funding

Auto Added by WPeMatico

Auto Added by WPeMatico

I’ve fundraised a lot. Tactically, fundraising is a skill like any other. You get better the more you do it. But practicing gets you nowhere if you don’t have a strong foundation in understanding a fundraising round’s core components.

As a founder, you will understand less than investors when it comes to fundraising. For investors, negotiating with founders is their full-time job. For founders, fundraising is just a small part of building a business. Understanding the basics of venture financing can help founders raise on better terms.

We’ll cover:

As a founder, you will understand less than investors when it comes to fundraising.

Venture financing takes place in rounds. The first stage is the pre-seed or seed round, then a Series A, then a Series B, then a Series C and so on. You can continue to raise funding until the company is profitable, gets acquired or goes public.

We will focus here on seed-stage funding — your very first funding round.

Post-money SAFEs are the most common way to raise funding. These documents are used by Y Combinator, angel investors and most early-stage funds. You should raise on post-money SAFEs using standard documents created by YC. Standard documents have consistent terms that have been drafted to be fair to both investors and founders.

By using the standard post-money SAFE, your negotiation can focus on the two terms that matter:

Powered by WPeMatico

Despite being one of the earliest adopters of using the world wide web to disrupt how its business is done and connect with more potential customers, the recruitment industry ironically remains one of the more fragmented and behind the times when it comes to using new, cloud-based services to work more efficiently. A new startup is hoping to change that, and it’s picked up some funding on strong, early signs of traction.

Dover, which has built what CEO and co-founder Max Kolysh describes as a “recruitment orchestration platform” — aimed at recruiters, it helps them juggle and aggregate multiple candidate pools to source suitable job candidates automatically, and then manage the process of outreach (including using tools to automatically re-write job descriptions, as well as to write recruitment and rejection letters) — has raised $20 million from an impressive list of investors.

Tiger Global led the Series A round, with Founders Fund, Abstract Ventures and Y Combinator also investing. Dover was part of YC’s Summer 2019 class (which debuted in August 2020), and Founders Fund led its seed round. Since leaving the incubator, it has picked up more than 100 customers, mostly from the world of tech, including ClearCo, Lattice, Samsara and others, even larger companies that you might have assumed would have their own in-house orchestration and automation platforms in place already.

“Orchestration” in the world of business IT is commonly used for software built for the fields of sales and marketing: In both of these, there is a lot of fragmentation and work involved in sourcing good leads to become potential customers, and so tech companies have built platforms both to source interesting contacts and handle some of the initial steps needed to reach out to them, and get them engaged.

That, it turns out, is a very apt way to think of the recruitment industry, too, not least because it also, to a degree, involves a company “selling” itself to candidates to get them interested.

“I would say recruiting is sales and marketing,” Kolysh said. “We’re comparable to sales ops, but sales is five-10 years ahead in terms of technology.”

Recruiters and hiring managers, especially those working in industries where talent is at a premium and therefore proactively hiring good people can be a challenge, are faced with a lot of busy work to find interesting candidates and engage them to consider open jobs, and subsequently handling the bigger process of screening, reaching out to them and potentially rejecting some while making offers to others.

This is mainly because the process of doing all of these is typically very fragmented: Not only are there different tools built to handle these different processes, but there is an almost endless list of sources today where people go to look for work, or get their names out there.

Dover’s approach is based on embracing that fragmentation and making it easier to handle. Using AI, it taps platforms like LinkedIn, Indeed and Triplebyte — a likely list, given its initial focus on tech — to source candidates that it believes are good fits for a particular opening at a company.

Dover does this with a mix of AI and understanding what a recruiter is looking for, plus any extra parameters if they have been set by the recruiter to carry this out (for example, diversity screening, if the employer would like to have a candidate pool that is in line with a company’s inclusion targets).

Dover also uses data science and AI to help calibrate a recruiter’s communications with would-be candidates, from the opening job description through to job offer or rejection letters. (Why dwell on rejection letters? Because these candidates are already in a short list, and so even if they didn’t get one particular job, they are likely good prospects for future roles.)

“No human wants to write 100 cold emails per week, but on the other hand, there are many people to hit up and connect with,” Kolysh said of the challenges that recruiters face. “When a company is seeing a lot of growth, it needs to scale fast. You just can’t do that without technology anymore.” Kolysh — who co-founded the company with Anvisha Pai (CTO) and George Carollo (COO) — said all three founders experienced that firsthand working at previous startups and trying to recruit while also building the other aspects of the business. (They are pictured above, along with founding engineer John Holliman.)

Given how much orchestration has caught on in the world of sales, there is a strong opportunity here for Dover to bring a similar approach to recruitment, based on what seems to be a very close understanding of the flawed recruitment process as it exists today. Whether that brings more competitors to the space — or more tools from some of the bigger players in, say, candidate sourcing — will be one factor to watch, as will how and if Dover manages to make the leap to other industries beyond tech.

But for now, its usefulness for a particular segment of the market is also what caught the eye of Tiger Global.

John Luttig, the partner who led the investment for Founders Fund, noted in an interview that most recruiting tools in the market today might best be described as point solutions, addressing scheduling or interviews, for example.

“It’s the full stack here that is appealing,” he told me. “And it’s automated, which is particularly valuable for early and mid-stage tech companies, to keep candidates from falling through the cracks. It also saves time from having to build up big recruiting departments. And because Dover owns all that work, those working in recruitment can instead focus on culture building, or assessing the candidates.”

