funding

Auto Added by WPeMatico

Auto Added by WPeMatico

HMD Global has been one of the mobile world’s biggest surprise hits in recent years. Founded by former Nokia execs, the Finnish company has made a name for itself reviving the dearly departed brand on Android smartphones to great effect. And it just managed to raise another $100 million, led by Ginko Ventures’ Alpha Ginko VC branch.

The new round puts the company’s valuation at more than $1 billion, according to HMD. It’s set to use this latest round to push even more “aggressively” into the mobile category with its branded devices, “doubl[ing] down on expanding channel reach in strategic markets while continuing to deliver innovation where it matters most to consumers.”

Not that the company’s been cautious in its push thus far, of course. HMD already has a lot of options out there for a business that’s essentially been in existence for a year-and-a-half. At MWC back in February, it announced five new phones sporting the legacy brand, including a reboot of the 8110. The company has also been positioning itself in developing markets, where the Nokia name still has a fair amount of cache, by wholeheartedly adopting Google’s Android One program.

It’s a tricky line to walk, between an embrace of retro appreciation and an attempt to offer innovation. Continuing its successful run is going to require more than just playing upon user nostalgia for a bygone brand.

The question moving forward is whether HMD will be able to reassert Nokia as a truly bleeding-edge brand as it continues to flood the market with branded devices. After all, the smartphone market is starting to plateau, and much of the competition has begun to scale back their releases.

Powered by WPeMatico

Managing, buying and selling commercial real estate is a fairly primitive process. CREXi founder Mike DeGiorgio remembers one experience in 2014 when he was required to fax and mail details about an urgent transaction to the leasing office, a move that made him think he was back in the era of Pogs and MTV’s Real World Season 1.

“There simply was no great industry solution for researching markets, finding comps, transacting, connecting with key stakeholders, purchasing or investing in properties, renting or leasing space, getting a loan, finding partners to purchase properties with, marketing yourself or the properties you own, sell or lease etc.,” he said. “I started thinking about technology solutions for the commercial real estate industry to solve many of these inefficiencies in the CRE space. I could not figure out why it hadn’t been done and set out to build CREXi to help industry stakeholders be more efficient and to make the industry more liquid, transparent and easier to access.”

CREXi — the CRE stands for “commercial real estate” — has been around since 2015, but recently announced an $11 million Series A as well as some interesting user numbers. Key investors include Jackson Square Ventures, Manifest Investment Partners, Lerer Hippeau, Freestyle Capital, TenOneTen Ventures and Founder Collective. The company has managed more than 100,000 “properties brought to market” on its platform and they have 200,000 users per month. They see more than 6,000 properties listed on the site each month.

The service is a suite of tools that streamlines the entire CRE processing.

“We give brokers the ability to find, manage and qualify leads, market their properties with customizable emails, and communicate with interested parties through in-app messaging. Additionally, our features help brokers interact with the industry and its stakeholders; solicit, make, accept, counter and negotiate offers; run competitive bidding processes; run escrow and closing processes; research markets and sold properties etc.,” said DeGiorgio.

While CRE isn’t very sexy, it’s clear that the industry can use all the help it can get. Considering CREXi manages $450 billion in property value, it’s also clear that this is a lucrative market ripe for disruption.

“We are the first platform to take the entire commercial real estate transaction process online with a simple to use and intuitive interface,” said DeGiorgio. “We collaborate with brokers and principals to blend technology with the fundamentals of CRE transactions, addressing the shifting needs of industry professionals to maximize revenue and minimize time spent on administrative tasks.”

Now he just has to get everyone to throw away their postal scales and fax machines and help CRE enter the era of Honey Boo Boo and leave the era of the Olsen Twins.

