funding

Auto Added by WPeMatico

Auto Added by WPeMatico

When we last heard from BigID at the end of 2020, the company was announcing a $70 million Series D at a $1 billion valuation. Today, it announced a $30 million extension on that deal valuing the company at $1.25 billion just four months later.

This chunk of money comes from private equity firm Advent International, and brings the total raised to more than $200 million across four rounds, according to the company. The late-stage startup is attracting all of this capital by building a security and privacy platform. When I spoke to CEO Dimitri Sirota in September 2019 at the time of the $50 million Series C, he described the company’s direction this way:

We’ve separated the product into some constituent parts. While it’s still sold as a broad-based [privacy and security] solution, it’s much more of a platform now in the sense that there’s a core set of capabilities that we heard over and over that customers want.

Sirota says he has been putting the money to work, and as the economy improves he is seeing more traction for the product set. “Since December, we’ve added employees as we’ve seen broader economic recovery and increased demand. In tandem, we have been busy building a whole host of new products and offerings that we will announce over the coming weeks that will be transformational for BigID,” he said.

He also said that as with previous rounds, he didn’t go looking for the additional money, but decided to take advantage of the new funds at a higher valuation with a firm that he believes can add value overall. What’s more, the funds should allow the company to expand in ways it might have held off on.

“It was important to us that this wouldn’t be a distraction and that we could balance any funding without the need to over-capitalize, which is becoming a bigger issue in today’s environment. In the end, we took what we thought could bring forward some additional product modules and add a sales team focused on smaller commercial accounts,” Sirota said.

Ashwin Krishnan, a principal on Advent’s technology team in New York, says that BigID was clearly aligned with two trends his firm has been following. That includes the explosion of data being collected and the increasing focus on managing and securing that data with the goal of ultimately using it to make better decisions.

“When we met with Dimitri and the BigID team, we immediately knew we had found a company with a powerful platform that solves the most challenging problem at the center of these trends and the data question,” Krishnan said.

Past investors in the company include Boldstart Ventures, Bessemer Venture Partners and Tiger Global. Strategic investors include Comcast Ventures, Salesforce Ventures and SAP.io.

Powered by WPeMatico

As businesses continue to adopt new digital tools to get their names out into the world, a startup that’s built a sales and marketing platform specifically for small and medium businesses is announcing a big round of funding. ActiveCampaign, which has built what it describes as a “customer experience automation” platform — providing a way not just to run digital campaigns but to follow up aspects of them automatically to make sales and marketing work more efficiently — has closed a $240 million round of funding. The Series C values the Chicago startup at over $3 billion.

The round is being led by a new, big-name investor, Tiger Global, with participation from another new backer Dragoneer, along with Susquehanna Growth Equity and Silversmith Capital Partners, which had both invested previously.

This funding round represents a huge leap for ActiveCampaign. It was only in January 2020 that it raised $100 million, and before that, the company, which was founded in 2003, had only raised $20 million.

But as we have seen in many other ways, the pandemic resulted in a surge of interest among businesses to do more — a lot more — online than ever before, not least because so many people were spending more time at home, carrying out their consumer lives over the internet. That led to ActiveCampaign growing to a customer base of 145,000 customers, up from 90,000 16 months ago.

That points not just to the company already growing at a decent clip before the pandemic, but how it capitalized on that at a time when companies were looking for more tools to run their businesses in the new world.

The growth was not about ActiveCampaign throwing more money into business development, founder and CEO Jason VandeBoom said in an interview. “It was the network effect of people finding success. Even today, organic word of mouth is our primary driver.”

The company’s tools fit into a wider overall trend in the world of business: automation, built on the back of new, cloud-based technology, is being adopted to carry out some of the less interesting and repetitive aspects of running a business.

In the case of sales, an example of what ActiveCampaign might provide is a way for an e-commerce business to identify when a logged-in customer (that is, a user who has an account already and is signed in) might have ‘abandoned’ a visit to a site before buying a product that had already been searched for, or clicked on, or even added to a cart. In these cases, it sends an email to customers reminding them of those items, with options for other follow-ups, in the event that the choice was due to being distracted or having second thoughts that might be persuaded otherwise.