Updated to note that Luttig is at Founders Fund, and to correct that the customer is ClearCo.

Powered by WPeMatico

Commercial real estate tenants and property managers have to abide by strict liability rules that any vendor entering the property must have insurance certificates and meet other requirements. The approval process for this currently can take days and is still largely done on paper.

Enter Jones. The New York-based commercial real estate startup is curating a marketplace of pre-approved vendors for tenants and property managers to find and hire the people they need in a compliant way.

To continue advancing its network, the company announced Monday it raised $12.5 million in Series A funding led by JLL Spark and Khosla Ventures that also included strategic investors Camber Creek, Rudin Management, DivcoWest and Sage Realty. This new investment brings Jones’ total raised to $20 million, according to Crunchbase data.

Jones, founded in 2017, also manages certifications and approvals, moving the whole process online. Its technology can process an insurance certificate in less than an hour and reduce the overall vendor approval time to 2.5 days — from 12 days — with 99.9% accuracy, co-founder and CEO Omri Stern told TechCrunch.

The accuracy portion is key. With much of the work being done by hand, current accuracy is at about 30%, he added. In addition, the certifications are lengthy, and it is typically up to property managers to parse through the insurance documents to identify what is missing rather than spending time with tenants.

“In the consumer world, a homeowner expects to go on a marketplace and find a service and hire them,” Stern said. “Office managers and tenants can’t get their preferred vendors through the approval process, so we want to provide a similar digital experience that they can consume and use in real estate.”

He says Jones’ differentiator from competitors is that all of the stakeholders are in place: a group of high-profile real estate customers, including Lincoln Property Co., Prologis, DivcoWest, Rudin Management, Sage Realty and JLL.

Yishai Lerner, co-CEO of JLL Spark, agrees, telling TechCrunch that commercial real estate is one of the largest and last asset classes that is undergoing a technology transformation, similar to what fintech was 20 years ago.

He estimates the U.S. market to be $16 trillion, of which technology could unlock a lot of the value. That opportunity was one of the drivers for JLL to create JLL Spark, where Jones is one of the first investments.

Though Lerner spent time with property management teams on the ground, he became up close and personal with the problem when his wife, while moving offices, found out her vendors were not allowed in the building because they didn’t have the right insurance.

“We learned that property managers spend half of their time just working to verify the compliance of vendors coming into their building,” Lerner said. “We wondered why there wasn’t technology for this. Jones was doing construction at the time, and we brought them into commercial real estate because they had an example of how technology could solve the problem.”

Meanwhile, the Series A comes at a time when Stern is seeing Jones’s SaaS tool take off in the past 10 months. He would not get specific with growth metrics, but did say that what is driving growth is “competing against the status quo” as companies are searching for and adapting workflow solutions.

The company intends to use the new funds on product development in both quicker and easier approvals and bringing on new vendors. Jones already works with tens of thousands of vendors. It will also focus on integration, offering an API that could be used in other industry verticals where compliance is necessary.

Stern would also like to continue building the team. Having brought in real estate experts, he is now also looking for people with backgrounds in fintech, cybersecurity and insurtech to bring in additional perspectives.

“We are building an incredible company with the opportunity to be the next big digital marketplace,” he added.

Powered by WPeMatico

As more consumers embrace plant-based diets and sustainable food practices, Rise Gardens is giving anyone the ability to have a green thumb from the comfort of their own home.

The Chicago-based indoor, smart hydroponic company raised $9 million in an oversubscribed Series A round, led by TELUS Ventures, with existing investors True Ventures and Amazon Alexa Fund and new investor Listen Ventures joining in. The company has a total of $13 million in venture-backed investments since Rise was founded in 2017, founder and CEO Hank Adams told TechCrunch.

Though he began in 2017, Adams, who has a background in sports technology, said he spent a few years working on prototypes before launching the first products in 2019. Rise’s IoT-connected systems are designed to grow vegetables, herbs and microgreens year-round.

Customers can choose between three system levels and get started with their first garden for about $300.

There is a “kind of joyousness” in being able to grow something, but people are looking for assistance because they don’t want to get into a hobby that will become demanding or stressful, Adams said. As a result, Rise’s accompanying mobile app monitors water levels and plant progress, then alert users when it’s time to water, fertilize or care for their plants.

“People are paying attention to food, and they care about what they eat,” he added. “Then the global pandemic played a part in this, with people leaning into growing their own food.”

In fact, customers leaned into growing food so much that Rise Gardens saw its sales eclipse seven figures in 2020, and gardens sold out three times during the year. Customers purchased close to 100,000 plants and have harvested 50,000.

The company estimates it helped keep more than 2,000 pounds of food from being wasted and saved 250,000 gallons of water since launching in 2019.

The concept of an indoor farm is not new. Incumbents include AeroGarden, AeroGrow, which was acquired by Scotts-Miracle Gro last November, and Click & Grow. Rise is among a new crop of startups that have raised funds that include Gardyn.

However, Rise Gardens is differentiating itself from those competitors by making its gardens from powder-coated metals and glass and are designed to be a focal point in the room. It is also offering ways for people to experiment with their gardens.

“We wanted something that would be flexible because once you have mastered a hobby, you will get bored,” he added. “You can start at one level and they swap out tray lids to grow more densely. We have a microgreens kit you can add, or add plant supports for tomatoes and peppers. You can also build a trellis to vine snap peas.”

