funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Before he was a partner at Lightspeed Venture Partners, Gaurav Gupta had his eye on Grafana Labs, the company that supports open-source analytics platform Grafana. But Raj Dutt, Grafana’s co-founder and CEO, played hard to get.

This week on Extra Crunch Live, the duo explained how they came together for Grafana’s Series A — and eventually, its Series B. They also walked us through Grafana’s original Series A pitch deck before Gupta shared the aspects that stood out to him and how he communicated those points to the broader partnership at Lightspeed.

Gupta and Dutt also offered feedback on pitch decks submitted by audience members and shared their thoughts about what makes a great founder presentation, pulling back the curtain on how VCs actually consume pitch decks.

We’ve included highlights below as well as the full video of our conversation.

We record new episodes of Extra Crunch Live each Wednesday at 12 p.m. PST/3 p.m. EST/8 p.m. GMT. Check out the February schedule here.

As soon as Gupta joined Lightspeed in June 2019, he began pursuing Dutt and Grafana Labs. He texted, called and emailed, but he got little to no response. Eventually, he made plans to go meet the team in Stockholm but, even then, Dutt wasn’t super responsive.

The pair told the story with smiles on their faces. Dutt said that not only was he disorganized and not entirely sure of his own travel plans to see his co-founder in Stockholm, Grafana wasn’t even raising. Still, Gupta persisted and eventually sent a stern email.

“At one point, I was like ‘Raj, forget it. This isn’t working’,” recalled Gupta. “And suddenly he woke up.” Gupta added that he got mad, which “usually does not work for VCs, by the way, but in this case, it kind of worked.”

When they finally met, they got along. Dutt said they were able to talk shop due to Gupta’s experience inside organizations like Splunk and Elastic. Gupta described the trip as a whirlwind, where time just flew by.

“One of the reasons that I liked Gaurav is that he was a new VC,” explained Dutt. “So to me, he seemed like one of the most non-VC VCs I’d ever met. And that was actually quite attractive.”

To this day, Gupta and Dutt don’t have weekly standing meetings. Instead, they speak several times a week, conversing organically about industry news, Grafana’s products and the company’s overall trajectory.

Dutt shared Grafana’s pre-Series A pitch deck — which he actually sent to Gupta and Lightspeed before they met — with the Extra Crunch Live audience. But as we know now, it was the conversations that Dutt and Gupta had (eventually) that provided the spark for that deal.

Powered by WPeMatico

Latitude, a startup building games with “infinite storylines” generated by artificial intelligence, is announcing that it has raised $3.3 million in seed funding.

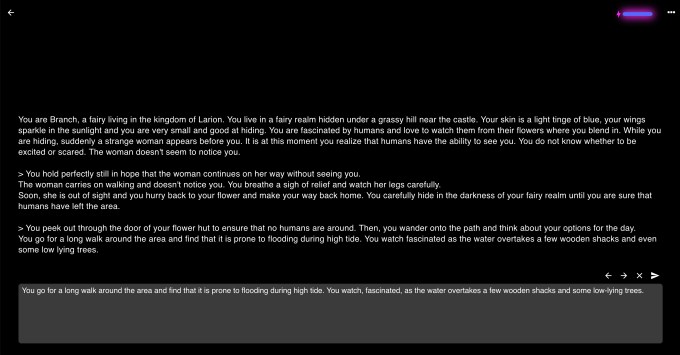

The idea of an AI-generated story might make you think of hilariously nonsensical experiments like “Sunspring,” but Latitude’s first title, AI Dungeon, is an impressively open-ended (and coherent) text adventure game where you can choose from a wide variety of genres and characters.

Unlike a classic text adventure like Zork — where players quickly become familiar with “you can’t do that”-style messages when they type something the designers hadn’t planned for — AI Dungeon can respond to any command. For example, when my brave knight was charging into battle, I typed “get depressed” and he quickly sat on a rock with his head between his hands.

“How does the AI know what’s a good story?” said co-founder and CEO Nick Walton. “Because it’s read a lot of good stories and knows the patterns involved in that.”

AI Dungeon actually started out as one of Walton’s hackathon projects. While the initial version didn’t win any prizes, he kept at it, assisted by improvements in OpenAI’s language generator, of which the most recent version is GPT-3.

AI Dungeon, Image Credits: Latitude

“The very first version of AI Dungeon I built was coherent on a sentence level, but on a paragraph level it made no sense,” Walton said. “Once you get to GPT-2, it makes a lot more sense. Once you get to GPT-3, it’s a lot more coherent on a story level. And so I think to a degree, these issues with coherency, the story not making sense, get solved as the AI gets better.”

Latitude says AI Dungeon is attracting 1.5 million monthly active users. The startup plans to create more AI-powered games, and eventually to release a platform allowing other game designers to do the same.

