funding

Auto Added by WPeMatico

Auto Added by WPeMatico

The working class of the United States doesn’t get many breaks these days. It’s not just a function of low pay and long hours, but also the incredible uncertainty of income and expenses that makes surviving week-to-week so challenging. One in five Americans have a negative net wealth, even in an economy where the unemployment rate is the lowest in almost two decades. Banks, meanwhile, are actively dissuading the working class from banking with them, creating a permanent class of unbanked and underbanked citizens.

For Jon Schlossberg, CEO and co-founder of Even.com, improving the plight of ordinary Americans and their finances is a deeply personal and professional mission. And now that mission has a huge new bucket of capital behind it, with Keith Rabois of Khosla Ventures leading a $40 million Series B round into the Oakland-based startup. Rabois is a return investor, having previously backed the company in its late 2014 seed round. With this latest round of capital, Even.com has now raised $50.5 million.

When Even.com first launched its eponymous app, the goal was to offer income smoothing for workers, helping them avoid usurious payday loans to make ends meet. Since that first launch several years ago, Schlossberg and his team learned that the only way to improve the finances for the working class is to help them budget better — ending the need for loans in the first place. “To do anything with your life, unless you are just born to the right family, you need to spend your money wisely, but we never teach you how to do that,” Schlossberg explained to me.

Last year, Even.com announced that it had stopped evening through its Pay Protection product. Instead, Schlossberg said that Even.com has evolved and wanted to “build a new kind of financial institution with products that fit your life.” It still has a feature it brands as Instapay, which allows users to request their earned pay in advance of their payday.

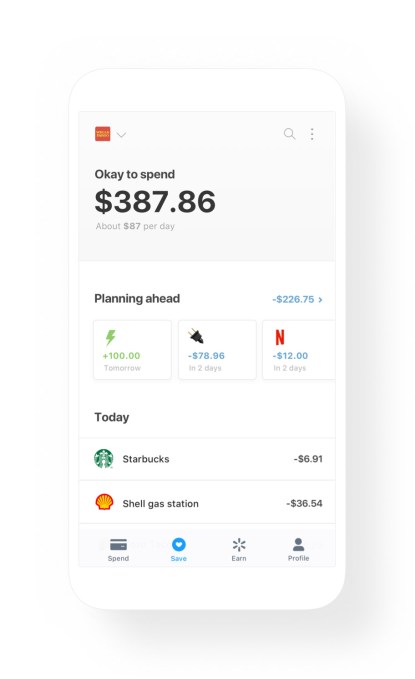

But Even.com is increasingly focused on improving the quality of its intelligent budgeting feature. Using artificial intelligence models honed over the past few years, the company now gives users of its Even app an “Okay to spend” figure that helps them think through their cash flow. By giving a predictive figure rather than a checking account balance, Even can help its users avoid sudden surprise expenses that can trigger the kind of financial death spiral that has become a familiar story in America. The company will also soon launch an automatic savings feature similar to Digit or Acorns that helps people build up regular savings.

Even’s Okay to spend feature gives insight into future cash flows before it is too late

While the company offers an increasingly comprehensive suite of financial tools, it has decided to avoid charging users specific use fees, opting instead for a subscription model. Schlossberg explained that “We are a mission-oriented company, but talk is cheap and where the rubber hits the road, it’s how you make money.” Even is free for users participating through partner employers, or $2.99 a month for individuals without a sponsor.

The company’s highest expense feature is Instapay due to underwriting, and so the company makes higher profits when fewer of its customers need access to payday credit. In other words, the better that its users budget, the fewer loans it will underwrite, and the more money the company makes. We are “directly incentivized to help people with their financial health,” Schlossberg noted.

Even has proven attractive to corporate customers, including Walmart, which partnered with the startup last December to offer its service to all 1.4 million employees at the retailer. Since the launch of that partnership, more than 200,000 Walmart employees regularly use the app, according to Even, and the typical active user checks their Okay to spend balance four times a week. A majority of active users have also taken out an Instapay through Even.

More interestingly, salaried employees at Walmart used the app slightly more than hourly workers, proving that just having a guaranteed income isn’t necessarily a panacea to financial trouble for many American households.

Even.com’s Series B round is all about expansion and growth for the company. Even intends to open an East Coast office this year, and intends to expand its product further into the Fortune 500 with partnerships similar to its Walmart deal. The company currently has 37 employees. In addition to Khosla, the startup raised funding from Valar Ventures, Allen & Company, Harrison Metal, SV Angel, Silicon Valley Bank and others.

Powered by WPeMatico

Y Combinator wants to lure more companies into the funnel for its accelerator while democratizing free access to startup knowledge. It’s simultaneously moving up and down market to conquer the acceleration space, with both its recent Series A program for more mature startups and $1 million in grants for high potential founders from its extra-early-stage online course.