Adams will focus the Series A dollars into product development, inventory, manufacturing, expansion into new markets and building up the team, especially in the areas of customer service and marketing. Rise has about 25 employees and plans to bring on another eight this year.

In addition, Rise Gardens’ products will soon be available on Amazon — its first channel outside of its website. The company is also expanding into schools in what Adams calls “version 2.0” of the school garden.

When Rich Osborn, president and managing partner of TELUS Ventures, evaluated the indoor garden space, he told TechCrunch that Adams and his team rose to the top of the list because of their background, data experience and syndication with Amazon.

Not only was consumer demand there for these kinds of products, but the sustainability and social impact created from these kinds of investments couldn’t be overemphasized, he said.

Nishan Majarian, co-founder and CEO of TELUS Agriculture, said he sees a future where there is a spectrum of food growth, and crop management will be at the plant level.

“Ever since Climate Corp. was acquired by Monsanto, there has been a massive influx into agriculture to get to the next billion-dollar exit,” Majarian added. “Agrifood is the last segmented supply chain. Every crop is different, every market is different. That makes it local, complex and fertile soil — pun intended — for startups who get capital to solve those issues and scale.”

Powered by WPeMatico

When you hire a marketing consultant, you don’t necessarily expect to wind up discussing your life’s purpose. Yet, that is what Spanish marketing expert and entrepreneur Alex Barrera often ends up doing with startup founders who hire him to help improve their pitch. They think they are going to get help convincing investors, and they do, but the byproduct of the process is that they reframe their startup’s vision.

In this context, ethical and philosophical considerations aren’t that far away, because more often than not, this includes a deep look at how their company impacts society. “The days where you could do whatever you wanted and dive into grey legal or moral areas are dwindling,” Barrera says. “Growth companies need to be careful about the potential fallouts of pursuing such strategies. While there are still plenty of investors that push for “growth at any cost,” the social pressure is changing and it’s suddenly becoming costlier to take such stances.”

You may have spotted Barrera’s cowboy hat at one of the many startup conferences he is involved with as a mentor, judge, host or speaker — and he does wear many hats.

Having previously co-founded two startup accelerators and Europe-focused tech publication Tech.eu, he now authors The Aleph Report, a periodical publication on cutting-edge technology and its implications. But it is through his Press42 venture that he collaborates with startups and corporations on organizational storytelling and strategic communications, and it is also what we discussed in the interview below (which has been edited for length and clarity).

TechCrunch is asking founders who have worked with growth marketers to share a recommendation in this survey. We’ll use your answers to find more experts to interview.

What do people often misunderstand about pitch training?

Well, it depends on their experience level. When first-time entrepreneurs hear about pitching, they immediately think of the infamous “elevator pitch,” roll their eyes and moan. For those with a bit more experience, pitching is about a set of slides to achieve a certain goal, mostly funding. However, seasoned managers end up discovering that telling the story of their product or service is not a one-way street. Having to sell a future vision of where the company is heading invariably affects your conception of the product in the now and what you need to build to achieve it. The vision impacts the product, because you need consistency between the product and storytelling.

What type of companies do you help?

I have been helping startups with pitching for years. This used to be mostly early-stage startups, and in groups, with accelerators and startup competitions calling me to help their entire batch or portfolio. I still provide that sort of training, but these days I will more often work one-on-one with a single client that is at a later stage. And I also sometimes work with tech companies getting ready for M&As, as well as large corporations.

“I don’t work with companies that sell smoke and mirrors or hurt society because they shamelessly disregard any responsibility for their impact on others.”

What is your sweet spot for startups you work with?

For one-on-one work, I have a preference for David versus Goliath, and less sexy spaces. I love these companies that were built without the noise: There’s a lack of hubris, they are really humble, but the numbers are there — the founders could be obnoxious, but it’s the opposite. I don’t work with companies that sell smoke and mirrors or hurt society because they shamelessly disregard any responsibility for their impact on others.

Luckily, that’s rarely the case of people who call me. Usually, they are a bit out of the circuit, and they often have impostor syndrome. So my work is also about helping them understand what they can be proud of what they do, and then how to show that in their pitch. They value talking to someone who understands them and their challenges. I spend a lot of time doing research on all verticals and thinking about the future, so the conversation will typically go like this: “Dude, you get it!”

What is one of your favorite things about one-on-one pitch-related consulting work?

I find it very fulfilling to see how much value it brings to those involved. I am also a developer, and I do project management, but most of the consulting I do is not the kind of growth marketing stuff that takes more time to show results. When you do growth hacking at the product level, it takes time to see the impact, and even then, it’s not always easy to connect the dots.

When we work together on their pitch, CEOs can instantly see if the new pitch resonates or not; and they also know if the exercise itself worked for them. Working on a pitch requires a lot of reflection and it entails a lot of tension between you and the CEO.

This is especially true at the beginning, when you keep questioning why they did this or that, what the product provides and to whom, or why it grew here and not there. All these questions force many founders and managers to stop and think hard about the product, the market or the roadmap. Sometimes it pushes them to provide data to back up certain claims. The process pushes them to revisit old biases, beliefs or even myths around their company. Many people are surprised by how much clarity they gain into their company when they work on a pitch.

Do you only work with founders and executives?

