funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Just about every week there’s a blockbuster round coming out of South America, but in certain countries such as Ecuador, things have been more hush-hush. However, Kushki, a Quito-based fintech, is bringing attention to the region with today’s announcement of an $86 million Series B and a $600 million valuation.

“We never thought that we would return home [from the U.S.] and build a company that was more valuable in Ecuador than we had built in the U.S.,” said Aron Schwarzkopf, CEO and co-founder of Kushki.

Schwarzkopf and his business partner, Sebastián Castro, previously built and sold a fintech called Leaf in the U.S. in 2014. The two are originally from Ecuador but moved to Boston for college, where they met watching soccer.

Unlike many other fintechs in LatAm that are out to help the unbanked, Kushki works behind the scenes building the tech infrastructure that companies like Nubank use to transfer money. Some of the functionalities they build enable both local and cross-border payment players in credit and debit cards, bank transfers, digital cash, mobile wallets and other alternative payment methods.

“We realized there was a gigantic opportunity to democratize and create infrastructure to move money,” Schwarzkopf told TechCrunch.

The company, which was founded in 2017, already has operations in Mexico, Colombia, Ecuador, Peru and Chile. The Series B will be used to accelerate growth and expand to Brazil and nine other markets in Central America.

Generally, expanding to Brazil is an expensive proposition, and therefore not a path that all companies can take, even though it can be an extremely profitable move if done right. Some of the challenges include the need to translate everything into Portuguese followed by the varying financial regulations.

That’s why Kushki’s approach has to be somewhat custom in each country.

“We focus on going into the markets and we basically rebuild an entire infrastructure, so we put everything into one API,” said Schwarzkopf.

Products similar to Kushki have been successful in other regions around the world, such as in India with Pine Labs, Africa with Flutterwave and Checkout.com, which now has 15 international offices.

To build all this infrastructure, Kushki, which means “cash” in a native Andes dialect, has raised a total of $100 million from SoftBank and an undisclosed global growth equity firm, as well as previous investors including DILA Capital, Kaszek Ventures, Clocktower Ventures and Magma Partners.

“From now until 2060, people will need servers and ways to move money, and we knew that the existing payment infrastructure couldn’t support that,” said Schwarzkopf.

Powered by WPeMatico

Scotland is slowly but surely drawing attention in the UK’s startup space. In 2020, Scottish startups collectively raised £345 million, according to Tech Nation, and with nearly 2,500 startups, it has the highest number of budding tech companies outside London. Venture capital fundraises are also consistently on the rise every year.

Scotland’s capital Edinburgh boasts a beautiful, hilly landscape, a robust education system and good access to grant funding, public and private investment. It’s also one of the top financial centers in the U.K., making it a great place to begin a business.

So to find out what the startup scene in Edinburgh looks like, we spoke to six founders, executives and investors. The city’s tech ecosystem appears to have a robust space for machine learning, artificial intelligence, biomedicine, fintech, travel tech, oil, renewables, e-commerce, gaming, health tech, deep tech, space tech and insurtech.

Use discount code SCOTLANDSURVEY to save 25% off an annual or two-year Extra Crunch membership.

This offer is only available to readers in the UK Europe and expires on June 30, 2021.

However, the city’s tech scene is apparently lackluster when it comes to legal tech, blockchain and consumer-facing technology.

Breakout companies that were founded in Edinburgh include Skyscanner and FanDuel. Notable among the current crop are Desana, Continuum Industries, Parsley Box, Current Health, Boundary, Zumo, Appointedd, Criton, Mallzee, TravelNest, TVSquared, Care Sourcer, Stampede, For-Sight, Vistalworks, Reath, InfraCost, Speech Graphics and Cyan Forensics.

The Edinburgh business-angel community appears to be quite strong, but it seems local founders find it difficult to get London-based investors to take an interest. Scottish investors are said to be “pretty conservative and risk-adverse” with some notable exceptions.

We surveyed:

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

It’s strong in space, biomedicine, fintech/insurtech, AI.

What are the tech investors like in Edinburgh? What’s their focus?

The Scottish business-angel community is said to be the largest in Europe. It’s difficult to get London-based investors take an interest in Scotland — investors can tend to look at where companies are based. It is hard for “underrepresented founders” to get investments in Scotland and beyond.

With the shift to remote working, do you think people will stay in Edinburgh or will they move out? Will others move in?

Stay. Not always easy to get people to come and live in Scotland. Edinburgh, there are lots of prejudices, despite it being one of the best cities to live in in the whole of the U.K.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Good to see more focus on impact investing. Par Equity is one of Edinburgh’s biggest investors, whereas Archangels is one of the biggest angel investors. Poonam Malik is great for diversity and female entrepreneurs, and she is on the board of Scottish Enterprise, and is a social entrepreneur and investor. Garry Bernstein is also an investor — he leads the Scottish chapter of Tech London Advocates and Global Tech Advocates, and as such is the founder of Tech Scot Advocates.

Where do you think the city’s tech scene will be in five years?

Thriving. The government is doing its best for the tech sector. Education in tech is currently an issue, though. Hope Brexit won’t be too much of an issue.

