funding

Auto Added by WPeMatico

Auto Added by WPeMatico

When you’re raising venture capital, it helps if you’ve had “exits.” In other words, if your company has been acquired or you’ve taken one public, investors are more inclined to take a bet on anything you do.

Boston -based serial entrepreneur David Cancel has sold not just one, but four companies. And after a few years running product for HubSpot, he’s in the midst of building number five.

That startup, Drift, managed to raise $47 million in its first three years. Now it’s announcing another $60 million led by Sequoia Capital, with participation from existing investors CRV and General Catalyst. The valuation is undisclosed.

So what is Drift? It’s “changing the way businesses buy from businesses,” said Cancel. He wants to eventually build an alternative to Amazon to make it easier for companies to make large orders.

Currently, Drift subscribers can use chatbots to help turn web visits into sales. It has 100,000 clients including Zenefits, MongoDB, Zuora and AdRoll.

Drift “turns those conversations into customers,” Cancel explained. He said that technology is comparable to what is commonly used for customer service. It’s the “same messaging that was used for support, but used in the sales context.”

In the long-run, Cancel says he hopes Drift will expand its offerings to compete with Salesforce.

The company wouldn’t disclose revenue, but says it is ten times better compared to whatever it was in the past year. And it’s on track to grow another five times this year. This, of course, means little without hard numbers.

Yet we’re told that the new round means that Drift will have $90 million in the bank. It plans to use some of the funding to make acquisitions in voice and video technology. Drift also plans to expand its teams in both Boston and San Francisco, with new offices for both. The company presently has 130 employees.

Powered by WPeMatico

Criminal records, driving records, employment verifications. Companies that use on-demand employees need to know that all the boxes have been checked before they send workers into the world on their behalf, and they often need those boxes checked quickly.

A growing number of them use Checkr, a San Francisco-based company that says it currently runs one million background checks per month for more than 10,000 customers, including, most newly, the car-share company Lyft, the services marketplace Thumbtack, and eyewear seller Warby Parker.

Investors are betting many more customers will come aboard, too. This morning, Checkr is announcing $100 million in Series C funding led by T. Rowe Price, which was joined by earlier backers Accel and Y Combinator.

The round brings the company’s total funding to roughly $150 million altogether, which is a lot of capital in not a lot of time. Yet Checkr is very well-positioned considering the changing nature of work. The company was born when software engineers Daniel Yanisse and Jonathan Perichon worked together at same-day delivery service startup Deliv and together eyed the chance to build a faster, more efficient background check. The number of flexible workers has only exploded in the four years since.

So-called alternative employment arrangements, in the parlance of the Bureau of Labor Statistics, including gig economy jobs, have grown from representing 10.1 percent of U.S. employees in 2005 to 15.8 percent of employees in 2015. And that percentage looks to rise further still as more digital platforms provide direct connections between people needing a service and workers willing to provide it.

Meanwhile, Checkr, which has been capitalizing on this race for talent, has its sights on much more than the on-demand workforce, says Yanisse, who is Checkr’s CEO. While the 180-person company counts Uber, Instacart, and GrubHub among its base of customers, Checkr is also actively expanding outside of the tech and gig economy, he says. It recently began working with the staffing giant Adecco, for example, as well as the major insurer Allstate.

At present, all of these customers pay Checkr per background check. That may change over time, however, particularly if the company plans to go public eventually, which Yanisse suggests is the case. (Public shareholders, like private shareholders, love recurring revenue.)

“Right now, our pricing model for customers is pay-per-applicant,” says Yanisse. “But we have a whole suite of SaaS products and tools” — including an interesting new tool designed to help hiring managers eradicate their unwitting hiring biases — “so we’re becoming more like a SaaS” business.

While things are ticking along nicely, every startup has its challenges. In Checkr’s case, one of these would seem to be those high-profile cases where background checks are painted as far from foolproof. One situation that springs to mind is the individual who began driving for Uber last year, six months before intentionally plowing into a busy bike path in New York. Indeed, though Checkr claims that it can tear through a lot of information within 24 hours — including education verification, reference checks, drug screening — we wonder if it isn’t so fast that it misses red flags.

