funding

Auto Added by WPeMatico

Auto Added by WPeMatico

On the heels of Jumio announcing a $150 million injection this week to continue building out its AI-based ID verification and anti-money laundering platform, another startup in the space is levelling up. Feedzai, which provides banks, others in the financial sector, and any company managing payments online with AI tools to spot and fight fraud — its cornerstone service involves super-quick (3 millisecond) checks happening in the background while transactions are being made — has announced a Series D of $200 million. It said that the new financing is being made at a valuation of over $1 billion.

The round is being led by KKR, with Sapphire Ventures and strategic backer Citi Ventures — both past investors — also participating. Feedzai said it will be using the funds for further R&D and product development, to expand into more markets outside the U.S. — it was originally founded in Portugal but now is based out of San Mateo — and towards business development, specifically via partnerships to integrate and sell its tools.

One of those partners looks to be Citi itself:

“Citi is committed to advancing global payments anchored on transparency, efficiency, and control, and our partnership with Feedzai is allowing us to provide customers with technology that seamlessly balances agility and security,” said Manish Kohli, global head of Payments and Receivables, with Citi’s Treasury and Trade Solutions, in a statement.

This latest round comes nearly four years after Feedzai raised its Series C, a $50 million round led by an unnamed investor and with an undisclosed valuation. Sapphire also participated in that round. It has now raised some $182 million to date.

Feedzai’s funding is happening at a time when the need for fraud protection for those managing transactions online has reached a high watermark, leading to a rush of customers for companies in the field.

Feedzai says that its customers include four of the five largest banks in North America, 80% of the world’s Fortune 500 companies, 154 million individual and business taxpayers in the U.S., and has processed $9 billion in online transactions for two of the world’s most valuable athletic brands. In total its reach covers some 800 million customers of businesses that use its services.

In addition to Citibank, its customers include Fiserv, Santander, SoFi and Standard Chartered’s Mox.

While money laundering, fraud and other kinds of illicit financial activity were already problems then, in the interim, the problem has only compounded, not least because of how much activity has shifted online, accelerating especially in the last year of pandemic-driven lockdowns. That’s been exacerbated also by a general rise in cybercrime — of which financial fraud remains the biggest component and motivator.

Within that bigger trend, solutions based on artificial intelligence have really emerged as critical to the task of identifying and fighting those illicit activities. Not only is that because AI solutions are able to make calculations and take actions and simply process more than non-AI based tools, or humans for that matter, but they are then able to go head to head with much of the fraud taking place, which itself is being built out on AI-based platforms and requires more sophistication to identify and combat.

For banking customers, Feedzai’s approach has been disruptive in part because of how it has conceived of the problem: It has built solutions that can be used across different scenarios, making them more powerful since the AI system is subsequently “learning” from more data. This is in contrast to how many financial service providers had conceived and tackled the issue in the past.

“Until now banks have used solutions based on verticals,” Nuno Sebastiao, co-founder and CEO of Feedzai, said in the past to TechCrunch. “The fraud solution you have for an ATM wouldn’t be the same fraud solution you would use for online banking which wouldn’t be the same fraud solution you would have for a voice call center.” As these companies have refreshed their systems, many have taken a more agnostic approach like the kind Feedzai has built.

The scale of the issue is clear, and unfortunately also something many of us have experienced firsthand. Feedzai says its data indicates that the last quarter of 2020 shows consumers saw a 650% increase in account takeover scams, a 600% in impersonation scams and a 250% increase in online banking fraud attacks versus the first quarter of 2020. (Those periods are, essentially, before-pandemic and during-pandemic comparisons.)

“The past 12 months have accelerated the world’s dependency on electronic financial services – from online banking to mobile payments, and in turn have increased fraud and money laundering activity. Our services are in more demand than ever,” said Sebastiao in a statement today.

Indeed, yesterday, when I covered Jumio’s $150 million round, I said I wouldn’t consider its funding to be an outlier (even though Jumio made clear it was the largest funding to date in its space): the fast follow from Feedzai, with an even higher amount of financing, really does underscore the trend at the moment.

In addition to these two, one of Feedzai’s biggest competitors, Kount, was acquired by credit ratings giant Equifax earlier this year for $640 million to move deeper into the space. (And related to that field, in the area of identity management, which goes hand-in-hand with tools for laundering and fraud, Okta acquired Auth0 for $6.5 billion.)

Other big rounds for startups in the wider space have included ForgeRock ($96 million round), Onfido ($100 million), Payfone ($100 million), ComplyAdvantage ($50 million), Ripjar ($36.8 million) Truework ($30 million), Zeotap ($18 million) and Persona ($17.5 million).

KKR’s involvement in this round is notable as another example of a private equity firm getting in earlier with venture rounds with fast-scaling startups, similar to Great Hill’s investment in Jumio yesterday and a number of other examples. The firm says it’s making this investment out of its Next Generation Technology Growth Fund II, which is focused on making growth equity investment opportunities in the technology space.

