funding

Auto Added by WPeMatico

Auto Added by WPeMatico

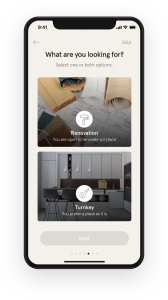

Casa Blanca, which aims to develop a “Bumble-like app” for finding a home, has raised $2.6 million in seed funding.

Co-founder and CEO Hannah Bomze got her real estate license at the age of 18 and worked at Compass and Douglas Elliman Real Estate before launching Casa Blanca last year.

She launched the app last October with the goal of matching home buyers and renters with homes using an in-app matchmaking algorithm combined with “expert agents.” Buyers get up to 1% of home purchases back at closing. Similar to dating apps, Casa Blanca’s app is powered by a simple swipe left or right.

Samuel Ben-Avraham, a partner and early investor of Kith and an early investor in WeWork, led the round for Casa Blanca, bringing its total raise to date to $4.1 million.

The New York-based startup recently launched in the Colorado market and has seen some impressive traction in a short amount of time.

Since launching the app in October, Casa Blanca has “made more than $100M in sales” and is projected to reach $280 million this year between New York and its Denver launch.

Bomze said the app experience will be customized for each city with the goal of creating a personalized experience for each user. Casa Blanca claims to streamline and sort listings based on user preferences and lifestyle priorities.

Image Credits: Casa Blanca

“People love that there is one place to book, manage feedback, schedule and communicate with a branded agent for one cohesive experience,” Bomze said. “We have a breadth of users from first time buyers to people using our platform for $15 million listings.”

Unlike competitors, Casa Blanca applies a direct-to-consumer model, she pointed out.

“While our agents are an integral part of the company, they are not responsible for bringing in business and have more organizational support, which allows them to focus on the individual more and creates a better end-to-end experience for the consumer,” Bomze said.

Casa Blanca currently has over 38 agents in NYC and Colorado, compared to about 15 at this time last year.

“We are in a growth phase and finding a unique opportunity in this climate, in particular, because there are many women exploring new, more flexible job opportunities,” Bomze noted.

The company plans to use its new capital to continue expanding into new markets, nationally and globally; as well as enhancing its technology and scaling.

“As we continue to grow in new markets, the app experience will be curated to each city — for example, in Colorado you can edit your preferences based on access to ski areas — to make sure we’re offering a personalized experience for each user,” Bomze said.

Powered by WPeMatico

As companies create machine learning models, the operations team needs to ensure the data used for the model is of sufficient quality, a process that can be time-consuming. Bigeye (formerly Toro), an early-stage startup is helping by automating data quality.

Today the company announced a $17 million Series A led Sequoia Capital with participation from existing investor Costanoa Ventures. That brings the total raised to $21 million with the $4 million seed, the startup raised last May.

When we spoke to Bigeye CEO and co-founder Kyle Kirwan last May, he said the seed round was going to be focused on hiring a team — they are 11 now — and building more automation into the product, and he says they have achieved that goal.

“The product can now automatically tell users what data quality metrics they should collect from their data, so they can point us at a table in Snowflake or Amazon Redshift or whatever and we can analyze that table and recommend the metrics that they should collect from it to monitor the data quality — and we also automated the alerting,” Kirwan explained.

He says that the company is focusing on data operations issues when it comes to inputs to the model, such as the table isn’t updating when it’s supposed to, it’s missing rows or there are duplicate entries. They can automate alerts to those kinds of issues and speed up the process of getting model data ready for training and production.

Bogomil Balkansky, the partner at Sequoia who is leading today’s investment, sees the company attacking an important part of the machine learning pipeline. “Having spearheaded the data quality team at Uber, Kyle and Egor have a clear vision to provide always-on insight into the quality of data to all businesses,” Balkansky said in a statement.

As the founding team begins building the company, Kirwan says that building a diverse team is a key goal for them and something they are keenly aware of.

