funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Orum, which aims to speed up the amount of time it takes to transfer money between banks, announced today it has raised $56 million in a Series B round of funding.

Accel and Canapi Ventures co-led the round, which also included participation from existing backers Bain Capital Ventures, Inspired Capital, Homebrew, Acrew, Primary, Clocktower and Box Group. The financing comes barely three months after Orum announced a $21 million Series A, and brings its total raised to over $82 million.

Orum CEO Stephany Kirkpatrick launched the company in 2019 after working for several years at LearnVest, a personal finance site founded by Alexa von Tobel that was acquired by Northwestern Mutual in 2015 for an estimated $375 million. Tobel went on to form Inspired Capital, a venture capital firm that put money in Orum’s $5.2 million seed round last August. Prior to that, the firm also provided Orum with an “inspiration check” that was the first money into the business.

“Most Americans are not familiar with the intricacies of ACH [automated clearing house) or why it takes multiple business days to move money between accounts,” Kirkpatrick said. “But none of us can allow money to wait 5-7 days to hit our accounts. It needs to be instant.”

Her mission with Orum is straightforward even if the technology behind it is complex. Put simply, Orum aims to use machine learning-backed APIs to “move money smartly across all payment rails, and in doing so, provide universal financial access.”

Orum’s first embeddable product, Foresight, launched in September of 2020. It’s an automated programming interface designed to give financial institutions a way to move money in real time. The platform uses machine learning and data science to predict when funds are available and to identify any potential risks. Its Momentum product “intelligently” routes funds across payments rails and is powered by banking providers JPMorgan Chase and Silicon Valley Bank.

“They power the back end of our Momentum platform that allows the money to move on a multirail basis,” Kirkpatrick told TechCrunch. “They power our access to real-time payments.”

Orum says it serves a range of enterprise partners, including Alloy, HM Bradley, First Horizon Bank and Zero Financial (which was recently acquired by Avant).

The volume of transactions being conducted with Orum is growing 100% month over month, Kirkpatrick said. Most of its early growth has come from word of mouth.

The remote-first company prides itself on diversity — in both its employee and investor base. For one, 48% of its 55-person headcount are female, and 48% are “nonwhite,” according to Kirkpatrick. Orum also recently joined the Cap Table Coalition — a partnership between high-growth startups and emerging investors who want to work to close the racial wealth gap — to allocate over 10% of its Series B round to underrepresented founders. For example, the financing includes investors such as the Neythri Features Fund, a group of South Asian women investing in the next generation of female founders and diverse teams.

Jeffrey Reitman, partner at Canapi Ventures (a firm whose LPs mostly consist of banks), told TechCrunch that those bank LPs conduct hundreds of millions of ACH transactions annually,

“They need a path to achieving a state where funds can be transferred instantly,” he said. “Orum’s product paves the path for many players in financial services and fintech — and beyond — to partake in faster money movement without compromising key risk principles.”

To Reitman, the company’s major differentiators are its team, which he describes as consisting of “the best group of data scientists and engineers in the space.”

“Many of their customers consider the team to be instrumental in helping to set the risk dials on how they fund transactions by teasing out key data and insights from historical transaction data,” he said. “Second, Orum is building one of the densest and most comprehensive data sets around the risks of money movement. Better data means better risk models, and it will be hard for other offerings to match Orum’s approach to building this rich data set.”

Accel Partner Sameer Gandhi, who joined Orum’s board as part of the latest financing, agrees. He believes that in an 18-month period, Orum has built “game-changing technology and an exceptional team.”

“Orum is tackling financial infrastructure from its foundation,” he said.

The headline was updated post-publication to reflect the correct funding amount.

Powered by WPeMatico

Accel announced Tuesday the close of three new funds totaling $3.05 billion, money that it will be using to back early-stage startups, as well as growth rounds for more mature companies. Notably, the 38-year-old Silicon Valley-based venture firm is doubling down on global investing.

The announcement underscores both the robust confidence investors continue to have for backing startups in the tech sector and the amount of money available to startups these days.

Specifically, today Accel is announcing its 15th early-stage U.S. fund at $650 million; its seventh early-stage European and Israeli fund also at $650 million and its sixth global growth stage fund at $1.75 billion. The latter fund is in addition, and designed to complement, a previously unannounced $2.3 billion global “Leaders” fund that is focused on later-stage investing that Accel closed in December.

Accel expects to invest in about 20 to 30 companies per fund on average, according to Partner Rich Wong. Its average investment in its growth fund will be in the $50 million to $75 million range, and $75 million and $100 million out of its global Leaders fund.

But the firm is also still eager and “excited” to incubate companies, Wong said.

“We’ll still write $500,000 to $1 million seed checks,” he told TechCrunch. “It’s important to us to work with companies from the very beginning and support them through their entire journey.”

Indeed, as TechCrunch recently reported, Accel has a history of backing companies that were previously bootstrapped (and often profitable) -– the latest example being Lower, a Columbus, Ohio-based fintech, which just raised a $100 million Series A.

Interestingly, Accel is often referred to some of these companies by existing portfolio companies (also in the case of Lower, whose CEO was referred to Accel by Galileo Clay Wilkes). More often than not, companies that Accel backs out of its early-stage and growth funds are bootstrapped and located outside of Silicon Valley.

The venture firm has long looked outside of Silicon Valley for opportunities, and has had offices not only in the Bay Area, but in London and Bangalore for years. Part of its investment thesis is to “invest early and locally,” according to Wong. Examples of this philosophy include investments in companies based all over the world — from Mexico to Stockholm to Tel Aviv to Munich.

Since the time of its last fund closure in 2019, the firm has seen 10 portfolio companies go public, including Slack, Austin-based Bumble, Bucharest-based UiPath, CrowdStrike, PagerDuty, Deliveroo and Squarespace, among others.

It also had 40 companies experience an M&A, including Utah-based Qualtrics’s $8 billion acquisition by SAP and Segment’s $3.2 billion acquisition by Twilio. Also, just last week, Rockwell Automation announced it was buying Michigan-based Plex Systems for $2.22 billion in cash. Accel first invested in Plex, which has developed a subscription-based smart manufacturing platform, in 2012.

