funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Massachusetts-based Soft Robotics announced this week that it’s raised $20 million in funding, courtesy of Scale Venture Partners, Calibrate Ventures, Honeywell Ventures and Tekfen Ventures, along with existing investors like robotics giant, ABB. The round follows a $5 million Series A the company closed back in late-2015.

The investment interest is pretty clear on this one. Picking and placing is the de rigueur industrial robotics challenge at the moment, and the company’s soft, air-filled hands offer a novel approach to the issue. The rubbery materials that comprise the company’s robotic grippers make them much more compliant and therefore more capable of picking up a variety of objects with minimal pre-programming and on-board vision systems.

Thus far, Soft has primarily found a spot for itself in the food industry, serving factories with delicate products like produce and pizza dough. It’s also been adopted by Just Born Quality Confections, the people who bring you Peeps.

According to the company, the new round will help push Soft even further into the food and beverage categories, along with a larger presence in retail and logistics. The involvement of Honeywell and Yamaha’s investment wings could also signal interest from those companies’ own warehouses. With the right air pressure applied, the system should be strong enough to pick up more solid objects.

Warehouse fulfillment has become increasingly strained in recent years, due to expectations from companies like Amazon, opening a space for robotics companies to address fast-paced but repetitive jobs like moving product onto and off of conveyor belts. Late last month, Soft showed off a low-cost, AI-driven warehouse system designed to retrieve products from bins to sort and fulfill retail orders with little oversight from its human counterparts.

Powered by WPeMatico

Google is betting big on the Assistant ecosystem and it’s now putting its money where its mouth is. The company announced today it’s launching a new program that will provide investment capital and other resources to early-stage startups that build applications in the Google Assistant ecosystem.

Typically, companies announce these kinds of programs to kickstart an ecosystem around a new product. While developers have already launched plenty of services for the Google Assistant, the company says that it is launching this new program to “promote more of this creativity.”

Google VP for search and the Google Assistant Nick Fox echoed this. “With the Google Assistant, we’re focused on fostering an open ecosystem for developers, device makers, and content partners to build new experiences,” he told me. “We’re already seeing a lot of creativity from developers with the Google Assistant, and to help promote this, we’re opening a new investment program for early-stage startups.”

Investments are one part of this program, but Google will also work with these startups directly to provide them with mentorship and advice from engineers, product managers and design experts. The startups in the program will also get early access to new features and tools, as well as access to the Google Cloud Platform and promotional support. That sounds a bit like an accelerator program, though that’s not quite what Google is calling it.

Fox tells me that Google won’t put a cap on the investments. “We’ll invest as much as we see fit, and are focused on helping startups succeed in this emerging space,” he said. “And we’re not just offering investment capital. We’re eager to partner with these startups and leverage our company’s strengths to help these products come to market poised for success.”

The first startups in this program include GoMoment, a concierge service for hotels and Edwin, a personal English tutor, as well as the developer tools BotSociety and Pulse Labs.

These startups are good representatives of what Google is after. Fox tells me that Google is looking for startups that are “pursuing an interesting space for Assistants, such as vertical industries like travel or gaming.” In addition, Google is also looking to deepen some of its partnerships, but for the most part, it’s simply looking for startups that are pushing technologies like the Assistant forward.

Powered by WPeMatico

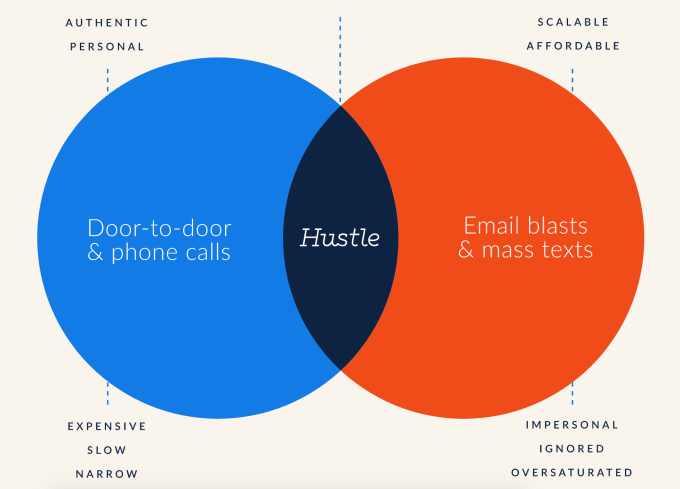

Hustle 20X’d its annual revenue run rate in 15 months by denying clients that contradict its political views. It’s a curious, controversial, yet successful strategy for the startup whose app lets activists and marketers text thousands of potential supporters or customers one at a time. Compared to generic email blasts and robocalls, Hustle gets much higher conversion rates because people like connecting with a real human who can answer their follow-up questions.

The whole business is built around those relationships, so campaigns, non-profits, and enterprises have to believe in Hustle’s brand. That’s why CEO Roddy Lindsay tells me “We don’t sell to republican candidates or committees. What it’s allowed us to do is build trust with the Democratic party and progressive organizations. We don’t have to worry about celebrating our clients’ success and offending other clients.”

