funding

Auto Added by WPeMatico

Auto Added by WPeMatico

GPS is one of those science fiction technologies whose use is effortless for the end user and endlessly challenging for the engineers who design it. It’s now at the heart of modern life: everything from Amazon package deliveries to our cars and trucks to our walks through national parks are centered around a pin on a map that monitors us down to a few meters.

Yet, GPS technology is decades old, and it’s going through a much-needed modernization. The U.S., Europe, China, Japan and others have been installing a new generation of GNSS satellites (GNSS is the generic name for GPS, which is the specific name for the U.S. system) that will offer stronger signals in what is known as the L5 band (1176 MHz). That means more accurate map pinpoints compared to the original generation L1 band satellites, particularly in areas where line-of-sight can be obscured, like urban areas. L5 was “designed to meet demanding requirements for safety-of-life transportation and other high-performance applications,” as the U.S. government describes it.

It’s one thing to put satellites into orbit (that’s the easy part!), and another to build power-efficient chips that can scan for these signals and triangulate a coordinate (that’s the hard part!). So far, chipmakers have focused on creating hybrid chips that pull from the L1 and L5 bands simultaneously. For example, Broadcom recently announced the second-generation of its hybrid chip.

OneNav has a totally different opinion on product design, and it placed it right in its name. Eschewing the hybrid chip model of mixing old signals with new, it wants one chip monitoring the singular band of L5 signals to drive cost and power savings for devices. One nav to rule them all, as it were.

The company announced today that it has closed a $21 million Series B round led by Karim Faris at GV, which is solely funded by Alphabet. Other investors included Matthew Howard at Norwest and GSR Ventures, which invested in earlier rounds of the company. All together, OneNav has raised $33 million in capital and was founded about two years ago.

CEO and co-founder Steve Poizner has been in the location business a long time. His previous company, SnapTrack, built out a GPS positioning technology for mobile devices that sold to Qualcomm for $1 billion in stock in March 2000, at the height of the dot-com bubble. His co-founder and CTO at OneNav, Paul McBurney, has similarly spent decades in the GNSS space, most recently at Apple, according to his LinkedIn profile.

OneNav CEO and co-founder Steve Poizner, seen here in 2009. Image Credits: David McNew via Getty Images

They saw an opportunity to build a new navigation company as L5 band satellites have switched on in recent years. As they looked at the market and the L5 tech, they decided they wanted to go further than other companies by eliminating the legacy tech of older GPS technology and moving entirely into the future. By doing that, its design is “half the size of the old system, but much higher reliability and performance,” Poizner said. “We are aiming to get location technology into a much broader number of products.”

He differentiated between upgrading GPS from upgrading wireless signals. “With these L5 satellites, we don’t need the L1 satellites anymore [but] with 5G, you still need 4G,” he said. L5 band GPS does everything that earlier renditions did, but better, whereas with wireless technologies, they often need to complement each other to offer peak performance.

There’s one caveat here: The L5 signal is still considered “pre-operational” by the U.S. government, since the U.S. GPS system only has 16 satellites broadcasting the signal today, and is targeting 24 satellites for full deployment by later in this decade. However, other countries have also deployed L5 GNSS satellites, which means that while it may not be fully operational from the U.S. government’s perspective, it may well be good enough for consumers.

OneNav’s goal according to Poizner is to be “the Arm of the GNSS space.” What he means is that like Arm, which produces the chip designs for nearly all mobile phones globally, OneNav creates comprehensive designs for L5 band GPS chips that can be integrated as a system-on-chip into the products of other manufacturers so that they can “embed a high-performance location engine based on their silicon.”

The company today also announced that its first design customer will be In-Q-Tel, the U.S. intelligence community’s venture capital and business development organization. Poizner said that through In-Q-Tel, “we now have a development contract with a U.S. government agency.” The company is expecting that its customer evaluation units will be completed by the end of this year with the objective of potentially having OneNav’s technology in end-user devices by late 2022.

Location tracking has become a major area of investment for venture capitalists, with companies working on a variety of technologies outside of GPS to offer additional detail and functionality where GPS falls short. Poizner sees these technologies as ultimately complementary to what he and his team are building at OneNav. “The better the GPS, the less pressure on these augmentation systems,” he said, while acknowledging that, “it is the case though that in certain environments [like downtown Manhattan or underground in a subway], you will never get the GPS to work.”