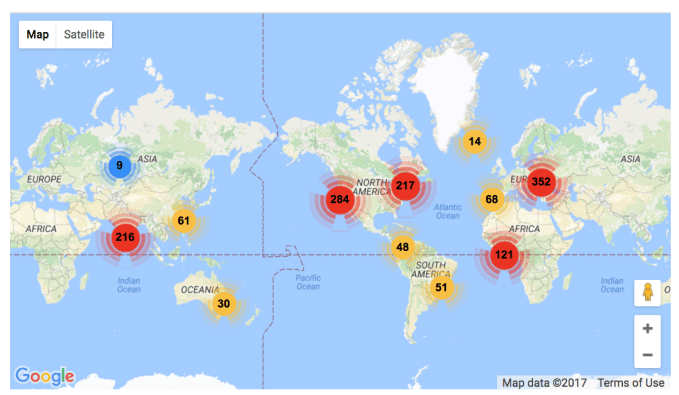

Today the entrepreneurship academy announced that the third year of its Startup School program will begin August 27, offering a 10-week set of lectures on how to build, grow and monetize a startup. More than 13,000 companies signed up last year, with 2,800 of the best receiving a YC alumni mentor, and 1,587 completing the program with an online Demo Day. It proved a powerful feeder, leading to 38 being admitted to YC’s core accelerator program that charges 7 percent equity for $120,000 in funding. Those included patent law firm Cognition IP, customer feedback platform Thematic and internet service provider Necto.

Startup School 2017’s participants came from around the world

But this year, YC is going to give 100 high-potential companies that complete the course a $10,000 grant for no equity in return. The cash comes from YC’s own bank account, filled from exits of its portfolio companies over the years and other revenue streams. These prizes could pique the interest of more founders around the world and keep them committed to following through with the self-directed learning. Interested companies can sign up here.

“Useful advice around how to grow products, how to sell, all the mechanics for starting a startup . . . there’s unending demand for that,” says Geoff Ralston, a YC partner and founder of RocketMail that was acquired and became Yahoo Mail. “In some countries it’s the only career path available,” he declares with a bit of the hyperbole Silicon Valley is known for. “In the U.S., it’s become way more mainstream than it ever was years ago.”

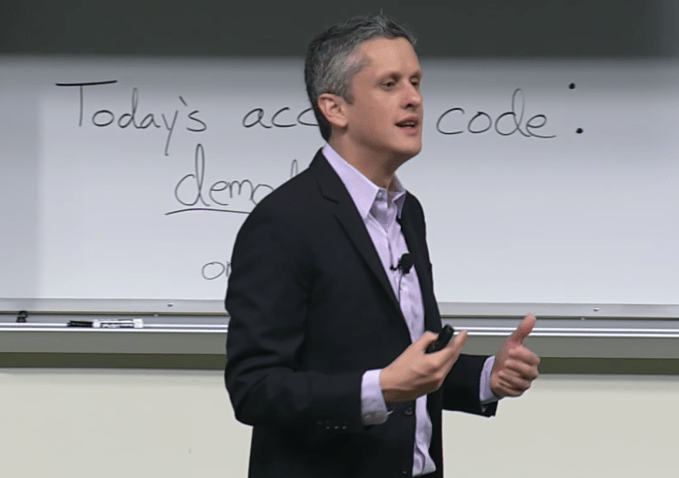

The last two years’ Startup School programs have included lectures from WhatsApp’s Jan Koum and Box’s Aaron Levie on how to build a product, Stripe’s Patrick Collison and Pinterest’s Ben Silbermann on hiring and culture, and investors Marc Andreessen and Ron Conway on how to raise money. YC won’t be running the program in partnership with Stanford University like last year, but still hopes to reach as many companies.

Box CEO Aaron Levie gives a Startup School lecture on building product

“Getting the most out of Startup School requires putting a lot in. I watched every lecture, took notes, attended all the office hours, and participated in the online community, and it was all worth it,” said Cognition IP co-founder Bryant Lee. “The learning experience will save you a ton of time down the road.”

Beyond the lectures and shot at the grants, YC will be offering participants more than $50,000 in credits to Amazon Web Services and other enterprise tools, plus discounted payment processing from Stripe. Graduates will also receive an online meeting with a YC partner later in the year to help them prep for applying to the core accelerator. Ralston says YC is already accustomed to vetting thousands of applications, so he’s confident it can sift through the Startup School students to find the gems.

The program effectively creates a vacuum that sucks in startups so YC can start forging a relationship with them. That’s critical, as it needs access to the best companies to make its program profitable since so many early-stage startups are destined to fail or end up generating paltry returns as acqui-hires by bigger corporations.

Startup School founders may be paired with a mentor like YC alum Christian Van Der Henst of Platzi for weekly online office hours

When asked if the “school” might delude some young wantrepreneurs, convincing them to abandon traditional higher learning or safer jobs to launch a company, Ralston countered, saying “I have to reject the idea that knowledge about what it takes to start a startup is weaponized or dangerous to people. I think there are way larger risks in the dynamicism and changes in the wold today than the risks of trying to start a startup or work at a startup and learn an incredible set of skills that are valuable in life or business.” At the very least, having their startup blow up in their face should build character.

“It can be tough for people if and when their startup doesn’t work out,” Ralston concludes. “But it can be tough when you work at a company for 10 years and get fired and don’t know where to go from there.”

Powered by WPeMatico

Once upon a time, it looked like cloud-based serviced would become the central hub for analyzing all IoT data. But it didn’t quite turn out that way because most IoT solutions simply generate too much data to do this effectively and the round-trip to the data center doesn’t work for applications that have to react in real time. Hence the advent of edge computing, which is spawning its own ecosystem of startups.

