funding

Auto Added by WPeMatico

Auto Added by WPeMatico

A new breed of startups is acquiring and growing small but promising third-party merchants, and building out their own economies of scale.

And while there are a number of such startups based in the U.S. and Europe, none had emerged in the Latin American market. Until now.

Valoreo, a Mexico City-based acquirer of e-commerce businesses, announced Tuesday that it has raised $50 million of equity and debt financing in a seed funding round.

The dollar amount is large for a seed round by any standards, but most certainly ranks among the highest ever raised by a Latin American startup — further evidence of increased investor interest in the region’s burgeoning venture scene.

Upper90, FJ Labs, Angel Ventures, Presight Capital and a slew of angel investors participated in the round. Those angels included David Geisen, head of Mercado Libre Mexico; BEA Systems’ co-founder Alfred Chuang; and Tushar Ahluwalia, founder of Razor Group, a European marketplace aggregator, among others.

Founded in late 2020, Valoreo aims to invest in, operate and scale e-commerce brands as part of its self-described mission “to bring better products at more affordable prices” to the Latin American consumer.

“We were substantially oversubscribed and were therefore able to select investors that not only provide capital, but also additional know-how in key areas,” said co-founder Alex Gruell.

Valoreo joins the growing number of startups focused on rolling up e-commerce brands.

The company’s model is similar to that of Thrasio — which just raised another $750 million –– and Perch in the U.S. But Valoreo says its approach has been tailored to “the specific needs of the Latin American market and is specifically focused on the Latin American end customer.”

Another new company in the space called Branded recently launched its own roll-up business on $150 million in funding. Others in the space include Berlin Brands Group, SellerX, Heyday and Heroes.

But as my colleague Ingrid Lunden points out, “the feverish pace of fundraising in the area of FBA roll-ups feels very much like a bubble in the market — not least because none of these still-young companies have yet to prove that the strategy to buy up and consolidate these sellers is a useful and profitable one.”

Valoreo (which the company says is an extension of the Spanish word “valor,” meaning to add value), acquires merchants that operate their own brands and primarily sell on online marketplaces such as Mercado Libre, Amazon and Linio. The company targets brands that offer “category-leading products” and which it believes have “significant growth potential.” It also develops brands in-house to offer a broader selection of products to the end customer.

Like Thrasio, Valoreo says it’s able to help entrepreneurs who may lack the resources and access to capital to take their businesses to the next level.

Co-founder and co-CEO Stefan Florea says the company takes less than five weeks typically from its initial contact with a seller to a final payout.

Then, the acquired and developed brands are integrated into the company’s consolidated holding. By tapping its team of “specialists” in areas such as digital marketing and supply chain management, it claims to be able to help these brands “reach new heights” while giving the entrepreneurs behind the companies “an attractive exit,” or partial exit in some cases.

“We have different structures, always taking into account the personal objectives of the seller,” Stefan Florea added.

Generally Valoreo acquires the majority of the business, with the purchase price typically being a combination of an upfront cash payment and a profit share component so sellers can still earn money.

Looking ahead, Valoreo plans to use its new capital mostly to acquire and develop “interesting” brands, as well as build out its current team of 10 while expanding its infrastructure and operations.

The company is currently focused on the Mexican and Brazilian markets, but is planning its expansion into other Latin American countries where it has strong local support systems, such as Colombia, according to co-founder Martin Florea.

“Our mission is to be a pan-Latin American player providing value to the entire region,” Martin Florea said. “Latin America in general and Mexico in particular are in a distinct situation which provides phenomenal opportunities for e-commerce merchants on the one hand but also presents particular challenges on the other hand.”

Those challenges, according to Martin Florea, include limited access to growth capital, a lack of specialized expertise in certain areas (such as supply chain management), limited opportunities to sell their business and pursue new ventures, as well as operational burdens and the lack of capacities to expand into new countries and marketplaces.

Valoreo emphasizes it is not out to compete with Mercado Libre, Amazon and other regional marketplaces but instead wants to partner with them.

“Without these platforms, this opportunity would not exist,” Martin Florea said.

