funding

Auto Added by WPeMatico

Auto Added by WPeMatico

As businesses continue to look for better ways to work more efficiently, a pioneer in the space of low-code tools to help automate how apps work together is announcing a round of funding on the back of impressive early traction.

Berlin-based n8n — which provides a framework for both technical and non-technical people to synchronize and integrate data and workflows — has raised $12 million in a Series A round of funding.

The startup plans to use the money to continue expanding its team, which now numbers 60 people, and to expand its platform and the services it provides to users.

Currently, n8n can help link up and integrate data and functions between more than 200 established applications, as well as any custom apps or services that you might be using in your specific organization. And since launching in October 2019, the startup has picked up an impressive 16,000 users — including both developers and “citizen developers” (those whose jobs might be described as non-technical but they are not afraid to be more hands-on in trying to build in ways to work better).

Now it wants to make the service easier for more of the latter group to get stuck in with using it.

“We are still seen as a technical product and less of one for citizen developers,” founder and CEO Jan Oberhauser said in an interview. “Our plan is to make n8n simpler to use, so that it’s much easier to adopt. We want to give everyone technical superpowers, whether it’s the marketing team or the IT department.” That means for example building not just chatbots but more intelligent ones, or creating new ways of visualizing data in Slack or something else altogether. And n8n’s platform can also be used to build automation within products, for example to monitor performance and flag when something might need maintenance.

The round is being led by Felicis Ventures, with Sequoia Capital, firstminute Capital and Harpoon Ventures also participating. Sequoia and firstminute co-led n8n’s seed round about a year ago, which also included participation from Eventbrite’s Kevin Hartz, Supercell’s Ilkka Paananen and unnamed early employees of Google and Zendesk, among others. The startup has now raised around $14 million and is not disclosing valuation.

There are a number of low-code and no-code startups on the market today and many of them have been seeing a surge of in interest in the last year. It’s a trend I suspect was brought about in no small part by the arrival of COVID-19.

The pandemic not only led to more people working remotely and relying on apps and other cloud-based services to get what they needed to do done, but in many cases it led organizations to refocus on how they were working, and what could be improved. In some cases, it also has meant a severe tightening of belts, and so companies are needing to do more with less human power, another factor leading to more proactive efforts to use software to get more out of… software.

That’s meant more strain on IT teams, and that too has led to more people within departments themselves getting proactive in improving their own workflows.

Other startups in the space include Bryter (which raised a $66 million Series B earlier this month) and Genesis (which raised $45 million in March), along with Zapier, Airtable, Rows, Gyana, Ushur, Creatio, EasySend and CapivateIQ, some of which are coming to the market with a variety of solutions targeting a set of generic tools, while others are building solutions for more narrow use cases.

In the case of n8n, the company might be considered a “pioneer” in the space not just because of its focus on the growing area of low-code tools, but because of how it views the world of software.

The basic approach n8n is taking is around the idea of “fair code.” This is somewhat similar to open-source, and is analogous to a freemium-style model for the concept. The code is available in a public repository and the idea is that this will never disappear (one issue many enterprises face on the bleeding edge of tech: companies and their services sometimes shut down). However, n8n itself limits how much it can be used for free, before users start to pay to use it so that n8n can monetize its work, which it does in the form of consulting and integration services. (In the case of n8n, that limit looks to be up to a limit of $30,000 in support services revenues.)

Oberhauser was an early proponent of the concept of n8n and he runs a site dedicated to spreading the word. (You can also read about the different approaches to fair code, and some of what led to the creation of the concept, here.)

While basic and limited access to the code will remain free, and even as a company like n8n aims to make it easier and easier for non-developers to build integrations, there will be areas that need attention to make those services accessible to the people within an organization. For starters, there is the issue of setting up the basic integration connectors, especially in cases where the software a company is using is proprietary or customized.

There is also another issue that is likely to become more prominent as low-code and no-code tools continue to grow in popularity, and that is security. While IT departments may not have oversight of every single integration, neither will the security teams, which means that new data vulnerabilities might well become more commonplace, too. For all of these reasons, n8n is betting that there will still be some integration and consulting involved in implementation.

“Almost every company needs help connecting outside and internal systems, to make it easier for people to get started,” Oberhauser said.

Aydin Senkut, founder and managing partner of Felicis Ventures, who led the round, said that what attracted him to n8n was the extensibility of the platform — that it could be applied not just for app integration and workflow automation in those apps but a much wider set of use cases — and the very early traction of 16,000 users that it’s picked up with very little fanfare, a sign that the service has some stickiness and usefulness to it.

And the fact that it lets developers — “citizen” or otherwise — play with so many options is also a key part of it.

“We feel that data is the new oil, and one of the special things here is not just low or no-code per se, but how n8n is making it seamless and easy to connect tens or even hundreds of apps.” Senkut said that it reminded him a little of Felicis’ early investment in Plaid. “Essentially, the more data and APIs you have the more valuable the company can be. I think to measure the potential of a company, look at the APIs. If you can connect disparate things together, that is key.”