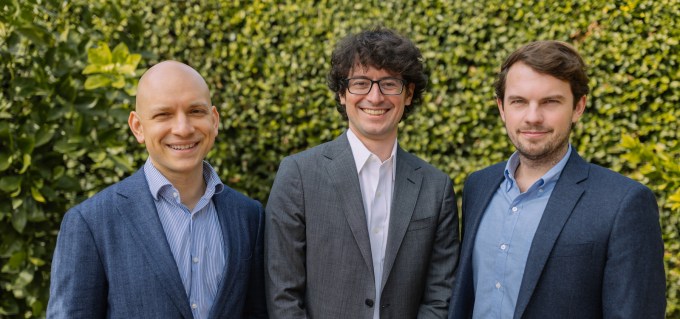

Hustle execs from left: COO Ysiad Ferreiras, CEO Roddy Lindsay, CTO Tyler Brock

Investors agree. Tempted by Hustle’s remarkable growth to well over a $10 million run rate and 85 million conversations started, Insight Venture Partners has led a $30 million Series B for the startup that’s joined by Google’s GV and Salesforce Ventures.

The round comes just 10 months after Hustle’s $8M Series A when it was only doing $3 million in revenue. Lindsay says he was impressed with Insight’s experience with communication utilities like Cvent and non-profit tools like Ministry Brands. Its managing director Hilary Gosher who specializes in growing sales teams will join Hustle’s board, which is a great fit since Hustle is hiring like crazy.

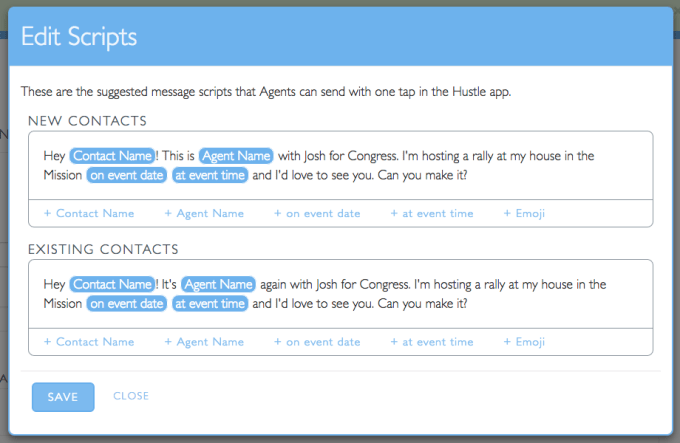

Founded in late 2014, Hustle’s app lets organizers write MadLibs-style text message scripts and import contact lists. Their staffers or volunteers send out the messages one by one, with the blanks automatically filled in to personalize the calls to action. Recipients can respond directly with the sender ready with answers to assuage their fears until they’re ready to donate, buy, attend, or help. Meanwhile, organizers can track their conversions, optimize scripts, and reallocate assignments so they can reach huge audiences with an empathetic touch.

The Hustle admin script editor

The app claims to be 77X faster than making phone calls and 5.5X more engaging than email, which has won Hustle clients like LiveNation’s concert empire, NYU, and the Sierra Club. Clients pay $0.30 per contact uploaded into Hustle, with discounts for bigger operations. Now at $41 million in total funding, Hustle plans to push further beyond its core political and non-profit markets and deeper into driving alumni donations for universities, sales for enterprises, and attendance for event promoters.

Hustle will be doing that without one of its three co-founders, Perry Rosenstein, who left at the end of 2017. [Disclosure: I know Lindsay from college and once worked on a short-lived social meetup app with Rosenstein called Signal.] Lindsay says Rosenstein’s “real excellence was about early stage activities and problems”. Indeed, in my experience he was more attuned to underlying product-market fit than the chores of scaling a business. “It was Perry’s decision, it was a departure we celebrated, and he’s still involved as an informal adviser to me and the company” Lindsay concluded.

Hustle is growing so fast, this recent photo is already missing a third of the team

Hustle has over 100 other employees in SF, NYC, and DC to pick up the torch, though. That’s up from just 12 employees at the start of 2017. And it’s perhaps one of the most diverse larger startups around. Lindsay says his company is 51 percent women, 48 percent people of color, and 21 percent LGBT. This inclusive culture attracts top diverse talent. “We see this as a key differentiator for us. It allows us to hire incredible people” Lindsay says. “It’s something we took seriously from day one and the results show.”

What started as a favored tool of the Bernie Sanders campaign has blossomed into a new method of communicating at scale. “We’re massively humanizing the way these organizations communicate” Lindsay said. “Humans really matter, no matter if what you care about is getting lots of people to come to events, vote, or renew a season ticket package. Having a relationship with another person can cut through the noise. That’s different than your interactions with bots or email marketing campaigns or things where it’s dehumanized.”

Lindsay felt the frustration of weak relationships when after leaving Facebook where he worked for six years as one of its first data scientists, he volunteered for Mark Zuckerberg’s Fwd.us immigration reform organization. Its email got just a 1 percent conversion rate. He linked up with Obama’s former Nevada new media director Rosenstein and CTO Tyler Brock to fix that with Hustle.