Hernán Fernández, founder and managing partner of Angel Ventures, believes Valoreo “will add a lot of value” to the Latin American e-commerce landscape, which is experiencing both market growth and the fragmentation of the seller space.

Jüsto co-founder and CEO (and Valoreo investor) Ricardo Weder notes that the e-commerce market is at an inflection point in Latin America. According to eMarketer, the region was the fastest-growing e-commerce market in the world in 2020, with 37% year over year growth. However, it is a much more fragmented and crowded market compared to other regions, such as the United States.

This, Valoreo believes, provides an opportunity for consolidation.

“There are still many consumers that are not aware of the great variety of outstanding local brands that sell innovative products on marketplaces online,” Stefan Florea said. “In the U.S. or Europe e-commerce is the new way of shopping, offering an even greater range of products and brands than offline shopping. We firmly believe it will not take long until end-customers in Mexico and across Latin America discover all the benefits that e-commerce offers.”

Powered by WPeMatico

Pex, a startup aiming to give rightsholders more control over how their content is used and reused online, has raised $57 million in new funding.

The round comes from existing investors including Susa Ventures and Illuminate Ventures, as well as Tencent, Tencent Music Entertainment, the CueBall Group, NexGen Ventures Partners, Amaranthine and others.

Founded in 2014, Pex had previously raised $7 million, and it acquired music rights startup Dubset last year. Founder and CEO Rasty Turek told me that while the product has evolved from what he described as “a Google-like search engine for rightsholders to find copyright infringement” into a broader platform, the vision of creating a better system of managing copyright and payments online has remained the same.

The startup describes its Attribution Engine as the “licensing infrastructure for the Internet,” bringing together the individuals and companies who own content rights, creators who might want to license and remix that content, the big digital platforms where content gets shared and the law enforcement agencies that want to monitor all of this.

The product includes six modules — an asset registry, a system for identifying those assets when they’re used in new content, a licensing system, a dispute resolution system, a payment system and data and reporting to see how your content is being used.

Turek said that while Pex is being used by “most of the largest rightsholders in the world,” the system was built to be accessible to “a struggling musician out on the streets of Los Angeles” who doesn’t have the resources to “police all of this content” online.

Pex CEO Rasty Turek. Image Credits: Pex

He also suggested that the broader regulatory environment is calling for a solution like Pex, with the European Union passing a new copyright directive that’s set to take effect this year, and new copyright legislation also on the table in the United States. The EU bill was criticized for potentially prompting larger platforms to preemptively block broad swaths of content, but Turek argued, “There’s so much content out there in search of an audience that this is going to be the opposite of overblocking.”

Not that Pex is relying entirely on regulators. Turek also said the platform is structured to balance the needs of the different groups using it — and that it has an incentive to strike that balance because its revenue comes from licensing deals, so it’s focused on “really being the Switzerland, really being the neutral party.”

“We designed all of our business around the idea that if we try to abuse the system, we lose, too,” he said. “We don’t make money [when someone] abuses the system, we only make money when everybody plays nice.”

Turek also claimed that public domain and Creative Commons licenses are “first-class citizens” on the platform, and that many of the rightsholders using the Attribution Engine don’t necessarily want monetary compensation: “A lot of people are happy to do this for recognition. We are social animals.” (Plus, recognition can lead to moneymaking opportunities.)

Pex says the new funding will allow it to continue scaling the Attribution Engine.

“I don’t believe investments are validation,” Turek added. “I believe they’re more obligation than validation, but they do prove you are directionally correct.”

Powered by WPeMatico

Titan, a startup that is building a retail investment management platform aimed at millennials, has closed on $12.5 million in a Series A round led by VC heavyweight General Catalyst.

A bevy of other investors put money in the round, including Sound Ventures (actor Ashton Kutcher and Guy Oseary’s VC firm), Scribble VC, BoxGroup, Y Combinator, South Park Commons, Instagram founder Mike Krieger, Lee Fixel and others.