Users can opt-out of these, but they can be useful given the genuine distraction exercise that is browsing online — with all of the unrelated notifications, plus other options for considering a purchase. Tellingly, ActiveCampaign integrates with 850 different apps, a measure of just how fragmented the online landscape is, and also how many ways your attention might be distracted, or snagged depending on your perspective.

Abandoned carts can cost a company, in aggregate, a lot of lost revenue, yet chasing those down is not the kind of task that a company would typically assign to a valuable employee to carry out. And that’s where companies like ActiveCampaign come in.

This, plus some 500 other actions like it around sales and marketing campaigns — VandeBoom calls them “recipes” — some of which have been contributed by ActiveCampaign’s own users, form the basis of the company’s platform.

The marketing and sales automation market is estimated to be worth billions of dollars today, and, thanks to the rise of social media and simply more places to spend time online (and more time spent online) is expected to be worth more than $8 billion by 2027, so it’s going after a lucrative and much-used tool for doing business online. (And others are looking at it as well, of couse, including newer entrants like Shopify coming from a different angle to the same problem. Shopify today is a valued partner of the company, VandeBoom said when I asked him about it.)

That gives ActiveCampaign not just a big opportunity to continue targeting, but possibly also makes it a target itself, for an acquisition.

The other key aspect of ActiveCampaign’s growth that is worth watching is related to its customers. While the company has a client base that includes recognized names like the Museum of Science and Industry based out of ActiveCampaign’s hometown, it also has some 145,000 others across nearly 200 countries with a big emphasis on small and medium businesses.

SMBs form the vast majority of all businesses globally, collectively representing a huge win for tech companies that can capture them as customers. But traditionally, they have proven to be a challenging sector, given that they cover so many different verticals, are in many ways more price-sensitive than their enterprise-sized counterparts, among other factors.

So for ActiveCampaign to have found successful traction with SMBs — including with pricing that works for many of them (using it starts at $9 for accounts with less than 500 contacts) — is likely another reason why the startup has caught the eye of investors keen to back winning horses.

While the company did not need to raise money, VandeBoom said he “saw it as an opportunity to bring in more partners, saying that investors like how it purposely went after the idea of customer experience not on vertical or locale.”

“We’ve been lucky enough to have a front row seat on this journey from early on – and it’s been pretty breathtaking,” said Todd MacLean, managing partner, Silversmith Capital Partners, in a statement to TechCrunch. “Even compared to other great growth companies, the momentum and capital efficiency are rare. But Jason is a rare entrepreneur and has built a team in his image. While there’s lots left to do, we believe we’ve only scratched the surface of this market opportunity and are excited to double-down on Jason and his vision.”

Powered by WPeMatico

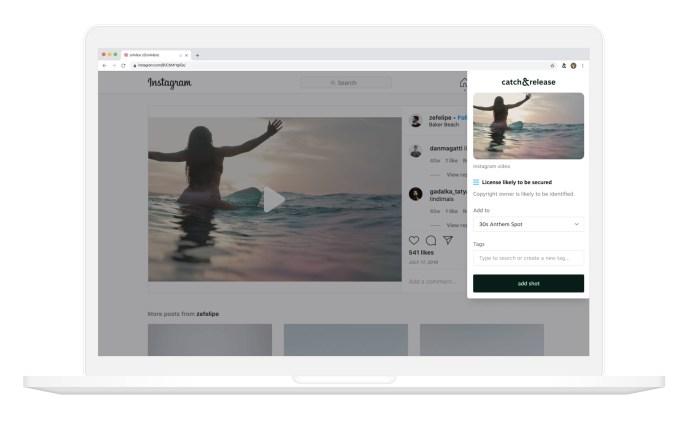

Catch&Release founder and CEO Analisa Goodin told me that she wants to help brands break free from the limitations of stock photography — and that her startup has raised $14 million in Series A funding to achieve that goal.

Goodin explained that the company started out as an image research firm before becoming a product-focused, venture-backed startup in 2015. The Series A was led by Accel (with participation from Cervin Ventures and other existing investors), and it brings Catch&Release’s total funding to $26 million.

Stock media and video services are moving in this direction themselves, for example by introducing their own libraries of user-generated content. Goodin applauded this, and she said Catch&Release isn’t opposed to the use of stock photos — it integrates with these stock marketplaces. At the same time, she suggested that she has a much bigger vision.

“This isn’t just about UGC, this is about tapping into the creative potential of the internet,” she said.

