funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Krafton, the developer of popular gaming title PUBG Mobile, has invested $22.4 million in Indian esports firm Nodwin Gaming, the two firms said Tuesday as the South Korean firm looks to maintain some presence in what was once its key overseas market.

Nodwin Gaming, a subsidiary of local gaming giant Nazara, has established itself as one of the largest esports firms in India.

The Gurgaon-headquartered firm today works with several firms, including Blizzard Entertainment, Valve, Riot Games and ESL to help them host events, provide commentary, produce and license content, and amass brands and sponsors.

Nodwin, which recently expanded to Africa, will deploy the fresh capital to accelerate its growth in international markets, it said.

Krafton and Nodwin have been engaging with one another for some time. The two firms last week announced that they will be collaborating to hold two PUBG Mobile events in Asia.

“Esports will be a key pillar to the growth of sports entertainment in the future. It sits at a wonderful intersection of sports, entertainment and technology where nations such as India can pave the path. With Krafton coming on board, we have an endorsement from the mecca of gaming and esports — South Korea — on what we are building from India for the world based on our competence in mobile first markets,” said Akshat Rathee, co-founder and managing director of Nodwin Gaming, in a statement.

India banned PUBG Mobile and hundreds of other apps with affiliation to China last year, citing cybersecurity concerns. Krafton has been attempting to bring PUBG Mobile back in India, but hasn’t had any luck yet.

To assuage New Delhi’s concerns about users’ security, Krafton said it had cut ties with Chinese publisher Tencent. (It also inked a global cloud deal with Microsoft.) Sean Hyunil Sohn, the head of Corporate Development at Krafton, said earlier this month at a gaming conference that the firm “will work hard” to bring PUBG Mobile back in India, but didn’t elaborate.

“Krafton is excited to partner with Nodwin Gaming to help foster the promising esports ecosystem and engage with our fans and players in India,” said Changhan Kim, chief executive of Krafton in a statement.

“Taking the momentum from this partnership, we will explore additional investment opportunities in the region to uphold our commitment and dedication in cultivating the local video game, esports, entertainment, and tech industries.”

Powered by WPeMatico

As the restaurant industry across different cities was massively hit by the pandemic-induced lockdowns last year, food aggregator platforms helped by driving online customers to them.

Koinz is one such startup in Egypt. Its value for food and beverages brands before, during and after the lockdowns has bagged the startup a $4.8 million seed round.

Founded in 2018 by Hussein Momtaz, Ahmed Said and Abdullah Al Khaldi, Koinz set out to solve two major problems in Egypt’s food aggregation industry.

The offline and online food and restaurant experience in the country are totally separate. Most food aggregators who deal with delivery tend to focus on the online customer, and there’s no sophisticated experience for the offline customer.

Next, the unit economics of the food aggregation industry is quite challenging. According to Momtaz, the startup’s CEO, the food aggregation industry usually takes about 25%-30% average commission from F&B players for business to start to make sense.

“This is not because they want to squeeze money from the hands of restaurants or brands,” Momtaz told TechCrunch. “But the cost of acquiring customers and retaining them for the food aggregator itself is very high; that’s why they need very high commissions from the brands or restaurants.”

This is where Koinz comes in. The company developed a mobile app for takeout and delivery orders that manages offline customer experiences while delivering an engagement platform to manage loyalty programs, customer feedback and analytics about the online and offline customer base.

Abdullah Al Khaldi (CRO), Hussein Momtaz (CEO), and Ahmed Said (CTO). Image Credits: Koinz

Online food experience for Koinz customers is like a treasure hunt, and Momtaz claims the company’s business model has cracked the industry’s unit economics. This, alongside providing brands with insights, differentiates the platform from other aggregators and makes its customer acquisition cost and retention cost 60% less than most of them.

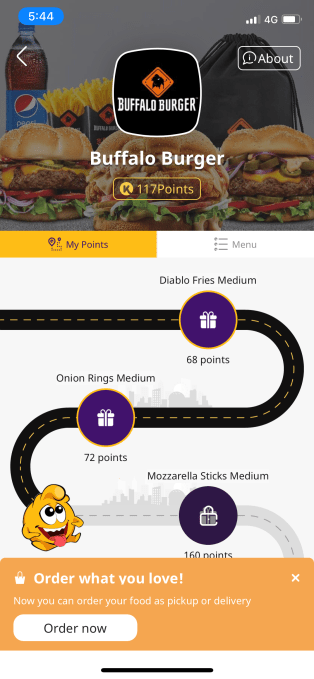

Here’s how the platform works. When customers visit a brand using for the first time, they enter their phone numbers to instantly receive points for their order via text message. After various restaurant visits and making orders, they accumulate enough points. They’ll need to download the Koinz mobile application to redeem them, thereby converting these offline customers to online ones.