For Poizner, it’s a bit of a return to entrepreneurship. Prior to starting OneNav, he had been heavily involved in California state politics. Several years after the sale of SnapTrack to Qualcomm, he unsuccessfully ran for a seat in the California State Assembly. He later was elected California’s insurance commissioner in 2007 under former Governor Arnold Schwarzenegger. He ran for governor in 2010, losing in the Republican primary against Meg Whitman, who made her name as the longtime head of eBay. He ran for his former seat of California insurance commissioner in 2018, this time as a political independent, but lost.

OneNav is based in Palo Alto and currently has more than 30 employees.

Powered by WPeMatico

Part of learning to be an engineer is understanding the tools you’ll have to work with — voltmeters, spectrum analyzers, things like that. But why use two, or eight for that matter, where one will do? The Moku:Go combines several commonly used tools into one compact package, saving room on your workbench or classroom while also providing a modern, software-configurable interface. Creator Liquid Instruments has just raised $13.7 million to bring this gadget to students and engineers everywhere.

The idea behind Moku:Go is largely the same as the company’s previous product, the Moku:Lab. Using a standard input port, a set of FPGA-based tools perform the same kind of breakdowns and analyses of electrical signals as you would get in a larger or analog device. But being digital saves a lot of space that would normally go toward bulky analog components.

The Go takes this miniaturization further than the Lab, doing many of the same tasks at half the weight and with a few useful extra features. It’s intended for use in education or smaller engineering shops where space is at a premium. Combining eight tools into one is a major coup when your bench is also your desk and your file cabinet.

Those eight tools, by the way, are: waveform generator, arbitrary waveform generator, frequency response analyzer, logic analyzer/pattern generator, oscilloscope/voltmeter, PID controller, spectrum analyzer and data logger. It’s hard to say whether that really adds up to more or less than eight, but it’s definitely a lot to have in a package the size of a hardback book.

You access and configure them using a software interface rather than a bunch of knobs and dials — though let’s be clear, there are good arguments for both. When you’re teaching a bunch of young digital natives, however, a clean point-and-click interface is probably a plus. The UI is actually very attractive; you can see several examples by clicking the instruments on this page, but here’s an example of the waveform generator:

Love those pastels.

The Moku:Go currently works with Macs and Windows but doesn’t have a mobile app yet. It integrates with Python, MATLAB and LabVIEW. Data goes over Wi-Fi.

Compared with the Moku:Lab, it has a few perks. A USB-C port instead of a mini, a magnetic power port, a 16-channel digital I/O, optional power supply of up to four channels and of course it’s half the size and weight. It compromises on a few things — no SD card slot and less bandwidth for its outputs, but if you need the range and precision of the more expensive tool, you probably need a lot of other stuff too.

Since the smaller option also costs $500 to start (“a price comparable to a textbook”… yikes) compared with the big one’s $3,500, there’s major savings involved. And it’s definitely cheaper than buying all those instruments individually.

The Moku:Go is “targeted squarely at university education,” said Liquid Instruments VP of marketing Doug Phillips. “Professors are able to employ the device in the classroom and individuals, such as students and electronic engineering hobbyists, can experiment with it on their own time. Since its launch in March, the most common customer profile has been students purchasing the device at the direction of their university.”

About a hundred professors have signed on to use the device as part of their fall classes, and the company is working with other partners in universities around the world. “There is a real demand for portable, flexible systems that can handle the breadth of four years of curriculum,” Phillips said.

Production starts in June (samples are out to testers), the rigors and costs of which likely prompted the recent round of funding. The $13.7 million comes from existing investors Anzu Partners and ANU Connect Ventures, and new investors F1 Solutions and Moelis Australia’s Growth Capital Fund. It’s a convertible note “in advance of an anticipated Series B round in 2022,” Phillips said. It’s a larger amount than they intended to raise at first, and the note nature of the round is also not standard, but given the difficulties faced by hardware companies over the last year, some irregularities are probably to be expected.

No doubt the expected B round will depend considerably on the success of the Moku:Go’s launch and adoption. But this promising product looks as if it might be a commonplace item in thousands of classrooms a couple years from now.

