funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Many companies spend a significant amount of money and resources processing data from logs, traces and metrics, forcing them to make trade-offs about how much to collect and store. Hydrolix, an early-stage startup, announced a $10 million seed round today to help tackle logging at scale, while using unique technology to lower the cost of storing and querying this data.

Wing Venture Capital led the round with help from AV8 Ventures, Oregon Venture Fund and Silicon Valley Data Capital.

Company CEO and co-founder Marty Kagan noted that in his previous roles, he saw organizations with tons of data in logs, metrics and traces that could be valuable to various parts of the company, but most organizations couldn’t afford the high cost to maintain these records for very long due to the incredible volume of data involved. He started Hydrolix because he wanted to change the economics to make it easier to store and query this valuable data.

“The classic problem with these cluster-based databases is that they’ve got locally attached storage. So as the data set gets larger, you have no choice but to either spend a ton of money to grow your cluster or separate your hot and cold data to keep your costs under control,” Kagan told me.

What’s more, he says that when it comes to querying, the solutions out there like BigQuery and Snowflake are not well-suited for this kind of data. “They rely really heavily on caching and bulk column scans, so they’re not really useful for […] these infrastructure plays where you want to do livestream ingest, and you want to be able to do ad hoc data exploration,” he said.

Hydrolix wanted to create a more cost-effective way of storing and querying log data, while solving these issues with other tooling. “So we built a new storage layer which delivers […] SSD-like performance using nothing but cloud storage and diskless spot instances,” Kagan explained. He says that this means that there is no caching or column scales, enabling them to do index searches. “You’re getting the low cost, unlimited retention benefits of cloud storage, but with the interactive performance of fully indexed search,” he added.

Peter Wagner, founding partner at investor Wing Venture Capital, says that the beauty of this tool is that it eliminates trade-offs, while lowering customers’ overall data processing costs. “The Hydrolix team has built a real-time data platform optimized not only to deliver superior performance at a fraction of the cost of current analytics solutions, but one architected to offer those same advantages as data volumes grow by orders of magnitude,” Wagner said in a statement.

It’s worth pointing out that in the past couple of weeks SentinelOne bought high-speed logging platform Scalyr for $155 million, then CrowdStrike grabbed Humio, another high-speed logging tool for $400 million, so this category is getting attention.

The product is currently compatible with AWS and offered through the Amazon Marketplace, but Kagan says they are working on versions for Azure and Google Cloud and expect to have those available later this year. The company was founded at the end of 2018 and currently has 20 employees spread out over six countries, with headquarters in Portland, Oregon.

Powered by WPeMatico

Engineering teams face steep challenges when it comes to staying on schedule, and keeping to those schedules can have an impact on the entire organization. Acumen, an Israeli engineering operations startup, announced a $7 million seed investment today to help tackle this problem.

Hetz, 10D, Crescendo and Jibe participated in the round, designed to give the startup the funding to continue building out the product and bring it to market. The company, which has been working with beta customers for almost a year, also announced it was emerging from stealth today.

As an experienced startup founder, Acumen CEO and co-founder Nevo Alva has seen engineering teams struggle as they grow due to a lack of data and insight into how the teams are performing. He and his co-founders launched Acumen to give companies that missing visibility.

“As engineering teams scale, they face challenges due to a lack of visibility into what’s going on in the team. Suddenly prioritizing our tasks becomes much harder. We experience interdependencies [that have an impact on the schedule] every day,” Alva explained.

He says this manifests itself in a decrease in productivity and velocity and ultimately missed deadlines that have an impact across the whole company. What Acumen does is collect data from a variety of planning and communications tools that the engineering teams are using to organize their various projects. It then uses machine learning to identify potential problems that could have an impact on the schedule and presents this information in a customizable dashboard.

The tool is aimed at engineering team leaders, who are charged with getting their various projects completed on time with the goal of helping them understand possible bottlenecks. The software’s machine learning algorithms will learn over time which situations cause problems, and offer suggestions on how to prevent them from becoming major issues.

