funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Indian cities are home to hundreds of millions of low-skilled workers who hail from villages in search of work. Many of them have lost their jobs amid the coronavirus pandemic that has slowed several economic activities in the world’s second-largest internet market.

Apna, a startup by an Apple alum, is helping millions of such blue and gray-collar workers upskill themselves, find communities and land jobs. On Wednesday it announced its acceptance by the market has helped it raise $70 million in a new financing round as the startup prepares to scale the 16-month-old app across India.

Insight Partners and Tiger Global co-led Apna’s $70 million Series B round, which valued the startup at $570 million. Existing investors Lightspeed India, Sequoia Capital India, Greenoaks Capital and Rocketship VC also participated in the round, which brings Apna’s to-date raise to over $90 million.

The startup, whose name is inspired from a 2019 Bollywood song, at its core is solving the network gap issue for workers. “Someone born in a privileged family goes to the best school, best college and makes acquaintance with influential people. Many born just a few kilometres away are dealt with a whole different kind of life and never see such opportunities,” said Nirmit Parikh, founder and chief executive of Apna, in an interview with TechCrunch.

Apna is building a scalable networking infrastructure, something that doesn’t currently exist in the market, so that these workers can connect to the right employers and secure jobs. “Apna’s focus on digitizing the process of job discovery, application and employer candidate interaction has the potential to revolutionize the hiring process,” said Griffin Schroeder, a partner at Tiger Global, in a statement.

The workers in India “already have a champion in them, we are just helping them find opportunities,” said Nirmit Parikh, founder and chief executive of Apna. (Apna)

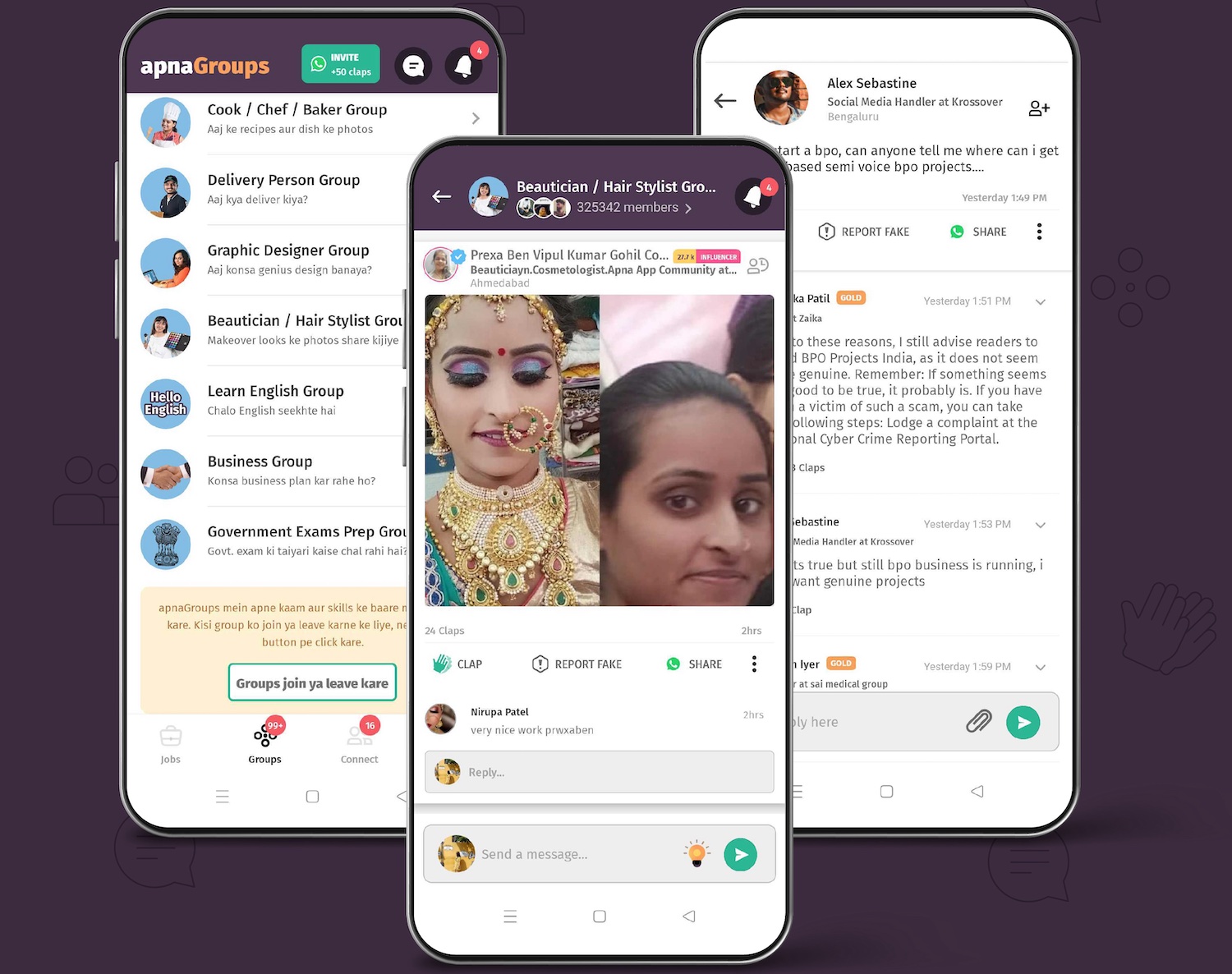

The startup’s eponymous Android app, available in multiple languages, features more than 70 communities today for skilled professionals such as carpenters, painters, field sales agents and many others.

