funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Crypto skeptics rejoice! A new way to short the cryptocurrency market is coming from dYdX, a decentralized financial derivatives startup. In two months it will launch its protocol for creating short and leverage positions for Ethereum and other ERC20 tokens that allow investors to amp up their bets for or against these currencies.

To get the startup there, dYdX recently closed a $2 million seed round led by Andreessen Horowitz and Polychain, and joined by Kindred and Abstract plus angels, including Coinbase CEO Brian Armstrong and co-founder Fred Ehrsam, and serial investor Elad Gil.

“The main use for cryptocurrency so far has been trading and speculation — buying and holding. That’s not how sophisticated financial institutions trade,” says dYdX founder Antonio Juliano. “The derivatives market is usually an order of magnitude bigger than the spot trading or buy/sell market. The cryptocurrency market is probably on the order of $5 billion to $10 billion in volume, so you’d expect the derivatives market would be 10X bigger. I think there’s a really big opportunity there.”

The idea is that you buy the short Ethereum token with ETH or a stable coin from an exchange or dYdX. The short Ethereum’s token price is inversely pegged to ETH, so it goes up in value when ETH goes down and vice versa. You can then sell the short Ethereum token for a profit if you correctly predicted an ETH price drop.

On the backend, lenders earn an interest rate by providing ETH as collateral locked into smart contracts that back up the short Ethereum tokens. Only a small number of actors have to work with the smart contract to mint or close the short Tokens. Meanwhile, dYdX also offers leveraged Ethereum tokens that let investors borrow to boost their profits if ETH’s price goes up.

The plan is to offer short and leveraged tokens for any ERC20 currency in the future. dYdX is building its own user-facing application for buying the tokens, but is also partnering with exchanges to offer the margin tokens “where people are already trading,” says Juliano.

“We think of it as more than just shorting your favorite shitcoin. We think of them as mature financial products.”

Coinbase has proven to be an incredible incubator for blockchain startup founders. Juliano was employed there as a software engineer after briefly working at Uber and graduating in computer science from Princeton in 2015. “The first thing I started was a search engine for decentralized apps. I worked for months on it full-time, but nobody was building decentralized apps so no one was searching for them. It was too early,” Juliano explains.

But along the way he noticed the lack of financial instruments for decentralized derivatives despite exploding consumer interest in buying and selling cryptocurrencies. He figured the big hedge funds would eventually come knocking if someone built them a bridge into the blockchain world.

But along the way he noticed the lack of financial instruments for decentralized derivatives despite exploding consumer interest in buying and selling cryptocurrencies. He figured the big hedge funds would eventually come knocking if someone built them a bridge into the blockchain world.

Juliano built dYdX to create a protocol to first begin offering margin tokens. It’s open source, so technically anyone can fork it to issue tokens themselves. But dYdX plans to be the standard-bearer, with its version offering the maximum liquidity to investors trying to buy or sell the margin tokens. His five-person team in San Francisco with experience from Google, Bloomberg, Goldman Sachs, NerdWallet and ConsenSys is working to find as many investors as possible to collateralize the tokens and exchanges to trade them. “It’s a race to build liquidity faster than anyone else,” says Juliano.

So how will dYdX make money? As is common in crypto, Juliano isn’t exactly sure, and just wants to build up usage first. “We plan to capture value at the protocol level in the future likely through a value adding token,” the founder says. “It would’ve been easy for us to rush into adding a questionable token as we’ve seen many other protocols do; however, we believe it’s worth thinking deeply about the best way to integrate a token in our ecosystem in a way that creates rather than destroys value for end users.”

“Antonio and his team are among the top engineers in the crypto ecosystem building a novel software system for peer-to-peer financial contracts. We believe this will be immensely valuable and used by millions of people,” says Polychain partner Olaf Carlson-Wee. “I am not concerned with short-term revenue models but rather the opportunity to permanently improve global financial markets.”

With the launch less than two months away, Juliano is also racing to safeguard the protocol from attacks. “You have to take smart contract security extremely seriously. We’re almost done with the second independent security audit,” he tells me.

The security provided by decentralization is one of dYdX’s selling points versus centralized competitors like Poloniex that offer margin trading opportunities. There, investors have to lock up ETH as collateral for extended periods of time, putting it at risk if the exchange gets hacked, and they don’t benefit from shared liquidity like dYdX will.

The security provided by decentralization is one of dYdX’s selling points versus centralized competitors like Poloniex that offer margin trading opportunities. There, investors have to lock up ETH as collateral for extended periods of time, putting it at risk if the exchange gets hacked, and they don’t benefit from shared liquidity like dYdX will.

