funding

Auto Added by WPeMatico

Auto Added by WPeMatico

It’s been a wild couple of years for Oura. Last year, in particular, proved to be a major driver for the wearable fitness manufacturer. With the pandemic bringing professional sports to a screeching halt in 2020, a number of major leagues have adopted the ring, including the NBA, WNBA, UFC and NASCAR.

The company has also been making a major push into health research courtesy of UCSF, which has published peer-review studies around the ring’s temperature monitor. That feature in particular has made it a big draw for the aforementioned leagues, as temperature spikes could point to larger issues, including the early stages of COVID-19.

Today the company is announcing a $100 million Series C. The round, led by The Chernin Group and Elysian Park (the Dodgers’ investment arm), brings the wearable company’s total funding up to $148.3 million. New investors include Temasek, JAZZ Venture Partners and Eisai, joining existing investors Forerunner Ventures, Square, MSD Capital, Marc Benioff, Lifeline Ventures, Metaplanet Holdings and Next Ventures.

The company initially set itself apart with its form factor, joining a crowded field that largely revolved around the wrist. Clearly, however, it’s come into its own over the last few years. To date, it’s sold more than 500,000 rings.

“The wearables industry is transitioning from activity trackers to health platforms that can improve people’s lives,” CEO Harpreet Singh Rai said in a press release tied to the news. “Oura focused first on sleep because it’s a daily habit, and lack of sleep has been linked to worsening health conditions including diabetes, cardiac disease, Alzheimer’s, cancer, poor mental health, and more.”

The company says the round will go toward R&D (both hardware and software development) and hiring, including additional marketing and customer experience. The round also sees the hiring of a number of key roles, including head of Science, Shyamal Patel; site leader Tommi Heinonen and Daniel Welch, who has been promoted to CFO.

“This year has shined a spotlight on gaps in our healthcare industry, and the increasing need for each of us to take control over our own health,” Forerunner Managing Director Eurie Kim said in the release. “Oura is emerging as the trusted leader and community in the space by empowering people with personalized data that provides actionable insights for health improvement.”

Powered by WPeMatico

Mental health, and how it is getting addressed, has been one of the major leitmotifs of the past year of pandemic living. COVID-19 not only has led to a lot of people getting ill or worse; it has increased isolation, economic uncertainty and led to a lot of other kinds of disappointments, and that all has had a knock-on effect on our collective and individual state of mind.

Today a startup called Headway, which has been working on building a better way for people to attend to themselves — by way of a three-sided marketplace of sorts, by helping a person to find and afford a therapist via a free-to-use portal, by making it possible for those therapists to accept a wider range of insurance plans and by helping those insurance plans facilitate more therapy appointments for their patient networks — is announcing a major round of funding on the heels of strong growth.

The startup has raised $70 million, money that it will be using to continue expanding its platform with more partnerships, more hiring for its team (it wants to have 300 people this year) and opening in new regions, aiming to be nationwide this year in the U.S. This round, a Series B, has a number of big names attached to it: It is being led by Andreessen Horowitz, with Thrive, GV and Accel also participating. (The latter three are repeat investors: Thrive and GV led its Series A, while Accel led its seed.) This Series B is coming in at a $750 million valuation.

The rapid pace of funding, the backers and that valuation all underscore the timeliness of the concept, and also the traction that Headway is getting for its approach.

When we last covered Headway — it raised $26 million just last November, six months ago — it said it had registered some 1,800 therapists on its platform in the New York metro area, where it is based. Now that number is up to more than 3,000 with its network now covering not just NYC, but also New Jersey, Florida, North Carolina, Texas, Georgia, Michigan, Virginia, Washington, Illinois and Colorado. It has more than 2,000 patients joining the platform each month and has so far helped facilitate 300,000 appointments, with a current average of 30,000 appointments each month. Revenues have in the last year, meanwhile, grown nine-fold.

The approach that Headway is taking — creating not just a vertical search portal for therapists, but building a back-end system to help those therapists grow their business by making it easier for them to accept insurance coverage — comes directly out of the experiences faced by one of the startup’s co-founders.

Andrew Adams, the CEO of Headway, told me last year he came up with the idea after he moved to New York from California several years ago to take a job. In seeking a therapist, he found most unwilling to accept his insurance plan as payment, making getting therapy unaffordable.