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Strong in fintech, health tech, data science, deep tech. Excited by quantum computing, advanced materials, AI in Edinburgh. Weak in blockchain and consumer.

Which are the most interesting startups in Edinburgh?

Current Health, InfraCost, Speech Graphics and Cyan Forensics.

What are the tech investors like in Edinburgh? What’s their focus?

Good at seed stage up to £1 million, okay for pre-series A (£1 million to £3 million) and non-existent for Series A (£3 million-£10 million). Quality of investors is improving. Par Equity is leading the way.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

Experiencing influx of new talent due to COVID-19. Edinburgh is a highly desirable city to live in. Recent new residents include Aaron Ross (Predictable Revenue) and Jules Pursuad (early employee at Airbnb and now VP at Omio).

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Par Equity (investor), Paul Atkinson, Alistair Forbes, Mark Logan, Lesley Eccles, Chris McCann, CodeBase.

Where do you think the city’s tech scene will be in five years?

One to two new unicorns. Promising number of high-growth tech companies. A much more sophisticated investor scene in the Series A space.

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Edinburgh is strong in fintech because of our proximity to so many financial services companies and banks. Also, there are some exciting games tech companies because of our history of games companies. We’re pretty weak in law tech, Valla’s area.

Which are the most interesting startups in Edinburgh?

Vistalworks for consumer tech; Sustainably for fintech; Reath for sustainable tech.

What are the tech investors like in Edinburgh? What’s their focus?

As a rule, Scottish investors are pretty conservative and risk-averse. The only real exception is Techstart Ventures, in my experience.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

I think more people will come to Edinburgh from London because the quality of life and cost of living are both so much better here.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Calum Forsyth and Mark Hogarth at Techstart Ventures; Janine Matheson at CodeBase; Jackie Waring from the Investing Women angel syndicate; Jim Newbury is a very well-respected developer and coach, and my co-founder Kate Ho is also well known. Also Danny Helson who runs the EIE event with the Bayes Centre.

Where do you think the city’s tech scene will be in five years?

We’ve had a few exits in the past few years (Skyscanner, FreeAgent), which means that talent is spreading out across the ecosystem here and we’re getting some fantastic new startups kicking off. In five years, that first crop should be coming into the Series A stage so we could see a lot of super exciting businesses!

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Strong in fintech, travel tech, health, oil, renewables, e-commerce, gaming (both video game and gambling tech). Excited by all bar oil (great driver of revenue, but not the future).

Which are the most interesting startups in Edinburgh?

Boundary, Parsley Box, Appointedd, Criton, Mallzee, TravelNest, TVSquared, Care Sourcer, Stampede, For-Sight.

What are the tech investors like in Edinburgh? What’s their focus?

Big fintech scene here. Travel tech is growing too, with Skyscanner’s influence strong.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

Most will stay, as it’s a very attractive city to live and work in. It’s a globally recognized and unique city. Very international flavor as evidenced by the makeup of our team.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Ex-Skyscanner people including Gareth Williams, Mark Logan, etc. Ian Ritchie, Alistair Forbes, the FanDuel’s founders and the CodeBase founders.

Where do you think the city’s tech scene will be in five years?

A lot bigger, as tech is a key growth target of the Scottish government and is underpinned/influenced/inspired by Skyscanner and FanDuel.

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Strong in machine learning/AI/digital. Weak in deep tech discovery, especially in biotech/therapeutics. Excited by the rise in adoption of AI in drug discovery — all these ideas that were sci-fi 20 years ago are now adopted in £B deals.

Which are the most interesting startups in Edinburgh?

Pheno Therapeutics.

What are the tech investors like in Edinburgh? What’s their focus?

Conservative angels and a few tech seed VCs.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

Move in.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Investors: Archangels, Techstart Ventures and Epidarex.

Where do you think the city’s tech scene will be in five years?

Growing.

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

I don’t think there are any sectors that stand out — it’s fairly evenly split. A good strength of the city is the talent that comes from the universities. There are some really good engineers that come from Edinburgh, Heriot Watt and Edinburgh Napier. The main weakness is that the ecosystem doesn’t favor the most ambitious founders. Most investors in the region are angels and aren’t interested in finding outliers that could grow 1000x and are more interested in backing companies that are less risky but might 5x their money. If you want to find investors that will back risky (but very ambitious) plans, it’s easier to find that elsewhere.

Which are the most interesting startups in Edinburgh?

Desana, Continuum Industries, Parsley Box, Current Health, Boundary, Zumo.

What are the tech investors like in Edinburgh? What’s their focus?

I would say it’s getting better, but there are still a lot of issues with the ecosystem. It is being helped in Scotland by the likes of Techstart investing at the earliest stages with high conviction and term sheets that are more similar to London VCs. Outside of this, though, it’s easy for founders to end up with a messy cap table due to the number of angels and lack of VCs looking for VC-type returns — the messiness of these cap tables can then make it hard to raise venture funding down the line. This is fine for a lot of companies that aren’t aiming for a venture-scale return (which admittedly is a lot), but it can hurt those that are.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

I imagine and hope others will move in. It is a great place to live with a very high quality of life, and this should be a natural attraction for people who want a good standard of living but want to remain in a city.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

SEP (investor), Techstart Ventures (investor), Gareth Williams (founder/investor), MBM Commercial (lawyers), Pentech, Bill Dobbie (investor), Jamie Coleman.