Recent investments include a number of fintech companies such as LatAm’s Flink, Berlin-based Trade Republic, Unit and Robinhood rival Public. Accel has also backed as existing portfolio companies such as Webflow, a software company that helps businesses build no-code websites and events startup Hopin.

Wong says Accel is “open-minded but thematic” in its investment approach.

Accel Partner Sonali de Rycker, who is based out of London, agrees.

“For example, we’ll look at automation companies, consumer businesses and security companies, but at a global scale. Our goal is to find the best entrepreneurs regardless of where they are,” she said.

That has only been intensified by the recent rise of the smartphone and cloud, Wong said.

“Before, companies were mostly selling to the consumer in their own country,” he added. “But now the size of the market is so dramatically bigger, allowing them to become even larger, which is one of the reasons why I believe we’re seeing investment pace at this speed.”

To support this, it’s notable that Accel’s global Leaders fund is “dramatically” larger than the $500 million Leaders fund the firm closed in 2019.

Also, de Rycker points out, companies are staying private longer so the opportunity to invest in them until they sell or go public is greater.

Accel is also patient. In some cases, the firm’s investors will develop “years-long” relationships with companies they are courting.

“1Password is an example of this approach,” Wong said. “Arun [Mathew] had that relationship for at least six years before that investment was made. Finally, 1Password called and said ‘We’re ready, and we want you to do it.’ ”

And so Accel led the Canadian company’s first external round of funding in its 14-year history — a $200 million Series A — in 2019.

While the firm is open-minded, there are still some industries it has not yet embraced as much as others. For example, Wong said, “We’re not announcing a $2.2 billion crypto fund, but we have done crypto investments, and see some very interesting trends there. We’ll look at where crypto takes us.”

Powered by WPeMatico

Side, a real estate technology company that works to turn agents and independent brokerages into boutique brands and businesses, has raised “$50 million-plus” in a funding round that more than doubles its valuation to $2.5 billion.

The latest financing comes just three months after the San Francisco-based startup raised $150 million in a Series D funding round led by Coatue Management at a $1 billion valuation. Tiger Global Management led the latest investment, which also included participation from ICONIQ Capital and D1 Capital Partners. With the latest capital infusion, Side’s total raised since its 2017 inception now totals over $250 million. Matrix Partners, Sapphire Ventures, Trinity Ventures and 8VC led its earlier rounds.

Side says that it is now “backed by the three top technology initial public offering (IPO) underwriters” and that the latest funding “sets the stage for a future IPO.”

The startup pulled in between “$30 million and $50 million in revenue” in 2020 (a wide range, we know), and expects to double revenue this year. In 2019, Side represented over $5 billion in annual home sales across all of its partners. Today, the company’s community of agent partners represents over $15 billion in annual production volume. And it’s predicting that by the end of 2021, it will have closed over $20 billion in home sales, positioning the company “as a top 10 national brokerage by volume.”

Today, Side supports more than 1,800 partner agents across California, Texas and Florida. It says it’s seen a 200% year-over-year increase in agent-represented home sales across its three operating markets of California, Texas and Florida. The company plans to enter 15 new states by year’s end.

Guy Gal, Edward Wu and Hilary Saunders founded Side on the premise that most real estate agents are “underserved and under-appreciated” by traditional brokerage models.

CEO Gal said existing brokerages are designed to support “average” agents and, as such, the top-producing agents end up having to do “all of the heavy lifting.”

Side’s white label model works with agents and teams by exclusively marketing their boutique brand, while also providing the required technology and support needed on the back end. The goal is to help partner agents “predictably grow” their businesses and improve their productivity.

“The way to think about Side is the way you think about what Shopify does for e-commerce […] When partnering with Side, top-producing agents, teams and independent brokerages, for the first time in history, gain full ownership of their own brand and business without having to operate a brokerage,” Gal told me at the time of the company’s last raise. “When you spend years solving the problems of this very specific community of agents, you are able to use software to drive enormous efficiency for them in a way that has never been done before.”

Existing brokerages, he argues, actively discourage agents from becoming top producers and teams, because agents who serve fewer clients can be forced into paying much higher commission fees on every transaction, which means the incentives between brokerages and top agents and teams are misaligned.

“Top producers want to grow and differentiate, and brokerages want them to do less business at higher fees and be one more of the same under the same brand,” Gal said. “Side, rather than discouraging and competing with top-producing agents and teams, enables them to grow and scale their own business and brand.”

This story was updated post-publication with an updated valuation figure.

