funding

Auto Added by WPeMatico

Auto Added by WPeMatico

One of the more tedious aspects of machine learning is providing a set of labels to teach the machine learning model what it needs to know. Snorkel AI wants to make it easier for subject matter experts to apply those labels programmatically, and today the startup announced a $35 million Series B.

It also announced a new tool called Application Studio that provides a way to build common machine learning applications using templates and predefined components.

Lightspeed Venture Partners led the round with participation from previous investors Greylock, GV, In-Q-Tel and Nepenthe Capital. New investors Walden and BlackRock also joined in. The startup reports that it has now raised $50 million.

Company co-founder and CEO Alex Ratner says that data labeling remains a huge challenge and roadblock to moving machine learning and artificial intelligence forward inside a lot of industries because it is costly, labor-intensive and hard for the subject experts to carve out the time to do it.

“The not so hidden secret about AI today is that in spite of all the technological and tooling advancements, roughly 80 to 90% of the cost and time for an average AI project goes into just manually labeling and collecting and relabeling this training data,” he said.

He says that his company has developed a solution to simplify this process to make it easier for subject experts to programmatically add the labels, a process he says decreases the time and effort required to apply labels in a pretty dramatic way from months to hours or days, depending on the complexity of the data.

As the company has developed this methodology, customers have been asking for help in the next step of the machine learning process, which is taking that training data and the model and building an application. That’s where the Application Studio comes in. It could be a contract classifier at a bank or a network anomaly detector at a telco and it helps companies take that next step after data labeling.

“It’s not just about how you programmatically label the data, it’s also about the models, the preprocessors, the post processors, and so we’ve made this now accessible in a kind of templated and visual no-code interface,” he said.

The company’s products are based on research that began at the Stanford AI Lab in 2015. The founders spent four years in the research phase before launching Snorkel in 2019. Today, the startup has 40 employees. Ratner recognizes the issues that the technology industry has had from a diversity perspective and says he has made a conscious effort to build a diverse and inclusive company.

“What I can say is that we tried to prioritize it at a company level, the full team level and at a board level from day one, and to also put action behind that. So we’ve been working with external firms for internal training and audits and strategy around DEI, and we’ve made pipeline diversity a non-negotiable requirement of any of our contracts with recruiting firms,” he said.

Ratner also recognizes that automation can hard code bias into machine learning models, and he’s hopeful that by simplifying the labeling process, it can make it much easier to detect bias when it happens.

“If you start with a dozen or two dozen of what we call labeling functions in Snorkel, you still need to be vigilant and proactive about trying to detect bias, but it’s easier to audit what taught your model to change it by just going back and looking at a couple of hundred lines of code.”

Powered by WPeMatico

With 17 startups participating, Berkeley SkyDeck’s Demo Day isn’t the largest cohort we’ve seen by any stretch. The collection of companies is, however, defined by a wide range of focuses, from pioneering diabetes treatments to retrofitting autonomous trucking, curated by the SkyDeck’s small team and a number of advisors.

Founded in 2012, the accelerator is focused on developing early-stage companies tied to the University of California system. Applicants must be affiliated with either one of the 10 UC schools or their national laboratories in Berkeley, Livermore and Los Alamos. Notable alumni include micromobility unicorn, Lime, and delivery robotics firm, Kiwi.

In 2020, SkyDeck — along with much of the rest of the world — went virtual.

“While flight restrictions did cause some international founders to pull crazy hours from our home countries to participate in the sessions, virtual sessions allowed additional members of our teams to participate that would otherwise not have been able to do so,” the accelerator’s organizers said in a TechCrunch post last year. “We are also hearing chatter that Demo Day will be larger than ever before because virtual events are much more scalable.”

The 17 startups presenting today were whittled down from 1,850 applicants, according to the accelerator. Being a member of the cohort involves six months of launch assistance from SkyDeck, coupled with up $105,000. “In six months, you’re going to pitch on stage at demo day, to an institutional investor in your industry,” Executive Director Caroline Winnett tells TechCrunch.

Here’s a closer look at six highlights from this Demo Day.

