funding

Auto Added by WPeMatico

Auto Added by WPeMatico

In 2017, Ironclad founder and CEO Jason Boehmig was looking to raise a Series A. As a former lawyer, Boehmig had a specific process for fundraising and an ultimate goal of finding the right investors for his company.

Part of Boehmig’s process was to ask people in the San Francisco Bay Area about their favorite place to work. Many praised RelateIQ, a company founded by Steve Loughlin who had sold it to Salesforce for $390 million and was brand new to venture at the time.

“I wanted to meet Steve and had kind of put two and two together,” said Boehmig. “I was like, ‘There’s this founder I’ve been meaning to connect with anyways, just to pick his brain, about how to build a great company, and he also just became an investor.’”

On this week’s Extra Crunch Live, the duo discussed how the Ironclad pitch excited Loughlin about leading the round. (So excited, in fact, he signed paperwork in the hospital on the same day his child was born.) They also discussed how they’ve managed to build trust by working through disagreements and the challenges of pricing and packaging enterprise products.

As with every episode of Extra Crunch Live, they also gave feedback on pitch decks submitted by the audience. (If you’d like to see your deck featured on a future episode, send it to us using this form.)

We record Extra Crunch Live every Wednesday at 12 p.m. PST/3 p.m. EST/8 p.m. GMT. You can see our past episodes here and check out the March slate right here.

When Boehmig came in to pitch Accel, Loughlin remembers feeling ambivalent. He had heard about the company and knew a former lawyer was coming in to pitch a legal tech company. He also trusted the reference who had introduced him to Boehmig, and thought, “I’ll take the meeting.”

Then, Boehmig dove into the pitch. The company had about a dozen customers that were excited about the product, and a few who were expanding use of the product across the organization, but it wasn’t until the ultimate vision of Ironclad was teased that Loughlin perked up.

Loughlin realized that the contract can be seen as a core object that could be used to collaborate horizontally across the enterprise.

“That was when the lightbulb went off and I realized this is actually much bigger,” said Loughlin. “This is not a legal tech company. This is core horizontal enterprise collaboration in one of the areas that has not been solved yet, where there is no great software yet for legal departments to collaborate with their counterparts.”

He listed all the software that those same counterparts had to let them collaborate: Salesforce, Marketo, Zendesk. Any investor would be excited to hear that a potential portfolio company could match the likes of those behemoths. Loughlin was hooked.

“There was a slide that I’m guessing Jason didn’t think much of, as it was just the data around the business, but I got pretty excited about it,” said Loughlin. “It said, for every legal user Ironclad added, they added nine other users from departments like sales, marketing, customer service, etc. It was evidence that this theory of collaboration could be true at scale.”

Powered by WPeMatico

The last year has been one of financial hardship for billions, and among the specific hardships is the elementary one of paying for utilities, taxes and other government fees — the systems for which are rarely set up for easy or flexible payment. Promise aims to change that by integrating with official payment systems and offering more forgiving terms for fees and debts people can’t handle all at once, and has raised $20 million to do so.

When every penny is going toward rent and food, it can be hard to muster the cash to pay an irregular bill like water or electricity. They’re less likely to be shut off on short notice than a mobile plan, so it’s safer to kick the can down the road… until a few bills add up and suddenly a family is looking at hundreds of dollars of unpaid bills and no way to split them up or pay over time. Same with tickets and other fees and fines.

The CEO and co-founder of Promise, Phaedra Ellis-Lamkins, explained that this (among other places) is where current systems fall down. Unlike buying a TV or piece of furniture, where payment plans may be offered in a single click during online checkout, there frequently is no such option for municipal ticket payment sites or utilities.

“We have found that people struggling to pay their bills want to pay and will pay at extremely high rates if you offer them reminders, accessible payment options and flexibility. The systems are the problem — they are not designed for people who don’t always have a surplus of money in their bank accounts,” she told TechCrunch.

