funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Cross-border payments startup dLocal has raised $150 million at a $5 billion valuation, less than seven months after securing $200 million at a $1.2 billion valuation.

This means that the five-year-old Uruguayan company has effectively quadrupled its valuation in a matter of months.

Alkeon Capital led the latest round, which also included participation from BOND, D1 Capital Partners and Tiger Global. General Atlantic led its previous round, which closed last September and made dLocal Uruguay’s first unicorn and one of Latin American’s highest-valued startups.

DLocal connects global enterprise merchants with “billions” of emerging market consumers in 29 countries across Asia-Pacific, the Middle East, Latin America and Africa. More than 325 global merchants, including e-commerce retailers, SaaS companies, online travel providers and marketplaces use dLocal to accept over 600 local payment methods. They also use its platform to issue payments to their contractors, agents and sellers. Some of dLocal’s customers include Amazon, Booking.com, Dropbox, GoDaddy, MailChimp, Microsoft, Spotify, TripAdvisor, Uber and Zara.

In conjunction with this latest round, dLocal has named Sumita Pandit to the role of COO. Pandit is former global head of fintech and managing director for JP Morgan, and also worked at Goldman Sachs.

“Sumita is a highly respected and accomplished fintech investment banker, and she’s played a pivotal role advising some of the world’s most successful fintech companies as they’ve scaled to become global leaders,” said dLocal CEO Sebastián Kanovich in a written statement.

Meanwhile, former COO Jacobo Singer has been promoted to president of dLocal.

The company plans to use its new capital to enhance its technology and continue to expand geographically.

Alkeon General Partner Deepak Ravichandran believes that emerging markets represent some of the fastest growth opportunities in digital payments.

“However, as global merchants look to access these markets, they are often faced with a complex web of local payment methods, cross-border regulations, and other operational roadblocks,” he said in a written statement. “dLocal’s unique platform empowers merchants with a single integrated payment solution, to reach billions of customers, accept payments, send payouts, and settle funds globally.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Natasha and Danny and Alex and Grace were all here to chat through the week’s biggest tech happenings. It was a busy week on the IPO front, Danny was buried in getting the Tonal EC-1 out, and Natasha took some time off. But the host trio managed to prep and record a show that was honestly a kick to record, and we think, a pleasure to listen to!

So, for your morning walk, here’s what we have for you:

It was a mix of laughs, ‘aha’ moments and honest conversations about how complex ambition in startups should be. One listener the other day mentioned to us that the pandemic made it harder to carve out time for podcasts, since listening was often reserved for commutes. We get it, and in true scrappy fashion, we’re curious how you’ve adapted to remote work and podcasts. Let us know how you tune into Equity via Twitter and remember that we’re thankful for your ears!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 AM PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Holler, described by founder and CEO Travis Montaque as “a conversational media company,” just announced that it’s raised $36 million in Series B funding.

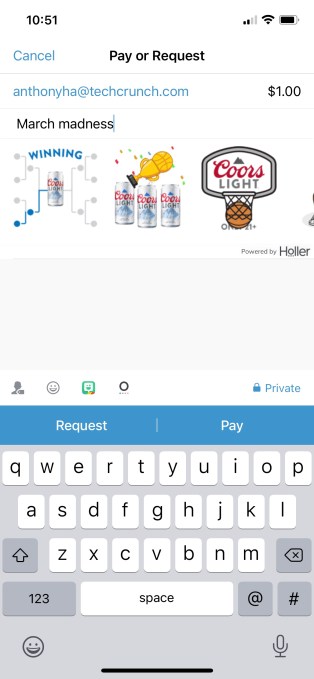

You may not know what conversational media is, but there’s a decent chance you’ve used Holler’s technology. For example, if you’ve added a sticker or a GIF to your Venmo payments, Holler actually manages the app’s search and suggestion experience around that media. (You may notice a little “powered by Holler” identifier at the bottom of the window.)

Montaque told me the company started out initially as a news and video content app before focusing on messaging in 2016. Messaging, he argued, is “the most important experience for people online,” since “it’s where we communicate with the people who are closest to us.”