Furthermore, these offline customers can now discover new places to eat, read and leave reviews, and order delivery or takeout.

“None of the small or big brands in the region had something like this before. The offline customer is like a ghost. He walks into the brands, takes his orders and leaves without the brands knowing anything about him. Koinz is changing that,” the CEO remarked.

Building its platform this way, Koinz tries to be different from other online aggregators that erode restaurant owners’ profit margins while delivering limited customer access and interaction. How? By collecting real-time data and leveraging a digital rewarding system designed to drive customers to deepen their relationship with restaurants.

Image Credits: Koinz

Brands can configure their gifts lists and determine for which items customers can redeem their points. For instance, customers in an Egyptian restaurant called Buffalo Burger can exchange 68 points for a Diablo Fries Medium; or wait till they get to 160 points to get a Mozzarella Sticks Medium; or 236 points for a Double Diggler.

Similarly, every brand has its own configuration. A customer cannot get points in Buffalo Burger and redeem them at Hamburgini. Koinz charges subscriptions to the brands for its engagement and feedback platform and collects commission whenever an order is made via its platform, which varies across its markets.

Because of its original business model, Koinz had to iterate several times. Before using phone numbers to collect customers’ information, the company used QR codes and NFC tags. Momtaz says this was highly ineffective, and the move to phone numbers helped skyrocket its growth and value.

The six-man team back in 2018 is now 80, and the platform, which is basically powering the growth of restaurants in the Middle East, claims to have had up to 4 million consumers earn points on its platform. These consumers have redeemed almost 300,000 rewards, while almost 800,000 customers have left reviews.

Since launching in Egypt, Koinz has expanded to Saudi Arabia and the UAE. Like Egypt, these markets have similar dynamics and demographics. They have also witnessed one of the highest rates of new or increased users in online deliveries — restaurant products and groceries — during the pandemic.

Besides, consumers in the Middle East are outpacing the global appetite in food delivery, with 64% ordering in at least once a week compared to 40% made by global consumers. And with the fast-food industry in MENA estimated at nearly $31 billion in 2020 and expected to reach nearly $60 billion by 2025, there’s so much room for Koinz to grow in the region. Momtaz says the company is also considering a move to Sub-Saharan Africa in the near future despite them having distinct demographics.

Entrepreneur and investor Justin Mateen led this seed round. Since leaving Tinder in 2014, Mateen has been an active investor in early-stage companies. Koinz is his first investment in the MENA region. According to him, Koinz’s ability to allow food and beverages brands to understand their customers’ needs and simultaneously increase their profit margins was one of the reasons he invested in the Egyptian-based startup.

“The company’s unique business model will continue to scale as the food delivery space evolves. Hussein’s drive and excitement for what the team is building are what convinced me to lead a round in the Middle East for the first time,” Mateen added.

African-focused VC 4DX Ventures and strategic angel investors from Egypt, Turkey and Saudi Arabia participated as well.

Peter Orth, co-founder and managing director of the firm, said of the investment that with restaurants in the region suffering under the traditional aggregator model, especially during the pandemic, Koinz has quickly become a win-win for both consumers and restaurant owners across the Middle East.

As the three-year-old company plans to use the capital to hire more talent and fuel its expansion across the Middle East, Mateen and Orth will join its board of directors.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Planted, a startup pursuing a unique method of creating a vegetarian chicken alternative, has raised an $18 million (CHF 17 million) Series A to expand its product offerings and international footprint. With new kebabs and pulled-style faux meats available and steak-like cuts in the (literal) pipeline, Planted has begun to set its sights outside central Europe.

The company was a spinout from ETH Zurich and made its debut in 2019, but has not rested on the success of its plain chicken recipe. Its approach, which relied on using pea protein and pea fiber extruded to recreate the fibrous structure of chicken for nearly 1:1 replacement in recipes, has proven to be adaptable for different styles and ingredients as well.

“We aim to use different proteins, so that there is diversity, both in terms of agriculture and dietary aspects,” said co-founder Christoph Jenny.