Among those is Swim.ai, which today announced that it has raised a $10 million Series B funding round led by Cambridge Innovation Capital, with participation from Silver Creek Ventures and Harris Barton Asset Management. The round also included a strategic investment from Arm, the chip design firm you may still remember as ARM (but don’t write it like that or their PR department will promptly email you). This brings the company’s total funding to about $18 million.

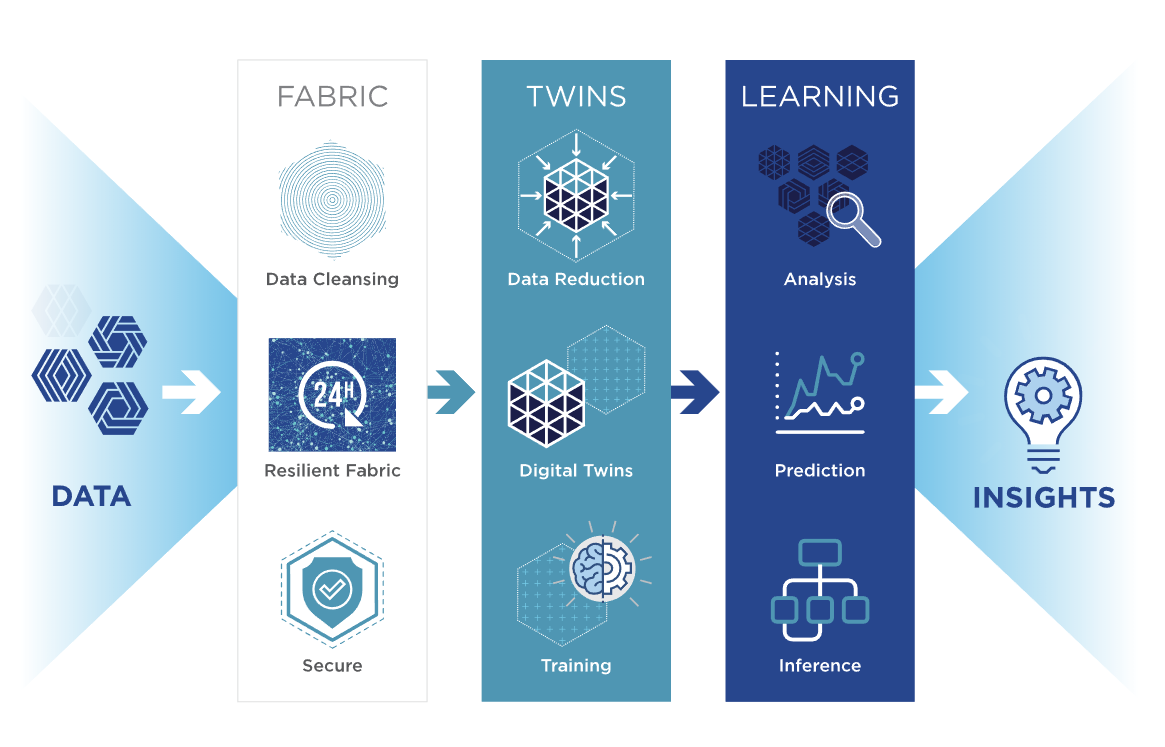

Swim.ai has an interesting take on edge computing. The company’s SWIM EDX product combines both local data processing and analytics with local machine learning. In a traditional approach, the edge devices collect the data, maybe perform some basic operations against the data to bring down the bandwidth cost and then ship it to the cloud where the hard work is done and where, if you are doing machine learning, the models are trained. Swim.ai argues that this doesn’t work for applications that need to respond in real time. Swim.ai, however, performs the model training on the edge device itself by pulling in data from all connected devices. It then builds a digital twin for each one of these devices and uses that to self-train its models based on this data.

“Demand for the EDX software is rapidly increasing, driven by our software’s unique ability to analyze and reduce data, share new insights instantly peer-to-peer – locally at the ‘edge’ on existing equipment. Efficiently processing edge data and enabling insights to be easily created and delivered with the lowest latency are critical needs for any organization,” said Rusty Cumpston, co-founder and CEO of Swim.ai. “We are thrilled to partner with our new and existing investors who share our vision and look forward to shaping the future of real-time analytics at the edge.”

The company doesn’t disclose any current customers, but it is focusing its efforts on manufacturers, service providers and smart city solutions. Update: Swim.ai did tell us about two customers after we published this story: The City of Palo Alto and Itron.

Swim.ai plans to use its new funding to launch a new R&D center in Cambridge, UK, expand its product development team and tackle new verticals and geographies with an expanded sales and marketing team.

Powered by WPeMatico

Dialpad announced a $50 million Series D investment today, giving the company plenty of capital to keep expanding its business communications platform.

The round was led by Iconiq Capital with help from existing investors Andreessen Horowitz, Amasia, Scale Ventures, Section 32 and Work-Bench. With today’s round, the company has now raised $120 million.

As technology like artificial intelligence and internet of things advances, it’s giving the company an opportunity to expand its platform. Dialpad products include UberConference conferencing software and VoiceAI for voice transcription applications.

The company is competing in a crowded market that includes giants like Google and Cisco and a host of smaller companies like GoToMeeting (owned by LogMeIn), Zoom and BlueJeans. All of these companies are working to provide cloud-based meeting and communications services.

Increasingly, that involves artificial intelligence like natural language processing (NLP) to provide on the fly transcription services. While none of these services is perfect yet, they are growing increasingly accurate.