This is a very typical problem, he said. Some 70% of therapists do not accept insurance today because it’s too complicated for them to integrate, since about 85% of all therapists happen to be solo practitioners. So something that should be accessible to everyone becomes something typically only used by those who can afford it, or have entered into social care programs that might provide it. But that leaves a massive gap in the middle.

“This is the defining problem in the space,” he said at the time. “Health insurance is built around a medical world dominated by billers and admins, but therapists are small practitioners and don’t have the bandwidth to handle that, so they don’t. So we thought if we could make it easier for them to, they would, and they have.”

And indeed, if you are needing to see a therapist, the very last thing you need or want to be doing is spending your time trying to work out the economics of doing so: You need to be focused on finding someone you feel you can talk to; someone who can help you.

The problem is a huge one. In the U.S. alone it’s estimated that there are some 82 million people who have treatable health conditions. Headway was founded on the premise that most of them currently do not seek that treatment because of cost or accessibility.

A lot of therapy has traditionally been about seeing people in person — and arguably the fact that we’ve had so much reduced contact with people has contributed to mental health issues this past year — but in the event, Headway has definitely adapted to the current climate.

The company says that some 89% of its appointments at the moment are being carried out remotely. This is down from 97% at the peak of the pandemic in the U.S., and has been slowly starting to taper off, the company said. Some of the increased volume, meanwhile, is a direct result of therapists working remotely — they can fit more people in to a daily schedule as a result.

In terms of insurers, the company currently works with Aetna, Cigna, United Healthcare, Oscar and Oxford and says the list will be growing. One interesting detail is that Headway has not only built out a bigger funnel for these insurers in terms of the practitioners they work with and individuals who can subsequently use insurance to pay for therapy, but conversely has served to be a conduit for those insurance groups in bringing more patients through to those therapists, who are now a part of their networks, by way of Headway’s platform.

Headway says that using its system can help a patient get an appointment within five days, versus the the 30-day average you typically face when using an insurance directory.

It’s the kind of scale and “software eating the world” efficiency that has attracted Andreessen Horowitz to backing companies before, with the added detail of this being particularly relevant to the time we are living in.

“By getting the mental health provider community on the same page with insurance companies for the first time, Headway unlocks affordable mental healthcare for millions of Americans,” said Scott Kupor, managing partner at Andreessen Horowitz. “We’re incredibly excited to work alongside the Headway team.” Kupor is also joining Headway’s board with this round.

Cherry Miao, a former partner at Accel and Headway’s lead seed investor, is also joining as head of Finance & Data.

“I’ve been fortunate to work with some of the world’s most influential startups, and know that being part of Headway’s meaningful mission, robust business model, and incredibly talented team is a once-in-a-lifetime opportunity,” she said. “I’m thrilled to be helping rebuild America’s mental healthcare system for access and affordability.”

Powered by WPeMatico

HoneyBook, which has built out a client experience and financial management platform for service-based small businesses and freelancers, announced today that it has raised $155 million in a Series D round led by Durable Capital Partners LP.

Tiger Global Management, Battery Ventures, Zeev Ventures, 01 Advisors as well as existing backers Norwest Venture Partners and Citi Ventures also participated in the financing, which brings the San Francisco-based company’s valuation to over $1 billion. With the latest round, HoneyBook has now raised $248 million since its 2013 inception. The Series D is a big jump from the $28 million that HoneyBook raised in March 2019.

When the COVID-19 pandemic hit last year, HoneyBook’s leadership team was concerned about the potential impact on their business and braced themselves for a drop in revenue.

Rather than lay off people, they instead asked everyone to take a pay cut, and that included the executive team, who cut theirs “by double” the rest of the staff.

“I remember it was terrifying. We knew that our customers’ businesses were going to be impacted dramatically, and would impact ours at the same time dramatically,” recalls CEO Oz Alon. “We had to make some hard decisions.”

But the resilience of HoneyBook’s customer base surprised even the company, who ended up reinstating those salaries just a few months later. And, as corporate layoffs driven by the COVID-19 pandemic led to more people deciding to start their own businesses, HoneyBook saw a big surge in demand.

“Our members who saw a hit in demand went out and found demand in another thing,” Oz said. As a result, HoneyBook ended up doubling its number of members on its SaaS platform and tripling its annual recurring revenue (ARR) over the past 12 months. Members booked more than $1 billion in business on the platform in the past nine months alone.