After all, you can now find pretty much any kind of content you can imagine somewhere online, but “a lot of advertising agencies and brands have been trained that if a piece of content comes from the internet, avoid it,” because it’s just “too hard” to figure out how to license it. (And indeed, that’s why I went with a stock photo for the lead image of this post.)

Image Credits: Catch&Release

Catch&Release aims to make that process as simple as possible, first with a browser extension that allows marketers to save any media that they find on the web, anytime they think they might want to use it in their own campaigns (this is the “catch” part of the process). It even presents a “licensability score,” which is a rating based on factors like the person who posted the content, the description and the comments, indicating how likely it is that a marketer will actually be able to license this content.

Then, when someone from a brand or advertising agency decides that they want to use a piece of content, they can send a licensing request with a push of a button (this is the “release”). Catch&Releases also analyzes the content for anything else that needs to be cleared or obscured, such as a company logo.

While we’ve written about other tools for licensing online content, Goodin emphasized that Catch&Release isn’t just about finding photos for a social media campaign. Part of the goal, she said, is to erase the “stigma” around UGC, which now “represents the entire spectrum of culturally relevant content.”

For example, she showed me a Red Lobster commercial that looks like a normal TV ad, but was in fact assembled entirely from footage found online — something that’s been even more useful in the past year, with pandemic-related safety concerns around large shoots. (Catch&Release has also been used to license content for ads promoting TechCrunch’s parent company Verizon.)

Goodin added that the new funding will allow Catch&Release to continue investing in product, engineering and marketing.

“No one has defined the commercial licensing layer for the web,” she said. “What’s got me really excited to build this product is being that layer for the internet, not just for photos and videos, but for writing, art, graphics and building the commercial licensing engine of the web.”

Powered by WPeMatico

Farshad Yousefi and Masoud Jalali used to drive through Palo Alto neighborhoods and marvel at the outrageous home prices. But the drives sparked an idea. They were not in a financial position to purchase a home in those neighborhoods (to be clear, not many people are) either for investment or to live. But what if they could invest in homes in up and coming cities throughout the U.S.?

Then they realized that even that might be a challenge, considering that with all their student debt, affording a down payment would be impossible.

“There was nothing available out there besides a crowdfunding platform, which when we first signed up, took away $1,000 from our account that we didn’t have, and then our capital would be locked up for three to 10 years,” recalls Yousefi.

So the pair started doing research and spoke to 1,000 individuals under the age of 35. Eight out of 10 said they would like to invest in real estate but were deterred by all the barriers to entry.

“There is clearly a large demand for access to real estate,” Yousefi said. “And we wanted to give people a way to invest in it like they can in stocks, via a mobile app.”

And so the idea for Fintor was born.

Yousefi and Jalali founded the company in 2020 with the goal of purchasing homes via an LLC, and turning each into shares through an SEC-approved broker dealer. Individuals can then buy shares of the homes via Fintor’s platform. Its next step is to sign agreements with individual real estate investors or bigger real estate development firms to list their properties on the platform and give people the opportunity to buy shares.

And now Fintor has raised $2.5 million in seed money to continue building out its fractional real estate investing platform. The startup aims to “fractionalize” houses and other residential property, giving people in the U.S. access to investment opportunities “starting with as little as $5.” The company attracted the interest of investors such as 500 Startups, Hustle Fund, Graphene Ventures, Houston-based real estate investor Manny Khoshbin, Mana Ventures and other angel investors such as Cindy Bi, Skyler Fernandes, VU Venture Partners, Minal Hasan, Andrew Zalasin, Alluxo CEO and founder Safa Mahzari, SquareFoot CEO and founder Jonathan Wasserstrum and Teachable CEO and founder Ankur Nagpal.

Image Credits: Fintor

Fintor is eying markets such as Kansas City, South Carolina and Houston, where it already has some properties. It’s looking for homes in the $80,000 to $350,000 price range, and millennials and Gen Zers are its target demographic.

“Fintor can give the same return as the stock market, but at half the risk,” Yousefi said. “As two [Iranian] immigrants, we’ve seen how much this country has to offer and how real estate sits at the top of everything, yet is so inaccessible.”

The pair had originally set out to raise just $1 million but the round was quickly “way oversubscribed,” according to Yousefi, and they ended up raising $2.5 million at triple the original valuation.