Titan is hoping to build on the momentum it saw in 2020, during which it grew revenue, customers and assets under management by 600%, “with effectively no marketing budget, according to co-founder Joe Percoco. The New York-based company says it’s approaching $500 million in assets under management and was cash flow positive last year.

Percoco met co-CEO Clay Gardner while the pair were at the Wharton School of the University of Pennsylvania.

“We came from two different backgrounds with respect to investing,” Percoco recalled. “He was the type that bought his first shares of stock at the ages of 11 and 12. I’m the exact opposite and couldn’t invest myself until after Goldman Sachs, where I went to work after Penn.”

Because the duo both worked in the industry, they found that friends and family were always asking them how they should manage their capital.

“We were sending them to ETFs and mutual funds in our day jobs,” Percoco said. “But we realized they did not have the same access to investing that the wealthier did.”

Frustrated with only helping the rich get richer, the pair founded Titan in 2017 with the goal of disrupting what they viewed as “an archaic industry. They’ve since built an operating system aimed at giving “everyday investors access to the types of investment products and experiences that they’ve historically been locked out of.” Or, as they describe, it a mobile version of what investment giants Fidelity and BlackRock created decades ago.

Titan’s capital management platform is designed for both accredited and unaccredited investors. The company says it provides access to services that would historically require a $1 million minimum, such as direct portfolio manager access. It charges a fee amounting to just 1% of assets, compared to the 2% – and in some cases 20% of profits – that legacy players charge.

“We believe Fidelity 2.0 will be direct-to-consumer with no walls and no black boxes,” Percoco said.

(For the unacquainted, according to Investopedia, black box accounting is the deliberate use of complex bookkeeping methodologies to make interpreting financial statements challenging and time-consuming.)

Its simplicity sets it apart. Titan chooses stocks via its “proprietary and discretionary” research process based on the principals’ previous experience.

The startup currently offers two stock-focused strategies on its platform,

One of those strategies, called Flagship, is focused on large cap growth. The other, called Opportunities, focuses on smaller, under-the-radar companies.

Titan’s core customer is the young professional in the 25-35 age range.

“They’re already investing money somewhere, even if not that much of their money,” Gardner said. “But they’re well attuned to the reasons they should be… And, most asset management products remain in the Stone Age, offering 90-page prospectuses and black-box client experiences.”

As former TC editor Josh Constine explained when the company raised a $2.5 million seed round in October 2018, Titan differs from Robinhood or E*Trade, where users essentially are left to fend for themselves. But clients also have some control, unlike passive options such as Wealthfront and Betterment.

Looking ahead, Titan plans to use its new capital to scale its engineering and investment team, as well as make “significant investments” in product, marketing and operations. It also plans to launch several investment products across a variety of asset classes.

“Many legacy players are hungry to have an OS to serve more folks they historically could not,” Percoco said. “We’re getting inbounds from legacy players in the space seeking to manage capital for new generations and realizing it will shift to mobile operating systems like Titan’s. Eventually, we can enable them to build their own investment products on Titan.”

Katherine Boyle, partner at General Catalyst and Titan board member, said she was struck by Percoco and Gardner’s “deep empathy” for investors who are often overlooked — such as millennials and new investors “who have cash sitting in their checking accounts and want expert management but don’t know where to go.”

“They don’t want to be stock pickers but they don’t want a set-it-and-forget-it product,” Boyle said. “There’s another level of sophistication with actively managed products where the best managers are making investment decisions on behalf of those who can afford it. But there’s no reason why retail investors should be excluded from this model.”

She thinks Titan can capitalize on what she believes is millennials’ “deep lack of trust” in legacy institutions.

“We need new institutions like Titan to combat this lack of trust,” Boyle said. “And these new institutions need to have incentives that are aligned with their clients, not with hedge funds or banks.”

Powered by WPeMatico

The only people who truly understand a relationship are the ones who are in it. Luckily for us, we’re going to have a candid conversation with both parties in the relationship between Ironclad CEO and cofounder Jason Boehmig and his investor and board member Accel partner Steve Loughlin.

Loughlin led Ironclad’s Series A deal back in 2017, making it one of his first Series A deals after returning to Accel.