Working with Bernie aligned with the team’s political sentiments, but they were quickly faced with whether they wanted to fuel both sides of the aisle — which would mean delivering fringe conservative campaign messages they couldn’t stomach. Hustle still has no formal policy about declining Republican money, and a spokesperson said they point potential clients to TechCrunch’s previous article mentioning the stance. Meanwhile, Hustle is growing its for-profit client base to make shunning the GOP feel like less of a loss. Having Salesforce as a strategic investor also creates a bridge to a potential exit option.

Focusing on the left is working for now. Over 25 state Democratic parties are clients. Hustle sent 2.5 million messages and reached over 700,000 voters — 1 in 5 total — during the Alabama special election, helping Democrat Doug Jones win the Senate seat.

“Let’s build this great business for the Democratic party. Let’s let someone else take the Republicans” Lindsay explains. A stealth startup called OpnSesame is doing just that, Lindsay mentions. But he says “we don’t actually see them as competitive. We see them as potential allies that advocate for the power of p2p texting in getting everyone included in our democracy.” Instead, Lindsay sees the potential for Hustle to lose its sense of purpose and drive as it rapidly hires as its biggest threat.

Long-term, Hustle hopes to propel the right side of history by sticking to the left. Lindsay concludes, “You can really just put on your business hat and see this is a good choice.”

Powered by WPeMatico

Artificial intelligence and the application of it across nearly every aspect of our lives is shaping up to be one of the major step changes of our modern society. Today, a startup that wants to help other companies capitalise on AI’s advances is announcing funding and emerging from stealth mode.

Allegro.AI, which has built a deep learning platform that companies can use to build and train computer-vision-based technologies — from self-driving car systems through to security, medical and any other services that require a system to read and parse visual data — is today announcing that it has raised $11 million in funding, as it prepares for a full-scale launch of its commercial services later this year after running pilots and working with early users in a closed beta.

The round may not be huge by today’s startup standards, but the presence of strategic investors speaks to the interest that the startup has sparked and the gap in the market for what it is offering. It includes MizMaa Ventures — a Chinese fund that is focused on investing in Israeli startups, along with participation from Robert Bosch Venture Capital GmbH (RBVC), Samsung Catalyst Fund and Israeli fund Dynamic Loop Capital. Other investors (the $11 million actually covers more than one round) are not being disclosed.

Nir Bar-Lev, the CEO and cofounder (Moses Guttmann, another cofounder, is the company’s CTO), started Allegro.AI first as Seematics in 2016 after he left Google, where he had worked in various senior roles for over 10 years. It was partly that experience that led him to the idea that with the rise of AI, there would be an opportunity for companies that could build a platform to help other less AI-savvy companies build AI-based products.

“We’re addressing a gap in the industry,” he said in an interview. Although there are a number of services, for example Rekognition from Amazon’s AWS, which allow a developer to ping a database by way of an API to provide analytics and some identification of a video or image, these are relatively basic and couldn’t be used to build and “teach” full-scale navigation systems, for example.

“An ecosystem doesn’t exist for anything deep-learning based.” Every company that wants to build something would have to invest 80-90 percent of their total R&D resources on infrastructure, before getting to the many other apsects of building a product, he said, which might also include the hardware and applications themselves. “We’re providing this so that the companies don’t need to build it.”

Instead, the research scientists that will buy in the Allegro.AI platform — it’s not intended for non-technical users (not now at least) — can concentrate on overseeing projects and considering strategic applications and other aspects of the projects. He says that currently, its direct target customers are tech companies and others that rely heavily on tech, “but are not the Googles and Amazons of the world.”

Indeed, companies like Google, AWS, Microsoft, Apple and Facebook have all made major inroads into AI, and in one way or another each has a strong interest in enterprise services and may already be hosting a lot of data in their clouds. But Bar-Lev believes that companies ultimately will be wary to work with them on large-scale AI projects:

“A lot of the data that’s already on their cloud is data from before the AI revolution, before companies realized that the asset today is data,” he said. “If it’s there, it’s there and a lot of it is transactional and relational data.

“But what’s not there is all the signal-based data, all of the data coming from computer vision. That is not on these clouds. We haven’t spoken to a single automotive who is sharing that with these cloud providers. They are not even sharing it with their OEMs. I’ve worked at Google, and I know how companies are afraid of them. These companies are terrified of tech companies like Amazon and so on eating them up, so if they can now stop and control their assets they will do that.”

Customers have the option of working with Allegro either as a cloud or on-premise product, or a combination of the two, and this brings up the third reason that Allegro believes it has a strong opportunity. The quantity of data that is collected for image-based neural networks is massive, and in some regards it’s not practical to rely on cloud systems to process that. Allegro’s emphasis is on building computing at the edge to work with the data more efficiently, which is one of the reasons investors were also interested.

“AI and machine learning will transform the way we interact with all the devices in our lives, by enabling them to process what they’re seeing in real time,” said David Goldschmidt, VP and MD at Samsung Catalyst Fund, in a statement. “By advancing deep learning at the edge, Allegro.AI will help companies in a diverse range of fields—from robotics to mobility—develop devices that are more intelligent, robust, and responsive to their environment. We’re particularly excited about this investment because, like Samsung, Allegro.AI is committed not just to developing this foundational technology, but also to building the open, collaborative ecosystem that is necessary to bring it to consumers in a meaningful way.”

