funding

Auto Added by WPeMatico

Auto Added by WPeMatico

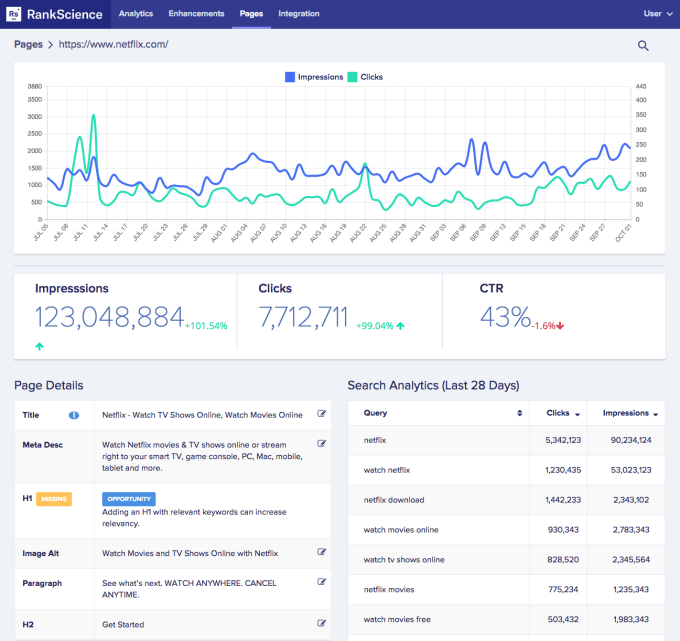

A couple of years ago YC-backed RankScience, which offers AI-enhanced SEO split-testing, put a few SEO experts’ noses out of joint when the fledgling startup brashly talked about replacing human expertise with automation.

Two years on its pitch has mellowed, with the team saying their self-service platform is “augmenting human SEO ability rather than replacing them”.

The startup has also — finally — closed a seed round, announcing $1.8M led by Initialized Capital, along with Adam D’Angelo, Michael Seibel, BoxGroup, Liquid2 Ventures, FundersClub, and Jenny 8 Lee participating.

The new roster of investors join a list of prior backers that includes Y Combinator, 500 Startups, Christina Cacioppo, and Jack Groetzinger.

So what took them so long? Founder Ryan Bednar tells TechCrunch they wanted to take their time with the seed, rather than raise more money than they needed — a position that was possible thanks to already being profitable at YC Demo Day.

“I admit that this is unusual,” he says of the slow seed, though he also says they did raise a “small amount” after demo day, before filling out the rest this month.

“I saw many YC batchmates raising massive rounds pre product-market-fit, which can end up being a mistake,” he adds. “We probably could have raised a few million at Demo Day but ultimately didn’t feel we were ready for it. I didn’t know what I would spend the money on, and we were growing without it, so we chose not to. I wanted to raise capital when I felt we were ready to use it for growth, and now’s that time.”

Bednar also says he is “selective” when it comes to investors — and “specifically” wanted to work with Initialized, saying he’s “known Garry and Alexis personally for years, and trust that they would support us in building a long-term scalable business”.

Commenting on the funding to TechCrunch, Initialized Capital’s Alexis Ohanian tells us: “Even though so many businesses depend on traffic from search, it’s a challenge for them to be data-driven about SEO. RankScience makes it easy to test changes to your website that can lift search traffic. They also automate a growing number of technical SEO tasks, which otherwise would take engineers away from building product and infrastructure, which is really exciting.”

RankScience plans to use the fresh funding to hire more AI and machine learning engineers, with headcount growth targeted at its SF office.

While the founders have stepped back from pronouncing ‘the death of the SEO expert’, they are still touting the power of automation AI for SEO — noting how, after crawling a customer’s site/s, the software automatically proposes “SEO enhancements and experiments” to customers — for “one-click [human] approval”.

It also includes what Bednar bills as a “self-driving car mode” — where the tech will deploy the touted “enhancements and experiments” without customer approval. But he concedes it’s not for all RankScience users.

“For about half of our customers, we’re their only SEO vendor so we automate SEO services 100% for them, and for the other half, our software augments human SEO ability, either from in-house marketers or agencies,” he says, explaining how the team has evolved their thinking on automation vs human agency and expertise.

“When we launched we didn’t think hard enough about what sorts of controls SEO managers at larger websites would want, and we tried to automate everything without giving marketers enough control. This was a mistake and we’ve worked hard on correcting it.

