funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Long before COVID-19 precipitated “digital transformation” across the world of work, customer services and support was built to run online and virtually. Yet it too is undergoing an evolution supercharged by technology.

Today, a startup called SightCall, which has built an augmented reality platform to help field service teams, the companies they work for, and their customers carry out technical and mechanical maintenance or repairs more effectively, is announcing $42 million in funding, money that it plans to use to invest in its tech stack with more artificial intelligence tools and expanding its client base.

The core of its service, explained CEO and co-founder Thomas Cottereau, is AR technology (which comes embedded in their apps or the service apps its customers use, with integrations into other standard software used in customer service environments including Microsoft, SAP, Salesforce and ServiceNow). The augmented reality experience overlays additional information, pointers and other tools over the video stream.

This is used by, say, field service engineers coordinating with central offices when servicing equipment; or by manufacturers to provide better assistance to customers in emergencies or situations where something is not working but might be repaired quicker by the customers themselves rather than engineers that have to be called out; or indeed by call centers, aided by AI, to diagnose whatever the problem might be. It’s a big leap ahead for scenarios that previously relied on work orders, hastily drawn diagrams, instruction manuals and voice-based descriptions to progress the work in question.

“We like to say that we break the barriers that exist between a field service organization and its customer,” Cottereau said.

The tech, meanwhile, is unique to SightCall, built over years and designed to be used by way of a basic smartphone, and over even a basic mobile network — essential in cases where reception is bad or the locations are remote. (More on how it works below.)

Originally founded in Paris, France before relocating to San Francisco, SightCall has already built up a sizable business across a pretty wide range of verticals, including insurance, telecoms, transportation, telehealth, manufacturing, utilities and life sciences/medical devices.

SightCall has some 200 big-name enterprise customers on its books, including the likes of Kraft-Heinz, Allianz, GE Healthcare and Lincoln Motor Company, providing services on a B2B basis as well as for teams that are out in the field working for consumer customers, too. After seeing 100% year-over-year growth in annual recurring revenue in 2019 and 2020, SightCall’s CEO says it’s looking like it will hit that rate this year as well, with a goal of $100 million in annual recurring revenue.

The funding is being led by InfraVia, a European private equity firm, with Bpifrance also participating. The valuation of this round is not being disclosed, but I should point out that an investor told me that PitchBook’s estimate of $122 million post-money is not accurate (we’re still digging on this and will update as and when we learn more).

For some further context on this investment, InfraVia invests in a number of industrial businesses, alongside investments in tech companies building services related to them such as recent investments in Jobandtalent, so this is in part a strategic investment. SightCall has raised $67 million to date.

There has been an interesting wave of startups emerging in recent years building out the tech stack used by people working in the front lines and in the field, a shift after years of knowledge workers getting most of the attention from startups building a new generation of apps.

Workiz and Jobber are building platforms for small business tradespeople to book jobs and manage them once they’re on the books; BigChange helps manage bigger fleets; and Hover has built a platform for builders to be able to assess and estimate costs for work by using AI to analyze images captured by their or their would-be customers’ smartphone cameras.

And there is Streem, which I discovered is a close enough competitor to SightCall that they’ve acquired AdWords ads based on SightCall searches in Google. Just ahead of the COVID-19 pandemic breaking wide open, General Catalyst-backed Streem was acquired by Frontdoor to help with the latter’s efforts to build out its home services business, another sign of how all of this is leaping ahead.

What’s interesting in part about SightCall and sets it apart is its technology. Co-founded in 2007 by Cottereau and Antoine Vervoort (currently SVP of product and engineering), the two are long-time telecoms industry vets who had both worked on the technical side of building next-generation networks.

SightCall started life as a company called Weemo that built video chat services that could run on WebRTC-based frameworks, which emerged at a time when we were seeing a wider effort to bring more rich media services into mobile web and SMS apps. For consumers and to a large extent businesses, mobile phone apps that work “over the top” (distributed not by your mobile network carrier but the companies that run your phone’s operating system, and thus partly controlled by them) really took the lead and continue to dominate the market for messaging and innovations in messaging.

After a time, Weemo pivoted and renamed itself as SightCall, focusing on packaging the tech that it built into whichever app (native or mobile web) where one of its enterprise customers wanted the tech to live.

The key to how it works comes by way of how SightCall was built, Cottereau explained. The company has spent 10 years building and optimizing a network across data centers close to where its customers are, which interconnects with Tier 1 telecoms carriers and has a lot of latency in the system to ensure uptime. “We work with companies where this connectivity is mission critical,” he said. “The video solution has to work.”

As he describes it, the hybrid system SightCall has built incorporates its own IP that works both with telecoms hardware and software, resulting in a video service that provides 10 different ways for streaming video and a system that automatically chooses the best in a particular environment, based on where you are, so that even if mobile data or broadband reception don’t work, video streaming will. “Telecoms and software are still very separate worlds,” Cottereau said. “They still don’t speak the same language, and so that is part of our secret sauce, a global roaming mechanism.”