Powered by WPeMatico

MasterClass, which sells a subscription to celebrity-taught classes, sits on the cusp of entertainment and education. It offers virtual, yet aspirational learning: an online tennis class with Serena Williams, a cooking session with Gordon Ramsay. While there’s the off chance that an instructor might actually talk to you — it has happened before — the platform mostly just offers paywalled documentary-style content.

The vision has received attention. MasterClass is raising funding that would value it at $2.5 billion, as scooped by Axios and confirmed independently by a source to TechCrunch. But while MasterClass has found a sweet spot, can the success be replicated?

Investors certainly think so. Outlier, founded by MasterClass’ co-founder, closed a $30 million Series C this week, for affordable, digital college courses. The similarities between Outlier and its founder’s alma mater aren’t subtle: It’s literally trying to apply MasterClass’ high-quality videography to college classes. This comes a week after I wrote about a “MasterClass for Chess lovers” platform launched by former Chess World Champion Garry Kasparov.

Two back-to-back MasterClass copycats raising millions in venture capital makes me think about if the model can truly be verticalized and focused down into specific niches. After 2020 and the rise of Zoom University, we know edtech needs to be more engaging, but we don’t know the exact way to get there. Is it by creating micro-learning communities around shared loves? Is it about gamification? Aspirational learning has different incentives than for-credit learning. In order to be successful, Outlier needs to prove to universities it can use MasterClass magic for true outcomes that rival in-person lectures. It’s a harder, and more ambtious promise.

My riff aside, I turned to two edtech founders to understand how they see the MasterClass effect panning out, and to cross-check my gut reaction.

Taylor Nieman, the founder of language learning startup Toucan:

Although I do love how these models try to lean into this theme of “invisible learning” like we leverage with Toucan, it faces the same issues as so many other consumer products that try to steal time out of people’s very busy days. Constantly competing for time leads to terrible engagement metrics and very high churn. That leads me to question what true learning outcomes could occur from little to no usage of the product itself.

Amanda DoAmaral, the founder of Fiveable, a learning platform for high school students:

Masterclass is important for showing us why educational content should be treated more like entertainment. All of our bars for content quality is much higher now than it ever was before and I’m excited to see how that affects learning across the board.

For students, it’s about creating environments that support them holistically and giving them space to collaborate openly. It feels so obvious that these spaces should exist for young people, but we’ve lost sight of what students actually need. At my school, we built policies that assumed the worst in students. I want to flip that. Assume the best, be proactive to keep them safe, and create ways to react when we need to.

Anyways, that’s just some nuance to chew on during this fine day. In the rest of this newsletter, we will focus a lot on tactical advice for founders, from the money they raise to the peacock dance they might want to do one day. Make sure to follow me on Twitter @nmasc_ so we can talk during the week, too!

You know when male peacocks fan their feathers to court a lover? That, but for startups trying to get acquired. As one of our many rabbit holes on Equity this week, we talk about Discord walking away from a Microsoft deal, and if that deal ever existed in the first place or if it was just a way to drum up investor excitement in the audio gaming platform.

Here’s what to know: Discord is reportedly pursuing an IPO after walking away from talks with multiple companies that were looking to acquire the audio gaming giant.

Discord aside, the consolidation environment continues to be hot for some sectors.

Image Credits: VectorInspiration / Getty Images

Clearbanc, a Toronto-based fintech startup that gives non-dilutive financing to businesses, has rebranded alongside a $100 million financing that valued it at $2 billion. Now rebranded as Clearco, the startup wants to be more than just a capital provider, but a services provider, too.

Here’s what to know: The startup has been on a tear of product development for the past year, launching services such as valuation calculators or runway tools. It’s a step away from what Clearbanc originally flexed: the 20-minute term sheet and rapid-fire investment. I talk about some of the levers at play in my piece:

Many of Clearco’s newest products are still in their infancy, but the potential success of the startup could nearly be tied to the general growth of startups looking for alternatives to venture capital when financing their startups. Similar to how AngelList’s growth is neatly tied to the growth of emerging fund managers, Clearco’s growth is cleanly related to the growth of founders who see financing as beyond a seed check from Y Combinator.

Abstract human brain made out of dollar bills isolated on white background. Image Credits: Iaremenko / Getty Images

Keeping on the theme of tactical advice for founders, let’s move onto talking about marketing. Tim Parkin, president of Parkin Consulting, explained how startup founders can use marketing as a tool to stand out in the noisy environment. Differentiation has never been harder, but also more imperative.

Here’s what to know: Parkin outlines four ways that martech will shift in 2021, strapped with anecdotes and a nod to the importance of investing in influencers.

Red ball on curved light blue paper, blue background. Image Credits: PM Images / Getty Images

Your humble yet favorite startup podcast, Equity, got nominated for a Webby! Me and the team need your help to win, so please vote for us here. Your support means a ton.