Jalali said the company will use machine learning technology to filter and rate properties as it scales its business model.

“We’ll use ML to categorize neighborhoods and to come up with the price of properties to offer to potential sellers,” he added. “Our ultimate goal is to create indexes so that people can invest in multiple properties in a given city. That creates diversification right away.”

Elizabeth Yin, co-founder and general partner of Hustle Fund, believes that Fintor is solving a generational problem with real estate.

“Retail investors have almost no access to great real estate investments today and the best opportunities are reserved for the select few,” she told TechCrunch. “Not to mention that in addition to access, retail investors often need a lot of capital in order to have a diversified portfolio or be accredited to join funds.”

Fintor’s approach to securitize real estate assets will give millions of investors who are not accredited investors access they would otherwise not have had, Yin added.

“Simultaneously, it provides increased liquidity to property owners, while improving the user experience for both parties,” she said. “Effectively this becomes a new asset class, because it’s entirely turnkey and is fractionalized, which opens up many new pockets of investors.”

Powered by WPeMatico

Pragma is building what it calls a “backend as a service,” providing ready-made infrastructure to developers of online, live service games. And it’s announcing today that it has raised $12 million in Series A funding.

The round was led by David Thacker at Greylock, with participation from Zynga founder Mark Pincus, Oculus founder Nate Mitchell and Cloudera founder Amr Awadallah, along with previous investors Upfront Ventures and Advancit Capital. Amy Chang, who sold her business intelligence startup Accompany to Cisco, is joining Pragma’s board of directors.

Co-founder and CEO Eden Chen told me that where Unity and Unreal have built popular frontend game engines, he and his co-founder Chris Cobb (former engineering lead at Riot Games) are hoping Pragma will fill the void for a “de facto backend game engine.”

And while “many companies tried to do this” over the past decade, Chen suggested that this is the right time to launch the platform, thanks to the continued rise of live service games (like League of Legends) that have to be treated as “living, breathing products,” as well as improved tooling around infrastructure platforms like Amazon Web Services.

Image Credits: Pragma

Pragma is launching a starter kit today designed to allow developers to quickly set up and test game loops. Meanwhile, the broader platform is currently in private beta testing with studios including One More Game (started by started by Pat Wyatt, one of Blizzard’s first employees) and Mitchell’s Mountain Top Studios.

Chen said the platform’s features fall into three broad categories — player accounts/social, game loops (including lobbies and matchmaking) and player/game data. Pragma isn’t building all of this from scratch; in some cases, it’s “acting as the integrator” for other platforms like Discord. Chen also noted that while the team plans to build a fully managed solution in the future, the current version is on-premise: “We’re building an instance of Pragma on the studio’s own infrastructure, [so they can] so they can take our code base and customize it to their own preferences.”

Pragma is initially targeting game studios with about 10 to 50 team members. Eventually, Chen hopes the platform could serve larger studios while also supporting “the democratization of these tools, so that a one- to five-person team can really leverage [them] to launch a networked, online game.”

He added, “The vision for us long term is that we really want to be innovating on the social side, creating social features that improve the game and build stronger connections.”

Powered by WPeMatico

Cape Privacy, the early-stage startup that wants to make it easier for companies to share sensitive data in a secure and encrypted way, announced a $20 million Series A today.

Evolution Equity Partners led the round with participation from new investors Tiger Global Management, Ridgeline Partners and Downing Lane. Existing investors Boldstart Ventures, Version One Ventures, Haystack, Radical Ventures and a slew of individual investors also participated. The company has now raised approximately $25 million, including a $5 million seed investment we covered last June.

Cape Privacy CEO Ché Wijesinghe says that the product has evolved quite a bit since we last spoke. “We have really focused our efforts on encrypted learning, which is really the core technology, which was fundamental to allowing the multi-party compute capabilities between two organizations or two departments to work and build machine learning models on encrypted data,” Wijesinghe told me.

Wijesinghe says that a key business case involves a retail company owned by a private equity firm sharing data with a large financial services company, which is using the data to feed its machine learning models. In this case, sharing customer data, it’s essential to do it in a secure way and that is what Cape Privacy claims is its primary value prop.

He said that while the data sharing piece is the main focus of the company, it has data governance and compliance components to be sure that entities sharing data are doing so in a way that complies with internal and external rules and regulations related to the type of data.