This episode of Extra Crunch Live goes down on Wednesday at 3pm ET/12pm PT, just like usual.

We’ll talk to the duo about how they met, what made them ‘choose’ each other, and how they’ve operated as a duo since. How they built trust, maintain honesty, and talk strategy are also on the table as part of the discussion.

Loughlin was an entrepreneur before he was an investor, founding RelateIQ (an Accel-backed company) in 2011. The company was acquired by Salesforce in 2014 for $390 million and later became Salesforce IQ. Loughlin then “came back home” to Accel in 2016, and has led investments in companies like Airkit, Ascend.io, Clockwise, Ironclad, Monte Carlo, Nines, Productiv, Split.io, and Vivun.

Not entirely unsurprising for a man who has dominated the legal tech sphere, Jason Boehmig is a California barred attorney who practiced law at Fenwick & West and was also an adjunct professor of law at Notre Dame Law School. Ironclad launched in 2014 and today the company has raised more than $180 million and, according to reports, is valued just under $1 billion.

Not only will we peel back the curtain on how this investor/founder relationship works, but we’ll also hear from these two tech leaders on their thoughts around bigger enterprise trends in the ecosystem.

Then, it’s time for the Pitch Deck Teardown. On each episode of Extra Crunch Live, we take a look at pitch decks submitted by the audience and our experienced guests give their live feedback. If you want to throw your hat pitch deck in the ring, you can hit this link to submit your deck for a future episode.

As with just about everything we do here at TechCrunch, audience members can also ask their own questions to our guests.

Extra Crunch Live has left room for you to network (you gotta network to get work, amirite?). Networking is open starting at 2:30pm ET/11:30am PT and stays open a half hour after the episode ends. Make a friend!

As a reminder, Extra Crunch Live is a members-only series that aims to give founders and tech operators actionable advice and insights from leaders across the tech industry. If you’re not an Extra Crunch member yet, what are you waiting for?

Loughlin and Boehmig join a stellar cast of speakers on Extra Crunch Live, including Lightspeed’s Gaurav Gupta and Grafana’s Raj Dutt, as well as Felicis’ Aydin Senkut and Guideline’s Kevin Busque. Extra Crunch members can catch every episode of Extra Crunch Live on demand right here.

You can find details for this episode (and upcoming episodes) after the jump below.

See you on Wednesday!

Powered by WPeMatico

Even though Kevin Busque is a co-founder of TaskRabbit, he didn’t get the response he was hoping for the first time he pitched his new venture to Felicis Ventures’ Aydin Senkut. Nonetheless, he said the outcome was one of the best things that could have happened.

“I’m kind of glad that he didn’t invest at the time because it really forced me to take a hard look at what we were doing and really enabled us to become Guideline,” said Busque. “That seed round was an absolute slog. I think I spent seven or eight months trying to raise a round for a product that didn’t exist, going purely on vision.”

Eventually, that idea evolved into Guideline, which describes itself as “a full-service, full-stack 401(k) plan” for small businesses. Eventually, Senkut did write a check — Felicis led Guideline’s $15 million Series B round. Today, Guideline has more than 16,000 businesses across 60+ cities, with more than $3.2 billion in assets under management. The company has raised nearly $140 million.

This week on Extra Crunch Live, Busque and Senkut discussed Guideline’s Series B pitch deck — which Senkut described as a “role model” — and how they built trust over time.

The duo also offered candid, actionable feedback on pitch decks that were submitted by Extra Crunch Live audience members. (By the way, you can submit your pitch deck to be featured on a future episode using this link right here.)

We’ve included highlights below as well as the full video of our conversation.

We record new episodes of Extra Crunch Live each Wednesday at 12 p.m. PST/3 p.m. EST/8 p.m. GMT. Check out the February schedule here.

Senkut and Busque met nearly a decade ago, when Busque was still at TaskRabbit. Several years later, Busque launched out on his own and went fundraising for his original idea. Even though he got a no from Senkut, it wasn’t an easy decision.

Looking back, Senkut said he had much more freedom to follow his instincts while angel investing.