This newsletter will always be free, but if you do want to support me, feel free to use code STARTUPSWEEKLY for 25% off a subscription to Extra Crunch.

Seen on TechCrunch

The rise of the next Coinbase, thanks to Coinbase

Tiger Global backs Indian crypto startup at over $500M valuation

Early Coinbase backer Garry Tan is keeping the ‘vast majority’ of his shares because of this deal

Seen on Extra Crunch

Dear Sophie: How can I get my startup off the ground and visit the US?

How to pivot your startup, save cash and maintain trust with investors and customers

How startups can ensure CCPA and GDPR compliance in 2021

Image Credits: TechCrunch

Thanks for reading along today and everyday. Sending love to my readers in India and everyone around the world that is facing yet another deadly surge of this horrible disease. I’m rooting for you.

Powered by WPeMatico

Last year was a record 12 months for venture-backed biotech and pharma companies, with deal activity rising to $28.5 billion from $17.8 billion in 2019. As vaccines roll out, drug development pipelines return to normal, and next-generation therapies continue to hold investor interest, 2021 is on pace to be another blockbuster year.

The median step up in valuations from seed to Series A is now 2x, higher than in all later rounds. As a result, biotech startups will continue to attract more investment at earlier stages from a larger, more diverse pool of venture capitalists.

This may also change the nature of biotech founders themselves: As a blog post from Y Combinator suggests, these founders are trending younger and perhaps less willing to cede control to VCs and hired executives than they might have in years past (i.e., via the “venture creation” model so predominant among early-stage biotech companies).

Founders are some of the most creative people out there, but legal documentation should be anything but.

As longtime members of the biotech startup community — as executives, entrepreneurs, advisors and legal counsel — we’ve seen our fair share of founder missteps early in the fundraising journey result in severe consequences.

In this exciting moment, when younger founders will likely receive more attention, capital and control than ever, it’s crucial to avoid certain pitfalls.

Founders are some of the most creative people out there, but legal documentation should be anything but. Keep it as simple and clear as possible. That means using National Venture Capital Corporation documents that everyone knows and understands, as well as keeping organized documentation for employee intellectual property (IP) assignment and NDAs, option grants, independent contractor agreements, tax documents and other key contracts and paperwork.

Powered by WPeMatico

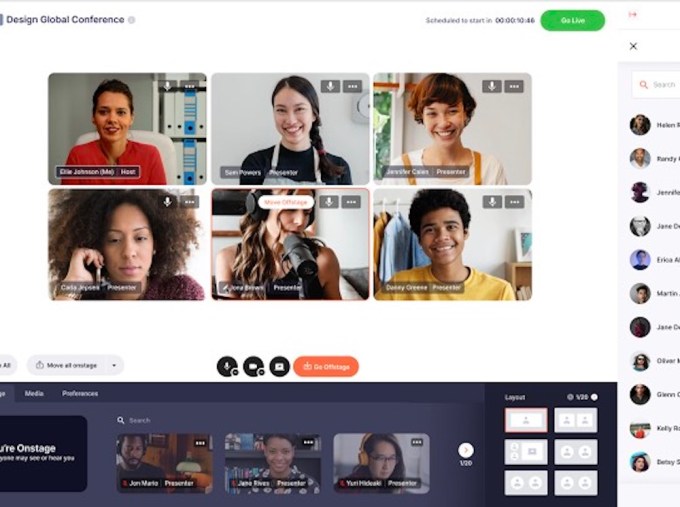

While there’s been plenty of attention and money lavished on virtual event platforms over the past year, Introvoke co-founder and CEO Oana Manolache predicted that we’re only at the beginning of a “third wave of digital transformation.”

In her framing, the first wave came at the beginning of the pandemic, when everyone was using video conferencing tools like Zoom for their virtual events. Next came conference platforms like Hopin (which has been raising money at a mind-boggling clip). But Manolache argued that even Hopin represents a “Band-Aid” that customers are hoping will tide them over until in-person events can resume — particularly when organizers have to point attendees to a third-party platform.

“One size does not fit all,” she said. “The Band-Aid solution that was only supposed to last for a couple months has had big benefits as companies grew their customer base and revenue targets. Now we’ve reached the third wave, as organizations want to bring solutions to their own universe and own their relationship with the audience.”

San Francisco-based Introvoke is a Techstars Accelerator graduate aiming to provide this third-wave solution. It’s announcing today that it has raised $2.7 million in funding led by Struck Capital, while Comcast, Social Leverage, Great Oaks, V1vc, Time CTO Bharat Krish and Resy co-founder Mike Montero also participated.

The startup offers components like virtual stages, chat rooms and networking hubs, all customizable and embeddable on a customer’s website. Manolache said Introvoke (the name comes from the idea of “thought-provoking introductions”) is designed for a hybrid future, which will take multiple forms: “Hybrid is going to mean virtual-only events, in-person only events and events that have in-person and virtual elements.”