Powered by WPeMatico

The TC Disrupt 2021 super early-bird deal took our best deal in its beak and flew the coop. But you can still buy a Startup Alley Pass and exhibit in our virtual expo area at a great price. Take advantage of our early-bird deal, cross an item off your to-do list and keep $50 in your wallet.

Pro Tip: The early-bird deadline is August 6 at 11:59 p.m. (PT), and if that feels like a long way off, don’t be fooled. It’ll be here before you know it, and Startup Alley Passes are selling faster than ever. Get yours for just $249 while you can.

In addition to your virtual exhibit space and the abundance of networking that goes on in the Alley, we have additional opportunities for exhibitors. For starters, each exhibiting startup gets to participate in a breakout pitch-feedback session.

You’ll have two minutes to pitch live to TechCrunch staff and thousands of Disrupt attendees around the world. And you’ll receive plenty of great feedback to improve your pitch deck.

“I walked away with a bunch of notes to reorganize my pitch deck. It’s a lot of work, but it’s very rewarding because now I have a clear path. Disrupt was like an authoritative instruction manual for how to finish my pitch deck.” — Michael McCarthy, CEO, Repositax.

Note: The TechCrunch Editorial team will choose two outstanding exhibiting startups to be Startup Battlefield Wild Cards. Those founders will get to compete for the $100,000 (equity-free) cash and massive exposure in the Startup Battlefield. It. Could. Be. You.

Team TechCrunch will also host a series of Startup Alley Crawls — one hour for each business category. Editors will go live on the Disrupt stage and interview various founders exhibiting in Startup Alley. It’s great global exposure.

Here’s another big reason to get your exhibitor pass sooner rather than later. It’s a new opportunity called Startup Alley+ and you must purchase a Startup Alley Pass before Friday, June 4 at 11:59 p.m. (PT) to be eligible for this VIP Disrupt experience. TechCrunch will choose up to 50 startups to participate. Read about all the perks and benefits here. Get your pass before the deadline, because the Startup Alley+ experience kicks off in July at Early Stage 2021 — Marketing and Fundraising.

So many great reasons to exhibit in Startup Alley at TC Disrupt 2021, but the clock is ticking on early-bird savings. Take one simple task off your overloaded to-do list, buy your Startup Alley Pass now — while it’s on your mind — and save yourself $50 bucks.

Is your company interested in sponsoring or exhibiting at Disrupt 2021? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

The podcasting world remains one of the most vibrant formats in media (and I am not just saying that since the Equity crew won a Webby yesterday for our not-that-humble podcast). Its openness, diversity, freedom and ease-of-authoring has broadened the medium to all sorts of hosts on every subject imaginable.

We experience that dynamism and verve in our own audio listening, but then we start to tune into our company’s internal communications, and, well, you certainly don’t need sleeping pills to zone out. Top-down, formal, banal — corporate comms remains mired in a 1950s way of speaking that is completely out-of-sync with the millennials and Gen Z majority of workers who expect something actually worth watching and listening to.

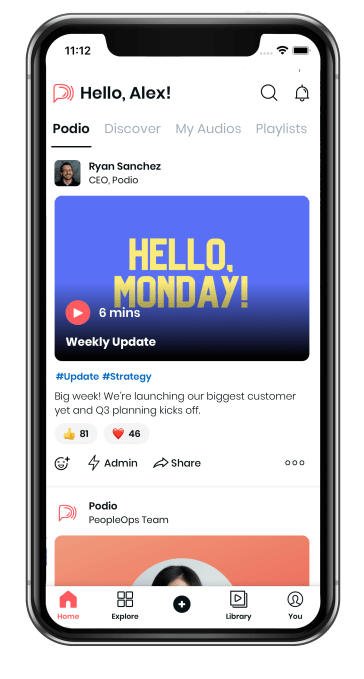

Spokn wants to make company-wide podcasting a must-listen event, not just for leaders to talk to their employees, but for every worker to have a voice and share their expertise and stories across their workplaces. Through its app, companies can deliver personalized podcast feeds on everything from a daily standup or weekly AMA to training and development content, all of which is secure and kept for internal use.

It’s an idea that has quickly attracted investor attention. The startup, which was part of Y Combinator’s most recent Winter 2021 batch, closed on a $4 million seed round two weeks before Demo Day led by Ann Bordetsky, a partner at NEA who joined earlier this year and previously served as COO of Rival. This is her first investment with the firm.