It also could compete for crypto haters with the CBOE that now offers Bitcoin futures and margin trading, though it doesn’t handle Ethereum yet. Juliano hopes that since dYdX’s protocol can mint short tokens for other ERC20 tokens, you could bet for or against a certain cryptocurrency relative to the whole crypto market by mixing and matching. dYdX will have to nail the user experience and proper partnerships if it’s going to beat the convenience of centralized exchanges and the institutional futures market.

If all goes well, dYdX wants to move into offering options or swaps. “Those derivatives are more often traded by sophisticated traders. We don’t think there are too many traders like that in the market right now,” Juliano explains. “The other types of derivatives that we’ll move to in the future will be really big once the market matures.” That “once the market matures” refrain is one sung by plenty of blockchain projects. The question is who’ll survive long enough to see that future, if it ever arrives.

[Featured Image via Nuzu and Bryce Durbin]

Powered by WPeMatico

Rent the Runway today announced that it has partnered with Temasek for a $200 million credit facility.

Founded in 2009, Rent the Runway lets users rent items of clothing for special events or occasions, bringing runway styles to folks without the cash to purchase the clothing outright.

Rent the Runway started out by letting users rent their wares for about 10 percent of the item’s price. But in 2017, RTR introduced a subscription model, giving users unlimited rentals for $89/month.

The model has already been proven by other businesses. RTR started giving users access to fashion in the same way that Netflix gives users access to video, Spotify gives access to music, or even the way ClassPass gives users access to studio fitness classes.

Since the subscription launch, RTR’s subscription business is up 150 percent year over year, and represents 50 percent of the company’s overall revenue.

According to the release, RTR will use the new funds to continue growing its subscription business, expand operations, and refinance its existing debt facility. As part of the deal, Temasek has received an observer seat on the board of directors.

In response to the question around why Rent The Runway chose a credit facility over traditional VC investment, CFO Scarlett O’Sullivan had this to say via email:

We are very pleased that the company has demonstrated the kind of business model, growth prospects and financial discipline that make it possible to access a credit facility of this size with an equity-minded long-term partner like Temasek – they have a proven track record of supporting disruptive high-growth companies.

We were specifically looking for debt for three key reasons:

1 – This facility gives us the ability to access more financing – we can draw capital as we need to, giving us flexibility to grow our subscription business more quickly

2 – We improved the terms of our prior facility which we refinanced with a portion of these funds — and debt for us is a lower cost option to finance the business

3 – It is less dilutive to our existing shareholders – we believe there will be significant value creation over the next several years as we continue to change consume behavior and help women put their closet in the cloud

Before this latest deal, Rent the Runway had raised more than $200 million in funding from investors such as Bain Capital, KPCB, Highland Capital, TCV, and more.

Powered by WPeMatico

Stampli, an invoice management platform, announced today the closing of a $6.7 million Series A funding round led by SignalFire, with participation from Bloomberg Beta, Hillsven Capital and UpWest Labs.

If you’ve ever freelanced for a company, you know that the long, instant ramen-filled days between filing an invoice and having it completed can be grueling. Brothers Eyal and Ofer Feldman launched Stampli in 2015 to help solve this problem and bridge the communication gap between accountants, related internal departments and vendors. Aimed at mid to large-size companies, to date Stampli has helped a wide range of companies (from fashion to tech) manage more than $4 billion in invoices through its AI-driven interface.

“Invoice management is like an elephant,” co-founder and CEO Eyal Feldman told TechCrunch. “One person sees the head, one person sees the tail, one person sees the legs. It’s a process that different people see different versions of but the whole picture should include everybody. The ability for all of these people to be involved is really the core of the process.”

Traditional invoice management between vendors and internal departments in a company can be a tangled mess of email exchanges, lost messages and ultimately delayed payments. But, Stampli’s interface (which can be integrated directly into a company’s enterprise resource planning software like NetSuite, Intuit QuickBooks or SAP) allows for every step of the invoice’s journey to have a central landing page on which every relevant party can collaborate.

“We found that 85 percent of our users are not accounting people,” said Feldman. “[They] are all the managers around and all the other people involved. What we found in our research is that when the process works for them is when accounting is happy.”

This landing page not only provides easy access to pertinent information between departments, but Stampli’s built-in AI, Billy the Bot, helps invoice managers fill in relevant information by first learning the structure of the invoice and then learning through observation the user’s behavior and work flow. When Billy passes an 80 percent confidence threshold for its decision, it goes ahead and auto-fills the information. But, if it’s feeling unsure about its choice, Billy will leave it as a suggestion instead to avoid introducing any errors to the paperwork.