“For example our newly launched planted.pulled consists of sunflower, oat and yellow pea proteins, changing both structure and taste to resemble pulled pork rather than chicken. The great thing about the sunflower proteins, they are upcycled from sunflower oil production. Hence, we are establishing a circular economy approach.”

When I first wrote about Planted, its products were only being distributed through a handful of restaurants and grocery stores. Now the company has a presence in more than 3,000 retail locations across Switzerland, Germany and Austria, and works with restaurant and food service partners as well. No doubt this strong organic (so to speak) growth, and the growth of the meat alternative market in general, made raising money less of a chore.

The cash will be directed, as you might expect for a company at this stage, towards R&D and further expansion.

“The funding will be used to expand our tech stack, to commercialize our prime cuts that are currently produced at lab scale,” said Jenny. “On the manufacturing side we look to significantly increase our current capacity of half a ton per hour to serve the increasing demand coming from international markets, first in neighboring countries and then further into Europe and overseas.”

“We will further invest in our structuring and fermentation platforms. Combining structuring technologies with the biochemical toolboxes of natural microorganisms will allow us to create ultimately new products with transformative character – all clean, natural, healthy and tasty,” said co-founder Lukas Böni in a press release.

No doubt this all will also help lower the price, a goal from the beginning but only possible by scaling up.

As other companies in this space also raise money (incidentally, rather large amounts of it) and expand to other markets, competition will be fierce — but Planted seems to be specializing in a few food types that aren’t as commonly found, at least in the U.S., where sausages, ground “beef” and “chicken” nuggets have been the leading forms of meat alternatives.

No word on when Planted products will make it to American tables, but Jenny’s “overseas” suggests it is at least a possibility fairly soon.

The funding round was co-led by Vorwerk Ventures and Blue Horizon Ventures, with participation from Swiss football (soccer) player Yann Sommer and several previous investors.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Optimizely co-founder Dan Siroker said the idea for his new startup Scribe goes back to a couple of personal experiences — and although Scribe’s first product is focused on Zoom, those experiences weren’t Zoom-related at all.

Instead, Siroker recalled starting to go deaf and then having an “epiphany” the first time he put in a hearing aid, as he recovered a sense he thought he’d lost.

“That really was the spark that got me thinking about other opportunities to augment things your body naturally fails at,” he said.

Siroker added that memory was an obvious candidate, particularly since he also has aphantasia — the inability to visualize mental images, which made it “hard to remember certain things.”

It may jog your own memory if I note that Siroker founded Optimizely with Pete Koomen in 2010, then stepped down from the CEO role in 2017, with the testing and personalization startup acquired by Episerver last year. (And now Episerver itself is rebranding as Optimizely.)

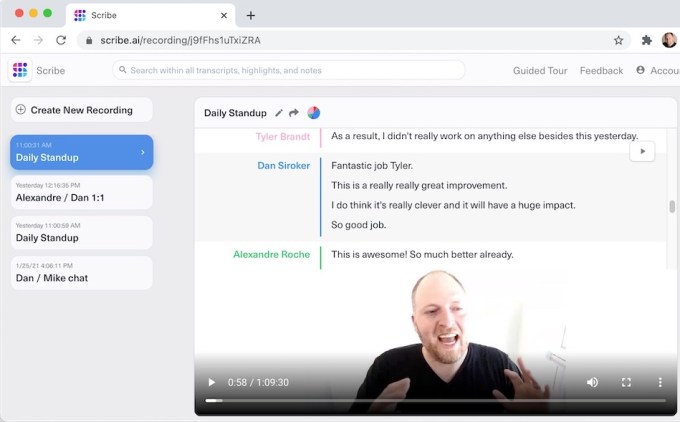

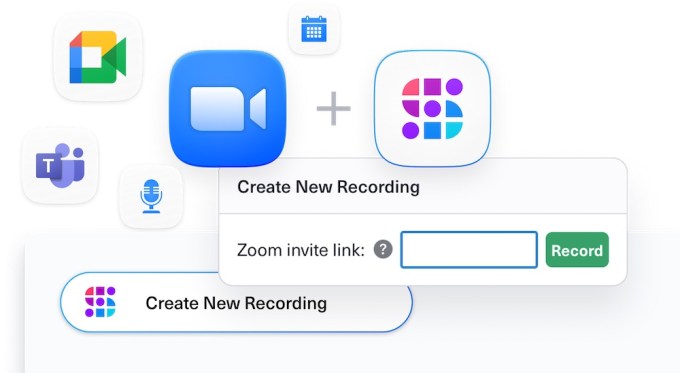

Fast-forward to the present day and Siroker is now CEO at Scribe, which is taking signups for its first product. That product integrates into Zoom meetings and transforms them into searchable, shareable transcripts.