Yanisse doesn’t think so. “Overall background checks aren’t a silver bullet,” he says. “Our job is to make the process faster, more efficient, more accurate, and more fair. But past information doesn’t guarantee future performance,” he adds. “This isn’t ‘Minority Report.’”

We also ask Yanisse about Checkr’s revenue. Often, a financing round of the size that Checkr is announcing today suggests a revenue run rate of $100 million or so. Yanisse declines to say, telling us Checkr doesn’t share revenue or its valuation publicly. “It’s still a bit early,” he says. “There’s this obsession with metrics in Silicon Valley, and we just want to make sure we’re focused on the right things.”

But, he adds, “you’re in the ballpark.”

Correction: An earlier version of this story incorrectly listed Visa as a customer.

Powered by WPeMatico

Who are you? That’s both an existential question, and also a very practical administrative concern. Today, identity is often exchanged through the use of government ID cards and official paperwork, but what happens when someone loses that paperwork or it is destroyed? Or, as is often the case in many countries around the world, a citizen never received the paperwork to begin with?

Element wants to completely change the way banks, hospitals, and other service providers work with their customers by providing a platform for decentralized biometric identity. The company’s software runs on any mobile device, and using the device’s camera, it can identify a user’s face, palm, and fingerprints to create a verified match. Users have options on which modality they want to use.

Biometric identification is a tough machine learning application, so it shouldn’t be surprising that Element, which was formed in 2012, was co-founded by Adam Perold, a Stanford-educated product designer, and Yann LeCun, a famed machine learning researcher. LeCun was the progenitor of convolution neural nets, which today form one of the foundational theories for deep learning AI. He is now chief science advisor for the company, having taken a role as Director of AI Research at Facebook in New York while continuing his professorship at NYU.

Element is announcing a $12 million Series A round, led by PTB Ventures and GDP Ventures, with David Fields of PTB and On Lee of GDP joining the company’s board of directors. Earlier investors of the company included Pandu Sjahrir, Scott Belsky, Box Group, and Recruit Strategic Partners.

While technologies like Apple’s Touch ID and Face ID systems have popularized biometric identity, neither of these were around when Element got started. The early years of the company were devoted to solving critical technical challenges. Wireless connectivity can be limited in many developing countries, which meant that identities had to be local to the device in order to be useful. That also meant that the platform couldn’t be a cloud infrastructure solution, since identity information had to be processed on the device.

Furthermore, given the quality of hardware available, data had to be extremely compressed to be useful, and the machine learning algorithms couldn’t use too much compute power since a low-powered Android device wouldn’t be able to execute an identity match quickly enough to provide a good user experience.

That’s where LeCun’s deep expertise in neural nets, and particularly in areas like optical character recognition, came in handy. The Element team managed to reduce the amount of data required to store the identity of a single person down to about two kilobytes, according to the company.

The next challenge the company faced in building out its platform was security. Identity data, particularly biometrics, is a major security challenge, but it was exacerbated by the fact that devices would often be shared between users. A single device at a bank, for instance, might service thousands of users, all of which need independent, secured data. The company said that these security challenges have been designed into the core of the system.

Ultimately, the company’s platform lives as an SDK behind the mobile apps of its partners. It provides not only the identity layer itself, but also a secure data infrastructure that allows records such as bank accounts and medical files to be connected to the underlying identity.

Element is targeting the developing world, and Perold tole me he spends more than half of his time traveling to Southeast Asia and Africa building partnerships and doing research on how the company’s technology can improve critical social services. Among the company’s signed partnerships is Telekom Indonesia, which as the service provider for 180 million subscribers, is one of the key connections between people and their identity in that fast-growing economy.

Another partnership formed by the company is with the Global Good Fund, a joint venture between Bill Gates and Intellectual Ventures. That project works to create better biometric identities for newborns and infants, which is critical for health outcomes. The company is working with icddr,b and the Angkor Hospital for Children in Cambodia to build out the program.

In addition to the lead investors, the company received strategic venture capital investments from Bank BCA (via Central Capital Ventura), Bank BRI, Telkom Indonesia (via MDI Ventures), and Maloekoe Ventures.