The more invoices users process through Stampli, the more Billy learns how to best streamline the process for that company.

In the arena of invoice management, Stampli faces competition from companies like Determine and Concur, which also offer all-in-one platforms for invoice management and, in the case of Concur, also incorporate machine learning to capture invoices.

According to Feldman, what helps Stampli stand apart from the competition is its emphasis on company collaboration and its no-fee installation of the software. With no upfront cost, the company only charges per invoice.

Powered by WPeMatico

Marc Piette had a revelation as he buzzed in and out of the Palo Alto Airport in pursuit of his pilot’s license. Instead of freedom, he saw restraint. He also saw potential.

“It became pretty apparent that there were major issues with the general aviation industry with smaller aircraft,” Piette said in a recent interview with TechCrunch. “And yet it had enormous potential to change the way people moved around.”

Now, Piette’s two-year-old autonomous-aviation startup Xwing is ramping up to unlock that potential. The company, which has kept a low profile since its founding, isn’t building autonomous helicopters and planes. Instead, it’s focused on the software stack that will enable pilotless flight of small passenger aircraft.

The company announced Tuesday that it has raised $4 million in a seed round led by Eniac Ventures. Array Ventures, along with Stripe founders John and Patrick Collison and Nat Friedman of Xamarin, Microsoft and GitHub, also participated in the round.

The funding will be used by the San Francisco-based company to scale operations and continue to hire aerospace and software talent.

The startup has about a dozen employees, including some uniquely talented folks who have experience with optionally piloted vehicles, unmanned systems and certified avionics. For example, the company’s CTO, Maxime Gariel, worked on autonomous-aviation projects such as DARPA Gremlins and the AgustaWestland SW4 Solo autonomous helicopter. Other members of the small team previously worked at Rockwill Collins, with the Naval Research Lab, Google, and McKinsey.

Piette, whose last company Locu was acquired by GoDaddy, sees several restraints to small passenger aircraft: the skill level required to fly a plane and the cost of earning a pilot’s license and accessing a plane. The relatively puny sales volume of small aircraft — just 3,293 general aviation aircraft, including helicopters, were delivered last year worldwide, in contrast to more than 80 million cars — has depressed innovation and kept prices high.

And even when people have both a license and an aircraft, they still must travel from a small airport to their final destination.

The company is focusing on the key functions of autonomous flight, such as sensing, reasoning and control.

Xwing isn’t pinned to one kind of aircraft. Piette said the system is designed to work across different kinds of aircraft. For instance, the company spent 18 months testing on a subscale fixed-wing aircraft. It tested on a helicopter more recently.

Xwing is developing and integrating those technologies for rotorcraft, general aviation fixed-wing and the emerging electric vertical takeoff and landing (known as eVTOL) aircraft.

The company’s sensor integration software enables aircraft to perceive the world around it and reliably detect ground-based and airborne hazards and precisely determine the vehicle’s position.

This perception technology is the building block for autonomous aircraft, and also can be used to increase the operational envelope of current-day piloted aircraft, according to Xwing.

From here, the company’s Autonomy Flight Management System (AFMS) allows the aircraft to act upon the information from its surroundings. The system will integrate with air traffic control, generate flight paths to navigate the airspace, monitor system health and address all contingencies to ensure passenger safety, the company says.

Now, Xwing is in discussion with various, and still unnamed, large companies about integrating the system into their aircraft.

Powered by WPeMatico

Every artificial intelligence startup or corporate R&D lab has to reinvent the wheel when it comes to how humans annotate training data to teach algorithms what to look for. Whether it’s doctors assessing the size of cancer from a scan or drivers circling street signs in self-driving car footage, all this labeling has to happen somewhere. Often that means wasting six months and as much as a million dollars just developing a training data system. With nearly every type of business racing to adopt AI, that spend in cash and time adds up.