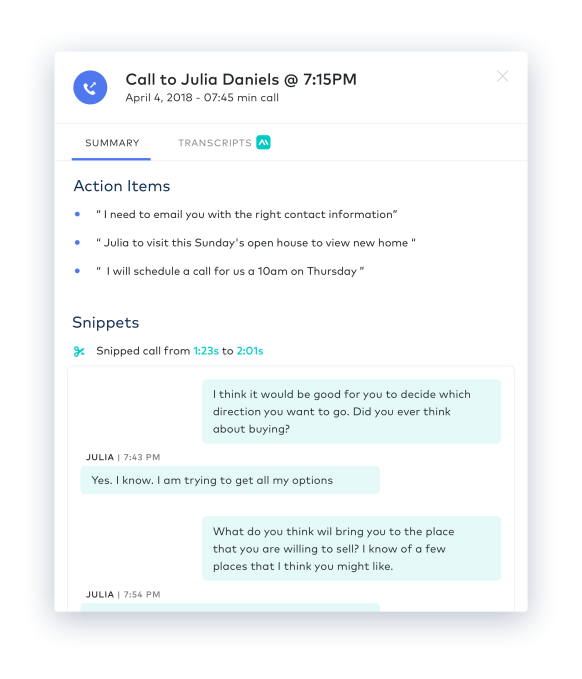

VoiceAI was launched shortly after Dialpad acquired TalkIQ in May to take this idea a step further by applying sentiment analysis and analytics to voice transcripts. The company plans to use the cash infusion to continue investing in artificial intelligence on the Dialpad platform.

Post call transcript generated by VoiceAI. Screenshot: Dialpad

CEO Craig Walker certainly sees the potential of artificial intelligence for the company moving forward. “Smart CIOs know AI isn’t just another trendy tech tool, it’s the future of work. By arming sales and support teams, and frankly everybody in the organization, with VoiceAI’s real-time artificial intelligence and insights, businesses can dramatically improve customer satisfaction and ultimately their bottom line,” Walker said in a statement.

Dialpad is also working with voice-driven devices like the Amazon Alexa and it announced Alexa integration with Dialpad in April. This allows Alexa users to make calls by saying something like, “Alexa, call Liz Green with Dialpad” and the Echo will make the phone call on your behalf using Dialpad software.

According to the company website, it has over 50,000 customers including WeWork, Stitch Fix, Uber and Reddit. The company says it has added over 10,000 new customers since its last funding round in September, 2017.

Powered by WPeMatico

Need to resize a video for IGTV? Add subtitles for Twitter? Throw in sound effects for YouTube? Or collage it with other clips for the Instagram feed? Kapwing lets you do all that and more for free from a mobile browser or website. This scrappy new startup is building the vertical video era’s creative suite full of editing tools for every occasion.

Pronounced “Ka-pwing,” like the sound of a ricocheted bullet, the company was founded by two former Google Image Search staffers. Now after six months of quiet bootstrapping, it’s announcing a $1.7 million seed round led by Kleiner Perkins.

Kapwing hopes to rapidly adapt to shifting memescape and its fragmented media formats, seizing on opportunities like creators needing to turn their long-form landscape videos vertical for Instagram’s recently launched IGTV. The free version slaps a Kapwing.com watermark on all its exports for virality, but users can pay $20 a month to remove it.

While sites like Imgur and Imgflip offer lightweight tools for static memes and GIFs, “the tools and community for doing that for video are kinda inaccessible,” says co-founder and CEO Julia Enthoven. “You have something you install on your computer with fancy hardware. You should able to create and riff off of people,” even if you just have your phone, she tells me. Indeed, 100,000 users are already getting crafty with Kapwing.

“We want to make these really relevant trending formats so anyone can jump in,” Enthoven declares. “Down the line, we want to make a destination for consuming that content.”

Kapwing co-founders Eric Lu and Julia Enthoven

Enthoven and Eric Lu both worked at Google Image Search in the lauded Associate Product Manager (APM) program that’s minted many future founders for companies like Quip, Asana and Polyvore. But after two years, they noticed a big gap in the creative ecosystem. Enthoven explains that “The idea came from using outdated tools for making the types of videos people want to make for social media — short-form, snackable video you record with your phone. It’s so difficult to make those kinds of videos in today’s editors.”

So the pair of 25-year-olds left in September to start Kapwing. They named it after their favorite sound effect from the Calvin & Hobbes comics when the make-believe tiger would deflect toy gunshots from his best pal. “It’s an onomatopoeia, and that’s sort of cool because video is all about movement and sound.”

After starting with a meme editor for slapping text above and below images, Kapwing saw a sudden growth spurt as creators raced to convert landscape videos for vertical IGTV. Now it has a wide range of tools, with more planned.

The current selection includes:

Kapwing definitely has some annoying shortcomings. There’s an 80mb limit on uploads, so don’t expect to be messing with much 4K videos or especially long clips. You can’t subtitle a GIF, and the meme maker flipped vertical photos sideways without warning. It also lacks some of the slick tools that Snapchat has developed, like a magic eraser for Photoshopping stuff out and a background changer, or the automatic themed video editing found in products like Google Photos.