Image Credits: Introvoke

Introvoke charges customers based on live event minutes, a model that it says is accessible to companies large and small. Its components can be embedded on websites built with WordPress, Squarespace, Wix, Splash and other platforms, but also on a customer’s internal intranet.

“We’ve been so impressed by the way customers are using the technology — conferences, career fairs, employee engagements,” Manolache said.

She added that as customers like Comcast, Wharton and Ritual Motion have used the platform in private preview mode, they’re beginning to break free of the in-person model. For example, Introvoke events can allow for attendees to chat with each other over weeks or months, not just a few days.

In a statement, Struck Capital founder and Managing Partner Adam B. Struck suggested that virtual events “will continue far beyond the COVID-19 pandemic.”

“Right now, virtual experiences, from conferences and concerts to company all-hands, are generally hosted on third party platforms, which creates a disjointed experience for the brand or organization hosting the event,” he continued. “Virtual enablement should be native to the website and platform of the enterprise itself, and it’s the role of technologists like the Introvoke team to make these experiences as seamless as any in-person event.”

Powered by WPeMatico

With the increase of digital transacting over the past year, cybercriminals have been having a field day.

In 2020, complaints of suspected internet crime surged by 61%, to 791,790, according to the FBI’s 2020 Internet Crime Report. Those crimes — ranging from personal and corporate data breaches to credit card fraud, phishing and identity theft — cost victims more than $4.2 billion.

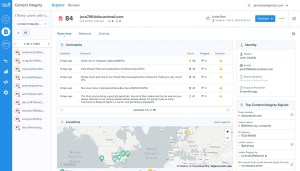

For companies like Sift — which aims to predict and prevent fraud online even more quickly than cybercriminals adopt new tactics — that increase in crime also led to an increase in business.

Last year, the San Francisco-based company assessed risk on more than $250 billion in transactions, double from what it did in 2019. The company has over several hundred customers, including Twitter, Airbnb, Twilio, DoorDash, Wayfair and McDonald’s, as well a global data network of 70 billion events per month.

To meet the surge in demand, Sift said today it has raised $50 million in a funding round that values the company at over $1 billion. Insight Partners led the financing, which included participation from Union Square Ventures and Stripes.

While the company would not reveal hard revenue figures, President and CEO Marc Olesen said that business has tripled since he joined the company in June 2018. Sift was founded out of Y Combinator in 2011, and has raised a total of $157 million over its lifetime.

The company’s “Digital Trust & Safety” platform aims to help merchants not only fight all types of internet fraud and abuse, but to also “reduce friction” for legitimate customers. There’s a fine line apparently between looking out for a merchant and upsetting a customer who is legitimately trying to conduct a transaction.

Sift uses machine learning and artificial intelligence to automatically surmise whether an attempted transaction or interaction with a business online is authentic or potentially problematic.

Image Credits: Sift

One of the things the company has discovered is that fraudsters are often not working alone.

“Fraud vectors are no longer siloed. They are highly innovative and often working in concert,” Olesen said. “We’ve uncovered a number of fraud rings.”

Olesen shared a couple of examples of how the company thwarted fraud incidents last year. One recently involved money laundering through donation sites where fraudsters tested stolen debit and credit cards through fake donation sites at guest checkout.

“By making small donations to themselves, they laundered that money and at the same tested the validity of the stolen cards so they could use it on another site with significantly higher purchases,” he said.

In another case, the company uncovered fraudsters using Telegram, a social media site, to make services available, such as food delivery, with stolen credentials.

The data that Sift has accumulated since its inception helps the company “act as the central nervous system for fraud teams.” Sift says that its models become more intelligent with every customer that it integrates.

Insight Partners Managing Director Jeff Lieberman, who is a Sift board member, said his firm initially invested in Sift in 2016 because even at that time, it was clear that online fraud was “rapidly growing.” It was growing not just in dollar amounts, he said, but in the number of methods cybercriminals used to steal from consumers and businesses.

“Sift has a novel approach to fighting fraud that combines massive data sets with machine learning, and it has a track record of proving its value for hundreds of online businesses,” he wrote via email.

When Olesen and the Sift team started the recent process of fundraising, Insight actually approached them before they started talking to outside investors “because both the product and business fundamentals are so strong, and the growth opportunity is massive,” Lieberman added.

“With more businesses heavily investing in online channels, nearly every one of them needs a solution that can intelligently weed out fraud while ensuring a seamless experience for the 99% of transactions or actions that are legitimate,” he wrote.

The company plans to use its new capital primarily to expand its product portfolio and to scale its product, engineering and sales teams.

Sift also recently tapped Eu-Gene Sung — who has worked in financial leadership roles at Integral Ad Science, BSE Global and McCann — to serve as its CFO.

As to whether or not that meant an IPO is in Sift’s future, Olesen said that Sung’s experience of taking companies through a growth phase such as what Sift is experiencing would be valuable. The company is also for the first time looking to potentially do some M&A.

“When we think about expanding our portfolio, it’s really a buy/build partner approach,” Olesen said.

