funding

Auto Added by WPeMatico

Auto Added by WPeMatico

As more companies become ever more reliant on digital infrastructure for everyday work, the more they become major targets for malicious hackers — both trends accelerated by the pandemic — and that is leading to an ever-greater need for IT and security departments to find ways of protecting data should it become compromised. Today, one of the companies that has emerged as a strong player in data backup and recovery is announcing its first major round of funding.

HYCU, which provides multi-cloud backup and recovery services for mid-market and enterprise customers, has raised $87.5 million, a Series A that it the Boston-based startup will be using to invest in building out its platform further, to bring its services into more markets, and to hire 100 more people.

HYCU’s premise and ambition, CEO and founder Simon Taylor said in an interview, is to provide backup and storage services that are as simple to use “as backing up in iCloud for consumers.”

“If you look at primary storage, it’s become very SaaS-ifed, with no professional services required,” he continued. “But backup has stayed very legacy. It’s still mostly focused on one specific environment and can’t perform well when multi-cloud is being used.”

And HYCU’s name fits with that ethos. It is pronounced “haiku”, which Taylor told me refers not just to that Japanese poetic form that looks simple but hides a lot of meaning, but also “hybrid cloud uptime.”

The company is probably known best for its integration with Nutanix, but has over time expanded to serve enterprises building and operating IT and apps over VMware, Google Cloud, Azure and AWS. The company also has built a tool to help migrate data for enterprises, HYCU Protégé, which will also be expanded.

The funding is being led by Bain Capital Ventures, with participation also from Acrew Capital (which was also in the news last week as an investor in the $118 million round for Pie Insurance). The valuation is not being disclosed.

This is the first major outside funding that the company has announced since being founded in 2018, but in that time it has grown into a sizeable competitor against others like Rubrik, Veeam, Veritas and CommVault. The Rubrik comparison is interesting, given that it is also backed by Bain (which led a $261 million round in Rubrik in 2019). HYCU now has more than 2,000 customers in 75 countries. Taylor says that not taking funding while growing into what it has become meant that it was “listening and closer to the needs of our customers,” rather than spending more time paying attention to what investors says.

Now that it’s reached a certain scale, though, things appear to be shifting and there will probably be more money down the line. “This is just round one for us,” Taylor said.

He added that this funding came in the wake of a lot of inbound interest that included not just the usual range of VCs and private equity firms that are getting more involved in VC, but also, it turns out, SPACs, which as they grow in number, seem to be exploring what kinds and stages of companies they tap with their quick finance-and-go-public model.

And although HYCU hadn’t been proactively pitching investors for funding, it would have been on their radars. In fact, Bain is a major backer of Nutanix, putting some $750 million into the company last August. There is some strategic sense in supporting businesses that figure strongly in the infrastructure of your other portfolio companies.

There is another important reason for HYCU raising capital to expand beyond what its balance sheet could provide to fuel growth: HYCU’s would-be competition is itself going through a moment of investment and expansion. For example, Veeam, which was acquired by Insight last January for $5 billion, then proceeded to acquire Kasten to move into serving enterprises that used Kubernetes-native workloads across on-premises and cloud environments. And Rubrik last year acquired Igneous to bring management of unstructured data into its purview. And it’s not a given that just because this is a sector seeing a lot of demand, that it’s all smooth sailing. Igneous was on the rocks at the time of its deal, and Rubrik itself had a data leak in 2019, highlighting that even those who are expert in protecting data can run up against problems.

Taylor notes that ransomware indeed remains a very persistent problem for its customers — reflecting what others in the security world have observed — and its approach for now is to remain focused on how it delivers services in an agent-less environment. “We integrate into the platform,” he said. “That is incredibly important. It means that you can be up and running immediately, with no need for professional services to do the integrating, and we also make it a lot harder for criminals because of this.”

Longer term, it will keep its focus on backup and recovery with no immediate plans to move into adjacent areas though such as more security services or other tools. “We’re not trying to be a Veritas and own the entire business end-to-end,” Taylor said. “The goal is to make sure the IT department has visibility and the cloud journey is protected.”

Enrique Salem, a partner at Bain Capital Ventures and the former CEO of Symantec, is joining HYCU’s board with this round and sees the opportunity in the market for a product like HYCU’s.