“They assume for example that if someone makes their first payment at 10 PM on the 15th, they will have the same amount of money the next month on the 15th at 10 PM,” she continued. “These systems do not recognize that most people are struggling with their basic needs. Payments may need to be weekly or split up into multiple payment types.”

Even those that do offer plans still see many failures to pay, due at least partly to a lack of flexibility on their part, said Ellis-Lamkins — failure to make a payment can lead to the whole plan being cancelled. Furthermore, it may be difficult to get enrolled in the first place.

“Some cities offer payment plans but you have to go in person to sign up, complete a multiple-page form, show proof of income and meet restrictive criteria,” she said. “We have been able to work with our partners to use self-certification to ease the process as opposed to providing tax returns or other documentation. Currently, we have over a 90% repayment rate.”

Promise acts as a sort of middleman, integrating lightly with the agency or utility, which in turn makes anyone owing money aware of the possibility of the different payment system. It’s similar to how you might see various payment options, including installments, when making a purchase at an online shop.

The user enrolls in a payment plan (the service is mobile-friendly because that’s the only form of internet many people have) and Promise handles that end of it, with reminders, receipts and processing, passing on the money to the agency as it comes in — the company doesn’t cover the cost up front and collect on its own terms. Essentially it’s a bolt-on flexible payment mechanism that specializes in government agencies and other public-facing fee collectors.

Promise makes money by subscription fees (i.e. SaaS) and/or through transaction fees, whichever makes more sense for the given customer. As you might imagine, it makes more sense for a utility to pay a couple bucks to be more sure of collecting $500, than to take its chance on getting none of that $500, or having to resort to more heavy-handed and expensive debt collection methods.

Lest you think this is not a big problem (and consequently not a big market), Ellis-Lamkins noted a recent study from the California Water Boards showing there are 1.6 million people with a total of $1 billion in water debt in the state — one in eight households is in arrears to an average of $500.

Those numbers are likely worse than normal, given the immense financial pressure that the pandemic has placed on nearly all households — but like payment plans in other circumstances, households of many incomes and types find their own reason to take advantage of such systems. And pretty much anyone who’s had to deal with an obtusely designed utility payment site would welcome an alternative.

The new round brings the company’s total raised to over $30 million, counting $10 million it raised immediately after leaving Y Combinator in 2018. The funding comes from existing investors Kapor Capital, XYZ, Bronze, First Round, YC, Village, and others.

Powered by WPeMatico

As the Biden administration works to bring legislation to Congress to address the endemic problem of immigration reform in America, on the other side of the nation a small California startup called SESO Labor has raised $4.5 million to ensure that farms can have access to legal migrant labor.

SESO’s founder Mike Guirguis raised the round over the summer from investors including Founders Fund and NFX. Pete Flint, a founder of Trulia, joined the company’s board. The company has 12 farms it’s working with and is negotiating contracts with another 46. The company’s other co-founder, Jordan Taylor, was the first product hire at Farmer’s Business Network and previously of Dropbox.

Working within the existing regulatory framework that has existed since 1986, SESO has created a service that streamlines and manages the process of getting H-2A visas, which allow migrant agricultural workers to reside temporarily in the U.S. with legal protections.

At this point, SESO is automating the visa process, getting the paperwork in place for workers and smoothing the application process. The company charges about $1,000 per worker, but eventually as it begins offering more services to workers themselves, Guirguis envisions several robust lines of revenue. Eventually, the company would like to offer integrated services for both farm owners and farm workers, Guirguis said.

SESO is currently expecting to bring in 1,000 workers over the course of 2021 and the company is, as of now, pre-revenue. The largest industry player handling worker visas today currently brings in 6,000 workers per year, so the competition, for SESO, is market share, Guirguis said.

The H-2A program was set up to allow agricultural employers who anticipate shortages of domestic workers to bring to the U.S. non-immigrant foreign workers to work on farms temporarily or seasonally. The workers are covered by U.S. wage laws, workers’ compensation and other standards, including access to healthcare under the Affordable Care Act.