The tech that the startup has built to date not only has given it a firm grounding against others who might be looking to build in this space, but has led to strong traction with customers. The next steps will be to continue building out that technology to tap deeper into the automation that is being adopted across the industries that already use SightCall’s technology.

“SightCall pioneered the market for AR-powered visual assistance, and they’re in the best position to drive the digital transformation of remote service,” said Alban Wyniecki, partner at InfraVia Capital Partners, in a statement. “As a global leader, they can now expand their capabilities, making their interactions more intelligent and also bringing more automation to help humans work at their best.”

“SightCall’s $42M Series B marks the largest funding round yet in this sector, and SightCall emerges as the undisputed leader in capital, R&D resources and partnerships with leading technology companies enabling its solutions to be embedded into complex enterprise IT,” added Antoine Izsak of Bpifrance. “Businesses are looking for solutions like SightCall to enable customer-centricity at a greater scale while augmenting technicians with knowledge and expertise that unlocks efficiencies and drives continuous performance and profit.”

Cottereau said that the company has had a number of acquisition offers over the years — not a surprise when you consider the foundational technology it has built for how to architect video networks across different carriers and data centers that work even in the most unreliable of network environments.

“We want to stay independent, though,” he said. “I see a huge market here, and I want us to continue the story and lead it. Plus, I can see a way where we can stay independent and continue to work with everyone.”

Powered by WPeMatico

Israeli security startup Cycode, which specializes in helping enterprises secure their DevOps pipelines and prevent code tampering, today announced that it has raised a $20 million Series A funding round led by Insight Partners. Seed investor YL Ventures also participated in this round, which brings the total funding in the company to $24.6 million.

Cycode’s focus was squarely on securing source code in its early days, but thanks to the advent of infrastructure as code (IaC), policies as code and similar processes, it has expanded its scope. In this context, it’s worth noting that Cycode’s tools are language and use case agnostic. To its tools, code is code.

“This ‘everything as code’ notion creates an opportunity because the code repositories, they become a single source of truth of what the operation should look like and how everything should function, Cycode CTO and co-founder Ronen Slavin told me. “So if we look at that and we understand it — the next phase is to verify this is indeed what’s happening, and then whenever something deviates from it, it’s probably something that you should look at and investigate.”

The company’s service already provides the tools for managing code governance, leak detection, secret detection and access management. Recently it added its features for securing code that defines a business’ infrastructure; looking ahead, the team plans to add features like drift detection, integrity monitoring and alert prioritization.

“Cycode is here to protect the entire CI/CD pipeline — the development infrastructure — from end to end, from code to cloud,” Cycode CEO and co-founder Lior Levy told me.

“If we look at the landscape today, we can say that existing solutions in the market are kind of siloed, just like the DevOps stages used to be,” Levy explained. “They don’t really see the bigger picture, they don’t look at the pipeline from a holistic perspective. Essentially, this is causing them to generate thousands of alerts, which amplifies the problem even further, because not only don’t you get a holistic view, but also the noise level that comes from those thousands of alerts causes a lot of valuable time to get wasted on chasing down some irrelevant issues.”

What Cycode wants to do then is to break down these silos and integrate the relevant data from across a company’s CI/CD infrastructure, starting with the source code itself, which ideally allows the company to anticipate issues early on in the software life cycle. To do so, Cycode can pull in data from services like GitHub, GitLab, Bitbucket and Jenkins (among others) and scan it for security issues. Later this year, the company plans to integrate data from third-party security tools like Snyk and Checkmarx as well.

“The problem of protecting CI/CD tools like GitHub, Jenkins and AWS is a gap for virtually every enterprise,” said Jon Rosenbaum, principal at Insight Partners, who will join Cycode’s board of directors. “Cycode secures CI/CD pipelines in an elegant, developer-centric manner. This positions the company to be a leader within the new breed of application security companies — those that are rapidly expanding the market with solutions which secure every release without sacrificing velocity.”

The company plans to use the new funding to accelerate its R&D efforts, and expand its sales and marketing teams. Levy and Slavin expect that the company will grow to about 65 employees this year, spread between the development team in Israel and its sales and marketing operations in the U.S.