“Feedzai offers a powerful solution to one of the biggest challenges we are facing today: financial crime in the digital age. Global commerce depends on future-proof technologies capable of dealing with a rapidly evolving threat landscape. At the same time, consumers rightfully demand a great customer experience, in addition to strong security layers when using banking or payments services,” said Stephen Shanley, managing director at KKR, in a statement

“We believe Feedzai’s platform uniquely meets these expectations and more, and we are looking forward to working with Nuno and the rest of the team to expand their offering even further,” added Spencer Chavez, principal at KKR.

Powered by WPeMatico

Y Combinator’s latest batch — W21 — features 350 startups from 41 nations. Fifty percent of the firms, the highest percentage to date, in the new batch are based outside of the United States.

India is the second-largest demographic represented in the new batch. The world’s second-largest internet market has delivered 43 startups in the new batch, another record figure in the history of the storied venture firm. (For comparison, the W20 batch had 25 Indian startups, up from 14 in S20, 12 each in S19 and W19 and one each in W16, S15 and W15.)

“YC going remote has helped make YC more attractive to companies at different stages and far away geographies. For companies in India, founders no longer have to spend three months away from their customers or teams. Covid has also taught us that building a program that is remote and more software based makes YC more accessible to founders around the globe,” the firm said in a statement to TechCrunch.

“When it comes to choosing founders in India, we accept them based on the same criteria we judge companies from anywhere else. Founders must be able to communicate their local context to investors. That is an important skill.”

Here’s a list of startups, in no particular order, from India that have made it to YC W21, with some context — wherever possible — on what they are attempting to build (several have elected to stay off the record).

QuestBook, from CreatorOS, is an app for professionals to teach in bite-sized courses using chat and a mobile-first experience. We wrote about CreatorOS last year.

Leap Club is attempting to build a Good Eggs for India. Leap Club users can order fresh and organic groceries sourced from local farms through the startup’s website or through WhatsApp. The startup says it delivers the item to customers within 12 hours of harvesting. Leap Club is already garnering over $14,000 in monthly revenue.

CashBook is building a cash account app for small businesses in India. There are over 60 million small businesses in the country, nearly all of which currently rely on traditional ways — pen and paper — for bookkeeping. The startup launched its app just six months ago and has already amassed 200,000 monthly active users. In the month of February, CashBook logged cash transactions of $511 million.

GimBooks is attempting to solve a similar problem as CashBook, though from a different angle. The startup says it offers industry-based invoicing and bookkeeping with integrated banking and payments. Its app has been downloaded more than 1.4 million times, amassed over 11,000 paying customers and clocked revenues of over $450,000.

BusinessOnBot is banking on the popularity of WhatsApp in India, where the Facebook-owned app has amassed over 450 million monthly active users. BusinessOnBot says it is building Shopify on WhatsApp for direct-to-consumer brands and small and medium-sized businesses, helping them acquire users and automate sales.

ZOKO is helping businesses do sales, marketing and customer support on WhatsApp.

Prescribe is a Shopify for hospitals. Its platform is aimed at helping doctor’s offices run their business online. Users can book appointments, chat with the doctor, pay and refer friends on WhatsApp.

Chatwoot is an open-source customer engagement suite alternative to Intercom and Zendesk. Over 1,000 companies are already using Chatwoot and it’s clocking $32,000 in ARR from six customers.

Weekday is helping companies hire engineers who are crowdsourced by their network of scouts. The startup says it has found a way to solve the biggest problem with referrals — that it doesn’t scale.

Fountain9 helps food brands and retailers reduce food wastage. According to some estimates, over $260 billion worth of food is wasted every year due to mismanaged inventory.

Dyte is attempting to build a Stripe for live video calls. The startup says a firm can integrate its branded, configurable and programmable video calling service within 10 minutes using the Dyte SDK.

YourQuote has built a writing platform, with over 100 million posts. It has over 250,000 daily active users. The startup clocked revenues of $200,000 last year and is profitable.

Fifthtry is building a GitHub for product documentation. The tool blocks code changes until documentation has been approved. It has piloted its tool with three companies, all of which have over 100 developers. The startup plans to launch its tool publicly next month.

Voosh is building an OYO for restaurants and dark kitchens in India, helping them improve their economics using tech.

Kodo is building a Brex for India, helping Indian startups and small businesses secure corporate credit cards. (Banks and other credit card companies are still not addressing this opportunity. The problem Brex solved in the U.S. is even acute in India, Deepti Sanghi, co-founder and chief executive of Kodo, said in the presentation.

Krab provides instant loans for trucking companies in India. India’s logistics market, despite being valued at $160 billion, remains one of the most inefficient sectors that continues to drag the economy. In recent years, a handful of startups have started to explore ways to work with trucking companies.

Bueno Finance says it wants to help the next billion users in India get access to financial services. It says it wants to solve for short-term cash needs of customers by using digital credit card over UPI. It was to build a Chime for India, and has amassed 70,000 customers.

Betterhalf is building a Match.com for 100 million Indians. It says it is generating $75,000 in monthly revenues, a figure that is growing 30% every month.

Pensil is helping teachers who use YouTube monetize their courses. “YouTube is the largest education platform in India — but it’s not built for teachers,” said Surender Singh, co-founder of Pensil, at the presentation on Tuesday. The startup has built tools to allow teachers to create content, facilitate discussions and collect payments.