Employers who use the visa program to hire workers are required to pay inbound and outbound transportation, provide free or rental housing and provide meals for workers (they’re allowed to deduct the costs from salaries).

H-2 visas were first created in 1952 as part of the Immigration and Nationality Act, which reinforced the national origins quota system that restricted immigration primarily to Northern Europe, but opened America’s borders to Asian immigrants for the first time since immigration laws were first codified in 1924. While immigration regulations were further opened in the sixties, the last major immigration reform package in 1986 served to restrict immigration and made it illegal for businesses to hire undocumented workers. It also created the H-2A visas as a way for farms to hire migrant workers without incurring the penalties associated with using illegal labor.

For some migrant workers, the H-2A visa represents a golden ticket, according to Guirguis, an honors graduate of Stanford who wrote his graduate thesis on labor policy.

“We are providing a staffing solution for farms and agribusiness and we want to be Gusto for agriculture and upsell farms on a comprehensive human resources solution,” says Guirguis of the company’s ultimate mission, referencing payroll provider Gusto.

As Guirguis notes, most workers in agriculture are undocumented. “These are people who have been taken advantage of [and] the H-2A is a visa to bring workers in legally. We’re able to help employers maintain workforce [and] we’re building software to help farmers maintain the farms.”

Farms need the help, if the latest numbers on labor shortages are believable, but it’s not necessarily a lack of H-2A visas that’s to blame, according to an article in Reuters.

In fact, the number of H-2A visas granted for agriculture equipment operators rose to 10,798 from October through March, according to the Reuters report. That’s up 49% from a year ago, according to data from the U.S. Department of Labor cited by Reuters.

Instead of an inability to acquire the H-2A visa, it was an inability to travel to the U.S. that’s been causing problems. Tighter border controls, the persistent global pandemic and travel restrictions that were imposed to combat it have all played a role in keeping migrant workers in their home countries.

Still, Guirguis believes that with the right tools, more farms would be willing to use the H-2A visa, cutting down on illegal immigration and boosting the available labor pool for the tough farm jobs that American workers don’t seem to want.

Photo by Brent Stirton/Getty Images.

David Misener, the owner of an Oklahoma-based harvesting company called Green Acres Enterprises, is one employer who has struggled to find suitable replacements for the migrant workers he typically hires.

“They could not fathom doing it and making it work,” Misener told Reuters, speaking about the American workers he’d tried to hire.

“With H-2A, migrant workers make 10 times more than they would get paid at home,” said Guirguis. “They’re taking home the equivalent of $40 an hour. The H-2A is coveted.”

Guirguis thinks that with the right incentives and an easier onramp for farmers to manage the application and approval process, the number of employers that use H-2A visas could grow to be 30% to 50% of the farm workforce in the country. That means growing the number of potential jobs from 300,000 to 1.5 million for migrants who would be under many of the same legal protections that citizens enjoy while they’re working on the visa.

Interest in the farm labor nexus and issues surrounding it came to the first-time founder through Guirguis’ experience helping his cousin start her own farm. Spending several weekends a month helping her grow the farm with her husband, Guirguis heard his stories about coming to the U.S. as an undocumented worker.

Employers using the program avoid the liability associated with being caught employing illegal labor, something that crackdowns under the Trump administration made more common.

Still, it’s hard to deny the program’s roots in the darker past of America’s immigration policy. And some immigration advocates argue that the H-2A system suffers from the same kinds of structural problems that plague the corollary H-1B visas for tech workers.

“The H-2A visa is a short-term temporary visa program that employers use to import workers into the agricultural fields … It’s part of a very antiquated immigration system that needs to change. The 11.5 million people who are here need to be given citizenship,” said Saket Soni, the founder of an organization called Resilience Force, which advocates for immigrant labor. “And then workers who come from other countries, if we need them, they have to be able to stay … H-2A workers don’t have a pathway to citizenship. Workers come to us afraid of blowing the whistle on labor issues. As much as the H-2A is a welcome gift for a worker it can also be abused.”