Walton noted that without AI, video games are always constrained by the imagination of its creators. Even when you get to games like The Elder Scrolls II: Daggerfall or No Man’s Sky, with randomly generated towns or planets, he argued that they’re really offering “the same spin on a similar concept.”

For example, he said that in Daggerfall, “When you go to all these towns, they’re all basically the same. That’s the problem with procedural generation: You’re not coming up with unique things.” AI, on the other hand, can come up with “something completely unique that’s so, so different every time.”

Latitude CEO Nick Walton. image Credits: Latitude

From a business perspective, he said that this could lower the cost of developing AAA games from more than $100 million to less than $100,000 — though Latitude has a ways to go before it reaches that level, since it hasn’t even released a game with graphics yet. Walton also said this could lead to new levels of immersion and interactivity.

“With this technology, you could have a world with tens of thousands of characters with their own hopes and wants and dreams,” he said. “You can have worlds that are dynamic, that are alive, rather than something like World of Warcraft, where you’ve got 10 million people who are doing the same quest.”

The startup’s funding was led by NFX, with participation from Album VC and Griffin Gaming Partners.

“Latitude is revolutionizing how games are made, creating a whole new genre of entertainment gaming fueled by AI,” said James Currier of NFX in a statement. “The best AI minds and engineers are gathering there to produce games that the world has never seen before. Latitude is already by far the leading AI games company.“

Powered by WPeMatico

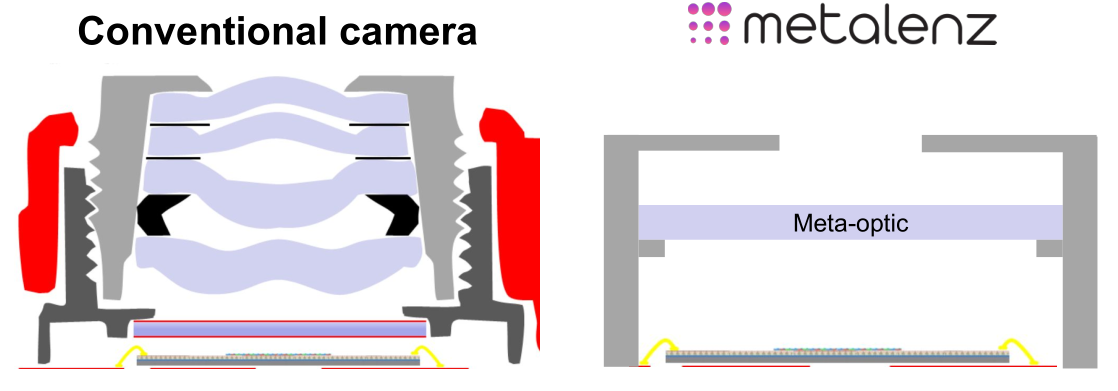

As impressive as the cameras in our smartphones are, they’re fundamentally limited by the physical necessities of lenses and sensors. Metalenz skips over that part with a camera made of a single “metasurface” that could save precious space and battery life in phones and other devices… and they’re about to ship it.

The concept is similar to, but not descended from, the “metamaterials” that gave rise to flat beam-forming radar and lidar of Lumotive and Echodyne. The idea is to take a complex 3D structure and accomplish what it does using a precisely engineered “2D” surface — not actually two-dimensional, of course, but usually a plane with features measured in microns.

In the case of a camera, the main components are of course a lens (these days it’s usually several stacked), which corrals the light, and an image sensor, which senses and measures that light. The problem faced by cameras now, particularly in smartphones, is that the lenses can’t be made much smaller without seriously affecting the clarity of the image. Likewise sensors are nearly at the limit of how much light they can work with. Consequently, most of the photography advancements of the last few years have been done on the computational side.

Using an engineered surface that does away with the need for complex optics and other camera systems has been a goal for years. Back in 2016 I wrote about a NASA project that took inspiration from moth eyes to create a 2D camera of sorts. It’s harder than it sounds, though — usable imagery has been generated in labs, but it’s not the kind of thing that you take to Apple or Samsung.

Metalenz aims to change that. The company’s tech is built on the work of Harvard’s Federico Capasso, who has been publishing on the science behind metasurfaces for years. He and Rob Devlin, who did his doctorate work in Capasso’s lab, co-founded the company to commercialize their efforts.

“Early demos were extremely inefficient,” said Devlin of the field’s first entrants. “You had light scattering all over the place, the materials and processes were non-standard, the designs weren’t able to handle the demands that a real world throws at you. Making one that works and publishing a paper on it is one thing, making 10 million and making sure they all do the same thing is another.”

Their breakthrough — if years of hard work and research can be called that — is the ability not just to make a metasurface camera that produces decent images, but to do it without exotic components or manufacturing processes.