Powered by WPeMatico

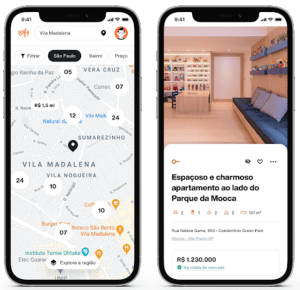

Nearly exactly one month ago, digital real estate platform Loft announced it had closed on $425 million in Series D funding led by New York-based D1 Capital Partners. The round included participation from a mix of new and existing investors such as DST, Tiger Global, Andreessen Horowitz, Fifth Wall and QED, among many others.

At the time, Loft was valued at $2.2 billion, a huge jump from its being just near unicorn territory in January 2020. The round marked one of the largest ever for a Brazilian startup.

Now, today, São Paulo-based Loft has announced an extension to that round with the closing of $100 million in additional funding that values the company at $2.9 billion. This means that the 3-year-old startup has increased its valuation by $700 million in a matter of weeks.

Baillie Gifford led the Series D-2 round, which also included participation from Tarsadia, Flight Deck, Caffeinated and others. Individuals also put money in the extension, including the founders of Better (Zach Frenkel), GoPuff, Instacart, Kavak and Sweetgreen.

Loft has seen great success in its efforts to serve as a “one-stop shop” for Brazilians to help them manage the home buying and selling process.

Image Credits: Loft

In 2020, Loft saw the number of listings on its site increase “10 to 15 times,” according to co-founder and co-CEO Mate Pencz. Today, the company actively maintains more than 13,000 property listings in approximately 130 regions across São Paulo and Rio de Janeiro, partnering with more than 30,000 brokers. Not only are more people open to transacting digitally, more people are looking to buy versus rent in the country.

“We did more than 6x YoY growth with many thousands of transactions over the course of 2020,” Pencz told TechCrunch at the time of the company’s last raise. “We’re now growing into the many tens of thousands, and soon hundreds of thousands, of active listings.”

The decision to raise more capital so soon was due to a variety of factors. For one, Loft has received “overwhelming investor interest” even after “a very, very oversubscribed main round,” Pencz said.

“We have seen a continued acceleration in our market share growth, especially in São Paulo and Rio de Janeiro, the two markets we currently operate in,” he added. “We saw an opportunity to grow even faster with additional capital.”

Pencz also pointed out that Baillie Gifford has relatively large minimum check size requirements, which led to the extension being conducted at a higher price and increased the total round size “by quite a bit to be able to accommodate them.”

While the company was less forthcoming about its financials as of late, it told me last year that it had notched “over $150 million in annualized revenues in its first full year of operation” via more than 1,000 transactions.

The company’s revenues and GMV (gross merchandise value) “increased significantly” in 2020, according to Pencz, who declined to provide more specifics. He did say those figures are “multiples higher from where they were,” and that Loft has “a very clear horizon to profitability.”

Pencz and Florian Hagenbuch founded Loft in early 2018 and today serve as its co-CEOs. The aim of the platform, in the company’s words, is “bringing Latin American real estate into the e-commerce age by developing online alternatives to analogue legacy processes and leveraging data to create transparency in highly opaque markets.” The U.S. real estate tech company with the closest model to Loft’s is probably Zillow, according to Pencz.

In the United States, prospective buyers and sellers have the benefit of MLSs, which in the words of the National Association of Realtors, are private databases that are created, maintained and paid for by real estate professionals to help their clients buy and sell property. Loft itself spent years and many dollars in creating its own such databases for the Brazilian market. Besides helping people buy and sell homes, it offers services around insurance, renovations and rentals.

In 2020, Loft also entered the mortgage business by acquiring one of the largest mortgage brokerage businesses in Brazil. The startup now ranks among the top-three mortgage originators in the country, according to Pencz. When it comes to helping people apply for mortgages, he likened Loft to U.S.-based Better.com.

This latest financing brings Loft’s total funding raised to an impressive $800 million. Other backers include Brazil’s Canary and a group of high-profile angel investors such as Max Levchin of Affirm and PayPal, Palantir co-founder Joe Lonsdale, Instagram co-founder Mike Krieger and David Vélez, CEO and founder of Brazilian fintech Nubank. In addition, Loft has also raised more than $100 million in debt financing through a series of publicly listed real estate funds.

Loft plans to use its new capital in part to expand across Brazil and eventually in Latin America and beyond. The company is also planning to explore more M&A opportunities.

This article was updated post-publication to reflect accurate investor information.

Powered by WPeMatico

The global venture capital market had a cracking start to the year. Coming off a 2020 high, VC totals in the United States, in Europe, and among competitive verticals like insurtech and AI are on pace to set new records in 2021.

The rapid-fire deal-making and trend of larger venture checks at higher valuations that The Exchange has tracked for some time require private-market investors to make decisions faster than ever. For venture capitalists, the timeline for reaching conviction around a startup’s thesis and executing due diligence has become compressed.

