funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Six months after completing Y Combinator’s 12-week accelerator program, The Lobby has closed a $1.2 million investment.

The startup connects job seekers to Wall Street bankers, venture capitalists and other finance “insiders” for advice and personalized career coaching. Founder and former investment banker Deepak Chhugani wants to help people who don’t come from elite backgrounds or have the network of an Ivy League graduate land high-profile finance roles.

“There’s a huge chunk of people that never get noticed,” Chhugani told TechCrunch. “The best opportunities are usually only privy to people that are from those wealthy networks.”

Chhugani, a Bentley University graduate who began his career at Merrill Lynch, believes he was only able to break into Wall Street because the firm had a hole in its Latin America M&A group and he’d grown up in Equador.

He and his other non-Ivy League friends who are or have been employed on Wall Street, in venture capital or private equity, are lucky, he says. Despite being perfectly able to succeed, many people of similar backgrounds have had no such luck navigating the finance job market.

“The Lobby is creating the real meritocracy that we tell ourselves the job market is –– or at least should be,” said Matt Mireles in a statement. Mireles, a scout investor at Social Capital, invested personally in the seed round alongside Y Combinator, Ataria Ventures, 37 Angels, former Travelocity CEO Carl Sparks and Columbia Business School’s chief innovation officer Angela Lee.

Using The Lobby, job seekers can connect with professionals over anonymous 30-minute phone calls. They can get the honest truth about what it’s like to work in finance, a sort-of real-life Glassdoor . Insiders, who are paid by The Lobby’s customers, can also give mock interviews and edit resumes.

As for the name, Chhugani says he can’t promise any of the startup’s customers a job, but he can promise to get them in the lobby.

“The ones who work really hard and deserve it will get up the stairs.”

Powered by WPeMatico

Fast, healthy food is one of those concepts that just seems too good to be true. But Farmer’s Fridge, a Chicago-based startup that recently closed a $30 million Series C round led by former Google CEO Eric Schmidt’s Innovation Endeavors, aims to make that a reality.

Farmer’s Fridge retrofits vending machines to serve up healthy foods — salads, sandwiches, granola, etc. — for people on the go, for anywhere from $5 to about $8. In order to ensure restaurant-quality food, Farmer’s Fridge has a chef on board who receives feedback from customers to constantly tweak the menu and the food. There’s also a large workforce in place to restock the food, which is prepared daily in Farmer’s Fridge’s kitchen, every morning. I tried the food while I was in Chicago, and I must admit that it was good. And this is coming from someone who generally dislikes salad.

While the amount of waste is low (about 5 percent left over) — thanks to its allocation algorithm that determines how much of each type of food to stock in each vending machine location — Farmer’s Fridge has a system in place to deliver leftover food to the Greater Chicago Food Depository, a food bank that works in partnership with 700 agencies, including soup kitchens, shelters and pantries.

“The hypothesis for the business is that it’s been done for ATMs, it’s been done for movies, and those things have nothing to do with each other. So the only connection would be that consumers generally want things that are faster and cheaper and more convenient, as long as they don’t have to sacrifice any quality from the experience,” Farmer’s Fridge founder and CEO Luke Saunders told me at the startup’s headquarters in Chicago.

Farmer’s Fridge founder and CEO Luke Saunders at the startup’s Chicago-based HQ

“So, renting a movie from a kiosk — there’s no difference,” he added. “It’s the same movie when you get home. With food, though, it was interesting because there’s a lot of businesses where the experience is supposedly the most important part, so ‘if you have really good service at a restaurant, could technology actually replace that experience’ was the core question of the business. Or is that an important sustained advantage for a restaurant versus our business model?”

So far, it’s been working. Since launching in 2013, Farmer’s Fridge has deployed 200 vending machines throughout Chicago and Milwaukee. Farmer’s Fridge vending machines can be found in airports, hospitals and in traditional retailers, like pharmacies, convenience stores and even the Amazon Go store in Chicago. Each location gets stocked at least five days a week, while the airport gets stocked seven days a week. Depending on the business partner, Farmer’s Fridge has a revenue model that ranges from subsidized accounts to revenue shares.