He continued, “It seemed bizarre that we haven’t seen much innovation in the text messaging experience since the first text message was sent in 1992.”

So Holler works with partners like PayPal-owned Venmo and The Meet Group to bring more compelling content into the messaging side of their apps — or as Montaque put it, the startup aims to “enrich conversations everywhere.”

Image Credits: Holler

There’s both an art and a science to this, he said. The art involves creating and curating the best stickers and GIFs, while the science takes the form of Holler’s Suggestion AI technology, which will recommend the right content based on the user’s conversations and contexts — the stickers and GIFs you want to send in a dating app are probably different from what you’d in a work-related chat. Montaque said that this context-focused approach allows the company to provide smart recommendations in a way that also respects user privacy.

“I believe that the future is context, not identity,” he said. “Because I don’t really need to know about Anthony, I just need to know someone is in need of lunch. If I know you’re in the mood for Mexican food, I don’t need to know every aspect of the last 10 times you went to a Mexican restaurant.”

Holler monetizes this content by partnering with brands like HBO Max, Ikea and Starbucks to create branded stickers and GIFs that become part of the company’s content library. Montaque said the startup has also worked with brands to measure the impact of these campaigns across a variety of metrics.

Holler’s content now reaches 75 million users each month, compared to 19 million users a year ago, while revenue has grown 226%, he said. (Apparently, last year was the first time the company saw significant revenue growth.)

The startup has now raised more than $51 million in total funding. The Series B was co-led by CityRock Venture Partners and New General Market Partners, with participation from Gaingels, Interplay Ventures, Relevance Ventures, Towerview Ventures and WorldQuant Ventures.

“Holler is more than simply a groundbreaking technology company,” said CityRock Managing Partner Oliver Libby in a statement. “Under Travis Montaque’s visionary leadership, Holler boldly stands for a new era of ethics in social media, and also deeply reflects the values of diversity, inclusion and belonging.”

Montaque (who, as a Black tech CEO, wrote a post for TechCrunch last year about bringing more diversity to the industry) said that Holler will use the funds to continue developing its product and advertising model. For one thing, he noted that although stickers and GIFs were an obvious starting point, the company is now looking to explore and create new media formats.

“We want to invent a new kind of content consumption paradigm,” he said.

Powered by WPeMatico

Every tech vendor has to pass security muster with customers, typically a tedious activity involving answering long questionnaires. Kintent, a new startup that wants to automate this process, announced a $4 million seed today led by Tola Capital with help from a bunch of tech industry angel investors.

After company co-founder and CEO Sravish Sridhar sold his previous startup Kinvey, which provided backend as a service to mobile app developers, he took a couple of years off while he decided what to do next. The sale to Progress Software in 2017 gave him that luxury.

He knew firsthand from his experience at Kinvey that companies like his had to adhere to a lot of compliance standards, and the idea for the next company began to form in his head. He wanted to create a new startup that could make it easier to figure out how to become compliant with a given standard, measure the current state of compliance and get recommendations on how to improve. He created Kintent to achieve that goal.

“So the big picture idea is can we build a system of record for trust and our first use case is information security and data privacy compliance, specifically if you’re a company that is building a SaaS business and you’re storing customer data or PHI, which is health information,” Sridhar explained.

The company’s product is called Trust Cloud. He says that they begin by looking at the lay of your technology land in terms of systems and the types of information you are storing, looking at how compliant each system is with whatever standard you are trying to adhere to.

Then based on how you classify your data, the Trust Cloud generates a list of best practices to stay in compliance with your desired standard, and finally it provides the means to keep testing to validate what you’ve done and that you are remaining in compliance.

The company launched in 2019, spent the first part of 2020 developing the product and began selling it last October. Today, it has 35 paying customers. “We’re in the high six figures in revenue. We’ve been growing at about 20-30% month-over-month consistently since we launched in October, and the customers are across 11 verticals already,” he said.

With 14 employees and some money in the bank from this funding round, he is thinking ahead to adding people. He says that diversity has to be more than something you just talk about, and he has made it one of the core founding values of the company, and one he takes very seriously.

“I’m very conscious with every hire that we make that we’re really pushing to extend ourselves to [find] people from different walks of life, different statuses and so on,” he said.