HoneyBook combines on its platform tools like billing, contracts and client communication, with the goal of helping business owners stay organized. Since its inception, service providers across the U.S. and Canada such as graphic designers, event planners, digital marketers and photographers have booked more than $3 billion in business on its platform. And as the pandemic had more people shift to doing more things online, HoneyBook prepared to help its members adapt by being armed with digital tools.

Image Credits: HoneyBook

“Clients now expect streamlined communication, seamless payments, and the same level of exceptional service online that they were used to receiving from business owners in person,” Alon said.

Oz co-founded HoneyBook with wife Naama and longtime friend Dror Shimoni. Oz and Naama were both small business owners themselves at one time, so they had firsthand insight on the pain points of running a service-based business.

HoneyBook’s software not only helps SMBs do more business, but helps them “convert potentials to actual clients,” Oz said.

“We help them communicate with potential clients so they can win their business, and then help them manage the relationship so they can keep them,” Naama said.

The company plans to use its new capital toward continued product development and to “dramatically” boost its 103-person headcount across its New York and Tel Aviv offices.

“We’re seeing so much demand for additional services and products, so we definitely want to invest and create better ways for our members to present themselves online,” Alon told TechCrunch. “We’re also seeing demand for financial products and the ability to access capital faster. So that’s just a few of the things we plan to invest in.”

The company also wants to make its platform “more customizable” for different categories and verticals.

Chelsea Stoner, general partner at Battery Ventures, said her firm recognized that the expansive market of productivity tools to serve small businesses and entrepreneurs was “a market of discrete and separate productivity tools.”

HoneyBook, she said, is a true platform for SMBs, “providing a huge array of functionality in one cohesive UX.”

“It unites and connects every task for the solopreneurs, from creating and distributing marketing collateral, to organizing and executing proposals, to sending invoices and collecting payments,” Stoner said. “The company is constantly innovating and iterating in response to its members; we also see a lot of opportunity with payments going forward…And, due to COVID-19 and other factors, the company is sitting on pent-up demand that will accelerate growth even more.”

Powered by WPeMatico

An Indian startup that began its life after the global pandemic broke last year said on Tuesday it has concluded its third financing round as it enables hundreds of thousands of teachers in the world’s second-largest internet market to run classes online and serve their students.

Bangalore-based Teachmint said today it has raised $16.5 million in its Series A financing round. The round was led by Learn Capital, the San Francisco Bay Area-headquartered venture capital firm that focuses on edtech firms and has backed some of the world’s most promising online learning startups, including Coursera, Udemy, Nerdy, Minerva and Brainly.

CM Ventures, and existing investors Better Capital, which first invested in Teachmint before the startup had even registered itself, and Lightspeed India Partners also participated in the new round, which brings the Indian startup’s to-date raise to $20 million.

Teachmint helps teachers conduct classes online through an app on their Android smartphone, iPhone or the web. The startup has built an all-in-one product that allows teachers to kickstart a live class, do doubt-clearing sessions, take attendance, conduct webinars, collect fees, find new students, offer support via phone calls and take tests, among other tasks.

“When the pandemic broke, teachers were struggling with several tools including Google Meet, Zoom and even YouTube/Facebook Live to teach online. They were using additional tools like Google Forms for tests and WhatsApp for communication. It was a difficult and disconnected experience for most teachers as none of these tools were productised for teaching. That’s when we decided to build a mobile-first video-first solution specifically for teaching,” said Mihir Gupta, co-founder and chief executive of Teachmint, in an interview with TechCrunch.

The product, available in 10 local languages, is highly localised for India-specific needs, said Gupta.

More than 700,000 teachers from over 1,500 cities and towns have signed up on the platform in less than 10 months since the launch of Teachmint’s product, said Gupta.

“From the Learn Capital team’s first meeting with Teachmint’s co-founders several months ago, it was clear that their collective team had meticulously architected an end-to-end, multi-modal, and best-in-class solution enabling teachers in India to instantly and seamlessly digitize their classrooms,” said Vinit Sukhija, partner at Learn Capital, in a statement.

“Now with over 700,000 teachers, Teachmint has become India’s leading online teaching platform,” he said, adding that Learn Capital believes that Teachmint can eventually expand its offering outside of India.

Gupta said Teachmint is currently not monetizing its product, and doesn’t intend to do so in the immediate future as it is currently prioritizing reaching more teachers in India and also expand its offerings.

He said most teachers have learnt about Teachmint through friends as it has limited investment in marketing. Teachmint is open to exploring any strategic acquisition opportunities with smaller startups, he said.