Some venture capitalists are turning to data to move more quickly. Some are spending more time preparing to be vetted themselves. And some investors are simply doing the work beforehand.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

We were tipped off to the concept of pre-diligence during the reporting process for a look into recent fundraising trends in the AI/ML space. Sapphire investor Jai Das, when asked about how he was handling a competitive and swiftly moving market for AI startup investments, said that “most firms are completing their due diligence way before the financing actually happens.”

How does that work in practice? Per Das, startups that raise quick Series A and B rounds are “tracked by [early-stage] investors as soon as they raise their seed financings. So there is no need to do any due diligence during the financing and hence most of these financings are pre-emptive.”

How does that work in practice? Per Das, startups that raise quick Series A and B rounds are “tracked by [early-stage] investors as soon as they raise their seed financings. So there is no need to do any due diligence during the financing and hence most of these financings are pre-emptive.”

Venture capital: Now more about sales than ever before!

This morning, The Exchange is digging into the question of how VCs are handling diligence in a world where the most attractive deals can open and close faster than ever, and old models of deep diligence and paced deal-making are outmoded.

One way that investors are betting on themselves in a bid to speed their diligence and decision-making is by investing in their own tech. That may sound obvious, given that venture capital dollars often land in the accounts of tech-focused companies, but in a business that was previously known for its relationship focus — more on that shortly — the trend is worth considering.

Powered by WPeMatico

Applied XL, a startup creating machine learning tools with what it describes as a journalistic lens, is announcing that it has raised $1.5 million in seed funding.

Emerging from the Newlab Venture Studio last year, the company is led by CEO Francesco Marconi (previously R&D chief at The Wall Street Journal) and CTO Erin Riglin (former WSJ automation editor). Marconi told me that Applied XL started out by working on a number of different data and machine learning projects as it looked for product-market fit — but it’s now ready to focus on its first major industry, life sciences, with a product launching broadly this summer.

He said that Applied XL’s technology consists of “essentially a swarm of editorial algorithms developed by computational journalists.” These algorithms benefit from “the point of view and expertise of journalists, as well as taking into account things like transparency and bias and other issues that derive from straightforward machine learning development.”

Marconi compared the startup to Bloomberg and Dow Jones, suggesting that just as those companies were able to collect and standardize financial data, Applied XL will do the same in a variety of other industries.

He suggested that it makes sense to start with life sciences because there’s both a clear need and high demand. Customers might include competitive intelligence teams at pharmaceutical companies and life sciences funds, which might normally try to track this data by searching large databases and receiving “data vomit” in response.

Update: Marconi provided additional context about the startup’s initial focus via email, writing,”The life science industry has specific information needs currently not being fully met by existing private and public data sources; for example, many existing data providers cannot provide the kind of real-time context life science organizations require to make decisions on clinical development, competitive positioning and commercialization.”

“Our solution for scaling [the ability to spot] newsworthy events is to design the algorithms with the same principles that a journalist would approach a story or an investigation,” Marconi said. “It might be related to the size of the study and the number of patients, it might be related to a drug that is receiving a lot of attention in terms of R&D investment. All of these criteria that a science journalist would bring to clinical trials, we’re encoding that into algorithms.”

Eventually, Marconi said the startup could expand into other categories, building industry “micro models.” Broadly speaking, he suggested that the company’s mission is “measuring the health of people, places and the planet.”

The seed funding was led by Tuesday Capital, with participation from Frog Ventures, Correlation Ventures, Team Europe (the investment arm of Delivery Hero co-founder Lukasz Gadowski) and Ringier executive Robin Lingg.

“With industry leading real-time data pipelining, Applied XL is building the tools and platform for the next generation of data-based decision making that business leaders will rely on for decades,” said Tuesday Capital partner Prashant Fonseka in a statement. “Data is the new oil and the team at Applied XL have figured out how to identify, extract and leverage one of the most valuable commodities in the world.”

Powered by WPeMatico

During the pandemic, having an automated solution for onboarding and updating Apple devices remotely has been essential, and today Kandji, a startup that helps IT do just that, announced a hefty $60 million Series B investment.

Felicis Ventures led the round, with participation from SVB Capital, Greycroft, Okta Ventures and The Spruce House Partnership. Today’s round comes just seven months after a $21 million Series A, bringing the total raised across three rounds to $88.5 million, according to the company.

CEO Adam Pettit says the company has been growing in leaps and bounds since the funding round last October.

“We’ve seen a lot more traction than even originally anticipated. I think every time we’ve put targets up onto the board of how quickly we would grow, we’ve accelerated past them,” he said. He said that one of the primary reasons for this growth has been the rapid move to work from home during the pandemic.

“We’re working with customers across 40+ industries now, and we’re even seeing international customers come in and purchase so everyone now is just looking to support remote workforces and we provide a really elegant way for them to do that,” he said.

While Pettit didn’t want to discuss exact revenue numbers, he did say that it has tripled since the Series A announcement. That is being fueled, in part, he says, by attracting larger companies, and he says they have been seeing more and more of them become customers this year.