Correction: The Global Good Fund is a joint venture with Bill Gates, not the Gates Foundation.

Powered by WPeMatico

TravelPerk, a Barcelona-based SaaS startup that’s built an end-to-end business travel platform, has closed a $21 million Series B round, led by Berlin-based Target Global and London’s Felix Capital. Earlier investors Spark Capital and Sunstone also participated in the round, alongside new investor Amplo.

When we last spoke to the startup back in June 2016 — as it was announcing a $7M Series A — it had just 20 customers. It’s now boasting more than 1,000, name-checking “high growth” companies such as Typeform, TransferWise, Outfittery, GetYourGuide, GoCardless, Hotjar, and CityJet among its clients, and touting revenue growth of 1,200% year-on-year.

Co-founder and CEO Avi Meir tells us the startup is “on pace” to generate $100M in GMV this year.

Meir’s founding idea, back in 2015, was to create a rewards program based around dynamic budgeting for business trips. But after conversations with potential customers about their pain-points, the team quickly pivoted to target a broader bundle of business travel booking problems.

The mission now can be summarized as trying to make the entire business travel journey suck less — from booking flights and hotels; to admin tools for managing policies; analytics; customer support; all conducted within what’s billed as a “consumer-like experience” to keep end-users happy. Essentially it’s offering end-to-end travel management for its target business users.

“Travel and finance managers were frustrated by how they currently manage travel and looked for an all in one tool that JUST WORKS without having to compare rates with Skyscanner, be redirected to different websites, write 20 emails back and forth with a travel agent to coordinate a simple trip for someone, and suffer bad user experience,” says Meir.

“We understood that in order to fix business travel there is no way around but diving into it head on and create the world’s best OTA (online travel agency), combined with the best in class admin tools needed in order to manage the travel program and a consumer grade, smart user experience that travelers will love. So we became a full blown platform competing head on with the big TMCs (travel management companies) and the legacy corporate tools (Amex GBT, Concur, Egencia…) .”

He claims TravelPerk’s one-stop business trip shop now has the world’s largest bookable inventory (“all the travel agent inventory but also booking.com, Expedia, Skyscanner, Airbnb… practically any flight/hotel on the internet — only we have that”).

Target users at this stage are SMEs (up to 1,500 employees), with tech and consulting currently its strongest verticals, though Meir says it “really runs the gamut”. While the current focus is Europe, with its leading markets being the UK, Germany and Spain.

TravelPerk’s business model is freemium — and its pitch is it can save customers more than a fifth in annual business travel costs vs legacy corporate tools/travel agents thanks to the lack of commissions, free customer support etc.

But it also offers a premium tier with additional flexibility and perks — such as corporate hotel rates and a travel agent service for group bookings — for those customers who do want to pay to upgrade the experience.

On the competition front the main rivals are “old corporate travel agencies and TMC”, according to Meir, along with larger players such as Egencia (by Expedia) and Concur (SAP company).

“There are a few startups doing what we are doing in the U.S. like TripActions, NexTravel, as well as some smaller ones that are popping up but are in an earlier stage,” he notes.

“Since our first round… TravelPerk has been experiencing some incredible growth compared to any tech benchmark I know,” he adds. “We’ve found a stronger product market fit than we imagined and grew much faster than planned. It seems like everyone is unhappy with the way they are currently booking and managing business travel. Which makes this a $1.25 trillion market, ready for disruption.”

The Series B will be put towards scaling “fast”, with Meir arguing that TravelPerk has landed upon a “rare opportunity” to drive the market.

“Organic growth has been extremely fast and we have an immediate opportunity to scale the business fast, doing what we are doing right now at a bigger scale,” he says.

Commenting in a statement, Antoine Nussenbaum, partner at Felix Capital, also spies a major opportunity. “The corporate travel industry is one of the largest global markets yet to be disrupted online. At Felix Capital we have a high conviction about a new era of consumerization of enterprise software,” he says.

While Target Global general partner Shmuel Chafets describes TravelPerk as “very well positioned to be a market leader in the business travel space with a product that makes business travel as seamless and easy as personal travel”.