Powered by WPeMatico

The identity verification space has been heating up for a while and the COVID-19 pandemic has only accelerated demand with more people transacting online.

Persona, a startup focused on creating a personalized identity verification experience “for any use case,” aims to differentiate itself in an increasingly crowded space. And investors are banking on the San Francisco-based company’s ability to help businesses customize the identity verification process — and beyond — via its no-code platform in the form of a $50 million Series B funding round.

Index Ventures led the financing, which also included participation from existing backer Coatue Management. In late January 2020, Persona raised $17.5 million in a Series A round. The company declined to reveal at which valuation this latest round was raised.

Businesses and organizations can access Persona’s platform by way of an API, which lets them use a variety of documents, from government-issued IDs through to biometrics, to verify that customers are who they say they are. The company wants to make it easier for organizations to implement more watertight methods based on third-party documentation, real-time evaluation such as live selfie checks and AI to verify users.

Persona’s platform also collects passive signals such as a user’s device, location, and behavioral signals to provide a more holistic view of a user’s risk profile. It offers a low code and no code option depending on the needs of the customer.

The company’s momentum is reflected in its growth numbers. The startup’s revenue has surged by “more than 10 times” while its customer base has climbed by five times over the past year, according to co-founder and CEO Rick Song, who did not provide hard revenue numbers. Meanwhile, Persona’s headcount has more than tripled to just over 50 people.

“When we look back at the space five to 10 years ago, AI was the next differentiation and every identity verification company is doing AI and machine learning,” Song told TechCrunch. “We believe the next big differentiator is more about tailoring and personalizing the experience for individuals.”

As such, Song believes that growth can be directly tied to Persona’s ability to help companies with “unique” use cases with a SaaS platform that requires little to no code and not as much heavy lifting from their engineering teams. Its end goal, ultimately, is to help businesses deter fraud, stay compliant and build trust and safety while making it easier for them to customize the verification process to their needs. Customers span a variety of industries, and include Square, Robinhood, Sonder, Brex, Udemy, Gusto, BlockFi and AngelList, among others.

“The strategy your business needs for identity verification and management is going to be completely different if you’re a travel company verifying guests versus a delivery service onboarding new couriers versus a crypto company granting access to user funds,” Song added. “Even businesses within the same industry should tailor the identity verification experience to each customer if they want to stand out.”

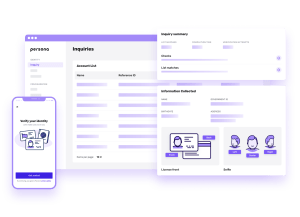

Image Credits: Persona

For Song, another thing that helps Persona stand out is its ability to help customers beyond the sign-on and verification process.

“We’ve built an identity infrastructure because we don’t just help businesses at a single point in time, but rather throughout the entire lifecycle of a relationship,” he told TechCrunch.

In fact, much of the company’s growth last year came in the form of existing customers finding new use cases within the platform in addition to new customers signing on, Song said.

“We’ve been watching existing customers discover more ways to use Persona. For example, we were working with some of our customer base on a single use case and now we might be working with them on 10 different problems — anywhere from account opening to a bad actor investigation to account recovery and anything in between,” he added. “So that has probably been the biggest driver of our growth.”

Index Ventures Partner Mark Goldberg, who is taking a seat on Persona’s board as part of the financing, said he was impressed by the number of companies in Index’s own portfolio that raved about Persona.

“We’ve had our antennas up for a long time in this space,” he told TechCrunch. “We started to see really rapid adoption of Persona within the Index portfolio and there was the sense of a very powerful and very user friendly tool, which hadn’t really existed in the category before.”

Its personalization capabilities and building block-based approach too, Goldberg said, makes it appealing to a broader pool of users.

“The reality is there’s so many ways to verify a user is who they say they are or not on the internet, and if you give people the flexibility to design the right path to get to a yes or no, you can just get to a much better outcome,” he said. “That was one of the things we heard — that the use cases were not like off the rack, and I think that has really resonated in a time where people want and expect the ability to customize.”

Persona plans to use its new capital to grow its team another twofold by year’s end to support its growth and continue scaling the business.

In recent months, other companies in the space that have raised big rounds include Socure and Sift.

Powered by WPeMatico

It looks like everyone and their mother is trying to reinvent the Brazilian banking system. Earlier this year we wrote about Nubank’s $400 million Series G, last month there was the PicPay IPO filing and today, alt.bank, a Brazilian neobank, announced a $5.5 million Series A led by Union Square Ventures (USV).

