funding

Auto Added by WPeMatico

Auto Added by WPeMatico

One clear outcome of the pandemic was that it pushed more people to do their shopping online, and that was as true for B2B as it was for B2C. Knowing which of your B2B customers are most likely to convert puts any sales team ahead of the game. Slintel, a startup providing that kind of data, announced a $20 million Series A today.

The company has attracted some big-name investors, with GGV leading the round and Accel, Sequoia and Stellaris also participating. The investment brings the total raised to over $24 million, including a $4.2 million seed round from last November.

That’s a quick turnaround from seed to A, and company founder and CEO Deepak Anchala says that while he had plenty of runway left from the seed round, the demand was such that it seemed prudent to take the A money sooner than he had planned. “So we had enough cash in the bank, but investors came to us and we got a pretty good valuation compared to the previous round, so we decided to take it and use that money to go faster,” Anchala said.

Certainly the market dynamics were working in Slintel’s favor. Without giving revenue details, Anchala said that revenue grew 5x last year in the middle of the worst of the pandemic. He says that meant buyers were spending less time with sales and marketing folks to understand products and more time online researching on their own.

“So what Slintel does as a product is we mine buyer insights. We understand where the buyers are in their journey, what their pain points are, what products they use, what they need and when they need it. So we understand all of this to create a 360-degree view of the buyer that you provide these insights to sales and marketing teams to help them sell better,” he said.

After growing at such a rapid clip last year, the company expected more modest growth this year at perhaps 3x, but with the added investment, he expects to grow faster again. “With the funding we’re actually looking at much bigger numbers. We’re looking at 5x in our revenue this year, and also trying for 4x revenue next year.”

He says that the money gives him the opportunity to improve the product and put more investment into marketing, which he believes will contribute to additional sales. Since the round closed six weeks ago, he says that he has increased his advertising budget and also hopes to attract customers via SEO, free tools on the company website and events.

The company had 45 employees at the time of its seed round in November and has more than doubled that number in the interim, to 100 spread out across 10 cities. He expects to double again by this time next year as the company is growing quickly. As a global company with some employees in India and some in the U.S., he intends to be remote-first even after offices begin to reopen in different areas. He says that he plans to have company gatherings each quarter to let people gather in person on occasion.

Powered by WPeMatico

Running a startup can be a complicated, difficult process fraught with pitfalls and ample opportunities to make mistakes. But the logistics of setting up a startup should be simple, because over the long run, complicated equity setups and cap tables cost more money in legal fees and administration time.

The logistics of setting up a startup should be simple, because over the long run, complicated equity setups and cap tables cost more money in legal fees and administration time.

My company, Pulley, has helped more than a thousand founders build their cap table and equity structure.

Here’s a tactical guide to get your startup running in just four days.

It is now standard to incorporate your company at the seed stage itself. In the U.S., startups incorporate as Delaware C Corporations with 10 million authorized shares. This is the standard setup when you use services like Stripe Atlas or Clerky.

Post incorporation, you need to answer a few questions on how to grant equity to founders and future employees.

First, you should determine how you want to split the equity between the founders. There is no standard for doing so — some founders split shares equally, while others do 49/51 splits for control. Some founders even may have an 80/20 equity split because one founder spent an extra year on the idea.

At the end of the day, a good equity split is one that all founders find fair. If you can’t agree on a structure, you should have a deeper discussion on whether this is the right team to work with for the next decade or more.

Powered by WPeMatico

After co-founding Insomnia Consulting, Stacey Abrams and Lara O’Connor Hodgson started Nourish to address a personal problem.

“We were at a meeting, I think for one of my campaigns,” explains Abrams, the Georgia-based lawyer and politician whose voting rights work became a focal point for the country in 2020. “[O’Connor Hodgson] needed to put together a baby bottle and had to trust the waiter to take the bottle back and wash it. She said, ‘I just wish there was a Dasani for babies.’ ”

Ultimately, however, Nourish ran into an issue. The company was a victim of its own successes, to hear Abrams describe it — or, more accurately, a victim of a system that didn’t provide it the right tools to grow. A problem with invoicing ultimately stopped the childcare in its tracks. But it was precisely those failings that planted the seed for their next company, the simply named Now.