“As an institutional fund with LPs, we were feeling the pressure of checking all the checkmarks,” explained Senkut. “It’s amazing how, sometimes, being more structured or analytical actually does not always lead you to make better decisions.”

When Busque came back around after the pivot, looking to raise a Series B, Senkut called it a “no-brainer,” particularly because of the type of CEO Busque is.

“My opinion of Kevin as a person is that he’s an excellent wartime CEO, but also he’s a product visionary,” said Senkut. “We call them ‘missionary CEOs.’ There are mercenary CEOs who can extract every ounce of dollar from a rock, but we are gravitating much more toward CEOs like Kevin who are focused on product first. People who have a really acute vision of what the problem is, and. a very specific vision for how to solve that problem and ultimately turn it into a long-term scalable and successful company.”

Busque said he was drawn to Senkut based on his level of conviction, explaining that Senkut doesn’t always have to go by the book.

“If he wants to write a check because the founder is great or the product is great, he does it,” said Busque. “It’s not necessarily that he has to see a certain metric or growth pattern.”

Obviously, years of staying connected and communicating (and not just about Guideline) laid the foundation for building a relationship. Busque said the honesty in their conversations, including Senkut’s initial rejection, lended itself greatly to the trust they have.

Powered by WPeMatico

Knife Capital, a South African venture capital firm, is raising a $50 million fund for startups looking to raise Series B financing. With Knife Fund III called the African Series B Expansion Fund, the firm seeks to directly invest in the aggressive expansion of South African breakout companies. It also plans to co-invest in companies across the rest of Africa.

The first fund, known as Knife Capital Fund I or HBD Venture Capital, was a closed private equity fund managed by Eben van Heerden and Keet van Zyl. The firm offered seed capital to startups. It also generated significant exits from its portfolio — Visa acquisition of fintech startup Fundamo, and orderTalk’s acquisition by UberEats come to mind.

In 2016, the VC firm launched its current 12J offering with Knife Capital Fund II. The fund (KNF Ventures), which invests primarily in Series A stage, has eight startups in its portfolio. Last year the firm told TechCrunch of its intention to extend the Fund II and open to new investors. The plan was to give startups access to networks, money and expansion opportunities.

“We want to help South African and African companies internationalize,” said co-managing partner Andrea Bohmert at the time. A testament to its cause, one of its portfolio companies, DataProphet, raised $6 million Series A to expand into the U.S. and Europe.

Bohmert tells TechCrunch that the third fund aims to address the critical Series B funding gap that has characterised the venture capital asset class in South Africa, resulting in businesses not reaching full potential or exiting too early.

“Lately, we see an increase in companies able to raise $2 million to $5 million funding rounds. And while the companies are operating within their home country, in our case South Africa, such amounts take you far due to the local cost structure,” Bohmert says. “However, once these companies start gaining international traction and need to build an infrastructure outside of their home country, they need to raise significant amounts to afford so. There are currently hardly any South African VC funds, perhaps other than Naspers Foundry, that can write checks of $5 million or more and are willing to deploy them to finance the externalization of South African companies into larger markets.”

As a result, Bohmert argues that Africa has become an incubator for international VCs who can write these checks but cannot provide the local support most of these companies still need. Likewise, there are instances where international investors actively search for local co-investors in South Africa to invest in a round, and not finding one might blow the chances of them going further with the investment. This is the gap Knife Capital intends to fill by launching this fund, Bohmert says.

“We want to be the local lead investor of choice for South African technology companies looking to internationalise, co-investing with international investors who can lead the Series B discussion and further.”

This week, Knife Capital secured $10 million from Mineworkers Investment Company (MIC), a South Africa-based investment firm. The commitment positions MIC as an anchor investor to the fund alongside other local and international investors.

Nchaupe Khaole, the CIO at MIC, explained that the move to change the way local institutional investors approach venture capital investment has been in MIC’s pipeline for a while. And by partnering with Knife Capital, this idea can begin to materialize.