On the app, users connect to each other and help with leads and share tips to improve at their jobs. The app also offers people the opportunity to upskill themselves, practice with their interview performance, and become eligible for even more jobs. The startup said it’s building Masterclass-like skilling modules, outcome or job based skilling, and also enabling peer-to-peer learning via its vertical communities. It plans to launch career counselling and resume building feature.

And that bet is working. The startup has amassed over 10 million users and just last month it facilitated more than 15 million job interviews, said Parikh. All jobs listed on the Apna platform are verified by the startup and free of cost for the candidates.

Apna has partnered with some of India’s leading public and private organizations and is providing support to the Ministry of Minority Affairs of India, National Skill Development Corporation and UNICEF YuWaah to provide better skilling and job opportunities to candidates.

Apna app (Apna)

More than 100,000 recruiters — including Byju’s, Unacademy, Flipkart, Zomato, Licious, Burger King, Dunzo, Bharti-AXA, Delhivery, Teamlease, G4S Global and Shadowfax — in the country today use Apna’s platform, where they have to spend less than five minutes to post job posts and are connect to hyperlocal candidates with relevant skills in within two days.

Apna has built the “market leading platform for India’s workforce to establish digital professional identity, network, access skills training, and find high quality jobs,” said Nikhil Sachdev, managing director, Insight Partners, in a statement.

“Employers are engaging with Apna at a rapid pace to help find high quality talent with low friction which is leading to best in class customer satisfaction scores. We believe that our investment will enable Apna to continue their steep growth trajectory, scale up their operations, and improve access to opportunities for India’s workforce.”

The startup plans to deploy the fresh capital to scale across India and eventually take the app to international markets, said Parikh. Apna, which has recently seen high-profile individuals from firms such as Uber, BCG and Swiggy join the firm, is also actively hiring for several tech roles in the South Asian market.

Apna has built the infrastructure and brand awareness in the market that it can launch in a new city within two days and drive over 10,000 interviews there in less than two days, it said.

“Our first goal is to restart India’s economy in the next couple of months and do whatever we can to help,” said Parikh, who was part of the iPhone product-operations team at Apple.

Powered by WPeMatico

How big is the market in India for a neobank aimed at teenagers? Scores of high-profile investors are backing a startup to find out.

Bangalore-based FamPay said on Wednesday it has raised $38 million in its Series A round led by Elevation Capital. General Catalyst, Rocketship VC, Greenoaks Capital and existing investors Sequoia Capital India, Y Combinator, Global Founders Capital and Venture Highway also participated in the new round, which brings FamPay’s to-date raise to $42.7 million.

TechCrunch reported early this month that FamPay was in talks with Elevation Capital to raise a new round.

Founded by Sambhav Jain and Kush Taneja (pictured above) — both of whom graduated from Indian Institute of Technology, Roorkee in 2019 — FamPay enables teenagers to make online and offline payments.

The thesis behind the startup, said Jain in an interview with TechCrunch, is to provide financial literacy to teenagers, who additionally have limited options to open a bank account in India at a young age. Through gamification, the startup said it’s making lessons about money fun for youngsters.

Unlike in the U.S., where it’s common for teenagers to get jobs at restaurants and other places and understand how to handle money at a young age, a similar tradition doesn’t exist in India.

After gathering the consent from parents, FamPay provides teenagers with an app to make online purchases, as well as plastic cards — the only numberless card of its kind in the country — for offline transactions. Parents credit money to their children’s FamPay accounts and get to keep track of high-ticket spendings.

In other markets, including the U.S., a number of startups including Greenlight, Step and Till Financial are chasing to serve the teenagers, but in India, there currently is no startup looking to solve the financial access problem for teenagers, said Mridul Arora, a partner at Elevation Capital, in an interview with TechCrunch.

It could prove to be a good issue to solve — India has the largest adolescent population in the world.

“If you’re able to serve them at a young age, over a course of time, you stand to become their go-to product for a lot of things,” Arora said. “FamPay is serving a population that is very attractive and at the same time underserved.”

The current offerings of FamPay are just the beginning, said Jain. Eventually the startup wishes to provide a range of services and serve as a neobank for youngsters to retain them with the platform forever, he said, though he didn’t wish to share currently what those services might be.

Image Credits: FamPay

Teens represent the “most tech-savvy generation, as they haven’t seen a world without the internet,” he said. “They adapt to technology faster than any other target audience and their first exposure with the internet comes from the likes of Instagram and Netflix. This leads to higher expectations from the products that they prefer to use. We are unique in approaching banking from a whole new lens with our recipe of community and gamification to match the Gen Z vibe.”