Powered by WPeMatico

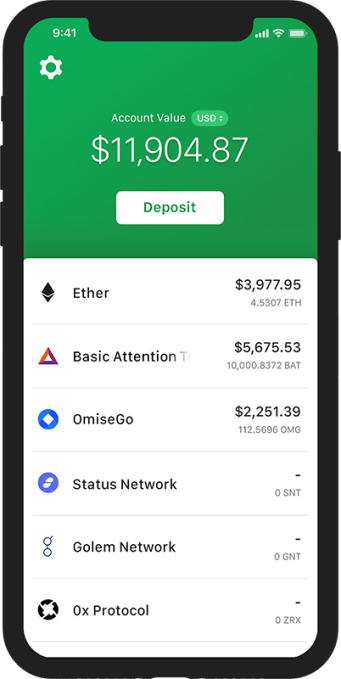

Compound wants to let you borrow cryptocurrency, or lend it and earn an interest rate. Most cryptocurrency is shoved in a wallet or metaphorically hidden under a mattress, failing to generate interest the way traditionally banked assets do. But Compound wants to create liquid money markets for cryptocurrency by algorithmically setting interest rates, and letting you gamble by borrowing and then short-selling coins you think will sink. It plans to launch its first five for Ether, a stable coin, and a few others, by October.

Today, Compound is announcing some ridiculously powerful allies for that quest. It’s just become the first-ever investment by crypto exchange juggernaut Coinbase’s new venture fund. It’s part of an $8.2 million seed round led by top-tier VC Andreessen Horowitz, crypto hedge fund Polychain Capital and Bain Capital Ventures — the startup arm of the big investment bank.

While right now Compound deals in cryptocurrency through the Ethereum blockchain, co-founder and CEO Robert Leshner says that eventually he wants to carry tokenized versions of real-world assets like the dollar, yen, euro or Google stock. That’s because Leshner tells me “My thesis is that almost every crypto asset is bullshit and not worth anything.”

Here’s how Compound tells me it’s going to work. It’s an “overnight” market that permits super-short-term lending. While it’s not a bank, it is centralized, so you loan to and borrow from it directly instead of through peers, alleviating you from negotiation. If you loan, you can earn interest. If you borrow, you have to put up 100 percent of the value of your borrow in an asset Compound supports. If prices fluctuate and your borrow becomes worth more than your collateral, some of your collateral is liquidated through a repo agreement so they’re equal.

To set the interest rate, Compound acts kind of like the Fed. It analyzes supply and demand for a particular crypto asset to set a fluctuating interest rate that adjusts as market conditions change. You’ll earn that on what you lend constantly, and can pull out your assets at any time with just a 15-second lag. You’ll pay that rate when you borrow. And Compound takes a 10 percent cut of what lenders earn in interest. For crypto-haters, it offers a way to short coins you’re convinced are doomed.

“Eventually our goal is to hand-off responsibility [for setting the interest rate] to the community. In the short-term we’re forced to be responsible. Long-term we want the community to elect the Fed,” says Leshner. If it gets the interest rate wrong, an influx of lenders or borrowers will drive it back to where it’s supposed to be. Compound already has a user interface prototyped internally, and it looked slick and solid to me.

“We think it’s a game changer. Ninety percent of assets are sitting in people’s cold storage, or wallets, or exchanges. They aren’t being used or traded,” says Leshner. Compound could let people interact with crypto in a whole new way.

Compound is actually the third company Leshner and his co-founder and CTO Geoff Hayes have started together. They’ve been teamed up for 11 years since going to college at UPenn. One of their last companies, Britches, created an index of CPG inventory at local stores and eventually got acquired by Postmates. But before that Leshner got into the banking and wealth management business, becoming a certified public accountant. A true economics nerd, he’s the chair of the SF bond oversight committee, and got into crypto five years ago.

Compound co-founder and CEO Robert Leshner

Sitting on coins, Leshner wondered, “Why can’t I realize the time value of the cryptocurrency I possess?” Compound was born in mid-2017, and came out of stealth in January.

Now with $8.2 million in funding that also came from Transmedia Capital, Compound Ventures, Abstract Ventures and Danhua Capital, Compound is pushing to build out its product and partnerships, and “hire like crazy” beyond its seven current team members based in San Francisco’s Mission District. Partners will be crucial to solve the chicken-and-egg problem of getting its first lenders and borrowers. “We are planning to launch with great partners — token projects, hedge funds and dedicated users,” says Leshner. Having hedge funds like Polychain should help.