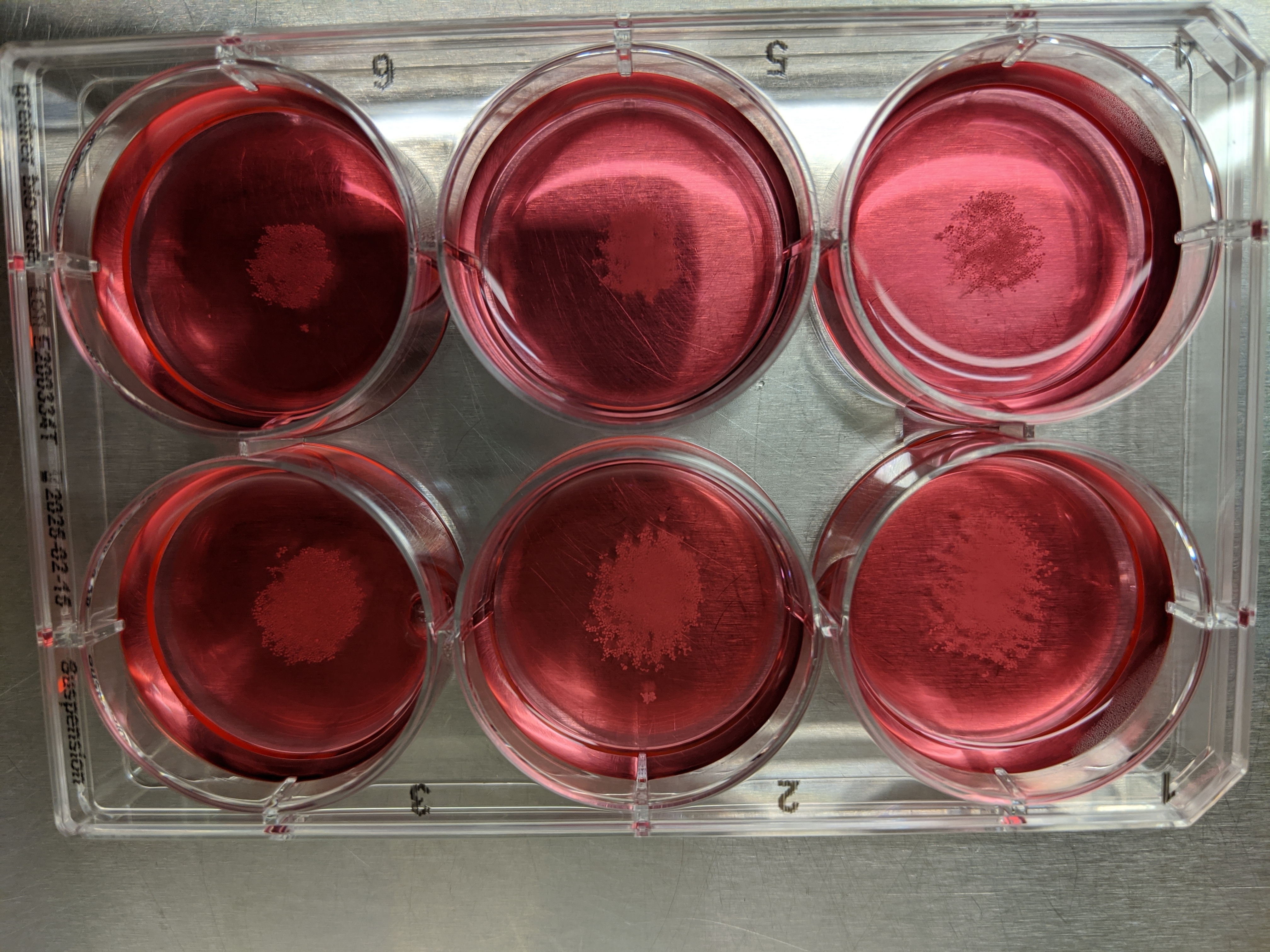

Image Credits: EndoCrine Bio, Inc.

Building on technologies developed in the stem cell research labs of UCSF, EndoCrine is looking to commercialize a better way to discover and develop drugs. Specifically, the startup is hoping to improve diabetes treatment beyond standard insulin injections.

“EndoCrine’s proprietary human stem cell-derived islet platform revolutionizes the drug discovery and development process, saving years of time and millions of dollars usually spent by pharma companies,” CEO Gopika Nair said in a statement offered to TechCrunch. “Our innovative solution opens an exciting era of personalized medicine in diabetes.”

The company says SkyDeck helped it take the earliest steps out of the lab and into startup mode.

Image Credits: NuPort Robotics Inc.

NuPort Robotics is among the most mature of the 17 startups included here. In fact, in mid-March, the startup signed a partnership with Canadian Tire and the Ontario government, as part of a $3 million investment in an autonomous middle-mile trucking solution.

Rather than building autonomous trucking from scratch, NuPort’s solution is designed to retrofit semis with autonomous technologies.

“This results in operational cost reduction by eliminating the need to replace their existing fleet and yields a safer, more efficient and sustainable transportation system,” CEO Raghavender Sahdev tells TechCrunch.

Image Credits: The Hurd Co.

The Hurd Co.’s goal is simple: reduce the environmental impact of clothing companies by helping to remove trees from the process. Specifically, the company creates cellulosic fiber pulp from agricultural byproducts. This is designed to bypass tree-based agrilose, which is used in the production of a wide variety of fabrics, including rayon.

“Apparel brands are scrambling for new, low-impact fabric that will allow them to meet their ambitious sustainability goals,” CEO Taylor Heisley-Cook tells TechCrunch. “We completely eliminate trees from the supply chain with a hyper-efficient process that dramatically reduces brands’ impact on the environment.”

The company says its process uses half the water and significantly less energy than standard processes. The technology was developed by Hurd’s CTO, Charles Cai.

Image Credits: Humm

I won’t lie, this is the one in the batch I have the most questions about, having seen a number of companies claim their wearables can increase memory.

Here’s what CEO Iain McIntyre has to say: “It’s ideal for activities that depend on memory, like reading, problem solving or multi-tasking. The Humm patch uses tACS (transcranial alternating stimulation) and in clinical research studies, the Humm patch saw a measurable (+~20%) improvement against placebo.”