Allegro.AI is not the first company with hopes of providing AI and deep learning as a service to the enterprise world: Element.AI out of Canada is another startup that is being built on the premise that most companies know they will need to consider how to use AI in their businesses, but lack the in-house expertise or budget (or both) to do that. Until the wider field matures and AI know-how becomes something anyone can buy off-the-shelf, it’s going to present an interesting opportunity for the likes of Allegro and others to step in.

Powered by WPeMatico

Over the past few years, the old language of “customer support” has been supplanted by the new language of “customer success.” In the old model, companies would essentially disappear following the conclusion of a sale, merely handling customer problems when they arose. Now, companies are actively reaching out to customers, engaging them with education and training and monitoring them with analytics to ensure they have the best time with the product as possible.

What’s changing is the nature of product and services today: subscription. Customers no longer just make a single buying decision about a product, but instead must actively commit to using the product, or else they churn.

New York-based Catalyst, founded by brothers Edward and Kevin Chiu, wants to rebuild customer success from the ground up with an integrated software platform. They have received some capital success of their own, securing $2.4 million in venture capital from Phil Black of True Ventures with participation from Ludlow Ventures and Compound.

New York has had something of an increase in founder mafias, as TechCrunch reported this weekend. Catalyst is no exception to this trend, with the Chiu brothers both working at DigitalOcean, one of New York’s many high-flying enterprise startups. Edward Chiu was director of customer success at the company for a number of years, but had a unique background in sales and also in coding before starting.

Kevin Chiu was head of inside sales at DigitalOcean . “I brought my brother on to do sales at DigitalOcean,” Edward Chiu explains. “We always knew that we wanted to start a company together, but wanted to see if we would kill each other.” The two worked together, and lo and behold, they didn’t kill each other.

Edward Chiu wanted to match the product experience of using DigitalOcean with the experience of using its internal customer success tools. Nothing on the market fit. “Given that DigitalOcean was a very technical product,” Chiu explained, “we decided to build our own tool.” Chiu thought of customer success at DigitalOcean as its own product, and his team built up the platform to improve its functionality and scalability. “We just used the tool and we loved it,” he said, so we “started to show this tool to a bunch of other customer success leaders I am connected with.”

Other customer success leaders said they wanted the platform, and “after the 20th person told me that,” he and his brother spun out of DigitalOcean to go on their own. Unlike enterprise startups in New York a couple of years ago that often struggled to find any investors, Catalyst found cash quickly. “Two weeks in we had more offers than we knew what to do with,” Chiu explained. The two said they had originally targeted a fundraise of $750,000, but ended up at $2.4 million.

Catalyst is a platform that integrates between a number of other major SaaS services such as Salesforce, Zendesk, Mixpanel and others to create a unified dashboard for data around customer success. From there, customer success managers have a set of automated tools to handle engagement, such as customer segmentation and email campaigns.

A major challenge in the customer success world is that these managers often don’t have the skills required to do advanced data analytics, so they often rely on their friends in engineering to run scripts or perform database lookups. The hope is that Catalyst’s feature set is powerful enough that these sorts of ad hoc tasks become a thing of the past. “Because we aggregate all this data, you can run queries,” Chiu explains.

Chiu says that Catalyst doesn’t just want to be a software platform, but rather a movement that pushes every company to think about how they can make their customers successful. “There are so many companies that are starting to understand that it is not something that you do once you raise a Series A, but something you do from day one,” Chiu said. “If you take care of your very first customer, they will constantly promote you and constantly promote your business.”

The company is based in Flatiron, and has eight employees.

Powered by WPeMatico

Capital Float, the fintech startup that says it is India’s largest online lender, announced today that it has raised $22 million in new funding from Amazon. At the end of last year, reports surfaced that Amazon was considering an investment in Capital Float as an extension of its $45 million Series C, which was announced last August. The Bangalore-based startup confirmed to TechCrunch that Amazon’s investment is indeed an extension of that round and brings the total equity it has raised over the past 12 months to $67 million.

Over the same period, Capital Float also raised $80 million of debt from banks and other financial companies, which it combines with its own balance sheet to finance loans to small businesses and other borrowers. Amazon India is among several e-commerce platforms that the company has partnered with to provide loans to sellers, including Snapdeal and Shopclues.

Since its inception in 2013 by co-founders Sashank Rishyasringa and Gaurav Hinduja, Capital Float has raised a total of about $110 million in equity funding from investors, including Ribbit Capital, SAIF Partners, Sequoia India, Creation Investments and Aspada, as well as total debt lines of $130 million.

During the last six months, Capital Float added 50,000 new customers, bringing its total customer base to more than 80,000 people in more than 300 cities. The startup says it currently disburses more than 10,000 loans each month and now has an outstanding loan portfolio of more than $170 million, with a default rate of about 2 percent. About 70 percent of its loans are microloans ranging from 25,000 rupees to 500,000 rupees (about $376 to $7,530).

With the investment from Amazon, the startup has set an ambitious goal of adding 300,000 new customers and originating more than $800 million in loans this year.