“We are in the early days of a multi-decade shift to the public cloud, but existing on-premises backup vendors are poorly equipped to enable this transition, creating tremendous opportunity for a new category of cloud-native backup providers,” he said in a statement. “As one of the early players in multi-cloud backup as a service bringing true SaaS to both on-premises and cloud-native environments, HYCU is a clear leader in a space that will continue to create large multi-billion dollar companies.”

Stefan Cohen, a principal at Bain Capital Ventures, will also be joining the board.

Powered by WPeMatico

One of the biggest pain points for startups and small businesses is keeping up with back office tasks such as bookkeeping and managing taxes.

QuickBooks, it seems, just doesn’t always cut it.

Three-time co-founders Waseem Daher, Jeff Arnold, and Jessica McKellar formed Pilot with the mission of affordably providing back office services to startups and SMBs. With over 1,000 customers, it has gained serious traction over the years. And Pilot has now also received validation from some big-name investors. On Friday, the company announced a $100 million Series C that doubles the company’s valuation to $1.2 billion.

Bezos Expeditions — Amazon founder Jeff Bezos’ personal investment fund — and Whale Rock Capital (a $10 billion hedge fund) co-led the round, which also included participation from Sequoia Capital, Index Ventures, Authentic Ventures and others.

Stripe and Index Ventures co-led Pilot’s $40 million Series B in April 2019. The latest financing brings the company’s total funding raised to over $158 million since its 2017 inception.

The founding team certainly has an impressive track record, having founded and sold two previous companies: Ksplice (to Oracle) and Zupli (to Dropbox).

Pilot’s pitch is about more than just software. The company combines its software with accountants to do things such as provide “CFO Services” to SMBs without a full-stack finance team. It also provides monthly variance analysis for all its bookkeeping customers, essentially serving as a controller for those companies, so they can make better budgeting and spending decisions.

It also helps companies access small business tax credits they may not have otherwise known about.

Last year, Pilot completed more than $3 billion in bookkeeping transactions for its customers, which range from pre-revenue startups to larger companies with more than $30M of revenue a year. Customers include Bolt, r2c and Pathrise, among others.

Pilot has also inked a number of co-marketing partnerships with companies such as American Express, Bill.com, Brex, Carta, Gusto, Rippling, Stripe, SVB, and Techstars.

Ironically, Pilot says it aspires to the “AWS of SMB backoffice.” (In fact, co-founder Waseem Daher started his career as an intern at Amazon). Put simply, Pilot wants to take care of all those back office tasks so companies can focus more on growth and winning business.

Pilot strives to offer an “exceptional customer experience,” which is reflected in the fact that over 80% of the company’s business is driven by customer referrals and organic interest, according to Daher.

Whale Rock Partner Kristov Paulus said that white-glove customer service experience and Pilot’s “carefully-engineered” software make a powerful combination.

“We look forward to supporting Pilot in their vision to make back office services as easy-to-use, scalable, and ubiquitous as AWS has with the cloud,” he said.

Pilot’s model reminds me a lot of that of ScaleFactor’s, an Austin-based startup that raised $100 million in a year before it crashed and burned. But the difference in this case is that Pilot seems to have satisfied customers.

Powered by WPeMatico

Hub, a productivity platform for technical pre-sales, has formally launched with $1 million in seed funding.

CEO Freddy Mangum and CTO Karl Gainey founded Hub in 2020. The pair both had experience in technical sales and recognized the challenges of using spreadsheets to manage their business.

They researched and surveyed sales engineers at big and small companies alike, discovering that many of these professionals were spending a lot of time doing things like “wrangling data to report to management, forcing individual contributors to enter data into a CRM (customer relationship management) system.”

“Performing these kinds of mundane tasks was taking time away from them actually selling,” said Mangum. “We also came to the conclusion that technical sales professionals have been the unsung heroes of sales, behind the scenes driving enterprise.”

So they set about creating a better way for presales, solution architects and sales engineers to manage their day-to-day technical sales activities.

Then COVID hit, and obviously, as Mangum puts it, digital selling became much more real.

“That really accentuated the need for specific commercial tooling,” he said.

San Francisco-based Hub was born. The company describes its offering as a SaaS application that “securely interconnects and complements popular CRM systems and productivity applications.”

