funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Armory, a startup that has built a CI/CD platform on top the open source Spinnaker project, announced a $10 million Series A today led by Crosslink Capital. Other investors included Bain Capital Ventures, Javelin Venture Partners, Y Combinator and Robin Vasan.

Software development certainly has changed over the last several years, going from long cycles between updates to a continuous delivery model. The concept is actually called CI/CD or continuous integration/continuous delivery. Armory’s product is designed to eliminate some of the complexity associated with deploying this kind of solution.

When they started the company, the founders made a decision to hitch their wagon to Spinnaker, a project that had the backing of industry heavyweights like Google and Netflix. “Spinnaker would become an emerging standard for enabling truly multi-cloud deployments at scale. Instead of re-creating the wheel and building another in-house continuous delivery platform, we made a big bet on having Spinnaker at the core of Armory’s Platform,” company CEO and co-founder Daniel R. Odio wrote in a blog post announcing the funding.

The bet apparently paid off and the company’s version of Spinnaker is widely deployed enterprise solution (at least according to them). The startup’s ultimate goal is to help Fortune 2000 companies deploy software much faster — and accessing and understanding CI/CD is a big part of that.

As every company out there becomes a software company, they find themselves outside their comfort zones. While Google and Netflix and other hyper-scale organizations have learned to deploy software at startling speed using state of the art methodologies, it’s not so easy for most companies with much smaller engineering teams to pull off.

That’s where a company like Armory could come into play. It takes this open source project and it packages it in such a way that it simplifies (to an extent) the complex world that these larger companies operate in on a regular basis, putting Spinnaker and CI/CD concepts in reach of organizations whose core competency might not involve sophisticated software deployment.

All of this relates to multi-cloud and cloud-native approaches to software development, which lets you manage your applications and infrastructure wherever they live across any cloud vendor or even on-prem in consistent way. Being able to manage continuous deployment is part of that.

Armory launched in 2016 and is based in the Bay area. It has raised a total of $14 million with a $4 million seed round coming last year. They were also a member of the Y Combinator Winter 2017 class and count Y Combinator as an investor in this round.

Powered by WPeMatico

It was quite a week for Slack, wasn’t it? The enterprise communications platform confirmed this publication’s earlier report that it had scored another $427 million investment on an over-the-moon valuation of over $7 billion. Slack took a market that had once been in the doldrums and turned it into something significant by making itself more than a communications tool.

It changed the game by making itself a work hub. Through APIs and UI updates, it has made it simple for countless third parties (like Evernote) to integrate with Slack and provide the long-sought workplace hub for the enterprise. Instead of task switching, you can work mostly in one place and keep your focus on your work.

It’s quite a value proposition and it has enabled Slack to raise $1.2 billion (with a b) across 11 funding rounds, according to data on Crunchbase. They have grown to 8 million daily active users. They boast 70,000 teams paying to use it. Whatever they are doing, it’s working.

That said, Slack’s success has always been a bit surprising because it’s facing off against giants like Microsoft, Facebook, Google, Cisco, Salesforce and many others, all gunning for this upstart’s market. In fact, Microsoft is giving Teams away for free to Office 365 customers. You could say it’s hard to compete with free, yet Slack continues to hold its own (and also offers a free version, for the record).

Perhaps that’s because it doesn’t require customers to use any particular toolset. Microsoft Teams is great for Microsoft users. Google Hangouts is great for G Suite users. You’re already signed in and it’s all included in the package, and there is a huge convenience factor there, but Slack works on anything and with anything and companies have shown there is great value in that.

The question is can Slack continue to play David to these corporate behemoths or will patience, bushels of cash on hand and a long view allow these traditional tech companies to eventually catch up and pass the plucky newbie. Nobody can see into the future, but obviously investors recognize it takes a lot of capital to keep up with what the competition is bringing to the table.

They also clearly have some confidence in the company’s ability to keep growing and keep the titans at bay or they wouldn’t have thrown all of that moolah at them. Up until now, they seem to have always found a way, but they need to step up if they are going to keep it going.

Alan Lepofsky, an analyst with Constellation Research, who keeps a careful eye on the enterprise collaboration market, says in a recent video commentary that it’s great they got all this money, but now that someone has shown them all of this dough, they have to prove they know what to do with it.

“For Slack to continue to be successful, they need to expand beyond what they are currently doing and really, truly redefine the way people communicate, collaborate, coordinate around their work. They need to branch out to project management, task management, content creation — all sorts of things more than just collaboration.”

Lepofsky says this could happen via a build or buy scenario, or even partnering, but they need to use their money strategically to differentiate the product from the hefty competition and stay ahead in this market.