“We’re really using all standard semiconductor processes and materials here, the exact same equipment — but with lenses instead of electronics,” said Devlin. “We can already make a million lenses a day with our foundry partners.”

The thing at the bottom is the chip where the image processor and logic would be, but the meta-optic could also integrate with that. The top is a pinhole. Image Credits: Metalenz

The first challenge is more or less contained in the fact that incoming light, without lenses to bend and direct it, hits the metasurface in a much more chaotic way. Devlin’s own PhD work was concerned with taming this chaos.

“Light on a macro [i.e. conventional scale, not close-focusing] lens is controlled on the macro scale, you’re relying on the curvature to bend the light. There’s only so much you can do with it,” he explained. “But here you have features a thousand times smaller than a human hair, which gives us very fine control over the light that hits the lens.”

Those features, as you can see in this extreme close-up of the metasurface, are precisely tuned cylinders, “almost like little nano-scale Coke cans,” Devlin suggested. Like other metamaterials, these structures, far smaller than a visible or near-infrared light ray’s wavelength, manipulate the radiation by means that take a few years of study to understand.

The result is a camera with extremely small proportions and vastly less complexity than the compact camera stacks found in consumer and industrial devices. To be clear, Metalenz isn’t looking to replace the main camera on your iPhone — for conventional photography purposes the conventional lens and sensor are still the way to go. But there are other applications that play to the chip-style lens’s strengths.

Something like the FaceID assembly, for instance, presents an opportunity. “That module is a very complex one for the cell phone world — it’s almost like a Rube Goldberg machine,” said Devlin. Likewise the miniature lidar sensor.

At this scale, the priorities are different, and by subtracting the lens from the equation the amount of light that reaches the sensor is significantly increased. That means it can potentially be smaller in every dimension while performing better and drawing less power.

Image (of a very small test board) from a traditional camera, left, and metasurface camera, right. Beyond the vignetting it’s not really easy to tell what’s different, which is kind of the point. Image Credits: Metalenz

Lest you think this is still a lab-bound “wouldn’t it be nice if” type device, Metalenz is well on its way to commercial availability. The $10 million Series A they just raised was led by 3M Ventures, Applied Ventures LLC, Intel Capital, M Ventures and TDK Ventures, along with Tsingyuan Ventures and Braemar Energy Ventures — a lot of suppliers in there.

Unlike many other hardware startups, Metalenz isn’t starting with a short run of boutique demo devices but going big out of the gate.

“Because we’re using traditional fabrication techniques, it allows us to scale really quickly. We’re not building factories or foundries, we don’t have to raise hundreds of mils; we can use what’s already there,” said Devlin. “But it means we have to look at applications that are high volume. We need the units to be in that tens of millions range for our foundry partners to see it making sense.”

Although Devlin declined to get specific, he did say that their first partner is “active in 3D sensing” and that a consumer device, though not a phone, would be shipping with Metalenz cameras in early 2022 — and later in 2022 will see a phone-based solution shipping as well.

In other words, while Metalenz is indeed a startup just coming out of stealth and raising its A round… it already has shipments planned on the order of tens of millions. The $10 million isn’t a bridge to commercial viability but short-term cash to hire and cover upfront costs associated with such a serious endeavor. It’s doubtful anyone on that list of investors harbors any serious doubts on ROI.

The 3D sensing thing is Metalenz’s first major application, but the company is already working on others. The potential to reduce complex lab equipment to handheld electronics that can be fielded easily is one, and improving the benchtop versions of tools with more light-gathering ability or quicker operation is another.

Though a device you use may in a few years have a Metalenz component in it, it’s likely you won’t know — the phone manufacturer will probably take all the credit for the improved performance or slimmer form factor. Nevertheless, it may show up in teardowns and bills of material, at which point you’ll know this particular university spin-out has made it to the big leagues.

Powered by WPeMatico

There is so much data sitting inside companies these days, but getting data to the people who need it most remains a daunting challenge. Polytomic, a graduate of the Y Combinator Winter 2020 cohort set out to solve that problem, and today the startup announced a $2.4 million seed.

Caffeinated Capital led the round with help from Bow Capital and a number of individual investors including the founders of PlanGrid, Tracy Young and Ralph Gootee, the company where Polytomic founders CEO Ghalib Suleiman and CTO Nathan Yergler both previously worked.

“We synch internal data to business systems. You can imagine your sales team living in Salesforce and would like to see who’s using your product from your customer data that lives in other internal databases. We have a no-code web app that moves internal data to the business systems of the office,” Suleiman told me.

Data lives in silos across every company, and Polytomic lets you build the connectors by dragging and dropping components in the Polytomic interface. This new data then shows up as additional fields in the target application. So you might have a usage percentage field added to Salesforce automatically if you were connecting to customer usage data.

