funding

Auto Added by WPeMatico

Auto Added by WPeMatico

UiPath is bringing automation to repetitive processes inside large organizations and it seems to have landed on a huge pain point. Today it announced a massive $225 million Series C on a $3 billion valuation.

The round was led by CapitalG and Sequoia Capital. Accel, which invested in the companies A and B rounds also participated. Today’s investment brings the total raised to $408 million, according to Crunchbase, and comes just months after a $153 million Series B we reported on last March. At that time, it had a valuation of over $1 billion, meaning the valuation has tripled in less than six months.

There’s a reason this company you might have never heard of is garnering this level of investment so quickly. For starters, it’s growing in leaps in bounds. Consider that it went from $1 million to $100 million in annual recurring revenue in under 21 months, according to the company. It currently has 1800 enterprise customers and claims to be adding 6 new ones a day, an astonishing rate of customer acquisition.

The company is part of the growing field of robotic process automation or RPA. While the robotics part of the name could be considered a bit of a misnomer, the software helps automate a series of mundane tasks that were typically handled by humans. It allows companies to bring a level of automation to legacy processes like accounts payable, employee onboarding, procurement and reconciliation without actually having to replace legacy systems.

Phil Fersht, CEO and chief analyst at HfS, a firm that watches the RPA market, says RPA isn’t actually that intelligent. “It’s about taking manual work, work-arounds and integrated processes built on legacy technology and finding way to stitch them together,” he told TechCrunch in an interview earlier this year.

It isn’t quite as simple as the old macro recorders that used to record a series of tasks and execute them with a keystroke, but it is somewhat analogous to that approach. Today, it’s more akin to a bot that may help you complete a task in Slack. RPA is a bit more sophisticated moving through a workflow in an automated fashion.

Ian Barkin from Symphony Ventures, a firm that used to do outsourcing, has embraced RPA. He says while most organizations have a hard time getting a handle on AI, RPA allows them to institute fundamental change around desktop routines without having to understand AI.

If you’re worrying about this technology replacing humans, it is somewhat valid, but Barkin says the technology is replacing jobs that most humans don’t enjoy doing. “The work people enjoy doing is exceptions and judgment based, which isn’t the sweet spot of RPA. It frees them from mundaneness of routine,” he said in an interview last year.

Whatever it is, it’s resonating inside large organizations and UiPath, is benefiting from the growing need by offering its own flavor of RPA. Today its customers include the likes of Autodesk, BMW Group and Huawei.

As it has grown over the last year, the number of employees has increased 3x and the company expects to reach 1700 employees by the end of the year.

Powered by WPeMatico

Looking for funding as a startup in Latin America is a lot like looking for a watering hole in the middle of the desert. You know it’s out there, but finding it in time is a life or death situation.

Granted, venture capital investment in the region is at an all-time high, with leading firms like Andreessen Horowitz, Sequoia Capital and Accel Partners having made inaugural investments in markets like Colombia, Brazil and Mexico, respectively. But, at the same time, while startup founders might be tantalized by the news of big investments happening around them, as many of them get closer to the funding stage themselves, they often realize it’s nothing but a mirage.

And this isn’t just a problem in Latin America. All over the world, startups are struggling to find investment, as VCs are investing more money in fewer deals in the endless search for the next unicorn. Due to a dwindling number of VC deals in both the United States and Europe, even entrepreneurs in established ecosystems are having to look further afield for the resources they need to build their businesses, bringing many of them to emerging markets like Latin America.

Fortunately, whether you’re a local or foreign founder in an emerging market, there is a way to quench your thirst for the international investment that you need to scale your company. Here’s what we recommend to the startups that are part of our UTEC Ventures accelerator program in Peru, and what we’d recommend to you, too.

As a startup in an emerging market, the prospect of finding local investment can seem challenging. In fact, this is probably why you’re looking for international investment in the first place. But the truth is, finding local seed money to get started is really the first prerequisite for securing international funding later on.

Last year in Peru, for example, US$7.2 million of seed capital was invested in the country’s startups, with barely over US$1 million coming from international funds. This goes to show that international investors peeking into emerging markets are less active in seed rounds, and more interested in later-stage rounds once a company has better demonstrated its worth.

If you want to attract international investors, you need to be an international startup.

As such, we advise all startups to raise a first or second seed round locally in Peru, and then seek international investors. The same can go for other emerging markets, as well.