The company is also working on a DEI component for the Trust Cloud, which it will be offering for free, which enables companies to provide a set of diversity metrics to measure against and then report on how well you are doing, and how you can improve your numbers.

Powered by WPeMatico

Competition in China’s gaming industry is getting stiffer in recent times as tech giants sniff out potential buyouts and investments to beef up their gaming alliance, whether it pertains to content or distribution.

Bilibili, the go-to video streaming platform for young Chinese, is the latest to make a major gaming deal. It has agreed to invest HK$960 million (about $123 million) into X.D. Network, which runs the popular game distribution platform TapTap in China, the company announced on Thursday.

Dual-listed in Hong Kong and New York, Bilibili will purchase 22,660,000 shares of X.D.’s common stock at HK$42.38 apiece, which will grant it a 4.72% stake.

The partners will initiate a series of “deep collaborations” around X.D.’s own games and TapTap, without offering more detail.

Though known for its trove of video content produced by amateur and professional creators, Bilibili derives a big chunk of its income from mobile games, which accounted for 40% of its revenues in 2020. The ratio had declined from 71% and 53% in 2018 and 2019, a sign that it’s trying to diversify revenue streams beyond distributing games.

Tencent has similarly leaned on games to drive revenues for years. The WeChat operator dominates China’s gaming market through original titles and a sprawling investment portfolio whose content it helps operate and promote.

X.D. makes games, too, but in recent years it has also emerged as a rebel against traditional game distributors, which are Android app stores operated by smartphone makers. The vision is to skip the high commission fees charged by the likes of Huawei and Xiaomi and monetize through ads. X.D.’s proposition has helped it attract a swathe of gaming companies to be its investors, including fast-growing studios Lilith Games and miHoYo, Alibaba, as well as ByteDance, which built up a 3,000-people strong gaming team within six years.

Bilibili’s investment further strengthens X.D.’s matrix of top-tier gaming investors. Tencent is conspicuously absent, but it’s no secret that ByteDance is its new nemesis after Alibaba. The TikTok parent recently outbid Tencent to acquire Moonton, a gaming studio that has gained ground in Southeast Asia, according to Reuters. Douyin, the Chinese version of TikTok, is also vying for user attention away from content published on WeChat.

Powered by WPeMatico

The gaming sector has never been hotter or had higher expectations from investors who are dumping billions into upstarts that can adjust to shifting tides faster that the existing giants will.

Bay Area-based Manticore Games is one of the second-layer gaming platforms looking to build on the market’s momentum. The startup tells TechCrunch they’ve closed a $100 million Series C funding round, bringing their total funding to $160 million. The round was led by XN, with participation from SoftBank and LVP alongside existing investors Benchmark, Bitkraft, Correlation Ventures and Epic Games.

When Manticore closed its Series B back in September 2019, VCs were starting to take Roblox and the gaming sector more seriously, but it took the pandemic hitting to really expand their expectations for the market. “Gaming is now a bona fide super category,” CEO Frederic Descamps tells TechCrunch.

Manticore’s Core gaming platform is quite similar to Roblox conceptually, the big difference is that the gaming company is aiming to quickly scale up a games and creator platform geared toward the 13+ crowd that may have already left Roblox behind. The challenge will be coaxing that demographic faster than Roblox can expand its own ambitions, and doing so while other venture-backed gaming startups like Rec Room, which recently raised at a $1.2 billion valuation, race for the same prize.

Like other players, Manticore is attempting to build a game discovery platform directly into a game engine. They haven’t built the engine tech from scratch; they’ve been working closely with Epic Games, which makes the Unreal Engine and made a $15 million investment in the company last year.

A big focus of the Core platform is giving creators a true drag-and-drop platform for game creation with a specific focus on “remixing,” allowing users to pick pre-made environments, drop pre-rendered 3D assets into them, choose a game mode and publish it to the web. For creators looking to inject new mechanics or assets into a title, there will be some technical know-how necessary, but Manticore’s team hopes that making the barriers of entry low for new creators means that they can grow alongside the platform. Manticore’s big bet is on the flexibility of their engine, hoping that creators will come on board for the chance to engineer their own mechanics or create their own path toward monetization, something established app stores wouldn’t allow them to.