The company was founded by Fawzy Abu Seif, Mariel Davis and Mohammad Galal Eldeen. Abu Seif and Davis met each other in an Egyptian jazz club in November 2017, about a week after he had quit his job. They eventually came together not just as a couple — they got married in the fall of 2019 — but as business partners, linking up with Galal Eldeen and incorporating Spokn in April 2018.

Spokn’s Mohammad Galal Eldeen, Mariel Davis and Fawzy Abu Seif. Image Credits: Spokn

Spokn’s product evolved across three iterations. First, the team tried to create audio narrations of evergreen content at major publishers like The New York Times. The idea was to help publishers reuse their best content as a new revenue source while connecting more listeners into these brands. Getting publishers to commit was tough though. “The consumer app wasn’t doing that great, and we started hunting around the data to see if something was working,” Davis said.

What they found was that professional development podcasts were much more popular compared to other topics, and so they had an opportunity to re-jigger the product to focus on training and specifically target enterprises. The idea was “let’s empower companies with the same tools we had as a consumer company,” Abu Seif said.

Prior to Spokn, Davis had worked with an entrepreneur in the Middle East building out a social enterprise network focused on skills training, a role in which she handled internal communications. She saw just how little impact media like email made for employees, particularly in the distributed workforce she was attempting to engage. The new direction for Spokn was far more enticing.

The newly married couple moved to New York City from Egypt and signed an apartment lease in early March 2020 — just as the COVID-19 pandemic spread widely in the region. We “multiplied the living expenses by 8-10x while doing the same Zoom calls we could make from there,” Abu Seif joked.

Eventually, the company realized that it could do much more than just training, and expanded into broader internal comms. “Async audio is a lot more personal than email,” Abu Seif said. This latest product iteration launched in November 2020, and included push notifications, an app for streaming, personalization features and analytics to allow companies to track what was working and what was not for employees.

Spokn’s app offers a personalized feed of company podcasts. Image Credits: Spokn

Perhaps most importantly, companies can tailor the access lists for individual podcasts to particular groups of people, such as senior execs, people managers, sales employees or any other logical grouping. We “get a lot of inbound from companies that are trying to duct-tape solutions together,” Davis said. For Abu Seif, “all the tools that marketers have to engage consumers, we are empowering companies to engage with their employees.”

Despite the startup and product’s youth, it has attracted a quick following among companies, with customers including Podium, ShipBob, Cedar, Mixpanel, ServiceNow and Superhuman. Podium’s CEO, for example, records weekly podcasts that are shipping on Spokn, and apparently even installed a podcast studio near his office just to make it easier to produce his shows.

Podcasting inside companies fixes a lot of problems with traditional internal comms. First and foremost, it can create a deeper connection where email cannot. Audio can feel more personal than even video, and also can be played in the background. It’s also asynchronous, unlike live video, allowing employees in different time zones to connect with key stories at an appropriate time.

Plus, employees can avoid all the fatigue that comes from being onscreen. “No one wants Zoom zombies,” Bordetsky of NEA said. “We need intuitive and asynchronous communication tools like Spokn to build connection and community in the workplace.” Her thesis for the investment is that “flexible, distributed work is here to stay and employee communication is at the heart of building a modern, virtual-first employee experience.”

Buyers of Spokn range from heads of people to sales teams, and the company is also focused on recruiting and retention as well. “Companies are pretty freaked out about retaining their great talent,” Davis said. Some companies are now sharing “stories with prospects even before their first day at the company.”

While the product is mostly used by leaders today, Spokn wants to expand that remit to employees talking with their peer colleagues, helping to build community in hybrid offices where it is harder than ever to make a connection with others.

Of course, companies can screw up podcasting just as much as they have screwed up every other medium to communicate like humans, and Davis says it’s become her full-time job to help them think through storytelling and how to connect better with their own employees. We “work to find the right storytellers in the company,” she said.

Outside NEA, other investors in the seed round included Reach Capital, Funders Club, Liquid2, Share Capital, SOMA Capital, Scribble VC and Hack VC.

Powered by WPeMatico

Britive, an early-stage startup that is trying to bring privileged access control to a multi-cloud world, announced a $10 million Series A this morning. Crosslink Capital led the investment, with participation from previous investors Upfront Ventures and One Way Ventures.