To raise these initial rounds, the most important thing is to show that you have a solid team, a business idea that works and has traction with clients chasing your product and that you’re better than any local competition. If you can demonstrate that you meet these requirements, finding local seed capital shouldn’t be too difficult; all you need is a good pitch deck and some patience when networking within local angel groups or at investor events.

If you want to attract international investors, you need to be an international startup. In other words, you need to demonstrate that you can sell your product in a bigger, more competitive market before turning the heads of international investors. For startups in Peru and other emerging markets in Latin America, that means successfully expanding to the region’s most developed markets in Mexico, Brazil or Argentina.

Consider, for example, the Colombian courier service Rappi. It wasn’t until after the company expanded its operations to Mexico at the beginning of 2016 that it secured its first major international investment, led by Andreessen Horowitz. The company then went on to close a Series B round just one month later, in addition to a US$130 million venture round at the beginning of this year, led by a German food delivery service with participation from a number of U.S.-based investors.

The same idea goes for emerging markets outside of Latin America, too. In Eastern Europe, which lags behind its western counterpart in terms of VC funding, many entrepreneurs will either set up their businesses in Western European countries from the get-go, or expand there as soon as they’ve achieved product/market fit and demonstrated success in their home countries.

This is a clear demonstration of the broader fact that if you want to start raising money from more developed markets, you generally need to be based in those markets, or at least a market of comparable size. Accordingly, your primary focus when seeking international funding should be to first succeed locally, and then replicate that success in a more developed market — whether that be in the United States, Mexico, Western Europe or anywhere else.

While it’s easy to be distracted by the glitz and glamour of securing a round from international VCs, startups have a number of other options at their disposal to secure international funding.

Foreign governments in emerging markets are increasingly stepping up their game with programs designed to bolster their local startup ecosystems as an engine for economic growth. As such, a number of foreign governmental programs have emerged, offering support in the form of equity-free cash to entrepreneurs who decide to set up shop in a given country.

Corporate capital has taken on a very important role in many emerging markets like Latin America.

There are plenty of examples in Latin America alone. Start-Up Chile, for example, offers entrepreneurs up to US$80,000 to launch their businesses in Chile as a launch pad to reach the rest of the world; Parallel18 in Puerto Rico offers entrepreneurs up to US$75,000 to do the same thing; and the Peruvian government plans to announce a similar program to help startups soft launch in Peru with up to US$40,000 at the upcoming Peru Venture Capital Conference.

Startups have another option, as well. Corporate capital, or startup investment from major corporations, has taken on a very important role in many emerging markets like Latin America. In fact, Qualcomm Ventures, the investment arm of U.S.-based tech giant Qualcomm, is the most active global corporate investor in Latin America. Naspers, American Express Ventures and other corporate funds have taken an active interest in the region’s startups, as well.

Together, the growing support of foreign governments and interest from international corporations highlights the fact that securing international funding is in fact possible, and not as hard as you’d expect. Knowing that there are options besides getting an international VC on board, you should take the time to find out which alternatives are available in the markets to which you’re hoping to expand.

So, no matter whether you’re a local or foreign entrepreneur in an emerging market, there’s no reason to give up hope on finding international funding. The key is to think globally and use technology to solve real-world challenges. Then, demonstrate success at home first, and duplicate it later in a bigger market. Resources are available to help you when taking your first step abroad, and if you do it well, you’ll find that the investment wells aren’t dry after all.

Powered by WPeMatico

Sisense, a company that helps customers understand and visualize their data across multiple sources, announced an $80 million Series E investment today led by Insight Venture Partners. They also announced that Zack Urlocker, former COO at Duo Security and Zendesk, has joined the organization’s board of directors.

The company has attracted a prestigious list of past investors, who also participated in the round, including Battery Ventures, Bessemer Venture Partners, DFJ Venture Capital, Genesis Partners and Opus Capital. Today’s investment brings the total raised to close to $200 million.

CEO Amir Orad says investors like their mission of simplifying complex data with analytics and business intelligence and delivering it in whatever way makes sense. That could be on screens throughout the company, desktop or smartphone, or via Amazon Alexa. “We found a way to make accessing data extremely simple, mashing it together in a logical way and embedding it in every logical place,” he explained.

It appears to be resonating. The company has over 1000 customers including Expedia, Oppenheimer and Phillips to name but a few. Orad says they are actually the analytics engine behind Nasdaq Corporate Solutions, which is the the main investor relations system used by CFOs.