Powered by WPeMatico

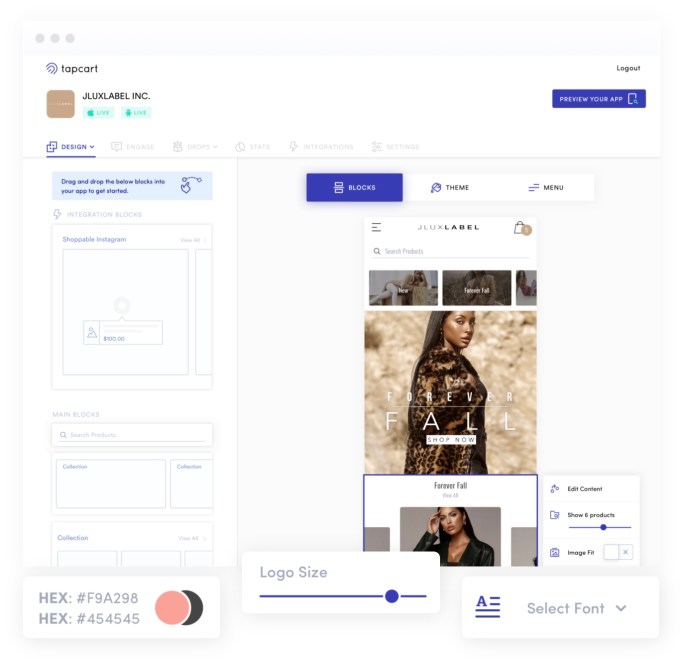

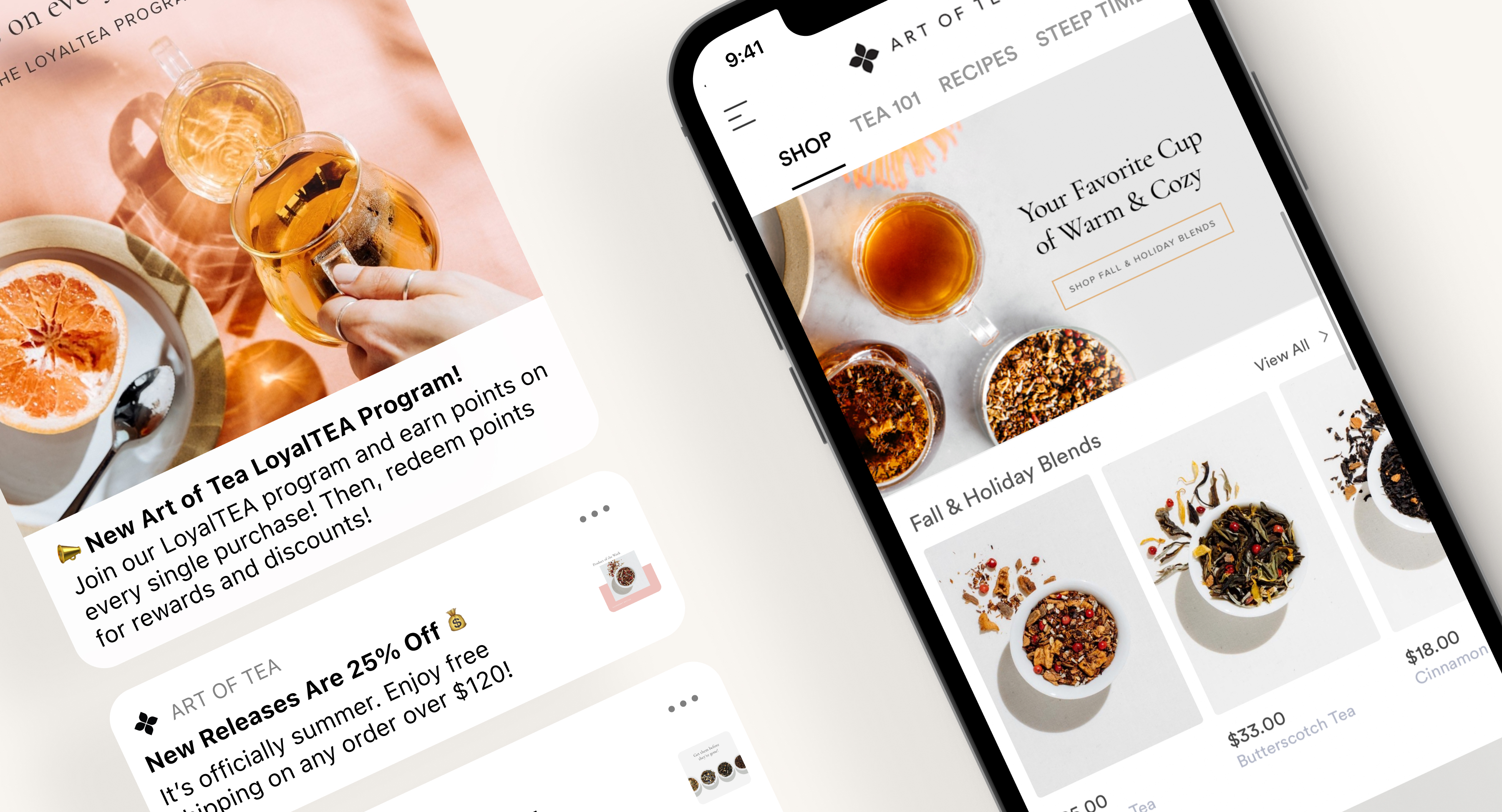

Shopify changed the e-commerce landscape by making it easier for merchants to set up their websites both quickly and affordably. A startup called Tapcart is now doing the same for mobile commerce.

The company, which has referred to itself as the “Shopify for mobile apps,” today powers the shopping apps for top brands, including Fashion Nova, Pier One Imports, The Hundreds, Patta, Culture Kings, and thousands more. Following a year of 3x revenue growth, in part driven by the pandemic, Tapcart is today announcing the close of a $50 million round of Series B funding, led by Left Lane Capital. Having clearly taken notice of Tapcart’s traction with its own merchant base, Shopify is among the round’s participants.

Other investors in the round include SignalFire, Greycroft, Act One Ventures and Amplify LA.

Tapcart’s co-founders, Sina Mobasser and Eric Netsch, have worked in the mobile app industry for years. Mobasser’s previous company, TestMax, offered one of the first test prep courses on iOS, while Netsch had more recently worked on the agency side to create mobile and digital experiences for brands. Together, the two realized the potential in helping online merchants bring their businesses to mobile, as easily as they were able to go online with Shopify.

Tapcart’s founders Sina Mobasser and Eric Netsch at their Santa Monica HQ. Image Credits: Tapcart

“Now, you can launch an app on our platform in a matter of weeks, where historically it would take up to a year if you wanted to custom build an app,” explains Mobasser. “And you can do it for a low monthly fee.”

Tapcart’s platform itself offers a simple drag-and-drop builder that allows anyone to create a mobile app for their existing Shopify store using tools to design their layout, customize the product detail pages, integrate checkout options, include product reviews, and even optionally add other branded content, like blogs, lookbooks, videos (including live video) and more. Everything is synced directly from Shopify to the app in real-time, so the merchant’s inventory, products and collections are all kept up-to-date. That’s a big differentiator from some rivals, which require duplicate sets of data and data transformation.

Tapcart, meanwhile, leverages all of Shopify’s APIs and SDKs to create a native application that works with Shopify’s existing data structures.

Image Credits: Tapcart

This tight integration with Shopify helps Tapcart because it doesn’t have to focus on the e-commerce infrastructure, as the way things are structured around inventory and collections are roughly 90% the same across brands. Instead, Tapcart focuses on the 10% that makes brands stand out from one another, which includes things like branding, content and design. Its CMS allows merchants to create exclusive content, change the colors and fonts, add videos and more to make the app look and feel fully customized.