The company actually sells the product to business operations teams, who would be charged with setting up a catalogue or menu of data sources that live in Polytomic. This is usually handled by someone like a business analyst who can configure the different sources. Once that’s done, anyone can build connectors to these data sources by selecting them from the menu and then choosing where to deliver the data.

The founders came up with the idea for the company because when they were at PlanGrid, they faced a problem getting data to the people who needed it in the company. The problem became more pronounced as the company grew and they had ever more data and more employees who needed access to it.

They left PlanGrid in 2018 and launched Polytomic a year later to begin attacking the problem. The two founders joined YC as a way to learn to refine the product, and were still working on it on Demo Day, delivering their presentation off the record because they weren’t quite done with it yet.

They released the first iteration of the product last September and report some progress getting customers and gaining revenue. Early customers include Brex, ShipBob, Sourcegraph and Vanta.

The company has no additional employees beyond the two founders as of yet, but with the seed funding in the bank, they plan to begin hiring a few people this year.

Powered by WPeMatico

When you want to buy a refrigerator or a television, you can walk to the nearby electronics store or visit an e-commerce website like Amazon. But where do you go when you’re looking for parts of a crane, a door or chassis of different machines?

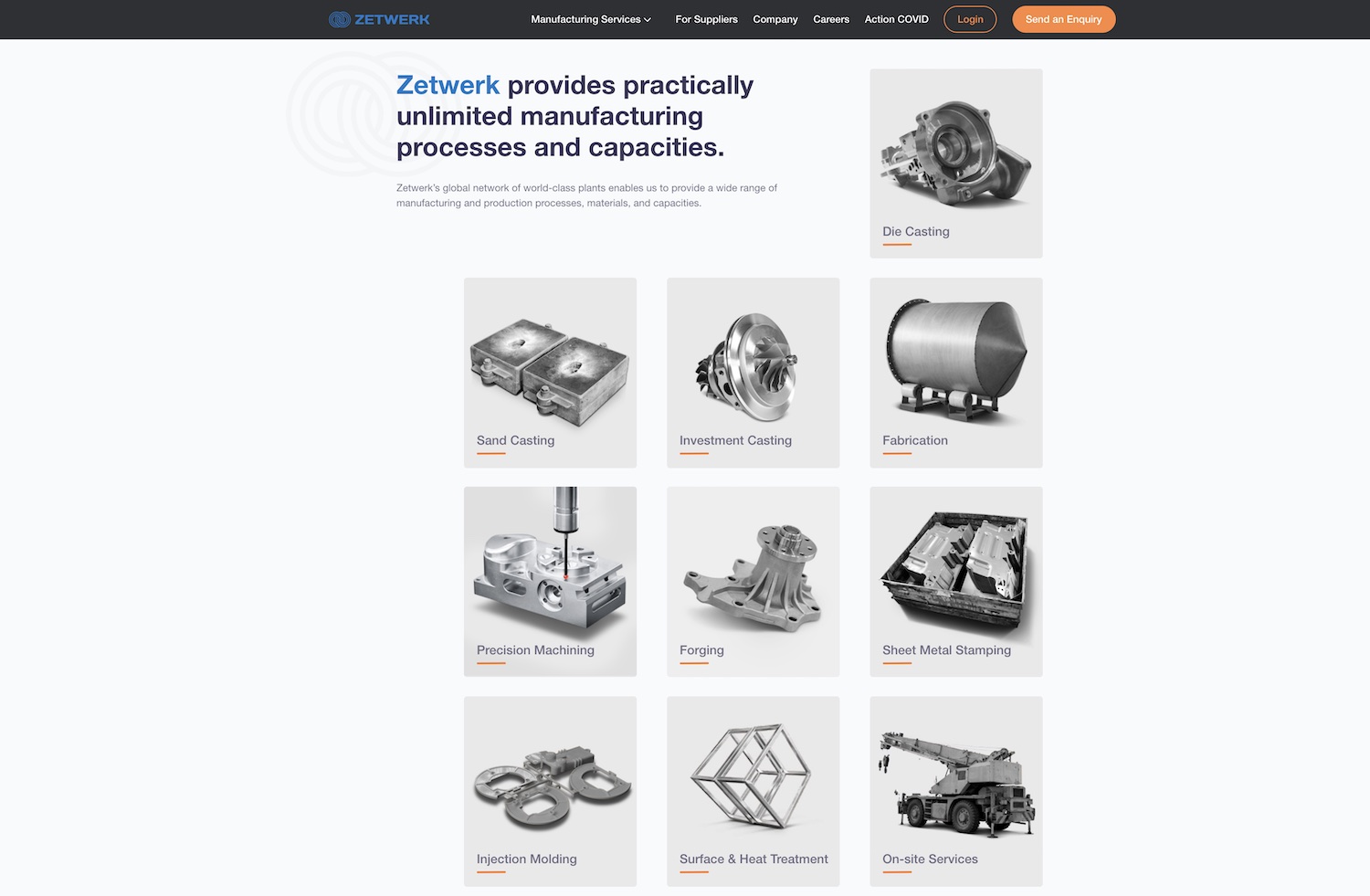

For several businesses globally, the answer to that question is increasingly Zetwerk, a Bangalore-based startup.