Soni said the precarity of a worker’s situation — and their dependence on a single employer for their ability to remain in the country legally — means they are less likely to speak up about problems at work, since there’s nowhere for them to go if they are fired.

“We are big proponents that if you need people’s labor you have to welcome them as human beings,” Soni said. “Where there’s a labor shortage as people come, they should be allowed to stay … H-2A is an example of an outdated immigration tool.”

Guirguis clearly disagrees and said a platform like SESO’s will ultimately create more conveniences and better services for the workers who come in on these visas.

“We’re trying to put more money in the hands of these workers at the end of the day,” he said. “We’re going to be setting up remittance and banking services. Everything we do should be mutually beneficial for the employer and the worker who is trying to get into this program and know that they’re not getting taken advantage of.”

Powered by WPeMatico

Today, that software is offered as a cloud service should be pretty much considered a given. Certainly any modern tooling is going to be SaaS, and as companies and employees add services, it becomes a management nightmare. Enter Torii, an early-stage startup that wants to make it easier to manage SaaS bloat.

Today, the company announced a $10 million Series A investment led by Wing Venture Capital, with participation from prior investors Entree Capital, Global Founders Capital, Scopus Ventures and Uncork Capital. The investment brings the total raised to $15 million, according to the company. Under the terms of the deal, Wing partner Jake Flomenberg is joining the board.

Uri Haramati, co-founder and CEO, is a serial entrepreneur who helped launch Houseparty and Meerkat. As a serial founder, he says that he and his co-founders saw firsthand how difficult it was to manage their companies’ SaaS applications, and the idea for Torii developed from that.

“We all felt the changes around SaaS and managing the tools that we were using. We were all early adopters of SaaS. We all [took advantage of SaaS] to scale our companies and we felt the same thing: The fact is that you just can’t add more people who manage more software, it just doesn’t scale,” Haramati told me.

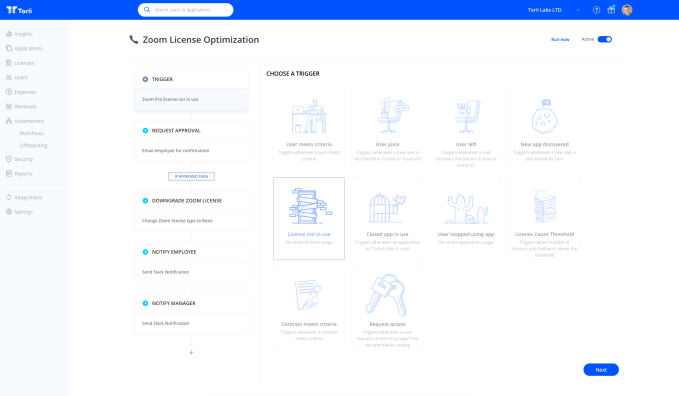

He said they started Torii with the idea of using software to control the SaaS sprawl they were experiencing. At the heart of the idea was an automation engine to discover and manage all of the SaaS tools inside an organization. Once you know what you have, there is a no-code workflow engine to create workflows around those tools for key activities like onboarding or offboarding employees.

Torii Workflow Engine. Image Credits: Torii

The approach seems to be working. As the pandemic struck in 2020, more companies than ever needed to control and understand the SaaS tooling they had, and revenue grew 400% YoY last year. Customers include Delivery Hero, Chewy, Monday.com and Palo Alto Networks.

The company also doubled its employees from a dozen with which they started last year, with plans to get to 60 people by the end of this year. As they do that, as experienced entrepreneurs, Haramati told me they already understood the value of developing a diverse and inclusive workforce, certainly around gender. Today, the team is 25 people with 10 being women and they are working to improve those ratios as they continue to add new people.

Flomenberg invested in Torii because he was particularly impressed with the automation aspect of the company and how it took a holistic approach to the SaaS management problem, rather than attempting to solve one part of it. “When I met Uri, he described this vision. It was really to become the operating system for SaaS. It all starts with the right data. You can trust data that is gathered from [multiple] sources to really build the right picture and pull it together. And then they took all those signals and they built a platform that is built on automation,” he said.