The company was founded in July 2019 and the founders spent the first 10 months working with a dozen design partners building out the first version of the product, making sure it could pass muster with various standards bodies like SOC-2. It has been in closed private beta since last year and is launching publicly this week.

Acumen currently has 20 employees with plans to add 10 more by the end of this year. After working remotely for most of 2020, Alva says that location is no longer really important when it comes to hiring. “It definitely becomes less and less important where they are. I think time zones are still a consideration when speaking of remote,” he said. In fact, they have people in Israel, the U.S. and eastern Europe at the moment among their 20 employees.

He recognizes that employees can feel isolated working alone, so the company has video meetings every day during which they spend the first part just chatting about non-work stuff as a way to stay connected. Starting today, Acumen will begin its go to market effort in earnest. While Alva recognizes there are competing products out there like Harness and Pinpoint, he thinks his company’s use of data and machine learning really helps differentiate it.

Powered by WPeMatico

The concept of the “marketing cloud” — sold by the likes of Salesforce, Oracle and Adobe — has become a standard way for large tech companies to package together and sell marketing tools to businesses that want to improve how they use digital channels to grow their business.

Some argue, however, that “cloud”, singular, might be a misnomer: typically those tools are not integrated well with each other and effectively are run as separate pieces of software. Today a startup called Blueshift — which claims to offer an end-to-end marketing stack, by having built it from the ground up to include both traditional marketing data as well as customer experience — is announcing some funding, pointing to the opportunity to build more efficient alternatives.

The startup has closed a round of $30 million, a Series C that co-founder and CEO Vijay Chittoor said it will be using to expand to more markets (it’s most active in the U.S. and Europe currently) and also to expand its technology.

“The product already has a unified format, to ingest data from multiple sources and redistribute that out to apps. Now, we want to distribute that data to more last-mile applications,” he said in an interview. “Our biggest initiative is to scale out the notion of us being not just an app but a platform.”

The company’s customers include LendingTree, Discovery Inc., Udacity, BBC and Groupon, and it has seen revenue growth of 858% in the last three years, although it’s not disclosing actual revenues, nor valuation, today.

The round is being led by Fort Ross Ventures, with strong participation also from Avatar Growth Capital. Past investors Softbank Ventures Asia (which led its last round of $15 million), Storm Ventures, Conductive Ventures and Nexus Venture Partners also invested.

The concept for Blueshift came out of Chittoor’s direct experience at Groupon — which acquired his previous startup, social e-commerce company Mertado — and before that a long period at Walmart Labs — which Walmart rebranded after it acquired another startup where Chittoor was an early employee, semantic search company Kosmix.

“The challenges we are solving today we saw firsthand as challenges our customers saw at Groupon and Walmart,” he said. “The connected customer journey is creating a thousand times more data than before, and people and brands are engaging across more touchpoints. Tracking that has become harder with legacy channel-centric applications.”

Blueshift’s approach for solving that has been, he said, “to unify the data and to make decisions at customer level.”

That is to say, although the customer experience today is very fragmented — you might potentially encounter something about a company or brand in multiple places, such as in a physical environment, on various social media platforms, in your email, through a web search, in a vertical search portal, in a marketplace on a site, in an app, and so on — the experience for marketers should not be.

The company addresses this by way of a customer data platform (CDP) it markets as “SmartHub.” Designed for non-technical users although customizable by engineers if you need it to be, users can integrate different data feeds from multiple sources, which then Blueshift crunches and organises to let you view in a more structured way.

That data can then be used to power actions in a number of places where you might be setting up marketing campaigns. And Chittoor pointed out — like other marketing people have — that these days, the focus on that is largely first-party data to fuel that machine, rather than buying in data from third-party sources (which is definitely part of a bigger trend).

“Our mission is to back category-leading companies that are poised to dominate a market. Blueshift clearly stood out to us as the leader in the enterprise CDP space,” said Ratan Singh of Fort Ross Ventures in a statement. “We are thrilled to partner with the Blueshift team as they accelerate the adoption of their SmartHub CDP platform.” Singh is joining Blueshift’s board with this round.