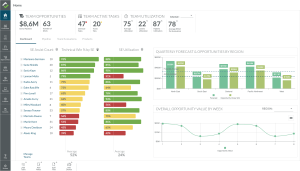

As a personalized productivity platform, Hub is designed to help individual contributors manage the sales process. By gaining greater visibility into every step, the goal is to better analyze and do more accurate forecasting so an organization can better “identify investment areas while taking corrective actions in real time,” Mangum said.

“Our tool can help them automate the mundane tasks and put the focus on high-value tasks to actually win more business,” he added.

Image Credits: Courtesy of Hub

Targeting technical sales professionals is an underserved market, according to Mangum, which presents tremendous opportunity.

Investors in the company include Tom Noonan, general partner of Atlanta-based TechOperators (and former chairman and CEO of Internet Security Systems, which was acquired in 2007 by IBM for $1.3 billion) and SalesLoft CEO and co-founder Kyle Porter.

To Noonan, the pandemic presented the challenge of keeping an enterprise sales force effective while working remotely.

“The biggest concern was not that sales people couldn’t engage with customers. It was how the technical part of the sales cycle was going to be conducted remotely, such as the concepts demonstrations integrations, the modifications, all the things that have to be articulately communicated, and also aligned with the customer’s needs,” he told TechCrunch. “And to me that just made the need for this model of selling that we’re in today.”

Looking ahead, Noonan believes these teams are going to question why they spent so much time on travel and on-site activities.

“More and more customers have actually gotten accustomed to remote interactions and even more importantly, many of the customers are not working in a place of business now either,” he said. “And that leaves a huge challenge for the solution architects, because they are the glue that bridge between a buyer saying that’s interesting, and an organization concluding that the capabilities of whatever system is being sold to them truly meets their needs both from a technical perspective and integration perspective and a functional perspective.”

Hub, he believes, can help address that challenge.

With a diverse founding team (Mangum is a Bolivian immigrant and Gainey is Black), Hub aims to reflect that diversity in its team. Its developers are based in Argentina, for example.

“As someone who graduated from ESL when I came to this country it is important that opportunities not be closed off to people just because of language barriers,” Mangum said.

Powered by WPeMatico

When the world shifted toward virtual one year ago, one service in particular saw heated demand: remote online notarization.

The ability to get a document notarized without leaving one’s home suddenly became more of a necessity than a luxury. Pat Kinsel, founder and CEO of Boston-based Notarize, worked to get appropriate legislation passed across the country to make it possible for more people in more states to get documents notarized digitally.

That hard work has paid off. Today, Notarize has announced $130 million in Series D funding led by fintech-focused VC firm Canapi Ventures after experiencing 600% year over year revenue growth. The round values Notarize at $760 million, which is triple its valuation at the time of its $35 million Series C in March of 2020. This latest round is larger than the sum of all of the company’s previous rounds to date, and brings Notarize’s total raised to $213 million since its 2015 inception.

A slew of other investors participated in the round, including Alphabet’s independent growth fund CapitalG, Citi Ventures, Wells Fargo, True Bridge Capital Partners and existing backers Camber Creek, Ludlow Ventures, NAR’s Second Century Ventures and Fifth Wall Ventures.

Notarize insists that it “isn’t just a notary company.” Rather, Canapi Ventures partner Neil Underwood described it as the “last mile” of businesses (such as iBuyers, for example).

The company has also evolved to “also bring trust and identity verification” into those businesses’ processes.

Over the past year, Notarize has seen a massive increase in transactions and inked new partnerships with companies such as Adobe, Dropbox, Stripe and Zillow Group, among others. It’s seen big spikes in demand from the real estate, financial services, retail and automotive sectors.

“In 2020, the world rushed to digitize. Online commerce ballooned, and businesses in almost every industry needed to transition to digital basically overnight so they could continue uninterrupted,” Kinsel said. “Notarize was there to help them safely close these deals with trust and convenience.”

The company plans to use its new capital to expand its platform and product and scale “to serve enterprises of all sizes.” It also plans to double down on hiring in the next year.

“Notarize is disrupting outdated business models and technologies, and there’s massive potential, particularly in the financial services space, as more companies will need to offer secure digital alternatives to in-person transactions,” Canapi’s Underwood said.