“I don’t look at FamPay just as a payments service. If the team is able to execute this, FamPay can become a very powerful gateway product to teenagers in India and their financial life. It can become a neobank, and it also has the opportunity to do something around social, community and commerce,” said Arora.

During their college life, Jain and Taneja collaborated and built an app and worked at a number of startups, including social network ShareChat, logistics firm Rivigo and video streaming service Hotstar. Jain said their work with startups in the early days paved the idea to explore a future in this ecosystem.

Prior to arriving at FamPay, Jain said the duo had thought about several more ideas for a startup. The early days of FamPay were uniquely challenging to the founders, who had to convince their parents about their decision to do a startup rather than joining firms or startups as had most of their peers from college. Until being selected by Y Combinator, Jain said he didn’t even fully understand a cap table and dilutions.

He credited entrepreneurs such as Kunal Shah (founder of CRED) and Amrish Rau (CEO of Pine Labs) for being generous with their time and guidance. They also wrote some of the earliest checks to the startup.

The startup, which has amassed over 2 million registered users, plans to deploy the fresh capital to expand its user base and product offerings, and hire engineers. It is also looking for people to join its leadership team, said Jain.

Powered by WPeMatico

Location-based services may have had their day as a salient category for hot apps or innovative tech leveraging the arrival of smartphones, but that’s largely because they are now part of the unspoken fabric of how we interact with digital services every day: We rely on location-specific information when we are on search engines, when we are using maps or weather apps, when we are taking and posting photos and more.

Still, there remain a lot of gaps in how location information links up with accurate information, and so today a company that’s made it its business to address that is announcing some funding as it scales up its service.

Uberall, which works with retailers and other brick-and-mortar operators to help them update and provide more accurate information about themselves across the plethora of apps and other services that consumers use to discover them, is announcing $115 million in funding. Alongside that, the Berlin startup is making an acquisition: it’s buying MomentFeed, a location marketing company based out of Los Angeles, to continue scaling its business.

The funding is being led by London-based investor Bregal Milestone, with Level Equity, United Internet and Uberall management also participating. From what we understand from sources, the funding values Uberall at around $500 million, and the deal for MomentFeed was made for between $50 million and $60 million.

The business combination is building way more scale into the platform: Uberall said that together they will manage the online presence for 1.35 million business locations, making the company the biggest in the field, with customers including the gas station operator BP, KFC, clothes and food chain Marks and Spencer, McDonald’s and Pizza Hut.

Florian Hübner, the CEO and co-founder of Uberall, noted in an interview that the companies have quite a lot of overlap, and in fact prior to the deal being made the companies worked together closely in the U.S. market, but all the same, MomentFeed has built some specific technology that will enrich the wider platform, such as a particularly strong tool for measuring sentiment analysis.

“Managing the online presence” is not a company’s website, nor is it its apps, but may nevertheless be its most common digital touchpoints when it comes to actually engaging with consumers online. It includes how those companies appear on local listings services like Yelp or TripAdvisor, or mapping apps like Google’s — which provide not just listings information like addresses and opening hours but also customer reviews — or social apps or location-based advertising. Altogether, when you are considering a company with multiple locations and the multiple touchpoints a consumer might use, it ends up being a complicated mess of places that need to be managed and kept up to date.

“We are the catalyst for this huge ecosystem where we enable the brands to use everything that the other tech platforms are offering in the best possible way,” Hübner told me. The tech platforms, meanwhile, are willing to work with middleware companies like Uberall to make the information on their services more accurate and complete by connecting with businesses when they have not managed to do so directly on their own. (And if you’ve ever been caught out by the wrong opening times on a Google Maps entry, or any other entry or piece of information elsewhere, you know this is an issue.)

And of course expecting any company with potentially hundreds of locations to provide the right details without a tool is also a nonstarter. “Casually updating 100,000 profiles is super hard,” Hübner said.

It also provides services to update information about vaccine and COVID-19 testing clinics, as well as other essential services that also have to contend with the same variations in location, opening hours and customer feedback as any other business on a site like Google Maps.

Altogether, Uberall has built out a platform that essentially connects up all of those end points, so that an Uberall customer can use a dashboard to provide updates that populate automatically everywhere, and also to read and respond to reviews.

Conversely, Uberall also can look out for instances where a company is being unofficially represented, or misrepresented, and locks those down. Alongside those, it has built a location-based marketing service that also serves ads for its customers. It is somewhat akin to social media management tools, which let you manage social media accounts and social media marketing campaigns, except that it’s covering a much more fragmented and disparate set of places where a company might appear online.

The bigger picture here is that just as location-based marketing is a fragmented business, so is the business of providing services to manage it. This move reduces down that field a little more and improves the efficiency of scaling such services.

“As we saw the market trending towards consolidation, we considered several potential companies to merge with. Uberall was by far our most preferred,” said MomentFeed CEO Nick Hedges in a statement. “This combination makes enormous strategic sense for our customers, who represent the who’s-who of leading U.S. omni channel brands. It helps accelerate our already rapid pace of innovation, giving customers an even greater edge in the hyper-competitive world of ’Near Me’ Marketing.” After the deal closes, Hedges will become Uberall’s chief strategy officer and EVP for North America.