Powered by WPeMatico

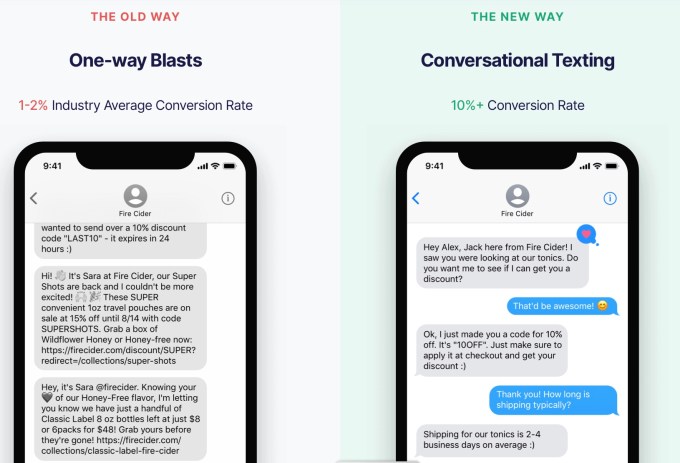

While more businesses are turning to text messages as a marketing channel, Emotive CEO Brian Zatulove argued that most of them are just treating it as another “newsletter blast.”

“The reason the channel performs so well is it’s not saturated,” Zatulove said. But that’s changing, and as it does, companies will have to do more to “cut through the noise.”

That’s what he said Emotive enables, with a platform focused on text marketing that feels like a real conversation with another human being, rather than just another email blast. He compared it to the sales associate who would greet you when you first walked into a department store, pre-COVID.

“The online sales associate really didn’t exist,” he said. “That’s what we’re trying to provide.”

Emotive saw 466% year-over-year revenue growth in 2020 and is announcing today that it has raised $50 million in a Series B funding round that values the company at $400 million. It was led by CRV, with participation from Mucker Capital, TenOneTen Ventures and Stripes.

Image Credits: Emotive

“Never underestimate the importance of building a product that your customers, and your customers’ customers adore,” said CRV general partner Murat Bicer in a statement. “One of the things that struck us about Emotive is the sheer amount of customer love Brian and [co-founder Zachary Wise] get from meal delivery services, manufacturing companies and even toddler shoe brands. Small businesses find it easy to set up campaigns and their customers genuinely prefer communicating with someone over text rather than email.”

Zatulove said he founded the company with Wise after they’d worked together on cannabis loyalty startup Reefer, eventually deciding there was a bigger opportunity after their early successes with text marketing. He explained that while Emotive works with larger customers, its sweet spot is mid-sized e-commerce businesses on Shopify, Magento, BigCommerce and WooCommerce.

Because those businesses usually don’t have any salespeople of their own yet, Emotive serves that function. It can start conversations around shopping cart abandonment and promote sales and new products, resulting in what the company says are 8% to 10% conversion rates (compared to 1% or 2% for a standard text marketing campaign). Zatulove said the platform largely relied on human responders at first, and although it’s become increasingly automated, Emotive still has an internal team handling responses when necessary.

“We never plan on losing that human touch as part of the dialog,” he added. “We see ourselves as a human-to-human marketing platform. That’s our biggest differentiator.”

Emotive had previously raised $8.2 million in funding, according to Crunchbase. Zatulove said this new round will allow the company to continue developing the product, to grow its headcount to more than 200 people and to open offices in Atlanta and Boston. Eventually, it could also expand beyond texting.

“Longer term, we see ourselves more as a conversation platform, not just as a text message platform,” he said.

Powered by WPeMatico

Real estate tech startup Sunroom Rentals, which leases units on behalf of property managers and apartment owners, has raised $11 million in a Series A round of funding led by Gigafund.