Ultimately, however, Nourish ran into an issue. The company was a victim of its own successes, to hear Abrams describe it — or, more accurately, a victim of a system that didn’t provide it the right tools to grow. A problem with invoicing ultimately stopped the childcare in its tracks. But it was precisely those failings that planted the seed for their next company, the simply named Now.

“We started looking for a loan. All we needed was the money to meet the order. This was during the credit crunch, and we could not get it,” Abrams tells TechCrunch. “We went from bank to credit union to factoring, and every time we got near the end, the credit model changed and we got kicked out of the program. Finally, unfortunately, we had to let our business die. We grew to death. We got too big to meet the needs and didn’t have a solution.”

Abrams and O’Connor Hodgson founded Now in 2010 to provide small businesses a quicker method for getting invoices paid. When a business submits an invoice through NowAccount, the service pays 100% of the invoice, minus a 3% merchant fee.

“We sell bonds in the capital market, just like American Express does,” O’Connor Hodgson explains. “We have very low-cost capital that we’re able to give that small business their revenue immediately. And then we’ve built a system that allows us to manage the cost and risk of that, because we’re going to then wait 30+ days to get paid.”

Today the Georgia-based company announced that it has raised $9.5 million in Series A funding. The round, led by Virgo Investment Group and featuring Cresset Capital Partners, will be used to help scale Now’s offerings. It comes as the pandemic has put even more of a strain on invoices for many companies. O’Connor Hodgson says the average wait time for invoice payment expanded from around 50 days to between 70-80.

“We have served over 1,000 small businesses and we have processed over $700 million in transactions,” says O’Connor Hodgson. “So that’s $700 million of their capital that they have received sooner.”

Thus far, Now’s growth has largely been a product of word of mouth. The new influx of funding will go, in part, to market and advertising to get the product in front of more small businesses.

“When you’re a small business and someone tells you we have a solution to a problem that no one has been willing to solve, we sound like magic,” says Abrams. “And what we want people to understand and a big part of our scaling challenge has been, you have to experience it to believe it. And getting companies to understand that this actually does work the way we say that it does actually benefit you in the way we imagine, and that it works.”

Powered by WPeMatico

Human resources is generally a salient cornerstone of any organization, but digitization has democratized a lot of the work that goes into HR, and that’s meant more people in businesses interested in, and using, the kind of data that HR people build and typically manage. Today, a startup called ChartHop that’s built a platform to cater to that trend is announcing $35 million in funding on the heels of strong growth.

The Series B is being led by Andreessen Horowitz, a past backer, with Elad Gil and previous investors Cowboy Ventures and SemperVirens also participating. We understand from sources close to the company that the round values ChartHop at between $300 million and $400 million.

ChartHop was founded in New York by Ian White, now the CEO, who first started building the tools to fill what he felt were gaps in his own knowledge when he founded, ran and eventually sold his previous company, Sailthru (which was acquired by CampaignMonitor).

He said he realized the company could build “all the tech we wanted,” but when it came down to thinking about how to run and scale the business, that was at its heart actually a people question, and also understanding how departments, and the entire organization, looked and worked as a whole.

Image Credits: ChartHop

“It was not as important as hiring, structuring a ‘single you’ of the organization,” he said. (Ian’s pictured here to the right.) Similar to the great analytics tools that have been built for developers, sales teams and others, “What I wanted was people analytics,” he said. “I wanted to understand my team.”

That’s actually a very multifaceted question. It’s not just a matter of an org chart — a big enough task in its own right that the very day that ChartHop came out of stealth in early 2020, another org chart startup, The Org, launched, too. It’s also retention strategy, employee satisfaction, turnover statistics, diversity statistics, predictive visualizations on finances if one area was compensated differently, or if hiring were frozen, etc. “All of those problems became mine and there was no great software out there to solve for it,” White said.

The ChartHop platform is built like all strong structures these days in the world of tech: tons of integrations to feed data into ChartHop to make it richer; tons of integrations also to export and use that data in more dedicated applications when needed; and an easy way for everyone to update data but also put in place easy and strong protections to keep confidential data as it should be.