Sometimes, the clarity and the strategic insight that working on a pitch provides to founders or CXOs becomes a trigger for them wanting to provide that level of understanding to other areas of the company, like sales, customer support or even the product team. In my case, being a developer myself enables me to switch and adapt my process to any layer of the organization, including the development team.

This is rare, but it eventually turns me into a kind of translator of the challenges of different parts of an organization, acting ultimately as the connector bridging different perceptions. In the end, that’s exactly what storytelling provides. It’s not just a tool for pitching, it’s a brutally effective way to communicate between humans, especially around challenging topics.

How would you describe the value that executives get from your collaboration?

One of the usual and even surprising values for most executives is the insight the process provides. When someone is running either a big company or a scaleup, their day to day is all about growing. They rarely have time to sit down and think about where they’re heading in terms of future product. They do have a roadmap, and their KPIs, but I rarely see a strong future vision broken down into steps.

The pitching process provides them with two valuable things: time and perception. Time because as they’re paying me, they’re stuck with me and need to allocate time for our sessions. That bubble, and the need to build a coherent story that tells why the company is at that particular point, create tremendous insight for most. And then, there’s perception. It’s funny because they’re the ones that provide all the pieces of the picture, I just help them put them together and then point at the obvious.

This process is very rewarding at a personal level for them. It helps them build a confidence that, while it was always there, it rarely shone through the pitch before. It also makes them reflect on where they want to go next, not just from a product perspective, but from a mission’s perspective. It reconnects them with that side that most of us care about, and the personal questions we ask ourselves about life and meaning.

How do you bridge the gap between what your clients already know and what’s next?

My clients already know how to grow a company. I always keep this in mind, not just with startups, but also with big corporations — too often, I see consultants talking to them and starting by telling: “You are doing it wrong!” Well, they got to where they are, didn’t they? It doesn’t mean that they don’t need help, but you can make them see that, you don’t have to dismiss what they have achieved. I see myself as the person that helps them get to the next level and build on top of what they have already done. Sometimes it takes some bruising to get there, but there is always massive respect for their achievements.

These people are very good professionals. It’s not that they don’t see or can’t see the vision. It’s that the need to connect the dots in detail allows for the emergence of a strategic vision of the organization. Now, here is where the real “coaching” kicks in. When such a picture emerges, many founders or executives tend to shy away from it. They have a hard time believing that they might be onto something groundbreaking or actually winning in their respective markets.

This is especially true for many scaleup companies. They’ve been fighting, first for market fit, and later on for market share, that they freeze at the possibility that they might be doing a fantastic job. Part of my role is precisely to break through their impostor syndrome and encourage them to be bolder, to believe in themselves, to trust the data.

How do you promote your services?

Well, it would be very hard for me to do cold calling. I wouldn’t be able to say: “It’s not just about pitching, you are going to see the future of your company!” — so I stopped even trying to market that. My best marketing tool is word of mouth from my clients, or even from people that see me perform on stage. But even then, people call for help with a specific milestone, like raising a round. It’s only through the process that they see that there’s way more to it. They begin to understand other parts about themselves that either enhance their capacity to raise more funds, or even take them to the next level like an acquisition or the development of a major breakthrough.

Have you worked with a talented individual or agency who helped you grow your startup?

Respond to our survey and help us find the best startup growth marketers!

What do you end up actually working on with founders?

Going higher up the chain, the pitch becomes a very powerful tool not just for fundraising, but also for thinking about your company strategically. It’s a place where founders can reach clarity about their strategy and what really matters — questions they don’t have time for on a day-to-day basis. They allocate time to it because they think it will help with fundraising, and then they find out that it helps them understand their company.

So typically, they will call me because they are raising a Series B round, or a very large A round. They realize that to unlock the next milestone, they need to fine-tune what they say. The game is different; it’s not about market fit anymore, or just about gaining market share, and what worked for them just no longer works — especially if they were semi-bootstrapped up to that point. They need to talk to someone who understands them and can help them prepare for the future, for instance by researching certain pitfalls or trends. I’m not just the guy that “pitches” but the guy that’s going to provide you with ammo to help you build a compelling case for your audience, whatever it is. The pitch is just an excuse!

“The thing is, scaleups and growth-stage startups have a choice in how they market themselves; so they need to be aware of ethical concerns that may arise sooner than later.”

What’s your take on comparing your startup to another one when pitching; for instance, calling yourself the “Uber for X”?

Analogies are very powerful. The major challenge when you are pitching any company, even a late-stage one, is that people have a tendency to put you in a box. So you have two options: either you let them do it, or you provide the tools to put you in a box. That’s where analogies work really well.

But then, who do you compare yourself to? It’s a challenge, because two elements are becoming increasingly important: capturing the right trends of the moment, and the ethics of how you do what you do. You want to control which box they place you, ideally one that’s trendy but at the same time one that doesn’t position you in apparently direct competition with someone you don’t want to be associated with.

Why do startups need to be careful when communicating?

Over the last few years, we have seen how startups are no longer seen as innocent by society; they no longer have “carte blanche,” and society is becoming a lot more sensitive. There’s a polarization issue around many topics, and we are increasingly going to see a clash between society and startups. It is even going to increase post-COVID, with tensions around automation versus jobs. And the thing is, scaleups and growth-stage startups have a choice in how they market themselves; so they need to be aware of ethical concerns that may arise sooner than later.