Haramati admits that it’s challenging to scale in the midst of a pandemic, but the company is growing and is already working to expand the platform to include product recommendations and help with compliance and cost control.

Powered by WPeMatico

Artie, a startup looking to rethink the distribution of mobile games, announced today that it has raised $10 million in funding.

There are some big names backing the company — its latest investors include Zynga founder Mark Pincus, Kevin Durant and Rich Kleiman’s Thirty Five Ventures, Scooter Braun’s Raised In Space, Shutterstock founder Jon Oringer, Tyler and Cameron Winklevoss, Susquehanna International Group, Harris Blitzer Sports & Entertainment + The Sixers Lab, Googler Manuel Bronstein and YouTube co-founder Chad Hurley.

This actually represents a pivot from Artie’s original vision of creating augmented reality avatars. CEO Ryan Horrigan said that he and his co-founder/CTO Armando Kirwin ended up building distribution technology that they felt solved “a much bigger problem.”

The problem, in part, is game developers “looking for ways outside of Apple’s App Stores rules and restrictions.” (That’s certainly something Fortnite-maker Epic Games seems to be fighting for.) So Artie’s platform allows users to play mobile games without installing an app, from the browser or wherever links can be shared online.

Image Credits: Artie

Artie isn’t the only startup focused on the idea of app-less mobile gaming, but Horrigan said that while other companies are limited by JavaScript and HTML5, Artie supports Unity, meaning it can build casual (rather than hyper-casual) games, and eventually games that might even go deeper.

“Similar to cloud games, we’re running Unity games on our cloud, but rather than rendering their graphics on the cloud and pushing the video to players, we’re not running graphics on the cloud,” he said. “We’re streaming assets and animations that are highly-optimized and rendered in real-time through the embedded web browser.”

In other words, the goal is to get frictionless distribution outside of app stores, while avoiding some of the issues facing cloud gaming, namely significant infrastructure costs and lag time.

The startup is developing and releasing games of its own, with an Alice in Wonderland game, a beer pong game and more on the schedule for later this year, then a massively multiplayer online game planned for 2022. But the company also plans to release an SDK allowing other developers to distribute through its platform as well.

Horrigan said Artie’s initial games will be free-to-play, monetized through in-game purchases. They’ll use cookies to remember where players were in the game, but players will also be able to create logins.

Artie is also developing games with a major music star and a superhero IP-owner, and he argued that by combining no-code/low-code authoring tools with Artie’s distribution platform, this could become a bigger trend.

“We want to be working with the next generation of influencers to make games using these low-code or no-code solutions, then publish to their audiences directly on YouTube,” he said. “Imagine what a branded game would look like from your favorite hip hop star. We think that’s coming, and we think Artie is the platform to make that happen.”

Powered by WPeMatico

Tens of thousands of students and professionals move out of India each year to pursue higher education and for work. Even after spending months in a new country, they struggle to get a credit card from local banks, and end up paying a premium to access a range of other financial services.

Banks in the U.S., or in most other countries for that matter, rely on local credit scores to determine the worthiness of potential applicants. Even if an individual had a great credit score in India, for instance, that wouldn’t hold any water for banks in a foreign land.

That was the takeaway Raghunandan G, the founder of ride-hailing firm TaxiForSure (sold to local giant Ola), returned to India with after a trip. After months of research and assembling a team, Raghunandan believes he has a solution.

Powered by WPeMatico

Talkshoplive is a startup that’s worked with stars like Paul McCartney and Garth Brooks, as well as small businesses, to host shopping-focused live videos. Today, it’s announcing that it has raised $3 million in seed funding from Spero Ventures.

CEO Bryan Moore founded the company with his sister Tina in 2018. Moore previously led social media efforts at Twentieth Television (previously known as Twentieth Century Fox) and CBS Television, and he said he was inspired to launch Talkshoplive by the rise of livestreamed shopping experiences in China.

