funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Restoring and preserving the world’s forests has long been considered one of the easiest, lowest-cost and simplest ways to reduce the amount of greenhouse gases in the atmosphere.

It’s by far the most popular method for corporations looking to take an easy first step on the long road to decarbonizing or offsetting their industrial operations. But in recent months the efficacy, validity and reliability of a number of forest offsets have been called into question thanks to some blockbuster reporting from Bloomberg.

It’s against this uncertain backdrop that investors are coming in to shore up financing for Pachama, a company building a marketplace for forest carbon credits that it says is more transparent and verifiable thanks to its use of satellite imagery and machine learning technologies.

That pitch has brought in $15 million in new financing for the company, which co-founder and chief executive Diego Saez Gil said would be used for product development and the continued expansion of the company’s marketplace.

Launched only one year ago, Pachama has managed to land some impressive customers and backers. No less an authority on things environmental than Jeff Bezos (given how much of a negative impact Amazon operations have on the planet), gave the company a shoutout in his last letter to shareholders as Amazon’s outgoing chief executive. And the largest e-commerce company in Latin America, Mercado Libre, tapped the company to manage an $8 million offset project that’s part of a broader commitment to sustainability by the retailing giant.

Amazon’s Climate Pledge Fund is an investor in the latest round, which was led by Bill Gates’ investment firm Breakthrough Energy Ventures. Other investors included Lowercarbon Capital (the climate-focused fund from über-successful angel investor, Chris Sacca), former Uber executive Ryan Graves’ Saltwater, the MCJ Collective, and new backers like Tim O’Reilly’s OATV, Ram Fhiram, Joe Gebbia, Marcos Galperin, NBA All-star Manu Ginobili, James Beshara, Fabrice Grinda, Sahil Lavignia and Tomi Pierucci.

That’s not even the full list of the company’s backers. What’s made Pachama so successful, and given the company the ability to attract top talent from companies like Google, Facebook, SpaceX, Tesla, OpenAI, Microsoft, Impossible Foods and Orbital Insights, is the combination of its climate mission applied to the well-understood forest offset market, said Saez Gil.

“Restoring nature is one of the most important solutions to climate change. Forests, oceans and other ecosystems not only sequester enormous amounts of CO2 from the atmosphere, but they also provide critical habitat for biodiversity and are sources of livelihood for communities worldwide. We are building the technology stack required to be able to drive funding to the restoration and conservation of these ecosystems with integrity, transparency and efficiency” said Saez Gil. “We feel honored and excited to have the support of such an incredible group of investors who believe in our mission and are demonstrating their willingness to support our growth for the long term.”

Customers outside of Latin America are also clamoring for access to Pachama’s offset marketplace. Microsoft, Shopify and SoftBank are also among the company’s paying buyers.

It’s another reason that investors like Y Combinator, Social Capital, Tobi Lutke, Serena Williams, Aglaé Ventures (LVMH’s tech investment arm), Paul Graham, AirAngels, Global Founders, ThirdKind Ventures, Sweet Capital, Xplorer Capital, Scott Belsky, Tim Schumacher, Gustaf Alstromer, Facundo Garreton and Terrence Rohan were able to commit to backing the company’s nearly $24 million haul since its 2020 launch.

“Pachama is working on unlocking the full potential of nature to remove CO2 from the atmosphere,” said Carmichael Roberts from BEV, in a statement. “Their technology-based approach will have an enormous multiplier effect by using machine learning models for forest analysis to validate, monitor and measure impactful carbon neutrality initiatives. We are impressed by the progress that the team has made in a short period of time and look forward to working with them to scale their unique solution globally.”

Powered by WPeMatico

Gaming and streamed video have been two of the biggest pastime winners during the last year+ of pandemic living. Today a startup that has created an app that brings those two entertainment formats together is announcing a notable seed round of funding as it prepares to come out of closed beta.

PortalOne, a hybrid gaming startup, is announcing a $15 million seed round of funding as it prepares to come out of closed beta with an app that lets people play on-demand games and also watch live shows in which users can play against a special guest.

The startup and its funding are notable in part because of who is doing the investing.

It includes Atari and camera maker ARRI, Founders Fund, TQ Ventures (the firm led by Scooter Braun and financiers Schuster Tanger and Andrew Marks), Coatue Management (specifically Arielle Zuckerberg), Rogue Capital Partners (Alice Lloyd George’s new fund), Signia Venture Partners (via Sunny Dhillon), Seedcamp, Talis Capital and SNÖ Ventures out of Europe.