“We shunned an ICO. We said, ‘let’s raise venture capital.’ I’m a very skeptical person and I think most ICOs are illegal,” Leshner notes. The round was just about to close when Coinbase announced Coinbase Ventures. So Leshner fired off an email asking if it wanted to join. “In 12 hours they researched us, met our team, diligenced it and evaluated it more than almost any investor had to date,” Leshner recalls. Asked if there’s any conflict of interest given Coinbase’s grand ambitions, he said, “They’re probably our favorite company in the world. I hope they survive for 100 years. It’s too early to tell they overlap.”

There are other crypto lending platforms, but none quite like Compound. Centralized exchanges like Bitfinex and Poloniex let people trade on margin and speculate more aggressively. But they’re off-chain, while Leshner says Compound is on-chain, transparent and can be built on top of. That could make it a more critical piece of the blockchain finance stack. There’s also a risk of these exchanges getting hacked and your coins getting stolen.

Meanwhile, there are plenty of peer-to-peer crypto lending protocols on the Ethereum blockchain, like ETHLend and Dharma. But interest rates, no need for slow matching, flexibility for withdrawing money and dealing with a centralized party could attract users to Compound.

Meanwhile, there are plenty of peer-to-peer crypto lending protocols on the Ethereum blockchain, like ETHLend and Dharma. But interest rates, no need for slow matching, flexibility for withdrawing money and dealing with a centralized party could attract users to Compound.

Still, the biggest looming threat for Compound is regulation. But to date, the SEC and regulators have focused on ICOs and how people fundraise, not on what people are building. People aren’t filing lawsuits against actual products. “All the operations have flown beneath the radar and I think that’s going to change in the next 12 months,” Leshner predicts. How exactly they’ll treat Compound is up in the air.

One source in the crypto hedge fund space told me about forthcoming regulation: “You’re either going to get annihilated and have to disgorge profits or dissolve. Or you pay a fine and you’re among the first legal funds in the space. This is the gamble you take before asset classes get baptized.” As Leshner confirmed, “That’s the number one risk, period.”

Money markets are just one piece of the financial infrastructure puzzle that still needs to emerge around blockchain. Custodians, auditors, administrators and banks are still largely missing. When those get hammered out to make the space safer, the big money hedge funds and investment banks could join in. For Compound, getting the logistics right will require some serious legal ballet.

Yet Leshner is happy to dream big despite all of the crypto world’s volatility. He concludes, “We want to be like Black Rock with a trillion under management, and we want to have 25 employees when we do that. They probably have [tens of thousands] of employees. Our goal is to be like them with a skeleton team.”

Powered by WPeMatico

As we increasingly hear about automation, artificial intelligence and robots taking away industrial jobs, Parsable, a San Francisco-based startup sees a different reality, one with millions of workers who for the most part have been left behind when it comes to bringing digital transformation to their jobs.

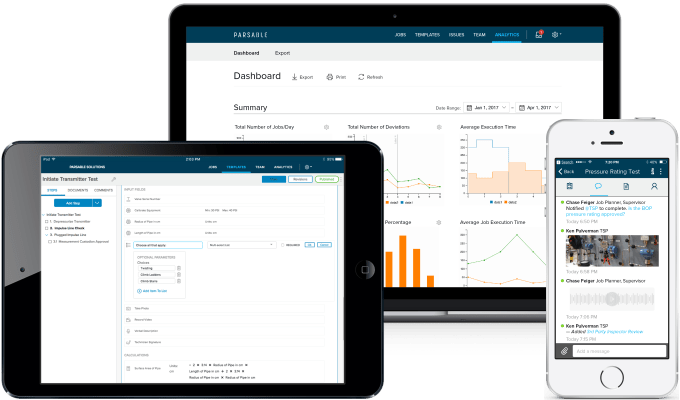

Parsable has developed a Connected Worker platform to help bring high tech solutions to deskless industrial workers who have been working mostly with paper-based processes. Today, it announced a $40 million Series C cash injection to keep building on that idea.

The round was led by Future Fund with help from B37 and existing investors Lightspeed Venture Partners, Airbus Ventures and Aramco Ventures. Today’s investment brings the total to nearly $70 million.