He was not in the mood to discuss the company’s valuation, an exercise he called “an ego boost he doesn’t relate to.” He says that he would prefer to be measured by how efficiently he uses the money investors give him or by customer satisfaction scores. Nor would he deal with IPO speculation. All he would say on that front was, “When you focus on the value you bring, positive things happen.”

In spite of that, he was clearly excited about having Urlocker join the board. He says the two spent six months getting to know each other and he sees a guy who has brought several companies to successful exit joining his team, and perhaps someone who can help him bring his company across the finish line, however that ultimately happens. Just last month, Cisco bought Urlocker’s former company, Duo Security for $2.35 billion.

For now Sisense, which launched in 2010, has another $80 million in the bank. They plan to add to the nearly 500 employees already in place in offices in New York, Tel Aviv, Kiev, Tokyo and Arizona. In particular, they plan to grow their international presence more aggressively, especially adding employees to help with customer success and field engineering. Orad also said that he was also open to acquiring companies should the right opportunity come along, saying “Because of talent, technology and presence, it’s something you have to be on lookout for.”

When a company reaches Series E and a couple of hundred million raised, it’s often a point where an exit could be coming sooner than later. By adding an experienced executive like Urlocker, it just emphasizes that possibility, but for now the company appears to be growing and thriving, and taking the view that whatever will be, will be.

Powered by WPeMatico

Let the computers do the legal busy work so attorneys can focus on complex problem solving for their clients. That’s the lucrative idea behind Atrium LTS, Twitch co-founder Justin Kan’s machine learning startup that digitizes legal documents and builds applications on top to speed up fundraising, commercial contracts, equity distribution and employment issues. For example, one of its apps automatically turns startup funding documents into Excel cap tables.

Automating expensive legal labor has led to a rapid rise to 110 employees and 250 clients for Atrium, including startups like Bird and MessageBird. Atrium only came of stealth a year ago with a $10.5 million party round before going into Y Combinator last winter. Today it announces it’s raised a $65 million round led by Andreessen Horowitz.

In characteristic dude fashion, Kan tells me “I’m pretty stoked about that because of having more resources for Atrium.” The venture firm’s partner Andrew Chen is taking a board seat and famed co-founder Marc Andreessen is joining as a board observer. “I wanted a visionary who’s always going to be pushing us to build something really big,” Kan says. General Catalyst, YC’s Continuity Fund and Ashton Kutcher’s Sound Ventures are also joining the round.

With the massive influx of cash, Atrium will be able to develop more internal tools it can use to crank out client work faster than its traditional competitors. “We can ultimately be this platform on top of which you’re building these legal businesses and eventually other professional services and software services,” Kan explains.”They’re all sitting on top of the platform that understands legal documents.”

In more Atrium news, Y Combinator’s leading partner Michael Seibel will join the startup’s board, too. And it’s acquired Tetra, a YC artificial intelligence startup that had raised $1.5 million to analyze voice, “to help us build our platform that understands and structures data,” Kan tells me.

What Kan didn’t initially mention is that two of Atrium’s co-founders, CTO Chris Smoak and legal partner BeBe Chueh, have left. He later admitted they had transitioned out of the company several months before the new funding. “BeBe wanted to spend time working on family (she just got engaged); Chris and I disagreed on his job role” regarding the definition of the CTO position, Kan tells me. He’ll now be running Atrium with remaining co-founder Augie Rakow, formerly of mega-law firm Orrick, and Kan’s long-term business partner and former McKinsey analyst Nick Cortes.

Justin Kan (Atrium) at TechCrunch Disrupt SF 2017

The law firm business model has left the door open for disruption by technology companies like Atrium. “Law firms generate revenue from hourly billing, and lack an incentive to vastly improve efficiency,” Chen writes. “Many law firms dividend out all their profits at the end of each year, making it hard to invest in the expensive investment of building software. Software is hard to build inside a software company, much less a law firm.”

But Atrium is an engineering company with a legal clientele. It takes the most common and time-consuming activities — often related to ingesting mountains of documents — and builds machine learning workarounds. Atrium’s lawyers can focus on advising their clients on what to do, rather than burning the midnight oil doing it as they look for tiny quirks in the paperwork. The legal services get faster, cheaper and more predictable, so Atrium can offer upfront pricing. It’s been using fundraising workshops and other educational materials to drum up leads.