“We are thrilled to partner with the Uberall team for this next phase of growth. Our strategic investment will significantly accelerate Uberall’s ambition to become the leading ‘Near Me’ Customer Experience platform worldwide. Uberall’s differentiated full-suite solution is unsurpassed by competition in terms of integration and functionality, providing customers with a real edge to reach, interact with, and convert online customers. We look forward to supporting Florian, Nick and their talented team to deliver on their exciting innovation and expansion roadmap,” said Cyrus Shey, managing partner of Bregal Milestone, in a statement.

Powered by WPeMatico

Sunlight is a great source of energy, but it rarely gets hot enough to fry an egg, let alone melt steel. Heliogen aims to change that with its high-tech concentrated solar technique, and has raised more than a hundred million dollars to test its 1,000-degree solar furnace at a few participating mines and refineries.

We covered Heliogen when it made its debut in 2019, and the details in that article still get at the core of the company’s tech. Computer vision techniques are used to carefully control a large set of mirrors, which reflect and concentrate the sun’s light to the extent that it can reach in excess of 1,000 degrees Celsius, almost twice what previous solar concentrators could do. “It’s like a death ray,” founder Bill Gross explained then.

That lets the system replace fossil fuels and other legacy systems in many applications where such temperatures are required, for example mining and smelting operations. By using a Heliogen concentrator, they could run on sunlight during much of the day and only rely on other sources at night, potentially halving their fuel expenditure and consequently both saving money and stepping toward a greener future.

Both goals hint at why utilities and a major mining and steel-making company are now investors. Heliogen raised a $25 million A-2, led by Prime Movers Lab, but soon also pulled together a much larger “bridge extension round” in their terminology of $83 million that brought in the miner ArcelorMittal, Edison International, Ocgrow Ventures, A.T. Gekko and more.

The money will be used both to continue development of the “Sunlight Refinery,” as Heliogen calls it, and deploy some actual on-site installations that would work in real production workflows at scale. “We are constantly making design and cost improvements to increase efficiency and decrease costs,” a representative of the company told me.

One of those pilot sites will be in Boron, California, where Rio Tinto operates a borates mine and will include Heliogen’s tech as part of its usual on-site processes, according to an MOU signed in March. Another MOU with ArcelorMittal will “evaluate the potential of Heliogen’s products in several of ArcelorMittal’s steel plants.” Facilities are planned in the U.S., MENA and Asia Pacific areas.

Beyond mining and smelting, the technique could be used to generate hydrogen in a zero-carbon way. That would be a big step toward building a working hydrogen infrastructure for next-generation fuel supply, since current methods make it difficult to do without relying on fossil fuels in the first place. And no doubt there are other industrial processes that could benefit from a free and zero-carbon source of high heat.

“We’re being granted the resources to do more projects that address the most carbon-intensive human activities and work toward our goals of lowering the price and emissions of energy for everyone on the planet,” Gross said in a release announcing the round(s). “We thank all of our investors for enabling us to pursue our mission and offer the world technology that will allow it to achieve a post-carbon economy.”

Powered by WPeMatico

Fraud protection startup nSure AI has raised $6.8 million in seed funding, led by DisruptiveAI, Phoenix Insurance, AXA-backed venture builder Kamet, Moneta Seeds and private investors.

The round will help the company bolster the predictive AI and machine learning algorithms that power nSure AI’s “first of its kind” fraud protection platform. Prior to this round, the company received $550,000 in pre-seed funding from Kamet in March 2019.

The Tel Aviv-headquartered startup, which currently has 16 employees, provides fraud detection for high-risk digital goods, such as electronic gift cards, airline tickets, software and games. While most fraud detection tools analyze each online transaction in an attempt to decide which purchases to approve and decline, nSure AI’s risk engine leverages deep learning techniques to accurately identify fraudulent transactions.

NSure AI, which is backed by insurance company AXA, said it has a 98% approval rating on average for purchases, compared to an industry average of 80%, allowing retailers to recapture nearly $100 billion a year in revenue lost by declining legitimate customers. The company is so confident in its technology that it will accept liability for any fraudulent transaction allowed by the platform.

Founders Alex Zeltcer and Ziv Isaiah started the company after experiencing the unique challenges faced by retailers of digital assets. The first week of their online gift card business found that 40% of sales were fraudulent, resulting in chargebacks. The founders began to develop their own platform for supporting the sale of high-risk digital goods after no other fraud detection service met their needs.

Zeltcer, co-founder and chief executive, said the investment “enables us to register thousands of new merchants, who can feel confident selling higher-risk digital goods, without accepting fraud as a part of business.”

NSure AI, which currently monitors and manages millions of transactions every month, has approved close to $1 billion in volume since going live in 2019.

Powered by WPeMatico

Andrea Campos has struggled with depression since she was eight years old. Over the years, she’s tried all sorts of therapies — from behavioral to pharmacotherapy.