“It’s easy to hire a lot of other people that fit a certain mold, and we want to be really careful that we’re doing the extra work to [understand that just because] it’s easy to source people within our network, we need to push and make sure that we’re hiring a team that has different backgrounds and different viewpoints and different types of people on it because that’s how we’re going to build the strongest team,” he said.

Bigeye offers on-prem and SaaS solutions, and while it’s working with paying customers like Instacart, Crux Informatics and Lambda School, the product won’t be generally available until later in the year.

Powered by WPeMatico

As computing systems become increasingly bigger and more complex, forensics have become an increasingly important part of how organizations can better secure them. As the recent SolarWinds breach has shown, it’s not always just a matter of being able to identify data loss, or prevent hackers from coming in in the first place. In cases where a network has already been breached, running a thorough investigation is often the only way to identify what happened, if a breach is still active and whether a malicious hacker can strike again.

As a sign of this growing priority, a startup called Cado Security, which has built forensics technology native to the cloud to run those investigations, is announcing $10 million in funding to expand its business.

Cado’s tools today are used directly by organizations, but also security companies like Redacted — a somewhat under-the-radar security startup in San Francisco co-founded by Facebook’s former chief security officer Max Kelly and John Hering, the co-founder of Lookout. It uses Cado to carry out the forensics part of its work.

The funding for London-based Cado is being led by Blossom Capital, with existing investors Ten Eleven Ventures also participating, among others. As another signal of demand, this Series A is coming only six months after Cado raised its seed round.

The task of securing data on digital networks has grown increasingly complex over the years: Not only are there more devices, more data and a wider range of configurations and uses around it, but malicious hackers have become increasingly sophisticated in their approaches to needling inside networks and doing their dirty work.

The move to the cloud has also been a major factor. While it has helped a wave of organizations expand and run much bigger computing processes as part of their business operations, it has also increased the so-called attack surface and made investigations much more complicated, not least because a lot of organizations run elastic processes, scaling their capacity up and down: This means when something is scaled down, logs of previous activity essentially disappear.

Cado’s Response product — which works proactively on a network and all of its activity after it’s installed — is built to work across cloud, on-premise and hybrid environments. Currently it’s available for AWS EC2 deployments and Docker, Kubernetes, OpenShift and AWS Fargate container systems, and the plan is to expand to Azure very soon. (Google Cloud Platform is less of a priority at the moment, CEO James Campbell said, since it rarely comes up with current and potential customers.)

Campbell co-founded Cado with Christopher Doman (the CTO) last April, with the concept for the company coming out of their respective experiences working on security services together at PwC, and respectively for government organizations (Campbell in Australia) and AlienVault (the security firm acquired by AT&T). In all of those, one persistent issue the two continued to encounter was the issue with adequate forensics data, essential for tracking the most complex breaches.

A lot of legacy forensics tools, in particular those tackling the trove of data in the cloud, was based on “processing data with open source and pulling together analysis in spreadsheets,” Campbell said. “There is a need to modernize this space for the cloud era.”

In a typical breach, it can take up to a month to run a thorough investigation to figure out what is going on, since, as Doman describes it, forensics looks at “every part of the disk, the files in a binary system. You just can’t find what you need without going to that level, those logs. We would look at the whole thing.”

However, that posed a major problem. “Having a month with a hacker running around before you can do something about it is just not acceptable,” Campbell added. The result, typically, is that other forensics tools investigate only about 5% of an organization’s data.

The solution — for which Cado has filed patents, the pair said — has essentially involved building big data tools that can automate and speed up the very labor intensive process of looking through activity logs to figure out what looks unusual and to find patterns within all the ones and zeros.

“That gives security teams more room to focus on what the hacker is getting up to, the remediation aspect,” Campbell explained.

Arguably, if there were better, faster tracking and investigation technology in place, something like SolarWinds could have been better mitigated.

The plan for the company is to bring in more integrations to cover more kinds of systems, and go beyond deployments that you’d generally classify as “infrastructure as a service.”