Beyond the mobile app creation aspect to its business, Tapcart also helps merchants automate their marketing. Through the Tapcart platform, merchants can communicate with their customers in real-time using push notifications that can alert them to new sales, to encourage them to return to abandoned carts, or any other promotions. The marketing campaigns can be automated, as well, which helps merchants schedule their upcoming launches and product drops ahead of time. The company claims these push notifications deliver click-through rates that are 72% higher than a traditional email or SMS text because of their interactivity and branding.

Image Credits: Tapcart

The platform has quickly found traction with SMB to mid-market enterprise customers who have reached the stage of their business where it makes sense for them to double down on customer retention and conversion and optimize their mobile workflow.

“Our sweet spot is when you have maybe a couple hundred customers in your database,” notes Netsch. “That’s a perfect time to now focus less on the paid acquisition portion of your business and more on how to retain and engage those existing customers, [so they’ll] shop more and have a better experience,” he says.

During the past 12 months, over $1.2 billion in merchant sales have flowed through Tapcart’s platform. And in 2020, Tapcart’s recurring revenue increased by 3x, as mobile apps grew even faster during the pandemic, which had increased consumer mobile screen time by 20% year-over-year from 2019. Mobile commerce spending also grew 55% year-over-year, topping $53 billion globally during the holiday shopping season, the company says. Tapcart’s own merchants saw mobile app orders at a rate of more than once-per-second during this time, and it believes these trends will continue even as the pandemic comes to an end.

Today, Tapcart generates revenue by charging a flat SaaS (software-as-a-service) fee, which differentiates it from a number of competitors who charge a percent of the merchant’s total sales.

Image Credits: Tapcart

With the additional funding, Tapcart plans to focus on its goal of becoming a vertically integrated mobile commerce suite of tools, which more recently includes support for iOS App Clips. It will also soon release an upgraded version of its insights analytics platform and will offer scripts that merchants can install on their mobile websites to compare what works on the site versus what works in the app.

Later this year, Tapcart plans to launch a full marketing automation product that will allow brands to automate and personalize their notifications even further. And it plans to invest in market expansions to make its product better designed for mobile, global commerce.

The funding will allow Santa Monica-based Tapcart to hire another 200 people over the next 24 months, up from the 70 it has currently. These will include new additions across time zones and even in markets like Australia and Europe as it moves toward global expansion.

Shopify’s investment will open up a number of new opportunities as well, including on product, engineering, business strategy and partnerships. It will also help to get Tapcart in front of Shopify’s 1.7 million global merchants.

“There’s still quite a lot of merchants that need better mobile experiences, but have yet to really double down on the mobile effort and get something like a native app,” notes Netsch. “There’s a lot of different ways and methods that merchants are experimenting with mobile growth, and we’re trying to offer all of the best parts of that in a single platform. So there’s tons of expansion for Tapcart to do just that with the existing target addressable market,” he says.

“We believe brands must be where their customers are, and today that means being on their phones,” said Satish Kanwar, VP of product acceleration at Shopify, in a statement. “Tapcart helps merchants create mobile-first shopping experiences that customers love, reinforcing Shopify’s mission to make commerce better for everyone. We look forward to seeing Tapcart expand its success on Shopify with the more than 1.7 million merchants on our platform today.”

Powered by WPeMatico

Mercuryo, a startup that has built a cross-border payments network, has raised $7.5 million in a Series A round of funding.

The London-based company describes itself as “a crypto infrastructure company” that aims to make blockchain useful for businesses via its “digital asset payment gateway.” Specifically, it aggregates various payment solutions and provides fiat and crypto payments and payouts for businesses.

Put more simply, Mercuryo aims to use cryptocurrencies as a tool for putting in motion next-gen, cross-border transfers or, as it puts it, “to allow any business to become a fintech company without the need to keep up with its complications.”

“The need for fast and efficient international payments, especially for businesses, is as relevant as ever,” said Petr Kozyakov, Mercuryo’s co-founder and CEO. While there is no shortage of companies enabling cross-border payments, the startup’s emphasis on crypto is a differentiator.

“Our team has a clear plan on making crypto universally available by enabling cheap and straightforward transactions,” Kozyakov said. “Cryptocurrency assets can then be used to process global money transfers, mass payouts and facilitate acquiring services, among other things.”

Image Credits: Left to right: Alexander Vasiliev, Greg Waisman, Petr Kozyakov / MercuryO

Mercuryo began onboarding customers at the beginning of 2019, and has seen impressive growth since with annual recurring revenue (ARR) in April surpassing over $50 million. Its customer base is approaching 1 million, and the company has partnerships with a number of large crypto players including Binance, Bitfinex, Trezor, Trust Wallet, Bithumb and Bybit. In 2020, the company said its turnover spiked by 50 times while run-rate turnover crossed $2.5 billion in April 2021.

To build on that momentum, Mercuryo has begun expanding to new markets, including the United States, where it launched its crypto payments offering for B2B customers in all states earlier this year. It also plans to “gradually” expand to Africa, South America and Southeast Asia.

Target Global led Mercuryo’s Series A, which also included participation from a group of angel investors and brings the startup’s total raised since its 2018 inception to over $10 million.

The company plans to use its new capital to launch a cryptocurrency debit card (spending globally directly from the crypto balance in the wallet) and continuing to expand to new markets, such as Latin America and Asia-Pacific.

Mercuryo’s various products include a multicurrency wallet with a built-in crypto exchange and digital asset purchasing functionality, a widget and high-volume cryptocurrency acquiring and OTC services.

Kozyakov says the company doesn’t charge for currency conversion and has no other “hidden fees.”

“We enable instant and easy cross-border transactions for our partners and their customers,” he said. “Also, the money transfer services lack intermediaries and require no additional steps to finalize transactions. Instead, the process narrows down to only two operations: a fiat-to-crypto exchange when sending a transfer and a crypto-to-fiat conversion when receiving funds.”

Mercuryo also offers crypto SaaS products, giving customers a way to buy crypto via their fiat accounts while delegating digital asset management to the company.

“Whether it be virtual accounts or third-party customer wallets, the company handles most cryptocurrency-related processes for banks, so they can focus more on their core operations,” Kozyakov said.