Powered by WPeMatico

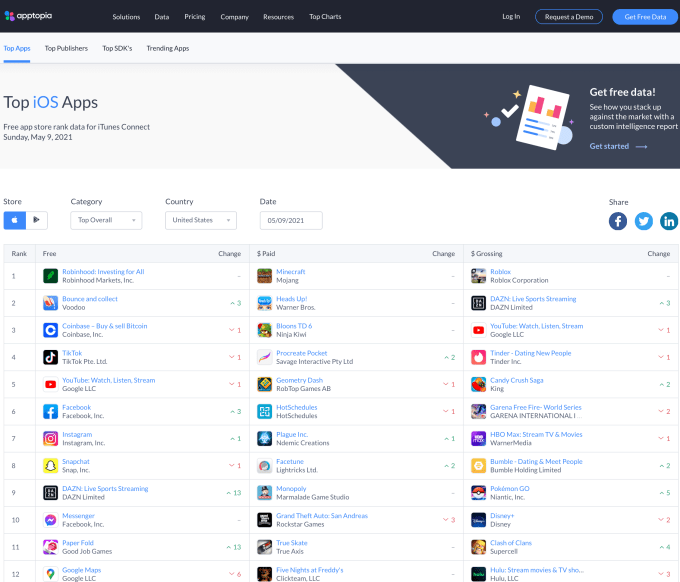

Boston-based Apptopia, a company providing competitive intelligence in the mobile app ecosystem, has closed on $20 million in Series C funding aimed at fueling its expansion beyond the world of mobile apps. The new financing was led by ABS Capital Partners, and follows three consecutive years of 50% year-over-year growth for Apptopia’s business, which has been profitable since the beginning of last year, the company says.

Existing investors, including Blossom Street Ventures, also participated in the round. ABS Capital’s Mike Avon, a co-founder of Millennial Media, and Paul Mariani, are joining Apptopia’s board with this round.

The funding follows what Apptopia says has been increased demand from brands to better understand the digital aspects of their businesses.

Today, Apptopia’s customers include hundreds of corporations and financial institutions, including Google, Visa, Coca-Cola, Target, Zoom, NBC, Unity Technologies, Microsoft, Adobe, Glu, Andreessen Horowitz and Facebook.

In the past, Apptopia’s customers were examining digital engagement and interactions from a macro level, but now they’re looking to dive deeper into specific details, requiring more data. For example, a brand may have previously wanted to know how well a competitor’s promotion fared in terms of new users or app sessions. But now they want to know the answers to specific questions — like how many unique users participated, whether those users were existing customers, whether they returned after the promotion ended, and so on.

The majority of Apptopia’s business is now focused on delivering these sorts of answers to enterprise customers who subscribe to Apptopia’s data — and possibly, to the data from its competitors like Sensor Tower and App Annie, with the goal of blending data sets together for a more accurate understanding of the competitive landscape.

Apptopia’s own data, historically, was not always seen as being the most accurate, admits Apptopia CEO Jonathan Kay. But it has improved over the years.

Kay, previously Apptopia COO, is now taking over the top role from co-founder Eliran Sapir, who’s transitioning to chairman of the board as the company enters its next phase of growth.

Apptopia’s rivals like Sensor Tower and App Annie use mobile panels to gather app data, among other methods, Kay explains. These panels involve consumer-facing apps like VPN clients and ad blockers, which users would download not necessarily understanding that they were agreeing to having their app usage data collected. This led to some controversy as the app data industry’s open secret was exposed to consumers, and the companies tweaked their disclosures, as a result.

But the practice continues and has not impacted the companies’ growth. Sensor Tower, for example, raised $45 million last year, as demand for app data continued to grow. And all involved businesses are expanding with new products and services for their data-hungry customer bases.

Image Credits: Apptopia

Apptopia, meanwhile, decided not to grow its business on the back of mobile panels. (Though in its earlier days it did test and then scrap such a plan.)

It gains access to data from its app developer customers — and this data is already aggregated and anonymized from the developers’ Apple and Google Analytics accounts.

Initially, this method put Apptopia at a disadvantage. Rivals had more accurate data from about 2016 through 2018 because of their use of mobile panels, Kay says. But Apptopia made a strategic decision to not take this sort of risk — that is, build a business that Apple or Google could shut off at any time.

“Instead, what we did is we spent years investing into data science and algorithms,” notes Kay. “We figured out how to extract an equal or greater signal from the same data set that [competitors] had access to.”

Using what Kay describes as “huge, huge amounts of historical data,” Apptopia over time learned what sort of signals went into an app’s app store ranking. A lot of people still think an app’s rank is largely determined by downloads, but there are now a variety of signals that inform rank, Kay points out.

“Really, a rank is just an accumulation of analytical data points that Apple and Google give points for,” he explains. This includes things like number of sessions, how many users, how much time is spent in an app, and more. “Because we didn’t have these panels, we had to spend years figuring out how to do reverse engineering better than our competitors. And, eventually, we figured out how to get the same signal that they could get from the panel from rank. That’s what allowed us to have such a fast-growing, successful business over the past several years.”

As Apptopia was already profitable, it didn’t need to fundraise. But the company wanted to accelerate its expansion into new areas, including its planned expansion outside of mobile apps.

Today, consumers use “apps” on their computers, on their smartwatches and on their TVs, in addition to their phones and tablets. And businesses no longer want to know just what’s happening on mobile — they want the full picture of “app” usage.