The three-year-old startup runs a business-to-business marketplace for manufacturing items that connects OEMs (original equipment manufacturers) and EPC (engineering procurement construction) customers with manufacturing small-businesses and enterprises.

All the products it sells today are custom-made. “Nobody has a stock of such inventories. You get the order, you find manufacturers and workshops that make them,” explained Amrit Acharya, co-founder and chief executive of Zetwerk, in an interview with TechCrunch.

Its customers — there are over 250 of them, up from 100 a year ago — operate across two-dozen industries (including process plants, oil & gas, steel, aerospace, medical devices, apparel and luxury goods) in the infrastructure space, and approach Zetwerk with digital designs they wish to be translated into physical products.

Customers aren’t alone in seeing value in Zetwerk. On Wednesday, the Indian startup said it has raised $120 million in a Series D financing round led by existing investors Greenoaks Capital and Lightspeed Venture Partners. Existing investors Sequoia Capital and Kae Capital also participated in the Series D round.

The new round, which brings Zetwerk’s to-date raise to $193 million, gives the firm a post-money valuation of somewhere between $600 million to $700 million, a person familiar with the matter told TechCrunch. (A quick side note: Zetwerk announced a $21 million Series C round last year, but ended up raising $31 million in that round.)

Zetwerk was co-founded by Acharya, Srinath Ramakkrushnan, Rahul Sharma and Vishal Chaudhary. Long before Acharya and Ramakkrushnan joined forces to tackle this space, they had been contemplating this idea.

Both of them studied at IIT Madras, went to the same exchange program in Singapore, and were colleagues at Kolkata-headquartered conglomerate ITC. While working there, they realized that part of a product manager’s job at the firm was dealing with gazillions of suppliers and the manufacturing items they offered.

The process was archaic: There were no databases, and people couldn’t track shipments.

The early version of Zetwerk, which was a database of suppliers, was a direct response to this. But after listening to requests from customers, the startup saw a bigger opportunity and transformed itself into a full-fledged marketplace with integrations with third-party vendors. Once a firm has placed an order, Zetwerk allows them to keep tabs on the progress of manufacturing and then the shipping. There are also quality checks in place.

Zetwerk website

Zetwerk operates in such a unique space today — Shailesh Lakhani, managing director at Sequoia India, says the startup has defined a new category of marketplace — that by and large it’s not competing with any other firm in India — or South Asia. (The startup competes with domain project consultants in the offline world.)

The opportunity in India itself is gigantic. According to industry reports, manufacturing today accounts for 14% of India’s GDP. Vaibhav Agarwal, a partner at Lightspeed, estimates that the market is as large as $40 billion to $60 billion in India and global trade-tailwinds that creates opportunity to serve international demand.

As more and more companies expand or shift their manufacturing to India — in part due to import duties imposed by India and geo-political tension with China, the global hub for manufacturing — this opportunity has only grown bigger in recent years.

“India has a lot of depth in manufacturing, but much of it has not been tapped well,” said Acharya.

Zetwerk — which grew 3X last year and reported revenue of $43.9 million in the financial year that ended in March, a 20X growth from the year prior — plans to deploy the new capital to expand to more areas of categories, and broaden its technology stack. Consumer goods (which covers items such as mixer grinders and TVs) is an area Zetwerk expanded to last year, and said it accounts for 15% of the revenue it generated in the last six months.

Currently 25 of its customers are in the U.S., Canada, Europe and other international markets. Acharya said the startup plans to open offices overseas this year as it scouts for more international customers.

“We are excited to partner with Zetwerk on the next leg of their journey, as they expand their value proposition globally. Zetwerk’s operating system for manufacturing has digitized multiple supply chains end-to-end, ensuring on-time delivery and high quality standards. This has led to rapid growth in India and internationally, with the potential to quickly become one of the most important manufacturing platforms globally,” said Neil Shah, partner at Greenoaks Capital, in a statement.

Powered by WPeMatico

Landed, a startup aiming to improve the hiring process for hourly employers and job applicants, is officially launching its mobile app today. It’s also announcing that it has raised $1.4 million in seed funding.

Founder and CEO Vivian Wang said that the app works by asking applicants to fill out a profile with information like work experience and shift availability, as well as recording videos that answer basic common interview questions. It then uses artificial intelligence to analyze those responses across 50 traits such as communication skills and body language, then matches them up with job listings from employers.