While the company is concentrating on financial services for now, because Wijesinghe has been working with these companies for years, he sees uses cases far beyond a single vertical, including pharmaceuticals, government, healthcare telco and manufacturing.

“Every single industry needs this and so we look at the value of what Cape’s encrypted learning can provide as really being something that can be as transformative and be as impactful as what SSL was for the adoption of the web browser,” he said.

Richard Seewald, founding and managing partner at lead investor Evolution Equity Partners likes that ability to expand the product’s markets. “The application in Financial Services is only the beginning. Cape has big plans in life sciences and government where machine learning will help make incredible advances in clinical trials and counter-terrorism for example. We anticipate wide adoption of Cape’s technology across many use cases and industries,” he said.

The company has recently expanded to 20 people and Wijesinghe, who is half Asian, takes DEI seriously. “We’ve been very, very deliberate about our DEI efforts, and I think one of the things that we pride ourselves in is that we do foster a culture of acceptance, that it’s not just about diversity in terms of color, race, gender, but we just hired our first nonbinary employee,” he said,

Part of making people feel comfortable and included involves training so that fellow employees have a deeper understanding of the cultural differences. The company certainly has diversity across geographies with employees in 10 different time zones.

The company is obviously remote with a spread like that, but once the pandemic is over, Wijesinghe sees bringing people together on occasion with New York City as the hub for the company, where people from all over the world can fly in and get together.

Powered by WPeMatico

“Challenger” startups in banking and insurance have upended their industries, and picked up significant business, by building more customer-friendly tools and services — more personalized, easier to access and usually competitively priced — than those typically provided by their bigger, incumbent rivals. Now, a startup out of Romania that is building tools to help the incumbents respond with better services of their own is announcing a significant round of funding as its business grows.

FintechOS, which has built a low-code platform aimed at larger (older) banking and insurance companies to help them build new services and analytics on top of and around their existing infrastructure, has raised €51 million ($61.5 million at today’s rates, but $60 million at the time of the deal closing) in a Series B round of funding.

FintechOS’s opportunity has been to target the wave of incumbents in the insurance and banking industries that have been slowly watching as newer players like Lemonade (in insurance) and a huge plethora of challenger banks (Revolut, N26, Monzo and many others) are swooping in and picking up customers, especially among younger demographics, while they have been unable to respond mostly because their infrastructure is too old and big. Turning a huge ship around, as we have seen, is no small task — a situation that has become only more apparent in the last year of pandemic living and the big shift to digital interactions that resulted from it.

“When we launched FintechOS in 2017, we could already see existing solutions to digital transformation would struggle to deliver tangible results. By contrast, our unique approach has quickly inspired a sea-change in how financial institutions address digitization and engage with their customers,” said Teodor Blidarus, co-founder and CEO at FintechOS, in a statement. “Events over the last year have only increased pressure on our industry to evolve and as a result we’re seeing growing demand for our powerful platforms. Our latest round of funding will help us grow at the pace needed to improve outcomes for financial institutions and their customers globally.”

(It is not the only one. Others out of Europe in the space of bringing new tools to incumbent banks to help them make more modern and competitive products include 10x, Thought Machine, Temenos, Mambu and many more.)

The Series B round of funding is being led by Draper Esprit, with Earlybird, Gapminder Ventures, Launchub and OTB Ventures (which all participated in its Series A in December 2019) also participating. There are other backers in the round that are not being disclosed at this time, the startup added. FintechOS is also not disclosing its valuation. The company, based out of Bucharest, has raised just under $80 million to date.

FintechOS is active today in the U.K. and Europe — where it has been growing at a CAGR of 200% and says its services touch “millions” of people, with some of its key customers including the likes of banking giants Societe Generale and IdeaBank and international insurance brokers Howden. The plan will be to continue investing in those markets, as well as expanding internationally.

And it will be adding more services. Today, the banking platform is designed to help banks launch more retail services for consumers and small and medium business customers, and for insurance companies to build new health, life and general insurance products (there are a lot of synergies in how insurance and financial services companies have been built over the years, and so it’s a natural couplet when it comes to building tools for those industries).