Other investors included Kevin Lin, the co-founder of Twitch; Mike Morhaime, co-founder of Blizzard and Dreamhaven; Amy Morhaime, co-founder of Dreamhaven; Marc Merrill, co-founder of Riot Games; Xen Lategan, former CTO and executive advisor at various companies such as Hulu; and Eugene Wei, former head of Video at Oculus and head of Product at Hulu.

PortalOne is part tech startup and part media company. On the one hand, it has spent the last three years building a full stack of hardware and software that can be used to build games, record live shows and integrate the two into an experience that blends both on-demand and real-time gaming and entertainment.

“One of the benefits of building first is that what we are doing is extremely hard to do on a technical level,” said co-founder and CEO Bård Anders Kasin. “The way we do it is the key. It is our secret sauce.”

On the other, it is using that tech to create a gaming and live events platform and brand — providing a place for itself and third parties to build games and bigger live experiences around them. It believes that it’s managed to do something here that has eluded others for years.

“We come from the entertainment industry and have also been in games many years,” said Stig Olav Kasin, Bård’s brother and the other co-founder (and chief content officer). “We’ve talked to all the big companies and know that hybrid gaming combining games and TV is difficult,” not least because of the silos in companies where different groups “own” TV and gaming.

The Oslo-based company has so far been running a pared-down, early version of its service in the U.S. and Norway — two games so far, one called Blockbuster that, well, involves you throwing a massive ball and knocking over blocks, and another a reimagined version of Centipede — with corresponding talk shows set out of a living room that’s actually all computer-generated on a green screen.

Users can play and watch all this either through a VR headset or over a phone, and they win “prizes” for placing well in gaming competitions. Alongside that, PortalOne will sell virtual goods, much as companies like Fortnite do today.

The plan is to more widely launch the first iteration of its service — PortalOne Arcade, a selection of 80s-themed, old-school arcade games reimagined as multiplayer, immersive experiences combined with interactive talk shows — in the U.S. and Norway later this year before extending to other markets.

Bård Anders Kasin — who previously built a VR company and worked as a technical director at Warner Brothers, making movies such as “The Matrix” trilogy — and Stig Olav Kasin — who worked with his brother on VR and before that was a media exec on shows like “The Voice” and “Who Wants to Be a Millionaire?” — founded PortalOne back in 2018.

Between then and June 2020, when PortalOne launched its closed beta, the startup’s focus was on building out its technology and its content strategy and early partners.

From the sounds of it, it was no small task. Its tech stack incorporates virtual reality, computer vision, gaming technology and software and hardware to capture and stream video that drastically reduces the resources required for both, among other IP. Some of it PortalOne built itself; other areas it worked with Arri, a major player in motion picture camera equipment, which built a new kind of 3D camera for PortalOne.

Part of the challenge that PortalOne has been tackling has been the very process of creating content for a hybrid platform like the one it envisioned.

Typically, recording immersive experiences is complex and expensive because of the volumetric equipment that is used, the set-up of studios necessary to capture the experiences and more, which involve Hollywood movie studio size, staffing and costs.

PortalOne’s breakthrough has been to turn that process into something that can be produced more easily and at a much lower cost, necessary “since we have daily shows and we want to scale and mass produce more daily shows for each game,” said Bård.

In the PortalOne setup, in addition to the host — an affable Norwegian with a mostly American English accent called Markus Bailey — and his guest, there are only two other people involved, technician-producers triggering effects and controlling when the action switches from talk to game and back again.

From previously needing large sets and dozens of people, “now we can do all of this in a YouTube-sized studio,” said Bård.

On the content front, PortalOne is building its own games, but it is also tapping into an old-school gaming aesthetic, it said.

Atari is not only investing, but has inked a seven-year deal with PortalOne, giving the latter exclusive global distribution rights to some of its most popular arcade game franchises, which PortalOne is reimagining and rebuilding for its hybrid platform.

Bård said that the company wants to work with brands in music, sport, travel and education to build other games, too. (Braun’s reach here might not extend to Taylor Swift, but he’s pulled in Justin Bieber for the promo video, and possibly more.)

“Massive opportunities continue to emerge in the interactive entertainment space as distribution and business models evolve,” said Kirill Tasilov, a principal at Talis Capital, in a statement. “PortalOne is redefining mobile by unlocking new hybrid experiences at the intersection of games and video, and we are thrilled to be a part of their journey.”

In some ways, what PortalOne is doing is not completely new, since the lines between what is a game, what is interactive and what is linear entertainment have been getting blurred for decades.

You could argue that even game shows, one of the earliest TV formats, was an early stage in hybrid interactivity, although more modern programs like the ones that Stig helped build out, with interactive voting from at-home audiences using phones, definitely pushed the concept in new ways.