In a press statement, Amazon India’s country manager Amit Agarwal said, “We’re excited to work with Capital Float and invest alongside other investors. We are highly impressed with what Gaurav and Sashank have built and we back missionary entrepreneurs and management teams. Credit in India is highly under-penetrated and Capital Float is bringing the right kind of credit solutions to the underserved and informally served segments of SMEs to help realize their full potential.”

Over the last year, Capital Float expanded into more verticals, including products for small- to mid-sized manufacturers, point-of-sale financing for retailers and loans for school construction and self-employed professionals like doctors. It also added new online payment gateways to make it easier for borrowers to repay loans and began piloting deep learning-based underwriting models that use data points like image processing, geotags and new policies such as the Goods and Service Tax (GST), an indirect tax launched last year that is levied at every step of the production chain and the banknote demonetization started by Prime Minister Narendra Modi’s government in 2016.

Powered by WPeMatico

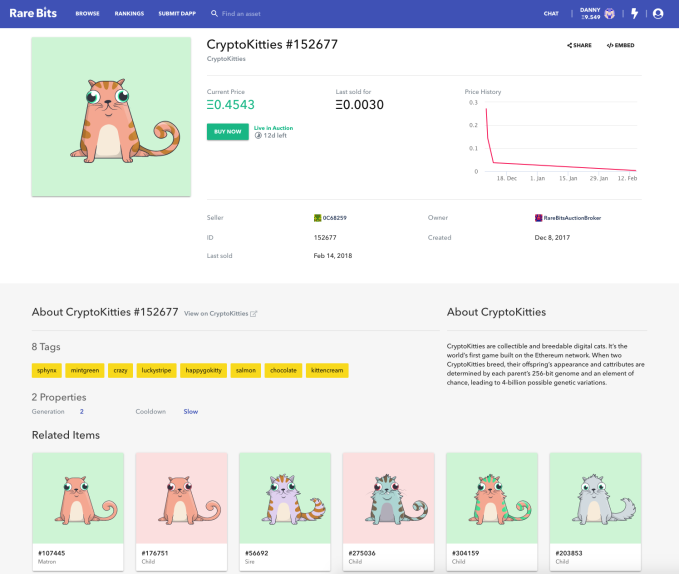

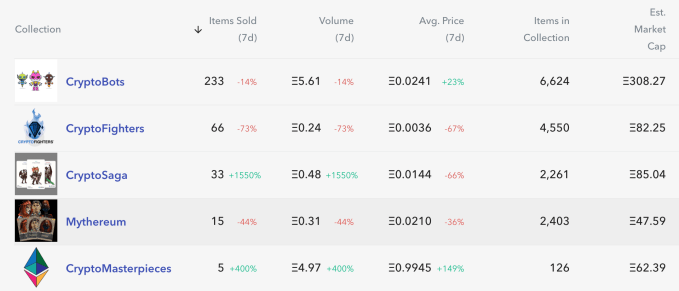

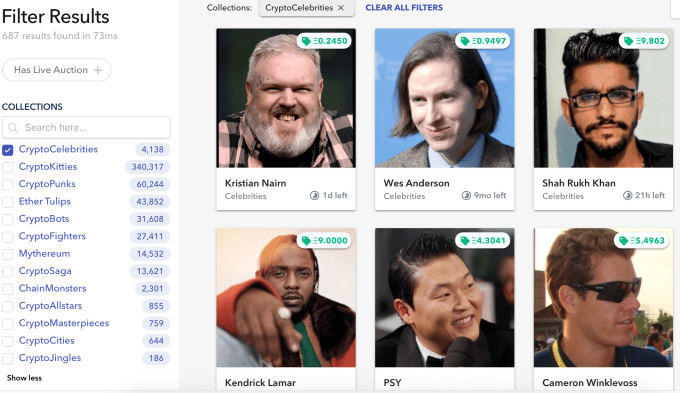

Rare Bits wants to be eBay for the blockchain, where you buy, sell and trade non-fungible crypto-goods. After CryptoKitties raised $12 million from Andreessen Horowitz last month for its digital collectibles game, there’s been an explosion of interest in the space. But without a popular marketplace, it’s hard to find the goods you want at the right price. Now a team of former Zynga staffers is building out the Rare Bits crypto-collectible auction and commerce site with a $6 million round led by Nabeel Hyatt at Spark Capital, and joined by First Round Capital, David Sacks’ Craft Ventures and SV Angel.

“Because of the Ethereum ledger, for the first time, users can truly own their digital items,” says co-founder Amitt Mahajan. “Previously in mobile or social games, virtual items earned through play or by spending money were actually owned by the company operating the game. If they shut down their servers, the items would go away and users would be out of luck. We believe this new asset class represents a paradigm shift in digital property whereby centralized assets will be moved onto decentralized systems.”  For now, Rare Bits isn’t slapping any extra fees on its marketplace, compared to paying up to 1 percent on other marketplaces like Open Sea, or even more elsewhere. Instead, if a crypto-item developer charges a fee on secondary sales, say 5 percent, they’ll split that with Rare Bits for arranging the transaction.

For now, Rare Bits isn’t slapping any extra fees on its marketplace, compared to paying up to 1 percent on other marketplaces like Open Sea, or even more elsewhere. Instead, if a crypto-item developer charges a fee on secondary sales, say 5 percent, they’ll split that with Rare Bits for arranging the transaction.