“Over the past year, enterprises have compressed their cloud adoption timelines while protecting the applications that enable their remote workforces,” said Imran Ghory, partner at Blossom Capital, in a statement. “Yet as high-profile breaches like SolarWinds illustrate, the complexity of cloud environments makes rapid investigation and response extremely difficult since security analysts typically are not trained as cloud experts. Cado Security solves for this with an elegant solution that automates time-consuming tasks like capturing forensically sound cloud data so security teams can move faster and more efficiently. The opportunity to help Cado Security scale rapidly is a terrific one for Blossom Capital.”

Powered by WPeMatico

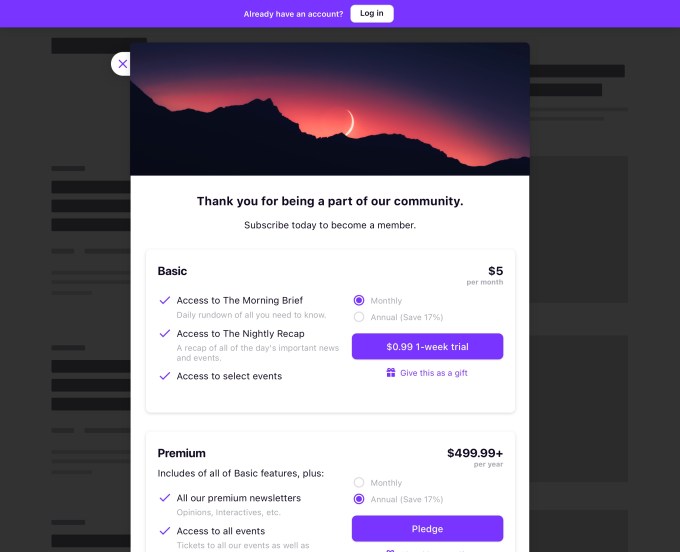

Pico, a New York startup that helps online creators and media companies make money and manage their customer data, announced today that it has launched an upgraded platform and raised $6.5 million in new funding.

In a statement, the startup’s co-founder and CEO Nick Chen said Pico helps creators with their two biggest problems — “how to make money more easily and how to get to know your audience better” — while also giving them control over their two most important assets, namely “your brand and the relationship to your audience.”

The company provides a long list of different tools, including landing pages, pop-ups to collect email addresses, paid newsletters, subscription paywalls, tiered membership programs, recurring and one-time donations and video revenue tools. With version 2.0, the company says it’s bringing all these features together with a unified data structure, so that customers can see “who is paying for what content and where they came from” in one dashboard.

Via email, co-founder and President Jason Bade (pictured above with Chen) pointed to “the power of our CRM to help creators understand their audience” as the most significant upgrade, suggesting that this “makes Pico the operating system for the creator economy.”

Image Credits: Pico

“A creator can’t scale a business without the proper tools,” Bade continued. “Take email capture, that is the first step in audience development. But what next? You need data and a CRM to handle it. 2.0 upgrades every part of Pico to rearchitect it for the scalability and extensibility that the creator economy demands.”

Pico also said it will be launching an API soon to support integrations with different parts of the platform.

Apparently, the company has seen its customer count increase nearly 5x in the past year, with customers including The Colorado Sun, Defector Media and The Generalist. And it recently recruited Rodolphe Ködderitzsch (who held a number of roles at YouTube, including global head of partner sales) as its chief revenue officer.

The new funding was led by Ann Lai at Bullpen Capital and brings Pico’s total funding to $10 million. Other investors include Precursor Ventures, Stripe, BloombergBeta and Village Global.

Powered by WPeMatico

There’s no doubt this past year has been a major watershed moment for the robotics industry. Warehouse and logistics have been a particular target for an automation push, as companies have worked to keep the lights on amidst stay at home orders and other labor shortages.