The No. 1 thing it needs is a selective cropping tool. Instead of letting you manually move the vertical frame around inside a landscape video so you always catch the action, it just grabs the center. That left me staring at blank space between myself and an interview subject when I uploaded this burger robot startup video. It’s something apps like RotateNFlip and Flixup already offer. Hopefully the funding that also comes from Shasta, Shrug Capital, Sinai, Village Global, and ZhenFund will let it tackle some of these troubles.

Beyond meme-loving teens and semi-pro creators, Kapwing has found an audience amongst school teachers. The simplicity and onscreen instructions make it well-suited for young students, and it works on Chromebooks because there’s no need to download software.

The paid version has found some traction with content marketers and sponsored creators who don’t want a distracting watermark included. That business model is always in danger of encroachment from free tools, though, so Kapwing hopes to also become a place to view the meme content it exports. That network model is more defensible if it gains a big enough audience, and could be monetized with ads. Though it will put it in competition with Imgur, Reddit and the big dogs like Instagram.

“We aspire to become a hub for consumption,” Enthoven concluded. “Consume, get an idea, and share with each other.”

Powered by WPeMatico

Yesterday, we learned that 18-month-old, Bay Area-based electric scooter rental company Lime is joining forces with the ride-hailing giant Uber, which is both investing in the company as part of a $335 million round and planning to promote Lime in its mobile app. According to Bloomberg, Uber also plans to plaster its logo on Lime’s scooters.

Lime isn’t being acquired outright, in short, but it looks like it will be. At least, Uber struck a similar arrangement with the electric bike company JUMP bikes before spending $200 million to acquire the company in spring.

There are as many questions raised by this kind of tie-up as answered, but the biggest may be what the impact means for Lime’s fiercest rival in the e-scooter wars, 15-month-old L.A.-based Bird, which several sources tell us also discussed a potential partnership with Uber.

Despite recently raising $300 million in fresh capital at a somewhat stunning $2 billion valuation, could its goose be, ahem, cooked?

At first glance, it would appear so. Uber’s travel app is the most downloaded in the U.S. by a wide margin, despite gains made last year by its closest U.S. competitor, Lyft, as Uber battled one scandal after another. It’s easy to imagine that Lime’s integration with Uber will give it the kind of immediate brand reach that most founders can only dream about.

A related issue for Bird is its relationship with Lyft, which . . . isn’t great. Bird’s founder and CEO, Travis VanderZanden, burned that bridge when, not so long after Lyft acqui-hired VanderZanden from a small startup he’d launched and made him its COO, he left to join rival Uber.

Lyft, which sued VanderZanden for allegedly breaking a confidentiality agreement when he joined Uber, later settled with him for undisclosed terms. But given their history, it’s hard to imagine Lyft — which also has a much smaller checkbook than Uber — paying top dollar to acquire his company.

Where that leaves Bird is an open question, but people familiar with both Bird and Lime suggest the e-scooter war is far from over.

For example, though Uber sees its partnership with Lime as “another step towards our vision of becoming a one-stop shop for all your transportation needs,” two sources familiar with Bird’s thinking are quick to underscore its plans to expand internationally quickly and not merely fight a turf war in the U.S. (It already has one office in China.)

That Sequoia Capital led Bird’s most recent round of funding helps on this front, given Sequoia Capital China’s growing dominancein the country and the relationships that go with it. Then again, Sequoia is also an investor in Uber, having acquired a stake in the company earlier this year. And alliances are generally temperamental in this brave new world of transportation. In just the latest unexpected twist, Lime’s newest round included not only Uber but also GV, the venture arm of Alphabet, which only recently resolved a lawsuit with Uber.

Another wrinkle to consider is the exposure that Lime receives from Uber, which could prove double-edged, given the company’s ups and downs. Uber’s new CEO, Dara Khosrowshahi, appears determined to steer the company to a smooth and decidedly undramatic public offering in another year or so. But for a company of Uber’s scale and scope, that’s a challenge, to say the least. (Its newest hire, Scott Schools — a former top attorney at the U.S. Justice Department and now Uber’s chief compliance officer — will undoubtedly be tasked with minimizing the odds of things going astray.)

Lime’s arrangement with Uber could potentially create other opportunities for Bird. First, by agreeing to allow Uber to apply its branding to its scooters, Lime will be diluting its own brand. Even if Uber never acquires the company, riders may well associate Lime with Uber and think, for better or worse, that it’s a subsidiary.

Further, Uber does not appear to have made any promises to Lime in terms of how prominently its app is featured within its own mobile app, which already crams in quite a lot, from offering free ride coupons to featuring local offers to promoting its Uber Eats business.

Consider that in January 2017, Google added to both the Android and iOS versions of its Google Maps service the ability to book an Uber ride. Uber might have thought that a coup, too, at the time. But last summer, Google quietly removed the feature from its iOS app, and it removed the service from Android just last month. If there wasn’t much outrage over the decision, likely it’s because so few users of Google Maps noticed the feature in the first place.

Lime’s arrangement could prove more advantageous than that. Only time will tell. But everything considered, whether or not Bird flies away with this competition will likely owe less to Lime’s new arrangement with Uber than with its own ability to execute. That includes making its own mobile app the kind of go-to destination that Uber’s has become.

Certainly, that’s what Bird’s flock would argue will happen. Yesterday afternoon, Roelof Botha, a partner at Sequoia and a Bird board member, declined to discuss the Lime deal, instead emailing one short observation seemingly designed to say it all: “Travis [VanderZanden] is far more customer obsessed than competitor obsessed. That is a quality we look for in great founders.”