Siroker demonstrated it for me during our Zoom call. Scribe appears in the meeting as an additional participant, recording video and audio while creating a real-time transcript. During or after the meeting, users can edit the transcript, watch or listen to the associated moment in the recording and highlight important points.

From a technological perspective, none of this feels like a huge breakthrough, but I was impressed by the seamlessness of the experience — just by adding an additional participant, I had a full recording and searchable transcript of our conversation that I could consult later, including while I was writing this story.

Image Credits: Scribe

Although Scribe is recording the meeting, Siroker said he wants this to be more like a note-taking replacement than a tape recorder.

“Let’s say you and I were meeting and I came to that meeting with a pen and paper and I’m writing down what you’re saying,” he said. “That’s totally socially acceptable — in some ways, it’s flattering … If instead, I brought a tape recorder and plopped in front of you and hit record — you might actually have this experience — with some folks, that feels very different.”

The key, he argued, is that Scribe recordings and transcripts can be edited, and you can also turn individual components on and off at any time.

“This is not a permanent record,” he said. “This is a shared artifact that we all create as we have a meeting that — just like a Google Doc — you can go back and make changes.”

That said, it’s still possible that Scribe could record some embarrassing comments, and the recordings could eventually get meeting participants in trouble. (After all, leaked company meeting recordings have already prompted a number of news stories.) Siroker said he hopes that’s “not common,” but he also argued that it could create an increased sense of transparency and accountability if it happens occasionally.

Scribe has raised around $5 million in funding, across a round led by OpenAI CEO Sam Altman and another led by First Round Capital.

Image Credits: Scribe

Siroker told me he sees Zoom as just the “beachhead” for Scribe’s ambitions. Next up, the company will be adding support for products like Google Meet and Microsoft Teams. Eventually, he hopes to build a new “hive mind” for organizations, where everyone is “smarter and better” because so many of their conversations and knowledge are now searchable.

“Where we go after that really depends on where we think we can have the biggest positive impact on people’s lives,” he said. “It’s harder to make a case for personal conversations you have with a spouse but … I think if you strike the right balance between value and privacy and control, you could really get people to adopt this in a way that actually is a win-win.”

And if Scribe actually achieves its mission of helping us to record and recall information in a wide variety of contexts, could that have an impact on our natural ability to remember things?

“Yes is the answer, and I think that’s okay,” he responded. “Your brain has limited energy … Remembering the things somebody said a few weeks ago is something a computer can do amazingly. Why waste your precious brain cycles doing that?”

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Eco, which has built out a digital global cryptocurrency platform, announced Friday that it has raised $26 million in a funding round led by a16z Crypto.

Founded in 2018, the SF-based startup’s platform is designed to be used as a payment tool around the world for daily-use transactions. The company emphasizes that it’s “not a bank, checking account, or credit card.”

“We’re building something better than all of those combined,” it said in a blog post. The company’s mission has also been described as an effort to use cryptocurrency as a way “to marry savings and spending,” according to this CoinList article.

Eco users can earn up to 5% annually on their deposits and get 5% cash back when transacting with merchants such as Amazon, Uber and others. Next up: The company says it will give its users the ability to pay bills, pay friends and more “all from the same, single wallet.” That same wallet, it says, rewards people every time they spend or save.

After a “successful” alpha test with millions of dollars deposited, the company’s Eco App is now available to the public.

A slew of other VC firms participated in Eco’s latest financing, including Founders Fund, Activant Capital, Slow Ventures, Coinbase Ventures, Tribe Capital, Valor Capital Group and more than one hundred other funds and angels. Expa and Pantera Capital co-led the company’s $8.5 million funding round.

CoinList co-founder Andy Bromberg stepped down from his role last fall to head up Eco. The startup was originally called Beam before rebranding to Eco “thanks to involvement by founding advisor, Garrett Camp, who held the Eco brand,” according to Coindesk. Camp is an Uber co-founder and Expa is his venture fund.

For a16z Crypto, leading the round is in line with its mission.