It’s an interesting underlying technology, and the advisors — which include a number of university professors in the sciences — certainly see commercial potential. There are some lingering questions around tACS.

Quoting Scientific American from January: “The potential therapeutic effects of tACS on memory, food craving and other neural processes have been tested in dozens of studies in the past. Questions have been raised about whether this method actually exerts any meaningful changes in the brain, however.”

Definitely interested in seeing more about this one and perhaps taking it for a spin when the product ships, later this year.

As far as elevator pitches go, Publica may have the best one of the show. “Publica is Shopify for Digital Content.” Essentially, the company wants to be a direct conduit between content creators and consumers.

“Publica is a service that enables authors and content creators to have their own custom storefront to share, market and sell e-books, audiobooks and any other types of digital content with no intermediaries,” CEO Pablo Laurino tells TechCrunch. “In the era of D2C and marketplaces, Publica helps authors and content to achieve that on their own storefront, offering authors complete control over their brand and ownership of the relationships.”

The system helps creators make their own own digital storefront to sell a wide variety of products, including audiobooks and e-books. The site is already up and running, with more than 1,200 stores created by 250 clients.

Image Credits: Serinus Labs

Serinus is developing a warning system for detecting failure in lithium-ion batteries.

Per CEO, Hossain Fahad, “Battery safety is the biggest challenge in the EV industry today. Serinus Labs’ proprietary LiCANS technology provides early warning signals to prevent catastrophic battery failure in electric vehicles.”

The tech uses gas sensing to detect early traces of vented gases that occur prior to battery failure.

Powered by WPeMatico

CaptivateIQ, which has developed a no-code platform to help companies design customized sales commission plans, has raised $46 million in a Series B round led by Accel.

Existing backers Amity, S28 Capital, Sequoia and Y Combinator also participated in the financing, which brings the San Francisco-based company’s total raised to $63 million since its 2017 inception.

CaptivateIQ must be doing something right. While it is not yet profitable, the startup’s revenue has grown 600% year-over-year. To date, it has processed more than $2 billion in commissions on its platform across hundreds of enterprise customers, including Affirm, TripActions, Udemy, Intercom, Newfront Insurance and JMAC Lending.

“A big part of our growth is that we can help any company that offers a performance-based compensation plan, so we don’t have any restrictions with the types of businesses we work with,” said co-CEO Mark Schopmeyer. “We typically see conversations start with teams that have a minimum of 25 sales people, though we easily serve enterprises and public companies as well.”

The number of payees — defined as someone receiving a payout in CapitvateIQ’s system — was up four times in December 2020 from the year prior. Plus, the company had “back-to-back record months” from September through the end of the year in 2020, according to Schopmeyer.

He, co-CEO Conway Teng and CTO Hubert Wong founded CaptivateIQ after coming out of Y Combinator’s Winter 2017 cohort.

Left to right: CaptivateIQ co-founders Hubert Wong, Mark Schopmeyer and Conway Teng. Image Credits: CaptivateIQ

The company touts its SaaS platform as a combination of the familiarity of spreadsheets with the scalability and performance of software, so that users can configure any commission plan “entirely on their own,” according to Teng.

“Calculating commissions is really complicated and mission-critical — think of it like a very complicated form of payroll — each company has a unique commission plan that involves a lot more calculations and data than your typical salary payroll math,” Teng said. “Also, in recent years, companies have access to more data than ever, giving them room to incentive employees on more performance metrics.”

Today, CaptivateIQ has 90 employees, more than triple what it did one year ago.

In 2020, the startup saw a bump in the number of non-high-technology companies buying its software, and as a result, CaptivateIQ is going to increase its efforts into those other verticals, according to Teng. So far, it has found success in particular in financial services, manufacturing and business services, among other sectors.

The pandemic served as a tailwind to its business. Sales teams generally rely on in-person interactions to stay productive, Schopmeyer points out. Without those activities over the past year, “having the right incentives in place became ever more critical as companies required new ways to motivate teams during the shift to remote work.”

“We saw our product usage skyrocket at the beginning of the pandemic as businesses quickly adjusted incentives, team quotas, SPIFs and other components of their comp plans to stay competitive,” he said.

The company plans to use its new capital to improve upon the user experience. Specifically, Teng said, it plans to introduce “more powerful data transformations, a richer set of formulas and off-the-shelf templates.”

Another goal is to automate and streamline the commissions process from beginning to end, he added. The startup is expanding its data integrations to support “all major data systems” and introducing new dashboarding capabilities. It’s also enhancing existing collaboration workflows around approvals, inquiries and contracts.

Looking ahead, CaptivateIQ is exploring the potential of applying its technology to solve for use cases outside the world of commissions — something that it says its customers are already doing.

“It’s exciting to see what people have been building, and we’re looking forward to enabling new solutions as we continue to release more of our core technology platform,” Teng said.

Accel Partner Ben Fletcher said the pain point of calculating and reporting sales commissions kept coming up among portfolio companies, with CaptivateIQ frequently referenced. Those companies, he said, tried more enterprise-grade solutions — “spending hundreds of thousands on implementation to ultimately find that their products did not work.” They also tried other newer tools that also just didn’t work well.