“We figured out a way to do that that doesn’t rely on any of what our competitors have done in the past,” says Kay. “So, we will not be using any apps to spy on people,” he states.*

[*Sensor Tower, in response to Kay’s statements, said the following: “We have never collected any personally identifying information (PII) on individual users, nor have we received any of the anonymous usage and engagement metrics our panel provides without user consent.”]

Apptopia was not prepared to offer further details around its future product plans at this time. But Kay said they would not rule out partnerships or being acquisitive to accomplish its goals going forward.

The company also sees a broader future in making its app data more accessible. Last year, for instance, it partnered with Bloomberg to bring mobile data to investors via the Bloomberg App Portal on the Bloomberg Terminal. And it now works with Amazon’s AWS Data Exchange and Snowflake to make access to app data available in other channels, as well. Future partnerships of a similar nature could come into play as another means of differentiating Apptopia’s data from its rivals.

The company declined to offer its current revenue run rate or valuation, but notes that it tripled its valuation from its last fundraise at the end of 2019.

In addition to product expansions, the company plans to leverage the funds to grow its team of 55 by another 25 in 2021, including in engineering and analysts. And it will grow its management team, adding a CFO, CPO and CMO this year.

To date, Apptopia has raised $30 million in outside capital.

Powered by WPeMatico

While consumers and businesses continue to use their purchasing power to spin the wheels of the globalized economy, one of the companies that’s built a technology platform to help that economy operate more smoothly is announcing an investment to double down on growth.

Zencargo, which has built a digital platform to enable freight forwarding — the process by which companies organize and track the movements of items they are making and selling (and the components needed for those items) — has raised £30 million (about $42 million). Alex Hersham, the CEO who co-founded the company with Richard Fattal (CCO) and Jan Riethmayer, said that London-based Zencargo will be using the funding to open offices in the Netherlands, Hong Kong and the U.S.; to more than double its headcount to 350 from 150 today; and to begin to make moves into trade finance — a critical lever for facilitating the trading activities that are the bread and butter of Zencargo’s business.

The Series B is being led by Digital+ Partners, with HV Capital, which led its previous round, also participating. Zencargo is not disclosing its valuation, but the company — which provides services both to companies and distributors like Amazon to ship goods to its fulfillment centers, and brands like Vivienne Westwood, Swoon Furniture, and Soho Home — said that it is on track to make £100 million in revenues this year, and £200 million in 2022.

That is against the backdrop of some major world events that have both proven to be challenges as well as opportunities for the startup.

Brexit in the U.K. has created quite a mess for moving goods in and out of the country and into Europe (difficult but ultimately a net positive for Zencargo: it helps facilitate some aspects of that movement for its clients). COVID-19, meanwhile, has impacted economies (again: a difficult impact but also a positive, in that people are spending more money on goods for themselves and less on travel, leading to more demand for shipping those goods around the globe).

The Suez Canal blockage, on the other hand, also continues to loom (not great: Hersham said that Zencargo and others are still dealing with the fallout of those delays, although it’s highlighted the need for blended approaches when it comes to moving goods, with some items shipped slower by sea, and others faster by air or road). And there is the growing priority of how shipping impacts carbon footprints (an area of opportunity, interestingly: Zencargo can provide more efficient routing, and also services to consider how to carbon offset shipping activities).

The more general challenge that Zencargo is tackling goes hand in hand with our existence as consumers.

Many of us do not blink an eye when we go online or to a store to procure something, and we get whatever that happens to be right away.

But the simplicity of wanting and subsequently obtaining goods sits on top of a huge, and hugely complex, logistics operation. It might involve components, assembly or growing and processing things, shipping from one place to another, passing through multiple distribution and shipping hubs, customs, retailers and finally delivery to your store, or directly to you — a logistics chain that, taking all the world’s goods into account, has been estimated to be worth up to $12 trillion annually. Freight forwarding is the process by which all of that logistics works as it should, and in itself accounts for hundreds of billions of dollars in spend, and potentially more than $1 trillion in costs when things go awry.

Traditionally, a lot of freight forwarding work has been done offline, a messy process involving paper and faxing, prone to mistakes, over- and under-supply based on sales and typically hard to scrutinize because of the lack of centralized information. Companies like Zencargo — along with others in the same space like Flexport — have built digitized platforms to manage all of this, tracking items by SKU data, matching shipments with real-time insights into sales and demand, and balancing different kinds of freight options to provide the right items at the right time. (Zencargo works across sea, air and land freight, with sea accounting for about half of all of its traffic, Hersham said.)

Zencargo’s services arguably will continue to see demand growing in line with the growth of the logistics industry, but the curveballs of the last several years, and in the last 12 months in particular, that have impacted the shipping business lay out an interesting road ahead for the startup in the future.

“The freight industry has struggled to keep pace with innovation. Archaic processes are still in place across the board, resulting in widespread inefficiencies,” said Patrick Beitel, managing director and founding partner at Digital+ Partners, in a statement. “Zencargo’s cutting edge technologies, plus deep industry experience and knowledge, are transforming the supply chain, and that marries up perfectly with Digital + Partners’ mission to back companies with best-in-class technology and exceptional management teams. We are honoured to join them on the next stage of their journey.”