AcadPal operates an eponymous app for India’s 10 million teachers to share homework with a tap. The startup is attempting to target a $1.4 billion market, which consists of over 400,000 private schools.

Pragmatic Leaders is attempting to build a platform to provide cost-effective alternative to an MBA. It is already clocking a monthly revenue of $112,000 and is cash-flow positive.

Splitsub is addressing a problem that tens of millions of users in India face — subscription fatigue. It says it has built a Pinduoduo for online subscriptions in India, allowing group buying and sharing of online subscriptions for services such as Netflix and Spotify.

Zingbus has built a platform for bus travel between Indian cities. (Several startups in India are helping users get cabs, three-wheelers autos and two-wheelers bikes. Buses have remained largely untapped.)

Tilt is building a docked bike-sharing platform for Indian campuses. The startup, which has generated about $20,000 in revenues this month so far, says it has been profitable for the past 18 months.

FanPlay is a platform for social media influencers, helping them monetize by playing mobile games with their fans and followers.

(Also read: Why Y Combinator Went 8,725 Miles Away From Mountain View To Find The Next Big Startup)

In India only a fraction of the nation’s 1.3 billion people currently have access to insurance and some analysts say that digital firms could prove crucial in bringing these services to the masses. According to rating agency ICRA, insurance products had reached less than 3% of the population as of 2017.

An average Indian makes about $2,100 a year, according to the World Bank. ICRA estimated that of those Indians who had purchased an insurance product, they were spending less than $50 on it in 2017.

Three startups in the current batch are planning to disrupt this market, which is largely commanded by state and bank-backed insurers.

GroMo is an app for independent agents to sell insurance in India. Most insurance policies in India are sold by agents. The startup says it is already generating monthly revenues of over $200,000.

Bimaplan is attempting to replace the agents with an app and reach users by a referral network. The app launched last month and has already sold 700 policies this month.

BimaPe helps users better understand their policies, and make informed decisions about whether those policies are right for them. The startup, leveraging New Delhi’s new regulations, is using a government issued ID card to fetch insurance policies.

Codingal is an online, after-school program for K-12 students in India to learn computer science. There are roughly 270 million K-12 students in the country.

Unschool provides professional education for college students in India. The founders say, “As former leaders in youth-run organisations with 3,000 members and edtech startups in India, we saw how colleges are not preparing students for the real world.”

Flux Auto builds self-driving kits for trucks.

SigNoz is an open-source alternative to DataDog, a $30 billion company, helping developers find and solve issues in their software deployed on cloud. The startup says recent laws such as GDPR and CPRA have helped drive adoption of SigNoz.

Pibit.ai are APIs to turn unstructured documents into structured data.

Invoid creates identity workflows in India. It’s tapping into a huge market opportunity: About 11 billion know-your-customers authentication is conduced by firms in India each year.

Redcliffe Lifesciences performs genetic testing and IVF treatments across India. Its revenue in March has topped $600,000.

Veera Health is an online clinic that treats Polycystic Ovary Syndrome (PCOS), a lifelong condition that affects 10-20% women in India. The startup says it launched 12 weeks ago, and 85% members have reported feeling “in control” of their PCOS after 1 month.

Snazzy is SmileDirectClub for India. The startup says it sells clear aligners that are 70% cheaper than those sold by dentists.

BeWell Digital is building the operating system for India’s 1.5 million hospitals, labs, clinics and pharmacies by starting with insurance regulatory compliance.

Triomics is operating a SaaS platform for end-to-end automation of clinical trials.

Powered by WPeMatico

ActionIQ, which helps companies use their customer data to deliver personalized experiences, is announcing that it has extended its Series C funding, bringing the round to a total size of $100 million.

That number includes the $32 million that ActionIQ announced in January of last year. Founder and CEO Tasso Argyros said the company is framing this as an extension rather than a separate round because it comes from existing investors — including March Capital — and because ActionIQ still has most of that $32 million in the bank.

Argyros told me that there were two connected reasons to raise additional money now. For one thing, ActionIQ has seen 100% year-over-year revenue growth, allowing it to increase its valuation by more than 250%. (The company isn’t disclosing the actual valuation.) That growth has also meant that ActionIQ is getting “a lot more ambitious” in its plans for product development and customer growth.

“We raised more money because we can, and because we need to,” Argyros said.

The company continues to develop the core platform, for example by introducing more support for real-time data and analysis. But Argyros suggested that the biggest change has been in the broader market for customer data platforms, with companies like Morgan Stanley, The Hartford, Albertsons, JCPenney and GoPro signing on with ActionIQ in the past year.

Some of these enterprises, he said, “normally would not work with a cutting-edge technology company like us, but because of the pandemic, they’re willing to take some risk and really invest in their customer base and their customer experience.”

Argyros also argued that as regulators and large platforms restrict the ways that businesses can buy and sell third-party data, products like ActionIQ, focusing on the first-party data that companies collect for their own use, will become increasingly important. And he said that ActionIQ’s growth comes as the big marketing clouds have “failed” — either announcing products that have yet to launch or launching products that don’t match ActionIQ’s capabilities.