The other elephant in the room is the idea that one of the competing mega corporations could make a run at them and try to acquire them. It would take a boat load of money to make that happen, but if someone had the cojones to do it, they would be getting the state of the art, the market share, the engineering, the whole package.

For now, that’s pure speculation. For now, Slack is sitting comfortably on a huge cash pile, and perhaps they should go shopping and expand their product set with their newly found wealth, as Lepofsky suggests. If they can do that, maybe they can keep the technology wolves from the door and make their way down the path to their seemingly inevitable IPO.

Powered by WPeMatico

Nylas, a startup that helps developers integrate email content into applications via an API, announced a $16 million Series B today led by Spark Capital.

Other investors joining in included Slack Fund, Industry Ventures, and ScaleUp along with existing investors 8VC, Great Oaks Capital, Rubicon Venture Capital and John Chambers’ personal fund. Today’s investment brings the total raised to $30 million.

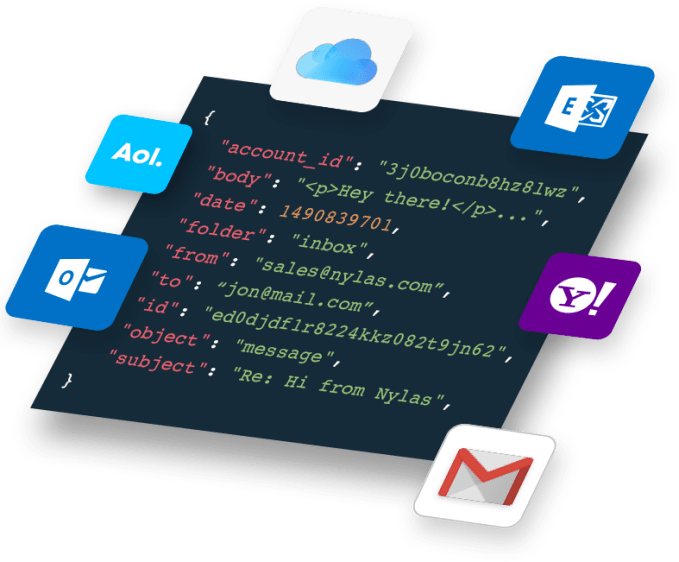

The Nylas API works in a similar way to Stripe or Twilio, but instead of helping developers connect to payments or communications with a couple of lines of code, Nylas helps them connect to email, calendar and contact information. The idea behind any API like this is to give developers who lack expertise in a particular area outside the core purpose of their application, easy access to a particular type of functionality.

Company CEO Gleb Polyakov says that prior to Nylas, there really wasn’t an effective way to connect to email systems without a lot of technical wrangling. “Every person who is using the Internet has an email address, and there’s an immense amount of data that lives in the mail box, in the calendar, in your address book. And up until now, companies have been unable to effectively use that data,” he told TechCrunch.

It seems like a must-have kind of ability to connect to this type of information from any application, but most companies have shied away from a comprehensive approach because it’s hard to do, says company co-founder and CTO Christine Spang.

“We have essentially built adapters for the native protocols for each email system: Gmail, Microsoft Exchange, open source IMap servers and all the different extensions that are available on the different IMap implementations. And the key part is that with these adapters, we can talk to backend providers like Google, GoDaddy and Yahoo, Spang explained.

Photo: Nylas

This capability could be useful for developers in lots of scenarios such as pulling data for a CRM tool from an email exchange between a salesperson and a customer, or to coordinate meetings around the calendars of several individuals and an open meeting room that works for all of their schedules.

The company, which has been around for five years, currently has 35 employees with offices in New York and San Francisco. With the new funding, they expect to double that number by the end of the year, as it adds engineering and builds out its sales and marketing team. While much of the marketing up to now has been inbound from developers, they want to expand their customer base by marketing directly to companies.

It currently counts 200 customers and thousands of developers using the product. Customers include Comcast, Hyundai, News Corp, Salesloft and Dialpad.

Powered by WPeMatico

Semmle, a startup that originally spun out of research at Oxford, announced a $21 million Series B investment today led by Accel Partners. It marked the second time Accel has led an investment in the company.

Work-Bench also participated in the round. Today’s investment brings the total to $31 million.

