funding

Auto Added by WPeMatico

Auto Added by WPeMatico

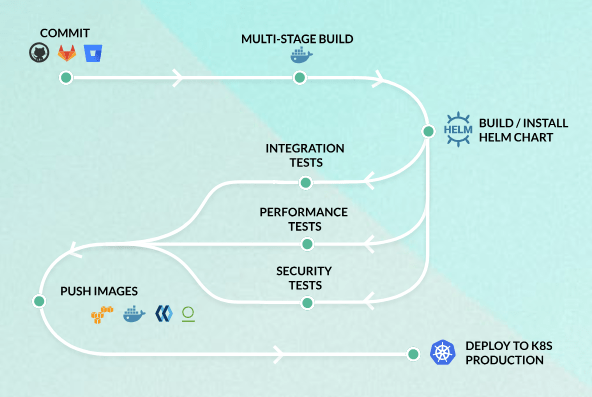

Codefresh, a continuous integration and delivery platform built for the Kubernetes container ecosystem, today announced that it has raised an $8 million Series B round led by M12, Microsoft’s venture fund. Viola Ventures, Hillsven and CEIF also participated in this round, which brings the company’s total funding to $15.1 million.

In a market where there are seemingly more CI/CD platforms every day, Codefresh sets itself apart thanks to its focus on Kubernetes, which is now essentially the de facto standard for container orchestration services and which is seeing a rapid growth in adoption. The service promises it can help developers automate their application deployments to Kubernetes and that teams will see “up to 24X faster development times.” That number seems a bit optimistic, but the whole point of adopting Kubernetes and CI/CD is obviously to speed up the development and deployment process.

“The meteoric rise of Kubernetes is happening so fast that most toolchains haven’t kept up, and M12 knows it,” said Raziel Tabib, Codefresh co-founder and CEO. “With this latest round of funding we’re going to aggressively accelerate our roadmap and expand our customer base.”

“The meteoric rise of Kubernetes is happening so fast that most toolchains haven’t kept up, and M12 knows it,” said Raziel Tabib, Codefresh co-founder and CEO. “With this latest round of funding we’re going to aggressively accelerate our roadmap and expand our customer base.”

The Codefresh platform hit general availability in 2017 and the company currently claims about 20,000 users, including the likes Giphy.

Powered by WPeMatico

b8ta, the retail-as-a-service startup, has closed a $19 million Series B round led by Macy’s, with participation from Sound Ventures, Palm Drive Capital, Capitaland, Graphene Ventures, Khosla Ventures and Plug and Play Ventures. This round brings b8ta’s total funding to $39 million.

Macy’s decision to lead this round comes in light of its recent partnership with b8ta to enhance the retailer’s experiential-based concept called The Market. Macy’s is also expanding its partnership with b8ta to launch The Market in a larger space, entirely powered by Built by b8ta, which functions as a retail-as-a-service platform for brands that want a physical presence. b8ta’s software solution includes checkout, inventory, point of sale, inventory management, staff scheduling services and more.

“Testing a shop with them in their store and having really good success made us feel bullish that this model would work well for them,” b8ta CEO Vibhu Norby told TechCrunch.

To the outsider, there’s this idea that Macy’s is struggling — in light of a bunch of store closures. That was a conversation b8ta had internally, Norby said.

“As an example, our board was initially not certain we should do something with them, but I felt like it was worth a shot,” Norby told me. “For us to get comfortable, we spent a lot of time trying to understand their business. What we found was that perception in the media didn’t really meet the reality for us. The reality is Macy’s is one of the most important companies in the country.”

Macy’s, Norby said, is also one of the largest real estate companies in the world and owns “so much real estate in all of the best places.”

He added, “it’s not that retail itself is dying, it’s just that it’s changing. The way people want to shop is changing and we have a shared alignment on bringing that next generation of a company into the space.”

In addition to the expanded partnership with Macy’s, b8ta is opening new flagship stores in Chicago and Tysons Corner, Va. b8ta currently has more than 78 flagship stores across the country to let consumers experience tech gadgets in real life.

Powered by WPeMatico

Jay-Z is behind a new venture fund called Marcy Venture Partners that is being launched with Walden Venture Capital managing director Larry Marcus and longtime business partner Roc Nation president Jay Brown, according to California regulatory filings.

The fund was first reported by Axios. Shawn “Jay-Z” Carter is no stranger to the venture world. The rap artist, producer and entrepreneur invested in Uber’s Series B round in 2011 when the company had a pre-money valuation of $300 million. Jay-Z has also invested in JetSmarter and Julep. Roc Nation backed Promise, a decarceration startup.

Jay-Z and Jay Brown were looking for a Silicon Valley partner for their fund last year. And at one time, it appeared they had landed on Sherpa Capital, a VC firm created by some of Uber’s other early investors. But that deal fell apart.

Now Walden Venture Capital’s Marcus will lead Marcy Venture Partners. Marcus has deep experience as an investor as an early backer of Pandora and Netflix. Marcus has also invested in sound and voice search startup SoundHound, retail tech company Skip and Terayon, which was acquired by Motorola.

Powered by WPeMatico

It’s been hard to miss the scooter startup wars opening fresh, techno-fueled rifts in Valley society in recent months. Another flavor of ride-sharing steed which sprouted seemingly overnight to clutter up sidewalks — drawing rapid-fire ire from city regulators apparently far more forgiving of traffic congestion if it’s delivered in the traditional, car-shaped capsule.

Even in their best, most-groomed PR shots, the dockless carelessness of these slimline electrified scooters hums with an air of insouciance and privilege. As if to say: Why yes, we turned a kids’ toy into a battery-powered kidult transporter — what u gonna do about it?

An earlier batch of electric scooter sharing startups — offering full-fat, on-road mopeds that most definitely do need a license to ride (and, unless you’re crazy, a helmet for your head) — just can’t compete with that. Last mile does not haul.

But a short-walk replacement tool that’s so seamlessly manhandled is also of course easily vandalized. Or misappropriated. Or both. And there have been a plethora of scooter dismemberment/kidnap horror stories coming out of California, judging by reports from the scooter wars front line. Hanging scooters in trees is presumably a protest thing.