“This should have been obvious but it turns out that SEO managers are highly selective about what sorts of HTML changes our software might make to their webpages. So we’ve spent the past year building tools to give SEO marketers complete control over everything our software does, and also advanced editors and tools so they can create their own SEO enhancements and run SEO split tests through the platform.”

For those who make use of RankScience’s ‘Self-Driving Car Mode’ the software is replacing SEO staff “completely”, but he adds: “This works especially well for startups and medium size businesses. But SEO is such a multifaceted problem, we want to give larger companies with marketing teams complete control over our platform, and so we work with both types of customers.”

As well as (finally) closing out its seed round now, RankScience is also launching a new self-service platform for startups and SMEs — touting greater controls.

On the customer front, Bednar says they have “hundreds” of sites on the platform now — and are serving “hundreds of millions of page views per month”. Cumulatively he says they’ve deployed “millions” of SEO split tests at this point.

“Our customers run the gamut from startups just getting started with SEO to publicly-traded companies,” he continues. “Our best industries are SaaS, ecommerce, marketplaces, healthcare, publishing, and location-based sites.

“We’ve recently been working with more consumer goods brands, and we’ve also launched a partnership program so that we can work with SEO and Digital Marketing Agencies and independent consultants.”

He says the vast majority of RankScience users are based in the US at this stage but adds that Europe is a “growing market”.

In terms of competition, Bednar name-checks the likes of Moz, Conductor (acquired this year by WeWork), BloomReach and BrightEdge — so it is swimming in a pool with some very big fish.

“Most of these products are more akin to advanced SEO analytics suites, and we differ in that RankScience is 100% focused on data-driven SEO automation,” he says, fleshing out the differences and RankScience’s edge, as he sees it. “Our software doesn’t just tell you what changes to make to your site to increase search traffic, it actually makes the changes for you. (Now with more controls!)”

Powered by WPeMatico

Photographer: Daro Sulakauri/Bloomberg

According to a new study conducted by the Center for American Entrepreneurship and NYU’s Shack Institute of Real Estate, the US may be losing its competitive advantage as the dominant nucleus of the startup and venture capital universe.

The analysis, led by senior Brookings Institution fellow Ian Hathaway and “Rise of the Creative Class” author Richard Florida, examines the flow of venture capital over 100,000 deals from 2005 to 2017 and details how the historically US-centric practice of venture capital has become a global phenomenon.

While the US still appears to produce the largest amount of venture activity in the world, America’s share of the global pie is falling dramatically and doing so quickly.

In the mid-90s, the US accounted for more than 95% of global venture capital investment. By 2012, this number had fallen to 70%. At the end of 2017, the US share of total venture investment had fallen to just 50%.

Over the last decade, non-US countries have propelled growth in the global startup and venture economy, which has swelled from $50 billion to over $170 billion in size. In particular, China, India and the UK now account for a third of global venture deal count and dollars – 2-3x the share held ten years ago. And with VC dollars increasingly circulating into modernizing Asia-Pac and European cities, the researchers found that the erosion in the US share of venture capital is trending in the wrong direction.

We’ve spent the summer discussing the notion of Silicon Valley reaching its parabolic peak – Observing the “rise of the rest” across smaller American tech hubs. In reality, the data reveals a “rise in the rest of the world”, with startup ecosystems outside the US growing at a faster pace than most US hubs.

The Bay Area remains the world’s preeminent beneficiary of VC investment, and New York, Los Angeles, and Boston all find themselves in the top ten cities contributing to global venture growth. However, only six of the top 20 cities are located in the US, while 14 are in Asia or Europe. At the individual level, only two American cities crack the top 20 fastest growing startup hubs.

Still, the authors found the bulk of VC activity remains highly concentrated in a small number of incumbent startup cities. More than 50% of all global venture capital deployed can be attributed to only six cities and half of the growth in VC activity over the last five years can be attributed to just four cities. Despite the growing number of ecosystems playing a role in venture decisions, the dominant incumbent startup hubs hold a firm grip on the majority of capital deployed.

Unsurprisingly, the largest contributor to the globalization of venture capital and the slimming share of the US is the rapid escalation of China’s startup ecosystem.

In the last three years, China has captured nearly a fourth of total VC investment. Since 2010, Beijing contributed more to VC deployment growth than any other city, while three other Chinese cities (Shanghai, Hangzhou, Shenzhen) fell in the top 15.