“As we dug in and talked with more and more customers, it was abundantly clear — CaptivateIQ was the best product in the space,” Fletcher said.

Besides ease of use, the fact that CaptivateIQ is a no-code tool, is a big deal to Accel.

“Similar to UIPath, Webflow, and Ada, CaptivateIQ is able to bring the power of customer development and automation to an easy to use, drag-and-drop product,” Fletcher said.

Powered by WPeMatico

The longer we continue to work with either all or part of our teams in remote, out-of-physical-office environments, the more imperative it becomes for those teams to have some tools in place to keep the channels of communication and management open, and for the individuals in those teams to have a sense of how well they are performing. Today, one of the startups that provides a team productivity app with that in mind is announcing a round of funding to fuel its growth.

Pathlight, which has built a performance management platform for customer-facing teams — sales, field service and support — to help managers and employees themselves track and analyze how they are doing, to coach them when and where it’s needed and to communicate updates and more, has picked up $25 million — money that it will be using to continue growing its customer base and the functionality across its app.

The funding is being led by Insight Partners, with previous backers Kleiner Perkins and Quiet Capital also participating, alongside Uncorrelated Ventures; Jeremy Stoppelman, CEO of Yelp; David Glazer, CFO of Palantir; and Michael Ovitz, co-founder of CAA and owner of Broad Beach Ventures. Pathlight has now raised $35 million.

Pathlight today provides users with a range of tools to visualize team and individual performance across various parameters set by managers, using data that teams integrate from other platforms like Salesforce, Zendesk and Outreach, among others.

Using that data and specific metrics for the job in question, managers can then initiate conversations with individuals to focus on specific areas where things need attention, and provide some coaching to help fix it. It can also be used to provide team-wide updates and encouragement, which sits alongside whatever other tools a person might use in their daily customer-facing work.

Since launching in March 2020, the startup has picked up good traction, with customers including Twilio, Earnin, Greenhouse and CLEAR. But perhaps even more importantly, the pandemic and resulting switch to remote work has underscored how necessary tools like Pathlight’s have become: The startup says that engagement on its platform has shot up 300% in the last 12 months.

Alexander Kvamme, the CEO of Pathlight, said that he first became aware of the challenges of communicating across customer-facing teams, and having transparency on how they are doing as individuals and as a group, when he was at Yelp. Yelp had acquired his startup, reservations service SeatMe, and used the acquisition to build and run Yelp Reservations.

He was quick to realize that there weren’t really effective tools for him to see how individuals in the sales team were doing, how they were doing compared to goals the company wanted to achieve and based on the sales data they already had in other systems, how to work more effectively with people to communicate when something needed changing, and how to tailor all that in line with new variations in the formula — in their case, how to sell new products like a reservations service alongside advertising and other Yelp services for businesses.

“Whether it’s five or 3,000 people, the problem doesn’t go away,” he said. “Everyone uses their own systems, and it hurts front-line employees when they don’t know how they are doing, or don’t get recognition when they are doing well, or don’t get coaching when they are not. Our thesis was that if software is eating the world, and you as a company are buying more software and analytics, over time managers will be more like data analysts. So we are providing a way for managers to be more data-driven.”

Five years down the line, Kvamme got the bug again to start a company and decided to return to that problem, teaming up with co-founder Trey Doig, the engineer who designed SeatMe and then turned it into Yelp Reservations and is now Pathlight’s CTO.

As they see it, the challenge has still not really been addressed. That’s not to say that there are not a number of companies — competitors to Pathlight — looking to fill that gap as well. Another people management platform called Lattice last year picked up $45 million (I’m guessing it will be raising money again around about now); HubSpot, Zoho, SalesLoft and a number of others also are taking different approaches to the same challenge: front-line customer-facing people spend the majority of their time and attention on interacting with people, and so there need to be better tools in place to help them figure out how to make that communication more effective, figure out what is working and what is not.

And all of this, of course, is not at all new: It’s not like we all woke up one day and suddenly wanted to know how we are doing at work, or managers suddenly felt they needed to communicate with staff.

What has changed, however, is how we work: Many of us have not seen the inside of our offices for more than a year at this point, and for a large proportion of us, we may never return again, or if we do it will be under different circumstances.

All of this means that some of the more traditional metrics and indicators of our performance, praising, management relationships and learning from teammates simply is not there anymore.

In customer-facing areas like sales, support and field service, that lack of contact may be even more acute, since many of the teams working in these environments have long relied on huddles and communication throughout the day, week and month to continuously tweak work and improve it. So while tools like Pathlight’s will be useful as data analytics provision for teams regardless of how we work, it can be argued that they are even more important right now.

“I think people have started to realize that if you can empower front line to be more independent, your numbers will go up and do better,” Kvamme said.

This is part of what went into the investment decision made here.

“With the acceleration of digital transformation across the enterprise, it’s not enough to rethink the way we work — we must also rethink the way we manage,” said Jeff Lieberman, MD at Insight Partners. “Pathlight is ushering in a new age of data-driven management, an ethos that we believe every enterprise will need to embrace — quickly. We are excited to partner with the Pathlight team as they bring their powerful platform to companies across the world.”