“We’re excited to support such an experienced and dedicated team that has a strong track record in the travel space,” he adds in a supporting statement. “TravelPerk is our first investment in Barcelona. We believe in a pan-European startup ecosystem and we look forward to seeing more opportunities in this emerging startup hub.”

Flush with fresh funding, the team’s next task is even more recruitment. “We’ll grow our teams all around with emphasis on engineering, operations and customer support. We’re also planning to expand, opening local offices in 4-5 new countries within the upcoming year and a half,” says Meir.

He notes the company has grown from 20 to 100 employees over the past 12 months already but adds that it will continue “hiring aggressively”.

Powered by WPeMatico

Entrepreneurs have it rough in Africa, India, Pakistan — places where VC cash doesn’t fall from the sky and necessary infrastructure like reliable banking and broadband can be hard to come by. But companies grow and thrive nevertheless in these rugged environments, and DFS Lab is an incubator focused on connecting them with the resources they need to go global.

The company was founded, and funded, on the back of a $4.8 million grant from the Gates Foundation, which of course is deeply concerned with tech-based solutions for well-being all over the world. Its name, Digital Financial Services Lab, indicates its area of focus: fintech. And anyone can tell you that sub-Saharan Africa is one of the most interesting places in the world for that.

This week DFS Lab is announcing a handful of new investments — modest ones on the scale companies are used to in Silicon Valley, but the money is only a small part of the equation. Investment comes at the end of a longer process, the most valuable of which may be the week-long sprint DFS Lab does on the ground, helping solidify ideas into products, or niche products into products at scale.

The relative lack of VCs and angel investors puts early-stage companies at risk and can discourage the most motivated entrepreneur, so the program is aimed at getting them over the hump and connected to a network of peers.

The latest round puts a total of $200,000 into four startups, each touching on a different aspect of a region or vertical’s financial needs. All, however, are largely driven by the massive growth of mobile money in Africa over the last decade and the more recent, ongoing transition to modern smartphones and the app/data landscape familiar to the U.S. and Europe.

The fourth company is choosing to remain in stealth mode for now, but you see the general theme here.

For one reason or another there are major gaps in everyday services that many of us take for granted — the ability to prove one’s identity, for example, is critical but commonly absent. I talked with Paul Damalie, founder of a DFS-funded company called Inclusive that helps address that particular shortcoming.

Basic ID verification can be difficult when you remove many of the things we take for granted. So when, for example, someone wanted to get a loan, a savings account, or some other basic financial service, “Originally you’d have to literally walk into the bank to do it,” Damalie said. Needless to say that isn’t always convenient, and banks as well as users want better options.

“We’ve been collecting existing databases and building a layer of rich access around it,” he continued. “Now we can use facial recognition to check those details. Once you have the ID, you need to check it with the government records” — which Inclusive also does. A range of other data creates a confidence score in the person’s identity, helping avoid identity fraud.

Another opportunity arises not from these gaps but from the unique ways in which the African ecosystem has evolved. USSD, which I mentioned before, is probably unknown to many of our readers — it certainly was to me. But it’s become a standard tool used regularly by millions for important tasks in Africa; if you want to work in that market, you have to deal with USSD one way or another.

Another opportunity arises not from these gaps but from the unique ways in which the African ecosystem has evolved. USSD, which I mentioned before, is probably unknown to many of our readers — it certainly was to me. But it’s become a standard tool used regularly by millions for important tasks in Africa; if you want to work in that market, you have to deal with USSD one way or another.

The problem is that, as you might guess from Nala trying to deprecate it, USSD is a technology dating back to the ’90s, a text-based interface that’s rudimentary but, much like SMS, universally accepted and intelligible. The importance of cross-platform compatibility in mobile markets as fragmented as these can’t be overstated.

So bridging the gap between USSD and a “traditional” (as we might call it) payment app is a unique opportunity, and one a company called Hover (also in the DFS Lab portfolio) is addressing. Its tech acts as a sort of translation layer between USSD and smartphone app interfaces, allowing for modern app design but also deep back-compatibility. It’s an opportunity specific to this time and this area of the world, but nevertheless one that may end up touching millions.