Landed has been in beta testing since March of last year — yes, right as COVID-19 was hitting the United States. Wang acknowledged that this was bad news for some of the startup’s potential customers, but she said businesses like grocery stores and fast food restaurants needed the product more than ever.

“That’s why we continuously grew through 2020,” she said.

After all, Landed allowed those businesses to continue hiring without having to conduct large group interviews in person. Even beyond health concerns, she said managers struggle with rapid turnover in these positions (something Wang saw herself during her time on the corporate team at Gap, Inc.) and with a hiring process that’s usually “only a small part of their job.” So Landed saves time and automates a large part of the product.

Landed CEO Vivian Wang. Image Credits: Landed

Meanwhile, Wang said job applicants benefit because they can find jobs more easily and quickly, often within a week of creating a profile. She also argued that Landed can improve on existing diversity and inclusion efforts by allowing managers to see a broader pool of candidates, and because its AI matching isn’t subject to the same unconscious biases that employers might have.

Of course, bias can also be inadvertently built into AI, but when I raised this issue, Wang pointed to Landed’s partnerships with local nonprofits to bring in underrepresented candidates, and she added, “AI can be scary when there are no human checks in place. We partner directly with our employers to ensure the matches that we’re sending them are the right matches, and there are calibration periods.”

Landed is free for job applicants, while it charges a monthly fee to employers, with customers already including Wendy’s, Chick-fil-A and Grocery Outlet franchisees. In fact, Grocery Outlet Ventura owner Eric Sawyer said that by using the app, he’s gone from hiring one person for every 10 interviews to hiring one person for every three interviews.

“My time spent on scheduling and performing interviews has been cut in half by utilizing the Landed app for most of my communications,” he said in a statement.

The new funding was led by Javelin Venture Partners, with participation from Y Combinator, Palm Drive Capital and various angel investors. Wang said this will allow Landed to continue expanding — the service is currently available in seven metro areas (Northern California; Southern California; Virginia Beach/Chesapeake, Virginia; Phoenix/Scottsdale, Arizona; Atlanta, Georgia; Reno, Nevada and Dallas-Ft. Worth, Texas), with a goal of tripling that number by the end of the year.

Wang added that eventually, she wants to provide other services to job applicants, such as loans (at a lower rate than payday lenders) and job training, turning Landed into a “lifestyle stability platform” that combines job stability, financial stability and educational “upskilling” for blue-collar workers.

Powered by WPeMatico

5G has been on a tear the last few years as wireless operators and smartphone manufacturers have made a marketing push touting higher bandwidth and lower latency for users. Yet, for all the attention that 5G gets from consumers, some of the most important new applications for the next-generation wireless technology are actually on the enterprise side. The canonical example is self-driving cars, which will presumably rely on a combination of edge computing, low latency and high bandwidth in order to work.

Yet, there are far more applications that are perhaps even more interesting and more readily deployable today than AVs. On farms, connectivity can help with managing equipment, monitoring livestock and analyzing water usage to optimize plant growth. Logistics companies need to monitor global supply chains, tracking shipping containers as they wend their way around the world from port to port.

There’s just one problem: 5G wireless is hard to implement in rural areas where base stations are unprofitable to deploy and therefore few and far between. On the oceans of course, there are no wireless base stations at all.

DC-based Omnispace wants to offer ubiquitous 5G-compliant connectivity for enterprise users using a hybrid of wireless ground technology and satellites. The idea is that by integrating these two different modes — terrestrial and space — into one cohesive package, end users like agriculture and logistics companies wouldn’t have to transition their IoT connectivity between different types of technologies in order to secure the promise of 5G.

Today, the company announced a $60 million equity investment led by Joshua Pack of Fortress Investment Group, who serves as the burgeoning firm’s head of credit investing and also co-leads one of the firm’s SPACs, Fortress Value Acquisition. Existing investors Columbia Capital, Greenspring Associates, TDF Ventures and Telcom Ventures also participated in the round.

Omnispace started in 2012 as a holding company for wireless spectrum assets, particularly around the 2Ghz “S band” spectrum, which were purchased from the remnants of ICO Global, a satellite-based provider that had previously gone into bankruptcy. CEO Ram Viswanathan, who joined Omnispace in early 2016, said that the company started looking at how to use a technology layer to integrate its various assets together, eventually identifying an opportunity around global 5G connectivity with specific applications in IoT.

“The 5G rollout is going to be gated by the scope and rollout of mobile operators,” Viswanathan said. “Neither all of the landmass or customers are going to be covered” using traditional ground-based wireless technology. “Satellite’s main utility is really extending the reach of the network into more remote and rural areas.”