Society is going to ask you for responsibility. What’s happening with big brands is trickling down, and scaleups are hitting that threshold sooner. Typically, it catches them unprepared, because they reach that stage only knowing local feelings about what they do, and suddenly getting national or regional blowback. Or they expand internationally with local operations led by really young people with no experience in dealing with politics, who suddenly face strong local blowback.

All of this has a lot to do with pitching, because it’s not about product anymore. So for instance, it’s about convincing public authorities at different levels to let you operate, when their incentives are very different from investors. It’s B2G2C — business to government to consumer. And we are seeing more and more startups, with regulation as a factor in their operations.

How can you talk to public authorities, customers and investors in a unified pitch?

The major pitch needs to bring all elements together. It needs to be clear on what you do, and hit the right notes on ethical concerns. It’s important both for regulators and for fundraising; because from the investors’ perspective, it also reduces uncertainty around your business. As a scaleup, your ability to scale is a concern, so it helps to show that you are thinking and planning around societal impact.

I have to say that an increasing amount of investors do genuinely care about this. It may be because they have been burned, for instance from seeing regulatory blowback firsthand, or just because they are growing conscious. There are still some investors that have the “Uber mindset” and only care about muscle — grow first, and only then, deal with regulators — but more and more, VCs are aware that this might not fly, because society is changing. The pandemic is just highlighting this even more.

What about startups? Do they also care more about their societal impact?

I think it’s a pendulum, and the current generation is a child of the previous regulatory blowback. Crypto might still be on the other side, but increasingly, startups are aware that there are societal implications they will have to deal with. I also try to bring that message across when I prepare my clients to pitch — and warn that it sometimes happens very quickly: We’ve seen how one prohibition in one place can spread like wildfire. So you need to regulate your initial message and also be prepared to adapt quickly.

Powered by WPeMatico

Visualping, a service that can help you monitor websites for changes like price drops or other updates, announced that it has raised a $6 million extension to the $2 million seed round it announced earlier this year. The round was led by Seattle-based FUSE, a relatively new firm with investors who spun out of Ignition Partners last year. Prior investors Mistral Venture Partners and N49P also participated.

The Vancouver-based company is part of the current Google for Startups Accelerator class in Canada. This program focuses on services that leverage AI and machine learning, and, while website monitoring may not seem like an obvious area where machine learning can add a lot of value, if you’ve ever used one of these services, you know that they can often unleash a plethora of false alerts. For the most part, after all, these tools simply look for something in a website’s underlying code to change and then trigger an alert based on that (and maybe some other parameters you’ve set).

Earlier this week, Visualping launched its first machine learning-based tools to avoid just that. The company argues that it can eliminate up to 80% of false alerts by combining feedback from its more than 1.5 million users with its new ML algorithms. Thanks to this, Visualping can now learn the best configuration for how to monitor a site when users set up a new alert.

“Visualping has the hearts of over a million people across the world, as well as the vast majority of the Fortune 500. To be a part of their journey and to lead this round of financing is a dream,” FUSE’s Brendan Wales said.

Visualping founder and CEO Serge Salager tells me that the company plans to use the new funding to focus on building out its product but also to build a commercial team. So far, he said, the company’s growth has been primarily product led.

As a part of these efforts, the company also plans to launch Visualping Business, with support for these new ML tools and additional collaboration features, and Visualping Personal for individual users who want to monitor things like ticket availability for concerts or to track news, price drops or job postings, for example. For now, the personal plan will not include support for ML. “False alerts are not a huge problem for personal use as people are checking two-three websites but a huge problem for enterprise where teams need to process hundreds of alerts per day,” Salager told me.

The current idea is to launch these new plans in November, together with mobile apps for iOS and Android. The company will also relaunch its extensions around this time, too.

It’s also worth noting that while Visualping monetizes its web-based service, you can still use the extension in the browser for free.

Powered by WPeMatico

Yummy, a Venezuela-based delivery app on a mission to create the super app for the country, announced Friday it raised $4 million in funding to expand its dark store delivery operations across Latin America.

Funding backers included Y Combinator, Tinder co-founder Justin Mateen, Canary, Hustle Fund, Necessary Ventures and the co-founders of TaskUs. The total investment includes pre-seeding capital raised in 2020.

“This appears to be a contrarian bet, but Yummy has quickly become the No. 1 super app in Venezuela and proven that the team can scale the business in a difficult territory,” Mateen said in a statement. “Now Vicente and the rest of the Yummy team will expand into more traditional markets with the necessary experience and support to overcome inevitable challenges that they will face.”

Vicente Zavarce, Yummy’s founder and CEO, launched the company in 2020 and is currently part of Y Combinator’s summer 2021 cohort. Born in Venezuela, Zavarce came to the U.S. for school and stayed to work in growth marketing at Postmates, Wayfair and Getaround before starting Yummy. Zavarce was a remote CEO over the past year, stuck in the U.S. due to travel restrictions, but said he is making the most of it.

Yummy’s app can be downloaded for free, and the company charges a delivery fee or merchant fee. In contrast to some of his food delivery competitors, Zavarce told TechCrunch Yummy’s fees are “the lowest in the market” so they do not affect the merchant’s ability to use the app.