Rare Bits lists more than 500,000 items from a dozen games, including CryptoPunks, Ether Tulips, CryptoBots, CryptoFighters, Mythereum and CryptoCelebrities. Users get the benefit of having all their crypto-collectibles in a single wallet. They can see historical pricing before they buy anything thanks to the transparency of the Ethereum ledger, whether they want to “Buy Now” or win an auction. The collectors can also see related items rather than transacting in a vacuum. One item sold for more than $10,000, and sales in the 5-10ETH range ($555 each today) aren’t uncommon.

Rare Bits founders from left: Danny Lee, Payom Dousti, Dave Pekar and Amitt Mahajan

Mahajan, Danny Lee and Dave Pekar all met after selling their gaming startups to Zynga . [Disclosure: I know Pekar from college.] Their fourth co-founder, Payom Dousti, worked at fintech VC fund 1/0 Capital and sold his sports analytics startup numberFire to FanDuel. With experience across the gaming, virtual goods and crypto space, Mahajan tells me, “We thought long and hard about potentially building blockchain-based games ourselves, but ultimately decided that there was a larger opportunity in focusing on crypto-based property as a whole.” The Rare Bits exchange launched in February and did more than $100,000 in transactions in its first month.

With some CryptoKitties selling elsewhere for as much as $200,000, investors liked the idea of taking a cut of everyone’s transactions rather than just launching another digital trading card. That led Rare Bits to raise a $1 million seed from Macro Ventures and angels like Steve Jang and Robin Chan. As scaling issues threaten to prevent the Bitcoin and Ethereum blockchains from supporting micropayments and mainstream commerce, new use cases like crypto-collectibles are taking the spotlight.

Now with the $6 million Series A, Rare Bits is bringing in some heavyweight angels from the world of gaming. That includes Emmet Shear and Justin Kan, the co-founders of Twitch. Former Dropbox execs and married couple Ruchi Sanghvi and Aditya Agrawal are also in the round, alongside Greenoaks Captial MD Neil Mehta and Channel Factory CEO Tony Chen.

The team hopes the runway will help it secure partnerships with developers and creatives to publish new collectibles for the blockchain that have a home on Rare Bits. Mahajan says, “People are viewing these items as assets that can be invested in instead of liabilities that are one way transfers of value towards the developer, it’s one of the major changes in this ecosystem versus traditional virtual items.”

Rare Bits will have to deal with the inherent scaling troubles of the Ethereum blockchain it operates on. For now, it’s refunding users the “gas” it costs to execute purchases and sales on its marketplace in a timely manner. Those range from a few cents to a few dollars, depending on network congestion. But Rare Bits could be looking at a steep bill or be forced to push those fees onto users if it gets popular enough.

There’s always the danger that CryptoKitties and the like are just the new Beanie Babies — valued today, but worthless when the fad dies. Rare Bits benefits from getting to follow the trend to whatever crypto-collectible is in vogue, and just has to hope the whole concept doesn’t fade.

But Rare Bits has a hedge against that. “While today most of these items are items from games and collectibles, we envision that we will see licenses, tickets, rights, even tokenized physical goods represented as digital assets,” Mahajan tells us. It’s now building a Fan Bits feature that will let YouTube creators, Twitch streamers and Instagram celebrities create crypto-based collectibles “to engage with their audience and let their fans support them,” he explains. You might one day be able to buy and resell a meet-and-greet pass for your favorite band.

“Our ultimate goal is to convince millions of new people to begin owning and transacting crypto-based property,” says Mahajan. But the founders will probably be okay regardless. “Like anyone crazy enough to start a crypto app company this early, we started buying and HODLing BTC and ETH years ago.”

Powered by WPeMatico

Investors, it seems, aren’t entirely soured on the world of 3D printing. The technology is still making progress in the enterprise sector, and Shapeways is certainly continuing to make a case for it in the world of online marketplaces. This morning, the New York-based company announced the closing of a $30 million Series E.

The round, led by Lux Capital, puts its total funding north of $100 million. That’s no small chunk of change, particularly as 3D printing has lost much of its luster in the consumer world over the past several years. But the company has been a bit of a quiet success in 3D printing, selling the technology as a service along with an Etsy-like online marketplace, rather than attempting to convince early adopters to spend $500-$1,000 on a desktop machine.

After a long search, the company appointed Gregory Kress its new CEO, back in February. At the time, he explained his vision of playing a stronger role in the world of hardware prototyping/startup incubation. “We can help them to market it and develop and sustain a small business,” said Kress. “I see Shapeways shifting from delivering one niche of that customer experience to truly helping our creators from almost a platform perspective and allowing us to become a one-stop shop.”

Now flush with extra cash, Shapeways is going to take that expansion further. “The capital will be used to accelerate company growth and launch additional services to support Shapeways’ overall vision to become the complete end-to-end platform helping creators ‘design, make, and sell,’ regardless of 3D modeling experience,” the company writes in a press release tied to the funding announcement.