The coronavirus pandemic and the fact that so many in-person live events were cancelled, meanwhile, definitely paved the way for content players to think outside the box when it came to building new kinds of “live” shows. With Marshmello getting a huge response to his Fortnite “show” in 2019, the game saw 12 million people flock to its Travis Scott concert last year; and Roblox said in December its show with Lil Nas will pave the way for future events.

“When we see virtual concerts inside of TikTok, Roblox and Fortnite, it’s great but PortalOne offers an evolution of interactive metaverse entertainment — true real-time, one-to-many interaction between gamers around the world, all in a mobile-native hybrid game format,” said Dhillon, a partner at Signia Venture Partners.

Yet if well-established platforms really pick up on this trend, that’s an endorsement of what PortalOne has built. But they could also feasibly build their own live game shows, too, and blow PortalOne out of the water just as it’s dipping its toes in.

This is also where its time spent building tech could prove either to be a boost or a bust. Gaming is a notoriously tough one to call when it comes to resonating and taking off with audiences, and so too will presumably the experiences that are built around those games.

“The next big social platform will likely be a convergence of media with gaming at its core — a truly new immersive interactive experience — and PortalOne is a major contender for becoming such a platform,” said Kevin Lin.

Indeed, if PortalOne finds an audience for what it’s making, it will have the tools to serve them more content efficiently and and cheaply. But if it doesn’t strike the right note, the question will be how and if that tech will otherwise be used.

For investors right now, it’s more about the opportunity.

“As PortalOne continues to grow, it is seamlessly integrating the gaming and entertainment worlds to create a single interactive experience and endless opportunities for content creation,” said Braun. “Creators and performers alike want new and innovative ways to bring their craft to life, and PortalOne is meeting that demand in a way that no other business has done. I’m excited to work with the entire team to realize their trailblazing vision. I have never seen anything like this before.”

Delian Asparouhov, a principal at Founders Fund — in the news today for another reason, his role in bringing a lot of attention to Miami as a new tech hot spot — also thinks that the building of infrastructure and tech combined with the media element will give the startup a lot of runway.

“We back companies that we believe have strong potential to become global category leaders,” he said in a statement. “PortalOne creates a new category and simultaneously the platform that is clearly set to dominate that new category. The market is ripe, the opportunity is clear, and the potential is unlimited. PortalOne is poised to create a before and after in the industry.”

Powered by WPeMatico

PreShow Interactive is giving gamers a new way to earn in-game currency in exchange for watching ads — a concept that’s become familiar in mobile games but hasn’t really made much headway on PCs or consoles.

The startup is led by MoviePass’ founding CEO Stacy Spikes. When I spoke to Spikes about PreShow two years ago, he was beta testing an app that provided users with free movie tickets in exchange for watching ads. But obviously, theatrical moviegoing has taken a big hit in the past year.

Spikes told me yesterday that he’d always hoped to bring the PreShow concept to four categories — theatrical movies, gaming, subscription streaming and video on demand — but the pandemic forced the startup to shift focus more quickly than expected and explore what a gaming experience might look like.

The current plan is to launch a new PreShow Interactive app this summer, where viewers can connect their in-game accounts and identify how much virtual currency they want to earn. Then they watch a package of ads and PreShow will automatically transfer the currency to their account — in other words, it’s buying the currency for them.

Users will have to download a separate app to watch the ads and get the benefits, but Spikes said this is actually better than trying to integrate advertising or branded content into the game itself, which can be a slow process for the developer and the advertiser, while also being distracting for the players. And this means PreShow Interactive should be able to support 20,000 games at launch, across PCs, consoles and virtual reality.

Image Credits: PreShow Interactive

“We just didn’t see the purpose of spending the time on integrations when it’s not really necessary,” he added. “Our deal is only with the consumer for their time. We’re saying, ‘This is your time. It has value.’ ”

One of the key elements to Preshow’s approach is technology that can detect when the viewer is actually looking at their phone screen — the ads will stop playing if you turn away. This has been criticized as “creepy surveillance tech,” but Spikes claimed that early PreShow users have embraced it. He also argued that it’s more transparent than the data collection and targeting currently driving online advertising.

“We used to think data was the new oil, but now our feeling is that permission and engagement and attention is the new oil,” he said.

In addition to revealing its new strategy, PreShow is announcing that it has raised $3 million in seed funding led by Harlem Capital, with participation by Canaan Partners, Wavemaker Partners, Front Row Fund, ROC Fund, BK Fulton and Monroe Harris.