For now, Atrium’s tech is limited to a narrow band of use cases. But “over $300 billion is spent per year in the enterprise legal market,” Chen writes, so there’s plenty of room to grow now that Atrium is well capitalized. It will have to convince big corporations to ditch the old way and let computers lend a hand. Luckily, Atrium isn’t a SAAS company forcing clients to use the tech themselves. Done right, they shouldn’t even know that it’s machine vision software, not junior associates, pouring over their docs. It will have to out-match fellow legal tech startups like Ravel, CaseText, Judicata, Premonition and more, though they’re often just tools rather than software-equipped law firms.

Kan also cops to his lack of experience in legal. “I think for any full stack vertical startup started by a non-subject matter expert (i.e. me who is not a lawyer), there is a risk that you come in and are very prescriptive on how things work. Then you build software that says ‘the providers must do it this way!’,” Kan tells me. “But the practical reality is that it doesn’t work with the nuanced, non-linear workflows that providers already have. So the technology doesn’t get adopted and fails to provide value. That to me is the biggest upcoming risk.”

Justin Kan, from lifevlogger to legal giant

Yet if Atrium can ease clients into this new world service by service, it could generate network effects that fuel the whole business. It’s just a matter of prioritization. “One of the things I always need to be focused on is…focusing. That’s sometimes a blind spot.” From Justin.tv to Twitch to its acquisition by Amazon to his role as YC partner, Kan delivers, but can be frenetic. “As an entrepreneur, I have a tendency to take on too much.”

But after leaving YC because “I had felt like I’d stopped learning,” Kan has found the legal space so full of knowledge and opportunity that it can hold his attention. “Part of why I like this business is because it was so different. I didn’t think it was something that would be as easily competed with,” Kan recalls. “I had this calendar company and Google came out with something similar. I told [Twitch co-founder] Emmett ‘We have to do something no one can compete with. At least Google will never do this.’ Then they did.”

But unlike with that game streaming startup, Atrium doesn’t have to worry about beating or getting bought by some legal tech giant. Instead, it wants to become one.

Powered by WPeMatico

Sonatype, a cybersecurity-focused open-source company, has raised $80 million from investment firm TPG.

The company said the financing will help extend its Nexus platform, which it touts as an enterprise ready repository manager and library, which among other things tracks code and helps to keep everything in the devops pipeline up-to-date and secure.

It’s that kind of technology that Sonatype says can prevent another Equifax -style breach of over 147 million consumers’ data. Earlier this year, the company found over dozens of Fortune Global 100 companies that downloaded outdated and vulnerable versions of Apache Struts, which Equifax failed to patch or update.

Sonatype’s chief executive Wayne Jackson his company can help prevent those type of breaches.

“We monitor literally millions of open source commits per day,” he told TechCrunch. “Last year hundreds of billions of components were downloaded by software developers, 12 percent of which had known security defects.”

The funding will go to extend the company’s Nexus platform, Jackson said.

The company said it’s had an 81 percent increase in year-over-year sales in the first-half of the year, and 1.5 million users added to its flagship Nexus platform since January. In all, the company has more than 10 million software developers and 1,000 enterprises on Nexus worldwide.

Sonatype’s last round of funding was in 2016, led by Goldman Sachs, snagging $30 million.

Powered by WPeMatico

PagerDuty, the popular service that helps businesses monitor their tech stacks, manage incidents and alert engineers when things go sideways, today announced that it has raised a $90 million Series D round at a valuation of $1.3 billion. With this, PagerDuty, which was founded in 2009, has now raised well over $170 million.

The round was led by T. Rowe Price Associates and Wellington Management . Accel, Andreessen Horowitz and Bessemer Venture Partners participated. Given the leads in this round, chances are that PagerDuty is gearing up for an IPO.

“This capital infusion allows us to continue our investments in innovation that leverages artificial intelligence and machine learning, enabling us to help our customers transform their companies and delight their customers,” said Jennifer Tejada, CEO at PagerDuty in today’s announcement. “From a business standpoint, we can strengthen our investment in and development of our people, our most valuable asset, as we scale our operations globally. We’re well positioned to make the lives of digital workers better by elevating work to the outcomes that matter.”

Currently PagerDuty users include the likes of GE, Capital One, IBM, Spotify and virtually every other software company you’ve ever heard of. In total, more than 10,500 enterprises now use the service. While it’s best known for its alerting capabilities, PagerDuty has expanded well beyond that over the years, though it’s still a core part of its service. Earlier this year, for example, the company announced its new AIOps services that aim to help businesses reduce the amount of noisy and unnecessary alerts. I’m sure there’s a lot of engineers who are quite happy about that (and now sleep better).