Notarize’s success comes after a difficult 2019, when the company saw “critical financing” fall through and had to lay off staff, according to Kinsel. Talk about a turnaround story.

Powered by WPeMatico

Pie Insurance, a startup offering workers’ compensation insurance to small businesses, announced this morning that it has closed on $118 million in a Series C round of funding.

Allianz X — investment arm of German financial services giant Allianz — and Acrew Capital co-led the round, which brings the Washington, D.C.-based startup’s total equity funding raised to over $300 million since its 2017 inception. Pie declined to disclose the valuation at which its latest round was raised, other than to say it was “a significant increase.”

Return backers Greycroft, SVB Capital, SiriusPoint, Elefund and Moxley Holdings also participated in the Series C financing.

The startup, which uses data and analytics in its effort to offer SMBs a way to get insurance digitally and more affordably, has seen its revenues climb by 150% since it raised $127 million in a Series B extension last May. Its headcount too has risen — to 260 from 140 last year.

Pie began selling its insurance policies in March 2018. The company declined to give recent hard revenue numbers, saying it only has grown its gross written premium to over $100 million and partnered with over 1,000 agencies nationwide. Last year, execs told me that in the first quarter of 2020, the company had written nearly $19 million in premiums, up 150% from just under $7.5 million during the same period in 2019.

Like many other companies over the past year, Pie Insurance — with its internet-driven, cloud-based platform — has benefited from the increasing further adoption of digital technologies.

“We are riding that wave,” said Pie Insurance co-founder and CEO John Swigart. “We believe small businesses deserve better than they have historically gotten. And we think that technology can be the means by which that better experience, that more efficient process, and fundamentally, that lower price can be delivered to them.”

Pie’s customer base includes a range of small businesses including trades, contractors, landscapers, janitors, auto shops and restaurants. Pie sells its insurance directly through its website and also mostly through thousands of independent insurance agents.

Workers’ compensation insurance is the only commercial insurance mandated for nearly every company in the United States, points out Lauren Kolodny, founding partner at Acrew Capital.

“Historically, it’s been extremely cumbersome to qualify, onboard and manage workers’ comp insurance — particularly for America’s small businesses which haven’t been prioritized by larger carriers,” she wrote via email.

Pie, Koldony said, is able to offer underwriting decisions “almost instantly,” digitally and more affordably than legacy insurance carriers.

“I have seen very few insurtech teams that come close,” she added.

Dr. Nazim Cetin, CEO of Allianz X, told TechCrunch via email that his firm believes Pie is operating in an “attractive and growing market that is ripe for digital disruption.”

The company, he said, leverages “excellent,” proprietary data and advanced analytics to be able to provide tailored underwriting and automation.

“We see some great collaboration opportunities with Allianz companies too,” he added.

Looking ahead, the company plans to use its new capital to invest further in technology and automation, as well as to grow its core workers’ comp insurance business and “lay the groundwork for new business offerings in 2021 and beyond.”

Powered by WPeMatico

In January, localized payments provider PPRO became the latest fintech-as-a-service startup to hit a billion-dollar valuation when it closed $180 million in funding. As a mark of how payments and e-commerce continue to be major areas of focus in the global economy, today PPRO is extending that round by another $90 million and adding in two new investors to its cap table.

The financing is coming by way of strategic backing from JPMorgan Chase and Eldridge (which is the second time this week the PE firm has been in the news for making a major investment in an enterprise tech company: earlier this week Eldridge was one of the leads on a $475 million round for real-time intelligence provider Dataminr).

The enlarged $270 million round — the January tranche was from Eurazeo Growth, Sprints Capital and Wellington Management — includes both primary and secondary capital, and this latest tranche is part of the secondary element, PPRO CEO Simon Black confirmed to me. Prior to this, London-based PPRO (pronounced “P-pro”) raised $50 million in August 2020 from Sprints, Citi and HPE Growth; and in 2018 it raised $50 million led by strategic investor PayPal.

PPRO’s core product is a set of APIs that e-commerce companies can integrate into their check-outs to accept payments in whatever local methods and currencies consumers prefer, removing the need for PPRO customers to build those complex and messy integrations themselves. Its business has boomed in the last year as one of the bigger providers of that localized payment technology, with transaction volumes up 60% in 2020 to $11 billion in processed payments.