“Each vertical behaves really differently,” Saunders said. “In a hospital, they care more about having an amenity overnight for employees who don’t have access to a cafeteria than they do about profitability. At O’Hare International Airport, it’s a revenue share because of the traffic generated. For some retailers, it’s about the traffic Farmer’s Fridge brings to those places.”

The app is probably the least technologically interesting part about Farmer’s Fridge, but what it offers is an easy way to see where you can find a fridge, the inventory of said fridge and the ability to reserve food from that fridge ahead of time. The fridge itself is the real technological achievement. It’s an internet-connected device that runs firmware and features a graphical user interface and cloud infrastructure.

Next year, the plan is to expand regionally and launch in an additional region. In the nearer term, Farmer’s Fridge is expecting to grow from 130 employees today to about 200 by the end of next year.

Powered by WPeMatico

Instana, an application performance monitoring (APM) service with a focus on modern containerized services, today announced that it has raised a $30 million Series C funding round. The round was led by Meritech Capital, with participation from existing investor Accel. This brings Instana’s total funding to $57 million.

The company, which counts the likes of Audi, Edmunds.com, Yahoo Japan and Franklin American Mortgage as its customers, considers itself an APM 3.0 player. It argues that its solution is far lighter than those of older players like New Relic and AppDynamics (which sold to Cisco hours before it was supposed to go public). Those solutions, the company says, weren’t built for modern software organizations (though I’m sure they would dispute that).

What really makes Instana stand out is its ability to automatically discover and monitor the ever-changing infrastructure that makes up a modern application, especially when it comes to running containerized microservices. The service automatically catalogs all of the endpoints that make up a service’s infrastructure, and then monitors them. It’s also worth noting that the company says that it can offer far more granular metrics that its competitors.

Instana says that its annual sales grew 600 percent over the course of the last year, something that surely attracted this new investment.

“Monitoring containerized microservice applications has become a critical requirement for today’s digital enterprises,” said Meritech Capital’s Alex Kurland. “Instana is packed with industry veterans who understand the APM industry, as well as the paradigm shifts now occurring in agile software development. Meritech is excited to partner with Instana as they continue to disrupt one of the largest and most important markets with their automated APM experience.”

The company plans to use the new funding to fulfill the demand for its service and expand its product line.

Powered by WPeMatico

23andMe, IBM and now uBiome is the next tech company to jump into the lucrative multi-billion dollar drug discovery market.

The company started out with a consumer gut health test to check whether your intestines carry the right kind of bacteria for healthy digestion but has since expanded to include over 250,000 samples for everything from the microbes on your skin to vaginal health — the largest data set in the world for these types of samples, according to the company.

Founder Jessica Richman now says there’s a wider opportunity to use this data to create value in therapeutics.

To support its new drug discovery efforts, the San Francisco-based startup will be moving its therapeutics unit into new Cambridge, Massachusetts headquarters and appointing former Novartis CEO Joseph Jimenez to the board of directors as well.

The company has a healthy pile of cash to help build out that new HQ, too, with a fresh $83 million Series C, lead by OS Fund and in participation with 8VC, Y Combinator, Dentsu Ventures and others.

The drug discovery market is slated to be worth nearly $86 billion by 2022, according to BCC Research numbers. New technologies — those that solve logistics issues and shorten the time between research and getting a drug to market in particular — are driving the growth and that’s where uBiome thinks it can get into the game.

“This financing allows us to expand our product portfolio, increase our focus on patent assets and further raise our clinical profile, especially as we begin to focus on commercialization of drug discovery and development of our patent assets,” Richman said.

Though its unclear at this time which drug maker the company might partner up with, Richman did say there would be plenty to announce later on that front.

So far, the company has published over 30 peer-reviewed papers on microbiome research, has entered into research partnerships with the likes of the Center for Disease Control (CDC) and leading research institutions such as Harvard, MIT and Stanford and has previously raised $22 million in funding. The additional VC cash puts the total amount raised to $105 million to date.

Powered by WPeMatico

GitLab, the developer service that aims to offer a full lifecycle DevOps platform, today announced that it has raised a $100 million Series D funding round at a valuation of $1.1 billion. The round was led by Iconiq.

As GitLab CEO Sid Sijbrandij told me, this round, which brings the company’s total funding to $145.5 million, will help it enable its goal of reaching an IPO by November 2020.