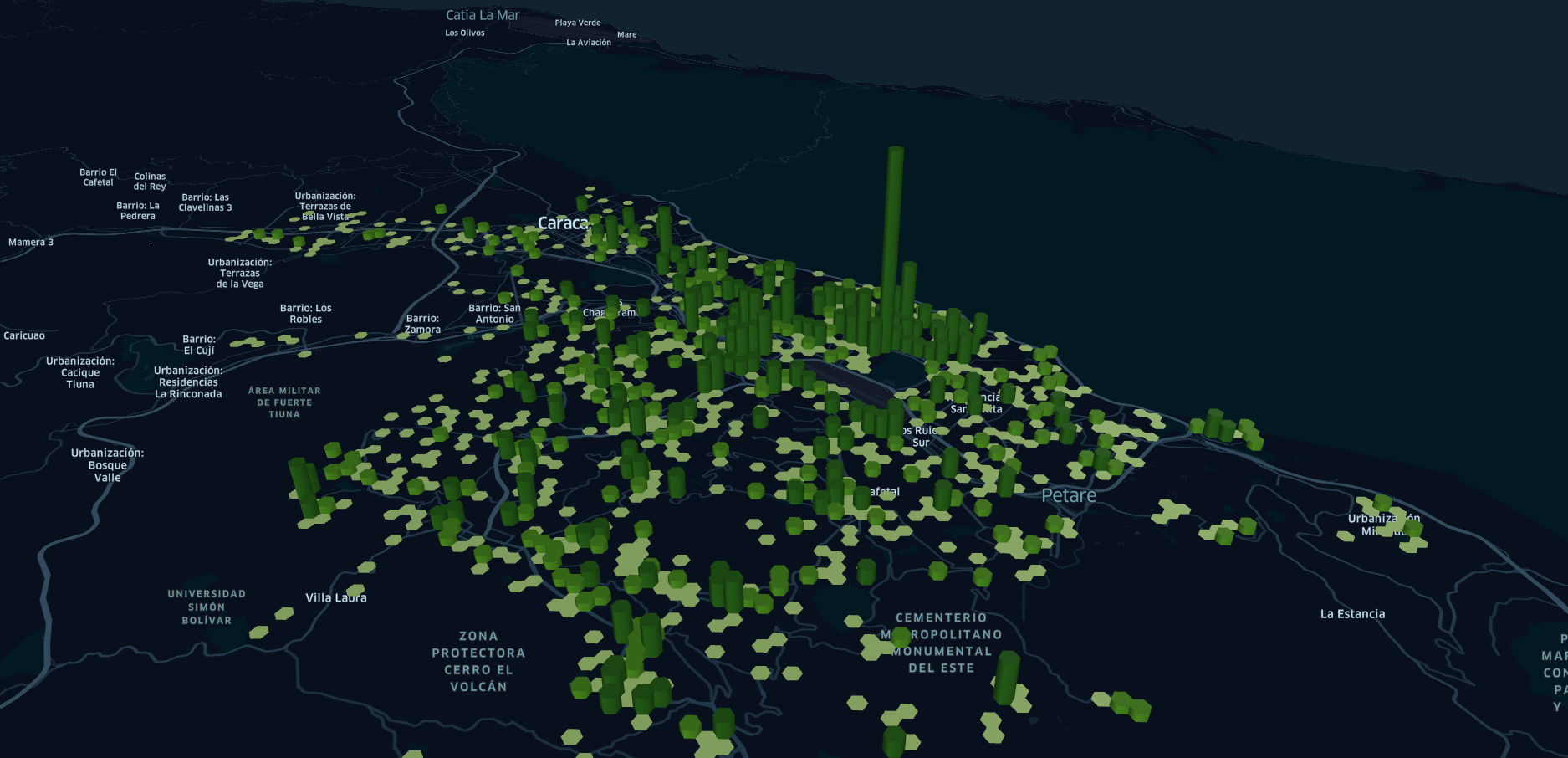

Yummy order heat map. Image Credits: Yummy

The company is pulling together additional key components for its super app strategy, which includes launching a ridesharing vertical this year. Yummy has already connected more than 1,200 merchants with hundreds of thousands of customers.

And, over the past year the company completed more than 600,000 deliveries of food, groceries, alcohol and shopping. It reached $1 million in monthly gross merchandise volume while also growing 38% in revenue month over month.

Over the past eight years, the political and economic challenges faced by the country have led to its recent adoption of the U.S. dollar, Zavarce said. In some cases up to 70% of transactions are happening in dollars on the ground. He said this has protected the business against hyperinflation and ultimately created the opportunity for startups to begin operating in Venezuela.

Because of that, combined with more consumer technology innovation over the past decade, Zavarce said there is no reason why Venezuela should not have the best last-mile logistics. It’s there that Yummy has an opportunity to connect multiple vertices into a super app with little to no competition.

“Eventually, other players will enter, but because we have a super app, we already have an amazing frequency of usage,” he added. “We also already have exclusivity with 60% of the food delivery marketplace, which has enabled us to build a moat around the market. We believe we are the right people to execute on this and feel it is our responsibility to do it.”

Plans for the new funding include user acquisition — the company has close to 200,000 registered users already — and to expand in Peru and Chile by August. At the same time, Zavarce will spend some of that capital to attract more users across Venezuela. He also expects to be in Ecuador and Bolivia by the end of the year.

Powered by WPeMatico

Halla wants to answer the question of how people decide what to eat, and now has $4.5 million in fresh Series A1 capital from Food Retail Ventures to do it.

Headquartered in New York, Halla was founded in 2016 by Gabriel Nipote, Henry Michaelson and Spencer Price to develop “taste intelligence,” using human behavior to steer shoppers to food items they want while also discovering new ones as they shop online. This all results in bigger basket orders for stores. SOSV and E&A Venture Capital joined in on the round, which brings Halla’s total capital raised to $8.5 million, CEO Price told TechCrunch.