Where do you think the city’s tech scene will be in five years?

Optimistically, I hope that there will be a good number of companies that are at the Series B/Series C stage, which will invite a lot more interest from investors outside of Edinburgh (London, Berlin, Paris, New York, San Francisco, etc.) to start investing more actively in the city at the earliest stages as well as these stages.

Powered by WPeMatico

Here in the U.S. the concept of using a driver’s data to decide the cost of auto insurance premiums is not a new one.

But in markets like Brazil, the idea is still considered relatively novel. A new startup called Justos claims it will be the first Brazilian insurer to use drivers’ data to reward those who drive safely by offering “fairer” prices.

And now Justos has raised about $2.8 million in a seed round led by Kaszek, one of the largest and most active VC firms in Latin America. Big Bets also participated in the round, along with the CEOs of seven unicorns, including Assaf Wand, CEO and co-founder of Hippo Insurance; David Vélez, founder and CEO of Nubank; Carlos Garcia, founder and CEO of Kavak; Sergio Furio, founder and CEO of Creditas; Patrick Sigrist, founder of iFood and Fritz Lanman, CEO of ClassPass. (There’s a seventh CEO who wishes to remain anonymous). Senior executives from Robinhood, Stripe, Wise, Carta and Capital One also put money in the round.

Serial entrepreneurs Dhaval Chadha, Jorge Soto Moreno and Antonio Molins co-founded Justos, having most recently worked at various Silicon Valley-based companies including ClassPass, Netflix and Airbnb.

“While we have been friends for a while, it was a coincidence that all three of us were thinking about building something new in Latin America,” Chadha said. “We spent two months studying possible paths, talking to people and investors in the United States, Brazil and Mexico, until we came up with the idea of creating an insurance company that can modernize the sector, starting with auto insurance.”

Ultimately, the trio decided that the auto insurance market would be an ideal sector considering that in Brazil, an estimated more than 70% of cars are not insured.

The process to get insurance in the country, by any accounts, is a slow one. It takes up to 72 hours to receive initial coverage and two weeks to receive the final insurance policy. Insurers also take their time in resolving claims related to car damages and loss due to accidents, the entrepreneurs say. They also charge that pricing is often not fair or transparent.

Justos aims to improve the whole auto insurance process in Brazil by measuring the way people drive to help price their insurance policies. Similar to Root here in the U.S., Justos intends to collect users’ data through their mobile phones so that it can “more accurately and assertively price different types of risk.” This way, the startup claims it can offer plans that are up to 30% cheaper than traditional plans, and grant discounts each month, according to the driving patterns of the previous month of each customer.

“We measure how safely people drive using the sensors on their cell phones,” Chadha said. “This allows us to offer cheaper insurance to users who drive well, thereby reducing biases that are inherent in the pricing models used by traditional insurance companies.”

Justos also plans to use artificial intelligence and computerized vision to analyze and process claims more quickly and machine learning for image analysis and to create bots that help accelerate claims processing.

“We are building a design-driven, mobile first and customer experience that aims to revolutionize insurance in Brazil, similar to what Nubank did with banking,” Chadha told TechCrunch. “We will be eliminating any hidden fees, a lot of the small text and insurance-specific jargon that is very confusing for customers.”

Justos will offer its product directly to its customers as well as through distribution channels like banks and brokers.

“By going direct to consumer, we are able to acquire users cheaper than our competitors and give back the savings to our users in the form of cheaper prices,” Chadha said.

Customers will be able to buy insurance through Justos’ app, website or even WhatsApp. For now, the company is only adding potential customers to a waitlist but plans to begin selling policies later this year..

During the pandemic, the auto insurance sector in Brazil declined by 1%, according to Chadha, who believes that indicates “there is latent demand raring to go once things open up again.”

Justos has a social good component as well. Justos intends to cap its profits and give any leftover revenue back to nonprofit organizations.

The company also has an ambitious goal: to help make insurance become universally accessible around the world and the roads safer in general.

“People will face everyday risks with a greater sense of safety and adventure. Road accidents will reduce drastically as a result of incentives for safer driving, and the streets will be safer,” Chadha said. “People, rather than profits, will become the focus of the insurance industry.”

Justos plans to use its new capital to set up operations, such as forming partnerships with reinsurers and an insurance company for fronting, since it is starting as an MGA (managing general agent).

It’s also working on building out its products such as apps, its back end and internal operations tools, as well as designing all its processes for underwriting, claims and finance. Justos’ data science team is also building out its own pricing model.

The startup will be focused on Brazil, with plans to eventually expand within Latin America, then Iberia and Asia.

Kaszek’s Andy Young said his firm was impressed by the team’s previous experience and passion for what they’re building.

“It’s a huge space, ripe for innovation and this is the type of team that can take it to the next level,” Young told TechCrunch. “The team has taken an approach to building an insurance platform that blends being consumer-centric and data-driven to produce something that is not only cheaper and rewards safety but as the brand implies in Portuguese, is fairer.”