The Parsable solution works on almost any smartphone or tablet and is designed to enter information while walking around in environments where a desktop PC or laptop simply wouldn’t be practical. That means being able to tap, swipe and select easily in a mobile context.

Photo: Parsable

The challenge the company faced was the perception these workers didn’t deal well with technology. Parsable CEO Lawrence Whittle says the company, which launched in 2013, took its time building its first product because it wanted to give industrial workers something they actually needed, not what engineers thought they needed. This meant a long period of primary research.

The company learned, it had to be dead simple to allow the industry vets who had been on the job for 25 or more years to feel comfortable using it out of the box, while also appealing to younger more tech-savvy workers. The goal was making it feel as familiar as Facebook or texting, common applications even older workers were used to using.

“What we are doing is getting rid of [paper] notebooks for quality, safety and maintenance and providing a digital guide on how to capture work with the objective of increasing efficiency, reducing safety incidents and increasing quality,” Whittle explained.

“What we are doing is getting rid of [paper] notebooks for quality, safety and maintenance and providing a digital guide on how to capture work with the objective of increasing efficiency, reducing safety incidents and increasing quality,” Whittle explained.

He likens this to the idea of putting a sensor on a machine, but instead they are putting that instrumentation into the hands of the human worker. “We are effectively putting a sensor on humans to give them connectivity and data to execute work in the same way as machines,” he says.

The company has also made the decision to make the platform flexible to add new technology over time. As an example they support smart glasses, which Whittle says accounts for about 10 percent of its business today. But the founders recognized that reality could change and they wanted to make the platform open enough to take on new technologies as they become available.

Today the company has 30 enterprise customers with 30,000 registered users on the platform. Customers include Ecolab, Schlumberger, Silgan and Shell. They have around 80 employees, but expect to hit 100 by the end of Q3 this year, Whittle says.

Powered by WPeMatico

MemSQL, a company best known for the real-time capabilities of its eponymous in-memory database, today announced that it has raised a $30 million Series D round, bringing the company’s overall funding to $110 million. The round was led by GV (the firm you probably still refer to as Google Ventures) and Glynn Capital. Existing investors Accell, Caffeinated Capital, Data Collective and IA Ventures also participated.

The MemSQL database offers a distributed, relational database that uses standard SQL drivers and queries for transactions and analytics. Its defining feature is the combination of its data ingestions technology that allows users to push millions of events per day into the service while its users can query the records in real time. The company recently showed that its tools can deliver a scan rate of over a trillion rows per second on a cluster with 12 servers.

The database is available for deployments on the major public clouds and on-premises.

MemSQL recently announced that it saw its fourth-quarter commercial booking hit 200 percent year-over-year growth — and that’s typically the kind of growth that investors like to see, even as MemSQL plays in a very competitive market with plenty of incumbents, startups and even open-source projects. Current MemSQL users include the likes of Uber, Akamai, Pinterest, Dell EMC and Comcast.

“MemSQL has achieved strong enterprise traction by delivering a database that enables operational analysis at unique speed and scale, allowing customers to create dynamic, intelligent applications,” said Adam Ghobarah, general partner at GV, in today’s announcement. “The company has demonstrated measurable success with its growing enterprise customer base and we’re excited to invest in the team as they continue to scale.”

Powered by WPeMatico

Auth0, a startup based in Seattle, has been helping developers with a set of APIs to build authentication into their applications for the last five years. It’s raised a fair bit of money along the way to help extend that mission, and today the company announced a $55 million Series D.

This round was led by led by Sapphire Ventures with help from World Innovation Lab, and existing investors Bessemer Venture Partners, Trinity Ventures, Meritech Capital and K9 Ventures. Today’s investment brings the total raised to $110 million. The company did not want to share its valuation.

CEO Eugenio Pace said the investment should help them expand further internationally. In fact, one of the investors, World Innovation Lab, is based in Japan and should help with their presence there. “Japan is an important market for us and they should help explain to us how the market works there,” he said.