Scooter brand Lime struck an especially tone-deaf tech note trying to fix this problem after an update added a security alarm that bellowed robotic threats to call the cops on anyone who fumbled to unlock them. Safe to say, littering abusive scooters in public spaces isn’t a way to win friends and influence people.

Even when functioning ‘correctly’, i.e. as intended, scooter rides can ooze a kind of brash entitlement. The sweatless convenience looks like it might be mostly enabling another advance in tech-fueled douche behavior as a t-shirt wearing alpha nerd zips past barking into AirPods and inhaling a takeaway latte while cutting up the patience of pedestrians.

None of this fast-seeded societal friction has put the brakes on e-scooter startup momentum, though. Au contraire. They’ve been raising massive amounts of investment on rapidly inflating valuations ($2BN is the latest valuation for Bird).

But buying lots of e-scooters and leaving them at the mercy of human whim is an expensive business to try scaling. Hence big funding rounds are necessary if you’re going to replace all the canal-dunked duds and keep scooting fast enough for the competition.

At the same time, there isn’t a great deal to differentiate one e-scooter experience over another — beyond price and proximity. Branding might do it but then you have to scramble even harder and faster to create a slick experience and inflate a brand that sticks. (And it goes without saying that a scooter sticky with fecal-matter is absolutely not that.)

The still fledgling startups are certainly scrambling to scale, with some also already pushing into international markets. Lime just scattered ~200 e-scooters in Paris, for example. It’s also been testing the waters more quietly in Zurich. While Bird has its beady eye on European territory too.

The idea underpinning some very obese valuations for these fledgling startups is that scooters will be a key piece of a reworked, multi-modal transport mix for urban mobility, fueled by app-based convenience and city buy-in to greener transport options with emissions-free benefits. (Albeit scooters’ greenness depends on what they’re displacing; Great if it’s gas-guzzling cars, less compelling if it’s people walking or peddling.)

And while investors are buying in to the vision that lots of city dwellers are going to be scooting the last mile in future, and betting big on sizable value being captured by a few plucky scooter startups — more than half a billion dollars has been funneled into just two of these slimline scooter brands, Bird and Lime, since February — there are skeptical notes being sounded too.

Asking whether the scooter model really justifies such huge raises and heady valuations. Wondering if it isn’t a bit crazy for a fledgling Bird to be 2x a unicorn already.

Shared bike and scooter fleets are paving the way to a revolution in urban mobility but will only capture little value in the long term. Investors are highly overestimating the virtue of these businesses.

— Thibaud Elziere (@tiboel) June 18, 2018

The bear case for these slimline e-scooters says they’re really only fixing a pretty limited urban mobility problem. Too spindly and unsafe to go the distance, too sedate of pace (and challenged for sidewalk space) to feel worthwhile if you don’t have far to go anyway. And of course you’re not going to be able to cart your kids and/or much baggage on a stand-up two wheeler. So they’re useless for families.

Meanwhile scooter invasions are illegal in some places and, where they are possible, are fast inviting public and regulatory frisson and friction — by contributing to congestion and peril on already crowded pavements.

After taking one of Lime’s just-landed e-scooters for a spin in Paris this week, Willy Braun, VC at early stage European fund Daphni, came away unimpressed. “I didn’t feel I was really saving time in a short distance, since there is always many people in our narrow sidewalks,” he tells us. “And it isn’t comfortable enough for me to imagine a longer distance. Also it’s quite expensive ($1 per use and $.15/min).

“Lastly: Before renting it I read two news media that told me I had to use it only on the sidewalks and they tell us that we should only use it on the road during the onboarding — and that wearing an helmet is mandatory without providing it). As a comparison, I’d rather use e-bikes (or emoto-bikes) for longer journey without hesitation.”

“Give us Jump instead of Lime!” he adds, namechecking the electric bike startup that’s been lodged under Uber’s umbrella since April, adding a greener string to its urban mobility bow — and which is also heading over to Europe as part of the ride-hailing giant’s ongoing efforts to revitalize its regionally battered brand.

“Uber stands ready to help address some of the biggest challenges facing German cities: tackling air pollution, reducing congestion and increasing access to cleaner transportation solutions,” said CEO Dara Khosrowshahi wheeling a bright red Jump bike on stage at the Noah conference in Berlin earlier this month. Uber’s Jump e-bikes will launch in Germany this summer.

E-bikes do seem to offer more urban mobility versatility than e-scooters. Though a scooter is arguably a more accessible type of wheeled steed vs a bike, given you can just stand on it and be moved.

But in Europe’s dense and dynamic urban environments — which, unlike the US, tend to be replete with public transit options (typically at a spectrum of price-points) — individual transport choices tend to be based firstly on economics. After which it’s essentially a matter of personal taste and/or the weather.

Urban transport horses for courses — depending on your risk, convenience and comfort thresholds, thanks to a publicly funded luxury of choice. So scooters have loads of already embedded competition.

TechCrunch’s resident Parisienne, Romain Dillet — a regular user of on-demand bike services in the city (of which there are many), and prior to that the city’s own dock-based bike rental scheme — also went for a test spin on a Lime scooter this week. And also came away feeling underwhelmed.

“This is bad,” he said after his ride. “It’s slow and you need to brake constantly. BUT the worst part is that it feels waaaaaay more dangerous than a bike. Basically you can’t brake abruptly because you’re just standing there.”

Index Venture’s Martin Mignot was also in Paris this week and he took the chance to take a Lime scooter for a spin too — checking out the competition in his case, given the European VC firm is a Bird backer. So what did he think?

“The experience is pretty cool. It’s slightly faster than a bike, there’s no sweating. The weather was just amazing and very hot in Paris so it was pretty amazing in terms of speed and lack of effort,” he says, rolling out the positively spun, vested view on scooter sharing. “Especially going up hill to go to Gare du Nord.

“And the lack of friction — just to get on board and get started. So in general I think it’s a great experience and I think it feels a really interesting niche between walking and on-demand bikes… In Paris you’ve also got the mopeds. So that kind of ‘in between offering’. I think there’s a big market there. I think it’s going to work pretty well in Paris.”