That starts with the introduction of the new Design With Shapeways tool, which is designed to walk creators through the 3D-printing process, starting with a 3D file, 2D drawing or even just an idea. The new Spring & Wonder line, meanwhile, offers a hands-on approach to creating personalized jewelry through the service.

Powered by WPeMatico

In the ongoing race to build the best and smartest applications that tap into the advances of artificial intelligence, a startup out of London has raised a large round of funding to double down on solving persistent problems in areas like healthcare and energy. BenevolventAI announced today that it has raised $115 million to continue developing its core “AI brain” as well as different arms of the company that are using it specifically to break new ground in drug development and more.

This venture round values the company at $2.1 billion post-money, its founder and executive chairman Ken Mulvaney confirmed to TechCrunch. Investors in this round include previous backer Woodford Investment Management, and while Mulvaney said the company was not disclosing the names of any other investors, he added it was a mix of family offices and some strategic backers, with a majority coming from the U.S., but would not specify any more. Notably, BenevolentAI does not have any backing from more traditional VCs, which more generally have been doubling down on investments in AI startups. Founded in 2013, the company has now raised more than $200 million to date.

The core of BenevolentAI’s business is focused around what Mulvaney describes as a “brain” built by a team of scientists — some of whom are disclosed, and some of whom are not, for competitive reasons; Mulvaney said: There are 155 people working at the startup in all, with 300 projected by the end of this year. The brain has been created to ingest and compute billions of data points in specific areas such as health and material science, to help scientists better determine combinations that might finally solve persistently difficult problems in fields like medicine.

The crux of the issue in a field like drug development, for example, is that even as scientists identify the many permutations and strains of, say, a particular kind of cancer, each of these strains can mutate, and that is before you consider that each mutation might behave completely differently depending on which person develops the mutation.

This is precisely the kind of issue that AI, which is massive computational power and “learning” from previous computations, can help address. (And BenevolventAI is not the only one taking this approach. Specifically in cancer, others include Grail and Paige.AI.)

But even with the speed that AI brings to the table, it’s a very long, long game for BenevolentAI. The division of BenevolentAI that is focused on drugs, called Benevolent Bio, currently has two drugs in more advanced stages of development, Mulvaney said, although neither of those happen to be in the area of cancer. A Parkinson’s drug is currently in Phase 2B clinical trials, after years of work.

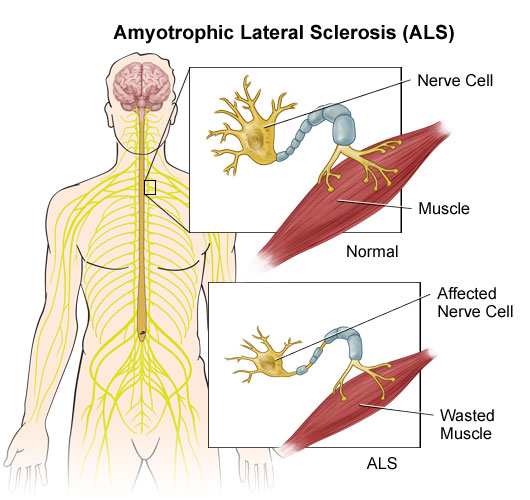

And an ALS medication currently in development — which Mulvaney says will aim to significantly extend the prospects for those who have been diagnosed with ALS — is about five years away from trials. It’s worth the effort to try, though: The best ALS medications on the market today at best only add about three months to a patient’s life expectancy.

And an ALS medication currently in development — which Mulvaney says will aim to significantly extend the prospects for those who have been diagnosed with ALS — is about five years away from trials. It’s worth the effort to try, though: The best ALS medications on the market today at best only add about three months to a patient’s life expectancy.

Some of the long period of development is because with drugs, there is a large regulatory framework a company must go through. “But we benefit from that,” Mulvaney said, “because it means you can actually then offer something in the market.” (Blood tests à la Theranos are very different in terms of regulatory requirements, he said.)

In part because of that long cycle, and also because BenevolentAI has spotted an adjacent opportunity, the company has more recently also been extending applications from its “brain” to other adjacent areas that also tap into chemistry and biology, such as material science.

One area Mulvaney said is of particular interest is to see if Benevolent can create materials that can both withstand extreme heat — to allow engines to work at higher rates without risks — as well as chemicals that could essentially create the next generation of efficient batteries that could provide more power in smaller formats for longer periods.

“There has been little development beyond a lithium-ion battery,” he noted, which may be fine for the Teslas of the world today. “But there is not enough lithium on this planet for us all to go electric, and there is not nearly enough energy density there unless you have thousands of batteries working together. We need other technology to provide more energy donation. That tech doesn’t exist yet because chemically it’s very difficult to do that.” And that spells opportunity for BenevolentAI.

Other areas where the startup hopes to move into over the coming months and years include agriculture, veterinary science, and other categories that sit alongside those BenevolentAI is already tapping.

Powered by WPeMatico

Justin Kan is qualified to teach you how to pitch, and isn’t shy about it. Having raised about $90 million for a few companies and sold his startup Twitch to Amazon for almost a billion dollars, not being shy is actually part of what Kan teaches. His legal services startup Atrium today officially launches Atrium Scale, its free Series A fundraising workshop that’s helped eight startups raise $100 million since it started in beta five months ago. The two-day in-person seminar includes pitch coaching, intros to investors and mentors, follow-up online pitch deck help, legal advice, Amazon and Google Cloud credits and tax and accounting services.