Powered by WPeMatico

As AI has grown from a menagerie of research projects to include a handful of titanic, industry-powering models like GPT-3, there is a need for the sector to evolve — or so thinks Dario Amodei, former VP of research at OpenAI, who struck out on his own to create a new company a few months ago. Anthropic, as it’s called, was founded with his sister Daniela and its goal is to create “large-scale AI systems that are steerable, interpretable, and robust.”

The challenge the siblings Amodei are tackling is simply that these AI models, while incredibly powerful, are not well understood. GPT-3, which they worked on, is an astonishingly versatile language system that can produce extremely convincing text in practically any style, and on any topic.

But say you had it generate rhyming couplets with Shakespeare and Pope as examples. How does it do it? What is it “thinking”? Which knob would you tweak, which dial would you turn, to make it more melancholy, less romantic, or limit its diction and lexicon in specific ways? Certainly there are parameters to change here and there, but really no one knows exactly how this extremely convincing language sausage is being made.

It’s one thing to not know when an AI model is generating poetry, quite another when the model is watching a department store for suspicious behavior, or fetching legal precedents for a judge about to pass down a sentence. Today the general rule is: the more powerful the system, the harder it is to explain its actions. That’s not exactly a good trend.

“Large, general systems of today can have significant benefits, but can also be unpredictable, unreliable, and opaque: our goal is to make progress on these issues,” reads the company’s self-description. “For now, we’re primarily focused on research towards these goals; down the road, we foresee many opportunities for our work to create value commercially and for public benefit.”

The goal seems to be to integrate safety principles into the existing priority system of AI development that generally favors efficiency and power. Like any other industry, it’s easier and more effective to incorporate something from the beginning than to bolt it on at the end. Attempting to make some of the biggest models out there able to be picked apart and understood may be more work than building them in the first place. Anthropic seems to be starting fresh.

“Anthropic’s goal is to make the fundamental research advances that will let us build more capable, general, and reliable AI systems, then deploy these systems in a way that benefits people,” said Dario Amodei, CEO of the new venture, in a short post announcing the company and its $124 million in funding.

That funding, by the way, is as star-studded as you might expect. It was led by Skype co-founder Jaan Tallinn, and included James McClave, Dustin Moskovitz, Eric Schmidt and the Center for Emerging Risk Research, among others.

The company is a public benefit corporation, and the plan for now, as the limited information on the site suggests, is to remain heads-down on researching these fundamental questions of how to make large models more tractable and interpretable. We can expect more information later this year, perhaps, as the mission and team coalesces and initial results pan out.

The name, incidentally, is adjacent to anthropocentric, and concerns relevancy to human experience or existence. Perhaps it derives from the “Anthropic principle,” the notion that intelligent life is possible in the universe because… well, we’re here. If intelligence is inevitable under the right conditions, the company just has to create those conditions.

Powered by WPeMatico

Fintech and proptech are two sectors that are seeing exploding growth in Latin America, as financial services and real estate are two categories in particular dire need of innovation in a region.

Brazil’s QuintoAndar, which has developed a real estate marketplace focused on rentals and sales, has seen impressive growth in recent years. Today, the São Paulo-based proptech has announced it has closed on $300 million in a Series E round of funding that values it at an impressive $4 billion.

The round is notable for a few reasons. For one, the valuation — high by any standards but especially for a LatAm company — represents an increase of four times from when QuintoAndar raised a $250 million Series D in September 2019.

It’s also noteworthy who is backing the company. Silicon Valley-based Ribbit Capital led its Series E financing, which also included participation from SoftBank’s LatAm-focused Innovation Fund, LTS, Maverik, Alta Park, an undisclosed U.S.-based asset manager fund with over $2 trillion in AUM, Kaszek Ventures, Dragoneer and Accel partner Kevin Efrusy.

Having backed the likes of Coinbase, Robinhood and CreditKarma, Ribbit Capital has historically focused on early-stage investments in the fintech space. Its bet on QuintoAndar represents clear faith in what the company is building, as well as its confidence in the startup’s plans to branch out from its current model into a one-stop real estate shop that also offers mortgage, title, insurance and escrow services.

The latest round brings QuintoAndar’s total raised since its 2013 inception to $635 million.

Ribbit Capital Partner Nick Huber said QuintoAndar has over the years built “a unique and trusted brand in Brazil” for those looking for a place to call home.

“Whether you are looking to buy or to rent, QuintoAndar can support customers through the entire transaction process: from browsing verified inventory to signing the final contracts,” Huber told TechCrunch. “The ability to serve customers’ needs through each phase of life and to do so from start to finish is a unique capability, both in Brazil and around the world.”

QuintoAndar describes itself as an “end-to-end solution for long-term rentals” that, among other things, connects potential tenants to landlords and vice versa. Last year, it expanded also into connecting a home buyers to sellers.

Image Credits: QuintoAndar

TechCrunch spoke with co-founder and CEO Gabriel Braga and he shared details around the growth that has attracted such a bevy of high-profile investors.