It’s no secret that the Brazilian banking system has been poised for disruption, considering the sector’s little attention to customer service and exorbitant fee structure that’s left most Brazilians unbanked, and alt.bank is just the latest company trying to take home a piece of the pie.

Following Nubank’s strategy of launching a bank with colors that are very un-bank-like, signaling that they do things differently, alt.bank similarly launched its first financial product in 2019 — a fluorescent-yellow debit card which the locals have endearingly dubbed, “o amarelinho,” meaning, “the little yellow card.”

The company, founded by serial entrepreneur Brad Liebmann, follows the founder’s $480 million exit of Simply Business, which was acquired by U.S. insurance giant Travelers in 2017.

Unlike many fintechs, alt.bank has a strong social mission and pays commissions for referrals that last for the customer’s lifetime.

“Most fintechs just help wealthy people get wealthier, so I thought let’s do something with a social mission,” Liebmann told TechCrunch in an interview.

To drive home the mission, and really target the unbanked, Liebman and his team of 80 employees have designed an app that can be used by the illiterate. Instead of words, users can follow color-coded prompts to complete a transaction. The company also plans to launch credit products soon.

According to the company, close to a million people have downloaded the android app since launch, but Liebman declined to disclose how many active users the company actually has.

Today, the company’s core offerings include the debit card, a prepaid credit card, Pix (similar to Zelle), a savings account and even telemedicine visits via a partnership with Dr. Consulta, a network of healthcare clinics throughout the country. The prepaid credit card is key because online stores in Brazil don’t accept debit card purchases.

In addition to the perk of ongoing commissions, alt.bank has also partnered with three major drugstores, allowing their users to get 5-30% off any item at the stores, including medication.

While the company is based in São Paulo and São Carlos, Liebmann and his family are currently based in London due to regulations around the pandemic.

The investment in alt.bank marks USV’s first investment in South America, solidifying a trend by other major U.S. investors such as Sequoia who only in the last several years have started looking to LatAm for deals.

“The bar was high for our first investment in South America,” said Union Square Ventures partner John Buttrick. “The combination of the alt.bank business model and world-class management team enticed us to expand our geographic focus to help build the leading digital bank targeting the 100 million Brazilians who are currently being neglected by traditional lenders,” he added in a statement.

Powered by WPeMatico

Sony and Discord have announced a partnership that will integrate the latter’s popular gaming-focused chat app with PlayStation’s own built-in social tools. It’s a big move and a fairly surprising one given how recently acquisition talks were in the air — Sony appears to have offered a better deal than Microsoft, taking an undisclosed minority stake in the company ahead of a rumored IPO.

The exact nature of the partnership is not expressed in the brief announcement post. The closest we come to hearing what will actually happen is that the two companies plan to “bring the Discord and PlayStation experiences closer together on console and mobile starting early next year,” which at least is easy enough to imagine.

Discord has partnered with console platforms before, though its deal with Microsoft was not a particularly deep integration. This is almost certainly more than a “friends can see what you’re playing on PS5” and more of a “this is an alternative chat infrastructure for anyone on a Sony system.” Chances are it’ll be a deep, system-wide but clearly Discord-branded option — such as “Start a voice chat with Discord” option when you invite a friend to your game or join theirs.

The timeline of early 2022 also suggests that this is a major product change, probably coinciding with a big platform update on Sony’s long-term PS5 roadmap.

While the new PlayStation is better than the old one when it comes to voice chat, the old one wasn’t great to begin with, and Discord is not just easier to use but something millions of gamers already do use daily. And these days, if a game isn’t an exclusive, being robustly cross-platform is the next best option — so PS5 players being able to seamlessly join and chat with PC players will reduce a pain point there.

Of course Microsoft has its own advantages, running both the Xbox and Windows ecosystems, but it has repeatedly fumbled this opportunity and the acquisition of Discord might have been the missing piece that tied it all together. That bird has flown, of course, and while Microsoft’s acquisition talks reportedly valued Discord at some $10 billion, it seems the growing chat app decided it would rather fly free with an IPO and attempt to become the dominant voice platform everywhere rather than become a prized pet.

Sony has done its part, financially speaking, by taking part in Discord’s recent $100 million H round. The amount they contributed is unknown, but perforce it can’t be more than a small minority stake, given how much the company has taken on and its total valuation.