According to Sijbrandij, GitLab’s original plan was to raise a new funding round at a valuation over $1 billion early next year. But since Iconiq came along with an offer that pretty much matched what the company set out to achieve in a few months anyway, the team decided to go ahead and raise the round now. Unsurprisingly, Microsoft’s acquisition of GitHub earlier this year helped to accelerate those plans, too.

“We weren’t planning on fundraising actually. I did block off some time in my calendar next year, starting from February 25th to do the next fundraise,” Sijbrandij said. “Our plan is to IPO in November of 2020 and we anticipated one more fundraise. I think in the current climate, where the macroeconomics are really good and GitHub got acquired, people are seeing that there’s one independent company, one startup left basically in this space. And we saw an opportunity to become best in class in a lot of categories.”

As Sijbrandij stressed, while most people still look at GitLab as a GitHub and Bitbucket competitor (and given the similarity in their names, who wouldn’t?), GitLab wants to be far more than that. It now offers products in nine categories and also sees itself as competing with the likes of VersionOne, Jira, Jenkins, Artifactory, Electric Cloud, Puppet, New Relic and BlackDuck.

As Sijbrandij stressed, while most people still look at GitLab as a GitHub and Bitbucket competitor (and given the similarity in their names, who wouldn’t?), GitLab wants to be far more than that. It now offers products in nine categories and also sees itself as competing with the likes of VersionOne, Jira, Jenkins, Artifactory, Electric Cloud, Puppet, New Relic and BlackDuck.

“The biggest misunderstanding we’re seeing is that GitLab is an alternative to GitHub and we’ve grown beyond that,” he said. “We are now in nine categories all the way from planning to monitoring.”

Sijbrandij notes that there’s a billion-dollar player in every space that GitLab competes. “But we want to be better,” he said. “And that’s only possible because we are open core, so people co-create these products with us. That being said, there’s still a lot of work on our side, helping to get those contributions over the finish line, making sure performance and quality stay up, establish a consistent user interface. These are things that typically don’t come from the wider community and with this fundraise of $100 million, we will be able to make sure we can sustain that effort in all the different product categories.”

Given this focus, GitLab will invest most of the funding in its engineering efforts to build out its existing products but also to launch new ones. The company plans to launch new features like tracing and log aggregation, for example.

With this very public commitment to an IPO, GitLab is also signaling that it plans to stay independent. That’s very much Sijbrandij’s plan, at least, though he admitted that “there’s always a price” if somebody came along and wanted to acquire the company. He did note that he likes the transparency that comes with being a public company.

“We always managed to be more bullish about the company than the rest of the world,” he said. “But the rest of the world is starting to catch up. This fundraise is a statement that we now have the money to become a public company where we’re not we’re not interested in being acquired. That is what we’re setting out to do.”

Powered by WPeMatico

After rebranding earlier this year and scrapping pretty much their whole mobile ads business, Wove, formerly known as TapFwd, has a fresh plan to disrupt the marketing industry.

Co-founders Eddie Siegel and Alex Wasserman have built what they call a brand collaboration network, a new way for companies to form marketing partnerships with similar brands. They say sourcing and closing a deal with another company on Wove is as easy as sending a Facebook friend request.

“Marketers don’t want to sell data with each other and they don’t want to share data with each other,” Siegel told TechCrunch. “They want to grow their core business and leverage their data assets without having to share it with another company, and they need a third-party network to form these partnerships.”

With the launch of their latest product comes new money: Wove has raised $9 million in a round led by August Capital, with participation from new investors Origin Ventures, Walmart’s SVP of U.S. e-commerce Anthony Soohoo, Canaan Partners general partner Deepak Kamra and existing investors Partech Partners, Angel Pad and Tekton Ventures. Partech previously led TapFwd’s $3 million seed round.

To develop a marketing partnership with Wove, a company has to sign up and pay an annual fee. Once you have an account, Wove will make recommendations of companies — other Wove users — to work with based on their market and/or customer demographic. When a pair of companies express mutual interest, Wove handles the execution and measures the effectiveness of the partnership with its suite of digital tools built into the platform.