Ben Doherty and Zachary Maurais, former founders of the delivery app Favor, launched Sunroom in May 2018 with the mission of “boosting the profitability” of mid-size property managers and apartment owners by giving them a way to outsource their leasing operations.

The pair sold Favor to Texas grocer H-E-B in 2018 and soon after shifted their focus on building out Sunroom. The Austin-based company has developed an app that it says gives renters a way to tour, apply for and lease a unit “entirely online.” COVID-19 has led to more renters wanting virtual ways to explore and secure rental units. Mobile-first, Maurais noted, is particularly appealing to millennials and Gen Zers.

“Personally, we love to create products that fulfill consumer’s most basic needs,” said Maurais, the company’s president. “With food under our belt, we decided to focus on housing.”

While one might wonder what the parallels between food delivery and housing might be beyond fulfilling consumers’ needs, CEO Doherty said the rental market in 2021 looks a lot like the food delivery market in 2013.

“In 2013, Grubhub had successfully put many restaurant menus online, but most of the transactions and delivery process was still offline,” he told TechCrunch. “We’re in a similar position with the rental market, as the majority of rental listings are online, but touring, applying or leasing units is still done offline.”

Since its launch, Sunroom Rentals has signed more than 2,000 leases and had over 100,000 renters sign up for its services in fast-growing Austin, where it focused its initial efforts.

“According to the U.S. Census, that represents roughly 10% of renters in the greater Austin metro,” Maurais said. “Instead of going shallow and wide nationally, we decided to go deep in markets, in an effort to gain network effects, which was a strategy that worked well for us at Favor.”

Sunroom Rentals claims that it’s leasing units five days faster than the market average. This benefits property managers, Doherty said, because they can grow quicker “while improving leasing performance.”

Looking ahead, the company will use the funding to expand across Texas, including in Houston, San Antonio and Dallas. It will also invest in its partner portal, which aims to give owners and property managers a way to view real-time data on leasing performance.

Sunroom Rentals currently has 18 employees with the goal of more than doubling its headcount this year. It’s in particular looking to hire across its engineering, product and sales departments.

As mentioned above, Gigafund led the Series A financing, which included participation from NextGen Venture Partners, Calpoly Ventures and a slew of angel investors, including Gokul Rajaram (Google & Square) and Homeward’s Tim Heyl, among others. Existing backers include Founders Fund Seed, Draper Associates, Boost VC and Capital Factory (among many others). The round marked Sunroom’s first “priced” round, meaning the first time it’s given up stock.

Jonathan Basset, managing partner at NextGen Venture Partners, believes Sunroom was essentially in the right place at the right time and “on trend with touchless leasing even before COVID hit.”

“I watched them build a profitable consumer marketplace in a competitive market with Favor and was impressed with them as operators,” he said. “These businesses have a surprising amount of similarities and I’m confident they can rise to the challenge.

Last week, TechCrunch reported on the raise of another startup operating in this increasingly crowded space. Seattle-based Knock — a company that has developed tools to give property management companies a competitive edge — raised $20 million in a growth funding round led by Fifth Wall Ventures.

Knock’s goal is to provide CRM tools to modernize front office operations for these companies so they can do things like offer virtual tours and communicate with renters via text, email or social media from “a single conversation screen.” For renters, it offers an easier way to communicate and engage with landlords.

Maurais said the two differ in that Knock is a CRM built for leasing agents with a SAAS model where as Sunroom is a marketplace, where renters match, tour and apply with partnered properties.

“Sunroom also provides a suite of leasing & analytics software to its partners and generates both transactional and subscription revenues,” he added.

Powered by WPeMatico

What is working in the office going to look like in a post-COVID-19 world?

That’s something one startup hopes to help companies figure out.

Saltmine, which has developed a web-based workplace design platform, has raised $20 million in a Series A funding round.

Existing backers Jungle Ventures and Xplorer Capital led the financing, which also included participation from JLL Spark, the strategic investment arm of commercial real estate brokerage JLL.

Notably, JLL is not only investing in Saltmine, but is also partnering with the San Francisco-based startup to sell its service directly to its clients — opening up a whole new revenue stream for the four-year-old company.