Powered by WPeMatico

Roblox, which allows kids to create 3D worlds and games, has raised an additional $150 million in funding.

The company didn’t disclose its valuation in the announcement, but a source with knowledge of the deal told us that it valued Roblox at more than $2.5 billion — the price that Microsoft paid to acquire Minecraft four years ago.

“This is a big year for us that fortifies the dream,” said co-founder and CEO David Baszucki .

Earlier this year, Roblox announced that it had become cash-flow positive, and Baszucki told me the company remains “extremely profitable.” So why raise more money?

“First and foremost, the reason to fundraise is to have a war chest, to have a buffer, to have the opportunity to do acquisitions, to have a strong balance sheet as we grow internationally,” he said.

In order to support that growth, Baszucki said Roblox will be opening offices in some regions like China (“most likely with a partner that hasn’t been announced yet”), but it also requires building out infrastructure like local language and local payment support.

Roblox has now raised a total of $185 million in equity funding. The new round was led by Greylock Partners and Tiger Global, with participation from existing investors Altos Ventures, Index Ventures, Meritech Capital Partners and others.

Greylock’s David Sze has had big successes in both gaming and social media, having backed Facebook, LinkedIn, SGN and others. But he said Roblox is the first company he’s seen to “unify those two together on a platform in a magical kind of way.”

Apparently, Sze has known Baszucki for a long time — their kids went to the same school, and Sze remembered Baszucki bringing an early version of Roblox to the science fair. Gaming companies can be a risky investment, because their business relies on creating new hits, but Sze said Roblox is different.

“They aren’t making the games,” Sze said. “They’re letting the long tail of developers develop all the games on the platform, they’re let users decide what the successes are. It’s much more like a YouTube or much more like an Apple with the App Store.”

In a blog post about the funding, Sze even suggested that some of the next big gaming franchises could emerge from the Roblox platform, a prediction he repeated in our interview

“I’d be surprised if there aren’t some huge, high quality games that aren’t originated on Roblox in the next three-to-five years,” he said.

Roblox says it now has more than 70 million monthly active users, with more than 4 million creators who have built more than 40 million-plus experiences.

Of course, having a big platform with lots of user-generated content also creates risks — as illustrated in a recent incident where characters mimed gang raping a young girl’s avatar. (Roblox said a single server had been hacked, allowing users to upload code that violated the company’s rules.)

Asked whether these risks gave him any pause, Sze said, “User protection, user safety, all the aspects of having of having youth on your platform, it takes those things extremely seriously.”

“Are we perfect? No,” he said. “But I can tell you from inside the company that it’s an incredibly high priority. They’ve already done lots of things to help protect and make the user experience the best, and they have a list of stuff that they’re already working on.”

I’ll be interviewing Baszucki on-stage at Disrupt SF this afternoon, so stay tuned to TechCrunch (or come on out to the event!) for more on the funding and his future plans.

This story has been updated with the corrected amount for Roblox’s total funding.

Powered by WPeMatico

Cloudian, a company that specializes in helping businesses store petabytes of data, today announced that it has raised a $94 million Series E funding round. Investors in this round, which is one of the largest we have seen for a storage vendor, include Digital Alpha, Fidelity Eight Roads, Goldman Sachs, INCJ, JPIC (Japan Post Investment Corporation), NTT DOCOMO Ventures and WS Investments. This round includes a $25 million investment from Digital Alpha, which was first announced earlier this year.

With this, the seven-year-old company has now raised a total of $174 million.

As the company told me, it now has about 160 employees and 240 enterprise customers. Cloudian has found its sweet spot in managing the large video archives of entertainment companies, but its customers also include healthcare companies, automobile manufacturers and Formula One teams.

What’s important to stress here is that Cloudian’s focus is on on-premise storage, not cloud storage, though it does offer support for multi-cloud data management, as well. “Data tends to be most effectively used close to where it is created and close to where it’s being used,” Cloudian VP of worldwide sales Jon Ash told me. “That’s because of latency, because of network traffic. You can almost always get better performance, better control over your data if it is being stored close to where it’s being used.” He also noted that it’s often costly and complex to move that data elsewhere, especially when you’re talking about the large amounts of information that Cloudian’s customers need to manage.