In the financial sector, FintechOS lets banks build in new digital onboarding flows, credit cards and loan products, savings and mortgage products. Insurance products include new approaches to generating and handling quotes, customer onboarding and management and claims automation — which may well bring FintechOS into closer contact and collaboration with the most successful startup to come out of its home country to date, the RPA juggernaut UiPath. In all cases, it helps stitch together data from a bank’s own systems with more modern tooling, and to link that up with yet more modern tools to help process that data more easily.

This is “low code,” but it typically means that the company needs to work with third parties to enable all of this. Partners include the likes of integrators and other global services technicians, such as Microsoft, Deloitte, CapGemini, KPMG and so on. (And the founders of the startup themselves come from consulting backgrounds so they well understand the role these companies play in the process of bringing technology into big businesses.)

FintechOS is tapping into a couple of very big trends that have arguably been the biggest in the financial and related insurance industries.

The first of these is the fact that core services around things like credit/loans, current deposits and savings are not just very complex to build but actually have largely become commoditized — similar to digital payments — and so packaging them up and turning them into services that can be integrated by way of an API makes them more easily accessed without the heavy lifting needed to build them from scratch. This lets companies focus instead on customer service or building more interesting tools around those basic services to customise them (for example AI-based personalization). Disintermediating basic functions from the services built around them is arguably a bigger trend, but it has been especially prevalent in enterprise, which has long been a slow-moving space when it comes to innovation in the back-end, and the front-end.

The second of these is the big swing toward using no-code and low-code tools to empower more people within organizations to get stuck in when they can see something not working as efficiently as it could, and building the workflows themselves to improve that. This also applies to trying out and testing new products — again something that typically has not been done in financial and insurance services but can now be possible with low-code and no-code tools.

“Not only is our technology helping financial institutions become customer centric, but it’s also helping them provide products and services to more people and businesses,” said Sergiu Negut, the other co-founder who is FintechOS’s CFO and COO, in a separate statement. “With so many markets still underserved, the ability to tailor offerings to a segment of one offers the opportunity to increase financial inclusion and adheres to our ideal that easy access to financial services is essential. We’re delighted to be working with investors who share our views on how fintech should be transforming the financial services industry.”

Notably, Draper Esprit also has backed Thought Machine, another big player in the world of fintech that is taking some of the learnings and models that have helped new entrants disrupt incumbents, and is packaging them up as services for incumbents, too. It takes a different approach to doing this, not using low-code but smart contracts, which could be one reason why the VC doesn’t see the investments as conflict of interest. They are also tackling an enormous market, and so at least for now there is room for them, and many others in the space, such as 10x, Temenos, Mambu, Rapyd and many others.

“When we met Teo and Sergiu, we were immediately convinced of their vision: a data led, end-to-end platform, facilitated with a low-code/no-code infrastructure,” Vinoth Jayakumar, partner at Draper Esprit, said in a statement. “Incumbent financial services firms have cost-to-income ratios up to 90%, so we see a huge and increasing need for infrastructure software that allows digitisation at speed, ease and lower cost. Draper Esprit builds enduring partnerships; with the team at FintechOS we hope to build an enduring fintech company that will dramatically change financial services experiences for people all over the world.”

Powered by WPeMatico

We’ve all heard the phrase “passive income” to describe how people can make money by owning rental properties. Many Americans would love to passively earn money, but the process of becoming a landlord can be intimidating and complicated.

I mean, how many people have looked back and wished they hadn’t sold a property after seeing its value rise years after selling it?

And those who are already landlords can get overwhelmed by the complexities of managing properties.

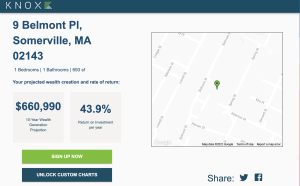

One startup out of Boston, Knox Financial, aims to help people identify and manage residential rentals with its algorithm-based platform, and it’s raised a $10 million Series A to help it further that goal. Boston-based G20 Ventures led the round, which included participation from Greycroft, Pillar VC, 2LVC, and Gaingels.

The investment brings Knox’s total raised since its inception in 2018 to $14.7 million. The company closed on a $3 million seed round in January 2020, led by Greycroft.

Knox co-founder and CEO David Friedman is no stranger to startups. He founded Boston Logic — an integrated marketing platform and online marketing services for real estate offices and agents — in 2004. He sold that company (now under the name Propertybase) to Providence Equity for an undisclosed amount in 2016.