JPMorgan Chase, meanwhile, is one of the world’s financial giants, providing banking and credit cards among its many other services. The idea is that it wants to build more payment services around its existing relationships and expand its payment business globally, working more closely with PPRO as part of that. There are two main areas where PPRO could figure: to help its credit card business gain more ubiquity as a payment method in more parts of the globe; and to be a service provider for its business banking customers to help them expand in more markets with more flexible, localized payments.

“We are extending into payments and we are looking to double down on addressing the needs of our clients and their clients, which can be consumers, suppliers or marketplace sellers,” said Sanjay Saraf, managing director and Global Head of the Integrated Payments Group at JPMorgan Chase, in an interview. “That last mile becomes important from a customer service perspective.”

In particular, the U.S. company is hoping to double down on its business and footprint in Latin America and Asia Pacific, two emerging markets still seeing a lot of growth in e-commerce, in particular compared to more developed, penetrated and mature markets like the U.S.

This latest round of financing underscores two trends of the moment in fintech.

First, it points to how active the e-commerce market has become — a trend fueled not in small part by the COVID-19 pandemic, and the resulting shift people have made to carrying out everyday tasks online. Second, it’s a sign of how global financial services companies are looking for ways to remain relevant in every market, tapping into more innovations from fintech startups to get there.

The problem, as it exists, is that payments remains a very fragmented business.

The standard methods that a person might use to pay for goods or services online in one country — for example a credit card in the U.S. — might differ drastically from the preferred methods when selling in another — for example, in Belgium one popular format is Bancontact (where you visit a new screen to authorize a transfer from directly from your bank checking account).

As with other payments and fintech-as-a-service startups, the attraction of using PPRO is that it has built a lot of those integrations at the backend and packaged them up as a service, taking away a lot of the complexity, in its case of identifying and integrating each of those payment methods manually, and making it something that can be done seamlessly and quickly.

JPMorgan is now one of several other partners. Those relationships work in both directions, providing partners a way to expand their consumer-facing products, and to help them work with more businesses in more markets. (Similar, I suspect, to how JPMorgan will work with it, too.)

Others in PPRO’s network of 100 large global customers include PayPal, Citi, Mastercard Payment Gateway Services, Mollie and Worldpay, which use PPRO’s APIs for a variety of functions, including localised gateway, processing and merchant acquirer services.

It is also not the only one that has identified the opportunity to simplify this part of the payment process and of other complex financial transactions that rely on localized approaches. Others in the same area include Rapyd, Mambu, Thought Machine, Temenos, Edera, Adyen, Stripe and newer players like Unit, with many of these raising very large amounts of money in recent times to double down on what is currently a rapidly expanding market.

The past year has been “an acceleration of a trend, where behaviors are being reinforced,” said Black in an interview. “At the consumer level, we are buying so many more products and services online, and we value convenience more than ever, which translates to a real strengthening of more demand for local payments.”

And while emerging technologies like cryptocurrency continue to see a lot of buzz, this is not at all where mass-market activity is for now. “The big trend is mobile wallets, not bitcoin,” Black said.

Powered by WPeMatico

Digital House, a Buenos Aires-based edtech focused on developing tech talent through immersive remote courses, announced today it has raised more than $50 million in new funding.

Notably, two of the main investors are not venture capital firms but instead are two large tech companies: Latin American e-commerce giant Mercado Libre and San Francisco-based software developer Globant. Riverwood Capital, a Menlo Park-based private equity firm, and existing backer early-stage Latin American venture firm Kaszek also participated in the financing.

The raise brings Digital House’s total funding raised to more than $80 million since its 2016 inception. The Rise Fund led a $20 million Series B for Digital House in December 2017, marking the San Francisco-based firm’s investment in Latin America.

Nelson Duboscq, CEO and co-founder of Digital House, said that accelerating demand for tech talent in Latin America has fueled demand for the startup’s online courses. Since it first launched its classes in March 2016, the company has seen a 118% CAGR in revenues and a 145% CAGR in students. The 350-person company expects “and is on track” to be profitable this year, according to Duboscq.