Mignot is a tad disparaging about the quality of Lime’s scooters vs the model being deployed by Bird — a scooter model he also personally owns. But again, as you’d expect given his vested interests.

“Obviously I’m biased but I would say that the Xiaomi scooter/Ninebot scooter is higher quality than the one that Lime are using,” he tells us. “I thought that the Lime one, the handlebar is a little bit too high. The braking is a little bit too soft. Maybe it was the one I used, I don’t know.”

Talking generally about scooter startups, he says investors’ excitement boils down to trip frequency — thanks exactly to journeys being these itty-bitty last mile links.

But it’s also then about the potential for all that last mile hopping to be a shortcut for winning a prized slot on smartphone users’ homescreens — and thus the underlying game being played looks like a jockeying for prime position in the urban mobility race.

Lime, for example, started out with bike rentals before jumping into scooters and going multi-modal. So scooter sharing starts to look like a strategy for mobility startups to scoot to the top of the attention foodchain — where they’re then positioned to offer a full mix and capture more value.

So really scooters might mostly be a tool for catching people’s app attention. Think of that next time you see one lying on a sidewalk.

“What’s very interesting if you look at the trip distribution, most of the trips are short. So the vast majority of trips if you’re walking, obviously, are less than three miles. So that’s actually where the bulk of the mobility happens. And scooters play really well in that field. So in terms of sheer number of trips I think it’s going to dwarf any other type of transportation. And especially ride-hailing,” says Mignot.

“If you look at how often do people use Uber or Lyft or Taxify… it’s going to be much less frequent than the scooter users. And I think that’s what makes it such an interesting asset… The frequency will be much higher — and so the apps that power the scooters will tend to be on the homescreen. And kind of on top of the foodchain, so to speak. So I think that’s what makes it super interesting.”

Scooters also get a big investor tick on merit of the lack of friction standing in the way of riding vs other available urban options such as bikes (or, well, non-electric scooters, skateboards, roller blades, public transport, and so on and on) — in both onboarding (getting going) and propulsion (i.e. the lack of sweat required to ride) terms.

“That’s what’s so brilliant with these devices, you just snap the QR code and off you go,” he says. “The difference with bikes is that you don’t have to produce any effort. I think there are cases where obviously bikes are better. But I think there are a lot of cases where people will want something where you don’t sweat.

“Where you don’t wrinkle your clothes. Which goes a little bit faster. Without going all the way to the moped experience where you need to put the helmet, which is a bit more dangerous, which a lot of people, especially women, are not super familiar with. So I think what’s exciting with scooters as a form factor is it’s actually very mainstream.

“Anyone can ride them. It’s very simple to manoeuvre. It’s not super fast, it’s not too dangerous. It doesn’t require any muscular effort — so for older people or for people who just don’t want to sweat because they’re going to a meeting or something. It’s just a fantastic option.”

Index has also invested in an e-bike startup (Cowboy) and the firm is fully signed up to the notion that urban mobility will be multimodal. So if e-scooters valuations are a bit overcooked Index is not going to be too concerned. People in cities are clearly going to be riding something. And backing a mix is a smart way to hedge the risk of any one option ending up more passing fad than staple urban steed.

Mostly Index is betting that people will keep on riding robotic horses for urban courses. And whatever they ride it’s a fairly safe bet that an app is going to be involved in the process of finding (docklessness is therefore another attention play) or unlocking (scan that QR code!) the mobility device — opening up the possibility that a single app could house multiple mobility options and thus capture more overall value.

“It’s not a one-size fits all. They’re all complementing each other,” says Mignot of the urban mobility options in play. “I would say e-bikes are probably a little bit more great for little bit longer trips because you’re sitting down. But again it takes a little bit longer, because you have to adjust the saddle, you need to start peddling. There’s a bit more friction both on the onboading and on the riding. But they’re a bit better for slightly longer distances. I would say for shorter distances there’s nothing better than the scooter.”

He also points out that scooters are both cheaper and less bulky than e-bikes. And because they take up less street space they can — at least in theory — be more densely stacked, thereby generating the claimed convenience by having them sitting near enough to convince someone not to bother walking 10 minutes to the café or gym — and just scoot instead. So scooters’ slimline physique is also especially exciting to investors. (Even if, ironically, it’s being deployed to urge people to walk less.)

“I think we will end up with more density of scooters. Which is super important,” he continues. “People will, in the end, tend to take the vehicle that they can find where they are. And I think it’s more likely, eventually, that they will get a scooter than an e-bike. Just simply because they take less space and they are less expensive.”

But why wouldn’t people who do get won over to the sweatless perks of last mile scooting just buy and own their own ride — rather than shelling out on an ongoing basis to share?

Unlike bikes, scooters are mobile enough to be picked up and moved around fairly easily. Which means they can go with you into your home, office, even a restaurant — disruptively reducing theft risk. Whereas talk to any bike owner and they’ll almost invariably have at least one tale of theft woe, which is a key part of what makes bike sharing so attractive: It erases theft worry.

Add to that, you can find e-scooters on sale in European electronics shops for as little as €140. So if you’re going to be a regular scooterer, the purely economic argument to just own your own looks pretty compelling.

And people zipping around on e-scooters is a pretty common sight in another dense European city, Barcelona, which has very scooter-friendly weather but no scooter startups (yet). But unless it’s a tourist weaving along the seafront most of these riders are not shared: People just popped into their local electronics shop and walked out with a scooter in a box.

So the rides aren’t generating repeat revenue for anyone except the electricity companies.

Asked why people who do want to scoot won’t just buy, rather than rent Mignot talks up the hassle of ownership — undermined slightly by the fact he is also a scooter owner (despite the claimed faff from problems such as frequent flat tires and the chore of the nightly charge).

“The thing you notice very rapidly: There are two things, one is the maintenance,” he says. “The models that exist today are not super robust. Maybe in a very flat, very smooth roads, maybe Santa Monica, maybe it’s a little bit less true but I would say in Europe the maintenance that is required is fairly high… I have to do something on mine every week.