And to be clear, Spikes said PreShow isn’t abandoning theatrical movies. He said that the PreShow app will eventually offer both movie and gaming deals “under one roof,” but brands aren’t currently eager to advertise to moviegoers.

“We’re ready to go when the marketplace is ready to go,” he said.

Powered by WPeMatico

Taking on Amazon S3 in the cloud storage game would seem to be a fool-hearty proposition, but Wasabi has found a way to build storage cheaply and pass the savings onto customers. Today the Boston-based startup announced a $112 million Series C investment on a $700 million valuation.

Fidelity Management & Research Company led the round with participation from previous investors. It reports that it has now raised $219 million in equity so far, along with additional debt financing, but it takes a lot of money to build a storage business.

CEO David Friend says that business is booming and he needed the money to keep it going. “The business has just been exploding. We achieved a roughly $700 million valuation on this round, so you can imagine that business is doing well. We’ve tripled in each of the last three years and we’re ahead of plan for this year,” Friend told me.

He says that demand continues to grow and he’s been getting requests internationally. That was one of the primary reasons he went looking for more capital. What’s more, data sovereignty laws require that certain types of sensitive data like financial and healthcare be stored in-country, so the company needs to build more capacity where it’s needed.

He says they have nailed down the process of building storage, typically inside co-location facilities, and during the pandemic they actually became more efficient as they hired a firm to put together the hardware for them onsite. They also put channel partners like managed service providers (MSPs) and value added resellers (VARs) to work by incentivizing them to sell Wasabi to their customers.

Wasabi storage starts at $5.99 per terabyte per month. That’s a heck of a lot cheaper than Amazon S3, which starts at 0.23 per gigabyte for the first 50 terabytes or $23.00 a terabyte, considerably more than Wasabi’s offering.

But Friend admits that Wasabi still faces headwinds as a startup. No matter how cheap it is, companies want to be sure it’s going to be there for the long haul and a round this size from an investor with the pedigree of Fidelity will give the company more credibility with large enterprise buyers without the same demands of venture capital firms.

“Fidelity to me was the ideal investor. […] They don’t want a board seat. They don’t want to come in and tell us how to run the company. They are obviously looking toward an IPO or something like that, and they are just interested in being an investor in this business because cloud storage is a virtually unlimited market opportunity,” he said.

He sees his company as the typical kind of market irritant. He says that his company has run away from competitors in his part of the market and the hyperscalers are out there not paying attention because his business remains a fraction of theirs for the time being. While an IPO is far off, he took on an institutional investor this early because he believes it’s possible eventually.

“I think this is a big enough market we’re in, and we were lucky to get in at just the right time with the right kind of technology. There’s no doubt in my mind that Wasabi could grow to be a fairly substantial public company doing cloud infrastructure. I think we have a nice niche cut out for ourselves, and I don’t see any reason why we can’t continue to grow,” he said.

Powered by WPeMatico

Cybersecurity nightmares like the SolarWinds hack highlight how malicious hackers continue to exploit vulnerabilities in software and apps to do their dirty work. Today a startup that’s built a platform to help organizations protect themselves from this by running threat detection and response at the network level is announcing a big round of funding to continue its growth.

Vectra AI, which provides a cloud-based service that uses artificial intelligence technology to monitor both on-premise and cloud-based networks for intrusions, has closed a round of $130 million at a post-money valuation of $1.2 billion.

The challenge that Vectra is looking to address is that applications — and the people who use them — will continue to be weak links in a company’s security set-up, not least because malicious hackers are continually finding new ways to piece together small movements within them to build, lay and finally use their traps. While there will continue to be an interesting, and mostly effective, game of cat-and-mouse around those applications, a service that works at the network layer is essential as an alternative line of defense, one that can find those traps before they are used.

“Think about where the cloud is. We are in the wild west,” Hitesh Sheth, Vectra’s CEO, said in an interview. “The attack surface is so broad and attacks happen at such a rapid rate that the security concerns have never been higher at the enterprise. That is driving a lot of what we are doing.”

Sheth said that the funding will be used in two areas. First, to continue expanding its technology to meet the demands of an ever-growing threat landscape — it also has a team of researchers who work across the business to detect new activity and build algorithms to respond to it. And second, for acquisitions to bring in new technology and potentially more customers.

(Indeed, there has been a proliferation of AI-based cybersecurity startups in recent years, in areas like digital forensics, application security and specific sectors like SMBs, all of which complement the platform that Vectra has built, so you could imagine a number of interesting targets.)