And while HR still “owns” the platform, White said, it can be accessed and used by anyone in the organization, and it is.

It seems that others have found the talent management software market lacking for it, too. Since 2019 it went from a team of one — White himself — to 75, with 130 corporates now using its services. The list has a strong list of household company names with a heavy emphasis in tech, from what White showed me. Revenues in the last 12 months — a time when the spread-out nature of many of our workplaces has meant an even greater need for a platform to manage all the information has possibly reached a high water mark — have grown at a rate of 17% month-by-month.

“With HR and people functions so crucial to the growth and success of businesses, it’s unfortunate that most HR teams lack the critical people data to drive organizational decision making,” said David Ulevitch, general partner at Andreessen Horowitz, in a statement. “ChartHop is the solution to this all-too-common problem, and is built by company leaders who have felt this pain personally. ChartHop’s visual approach to people analytics allows leaders to make organizational planning and strategy decisions with confidence. We’re thrilled to lead ChartHop’s Series B because of their impressive growth, the company’s vision, and the terrific, mission-oriented team they’ve assembled.” He also led the company’s seed round in February 2020.

“Since implementing ChartHop earlier this year, we’ve seen significant improvement in our engagement with talent routines as they’re managed via ChartHop,” said Sara Howe, vice president human resources at ZoomInfo, a customer of ChartHop, in a statement. “Our employees have found the simple user interface and the centralized view of their data as the most helpful features. Leaders across ZoomInfo have also leveraged ChartHop to ensure that their organizations are well structured to support our continued rapid growth.”

Powered by WPeMatico

“Digital transformation” has been on the mind of many an organization in the last year: the pandemic and the shift it’s brought to how we work are speeding up investments in new apps, infrastructure and work practices to improve productivity regardless of where we sit all day. Now, it looks like we’re on to the next stage of that journey: actually figuring out how to adopt and run with all that new tech.

In a sign of the times, today a startup called Whatfix — which has built a platform that helps make better use of tech investments by giving chatbot-style guidance to users on how to use apps, with the option also to apply AI to understand what a person is doing to suggest what actions to take next — is announcing $90 million in funding. It will use the money to continue expanding its tech platform and hiring more talent to meet demand, said CEO Khadim Batti, who co-founded the company with Vara Kumar (CTO), in an interview this week.

Sources close to the company — co-headquartered in San Jose and Bangalore — confirmed that the Series D round was made at a valuation of around $600 million, triple Whatfix’s value in its Series C round last year.

That sharp rise is due in part to the state of the market today, but also the company’s growth within that bigger trend. Whatfix today has some 500 global customers on its books, The Netherlands Red Cross, Experian, Sentry Financial Services, Cardinal Health Canada, BMC Software Inc., and Bausch & Lomb among them. Some 75% of its business is coming out of the U.S., with another 18% from Europe. Revenues in the last six months have been growing at a rate of 100% quarter-on-quarter.

“This pandemic has proven an inflection point for adoption,” said Batti (pictured above, left with Kumar, right).

This latest tranche of equity funding is coming from a mix of financial and strategic investors.

SoftBank’s Vision Fund 2 is leading the round, with Eight Roads Ventures, Sequoia Capital India, Dragoneer Investment Group, F-Prime Capital and Cisco Investments also investing. The company has raised just under $140 million in total.

“Digital adoption solutions” — the general term describing what Whatfix has built — have become a popular solution for enterprises that have found themselves in an IT pickle, Batti said.

“We’ve seen more than $500 billion spent on enterprise software, with areas like SaaS growing very fast. There is so much there, and every employee has access to do better work. But most are not adopting or using that software. This means a lot [of inefficiency] in ‘digital transformation,’” said Batti. “We are focusing on fixing this problem.”

Digital adoption and digital experience overall can come in many forms these days.

They include assistants that are embedded directly into apps themselves (with some versions of this — such as Clippy on Word — nearly as old as software itself). The category also includes separate platforms that integrate at the back end with the apps that you use, providing not just a single ingestion point for data but intelligence on how best to use it, and what to use. (Dooly for sales teams is an example of that, although I don’t know if it would describe itself as a “digital adoption solution” per se.)