Companies that were already using ActionIQ include The New York Times. In fact, the funding announcement includes a statement from The Times’ senior vices president of data and insights Shane Murray declaring that the newspaper is using ActionIQ to deliver “hundreds of billions of personalized customer experiences” across “mail, in-app, site, and paid media.”

ActionIQ has now raised around $145 million total, according to Crunchbase.

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20 percent off tickets right here.

Powered by WPeMatico

For patients and healthcare professionals to properly track and manage illnesses, especially chronic ones, healthcare needs to be decentralized. It also needs to be more convenient, with a patient’s health information able to follow them wherever they go.

Redbird, a Ghanaian health tech startup that allows easy access to convenient testing and ensures that doctors and patients can view the details of those test results at any time, announced today that it has raised a $1.5 million seed investment.

Investors who participated in the round include Johnson & Johnson Foundation, Newton Partners (via the Imperial Venture Fund) and Founders Factory Africa. This brings the company’s total amount raised to date to $2.5 million.

The health tech company was launched in 2018 by Patrick Beattie, Andrew Quao and Edward Grandstaff. As a founding scientist at a medical diagnostics startup in Boston, Beattie’s job was to develop new rapid diagnostic tests. During his time in Accra in 2016, he met Quao, a trained pharmacist in Ghana at a hackathon whereupon talking found out that their interests in medical testing overlapped.

Beattie told TechCrunch that while he saw many exciting new tests in development in the U.S., he didn’t see the same in Ghana. Quao, who is familiar with how Ghanaians use pharmacies as their primary healthcare point, felt perturbed that these pharmacies weren’t doing more than transactional purchases.

They both settled that pharmacies in Ghana needed to imbibe the world of medical testing. Although both didn’t have a tech background, they realized technology was necessary to execute this. So, they enlisted the help of Grandstaff to be CTO of Redbird while Beattie and Quao became CEO and COO, respectively.

L-R: Patrick Beattie (CEO), Andrew Quao (COO) and Edward Grandstaff (CTO). Imge Credits: Redbird

Redbird enables pharmacies in Ghana to add to their pharmacy services rapid diagnostic testing for 10 different health conditions. These tests include anaemia, blood sugar, blood pressure, BMI, cholesterol, Hepatitis B, malaria, typhoid, prostate cancer screening and pregnancy.

Also, Redbird provides pharmacies with the necessary equipment, supplies and software to make this possible. The software — Redbird Health Monitoring — is networked across all partner pharmacies and enables patients to build medical testing records after going through five-minute medical tests offered through these pharmacies.

Rather than employing a SaaS model that Beattie says is not well appreciated by its customers, Redbird’s revenue model is based on the supply of disposable test strips.

“Pharmacies who partner with Redbird gain access to the software and all the ways Redbird supports our partners for free as long as they purchase the consumables through us. This aligns our revenue with their success, which is aligned with patient usage,” said the CEO.

This model is being used with more than 360 pharmacies in Ghana, mainly in Accra and Kumasi. It was half this number in 2019, which Redbird has since doubled despite the pandemic. These pharmacies have recorded over 125,000 tests in the past three years from more than 35,000 patients registered on the platform.

Redbird will use the seed investment to grow its operations within Ghana and expand to new markets that remain undisclosed.

In 2018, Redbird participated in the Alchemist Accelerator just a few months before launch. It was the second African startup after fellow Ghanaian health tech startup mPharma to take part in the six-month program. The company also got into Founders Factory Africa last April.

According to Beattie, most of the disease burden Africans might experience in the future will be chronic diseases. For instance, diabetes is projected to grow by 156% over the next 25 years. This is why he sees decentralized, digitized healthcare as the next leapfrog opportunity for sub-Saharan Africa.

“Chronic disease is exploding and with it, patients require much more frequent interaction with the healthcare system. The burden of chronic disease will make a health system that is highly centralized impossible,” he said. “Like previous leapfrog events, this momentum is happening all over the world, not just in Africa. Still, the state of the current infrastructure means that healthcare systems here will be forced to innovate and adapt before health systems elsewhere are forced to, and therein lies the opportunity,” he said.

But while the promise of technology and data is exciting, it’s important to realize that health tech only provides value if it matches patient behaviors and preferences. It doesn’t really matter what amazing improvements you can realize with data if you can’t build the data asset and offer a service that patients actually value.

Beattie knows this all too well and says Redbird respects these preferences. For him, the next course of action will be to play a larger role in the world’s developing ecosystem where healthcare systems build decentralised networks and move closer to the average patient.

This decentralised approach is what attracted U.S. and South African early-stage VC firm Newtown Partners to cut a check. Speaking on behalf of the firm, Llew Claasen, the managing partner, had this to say.

“We’re excited about Redbird’s decentralised business model that enables rapid diagnostic testing at the point of primary care in local community pharmacies. Redbird’s digital health record platform has the potential to drive significant value to the broader healthcare value chain and is a vital step toward improving healthcare outcomes in Africa. We look forward to supporting the team as they prove out their business model and scale across the African continent.”

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20% off tickets right here.