The company’s API technology is a plug-and-play platform that leverages more than 100 billion shopper and product data points and funnels it into three engines: Search, which takes into account a shopper’s preferences; Recommend, which reveals relevant complementary products as someone shops; and Substitute, which identifies replacement options.

Halla’s Substitute product was released earlier this year as an answer to better recommendations for out-of-stock items that even retailers like Walmart are creating technology to solve. Price cited a McKinsey report that found 20% of grocery shoppers sought out competitors following a negative outcome from bad substitutions.

Halla Substitute. Image Credits: Halla

None of these data points are linked to any shoppers’ private data, just the attributes around the shopping itself. The APIs, rather, are looking for context to return relevant recommendations and substitutions. For example, Halla’s platform would take into account the way someone adds items to their cart and suggest next ones: if you added turkey and then bread, the platform may suggest cheese and condiments.

“It’s also about personalization when it comes to grocery shopping and food,” Price said. “When you want organic eggs from a specific brand and it is out of stock, it is often up to your personal shopper’s discretion. We want to lead them to the right substitutions, so you can still cook the meal you intended instead of ‘close enough.’ ”

Halla’s technology is now live in more than 1,100 e-commerce storefronts. The new funding gives Halla some fuel for the fire Price said is happening within the company, including plans to double the number of stores it supports across accounts. He also expects to double employees to 30 in order to support growth and customer base, admitting there is “more inbound interest that we can handle.” Halla has been busy fast-tracking big customers for pilots, and at the same time, wants to expand internationally with additional product lines over the next 18 months.

The company is also seeing “a near infinite increase in recurring revenue,” as it attracts six- and seven-figure contracts that push the company closer to cash flow positivity. All of that growth is positioning Halla for a Series B if it needs it, Price said.

Meanwhile, as part of the investment, Food Retail Ventures’ James McCann will join Halla’s board of directors.

McCann, who only invests in food and retail technology, told TechCrunch that grocery stores need a way to inspire shoppers, that Halla is doing that and in a better way than other intelligence versions he has seen.

“Their technology is miles ahead of everyone else,” he added. “They have a terrific team and a terrific product. They are seeing huge uplifts in terms of suggestions and what people are buying, and their measurements are out of this world.”

Photo includes Halla co-founders, from left, Spencer Price (CEO), Henry Michaelson (CTO & President) and Gabriel Nipote (COO).

Powered by WPeMatico

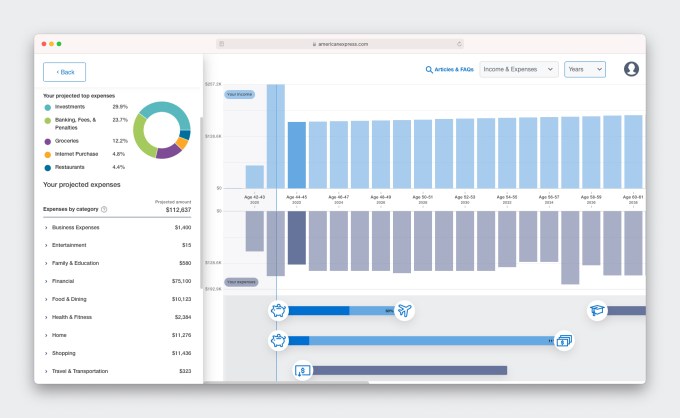

American Express is branching out into financial planning, with a little help from a seven-person startup called BodesWell.

This week, the credit card giant launched a pilot of its first self-service digital financial planning tool, dubbed “My Financial Plan (MFP).” The six-month pilot kicked off on July 11 with about 25,000 select Amex cardmembers.

American Express quietly invested in BodesWell in late 2020 via its venture arm, Amex Ventures. Since then, the financial services behemoth teamed up with the tiny startup to develop the financial planning tool for its users. The new product is designed to give users a complete picture of their financial health and help them make and achieve major life goals, such as buying a house or retirement.

TechCrunch talked with Amex Ventures’ Julia Huang, who led the investment and strategy around the new product, and BodesWell co-founder and CEO Matthew Bellows to learn more details.

The pair actually met while serving on a panel together in 2019.

“I was drawn to the fact that it was not a round-up savings tool, but rather a holistic tool to understand your full financial picture that could be used to plan for the financial impact of your life decisions,” Huang told TechCrunch.

Before deciding to invest in BodesWell, Huang says Amex Ventures — which over time has backed more than 70 startups — had “evaluated the space quite extensively.”

Huang introduced Bellows and his staff to Amex’s Digital Labs team and they embarked on jointly developing a specialized offering for Amex customers. (While Bellow is based in Boston, he says the startup is “globally distributed.”)

“Our goal is to democratize financial planning with our cardmembers by providing detailed insights and forecasts to help them with their holistic planning,” she told TechCrunch.

Image Credits: Amex Ventures

Bellows started BodesWell in early 2019 with the goal of empowering clients and customers to build their own financial plan.

“So much of financial planning software is aimed at financial advisors, and requires them to run it,” he said. “So, most people can’t get the benefits of financial planning…Our hope is to expand benefits to a lot more people.”

BodesWell will guide users in setting up a financial plan and will work even better if they sync with their other financial information via Plaid so it can “update in real time,” Huang said.