Others like Pendo are geared more at observing how your sites and apps are being adopted and used by others. And there are a number of others out there specifically looking at digital adoption by enterprises and competing directly with Whatfix: they include Apty, Userlane, Applearn.

One of the biggest — WalkMe — yesterday announced an IPO at an estimated $2.5 billion valuation.

Overall digital adoption and digital experience are big businesses: one analyst estimates that the market is growing currently at a rate of just under 11% annually and will be worth $15.8 billion by 2025.

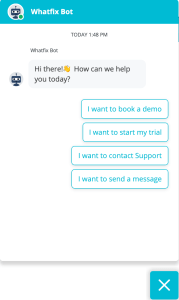

Whatfix is built around the premise that it sits on top of whatever apps a company may choose to use, and will work with just about any piece of modern software, Batti said. That includes Whatfix being able to provide assistance on apps even when they have been customised for a particular workplace. It most commonly appears like a little chatbot on the user’s screen, like the one in this paragraph, which can expand with more details and information as needed, like this:

Whatfix is built around the premise that it sits on top of whatever apps a company may choose to use, and will work with just about any piece of modern software, Batti said. That includes Whatfix being able to provide assistance on apps even when they have been customised for a particular workplace. It most commonly appears like a little chatbot on the user’s screen, like the one in this paragraph, which can expand with more details and information as needed, like this:

The company works with the most popular software packages — including Salesforce, MS Dynamics, Oracle’s CRM platform, ServiceNow, SuccessFactors, SharePoint, Workday — but, since it is used in the form of a browser extension or an overlay integrated by a company’s IT department, it can be used to help guide people with any application that’s available over the web. Batti said that one priority the startup has is to build deeper integrations with specific apps so that Whatfix can be used better across mobile and with local apps in future, not just via the web.

Many might think of “digital adoption” as training someone to use a particular software package, and while Whatfix is used for that, the company has also found a lot of traction as a tool beyond it, providing support on a more regular basis and across a wider variety of use cases, whether it’s to help guide people through app usage, or to monitor what they are doing in order to help suggest what to do next, and even populate relevant fields if “next” means using a different app.

The platform can be used to create usage guides, multilingual support, multi-device support, user tracking and more, and it comes with low-code options (it can be intergrated into an app with a single line of code, the company says).

The company claims its assistants can increase employee productivity by 35%, reduce training time and costs by 60%, reduce employee case tickets by 50% and increase application data accuracy by 20%.

While the field for digital adoption is very crowded today, it’s numbers like these, Whatfix’s own growth, and the fact that software is continuing to get more capable, but also more complex, that have interested investors.

“Digital Adoption Solutions are enhancing the growth and importance of SaaS products for enterprises globally,” said Munish Varma, Managing Partner, SoftBank Investment Advisers, in a statement. “Whatfix makes it easier for companies to use SaaS products, which increases productivity. Whatfix, with its roster of global clients, is well placed to become a DAS leader, and we are excited to be part of their journey.” Sumer Juneja, Partner, SoftBank Investment Advisers, added: “Enterprises spend billions on applications across multiple functions and yet employee adoption is low. Quick adoption ensures payback on software investments. Whatfix’s solutions will be a key driver for enterprises to achieve this goal, which is reflected in their growth.”

What will be interesting to watch is how platforms like Whatfix’s will evolve over time, and what further functions they might take on. For example, in enterprises, one of the biggest vulnerabilities in security has been how people mistakenly click on dodgy links in emails or otherwise inadvertently pass on information to malicious hackers. Could there be a role for digital adoption assistants to identify when this might happen and alert people before they click the wrong way? Regardless, the question and very existence of loopholes like that are signals for why we’ll probably why we’ll continue to see tools like Whatfix’s around for some time to come.

Powered by WPeMatico

Briq, which has developed a fintech platform used by the construction industry, has raised $30 million in a Series B funding round led by Tiger Global Management.

The financing is among the largest Series B fundraises by a construction software startup, according to the company, and brings Briq’s total raised to $43 million since its January 2018 inception. Existing backers Eniac Ventures and Blackhorn Ventures also participated in the round.

Briq CEO and co-founder Bassem Hamdy is a former executive at construction tech giant Procore (which recently went public and has a market cap of $10.4 billion) and Canadian software giant CMiC. Wall Street veteran Ron Goldshmidt is co-founder and COO.