I went through Atrium Scale myself, pretending I was the founder of a hypothetical startup that replaces your phone’s contacts app. While the lectures were full of valuable tips, you can get a lot of those from instructional blog posts by Kan and other VCs. But the small group Q&A and coaching with entrepreneurs who’d successfully raised did a remarkable job of improving attendees’ pitches and the esoteric song-and-dance necessary to get investors to part with their cash.

Atrium co-founder Justin Kan

Here’s a breakdown of how Atrium Scale works:

The Atrium Scale method revolves around the concepts of how to pitch and when. While there are plenty of ways to show off a business, Kan recommends a calculated approach to storytelling. “When should you raise? When you can convince investors to give you money and when cash is the constraint to scaling your business,” Kan said to kick off our program.

“It all starts with a narrative — 99 percent is the work of building the business, but an important 1 percent is convincing people,” Kan relays.

First, explain how the world is a certain way. Describe the problem, why it’s big and who in the market would pay for a solution. Demonstrate that you’re an expert.

Second, explain how the world is changed by your solution to the problem. Frame what’s possible for businesses or consumers once they have your product.

Third, explain how the world is new now that your solution exists. Provide metrics on traction and mechanisms for growth, and show why your team is uniquely equipped to succeed. Identify adjacent markets your product will conquer.

Unlike the frothy days of yore, “people are no longer willing to lose money on a per-unit basis,” says Kan. VCs will demand to understand your unit economics and scalable customer acquisition strategy that turns cash invested into more cash earned.

Perhaps the most important part of the pitch is practice, though. Pitch to fellow founders, investors or angels, but explicitly tell them you want feedback, not money. Running through the pitch over and over boosts confidence, A/B tests narratives and unearths questions. Know your numbers by heart so you always seem sure of where the business is heading, and define a personal pitching style that plays to your personality strengths.

Kan says it all comes down to making investors see your vision for how you’re going to become a massive company.

Atrium Scale helps here by letting you pitch in groups, as well as one-on-one with mentors. Simply being surrounded by people all trying to improve creates an atmosphere conducive to progress rather than getting defensive about criticism. There could be better homework or takeaway materials to help startups continue to improve after the workshop ended, but I heard entrepreneurs work out kinks and trim off tangents that could have derailed their pitch during a real meeting.

Where Atrium Scale shined brightest was digging into the cadence of the fundraising process. Anyone can work out a decent pitch in their garage, but it takes special know-how to navigate turning that pitch into money in the bank. This is the kind of in-group knowledge that often makes it tough for outsiders to break into Silicon Valley.

You should pitch wide, planning to talk to at least 10 to 20 investors, but knowing it can take 100 ‘nos’ to get a ‘yes.’ Pick investors not based on their firm’s name recognition but their expertise and track record in your industry. Contact investors at least three to four weeks out and schedule meetings in as rapid succession as possible. The goal is to be able to get term sheets back at the same time so you can play firms off each other and pick the best deal.

You’ll start with single partner meetings. You’ll hear back within 24 to 48 hours if they go well, and you can assume they didn’t if you don’t hear back soon. Those that like you will set up multi-partner meetings, and you should ask them what their colleagues will want to know. If that goes well you’ll be brought in for an exhaustive full-partnership pitch where they’ll try to poke holes in your business. Lots of questions means lots of interest, while few questions and VCs bored on their phones means you’re toast.

If the partnership believes in you, you’ll quickly receive a term sheet, but you don’t have to sign it right away. Since you can’t fire your investors, be sure to call their references so you’re sure which you want to work with forever. This also gives you time to go back to other firms you’ve pitched. Don’t say who it’s from, but use your existing term sheet as leverage to get them to give you one or one with a better deal.

Aim for a lead investor that will put in at least 25 percent of the round volume and then fill it out with other firms, strategics and angels. Know that the median delay for investor due diligence is 41 days, so make sure you have enough runway to wait that long after you complete the pitch process. The fundraise should last you 12 to 18 months, but be careful because your spending will expand to take up what’s in the bank. Be ready by then to show you’ve hit new milestones that de-risk your business.

The program also reviewed more advanced topics like raising money from strategic investors, equity versus SAFE financing, crooked deal terms like ratchets and liquidation preferences and how to manage your board. That one-size-fits all info is certainly helpful, but thanks to the small class size, Atrium Scale’s Q&As let founders get answers to industry-specific questions and their own edge cases.

There are plenty of people looking to help startups in Silicon Valley, but few are giving away this high-quality of education for free. Accelerators can charge 7 percent of equity and advisors can charge a percentage point or two. That can be worth a lot if the startup does well. Consultants want cash that pre-A startups rarely have. But Atrium is merely looking for lead generation and it needs them to raise money to be able to afford its legal services. That aligns the workshop well with the outcomes for the companies.

If you have a dumb business idea, no amount of turd polishing will get you legitimate funding. But for startups on to something that just need help communicating, Atrium Scale could be a quick and cheap way to boost their chances of getting picked from the crowd.

Powered by WPeMatico