Powered by WPeMatico

It’s clear that automated workflow tooling has become increasingly important for companies. Perhaps that explains why Camunda, a Berlin startup that makes open-source process automation software, announced an €82 million Series B today. That translates into approximately $98 million U.S.

Insight Partners led the round with help from A round investor Highland Europe. When combined with the $28 million A investment from December 2018, it brings the total raised to approximately $126 million.

What’s attracting this level of investment says Jakob Freund, co-founder and CEO at Camunda, is the company is solving a problem that goes beyond pure automation. “There’s a bigger thing going on which you could call end-to-end automation or end-to-end orchestration of endpoints, which can be RPA bots, for example, but also micro services and manual work [by humans],” he said.

He added, “Camunda has become this endpoint agnostic orchestration layer that sits on top of everything else.” That means that it provides the ability to orchestrate how the automation pieces work in conjunction with one another to create this full workflow across a company.

The company has 270 employees and approximately 400 customers at this point, including Goldman Sachs, Lufthansa, Universal Music Group and Orange. Matt Gatto, managing director at Insight Partners, sees a tremendous market opportunity for the company and that’s why his firm came in with such a big investment.

“Camunda’s success demonstrates how an open, standards-based, developer-friendly platform for end-to-end process automation can increase business agility and improve customer experiences, helping organizations truly transform to a digital enterprise,” Gatto said in a statement.

Camunda is not your typical startup. Its history actually dates back to 2008 as a business process management (BPM) consulting firm. It began the Camunda open-source project in 2013, and that was the start of pivoting to become an open-source software company with a commercial component built on top of that.

It took the funding at the end of 2018 because the market was beginning to catch up with the idea, and they wanted to build on that. It’s going so well that the company reports it’s cash-flow positive, and will use the additional funding to continue accelerating the business.

Powered by WPeMatico

Ideally, it is expected of every business to reach its customers effectively. However, that’s not the case, as limiting factors that hinder proper digital communication come into play at different growth stages. Termii, a Nigerian communications platform-as-a-service startup that solves this problem for African businesses, announced today that it has closed a $1.4 million seed round.

The round was co-led by African early-stage VC firm Future Africa and Japanese but Africa-focused VC Kepple Africa Ventures. Other investors include Acuity Ventures, Aidi Ventures, Assembly Capital, Kairos Angels, Nama Ventures, RallyCap Ventures and Remapped Ventures.

Angel investors like Ham Serunjogi, co-founder and CEO of Chipper Cash; Josh Jones, former co-founder and CTO, Dreamhost; and Tayo Oviosu, co-founder and CEO of Paga also participated.

Gbolade Emmanuel and Ayomide Awe launched Termii after Emmanuel’s experience as a digital marketer helped him recognize the need for businesses to have exceptional communication channels. The CEO consulted for these companies and leveraged emails to retain customers, but as he found out that this process was lethargic, he sought other channels as a replacement.

“That got me to start thinking about multichannel messaging. What it meant was that we needed to find how to allow companies to use WhatsApp, voice, SMS effectively,” he said to TechCrunch. “And we had to make the process simple because in the African market, you can’t do complex stuff. You have to be as simple as possible.”

In 2017, the company officially launched and subsequently secured investment from Lagos-based VC Microtraction. Emmanuel says the company found product-market fit two years later after collating enough data from companies in different industries to understand what they really wanted.

Termii found out that in addition to assisting businesses to retain customers, there was a clear need to verify, authenticate and engage them.

“Many of these businesses we started engaging said they required tools to effectively communicate and verify customers because they were losing money at those points. For us, we saw it was a bigger problem,” Emmanuel added.

After making some tweaks, the team began to see an increase in customer numbers, especially amongst fintech startups. Positioning itself in the fast-moving space, Termii created an API-based communication infrastructure that caters to more than 500 fintech startups across the continent. That’s not all. More than 1,000 businesses and developers are also using Termii’s API.

Some of these businesses include uLesson, Yassir, Helium Health, PiggyVest, Bankly, Paga and TeamApt.

Playing in a $3.6 billion B2C communications market estimated to grow 6% annually, Termii runs a B2B2C model. But how does it make money? While a subscription-based model would’ve made sense, the two years spent by the company trying to find PMF made them think otherwise.

So the company leverages a virtual wallet system tied to a bank account and customers can make payments to the platform using mobile money, bank transfer and credit cards. The startup charges these wallets on a per-message basis. It also does the same on every successful customer verification made toward customers’ contacts.

The Termii team. Image Credits: Termii

In early 2020, Termii started seeing immense progress and this coincided with their acceptance into Y Combinator. The growth continued throughout the year, growing its messaging transactions by 1,000% and experiencing a 400% increase in its ARR.

Spilling into this year, Emmanuel says the company’s revenue is growing 60% month-on-month as a result of the surge in online financial transactions, which to date makes up for 68% of the company’s total messaging transactions.

The seed investment that is coming a year after Termii graduated from YC will be used for expansion and launch more messaging offerings across Africa.

Emmanuel says the company has its sights set on North Africa with a physical presence in Algeria for the expansion. The reason lies behind the fact that in this quarter, Nigeria has accounted for 76% of the company’s messaging transactions, while Algeria currently accounts for 15%.