Briq describes its offering as a financial planning and workflow automation platform that “drastically reduces” the time to run critical financial processes, while increasing the accuracy of forecasts and financial plans.

Briq has developed a toolbox of proprietary technology that it says allows it to extract and manipulate financial data without the use of APIs. It also has developed construction-specific data models that allows it to build out projections and create models of how much a project might cost, and how much could conceivably be made. Currently, Briq manages or forecasts about $30 billion in construction volume.

Specifically, Briq has two main offerings: Briq’s Corporate Performance Management (CPM) platform, which models financial outcomes at the project and corporate level, and BriqCash, a construction-specific banking platform for managing invoices and payments.

Put simply, Briq aims to allow contractors “to go from plan to pay” in one platform with the goal of solving the age-old problem of construction projects (very often) going over budget. Its longer-term, ambitious mission is to “manage 80% of the money workflows in construction within 10 years.”

The company’s strategy, so far, seems to be working.

From January 2020 to today, ARR has climbed by 200%, according to Hamdy. Briq currently has about 100 employees, compared to 35 a year ago.

Briq has 150 customers, and serves general and specialty contractors from $10 million to $1 billion in revenue. They include Cafco Construction Management, WestCor Companies and Choate Construction and Harper Construction. The company is currently focused on contractors in North America but does have long-term plans to address larger international markets, Hamdy told TechCrunch.

Hamdy came up with the idea for Santa Barbara, California-based Briq after realizing the vast amount of inefficiencies on the financial side of the construction industry. His goal was to do for construction financials what Procore did to document management, and PlanGrid to construction drawing. He started Briq with his own cash, amassed through secondary sales as Procore climbed the ranks of startups to become a construction industry unicorn.

Briq CEO and co-founder Bassem Hamdy. Image Credits: Briq

“I wanted to figure out how to bring the best of fintech into a construction industry that really guesses every month what the financial outcomes are for projects,” Hamdy told me at the time of the company’s last raise — a $10 million Series A led by Blackhorn Ventures announced in May of 2020. “Getting a handle on financial outcomes is really hard. The vast majority of the time, the forecasted cost to completion is plain wrong. By a lot.”

In fact, according to McKinsey, an astounding 80% of projects run over budget, resulting in significant waste and profit loss.

So at the end of a project, contractors often find themselves having doled out more money and resources than originally planned. This can lead to negative cash flow and profit loss. Briq’s platform aims to help contractors identify outliers, and which projects are more at risk.

Throughout the COVID-19 pandemic, Briq has proven to be “extremely valuable” to contractors, Hamdy said.

“In an industry where margins are so thin, we have given contractors the ability to truly understand where they stand on cash, profit and labor,” he added.

Powered by WPeMatico

The medical industry is sitting on a huge trove of data, but in many cases it can be a challenge to realize the value of it because that data is unstructured and in disparate places.

Today, a startup called Mendel, which has built an AI platform both to ingest and bring order to that body of information, is announcing $18 million in funding to continue its growth and to build out what it describes as a “clinical data marketplace” for people not just to organize, but also to share and exchange that data for research purposes. It’s also going to be using the funding to hire more talent — technical and support — for its two offices, in San Jose, California and Cairo, Egypt.

The Series A round is being led by DCM, with OliveTree, Zola Global, and MTVLP, and previous backers Launch Capital, SOSV, Bootstrap Labs and chairman of UCSF Health Hub Mark Goldstein also participating.

The funding comes on the heels of what Mendel says is a surge of interest among research and pharmaceutical companies in sourcing better data to gain a better understanding of longer-term patient care and progress, in particular across wider groups of users, not just at a time when it has been more challenging to observe people and run trials, but in light of the understanding that using AI to leverage much bigger data sets can produce better insights.

This can be important, for example, in proactively identifying symptoms of particular ailments or the pathology of a disease, but also recurring and more typical responses to specific treatment courses.

We previously wrote about Mendel back in 2017 when the company had received a seed round of $2 million to better match cancer patients with the various clinical trials that are regularly being run: the idea was that certain trials address specific types of cancers and types of patients, and those who are willing to try newer approaches will be better or worse suited to each of these.