Saltmine claims its cloud-based technology does for corporate real estate heads what Salesforce did for CROs in digitizing and streamlining the office design process. It saw an 80% spike in ARR (annual recurring revenue) last year while doubling the number of companies it works with, according to CEO and founder Shagufta Anurag. Its more than 35 customers include PG&E, Snowflake, Fidelity and Workday, among others. Its mission, put simply, is to help companies “create the best possible workplaces for their employees.”

Saltmine claims to have a 95% customer retention rate and in 2020 saw 350% year over year growth in monthly active users of its SaaS platform. So far, the square footage of all the office real estate properties designed and analyzed by customers on Saltmine totals 50 million square feet across 1,500 projects.

Saltmine says it offers companies tools to do things like establish social distancing measures in the office. Its platform, the company says, houses all workplace data — including strategy, design, pricing and portfolio analytics — in one place. It combines and analyzes floor plans with project requirements with real-time behavioral data (aggregated through a combination of utilization sensors and employee feedback) to identify companies’ design needs. Besides aiming to improve the workplace design process, Saltmine claims to be able to help companies “optimize their real estate portfolios.”

The pandemic has dramatically increased the need for a digital transformation of how workplaces are designed and reimagined, according to Anurag.

“Given the need for social distancing capabilities and a greater emphasis on work-life balance in many office settings, few workers expect a complete ‘return to normal,’ ” she said. “There is now enormous pressure on corporate heads of real estate to adapt and modify their workplaces.”

Once companies identify their new needs, Saltmine uses “immersive” digital 3D renderings to help them visualize the necessary changes to their real estate properties.

Singapore-based Anurag has previous experience in the design world, having founded Space Matrix, a large interior design firm in Asia, as well as Livspace, a digital home interior design company.

“I saw the same pain points and unmet needs in office real estate that I did in the residential market,” she said. “Real estate is the second-largest cost for companies and has a direct impact on their largest cost — their people.”

Looking ahead, Saltmine plans to use its new capital to (naturally) do some hiring and continue to acquire customers — in particular, seeking to expand its portfolio of Global 2000 companies.

Saltmine has about 125 employees in five offices across Asia, Europe and North America. It expects to have 170 employees by year’s end and to be profitable by the end of fiscal year 2021.

The company’s initial focus has been in North America, but it is now beginning to expand into APAC and Australia.

JLL Technologies’ co-CEO Yishai Lerner said JLL Spark was drawn to Saltmine’s approach of making data and analytics accessible in one place.

“Having a single source of truth for data also facilitates collaboration across teams, which is important, for example, in workspace planning,” he told TechCrunch. “This reduces inefficiencies and improves workflows in today’s fragmented design, build and fit-out market.”

JLL Spark invests in companies that it believes can benefit from its distribution and network — hence the firm’s agreement to sell Saltmine’s software directly to its customers.

“As JLL tenants and clients continue to embrace the future of work, they are seeking technology solutions that keep their buildings running efficiently and effectively,” Lerner said. “Saltmine’s platform checks all of the boxes by streamlining stakeholder collaboration, increasing transparency and simplifying data management.”

Powered by WPeMatico

It would be an understatement to say that enterprise-focused startups have fared well during the pandemic. As organizations look to go remote, and the way we work has been flipped on its head, quickly growing tech companies that simplify this transition are in high demand.

One such startup has, in fact, raised $61.5 million in the last 12 months alone. Electric, a company looking to put IT departments in the cloud, just announced the close of a $40 million Series C round. This comes after an extension of its Series B in March of 2020, when it raised $14.5 million, and then an additional $7 million from 01 Advisors in May of 2020.

This Series C round was led by Greenspring Associates, with participation from existing investors Bessemer Venture Partners, GGV Capital, 01 Advisors and Primary Venture Partners as well as new investors including Atreides Management and Vintage Investment Partners.