“The other thing is it takes a little bit of space. If you have to bring it to a restaurant or whatever type of crowded place, a movie theatre or wherever you’re going, to an office, to a meeting room, it’s a little bit on the heavy side, and it’s a little bit inconvenient. So certainly some people will buy them… But I also think that there are a lot of cases where you’d rather have it just on-demand.”

Unlike Mignot and Index, Tom Bradley, of UK focused VC firm Oxford Capital, is not so convinced by the on-demand scooter craze.

The firm has not made any e-scooter investments itself, though mobility is a “core theme”, with the portfolio including an on-demand coach travel startup (Sn-ap), and technology plays such as Morpheus Labs (machine learning for driverless cars) and UltraSoc (complex circuits for automotive parts, which sells to the likes of Tesla).

But it’s just not been sold on scooter startups. Bradley describes it as an “open question” whether scooters end up being “an important part of how people move around the cities of the future”. He also points to theft problems with dockless bike share schemes that have not played out well in the UK.

“We’re not convinced that this is a fundamental part of the picture,” he says of scooter sharing. “It may be a part of the picture but I personally am not yet convinced that it’s as big a part of the picture that people seem to be prepared to pay for.”

“I keep thinking of the Segway example,” he adds. “It’s an absolutely delightful product. It’s brilliant. It’s absolutely brilliant. In a way that these electric scooters are not. But obviously it was much more expensive. And it made people feel a bit weird. But it was supposed to be the answer — and it’s not the answer. Before its time, perhaps.”

Of course he also accepts that capital is “being used as a weapon”, as he puts it, to scoot full-pelt towards a future where shared electric scooters are the norm on city streets by waging a “marketing war” to get there.

“Venture capital valuations are what someone is prepared to pay. And in this case people are valuing potential rather than valuing the business… so the valuations [of Bird and Lime] are being driven more than anything by the amount of money being raised,” he says. “So you decide a rule of thumb about what is acceptable dilution, and if you’re going to raise $400M or whatever then the valuation’s got to be somewhere between $1.6BN and $2BN to make that sort of raise make sense — and leave enough equity for the previous investors and founders. So there’s an element of this where the valuations are being driven by the amount of capital being raised.”

Oxford Capital’s bearish view on scooter sharing is also bounded by the fund only investing in UK-based startups. And while Bradley says it sees lots of local mobility strengths — especially in the automotive market — he admits it’s more of a mental leap to imagine a world leading scooter startup sprouting from the country’s green and pleasant lands. Not least because it’s not legal to use them on UK public roads or pavements.

“If you look at places like Amsterdam, Berlin, they’re sort of built for bikes. London’s getting towards being built for bikes… Cycling’s been one of the big success stories in London. Is [scooter sharing] going to replace cycling? I don’t know. Not so convinced… It’s obviously easy for anyone to get on and off these things, young and old. So that’s good, it’s inclusive. But it feels a little bit like a solution looking for a problem, the sorts of journeys people talk about for these things — on campus, short urban journeys. A lot of these are walkable or cycle journeys in a lot of cities. So is there a mass need?

“Is this Segway 2 or is this bike hire 2… it’s hard to tell. And we’re coming down on the former. We’re not convinced this is going to be a fundamental part of the transport space. It will be a feature but not a huge part.”

But for Mignot the early days of the urban mobility attention wars mean there’s much to play for — and much that can be favorably reshaped to fit scooters into the mix.

“The whole thing, even on-demand bikes, it’s a two year old phenomenon really,” he says. “So I think everyone is just trying to learn and figure out and adapt to this new reality, whether it’s users or companies or cities. I think it’s very similar to when cars were first introduced. There were no parking spaces at the time and there were no rules on the road. And fast forward 100 years and it looks very different.

“If you look at the amount of infrastructure and effort and spend that has been put into making — and I would argue way more than should have — into making a city car-friendly, if you only do a 100th of the same amount of effort and spend into making some space for bicycles and light two-wheel vehicles I think we’ll be fine.

“That’s the beauty of this model. If you compare the space of the tech and if you look at the efficiency of moving people around vs the space, the scooters are simply the most efficient because their footprint on the ground is just so small.”

He even makes the case for scooters working well in London — arguing the sprawl of the city amps up the utility because there are so many tedious last mile trips that people have to make.

Even more so than in denser European cities like Paris, where he admits that hopping on a scooter might just be more of a “nice to have”, given shorter distances and all the other available options. So, really, where urban mobility is concerned, it can actually be courses for horses.

Yet, the reality is London is off-limits to the likes of Bird and Lime for now — thanks to UK laws barring this type of unlicensed personal electric vehicle from public roads and spaces.

You can buy e-scooters for use on private land in the UK but any scooter startups that tried their usual playbook in London would be scooting straight for legal hot water.

It’s not just the British weather that’s inclement.

“I’m really hoping that TfL [Transport for London] and the Department for Transport are going to make it possible,” says Mignot on that. “I think any city should welcome this with open arms. Some cities are, by the way. And I think over time once they see the success stories in other parts of the world I think they all will. But I wish London was one of those cutting edge cities that would welcome new innovation with open arms. I think right now, unfortunately, it’s not there.

“There’s a lot of talk about air quality, and so on, but actually, when push comes to shove… you have a lot of resistance and a lot of pushback… So it’s a little bit disappointing. But, you know, we’ll get there eventually.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines. This week TechCrunch’s Silicon Valley Editor Connie Loizos and I jammed out on a couple of topics as Alex Wilhelm was out managing his fake stock game spreadsheets or something. (The jury is out on whether this was a good or bad thing.)

First up is Twitter buying Smyte, a startup targeting fixes for spam and abuse. This is, of course, Twitter’s perennial problem and it’s one that it’s been trying to fix for some time — but definitely not there yet. The deal terms weren’t disclosed, but Twitter to its credit has seen its stock basically double this year (and almost triple in the past few years). Twitter is going into a big year, with the U.S. midterm elections, the 2018 World Cup, and the Sacramento Kings probably finding some way to screw up in the NBA draft. This’ll be a close one to watch over the next few months as we get closer to the finals for the World Cup and the elections. Twitter is trying to bill itself as a home for news, focusing on live video, and a number of other things.