It turned out, however, that Mendel discovered a problem in the data that it would have needed to enable its matching algorithms to work, said Dr. Karim Galil, Mendel’s CEO and founder.

“As we were trying to build the trial business, we discovered a more basic problem that hadn’t been solved,” he said in an interview. “It was the reading and understanding medical records of a patient. If you can’t do that you can’t do trial matching.”

So the startup decided to become an R&D shop for at least three years to solve that problem before doing anything with trials, he continued.

Although there are today many AI companies that are parsing unstructured information in order to extract better insights, Mendel is what you might think of as part of the guard of tech companies that are building out specific AI knowledge bases for distinct verticals or areas of expertise. (Another example from another vertical is Eigen, working in the legal and finance industries, while Google’s DeepMind is another major AI player looking at ways of better harnessing data in the sphere of medicine.)

The issue of “reading” natural language is more nuanced than you might think in the world of medicine. Galil compared it to the phrase “I’m going to leave you” in English, which could just as easily mean someone is departing, say, a room, as someone is walking out of a relationship. The “true” answer — and as we humans know even truth can be elusive — can only start to be found in the context.

The same goes for doctors and their observation notes, Galil said. “There is a lot hidden between the lines, and problems can be specific to a person,” or to a situation.

That has proven to be a lucrative area to tackle.

Mendel uses a mix of computer vision and natural language processing built by teams with extensive experience in both clinical environments and in building AI algorithms and currently provides tools to automate clinical data abstraction, OCR, special tools to redact and remove personal identifiable information automatically to share records, search engines to search clinical data and — yes — an engine to enable better matching of people to clinical trials. Customers include pharmaceutical and life science companies, real-world data and real-world evidence (RWD and RWE) providers and research groups.

And to underscore just how much there is still left to do in the world of medicine, along with this funding round, Mendel is announcing a partnership with eFax, an online faxing solution used by a huge number of healthcare providers.

Faxing is totally antiquated in some parts of the world now — I’m not even sure that people the age of my children (tweens) even know what a “fax” is — but they remain one of the most-used ways to transfer documents and information between people in the worlds of healthcare and medicine, with 90% of the industry using them today. The partnership with Mendel will mean that those eFaxes will now be “read” and digitized and ingested into wider platforms to tap that data in a more useful way.

“There is huge potential for the global healthcare industry to leverage AI,” said Mendel board member and partner at DCM, Kyle Lui, in a statement. “Mendel has created a unique and seamless solution for healthcare organizations to automatically make sense of their clinical data using AI. We look forward to continuing to work with the team on this next stage of growth.”

Powered by WPeMatico

Many people in emerging markets depend on informal public transport to move across cities. But while there are ride-hailing and bus-hailing applications in some of these cities, there’s a dire need for journey-planning apps to improve mobility for users and reduce the time they spend commuting.

South African-founded startup WhereIsMyTransport is one such company filling that gap for now. Today, it is announcing a $14.5 million Series A extension to continue its expansion across emerging markets; the company already has a presence in South Africa and Mexico.

Naspers, via its investment arm, Naspers Foundry, co-led the investment with Cathay AfricInvest Innovation Fund. According to Naspers, the size of its check was $3 million. Japan’s SBI Investment also participated in the round.

The extension round is coming a year after WhereIsMyTransport received a $7.5 million Series A investment from VC firms and strategic investment from Google, Nedbank and Toyota Tsusho Corporation (TTC).

Devin de Vries, Chris King and Dave New started the company in 2015. As a mobility startup, WhereIsMyTransport maps formal and informal public transport networks. The company then uses data gotten to improve the public transport experience, making commuting safe and accessible.

In addition to this, WhereIsMyTransport licenses some of this data to governments, DFIs, NGOs, operators, and third-party developers. It claims this is done for research, analytics, insights and consumer and enterprise solutions purposes.

“WhereIsMyTransport started in South Africa, focused on becoming a central source of accurate and reliable public transport data for high-growth markets. We’re thrilled to welcome Naspers as an investor as our journey continues in megacities across the majority world,” said CEO Devin de Vries in a statement.