“Creators can implement their own styles of [in-app purchases] and what we’re really hoping for here is that maybe the next battle pass equivalent innovation will come out of this,” co-founder Jordan Maynard tells us.

This all comes at an added cost; developers earn 50% of revenues from their games, leaving more potential revenue locked up in fees routed to the platforms that Manticore depends on than if they built for the App Store directly, but this revenue split is still much friendlier to creators than what they can earn on platforms like Roblox.

Building cross-platform secondary gaming platforms is host to plenty of its own challenges. The platforms involved not only have to deal with stacking revenue share fees on non-PC platforms, but some hardware platforms that are reticent to allow them all, an area where Sony has been a particular stickler with PlayStation. The long-term success of these platforms may ultimately rely on greater independence, something that seems hard to imagine happening on consoles and mobile ecosystems.

Powered by WPeMatico

As companies embrace the use of data, hiring more data scientists, a roadblock persists around sharing that data. It requires too much copying and pasting and manual work. Hex, a new startup, wants to change that by providing a way to dispense data across the company in a streamlined and elegant way.

Today, the company announced a $5.5 million seed investment, and also announced that it’s opening up the product from a limited beta to be more widely available. The round was led by Amplify Partners, with help from Box Group, XYZ, Data Community Fund, Operator Collective and a variety of individual investors. The company closed the round last July, but is announcing it for the first time today.

Co-founder and CEO Barry McCardel says that it’s clear that companies are becoming more data-driven and hiring data scientists and analysts at a rapid pace, but there is an issue around data sharing, one that he and his co-founders experienced firsthand when they were working at Palantir.

They decided to develop a purpose-built tool for sharing data with other parts of the organization that are less analytically technical than the data science team working with these data sets. “What we do is we make it very easy for data scientists to connect to their data, analyze and explore it in notebooks. […] And then they can share their work as interactive data apps that anyone else can use,” McCardel explained.

Most data scientists work with their data in online notebooks like Jupyter, where they can build SQL queries and enter Python code to organize it, chart it and so forth. What Hex is doing is creating this super-charged notebook that lets you pull a data set from Snowflake or Amazon Redshift, work with and format the data in an easy way, then drag and drop components from the notebook page — maybe a chart or a data set — and very quickly build a kind of app that you can share with others.

Image Credits: Hex

The startup has nine employees, including co-founders McCardel, CTO Caitlin Colgrove and VP of architecture Glen Takahashi. “We’ve really focused on the team front from an early stage, making sure that we’re building a diverse team. And actually today our engineering team is majority female, which is definitely the first time that that’s ever happened to me,” Colgrove said.

She is also part of a small percentage of female founders. A report last year from Silicon Valley Bank found that while the number was heading in the right direction, only 28% of U.S. startups have at least one female founder. That was up from 22% in 2017.

The company was founded in late 2019 and the founders spent a good part of last year building the product and working with design partners. They have a small set of paying customers, and are looking to expand that starting today. While customers still need to work with the Hex team for now to get going, the plan is to make the product self-serve some time later this year.

Hex’s early customers include Glossier, imgur and Pave.

Powered by WPeMatico

Capitolis, which makes technology for capital markets players such as investment and merchant banks, has closed on a $90 million Series C funding round led by Andreessen Horowitz (a16z).

The financing included participation from existing backers Index Ventures, Sequoia Capital, S Capital, Spark Capital, SVB Capital, Citi, J.P. Morgan and State Street, and brings Capitolis’ total funding to date to $170 million. SVB Capital and Spark Capital co-led a $40 million Series B for the company in November 2019.

Capitolis CEO and founder Gil Mandelzis said the startup’s mission since its 2017 inception has been to “fundamentally re-imagine how the capital markets operate” after the last financial crisis and the “bold steps taken by regulators” in its aftermath.

The company says that its advanced workflow technology and proprietary algorithms allows banks, hedge funds and asset managers to eliminate, move or create trading positions by collaborating with other financial institutions. That results in freed up capital, open credit lines and access to capital from a bigger pool of sources, the company claims.