A Bird spokesperson offered an equally sanguine quote, saying that Bird is “happy to see our friends in the ride-sharing industry coalesce on the pressing need to offer a sustainable and affordable alternative to car trips.”

Powered by WPeMatico

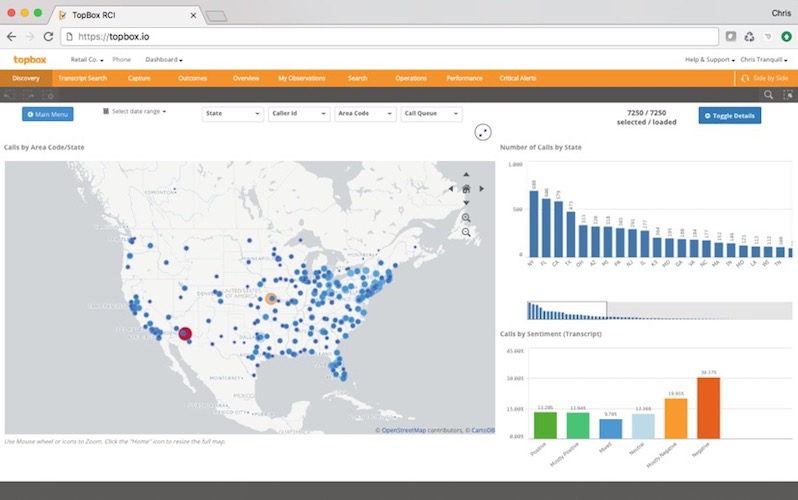

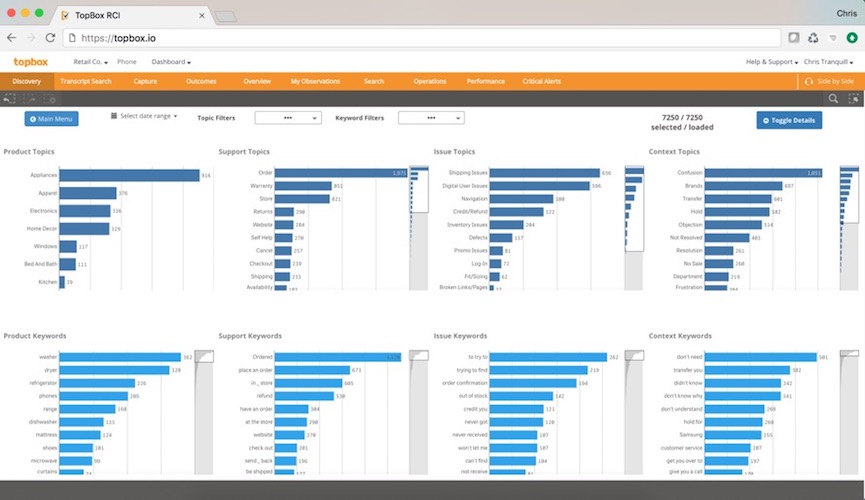

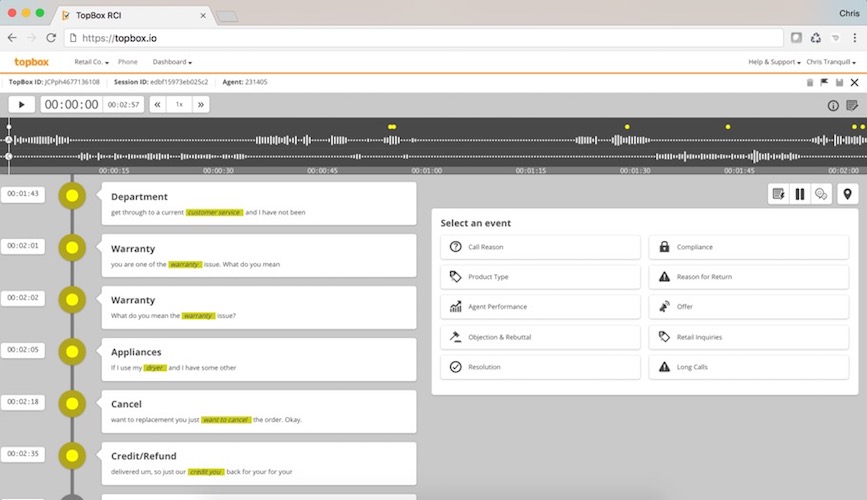

Topbox helps businesses understand how their customers experience their products and where they run into issues by analyzing voice and text chats to surveys, social media posts and online reviews. Today, the company announced it has raised a $5 million funding round led by Telescope Partners, with participation from Cascade Angels, Flyover Capital and the Maryland Venture Fund.

Topbox CEO Chris Tranquill told me he first experienced the problem he’s trying to solve when he was running call centers with thousands of agents. All of the companies that contracted his services faced the same problem: understanding the friction points their customers were experiencing.

“We always had this vision that being able to really understand those friction points with deep context — that’s what the key is — but really getting to that granular level of detail so that you can have that context to support a decision,” Tranquill said. Say you want to understand what issues customers are having with a new shoe. Ideally, Topbox will aggregate all of the data across all channels about that shoe and help the company understand who the wearers are and what issues they are experiencing.