The company offers an easy way for developers to build in authentication services into their applications, also known as Identification as a Service (IDaaS). It’s a lot like Stripe for payments or Twilio for messaging. Instead of building the authentication layer from scratch, they simply add a few lines of code and can take advantage of the services available on the Auth0 platform.

That platform includes a range of service such as single-sign on, two-factor identification, passwordless log-on and breached password detection.

They have a free tier, which doesn’t even require a credit card, and pay tiers based on the types of users — regular versus enterprise — along with the number of users. They also charge based on machine-to-machine authentication. Pace reports they have 3500 paying customers and tens of thousands of users on the free tier.

All of that has added up to a pretty decent business. While Pace would not share specific numbers, he did indicate the company doubled its revenue last year and expected to do so again this year.

With a cadence of getting funding every year for the last three years, Pace says this round may mark the end of that fundraising cycle for a time. He wasn’t ready to commit to the idea of an IPO, saying that is likely a couple of years away, but he says the company is close to profitability.

With the new influx of money, the company does plan to expand its workforce as moves into markets across the world . They currently have 300 employees, but within a year he expects to be between 400 and 450 worldwide.

The company’s last round was a $30 million Series C last June led by Meritech Capital Partners.

Powered by WPeMatico

“Whether for AR or robots, anytime you have software interacting with the world, it needs a 3D model of the globe. We think that map will look a lot more like the decentralized internet than a version of Apple Maps or Google Maps.” That’s the idea behind new startup Fantasmo, according to co-founder Jameson Detweiler. Coming out of stealth today, Fantasmo wants to let any developer contribute to and draw from a sub-centimeter accuracy map for robot navigation or anchoring AR experiences.

Fantasmo plans to launch a free Camera Positioning Standard (CPS) that developers can use to collect and organize 3D mapping data. The startup will charge for commercial access and premium features in its TerraOS, an open-sourced operating system that helps property owners keep their maps up to date and supply them for use by robots, AR and other software equipped with Fantasmo’s SDK.

With $2 million in funding led by TenOneTen Ventures, Fantasmo is now accepting developers and property owners to its private beta.

Directly competing with Google’s own Visual Positioning System is an audacious move. Fantasmo is betting that private property owners won’t want big corporations snooping around to map their indoor spaces, and instead will want to retain control of this data so they can dictate how it’s used. With Fantasmo, they’ll be able to map spaces themselves and choose where robots can roam or if the next Pokémon GO can be played there.

“Only Apple, Google, and HERE Maps want this centralized. If this data sits on one of the big tech company’s servers, they could basically spy on anyone at any time,” says Detweiler. The prospect gets scarier when you imagine everyone wearing camera-equipped AR glasses in the future. “The AR cloud on a central server is Big Brother. It’s the end of privacy.”

Detweiler and his co-founder Dr. Ryan Measel first had the spark for Fantasmo as best friends at Drexel University. “We need to build Pokémon in real life! That was the genesis of the company,” says Detweiler. In the meantime he founded and sold LaunchRock, a 500 Startups company for creating “Coming Soon” sign-up pages for internet services.

After Measel finished his PhD, the pair started Fantasmo Studios to build augmented reality games like Trash Collectors From Space, which they took through the Techstars accelerator in 2015. “Trash Collectors was the first time we actually created a spatial map and used that to sync multiple people’s precise position up,” says Detweiler. But while building the infrastructure tools to power the game, they realized there was a much bigger opportunity to build the underlying maps for everyone’s games. Now the Santa Monica-based Fantasmo has 11 employees.

“It’s the internet of the real world,” says Detweiler. Fantasmo now collects geo-referenced photos, scans them for identifying features like walls and objects, and imports them into its point cloud model. Apps and robots equipped with the Fantasmo SDK can then pull in the spatial map for a specific location that’s more accurate than federally run GPS. That lets them peg AR objects to precise spots in your environment while making sure robots don’t run into things.