Ultimately, Capitolis’ network software is designed to help financial institutions optimize their balance sheets and reduce risk.

Seventy-five financial institutions currently use the Capitolis platform. The company says it grew its revenue run rate by “sixfold” in 2020. Since 2019, Capitolis has experienced a 230% increase in the number of users of its platform. To date, the startup says it has optimized $9 trillion in terms of gross notional balances.

Alex Rampell, partner at a16z, said that his firm believes that what sets Capitolis apart from other financial services players “is the sheer scale of management’s ambition and the substantial talent, technology and capital milestones they have achieved.”

The New York-based company says it plans to use its new capital toward product development and to boost its customer support and sales staff. It plans to increase its headcount from 90 today to over 150 by year’s end.

Capitolis currently covers foreign exchange products and equity swaps. It says it could expand into others if there is client demand.

This article was updated post-publication with additional information from the company

Powered by WPeMatico

AI has become a fundamental cornerstone of how tech companies are building tools for salespeople: they are useful for supercharging (and complementing) the abilities of talented humans, or helping them keep themselves significantly more organised; even if in some cases — as with chatbots — they are replacing them altogether. In the latest development, 6sense, one of the pioneers in using AI to boost the sales and marketing experience, is announcing a major round of funding that underscores the traction AI tools are seeing in the sales realm.

The startup has raised $125 million at a valuation of $2.1 billion, a Series D being led by D1 Capital Partners, with Sapphire Ventures, Tiger Global and previous backer Insight Partners also participating.

The company plans to use the funding to expand its platform and its predictive capabilities across a wider range of sources.

For some context, this is a huge jump for the company compared to its last fundraise: at the end of 2019, when it raised $40 million, it was valued at a mere $300 million, according to data from PitchBook.

But it’s not a big surprise: at a time when a lot of companies are going through “digital transformation” and investing in better tools for their employees to work more efficiently remotely (especially important for sales people who might have previously worked together in physical teams), 6sense is on track for its fourth year of more than 100% growth, adding 100 new customers in the fourth quarter alone. It caters to small, medium, and large businesses, and some of its customers include Dell, Mediafly, Sage and SocialChorus.

The company’s approach speaks to a classic problem that AI tools are often tasked with solving: the data that sales people need to use and keep up to date on customer accounts, and critically targets, lives in a number of different silos — they can include CRM systems, or large databases outside of the company, or signals on social media.

While some tools are being built to handle all of that from the ground up, 6sense takes a different approach, providing a way of ingesting and utilizing all of it to get a complete picture of a company and the individuals a salesperson might want to target within it. It takes into account some of the harder nuts to crack in the market, such as how to track “anonymous buying behavior” to a more concrete customer name; how to prioritizes accounts according to those most likely to buy; and planning for multi-channel campaigns.

6sense has patented the technology it uses to achieve this and calls its approach building an “ID graph.” (Which you can think of as the sales equivalent of the social graph of Facebook, or the knowledge graph that LinkedIn has aimed to build mapping skills and jobs globally.) The key with 6sense is that it is building a set of tools that not just sales people can use, but marketers too — useful since the two sit much closer together at companies these days.

Jason Zintak, the company’s CEO (who worked for many years as a salesperson himself, so gets the pain points very well), referred to the approach and concept behind 6sense as “revtech”: aimed at organizations in the business whose work generates revenue for the company.

“Our AI is focused on signal, identifying companies that are in the market to buy something,” said Zintak in an interview. “Once you have that you can sell to them.”

That focus and traction with customers is one reason investors are interested.

“Customer conversations are a critical part of our due diligence process, and the feedback from 6sense customers is among the best we’ve heard,” said Dan Sundheim, founder and chief investment officer at D1 Capital Partners, in a statement. “Improving revenue results is a goal for every business, but it’s easier said than done. The way 6sense consistently creates value for customers made it clear that they deliver a unique, must-have solution for B2B revenue teams.”

Teddie Wardi at Insight highlights that AI and the predictive elements of 6sense’s technology — which have been a consistent part of the product since it was founded — are what help it stand out.