Theoretically, companies could do this on their own, but all of this data exists in various silos and combining those disparate data sets is a major challenge. Topbox uses its technology to ingest this data (and it’s pretty agnostic about where it comes from) and then runs it through its classification models. Indeed, as Tranquill told me, it’s this model that’s the secret sauce behind the company’s ability to classify data.

It’s not just about getting a high-level overview of your customer’s reactions, though. Tranquill stressed that users can go deeper. “The big thing for us is granularity,” he told me. “I can find high-level data all day long, but can I find the root cause?” With a few clicks, any Topbox user should be able to understand what issues their customers are facing, no matter whether that’s a product issue, a shipping problem or something else.

Current Topbox customers include the likes of Orvis, Bed Bath & Beyond and Western Union. With this new round, Topbox expects to build out its go-to-market strategy and continue to develop its product. Currently, the company focuses on a number of verticals where its model works best (retailers, mobile telcos, cable and broadband providers and healthcare companies), and Tranquill tells me this is where it will focus its energy for now. The company will also soon launch a new user interface and bring on more machine learning experts as it looks to provide its users deeper insights into their data.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This week we were back in the studio with Connie Loizos and myself hanging out with Jai Das, a managing director at Sapphire Ventures. Our beloved Matthew Lynley was off this week, but he’ll be back for the next episode.

This week we had an excellent list of things to get to, first of which was Lyft’s latest shopping run. This time Lyft accreted to itself Motivate, a bike-sharing company that operates various programs in cities like New York City and San Francisco.

The context for the transaction is threefold. First, Lyft just raised a bundle of money for effectively diddly dilution. Second, Uber bought Jump and there is no FOMO in the market today like ridesharing FOMO. And third, scooters now lurk in the background of any and every ridesharing conversation, so the big shops are on a bit of defense.

The sum is that Uber and Lyft now own bike companies, which feels a bit 2017.

But moving along Unicorn Row we quickly found ourselves at the door of Airbnb, which is prepping for a 2019-2020 IPO and a change to its personnel comp cadence, the latter due to its age and a market trend that Das noted concerned employee comp and shareholder dilution.

In other news, Airbnb needs a CFO, so if you are in the market, that’s who to call.

Next up was Automation Anywhere’s epic $250 million Series A, which brought the software process-automation company to a valuation of $1.8 billion. The firm helps companies execute repetitive software tasks at a fraction of the cost of having humans click the buttons.

And we wrapped with Juul, everyone’s favorite e-cigarette company that has simply beautiful financials. Whether it’s ethical is something that we spent a moment talking about.

So fire up your vape or just hit play and we’ll be right back in seven days.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

There is perhaps no firm that has done as much to promote the adoption of Ethereum as the dominant cryptocurrency platform for actual product development as Consensys.

Founded by Ethereum Foundation co-founder Joe Lubin, Consensys has emerged as an investor, accelerator, educator and product developer in its own right in little more than three years that it has been in existence.

A Princeton-educated roboticist and autonomous vehicle researcher, Lubin has become a billionaire through his bet on Ethereum as the cryptocurrency that would win the hearts and minds of developers.

And with Consensys he’s built an empire that spans the globe. From its headquarters in Brooklyn, Consensys now has operations, offices and partnerships in Ireland, Israel, and Singapore, and the global expansion shows no sign of slowing down.

That’s why we’re absolutely thrilled to have Joe Lubin, Chief Marketing Officer Amanda Gutterman, and Chief Strategy Officer Sam Cassatt join us on the Disrupt SF stage.

Nothing summarizes Lubin’s ambitions for Ethereum better than this comment on the transformative power that he sees in the cryptocurrency.

“We are all passionately building the decentralized world wide web on which economic, social, and political systems will be built going forward.” A short and sweet overview of the @ConsenSys organism from @EtherealSummit at the @knockdowncenter in May. https://t.co/8DGdiyu29E

— Joseph Lubin (@ethereumJoseph) June 19, 2018

Lubin, Gutterman and Cassatt join a world-class agenda, with speakers like Brian Armstrong, Kirsten Green, Reid Hoffman, and Marty Chavez. Tickets to the show, which runs September 5-7, are available here.