Powered by WPeMatico

Artificial intelligence has become a fundamental cornerstone of how a lot of business software works, providing a useful boost in reading, understanding and using the often-fragmented trove of data that organizations generate these days. In the latest development, an Israeli startup called Blue dot, which uses AI to help companies handle their tax accounting, is announcing $32 million in funding to continue its growth, specifically addressing the demand from companies for more user-friendly tools to help read and correctly itemize expenses for tax purposes.

“The tax sector is very complicated, and we are playing in a very large space, but it’s a huge revolution,” Blue dot’s CEO and co-founder Isaac Saft said in an interview. “Business and enterprise accounting is just not going to look the same in the future as it does today.”

The funding is being led by Ibex Investors in partnership with Lutetia Technology Partners, with past investors La Maison Partners, Viola and Target Global also contributing. Blue dot rebranded only last week from its original name, VATBox (part of the funding will be used to help Blue dot move deeper into the U.S. market, where the concept of VAT is not quite so ubiquitous: there is no national sales tax and states determine the rates themselves).

PitchBook notes that under its previous name, the startup last raised money in 2017, a $20 million Series B led by Viola at a $120 million post-money valuation.

While Blue dot is not disclosing valuation today, it’s likely to be significantly higher than this based on some of its engagements. In addition to customers like Amazon, tobacco giant BAT and Dell, it also has a partnership with one of the bigger names in expense accounting, SAP Concur, which uses Blue dot to power its expense data entry tool to automatically read charges and figure out how to itemize them so that employees or accountants don’t need to go through the pain of that themselves.

As Saft describes it, part of what is propelling his company’s business is the bigger trend of consumerization and the role that it has played in enterprise services: the working world has picked up a lot of technology tools, led by the smartphone, to help them organize their personal lives, and a lot of what they are being “served” through technology is increasingly personalized with lower barriers of entry, whether its on e-commerce sites, entertainment or social media. In the working world, people can often be frustrated as a result with how much work something like expenses can involve — a process that gets ever more complicated the more strict tax regimes become.

Blue dot’s approach is to essentially view the tax accounting process as something that can be improved with AI to make it easier for people to use — whether those people are workers itemizing their expenses, or accountants auditing them and running those through even bigger accounting processes. With a machine learning system that both takes into account a company’s own internal compliance and company policies, and the wider tax and regulatory framework, Blue dot helps “read” an expense and figure out how to notate it, how much tax should be accounted and where, and so on.

This is especially important as the process of entering and managing expenses gets pushed out to the people spending the money, rather than dedicated accountants handling that work on their behalf. An awareness of how modern offices are functioning today and evolving is one reason why investors were interested here.

“We believe Blue dot can change the way organizations worldwide manage accounting and its tax implications for their expenses,” Gal Gitter, a partner at Ibex, said in a statement. “There’s been a major market shift away from centralization of enterprise functions, including procurement. As that accelerates, more companies will be looking for ways to replace costly and complex manual processes with digital, automated solutions that use data and AI to essentially enable transactions to report themselves, which Blue dot delivers.”

Powered by WPeMatico

No-code startups continue to see a lot of traction among enterprises, where employees — strictly speaking, non-technical, but still using software every day — are getting hands-on and building apps to take on some of the more repetitive aspects of their jobs, the so-called “citizen coders” of the working world.

And in one of the latest developments, Bryter — an AI-based no-code startup that has built a platforms used by some 100 global enterprises to date across some 2,000 business applications and workflows — is announcing a new round of funding to double down on that opportunity. The Berlin-based company has closed a Series B of $66 million, money that it will be investing into its platform and expanding in the U.S. out of a New York office it opened last year. The funding comes on the heels of seeing a lot of demand for its tools, CEO and co-founder Michael Grupp said in an interview.

“It was a great year for low-code and no-code platforms,” said Grupp, who co-founded the company with Micha-Manuel Bues and Michael Hübl. “What everyone has realized is that most people don’t actually care about the tech. They only care about the use cases. They want to get things done.” Customers using the service include the likes of McDonald’s, Telefónica, PwC, KPMG and Deloitte in Europe, as well as banks, healthcare and industrial enterprises.

Tiger Global is leading this round, with previous backers Accel, Dawn Capital, Notion Capital and Cavalry Ventures also participating, along with a number of individual backers (they include Amit Agarwal, CPO of Datadog; Lars Björk, former CEO of Qlik; Ulf Zetterberg, founder and CEO of Seal Software; and former ServiceNow global SVP James Fitzgerald). The valuation is not being disclosed; Bryter has raised around $90 million to date.

Accel and Dawn co-led Bryter’s Series A of $16 million less than a year ago, in June 2020, a rapid funding pace that underscores both interest in the no-code/low-code space — Bryter’s enterprise customer base has doubled from 50 since then — and the fact that startups in it are striking while the iron is hot.

Bryter’s not the only one: Airtable, Genesis, Rows, Creatio and Ushur are among the many startups building “hands-on tech creation for non-techie people” that have raised money in the last several months.