Knox launched its platform in March of 2019, with the goal of offering homeowners who are ready to move “a completely hands-off way” of converting a home they’re moving out of into an investment property. It also claims to help landlords more easily and efficiently manage their rentals.

At the time of its seed round early last year, the company was only operating in the Boston market and had 50 units on its platform. It’s now operating in seven states, has “hundreds” of investment properties on its platform and is overseeing a portfolio of more than $100 million.

So how does it work? Once a property is enrolled on Knox’s “Frictionless Ownership Platform,” the company automates and oversees the property’s finances and taxes, insurance, leasing and legal, tenant and property care, banking and bill pay.

Knox also has developed a rental pricing and projection model for calculating the investment rate of return a property will produce over time.

Image Credits: Knox Financial

“We save investors a lot and almost always make their portfolios more profitable,” Friedman said. “If someone is moving or upsizing, we can turn properties into incredible ROI generators or cash flow.”

The company’s revenue model is simple.

“When a dollar of rent moves through our system, we keep a dime,” Friedman told TechCrunch. “We align our interests with our customers. If there’s no rent coming in, we’re not making money. Or if a tenant doesn’t pay rent, we don’t make money.”

Knox plans to use its new capital to continue expanding geographically and getting the word out to more people.

“We want to become the de facto platform for real estate investment acquisition and ownership,” Friedman said. “And we have to be coast to coast to really do that for everybody. So, we’re still very early in our growth trajectory.”

Bob Hower, co-founder and partner of G20 Ventures, shared that weeks after his college graduation, he had bought a fixer upper with his mother’s help. A week after finishing renovations, he put the house on the market. Over the subsequent five months, he gradually reduced the price as the market softened, and eventually the property sold at a small profit.

“That house now is worth a multiple of what I paid for it,” Hower recalls. “In hindsight, the mistake I made was deciding to sell the house at all.”

That experience helped Hower appreciate what he describes as a “clarity of thinking” in Knox’s business model.

“Had Knox existed decades ago, I’d likely still have that fixer-upper I bought after college,” he said. “Investing platforms such as Betterment have collapsed multiple advising and optimization activities into a simple single-sign-on service, and Knox is the first company to apply this type model to residential real estate investing.”

Powered by WPeMatico

Cannabis financing company Bespoke Financial today announced it raised $8 million in a Series A financing round. Through this round, the company brought new, key investors into its corner as it fights to bring financing solutions to companies in the cannabis space.

Bespoke is a direct lender and provides several financing solutions to companies operating in cannabis. These short-term loans allow the companies to build credit with Bespoke, which then offers better terms on subsequent loans and products. The company says its loan origination volume has grown exponentially, outgrowing forecasts by 25% over the proceeding year. The company has deployed $120 million in gross merchandise volume over 2,000 cannabis license holders, with zero defaults to date.

With this new round of capital, Bespoke intends to launch new financing structures and expand its financing options across various distribution channels.

CEO and co-founder George Mancheil calls this round a pivotal moment for his company and stamp of validation on the direction and products offered by Bespoke Financial. As he tells TechCrunch, this round provides several key partners to the growing startup.

The financing round was co-led by Snoop Dogg’s Casa Verde Capital and Sweat Equity Ventures, along with Ceres Group Holdings, Greenhouse Capital Partners, DoubleLine Capital’s co-founder and former president Philip Barach, and Robert Stavis, an investor based in New York.

This is Sweat Equity Ventures’ (SEV) first investment into a cannabis company. SEV, backed and funded by LinkedIn founder Reid Hoffman, is led by Dan Portillo and works differently from traditional venture funds. SEV works with founders to provide top engineering and business talent to its portfolio companies. In exchange for these services, SEV takes equity from the companies instead of just writing checks.

“This is our firm’s first investment in the cannabis industry, and we are excited to partner with Bespoke as more and more states legalize cannabis use, and the Federal government contemplates nationwide legalization. This partnership combines Bespoke’s finance and cannabis acumen with our team’s expertise scaling innovative tech companies, and will provide cannabis companies greater access to streamlined financing while benefiting investors with increased transparency and enhanced risk surveillance,” says Dan Portillo, managing partner of Sweat Equity Ventures, in a released statement.

Karan Wadhera, managing partner at Casa Verde Capital, says Bespoke Financial addresses real needs in a growing industry. Casa Verde Capital previously invested in Bespoke Capital, including in a $7 million round in 2019.