The company helps automate permissioning across multiple cloud vendors and software services, whether that involves a human or a machine seeking permission. In a world of increasing automation, it’s often a machine seeking access, and that makes permissioning all the more critical, says Britive co-founder and CEO Art Poghosyan.

“What we offer is an automated approach to access, [moving from] what we call statically granted access, which constantly gets added all the time […] to completely ‘just in time access’,” he said. That means that after you define a policy, it sets the ground rules for access, and grants it based on that policy for the time required, and nothing more, whether you’re a human or a machine.

In today’s complex development, world that could take many forms, including API keys and secrets. “Yes, sometimes those things are granted to a human actor like a DevOps engineer, but a lot of times it also needs to be granted — quote, unquote — to a Terraform script or to GitHub to go and build out application infrastructure or deploy an application,” he said.

The company currently has 40 employees, a number that Poghosyan expects to double in the next 12 months as he puts this capital to work. As a first-generation Armenian immigrant, Poghosyan says that he takes diversity and inclusion extremely seriously as he hires more employees.

“We’ve always been committed — in this business and our previous startup — to providing equal opportunities to talented people, no matter what background they come from. I’m really proud that even as a small company — we’re 40 at the moment — we have more than 50% of our workforce which comes from ethnic minority groups,” he said.

Britive, which is based in Los Angeles, launched in 2018 and brought its first product to market in 2019. The company raised a $5.4 million seed round last July, which it announced in September, making the total raised so far approximately $15.4 million.

Powered by WPeMatico

Project management has long been a people-led aspect of the workplace, but that has slowly been changing. Trends in automation, big data and AI have not only ushered in a new wave of project management applications, but they have led to a stronger culture of people willing to use them. Today, one of the startups building a platform for the next generation of project management is announcing some funding — a sign of the traction it’s getting in the market.

Forecast, a platform and startup of the same name that uses AI to help with project management and resource planning — put simply, it uses artificial intelligence to both “read” and integrate data from different enterprise applications in order to build a bigger picture of the project and potential outcomes — has raised $19 million to continue building out its business.

The company plans to use some of the funding to expand to the U.S., and some to continue building out its platform and business, headquartered in London with a development office also in Copenhagen.

This funding, a Series A, comes less than a year after the startup’s commercial launch, and it was led by Balderton Capital, with previous investors Crane Ventures Partners, SEED Capital and Heartcore also participating.

Forecast closed a seed round in November 2019 and then launched just as the pandemic was kicking off. It was a time when some projects were indeed put on ice, but others that went ahead did so with more caution on all sorts of fronts — financial, organizational and technical. It turned out to be a “right place, right time” moment for Forecast, a tool that plays directly into providing a technical platform to manage all of that in a better way, and it tripled revenues during the year. Its customers include the likes of the NHS, the Red Cross, Etain and more. It says over 150,000 projects have been created and run through its platform to date.

Project management — the process of planning what you need to do, assigning resources to the task and tracking how well all of that actually goes to plan — has long been stuck between a rock and a hard place in the world of work.

It can be essential to getting things done, especially when there are multiple departments or stakeholders involved; yet it’s forever an inexact science that often does not reflect all the complexities of an actual project, and therefore may not be as useful as it could or should be.

This was a predicament that founder and CEO Dennis Kayser knew all too well, having been an engineer and technical lead on a number of big projects himself. His pedigree is an interesting one: One of his early jobs was as a developer at Varien, where he built the first version of Magento. (The company was eventually rebranded as Magento and then acquired by eBay, then spun out, then acquired again, this time by Adobe for nearly $1.7 billion, and is now a huge player in the world of e-commerce tools.) He also spent years as a consultant at IBM, where among other things he helped build and formulate the first versions of ikea.com.

In those and other projects, he saw the pitfalls of project management not done right — not just in terms of having the right people on a project at the right time, but the resource planning needed, better calculations of financial outcomes in the event of a decision going one way or the other, and so on.