Automation has been the bigger trend that has propelled a lot of this activity. Knowledge workers spend most of their time these days in apps — a state of affairs that pre-dates the COVID-19 pandemic, but has definitely been furthered throughout it. While some of that work still requires manual involvement and evaluation from those workers, software has automated large swathes of those jobs.

RPA — robotic process automation, where companies like UiPath, Automation Anywhere and Blue Prism have taken a big lead — has accounted for a significant chunk of that activity, especially when it comes to reading forms and lots of data entry. But there remains a lot of other transactions and activities within specific apps where RPA is typically not used (not yet at least!). And this is where non-tech workers are finding that no-code tools like Bryter, which use artificial intelligence to deliver more personalised, yet scalable, automation, can play a very useful role.

“We sit on top of RPA in many cases,” said Grupp.

The company says that business functions where its platform has been implemented include compliance, legal, tax, privacy and security, procurement, administration and HR, and the kinds of features that are being built include virtual assistants, chatbots, interactive self-service tools and more.

These don’t replace people as such, but cut down the time they need to spend in specific tasks to process and handle information within them, and could in theory also be used to build tools for customers to interact with services more easily, cutting down on the amount of time that agents are getting details and handling engagements.

That scalability and the rapid customer up-take from a pool of users that extends beyond tech early adopters are part of what attracted the funding.

“Bryter has all the characteristics of a top-tier software company: high quality product that solves a real customer pain point, a large market opportunity and a world-class founding team,” said John Curtius, a partner at Tiger Global, in a statement. “The feedback from Bryter’s customers was resoundingly positive in our research, and we are excited to see the company reach new heights over the coming years.”

“Bryter has seen explosive growth over the last year, signing landmark customers across a large number of sectors and use cases. This does not come as a surprise. In the pandemic-affected world, digitalisation is no longer a nice to have, it is an imperative,” added Evgenia Plotnikova, a partner at Dawn Capital.

Powered by WPeMatico

Digital transformation is the name of the game these days, and companies that are enabling businesses to take a leap into the future, by helping them tackle their most complex operations, are reaping the rewards. In the latest development, OneStream, a startup that provides a toolkit of services to enterprises to help them run financial operations (for example, reporting, planning, tax and more), has raised $200 million in primary equity. The funding values OneStream at $6 billion.

D1 Capital Partners led the financing, with participation from Tiger Global and Investment Group of Santa Barbara (IGSB), the company said. Tiger Global and D1 appear to share at least one common backer, Tiger Management, which may be one reason why you see them together in many big deals.

The company plans to use the funding to continue building out the tools that it provides to customers, and to keep up with demand for its services as more customers replace legacy applications and very basic, spreadsheet-based operations.

“We remain sharply focused on delivering innovative planning, reporting and analysis solutions designed to help our customers succeed for today’s fast-paced and increasingly complex business environment,” said Tom Shea, CEO of OneStream Software, in a statement. “The valuation we received is great recognition of the value our employees and stakeholders have helped to create, as well as the exciting opportunities ahead for OneStream.”

To put these large numbers into some context, OneStream was valued at $1 billion only two years ago, when KKR took a majority stake in the company worth more than $500 million. The company’s CFO, Bill Koefoed, has confirmed to us that KKR will continue to be “substantially OneStream’s largest shareholder and remains a very supportive investor”. The company meanwhile appears to be holding off any plans for going public for the time being — despite some possible hints that it was considering that move.

“OneStream is currently focused on delivering 100% customer access, continuing to grow the business and creating value for stakeholders,” Koefoed said. “IPO is a potential exit and OneStream is preparing to be a public company. However, there is no specific timeline.”

The growth in valuation, meanwhile, reflects the surge of business that OneStream has seen in the last two years, and in particular in the last 12 months, as companies have been compelled to update their systems to work more efficiently and flexibly amid the COVID-19 pandemic and the impact it has had around in-person interactions. OneStream said annual recurring revenue grew 85% in 2020, with customers growing by 40% to 650 enterprises.

The company’s focus is specifically in the area commonly called corporate performance management (CPM), which includes a number of the financial corporate operations that a company runs behind the scenes to keep its business ticking.

Some of these would have fallen to a range of software providers, and much of the work would have been carried out by way of on-premise solutions, with companies like SAP, Oracle Hyperion and IBM dominating the space with all-in solutions, and others like Anaplan and Blackline providing point solutions addressing specific aspects of those functions.

But as with other areas of enterprise services, the advances of technology and software have created opportunities to take a lot of that functionality into the cloud and to run the processes across a single system to improve analytics and efficiency, and that has provided an opportunity to the likes of OneStream.

The impact of the pandemic should not be underestimated in this trend, and it was one that OneStream was able to nail because its software can be used across disparate teams and can draw a direct line to helping companies manage their finances better. And unlike a lot of tech companies that raise venture funding, one interesting detail with OneStream is that it has extended its customer base well outside the realm of technology companies and other early adopters. Those using its software include the likes of Fruit of the Loom, McCain (the frozen fries king) and AAA, but also Takeaway.com, the Carlyle Group and many others.