Here’s an example of a hypothetical partnership born out of Wove: A dog-walking startup like Wag logs onto Wove and is matched with Ollie, a dog food startup. The pair agree to set up a short-term promotion, providing discounts to Ollie customers if they set up a Wag account and vice versa. Wove then negotiates the terms of the partnership, develops the promotional materials and ultimately determines how well that partnership bolstered the businesses.

The idea for this marketing matchmaking service came, Siegel says, from TapFwd’s customers.

“We got here because our customers pulled us over here,” Siegel said. “This originally grew as a pretty organic side project and now we are catching up to the customer demand. We have a lot more demand than we can service.”

With the $9 million investment, the San Francisco-based startup, which counts HotelTonight, Turo and Winc as customers, plans to scale its engineering team.

August Capital’s Howard Hartenbaum has joined the startup’s board of directors as part of the round.

Powered by WPeMatico

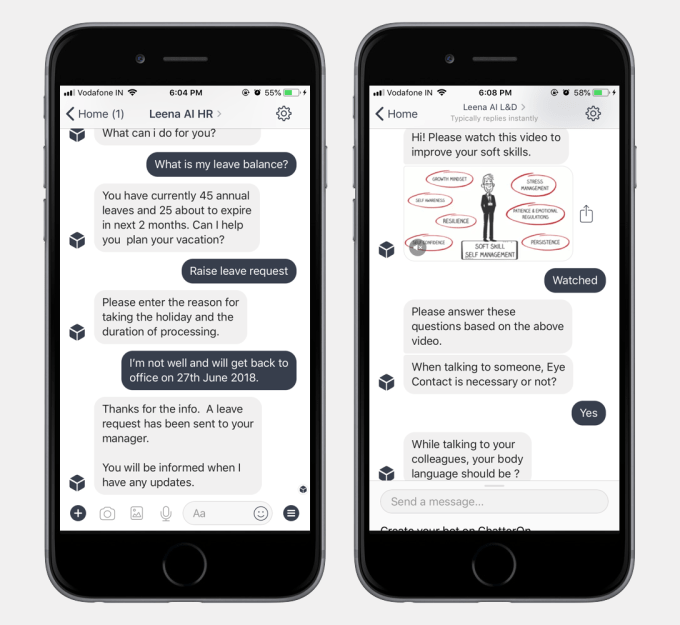

Leena AI, a recent Y Combinator graduate focusing on HR chatbots to help employees answer questions like how much vacation time they have left, announced a $2 million seed round today from a variety of investors including Elad Gil and Snapdeal co-founders Kunal Bahl and Rohit Bansal.

Company co-founder and CEO Adit Jain says the seed money is about scaling the company and gaining customers. They hope to have 50 enterprise customers within the next 12-18 months. They currently have 16.

We wrote about the company in June when it was part of the Y Combinator Summer 2018 class. At the time Jain explained that they began in 2015 in India as a company called Chatteron. The original idea was to help others build chatbots, but like many startups, they realized there was a need not being addressed, in this case around HR, and they started Leena AI last year to focus specifically on that.

As they delved deeper into the HR problem, they found most employees had trouble getting answers to basic questions like how much vacation time they had or how to get a new baby on their health insurance. This forced a call to a help desk when the information was available online, but not always easy to find.

Jain pointed out that most HR policies are defined in policy documents, but employees don’t always know where they are. They felt a chatbot would be a good way to solve this problem and save a lot of time searching or calling for answers that should be easily found. What’s more, they learned that the vast majority of questions are fairly common and therefore easier for a system to learn.

Employees can access the Leena chatbot in Slack, Workplace by Facebook, Outlook, Skype for Business, Microsoft Teams and Cisco Spark. They also offer Web and mobile access to their service independent of these other tools.

Photo: Leena AI

What’s more, since most companies use a common set of backend HR systems like those from Oracle, SAP and NetSuite (also owned by Oracle), they have been able to build a set of standard integrators that are available out of the box with their solution.

The customer provides Leena with a handbook or a set of policy documents and they put their machine learning to work on that. Jain says, armed with this information, they can convert these documents into a structured set of questions and answers and feed that to the chatbot. They apply Natural Language Processing (NLP) to understand the question being asked and provide the correct answer.

They see room to move beyond HR and expand into other departments such as IT, finance and vendor procurement that could also take advantage of bots to answer a set of common questions. For now, as a recent YC graduate, they have their first bit of significant funding and they will concentrate on building HR chatbots and see where that takes them.