Then we have Juul Labs, an e-cigarette company that is somehow worth $10 billion. The Information reports that the PAX Labs spinout from 2015 has gone from a $250 million valuation all the way to $10 billion faster than you can name each scooter company that’s raising a new $200 million round from Sequoia that will have already been completed by the time you finish this sentence. Obviously the original cigarette industry was a complicated one circa the 20th century, so this one will be an interesting one to play out over the next few years.

Finally, we have meditation app Calm raising a $27 million round at a $250 million pre-money valuation. Calm isn’t the only mental health-focused startup that’s starting to pick up some momentum, but it’s one that’s a long time coming. I remember stumbling upon Calm.com back in 2012, where you’d just chill out on the website for a minute or so, so it’s fun to see a half-decade or so later that these apps are showing off some impressive numbers.

That’s all for this week, we’ll catch you guys next week. We apologize in advance if Alex makes it back on to the podcast.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocketcast, Downcast and all the casts.

Powered by WPeMatico

Urban Airship has raised $25 million in Series F funding.

The company started out as a platform supporting push notifications, but has since expanded to include other marketing channels like email, SMS, mobile wallets and voice assistants. The goal is to be the platform managing messaging and unifying customer data across all these channels.

Altogether, Urban Airship said it’s now delivered more than two trillion messages, doubling the number from a year ago.

Recent product additions include voice notifications on Amazon Alexa (which is still in beta testing) and automated in-app messaging. The company has signed up new enterprise customers like AMC, Magazine Luiza and Royal Automobile Club.

This funding was led by Foundry Group (which previously led the company’s Series B), with participation from True Ventures, August Capital, Intel Capital, Verizon Ventures, QuestMark Partners and Franklin Park Associates.

Brett Caine, who joined as CEO in 2014, said Urban Airship is currently breaking even, and he described this as “the first time in the eight nine years of the company where we’re raising money when we didn’t need it.”

So then why raise again? Caine said he sees “a lot of opportunity to grow and continue to expand globally and certainly look at the broad set of channels emerging in the market.”

“Instead of saying, ‘Oh gosh, we’ve gotta go out and raise money,’ and it was, ‘Let’s raise money to go faster,’” he added.

In addition to the growth of new marketing channels, Caine said growing discussion and regulation around online privacy serve as “wind shifts” in the company’s favor — because Urban Airship is focused on helping marketers use their own data to communicate directly with customers who have opted in to hearing from them.

“We’ve been opt-in, first-party from day one,” Caine said. “All of digital channels that we want to power, they only use first-party data. We don’t do anything with third-party, we don’t do any advertising.”

Urban Airship has now raised more than $100 million in total funding, according to Crunchbase.

Powered by WPeMatico

While applications like Google Maps and Yelp seem to provide an inexhaustible source of information about local restaurants, stores and other points of interest, they also can come up short — moments when you arrive somewhere only to discover that the hours you had were wrong, or the store is closed for a holiday, or it’s just shut down altogether.

The team at StreetCred is trying to build a better system for gathering and selling that data. And it’s raised $1 million in seed funding from Bowery Capital and Notation Capital.

CEO Randy Meech explained that if someone wanted to build the next Uber or the next Pokémon GO, they’d need location data to make it work. And while they could buy that data now, it’s “very difficult, very expensive.”

Plus, he sees room for lots more data — while Foursquare has data about 105 million points of interest and Google has 100 million, Meech estimates that there are more than 1 billion POIs across the world, many of them in developing nations where the data is more spotty.

So StreetCred is building a marketplace where users should be rewarded for collecting this data, while interested companies should be able to buy the data more easily.

Meech has been working on mapping for years, serving as the CTO at MapQuest (which, like TechCrunch, is owned by Verizon/Oath) and then as CEO at Mapzen, an open-source mapping subsidiary of Samsung. That’s where Meech met his StreetCred co-founder Diana Shkolnikov — he said StreetCred was created partly in response to the disappointment of shutting down Mapzen earlier this year.

“If we can get this protocol and data economy right, it can’t be shut down,” Meech said. That means leveraging blockchain technology: “It’s a very natural way to open up and decentralize the data and also to build a payment mechanism around that.”

StreetCred is just starting to test the system out around New York City. The idea is that users can download an app and then collect location data around the city, earning crypto tokens as they do. (They take photos to validate their location, and the data is also verified by other users.) Then companies that want to buy the data can do so by purchasing tokens.

Meech drew parallels to Foursquare, which started as a location-sharing app before building a business around its data. StreetCred, on the other hand, won’t have any social component — Meech said the app will be “completely anonymous” and focus entirely on the collection of location data.

The team is still experimenting with the specific details of how contributions are incentivized and compensated, but Meech said users will be paid through an “anonymized wallet mechanism.” And while it’s important to make sure StreetCred’s tokens can be converted into “fiat currency” (i.e. regular money), Meech said this approach should also mean users are more invested in StreetCred’s success: “We want to build an asset where the value of the currency is tied to the value of the data,” Meech emphasized.

“Our thesis is that if you make the data much more accessible, much cheaper to buy … you’re going to make things a lot easier and enable things that don’t exist today,” he said.

Powered by WPeMatico

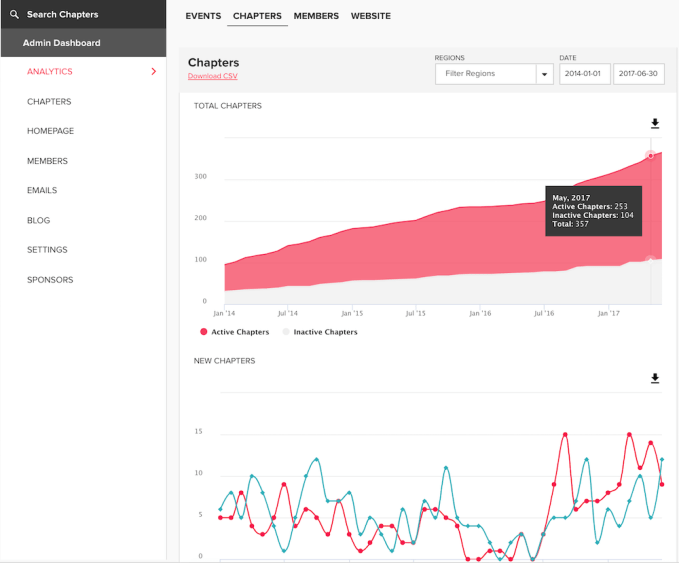

The founders of entrepreneurial community Startup Grind have a startup of their own — Bevy, which announced today that it has raised $6.4 million in Series A funding.