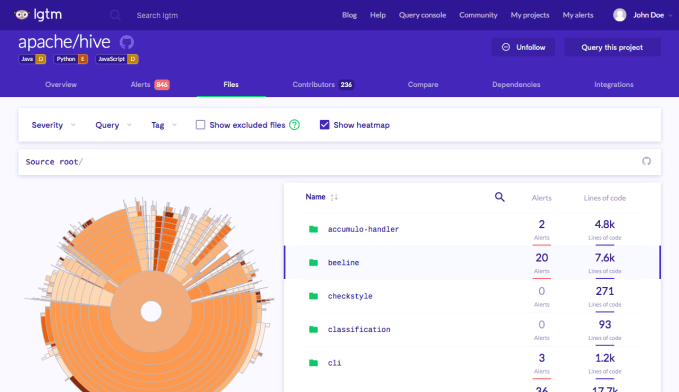

Semmle has warranted this kind of interest by taking a unique approach to finding vulnerabilities in code. “The key idea behind our technology is to treat code as data and treat analysis problems as simple queries against a database. What this allows you to do is very easily encode domain expertise, security expertise or any other kinds of specialist knowledge in such a way it can be easily and automatically applied to large amounts of code,” Pavel Avgustinov, Semmle co-founder and VP of platform engineering told TechCrunch.

Screenshot: Semmle

Once you create the right query, you can continuously run it against your code to prevent the same mistakes from entering the code base on subsequent builds. The key here is building the queries and the company has a couple of ways to deal with that.

They can work with customers to help them create queries, although in the long run that is not a sustainable way of working. Instead, they share queries, and encourage customers to share them with the community.

“What we find is that the great tech companies we work with have the best security teams in the world, and they are giving back what they created on the Semmle platform with other users in an open source fashion. There is a GitHub repository where we publish queries, but Microsoft and Google are doing the same thing,” Oege de Moor, company CEO and co-founder explained.

In fact, the Semmle solution is freely available to open source programmers to use with their applications, and the company currently analyzes every commit of almost 80,000 open source projects. Open source developers can run shared queries against their code or create their own.

They also have a paid version with customers like Microsoft, Google, Credit Suisse, NASA and Nasdaq. They have relied mostly on these strategic partners up until now. With today’s investment they plan to build out their sales and marketing departments to expand their customer base into a wider enterprise market.

The company spun out of research at Oxford University in 2006. They are now based in San Francisco with 60 employees, a number that should go up with this investment. They received an $8 million Series A in 2014 and $2 million seed round in 2011.

Powered by WPeMatico

As renewable energy use surges in the U.S. and the effects of global climate change become more visible, companies like Arcadia Power are pitching a nationwide service to make renewable energy available to residential customers.

While states like New York, California and regions across the upper Midwest have access to renewable energy through their utilities and competitive marketplaces, not all states in the country have utilities that are building renewable power generation to offset coal and natural gas energy production.

Enter Arcadia Power and its new $25 million in financing, which will be used to redouble its marketing efforts and expand its array of services in the U.S.

Right now, renewable energy is the fastest growing component of the U.S. energy mix. It’s grown from 15 percent to 18 percent of all power generation in the country, according to a 2018 report from Business Council for Sustainable Energy and Bloomberg New Energy Finance.

And while Arcadia Power is only accounting for 120 megawatts of the 2.9 gigawatts of new renewable energy projects initiated since 2017, its new $25 million in financing will help power new projects.

When we first wrote about the company in 2016, it was just developing solar projects that would generate power for the grid to offset electricity usage from its customers.

Now the company is expanding its array of services. All customers are automatically enrolled in a 50 percent wind energy offset program, where half of their monthly usage is matched in investments in wind farms — and they can upgrade to fully offset their energy usage with wind power. Meanwhile, community solar projects are also available for free or customers can then purchase a panel and receive a guaranteed solar savings on each monthly power bill.

Reduced prices are given to customers through the consolidation of their buying power across multiple competitive energy markets.

Finally, Arcadia is offering new home efficiency upgrades like LED lighting and smart thermostats, along with smart metering and tracking services to improve customers’ payment options, the company said.

“The electricity industry hasn’t changed much in the last hundred years, and we believe that homeowners and renters want a new approach that puts them first. Our platform places clean energy, home efficiency and data insights front and center for residential energy customers in all 50 states,” said chief executive Kiran Bhatraju.

Kiran Bhatraju, chief executive officer Arcadia Power

Funding for the new Arcadia Power financing was led by G2VP, the investment firm that spun out from Kleiner Perkins cleantech investing, ValueAct Spring Fund, McKnight Foundation, Energy Impact Partners, Cendana Capital, Wonder Ventures, BoxGroup and existing investors, according to the company. As a result of the investment, Alex Laskey, Opower’s founder and president; Ben Kortlang, a partner at G2VP; and Dan Leff, a longtime investor in energy technology companies, will all join the Arcadia board of directors.

“We’re taking a piece of the savings that is a part of the power purchase agreement,” says Bhatraju. “Customers get a 5 percent guaranteed savings against the utility rate. In competitive markets like Ohio or Maryland, it’s a shared savings model.”