“The pandemic accelerated OneStream’s business given that it was a wake-up call for many companies that had not digitally transformed their key finance processes,” said Koefoed. “As a result, we have seen increased demand from companies who were using spreadsheets or legacy CPM applications to manage their financial close, consolidation, reporting, planning and forecasting processes… They are better able to keep their finance teams connected and collaborating while physically dispersed. In addition, we have seen many organizations increasing the frequency of their forecasting and scenario modeling from quarterly or monthly to weekly and daily in some cases, especially during the early days of the pandemic when modeling revenue and cash flow was critical.”

For investors, the interest more specifically was how OneStream managed to add more customers away from competitors in the last year.

“OneStream’s platform delivers exceptional customer value,” said Andrew Wynne, a principal at D1 Capital Partners, in a statement. “Management’s intense focus on customer success has enabled OneStream to capture significant market share from incumbents, while posting strong growth in both revenue and customer acquisition. We believe OneStream has both the vision and product required to be a dominant force in its industry.”

Going forward, it sounds like the company will continue to build on what it has already established. That will include more business into Asia Pacific alongside its current operations in North America and Europe, Koefoed said. It will also use its foothold in finance and providing services to the finance department to make inroads into other areas that link closely to money management: money spending and revenue generation, with tools to plan and operate in areas like HR, IT, sales, marketing, supply chain management “and other areas to ensure alignment and optimal resource allocations,” he added.

Powered by WPeMatico

Cora, a São Paulo-based technology-enabled lender to small and-medium-sized businesses, has raised $26.7 million in a Series A round led by Silicon Valley VC firm Ribbit Capital.

Kaszek Ventures, QED Investors and Greenoaks Capital also participated in the financing, which brings the startup’s total raised to $36.7 million since its 2019 inception. Kaszek led Cora’s $10 million seed round (believed at that time to be one of the largest seed investments in LatAm) in December 2019, with Ribbit then following.

Last year, Cora got its license approved from the Central Bank of Brazil, making it a 403 bank. The fintech then launched its product in October 2020 and has since grown to have about 60,000 customers and 110 employees.

Cora offers a variety of solutions, ranging from a digital checking account, Visa debit card and management tools such as an invoice manager and cashflow dashboard. With the checking account, customers have the ability to send and receive money, as well as pay bills, digitally.

This isn’t the first venture for Cora co-founders Igor Senra and Leo Mendes. The pair had worked together before — founding their first online payments company, MOIP, in 2005. That company sold to Germany’s WireCard in 2016 (with a 3 million-strong customer base), and after three years the founders were able to strike out again.

Cora co-founders Leo Mendes and Igor Senra; Image courtesy of Cora

With Cora, the pair’s long-term goal is to “provide everything that a SMB will need in a bank.”

Looking ahead, the pair has the ambitious goal of being “the fastest growing neobank focused on SMBs in the world.” It plans to use the new capital to add new features and improve existing ones; on operations; and launching a portfolio of credit products.

In particular, Cora wants to go even deeper in certain segments, such as B2B professional services such as law and accounting firms, real estate brokerages and education.

Ribbit Capital partner Nikolay Kostov believes that Cora has embarked on “an ambitious mission” to change how small businesses in Brazil are able to access and experience banking.

“While the consumer banking experience has undergone a massive transformation thanks to new digital experiences over the last decade, this is, sadly, still not the case on the small business side,” he said.

For example, Kostov points out, opening a traditional small business bank account in Brazil takes weeks, “reels of paper, and often comes with low limits, poor service and antiquated digital interfaces.”

Meanwhile, the number of new small businesses in the country continues to grow.

“The combination of these factors makes Brazil an especially attractive market for Cora to launch in and disrupt,” Kostov told TechCrunch. “The Cora founding team is uniquely qualified and deeply attuned to the challenges of small businesses in the country, having spent their entire careers building digital products to serve their needs.”

Since Ribbit’s start in 2012, he added, LatAm has been a core focus geography for the firm “given the magnitude of challenges, and opportunities in the region to reinvent financial services and serve customers better.”

Ribbit has invested in 15 companies in the region and continues to look for more to back.

“We fully expect that several fintech companies born in the region will become global champions that serve to inspire other entrepreneurs across the globe,” Kostov said.

Powered by WPeMatico

Over the course of their careers, Alex Bovee and Paul Querna realized that while the use of SaaS apps and cloud infrastructure was exploding, the process to give employees permission to use them was not keeping up.

The pair led Zero Trust strategies and products at Okta, and could see the problem firsthand. For the unacquainted, Zero Trust is a security concept based on the premise that organizations should not automatically trust anything inside or outside its perimeters and, instead must verify anything and everything trying to connect to its systems before granting access.

Bovee and Querna realized that while more organizations were adopting Zero Trust strategies, they were not enacting privilege controls. This was resulting in delayed employee access to apps, or to the over-permissioning employees from day one.

Last summer, Bovee left Okta to be the first virtual entrepreneur-in-residence at VC firm Accel. There, he and Accel partner Ping Li got to talking and realized they both had an interest in addressing the challenge of granting permissions to users of cloud apps quicker and more securely.

Recalls Li: “It was actually kind of fortuitous. We were looking at this problem and I was like ‘Who can we talk to about the space?’ And we realized we had an expert in Alex.”