Electric launched in 2016 with a mission to make IT much simpler for small and medium-sized businesses. Rather than bringing on a dedicated IT department, or contracting out high-priced local service providers, Electric’s software allows one admin to manage devices, software subscriptions, permissions and more.

According to founder Ryan Denehy, the vast majority of IT’s work is administration, distribution and maintenance of the broad variety of software programs at any given company. Electric does most of that job on behalf of IT, meaning that a smaller business only needs to worry about desk-side troubleshooting when it comes up, rather than the whole kit and caboodle.

Electric charges a flat price per seat per month, and Denehy says the company more than doubled its customer base in the last year. It now supports around 25,000 users across more than 400 individual customer organizations, which puts Electric just shy of $20 million ARR.

This is the first time Denehy has come anywhere close to sharing revenue numbers publicly, but it’s a good time to flex. The company has recently introduced a new lighter-weight offering that includes all of the same functionality as its more expensive product, but without access to chat functionality.

“The name of the game is just simplicity, simplicity, simplicity,” said Denehy. “Part of this is in response to the fact that people are realizing the permanence of hybrid work. During the pandemic, people stopped paying their landlords but they didn’t stop paying us. So in the summer, we started to focus on how we can create more offerings that we can get in the hands of more businesses and let them start their journey with us.”

Denehy says that a little less than half of Electric’s client base are tech startups, which makes sense considering the company launched in New York in a tech and media-centric ecosystem. As a way to expand into other verticals, Electric acquired Sinu, an IT service provider who happened to have an impressive roster of clients outside of Electric’s comfort zone, such as legal, accounting and nonprofit.

Here’s what Denehy said at the time:

Organic market entry, even in adjacent markets can be extremely time consuming and expensive. Sinu’s team has done an excellent job winning and pleasing customers in a lot of industries where we currently don’t play but probably should. The combination of our two companies is a massive shot in the arm to our national expansion strategy.

Alongside growth, both of the Electric team and its customer base, the company is also investing in expanding its diversity programs and philanthropic efforts.

The Electric team is currently made up of just under 250 full-time employees, with 32.5% women and around 30% of employees being non-white. Specifically, nearly 12% of employees are Black and 10% are Latinx.

Denehy explained that he thinks of the company’s payroll, which is in the tens of millions of dollars, as one of the biggest ways he can make a change in the world.

“We will wait longer to fill a role to make sure that we have the most diverse pipeline of candidates possible,” said Denehy. “A lot of founders will say that nobody applied. Well, the reality is you didn’t look hard enough. We’ve just accepted that it may take us longer to fill certain roles.”

This latest round brings Electric’s total funding to more than $100 million.

Powered by WPeMatico

A new VC fund, 2150, is launching with the first close of a €200 million ($240 million) fund which will back technologies aimed largely at reducing the carbon footprint of cities. For example, startups that inject carbon into concrete, or monitor the energy of buildings. The final close is anticipated by mid-2021.

The advisory board for 2150 includes the former chief sustainability officer in the Obama administration, as well as renowned urbanist and academic, Richard Florida. 2150 is based around the idea that half of the world’s population lives in cities, and this will increase to two-thirds by 2050, creating a growing environmental impact that the world can ill-afford, given the climate crisis.

Based across London, Copenhagen and Berlin, the fund’s limited partners include a mix of institutional capital and family offices, including Chr. Augustinus Fabrikker, Denmark’s Green Future Fund and Novo Holdings. 2150 says it has other LP partners who are building or managing “over 16 million square meters of real estate”, who will come in handy, kicking the tires on the efficacy of 2150 investments. The anchor funding has come from NREP, a sustainable real estate fund manager with a large Northern European footprint and platform.

The founding partners include Mikkel Bülow-Lehnsby, chairman and co-founder of large real estate logistics company NREP; Jacob Bro, former chief product officer at Rocket Internet; Christian Jølck, the founder and former chairman of industry climate advocacy group SYNERGI; Christian Hernandez, former Facebook executive and VC; Nicole LeBlanc, formerly with Alphabet’s urban product incubator Sidewalk Labs; Rahul Parekh, founder of VC-backed food tech startup EatFirst and former executive director at Goldman Sachs; and Alexandra Perez, who incubated and launched urban tech startups at Tech City Ventures.