Powered by WPeMatico

While incumbent insurance providers continue to get disrupted by startups like Lemonade, Alan, Clearcover, Pie and many others applying tech to rethink how to build a business around helping people and companies mitigate against risks with some financial security, one issue that has not disappeared is fraud. Today, a startup out of France is announcing some funding for AI technology that it has built for all insurance providers, old and new, to help them detect and prevent it.

Shift Technology, which provides a set of AI-based SaaS tools to insurance companies to scan and automatically flag fraud scenarios across a range of use cases — they include claims fraud, claims automation, underwriting, subrogation detection and financial crime detection — has raised $220 million, money that it will be using both to expand in the property and casualty insurance market, the area where it is already strong, as well as to expand into health, and to double down on growing its business in the U.S. It also provides fraud detection for the travel insurance sector.

This Series D is being led by Advent International, via Advent Tech, with participation from Avenir and others. Accel, Bessemer Venture Partners, General Catalyst and Iris Capital — who were all part of Shift’s Series C led by Bessemer in 2019 — also participated. With this round, Paris-and-Boston-based Shift Technology has now raised some $320 million and has confirmed that it is now valued at over $1 billion.

The company currently has around 100 customers across 25 different countries — with the list including Generali France and Mitsui Sumitomo, to give you an idea of where it’s pitching its business — and says that it has already analyzed nearly two billion claims, data that’s feeding its machine learning algorithms to improve how they work.

The challenge (or I suppose, opportunity) that Shift is tackling, however, is much bigger. The Coalition Against Insurance Fraud, a nonprofit in the U.S., estimates that at least $80 billion of fraudulent claims are made annually in the U.S. alone, but the figure is likely significantly higher. One problem has, ironically, been the move to more virtualized processes, which open the door to malicious actors exploiting loopholes in claims filing and fudging information. Another is the fact that insurance has grown as a market, but so too has the amount of people who are in financial straights, leading to more desperate and illegal acts to gain an edge.

Shift is also not alone in tackling this issue: the market for insurance fraud detection technology globally was estimated to be worth $2.5 billion in 2019 and projected to be worth as much as $8 billion by 2024.

In addition to others in claims management tech such as Brightcore and Guidewire, many of the wave of insurtech startups are building in their own in-house AI-based fraud protection, and it’s very likely that we’ll see a rise of other fraud protection services, built out of adjacent areas like fintech to guard against financial crime, making their way to insurance. As many a fintech entrepreneur has said to me in the past, the mechanics of how the two verticals work and the compliance issues both face are very closely aligned.

“The entire Shift team has worked tirelessly to build this company and provide insurers with the technology solutions they need to empower employees to best be there for their policyholders. We are thrilled to partner with Advent International, given their considerable sector expertise and global reach and are taking another giant step forward with this latest investment,” stated Jeremy Jawish, CEO and co-founder, Shift Technology, in a statement. “We have only just scratched the surface of what is possible when AI-based decision automation and optimization is applied to the critical processes that drive the insurance policy lifecycle.”

For its backers, one key point with Shift is that it’s helping older providers bring on more tools and services that can help them improve their margins as well as better compete against the technology built by newer players.

“Since its founding in 2014, Shift has made a name for itself in the complex world of insurance,” said Thomas Weisman, an Advent director, in a statement. “Shift’s advanced suite of SaaS products is helping insurers to reshape manual and often time-consuming claims processes in a safer and more automated way. We are proud to be part of this exciting company’s next wave of growth.”

Powered by WPeMatico

EngineEars today announced a $1 million raise. The company’s first round of funding features investments from Kendrick Lamar, DJ Mustard, Roddy Rich and Slauson and Co. “Quality of sound is still important in music,” Lamar said in a quote provided to TechCrunch. “Ali has always been a progressive thinker. Engineers will transcend the culture.”

The service was launched in 2018 by Grammy winner Derek “MixedByAli” Ali, who has worked on a slew of high-profile tracks from artists including Lamar, Jay Rock, SZA, Nipsey Hussle and Snoop Dogg.

The educational courses turned into a touring curriculum, with 15 workshops in four countries, where Ali says he was able to determine what the community most needed.

“During that time, we really learned what the problem is,” says Ali. “All of the problems entailed tracking payments, being credited, the antiquated business model of file transfers and essentially just helping an independent audio engineer sustain and create a business for themselves.”

EngineEars has since branched out into something more akin to a marketplace for audio engineers. Independent mixers can offer their services and connect with artists and labels, get credit for the tracks they’ve worked on and — perhaps most importantly in the world of freelancing — get paid.

The platform launched an alpha version in January and since has 120 engineers verified by an existing vetting process. The invite-only service has another 2,000 people on its waiting list, according to Ali.