“Our commitment brings to the table the investment, along with many of our strengths as an experienced player. One of which is our ability to influence the companies within our portfolio to partner with us and effect real, tangible change to the South African economy. We are delighted to be a key catalyst in the success of this funding round,” he said.

As per other details, Knife Capital aims for a first close by May and a final close by the end of the year. Most of its participation will be co-investing, and the idea is to do that in 10 to 12 companies.

Powered by WPeMatico

Typically when we talk about tech and security, the mind naturally jumps to cybersecurity. But equally important, especially for global companies with large, multinational organizations, is physical security — a key function at most medium-to-large enterprises, and yet one that to date, hasn’t really done much to take advantage of recent advances in technology. Enter Base Operations, a startup founded by risk management professional Cory Siskind in 2018. Base Operations just closed their $2.2 million seed funding round and will use the money to capitalize on its recent launch of a street-level threat mapping platform for use in supporting enterprise security operations.

The funding, led by Good Growth Capital and including investors like Magma Partners, First In Capital, Gaingels and First Round Capital founder Howard Morgan, will be used primarily for hiring, as Base Operations looks to continue its team growth after doubling its employe base this past month. It’ll also be put to use extending and improving the company’s product and growing the startup’s global footprint. I talked to Siskind about her company’s plans on the heels of this round, as well as the wider opportunity and how her company is serving the market in a novel way.

“What we do at Base Operations is help companies keep their people in operation secure with ‘Micro Intelligence,’ which is street-level threat assessments that facilitate a variety of routine security tasks in the travel security, real estate and supply chain security buckets,” Siskind explained. “Anything that the chief security officer would be in charge of, but not cyber — so anything that intersects with the physical world.”

Siskind has firsthand experience about the complexity and challenges that enter into enterprise security since she began her career working for global strategic risk consultancy firm Control Risks in Mexico City. Because of her time in the industry, she’s keenly aware of just how far physical and political security operations lag behind their cybersecurity counterparts. It’s an often overlooked aspect of corporate risk management, particularly since in the past it’s been something that most employees at North American companies only ever encounter periodically when their roles involve frequent travel. The events of the past couple of years have changed that, however.

“This was the last bastion of a company that hadn’t been optimized by a SaaS platform, basically, so there was some resistance and some allegiance to legacy players,” Siskind told me. “However, the events of 2020 sort of turned everything on its head, and companies realized that the security department, and what happens in the physical world, is not just about compliance — it’s actually a strategic advantage to invest in those sort of services, because it helps you maintain business continuity.”

The COVID-19 pandemic, increased frequency and severity of natural disasters, and global political unrest all had significant impact on businesses worldwide in 2020, and Siskind says that this has proven a watershed moment in how enterprises consider physical security in their overall risk profile and strategic planning cycles.

“[Companies] have just realized that if you don’t invest [in] how to keep your operations running smoothly in the face of rising catastrophic events, you’re never going to achieve the profits that you need, because it’s too choppy, and you have all sorts of problems,” she said.

Base Operations addresses this problem by taking available data from a range of sources and pulling it together to inform threat profiles. Their technology is all about making sense of the myriad stream of information we encounter daily — taking the wash of news that we sometimes associate with “doom-scrolling” on social media, for instance, and combining it with other sources using machine learning to extrapolate actionable insights.

Those sources of information include “government statistics, social media, local news, data from partnerships, like NGOs and universities,” Siskind said. That data set powers their Micro Intelligence platform, and while the startup’s focus today is on helping enterprises keep people safe, while maintaining their operations, you can easily see how the same information could power everything from planning future geographical expansion, to tailoring product development to address specific markets.

Siskind saw there was a need for this kind of approach to an aspect of business that’s essential, but that has been relatively slow to adopt new technologies. From her vantage point two years ago, however, she couldn’t have anticipated just how urgent the need for better, more scalable enterprise security solutions would arise, and Base Operations now seems perfectly positioned to help with that need.