He didn’t say this outright, but I’m sure one of the points of contention was the fact that the first ikea.com site didn’t actually have any e-commerce in it, just a virtual window display of sorts. That was because Ikea wanted to keep people shopping in its stores, away from the efficiency of just buying the one thing you actually need and not the 10 you do not. Yes, there are plenty of ways now of recirculating people to buy more when you select one item for a shopping cart — something the likes of Amazon has totally mastered — but this was years ago when there was still even more opportunities for innovation than there are now. All of this is to say that you might very reasonably argue that had there been better project managing and resource planning tools to give forecasts of potential outcomes of one or another route taken, people advocating for a different approach could have made their case better. And maybe Ikea would have jumped on board with digital commerce far sooner than it did.

“Typically you get a lot of spreadsheets, people scattered across different tools that include accounting, CRM, Gitlab and more,” Kayser said.

That became the impetus for trying to build something that can take all of that into account and make a project management tool that — rather than just being a way of accounting to a higher-up, or reflecting only what someone can be bothered to update in the system — something that can help a team.

“Connecting everything into our engine, we leverage data to understand what they are working on and what is the right thing to be working on, what the finances are looking like,” he continued. “So if you work in product, you can plan out who is where, and what resourcing you need, what kind of people and skills you require.” This is a more dynamic progression of some of the other newer tools that are being used for project management today, targeting, in his words, “people who graduate from Monday and Asana who need something more robust, either because they have too many people working on a project or because it’s too complicated, there is just too much stuff to handle.”

More legacy tools he said that are used include Oracle “to some degree” and Mavenlink, which he describes as possibly Forecast’s closest competitor, “but its platform is aging.”

Currently the Forecast platform has some 26 integrations of popular tools used for projects to produce its insights and intelligence, including Salesforce, Gitlab, Google Calendar, and, as it happens, Asana. But given how fragmented the market is, and the signals one might gain from any number of other resources and apps, I suspect that this list will grow as and when its customers need more supported, or Forecast works out what can be gleaned from different places to paint an even more accurate picture.

The result may not ever replace an actual human project manager, but certainly starts to then look like a “digital twin” (a phrase I have been hearing more and more these days) that will definitely help that person, and the rest of the team, work in a smarter way.

“We are really excited to be an early investor in Forecast,” said James Wise, a partner at Balderton Capital, in a statement. “We share their belief that the next generation of SaaS products will be more than just collaboration tools, but use machine learning to actively solve problems for their users. The feedback we got from Forecast’s customers was quite incredible, both in their praise for the platform and in how much of a difference it had already made to their operations. We look forward to supporting the company to scale this impact going forward.”

Powered by WPeMatico

Electric aviation startup Beta Technologies closed a $368 million Series A funding round on Tuesday, with investments from Amazon’s Climate Pledge Fund. The new capital is the second round of funding announced by the company this year, after the company raised $143 million in private capital in March.

The funding round was led by Fidelity Management & Research Company, with undisclosed additions from Amazon’s Climate Pledge Fund, a $2 billion fund established in September 2019 to advance the development of sustainable technologies. The Climate Pledge fund has also made contributions toward electric vehicle manufacturer Rivian, battery recycler Redwood Materials and ZeroAvia, a hydrogen fuel cell aviation company.

The company’s valuation is now at $1.4 billion, CNBC reported, putting it in a small circle of electric vertical take-off and landing (eVTOL) companies to have achieved valuations at over a billion dollars.

Unlike developers Joby Aviation and Archer Aviation, which have each also achieved valuations over the billion-dollar mark, Beta is not primarily focused on air taxis. Instead, it’s been targeting defense applications, cargo delivery and medical logistics, as well as building out its network of rapid-charging systems in the northeast U.S. Its debut aircraft, the ALIA-250c, was built to serve these various solutions by being capable of carrying six people or a pilot and 1,500 pounds.

The Vermont-based startup has already scored major partnerships in all of these industries, including with United Therapeutics to transport synthetic organs for human transplant; UPS, which purchased 10 ALIA aircraft with the option of buying 140 more; and the U.S. Air Force.

The company has not entirely ignored passenger transportation, however, announcing last month a partnership with Blade Urban Air Mobility for five aircraft to be delivered in 2024.

Beta was the first company to be awarded airworthiness approval from the U.S. Air Force. The company expects to sign a contract in June with the Air Force to allow access to Beta’s aircraft and flight simulators in Washington, D.C. and Springfield, Ohio. However, it still must achieve certification with the Federal Aviation Administration.