Powered by WPeMatico

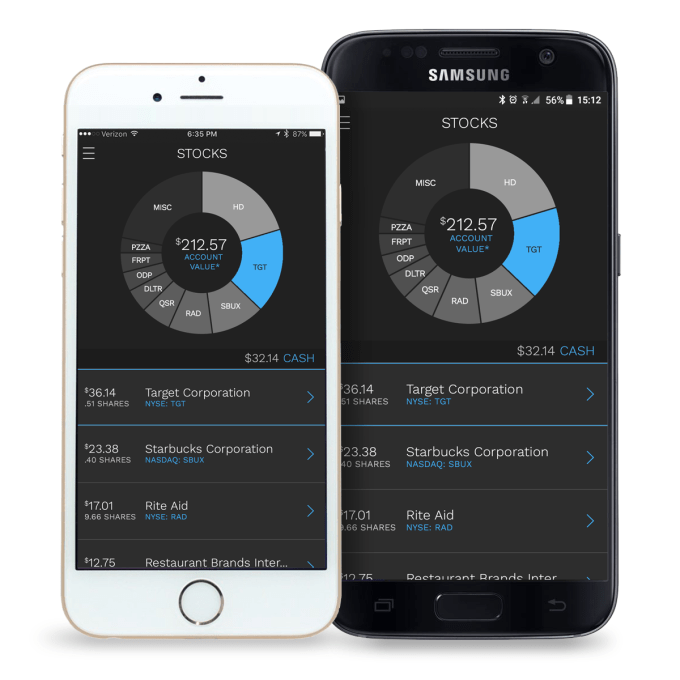

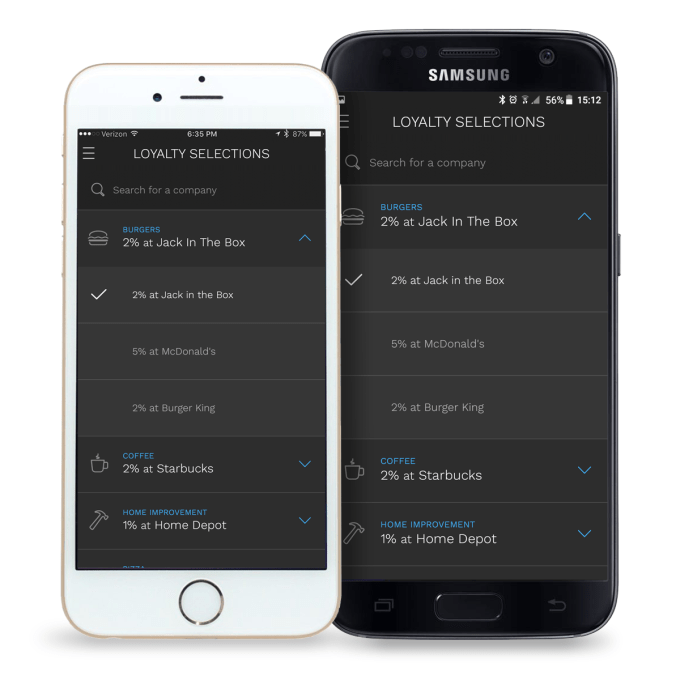

What does brand loyalty even mean anymore? App downloads, points, stars and other complex reward systems have not just spawned their own media empires trying to decipher them, they have failed at their most basic objective: building a stronger bond between a brand and its consumers.

Bumped wants to reinvent the loyalty space by giving consumers shares of the companies they patronize. Through Bumped’s app, consumers choose their preferred retailer in different categories (think Lowe’s versu The Home Depot in home improvement), and when they spend money at that store using a linked credit card, Bumped will automatically give them ownership in that company.

The startup, which is based in Portland and was founded in March 2017, announced the beta launch of its service today, as well as a $14.1 million Series A led by Dan Ciporin at Canaan Partners, along with existing seed investors Peninsula Ventures, Commerce Ventures and Oregon Venture Fund.

Bumped is a brokerage, and the company told me that it has passed all FINRA and SEC licensing. When consumers spend money at participating retailers, they receive bona fide shares in the companies they shop at. Each retailer determines a loyalty percentage rate, which is a minimum of 1 percent and can go up to 5 percent. Bumped then buys shares off the public market to reward consumers, and in cases where it needs to buy fractional shares, it will handle all of those logistics.

Bumped’s app allows users to track their shares

For founder and CEO David Nelsen, the startup doesn’t just make good business sense, it can have a wider social impact of democratizing access to the public equity markets. “A lot of brands need to build an authentic relationship with the customers,” he explained to me. “The brands that have a relationship with consumers, beyond price, are thriving.” With Bumped, Nelsen’s goal is to “align the interests of a shareholder and consumer, and everybody wins.”

His mission is to engage more Americans into the equity markets and the power of ownership. He notes that far too many people fail to set up their 401k, and don’t invest regularly in the stock market, citing a statistic that only 13.9 percent of people directly own a share of stock. By offering shares, he hopes that Bumped engages consumers to think about their relationship to companies in a whole new way. As Nelsen put it, “we are talking about bringing a whole new class of shareholders into the market.”

This isn’t the first time that Nelsen has built a company in the loyalty space. He previously was a co-founder and CEO of Giftango, a platform for prepaid digital gift cards that was acquired by InComm in late 2012.

Consumers will have to choose their Bumped loyalty partner in each category, like burgers

That previous experience has helped the company build an extensive roster for launch. Bumped has 19 brands participating in the beta, including Chipotle, Netflix, Shake Shack, Walgreens and The Home Depot. Another six brands are currently papering contracts with the firm.

Ciporin of Canaan said that he wanted to fund something new in the loyalty space. “There has been just a complete lack of innovation in the loyalty space,” he explained to me. “I think about it as Robinhood meets airline points programs.” One major decider for Ciporin in making the investment was academic research, such as this paper by Jaakko Aspara, showing that becoming a shareholder in a company tended to make consumers significantly more loyal to those brands.

In the short run, Bumped heads into a crowded loyalty space that includes companies like Drop, which I have covered before on TechCrunch. Nelsen believes that the stock ownership model is “an entirely different mechanism” in loyalty, and that makes it “hard to compare” to other loyalty platforms.

Longer term, he hints at exploring how to offer this sort of equity loyalty model to small and medium businesses, a significantly more complex challenge given the lack of liquid markets for their equity. Today, the company is exclusively focused on publicly traded companies.

Bumped today has 14 people, and is targeting a team size of around 20 employees.

Powered by WPeMatico