Beyond the savings, the offsets can do something to reduce the carbon emissions that are exacerbating the problems of global climate change.

“When you build community solar projects you are displacing former fossil fuel plants from being used because these of customers,” Bhatraju said. But the entrepreneur recognizes that they have a long way to go to make a difference. “120 MW is not nearly enough,” Bhatraju said. “We’ve got a long way to go.”

Powered by WPeMatico

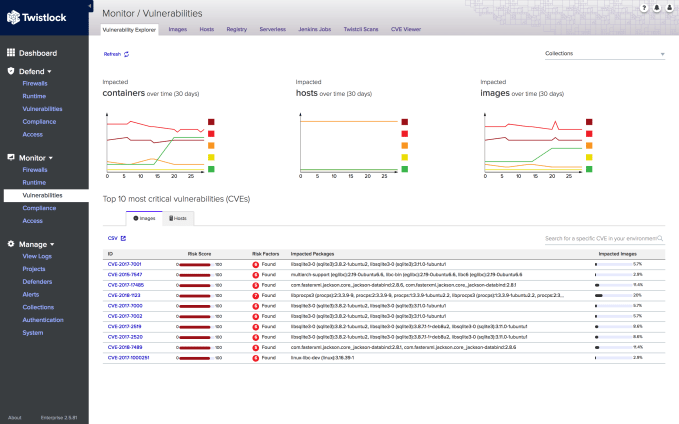

As the world shifts to a cloud native approach, the way you secure applications as they get deployed is changing too. Twistlock, a company built from the ground up to secure cloud native environments, announced a $33 million Series C round today led by Iconiq Capital.

Previous investors YL Ventures, TenEleven, Rally Ventures, Polaris Partners and Dell Technologies Capital also participated in the round. The company reports it has received a total of $63 million in venture investment to date.

Twistlock is solving a hard problem around securing containers and serverless, which are by their nature ephemeral. They can live for fractions of seconds making it hard track problems when they happen. According to company CEO and co-founder Ben Bernstein, his company came out of the gate building a security product designed to protect a cloud-native environment with the understanding that while containers and serverless computing may be ephemeral, they are still exploitable.

“It’s not about how long they live, but about the fact that the way they live is more predictable than a traditional computer, which could be running for a very long time and might have humans actually using it,” Bernstein said.

Screenshot: Twistlock

As companies move to a cloud native environment using Dockerized containers and managing them with Kubernetes and other tools, they create a highly automated system to deal with the deployment volume. While automation simplifies deployment, it can also leave companies vulnerable to host of issues. For example, if a malicious actor were to get control of the process via a code injection attack, they could cause a lot of problems without anyone knowing about it.

Twistlock is built to help prevent that, while also helping customers recognize when an exploit happens and performing forensic analysis to figure out how it happened.

It’s not a traditional Software as a Service as we’ve come to think of it. Instead, it is a service that gets installed on whatever public or private cloud that the customer is using. So far, they count just over 200 customers including Walgreens and Aetna and a slew of other companies you would definitely recognize, but they couldn’t name publicly.

The company, which was founded in 2015, is based in Portland, Oregon with their R&D arm in Israel. They currently have 80 employees. Bernstein said from a competitive standpoint, the traditional security vendors are having trouble reacting to cloud native, and while he sees some startups working at it, he believes his company has the most mature offering, at least for now.

“We don’t have a lot of competition right now, but as we start progressing we will see more,” he said. He plans to use the money they receive today to help expand their marketing and sales arm to continue growing their customer base, but also engineering to stay ahead of that competition as the cloud-native security market continues to develop.

Powered by WPeMatico

Noisy open offices don’t foster collaboration, they kill it, according to a Harvard study that found the less-private floor plan led to a 73 percent drop in face-to-face interaction between employees and a rise in emailing. The problem is plenty of young companies and big corporations have already bought into the open office fad. But a new startup called ROOM is building a prefabricated, self-assembled solution. It’s the IKEA of office phone booths.

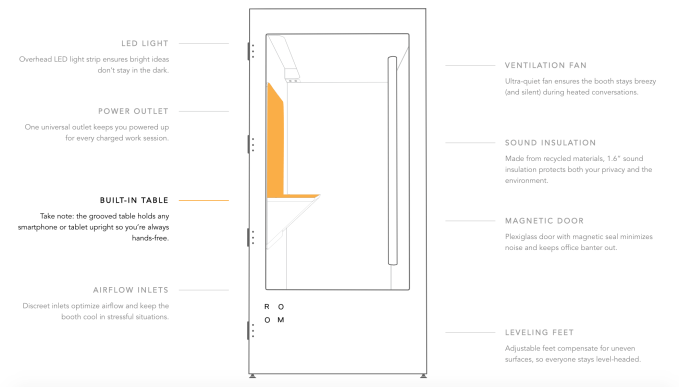

The $3,495 ROOM One is a sound-proofed, ventilated, powered booth that can be built in new or existing offices to give employees a place to take a video call or get some uninterrupted time to focus on work. For comparison, ROOM co-founder Morten Meisner-Jensen says, “Most phone booths are $8,000 to $12,000. The cheapest competitor to us is $6,000 — almost twice as much.” Though booths start at $4,500 from TalkBox and $3,995 from Zenbooth, they tack on $1,250 and $1,650 for shipping, while ROOM ships for free. They’re all dividing the market of dividing offices.