At that point, Bovee told Li he was actually thinking of starting a company to solve the problem. And so he did. Months later, Querna left Okta to join him in getting the startup off the ground. And today, ConductorOne announced that it raised $5 million in seed funding in a round led by Accel, with participation from Fuel Capital, Fathom Capital and Active Capital.

ConductorOne plans to use its new capital to build what the company describes as “the first-ever identity orchestration and automation platform.” Its goal is to give IT and identity admins the ability to automate and delegate employee access to cloud apps and infrastructure, while preserving least-privilege permissions.

“The crux of the problem is that you’ve got these identities — you’ve got employees and contractors on one side and then on the other side you’ve got all this SaaS infrastructure and they all have sort of infinite permutations of roles and permissions and what people can do within the context of those infrastructure environments,” Bovee said.

Companies of all sizes often have hundreds of apps and infrastructure providers they’re managing. It’s not unusual for an IT helpdesk queue to be more than 20% access requests, with people needing urgent access to resources like Salesforce, AWS or GitHub, according to Bovee. Yet each request is manually reviewed to make sure people get the right level of permissions.

“But that access is never revoked, even if it’s unused,” Bovee said. “Without a central layer to orchestrate and automate authorization, it’s impossible to handle all the permissions, entitlements and on- and off-boarding, not to mention auditing and analytics.”

ConductorOne aims to build “the world’s best access request experience,” with automation at its core.

“Automation that solves privilege management and governance is the next major pillar of cloud identity,” Accel’s Li said.

Bovee and Querna have deep expertise in the space. Prior to Okta, Bovee led enterprise mobile security product development at Lookout. Querna was the co-founder and CTO of ScaleFT, which was acquired by Okta in 2018. He also led technology and strategy teams at Rackspace and Cloudkick, and is a vocal and active open-source software advocate.

While the company’s headquarters are in Portland, Oregon, ConductorOne is a remote-first company with 10 employees.

“We’re deep in building the product right now, and just doing a lot of customer development to understand the problems deeply,” Bovee said. “Then we’ll focus on getting early customers.”

Powered by WPeMatico

Swiggy has raised about $800 million in a new financing round, the Indian food delivery startup told employees on Monday, as it looks to expand its business in the country quarters after the startup cut its workforce to navigate the pandemic.

In an email to employees, first reported by Times of India journalist Digbijay Mishra, Swiggy co-founder and chief executive Sriharsha Majety said the startup had raised about $800 million from new investors, including Falcon Edge Capital, Goldman Sachs, Think Capital, Amansa Capital and Carmignac, and existing investors Prosus Ventures and Accel.

“This fundraise gives us a lot more firepower than the planned investments for our current business lines. Given our unfettered ambition though, we will continue to seed/experiment new offerings for the future that may be ready for investment later. We will just need to now relentlessly invent and execute over the next few years to build an enduring iconic company out of India,” wrote Majety in the email obtained by TechCrunch.

Majety didn’t disclose the new valuation of Swiggy, but said the new financing round was “heavily subscribed given the very positive investor sentiments towards Swiggy.” According to a person familiar with the matter, the new round valued Swiggy at over $4.8 billion $4.9 billion. The startup has now raised about $2.2 billion to date.

Swiggy had raised $157 million last year at about $3.7 billion valuation. That investment is not part of the new round, a person familiar with the matter told TechCrunch.

He said the long-term goal for the startup, which competes with heavily-backed Zomato and new entrant Amazon, is to serve 500 million users in the next 10-15 years, pointing to Chinese food giant Meituan, which had 500 million transacting users last year and is valued at over $100 billion.

“We’re coming out of a very hard phase during the last year given Covid and have weathered the storm, but everything we do from here on needs to maximise the chances of our succeeding in the long-term,” wrote Majety.

Swiggy last year eliminated some jobs — so did Zomato — and scaled down its cloud kitchen efforts as it attempted to stay afloat during the pandemic, which had prompted New Delhi to enforce a months-long lockdown.

Monday’s reveal comes amid Zomato raising $910 million in recent months as the Gurgaon-headquartered firm prepares for an IPO this year. The last tranche of investment valued Zomato at $5.4 billion. During its fundraise, Zomato said it was raising money partially to fight off “any mischief or price wars from our competition in various areas of our business.”

A third player, Amazon, also entered the food delivery market in India last year, though its operations are still limited to parts of Bangalore.

At stake is India’s food delivery market, which analysts at Bernstein expect to balloon to be worth $12 billion by 2022, they wrote in a report to clients earlier this year. Zomato currently leads the market with about 50% market share, Bernstein analysts wrote.

“We find the food-tech industry in India to be well positioned to sustained [sic] growth with improving unit economics. Take-rates are one of the highest in India at 20-25% and consumer traction is increasing. Market is largely a duopoly between Zomato and Swiggy with 80%+ share,” wrote analysts at Bank of America in a recent report, reviewed by TechCrunch.

“The food delivery business is the strongest it’s ever been, and we’re now well on our way to drive continued growth over the next decade. In addition, some of our new bets like Instamart [grocery delivery business] are showing amazing promise while we’ve also made strides in setting up some of our other adjacencies for liftoff very soon.”

Powered by WPeMatico