In 2017, when Campos was in her early 20s, she learned to program and created a system to help manage her mental health. It started as a personal project, but as she talked to more people, Campos realized that many others might benefit from the system as well.

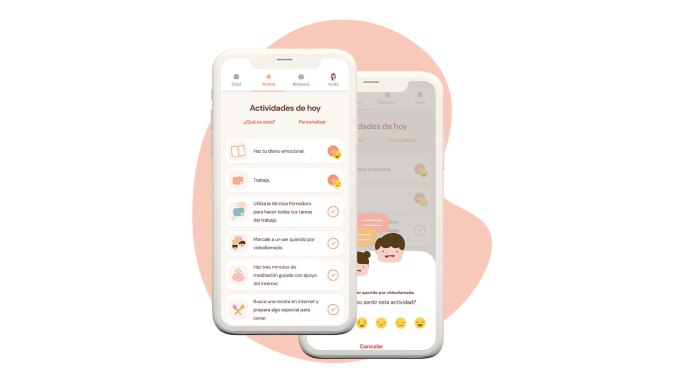

So she built an application to provide access to mental health tools for Spanish-speaking people and began testing it with a small group. At first, Campos herself was her own chatbot, texting with users who were tired of dealing with depression.

“During the month, I was pretending I was an app, and would send these people a list of activities they had to complete during the day, such as writing in a gratitude journal, and then asking them how those activities made them feel,” Campos recalls.

Her thinking was that sometimes with depression and anxiety comes “a lot of avoidance,” where people resist potential treatment out of fear.

The results from her small experiment were encouraging. So, Campos set out to conduct a bigger sample of experiments, and raised about $10,000 via a crowdfunding campaign. With that money, she hired a developer to build a chatbot for her app, which was mostly being used via Facebook Messenger.

Then an earthquake hit Mexico City and that developer lost everything — including his home and computer — and had to relocate.

“I was left with nothing,” Campos says. But that developer introduced her to another, who disappeared with his payment, and again, left Campos, “with nothing.”

“I realized at the beginning of 2019, I was going to have to do this by myself,” Campos said. So she used a site that she described as a “Wix for chatbots,” and created one herself.

After experimenting with the app with a sample of 700 people, Campos was even more encouraged and raised an angel round of funding for Yana, the startup behind her app. (Yana is an acronym for “You Are Not Alone.”) By early 2020, with just three months of runway left, she pivoted to create an app with chatbot integration that wasn’t just limited to use via Facebook Messenger.

Campos ended up launching the app more broadly during the same week that her city in Mexico went into quarantine.

Image Credits: Yana

At first, she said, she saw “normal, steady growth.” But then on October 10, 2020, Apple’s App Store highlighted Yana for International Mental Health Day, and the response was overwhelming.

“It was also my birthday so I was at a spa in a nearby town, relaxing, when I started hearing my cell phone go crazy,” Campos recalls. “Everything went nuts. I had to go back to Mexico City because our servers were exploding since they were not used to having that kind of volume.”

As a result of that exposure, Yana went from having around 80,000 users to reaching 1 million users two weeks later. Soon after that, Google highlighted the app as one of best for personal growth in 2020, and that too led to another spike in users. Today, Yana is about to hit the 5 million-user mark and is also announcing it has raised $1.5 million in funding led by Mexico’s ALLVP, which has also invested in the likes of Cornershop, Flink and Nuvocargo.

When the pandemic hit last year, six of Yana’s nine-person team decided to quarantine together in a “startup house” in Cancun to focus on building the company. Earlier this year, the company had raised $315,000 from investors such as 500 Startups, Magma and Hustle Fund. The company had pitched ALLVP, which was intrigued but wanted to wait until it could write a bigger check.

That time is now, and Yana is now among the top three downloaded apps in Mexico and 12 countries, including Spain, Chile, Ecuador and Venezuela.

With its new capital, Yana is planning to “move away from the depression/anxiety narrative,” according to Campos.

“We want to compete in the wellness space,” she told TechCrunch. “A lot of people were looking for us to deal with crises such as a breakup or a loss but then they didn’t always see a necessity to keep using Yana for longer than the crisis lasted.”

Some of those people would download the app again months later when hit with another crisis.

“We don’t want to be that app anymore,” Campos said. “We want to focus on whole wellness and mental health and transmit something that needs to be built every single day, just like we do with exercise.”

Moving forward, Yana aims to help people with their mental health not just during a crisis but with activities they can do on a daily basis, including a gratitude journal, a mood tracker and meditation — “things that prevent depression and anxiety,” Campos said.

“We want to be a vitamin for our soul, and keeping people mentally healthy on an ongoing basis,” she said. “We also want to include a community inside our application.”

ALLVP’s Federico Antoni is enthusiastic about the startup’s potential. He first met Campos when she was participating in an accelerator program in 2017, and then again recently.

The firm led Yana’s latest round because it “wanted to be on her team.”

“She [Campos] has turned into an amazing leader, and we realized her potential and strength,” he said. “Plus, Yana is an amazing product. When you download it, it’s almost like you can see a soul in there.”