And from the narrowness of its vision that DFS Lab derives its effectiveness.

“They’re one of the most specialized accelerators in the world,” said Damalie. “It goes beyond just funding — it involves having the right kind of network: access to partners, data, sources across the continent. They had context-relevant fellows, people who had very specific challenges.”

“The grant was useful and let us build a proof of concept, and of course the Gates Foundation gives us credibility. But they were taking bets on us as individuals.”

Although DFS Lab has heretofore been funded by the Gates infusion, that well will run dry soon. Jake Kendall, DFS Lab’s executive director, indicated that the plan is to move towards a more traditional investor fund. They already focus on profitability and the potential for growth to the continental stage or beyond; this isn’t a charity but tactical investment in such a way that social good is a necessary byproduct.

“The best way to have a global impact is to be self-sustaining,” he said.

Powered by WPeMatico

Fleetsmith, a startup that wants to make it easier for companies to manage their Apple devices, announced a $7.7 million Series A round today led by Upfront Ventures.

Seed investors Index Ventures and Harrison Metal also participated in the round. The company has raised a total of $11 million. They also announced that Luke Kanies, founder and former CEO of Puppet has joined their advisory board.

Fleetsmith wants to help SMBs provision and manage Apple devices whether that’s computers, phones, iPads or Apple TVs. Trying to provision these devices manually is a time-consuming process, one that larger organizations no longer have to deal with because of other commercial options or in-house solutions, but Fleetsmith puts that same kind of efficient device management within reach of smaller organizations by offering it as a cloud service.

Two of the co-founders, Zack Blum and Jesse Endahl, who came from Dropbox and Fandom, were both in positions where they needed to buy and deploy Apple devices and couldn’t find a good way for a small company to do that on the market.

“How do you manage a fleet of Macs and secure them through the internet? We looked around when we were in a build/buy position and saw a lot to be done. We are democratizing what companies like Google and Facebook have with their own [home-grown] internal Mac management tools,” CEO Blum told TechCrunch.

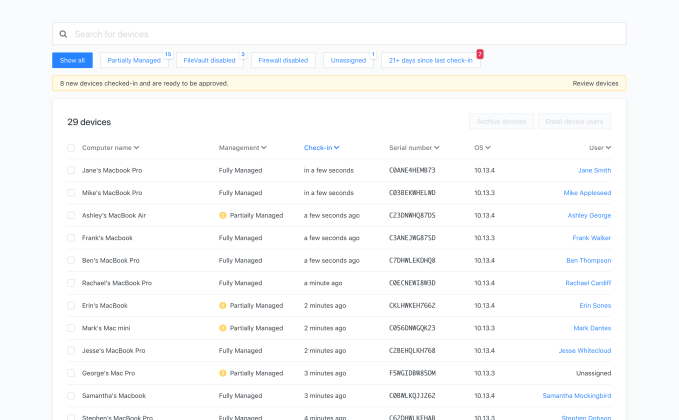

Fleetsmith device admin console. Photo: Fleetsmith

The company takes advantage of the Device Enrollment Program, a business device management service offered by Apple to simplify provisioning of Apple products. As long as the IT administrator is enrolled in DEP, you can use Fleetsmith for zero touch deployment, Blum explained. An employee can then order a laptop (or any device), and when they connect to WiFi, it connects to Fleetsmith, which configures the device automatically.

“The really cool thing about how DEP integrates into our feature set is that as soon as the employee connects to WiFi, it take care of deployment. The account is created, software gets installed, the drive gets encrypted. It makes installing and enrolling new people really simple,” he said. Once you’re setup with everything you need installed, the admin can force critical updates, but the system will give you several warnings before installing the update.

“Fleetsmith is automation applied perfectly, handing all of the menial work to the computer so the people do less firefighting and more strategic work. This is especially important in the mid-market because the teams are leaner and every computer counts,” new advisory board member Kanies said in a statement.