Digital House CEO and co-founder Nelson Duboscq. Image Credits: Digital House

In 2020, 28,000 students across Latin America used its platform. The company projects that more than 43,000 will take courses via its platform in 2021. Fifty percent of its business comes out of Brazil, 30% from Argentina and the remaining 20% in the rest of Latin America.

Specifically, Digital House offers courses aimed at teaching “the most in-demand digital skills” to people who either want to work in the digital industry or for companies that need to train their employees on digital skills. Emphasizing practice, Digital House offers courses — that range from six months to two years — teaching skills such as web and mobile development, data analytics, user experience design, digital marketing and product development.

The courses are fully accessible online and combine live online classes led by in-house professors, with content delivered through Digital House’s platform via videos, quizzes and exercises “that can be consumed at any time.”

Digital House also links its graduates to company jobs, claiming an employability rate of over 95%.

Looking ahead, Digital House says it will use its new capital toward continuing to evolve its digital training platforms, as well as launching a two-year tech training program — dubbed the the “Certified Tech Developer” initiative — jointly designed with Mercado Libre and Globant. The program aims to train thousands of students through full-time two-year courses and connect them with tech companies globally.

Specifically, the company says it will also continue to expand its portfolio of careers beyond software development and include specialization in e-commerce, digital marketing, data science and cybersecurity. Digital House also plans to expand its partnerships with technology employers and companies in Brazil and the rest of Latin America. It also is planning some “strategic M&A,” according to Duboscq.

Francisco Alvarez-Demalde, co-founder & co-managing partner of Riverwood Capital, noted that his firm has observed an accelerating digitization of the economy across all sectors in Latin America, which naturally creates demand for tech-savvy talent. (Riverwood has an office in São Paulo).

For example, in addition to web developers, there’s been increased demand for data scientists, digital marketing and cybersecurity specialists.

“In Brazil alone, over 70,000 new IT professionals are needed each year and only about 45,000 are trained annually,” Alvarez-Demalde said. “As a result of such a talent crunch, salaries for IT professionals in the region increased 20% to 30% last year. In this context, Digital House has a large opportunity ahead of them and is positioned strategically as the gatekeeper of new digital talent in Latin America, preparing workers for the jobs of the future.”

André Chaves, senior VP of Strategy at Mercado Libre, said the company saw in Digital House a track record of “understanding closely” what Mercado Libre and other tech companies need.

“They move as fast as we do and adapt quickly to what the job market needs,” he said. “A very important asset for us is their presence and understanding of Latin America, its risks and entrepreneurial environment. Global players have succeeded for many years in our region. But things are shifting gradually, and local knowledge of risks and opportunities can make a great difference.”

Powered by WPeMatico

Ketch, a startup aiming to help businesses navigate the increasingly complex world of online privacy regulation and data compliance, is announcing that it has raised $23 million in Series A funding.

The company is also officially coming out of stealth. I actually wrote about Ketch’s free PrivacyGrader tool last year, but now it’s revealing the broader vision, as well as the products that businesses will actually be paying for.

The startup was founded by CEO Tom Chavez and CTO Vivek Vaidya. The pair previously founded Krux, a data management platform acquired by Salesforce in 2016, and Vaidya told me that Ketch is the answer to a question that they’d begun to ask themselves: “What kind of infrastructure can we build that will make our former selves better?”

Chavez said that Ketch is designed to help businesses automate the process of remaining compliant with data regulations, wherever their visitors and customers are. He suggested that with geographically specific regulations like Europe’s GDPR in place, there’s a temptation to comply globally with the most stringent rules, but that’s not necessary or desirable.

“It’s possible to use data to grow and to comply with the regulations,” Chavez said. “One of our customers turned off digital marketing completely in order to comply. This has got to stop […] They are a very responsible customer, but they didn’t know there are tools to navigate this complexity.”