Like most other businesses around the world, QuintoAndar braced itself for the worst when the COVID-19 pandemic hit last year — especially considering one core piece of its business is to guarantee rents to the landlords on its platform.

“In the beginning, we were afraid of the implications of the crisis but we were able to honor our commitments,” Braga said. “In retrospect, the pandemic was a big test for our business model and it has validated the strength and defensibility of our business on the credit side and reinforced our value proposition to tenants and landlords. So after the initial scary moments, we actually felt even more confident in the business that we are building.”

QuintoAndar describes itself as “a distant market leader” with more than 100,000 rentals under management and about 10,000 new rentals per month. Its rental platform is live in 40 cities across Brazil, while its home-buying marketplace is live in four. Part of its plans with the new capital is to expand into new markets within Brazil, as well as in Latin America as a whole.

The startup claims that, in less than a year, QuintoAndar managed to aggregate the largest inventory among digital transactional platforms. It now offers more than 60,000 properties for sale across Sao Paulo, Rio de Janeiro, Belho Horizonte and Porto Alegre. To give greater context around the company’s growth of that side of its platform: In its first year of operation, QuintoAndar closed more than 1,000 transactions. It has now surpassed the mark of 8,000 transactions in annualized terms, growing between 50% and 100% quarter over quarter.

As for the rentals side of its business, Braga said QuintoAndar has more than 100,000 rentals under management and is closing about 10,000 new rentals per month. The company is not profitable as it’s focused on growth, although it’s unit economics are particularly favorable in certain markets such as Sao Paulo, which is financing some of its growth in other cities, according to Braga.

Now, the 2,000-person company is looking to begin its global expansion with plans to enter the Mexican market later this year. With that, Braga said QuintoAndar is looking to hire “top-tier” talent from all over.

“We want to invest a lot in our product and tech core,” he said. “So we’re trying to bring in more senior people from abroad, on a global basis.”

CEO Braga and CTO André Penha came up with the idea for QuintoAndar after receiving their MBAs at Stanford University. As many startups do, the company was founded out of Braga’s personal “nightmare” of an experience — in this case, of trying to rent an apartment in Sao Paulo.

The search process, he recalls, was difficult as there was not enough information available online and renters were forced to provide a guarantor, or co-signer, from the same city or pay rent insurance, which Braga described as “very expensive.”

“Overall, I felt it was a very inefficient and fragmented process with no transparency or tech,” Braga told me at the time of the company’s last raise. “There was all this friction and high cost involved, just real tangible problems to solve.”

The concept for QuintoAndar (which can be translated literally to “Fifth Floor” in Portuguese) was born.

“Little by little, we created a platform that consolidated supply and inventory in a uniform way,” Braga said.

The company took the search phase online for the first time, according to Braga. It also eliminated the need for tenants to provide a guarantor, thereby saving them money. On the other side, QuintoAndar also works to help protect the landlord with the guarantee that they will get their rent “on time every month,” Braga said.

It’s been interesting watching the company evolve and grow over time, just as it’s been fascinating seeing the region’s startup scene mature and shine in recent years.

Powered by WPeMatico

Breinify is a startup working to apply data science to personalization, and do it in a way that makes it accessible to nontechnical marketing employees to build more meaningful customer experiences. Today the company announced a funding round totaling $11 million.

The investment was led by Gutbrain Ventures and PBJ Capital with participation from Streamlined Ventures, CXO Fund, Amino Capital, Startup Capital Ventures and Sterling Road.

Breinify co-founder and CEO Diane Keng says that she and co-founder and CTO Philipp Meisen started the company to bring predictive personalization based on data science to marketers with the goal of helping them improve a customer’s experience by personalizing messages tailored to individual tastes.

“We’re big believers that the world, especially consumer brands, really need strong predictive personalization. But when you think about consumer big brands or the retailers that you buy from, most of them aren’t data scientists, nor do they really know how to activate [machine learning] at scale,” Keng told TechCrunch.

She says that she wanted to make this type of technology more accessible by hiding the complexity behind the algorithms powering the platform. “Instead of telling you how powerful the algorithms are, we show you [what that means for the] consumer experience, and in the end what that means for both the consumer and you as a marketer individually,” she said.

That involves the kind of customizations you might expect around website messaging, emails, texts or whatever channel a marketer might be using to communicate with the buyer. “So the AI decides you should be shown these products, this offer, this specific promotion at this time, [whether it’s] the web, email or SMS. So you’re not getting the same content across different channels, and we do all that automatically for you, and that’s [driven by the algorithms],” she said.

Breinify launched in 2016 and participated in the TechCrunch Disrupt Startup Battlefield competition in San Francisco that year. She said it was early days for the company, but it helped them focus their approach. “I think it gave us a huge stage presence. It gave us a chance to test out the idea just to see where the market was in regards to needing a solution like this. We definitely learned a lot. I think it showed us that people were interested in personalization,” she said. And although the company didn’t win the competition, it ended up walking away with a funding deal.

Today the startup is growing fast and has 24 employees, up from 10 last year. Keng, who is an Asian woman, places a high premium on diversity.