Mike Lobanov, Target Global’s co-founder, said that as an experiment, his firm tested numerous solutions to buy Bitcoin.

“Doing our diligence, we measured ‘time to crypto’ – how long it takes from going to the App Store and downloading the app until the digital assets arrive in the wallet,” he said.

Mercuryo came first with 6 minutes, including everything from KYC and funding to getting the cryptocurrency, according to Lobanov.

“The second-best result was 20 minutes, while some apps took forever to process our transaction,” he added. “This company is a game-changer in the field, and we are delighted to have been their supporters since the early days.”

Looking ahead, the startup plans to release a product that will give businesses a way to send instant mass payments to multiple customers and gig workers simultaneously, no matter where the receiver is located.

Powered by WPeMatico

Snowflake changed the conversation for many companies when it comes to the potentials of data warehousing. Now one of the startups that’s hoping to disrupt the disruptor is announcing a big round of funding to expand its own business.

Firebolt, which has built a new kind of cloud data warehouse that promises much more efficient, and cheaper, analytics around whatever is stored within it, is announcing a major Series B of $127 million on the heels of huge demand for its services.

The company, which only came out of stealth mode in December, is not disclosing its valuation with this round, which brings the total raised by the Israeli company to $164 million. New backers Dawn Capital and K5 Global are in this round, alongside previous backers Zeev Ventures, TLV Partners, Bessemer Venture Partners and Angular Ventures.

Nor is it disclosing many details about its customers at the moment. CEO and co-founder Eldad Farkash told me in an interview that most of them are U.S.-based, and that the numbers have grown from the dozen or so that were using Firebolt when it was still in stealth mode (it worked quietly for a couple of years building its product and onboarding customers before finally launching six months ago). They are all migrating from existing data warehousing solutions like Snowflake or BigQuery. In other words, its customers are already cloud-native, Big Data companies: it’s not trying to proselytize on the basic concept but work with those who are already in a specific place as a business.

“If you’re not using Snowflake or BigQuery already, we prefer you come back to us later,” he said. Judging by the size and quick succession of the round, that focus is paying off.

The challenge that Firebolt set out to tackle is that while data warehousing has become a key way for enterprises to analyze, update and manage their big data stores — after all, your data is only as good as the tools you have to parse it and keep it secure — typically data warehousing solutions are not efficient, and they can cost a lot of money to maintain.

The challenge was seen firsthand by the three founders of Firebolt, Farkash (CEO), Saar Bitner (COO) and Ariel Yaroshevich (CTO) when they were at a previous company, the business intelligence powerhouse Sisense, where respectively they were one of its co-founders and two members of its founding team. At Sisense, the company continually came up against an issue: When you are dealing in terabytes of data, cloud data warehouses were straining to deliver good performance to power their analytics and other tools, and the only way to potentially continue to mitigate that was by piling on more cloud capacity. And that started to become very expensive.

Firebolt set out to fix that by taking a different approach, rearchitecting the concept. As Farkash sees it, while data warehousing has indeed been a big breakthrough in Big Data, it has started to feel like a dated solution as data troves have grown.

“Data warehouses are solving yesterday’s problem, which was, ‘How do I migrate to the cloud and deal with scale?’” he told me back in December. Google’s BigQuery, Amazon’s RedShift and Snowflake are fitting answers for that issue, he believes, but “we see Firebolt as the new entrant in that space, with a new take on design on technology. We change the discussion from one of scale to one of speed and efficiency.”

The startup claims that its performance is up to 182 times faster than that of other data warehouses with a SQL-based system that works on academic research that had yet to be applied anywhere, around how to handle data in a lighter way, using new techniques in compression and how data is parsed. Data lakes in turn can be connected with a wider data ecosystem, and what it translates to is a much smaller requirement for cloud capacity. And lower costs.

Fast forward to today, and the company says the concept is gaining a lot of traction with engineers and developers in industries like business intelligence, customer-facing services that need to parse a lot of information to serve information to users in real time and back-end data applications. That is proving out what investors suspected would be a shift before the startup even launched, stealthily or otherwise.

“I’ve been an investor at Firebolt since their Series A round and before they had any paying customers,” said Oren Zeev of Zeev Ventures. “What had me invest in Firebolt is mostly the team. A group of highly experienced executives mostly from the big data space who understand the market very well, and the pain organizations are experiencing. In addition, after speaking to a few of my portfolio companies and Firebolt’s initial design partners, it was clear that Firebolt is solving a major pain, so all in all, it was a fairly easy decision. The market in which Firebolt operates is huge if you consider the valuations of Snowflake and Databricks. Even more importantly, it is growing rapidly as the migration from on-premise data warehouse platforms to the cloud is gaining momentum, and as more and more companies rely on data for their operations and are building data applications.”

Powered by WPeMatico

Making the choice to adopt, or to find an adopting family, is a legally complex, emotionally taxing, expensive and time-consuming process. PairTree aims to make one part at least considerably easier and faster with its online matching platform where expectant mothers and hopeful adopters can find each other without the facilitation of an agency or other organization. The company has just raised a $2.25 million seed round, a rarity in the industry.

The path to adoption is different for everyone, but there are generally some things they have in common: Once the process is started, it can take upwards of $50,000 and over a year-and-a-half to organize a match. While some of this comprises the ordinary legal hurdles involved in any adoption, a big part of it is simply that there are limited opportunities for adoption, and compatibility isn’t guaranteed. As many people considering adoption are doing so on the heels of unsuccessful fertility treatment, it can be a lot to take on and a dispiriting wait.

Erin Quick, CEO and co-founder (with CTO Justin Friberg) of PairTree, said that the modern adoption landscape is marked by the fact that nearly 95 percent of adoptions are open, meaning there is ongoing contact between a biological mother and adopting family.

“They’ll be working together forever, and that makes finding a highly compatible match that much more important,” Quick, herself a happy adopter, told TechCrunch in an interview. But because of the way adoption is generally done — through agencies licensed by states — there are limitations on how far anyone involved can reach.