As they’ve grown revenue and added customers, they’ve also brought on new employees, growing from 40 to 100 since October. Pettit says that the startup is committed to building a diverse and inclusive culture at the company and a big part of that is making sure you have a diverse pool of candidates from which to choose.

“It comes down to at the onset just making the decision that it’s important to you and it’s important to the company, which we’ve done. Then you take it step by step all the way through, and we start at the back into the funnel where our candidates are coming from.”

That means clearly telling their recruiting partners that they want a diverse candidate pool. One way to do that is being remote and having a broader talent pool with which to work. “We realized that in order to hold true to [our commitment], it was going to be really hard to do that just sticking to the core market of San Diego or San Francisco, and so now we’ve expanded nationally and this has opened up a lot of [new] pools of top tech talent,” he said.

Pettit is thinking hard right now about how the startup will run its offices whenever they are allowed back, especially with some employees living outside major tech hubs. Clearly it will have some remote component, but he says that the tricky part of that will be making sure that the folks who aren’t coming into the office still feel fully engaged and part of the team.

Powered by WPeMatico

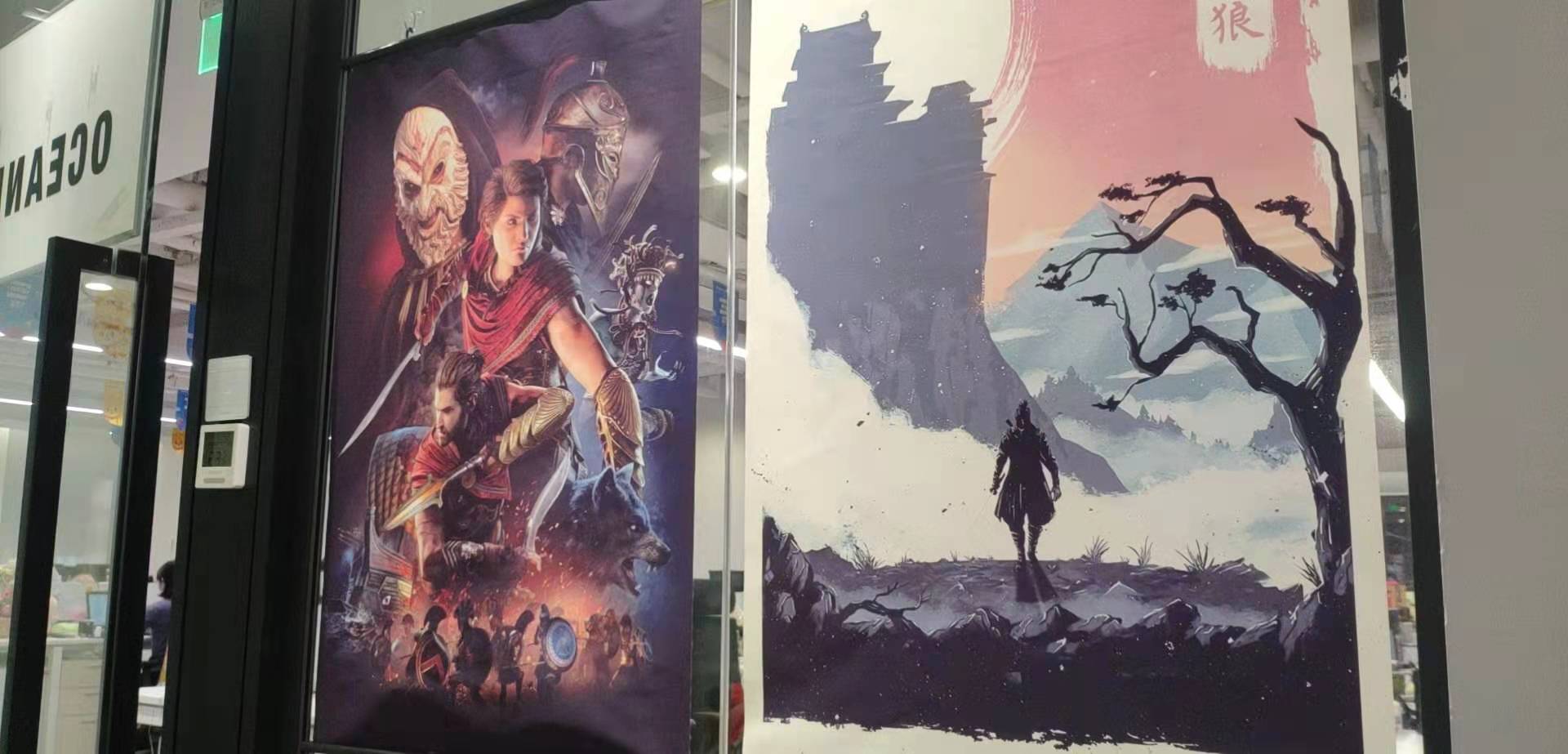

In Hefei, a Chinese city known for its relics from the Three Kingdoms period and its manufacturing industry today, Maxim Rate was thrilled to find a small studio crafting a Western role-playing game, a genre that attracts lovers of gritty aesthetics and dark storylines.