The idea might seem simple, but the booths could save businesses a ton of money on lost productivity, recruitment and retention if it keeps employees from going crazy amidst sales call cacophony. Less than a year after launch, ROOM has hit a $10 million revenue run rate thanks to 200 clients ranging from startups to Salesforce, Nike, NASA and JP Morgan. That’s attracted a $2 million seed round from Slow Ventures that adds to angel funding from Flexport CEO Ryan Petersen. “I am really excited about it since it is probably the largest revenue-generating company Slow has seen at the time of our initial Seed stage investment,” says partner Kevin Colleran.

“It’s not called ROOM because we build rooms,” Meisner-Jensen tells me. “It’s called ROOM because we want to make room for people, make room for privacy and make room for a better work environment.”

You might be asking yourself, enterprising reader, why you couldn’t just go to Home Depot, buy some supplies and build your own in-office phone booth for way less than $3,500. Well, ROOM’s co-founders tried that. The result was… moist.

Meisner-Jensen has design experience from the Danish digital agency Revolt that he started before co-founding digital book service Mofibo and selling it to Storytel. “In my old job we had to go outside and take the call, and I’m from Copenhagen, so that’s a pretty cold experience half the year.” His co-founder Brian Chen started Y Combinator-backed smart suitcase company Bluesmart, where he was VP of operations. They figured they could attack the office layout issue with hammers and saws. I mean, they do look like superhero alter-egos.

Room co-founders (from left): Brian Chen and Morten Meisner-Jensen

“To combat the issues I myself would personally encounter with open offices, as well as colleagues, we tried to build a private ‘phone booth’ ourselves,” says Meisner-Jensen. “We didn’t quite understand the specifics of air ventilation or acoustics at the time, so the booth got quite warm — warm enough that we coined it ‘the sweatbox.’ ”

With ROOM, they got serious about the product. The 10-square-foot ROOM One booth ships flat and can be assembled in less than 30 minutes by two people with a hex wrench. All it needs is an outlet to power its light and ventilation fan. Each is built from 1088 recycled plastic bottles for noise cancelling, so you’re not supposed to hear anything from outside. The box is 100 percent recyclable, plus it can be torn down and rebuilt if your startup implodes and you’re being evicted from your office.

The ROOM One features a bar-height desk with outlets and a magnetic bulletin board behind it, though you’ll have to provide your own stool. It’s actually designed not to be so comfy that you end up napping inside, which doesn’t seem like it’d be a problem with this somewhat cramped spot. “To solve the problem with noise at scale you want to provide people with space to take a call but not camp out all day,” Meisner-Jensen notes.

Booths by Zenbooth, Cubicall and TalkBox (from left)

Couldn’t office managers just buy noise-cancelling headphones for everyone? “It feels claustrophobic to me,” he laughs, but then outlines why a new workplace trend requires more than headphones. “People are doing video calls and virtual meetings much, much more. You can’t have all these people walking by you and looking at your screen. [A booth is] also giving you your own space to do your own work, which I don’t think you’d get from a pair of Bose. I think it has to be a physical space.”

But with plenty of companies able to construct physical spaces, it will be a challenge for ROOM to convey the subtleties of its build quality that warrant its price. “The biggest risk for ROOM right now are copycats,” Meisner-Jensen admits. “Someone entering our space claiming to do what we’re doing better but cheaper.” Alternatively, ROOM could lock in customers by offering a range of office furniture products. The co-founder hinted at future products, saying ROOM is already receiving demand for bigger multi-person prefab conference rooms and creative room divider solutions.

The importance of privacy goes beyond improved productivity when workers are alone. If they’re exhausted from overstimulation in a chaotic open office, they’ll have less energy for purposeful collaboration when the time comes. The bustle could also make them reluctant to socialize in off-hours, which could lead them to burn out and change jobs faster. Tech companies in particular are in a constant war for talent, and ROOM Ones could be perceived as a bigger perk than free snacks or a ping-pong table that only makes the office louder.