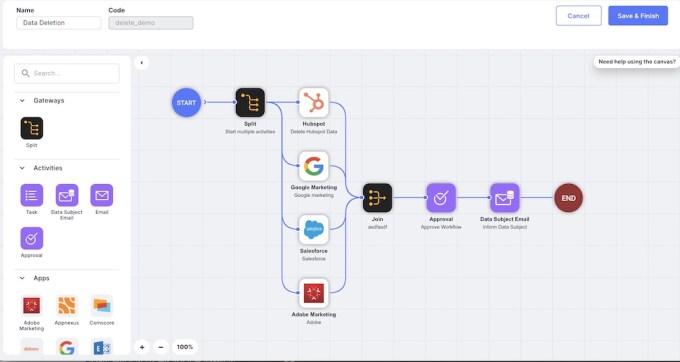

Image Credits: Ketch

The pair also suggested that things are even more complex than you might think, because true compliance means going beyond the “Hollywood façade” of a privacy banner — it requires actually implementing a customer’s requests across multiple platforms. For example, Vaidya said that when someone unsubscribes to your email list, there’s “a complex workflow that needs to be executed to ensure that the email is not going to continue … and make sure the customer’s choices are respected in a timely manner.”

After all, Chavez noted, if a customer tells you, “I want to delete my data,” and yet they keep getting marketing emails or targeted ads, they’re not going to be satisfied if you say, “Well, I’ve handled that in the four walls of my own business, that’s an issue with my marketing and email partners.”

Chavez also said that Ketch isn’t designed to replace any of a business’ existing marketing and customer data tools, but rather to “allow our customers to configure how they want to comply vis-à-vis what jurisdiction they’re operating in.” For example, the funding announcement includes a statement from Patreon’s legal counsel Priya Sanger describing Ketch as “an easily configurable consent management and orchestration system that was able to be deployed internationally” that “required minimal engineering time to integrate into our systems.”

As for the Series A, it comes from CRV, super{set} (the startup studio founded by Chavez and Vaidya), Ridge Ventures, Acrew Capital and Silicon Valley Bank. CRV’s Izhar Armony and Acrew’s Theresia Gouw are joining Ketch’s board of directors.

And if you’d like to learn more about the product, Ketch is hosting a webinar at 11am Pacific today.

Powered by WPeMatico

You might expect that a startup that makes community building software would be thriving during a pandemic when it’s so difficult for us to be together. And Bevy, a company whose product powers community sites like Salesforce Trailblazers and Google Developers announced it has raised a $40 million Series C this morning, at least partly due to the growth related to that dynamic.

The round was led by Accel with participation from Upfront Ventures, Qualtrics co-founder Ryan Smith and LinkedIn, but what makes this investment remarkable is that it included 25 Black investors representing 20% of the investment.

One of those investors, James Lowery, who is a management consultant and entrepreneur, and was the first Black employee hired at McKinsey in 1968, sees the opportunity for this approach to be a model to attract investment from other under-represented groups.

“I know for a fact because of my friendship and my network that there are a lot of people, if they had the opportunity to invest in opportunities like this, they will do it, and they have the money to do it. And I think we can be the model for the nation,” Lowery said.

Unfortunately, there has been a dearth of Black VC investment in startups like Bevy. In fact, only around 3% of venture capitalists are Black and 81% of VC firms don’t have a single Black investor.

Kobie Fuller, who is general partner at investor Upfront Ventures, a Bevy board member and runs his own community called Valence, says that investments like this can lead to a flywheel effect that can lead to increasing Black investment in startups.

“So for me, it’s about how do we get more Black investors on cap tables of companies early in their lifecycle before they go public, where wealth can be created. How do we get key members of executive teams being Black executives who have the ability to create wealth through options and equity. And how do we also make sure that we have proper representation on the boards of these companies, so that we can make sure that the CEOs and the C suite is held accountable towards the diversity goals,” Fuller said.

He sees a software platform like Bevy that facilitates community as a logical starting point for this approach, and the company needs to look like the broader communities it serves. “Making sure that our workforce is appropriately represented from a perspective of having appropriate level of Black employees to the board to the actual investors is just good business sense,” he said.

But the diversity angle doesn’t stop with the investor group. Bevy CEO and co-founder Derek Anderson says that last May when George Floyd was killed, his firm didn’t have a single person of color among the company’s 27 employees and not a single Black investor in his cap table. He wanted to change that, and he found that in diversifying, it not only was the right thing to do from a human perspective, it was also from a business one.

“We realized that if we really started including people from the Black and brown communities inside of Bevy that the collective bar of a talent was going to go up. We were going to look from a broader pool of candidates, and what we found as we’ve done this is that as the culture has started to change, the customer satisfaction is going up, our profits and our revenues — the trajectory is going up — and I see this thing is completely correlated,” Anderson said.