“AI generally is a buzzword, but here it is a key part of the solution, the brand behind the platform,” he said in an interview. “Instead of having massive funnels, 6sense switches the whole thing around. Catching the right person at the right time and in the right context make sales and marketing more effective. And the AI piece is what really powers it. It uses signals to construct the buyer journey and tell the sales person when it is the right time to engage.”

Powered by WPeMatico

Cybersecurity training is one of those things that everyone has to do but not something everyone necessarily looks forward to.

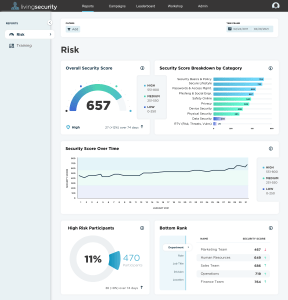

Living Security is an Austin-based startup out to change cybersecurity training something you look forward to, not dread. And the company has just closed on a $14 million Series B to continue its expansion beyond cybersecurity awareness training into human risk management.

Washington, D.C. based-Updata Partners led the financing, which also included participation from existing investors Silverton Partners, Active Capital, Rain Capital and SaaS Venture Partners. The investment comes after its $5 million Series A, led by Austin-based Silverton, raised last April.

Husband and wife Drew and Ashley Rose founded Living Security out of their house in June 2017 with the mission of making cybersecurity training less boring and more effective via gamified learning, with live action immersive storylines, role-based micro modules and reporting.

Living Security launched with its flagship product — Cyber Escape Room. When the pandemic hit, the startup brought its in-person training sessions online through the launch of CyberEscape Online.

With more people working remotely, the need for the type of offering Living Security provides has become even more paramount, considering how many people use personal devices for professional reasons, among other things. Employees are more vulnerable than ever to inadvertently providing entry points into the networks of the enterprises where they work — whether through social engineering, phishing or other methods.

Today, Living Security works with more than 100 large enterprises to train their global workforces to better protect sensitive data and secure their organizations. The startup’s customer list is impressive, and includes large enterprises such as CVS Health, Mastercard, Verizon, MassMutual, Biogen, AmerisourceBergen, Hewlett Packard, JPMorgan and Target.

So it’s not a big surprise that in 2020, Living Security tripled its revenue and employee headcount and more than doubled its customer count. The company declined to provide hard revenue figures, saying only that ARR grew nearly 200% last year.

“We have seen a significant increase in account growth and expansion in existing accounts…largely in part due to the scalability of our digital solution,” CEO Ashley Rose said.

With the success of its escape rooms and gamified training, Living Security’s team then asked themselves how they could make their efforts “more predictable.”

“We added risk management and scoring so program and security owners could become more targeted and focused on the delivery of their training,” Rose said.

So now Living Security aims to use behavioral data and analytics to measure and manage human risk. It plans to take that data and provide “predictive interventions” to employees.

“We’re focused on ‘How do we turn people from our greatest risk, to our greatest assets in cybersecurity?’ ” Rose said. “That’s our big vision for the company.”

Image Credits: Living Security

With its “Unify” human risk management platform, Living Security wants to provide an even more scalable solution. The company also plans to use its new capital toward expanding its geographic reach and scaling both direct and channel sales efforts.

Currently, Living Security has 55 employees, with the goal of having 90 by year’s end.

Deb Walter, director of information security training and awareness at AmerisourceBergen, said she first engaged with Living Security in 2017 when she requested its CyberSecurity Card game.

“I wanted to gamify how I presented training,” she recalls.

Introducing episodic gamification and its “bingeable” content into her training program was a big hit with employees, according to Walter.

“Their new platform is enabling us to deploy an ‘Information security academy’ to encourage associates and contractors to use several modes of training to earn points and track themselves on a leaderboard,” she said.

Updata General Partner Jon Seeber, who is taking a seat on Living Security’s board with the funding, said his firm saw “breakout potential” in the startup’s platform.

“It comes as close as you can to closing the loop between people and the systems on which they’re operating,” he said.

Plus, he said, it does it in a way that avoids the compliance-focused, “check-the-box” mindset that so often dominates employee-focused cybersecurity solutions.

Powered by WPeMatico