The service is currently working on a feature roadmap based on the requests of existing users and looking toward potential additions like the ability to buy beats, going forward. Other suggested features include contract negotiations for work-for-hire, but much of this is still very much in early stages.

Powered by WPeMatico

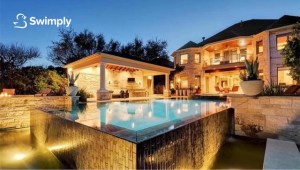

As the oldest of 12 children, Bunim Laskin spent much of his teen years looking for ways to help keep his siblings entertained. Noticing that a neighbor’s pool was often empty, Laskin reached out to ask if his family could use her pool. To make it worth her while, he suggested that they could help cover her expenses for maintaining the pool.

Soon after, five other families had made the same arrangement with her and the pool owner had six families covering 25% of her expenses. This meant that the neighbor was actually making money off her pool. The arrangement sparked a business idea in Laskin’s mind. At the age of 20, he founded Swimply, a marketplace for homeowners to rent out their underutilized pools to local swimmers, with Asher Weinberger.

The Cedarhurst, New York-based company launched a beta in 2018, starting with four pools in the New Jersey area.

“We used Google Earth to find houses, and then knocked on 80 doors with a pool,” CEO Laskin recalls. “We got to 100 pools organically. Word of mouth really helped us grow.” The site was pretty bare bones, he admits, with potential customers only able to view photos of the pools and connect with the pool owner by phone.

That year, Swimply did around 400 reservations and raised $1.2 million from friends and family.

In 2019, Swimply launched what he describes as a “proper” website and app with an automated platform. It grew “four to five times” that year, again mostly organically. In an episode that aired in March 2020, the company appeared on Shark Tank but went home without a deal.

Then the COVID-19 pandemic hit. Swimply, Laskin said, pivoted right into the pandemic.

“We were the perfect solution for people when the world was falling on its head,” he said. The company restructured its offering to ensure that pool owners did not have to interact with guests. “It was the perfect, contact-free, self-serve experience to hang out and be with people you quarantined with.”

The CDC then came out to say that it was safe to swim because chlorine could help kill the virus, and that proved to be a big boon to its business.

“On one end, it was a way for people to have a normal day and on the other, it helped give owners a way to earn an income, at a time when many people were being affected financially,” Laskin told TechCrunch.

Business took off in 2020 with revenue growing 4,000% and now Swimply is announcing a $10 million Series A round. Norwest Venture Partners led the financing, which also included participation from Trust Ventures and a number of angel investors such as Poshmark founder and CEO Manish Chandra; Rob Chesnut, former general counsel and chief ethics officer at Airbnb; Ancestry.com CEO Deborah Liu and Michael Curtis.

Swimply is now operating in a total of 125 U.S. markets, two markets in Canada and five markets in Australia. It plans to use its new capital in part to expand into new markets and toward product development.

Image Credits: Swimply

The way it works is pretty straightforward. Swimply simply connects homeowners that have underutilized backyard spaces and pools with those seeking a way to gather, cool off or exercise, for example. People or families can rent pools by the hour, ranging in price from $15 to $60 per hour (at an average of $45/hour) depending on the amenities. New markets that Swimply has recently expanded to include Portland, Oregon; Raleigh, North Carolina and the California cities of Oakland, San Luis Obispo and Los Gatos.

“The shifting mindset from younger generations about ownership is a huge contributor to increased growth of the Swimply marketplace,” said co-founder Weinberger, who serves as Swimply’s COO. “Swimming is the third most popular activity for adults and number one for children, and yet no other company has tackled the aquatic space to make swimming more affordable and accessible…until now.”

While the company declined to provide hard revenue figures, Laskin said Swimply was seeing “seven digits a month in revenue” and 15,000 to 20,000 reservations a month. Families represent the most popular reservation.

“People can book and pay through our platform, and only 20% of hosts ever meet their guests,” Laskin said. “We’re enabling a new kind of consumer behavior with what we’re doing.”

The company is planning to use its new capital to also rebuild much of its tech infrastructure and boost its customer support team to be more “readily available.”

It is also now offering a complimentary up to $1 million worth of insurance per booking for liability as well as $10,000 for property damage.

Swimply has a little over 20 employees, up 10 times from two people in December of 2020. It plans to double that number over the next few months.

The company’s model has proven quite lucrative for some owners, according to Laskin.

“Last year, there were some owners who earned $10,000 a month. One owner in Denver earned $50,000 last year and he had signed up toward the end of the summer. He should make over $100,000 this year,” Lasken projects.

Its only criteria is that owners offer a clean pool. Eighty-five percent of hosts offer restrooms as well. If they don’t, they are limited to one-hour reservations with a max of five guests. Swimply has also partnered with local pool companies, and if they pay one of its owners a visit and certify that pool, that owner gets a badge on the site “so guests get an additional level of security,” Laskin said.