“I don’t think the solution is to go back to a world of cubicles and corner offices,” Meisner-Jensen concludes. It could take another decade for office architects to correct the overenthusiasm for open offices despite the research suggesting their harm. For now, ROOM’s co-founder is concentrating on “solving the issue of noise at scale” by asking, “How do we make the current workspaces work in the best way possible?”

Powered by WPeMatico

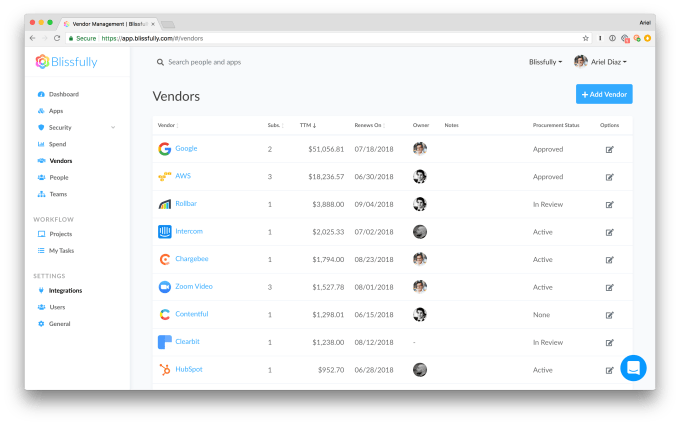

Blissfully, a New York City startup that helps companies understand their SaaS usage inside their organizations, announced it has received a $3.5 million seed round.

The investment was led by Hummer Winblad Venture Partners. Hubspot, Founder Collective, and several unnamed pre-seed investors also participated. They got a $1.5 million pre-seed investment, bringing the total so far to $5 million, according the company.

Company co-founder and CEO Ariel Diaz says Blissfully actually helped him and his co-founder solve a problem they were having tracking the SaaS usage at their previous startups. Like many companies, they were using spreadsheets to track this information and they found it was untenable as the company grew beyond 30 or 40 people. They figured there had to be a better way, so they built one.

Their product is much more than simply a database of the SaaS products in use inside an organization. It can integrate with existing company systems like single sign-on tools such as Okta and OneLogIn, financial reporting systems and G Suite login information. “We are trying to automate as much of the data collection as possible to discover what you’re using, who’s using it and how much you are spending,” he said.

Blissfully SaaS report. Screenshot: Blissfully

Their scans often turn up products customers thought they had canceled or those that IT had asked employees to stop using. More than finding Shadow IT, the product also gives insight to overall SaaS spend, which many companies have trouble getting a grip on. They can find most usage with a scan. Some data such as customized contract information may have to be manually entered into the system, he says.

Hubspot CEO Brian Halligan, whose company is one of the investors in this round, sees a growing need for this kind of tool. “The widespread growth of SaaS across companies of all sizes is a leading indicator of the market need for Blissfully. As business’ investments in SaaS increase, they lose visibility into issues ranging from spending to security,” Halligan said in a statement.

The company offers a freemium and pay model and is available in the G Suite Marketplace. If you go for the free version, you can scan your systems for SaaS usage, but if you want to do more complex integrations with company systems, you have to pay. They currently have 10 employees and 500 customers with a mix of paying and free.

One interesting aspect of the Blissfully tool is that it is built entirely using Serverless architecture on AWS Lambda.

Powered by WPeMatico

Audius wants to cut the middlemen out of music streaming so artists get paid their fair share. Coming out of stealth today led by serial entrepreneur and DJ Ranidu Lankage, Audius is building a blockchain-based alternative to Spotify or SoundCloud.

Users will pay for Audius tokens or earn them by listening to ads. Their wallet will then pay out a fraction of a cent per song to stream from decentralized storage across the network, with artists receiving roughly 85 percent — compared to roughly 70 percent on the leading streaming apps. The rest goes to compensating whomever is hosting that song, as well as developers of listening software clients, one of which will be built by Audius.

Audius plans to launch its open-sourced product in beta later this year. But it’s already found some powerful investors that see SoundCloud as vulnerable to the cryptocurrency revolution. Audius has raised a $5.5 million Series A led by General Catalyst and Lightspeed, with participation from Kleiner Perkins, Pantera Capital, 122West and Ascolta Ventures. They’re betting that Audius’ token will grow in value, making the stockpile it keeps worth a fortune. It could then sell chunks of its tokens to earn revenue instead of charging artists directly.

Audius co-founders (from left): head of product Forrest Browning, CEO Ranidu Lankage, CTO Roneil Rumburg

“The biggest problem in the music industry is that streaming is taking off and artists aren’t necessarily earning a lot of money. And it can take three months, or up to 18 months for unsigned artists, to get paid for streams,” says Lankage. “That’s what crypto really solves. You can pay artists in near real-time and make it fully transparent.”