The tool “takes into account income, assets, expenses and liabilities — what cash flow looks like holistically so that users can drag & drop to plan life events,” Bellow said.

An estimated 85 million American households don’t have a financial, planner for a variety of reasons — including mistrust of a planner’s intentions or just feeling overwhelmed by the process.

The product is free during the pilot phase and American Express hasn’t yet determined if it will charge for it afterwards.

“We’re gauging first for engagement and the power of the product for our customers,” Huang told TechCrunch. “We want to make sure the product resonates and that we iterate on the product to make sure it’s good for the broader population. Our primary goal is that our customers use it and find it valuable.”

Amex Ventures has formed “some level of partnership” with more than two-thirds of its portfolio companies, she added.

“We try to engage with our portfolio in that way, to provide value with our startup ecosystem,” Huang said.

For its part, BodesWell had previously raised about $1.5 million from investors such as Cleo Capital, Ex Ventures, Riot.vc, GritCapital and Argon Capital and angels like HubSpot CEO Brian Halligan and Kintent CEO Sravish Sridhar.

Powered by WPeMatico

The need for more affordable housing has never been more urgent as a shortage in the U.S. housing market persists.

Startups attempting to help address the shortage in a variety of ways abound. One such startup, Abodu, has raised $20 million in a Series A funding round led by Norwest Venture Partners. Previous backer Initialized Capital also participated in the financing, along with Redfin CEO Glenn Kelman, former Stockton, California Mayor Michael Tubbs, GGV investor Hans Tung and Paradox Capital’s Kyle Tibbitts.

The California legislature changed laws in 2017 to make it easier to build Accessory Dwelling Units (ADUs). Then on January 1, 2020, the state of California made it dramatically easier to add extra housing units to single-family home sites. Cities and local agencies have to quickly approve or deny ADU projects within 60 days of receiving a permit application. The state also now prevents cities from imposing minimum lot size requirements, maximum ADU dimensions or off-street parking requirements.

Redwood City, California-based Abodu, which builds prefabricated ADUs, was founded in 2018 to serve as a “one-stop shop” for building an ADU, or as some describe it, a home in a backyard.

Image Credits: Co-founders John Geary and Eric McInerney / Abodu

What sets the company apart from others in the space, its execs claim, is that it not only builds and installs the units, it helps homeowners with the painful process of getting permits. Abodu says it pre-approves its structural engineering with California state-level agencies to ensure its units can be built statewide and works with local agencies to pre-approve its foundation systems to ensure projects can proceed on predictable timelines.

It also claims to offer a cheaper and faster process than if one were to build an ADU from start to finish. Specifically, the startup claims that one of its backyard homes can be installed in just 10% of the time it would take for a traditional ADU to be built.

Abodu has been active in the market, selling and building its ADUs since the fall of 2019. Since then, it has put “dozens and dozens” of units in the ground, and has multiple dozen units in production on top of that, according to CEO and co-founder John Geary. So far, it’s operating in the Bay Area, Los Angeles and Seattle. The company claims it can deliver an ADU in as little as 30 days in San Jose and Los Angeles thanks to the cities’ pre-approval process. In other cities in California and Washington, turnaround is “as little as 12 weeks.” But a standard bespoke project takes 4-5 months from start to finish, according to Geary.

The startup’s three products include a 340-square foot studio; a 500-square foot one bedroom, one bath, and a 610-square foot two bedroom unit. All have kitchens and living space.

Pricing starts at $190,000, but the average project cost across all sizes is around $230,000, Geary said, inclusive of permits and site work.

There are a variety of use cases for ADUs, the most popular of which is to house family and for rental income.

“During the pandemic, multigenerational living has been at an all-time high. There are acute family needs that people are trying to solve for,” Geary said. “In addition, folks are earning extra money by renting them out to members of the community such as teachers or fireman, a single person or younger couple.”

Next, Abodu is eyeing the San Diego market.

Earlier this week, we covered the recent raise of Mighty Buildings, another Bay Area-based startup building ADUs and other housing. The biggest difference between the two companies, according to Geary, is that Mighty Buildings is focused on innovation in construction with its 3D-printed method.

“We decided early on that we didn’t want to reinvent the wheel from the construction standpoint,” Geary said. “Instead, we looked at ‘how can we solve for speed and ease?’ ”

Abodu operates with an asset-light model, and doesn’t own any factories. Instead, it has built a network of factory “partners” across the Western U.S. that builds its units depending on how their capacities look at any given time.

Naturally, the company’s investors are bullish on the company’s business model.

Jeff Crowe, managing partner of Norwest Venture Partners, believes that Abodu’s “beautifully crafted units” are just one of the company’s selling points.

“John, Eric, and their team manage the end-to-end process of permitting, building, and installing on behalf of their customers,” he told TechCrunch. “And with the expedited permitting that Abodu has been granted in over two dozen cities, it has faster time-to-installation than other ADU market participants. The result has been very high levels of customer satisfaction and rapid growth.”

Former Stockton Mayor Tubbs said Abodu is tackling two of California’s most consequential issues: the statewide housing shortage and its impacts on racial and economic segregation in our neighborhoods.

“By making it fast and accessible for normal homeowners to build high-quality backyard housing units, Abodu’s success will mean integrating options for both renters and homeowners in the same neighborhoods, while supporting small landlords and property owners in building equity in their homes,” he wrote via email.

Powered by WPeMatico