At the same time, Moore said it wasn’t enough to just copy what worked in China: “Small businesses are different here, talent is different, the needs are different.” One of the keys, in his view, is to focus on helping creators and businesses meet their customers where those customers already are — which he also suggested differentiates Talkshoplive from competing services as well.

For one thing, the startup does not require consumers to download any additional apps in order to watch its videos. Instead, it’s created a video player that works on the Talkshoplive website, on the websites of its partners and anywhere else that videos can be embedded. And wherever those videos are played, they also include a one-click buy button.

Moore said Talkshoplive started out with a focus in books and music, working with famous names like Matthew McConaughey, Alicia Keys and Dolly Parton, as well as the aforementioned Brooks and McCartney. For example, Brooks used Talkshoplive to exceed more than 1 million vinyl pre-sales for his “Legacy Collection” box set in 2019.

On the book side, Talkshoplive has worked with publishers including Harper Collins, Penguin Random House, Simon & Schuster and Macmillan. Moore claimed the platform is driving three to nine times the sales an author would see on other e-commerce sites.

At the same time, he emphasized that the startup is also working with more than 3,500 small businesses, and he said that when a small business owner is broadcasting on Talkshoplive, “You’re creating your own microfandom by being able to tell the story … You’re making yourself a brand story, even as a small business.”

He added, “When you’re able to help people move $25,000 in a show — for a small business, that’s a huge deal.”

In this sense, Moore said he sees Talkshoplive as a continuation of his previous work in social media, all connected by the question, “How are you creating human connection in a digital landscape?” The “ultimate goal,” he added, is to turn the platform into a “digital Main Street” for businesses everywhere.

More recently, Talkshoplive has been moving into other categories like food and beauty, and Moore said he’s excited to work with Spero founding partner Shripriya Mahesh (previously an executive at eBay and First Look Media) to “continually evolve our product and create these tools that help us scale faster — and also help benefit these businesses.”

“From the moment we met the Talkshoplive team, we were impressed with their focus on enabling SMB’s with a new, creative, innovative way to build their businesses,” Mahesh said in a statement. “Talkshoplive also innovates on the marketplace model with a way for buyers to truly engage with the sellers, get to know them, and experience shopping in a whole new way. We are incredibly excited by the community that is taking shape at Talkshoplive and are thrilled to be working with Bryan, Tina, and the TSL team as they grow their community and the marketplace.”

Powered by WPeMatico

The creator movement has exploded in the last few years as platforms ranging from Substack to Clubhouse have made it easier than ever to reach an audience of willing readers and listeners. Yet the key to building sustainable creator businesses is the economics of these enterprises themselves. Get enough subscribers, and what often starts as a side hobby can quickly become a full-time job.

Circle was founded in January 2020 to make engaging with paying customers and thus building creator businesses as effortless as possible. We profiled the NYC-based startup last year when it announced its $1.5 million seed round in August, discussing how its founder DNA originates in the online course platform Teachable. Since then, all signs point to very strong early growth.

The company surpassed $1 million ARR last month, and it already has 1,000 paying customers and is heading toward 2,000 paying communities. Usage is also growing rapidly, expanding 40-50% per month for both DAUs and MAUs, according to the company. It also brought its iOS app out of beta last month.

CEO and co-founder Sid Yadav said that “we happened to catch the tide at the right time [with] the creator movement, the community movement.” So far, paying communities have been largely centered around “a lot of YouTubers, course creators, Twitch streamers, Patreon personalities,” with Yadav estimating that 60% of the platform’s communities are “personality-led.” That said, “a lot of brands are starting to think of this creatively.”

All that positive news can’t be ignored by VCs too long. The company announced today that it has raised a $4 million seed round at a valuation “north of” $40 million, which closed late last year. The round was officially led by Notation Capital, which led the company’s pre-seed round last year, but the firm only took a quarter of a round according to Yadav.