A major part of China’s ascension can be tied to the idiosyncratic rise of late-stage “mega deals”, which the study defines as $500 million or more in size. Once an extremely rare occurrence, mega deals now make up a significant portion of all venture dollars deployed. From 2005-2007, only two mega deals took place. From 2010-2012, eight of such deals took place. From 2015-2017, there were 80 global mega deals, representing a fifth of the total venture capital activity. Chinese cities accounted for half of all mega deal investment over the same period.

It’s not all bad for the US, with the study highlighting continued ecosystem growth in established US hubs and leading roles for non-valley markets in NY, LA, and Boston.

And the globalization of the startup and venture economy is by no means a “bad thing”. In fact, access to capital, the spread of entrepreneurial spirit, and stronger global economic development and prosperity is almost unquestionably a “good thing.”

However, the US’ share of venture-backed startups is falling, and the US losing its competitive advantage in the startup and venture capital market could have major implications for its future as a global economic leader. Five of the six largest US companies were previously venture-backed startups and now provide a combined value of around $4 trillion.

The intense competition for talent marks another major challenge for the US who has historically been a huge beneficiary of foreign-born entrepreneurs. With the rise of local ecosystems across the globe, entrepreneurs no longer have to flock to the US to build their companies or have access to venture capital. The problem attracting entrepreneurs is compounded by notoriously unfriendly US visa policies – not to mention recent harsh rhetoric and tension over immigration that make the US a less attractive destination for skilled immigrants.

At a recent speaking event, Florida stated he believed the US’ fading competitive advantage was a greater threat to American economic power than previous collapses seen in the steel and auto industries. A sentiment echoed by Techstars co-founder Brad Feld, who in the report’s forward states, “government leaders should read this report with alarm.”

It remains to be seen whether the train has left the station or if the US can hold on to its position as the world’s venture leader. What is clear is that Silicon Valley is no longer the center of the universe and the geography of the startup and venture capital world is changing.

“The Rise of the Global Startup City: The New Map of Entrepreneurship and Venture Capital” tries to illustrate these tectonic shifts and identifies tiers of global startup cities based on size, growth and balance of VC deals and investments.

Powered by WPeMatico

When Amazon rolled out its membership-based two-day shipping service in 2005, e-commerce and customer expectations around fulfillment speed changed forever.

Today, more than 100 million people use Amazon Prime. That means, 100 million people are fully accustomed to two-day shipping and if they can’t have it, they shop elsewhere. As The Wall Street Journal’s Christopher Mims recently put it: “Alongside life, liberty and the pursuit of happiness, you can now add another inalienable right: two-day shipping on practically everything.”

Only recently have Amazon’s competitors begun to offer similar fast delivery options. About two years ago, Walmart launched its own free two-day delivery service for its owned-inventory; eBay followed suit, establishing a three-day or less delivery guaranteed option for shoppers in March 2017.

To power these Prime-like delivery options, Walmart, eBay and the Canadian e-commerce business Shopify are relying on a little upstart.

One-year-old Deliverr helps businesses offer rapid delivery experiences to their customers. Today, the company is announcing a $7.1 million Series A led by Joe Lonsdale’s 8VC, with participation from Zola founder Shan-Lyn Ma, Flexport chief executive officer Ryan Peterson and others.

The San Francisco-based startup uses machine learning and predictive intelligence to determine which of its warehouses to store its client’s goods.

Currently, Deliverr operates out of more than 10 warehouses in Texas, Missouri, Pennsylvania, Ohio and New Jersey, among other states, though co-founder Michael Krakaris says that number is growing every week. Its customers typically store inventory in three to five different locations based on Deliverr’s predictive algorithms.

Unlike Amazon, which owns more than 75 fulfillment centers, Deliverr doesn’t own its warehouses. Krakaris describes the company’s strategy as a sort of Uber for fulfillment.

“Uber didn’t change the physical infrastructure of cars. They didn’t build their own taxis. What they did was create software that could connect excess capacity drivers,” Krakaris told TechCrunch. “Most warehouses aren’t going to be full. We are going in and filling that extra space they wouldn’t otherwise fill.”