The big question will be whether Audius can use the token economy to crack the chicken-and-egg problem of getting its first creators and listeners on a platform that might be less functionally robust than its traditional competitors. There are a lot of moving parts to decentralize, but there are also plenty of disgruntled musicians out there waiting for something better.

Most startup guys don’t have Billboard charting singles on their bio, but Lankage does. Born in Sri Lanka, his hip-hop songs in his native tongue of Sinhalese were the first of the language to be played on the BBC and MTV. He got signed to Sony and even went platinum, but left the label seeking greater control over his work. After going to Yale, he applied his music business knowledge to build a Reddit for dance music called The Drop with Twitch’s Justin Kan back in 2015.

The two teamed up again on a video version of Q&A app Quora called Whale, but that fizzled out too. Lankage’s next venture Polly, a polling tool built as a complement to Snapchat, inspired the now super-popular Instagram Stories polls and questions stickers. But after an acqui-hire by Reddit fell through, he returned to his first love: music.

“I’ve always been passionate about building tools for creators,” says Lankage. But this time, he wanted to focus on helping them turn their art into a profession. He teamed up with CTO Roneil Rumburg, an engineering partner at Kleiner Perkins who’d build a crypto wallet called Backslash, and head of product Forrest Browning, who’d sold his software metering startup StacksWare to Avi Networks.

Their goal is to build a blockchain streaming music service where listeners don’t have to understand blockchains. “A user wouldn’t even know that they have a wallet,” says Rumburg. They’ll just hear an ad every once in a while, get a subscription, or pay per stream. Since Audius is open sourced, developers will be able to build their own listening clients on top, which could specialize in discovery of certain types of music or offer their own payment schemes.

“I have known Ranidu, Forrest and Roneil for a long time, and have always been impressed with their ability to blend art, technology and business together,” says investor Niko Bonatsos of General Catalyst. “In Audius, they bring together all three skills, with a deep technical heart and a compelling solution for a very big marketplace.”

For starters, Audius is focusing on signing up independent electronic musicians. These are the types that might be popular on SoundCloud but actually have to pay for hosting there while not getting much back due to the platform’s weak monetization options. Don’t expect U2 and Ariana Grande on Audius, at least not yet. But the startup could differentiate by offering access to content you can’t find elsewhere.

To get artists on board, Lankage tells me Audius plans “to use token incentives.” Those willing to jump on first before there are many listeners could get a bonus allotment of tokens that might be worth more if they help popularize the service. And where artists go, their fans will follow. Audius is hoping artists will share its links first because that’s where they’ll earn the most money.

Audius has also lined up a legion of big-name advisors to help it develop its blockchain product and artist relationships. Those include Augur co-founder Jeremy Gardner, EDM artist 3LAU, EA co-founder Bing Gordon and more it can’t announce just yet.

Audius has also lined up a legion of big-name advisors to help it develop its blockchain product and artist relationships. Those include Augur co-founder Jeremy Gardner, EDM artist 3LAU, EA co-founder Bing Gordon and more it can’t announce just yet.

The linchpin of Audius will be the user experience. If the system feels too complicated, listeners and artists will stay elsewhere. A DJ might earn more per stream from Audius, but if Spotify or SoundCloud offer better ways for fans to subscribe to them and generate more plays long-term, they’ll still direct supporters there. But if Audius can hide the nerdy bits while solving the music industry’s problems, it has the potential to be one of the first mainstream consumer blockchain projects that treats the tech as a utility, not just a new stock market to bet on.

Powered by WPeMatico

The artificial intelligence revolution is underway in the world of technology, but as it turns out, some of the most faithful foot soldiers are still humans. A startup called Scale, which works with a team of contractors who examine and categorise visual data to train AI systems in a two-sided marketplace model, announced that it has raised an additional $18 million in a Series B round. The aim will be to expand Scale’s business to become — in the words of CEO Alexandr Wang, the 21-year-old MIT grad who co-founded Scale with Lucy Guo — “the AWS of AI, with multiple services that help companies build AI algorithms.”

“Our mission is to accelerate the development of AI apps,” Wang said. “The first product is visual data labelling, but in the future we have a broad vision of what we hope to provide.”

Wang declined to comment on the startup’s valuation in an interview. But according to Pitchbook, which notes that this round actually closed in May of this year, the post-money valuation of Scale is now $93.50 million ($75 million pre-money).

The money comes on the back of an eventful two years since the company first launched, with revenues growing 15-fold in the last year, and “multiple millions of dollars in revenue” from individual customers. (It doesn’t disclose specific numbers, however.)