The service costs is just $99 per year per device to access the cloud service. They offer a freemium version to manage up to 10 devices at no cost. The company launched in 2016 and currently has 20 employees. Customers include HackerOne, Robinhood and Nuna.

Powered by WPeMatico

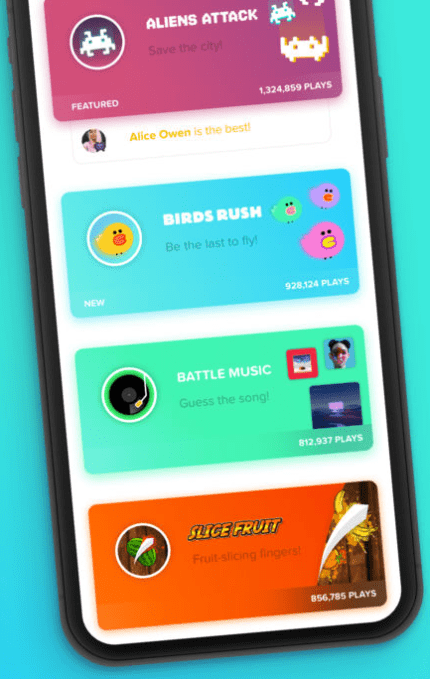

Sick of chatting but want to stay connected? Tribe‘s app lets you play clones of Space Invaders, Flappy Bird, Fruit Ninja, Name That Tune and more while video chatting with up to 7 friends or strangers. Originally a video messaging app, Tribe failed to gain traction in the face of Snapchat and Facebook Messenger. But thanks to a $3 million funding round led by Kleiner Perkins in June, Tribe had the runway to pivot into video chat gaming that could prove popular, even if not in its app.

“As we all know, Messaging is a super crowded area” says Tribe co-founder Cyril Paglino. “If you look closely, very few communication products have been blowing up in the past three years.” Now, he says “we’re building a ‘Social Game Boy.’”

A former breakdancer, Paglino formed his team in France before renting a “hacker house” and moving to San Francisco. They saw traction in late 2016, hitting 500,000 downloads. Tribe’s most innovative feature was speech recognition that could turn a mention of “coffee” into a pre-made calendar request, a celebrity’s name into a link to their social media accounts, locations into maps, and even offer Spotify links to songs playing in the background.

The promise of being the next hit teen app secured Tribe a $500,000 pre-seed from Kima and Ludlow Ventures in 2015, a $2.5 million seed in 2016 led by prestigious fund Sequoia Capital, and then the June 2017 $3 million bridge from KPCB and others. But that $6 million couldn’t change the fact that people didn’t want to sign up for a new chat app when their friends were already established on others.

Luckily, Tribe saw a new trend emerging. Between HQ Trivia’s rise, the Apple App Store adding a Gaming tab, celebrities like Drake streaming their gameplay, and Snapchat acquiring 3D gaming engine PlayCanvas, the Tribe team believed there was demand for a new way to play.

Luckily, Tribe saw a new trend emerging. Between HQ Trivia’s rise, the Apple App Store adding a Gaming tab, celebrities like Drake streaming their gameplay, and Snapchat acquiring 3D gaming engine PlayCanvas, the Tribe team believed there was demand for a new way to play.

Tribe’s rebuilt iOS and Android apps let you rally a crew of friends or join in with strangers to play one of its old school games. You’ll hear their voices and see their faces in the corner of the screen as everyone in your squad vies for first place. It’s like Houseparty’s group video chat, but with something to do. Facebook Messenger has its own gaming platform, but the games are largely asynchronous. That means you play separately and merely compare scores. That’s a lot less fun than laughing it up together as one of your buddies runs their race car off the road or gets attacked by an alien.

Powered by WPeMatico

UK startup Juro, which is applying a “design centric approach” and machine learning tech to help businesses speed up the authoring and management of sales contracts, has closed $2m in seed funding led by Point Nine Capital.

Prior investor Seedcamp also contributed to the round. Juro is announcing Taavet Hinrikus (TransferWise’s co-founder) as an investor now too, as well as Michael Pennington (Gumtree co-founder) and the family office of Paul Forster (co-founder of Indeed.com).