Powered by WPeMatico

Just three years after its founding, biotech startup Immunai has raised $60 million in Series A funding, bringing its total raised to over $80 million. Despite its youth, Immunai has already established the largest database in the world for single cell immunity characteristics, and it has already used its machine learning-powered immunity analysts platform to enhance the performance of existing immunotherapies. Aided by this new funding, it’s now ready to expand into the development of entirely new therapies based on the strength and breadth of its data and ML.

Immunai’s approach to developing new insights around the human immune system uses a “multiomic” approach — essentially layering analysis of different types of biological data, including a cell’s genome, microbiome, epigenome (a genome’s chemical instruction set) and more. The startup’s unique edge is in combining the largest and richest data set of its type available, formed in partnership with world-leading immunological research organizations, with its own machine learning technology to deliver analytics at unprecedented scale.

“I hope it doesn’t sound corny, but we don’t have the luxury to move more slowly,” explained Immunai co-founder and CEO Noam Solomon in an interview. “Because I think that we are in kind of a perfect storm, where a lot of advances in machine learning and compute computations have led us to the point where we can actually leverage those methods to mine important insights. You have a limit or ceiling to how fast you can go by the number of people that you have — so I think with the vision that we have, and thanks to our very large network between MIT and Cambridge to Stanford in the Bay Area, and Tel Aviv, we just moved very quickly to harness people to say, let’s solve this problem together.”

Solomon and his co-founder and CTO Luis Voloch both have extensive computer science and machine learning backgrounds, and they initially connected and identified a need for the application of this kind of technology in immunology. Scientific co-founder and SVP of Strategic Research Danny Wells then helped them refine their approach to focus on improving efficacy of immunotherapies designed to treat cancerous tumors.

Immunai has already demonstrated that its platform can help identify optimal targets for existing therapies, including in a partnership with the Baylor College of Medicine where it assisted with a cell therapy product for use in treating neuroblastoma (a type of cancer that develops from immune cells, often in the adrenal glands). The company is now also moving into new territory with therapies, using its machine learning platform and industry-leading cell database to new therapy discovery — not only identifying and validating targets for existing therapies, but helping to create entirely new ones.

“We’re moving from just observing cells, but actually to going and perturbing them, and seeing what the outcome is,” explained Voloch. This, from the computational side, later allows us to move from correlative assessments to actually causal assessments, which makes our models a lot more powerful. Both on the computational side and on the lab side, this are really bleeding edge technologies that I think we will be the first to really put together at any kind of real scale.”

“The next step is to say, ‘Okay, now that we understand the human immune profile, can we develop new drugs?’,” said Solomon. “You can think about it like we’ve been building a Google Maps for the immune system for a few years — so we are mapping different roads and paths in the immune system. But at some point, we figured out that there are certain roads or bridges that haven’t been built yet. And we will be able to support building new roads and new bridges, and hopefully leading from current states of disease or cities of disease, to building cities of health.”

Powered by WPeMatico

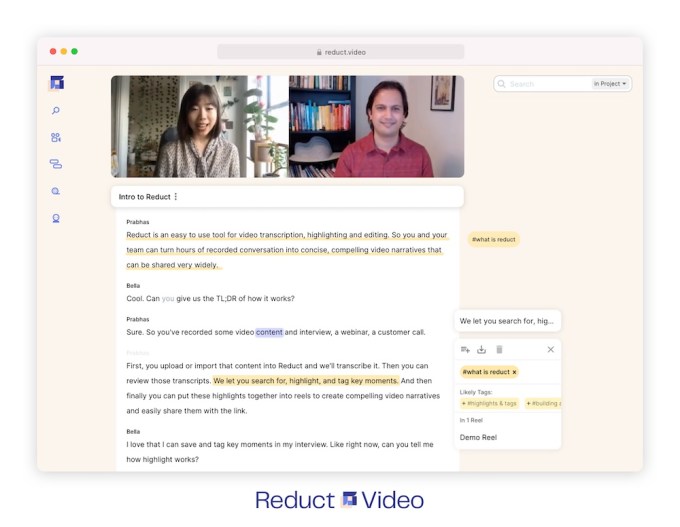

The team at Reduct.Video is hoping to dramatically increase the amount of videos created by businesses.