Powered by WPeMatico

Beauty and wellness businesses have come roaring back to life with the decline of COVID-19 restrictions, and a startup that’s built a platform that caters to the many needs of small enterprises in the industry today is announcing a big round of funding to grow with them.

Fresha — a multipurpose commerce tool for independent wellness and beauty businesses such as hair, nail and skin salons, yoga instructors and more, based first and foremost around a completely free subscription platform for those businesses to schedule bookings from customers — has picked up $100 million.

Fresha plans to use the funds to expand the list of countries where it operates, to grow the categories of companies that use its services (mental health practitioners is one example; fitness is another) and to build more services complementing what it already provides, helping customers do their work by providing them with more insights and data about what they do already. It will also be making acquisitions to expand its customer base.

General Atlantic is leading this Series C, with Huda Kattan, Michael Zeisser of FMZ Ventures and Jonathan Green of Lugard Road Capital also participating, along with past investors Partech, Target Global and FJ Labs.

Fresha has raised $132 million to date, and it’s not disclosing its valuation. But as a point of reference, when it closed its Series B (as Shedul; the company rebranded in February 2020), it was valued at $105 million.

Chances are that figure is significantly higher now.

Fresha’s current range of services include a free-to-use platform for booking appointments; free software for managing accounts; a payments service that includes both a physical point of sale and digital interface; and a wider marketplace both to provide goods to the businesses (B2B); and for the businesses to sell goods to customers (B2C).

The London-based company has 50,000 business customers and 150,000 stylists and professionals in 120+ countries (mostly in the U.K., the U.S., Canada, Australia, New Zealand and Europe), with some 250 million appointments booked to date.

And while many businesses did have to curtail how they operated (and in some countries had to stop operating altogether), Fresha found that it was attracting a lot of new business in part because of its “free” model that meant customers didn’t have to pay to maintain a booking platform at a time when they weren’t taking bookings, but could use Fresha to generate revenues in other ways (such as through the sale of goods, vouchers for future services and more.)

So in a year when you might have thought that a company based around providing services to industries that were hard hit by COVID would have also been hard-hit, in fact Fresha saw a 30x increase in card payment transactions versus the year before, and more than $12 billion worth of booking appointments made on its platform.

In a market that is very crowded with tech companies building platforms to book beauty (and other) services and to manage the business of independent retailers — they include giants like Lightspeed POS, as well as smaller players like Booksy (which also recently raised) and StyleSeat, but also players like Square and PayPal, and many others — the core of Fresha’s offering is a booking platform built as a totally free product.

Why free? To attract more users to its other services (such as payments, which do come at a price), and because co-founders William Zeqiri (CEO) and Nick Miller (product chief) — pictured above, respectively left and right — think this the only way to build a business like this in a crowded market.

“We believe that software is a commodity,” said Zeqiri in an interview. “A lot of our competitors are beating each other on price to the bottom. We wanted to consolidate the supply side of the software, gather data about the businesses, how they use what they use.”

That data led, first, to identifying the need for and building out software and launching its B2B and B2C marketplaces, and the idea is that it will likely lead to more products as it continues to mature, whether it’s better analytics for its current customers so that they can better price or develop their services accordingly, or entirely new tools for new categories of users.

Meanwhile, the services that it already provides, like payments, have taken off like a shot, not least because they’ve served a need for any virtual transactions, like selling vouchers or items.

Miller noted that while a lot of its customers actually interface with tech with a lot of reluctance — they are the essence of “physical” retailers when you think about it — they also found themselves having to use more digital services simply because of circumstances. “Looking back at what happened, tech adoption accelerated for our customers,” said Miller. He said that current customers usage for the point-of-sale systems and online payments is roughly equal.

Looking ahead, Fresha’s investor list is notable for its strategic mix and might shed some light on how it grows. Kattan, a “beauty influencer” and the founder of Huda Beauty, is investing by way of HB Investments, a strategic venture arm; while Zeisser’s FMZ focuses on “experience economy” investments today, but he himself has a long history working at tech companies building marketplaces, including years with Alibaba as head of its U.S. investment practice. These speak to areas where Fresha is likely interested in expanding its reach — more marketplace activity; and perhaps more social media angles and exposure for its customers at a time when social media really has become a key way for beauty and wellness businesses to market themselves.

“Fresha has emerged as a leader powering the beauty and wellness industry,” said Aaron Goldman, Global co-head of financial services and managing director at General Atlantic, in a statement. “William, Nick and the Fresha team have built a product that is resonating with the market and creating long-term value through the intersection of its payments, software and marketplace offerings. We are thrilled to be partnering with the company and believe Fresha has significant opportunity to further scale its innovative platform.”

“I’ve witnessed firsthand the positive impact Fresha has for beauty entrepreneurs,” added Kattan. “The company is a force for good in the growing community of beauty professionals around the globe, who are increasingly adopting a self-employed approach. By making top business software accessible without any subscription fees, Fresha lets professionals focus on what they do best — offering great experiences for their customers.”