The funds will be used to refine the ALIA’s electric propulsion system and controls, as well as to build out manufacturing space, including expanding its footprint in Vermont on land at the Burlington International Airport, the company said in a news release Tuesday.

Powered by WPeMatico

Like “innovation,” machine learning and artificial intelligence are commonplace terms that provide very little context for what they actually signify. AI/ML spans dozens of different fields of research, covering all kinds of different problems and alternative and often incompatible ways to solve them.

One robust area of research here that has antecedents going back to the mid-20th century is what is known as stochastic optimization — decision-making under uncertainty where an entity wants to optimize for a particular objective. A classic problem is how to optimize an airline’s schedule to maximize profit. Airlines need to commit to schedules months in advance without knowing what the weather will be like or what the specific demand for a route will be (or, whether a pandemic will wipe out travel demand entirely). It’s a vibrant field, and these days, basically runs most of modern life.

Warren B. Powell has been exploring this problem for decades as a researcher at Princeton, where he has operated the Castle Lab. He has researched how to bring disparate areas of stochastic optimization together under one framework that he has dubbed “sequential decision analytics” to optimize problems where each decision in a series places constraints on future decisions. Such problems are common in areas like logistics, scheduling and other key areas of business.

The Castle Lab has long had industry partners, and it has raised tens of millions of dollars in grants from industry over its history. But after decades of research, Powell teamed up with his son, Daniel Powell, to spin out his collective body of research and productize it into a startup called Optimal Dynamics. Father Powell has now retired full-time from Princeton to become chief analytics officer, while son Powell became CEO.

The company raised $18.4 million in new funding last week from Bessemer led by Mike Droesch, who recently was promoted to partner earlier this year with the firm’s newest $3.3 billion fundraise. The company now has 25 employees and is centered in New York City.

So what does Optimal Dynamics actually do? CEO Powell said that it’s been a long road since the company’s founding in mid-2017 when it first raised a $450,000 pre-seed round. We were “drunkenly walking in finding product-market fit,” Powell said. This is “not an easy technology to get right.”

What the company ultimately zoomed in on was the trucking industry, which has precisely the kind of sequential decision-making that father Powell had been working on his entire career. “Within truckload, you have a whole series of uncertain variables,” CEO Powell described. “We are the first company that can learn and plan for an uncertain future.”

There’s been a lot of investment in logistics and trucking from VCs in recent years as more and more investors see the potential to completely disrupt the massive and fragmented market. Yet, rather than building a whole new trucking marketplace or approaching it as a vertically integrated solution, Optimal Dynamics decided to go with the much simpler enterprise SaaS route to offer better optimization to existing companies.

One early customer, which owned 120 power units, saved $4 million using the company’s software, according to Powell. That was a result of better utilization of equipment and more efficient operations. They “sold off about 20 vehicles that they didn’t need anymore due to the underlying efficiency,” he said. In addition, the company was able to reduce a team of 10 who used to manage trucking logistics down to one, and “they are just managing exceptions” to the normal course of business. As an example of an exception, Powell said that “a guy drove half way and then decided he wanted to quit,” leaving a load stranded. “Trying to train a computer on weird edge events [like that] is hard,” he said.

Better efficiency for equipment usage and then saving money on employee costs by automating their work are the two main ways Optimal Dynamics saves money for customers. Powell says most of the savings come in the former rather than the latter, since utilization is often where the most impact can be felt.

On the technical front, the key improvement the company has devised is how to rapidly solve the ultra-complex optimization problems that logistics companies face. The company does that through value function approximation, which is a field of study where instead of actually computing the full range of stochastic optimization solutions, the program approximates the outcomes of decisions to reduce compute time. We “take in this extraordinary amount of detail while handling it in a computationally efficient way,” Powell said. That’s where we have really “wedged ourselves as a company.”

Early signs of success with customers led to a $4 million seed round led by Homan Yuen of Fusion Fund, which invests in technically sophisticated startups (i.e. the kind of startups that take decades of optimization research at Princeton to get going). Powell said that raising the round was tough, transpiring during the first weeks of the pandemic last year. One corporate fund pulled out at the last minute, and it was “chaos ensuing with everyone,” he said. This Series A process meanwhile was the opposite. “This round was totally different — closed it in 17 days from round kickoff to closure,” he said.