Viswanathan has spent decades in the satellite and wireless market, most recently as the co-founder of Devas Multimedia, an India-focused connectivity startup that has been embroiled in a long-running legal spat with the government there over the cancelation of the firm’s satellite launch, with U.S. courts recently ordering a government-affiliated commercialization business to pay Devas $1.2 billion in compensation.

While there is perhaps an easy comparable with SpaceX’s Starlink project, Omnispace is not focused on the consumer broadband market, but rather enterprise and IoT use cases. Furthermore, Omnispace is a hybrid network using a mix of different technologies, whereas Starlink is focused only on space deployment.

Omnispace is using its new capital from Fortress to flesh out its services and finish up pilot trials with some mobile operators and prepare the network for commercial usage starting in 2023, with the network ready in 2022. Viswanathan said that “our aim is to provide the service globally” with “a footprint that covers everywhere.”

Omnispace has contracted with Thales Alenia, part of the French space and defense conglomerate Thales Group, to execute on its space strategy. On the terrestrial side, it is tying together its spectrum assets and piloting with several mobile operators to bring out a cohesive solution, with early strength in Asia-Pacific and Latin America.

Powered by WPeMatico

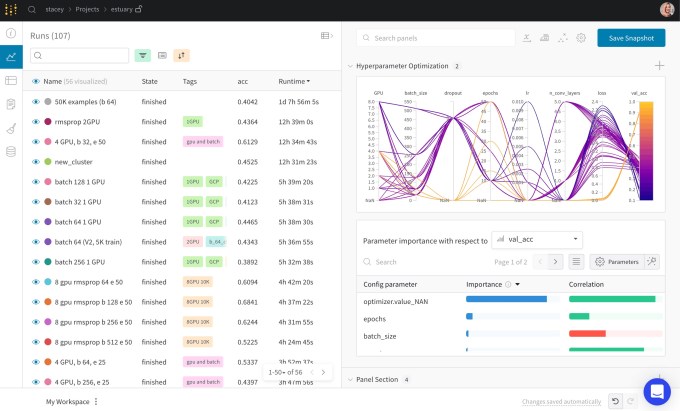

Weights & Biases, a startup building tools for machine learning practitioners, is announcing that it has raised $45 million in Series B funding.

The company was founded by Lukas Biewald, Chris Van Pelt and Shawn Lewis — Biewald and Van Pelt previously founded CrowdFlower/Figure Eight (acquired by Appen). Weights & Biases says it now has more than 70,000 users at more than 200 enterprises.

Biewald (whom I’ve known since college) argued that while machine learning practitioners are often compared to software developers, “they’re more like scientists in some ways than engineers.” It’s a process that involves numerous experiments, and Weights & Biases’ core product allows practitioners to track those experiments, while the company also offers tools around data set versioning, model evaluation and pipeline management.

“If you have a model that’s controlling a self-driving car and the car crashes, you really want to know what happened,” Biewald said. “If you built that model years ago and you’ve run all these experiments since then, it can be hard to systematically trace through what happened” unless you’re using experiment tracking.

He described the startup as “an early leader” in this market, and as competing tools emerge, he said it’s also differentiated because it is “completely focused on the ML practitioner” rather than top-down enterprise sales. Similarly, he said that as machine learning has been adopted more widely, Weights & Biases is occasionally confronted by a “high-class problem.”

Image Credits: Weights & Biases

“We’re not interested in selling to companies that are doing machine learning for machine learning’s sake,” Biewald said. “With some companies, there’s a mandate from the CEO to sprinkle some machine learning in the company. That’s just really depressing to me, to not have any impact. But I would actually say the vast majority of companies that we talk to really do something useful.”

For example, he said agriculture giant John Deere is using the startup’s platform to continually improve the way it uses robotics to spray fertilizer, rather than pesticides, to kill weeds and pests. And there are pharmaceutical companies using the platform for how they model how different molecules will behave.

Weights & Biases previously raised $20 million in funding. The new round was led by Insight Partners, with participation from Coatue, Trinity Ventures and Bloomberg Beta. Insight’s George Mathew is joining the board of directors.

“I’ve never seen a MLOps category leader with such a high NPS and deep customer focus as Weights and Biases,” Mathew said in a statement. “It’s an honor to make my first investment at Insight to serve an ML practitioner user-base that grew 60x these last two years.”

The startup says it will use the funding to continue hiring in engineering, growth, sales and customer success.

Powered by WPeMatico

Many founders only know their own experience fundraising and don’t hear much about what other founders went through. On Extra Crunch Live on Wednesday, we’re going to remedy that.

Grafana Labs has raised upward of $75 million since it launched in 2014. Lightspeed Venture Partners, and partner Gaurav Gupta to be specific, led both the startup’s Series A and Series B rounds. As far as commitments go, that’s a pretty significant one.