Powered by WPeMatico

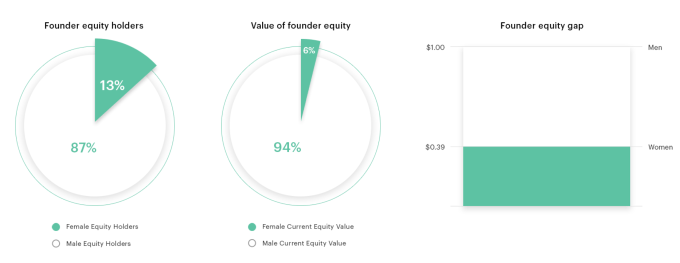

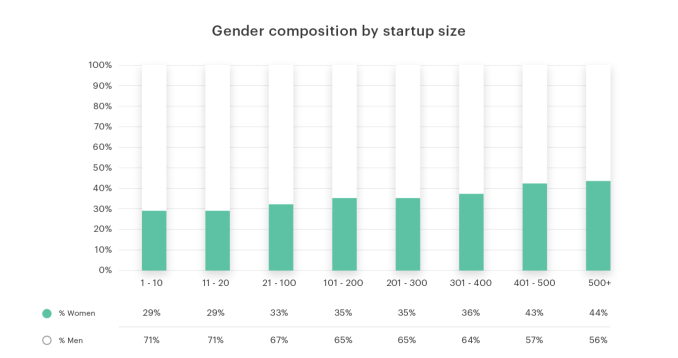

Even bigger than the salary gap that sees women earn $.82 on the dollar is the equity gap. A new study from Carta and the ex-Twitter female investor group #Angels reveals that women make up 35 percent of startup equity-holding employees, yet own just 20 percent of the equity. That means they own just $0.47 for every $1 that men own. Even worse, women account for 13 percent of startup founders but just 6 percent of founder equity — or merely $0.39 on the dollar.

Combined, that means only 9 percent of founder and employee startup equity is owned by women.

“This is not just about wealth” says #Angels’ Chloe Sladden. “Wealth from successful exits goes on to shape the entire industry. It’s about who has power and who gets to decide what gets funded.” #Angels’ Jessica Verrilli notes that “Having this data is going to be a watershed moment and catalyze more urgency to address this underrepresentation.”

The study by cap table management tool Carta (formerly eShares) looked at a subset of its privately held company customers including roughly 180,000 employees, 15,000 founders, and 6,000 companies encompassing $45 billion in equity value.

Amongst the hypothesized causes of the gap are that female-led startups get valued lower and diluted more, there’s less total capital allocated to women due to investor and industry bias, the underrepresentation of women as investors, challenges facing women during negotiations, and that they often team-up with more co-founders that have to split the equity pool.

#Angels’ Jana Messerschmidt explains that the gap table spotlights how women aren’t being hired for early engineering and leadership positions. These roles often get the lion’s share of equity, and when women are hired for sales, marketing, and HR jobs, “those folks are getting less equity because they are joining later and we have a hypothesis of how those roles are valued differently.” Sladden reminds founders to focus on diversity from day one. “Don’t push this off as something you’ll fix down the road as you’re facing all the other challenges.”

Once a successful startup gets acquired or IPOs and paper money turns into cash, tech workers often reinvest their winnings into more startups as angels, fund LPs, or by starting their own venture firm. If only men are getting enough equity to make those downstream investments, their biases could further unbalance the gender breakdown of the tech industry. The #Angels say they’ve found this translates into fewer fundraising term sheets and bargaining power for female founders when they come to the Sand Hill Road boy’s club for venture capital.

Beyond more diverse hiring, the #Angels believe it’s critical that the industry demystify equity so more women know how to exercise stock options and score tax advantages for maximum gain. “You shouldn’t need to have an MBA to know the importance of equity and how to negotiate for it” says Sladden. Better financing avenues for those women who need up-front capital to exercise their stock options could also ensure it’s not just those who already have money who can make money through equity.

Sladden concludes, “We hope this is going to start a movement. We hope that CEOs will start to measure it and talk about it.”

Powered by WPeMatico

On-demand delivery service Postmates announced this morning that it has raised $300 million in additional funding led by Tiger Global Management.