2150 will focus on startups that can make cities more resilient, efficient and sustainable, investing in tech associated with the urban environment, materials, automation and sensor-based monitoring to improve the health, safety and productivity of building occupants. It says it will only invest where sustainability impact can be measured, aiming for a first portfolio of around 20 companies. Ticket sizes will be €4-5 million Series A for startups, but it will also invest in existing companies that want to expand.

Its first investment is in CarbonCure Technologies — a Canadian company lowering the CO2 footprint of concrete — in which 2150 participated in a funding round last year, investing alongside Amazon’s Climate Pledge Fund, Bill Gates-backed Breakthrough Energy Ventures and Microsoft’s Climate Innovation Fund. At present, concrete accounts for 8% of all global CO2 emissions

Speaking to TechCrunch, Hernandez said 2150 was particularly interested in what’s coming to be known as “ESG Analytics” or “Carbon Accounting”. In other words, platforms that can analyze the impact of developments for an ESG and CO2 perspective.

The other background data which inspired the creation of the fund includes the fact that two billion new homes will need to be built over the next 80 years; cities consume over two-thirds of the world’s energy and account for more than 70% of global CO2 emissions; 13% of global GDP is spent on construction, but the industry is slow to adopt new technology; and the UN has said ground-breaking innovation is needed in cities, where the battle for sustainable development will be “won or lost”.

Mikkel Bülow-Lehnsby, partner at 2150 and chairman and co-founder of NREP, said: “With NREP we have been on a 15-year mission of making real estate and cities more efficient, customer-centric and sustainable. With 2150 we are leveraging all of NREP’s learnings and ambitions and partnering with our industry peers to identify and accelerate technology that can help us support our purpose of making real estate better. I am convinced that 2150’s mission-aligned team will play an important role in designing a future in which the convergence of entrepreneurship, technology and sustainability will reverse the built environment’s negative impact on the planet.”

Christian Hernandez, Partner at 2150, said: “Cities are complex living systems that are constantly expanding, evolving and adapting, with half the world’s population now living in urban environments and rising. Cities, while vehicles for the betterment of humanity, currently emit 70% of the world’s greenhouse gases and generate the vast majority of the planet’s waste. We see a huge opportunity to make a serious impact on the way cities are developed and the way our citizens live, work and are cared for by completely reimagining and reshaping the urban environment for good.”

The advisory board for 2150 includes technologists, scientists and designers, including well-known architect Bjarke Ingels; the director of Princeton’s Andlinger Center for Energy and the Environment, Dr. Lynn Loo; Unity’s head of AI, Danny Lange; the former chief sustainability officer in the Obama Administration, Christine Harada; and the founder of sustainable developer EDGE Technologies, Coen van Oostrom.

Powered by WPeMatico

Zomato has raised $250 million, two months after closing a $660 million Series J financing round, as the Indian food delivery startup builds a war-chest ahead of its IPO later this year.

Kora (which contributed $115 million), Fidelity ($55 million), Tiger Global ($50 million), Bow Wave ($20 million) and Dragoneer ($10 million) pumped the new capital into the 12-year-old Gurgaon-headquartered startup, Info Edge, a publicly listed investor in Zomato, disclosed in a filing (PDF) to a local stock exchange. The new investment gives Zomato a post-money valuation of $5.4 billion, up from $3.9 billion in December last year, said Info Edge, which owns 18.4% stake in the Indian startup.

The new investment reinforces the strong confidence investors have in Zomato, which struggled to raise money for much of last year. Zomato, which acquired the Indian food delivery business of Uber early last year, competes with Prosus Ventures-backed Swiggy (valued at about $3.6 billion) in India. Together they work with over 440,000 delivery partners, a larger workforce than that employed by Indian Department of Posts.