The funding is being led by funds managed by Blackstone Growth, with unnamed existing investors participating (past backers include Accel, Khosla and TCV, among other financial and strategic investors). Vectra today largely focuses on enterprises, highly demanding ones with lots at stake to lose. Blackstone was initially a customer of Vectra’s, using the company’s flagship Cognito platform, Viral Patel — the senior MD who led the investment for the firm — pointed out to me.

The company has built some specific products that have been very prescient in anticipating vulnerabilities in specific applications and services. While it said that sales of its Cognito platform grew 100% last year, Cognito Detect for Microsoft Office 365 (a separate product) sales grew over 700%. Coincidentally, Microsoft’s cloud apps have faced a wave of malicious threats. Sheth said that implementing Cognito (or indeed other network security protection) “could have prevented the SolarWinds hack” for those using it.

“Through our experience as a client of Vectra, we’ve been highly impressed by their world-class technology and exceptional team,” John Stecher, CTO at Blackstone, said in a statement. “They have exactly the types of tools that technology leaders need to separate the signal from the noise in defending their organizations from increasingly sophisticated cyber threats. We’re excited to back Vectra and Hitesh as a strategic partner in the years ahead supporting their continued growth.”

Looking ahead, Sheth said that endpoint security will not be a focus for the moment because “in cloud there is so much open territory”. Instead it partners with the likes of CrowdStrike, SentinelOne, Carbon Black and others.

In terms of what is emerging as a stronger entry point, social media is increasingly coming to the fore, he said. “Social media tends to be an effective vector to get in and will remain to be for some time,” he said, with people impersonating others and suggesting conversations over encrypted services like WhatsApp. “The moment you move to encryption and exchange any documents, it’s game over.”

Powered by WPeMatico

The last year of pandemic living has been real-world, and sometimes harrowing, proof of how important it can be to have efficient and well-equipped emergency response services in place. They can help people remotely if need be, and when they cannot, they make sure that in-person help can be dispatched quickly in medical and other situations. Today, a company that’s building cloud-based tools to help with this process is announcing a round of funding as it continues to grow.

RapidDeploy, which provides computer-aided dispatch technology as a cloud-based service for 911 centers, has closed a round of $29 million, a Series B round of funding that will be used both to grow its business and continue expanding the SaaS tools that it provides to its customers. In the startup’s point of view, the cloud is essential to running emergency response in the most efficient manner.

“911 response would have been called out on a walkie talkie in the early days,” said Steve Raucher, the co-founder and CEO of RapidDeploy, in an interview. “Now the cloud has become the nexus of signals.”

Austin-based RapidDeploy provides data and analytics to 911 centers — the critical link between people calling for help and connecting those calls with the nearest medical, police or fire assistance — and today it has about 700 customers using its RadiusPlus, Eclipse Analytics and Nimbus CAD products.

That works out to about 10% of all 911 centers in the U.S. (7,000 in total), and covering 35% of the population (there are more centers in cities and other dense areas). Its footprint includes state coverage in Arizona, California and Kansas. It also has operations in South Africa, where it was originally founded.

The funding is coming from an interesting mix of financial and strategic investors. Led by Morpheus Ventures, the round also had participation from GreatPoint Ventures, Ericsson Ventures, Samsung Next Ventures, Tao Capital Partners and Tau Ventures, among others. It looks like the company had raised about $30 million before this latest round, according to PitchBook data. Valuation is not being disclosed.

Ericsson and Samsung, as major players in the communication industry, have a big stake in seeing through what will be the next generation of communications technology and how it is used for critical services. (And indeed, one of the big leaders in legacy and current 911 communications is Motorola, a would-be competitor of both.) AT&T is also a strategic go-to-market (distribution and sales) partner of RapidDeploy’s, and it also has integrations with Apple, Google, Microsoft and OnStar to feed data into its system.

The business of emergency response technology is a fragmented market. Raucher describes them as “mom-and-pop” businesses, with some 80% of them occupying four seats or less (a testament to the fact that a lot of the U.S. is actually significantly less urban than its outsized cities might have you think it is), and in many cases a lot of these are operating on legacy equipment.

However, in the U.S. in the last several years — buffered by innovations like the Jedi project and FirstNet, a next-generation public safety network — things have been shifting. RapidDeploy’s technology sits alongside (and in some areas competes with) companies like Carbyne and RapidSOS, which have been tapping into the innovations of cell phone technology both to help pinpoint people and improve how to help them.

RapidDeploy’s tech is based around its RadiusPlus mapping platform, which uses data from smart phones, vehicles, home security systems and other connected devices and channels it to its data stream, which can help a center determine not just location but potentially other aspects of the condition of the caller. Its Eclipse Analytics services, meanwhile, are meant to act as a kind of assistant to those centers to help triage situations and provide insights into how to respond. The Nimbus CAD then helps figure out who to call out and routing for response.