In a blog post co-written by Katie Haun and Arianna Simpson, the firm outlined why it’s pumped about Eco and its plans.

“One of the challenges in any new industry — crypto being no exception — is building things that are not just cool for the sake of cool, but that manage to reach and delight a broad set of users,” they wrote. “Technology is at its best when it’s improving the lives of people in tangible, concrete ways…At a16z Crypto, we are constantly on the lookout for paths to get cryptocurrency into the hands of the next billion people. How do we think that will happen? By helping them achieve what they already want to do: spend, save, and make money — and by focusing users on tangible benefits, not on the underlying technology.”

Eco is not the only crypto platform offering rewards to users. Lolli gives users free bitcoin or cash when they shop at over 1,000 top stores.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

It’s not uncommon these days to hear of U.S.-based investors backing Latin American startups.

But it’s not every day that we hear of Latin American VCs investing in U.S.-based startups.

Berkeley-based fintech Flourish has raised $1.5 million in a funding round led by Brazilian venture capital firm Canary. Founded by Pedro Moura and Jessica Eting, the startup offers an “engagement and financial wellness” solution for banks, fintechs and credit unions with the goal of helping them engage and retain clients.

Also participating in the round were Xochi Ventures, First Check Ventures, Magma Capital and GV Angels as well as strategic angels including Rodrigo Xavier (former Bank of America CEO in Brazil), Beth Stelluto (formerly of Schwab), Gustavo Lasala (president and CEO of The People Fund) and Brian Requarth (founder of Viva Real).

With clients in the U.S., Bolivia and Brazil, Flourish has developed a solution that features three main modules:

In the U.S., Flourish began by testing end-user mechanics with organizations such as CommonWealth and Opportunity Fund. In 2019, it released a B2C version of the Flourish app (called the Flourish Savings App) as a pilot for its banking platform, which can integrate with banks through an SDK or an API. It is also now licensing its engagement technology to banks, retailers and fintechs across the Americas. Flourish has piloted or licensed its solution to U.S.-based credit unions, Sicoob (Brazil’s largest credit union) and BancoSol in Bolivia.

The startup makes money through a partnership model that focuses on user activation and engagement.

Both immigrants, Moura and Eting met while in the MBA program at the Haas School of Business at UC Berkeley. Moura came to the U.S. from Brazil as a teen, while Eting is the daughter of a Filiponio father and mother of Mexican descent.

The pair bonded on their joint mission of building a business that empowered people to create positive money habits and understand their finances.

Currently, the 11-person team works out of the U.S., Mexico and Brazil. It plans to use its new capital to increase its number of customers in LatAm, do more hiring and develop new functionalities for the Flourish platform.

In particular, it plans to next focus on the Brazilian market, and will scale in a few select countries in the Americas.

“There are three things that make Latin America, and more specifically Brazil, attractive to us at this moment,” Moura said. “Currently, the B2B financial technology market is still in its nascency. This combined with open banking regulation and the need for more responsible products provides Flourish a unique opportunity in Brazil.”

Powered by WPeMatico

A lot of our communication these days with each other is digital, and today one of the companies enabling that — with APIs to build chat experiences into apps — is announcing a round of funding on the back of some very strong growth.

Stream, which lets developers build chat and activity streams into apps and other services by way of a few lines of code, has raised $38 million, funding that it will be using to continue building out its existing business as well as to work on new features.

Stream started out with APIs for activity feeds, and then it expanded to chat, which today can be integrated into apps built on a variety of platforms. Currently, its customers integrate third-party chatbots and use Dolby for video and audio within Stream, but over time, these are all areas where Stream itself would like to do more.

“End-to-end encryption, chatbots: We want to take as many components as we can,” said Thierry Schellenbach, the CEO who co-founded the startup with the startup’s CTO Tommaso Barbugli in Amsterdam in 2015 (the startup still has a substantial team in Amsterdam headed by Barbugli, but its headquarters is now in Boulder, Colorado, where Schellenbach eventually moved).

Image Credits: Stream (opens in a new window)

The company already has amassed a list of notable customers, including Ikea-owned TaskRabbit, NBC Sports, Unilever, Delivery Hero, Gojek, eToro and Stanford University, as well as a number of others that it’s not disclosing across healthcare, education, finance, virtual events, dating, gaming and social. Together, the apps Stream powers cover more than 1 billion users.