With new capital in the bank, the company is looking to expand from 25 employees to 75 this year, who will be trickling back to the company’s office in the Flatiron neighborhood of Manhattan in the coming months. Optimal Dynamics targets customers with 75 trucks or more, either fleets for rent or private fleets owned by companies like Walmart who handle their own logistics.

Powered by WPeMatico

Without good data, it’s impossible to build an accurate predictive machine learning model. Explorium, a company that has been building a solution over the last several years to help data pros find the best data for a given model, announced a $75 million Series C today — just 10 months after announcing a $31 million Series B.

Insight Partners led today’s investment with participation from existing investors Zeev Ventures, Emerge, F2 Venture Capital, 01 Advisors and Dynamic Loop Capital. The company reports it has now raised a total of $127 million. George Mathew, managing partner at Insight, and former president and COO at Alteryx, will be joining the board, giving the company someone with solid operator experience to help guide them into the next phase.

Company co-founder and CEO Maor Shlomo, says that in spite of how horrible COVID has been from a human perspective, it has been a business accelerator for his company and he saw revenue quadruple last year (although he didn’t share specific numbers beyond that). “It’s related to the nature of our business. We’re helping enterprises and data practitioners find new data sources that can help them solve business challenges,” Sholmo explained.

He says that during the pandemic, a lot of companies had to find new data sources because the old data wasn’t especially helpful for predictive models. That meant that customers required new sources to give them visibility into the shifts and movements in the market to help them adjust and make decisions during pandemic. “And given that’s basically what our platform does in its essence, we’ve seen a lot of growth [over the past year],” he says.

With the revenue growth the company has been experiencing, it has been adding employees at rapid clip. When we spoke to Explorium last July, the company had 87 people. Today that number has grown to 130 with plans to get to 200 perhaps by the end of 2021 or early 2022, depending on how the business continues to grow.

The company has offices in Tel Aviv and San Mateo, California with plans to open a new office in New York City whenever it’s possible to do so. While Shlomo wants a flexible workplace, he’s not going fully remote with plans to allow people to work two days from home and three in the office as local rules allow.

Powered by WPeMatico

Email marketing is decades old, but it’s a category that has surprising life in it. Multiple generations of email marketing companies have come through and sustained success, from Constant Contact to Mailchimp. These brands often become household names — after all, you probably have hundreds of emails with their logos attached to the email footer.

Klaviyo is not as much of a household name right now, but it is absolutely on its way to the paramount of the next-generation of email marketing startups.

The company announced today that it has raised $320 million in new capital in a Series D round, led by Sands Capital, a private and public equity investor that has, among many areas of focus, a thesis in ecommerce. That brings the company’s total fundraising to $675 million, following a $200 million Series C round from just six months ago.

Klaviyo was the subject of one of our most recent EC-1 analyses, where we looked at the company’s history of growth, how it is rebuilding what’s been dubbed “owned marketing” (i.e. marketing channels that a business owns like email rather than channels owned by platforms like Facebook and Instagram), how marketers are using Klaviyo post-COVID, and some startup growth lessons from the business as well.

There is nearly 10,000 words of analysis packed into that whole story, so read that or save it for the weekend if you really want to get into the nitty-gritty of Klaviyo’s story and how it is fitting in to the wider email marketing space. But suffice it to say that the company’s secret sauce is perhaps obvious: it’s a marketing company that’s pretty damn good at marketing. That’s allowed it to pull in gargantuan numbers of new customers as many retailers and brick-and-mortar businesses fled online in the wake of the COVID-19 pandemic.

In its press statement, the company wrote that “Klaviyo’s customer base doubled over the past 12 months and the company now serves over 70,000 paying customers, a more than 110% increase from 2019 — ranging from small businesses to Fortune 500 companies, in more than 120 countries.” It also said that it plans to increase its head count from 800 to 1,300 people this year.

The company is headquartered in Boston, and Klaviyo’s all-but decacorn valuation is a major win for the Boston enterprise ecosystem, which continues to percolate on high.

In addition to Sands, Counterpoint Global, Whale Rock Capital Management, ClearBridge Investments, Lone Pine Capital, Owl Rock Capital, and Glynn Capital also joined the round as new investors. Previous investors Accel and Summit Partners also participated.

Powered by WPeMatico