Longer term, the plan will be to leverage cloud architecture to bring in new data sources and ways of communicating between callers, centers and emergency care providers.

“It’s about being more of a triage service rather than a message switch,” Raucher said. “As we see it, the platform will evolve with customers’ needs. Tactical mapping ultimately is not big enough to cover this. We’re thinking about unified communications.” Indeed, that is the direction that many of these services seem to be going, which can only be a good thing for us consumers.

“The future of emergency services is in data, which creates a faster, more responsive 9-1-1 center,” said Mark Dyne, founding partner at Morpheus Ventures, in a statement. “We believe that the platform RapidDeploy has built provides the necessary breadth of capabilities that make the dream of Next-Gen 9-1-1 service a reality for rural and metropolitan communities across the nation and are excited to be investing in this future with Steve and his team.” Dyne has joined the RapidDeploy board with this round.

Powered by WPeMatico

Vena, a Canadian company focused on the Corporate Performance Management (CPM) software space, has raised $242 million in Series C funding from Vista Equity Partners.

As part of the financing, Vista Equity is taking a minority stake in the company. The round follows $25 million in financing from CIBC Innovation Banking last September, and brings Vena’s total raised since its 2011 inception to over $363 million.

Vena declined to provide any financial metrics or the valuation at which the new capital was raised, saying only that its “consistent growth and…strong customer retention and satisfaction metrics created real demand” as it considered raising its C round.

The company was originally founded as a B2B provider of planning, budgeting and forecasting software. Over time, it’s evolved into what it describes as a “fully cloud-native, corporate performance management platform” that aims to empower finance, operations and business leaders to “Plan to Grow” their businesses. Its customers hail from a variety of industries, including banking, SaaS, manufacturing, healthcare, insurance and higher education. Among its over 900 customers are the Kansas City Chiefs, Coca-Cola Consolidated, World Vision International and ELF Cosmetics.

Vena CEO Hunter Madeley told TechCrunch the latest raise is “mostly an acceleration story for Vena, rather than charting new paths.”

The company plans to use its new funds to build out and enable its go-to-market efforts as well as invest in its product development roadmap. It’s not really looking to enter new markets, considering it’s seeing what it describes as “tremendous demand” in the markets it currently serves directly and through its partner network.

“While we support customers across the globe, we’ll stay focused on growing our North American, U.K. and European business in the near term,” Madeley said.

Vena says it leverages the “flexibility and familiarity” of an Excel interface within its “secure” Complete Planning platform. That platform, it adds, brings people, processes and systems into a single source solution to help organizations automate and streamline finance-led processes, accelerate complex business processes and “connect the dots between departments and plan with the power of unified data.”

Early backers JMI Equity and Centana Growth Partners will remain active, partnering with Vista “to help support Vena’s continued momentum,” the company said. As part of the raise, Vista Equity Managing Director Kim Eaton and Marc Teillon, senior managing director and co-head of Vista’s Foundation Fund, will join the company’s board.

“The pandemic has emphasized the need for agile financial planning processes as companies respond to quickly-changing market conditions, and Vena is uniquely positioned to help businesses address the challenges required to scale their processes through this pandemic and beyond,” said Eaton in a written statement.

Vena currently has more than 450 employees across the U.S., Canada and the U.K., up from 393 last year at this time.

Powered by WPeMatico

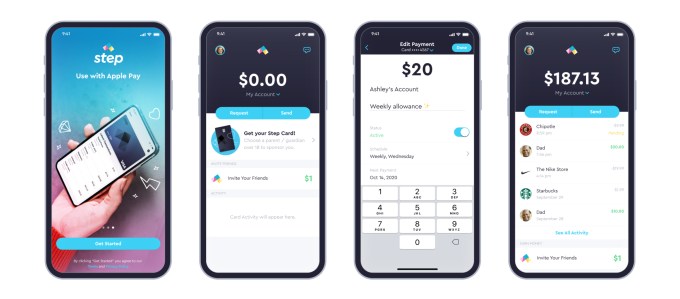

Step, the digital banking service aimed at teens and endorsed by TikTok star Charli D’Amelio, announced this morning the close of a $100 million round of Series C funding after growing to more than 1.5 million users just six months after launch. The new round, led by General Catalyst, comes shortly after Step’s $50 million Series B, announced at the end of last year after the startup hit half a million users in only two months post-launch.