MIT spinoff Pickle is one of the latest startups to enter the fray. The company launched with limited funding and a small team, though it’s recently changed one of these, telling TechCrunch this week that it has raised $5.57 million in funding during this hot investment streak. The seed round was led by Hyperplane and featured Third Kind Venture Capital, Box Group and Version One Ventures, among others.

The company’s making some pretty big claims around the efficacy of its first robot named, get this, “Dill” (the company clearly can’t avoid a clever name). It says the robot is capable of 1,600 picks per hour from the back of a trailer, a figure it claims is “double the speed of any competitors.”

CEO Andrew Meyer says collaboration is a key to the company’s play. “We designed people into the system from the get-go and focused on a specific problem: package handling in the loading dock. We got out of the lab and put robots to work in real warehouses. We resisted the fool’s errand of trying to create a system that could work entirely unsupervised or solve every robotics problem out there.”

Orders for the first product targeted at trailer unloading will open in June, with an expected ship date of early 2022.

Powered by WPeMatico

Banking tech startup Zeta is inching closer to the much sought-after unicorn status as it engages with investors to finalize a new round, two sources familiar with the matter told TechCrunch.

SoftBank Vision Fund 2 is in advanced stages of talks to lead a ~$250 million Series D round in the five-year-old startup, the sources said. The investment proposal values the Indian startup, co-founded by high-profile entrepreneur Bhavin Turakhia, at over $1 billion, up from $300 million in its maiden external funding (Series C) in 2019.

The round has yet to close, a third person said.

A SoftBank spokesperson declined to comment.

Five-year-old Zeta helps banks launch modern retail and fintech products. The thesis is that banks — largely operating on antiquated technologies — today don’t have the time and expertise to offer the best experience to hundreds of millions of customers and fintech firms they serve.

Zeta is attempting to help banks either use the startup’s cloud-native, API-first banking stack as its core framework or build services atop it to offer better a experience to all customers — think of improved mobile app and debit and credit features. It also offers API, SDKs and payment gateways to banks to work more efficiently with fintech firms.

The startup has amassed clients in several Asian and Latin American markets.

Turakhia, with his brother Divyank, started his first venture in 1998. Along the way, they sold four web companies to Endurance for $160 million. Zeta is the third startup Bhavin has co-founded since then — the other being business messaging platform Flock and Radix.

When the deal is finalized, Zeta would join a growing list of Indian startups that have turned a unicorn in recent months. Last week, social commerce Meesho — also backed by SoftBank Vision Fund 2 — fintech firm CRED, e-pharmacy firm PharmEasy, millennials-focused Groww, business messaging platform Gupshup and social network ShareChat attained the unicorn status.

The story was updated with additional details and to note that the round hasn’t closed.

Powered by WPeMatico

A few weeks ago, we wrote about fintech Pilot raising a $100 million Series C that doubled the company’s valuation to $1.2 billion.

Bezos Expeditions — Amazon founder Jeff Bezos’ personal investment fund — and Whale Rock Capital joined the round, adding $40 million to a $60 million raise led by Sequoia about one month prior.

That raise came after a $40 million Series B in April 2019 co-led by Stripe and Index Ventures that valued the company at $355 million.

Both raises were notable and warranted coverage. But sometimes it’s fun to take a peek at the stories behind the raises and dig deeper into the numbers.

So here we go.

First off, San Francisco-based Pilot — which has a mission of affordably providing back-office services such as bookkeeping to startups and SMBs — apparently had term sheets that offered “2x the $40M” raised in its Series B. But it chose not to raise so much capital.

I also heard that the same investor that ended up leading a now defunct competitor’s $60 million raise first asked to invest $60 million in Pilot as a follow-on to that Series B prior to making the other investment. While I don’t know for sure, I can only presume that what is being referred to is ScaleFactor’s $60 million Series C raise in August 2019 that was led by Coatue Management. (ScaleFactor crashed and burned last year.)