“We partner with about four different kinds of diversity groups right now to source candidates, but at the end of the day, I think if you are someone that’s eager to learn, and you might not have all the skills yet, and you’re [part of an under-represented] group we encourage everyone to apply as much as possible. We put a lot of work into trying to create a really well-rounded group,” she said.

Powered by WPeMatico

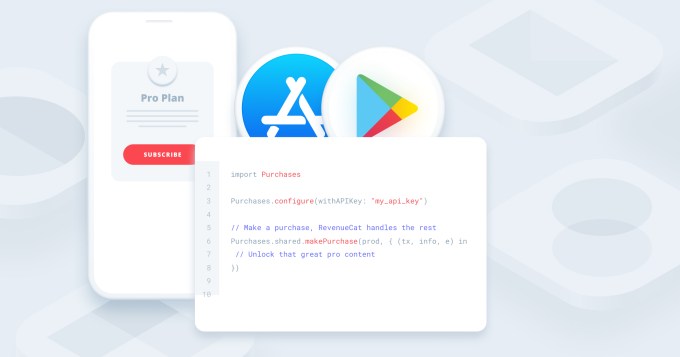

RevenueCat, a startup offering a series of tools for developers of subscription-based apps, has raised $40 million in Series B funding, valuing its business at $300 million, post-money. Founded by developers who understood the difficulties in scaling a subscription app firsthand, RevenueCat’s software development kit (SDK) solution gives companies the tools they need to build a subscription business, including not just adding subscriptions themselves, but maintaining them over time even as the app stores implement changes. It also aids by sharing subscription data with other tools the business uses, like those for advertising, analytics or attribution.

The funding round was led by Y Combinator’s Continuity Fund and included participation from Index Ventures, SaaStr, Oakhouse, Adjacent and FundersClub, as well as Blinklist CTO Tobias Balling and Algolia CEO Nicolas Dessaigne. With the round, YC Continuity Partner Anu Hariharan is joining RevenueCat’s board, which today includes Index’s Mark Fiorentino in addition to the founders.

Explains RevenueCat CEO Jacob Eiting, the idea for the company came about after he and co-founder Miguel Carranza Guisado (CTO) struggled to figure out subscription infrastructure while working together at Elevate. After years of untangling a “subscription mess” in order to figure out answers to basic questions like subscriber retention and lifetime value, they realized there was potential in helping solve this problem for other developers.

Apple and Google, Eiting explains, aren’t always up to date with what companies actually need to build subscription businesses. “They’re kind of learning as they go. They just weren’t able to provide us the data we needed, and then also the infrastructure to do that is non-trivial.”

Image Credits: RevenueCat

When Eiting and Guisado sat down to work on RevenueCat in 2017, no one else was even building anything like this. But the demand for the startup’s tools and integrations soon resonated with developers who had faced similar challenges in the growing subsection app market.

Using the service, developers can access a real-time dashboard that display key metrics, like subscription revenue, churn, LTV (lifetime value), subscriber numbers, conversions and more. The data can then be shared through integrations with other tools and services, like Adjust, Amplitude, Apple Search Ads, AppsFlyer, Branch, Facebook Ads, Google Cloud Intercom, Mixpanel, Segment and several others.

After launching out of Y Combinator’s accelerator the following year, RevenueCat was soon live with 100 apps and had crossed $1 million in tracked revenue by the time it raised its $1.5 million seed round.

Today, RevenueCat has more than 6,000 apps live on its platform, with over $1 billion in tracked subscription revenue being managed by its tools. That’s double the number of apps that were using its service as of its $15 million Series A last August.

With the additional funding, the company will lower its pricing to put its tools in reach of more developers. Previously, it charged $120 per month for its charts and some of its integrations, or $499 per month for access to all integrations. This was affordable for larger companies, but could still be a difficult sell to the long tail of app developers where revenues ranged from $10K to $50K per month.

Now, RevenueCat will charge a small percentage of an app’s sales instead of a flat fee. Developers with up to $10,000 in monthly tracked revenue (MTR) can get started with the service for free and as their demands grow — like needing access to charts, support for web hooks, integrations and others — they can move up to either the Starter or Pro plans as $8/mo or $12/mo per $1,000 in MTR, respectively.

“I’m excited to give those tools to developers, especially on the small end, because it might be what they need to get out of that ‘less than $10K range,’ ” Eiting says. “Also, the beauty of freemium, or having a really generous free tier, is that it makes your tool the de facto — you remove as much friction as possible for providing software services and then, if you get your pricing right — which I think we have — it all kind of pays for itself,” he adds.

The company also plans to use the new funds to further invest in its business, expanding from App Store and Google Play support to include Amazon’s Appstore. It will also grow its team.

As part of its expected growth, RevenueCat recently hired a head of Product, Jens-Fabian Goetzmann, previously a PM at Microsoft and then product head at fitness app 8fit. Currently 30 people, in the year ahead, RevenueCat will grow to 60 people, hiring across design, product, engineering, sales and other roles.

“The world is moving toward subscriptions — and for companies, building out this model translates to weeks of developers’ time,” says YC Continuity’s Hariharan. “RevenueCat helps developers roll out subscriptions in minutes and creates a source of truth for customer data. With developers creating solutions to problems in the world, it’s important that they can find ways to monetize, grow, and support their most committed customers. RevenueCat is doing so by building subscriptions 2.0.”