Powered by WPeMatico

Tiger Global is in talks to lead a $30 million round in Indian edtech startup Classplus, according to sources familiar with the matter.

The new round, which includes both primary investment and secondary transactions, values the five-year-old Indian startup at over $250 million, two sources told TechCrunch.

The new round follows another ~$30 million investment that was led by GSV recently, one of the sources said. The new round hasn’t closed, so terms may change.

Classplus — which has built a Shopify-like platform for coaching centers to accept fees digitally from students and deliver classes and study material online — also raised $10.3 million in September last year from Falcon Edge’s AWI, cricketer Sourav Ganguly and existing investors RTP Global and Blume Ventures. That round had valued Classplus at about $73 million, according to research firm Tracxn.

Classplus didn’t respond to a request for comment. Sources requested anonymity, as the matter is private.

As tens of millions of students — and their parents — embrace digital learning apps, Classplus is betting that hundreds of thousands of teachers and coaching centers that have gained reputation in their neighborhoods are here to stay.

The startup is serving these hyperlocal tutoring centers that are present in nearly every nook and cranny in India. “Anyone who was born in a middle-class family here has likely attended these tuition classes,” Mukul Rustagi, co-founder and chief executive of Classplus, told TechCrunch last year.

“These are typically small and medium setups that are run by teachers themselves. These teachers and coaching centers are very popular in their locality. They rarely do any marketing and students learn about them through word-of-mouth buzz,” he said then.

Rustagi had described Classplus as “Shopify for coaching centers.” Like Shopify, Classplus does not serve as a marketplace that offers discoverability to these teachers or coaching centers and instead it offers a way for these teachers to leverage its tech platform to engage with customers.

This year, Tiger Global has backed — or in talks to back — about two dozen startups in India.