According to CFO Paul Jun: “There were many periods when Pilot turned away new customers and growth capital instead of absolutely maximizing short-term growth…Pilot prioritized building the foundational investments needed for scalability, reliability and high velocity. When it was presented with the opportunity for additional funding towards further growth in 2019, it declined to do so.”

Co-founder and CEO Waseem Daher elaborates, pointing out that the first company that Pilot’s founding team ran, Ksplice, was bootstrapped before getting acquired by Oracle in 2011. (It’s also worth noting that the founding team are all MIT computer scientists.)

“Ultimately, the reason to raise money is you believe that you can deploy the capital, to grow the company or to basically cause the company to grow at the rate you’d like to grow. And it doesn’t make sense to raise money if you don’t need it, or don’t have a good plan for what to do with it,” Daher told TechCrunch. “Too much capital can be bad because it sort of leads you to bad habits…When you have the money, you spend the money.”

So despite what he describes as “a great deal of institutional interest” in 2019, Pilot opted to raise just $40 million, instead of $80 million to $100 million, because it was the amount of capital the company had confidence that it could deploy successfully.

Also, Jun shared some numbers beyond the recent raise amount and valuation.

Bottom line is companies don’t have to accept all the capital that’s offered to them. And maybe in some cases, they shouldn’t.

Powered by WPeMatico

School closures due to the pandemic have interrupted the learning processes of millions of kids, and without individual attention from teachers, reading skills in particular are taking a hit. Amira Learning aims to address this with an app that reads along with students, intelligently correcting errors in real time. Promising pilots and research mean the company is poised to go big as education changes, and it has raised $11 million to scale up with a new app and growing customer base.

In classrooms, a common exercise is to have students read aloud from a storybook or worksheet. The teacher listens carefully, stopping and correcting students on difficult words. This “guided reading” process is fundamental for both instruction and assessment: It not only helps the kids learn, but the teacher can break the class up into groups with similar reading levels so she can offer tailored lessons.

“Guided reading is needs-based, differentiated instruction and in COVID we couldn’t do it,” said Andrea Burkiett, director of Elementary Curriculum and Instruction at the Savannah-Chatham County Public School System. Breakout sessions are technically possible, “but when you’re talking about a kindergarten student who doesn’t even know how to use a mouse or touchpad, COVID basically made small groups nonexistent.”

Amira replicates the guided reading process by analyzing the child’s speech as they read through a story and identifying things like mispronunciations, skipped words and other common stumbles. It’s based on research going back 20 years that has tested whether learners using such an automated system actually see any gains (and they did, though generally in a lab setting).

In fact I was speaking to Burkiett out of skepticism — “AI” products are thick on the ground and while it does little harm if one recommends you a recipe you don’t like, it’s a serious matter if a kid’s education is impacted. I wanted to be sure this wasn’t a random app hawking old research to lend itself credibility, and after talking with Burkiett and CEO Mark Angel I feel it’s quite the opposite and could actually be a valuable tool for educators. But it needed to convince educators first.

“You have to start by truly identifying the reason for wanting to employ a tech tool,” said Burkiett. “There are a lot of tech tools out there that are exciting, fun for kids, etc., but we could use all of them and not impact growth or learning at all because we didn’t stop and say, this tool helps me with this need.”

Amira was decided on as one that addresses the particular need in the K-5 range of steadily improving reading level through constant practice and feedback.

“When COVID hit, every tech tool came out of the woodwork and was made free and available,” Burkiett recalled. “With Amira you’re looking at a 1:1 tutor at their specific level. She’s not a replacement for a teacher — though it has been that way in COVID — but beyond COVID she could become a force multiplier,” said Burkiett.

You can see the old version of Amira in action below, though it’s been updated since:

Testing Amira with her own district’s students, Burkiett replicated the results that have been obtained in more controlled settings: As much as twice or three times as much progress in reading level based on standard assessment tools, some of which are built into the teacher-side Amira app.