Last year when we covered the company, it had mapped 34 cities in Africa while actively mapping some in India, Southeast Asia and Latin America. Since then, it expanded into Mexico City last November and has completed multiple data production projects in the city alongside Lima, Bangkok, Gauteng and Dhaka. Right now, the company has worked in 41 cities across 28 countries.

WhereIsMyTransport also launched its first consumer product Rumbo, which provides network information from all modes of public transport in Mexico with more than 100,000 users delivering over 750,000 real-time network alerts. The company says there are plans to launch Rumbo in Lima, Peru later this year.

Devin de Vries (CEO WhereIsMyTransport). Image Credits: WhereIsMyTransport

For co-lead investor Naspers Foundry, this is the firm’s first investment in mobility. So far, it has funded four other South African startups — Aerobotics, SweepSouth, Food Supply Network and The Student Hub — with a focus on edtech, food and cleaning sectors.

“We couldn’t pass on the opportunity to back an extraordinary South African founder who has built his business here in Cape Town to a global market leader in mapping formal and informal transportation with a strong focus on emerging markets,” head of Naspers Foundry Fabian Whate told TechCrunch.

He also added that there is an overlap between mobility and the food and e-commerce businesses that seem to be the main focus from a Naspers perspective. “The global food and e-commerce businesses, often operating in emerging markets, are quite reliant on mobility solutions. So there’s a great overlap between what the Naspers Group does and the vision for WhereIsMyTransport.”

In South Africa, WhereIsMyTransport’s clients include Johannesburg commuter rail system Gautrain and Transport for Cape Town. On the other hand, its international client base includes Google, the World Bank and WSP, and others.

South Africa CEO of Naspers Phuthi Mahanyele-Dabengwa said: “Mobility remains an obstacle for billions of people in high-growth markets across the world. Our investment in WhereIsMyTransport is a testimony of our belief that great innovation and tech talent is found in South Africa, and with the right backing and support, these businesses can provide solutions to local challenges that can improve the lives of ordinary people in South Africa and abroad.”

Powered by WPeMatico

Google has selected 30 startups to receive a share of its $2 million Black Founders Fund in Europe, providing these companies with a spot of cash, some valuable cloud services and a bit of good old-fashioned networking among the Google crew.

The fund was announced last fall as part of a company-wide effort toward “building a more equitable future for everyone,” alongside grants and new sponsorships. More than 800 companies applied and Google interviewed 100 of them, ultimately winnowing that down to the 30 announced today.

Each company will receive “up to” $100,000 in non-dilutive funding, and up to $120,000 in Ads grants and $100,000 in Cloud credits. (I’ve asked Google for more details on how the fund was divided, and if any company received this full amount. I’ll update if I hear back.)

They’ll also get access to Google’s entrepreneurial network, tech support and some other assets that don’t have hard numbers associated with them.

All the startups are led by Black founders, and 40% by women of color. One of the latter is Nancy de Fays, co-founder of LINE, which makes these cool battery-hub combos for the MacBook “Pro” that add a ton of ports and battery life and look sweet to boot. I’ve learned a lot chatting with her at trade shows, and regret that I do most of my work at a desktop so I don’t have an excuse to use one of the company’s gadgets.

In response to being selected for Google funding, de Fays penned a blog post exhorting corporations to throw their weight around in favor of social change, and for startups to lead the way in diversity and equity:

We buy values and standards more than we buy the product itself. We buy ideals of life more than the actual features. Putting the these two parameters in the equation – the capability of big corps to shout loud, and consumers’ receptiveness to brands values and messages – it does make sense to me that to drive such a society change, big companies should voice and convey strong messages.

Founders need to build diverse teams without falling into compassion fatigue. They must show empathy and respect and bring onboard the best talents. Period. They need to be outspoken about their values, convey a strong, global mindset and build their organisation around them. And if they find themselves scoring low on diversity along the way, they should question themselves on the why and act on it without doing charity.

It’s something of a counterpoint to the idea, also commonly expressed these days, that companies should be mission-focused and objective.

Here are the other 29 companies that Google will be giving a boost to (descriptions taken from the blog post):

Feels like we’ll be hearing from most of these folks again. You can find out more about Google’s startup programs here.