Powered by WPeMatico

Remote work is no longer a new topic, as much of the world has now been doing it for a year or more because of the COVID-19 pandemic.

Companies — big and small — have had to react in myriad ways. Many of the initial challenges have focused on workflow, productivity and the like. But one aspect of the whole remote work shift that is not getting as much attention is the culture angle.

A 100% remote startup that was tackling the issue way before COVID-19 was even around is now seeing a big surge in demand for its offering that aims to help companies address the “people” challenge of remote work. It started its life with the name Icebreaker to reflect the aim of “breaking the ice” with people with whom you work.

“We designed the initial version of our product as a way to connect people who’d never met, kind of virtual speed dating,” says co-founder and CEO Perry Rosenstein. “But we realized that people were using it for far more than that.”

So over time, its offering has evolved to include a bigger goal of helping people get together beyond an initial encounter –– hence its new name: Gatheround.

“For remote companies, a big challenge or problem that is now bordering on a crisis is how to build connection, trust and empathy between people that aren’t sharing a physical space,” says co-founder and COO Lisa Conn. “There’s no five-minute conversations after meetings, no shared meals, no cafeterias — this is where connection organically builds.”

Organizations should be concerned, Gatheround maintains, that as we move more remote, that work will become more transactional and people will become more isolated. They can’t ignore that humans are largely social creatures, Conn said.

The startup aims to bring people together online through real-time events such as a range of chats, videos and one-on-one and group conversations. The startup also provides templates to facilitate cultural rituals and learning & development (L&D) activities, such as all-hands meetings and workshops on diversity, equity and inclusion.

Gatheround’s video conversations aim to be a refreshing complement to Slack conversations, which despite serving the function of communication, still don’t bring users face-to-face.

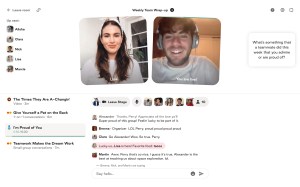

Image Credits: Gatheround

Since its inception, Gatheround has quietly built up an impressive customer base, including 28 Fortune 500s, 11 of the 15 biggest U.S. tech companies, 26 of the top 30 universities and more than 700 educational institutions. Specifically, those users include Asana, Coinbase, Fiverr, Westfield and DigitalOcean. Universities, academic centers and nonprofits, including Georgetown’s Institute of Politics and Public Service and Chan Zuckerberg Initiative, are also customers. To date, Gatheround has had about 260,000 users hold 570,000 conversations on its SaaS-based, video platform.

All its growth so far has been organic, mostly referrals and word of mouth. Now, armed with $3.5 million in seed funding that builds upon a previous $500,000 raised, Gatheround is ready to aggressively go to market and build upon the momentum it’s seeing.

Venture firms Homebrew and Bloomberg Beta co-led the company’s latest raise, which included participation from angel investors such as Stripe COO Claire Hughes Johnson, Meetup co-founder Scott Heiferman, Li Jin and Lenny Rachitsky.

Co-founders Rosenstein, Conn and Alexander McCormmach describe themselves as “experienced community builders,” having previously worked on President Obama’s campaigns as well as at companies like Facebook, Change.org and Hustle.

The trio emphasize that Gatheround is also very different from Zoom and video conferencing apps in that its platform gives people prompts and organized ways to get to know and learn about each other as well as the flexibility to customize events.

“We’re fundamentally a connection platform, here to help organizations connect their people via real-time events that are not just really fun, but meaningful,” Conn said.

Homebrew Partner Hunter Walk says his firm was attracted to the company’s founder-market fit.

“They’re a really interesting combination of founders with all this experience community building on the political activism side, combined with really great product, design and operational skills,” he told TechCrunch. “It was kind of unique that they didn’t come out of an enterprise product background or pure social background.”

He was also drawn to the personalized nature of Gatheround’s platform, considering that it has become clear over the past year that the software powering the future of work “needs emotional intelligence.”

“Many companies in 2020 have focused on making remote work more productive. But what people desire more than ever is a way to deeply and meaningfully connect with their colleagues,” Walk said. “Gatheround does that better than any platform out there. I’ve never seen people come together virtually like they do on Gatheround, asking questions, sharing stories and learning as a group.”

James Cham, partner at Bloomberg Beta, agrees with Walk that the founding team’s knowledge of behavioral psychology, group dynamics and community building gives them an edge.