“It’s so bound by geography,” she said. “It’s regulated at the state level and has been facilitated by state level, not because of state laws — there’s no rule saying you can’t adopt out of state — but because the facilitators are small nonprofits. They bind themselves to their geographic region because that’s what they can serve. We’re building a platform that makes what people are already doing much easier and more efficient.”

That platform is in many ways very much like a dating app, though of course the comparison is not exact and does not reflect the gravity of choosing to adopt. But like in the dating world, in adoption you have a cloud of people looking to connect over something highly dependent on personality and individual needs.

PairTree onboards both expectant mothers and adopters with personality tests — not the light-hearted stuff of OkCupid but a broader, more consequential set of Jungian archetypes that signal a person’s high-level priorities in life. Think “wants to travel and learn” versus “wants to provide and nurture” (not that these are necessarily incompatible) — they serve as important indicators of preferences that might not be so easily summarized with a series of checkboxes. That’s not the only criterion, of course. Other demographic and personal details are also collected.

The adopters are added to a pool through which expectant mothers can sift and, if desired, contact (in this, Quick suggested, PairTree mirrors Bumble, where women must message first). PairTree also does basic due diligence stuff like identify verification and confirmation of other important steps like home studies.

If a likely match is found, all the relevant information is passed to the adoption facilitator, who will be coordinating the other legal and financial steps. PairTree isn’t looking to replace these agencies — in fact Quick said that they have been huge proponents of the platform, since it can shorten wait times and improve outcomes. She said based on their existing successful adoptions that the wait can be cut by half or even two-thirds, and thus the cost (which involves recurring payments as the agency searches and does the legal work) by a similar amount.

“These are small nonprofits; they don’t have a lot of tech chops. When we launched we went to attorneys first, actually, and we were surprised when agencies started reaching out,” she explained.

Agencies have been referring their adopters to PairTree, which has led to a lot of early traction, Quick said. And importantly, they’ve seen great diversity in their early success.

“Adoption has historically been denied by faith-based systems — LGBTQ families and single women have been subject to discrimination,” she noted. And in fact just last week a Supreme Court decision held up the right of religious adoption agencies to deny services to same-sex couples. Quick was proud to say that they have already facilitated adoptions by same-sex couples and single parents.

The company will also set aside 5 percent of its net profits, which hopefully will manifest in volume, for the Lifetime Healing Foundation, which offers counseling and support to birth mothers who have gone though the adoption process.

The $2.25 million seed round was led by Urban Innovation Fund, with Founder Collective, Female Founders Alliance and Techstars participating. It will surprise few to hear that adoption is not a particularly hot industry for venture capital, but rising interest and investment in fertility tech may have shed light on opportunities in adjacent spaces. Adoption is one where significant improvements can be enabled by technology, meaning startups can grow fast while having a positive impact.

The company plans to use the money to expand its product portfolio, pursue more partnerships, and perhaps most importantly for its users, build a native mobile app, since 90 percent of the service’s viewership is mobile.

“We’re grateful to our expert and diverse group of investors who share our vision that adoption should be a viable path to parenting for more people,” said Quick in the release announcing the raise. “Like us, our investors believe in the importance of supporting Biological and Adopting Families along with the Adoptees, because adoption is not a single transaction but a journey they’re taking over the course of a lifetime.”

Powered by WPeMatico

Five-year old self-driving truck startup Embark Trucks Inc. said Wednesday it would merge with special purpose acquisition company Northern Genesis Acquisition Corp. II in a deal valued at $5.2 billion.

Embark takes a different approach to autonomous trucking: As opposed to manufacturing and operating a fleet of trucks themselves, which is the route rival TuSimple is taking, Embark offers its AV software as a service. Carriers and fleets can pay a per-mile subscription fee to access it. The company includes carriers Mesilla Valley Transportation and Bison Transport, and companies Anheuser-Busch InBev and HP Inc., among its partners.

Carriers purchase trucks with compatible hardware directly from OEMs, so Embark says it has designed its system to be “platform agnostic” across multiple components and manufacturers. The company says its software can simulate up to 1,200, 60-second scenarios per second, and make adaptive predictions using those scenarios for the behavior of other vehicles on the road.

Embark said in an investor presentation for the SPAC deal that it was targeting “driver-out,” or operating on roads without a safety driver, by 2023 and launching at a commercial scale across the American sunbelt the following year. However, Embark still has technical milestones yet to achieve, noting in the presentation that the software still needs to accomplish actions, such as interactions with emergency vehicles and responding to blown tires and other mechanical failures.

Upon closing, the transaction will inject Embark with around $615 million in gross cash proceeds, including $200 million in private investment in public equity (PIPE) funding from investors, including CPP Investments, Knight-Swift Transportation, Mubadala Capital, Sequoia Capital and Tiger Global Management.

Embark also said former Department of Transportation Secretary Elaine Chao was joining its board, likely a boon for a company operating in the autonomous trucking industry, which is still only authorized for commercial deployment in 24 states.

Embark was founded in 2016 by CEO Alex Rodrigues and CTO Brandon Moak, who worked together on autonomous driving while completing engineering degrees from Canada’s University of Waterloo. After launching out of Y Combinator, the company quickly went on to raise $117 million in total funding, including a $30 million Series B led by Sequoia Capital and a $70 million Series C led by Tiger Global Management.

The transaction is anticipated to close in the second half of 2021. The company joins competitor AV trucking developer Plus in going public via a SPAC merger. TuSimple opted for a traditional initial public offering in March.

Powered by WPeMatico

Lower, an Ohio-based home finance platform, announced today it has raised $100 million in a Series A funding round led by Accel.

This round is notable for a number of reasons. First off, it’s a large Series A even by today’s standards. The financing also marks the previously bootstrapped Lower’s first external round of funding in its seven-year history. Lower is also something that is kind of rare these days in the startup world: profitable. Silicon Valley-based Accel has a history of backing profitable, bootstrapped companies, having also led large Series A rounds for the likes of 1Password, Atlassian, Qualtrics, Webflow, Tenable and Galileo (which went on to be acquired by SoFi).

In fact, Galileo founder Clay Wilkes introduced the VC firm to Dan Snyder, Lower’s founder and CEO. The two companies have a few things in common besides being profitable: they were both bootstrapped for years before taking institutional capital and both have headquarters outside of Silicon Valley.