The new round also includes participation from Step’s existing investors, Coatue, Stripe, Charli D’Amelio, The Chainsmokers, Will Smith and Jeffrey Katzenberg, and brings on newcomer Franklin Templeton, signaling a plan to move into investments is on the horizon. It also includes actor and musician Jared Leto. Step is also formally announcing NBA All-Star Stephen Curry as an investor, which had not previously been disclosed, as well as former Square executives Sarah Friar, Jacqueline Reses and Gokul Rajaram.

As a result of the fundraise, Kyle Doherty of General Catalyst is joining Step’s board. To date, Step has raised more than $175 million.

Image Credits: Step

According to CEO CJ MacDonald, Step hasn’t yet spent the money from its Series B, but believes the additional funds can help the startup grow more quickly.

“We’ve signed up more than a million and a half accounts in the first six months. We’re signing up 10,000 accounts-plus a day, and there’s just a lot of things that we want to do to bring this to millions and millions of households to help educate the next generation be smarter with money,” he says. At the time of the Series B, for comparison, Step said it was adding around 7,000 to 10,000 accounts per day.

“Honestly we don’t need the capital,” MacDonald added. “It’s just we think speed to market is really key and we think we can accelerate our growth and invest in infrastructure.”

The company is also planning to hire across operations, engineering, product and design, to double its now 65-person team over the next year.

Step today competes in a crowded market of mobile banking services aimed at a younger demographic, but it’s one of very few that targets teenagers ages 13 to 18. Through Step’s app, teens gain access to an FDIC-insured bank account without fees and a secured Visa card that helps them establish credit before they turn 18. The app also offers Venmo-like functionality for sending money to friends.

Image Credits: Step

Step’s growth so far has benefitted from a combination of factors, including word-of-mouth, use of social media and its popular referral program, which has paid out a few dollars per new sign-up. Step has also leveraged its partnerships with social media influencers like D’Amelio and Josh Richards, as well as celebs like Step investor Justin Timberlake.

The company believes the Curry announcement may also help to raise awareness about the banking app. As a father of three, if Curry talks about introducing Step to his own children, people will take notice.

While the additional funds are focused on driving growth, Step is also thinking about its future as its existing users begin to age up. The company plans to enter into the credit and lending market, as well as introduce investments at some point in the future. The Franklin Templeton investment could be useful here, MacDonald notes.

“Franklin [Templeton is] obviously, one of the largest financial institutions in the world. And, as we start thinking about investments and the journey of the customer, to have a great brand like Franklin Templeton that’s invested in this round — I think it’s just a testament to where they see the world going,” he says.

Step’s fundraise falls on the same day that competitor Current and Greenlight, both which focus on families, also raised new rounds.

Powered by WPeMatico

U.S.-based challenger bank Current, which has now grown to nearly 3 million users, announced this morning it has raised a $220 million round of Series D funding, led by new investor Andreessen Horowitz (a16z). The funding swiftly follows Current’s $131 million Series C at the end of last year, at which point the company had doubled its user base over just six months to more than 2 million users.

As a result of the new round, the fintech company has roughly tripled its valuation in five months, to $2.2 billion.

Other participants in the round include returning investors Tiger Global Management, TQ Ventures (the fund managed by media executive Scooter Braun), Avenir, Sapphire Ventures, Foundation Capital, Wellington Management and EXPA. David George, who led the round with a16z, will become a Current board member.

Current began its life as a teen debit card controlled by parents, but later expanded to offer personal checking accounts powered by the same underlying banking technology. Like a range of modern-day “neobanks,” or digital banks, the Current app offers a baseline of standard features like free overdrafts, no minimum balance requirements, faster direct deposits, instant spending notifications, banking insights, free ATMs, check deposits using your phone’s camera and more. It also last year launched a points rewards program in an effort to better differentiate its service from the growing number of competitors and became one of the first banks to transfer the early round of stimulus payments during the pandemic.

These days, Current is partnering with creators, like the recently announced MrBeast (aka Jimmy Donaldson), who said last week on his YouTube channel that he will personally send $1 to the first 100,000 people who sign up using his Creator code. MrBeast is also an investor.

Like other fintechs in its same space, Current has benefitted from the younger generation’s adoption of mobile banking apps instead of larger, traditional banks, which they feel don’t serve their interests. Its average customer age is 27, for example. Digital banks can keep costs down by not having to pay for the overhead of brick-and-mortar locations, allowing them to roll out benefits like reduced or zero account fees and other consumer-friendly protections.