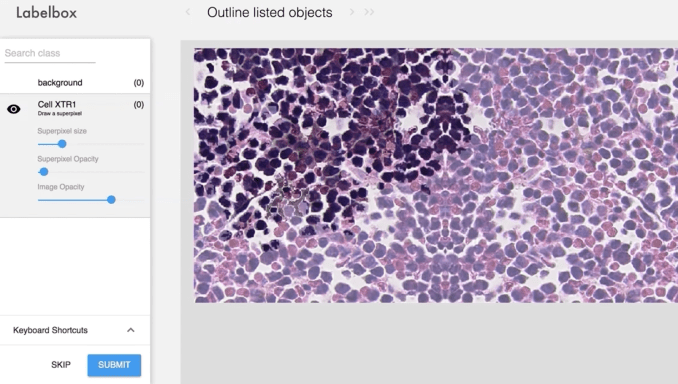

Labelbox builds artificial intelligence training data labeling software so nobody else has to. What Salesforce is to a sales team, Labelbox is to an AI engineering team. The software-as-a-service acts as the interface for human experts or crowdsourced labor to instruct computers how to spot relevant signals in data by themselves and continuously improve their algorithms’ accuracy.

Today, Labelbox is emerging from six months in stealth with a $3.9 million seed round led by Kleiner Perkins and joined by First Round and Google’s Gradient Ventures.

“There haven’t been seamless tools to allow AI teams to transfer institutional knowledge from their brains to software,” says co-founder Manu Sharma. “Now we have over 5,000 customers, and many big companies have replaced their own internal tools with Labelbox.”

Kleiner’s Ilya Fushman explains that “If you have these tools, you can ramp up to the AI curve much faster, allowing companies to realize the dream of AI.”

Sharma knew how annoying it was to try to forge training data systems from scratch because he’d seen it done before at Planet Labs, a satellite imaging startup. “One of the things that I observed was that Planet Labs has a superb AI team, but that team had been for over six months building labeling and training tools. Is this really how teams around the world are approaching building AI?,” he wondered.

Before that, he’d worked at DroneDeploy alongside Labelbox co-founder and CTO Daniel Rasmuson, who was leading the aerial data startup’s developer platform. “Many drone analytics companies that were also building AI were going through the same pain point,” Sharma tells me. In September, the two began to explore the idea and found that 20 other companies big and small were also burning talent and capital on the problem. “We thought we could make that much smarter so AI teams can focus on algorithms,” Sharma decided.

Labelbox’s team, with co-founders Ysiad Ferreiras (third from left), Manu Sharma (fourth from left), Brian Rieger (sixth from left) Daniel Rasmuson (seventh from left)

Labelbox launched its early alpha in January and saw swift pickup from the AI community that immediately asked for additional features. With time, the tool expanded with more and more ways to manually annotate data, from gradation levels like how sick a cow is for judging its milk production to matching systems like whether a dress fits a fashion brand’s aesthetic. Rigorous data science is applied to weed out discrepancies between reviewers’ decisions and identify edge cases that don’t fit the models.

“There are all these research studies about how to make training data” that Labelbox analyzes and applies, says co-founder and COO Ysiad Ferreiras, who’d led all of sales and revenue at fast-rising grassroots campaign texting startup Hustle. “We can let people tweak different settings so they can run their own machine learning program the way they want to, instead of being limited by what they can build really quickly.” When Norway mandated all citizens get colon cancer screenings, it had to build AI for recognizing polyps. Instead of spending half a year creating the training tool, they just signed up all the doctors on Labelbox.

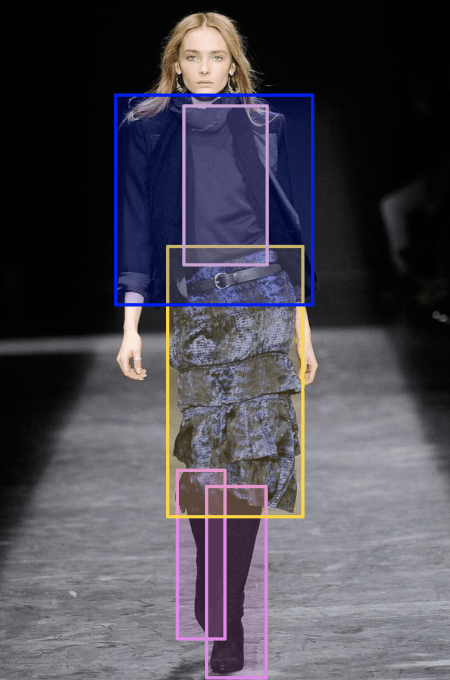

Any organization can try Labelbox for free, and Ferreiras claims hundreds have. Once they hit a usage threshold, the startup works with them on appropriate SaaS pricing related to the revenue the client’s AI will generate. One called Lytx makes DriveCam, a system installed on half a million trucks with cameras that use AI to detect unsafe driver behavior so they can be coached to improve. Conde Nast is using Labelbox to match runway fashion to related items in their archive of content.