Fantasmo identifies objects in geo-referenced photos to build a 3D model of the world

“I think this is the most important piece of infrastructure to be built during the next decade,” Detweiler declares. That potential attracted funding from TenOneTen, Freestyle Capital, LDV, NoName Ventures, Locke Mountain Ventures and some angel investors. But it’s also attracted competitors like Escher Reality, which was acquired by Pokémon GO parent company Niantic, and Ubiquity6, which has investment from top-tier VCs like Kleiner Perkins and First Round.

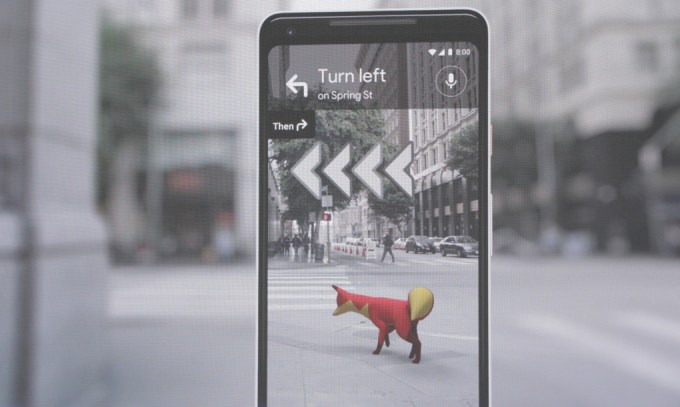

Google is the biggest threat, though. With its industry-leading traditional Google Maps, experience with indoor mapping through Tango, new VPS initiative and near limitless resources. Just yesterday, Google showed off using an AR fox in Google Maps that you can follow for walking directions.

Fantasmo is hoping that Google’s size works against it. The startup sees a path to victory through interoperability and privacy. The big corporations want to control and preference their own platforms’ access to maps while owning the data about private property. Fantasmo wants to empower property owners to oversee that data and decide what happens to it. Measel concludes, “The world would be worse off if GPS was proprietary. The next evolution shouldn’t be any different.”

Powered by WPeMatico

Gamalon wants to change the game when it comes to understanding text-based customer communications. Instead of using neural networks to learn about a vast corpus of information, the startup takes a different approach, putting the text in a database and building decision trees to very rapidly train the data to arrive at the required information. Today, it announced a $20 million Series A investment led by Intel Capital.

Other participants in the round included .406 Ventures and Omidyar Technology Ventures along with existing investors Boston Seed Capital, Felicis Ventures and Rivas Capital. Today’s investment brings the total raised by the company since inception in 2013 to $32 million including backing from DARPA in earlier rounds.

Gamalon CEO Ben Vigoda says they developed a new approach to analyzing customer interactions because the state of the art in AI and machine learning was too much of a black box.

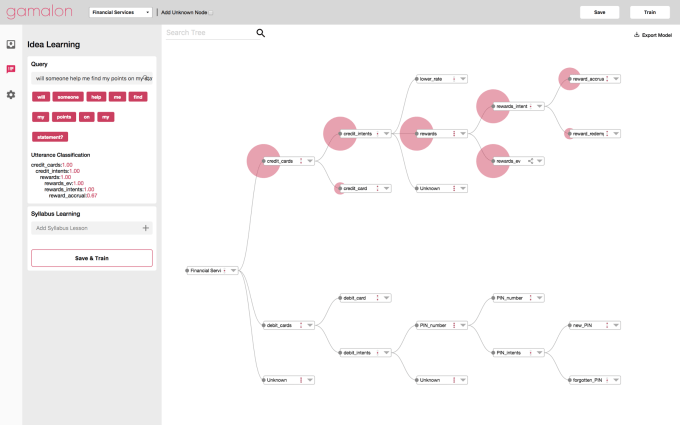

His company wants to change that by making the whole process much more interactive. To that end Gamalon also released a new tool called Idea Studio, a product that can automatically build learning trees to help users arrive at answers extremely fast or allow a business analyst or data scientists to simply enter a series of queries and build a decision tree on the fly based on the text. With neural networks, Vigoda says, the user has no control over the end result, but with Idea Studio you can edit the trees and refine the results immediately.

Gamalon Idea Studio decision tree. Photo: Gamalon

The product still needs a way to review all of the text-based content, of course, but instead of having humans categorize it all manually, with Gamalon you import your data into a database, do analytics on it and then make it available for rapid categorization and response.