This Series B round is being led by Felicis Ventures’ Aydin Senkut, with previous backers GGV Capital and 01 Advisors (the fund co-founded by Twitter’s former CEO and COO, Dick Costolo and Adam Bain) also participating.

Alongside them, a mix of previous and new individual and smaller investors also participated: Olivier Pomel, CEO of Datadog; Tom Preston-Werner, co-founder of GitHub; Amsterdam-based Knight Capital; Johnny Boufarhat, founder and CEO of Hopin; and Selcuk Atli, co-founder and CEO of social gaming app Bunch (itself having raised a notable round of $20 million led by General Catalyst not long ago).

That list is a notable indicator of what kinds of startups are also quietly working with Stream.

The company is not disclosing its valuation but said chat revenue grew by 500% in 2020.

Indeed, the Series B speaks of a moment of opportunity: It is coming only about six months after the startup raised a Series A of $15 million, and in fact Stream wasn’t looking to raise right now.

“We were not planning to raise funding until later this year but then Aydin reached out to us and made it hard to say no,” Schellenbach said.

“More than anything else, they are building on the platforms in the tech that matters,” Senkut added in an interview, noting that its users were attesting to a strong return on investment. “It’s rare to see a product so critical to customers and scaling well. It’s just uncapped capability… and we want to be a part of the story.”

That moment of opportunity is not one that Stream is pursuing on its own.

Some of the more significant of the many players in the world of API-based communications services like messaging, activity streams — those consolidated updates you get in apps that tell you when people have responded to a post of yours or new content has landed that is relevant to you, or that you have a message, and so on — and chat include SendBird, Agora, PubNub, Twilio and Sinch, all of which have variously raised substantial funding, found a lot of traction with customers, or are positioning themselves as consolidators.

That may speak of competition, but it also points to the vast market there for the tapping.

Indeed, one of the reasons companies like Stream are doing so well right now is because of what they have built and the market demand for it.

Communications services like Stream’s might be best compared to what companies like Adyen (another major tech force out of Amsterdam), Stripe, Rapyd, Mambu and others are doing in the world of fintech.

As with something like payments, the mechanics of building, for example, chat functionality can be complex, usually requiring the knitting together of an array of services and platforms that do not naturally speak to each other.

At the same time, something like an activity feed or a messaging feature is central to how a lot of apps work, even if they are not the core feature of the product itself. One good example of how that works are food ordering and delivery apps: they are not by their nature “chat apps” but they need to have a chat option in them for when you do need to communicate with a driver or a restaurant.

Putting those forces together, it’s pretty logical that we’d see the emergence of a range of tech companies that both have done the hard work of building the mechanics of, say, a chat service, and making that accessible by way of an API to those who want to use it, with APIs being one of the more central and standard building blocks in apps today; and a surge of developers keen to get their hands on those APIs to build that functionality into their apps.

What Stream is working on is not to be confused with the customer-service focused services that companies like Zendesk or Intercom are building when they talk about chat for apps. Those can be specialized features in themselves that link in with CRM systems and customer services teams and other products for marketing analytics and so on. Instead, Stream’s focus are services for consumers to talk to other consumers.

What is a trend worth watching is whether easy-to-integrate services like Stream’s might signal the proliferation of more social apps over time.

There is already at least one key customer — which I am now allowed to name — that is a steadily growing, still young social app, which has built the core of its service on Stream’s API.

With just a handful of companies — led by Facebook, but also including ByteDance/TikTok, Tencent, Twitter, Snap, Google (via YouTube) and some others depending on the region — holding an outsized grip on social interactions, easier, platform-agnostic access to core communications tools like chat could potentially help more of these, with different takes on “social” business models, find their way into the world.

“Stream’s technology addresses a common problem in product development by offering an easy-to-integrate and scalable messaging solution,” said Dick Costolo of 01 Advisors, and the former Twitter CEO, in a statement. “Beyond that, their team and clear vision set them apart, and we ardently back their mission.”

Updated to correct that the revenue growth is not related to the valuation figure.

Powered by WPeMatico

Healthcare is one of the most complex industries out there, creating frustration on the consumer side but also the opportunity for huge improvements from, in a way, rather simple methods. Halo Diagnostics (or Dx for short) has raised a $19 million Series A to improve diagnosis of several serious illnesses by crossing the streams from multiple tests and making the improved process easily available to providers. They’ve also taken the unusual step of taking out an eight-figure line of credit to buy outright the medical facilities they’ll need to do it.