The funding comes from Upfront Ventures, author Steve Blank, Qualtrics founders Ryan Smith and Jared Smith, and Pluralsight CEO Aaron Skonnard.

CEO Derek Andersen (who founded and runs both Bevy and Startup Grind with CTO Joel Fernandes) said that the product was created to deal with Startup Grind’s challenges as the team tried to organize events using a mix of Eventbrite, Meetup and MailChimp,

“It worked fine at first, but a few years later, we looked up and we had hundreds of cities, and we had maybe 500 people that were working on it, and it was too much,” Andersen said. “For the first time in many years, we started to get smaller instead of bigger. We were spending all of this time just running triage and maintenance on the platform.”

So in early 2016, the team built its own event management software, with what Andersen said was “no intention of anyone else using it.” But eventually, he realized that other companies were facing similar problems, so he launched Bevy as a separate startup to further develop and commercialize the product.

“We really focus on the smaller, community events,” Andersen added. “If you just do a conference, Eventbrite is great — I’ve hosted thousands of events on Eventbrite. But if you want to host five or 10 events a month or jack that number up anywhere above that, and you don’t want to hire 10 people, then that’s really what we’re perfect to do.”

Usually, these are events where community members play a big role, or are even doing most of the organizing themselves. So beyond supporting tasks like creating event listings, sending out promotional emails and managing sponsorships, Andersen said one of Bevy’s big differentiators is the ability to precisely control which users are authorized to perform different roles at different events.

In addition, Andersen said that with Bevy, companies can create fully branded experiences and get full access to the customer data around their events. Customers include Atlassian, Duolingo, Docker, Evernote and Asana.

Andersen also suggested that the company is taking advantage of a broader shift in marketing, where companies are relying more on their own customers and communities.

“All the best companies do it today,” he said. He predicted that in the future, “Every company will have a customer-to-customer marketing strategy. Now we’ve made it affordable and turnkey.”

Powered by WPeMatico

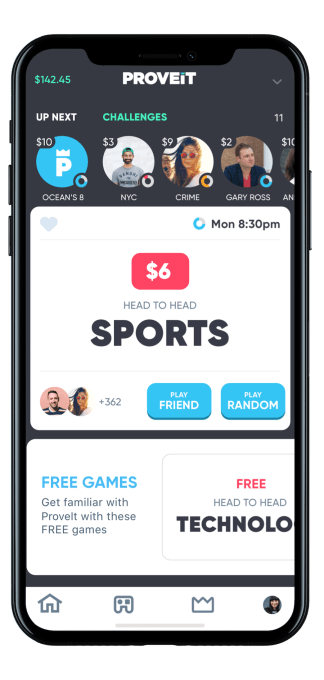

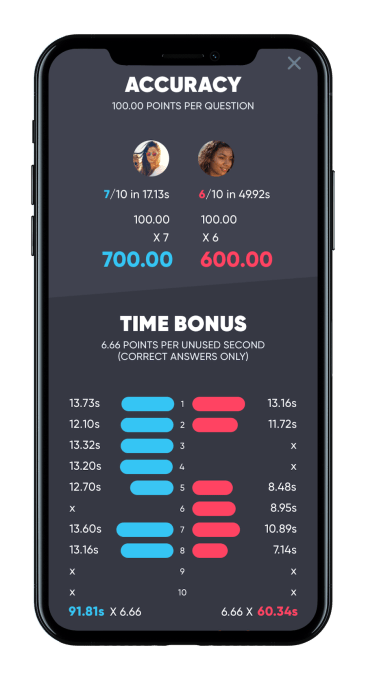

Pick a category, wager a few dollars and double your money in 60 seconds if you’re smarter and faster than your opponent. Proveit offers a fresh take on trivia and game show apps by letting you win or lose cash on quick 10-question, multiple choice quizzes. Sick of waiting to battle a million people on HQ for a chance at a fraction of the jackpot? Play one-on-one anytime you want or enter into scheduled tournaments with $1,000 or more in prize money, while Proveit takes around 10 percent to 15 percent of the stakes.

“I’d play Jeopardy all the time with my family and wondered ‘why can’t I do this for money?’ ” says co-founder Prem Thomas.

Remarkably, it’s all legal. The Proveit team spent two years getting approved as “skill-based gaming” that exempts it from some laws that have hindered fantasy sports betting apps. And for those at risk of addiction, Proveit offers players and their loved ones a way to cut them off.

The scrappy Florida-based startup has raised $2.3 million so far. With fun games and a snackable format, Proveit lets you enjoy the thrill of betting at a moment’s notice. That could make it a favorite amongst players and investors in a world of mobile games without consequences.

“I could spend $50 for a three-hour experience in a movie theater, or I could spend $2 to enter a Proveit Movies tournament that gives me the opportunity to compete for several thousand dollars in prize money,” says co-founder Nathan Lehoux. “That could pay for a lot of movies tickets!”

St. Petersburg, Fla. isn’t exactly known as an innovation hub. But outside Tampa Bay, far from the distractions, copycatting and astronomical rent of Silicon Valley, the founders of Proveit built something different. “What if people could play trivia for money just like fantasy sports?” Thomas asked his friend Lehoux.

St. Petersburg, Fla. isn’t exactly known as an innovation hub. But outside Tampa Bay, far from the distractions, copycatting and astronomical rent of Silicon Valley, the founders of Proveit built something different. “What if people could play trivia for money just like fantasy sports?” Thomas asked his friend Lehoux.