Ed Yip of Norwest Venture Partners admits that when he first heard of the concept of Swimply, he “didn’t know what to make of it.”

But the more he heard about it, the more excited he got.

“This is the Holy Grail for a consumer investor. We’re not changing consumer behavior, but rather [we] productize the experience and make it safer and easier on both sides,” Yip told TechCrunch.

What also gets the investor excited is the potential for Swimply beyond just swimming pools in the future.

“We’re seeing a ton of demand from hosts wanting to list hot tubs and tennis courts, for example,” Yip said. “So this can turn into a marketplace for shared outdoor resources and that’s a huge market opportunity that adds value on both sides.”

Indeed, the concept of monetizing underutilized space is a growing concept. Earlier this year, we reported on Neighbor, which operates a self-storage marketplace, raising $53 million in a Series B round of funding. Neighbor’s unique model aims to repurpose under-utilized or vacant space — whether it be a person’s basement or the empty floor of an office building — and turn it into storage.

Powered by WPeMatico

Timescale, makers of the open-source TimescaleDB time series database, announced a $40 million Series B financing round today. The investment comes just over two years after it got a $15 million Series A.

Redpoint Ventures led today’s round, with help from existing investors Benchmark, New Enterprise Associates, Icon Ventures and Two Sigma Ventures. The company reports it has now raised approximately $70 million.

TimescaleDB lets users measure data across a time dimension, so anything that would change over time. “What we found is we need a purpose-built database for it to handle scalability, reliability and performance, and we like to think of ourselves as the category-defining relational database for time series,” CEO and co-founder Ajay Kulkarni explained.

He says that the choice to build their database on top of Postgres when it launched four years ago was a key decision. “There are a few different databases that are designed for time series, but we’re the only one where developers get the purpose-built time series database plus a complete Postgres database all in one,” he said.

While the company has an open-source version, last year it decided rather than selling an enterprise version (as it had been), it was going to include all of that functionality in the free version of the product and place a bet entirely on the cloud for revenue.

“We decided that we’re going to make a bold bet on the cloud. We think cloud is where the future of database adoption is, and so in the last year […] we made all of our enterprise features free. If you want to test it yourself, you get the whole thing, but if you want a managed service, then we’re available to run it for you,” he said.

The community approach is working to attract users, with over 2 million monthly active databases, some of which the company is betting will convert to the cloud service over time. Timescale is based in New York City, but it’s a truly remote organization, with 60 employees spread across 20 countries and every continent except Antarctica.

He says that as a global company, it creates new dimensions of diversity and different ways of thinking about it. “I think one thing that is actually kind of an interesting challenge for us is what does D&I mean in a totally global org. A lot of people focus on diversity and inclusion within the U.S., but we think we’re doing better than most tech companies in terms of racial diversity, gender diversity,” he said.

And being remote-first isn’t going to change even when we get past the pandemic. “I think it may not work for every business, but I think being remote first has been a really good thing for us,” he said.

Powered by WPeMatico

With cybercrime on course to be a $6 trillion problem this year, organizations are throwing ever more resources at the issue to avoid being a target. Now, a startup that’s built a platform to help them stress-test the investments that they have made into their security IT is announcing some funding on the back of strong demand from the market for its tools.

Cymulate, which lets organizations and their partners run machine-based attack simulations on their networks to determine vulnerabilities and then automatically receive guidance around how to fix what is not working well enough, has picked up $45 million, funding that the startup — co-headquartered in Israel and New York — will be using to continue investing in its platform and to ramp up its operations after doubling its revenues last year on the back of a customer list that now numbers 300 large enterprises and mid-market companies, including the Euronext stock exchange network as well as service providers such as NTT and Telit.

London-based One Peak Partners is leading this Series C, with previous investors Susquehanna Growth Equity (SGE), Vertex Ventures Israel, Vertex Growth and Dell Technologies Capital also participating.

According to Eyal Wachsman, the CEO and co-founder, Cymulate’s technology has been built not just to improve an organization’s security, but an automated, machine learning-based system to better understand how to get the most out of the security investments that have already been made.

“Our vision is to be the largest cybersecurity ‘consulting firm’ without consultants,” he joked.

The valuation is not being disclosed, but as some measure of what is going on, David Klein, managing partner at One Peak, said in an interview that he expects Cymulate to hit a $1 billion valuation within two years at the rate it’s growing and bringing in revenue right now. The startup has now raised $71 million, so it’s likely the valuation is in the mid-hundreds of millions. (We’ll continue trying to get a better number to have a more specific data point here.)

Cymulate — pronounced “sigh-mulate”, like the “cy” in “cyber” and a pun of “simulate”) is cloud-based but works across both cloud and on-premises environments and the idea is that it complements work done by (human) security teams both inside and outside of an organization, as well as the security IT investments (in terms of software or hardware) that they have already made.