As anyone who’s had to deal with major health concerns can attest, the care you get differs widely from one provider to another depending on many factors, not least of which are what your insurance covers and what methods are already in use by the provider.

For men going in to get a prostate cancer screening, for instance, the common bloodwork and rectal exam haven’t changed in years, and really aren’t that great at predicting problems, leading to uncertainty and unnecessary procedures like biopsies.

Of course, if you’re lucky, your provider might offer multiparametric MRIs, which are much better at finding problems — and if you combine that MRI with a urine test that checks for genetic markers, the detection accuracy rises to practically foolproof levels.

But these tests are more expensive, take special facilities and personnel and may otherwise not fit into the provider’s existing infrastructure. Halo aims to provide that infrastructure by revamping the medical data stream to allow for this kind of multi-factor diagnosis.

“Basically doctors and imaging centers aren’t offering latest level of care. If you’re lucky you might get it, but in community medicine you’re not going to,” said Brian Axe, co-founder and chief product officer at Halo Dx. “As perverse as it sounds, what the healthcare industry needs to adopt the latest medical advancements is better financial alignment in addition to better outcomes. The challenge is the integrated diagnostic solution — how do you get these orders, go to market and talk with primary care providers?”

An added obstacle is that multi-modal testing isn’t really the kind of thing medical imaging or testing providers just decide to get into. An imaging center isn’t going to hear that a urine test improves reliability and think “well let’s buy the building next door and start doing that too!” It’s costly and complex to build out testing facilities, and getting the expertise to run them and combine the results is another hurdle.

So Halo Dx is parachuting in with tens of millions of dollars and purchasing the imaging and testing centers themselves (four so far), taking over their operations and combining them with other tests.

Assuming that much liability as a young company may seem like folly, but it helps that these imaging centers are strong businesses already — not derelict, half-paid-off MRI machines being operated at a loss.

“The imaging orders are coming in already; the centers are profitable. They’re coming on board because they see how technology is coming to disrupt them, and they want to help drive the change,” said Axe.

Prostate and breast cancers are the first target, but more and better data produce similarly improved diagnosis and treatment planning for more conditions, potentially (these are still being proven out), like Multiple Sclerosis, Parkinson’s and other neurodegenerative diseases.

With one company running multiple intake, imaging and testing facilities and integrating the results, it’s much more likely that providers will sign up. And Halo Dx is trying to bring some of the enterprise-grade software expertise to bear on the historically neglected field of medical data storage and communication.

Axe deferred to the company’s chief medical officer, Dr. John Feller, on the perils of that aspect of the field.

“Dr Feller describes this so well: ‘I have this state of the art MRI machine that can see inside your body, but because of the fragmented solutions that are out there, from intake to the storage centers, I feel like I’m living with pre-dot-com era tech and it’s crippling,’ ” Axe recalled. “If you want to look at records or recommend additional tests, software vendors don’t talk to each other or integrate. You have three providers that need to talk to each other and there’s a dozen systems between them.”

Axe compared the company’s approach here to One Medical’s — increasing efficiency and using that to make the relationship with the consumer lighter and easier, leading to more interactions.

In some ways it seems like a risky move, taking on nearly a hundred million in obligations and jumping into a hugely complex and highly regulated space. But the team is accomplished, the backers are notable, the potential for growth is there, and the success of the likes of One Medical have likely emboldened all involved.

Zola Global Investors led the round, and a who’s-who in medical and tech participated: Anne Wojcicki, Fred Moll, Stephen Pomeranz, Bob Reed, Robert Ciardi, Jim Pallotta and, believe it or not, Ronnie Lott of 49ers fame.

These and others involved make for a strong statement of confidence in both the model and the specific approach Halo Dx is taking to expanding and advancing care. Here’s hoping, however, that you won’t have to make use of their services.

Powered by WPeMatico

Colombian startup Elenas says it’s helping tens of thousands of women make money by selling products online. And today, it announced that it has raised $6 million in Series A funding.

That’s on top of the $2 million seed round that Elenas announced last fall. Founder and CEO Zach Oschin said that demand continues to grow, particularly with high unemployment levels (particularly among women), while consumers remain nervous about in-person shopping during the pandemic.

“We’ve been able to provide opportunities for tens of thousands of women to earn extra income,” Oschin said.