With this new fundraising, the company plans to tap into the wealth of experience from some of its new investors like Oviosu and Serunjogi, who have also taken local companies into expansion phases.

Termii’s round is also noteworthy because it strays away from the usual fintech, mobility, agritech and cleantech sectors that investors typically notice. In fact, there are only a handful of venture-backed communications platform-as-a-service companies on the continent. A notable example is Kenya’s Africa Talking. It might be a stretch to say we might see more funding activity from this segment, but one thing is apparent — investors are willing to place bets on less popular sectors.

Another highlight of Termii’s investment is that while foreign investors continue to dominate rounds in African tech startups, local and Africa-focused firms are beginning to step up by leading some, which is a good sign for the bubbling ecosystem.

This round is also a big step for Future Africa. According to publicly available information, the firm is leading a million-dollar round for the first time since officially launching last year. This achievement is a continuation of its work over the past three quarters, having invested in more than 10 African startups in the last three quarters and 30 startups in general.

Kepple Africa Ventures, the co-lead, is also an active investor and can be argued to be the most early-stage VC firm on the continent — in terms of the number of deals made. So far, the firm has invested in 79 companies across 11 countries.

Speaking on the investment for Kepple Africa, Satoshi Shinada, a partner at the firm, said, “Fragmented and unstable communication channels are one of the biggest challenges for the digitization of businesses in Africa. Emmanuel has proven that with his visionary goals and solid implementation of iterations on the ground, his team is unparalleled to build an innovative solution in this space.”

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20% off tickets right here.

Powered by WPeMatico

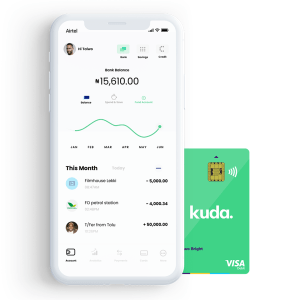

Challenger banks continue to make significant advances in attracting customers away from the big incumbents by providing more modern, user-friendly tools to manage their money. Today, one of the trailblazers in this area, Kuda Technologies, is announcing funding to continue building out its specific ambition: to provide a modern banking service for Africans and the African diaspora, or as co-founder and CEO Babs Ogundeyi describes them, “every African on the planet, wherever you are in the world.”

The company, which currently offers mobile-first banking services in Nigeria, has picked up $25 million in a Series A being led by Valar Ventures, the firm co-founded and backed by Peter Thiel, with Target Global and other unnamed investors participating. This is the first time that Valar — which has invested in a number of fintech startups, including N26, TransferWise, Stash and, just in the last week, BlockFi and BitPanda — has backed an African startup.

Kuda currently provides services for consumers to save and spend money, and it has recently introduced overdrafts (essentially revolving credit for individuals). Ogundeyi said in an interview that the plan is to use these new funds to continue expanding its credit offerings, to build out services for businesses, to add in more integrations and to move into more markets.

The funding is coming on the heels of very strong growth for Kuda, which is co-headquartered in London and Lagos.

When we last wrote about the startup, four months ago, it had just closed a seed round of $10 million led by Target Global. That was, at the time — and I think still is — the largest-ever seed round raised by a startup out of Africa, and thus as much of a milestone for the tech industry there as it was for Kuda itself.

At the time of the seed round, Kuda had registered 300,000 customers: now, that figure has more than doubled to 650,000, and tellingly, that base is spending more money through the Kuda app.

“In November we were doing about $500 million in transactions per month,” Ogundeyi said, for services like bill payments, card transactions and phone top-ups. “We closed February at $2.2 billion.”

Image Credits: Kuda

Kuda, as we described in our profile of the company when covering its seed round, is following in the footsteps of a number of other so-called “neobanks”, building a suite of banking services with a more accessible user interface and a more modern approach: you interact with the bank using a mobile app, and in addition to basic banking services, it provides tools to help people manage their money more intelligently.

But Kuda is also different from many of these, specifically because it taps into some financial practices that are unique to its market.

As Ogundeyi describes it, most people who are employed by companies will have “salary accounts” at banks, where companies pay in a person’s wages on a regular basis. These will typically be at incumbent banks, but they do not offer the same ranges of services to customers. No mobile apps, no facilities to buy mobile top-ups or make other kinds of bill payments, no AI-based calculators to figure out your monthly spend and provide suggestions on how to manage your budget, and so on.

That has opened a gap in the market for others to provide those services in their place. Kuda’s deposits, Ogundeyi said, typically start as basic transfers that people make from those “salary accounts” elsewhere. These start out small, maybe 20% of a person’s wages, but as those users find themselves using Kuda’s payment and other tools more, they are increasing how much they transfer in each payment period.

“As the trust increases you’re naturally more comfortable having money with Kuda,” he said. The next stage from that will be people depositing money directly with Kuda. A small minority already do this, he added, although the startup “has a bit more work to do” to get more companies integrated into its platform. (This is one of the areas that will be developed with this latest round of funding.)

