solution to solve the underrepresentation of African genomics data in global genomics research, 54gene got accepted into the winter batch in January 2019, the same month it officially launched.

Excluding 54gene, there were six other African-focused startups in the YC W19 batch. Two out of the six, Schoolable and Wallets Africa, were Microtraction portfolio companies. Others accepted into YC before and after include BuyCoins, Cowrywise, Termii and two unannounced startups.

Microtraction-backed ThankUCash and a second unannounced startup have also joined cohorts at 500 Startups. On the other hand, Festival Coins is the only startup to be selected into Google for Startups Accelerator. With all accounted for, 11 out of the 21 startups are either backed by Y Combinator, 500 Startups or Google for Startups.

The Microtraction team with founding partner, Yele Bademosi (far right). Image Credits: Microtraction

Getting into these global accelerators is a surefire way to receive follow-up investment, ranging from $125,000 to $150,000. From the outside in, startups see Microtraction and other early-stage VC firms like Ventures Platform as a means to that end. There have also been arguments that these firms build startups to be “YC or any global accelerator ready.”

However, Dayo Koleowo, a partner at Microtraction alongside Chidinma Iwueke, debunks it saying there’s no formula behind the numbers we see. He believes YC and other accelerators share the same fundamentals with Microtraction, which revolves around the team, the market and traction.

“We love super technical teams that understand the industry they are in and are likely to succeed without us. We are always looking for companies that are solving huge problems that a lot of people face,” he told TechCrunch. “Also, the tech and startup world moves fast, so we like teams who understand that and can show in real-time that they can execute. I believe that these global accelerators look for these same things.”

Typically, YC and other accelerators may perform extended due diligence and risk assessments before cutting cheques for any African startup without a local backer. Koleowo points out that this might be why Microtraction portfolio companies get accepted quicker. “The icing on the cake is that there is a level of de-risking that has been done by Microtraction and other local investors on the ground before these global accelerators step in,” he added.

That said, there’s no denying the significance of Microtraction’s advisory board in playing a part as to why half the firm’s portfolio are in global accelerators. Besides the names mentioned earlier, some of its past advisors included Lexi Novitske, former PIO at Singularity Investments; Dotun Olowoporoku, VC at Novastar Ventures; and Monique Woodward, ex-venture partner at 500 Startups.

And with the growing trends of globalization, plus the acceptance of a more decentralised approach to building and operations in the tech industry because of COVID-19, it’s a trend that might continue for a while.

Powered by WPeMatico

The line between social networking and gaming is increasingly blurring, and internet incumbents are taking notice. NetEase, the second-largest gaming company in China (behind Tencent), is among a group of investors who just backed IMVU, an avatar-focused social network operating out of California.

Menlo Park-based Structural Capital among other institutions that also joined in the strategic round totaling $35 million. IMVU has raised more than $77 million from five rounds since it was co-founded by “The Lean Startup” author Eric Ries back in 2004. The company declined to disclose its post-money valuation.

The fresh investment will be used to fund IMVU’s product development and comes fresh off a restructuring at the company. A new parent organization called Together Labs was formed to oversee its flagship platform IMVU, in which users can create virtual rooms and chat with strangers using custom avatars, a product that’s today considered by some a dating platform; a new service called Vcoin, which lets users buy, gift, earn and convert a digital asset from the IMVU platform into fiat; and other virtual services.

“NetEase operates some of the most successful, biggest in scale, and evergreen MMO [massively multiplayer online] games in China and they see in IMVU business highlights echoing theirs,” Daren Tsui, chief executive officer at Together Labs, told TechCrunch.

“IMVU operates one of the world’s oldest, yet most vibrant and young — in terms of our user base — metaverses. We have many shared business philosophies and complementary know-how. It is a natural fit for us to become partners,” he added.

Founded in 2005, NetEase is now known for its news portal, music streaming app, education products and video games that compete with those of Tencent. It has over the years made a handful of minority investments in companies outside China, though it’s not nearly as aggressive as Tencent in terms of investment pace and volume.

A NetEase spokesperson declined to comment on the investment in IMVU.

The partnership, according to Tsui, would allow the virtual networking company to tap NetEase’s game development and engineering capabilities as well as leverage NetEase’s knowledge in global market strategy as Together Labs launches future products, including one called WithMe.

In 2020, IMVU saw record growth, with over 7 million monthly active users and 400,000 products created every month by IMVU users. The service currently has a footprint in more than 140 countries and is “always looking to expand” in existing markets, including Asia, in which it already has a localized Korean app, according to Tsui.

“With IMVU’s accelerating growth over recent years, the launch of VCOIN, and the development of the new WithMe platform, we felt timing was right to bring all of these products under a new roof to reinforce our commitment for creating authentic human connections in virtual spaces,” said the chief executive.

Powered by WPeMatico