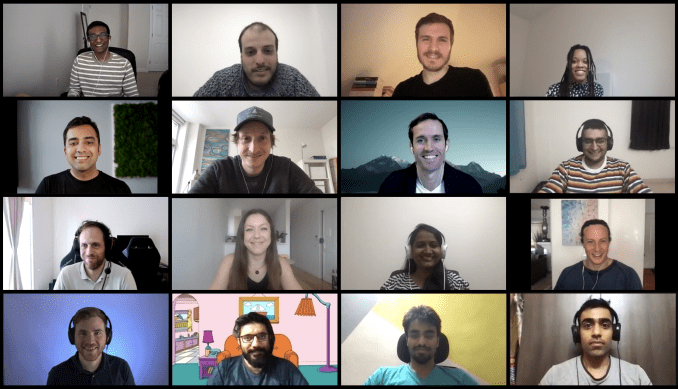

Circle’s team has grown to 20 across multiple continents. Photo via Circle.

Instead, much of the round’s allocations were handed out to the entrepreneurs building on the platform. “We had all of these offers from top-tier firms, but for the kind of product that we are — which is a creator platform — it made sense to allocate the round as much as possible to our customers,” Yadav said. According to the company, a majority of the round went to individual angels and community builders on the platform, among them Anne-Laure Le Cunff, David Perell, Tiago Forte and Nat Eliason.

Given the company’s early stage, product development remains the highest priority. “Our approach is like a Notion,” Yadav said, describing how Circle allows its communities to stitch together “building blocks” to lay out pages. Circle’s primary mode is through a Space, where community members can discuss topics with each other and the creator as well. Communities built on Circle can be white-labeled, with their own custom domains.

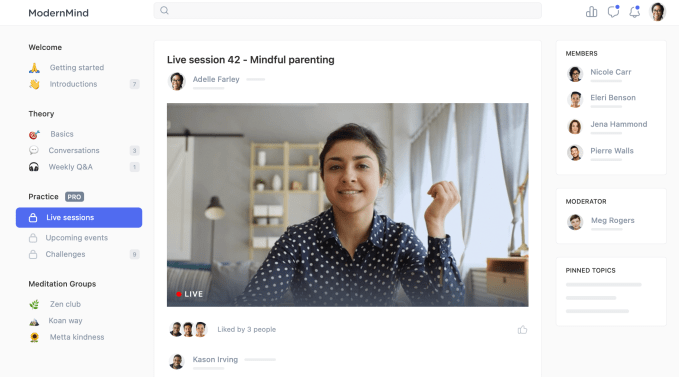

Circle’s community platform allows creators to publish content and engage with their community. Photo via Circle.

Circle’s ultimate goal is to integrate under one roof every tool a creator needs to engage with a customer, from publishing newsletters and podcasts to setting up streaming, event ticket sales, merchandise and event calendars — all buttressed by a payments layer. Many of those features remain to be built on top of the company’s core community platform, but Yadav and his team are certainly ambitious in their expansive scope.

Circle’s team is now 20 people, with team members in Europe, India, Australia and across the United States.

Powered by WPeMatico

After working as a general manager for Uber in Nevada, Jason Radisson realized the need for a way to connect blue-collar workers to companies looking to employ them.

So in late 2018, the idea for Shift One — a marketplace aimed at pairing workers and employers — was born. The startup is focused on last-mile logistics and delivery, e-commerce fulfillment and large-scale event management.

Since formally launching in 2019, Shift One has grown to have 25,000 workers on its platform — many of whom it says were unemployed at the time of hire. And it has about 50 clients in the U.S. and Colombia, including Amazon, NASCAR, Weee!, Mensajeros Urbanos and the Consumer Electronics Show (CES).

It matches employers with workers, and also helps them with tasks such as time, taxes, attendance, productivity and work-order management.

To help it grow and further expand its reach, Shift One just raised a $5.2 million seed round led by City Light Capital and Tinder co-founder Justin Mateen’s JAM fund, with participation from K50 Ventures, Ventura Investments and Human Ventures, as well as angel Felipe Villamarin.

On the operations side, all of Shift One’s original team either worked for Uber or Lyft, according to founder and CEO Radisson. The early technical team were all previously Uber employees.