“We were immediately intrigued because Ohio-based Lower echoes both of these themes,” said Accel partner John Locke, who led the firm’s investment in Lower and is taking a seat on the company’s board as part of the investment. “Like Galileo, Lower will be one of the most successful bootstrapped fintech companies globally. The combination of a company built in a nontraditional region across the globe and a bootstrapped company reminds us of [other] companies we have partnered with for a large Series A.”

There were other unnamed participants in the round, but Accel provided the “majority” of the investment, according to Lower.

Snyder co-founded Lower in 2014 with the goal of making the home-buying process simpler for consumers. The company launched with Homeside, its retail brand that Snyder describes as “a tech-leveraged retail mortgage bank” that works with realtors and builders, among others.

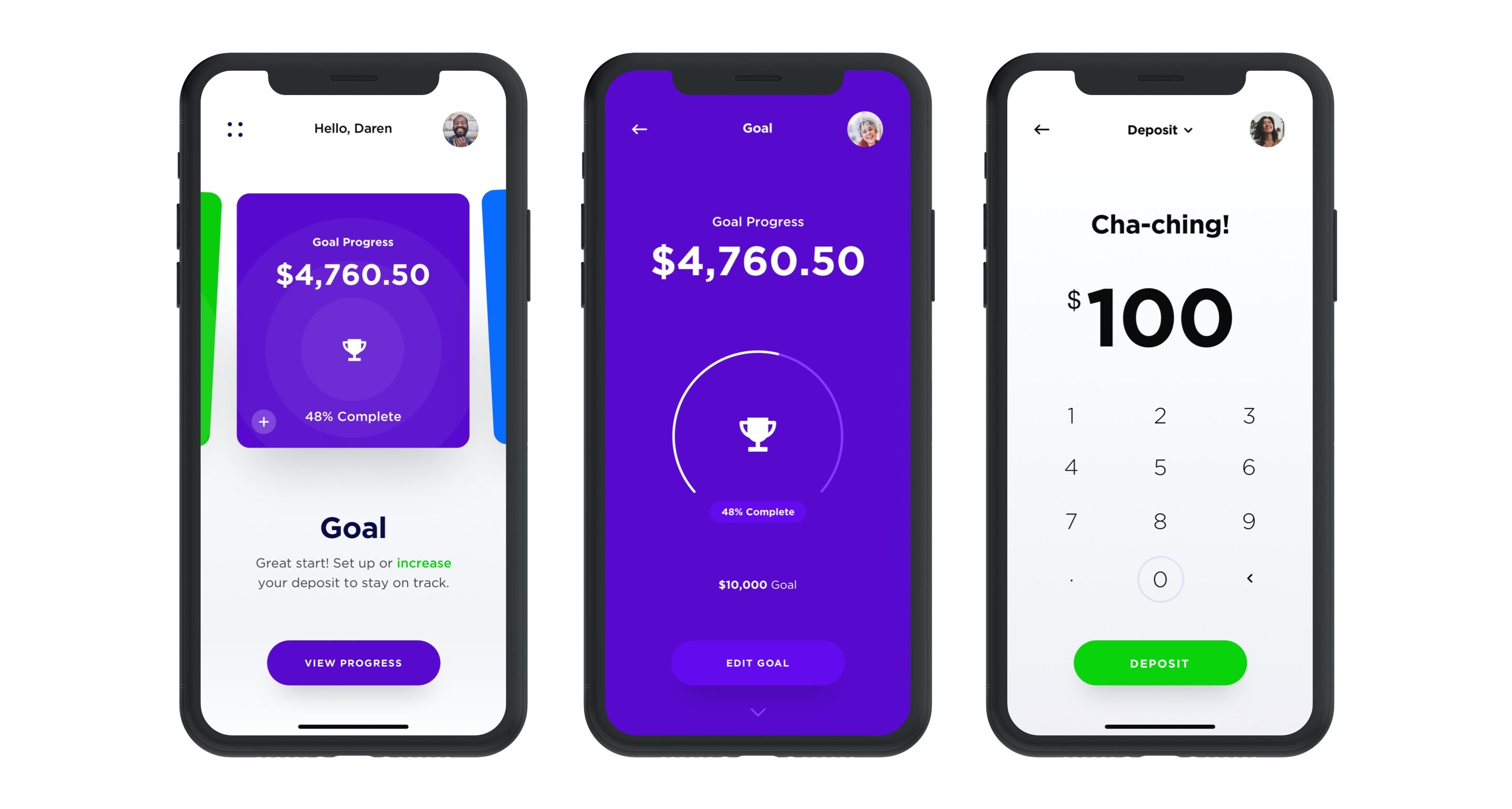

In 2018, the company launched the website for Lower, its direct-to-consumer digital lending brand with the mission of making its platform a one-stop shop where consumers can go online to save for a home, obtain or refinance a mortgage and get insurance through its marketplace. This year, it launched the Lower mobile app with a savings account.

Sitting (L to R): Co-founders Dan Snyder, Grayson Hanes

Standing (L to R): Co-founders Mike Baynes, Chris Miller

Not pictured: Robert Tyson; Image credit: Lower

Over the years, Lower has funded billions of dollars in loans and notched an impressive $300 million in revenue in 2020 after doubling revenue every year, according to Snyder.

“Our history is maybe a little atypical of fintech companies today,” he told TechCrunch. “We’ve had a view going back to the start of the company that we wanted to run it profitably. That’s been one of our pillars, so that’s what we’ve done. Also, we all grew up in the mortgage industry, so we saw firsthand the size of the market, but also how broken it was, so we wanted to change it.”

In launching the direct-to-consumer digital lending brand, the company was working to make the homebuying process more “digital, transparent and easier for consumers to access,” Snyder said.

At the same time, the company didn’t want to lose the human touch.

“We tried to design the app flow in a way where you can get as far along as you can in the application but if you want, at any point in time, to talk or chat with someone, we’re available,” Snyder added.

Image Credits: Lower

Lower’s typical customer is the millennial and now Gen Z who’s aspiring to own their first home, according to Snyder.