The big challenge is convincing companies that they’re better off leaving the training software to the experts instead of building it in-house where they’re intimately, though perhaps inefficiently, involved in every step of development. Some turn to crowdsourcing agencies like CrowdFlower, which has their own training data interface, but they only work with generalist labor, not the experts required for many fields. Labelbox wants to cooperate rather than compete here, serving as the management software that treats outsourcers as just another data input.

Long-term, the risk for Labelbox is that it’s arrived too early for the AI revolution. Most potential corporate customers are still in the R&D phase around AI, not at scaled deployment into real-world products. The big business isn’t selling the labeling software. That’s just the start. Labelbox wants to continuously manage the fine-tuning data to help optimize an algorithm through its entire life cycle. That requires AI being part of the actual engineering process. Right now it’s often stuck as an experiment in the lab. “We’re not concerned about our ability to build the tool to do that. Our concern is ‘will the industry get there fast enough?’” Ferreiras declares.

Long-term, the risk for Labelbox is that it’s arrived too early for the AI revolution. Most potential corporate customers are still in the R&D phase around AI, not at scaled deployment into real-world products. The big business isn’t selling the labeling software. That’s just the start. Labelbox wants to continuously manage the fine-tuning data to help optimize an algorithm through its entire life cycle. That requires AI being part of the actual engineering process. Right now it’s often stuck as an experiment in the lab. “We’re not concerned about our ability to build the tool to do that. Our concern is ‘will the industry get there fast enough?’” Ferreiras declares.

Their investor agrees. Last year’s big joke in venture capital was that suddenly you couldn’t hear a startup pitch without “AI” being referenced. “There was a big wave where everything was AI. I think at this point it’s almost a bit implied,” says Fushman. But it’s corporations that already have plenty of data, and plenty of human jobs to obfuscate, that are Labelbox’s opportunity. “The bigger question is ‘when does that [AI] reality reach consumers, not just from the Googles and Amazons of the world, but the mainstream corporations?’”

Labelbox is willing to wait it out, or better yet, accelerate that arrival — even if it means eliminating jobs. That’s because the team believes the benefits to humanity will outweigh the transition troubles.

“For a colonoscopy or mammogram, you only have a certain number of people in the world who can do that. That limits how many of those can be performed. In the future, that could only be limited by the computational power provided so it could be exponentially cheaper” says co-founder Brian Rieger. With Labelbox, tens of thousands of radiology exams can be quickly ingested to produce cancer-spotting algorithms that he says studies show can become more accurate than humans. Employment might get tougher to find, but hopefully life will get easier and cheaper too. Meanwhile, improving underwater pipeline inspections could protect the environment from its biggest threat: us.

“AI can solve such important problems in our society,” Sharma concludes. “We want to accelerate that by helping companies tell AI what to learn.”

Powered by WPeMatico

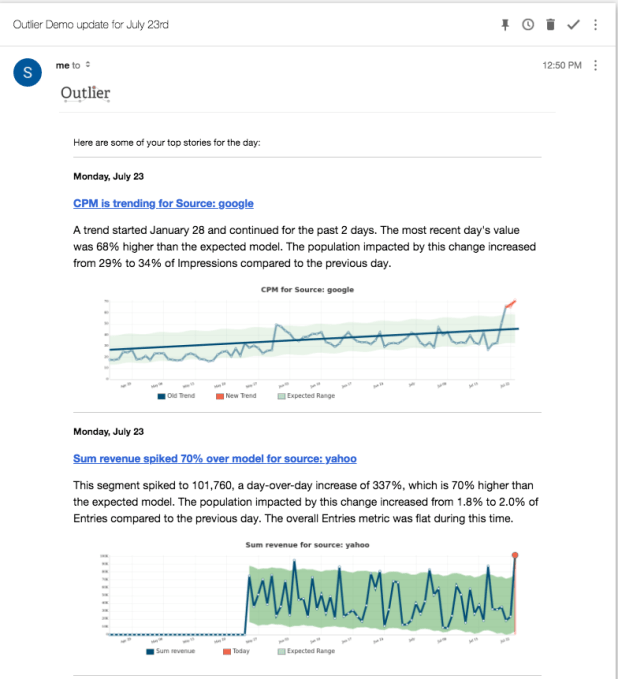

Traditionally, companies have gathered data from a variety of sources, then used spreadsheets and dashboards to try and make sense of it all. Outlier wants to change that and deliver a handful of insights right to your inbox that matter most for your job, company and industry. Today the company announced a $6.2 million Series A to further develop that vision.

The round was led by Ridge Ventures with assistance from 11.2 Capital, First Round Capital, Homebrew, Susa Ventures and SV Angel. The company has raised over $8 million.