Last summer the company set a two year goal to get to 20% of employees being Black. While the number of employees is small, Bevy went from zero to 5% in June, and 10% by September. Today it is just under 15% and expects to hit the 20% goal by summer, a year ahead of the goal it set last year.

Bevy grew out of a community called Startup Grind that Anderson started several years ago. Unable to find software to run and manage the community, he decided to build it himself. In 2017, he spun that product into a separate company that became Bevy, and he has raised $60 million, according to the company.

In addition to Salesforce and Google, other large enterprises are using Bevy to power their communities and events, including Adobe, Atlassian, Twilio, Slack and Zendesk.

Today, the startup is valued at $325 million, which is 4x the amount it was valued at when it raised its $15 million Series B in May 2019. It expects to reach $30 million in ARR by the end of this year.

Powered by WPeMatico

As the Ubers of the world continue to scale, a smaller on-demand transportation startup has raised some funding in Germany, underscoring the opportunities that remain for startups in the space targeting specific service niches. Blacklane — the Berlin startup that provides on-demand black-car chauffeur services in Berlin, London, Dubai, Los Angeles, New York, Paris, Singapore and 16 other cities — has closed a round of €22 million ($26 million at current rates). After taking a majority stake in Havn, the Jaguar-hatched electric car service in London, in February, Blacklane said that it will be using this latest round of funding to continue expanding sustainable travel initiatives, and to continue expanding its existing business with more flexible options for riding.

The funding, which is being made at an up round valuation, is a sign of how the company is showing signs of growth after a year in which monthly revenues dropped 99% in the wake of the COVID-19 pandemic and the resulting drop in travel, and specifically people willing to be in small spaces that are shared with others.

“The global travel and mobility industries have suffered, with several players struggling between drastic cuts, hibernation or ceasing operations. Blacklane has taken the opportunity to cater to travelers’ emerging needs,” said Dr. Jens Wohltorf, CEO and co-founder of Blacklane, in a statement. “Thanks to this financing, we will continue to fast-track our innovation, with zero layoffs.”

The company said that the investment is coming from existing investors German automotive giant Daimler, the UAE’s ALFAHIM Group and btov Partners. And while it is coming at an up round, Blacklane is not disclosing any figures, nor has it ever disclosed valuation. Previous backers of the company also include the strategic investment arm of Recruit Holdings, the Japanese HR giant, and it has raised around $100 million to date, including a round of about $45 million in 2018.

The funding is coming after what has been an extremely rough year for travel and transportation startups due to the COVID-19 pandemic, with Blacklane itself seeing monthly revenues drop 99% after the pandemic hit last year, the company tells me.

Some others in the space that diversified into other areas like food delivery or other kinds of transport (e.g. bikes or scooters) were able to offset declines in their more core ride-hailing services, which in the meantime were repositioned as a safer alternative to public transportation. Blacklane, however, had never positioned itself as a ride for “everyman” — its core use case were higher-end rides and airport trips (which had also died a death) — so when movement shut down, Blacklane’s business nosedived.

It was particularly bad timing for Blacklane, considering that in the lead up to the pandemic, it looked to be on course to turn a profit on its focused model. (While financials for 2020 will take a while to be posted, the most recent results for the company showed a net loss of about $18 million in 2018.)

The reason that Blacklane has managed to raise at an up round tells another side of the story, however.

As companies in transport and travel gingerly started to show the smaller signs of recovery last summer, so too did Blacklane. It coupled that with the first steps of diversification itself.

Earlier this month, it added “chauffeur hailing” in 22 cities, an on-demand service that reduced the lead time for an order to under 30 minutes (its previous service was based on more advanced bookings). It also changed its pricing structure to get more competitive on shorter distances, since so many of the airport rides that were the basis of its revenues have yet to return.

In addition to that, Blacklane took a majority stake in Havn, an electric-based car service hatched by Jaguar, for an undisclosed sum, to spearhead a move into more sustainable travel options alongside the fleet of Teslas already operated by Blacklane.

“Worldwide travel restrictions give us a one-time chance to reset our expectations for safe and sustainable trips,” said Wohltorf in a statement. “Blacklane will recover responsibly and continue to grow while caring for both people and the planet.”

Powered by WPeMatico