This could have multiple utilities, whether for customer service agents to find answers very quickly or customers to interact with bots and find answers much faster. Analysts could use it to locate answers to business issues, and it’s sophisticated enough for data scientists to build machine learning projects based on a large corpus of data.

You can build a learning tree by entering related text to train it. GIF: Gamalon

Naveen Rao, corporate vice president and general manager in the Artificial Intelligence Products Group at Intel Corporation says they like how Gamalon puts machine learning into hands of many different employees around the customer information use case. “We want enterprises of all levels of AI capability to take full advantage of this growing volume and complexity of data. Gamalon’s unique approach can help users better understand billions of customer communications, customize individual responses, and take action to better serve those customers,” Rao explained in a statement.

The company is based in Cambridge, MA and has 23 employees. They have six large customers including Avaya.

Powered by WPeMatico

Purple Carrot announced this morning that it has raised $4 million in strategic funding from Fresh Del Monte Produce.

The company, which delivers completely plant-based (vegan) meal kits to subscribers, was founded in 2014. It has, in part, gotten attention through celebrity involvement, first by enlisting food writer Mark Bittman as its chief innovation officer (Bittman departed in 2016), then by partnering with football star and notorious strawberry hater Tom Brady to launch TB12 meal kits.

Purple Carrot had previously raised $6 million in funding, according to Crunchbase. The company says that this new investment will allow it to improve its supply chain, get access to more retail opportunities and explore expansion into other categories.

“Securing this strategic investment from Fresh Del Monte is a huge validation of our business model, and an important step forward for our company,” said Purple Carrot founder and CEO Andy Levitt in the announcement. “Helping people eat more plant-based foods represents our differentiated, purpose-driven commitment to making the planet and the people who live on it healthier.”

Fresh Del Monte (which is the company behind Del Monte pineapples and other produce) is just the latest established player in the food and grocery world to invest in meal delivery startups. Last year, for example, Unilever backed Sun Basket and Nestlé led a $77 million round for Freshly.

Powered by WPeMatico

Mesosphere, a company that created an operating system of sorts for the modern datacenter, announced today that it has raised $125 million for their Series D round. Today’s investment brings total funding since it formed in 2013 to almost $250 million.

The round was led by T. Rowe Price Associates and Koch Disruptive Technologies (KDT). New investors ZWC Ventures, Qatar Investment Authority (QIA) and Disruptive Technology Advisers (DTA) also participated along with existing investors Andreessen Horowitz, Two Sigma Ventures, Khosla Ventures and Hewlett Packard Enterprise.

The funding comes at a time when the company has tripled its revenue and wants to take that momentum and expand more into international markets. They currently have 300 employees, 125 customers and are on a $50 million revenue run rate, according to information supplied by Mesosphere .

CEO Florian Leibert says his company decided to take on this money at this point because it sees a market opportunity and needed the funds to expand. “With this latest round, we’ll be able to ramp up R&D and hone our product roadmap toward repeatable, proven solutions around data engineering and data science,” Leibert told TechCrunch.

He wants to take those products to more international markets including Europe, China and the Middle East, while increasing their channel presence, especially with international and regional systems integrators, who can help pave the way into these markets.

Mesosphere’s core technology called DC/OS, provides a way to manage datacenter resources, whether private or in the public cloud, much more efficiently than traditional tools by treating the entire datacenter as a single pool of resources, Tobias Knaup, Mesosphere CTO explained. This allows an operations team to see multiple locations, zones and regions from a single interface, he said.

Mesosphere has taken on a mix of traditional venture capitalists, international funding authorities and strategic corporate backers, but the presence of T Rowe Price and the size of the round could be a signal that the company intends to go public at some point. Leibert wasn’t willing to give anything away, however.

“We are focused on growth and building a self-sustaining company. We certainly haven’t ruled out a public event in the future, but I can’t speak to any specific plans at this time.” In other words, the standard CEO answer to such a question.

The company’s last round was in March 2016 for $73.5 million.

Powered by WPeMatico