The startup is trying to solve a difficult problem around delivering meaningful insight without requiring the customer to ask the right questions. With traditional BI tools, you get your data and you start asking questions and seeing if the data can give you some answers. Outlier wants to bring a level of intelligence and automation by pointing out insight without having to explicitly ask the right question.

Company founder and CEO Sean Byrnes says his previous company, Flurry, helped deliver mobile analytics to customers, but in his travels meeting customers in that previous iteration, he always came up against the same question: “This is great, but what should I look for in all that data?”

It was such a compelling question that after he sold Flurry in 2014 to Yahoo for more than $200 million, that question stuck in the back of his mind and he decided to start a business to solve it. He contends that the first 15 years of BI was about getting answers to basic questions about company performance, but the next 15 will be about finding a way to get the software to ask good questions based on the huge amounts of data.

Byrnes admits that when he launched, he didn’t have much sense of how to put this notion into action, and most people he approached didn’t think it was a great idea. He says he heard “No” from a fair number of investors early on because the artificial intelligence required to fuel a solution like this really wasn’t ready in 2015 when he started the company.

He says that it took four or five iterations to get to today’s product, which lets you connect to various data sources, and using artificial intelligence and machine learning delivers a list of four or five relevant questions to the user’s email inbox that points out data you might not have noticed, what he calls “shifts below the surface.” If you’re a retailer that could be changing market conditions that signal you might want to change your production goals.

Outlier email example. Photo: Outlier

The company launched in 2015. It took some time to polish the product, but today they have 14 employees and 14 customers including Jack Rogers, Celebrity Cruises and Swarovski.

This round should allow them to continuing working to grow the company. “We feel like we hit the right product-market fit because we have customers [generating] reproducible results and really changing the way people use the data,” he said.

Powered by WPeMatico

Rescale, the startup that wants to bring high performance computing to the cloud, announced a $32 million Series B investment today led by Initialized Capital, Keen Venture Partners and SineWave Ventures.

They join a list of well-known early investors that included Sam Altman, Jeff Bezos, Richard Branson, Paul Graham, Ron Conway, Chris Dixon, Peter Thiel and others. Today’s investment brings the total amount raised to $52 million, according to the company.

Rescale works with engineering, aerospace, scientific and other verticals and helps them move their legacy high performance computing applications to the cloud. The idea is to provide a set of high performance computing resources, whether that’s on prem or in the cloud, and help customers tune their applications to get the maximum performance.

Traditionally HPC has taken place on prem in a company’s data center. These companies often have key legacy applications they want to move to the cloud and Rescale can help them do that in the most efficient manner, whether that involves bare metal a virtual machine or a container.

“We help take a portfolio of [legacy] applications running on prem and help enable them in the cloud or in a hybrid environment. We tune and optimize the applications on our platform and take advantage of capital assets on prem, then we help extend that environment to different cloud vendors or tune to best practices for the specific application,” company CEO and co-founder Joris Poort explained.

Photo: Rescale

Ben Verwaayen, who is a partner at one of the lead investors, Keen Venture Partners, sees a company going after a large legacy market with a new approach. “The market is currently 95% on-premise, and Rescale supports customers as they move to hybrid and eventually to a fully cloud native solution. Rescale helps CIOs enable the digital transformation journey within their enterprise, to optimize IT resources and enable meaningful productivity and cost improvements,” Verwaayen said in a statement.

The new influx of cash should help Rescale, well, scale, and that will involve hiring more developers, solutions architects and the like. The company wants to also use the money to expand its presence in Asia and Europe and establish relationships with systems integrators, who would be a good fit for a product like this and help expand their market beyond what they can do as a young startup.

The company, which is based in San Francisco, was founded in 2011 and has 80 employees. They currently have 150 customers including Sikorsky Innovation, Boom Aerospace and Trek Bikes.

Powered by WPeMatico

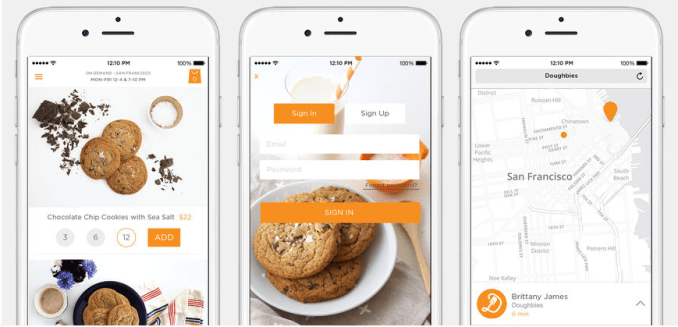

Doughbies should have been a bakery, not a venture-backed startup. Founded in the frothy days of 2013 and funded with $670,000 by investors, including 500 Startups, Doughbies built a same-day cookie delivery service. But it was never destined to be capable of delivering the returns required by the VC model that depends on massive successes to cover the majority of bets that fail. The startup became the butt of jokes about how anything could get funding.