Naturally it isn’t possible to simply attribute all this improvement to Amira — there are other variables in play. But it appears to help and doesn’t hinder, and the effect correlates with frequency of use. The exact mechanism isn’t as important as the fact that kids learn faster when they use the app versus when they don’t, and furthermore this allows teachers to better allocate resources and time. A kid who can’t use it as often because their family shares a single computer is at a disadvantage that has nothing to do with their aptitude — but this problem can be detected and accounted for by the teacher, unlike a simple “read at home” assignment.

“Outside COVID we would always have students struggling with reading, and we would have parents with the money and knowledge to support their student,” Burkiett explained. “But now we can take this tool and offer it to students regardless of mom and dad’s time, mom and dad’s ability to pay. We can now give that tutor session to every single student.”

This is familiar territory for CEO Mark Angel, though the AI aspect, he admits, is new.

“A lot of the Amira team came from Renaissance Learning. bringing fairly conventional edtech software into elementary school classrooms at scale. The actual tech we used was very simple compared to Amira — the big challenge was trying to figure out how to make applications work with the teacher workflow, or make them friendly and resilient when 6-year-olds are your users,” he told me.

“Not to make it trite, but what we’ve learned is really just listen to teachers — they’re the superusers,” Angel continued. “And to design for radically sub-optimal conditions, like background noise, kids playing with the microphone, the myriad things that happen in real-life circumstances.”

Once they were confident in the ability of the app to reliably decode words, the system was given three fundamental tasks that fall under the broader umbrella of machine learning.

The first is telling the difference between a sentence being read correctly and incorrectly. This can be difficult due to the many normal differences between speakers. Singling out errors that matter, versus simply deviation from an imaginary norm (in speech recognition that is often, effectively, American English as spoken by white people) lets readers go at their own pace and in their own voice, with only actual issues like saying a silent k noted by the app.

On that note, considering the prevalence of English language learners with accents, I asked about the company’s performance and approach there. Angel said they and their research partners went to great lengths to make sure they had a representative dataset, and that the model only flags pronunciations that indicate a word was not read or understood correctly.

The second is knowing what action to take to correct an error. In the case of a silent k, it matters whether this is a first grader who is still learning spelling or a fourth grader who is proficient. And is this the first time they’ve made that mistake, or the tenth? Do they need an explanation of why the word is this way, or several examples of similar words? “It’s about helping a student at a moment in time,” Angel said, both in the moment of reading that word, and in the context of their current state as a learner.

Third is a data-based triage system that warns students and parents if a kid may potentially have a language learning disorder like dyslexia. The patterns are there in how they read — and while a system like Amira can’t actually diagnose, it can flag kids who may be high risk to receive a more thorough screening. (A note on privacy: Angel assured me that all information is totally private and by default is considered to belong to the district. “You’d have to be insane to take advantage of it. We’d be out of business in a nanosecond.”)

The $11 million in funding comes at what could be a hockey-stick moment for Amira’s adoption. The round was led by Authentic Ventures II, LP, with participation from Vertical Ventures, Owl Ventures and Rethink Education.

“COVID was a gigantic spotlight on the problem that Amira was created to solve,” Angel said. “We’ve always struggled in this country to help our children become fluent readers. The data is quite scary — more than two-thirds of our fourth graders aren’t proficient readers, and those two-thirds aren’t equally distributed by income or race. It’s a decades-long struggle.”

Having basically given the product away for a year, the company is now looking at how to convert those users into customers. It seems like, just like the rest of society, “going back to normal” doesn’t necessarily mean going back to 2019 entirely. The lessons of the pandemic era are sticking.

“They don’t have the intention to just go back to the old ways,” Angel explained. “They’re searching for a new synthesis — how to incorporate tech, but do it in a classroom with kids elbow to elbow and interacting with teachers. So we’re focused on making Amira the norm in a post-COVID classroom.”

Part of that is making sure the app works with language learners at more levels and grades, so the team is working to expand its capabilities upward to include middle-school students as well as elementary. Another is building out the management side so that success at the classroom and district levels can be more easily understood.