“More than anything, though, they care about helping the world unite and feel connected, and have spent their entire careers building organizations to make that happen,” he said in a written statement. “So it was a no-brainer to back Gatheround, and I can’t wait to see the impact they have on society.”

The 14-person team will likely expand with the new capital, which will also go toward helping adding more functionality and details to the Gatheround product.

“Even before the pandemic, remote work was accelerating faster than other forms of work,” Conn said. “Now that’s intensified even more.”

Gatheround is not the only company attempting to tackle this space. Ireland-based Workvivo last year raised $16 million and earlier this year, Microsoft launched Viva, its new “employee experience platform.”

Powered by WPeMatico

Columbus, Ohio-based firm Path Robotics today announced the completion of a $56 million Series B. The round, led by Addition (featuring Drive Capital, Basis Set and Lemnos Lab) brings the robotic welding company’s total funding to $71 million.

Adding another piece to the broader automated manufacturing puzzle, the company is focused on robotic welding. The system uses scanning, computer vision and AI to adjust itself to different parts, understanding that sizing parts is a kind of imperfect science. Add to that the additional difficulty of working with highly reflective metals and you’ve got some interesting robotics problems to solve.

“Current industrial robotics have very little ability to understand their environment and the task at hand. Most robots merely repeat what they are told and have no ability to improve themselves,” CEO Andrew Lonsberry said in a release tied to the news. Our goal is to change this. The future of manufacturing hinges on highly capable robotics.”

The company says it’s looking to address a shortage in the welding workforce, which the American Welding Society says will experience a shortage of around 400,000 by 2024. The pandemic has also driven a number of companies to look for a more localized solution, apparently somewhat curbing the trend of offshoring the industry has seen in recent decades.

Powered by WPeMatico

Barely more than eight months after announcing a $37 million funding round, Mux has another $105 million.

The Series D was led by Coatue and values the company at more than $1 billion (Mux isn’t disclosing the specific valuation). Existing investors Accel, Andreessen Horowitz and Cobalt also participated, as did new investor Dragoneer.

Co-founder and CEO Jon Dahl told me that Mux didn’t need to raise more funding. But after last year’s Series C, the company’s leadership kept in touch with Coatue and other investors who’d expressed interest, and they ultimately decided that more money could help fuel faster growth during “this inflection moment in video.”

Building on the thesis popularized by a16z co-founder Marc Andreessen, Dahl said, “I think video’s eating software, the same way software was eating the world 10 years ago.” In other words, where video was once something we watched at our desks and on our sofas, it’s now everywhere, whether we’re scrolling through our social media feeds or exercising on our Pelotons.

“We’re at the early days of a five- or 10-year major transition, where video is moving into being a first-class part of every software project,” he said.

Dahl argued that Mux is well-suited for this transition because it’s “a video platform for developers,” with an API-centric approach that results in faster publishing and reliable streaming for viewers. Its first product was a monitoring and analytics tool called Mux Data, followed by its streaming video product Mux Video.

“If you’re going to build a video platform and do it data-first, you need heavy data and monitoring and analytics,” Dahl explained. “We built the data layer [and then] we built the streaming platform.”

Customers include Robinhood, PBS, ViacomCBS, Equinox Media and VSCO — Dahl said that while Mux works with digital media companies, “our core market is software.” He suggested that back when the company was founded in 2015, video was largely seen as a “niche,” or “something you needed if you were ESPN or Netflix.” But the last few years have illustrated that “video is a fundamental part of how we communicate” and that “every software company should have video as a core part of its products.”

Mux founders Adam Brown, Steven Heffernan, Matt McClure and Jon Dahl. Image Credits: Mux

Not surprisingly, demand increased dramatically during the pandemic. During the past year, on-demand streaming via the Mux platform grew by 300%, while live video streaming grew 3,700% and revenue quadrupled.

“Which is a lot of work,” Dahl said with a laugh. “We definitely spent a lot of the last year ramping and scaling and investing in the platform.”

This new funding will allow Mux (which has now raised a total of $175 million) to continue that investment. Dahl said he plans to grow the team from 80 to 200 employees and to explore potential acquisitions.

“We were impressed by Mux’s laser focus on the developer community, and saw impressive customer retention and expansion indicative of the strong value their solutions provide,” said Coatue General Partner David Schneider in a statement. “This funding will enable Mux to continue to build on their customer-centric platform and we are proud to partner with Mux as it leads the way to this hybrid future.”

Powered by WPeMatico