Powered by WPeMatico

The agriculture sector is ripe for technological improvements, but beyond satellite-based crop management and bees-as-a-service, the actual people who work in the fields should be benefiting as well. Ganaz, empowered by a $7 million A round, aims to change how people with little documentation and no bank account get paid and send money with a modern workforce stack that embraces low tech as well.

Growers — that is to say, the companies that own and operate the fields and sell the crops — are under pressure from multiple directions as wages rise, regulations increase and willing workers dwindle. They need to save money to make money, but they can’t do so by paying less; in addition to being cruel to a marginalized class of people, it would only exacerbate the labor shortage in the sector.

There are plenty of companies out there that help save costs by automating things like payroll and onboarding, but the agriculture business has some unique limitations.

“It’s still operating like it’s the ’80s,” explained Ganaz founder and CEO Hannah Freeman. The number one service these workers rely on is check cashing or payday loans, and fees from these, currency exchange, ATM fees and remittances eat up a significant portion of each paycheck. “The workforce in our world definitely doesn’t have corporate email and rarely uses personal email. They have trouble downloading and using mobile apps, don’t use usernames. But they’re very conversant in WhatsApp and SMS — so you have to kind of know how to build for them.”

The ecosystem has parallels to other regions that have stuck with older, cheaper technologies instead of adopting the latest and most expensive tech. Entire markets in Africa and South America, for instance, run on text-based commerce taking place on aging and unreliable infrastructure.

Ganaz has opted for a hybrid approach. The company’s platform offers several services on both the worker and employer side.

Onboarding and basic training can be done simply and intuitively for people who may not be highly literate, via tablets loaded with apps that also operate offline. The most common alternative seems to be file folders served out of a crate in the back of a pickup — that’s not a dig, it’s just what has made sense for years for this highly fluid, distributed workforce.

Payment and balance checks all happen over SMS or WhatsApp with workers, but for sensitive information they are shunted to a web app; similarly, integrated remittance partnerships are coming that will keep things simple and reduce fees.

On the employer side, the workers and all their vital stats and documents are tracked centrally in the kind of interface companies have grown to expect. And Ganaz works as an intermediary to send text alerts and questions.

So far Ganaz has 75 employers signed up, one of which is a Costco supplier group, and all told around 175,000 workers on the platform. Their ARR and user count both approximately tripled year over year, so they’re clearly on to something.

The company has tempered its rapid growth with designation as a public benefit corporation, which emphasizes the intention to do more than grow shareholder value. I asked about the tension between needing to show a profit and working in the service of a marginalized group.

“This keeps me up at night,” admitted Freeman. “We try to make sure to set ourselves up to be true to our mission. That means the folks we hire, our board of directors… we want to make sure we’re empathizing and honoring the trust we’ve built with people.”

That includes investors as well, and Freeman noted that the company ended up going with Trilogy as lead for this round partly because of that firm’s experience with Remit.ly.

For instance, Freeman noted, while it would be easy to juice profits by bumping ATM fees, that directly harms the people they’re trying to help. Instead, when they issue their payroll Mastercard later this year, that will allow workers to skip the check cashing step and its fees, and then Ganaz gets a share of the normal card transaction fee. “We can be equally successful that way,” said Freeman, and it doesn’t just replace another predatory structure.

After the cards the plan is to automate remittances, so a user can easily choose to send money to their family in a way that minimizes handling fees and so on. And there will be other options, accessible via text, to choose where money goes if not to the card.

Ganaz’s main market is the U.S. and Mexico, since the agriculture business and workforce are both largely binational, but there are other targets on the horizon. First, though, the company wants to solidify its position and feature set here. “There’s no breakaway winner yet, so we want to be that winner,” said Freeman.

The $7 million round also had participation from Bessemer Venture Partners, Founders’ Co-op, Taylor Ventures, AgFunder and Techstars. Rapid expansion and aggressive pursuit of the roadmap are next up for Ganaz.

“We are conscious of both the huge opportunity ahead of us to digitize billions of dollars in payroll, as well as the responsibility to build inclusive, low-cost, wealth-building tools for workers,” said Freeman.

Powered by WPeMatico