Back in January 2017 the London-based startup closed a $750,000 (£615k) seed round, though CEO and co-founder Richard Mabey tells us that was really better classed as an angel round — with Point Nine Capital only joining “late” in the day.

“We actually could have strung it out to Series A,” he says of the funding that’s being announced now. “But we had multiple offers come in and there is so much of an explosion in demand for the [machine learning] that it made sense to do a round now rather than wait for the A. The whole legal industry is undergoing radical change and we want to be leading it.”

Juro’s SaaS product is an integrated contracts workflow that combines contract creation, e-signing and commenting capabilities with AI-powered contract analytics.

Its general focus is on customers that have to manage a high volume of contacts — such as marketplaces.

The 2016-founded startup is not breaking out any customer numbers yet but says its client list includes the likes of Estee Lauder, Deliveroo and Nested. And Mabey adds that “most” of its demand is coming from enterprise at this point, noting it has “several tech unicorns and Fortune 500 companies in trial”.

While design is clearly a major focus — with the startup deploying clean-looking templates and visual cues to offer a user-friendly ‘upgrade’ on traditional legal processes — the machine learning component is its scalable, value-added differentiator to serve the target b2b users by helping them identify recurring sticking points in contract negotiations and keep on top of contract renewals.

Mabey tells TechCrunch the new funding will be used to double down on development of the machine learning component of the product.

“We’re not the first to market in contract management by about 25 years,” he says with a smilie. “So we have always needed to prove out our vision of why the incumbents are failing. One part of this is clunky UX and we’ve succeeded so far in replacing legacy providers through better design (e.g. we replace DocuSign at 80% of our customers).

“But the thing we and our investors are really excited about is not just helping businesses with contract workflow but helping them understand their contract data, auto-tag contracts, see pattens in negotiations and red flag unusual contract terms.”

While this machine learning element is where he sees Juro cutting out a competitive edge in an existing and established market, Mabey concedes it takes “quite a lot of capital to do well”. Hence taking more funding now.

“We need a level of predictive accuracy in our models that risk averse lawyers can get comfortable with and that’s a big ask!” he says.

Specifically, Juro will be using the funding to hire data scientists and machine learning engineers — building out the team at both its London and Riga offices. “We’re doing it like crazy,” adds Mabey. “For example, we just hired from the UK government Digital Service the data scientist who delivered the first ML model used by the UK government (on the gov.uk website).

“There is a huge opportunity here but great execution is key and we’re building a world class team to do it. It’s a big bet to grow revenue as quickly as we are and do this kind of R&D but that’s just what the market is demanding.”

Juro’s HQ remains in London for now, though Mabey notes its entire engineering team is based in the EU — between Riga, Amsterdam and Barcelona — “in part to avoid ‘Brexit risk’”.

“Only 27% of the team is British and we have customers operating in 12 countries — something I’m quite proud of — but it does leave us rather exposed. We’re very open minded about where we will be based in the future and are waiting to hear from the government on the final terms of Brexit,” he says when asked whether the startup has any plans to Brexit to Berlin.

“We always look beyond the UK for talent: if the government cannot provide certainty to our Romanian product designer (ex Kalo, Entrepreneur First) that she can stay in the UK post Brexit without risking a visa application, tbh it makes me less bullish on London!”

Powered by WPeMatico

In an interview last month with Julie Bort from Business Insider, Parker Harris and Marc Benioff told the story of how when they first launched the company, they were trying to raise money and nobody would give them a dime. Benioff said he went to every venture capital in Silicon Valley — and was turned down every single time.

This could be a lesson for every startup out there with a vision, who is not able to find conventional financing for your idea. Salesforce found the money, but it took one on one fundraising, rather than the traditional VC route.

The company famously launched in an apartment that Benioff rented, and he put up some of his own money to buy the company’s first computers. Then it was time to go downtown and ask the VCs for money and it did not go well.

“I had to go hat in hand, like I was a high tech beggar, down to Silicon Valley to raise some money…And as I go from venture capitalist to venture capitalist to venture capitalist — and a lot of them are my friends, people I’ve gone to lunch with — and each and every one of them said no,” Benioff said. “Salesforce was never able to raise a single dollar from a venture capitalist,” he added.