In turn, having more money in Kuda accounts is likely to spur another wave of services being turned on at the startup, such as loans with more competitive interest rates, because they will not just be based on how much money people have but also their spending histories on the platform. “We can offer loans to salaried customers instantly as long as their salary is with Kuda,” he said.

Much of this is being enabled because of how Kuda is built. A lot of challenger banks have tapped into a world of finance and banking APIs built by another wave of fintech startups, partnering with other banks to provide backend deposit and other services: their value-add is in building efficient customer service and tools to help people manage and borrow money in smarter ways.

Kuda, on the other hand, has its own microfinance banking license from the central bank of Nigeria. This means that on top of building those same money management services, Kuda can also issue debit cards (in partnership with Visa and Mastercard), manage payments and transfers, and build all of the services in the stack itself, including those salary account services and loans. (Kuda does have partnerships with incumbent banks, specifically Zenith Bank, Guaranteed Trust and Access Bank, for people to come in for physical deposits and withdrawals when needed.)

While the service is still only live in Nigeria, the “vision is still to serve all Africans in Africa as well as outside of it,” Ogundeyi said.

The first step of that will likely be Nigerians outside of Nigeria — most likely in the U.K., where Kuda already has a headquarters, and where it has a ready market: London alone has been estimated to be home to upwards of 1 million Nigerian immigrants and people of Nigerian descent (the number of U.K. residents actually born in Nigeria is considerably smaller, more like 200,000: that is the diaspora at work).

He added that the startup is also at work on preparing for the next countries on the continent to expand its service, another area where this funding will go: “It will let us fast-track teams, on-the-ground operational teams,” he said.

The bigger picture is that the market for financial services targeting Africans has been on a significant upswing and so we will be seeing a lot more activity coming out of the region, not just from home-grown startups, but also out of other tech companies increasingly doing more business in that part of the world.

Cases in point: In addition to Stripe acquiring Nigerian payments company Paystack last year, just earlier this week, PayPal announced a deal with Flutterwave to bring PayPal services to more merchants in the region — specifically so that PayPal customers can pay merchants in the region using PayPal rails. Square’s CEO, Jack Dorsey, meanwhile, never did make his intended move to the continent — COVID-19 has derailed many plans, as we all know — but it shows that the company is trying not to overlook opportunities there, either.

PayPal, to be clear, has been active in Nigeria since 2014, but partnering with a significant player in the region represents an important step for it: Flutterwave itself earlier this month raised $170 million and became Africa’s latest unicorn, in what is still a pretty small list.

The fact that there is so much more to be done with payments and more financial services leaves the door open wide for Kuda to move in a number of different directions if it chooses. Having customers in two countries, especially with one foot in the developed market and another in an emerging market, for example, gives the company an interesting window into the world of remittances.

Money transfer has been one of the very biggest, and most important financial services for African diasporas — alongside those from many other emerging markets.

Even in cases where people are “unbanked” and have no other financial footprints, they have been turning to remittance services to send money home to their families from abroad. Kuda, with its integrations into people’s salaries, could easily become an efficient, one-stop-shop conduit for that activity too. (That’s one reason, likely, that remittance startup, Remitly, has also moved into starting to offer accounts to its users in originating countries.)

All of this to say that Valar’s making a new kind of bet here, but one laden with possibilities and a differentiated approach compared to the rest of its investment activities.

“Nigeria is at a tipping point in the adoption of digital banking,” noted Andrew McCormack, a general partner and co-founder at Valar, who led its investment here. “With the rapidly growing, youthful population who are open to new financial alternatives, Kuda is well-positioned to benefit and will transform the landscape of African banking. We are excited to lead their Series A and continue on the journey alongside Kuda.”

Powered by WPeMatico

SecurityScorecard has been helping companies understand the security risk of its vendors since 2014 by providing each one with a letter grade based on a number of dimensions. Today, the company announced a $180 million Series E.

The round includes new investors Silver Lake Waterman, T. Rowe Price, Kayne Anderson Rudnick and Fitch Venture, along with existing investors Evolution Equity Partners, Accomplice, Riverwood Capital, Intel Capital, NGP Capital, AXA Venture Partners, GV (Google Ventures) and Boldstart Ventures. The company reports it has now raised $290 million.

Co-founder and CEO Aleksandr Yampolskiy says the company’s mission has not changed since it launched. “The idea that we started the company was a realization that when I was CISO and CTO I had no metrics at my disposal. I invested in all kinds of solutions where I was completely in the dark about how I’m doing compared to the industry and how my vendors and suppliers were doing compared to me,” Yampolskiy told me.

He and his co-founder COO Sam Kassoumeh likened this to a banker looking at a mortgage application and having no credit score to check. The company changed that by starting a system of scoring the security posture of different companies and giving them a letter grade of A-F just like at school.

Today, it has ratings on more than 2 million companies worldwide, giving companies a way to understand how secure their vendors are. Yampolskiy says that his company’s solution can rate a new company not in the data set in just five minutes. Every company can see its own scorecard for free along with advice on how to improve that score.

He notes that the disastrous SolarWinds hack was entirely predictable based on SecurityScorecard’s rating system. “SolarWinds’ score has been lagging below the industry average for quite a long time, so we weren’t really particularly surprised about them,” he said.