A third player, Amazon, also entered the food delivery market in India last year, though its operations are still limited to parts of Bangalore.

At stake is India’s food delivery market, which analysts at Bernstein expect to balloon to be worth $12 billion by 2022, they wrote in a report to clients. With about 50% of the market share, Zomato is the current leader among the three, Bernstein analysts wrote.

“We find the food-tech industry in India to be well positioned to sustained growth with improving unit economics. Take-rates are one of the highest in India at 20-25% and consumer traction is increasing. Market is largely a duopoly between Zomato and Swiggy with 80%+ share,” wrote analysts at Bank of America in a recent report, reviewed by TechCrunch.

Zomato and Swiggy have improved their finances in recent years, which is especially impressive because making money with food delivery is very often more challenging in India. Unlike Western markets such as the U.S., where the value of each delivery item is about $33, in India, a similar item carries the price tag of $3 to $4, according to research firms.

Both the startups eliminated hundreds of jobs last year as the coronavirus pandemic hit their businesses. Zomato co-founder and chief executive Deepinder Goyal said in December that the food delivery market was “rapidly coming out of COVID-19 shadows.”

“December 2020 is expected to be the highest ever GMV month in our history. We are now clocking ~25% higher GMV than our previous peaks in February 2020. I am supremely excited about what lies ahead and the impact that we will create for our customers, delivery partners and restaurant partners,” he said.

In an email to employees in September last year, Goyal said Zomato was working on its IPO for “sometime in the first half” of 2021 and was raising money to build a war-chest for “future M&A, and fighting off any mischief or price wars from our competition in various areas of our business.”

Powered by WPeMatico

EquityBee, a stock option marketplace startup, has raised $20 million in a Series A round of funding.

Group 11 led the financing, which also included participation from Oren Zeev Ventures, Battery Ventures and ICON Continuity Fund. It brings the company’s total raised to over $28 million since its 2018 inception.

EquityBee CEO and co-founder Oren Barzilai says his company’s mission is to help educate startup employees on the meaning of their stock options, as well as provide them with funds to be able to purchase them.

“I have seen many of my friends and colleagues negotiate a $500 salary increase, but completely disregard their stock options package, from lack of knowledge due to the whole field of startup stock options being opaque,” said Barzilai, who also founded Tapingo, which was acquired by Grubhub in 2018 for $150 million. “As a founder I saw my team members who helped build the company not take part in our success because they left prematurely and didn’t exercise their stock options.”

The way it works is fairly straightforward. EquityBee provides capital to startup employees so they can purchase stock options. The employees get money to cover the cost of exercising their stock options and the taxes. The investors who helped provide the funding so they could do that get a return, or a share of the profit, if there’s “a liquidity event.” EquityBee makes money by charging an upfront fee from the investor on the investment day, as well as any carried interest upon a successful exit or IPO.

Barzilai said that many employees don’t realize they have about 90 days to exercise options before they expire once they leave a company. And even if they do, they may not always have the money to exercise them. That’s where EquityBee wants to help.

The company was originally founded in Israel before launching in the U.S. market, and moved its headquarters to Silicon Valley in February 2020. Since then, it’s funded employees from “hundreds” of companies, including Airbnb, Palantir, DoorDash and Unity, with capital provided by family offices, funds and high-net individuals. Its investor community is made up of 8,000 funds, family offices and high-net worth individuals.

2020 was a good year for EquityBee, according to Barzilai, who says it grew by more than 560% the amount of money it raised to fund employee stock options. It also saw a 360% increase in the number of individual employees funded through its platform.

Looking ahead, the 33-person company plans to use the money toward hiring and expanding product offerings.

Dovi Frances, founding partner of Group 11, said it doubled down on EquityBee after backing the company in its $6.6 million funding round in February 2020 because it’s impressed by what it described as the company’s “perfect product market fit” and triple-digit growth.

WeWork co-founder Adam Neumann led the company’s $1.5 million seed round in September of 2018.

Powered by WPeMatico