Bespoke CEO Mancheil tells TechCrunch his company is focused on being more than just a lender; it wants to be a modern financing company that allows it to act as a true partner with the cannabis industry.

With this $8 million in financing, Bespoke Financial has raised $28 million to date. The company was founded in 2019 and, as of this announcement, has 12 employees.

Powered by WPeMatico

The online grocery market is poised to get a little more crowded in the next several months, with the launch of a startup led by a veteran founder who has taken big hits from Amazon in the past, but now hopes to come back swinging with the help of an army of robots.

Home Delivery Services, a delivery startup founded by Louis Borders that plans to sell groceries and general merchandise online using a massive, automated system to power the fulfillment and logistics, is today announcing funding of $3 million to finalize the finishing touches on an AI-based robotic demonstration center outside of Indianapolis.

The plan is for the center to showcase the technology that HDS Global has been building over the last several years (plans first emerged as long ago as 2014), robots and other automation under the name RoboFS, that will power a wide fulfillment system extending from stocking, sorting and picking items that will then be delivered, mostly by humans, to consumers, to take on what Borders describes as a $1 trillion grocery market in the U.S.

“The $1 trillion grocery in the U.S. is not well penetrated,” he said, comparing the opportunity to the one that Walmart seized 20 years ago in physical stores. “We want to offer a complete selection of groceries and general merchandise in one order.” The idea is to build warehouses that cover some 150,000 square feet to do $200 million in revenue over millions of SKUs for one-hour deliveries.

A funding round of $3 million — which is coming from Bob DiRumualdo, the chairman of Ulta and CEO of Naples Ventures — might sound a little modest, especially considering the hundreds of millions of dollars that have been collectively raised by online grocery players in the last several months — all of them racing to scale up their businesses in the wake of huge consumer demand for online shopping alternatives to visiting stores in person in the wake of the COVID-19 pandemic.

Borders said in an interview that this small round is primarily to kick off the demo center to show off RoboFS to help bring on new investors and new partners with the proof of concept. It already has a few investor partners (Ingram Micro and Toyota), and the idea will be to add more.

And he confirmed that HDS — which will unveil a different name when it launches commercially, he added — is also working on a much bigger round of funding, likely to close in the next 15 months, to fuel that wider commercial launch. It has raised $38 million to date, he said.

Borders’ name will ring a bell to many in the worlds of retail and technology: He was the founder and head of the Borders book superstores and later started Webvan, a very early mover in the world of online grocery ordering and delivery. Both companies crashed hard in their times and became case studies, and more specifically cautionary tales, around how to build businesses in the digital era: Beware the specter of Amazon, of innovating too early or too late, of being less agile, too inefficient and of not correctly identifying where the puck was going and skating to it.

This time around, the idea is that he’s focusing first and foremost on technology to try to head off those problems in ways that his previous ventures did not. This is one reason why HDS has spent so many years on building the technology: automation, specifically in areas like picking groceries, is one area that has foxed a lot of companies to date — Amazon continues to work on this, and Ocado, a leader in the space, has yet to launch robotic picking, although it says this is coming soon. Borders estimates that bringing in automation can bring down the cost of labor by two-thirds, with people instead focused on delivering and selling at people’s doors.

“When we went out to buy the tech we didn’t see what we wanted,” Borders said. “We’re trying to be smart about technology but the tech was just not there when we decided to build this five years ago. So we started with building that system. This became our opportunity.”

The interesting opportunity is not just to build services that don’t quite exist yet, but to provide a set of infrastructure that can be a viable alternative and supply chain to Amazon — a common goal that brings together players from a lot of disparate yet interconnected areas in the grocery value chain. This is one reason why companies like Toyota and Ingram have come on board to work with the startup.

Given that it’s been so many years in the making and has yet to see the proof of concept, there will continue to be a lot of factors that could not come together, but it’s a play that HDS, Borders and their partners are willing to make.

“Ecommerce has become an essential component in people’s daily lives but what many don’t realize is that it can be exponentially better than what is offered today,” said DiRumualdo in a statement. “I was attracted to working with Louis again and to the company’s big idea approach – an all-new robotic fulfillment system purpose-built for ecommerce – which can deliver a vastly improved experience at lower cost. I am excited to be a part of bringing this vision to life.”

Powered by WPeMatico