He suggested there were a lot of reasons for that including competitors who would call after his meetings and deliberately sabotage him or people who simply didn’t believe in the cloud as a vision of the future of software.

Whatever the reasons, Salesforce was eventually able to raise over $60 million from private individual investors, before going public in 2004. In the context of today’s venture capital environment, it is pretty tough to imagine a guy like Benioff not finding one taker, especially when you consider that he was not exactly an unknown quantity. And still no one would write him a check.

But this wasn’t now. It was in the late 1990s when nobody was thinking about cloud computing and the notion of software on the internet was a distant idea. Benioff was imagining something completely different and not one firm had the vision to see what was coming. Today, Salesforce is a $10 billion company and those folks that turned him down have to be wondering what they were thinking.

“When you start something like Salesforce, you want to surround yourself with people who do believe in you, who do believe you’re going to be successful because you’re going to have a whole bunch of people who are going to tell you that you’re not, Benioff said.

That’s something every entrepreneur should remember.

Powered by WPeMatico

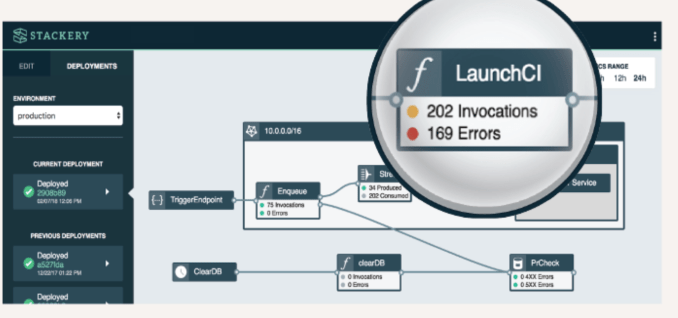

When Stackery’s founders were still at New Relic in 2014, they recognized there was an opportunity to provide instrumentation for the emerging serverless tech market. They left the company after New Relic’s IPO and founded Stackery with the goal of providing a governance and management layer for serverless architecture.

The company had a couple of big announcements today starting with their $5.5 million round, which they are calling a “seed plus” — and a new tool for tracking serverless performance called the Health Metrics Dashboard.

Let’s start with the funding round. Why the Seed Plus designation? Company co-founder and CEO Nathan Taggart says they could have done an A round, but the designation was a reflection of the reality of where their potential market is today. “From our perspective, there was an appetite for an A, but the Seed Plus represents the current stage of the market,” he said. That stage is still emerging as companies begin to see the benefits of the serverless approach.

HWVP led the round. Voyager Capital, Pipeline Capital Partners, and Founders’ Co-op also participated. Today’s investment brings the total raised to $7.3 million since the company was founded in 2016.

Serverless computing like AWS Lambda or Azure Functions is a bit of a misnomer. There is a server underlying the program, but instead of maintaining a dedicated server for your particular application, you only pay when there is a trigger event. Like cloud computing that came before, developers love it because it saves them a ton of time configuring (or begging) for resources for their applications.

But as with traditional cloud computing — serverless is actually a cloud service — developers can easily access it. If you think back to the Consumerization of IT phenomenon that began around 2011, it was this ability to procure cloud services so easily that resulted in a loss of control inside organizations.

As back then, companies want the advantages of serverless technology, but they also want to know how much they are paying, who’s using it and that it’s secure and in compliance with all the rules of the organization. That’s where Stackery comes in.

As for the new Health Metrics Dashboard, that’s an extension of this vision, one that fits in quite well with the monitoring roots of the founders. Serverless often involves containers, which can encompass many functions. When something goes wrong it’s hard to trace what the root cause was.

Stackery Health Metrics Dashboard. Photo: Stackery

“We are showing architecture-wide throughput and performance at each resource point and [developers] can figure out where there are bottlenecks, performance problems or failure.

The company launched in 2016. It is based in Portland, Oregon and currently has 9 employees, of which five are engineers. They plan to bring on three more by the end of the year.

Powered by WPeMatico