The company is also launching a new app aimed at parents rather than teachers. “A year ago 100% of our usage was in the classroom, then three weeks later 100% of our usage was at home. We had to learn a lot about how to adapt. Out of that learning we’re shipping Amira and the Story Craft that helps parents work with their children.”

Hundreds of districts are on board provisionally — aided by a distribution partnership with Houghton Mifflin Harcourt, also an investor — but decisions are still being kicked down the road as they deal with outbreaks, frustrated parents and every other chaotic aspect of getting back to “normal.”

Perhaps a bit of celebrity juice may help tip the balance in their favor. A new partnership with Miami Dolphins (former Houston Texans) linebacker Brennan Scarlett has the NFL player advising the board and covering the cost of 100 students at a Portland, OR school through his education charity, the Big Yard Foundation — and more to come. It may be a drop in the bucket in the scheme of things, with a year of schooling disrupted, but teachers know that every drop counts.

Powered by WPeMatico

Digital transformation has been one of the biggest catchphrases of the past year, with many an organization forced to reckon with aging IT, a lack of digital strategy, or simply the challenges of growth after being faced with newly-remote workforces, customers doing everything online and other tech demands.

Now, a startup called Upstack that has built a platform to help those businesses evaluate how to grapple with those next steps — including planning and costing out different options and scenarios, and then ultimately buying solutions — is announcing financing to do some growth of its own.

The New York startup has picked up funding of $50 million, money that it will be using to continue building out its platform and expanding its services business.

The funding is coming from Berkshire Partners, and it’s being described as an “initial investment”. The firm, which makes private equity and late-stage growth investments, typically puts between $100 million and $1 billion in its portfolio companies so this could end up as a bigger number, especially when you consider the size of the market that Upstack is tackling: the cloud and internet infrastructure brokerage industry generates annual revenues “in excess of $70 billion,” the company estimates.

We’re asking about the valuation, but PitchBook notes that the median valuation in its deals is around $211 million. Upstack had previously raised around $35 million.

Upstack today already provides tools to large enterprises, government organizations, and smaller businesses to compare offerings and plan out pricing for different scenarios covering a range of IT areas, including private, public and hybrid cloud deployments; data center investments; network connectivity; business continuity and mobile services, and the plan is to bring in more categories to the mix, including unified communications and security.

Notably, Upstack itself is profitable and names a lot of customers that themselves are tech companies — they include Cisco, Accenture, cloud storage company Backblaze, Riverbed and Lumen — a mark of how digital transformation and planning for it are not necessarily a core competency even of digital businesses, but especially those that are not technology companies. It says it has helped complete over 3,700 IT projects across 1,000 engagements to date.

“Upstack was founded to bring enterprise-grade advisory services to businesses of all sizes,” said Christopher Trapp, founder and CEO, in a statement. “Berkshire’s expertise in the data center, connectivity and managed services sectors aligns well with our commitment to enabling and empowering a world-class ecosystem of technology solutions advisors with a platform that delivers higher value to their customers.”

The core of the Upstack’s proposition is a platform that system integrators, or advisors, plus end users themselves, can use to design and compare pricing for different services and solutions. This is an unsung but critical aspect of the ecosystem: We love to hear and write about all the interesting enterprise technology that is being developed, but the truth of the matter is that buying and using that tech is never just a simple click on a “buy” button.

Even for smaller organizations, buying tech can be a hugely time-consuming task. It involves evaluating different companies and what they have to offer — which can differ widely in the same category, and gets more complex when you start to compare different technological approaches to the same problem.

It also includes the task of designing solutions to fit one’s particular network. And finally, there are the calculations that need to be made to determine the real cost of services once implemented in an organization. It also gives users the ability to present their work, which also forms a critical part of the evaluating and decision-making process. When you think about all of this, it’s no wonder that so many organizations have opted to follow the “if it ain’t broke, don’t fix it” school of digital strategy.