He suggested that Elenas is essentially a reinvention of the direct sales/catalog sales model that 11 million women participate in across the Latin America. The idea is that independent seller/entrepreneurs (often but not always women) can browse a catalog of products in categories like beauty, personal care and electronics, from more than 250 distributors and brands, all available at a discounted wholesale price. They decide what they want to sell, how much they want to mark the price up and then promote the products on social channels like WhatsApp and Facebook.

Besides its digital focus, Oschin said Elenas is better for the resellers because there’s less risk: “We don’t hold inventory for the company, which is very different than traditional direct sales, and our entrepreneurs don’t ever hold inventory.” Nor do those entrepreneurs need to get involved in things like payment collection or delivery, because Elenas and its distributor partners handle all of that.

“For us, the goal is to provide this backend operating system that gives women everything they need to run their store,” he added.

Elenas offers an automated on-boarding process for the sellers, but Oschin said that within the app, “we do a lot of work to train our sellers how to sell.”

Elenas CEO Zach Oschin. Image Credits: Elenas

The company (which participated in our Latin American Startup Battlefield in 2018) says it’s now paid out more than $7 million to its sellers. It doesn’t limit participation by gender, but Oschin estimated that more than 95% of sellers are women, with 80% of them under the age of 30 and about a third of them without any previous direct sales experience.

The new funding comes from Leo Capital, FJ Labs, Alpha4 Ventures and Meesho. Oschin said the company’s investors have a presence across six different continents, reflecting its international vision. Indeed, one of its next steps is expanding across Latin America, starting with Mexico and then Peru.

“Having seen the meteoric growth of social commerce in India and China we are excited to partner with Elenas as they have demonstrated the right product and operating model for the region,” said Leo Capital co-founder Shwetank Verma in a statement. “The Elenas team has built a solution that’s inclusive, impactful and is well positioned for exponential growth.”

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Aero, a startup backed by Garrett Camp’s startup studio Expa, has raised $20 million in Series A funding — right as CEO Uma Subramanian said demand for air travel is returning “with a vengeance.”

I last wrote about Aero in 2019, when it announced Subramanian’s appointment as CEO, along with the fact that it had raised a total of $16 million in funding. Subramanian told me that after the announcement, the startup (which had already run test flights between Mykonos and Ibiza) spent the next few months buying and retrofitting planes, with plans for a summer 2020 launch.

Obviously, the pandemic threw a wrench into those plans, but a smaller wrench than you might think. Subramanian said that as borders re-opened and travel resumed in a limited capacity, Aero began to offer flights.

“We had a great summer,” she said. “We sold a lot of seats, and we were gross margin positive in July and August.”

The startup describes its offering as “semi-private” air travel — you fly out of private terminals, on small and spacious planes (Subramanian said the company has taken vehicles with 37 seats and retrofitted them to hold only 16), with a personalized, first-class experience delivered by its concierge team. Aero currently offers a single route between Los Angeles and Aspen, with one-way tickets costing $1,250.

Subramanian was previously CEO of Airbus’ helicopter service Voom, and she said she approached the company “very skeptically,” since the conventional wisdom in the aviation industry is that the business is all about “putting as many people into a finite amount of square footage” as possible. But she claimed that early demand showed her that “the thesis is real.”

“There is a set of people who want this,” she said. “Air travel used to be aspirational, something people got dressed up for. We want to bring back the magical part of the travel experience.”

After all, if you’re the kind of “premium traveler” who might already spend “thousands of dollars a night” on a vacation in Amangiri, Utah, it seems a little silly to be “spending hours trying to find a low-cost flight out of Salt Lake City.”

Image Credits: Aero

Subramanian suggested that while demand for business travel may be slow to return (it sounds like she enjoyed the ability to fundraise without getting on a plane), the demand for leisure travel is already back, and will only grow as the pandemic ends. Plus, the steps that Aero took to create a luxury experience also meant that it’s well-suited for social distancing.

Speaking of fundraising, the Series A was led by Keyframe Capital, with Keyframe’s chief investment officer John Rapaport joining the Aero board. Cyrus Capital Partners and Expa also participated.

The new funding will allow Aero to grow its team and to add more flights, Subramanian said. Next up is a route between Los Angeles and Cabo San Lucas scheduled to launch in April, and she added that the company will be returning to Europe this year.

“It’s a horrendous time to be Lufthansa, but counterintuitively, it’s the best time to start something from scratch,” she said — in large part because it’s been incredibly affordable to buy planes and other assets.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico