funding

Auto Added by WPeMatico

Auto Added by WPeMatico

SalesLoft, an Atlanta-based startup that helps companies manage the contact phase of the sales process, announced a $50 million Series C today.

Insight Venture Partners was lead investor with participation from LinkedIn and Emergence Capital, which also participated in the company’s A and B rounds. Today’s investment brings the total raised to $75 million, so this was a significant capital infusion.

What attracted investors was that SalesLoft has concentrated on an area of the sales pipeline called ‘sales engagement.’ It provides a framework for sales people around how to contact potential customers, how often and with what language. It is significant enough that it caught the attention of Jeff Horing, co-founder and managing director at Insight Venture Partners, who was willing to write a big check.

He sees sales engagement an emerging and fast-growing area of the sales stack. “SalesLoft consistently helps customers increase their pipelines, but also strengthen their relationships with buyers — that’s a huge differentiator,” Horing said in a statement.

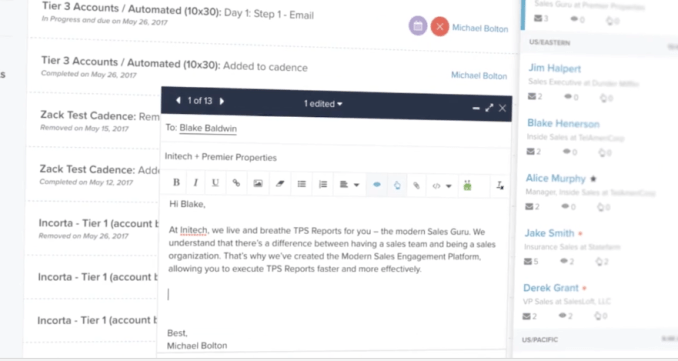

Kyle Porter, co-founder and CEO at SalesLoft says that what his company does is essentially create a contact workflow for the sales team. It provides a framework or blueprint, while applying a measurable structure to the process for management. Whether the sale is successful or not, there is an audit trail of all the interactions and what the software recommended for actions and what actions the sales person took.

That involves providing the sales team with the next best actions, which could be an email, a phone call or even a handwritten note.”The suggested email content and phone scripts come from experience with buyers. Here’s the right way to communicate,” Porter said. “At the end of the day, we are enabling our customers to deliver better sales experience,” he added.

The software can recommend the best person to email next with suggested text. Photo: SalesLoft

Machine learning will play an increasing role in building that workflow, as the system learns what types of interactions work best for certain types of customers, it will learn from that, and the system’s recommendations should improve over time.

It appears to be working. The company, which launched in 2011, currently has 230 employees and over 2000 customers including Square, Cisco, Alteryx, Dell and MuleSoft (which Salesforce bought last month for $6.5 billion.) The company reported that they have increased revenue over the last two years by 800 percent (yes, 800 percent).

Porter says this money sets them up to really scale the company with plans to reach 350 employees by the end of the year. In fact, they have more than 40 openings at the moment.

Powered by WPeMatico

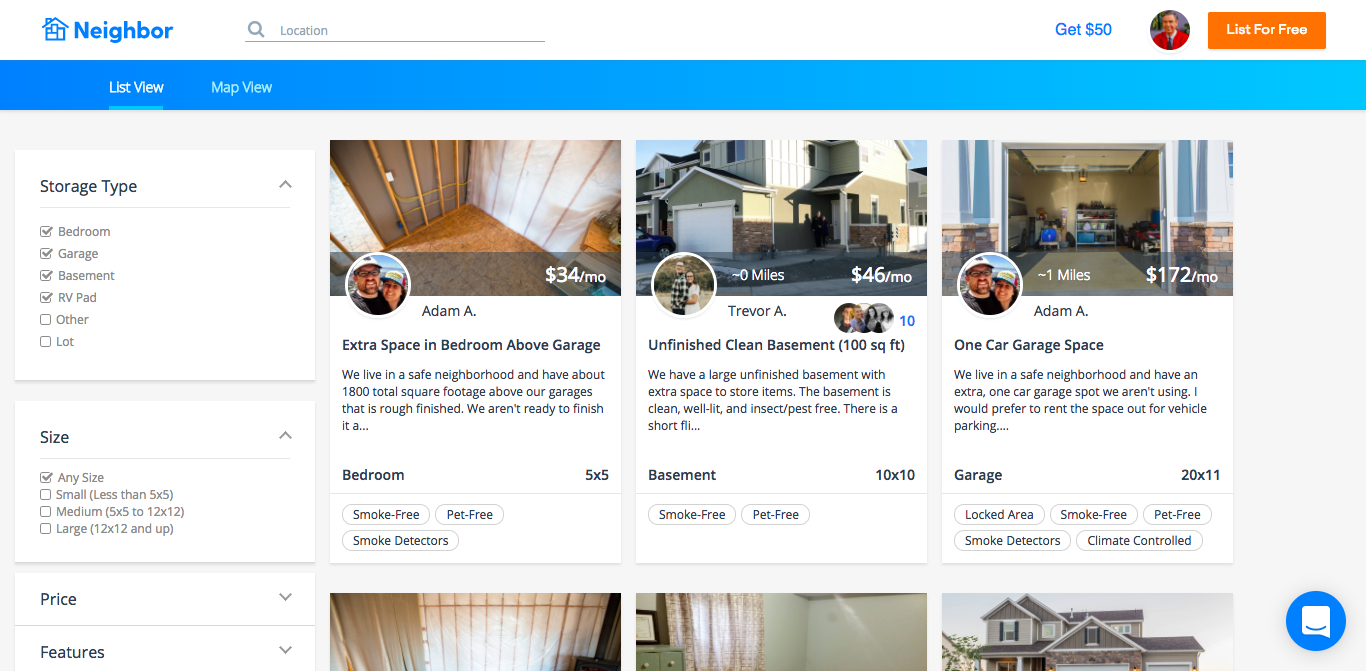

Neighbor is another startup with designs on your spare space. Not for letting to guests to bed down in, like Airbnb, but for self-storage. The 2017 founded, Salt Lake City based startup is announcing $2.5 million in seed funding today, raised from Peak Ventures and Pelion Ventures.

The core business idea is to build a trusted marketplace for storage needs by offering people with items on their hands what it bills as a cheaper (and potentially easier) alternative to traditional self-storage solutions — and, on the host side, a platform to earn a little money for not having to do too much (just having space where you can let stuff safely sit).

There’s a social element in that Neighbor is plugging into Facebook’s Graph API and another of its APIs (called All Mutual Friends) so that users who sign in with Facebook can make use of a “store with a friend” feature — which shows which (if any) of their Facebook friends or mutual friends are also hosts or renters on the platform.

The idea being that a degree of linked acquaintance will help Neighbor offer users “more personalized, localized and trustworthy storage options while helping hosts advertise their storage spaces to friends and family on social media”, as it puts it.

The startup claims this feature is “completely unique to the sharing economy space”, though it has been used by other apps — such as dating app, Tinder, to (in that case) enable people to hook up with friends of friends.

Neighbor says it’s banking on the Facebook connection to help it build trust between users and grease activity for a marketplace that’s otherwise essentially asking a pair of strangers to agree to store/host others’ items in their home.

Co-founder Preston Alder says he came up with the idea for the business when he was a student about to move to Peru for a summer internship and needed to find a nearby place to store his stuff — but didn’t want to fork out on traditional storage costs.

“On the two hour drive to a friend’s house who had agreed to store his stuff, he realized there were probably a lot of people with extra storage space who lived closer that would agree to store his stuff for the summer — he just didn’t know how to find them,” say other co-founders Joseph Woodbury (also CEO) and Colton Gardner.

The team put up a basic landing page was put up in early 2017 — initially fielding enquiries by phone. In March 2017 they launched a website to meet early demand.

“During that time, we won grants from Get Seeded, the Opportunity Quest, the New Venture Challenge, and the Utah Entrepreneurship Challenge, which helped us build out the website and do some basic local marketing,” they add. “We then turned down the jobs we had lined up post-graduation to keep building the business. Since then, our primary focus has been to build out the platform — we’re just now coming to a point where we’re going to double down on marketing.”

A year on from the website launch they say they have “thousands” of users in 11 different US states — claiming this is mostly organic as they’ve only done a regional marketing rollout in Utah thus far.

They are about to step up on that front now though, with the VC cash injection — including with discount offers for people wanting to rent space to store stuff.

“The seed funding will be used for continued platform improvements and to market the service more broadly across the US,” they tell TechCrunch. The funding will also go towards “technologies to foster trust”.

“Trust is our central focus at Neighbor — it’s why we chose to call our company ‘Neighbor’,” they add. “Our goal is not just to provide you storage, but to provide the safest option available on the market.”

To back up that claim the startup says it’s carrying out verification of users (both hosts and renters) — including by ID verification and background checks.

“We require the submission of a government ID or passport, and any user can request that a background check be performed,” they say. “A host can request the check on their renter or a renter on their respective host.”

On the trust front there are some pretty obvious risks when strangers are caching unknown items in other people’s home. So there’s also a list of banned items — such as firearms, toxins, drugs and so on.

Space renters are also required to submit a list of the exact items that will be stored for Neighbor and the host to approve ahead of a transaction getting the go ahead.

“If a renter is caught misleading a host or Neighbor about their items, then they are promptly evicted and fined,” they say. “It is worth noting that there is an excellent sifting mechanism that occurs due to Neighbor’s business model. Because of the high amount of personal interaction that occurs on Neighbor, individuals seeking to store prohibited items are likely to avoid Neighbor because they are concerned about keeping their items concealed from their host. We anticipate renters with illicit items will naturally prefer industrially zoned storage facilities.”

Who’s liable if something goes wrong? “Neighbor assigns liability in the same way as a self-storage facility,” the team says. “The host is liable for gross negligence (i.e. the host knocks over one of the renter’s boxes and the contents break). The renter, however, is liable for all other instances (i.e. fire, flood, etc). For this reason we provide a $10,000 guarantee to the renters and encourage renters to obtain a renter’s insurance policy through our local insurance partner.”

Another perhaps more sticky potential issue vis-a-via insurance is whether a host might be risking voiding any existing buildings or contents insurance they have by using the service and thereby opening their home to a third party (and their stuff).

Neighbor says it recommends hosts verify with their insurance provider “on a case by case basis”. Though it also claims there hasn’t yet been a single host insurance dispute in the history of the company.

“Storing a neighbor’s items is a longstanding and accepted practice,” it adds, saying it doesn’t currently have any plans to offer hosts insurance packages.

In terms of other logistics, space renters are asked on sign up how long they estimate they’ll need to store their stuff to give hosts an idea of the time commitment.

“Once their stuff makes it into storage, the renter starts paying a monthly subscription that can be cancelled anytime by the host or renter with 30 days notice. So the length of storage time is ultimately up to both the host and renter,” they add.

While hosts can set their own flexibility in terms of providing renters with access to their stuff — from 24/7, to ‘upon request’ — which, in turn, renters would be agreeing to ahead of time.

Hosts can also set their own pricing for the space rental, with Neighbor charging renters a 15% service fee on top of that to make its cut.

Hosts aren’t charged for listing their space on the platform. And while they are free to choose how much to charge for their space, Neighbor also says it’s using algorithmic pricing to recommend how much they charge — with the aim of keeping prices on the platform at half the cost of a traditional self-storage facility. So it sounds confident it can nudge hosts to set the kind of prices that will drive custom.

“When we saw what Neighbor was doing, we were blown away by the potential,” said Chad Packard, investor at Pelion Ventures, commenting on the funding in a statement. “The concept is simple and straightforward, the market potential is incredibly high, and the team is whip-smart. We knew really quickly that we wanted to work with them.”

So what are early Neighbor users using the service to store at this point? All sorts of stuff, according to the founders — although the biggest chunk of current business (~35%) involves big but moveable stuff: Boats, vehicles, trailers or RV’s.

Then they say another 25% is household goods; another 25% large furniture items; and the remaining 15% is “comprised principally of small business inventory”.

On the competitive front, the team names Spacer (based in Australia but with a US presence) and Stowit as US operating rivals with similar business models. Internationally, it lists the likes of Stashbee and Costockage but says that 80 percent of the global storage market is in the US — arguing that “no one has won that market yet”.

Powered by WPeMatico

Dandelion, a clean energy startup that was originally incubated inside Google parent Alphabet, has raised $4.5 million in funding to build out its business — a geothermal heating and cooling system for homes that claims it will drastically reduce its customers’ bills — it claims to cut bills in half (notwithstanding the upfront costs, more on that below) — while also being significantly more friendly for the environment compared to conventional systems that use gas and fossil fuels.

The company opened for business first in Upstate New York — a market with extreme cold and hot spells — where it says it has started to install systems in people’s homes, and it’s going to use the funding to help work through what it says is a waitlist of “thousands” of customers nationally.

“We have been overwhelmed with demand and support from homeowners across the country,” said Kathy Hannun, cofounder and CEO of Dandelion, in a statement. “This round will help us ramp up operations to serve these customers and launch our new and improved 2018 offering.”

The funding was led by New Enterprise Associates, with participation also from new investors BoxGroup, Daniel Yates, and Ground Up, and previous investors Borealis Ventures, Collaborative Fund, and ZhenFund, the Chinese-based VC associated with Sequoia in China. It brings the total raised by Dandelion to $6.5 million, including a seed round it announced when first spinning out in July of last year.

The impressive list of backers — and the fact that Dandelion was originally incubated at Alphabet X, the company’s “moonshot” factory — underscores a couple of trends worth pointing out.

The first is the double maxim that everything is now a “tech” challenge, and that the interests of the tech world touch everything. As legacy businesses continue to try to update their systems or become more responsive to some of the challenges of running their legacy operations, a company like Dandelion becomes a direct threat, or a potential, strategic acquisition target.

The second is the ongoing interest among tech investors and tech companies to expand their horizons and explore companies and ideas that might prove to be disruptive in the same way that tech has been, further down the line; or whose solutions could prove to be a helpful boost to their more direct tech interests — for example by becoming acquirers of data systems to run these services better, or by making the cost of electricity to run other services (like internet, or maybe, these days, bitcoin mining) less expensive. (Dandelion is already proving its role in that wider ecosystem: just earlier this month, it acquired Geo-Connections, a geothermal SaaS startup.)

“Over the next decade, homeowners across America will replace their expensive, conventional home heating systems with Dandelion geothermal,” said Yates in a statement. “I’m thrilled to be part of the team that will lead this transition.” Yates — who had founded the energy efficiency startup Opower, which went public and then was acquired by Oracle — is joining the board as an executive director with this round.

In the case of Dandelion, its challenge and opportunity has been in the world of legacy energy services. Built largely on fossil fuel systems and centralised operation models — you have large plants and generators located in one place that distribute their energy to smaller stations, which distribute to individuals — the idea behind Dandelion has been to build a heating and cooling system that is significantly more decentralised: it operates directly from a person’s home — or more specifically, underneath it — leveraging the ground’s natural state of being 50°F, in order to work.

One big issue with scaling up geothermal energy solutions prior to Dandelion has been the up-front installation costs, both from a financial and practical point of view. As Hannun has described it:

The process of installing ground loops in homeowners’ yards has typically been messy and intrusive, using wide drills that are designed to dig water wells at depths of over 1,000 feet. These machines are unnecessarily large and slow for installing a system that needs only a few 4” diameter holes at depths of a few hundred feet. So we decided to try to design a better drill that could reduce the time, mess and hassle of installing these pipes, which could in turn reduce the final cost of a system to homeowners.

The company’s solution has been to build a system that bores a much smaller hole (a few inches is all that’s needed) at a much shallower depth of hundreds of feet — making the installation something that can be done in less than a day.

So far, the company’s upfront costs might prove to be too much of a gating factor for the majority of homeowners. Installations run between $20,000 and $25,000 in upfront costs alone. For those willing to take the plunge — or dig into the challenge, as the case may be — over twenty years, the company has claimed that savings can be about $35,000.

The company also tells me that homeowners are buying a lot of these using financing and will save around 20 percent annually if they finance. (The savings percentage comes after a tax credit, a spokesperson said. “Here is a real example from one of our homeowners. He needed a 4-ton system, which is the size most homes require. He formerly spent $2,621 on fuel oil annually (832 gallons over the year at $3.15/gallon). To run geothermal, he requires $803 in additional electricity costs. With Dandelion pricing, starting at $115/mo, geothermal heating costs for his home are $1,380 + $803 = $2,183. This is about 20% savings annually for heating alone. His air conditioning will also be over twice as efficient with geothermal than it was with conventional a/c.”)

The savings in terms of using clean versus dirty energy, of course, come from the start.

Powered by WPeMatico

Dropbox was off to the races on its first day as a public company.

It’s surely a sign of public investor enthusiasm for the cloud storage business, which had initially hoped to price its IPO between $16 and $18, then raised it from $18 to $20.

It also means that Dropbox closed well above the $10 billion it was valued at its last private round. Its market cap is now above $12 billion, fully diluted.

Dropbox brought in $1.1 billion in revenue for the last year. This compares to $845 million in revenue the year before and $604 million for 2015.

While it’s been cash flow positive since 2016, it is not yet profitable, having lost nearly $112 million last year. But it has significantly improved margins when compared to losses of $210 million for 2016 and $326 million for 2015.

Its average revenue per paying user is $111.91.

There has been a debate about whether to value Dropbox, which has a freemium model, as a consumer company or an enterprise business. It has convinced just 11 million of its 500 million registered customers to pay for its services.

Dropbox “combines the scale and virality of a consumer company with the recurring revenue of a software company,” said Bryan Schreier, a partner at Sequoia Capital and board member at the company. He said that now was the time for Dropbox to list because “the business had reached a level of scale and also cash flow that warranted a public debut.”

He also talked about the early days of Dropbox pitching at a TechCrunch event in 2008 and how disappointed they were that the slides stopped working during the presentation. We have footage of that here.

Sequoia Capital owned 23.2 percent of the overall shares outstanding at the time of the IPO. They shared Dropbox’s original seed pitch from 2007.

Accel was the next largest shareholder, owning 5 percent overall. Sameer Gandhi made the investment at Sequoia and then invested in Dropbox again when he went over to Accel.

Founder and CEO Drew Houston owned 25.3 percent of the company.

Greylock Partners also had a small stake. John Lilly, a general partner there, said he “invested in Dropbox because Drew and the team had an exceptionally clear vision of what the future of work would look like and built a product that would meet the demands of the modern workforce.”

But there are quite a few other businesses with similar products to Dropbox. The prospectus warned of the competitive landscape.

“The market for content collaboration platforms is competitive and rapidly changing. Certain features of our platform compete in the cloud storage market with products offered by Amazon, Apple, Google, and Microsoft, and in the content collaboration market with products offered by Atlassian, Google, and Microsoft. We compete with Box on a more limited basis in the cloud storage market for deployments by large enterprises.”

Note that it downplayed its competition with Box, a company that’s often mentioned in the same sentence as Dropbox. While the products are similar, the two have different business models and Dropbox was hoping that this would be respected with a better revenue multiple. If the first day is any indication, it looks like that strategy worked.

The company listed on the Nasdaq, under the ticker “DBX.”

We talked about Dropbox’s first day and the outlook for upcoming public debuts like Spotify on our “Equity” podcast episode below. We were joined by Eric Kim, managing partner at Goodwater Capital. He authored a research report here.

Powered by WPeMatico

Clari — a startup that has built a predictive sales tool that provides just-in-time assistance for sales people close deals and for those who work in the bigger chain of command to monitor the progress of the sales operation — is capitalising on the big boom in interest for all things AI in the business world. The company is today announcing that it has closed a Series B round of $35 million, funding that it will be using to build out its own sales and marketing team and expand its platform capabilities.

The round was led by Tenaya Capital, the VC fund that started its life as a part of Lehman Brothers, along with participation from other new investors Thomvest Ventures and Blue Cloud Ventures, and previous investors Sequoia Capital, Bain Capital Ventures and Northgate Capital. It brings the total raised by Clari to $61 million.

Andy Byrne, the founder and CEO who is a repeat entrepreneur and has been involved in several exits, said the funding closed “definitely at an upround, and much bigger than we thought it was going to be,” but declined to give a number. For some context, Clari, according to Pitchbook, had a relatively modest post-money valuation of $83.5 million in its last round in 2014, so my guess is that it’s now comfortably into hundred-million territory, once you add in this latest $35 million.

The funding comes at an interesting time for AI startups, particularly those aimed at enterprise IT.

When Clari first emerged from stealth in April 2014, the idea of applying AI to solve pain points for non-technical people in organizations was a fairly nascent and still-novel concept.

Fast forward to today, things have moved very fast, as is often the case in the tech world. Now, you can’t seem to move for all the enterprise IT startups that are either using or claiming to use AI in their solutions. There are so many startup hopefuls, and so many organizations looking for the best way to use AI to improve their business and operations, that there are even startups being founded to manage that opportunity of connecting the two pieces together, such as Element AI.

“I’m not saying we were clairvoyant for targeting the idea of using AI for sales in 2013,” Byrne said. “There has been a large macro trend and if you happen to be a small company that is along for the ride. When we first launched, we had this thesis about AI for sales. Now it’s not the number three or two priority for sales teams, it’s number one. It’s everywhere. Businesses want to invest and spend more money on AI and making things more efficient.”

Clari says that its customer base has tripled in the last year, with customers including Adobe, Audi, Check Point Software, Equinix, Epicor Software Corporation, GE, and PerkinElmer.

Clari’s approach for using AI for the sales team comes in two main areas. First, the company’s system is aimed to reduce some of the busywork that salespeople have in maintaining and updating files on people, by bringing in a number of different data sources and using them to provide composite pictures of target companies that salespeople might have had to otherwise compile with more manual means. Second, Clari puts a lot of focus on its “Opportunity-to-Close (OTC) solutions” — a type of risk-analysis for salespeople and their managers to help them figure out which leads and strategic directly would be the most likely to produce sales.

“Working with Clari since inception, we have been impressed with its growth and strong execution,” said Aaref Hilaly, Partner at Sequoia Capital, in a statement. “Clari has fast become indispensable to many of the most successful sales teams, giving them visibility into their most important metrics: rep productivity, pipeline health, and forecast accuracy.”

Indeed, risk and outcome is a smart area to be in: using AI to help model this is a key area of focus in enterprise IT at the moment, according to feedback I’ve had from a number of others in the enterprise world.

“If you have 150 opportunities presented to you as a salesperson, how do you choose 10 where you should spend your time?” Byrne asked. “A more traditional CRM platform has never showcased your risk and outcomes.”

While up to now Clari has focused on providing intelligence on what is already in a company’s account database, the next step, Byrne noted, is to draw on data from around the web, providing completely new business leads to the sales team.

When we last covered a funding round for Clari, we noted that the company’s laser focus on sales was something that made the company stand out for investors: nailing one aspect of a business’s operations without distractions from other parts of the organization and what it could be spending time solving elsewhere (in fact, when you think about it, the very goal that Clari has been aiming to achieve for salespeople through its product).

But four years on, the company is now widening that ambition. It’s applying its AI engine now to help marketeers weigh up the best opportunities for reaching out to prospective customers; and interestingly it sounds like it will also be applying its engine to product development and specifically supply chain management.

Byrne described one customer, a medical device maker, that was encountering “inefficiencies” around what they should build and when to meet market demand. “Now that they can predict and forecast order bookings and revenue targets, and what’s happened is that their supply chain has become more efficient,” he said. “It is great example of how our AI is now being expanded.”

“The Clari team has leveraged its deep AI expertise to build a unique platform that surfaces predictive insights for sales reps, managers, and execs during the opportunity-to-close process,” said Brian Paul, MD at Tenaya Capital, in a statement. “We see a massive opportunity for AI to transform how sales teams operate which is clearly validated by Clari’s customers and the impressive growth the team has achieved.”

Powered by WPeMatico

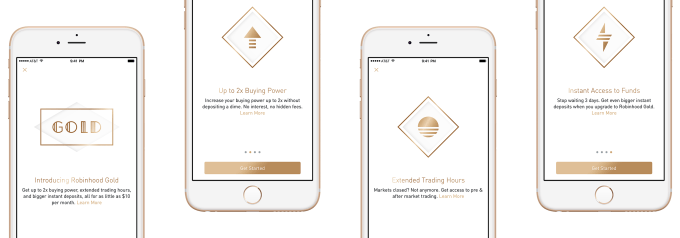

By adding a cryptocurrency exchange, a web version and stock option trading, Robinhood has managed to quadruple its valuation in a year, according to a source familiar with a new round the startup is raising. Robinhood is closing in on around $350 million in Series D funding led by Russian firm DST Global, the source says. That’s just 11 months after Robinhood confirmed TechCrunch’s scoop that the zero-fee stock trading app had raised a $110 million Series C at a $1.3 billion valuation. The new raise would bring Robinhood to $526 million in funding.