Unsurprisingly, companies that have this much data now want to use it for machine learning, too, so Cloudian is starting to get into this space, as well. As Cloudian CEO and co-founder Michael Tso also told me, companies are now aware that the data they pull in, whether from IoT sensors, cameras or medical imaging devices, will only become more valuable over time as they try to train their models. If they decide to throw the data away, they run the risk of having nothing with which to train their models.

Cloudian plans to use the new funding to expand its global sales and marketing efforts and increase its engineering team. “We have to invest in engineering and our core technology, as well,” Tso noted. “We have to innovate in new areas like AI.”

As Ash also stressed, Cloudian’s business is really data management — not just storage. “Data is coming from everywhere and it’s going everywhere,” he said. “The old-school storage platforms that were siloed just don’t work anywhere.”

Powered by WPeMatico

Sarah Kunst has filed to raise $10 million for her debut venture capital fund, Cleo Capital. According to Axios, the firm will give cash to female entrepreneurs who will act as scouts.

Scouts look for viable early-stage startups for firms to invest in and then receive a cut of the profits on the investments. Kunst, pictured above, is a scout for Sequoia; it’s unclear if that will change now that she’s running her own firm. She’s also the founder of ProDay, a fitness tech startup that had raised at least $500,000 from angel investors, including Arielle Zuckerberg, but folded earlier this year.

We’ve reached out to Kunst for comment.

Cleo isn’t the only female-focused fund with which Kunst is involved. She joined Bumble as a senior adviser in February, and earlier this month, the popular dating app announced the launch of a VC fund targeting early-stage startups with women at the helm. Kunst is co-leading fund strategy alongside Bumble’s COO, Sarah Jones Simmer.

It’s no surprise Kunst is working to deploy capital to the next generation of female-founded companies. She’s been actively championing female and minority founders at least for the last several years and was one of the most vocal in the industry during tech’s #MeToo moment.

She spoke to The New York Times last year about her experience with 500 Startups founder Dave McClure, who sent her inappropriate messages on Facebook in 2014. McClure followed up with a public apology in the form of a Medium post titled “I’m a creep. I’m sorry,” and shortly after resigned from the accelerator.

Kunst spoke at TechCrunch Disrupt last year a few months after The New York Times piece was published. On a panel focused on diversity in tech, she called out tech founders for a lack of diverse hiring practices: “I do this crazy thing that is hiring people that aren’t just white dudes. It works really great — you guys should try it,” she said.

In 2017, only 11.3 percent of partners at VC firms were women, according to PitchBook data. Female founders, meanwhile, raised just 2.2 percent of all venture funding.

On the bright side, it looks like more women are fundraising on the other side of the table. Women-run VC firms have gathered nearly $2.5 billion so far this year, putting them on pace to surpass last year’s decade high of $3.2 billion. That includes Cowboy Ventures’ $95 million fundraise and Aspect Ventures’ $181 million sophomore vehicle. Cowboy is led by Aileen Lee, a former partner at Kleiner Perkins, while Aspect is co-led by former Draper Fisher Jurvetson managing director Jennifer Fonstad and former Accel partner Theresia Gouw.

Powered by WPeMatico

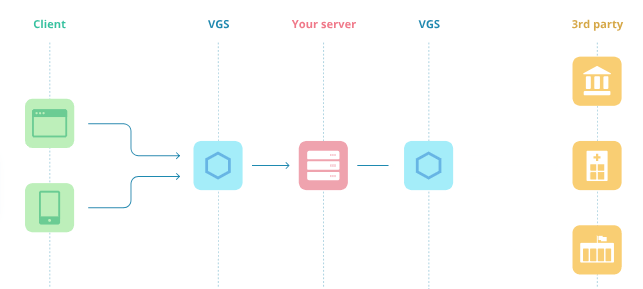

“You can’t hack what isn’t there,” Very Good Security co-founder Mahmoud Abdelkader tells me. His startup assumes the liability of storing sensitive data for other companies, substituting dummy credit card or Social Security numbers for the real ones. Then when the data needs to be moved or operated on, VGS injects the original info without clients having to change their code.

It’s essentially a data bank that allows businesses to stop storing confidential info under their unsecured mattress. Or you could think of it as Amazon Web Services for data instead of servers. Given all the high-profile breaches of late, it’s clear that many companies can’t be trusted to house sensitive data. Andreessen Horowitz is betting that they’d rather leave it to an expert.