As technology has evolved, the concept of digital transformation itself has become more complicated, making tools like Upstack’s more in demand both by companies and the people they hire to do this work for them. Upstack also employs a group of about 15 advisors — consultants — who also provide insight and guidance in the procurement process, and it seems some of the funding will also be used to invest in expanding that team.

(Incidentally, the model of balancing technology with human experts is one used by other enterprise startups that are built around the premise of helping businesses procure technology: BlueVoyant, a security startup that has built a platform to help businesses manage and use different security services, also retains advisors who are experts in that field.)

The advisors are part of the business model: Upstack’s customers can either pay Upstack a consulting fee to work with its advisors, or Upstack receives a commission from suppliers that a company ends up using, having evaluated and selected them via the Upstack platform.

The company competes with traditional systems integrators and consultants, but it seems that the fact that it has built a tech platform that some of its competitors also use is one reason why it’s caught the eye of investors, and also seen strong growth.

Indeed, when you consider the breadth of services that a company might use within their infrastructure — whether it’s software to run sales or marketing, or AI to run a recommendation for products on a site, or business intelligence or RPA — it will be interesting to see how and if Upstack considers deeper moves into these areas.

“Upstack has quickly become a leader in a large, rapidly growing and highly fragmented market,” said Josh Johnson, principal at Berkshire Partners, in a statement. “Our experience has reinforced the importance of the agent channel to enterprises designing and procuring digital infrastructure. Upstack’s platform accelerates this digital transformation by helping its advisors better serve their enterprise customers. We look forward to supporting Upstack’s continued growth through M&A and further investment in the platform.”

Powered by WPeMatico

You might think that a startup whose primary customers are tourism bureaus would have had a pretty rough 2020, but CEO Monir Parikh said Bandwango‘s customer base more than doubled in the past year, growing from 75 to 200.

In Parikh’s words, the Murray, Utah-based startup has built a platform called the Destination Experience Engine which is designed for “connecting businesses with communities.” That means bringing together offers from local restaurants, retailers, wineries, breweries, state parks and more into package deals — such as the Newport Beach Dine Pass and the Travel Iowa State Passport — which are then sold by tourism bureaus.

Obviously, the pandemic dealt a big blow to tourism, but in response, many of these organizations shifted focus to deals that could entice locals to support nearby businesses and attractions. Parikh predicted that even after the pandemic, tourism bureaus will continue to understand that “local-focused tourism is going to be part of the mix of what we do — locals are your ambassadors, they are the best organic marketing channel.”

Plus, Parikh said that as new privacy regulations make it harder to collect data about online visitors, it’s becoming more challenging for tourism bureaus “to prove to their funders that they’re having an economic impact.” So where bureaus were content in the past to advertise deals and then link out to other sites where customers could make the actual purchases, selling the deals themselves has become a new way to prove their worth.

Bandwango founder and CEO Monir Parikh. Image Credits: Bandwango

With last year’s growth, Bandwango has raised $3.1 million in seed funding led by Next Frontier Capital, with participation from Kickstart, Signal Peak Ventures, SaaS Ventures and Ocean Azul Partners. (The startup had previously raised only $700,000 in funding.)

Parikh said that until now, Bandwango has been a largely full-service option. The selling point, after all, is that the tourism bureaus already “have great relationships with these local businesses,” but the startup can handle the hard work of “trying to wrangle 200 of their local businesses” to offer deals and accept those deals in-store.

“Our mantra is: We become your back office,” he added. But with the new funding, he wants the startup to build a self-serve product as well. “What I say to my team is that a 90-year-old grandmother, as well as 12-year-old teenager, should be able to come into our platform and say, ‘I want to create a local savings program or an ale trail’ and do it end-to-end, without our assistance.”

And while Bandwango is currently focused on providing a white-label solution to its customers (rather than building a consumer deal destination of its own), Parikh said it will eventually distribute these deals more broadly by creating its own “private label brands.”

Powered by WPeMatico