Details of the Series D were first reported by The Wall Street Journal.

The astronomical value growth shows that investors see Robinhood as a core part of the mobile finance tools upon which the next generation will rely. The startup also just proved its ability to nimbly adapt to trends by building its cryptocurrency trading feature in less than two months to make sure it wouldn’t miss the next big economic shift. One million users waitlisted for access in just the five days after Robinhood Crypto was announced.

The launch completed a trio of product debuts. The mobile app finally launched a website version for tracking and trading stocks without a commission in November. In December it opened options trading, making it a more robust alternative to brokers like E*Trade and Scottrade. They often charge $7 or more per stock trade compared to zero with Robinhood, but also give away features that are reserved for Robinhood’s premium Gold subscription tier.

Robinhood won’t say how many people have signed up for its $6 to $200 per month Gold service that lets people trade on margin, with higher prices netting them more borrowing power. That and earning interest on money stored in Robinhood accounts are the startup’s primary revenue sources.

Rapid product iteration and skyrocketing value surely helped recruit Josh Elman, who Robinhood announced yesterday has joined as VP of product as he transitions to a part-time roll at Greylock Partners. He could help the company build a platform business as a backbone for other fintech apps, they way he helped Facebook build its identity platform.

In effect, Robinhood has figured out how to make stock trading freemium. Rather than charge per trade with bonus features included, Robinhood gives away the bare-bones trades and charges for everything else. That could give it a steady, scalable business model akin to Dropbox, which grew by offering small amounts of free storage and then charging for extras and enterprise accounts. From a start with free trades, Robinhood could blossom into a hub for your mobile finance life.

Powered by WPeMatico

With more money flowing into a shrinking number of deals, the average startup funding round is getting bigger. And it’s not by a small margin, either. Supergiant funding rounds are coming to dominate the funding landscape at all stages. Here we take a look at this growing phenomenon, what it means and what might be happening “under the hood” in supergiant seed rounds. Read More

With more money flowing into a shrinking number of deals, the average startup funding round is getting bigger. And it’s not by a small margin, either. Supergiant funding rounds are coming to dominate the funding landscape at all stages. Here we take a look at this growing phenomenon, what it means and what might be happening “under the hood” in supergiant seed rounds. Read More

Powered by WPeMatico

Tigera, a San Francisco-based startup that helps businesses connect and secure their container-based applications, today announced that it has raised an additional $10 million in a funding round led by Madrona Venture Group, with participation from New England Associates (NEA) and Wing Venture Capital. Read More

Tigera, a San Francisco-based startup that helps businesses connect and secure their container-based applications, today announced that it has raised an additional $10 million in a funding round led by Madrona Venture Group, with participation from New England Associates (NEA) and Wing Venture Capital. Read More

Powered by WPeMatico

Who needs Amazon when you can make your own online distribution channel? At least, that’s the idea behind Grove Collaborative, a natural home care products company that ships natural cleaning brands like Method and Mrs. Meyer’s. Co-founder Stuart Landesberg started the company in 2014 after working with retail brands during his time as an investor at TPG. He noticed how limited… Read More

Who needs Amazon when you can make your own online distribution channel? At least, that’s the idea behind Grove Collaborative, a natural home care products company that ships natural cleaning brands like Method and Mrs. Meyer’s. Co-founder Stuart Landesberg started the company in 2014 after working with retail brands during his time as an investor at TPG. He noticed how limited… Read More

Powered by WPeMatico

Just a few weeks ago I was in Utah for the holidays, spending time with the many family members my husband and I both have there. At one family gathering, a cousin began talking about how he bought a brand new home and sold his own home all without a real estate agent on a site called Homie. Read More

Just a few weeks ago I was in Utah for the holidays, spending time with the many family members my husband and I both have there. At one family gathering, a cousin began talking about how he bought a brand new home and sold his own home all without a real estate agent on a site called Homie. Read More

Powered by WPeMatico