Powered by WPeMatico

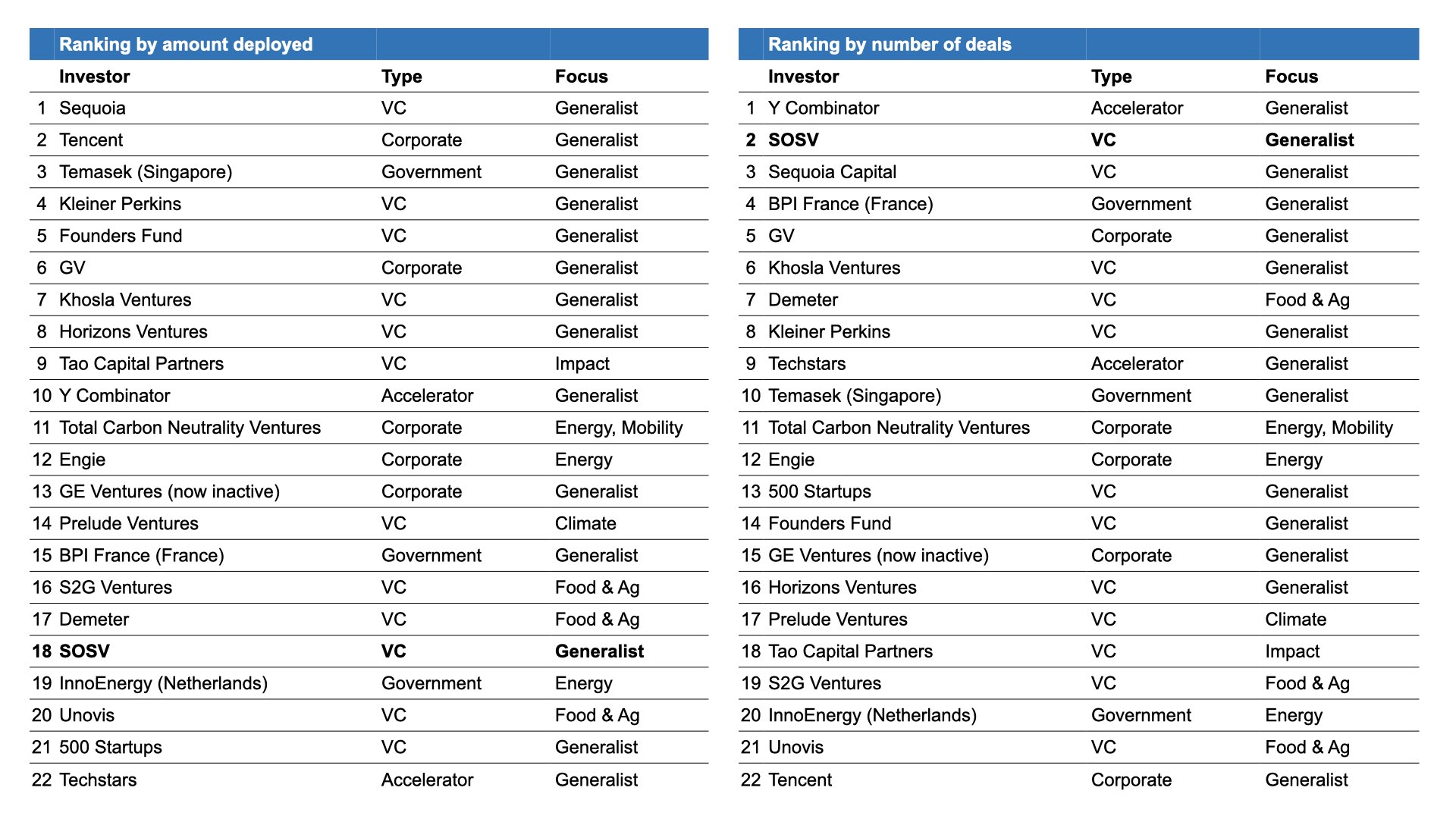

On Earth Day, April 22, SOSV published the SOSV Climate Tech 100, a list of the best startups that we’ve supported from their earliest stages to address climate change. There are always valuable insights embedded in a list like the 100. A TechCrunch story captured the investment perspective, and an SOSV post went deeper into the companies’ category breakdown and founder profiles.

But what can founders learn from the list about climate tech investors? In other words, who invested in the Climate Tech 100? We dug into the “who’s who” of the list, which had more than 500 investors, and here’s what we found.

If you think 500 investors in 100 companies is a lot of investors, you’re right. There are clearly a lot of investors interested in climate tech, and most are generalists just testing the waters. For the Climate Tech 100, about 10% of investors put their money in more than one startup and only seven (less than 2%) wrote a check to four or more. These included Blue Horizon, CPT Capital, EF, Fifty Years, Hemisphere Ventures and Horizons Ventures.

That pattern tracks well with data from PwC, which found that 2,700 unique investors had backed 1,200 startups in its State of Climate Tech 2020 report covering the 2013-2019 period. The report found that only 10 firms out of 2,700 made four or more climate tech deals per year, on average, over the 2013-2019 period. The most active firms are listed in the table below.

Image Credits: PwC, 2020; additional research by SOSV

Capital deployed in climate tech grew at five times the venture capital overall growth rate over the 2013-2019 period.

There is reason to believe that the fragmentation will diminish with the launch of more funds focused on climate tech. Four funds worth more than a billion dollars each have launched since 2020 that fit the description (see chart below).

It’s also encouraging to see that capital deployed in climate tech grew at five times the venture capital overall growth rate over the 2013-2019 period.

Even so, climate tech still only represented 6% of total venture capital deployed in 2019, so there is plenty of room to grow.

Powered by WPeMatico

When companies are considering buying a particular software service, they typically want to test it in their own environments, a process that can be surprisingly challenging. TestBox, a new startup, wants to change that by providing a fully working package with pre-populated data to give the team a way to test and collaborate on the product before making a buying decision.

Today the company announced it was making the product widely available; they also announced a $2.7 million seed round from SignalFire and Firstminute Capital along with several other investors and industry angels.

Company co-founder Sam Senior says he and his co-founder Peter Holland recognized that it was challenging for companies buying software to test it in a realistic way. “So TestBox is the very first time that companies are going to be able to test drive multiple pieces of enterprise software with an insanely easy-to-use live environment that’s uniquely configured to them with guided walk-throughs to make it really easy for them to get up to speed,” Senior explained.

He says that until now, even with free versions or free testing periods, it was hard to test and collaborate in that kind of environment with key stakeholders in the company. TestBox comes pre-populated with data generated by GPT-3 OpenAI to test how the software behaves and lets participants grade different features on a simple star rating system and provide comments as needed. All the feedback is recorded in a “notebook,” giving the company a central place to gather all the data.

What’s more, it puts the company buying the software more in control of the process instead of being driven by the vendor, which is typically the case. “Actually, now [the customer gets to] be the one who defines the experience, making them lead the process, while making it collaborative, and giving them more confidence [in their decision],” he said.

For now, the company plans to concentrate on customer support software and is working with Zendesk, HubSpot and Freshdesk, but has plans to expand and add partners over time. It has been talking with Salesforce about adding Service Cloud and hopes to have them in some form on the platform later this year. It also plans to expand into other verticals over time, like CRM, martech and IT help desks.

Senior is a former Bain consultant who worked with companies buying enterprise software, and saw the issues firsthand that they faced when it came to testing software before buying. He quit his job last summer, and began by talking to 70 customers, vendors and experts to get a real sense of what they were looking for in a solution.

He then teamed up with Holland and built the first version of the software before raising their seed money last October. The company began hiring in February and has eight employees at this point, but he wants to keep it pretty lean through the early stage of the company’s development.

Even at this early stage, the company is already taking a diverse approach to hiring. “Already when we have been working with recruiting firms, we’ve been saying that they need to split the pipeline as much as they can, and that’s been something we have spent a long, long time on. […] We spent actually six months with an open role on the front end because we are looking to build more diversity in our team as quickly as possible,” he said.

He reports that the company has a fairly equitable gender and ethnic split to this point, and holds monthly events to raise awareness internally about different groups, letting employees lead the way when it makes sense.

At least for now, he’s planning on running the company in a distributed manner, but acknowledges that as it gets bigger, he may have to look at having a centralized office as a home base.

Powered by WPeMatico