Powered by WPeMatico

Most marketers today know how to send targeted communications to customers, and there are many tools to help, but when it comes to sending personalized in-house messages, there aren’t nearly as many options. Pyn, an early-stage startup based in Australia, wants to change that, and today it announced an $8 million seed round.

Andreessen Horowitz led the investment with help from Accel and Ryan Sanders (the co-founder of BambooHR) and Scott Farquhar (co-founder and co-CEO at Atlassian).

That last one isn’t a coincidence, as Pyn co-founder and CEO Joris Luijke used to run HR at the company and later at Squarespace and other companies, and he saw a common problem trying to provide more targeted messages when communicating internally.

“I’ve been trying to do this my entire professional life, trying to personalize the communication that we’re sending to our people. So that’s what Pyn does. In a nutshell, we radically personalize employee communications,” Luijke explained. His co-founder Jon Williams was previously a co-founder at Culture Amp, an employee experience management platform he helped launch in 2011 (and which raised more than $150 million), so the two of them have been immersed in this idea.

They bring personalization to Pyn by tracking information in existing systems that companies already use, such as Workday, BambooHR, Salesforce or Zendesk, and they can use this data much in the same way a marketer uses various types of information to send more personalized messages to customers.

That means you can cut down on the company-wide emails that might not be relevant to everyone and send messages that should matter more to the people receiving them. And as with a marketing communications tool, you can track how many people have opened the emails and how successful you were in hitting the mark.

David Ulevitch, general partner at a16z and lead investor in this deal, points out that Pyn also provides a library of customizable communications materials to help build culture and set policy across an organization. “It also treats employee communication channels as the rails upon which to orchestrate management practices across an organization [by delivering] a library of management playbooks,” Ulevitch wrote in a blog post announcing the investment.

The startup, which launched in 2019, currently has 10 employees, with teams working in Australia and the Bay Area in California. Williams says that already half the team is female and the plan is to continue putting diversity front and center as they build the company.

“Joris has mentioned ‘radical personalization’ as this specific mantra that we have, and I think if you translate that into an organization, that is all about inclusion in reality, and if we want to be able to cater for all the specific needs of people, we need to understand them. So [diversity is essential] to us,” Williams said.

While the company isn’t ready to discuss specifics in terms of customer numbers, it cites Shopify, Rubrik and Carta as early customers, and the founders say there was a lot of interest when the pandemic hit last year and the need for more frequent and meaningful types of communication became even more paramount.

Powered by WPeMatico

Drug discovery is a large and growing field, encompassing both ambitious startups and billion-dollar Big Pharma incumbents. Engine Biosciences is one of the former, a Singaporean outfit with an expert founding crew and a different approach to the business of finding new therapeutics, and it just raised $43 million to keep growing.

Digital drug discovery in general means large-scale analysis of biological data like genes, gene expression, protein structures, binding sites, things like that. Where it has hit a wall in the past is not on the digital side, where any number of likely molecules or processes can be generated, but on the next step, when those notions need to be tested in vitro. So a new crop of biotech companies have worked to integrate these aspects.

Engine does so with a pair of tools it has dubbed NetMAPPR and CombiGEM. NetMAPPR is a huge sort of search engine for genes and gene interactions, taking special note of “errors” that could provide a foothold for a molecule or treatment. CombiGEM is like a mass genetic testing process that can look into thousands of gene combinations and edits on diseased cells simultaneously, providing quick experimental confirmation of the targets and effects proposed by the digital side. The company is focused on anti-cancer drugs but is looking into other fields as they become viable.

The focus on gene interactions sets their approach apart, said co-founder and CEO Jeffrey Lu.

“Gene interactions are relevant to all diseases, and in cancers, where we focus, a proven approach for effective precision medicines,” he explained. “For example, there are four approved drugs targeting the PARP enzyme in the context of mutation in the BRCA gene that is changing cancer treatment for millions of people. The fundamental principle of this precision medicine is based on understanding the gene interaction between BRCA and PARP.”

The company raised a $10 million seed in 2018 and has been doing its thing ever since — but it needs more money if it’s going to bring some of these things to market.

“We already have chemical compounds directed toward the novel biology we have uncovered,” said Lu. “These are effectively prototype drugs, which are showing anti-cancer effects in diseased cells. We need to refine and optimize these prototypes to a suitable candidate to enter the clinic for testing in humans.”

Right now they’re working with other companies to do the next step up from automated testing, which is to say animal testing, to clear the way for human trials.

The CombiGEM experiments — hundreds of thousands of them — produce a large amount of data as well, and they’re sharing and collaborating on that front with several medical centers throughout Asia. “We have built what we believe to be the largest data compendium related to gene interactions in the context of cancer disease relevance,” said Lu, adding that this is crucial to the success of the machine learning algorithms they employ to predict biological processes.

The $43 million round was led by Polaris Partners, with participation by newcomers Invus and a long list of existing investors. The money will go toward the requisite testing and paperwork involved in bringing a new drug to market based on promising leads.