While the company’s press release doesn’t mention this, Fortune reports that the deal valued Postmates at $1.2 billion. Tiger’s Scott Schleifer is joining the board of directors.

Postmates does say that it’s completing “millions” of deliveries every month and is profitable in 90 percent of its markets, and that over the past four years, gross margins have “improved dramatically to nearly 50%.”

Over the past few months, Postmates expanded into more than 100 new cities (it’s now available in more than 400 U.S. cities, as well as Mexico City) and also announced partnerships with companies like Instacart and Walmart.

Postmates previously raised a $140 million round at a $600 million valuation in 2016. More broadly, it looks like VCs aren’t backing away from the on-demand delivery market — DoorDash, for example, recently raised $250 million at a $4 billion valuation.

“The transformation of how commerce moves in cities demands that we build the most innovative tools for businesses to keep up and distribute their products to the modern consumer — efficiently and cost effectively,” said Postmates CEO Bastian Lehmann in the release. “Postmates is proud to be the first and largest on-demand network that is enabling the growth of retail across the country, and today’s investment accelerates our ability to pair technology with the vitality of our neighborhoods.”

Powered by WPeMatico

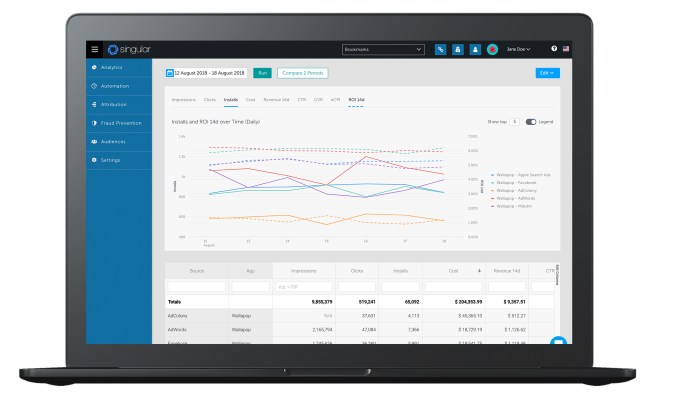

Singular, a startup working to unify data for marketers, is announcing that it has raised $30 million in Series B funding.

The company was founded by former Onavo executives, including Gadi Eliashiv, Eran Friedman and Susan Kuo — who now serve, respectively, as Singular’s CEO, CTO and COO.

Eliashiv explained that Singular was created in response to “this trend of data explosion in the marketing stack,” which require marketers to pull data from hundreds or thousands of different systems.

“Essentially what we see is the creation of this new category of marketing intelligence, where the complexity of the marketing stack has created the need for this layer that sits on top,” he said. “It doesn’t matter if you use a marketing cloud like Adobe that’s bundling five products together — at the end of the day, you need a layer on top making sense of it, helping you make better decisions.”

Eliashiv said Singular is able to go from a high-level dashboard summary for CMOs to “the finest level of detail.” He also noted that while the company is designed to integrate with existing marketing tools, it will “oftentimes displace smaller point solutions.”

“Our principal is, it has to be relevant for data, meaning we’re never going to displace your ad-buying tool,” he added. “It’s not what we do. We’re an intelligence platform.”

The idea of unifying marketing data is one that I hear a lot, but Eliashiv’s claims seem weightier when you see that Singular is already working with a number of big names, including Lyft, Yelp, Airbnb, LinkedIn, Symantec, Zynga, Match and Twitter.

Singular previously raised $20 million in funding. Norwest Venture Partners led the new round, with partner Scott Beechuk joining the board of directors.

Beechuk told me that he’d been studying the marketing analytics market for quite some time, and he argued, “There is something really unique and special about Singular. It’s the bridge between mobile, web and offline, all on a single platform.”

“What you’re going to find is, there are going to be a lot of technologies that Singular replaces,” Beechuk continued. “Let’s say a CMO or [chief growth officer] has 300 different outlets where they are advertising … Every one of those systems tends to have their own analytics built in. The first thing Singular does, it replaces all of those analytics systems with a single pane of glass.”

General Catalyst, Method Capital, Telstra Ventures, Translink Capital and Thomvest also participated in the new funding.

Powered by WPeMatico