This weekend, Doughbies announced it was shutting down immediately. Surprisingly, it didn’t run out of money. Doughbies was profitable, with 36 percent gross margins and 12 percent net profit, co-founder and CEO Daniel Conway told TechCrunch. “The reason we were able to succeed, at this level and thus far, is because we focused on unit economics and customer feedback (NPS scoring). That’s it.”

Many other startups in the on-demand space missed that memo and vaporized. Shyp mailed stuff for you and Washio dry cleaned your clothes, until they both died sudden deaths. Food delivery has become a particularly crowded cemetery, with Sprig, Maple, Juicero and more biting the dust. Asked his advice for others in the space, Conway said to “Make sure your business makes sense — that you’re making money, and make sure your customers are happy.”

Doughbies certainly did that latter. They made one of the most consistently delicious chocolate chip cookies in the Bay Area. I had them cater our engagement party. At roughly $3 per cookie plus $5 for delivery, it was pricey compared to baking at home, but not outrageous given SF restaurant rates. From its launch at 500 Startups Demo Day with an “Oprah” moment where investors looked beneath their seats to find Doughbies waiting for them, it cared a lot about the experience.

But did it make sense for a bakery to have an app and deliver on-demand? Probably not. There was just no way to maintain a healthy Doughbies habit. You were either gunning for the graveyard yourself by ordering every week, or like most people you just bought a few for special occasions. Startups like Uber succeed by getting people to routinely drop $30 per day, not twice a year. And with the push for nutritious and efficient offices, it was surely hard for enterprise customers to justify keeping cookies stocked.

Flanked by Instacart and Uber Eats, there weren’t many ripe adjacent markets for Doughbies to conquer. It was stuck delivering baked goods to customers who were deterred from growing their cart size by a sense of gluttony.

Without stellar growth or massive sales volumes, there aren’t a lot of exciting challenges to face for people like Conway and his co-founder Mariam Khan. “Ultimately we shut down because our team is ready to move on to something new,” Conway says.

The startup just emailed customers explaining that “We’re currently working on finding a new home for Doughbies, but we can’t make any promises at this time.” Perhaps a grocery store or broader food company will want its logistics technology or customer base. But delivery is a brutal market to break into, dominated by those like Uber who’ve built economies of scale through massive fleets of drivers to maximize routing efficiency.

In the end, Doughbies was a lifestyle business. That’s not a dirty word. A few co-founders with a dream can earn a respectable living doing what they care about. But they have to do it lean, without the advantage of deep-pocketed investors.

As soon as a company takes venture funding, it’s under pressure to deliver adequate returns. Not 2X or 5X, but 10X, 100X, even 1,000X what they raise. That can lead to investors breathing down their neck, encouraging big risks that could tank the business just for a shot at those outcomes. Two years ago we saw a correction hit the ecosystem, writing down the value of many startups, and we continue to see the ripple effect as companies funded before hit the end of their runway.

Desperate for cash, founders can accept dirty funding terms that screw over not just themselves, but their early employees and investors. FanDuel raised more than $416 million at a peak valuation of $1.3 billion. But when it sold for $465 million, the founders and employees received zero as the returns all flowed to the late-stage investors who’d secured non-standard liquidation preferences. After nearly 10 years of hard work, the original team got nothing.

Not every business is a startup. Not every startup is a rocket ship. It takes more than just building a great product to succeed. It can require suddenly cutting costs to become profitable before you run out of funding. Or cutting ambitions and taking less cash at a lower valuation so you can realistically hit milestones. Or accepting a low-ball acquisition offer because it’s better than nothing. Or not raising in the first place, and building up revenues the old-fashioned way so even modest growth is an accomplishment.

Investors are often rightfully blamed for inflating the bubble, pushing up raises and valuations to lure startups to take their money instead of someone else’s. But when it comes to deciding what could be a fast-growing business, sometimes its the founders who need the adjustment.

Powered by WPeMatico

Xage (pronounced Zage), a blockchain security startup based in Silicon Valley, announced a $12 million Series A investment today led by March Capital Partners. GE Ventures, City Light Capital and NexStar Partners also participated.