“The design and computer graphics are really good. You can’t tell they are a Chinese team,” said Rate.

Rate’s mission is to find Chinese studios like the bootstrapped Hefei team and help them woo international players. As Chinese regulators tighten rules on game publishing and make licenses hard to obtain, small studios find themselves struggling. Since last year, Apple has pulled thousands of unlicensed games from its Chinese App Store at the behest of local authorities. Small-time developers began to look beyond their home turf.

“The problem is these startups have no experience in overseas expansion,” said Rate.

An avid gamer himself, Rate quit his job at a Chinese cross-border payment firm last year and launched a part-incubator, part-investment vehicle to take Chinese games abroad. The firm, called Westward Gaming Ventures, took inspiration from Zheng He, a Chinese diplomat and explorer who embarked on state-sponsored naval expeditions to the “Western Oceans” during the Ming Dynasty.

Westward plans to raise 200 million yuan ($30 million) for its debut fund, Rate told TechCrunch in an interview. It plans to deploy the capital over the next three years with an intended check size of 2-4 million yuan per studio. It’s currently in talks with 20-30 teams that span a wide range of genres.

The Chinese fund being established is a so-called Qualified Foreign Limited Partners Fund, which, Rate said, for the first time will enable foreign investors (USD and EUR) to invest directly in Chinese gaming firms. Only a few institutions own a license for QFLP, and while Westward itself doesn’t hold one, it gained legitimacy for direct foreign investment by partnering with the private equity arm of a major Chinese financial conglomerate, which declined to be named at this stage.

To navigate such regulatory complications, Westward also seeks help from its advisors, including one that oversaw the legal and financial process of one of the largest joint ventures established between Chinese and foreign gaming firms in recent years. The partnership, which can’t be named, was also the first time a foreign entity has become the majority shareholder in a gaming joint venture in China.

China limits foreign investments in areas it considers sensitive, such as value-added services, so many companies resort to setting up elaborate offshore entities to receive overseas funding. The restriction makes it difficult for resource-strapped studios to land foreign investors, who could help them venture into global markets. They are left with the option of getting backed or bought by Chinese giants like Tencent or ByteDance.

The idea of Westward is not just to lower the barriers for independent Chinese games to secure foreign capital but also to better prepare them for overseas expansion.

“Chinese gaming studios, big or small, used to rely heavily on ads for user acquisition when they went abroad,” said Rate. “Sometimes a game would take off, but the team had no idea why, so they continued to test. Those who failed may just give up.”

But taking a game abroad is not as simple as translating it, hitting the publish button and launching an ad campaign on Facebook.

Westward’s plan is to get involved in a game’s early development phase and help them position: Is it an RPG? Is the targeted user a casual or serious player? What’s the graphic style? In addition, the firm also plans to supply developers with workspace, technical assistance, marketing and localization expertise, connection to publishers and overseas operation help.

Image Credits: Westward Gaming Ventures

To provide post-investment support, Westward has partnered up with V+ Gaming Society, an incubator for games headquartered in Shenzhen, which Westward also calls home.

Chinese tech companies are facing mounting challenges in the West as geopolitical tensions rise. Many now prefer calling themselves “global firms” and even deny their Chinese roots outright.

But for Westward, the games it helps create don’t need to pretend they are non-Chinese. “Most players don’t consider where a game is from if it is a really good game,” said Rate.

“We actually hope to see elements of Chinese culture in these games that can be understood by overseas players.”

Amy Ho, a partner at Westward along with Rate and Edward He, said one of the few Chinese games that have managed to be both “Chinese” and transcend cultural boundaries is “Chinese Parents.” The simulation game became a global hit by letting users experience what it is like to raise a child in China.

The benchmark Rate gave was the generation of Japanese games that began exporting 20-30 years ago, which he described as “Japanese” in spirit but “globalized” in graphics and game design.

There have already been globally successful titles from Chinese makers like Tencent and rising studios Lilith and Mihoyo. In the past, many Chinese users on Steam would be asking foreign titles to rush out Chinese versions. Now, it’s not uncommon to see Western users demanding English editions of Chinese games, Rate observed.

Rather than politics, the bigger challenge, especially for small studios, is how to “collect key data for product iteration while complying with local privacy laws,” said Ho.

Westward expects 50-70% of its capital to come from Chinese institutions. The presence of Chinese investments inevitably leads to questions around censorship. Ho said while Westward provides resources and capital to studios, it will work to ensure their independence from investor influence.

If things go well, Westward could help facilitate cultural exchange between China and the rest of the world. Beijing has been trying to export the country’s soft power, and games may be a suitable conduit, suggested Rate. Amid the ongoing trade war, having foreign funding in Chinese companies may also do good to China’s “brand”, he said.

Powered by WPeMatico