That’s the same pitch that got me interested when Lehoux tracked me down at TechCrunch’s SXSW party earlier this year. Lehoux is a jolly, outgoing fella who became interested in startups while managing some angel investments for a family office. Thomas had worked in banking and health before starting a yoga-inspired sandals brand. Neither had computer science backgrounds, and they’d raised just a $300,000 seed round from childhood friend Hilt Tatum who’d co-founded beleaguered real money gambling site Absolute Poker.

Yet when he Lehoux thrust the Proveit app into my hand, even on a clogged mobile network at SXSW, it ran smoothly and I immediately felt the adrenaline rush of matching wits for money. They’d initially outsourced development to an NYC firm that burned much of their initial $300,000 seed funding without delivering. Luckily, the Ukrainian they’d hired to help review that shop’s code helped them spin up a whole team there that built an impressive v1 of Proveit.

Meanwhile, the founders worked with a gaming lawyer to secure approvals in 33 states including California, New York, and Texas. “This is a highly regulated and highly controversial space due to all the negative press that fantasy sports drummed up,” says Lehoux. “We talked to 100 banks and processors before finding one who’d work with us.”

Proveit founders (from left): Nathan Lehoux, Prem Thomas

Proveit was finally legal for the three-fourths of the U.S. population, and had a regulatory moat to deter competitors. To raise launch capital, the duo tapped their Florida connections to find John Morgan, a high-profile lawyer and medical marijuana advocate, who footed a $2 million angel round. A team of grad students in Tampa Bay was assembled to concoct the trivia questions, while a third-party AI company assists with weeding out fraud.

Proveit launched early this year, but beyond a SXSW promotion, it has stayed under the radar as it tinkers with tournaments and retention tactics. The app has now reached 80,000 registered users, 6,000 multi-deposit hardcore loyalists and has paid out $750,000 total. But watching HQ trivia climb to more than 1 million players per game has proven a bigger market for Proveit.

“We’re actually fans of HQ. We play. We think they’ve revolutionized the game show,” Lehoux tells me. “What we want to do is provide something very different. With HQ, you can’t pick your category. You can’t pick the time you want to play. We want to offer a much more customized experience.”

To play Proveit, you download its iOS-only app and fund your account with a buy-in of $20 to $100, earning more bonus cash with bigger packages (no minors allowed). Then you play a practice round to get the hang of it — something HQ sorely lacks. Once you’re ready, you pick from a list of game categories, each with a fixed wager of about $1 to $5 to play (choose your own bet is in the works). You can test your knowledge of superheroes, the ’90s, quotes, current events, rock ‘n roll, Seinfeld, tech and a rotating selection of other topics.

In each Proveit game you get 10 questions, 1 at a time, with up to 15 seconds to answer each. Most games are head-to-head, with options to be matched with a stranger, or a friend via phone contacts. You score more for quick answers, discouraging cheating via Google, and get penalized for errors. At the end, your score is tallied up and compared to your opponent, with the winner keeping both player’s wagers minus Proveit’s cut. In a minute or so, you could lose $3 or win $5.28. Afterwards you can demand a rematch, go double-or-nothing, head back to the category list or cash out if you have more than $20.

The speed element creates intense, white-knuckled urgency. You can get every question right and still lose if your opponent is faster. So instead of second-guessing until locking in your choice just before the buzzer like on HQ, where one error knocks you out, you race to convert your instincts into answers on Proveit. The near instant gratification of a win or humiliation of a defeat nudge you to play again rather than having to wait for tomorrow’s game.

The speed element creates intense, white-knuckled urgency. You can get every question right and still lose if your opponent is faster. So instead of second-guessing until locking in your choice just before the buzzer like on HQ, where one error knocks you out, you race to convert your instincts into answers on Proveit. The near instant gratification of a win or humiliation of a defeat nudge you to play again rather than having to wait for tomorrow’s game.

Proveit will have to compete with free apps like Trivia Crack, prize games like student loan repayer Givling and virtual currency-based Fleetwit, and the juggernaut HQ.

“The large tournaments are the big draw,” Lehoux believes. Instead of playing one-on-one, you can register and ante up for a scheduled tournament where you compete in a single round against hundreds of players for a grand prize. Right now, the players with the top 20 percent of scores win at least their entry fee back or more, with a few geniuses collecting the cash of the rest of the losers.

Just like how DraftKings and FanDuel built their user base with big jackpot tournaments, Proveit hopes to do the same… then get people playing little one-on-one games in-between as they wait for their coffee or commute home from work.

Thankfully, Proveit understands just how addictive it can be. The startup offers a “self-exclusion” option. “If you feel that you need to take greater control of your life as it relates to skill-gaming,” users can email it to say they shouldn’t play any more, and it will freeze or close their account. Family members and others can also request you be frozen if you share a bank account, they’re your dependant, they’re obligated for your debts or you owe unpaid child support.

“We want Proveit to be a fun, intelligent entertainment option for our players. It’s impossible for us to know who might have an issue with real-money gaming,” Lehoux tells me. “Every responsible real-money game provides this type of option for its users.

That isn’t necessarily enough to thwart addiction, because dopamine can turn people into dopes. Just because the outcome is determined by your answers rather than someone else’s touchdown pass doesn’t change that.

Skill-based betting from home could be much more ripe for abuse than having to drag yourself to a casino, while giving people an excuse that they’re not gambling on chance. Zynga’s titles like Farmville have been turning people into micro-transaction zombies for a decade, and you can’t even win money from them. Simultaneously, sharks could study up on a category and let Proveit’s random matching deliver them willing rookies to strip cash from all day. “This is actually one of the few forms of entertainment that rewards players financially for using their brain,” Lehoux defends.

With so much content to consume and consequence-free games to play, there’s an edgy appeal to the danger of Proveit and apps like it. Its moral stance hinges on how much autonomy you think adults should be afforded. From Coca-Cola to Harley-Davidson to Caesar’s Palace, society has allowed businesses to profit off questionably safe products that some enjoy.

For better and worse, Proveit is one of the most exciting mobile games I’ve ever played.