The startup’s technology is already used by customers including Intuit, Autodesk, Facebook, Dell, Spotify, Indeed, Superhuman and IDEO. And today, Reduct is announcing that it has raised a $4 million round led by Greylock and South Park Commons, with participation from Figma CEO Dylan Field, Hopin Chief Business Officer Armando Mann and former Twitter exec Elad Gil.

Reduct was founded by CEO Prabhas Pokharel and CTO Robert Ochshorn (both pictured above). Pokharel argued that despite the proliferation of streaming video platforms and social media apps on the consumer side, video remains “underutilized” in a business context, because it simply takes so much time to sort through video footage, much less edit it down into something watchable.

As Pokharel demonstrated for me, Reduct uses artificial intelligence, natural language processing and other technologies to simplify the process by automatically transcribing video footage (users can also pay for professional transcription), then tying that transcript to the video.

“The magic starts there: Once the transcription has been made, every single word is connected to the [corresponding] moment in the video,” he said.

Image Credits: Reduct.Video

That means editing a video is as simple as editing text. (I’ve taken advantage of a similar linkage between text and media in Otter, but Otter is focused on audio and I’ve treated it more as a transcription tool.) It also means you can search through hours of footage for every time a topic is mentioned, then organize, tag and share it.

Pokharel said that AI allows Reduct to simplify parts of the sorting and editing process, like understanding how different search terms might be related. But he doesn’t think the process will ever become fully automated — instead, he compared the product to an “Iron Man suit,” which makes a human editor more powerful.

He also suggested that this approach changes businesses’ perspective on video, and not just by making editing faster and easier.

“Users on Reduct emphasize authenticity over polish, where it’s much more the content of the video that matters,” Pokharel said. He added that Reduct has been “learning from our customers” about what they can do with the product — user research teams can now easily organize and share hundreds of hours of user footage, while marketers can turn customer testimonials and webinars into short, shareable videos.

“Video has been so supply constrained, it’s crazy,” he continued. “There are all these use cases for asynchronous video that [companies] haven’t even bothered with.”

For example, he recalled one customer who said that she used to insist that team members attend a meeting even if there was only two minutes of it that they needed to hear. With Reduct, she can “give them that time back” and just share the parts they need.

Powered by WPeMatico

Scalarr, a startup that says it uses machine learning to combat ad fraud, is announcing that it has raised $7.5 million in Series A funding.

The company was founded by CEO Inna Ushakova and CPO Yuriy Yashunin, who previously led the mobile marketing agency Zenna. Ushakova told me that while at Zenna, they realized that ad fraud had grown to the point that it posed a real threat to their business.

At the same time, the team wasn’t impressed by any of the existing anti-fraud solutions, so it built its own technology. Eventually, they shut down Zenna completely and moved the entire team over to Scalarr.

The startup’s products include AutoBlock, which is supposed to detect fraud before the advertiser bids on an ad, and DeepView, which is used by adtech platforms (including ad exchanges, demand-side platforms and supply-side platforms).

Scalarr says it can detect 60% more fraud than existing products on the market and that it saved its clients $22 million in ad fraud refunds in 2020. Ushakova attributed this in large part to the startup’s extensive use of machine learning technology.

She added that while large ad attribution companies are adding anti-fraud products, they aren’t the focus. And historically, companies have tried to detect fraud through a “rules-based approach,” where there’s a list of behaviors that suggest fraudulent activity — but no matter how quickly they create those rules, it’s hard to keep up with the fraudsters.

“Fraud is ever evolving,” Ushakova said. “It’s like a Tom and Jerry game, so they are ahead of you and we are trying to catch them.”

As for why machine learning works so much more effectively, she said, “Only ML could help you predict the next step, and with ML, you should be able to detect abnormalities that are not classified. Right after that, our analytics should be able to take a look at those abnormalities and decide whether something is statistically important.”

Scalarr’s Series A was led by the European Bank of Reconstruction and Development, with participation from TMT Investments, OTB Ventures and Speedinvest. Among other things, the company will use the money to expand its presence in Asia and continue developing the product.

Powered by WPeMatico