“We do not replace — we bring back the power of the expert by validating security controls and checking whether everything is working correctly to optimize a company’s security posture,” Wachsman said. “Most of the time, we find our customers are using only 20% of the capabilities that they have. The main idea is that we have become a standard.”

The company’s tools are based in part on the MITRE ATT&CK framework, a knowledge base of threats, tactics and techniques used by a number of other cybersecurity services, including a number of others building continuous validation services that compete with Cymulate. These include the likes of FireEye, Palo Alto Networks, Randori, Khosla-backed AttackIQ and many more.

Although Cymulate is optimized to help customers better use the security tools they already have, it is not meant to replace other security apps, Wachsman noted, even if the by-product might become buying fewer of those apps in the future.

“I believe my message every day when talking with security experts is to stop buying more security products,” he said in an interview. “They won’t help defend you from the next attack. You can use what you’ve already purchased as long as you configure it well.”

In his words, Cymulate acts as a “black box” on the network, where it integrates with security and other software (it can also work without integrating, but integrations allow for a deeper analysis). After running its simulations, it produces a map of the network and its threat profile, an executive summary of the situation that can be presented to management and a more technical rundown, which includes recommendations for mitigations and remediations.

Alongside validating and optimising existing security apps and identifying vulnerabilities in the network, Cymulate also has built special tools to fit different kinds of use cases that are particularly relevant to how businesses operate today. They include evaluating remote working deployments, the state of a network following an M&A process, the security landscape of an organization that links up with third parties in supply chain arrangements, how well an organization’s security architecture is meeting (or potentially conflicting) with privacy and other kinds of regulatory compliance requirements, and it has built a “purple team” deployment, where in cases where security teams do not have the resources for running separate “red teams” to stress test something, blue teams at the organization can use Cymulate to build a machine learning-based “team” to do this.

The fact that Cymulate has built the infrastructure to run all of these processes speaks to a lot of potential of what more it could build, especially as our threat landscape and how we do business both continue to evolve. Even as it is, though, the opportunity today is a massive one, with Gartner estimating that some $170 billion will be spent on information security by enterprises in 2022. That’s one reason why investors are here, too.

“The increasing pace of global cyber security attacks has resulted in a crisis of trust in the security posture of enterprises and a realization that security testing needs to be continuous as opposed to periodic, particularly in the context of an ever-changing IT infrastructure and rapidly evolving threats. Companies understand that implementing security solutions is not enough to guarantee protection against cyber threats and need to regain control,” said Klein, in a statement. “We expect Cymulate to grow very fast,” he told me more directly.

Powered by WPeMatico

An issue every developer faces is dealing with problems on a live application without messing it up. In fact, in many companies such access is restricted. Cased, an early stage startup, has come up with a solution to provide a way to work safely with the live application.

Today, the company announced a $2.25 million seed round led by Founders Fund along with a group of prestigious technology angel investors. The company also announced that the product is generally available to all developers today for the first time. It’s worth noting that the funding actually closed last April, and they are just announcing it today.

Bryan Byrne, CEO and co-founder at Cased says he and his fellow co-founders, all of whom cut their teeth at GitHub, experienced this problem of working in live production environments firsthand. He says that the typical response by larger companies is to build a tool in-house, but this isn’t an option for many smaller companies.

“We saw firsthand at GitHub how the developer experience gets more difficult over time, and it becomes more difficult for developers to get production work done. So we wanted to provide a developer friendly way to get production work done,” Byrne explained.

He said without proper tooling, it forces CTOs to restrict access to the production code, which in turn makes it difficult to fix problems as they arise in production environments. “Companies are forced to restrict access to production and restrict access to tools that developers need to work in production. A lot of the biggest tech companies invest in millions to deliver great developer experiences, but obviously smaller companies don’t have those resources. So we want to give all companies the building blocks they need to deliver a great developer experience out of the box,” he said.

This involves providing development teams with open access to production command line tools by adding logging and approval workflows to sensitive operations. That enables executives to open up access with specific rules and the ability to audit who has been accessing the production environment.

The company launched at the beginning of last year and the founders have been working with design partners and early customers prior to officially opening the site to the general public today.

They currently have five people including the four founders, but Byrne says that they have had a good initial reaction to the product and are in the process of hiring additional employees. He says that as they do, diversity and inclusion is a big priority for the founders, even as a very early stage company.

“It’s very prominent in our company handbook, so that we make sure we prioritize an inclusive culture from the very beginning because [ … ] we know firsthand that if you don’t invest in that early, it can really hold you back as a company and as a culture. Culture starts from day one, for sure,” he said.

As part of that, the company intends to be remote first even post-pandemic, a move he believes will make it easier to build a diverse company.

“We will definitely be remote first. We believe that also helps with diversity and inclusion as you allow people to work from anywhere, and we have a lot of experience in leading remote-first culture from our time at GitHub, so we began as a remote culture and we will continue to do that,” he said.

Powered by WPeMatico