The industry average is around 85 or a solid B in the letter grade system, whereas SolarWinds was sitting at 70 or a C for quite some time, indicating its security posture was suspect, he reports.

While Yampolskiy didn’t want to discuss valuation or revenue or even growth numbers, he did say the company has 17,000 customers worldwide, including 7 of the 10 top pharmaceutical companies in the world.

The company has reached a point where this could be the last private fundraise it does before going public, but Yampolskiy kept his cards close on timing, saying it could happen some time in the next couple of years.

Powered by WPeMatico

Cymbio, a Tel Aviv-based startup focused on what it calls “brand-to-retailer connectivity,” announced today that it has raised $7 million in Series A funding.

CEO Roy Avidor, who founded the company with Mor Lavi and Gilad Zirkel, told me that the platform is designed to help brands sell their products on any e-commerce marketplace that they want. Whereas adding a new market might normally require a cost-benefit analysis (“How much money will it cost me to set up this retailer? How much sales will this retailer drive? Will the margins justify this?”), Avidor said Cymbio turns the process into a “no brainer” with immediate integration.

That’s because the platform automatically handles all the differences between marketplaces, whether that involves the taxonomy of the product pages or the background color of the product images, as well as inventory syncing, tracking and returns. It allows the brand to fulfill orders using drop shipping — so the brand stores and ships the products, rather than the marketplace, getting access to customer names and addresses in the process.

Avidor said that increasingly, brands realize “they need to be where the customers are.” That doesn’t mean they’ll sell on every single marketplace, but with Cymbio, “brand perception and visibility” are the main limitations, rather than time and money.

Cymbio founders. Image Credits: Cymbio

In 2020, the company says that its customer count increased 12x and now includes Steve Madden, Marchesa, Camper and Micro Kickboard. The company also says that it reduces the time to launch on a new marketplace by 91%, while increasing digital revenue for the average customer by 65%.

The company says the Series A will allow it to expand its sales and marketing team while continuing to develop the product — on the product front, Avidor said the team is working on “a no-code integration where anyone can connect to anything quickly, no developers needed.”

The new funding was led by Vertex Ventures, with participation from Udian Investments, Payoneer founder Yuval Tal and Sapiens co-founder Ron Zuckerman.

“We believe deeply that Cymbio’s technology will fundamentally change the game for brands that sell online, making long, cumbersome integrations a thing of the past,” said Emanuel Timor, general partner at Vertex Ventures Israel, in a statement.

Powered by WPeMatico

One of the biggest gripes about investing apps is that they are not acting responsibly by not educating users properly and allegedly letting them fend for themselves. This can result in people losing a lot of money, as evidenced by the number of lawsuits against Robinhood.

Today, an eight-year-old company that has been focused on nothing but financial education is now offering trading and banking services in the U.S..

Over the years, London-based Invstr has built out an educational platform with features such as an investing academy. It’s created a Fantasy Finance game, which gives users the ability to manage a virtual $1 million portfolio so they can learn more about the markets before risking their own money for real. Via social gamification, Invstr has set out to make the educational process fun.

It has also built a community around users so they can learn from each other (something another Robinhood competitor Gatsby is also doing).

Over 1 million users have downloaded the platform globally.

Invstr, according to CEO and founder Kerim Derhalli, is taking a different approach from competitors by offering education and learning tools upfront. And in addition to giving users the ability to make commission-free stock trades, it’s also giving them a way to digitally bank and invest using their Invstr+ accounts “without ever needing to move money from one place to another.”

Invstr takes it all a step further for subscribers who have access to an “Invstr Score,” performance stats and behavioral analytics among other things.

Derhalli said moving in this direction with the company was part of his business plan from day one.

“I think the most powerful trend in the U.S. is self-directed investing,” Derhalli told TechCrunch. “Younger generations have grown up in an app world and they expect to be autonomous and do things for themselves. Many distrust the banking system, and they don’t want to follow in their parents’ footsteps when it comes to banking and finance. We think this is a massive opportunity.”

In the unveiling of its new offerings, Invstr also announced Wednesday that it has closed on a $20 million Series A in the form of a convertible offering. This builds upon $20 million it previously raised across two seed rounds from investors such as Ventura Capital, Finberg, European angel investor Jari Ovaskainen and Rick Haythornthwaite, former global chairman of Mastercard.

Derhalli said he felt compelled to found Invstr after seeing firsthand how a lack of knowledge and confidence can prevent individuals from starting to invest. He worked for three decades in senior leadership roles at Deutsche Bank, Lehman Brothers, Merrill Lynch and JPMorgan before founding Invstr “so that anyone, anywhere could learn how to invest.”

Invstr is offering its new investing services in partnership with Apex Clearing, which formerly provided execution and settlement services to Robinhood. Its digital banking services are being offered through a partnership with Vast Bank. To address the security piece, Invstr said its user data is also protected by technology from Okta.

The company, which also has offices in New York and Istanbul, plans to use the new capital to launch new brokerage and analytics tools and a portfolio builder.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20% off tickets right here.

Powered by WPeMatico