Current today continues to offer teen banking, in a challenge to mobile banking app Step, which has also leveraged social media influencers to get the word out with a younger demographic. But Step today is appealing to the 13 to 18-year-old crowd directly, offering banking services and a secured card. Current, meanwhile, targets its service to the parents.

Its teen account costs $36 per year, while personal checking is available both as a free and premium ($4.99/mo) service. The company in the past has said its primary focus is the more than 130 million Americans who live paycheck to paycheck. This continues to be its main drive today, though the mission may attract a broader slice of the American population over time.

“We are still focused on onboarding people to the financial system, making sure that everyone has access to everything, and then democratizing — or going out and getting that value — in this new world that’s being rewritten and bringing it back to as many people as possible,” says Current CEO and founder Stuart Sopp. “Now, in that increase of scope and time. I think we’re going to pick up more and more people.”

Current says the new funds will be used to grow the company and its member base as it expands it range of banking products. One key area of new investment will be cryptocurrency, it says, which will involve a partnership and an educational component to help Current’s users better understand the crypto market.

As it turns out, Sopp’s background includes crypto, in addition to Wall Street trading. In fact, an early version of Current designed by Sopp and CTO Trevor Marshall involved crypto.

“A little-known fact is that Current started with Bitcoin wallet addresses and Ripple gateways,” he says. But the team realized the technology was a little too nascent at the time, and moved to mobile banking. “We have this background, and this knowledge of how it all works. Now do we need to build it ourselves? No, I don’t think we need to build it all ourselves. There’s lots of good companies out there,” he says.

Crypto fits into Current’s vision of democratizing access to financial systems to those in the U.S. who are today underserved by traditional banking and investing products and services.

“There’s a ton of value being created [in crypto] and we want to make sure we have this nexus of providing safe, and trustworthy financial services in that world, as well as what we already exist in,” notes Sopp. “And then, lending, credit cards,” he adds, noting how important these moves are “done safely, in a respectful way for our demographic — because traditionally most of our members have a FICO score of 650.”

In addition, Current will use the new funds for hiring across all roles, including marketing, product, engineering, finance, customer success, fraud and risk, and, of course, crypto. The company today has 100 employees, and plans to grow to around 200 or 300 in the next 18 months.

Current’s fundraise remarkably falls on the same day that competitor Step and Greenlight, both which focus on families, also raised new rounds.

“This new generation of customers doesn’t want to bank in physical branches,” said a16z’s David George, in a statement. “We believe there will be a shift in the next 10 years to mobile and consumer-focused banking services powered by innovation in technology, and with Current’s exceptional growth over the past year, they’ve clearly demonstrated they’re at the forefront of this trend. Their product is among the best in the market, and they have proven an ability to reach customers who previously were unserved or underserved by traditional banks,” he said.

Powered by WPeMatico

Getting actionable business information into the hands of users who need it has always been a challenge. If you have to wait for experts to help you find the answers, chances are you’re going to be too late. Enter Tellius, an early-stage startup building a solution to help business users find the information they need when they need it.

Today the company announced an $8 million Series A led by Sands Capital Ventures, with participation from Grotech. Today’s investment brings the total raised to $17 million, according to the company.

CEO and founder Ajay Khanna says the company is attempting to marry two technologies that have traditionally lived in silos: business intelligence and artificial intelligence. He believes that bringing them together can lead to greater wisdom and help close the insight gap.

“Tellius is an AI-driven decision intelligence platform, and what we do is we combine machine learning — AI-driven automation — with a Google-like natural language interface, so combining the left brain and the right brain to enable business teams to get insights on the data,” Khanna told me.

The idea is to let the machine learning teams and the business analysts continue to do their thing, but provide an application where business users can put all of that to work. “We believe that to go from data to decisions, you need to know not only what happened, but why things change and how you can improve your company,” he said.

The product takes aim at three employee groups. The first is the business user, who can simply query the data with a natural language question to get results. The second is a data analyst, who can get more granular by choosing a specific model to base the query on, and finally a data scientist who can enhance the query with Python or Spark code.

It connects to various data sources, including Salesforce and Google Analytics, data lakes like Snowflake, csv files to take advantage of Excel data or cloud storage tools like Amazon S3. It comes in two versions: one that the customer can connect to the cloud infrastructure provider of choice, and one which they run as a service and manage for the customers.

Khanna says that as companies struggled to change the way they do business during the pandemic, they needed the kind of insights his company provides, and business grew 300% last year as a result.

The startup launched in 2016 after Khanna sold a previous company, which allowed him to bootstrap while in stealth. They spent a couple of years building the product and brought the first version of Tellius to market in Q3 2018. That’s when they took a $7.5 million seed round.

Powered by WPeMatico