“They might be thinking, ‘OK, I might be living in an apartment now, but in the next few years I’m going to meet someone and/or have a child and I want to unlock the investment that is a home,’” he told TechCrunch. “And we’ll help them on that journey.”

Lower’s recently launched new app offers a deposit account it’s dubbed “HomeFund.” The interest-bearing, FDIC-insured deposit account offers a 0.75% Annual Percentage Yield and is designed to help consumers save for a home with a “dollar-for-dollar match in rewards” up to the first $1,000 saved, Snyder said.

Lower works with more than 35 major insurance carriers nationally, including Nationwide, Liberty Mutual and Allstate. It has more than 1,600 employees, about half of which are based in Lower’s home state. That’s up from about 650 employees in June of 2020.

Looking ahead, the company plans to add more services and has an “aggressive roadmap” for adding new features to its platform. Today, for example, Lower sells primarily to Fannie Mae and Freddie Mac. And while it services the majority of its loans, like many large lenders, it uses a subservicer. That will change, however, in early 2022, when Lower intends to launch its own native servicing platform.

And while the company intends to continue to run profitably, Snyder said he and his co-founders “think the time is now to gain share.”

“We want to become a global brand, raise money and gain market share,” he added. “We’re going to continue to double down on product and build out our capabilities. We are the best-kept secret in fintech and plan to change that with smart branding, advertising and sponsorships.”

And last but not least, Lower is eyeing the public markets as part of its longer-term roadmap.

“Ultimately, we know we can build a great public company,” Snyder told TechCrunch. “We’re of the scale to be a public company right now, but we’re going to keep our heads down and we’re going to keep building for the next few years and then I think we can be in a spot to be a strong public business.”

Accel’s Locke points out that in the U.S., mortgage and home finance are among the largest financial service markets, and they have primarily been handled by large banks.

“For most consumers, getting a mortgage through these banks continues to be an overly complex, slow-moving process,” Locke told TechCrunch. “We believe by providing consumers a great mobile experience, Lower will gain share from incumbent banks, in the same way that companies like Monzo have in banking or Venmo in payments or Trade Republic and Robinhood in stock trading.”

Powered by WPeMatico

Diversity and inclusion have become central topics in the world of work. In the best considerations, improving them is a holistic effort, involving not just conceiving of products with this in mind, but hiring and managing talent in a diverse and inclusive way, too. A new startup called Pequity, which has built a product to help with the latter of these areas, specifically in equitable compensation, has now raised some funding — a sign of the demand in the market, as well as how tech is being harnessed in aid of helping it.

The San Francisco-based startup has raised $19 million in a Series A led by Norwest Venture Partners. First Round Capital, Designer Fund, and Scribble Ventures also participated in the fundraise, which will be used to continue investing in product and also hiring: the company has 20 on its own books now and will aim to double that by the end of this year, on the heels of positive reception in the market.

Since launching officially last year, Pequity has picked up over 100 customers, with an initial focus on fast-scaling companies in its own backyard, a mark of how D&I have come into focus in the tech industry in particular. Those using Pequity to compare and figure out compensation include Instacart, Scale.ai and ClearCo, and the company said that in the last four months, the platform’s been used to make more then 5,000 job offers.

Image Credits: Pequity (opens in a new window)

Kaitlyn Knopp, the CEO who co-founded the company with Warren Lebovics (both pictured, right), came up for the idea for Pequity in much the same way that many innovations in the world of enterprise IT come to market: through her own first-hand experience.

She spent a decade working in employment compensation in the Bay Area, with previous roles at Google, Instacart, and Cruise. In that time, she found the tools that many companies used were lacking and simply “clunky” when it came to compensation analysis.

“The way the market has worked so far is that platforms had compensation as an element but not the focus,” she said. “It was the end of the tagline, the final part of a ‘CRM for candidates.’ But you still have to fill in all the gaps, you have to set the architecture the right way. And with compensation, you have to bake in your own analytics, which implies that you have to have some expertise.”

Indeed, as with other aspects of enterprise software, she added that the very biggest tech companies sometimes worked on their own tools, but not only does that leave smaller or otherwise other-focused businesses out of having better calculation tools, but it also means that those tools are siloed and miss out on being shaped by a bigger picture of the world of work. “We wanted to take that process and own it.”

The Pequity product essentially works by plugging into all of the other tools that an HR professional might be using — HRIS, ATS, and payroll products — to manage salaries across the whole of the organization in order to analyse and compare how compensation could look for existing and prospective employees. It combines a company’s own data and then compares it to data from the wider market, including typical industry ranges and market trends, to provide insights to HR teams.

All of this means that HR teams are able to make more informed decisions, which is step number one in being more transparent and equitable, but is also something that Pequity is optimized to cover specifically in how it measures compensation across a team.

And in line with that, there is another aspect of the compensation mindset that Knopp also wanted to address in a standalone product, and that is the idea of building a tool with a mission, one of providing a platform that can bring in data to make transparent and equitable decisions.

“A lot of the comp tools that I’ve interacted with are reactive,” she said. “You may have to do, say, a pay equity test, you do your promotion and merit cycles, and then you find all these issues that you have to solve. We’re flagging those things proactively with our analytics, because we’re plugging into those systems, which will give you those alerts before the decisions need to be made.”

As an added step in that direction, Knopp said that ultimately she believes the tool should be something that those outside of HR, such as managers and emploiyees themselves, should be able to access to better understand the logic of their own compensation and have more information going into any kind of negotiation.

Ultimately, it will be interesting to see whether modernized products like Pequity, which are tackling old problems with a new approach and point of view, find traction in the wider market. If one purpose in HR is to address diversity and inclusion, and part of the problem has been that the tools are just not fit for that purpose, then it seems a no-brainer that we’ll see more organizations trying out new things to see if they can help them in their own race to secure talent.

“Compensation reflects a company’s values, affects its ability to hire talent, and is the biggest expense on its P&L. And yet, most comp teams run on spreadsheets and emails,” said Parker Barrile, Partner at Norwest, in a statement. “Pequity empowers comp teams to design and manage equitable compensation programs with modern software designed by comp professionals, for comp professionals.”

Powered by WPeMatico