The company emerged from stealth in December with a novel idea to secure the myriad of devices in the industrial internet of things on the blockchain. Here’s how I described it in a December 2017 story:

Xage is building a security fabric for IoT, which takes blockchain and synthesizes it with other capabilities to create a secure environment for devices to operate. If the blockchain is at its core a trust mechanism, then it can give companies confidence that their IoT devices can’t be compromised. Xage thinks that the blockchain is the perfect solution to this problem.

It’s an interesting approach, one that attracted Duncan Greatwood to the company. As he told me in December his previous successful exits — Topsy to Apple in 2013 and PostPath to Cisco in 2008 — gave him the freedom to choose a company that really excited him for his next challenge.

When he saw what Xage was doing, he wanted to be a part of it, and given the unorthodox security approach the company has taken, and Greatwood’s pedigree, it couldn’t have been hard to secure today’s funding.

The Industrial Internet of Things is not like its consumer cousin in that it involves getting data from big industrial devices like manufacturing machinery, oil and gas turbines and jet engines. While the entire Internet of Things could surely benefit from a company that concentrates specifically on keeping these devices secure, it’s a particularly acute requirement in industry where these devices are often helping track data from key infrastructure.

GE Ventures is the investment arm of GE, but their involvement is particularly interesting because GE has made a big bet on the Industrial Internet of Things. Abhishek Shukla of GE Ventures certainly saw the connection. “For industries to benefit from the IoT revolution, organizations need to fully connect and protect their operation. Xage is enabling the adoption of these cutting edge technologies across energy, transportation, telecom, and other global industries,” Shukla said in a statement.

The company was founded just last year and is based in Palo Alto, California.

Powered by WPeMatico

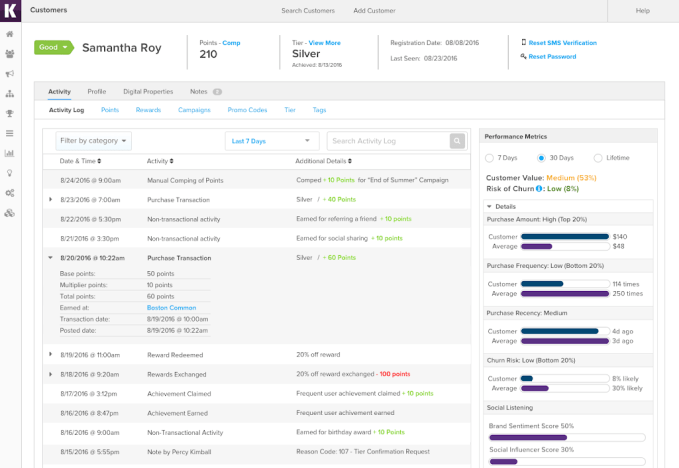

SessionM announced a $23.8 million Series E investment led by Salesforce Ventures. A bushel of existing investors including Causeway Media Partners, CRV, General Atlantic, Highland Capital and Kleiner Perkins Caufield & Byers also contributed to the round. The company has now raised over $97 million.

At its core, SessionM aggregates loyalty data for brands to help them understand their customer better, says company co-founder and CEO Lars Albright. “We are a customer data and engagement platform that helps companies build more loyal and profitable relationships with their consumers,” he explained.

Essentially that means, they are pulling data from a variety of sources and helping brands offer customers more targeted incentives, offers and product recommendations “We give [our users] a holistic view of that customer and what motivates them,” he said.

Screenshot: SessionM (cropped)

To achieve this, SessionM takes advantage of machine learning to analyze the data stream and integrates with partner platforms like Salesforce, Adobe and others. This certainly fits in with Adobe’s goal to build a customer service experience system of record and Salesforce’s acquisition of Mulesoft in March to integrate data from across an organization, all in the interest of better understanding the customer.

When it comes to using data like this, especially with the advent of GDPR in the EU in May, Albright recognizes that companies need to be more careful with data, and that it has really enhanced the sensitivity around stewardship for all data-driven businesses like his.

“We’ve been at the forefront of adopting the right product requirements and features that allow our clients and businesses to give their consumers the necessary control to be sure we’re complying with all the GDPR regulations,” he explained.

The company was not discussing valuation or revenue. Their most recent round prior to today’s announcement, was a Series D in 2016 for $35 million also led by Salesforce Ventures.

SessionM, which was founded in 2011, has around 200 employees with headquarters in downtown Boston. Customers include Coca-Cola, L’Oreal and Barney’s.

Powered by WPeMatico