The new and improved Extra Crunch Live pairs founders and the investors who led their earlier rounds to talk about how the deal went down, from the moment they met to the conversations they had (including some disagreements) to the relationship as it exists today. Hell, we may even take a peek at the original pitch deck that made it all happen.

Then, we’ll turn our eyes back to you, the audience. That same founder/investor duo (in this case, Grafana Labs CEO Raj Dutt and LVP’s Gaurav Gupta) will take a look at your pitch decks and give their own feedback. (If you haven’t yet submitted a pitch deck to be torn down on Extra Crunch Live, you can do so here.)

The hour-long episode is sandwiched between two 30-minute rounds of networking. From start to finish, it goes from 11:30 a.m. PST/2:30 p.m. EST to 1:30 p.m. PST/4:30 p.m. EST. And Extra Crunch Live will come to you at the same time, every week, with a new pair of speakers.

So let’s learn a little bit more about Gupta and Dutt.

Before becoming an investor, Gupta enjoyed a rich career in the product development sphere, holding positions at Elastic (where he led product management), Splunk (VP of Products), as well as Google, Gateway and the McKenna Group. He joined Lightspeed in 2019 as a partner, focusing primarily on enterprise software. He’s led investments in Impira, Blameless, Hasura and Panther, and of course, Grafana. He sits on the board of the last three companies in that list.

Dutt is the co-founder and CEO at Grafana Labs, but the fast-growing company isn’t his first go at entrepreneurialism. Dutt also founded and led Voxel, a cloud-hosting startup that was acquired by Internap for $30 million in 2012.

We’re absolutely thrilled to have Gupta and Dutt join us on our first episode of Extra Crunch Live in 2021. As a reminder, Extra Crunch Live is for Extra Crunch members only. We’re coming to you with a new pair of speakers every week, and you can catch everything you missed on-demand if you can’t join us live. It’s worth the cost of the subscription on its own, but EC members also get access to our premium content, including market maps and investor surveys. Long story short? Subscribe, smarty. You won’t regret it.

Oh, and here’s a look at other speakers you can expect to see on Extra Crunch Live:

Aydin Senkut (Felicis) + Kevin Busque (Guideline) — February 10

Steve Loughlin (Accel) + Jason Boehmig (Ironclad) — February 17

Matt Harris (Bain Capital Ventures) + Isaac Oates (Justworks) — February 24

And that’s just the February slate!

All the details to register for this upcoming episode (and more) are available below. Can’t wait to see you there!

Powered by WPeMatico

For American importers, finding suppliers these days can be challenging not only due to COVID-19 travel restrictions. The U.S. government’s entity list designations, human-rights-related sanctions, among other trade blacklists targeting Chinese firms have also rattled U.S. supply chains.

One young company called International Compliance Workshop, or ICW, is determined to make sourcing easier for companies around the world as it completed a fresh round of funding. The Hong Kong-based startup has just raised $5.75 million as part of its Series A round, boosting its total funding to around $10 million, co-founder and CEO Garry Lam told TechCrunch.

ICW works like a matchmaker for suppliers and buyers, but unlike existing options like Alibaba’s B2B platform or international trade shows, ICW also vets suppliers over compliance, product quality and accreditation. It gathers all that information into its growing database of over 40,000 suppliers — 80% of which are currently in China — and recommends them to customers based on individual needs.

Founded in 2016, ICW’s current client base includes some of the world’s largest retailers, including Ralph Lauren, Prenatal Retail Group, Blokker, Kmart and a major American pharmacy chain that declined to be named.

ICW’s latest funding round was led by Infinity Ventures Partners with participation from Integrated Capital and existing investors MindWorks Capital and the Hong Kong government’s $2 billion Innovation and Technology Venture Fund.

In line with the ongoing shift of sourcing outside China, in part due to the U.S.-China trade war and China’s growing labor costs, ICW has seen more customers diversifying their supply chains. But the transition has limitations in the short run.

“It’s still very difficult to find suppliers of certain product categories, for example, Bluetooth devices and power banks, in other countries,” observed Lam. “But for garment and textile, the transition already began to happen a decade ago.”

In Southeast Asia, which has been replacing a great deal of Chinese manufacturing activity, each country has its slight specialization. Whereas Vietnam abounds with wooden furniture suppliers, Thailand is known for plastic goods and Malaysia is a good source for medical supplies, said Lam.

When it comes to trickier compliance burdens, such as human rights sanctions, ICW relies on third-party certification institutes to screen and verify suppliers.

“There is a [type of] qualification standard that verifies whether a supplier has fulfilled its corporate social responsibility … like whether the factory fulfills the labor law, the minimum labor rights or the payroll, everything,” Lam explained.

ICW plans to use the fresh proceeds to further develop its products, including its compliance management system, product testing platform and B2B-sourcing site.

Powered by WPeMatico