Powered by WPeMatico

Step aside, Allbirds. Atoms come in quarter-sizes you can mix-and-match. Emerging from stealth today in a TechCrunch exclusive, this shoe startup’s obsession with satisfaction allowed it to replace my Nikes. I’ve spent the last two months wearing Atoms every day. They’re the first sneaker classy-looking enough for semi-formal occasions, but that I can comfortably walk or even hike in for hours.

Here’s how Atoms is modernizing the footwear experience:

Image via Jeff Macke

At $179, Atoms are pricier than $100 lifestyle Nikes or $79 Allbirds. But the basketball shoe giant just sells in half sizes, while Allbirds offers only whole sizes that fit few perfectly. The right quarter-size Atoms for each foot makes them feel molded to your body.

“To make shoes better, you need to know why people wear shoes,” Atoms co-founder Waqas Ali tells me. People buy fancy dress shoes they never wear, yet feel embarrassed by the childish designs and branding on most sneakers. “We perfected Atoms for your everyday routine — walking, standing and commuting,” he explains. “You are a person not a billboard, so there’s no logo.”

That hasn’t stopped the shoes from going viral during their beta-testing phase. Everyone who tries them on seems to rave about them. That’s driven 4,000 people to sign up on the Atoms waitlist, which you can join to be first in line. Atoms launch this summer in the U.S., with the first wave of customers getting their shoes in late June/early July.

Husband and wife duo Waqas and Sidra Ali started their first shoe company Markhor in Okara, Pakistan back in 2012. They attacked the market with one of the best qualities you can find in an entrepreneur: curiosity. Instead of coming in with preconceived notions, they traveled the world to research how people actually wear shoes. “You might assume that ‘Oh in Italy, everyone wears leather shoes,’ but the young people there were all wearing sneakers,” Waqas recalls.

After launching a Kickstarter, the Alis came to Silicon Valley to go through the prestigious Y Combinator startup accelerator in Summer 2015. There, they drilled into more customer research and product design.

Comfort and style were the big deciding factors in most sneaker purchases, so that’s where the couple wanted to differentiate. They discovered that more than 70 percent of people have at least a quarter-size difference in their two feet, and more than 7 percent have a half-size discrepancy. So why don’t other shoe companies offer quarter-sizes? “They make tons of different shoes,” Waqas says.

Suddenly, the two guiding principles of Atoms aligned. By designing just a single unisex model in a limited set of colors, it could make quarter-sizing scalable while stripping away all the goofy extra fabrics and patterns. Indeed, 35 percent of customers already take two different sizes. That breakthrough attracted $560,000 in seed funding from LinkedIn’s ex-head of growth Aatif Awan and Shrug Capital.

But Atoms is determined to avoid being labeled a Silicon Valley shoe. Rather than coders, the company wants creative types like painters and graphic designers to be its early adopters. The vision is to create a sneaker a head chef could wear all night in the kitchen without hurting, but that look elegant enough that they could stride into the chic dining room with confidence.

“Most shoes in the market that claim they’re comfortable are only comfortable when you try them on,” Waqas laments. Take that other shoe startup Allbirds. They’re super-soft and made of wool, and the first steps feel like you’re wearing cloud slippers. But walk 10 blocks and you’ll find the bendy bottoms don’t protect you much.

That’s why Atoms hired 18-year-veteran of the shoe business Sangmin Lee, who’s worked with Adidas and Puma out of Portland and South Korea. He prototyped tons of different versions for Atoms. The result is a strong but light outsole on the bottom with indents cut out for anti-slip traction and to reduce weight. Meanwhile, the upper’s tough mesh material breathes but holds its shape, and refuses stains.

Image via Adam Bain

“Shoe companies say they use sustainable materials but you go to the factories and everything is falling apart,” Sidra tells me. Organic materials sound nice but can break down too quickly. “The way we make our shoes environmentally friendly is that they last long,” Waqas says with a laugh.

Two months of tough wear later, my Atoms are holding up great. The foamy mid-sole has frayed a tiny bit in the front like many shoes. And the knit materials ingrained some dust when I went camping in them that needed some brushing to get out. But they’ve succeeded in becoming my go-to shoe I can chill, work and play in.

Now Atoms is trying to build more commerce innovation to turn buyers into lifetime wearers. It’s working on a special pattern for the insole that will rub off based on where you put your weight. The idea is that when people send their old pairs in for a discount on the next, it can analyze that insole pattern to improve the shape of future models.

One day, Atoms hopes to create a completely personalized shoe shopping experience. It hopes to actually give you slightly different insoles with more or less arch support depending on how you wore the last ones. And it’s planning early access to new color combinations and laces for repeat buyers.

Atoms will need loyalty in case the shoe giants come out with their own minimalist, quarter-sized sneakers. Such a limited set of colors and single style mean plenty of people will simply find them ugly or outside their taste. And no, they’re not a great fit for the gym or with a suit. But if you want understated, durable shoes you don’t have to think about, Atoms excel.

The startup must rely on its nimbleness and a flawless customer experience if it’s going to gain a foothold in a business dominated by brands with huge ad campaigns and brick-and-mortar distribution. One thing it’s thankful to its shoe startup competitor for is that “Allbirds has shown the world is not just ruled by Nike and Adidas.”

The startup must rely on its nimbleness and a flawless customer experience if it’s going to gain a foothold in a business dominated by brands with huge ad campaigns and brick-and-mortar distribution. One thing it’s thankful to its shoe startup competitor for is that “Allbirds has shown the world is not just ruled by Nike and Adidas.”

Luckily Atoms has strong differentiation in a world of interchangeable sneakers. One customer “thought quarter-sizing was a joke or gimmick until I tried the 10.25s,” Airbnb designer Bryce Daniel tweeted. “How will I go back to a 10.5 when 10.25 fits so well?” Personally, there hasn’t been another tech or startup product in the past 10 years beyond Apple’s AirPods that has cemented itself so deeply into my daily life.

“There’s no way to hack shoes” Waqas concludes. “You just have to make a good shoes.”

Powered by WPeMatico