That’s why the famous venture firm is leading an $8.5 million Series A for VGS, and its partner Alex Rampell is joining the board. The round also includes NYCA, Vertex Ventures, Slow Ventures and PayPal mafioso Max Levchin. The cash builds on VGS’ $1.4 million seed round, and will pay for its first big marketing initiative and more salespeople.

“Hey! Stop doing this yourself!,” Abdelkader asserts. “Put it on VGS and we’ll let you operate on your data as if you possess it with none of the liability.” While no data is ever 100 percent unhackable, putting it in VGS’ meticulously secured vaults means clients don’t have to become security geniuses themselves and instead can focus on what’s unique to their business.

“Privacy is a part of the UN Declaration of Human Rights. We should be able to build innovative applications without sacrificing our privacy and security,” says Abdelkader. He got his start in the industry by reverse-engineering games like StarCraft to build cheats and trainer software. But after studying discrete mathematics, cryptology and number theory, he craved a headier challenge.

Abdelkader co-founded Y Combinator-backed payment system Balanced in 2010, which also raised cash from Andreessen. But out-muscled by Stripe, Balanced shut down in 2015. While transitioning customers over to fellow YC alumni Stripe, Balanced received interest from other companies wanting it to store their data so they could be PCI-compliant.

Very Good Security co-founder and CEO Mahmoud Abdelkader

Now Abdelkader and his VP from Balanced, Marshall Jones, have returned with VGS to sell that as a service. It’s targeting startups that handle data like payment card information, Social Security numbers and medical info, though eventually it could invade the larger enterprise market. It can quickly help these clients achieve compliance certifications for PCI, SOC2, EI3PA, HIPAA and other standards.

VGS’ innovation comes in replacing this data with “format preserving aliases” that are privacy safe. “Your app code doesn’t know the difference between this and actually sensitive data,” Abdelkader explains. In 30 minutes of integration, apps can be reworked to route traffic through VGS without ever talking to a salesperson. VGS locks up the real strings and sends the aliases to you instead, then intercepts those aliases and swaps them with the originals when necessary.

“We don’t actually see your data that you vault on VGS,” Abdelkader tells me. “It’s basically modeled after prison. The valuables are stored in isolation.” That means a business’ differentiator is their business logic, not the way they store data.

For example, fintech startup LendUp works with VGS to issue virtual credit card numbers that are replaced with fake numbers in LendUp’s databases. That way if it’s hacked, users’ don’t get their cards stolen. But when those card numbers are sent to a processor to actually make a payment, the real card numbers are subbed in last-minute.

VGS charges per data record and operation, with the first 500 records and 100,000 sensitive API calls free; $20 a month gets clients double that, and then they pay 4 cent per record and 2 cents per operation. VGS provides access to insurance too, working with a variety of underwriters. It starts with $1 million policies that can be much larger for Fortune 500s and other big companies, which might want $20 million per incident.

Obviously, VGS has to be obsessive about its own security. A breach of its vaults could kill its brand. “I don’t sleep. I worry I’ll miss something. Are we a giant honey pot?,” Abdelkader wonders. “We’ve invested a significant amount of our money into 24/7 monitoring for intrusions.”

Obviously, VGS has to be obsessive about its own security. A breach of its vaults could kill its brand. “I don’t sleep. I worry I’ll miss something. Are we a giant honey pot?,” Abdelkader wonders. “We’ve invested a significant amount of our money into 24/7 monitoring for intrusions.”

Beyond the threat of hackers, VGS also has to battle with others picking away at part of its stack or trying to compete with the whole, like TokenEx, HP’s Voltage, Thales’ Vormetric, Oracle and more. But it’s do-it-yourself security that’s the status quo and what VGS is really trying to disrupt.

But VGS has a big accruing advantage. Each time it works with a clients’ partners like Experian or TransUnion for a company working with credit checks, it already has a relationship with them the next time another clients has to connect with these partners. Abdelkader hopes that, “Effectively, we become a standard of data security and privacy. All the institutions will just say ‘why don’t you use VGS?’”

That standard only works if it’s constantly evolving to win the cat-and-mouse game versus attackers. While a company is worrying about the particular value it adds to the world, these intelligent human adversaries can find a weak link in their security — costing them a fortune and ruining their relationships. “I’m selling trust,” Abdelkader concludes. That peace of mind is often worth the price.

Powered by WPeMatico