Today, Scale’s base of contractors numbers around 10,000, and it works with a plethora of businesses that are developing autonomous vehicle systems such as General Motors’ Cruise, Lyft Zoox, Nuro, Voyage, nuTonomy and Embark. These companies send Scale’s contractors raw, unlabelled data sets by way of Scale’s API, which provides services like Semantic Segmentation, Image Annotation, and Sensor Fusion, in conjunction with its clients LIDAR and RADAR data sets. In total, it says it’s annotated 200,000 “miles of data” collected by self-driving cars.

AV companies are not its only customers, though. Scale also works with several non-automotive companies like Airbnb and Pinterest, to help build their AI-based visual search and recommendation systems. Airbnb, for example, is looking for more ways of being able to ascertain what kinds of homes repeat customers like and don’t like, and also to start to provide other ways of discovering places to stay that are based not just on location and number of bedrooms (which becomes more important especially in cities where you may have too many choices and want a selection more focused on what you are more likely to rent).

This latest funding round was led by Index, with existing investors Accel and Y Combinator (where Scale was incubated), also participated in this Series B, along with some notable, new individual investors such as Dropbox CEO Drew Houston and Justin Kan (two YC alums themselves who have been regular investors in other YC companies). This latest round brings the total raised by Scale to $22.7 million.

When Scale first made its debut in July 2016 as part of YC’s summer cohort, the company presented itself as a more intelligent alternative to Mechanical Turk, specifically to address the demands of artificial intelligence systems that needed more interaction and nuanced responses than the typical microtask asked of a Turker.

“We’re honing in on AI broadly,” Wang said. “Our goal is to be a pick axe in the AI goldrush.”

Early efforts covered a wide spread of applications — categorization/content moderation, comparison, transcription, and phone calling as some examples. But more recently the company has seen a particular interest from self-driving car companies, and specifically the ability to look at, understand and categorise images of what might appear on a road with the kind of recognition that only a human can provide for training purposes. For example, to be able to identify a scooter versus a wagon, a piece of asphalt or an article of granite-colored clothing on a person that could potentially look like asphalt to an unsuspecting camera, or whatever.

“This sub-segment of AI, autonomous vehicles, really took off after we launched, and that segment has been the killer use case for us,” Wang said.

My experience in talking with autonomous car companies and those who work with them has been that many of them are extremely guarded about their data, so much so that there are entire companies being built to help manage this IP standoff so that no one has to share what they know, but they can still benefit from each other.

Wang says that the same holds for Scale’s clients, and part of its unique selling point is that it not only provides data identification services but does so with the assurance that its systems retain none of that data for its own or other companies’ purposes.

“We don’t share across different silos and are very clear about that,” Wang said. “These companies are very sensitive, as are all AI companies about their data and where it goes, and we’ve been able to gain trust as a partner because will not share or sell data to any other parties.”

Scale uses AI itself to help select contractors. “We have built a bunch of algorithms and AI to vet and train contractors,” Wang said. In the training, “we provide feedback and determine if they are getting good enough to do the work, and in terms of ensuring the quality of their work, our algorithms go through what they are doing and verify the work against our models, too. There are a lot of algorithms.”

For clients who are calling in data from the public web — for example Pinterest or Airbnb — Scale uses a broader contractor pool that could include stay-at-home moms, students or others looking for extra money.

For clients who are sensitive about the data that’s being analysed — such as the car companies — the conditions are more restricted, and sometimes include centres where Scale controls the machines that are being used as well as how the data sets can be viewed.

This is one reason why Scale isn’t simply focused on growing the numbers of contractors as its only route for growing business. “We’ve noticed that when you have people who spend more time on this they do better work,” Wang said.

Wang said the Series B funding will be used to expand the kind of work Scale does for existing customers in the area of visual data analysis, as well as to gradually add in other categories of data, such as text.

“Our first goal is to improve algorithms for customers today,” he said. “There is no limit to how accurate they want to make their systems, and they need to be constantly feeding their AI with more data. All of our customers have this, and it’s an evergreen problem.”

The second is to diversify more outside driving and the visual data set, he said. “Right now, so much of the success has been in processing imagery and robotics or other perception challenges, but we really want to be the fabric of the AI world for new applications, including text or audio. That is another use of funds to expand to those areas.”

“Fabric” is the operative word, it seems: “Scale has the potential to become the fabric that connects and powers the Artificial Intelligence world,” said Mike Volpi, General Partner, Index Ventures, in a statement. “For autonomous vehicles in particular, Scale is well-positioned to take over an emerging field of data annotation regardless of which players ultimately come out on top. Alex…has recruited a highly talented and technical team to tackle this challenge and their progress is evident in the marquee list of customers they’ve won in such a short amount of time.”

Powered by WPeMatico