“We have small molecule compounds for our lead cancer programs with data from in vitro (in cancer cells) experiments. We are refining the chemistry and expanding studies this year,” said Lu. “Next year, we anticipate having our first drug candidate enter the late preclinical phase of development and regulatory work for an IND (investigational new drug) filing with the FDA, and starting the clinical trials in 2023.”

It’s a long road to human trials, let alone widespread use, but that’s the risk any drug discovery startup takes. The carrot dangling in front of them is not just the possibility of a product that could generate billions in income, but perhaps save the lives of countless cancer patients awaiting novel therapies.

Powered by WPeMatico

We don’t hear as much these days about “Zoom fatigue” as we did in the first months after the COVID-19 pandemic kicked off last year, but what’s less clear is whether people became more tolerant of the medium, or if they found ways of coping with it better, or if they were hopeful that tools for coping would soon be around the corner.

Today, a startup that has come up with a solution to handling all that video is announcing some funding to grow, on the understanding that whatever people are doing with video today, there will be a lot more video to handle in the future, and they will need more than just a good internet connection, microphone and video camera to deal with it.

Rewatch, which has built a set of tools for organizations to create a “system of record” for their internal video archives — not just a place to “rewatch” all of their older live video calls, but to search and organise information arising from those calls — has closed a $20 million round of funding.

Along with this, Rewatch from today is opening up its platform from invite-only to general availability.

This latest round is a Series A and is being led by Andreessen Horowitz, with Semil Shah at Haystack and Kent Goldman at Upside Partners, as well as a number of individuals, also participating.

It comes on the heels of Rewatch announcing a $2 million seed round only in January of this year. But it’s had some buzz in the intervening months: Customers that have started using Rewatch include GitHub (where co-founders Connor Sears and Scott Goldman previously worked together), Brex, Envoy and The Athletic.

The issue that Rewatch is tackling is the fact that a lot more of our work communications are happening over video. But while video calling has been hailed as a great boost to productivity — you can work wherever you are now, as long as you have a video connection — in fact, it’s not.

Yes, we are talking to each other a lot, but we are also losing information from those calls because they’re not being tracked as well as they could be. And, by spending all of our time talking, many of us are working on other things less, or are confined into more rigid times when we can.

Rewatch has built a system that plugs into Zoom and Google Meet, two of the most-used video tools in the workplace, and automatically imports all of your office’s or team’s video chats into a system. This lets you browse libraries of video-based conversations or meetings to watch them on-demand, on your time. It also provides transcripts and search tools for finding information in those calls.

You can turn off the automatic imports, or further customize how meetings are filed or accessibility. Sears said that Rewatch can be used for any video created on any platform; for now those require manually importing the videos into the Rewatch system.

Sears also said that over time it will also be adding ways to automatically turn items from meetings into, say, work tickets to follow them up.

While there are a number of transcription services available on tap these days, as well as any number of cloud-based storage providers where you can keep video archives, what is notable about Rewatch is that it has identified the pain point of managing and indexing those archives and keeping them in a single place for many to use.

In this way, Rewatch is highlighting and addressing what I think of as the crux of the productivity paradox.

Essentially, it is this: The tech industry has given us a lot of tools to help us work better, but actually, the work required to use those tools can outweigh the utility of the tools themselves.

(And I have to admit, this is one of the reasons I’ve grown to dislike Slack. Yes, we all get to communicate on it, and it’s great to have something to connect all of us, but it just takes up so much damn time to read through everything and figure out what’s useful and what is just watercooler chat.)

“We go to where companies already are, and we automate, pull in video so that you don’t have to think about it,” Sears said. “The effort around a lot of this takes a lot of diligence to make sure people are recording and transcribing and distributing and removing. We are making this seamless and effortless.”

It sometimes feels like we are on the cusp, technologically, of leaning on tools by way of AI and other innovations that might finally cross that chasm and give us actual productivity out of our productivity apps.

In another example of how this is playing out, Dooly, which raised funding last week, is looking to do the same in the world of sales software (automatically populating various sales software with data from your phone, video and text chats, and other sources).

Similarly, we’re starting to see an interesting wave of companies emerge that are looking for better ways to manage and tap into all that video content that we now have swimming around us.

AnyClip, which announced funding yesterday, is also applying better analytics and search to internal company video libraries, but also has its sights on a wider opportunity: organizing any video trove. That points, too, to the bigger opportunity for Rewatch.

For now, though, enterprises and businesses are an opportunity enough.

“As investors we get excited about founders first and foremost, and Connor and Scott immediately impressed us with their experience, clear articulation of the problem, and their vision for how Rewatch could be the end-all solution for video and knowledge management in an organization,” noted David Ulevitch, a general partner at Andreessen Horowitz, in a blog post. “They both worked at GitHub in senior roles from the early days, as a Senior Director of Product Design and a Principal Engineer, respectively, and have first-hand experience scaling a product. Since founding Rewatch in early 2020, they have very quickly built a great product, sold it to large-scale customers, and hired top-tier talent, demonstrating rapid founder and company velocity that is key to building an enduring company.”

Powered by WPeMatico