Radisson says the impetus behind starting the company was the desire “to correct and improve some of the things in Gig 1.0.”

“We wanted it to be more balanced for workers, and break some negative flywheels where people were cycling through a lot of logistics jobs and not getting paid well,” he told TechCrunch. “We wanted to give them stability.”

At the same time, Radisson said, he knew that companies on the logistics side were struggling to find good workers. Shift One works with a range of skill levels, from entry-level employees to supervisors and warehouse managers.

Knowing that many logistics workers are used to working as contract employees with no benefits, Shift One gives all the workers on its platform full benefits with “low contributions” from the first day of hire. It also provides them with checking accounts and debit cards.

“A lot of these workers are unbanked and didn’t have the ability to even get a paycheck,” Radisson said.

It also aims to give them “full schedules” and have them work on whole teams as much as possible.

“It’s part of our value prop that our teams are cohesive and really high functioning,” he added.

Until now, San Francisco-based Shift One has been bootstrapped. It is “slightly” profitable and has been re-investing that money into growing the business. It saw its revenue climb by tenfold in 2020 from an admittedly “small base.” The startup has offices in Las Vegas, Minneapolis, Bogotá and Bucharest.

Looking ahead, it plans to use its new capital to expand into new markets (it’s currently operating in about 12 states), boost its headcount of 20 and accelerate its tech roadmap.

“In the last four to five months, we’ve moved very strong into last mile” as the COVID-19 pandemic has continued, Radisson said. “We want to give opportunities to millions that didn’t go to college and that have seen stagnant wages for years. We want to give them opportunities to get ahead.”

JAM Fund principal and Tinder co-founder Mateen believes Shift One is turning the labor problem of “adverse selection” on its head.

“Gig work has been defined by seasonality and availability — neither are particularly good for workers,” he said.

Even Miami Mayor Francis Suarez has thoughts, pointing out that blue-collar jobs have been among the hardest hit by COVID-19.

With Shift One, “workers receive fairly compensated jobs with the opportunity to grow and develop,” he said in a written statement. “Companies get access to a steady, predictable source of high-quality labor. And Miami benefits from the virtuous circle of higher employment and strong local businesses.”

Powered by WPeMatico

One of the new space startups with the loftiest near-term goals has raised $130 million in a Series B round that demonstrates investor confidence in the scope of its ambitions: Axiom Space, which has been tapped by NASA to add privately developed space station modules to the ISS, announced the new funding led by C5 Capital.

This is the latest in a string of high-profile announcements for Axiom, which was founded in 2016 by a team including space professionals with a history of demonstrated expertise working on the International Space Station. Eventually, Axiom hopes to go from adding the first private commercial modules to the existing station, to creating their own, wholly private on-orbital platforms — for research, space tourism and more.

Axiom announced the people who will take part in its first-ever private astronaut launch to the ISS, which is set to fly next January using a SpaceX Dragon spacecraft and Falcon 9 rocket. Axiom is the service provider for the mission, brokering the deal for the private spacefarers and setting up training and mission profile. That should be the first time we see a crew made up entirely of private individuals (i.e. not astronauts selected, trained and employed by their respective national government) make its way to the station.

The company was also in discussions with Tom Cruise about filming at least part of an upcoming film aboard the ISS, and it’s in development with a production company on a forthcoming competition reality show that will see contestants vie for a spot on a private flight to the station.

Axiom is emerging as the leading linkage between private human spaceflight and the existing infrastructure and industry, covering both public sector partners like NASA, and the “rails” of the bourgeoning industry — SpaceX and its ilk. It’s been focused on this unique opportunity longer than most in the private market, and it has all the relationships and in-house expertise to make it work.

This new, significant injection of capital will help the company hire, as well as boost its ability to construct the pieces of its forthcoming private space station modules, as well as its eventual station itself. The Houston-based company aims to put its ISS modules on the station by 2024, and it has raised $150 million to date.

Powered by WPeMatico