One of the startup’s tricks is to use brand-neutral packaging so any and all marketplaces could theoretically power fulfillment through Deliverr. Amazon, of course, sticks a Prime sticker on all its outgoing packages. And because Amazon’s fulfillment service is used by some eBay sellers, eBay items are known to show up at customers’ homes in Amazon-branded packaging. Not a great look for eBay.

“You need an independent fulfillment service that can handle all these different fulfillment channels and be neutral,” Krakaris said.

Deliverr plans to use the investment to scale its team and ink partnerships with additional online retailers.

Powered by WPeMatico

Consumer messaging apps like WhatsApp are not only insanely popular for chatting with friends but have pushed deep into the workplace too, thanks to the speed and convenience they offer. They have even crept into hospitals, as time-strapped doctors reach for a quick and easy way to collaborate over patient cases on the ward.

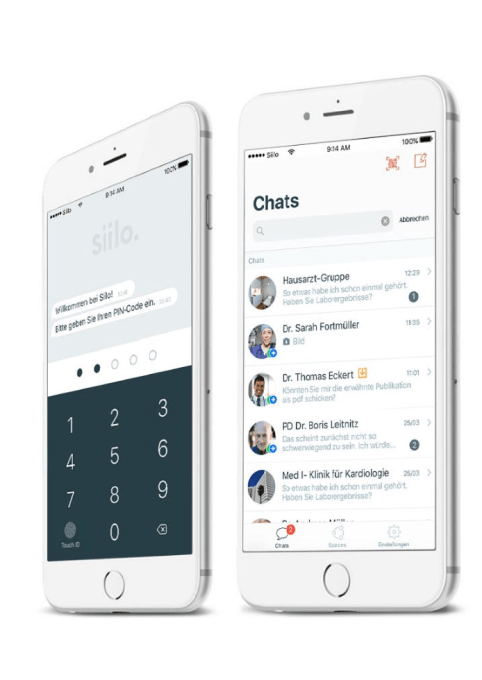

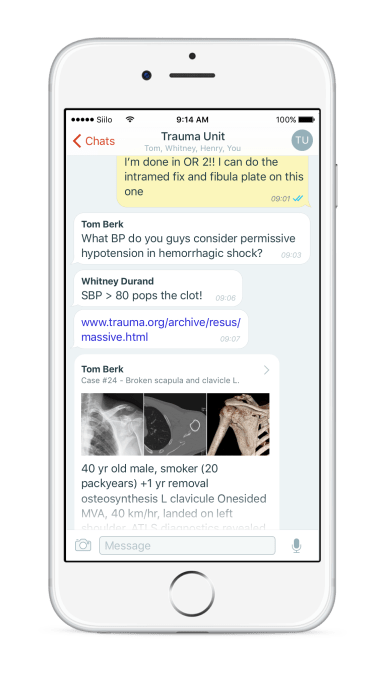

Yet WhatsApp is not specifically designed with the safe sharing of highly sensitive medical information in mind. This is where Dutch startup Siilo has been carving a niche for itself for the past 2.5 years — via a free-at-the-point-of-use encrypted messaging app that’s intended for medical professions to securely collaborate on patient care, such as via in-app discussion groups and being able to securely store and share patient notes.

A business goal that could be buoyed by tighter EU regulations around handling personal data, say if hospital managers decide they need to address compliance risks around staff use of consumer messaging apps.

The app’s WhatsApp-style messaging interface will be instantly familiar to any smartphone user. But Siilo bakes in additional features for its target healthcare professional users, such as keeping photos, videos and files sent via the app siloed in an encrypted vault that’s entirely separate from any personal media also stored on the device.

Messages sent via Siilo are also automatically deleted after 30 days unless the user specifies a particular message should be retained. And the app does not make automated back-ups of users’ conversations.

Other doctor-friendly features include the ability to blur images (for patient privacy purposes); augment images with arrows for emphasis; and export threaded conversations to electronic health records.

There’s also mandatory security for accessing the app — with a requirement for either a PIN-code, fingerprint or facial recognition biometric to be used. While a remote wipe functionality to nix any locally stored data is baked into Siilo in the event of a device being lost or stolen.

Like WhatsApp, Siilo also uses end-to-end encryption — though in its case it says this is based on the opensource NaCl library

It also specifies that user messaging data is stored encrypted on European ISO-27001 certified servers — and deleted “as soon as we can”.

It also says it’s “possible” for its encryption code to be open to review on request.

Another addition is a user vetting layer to manually verify the medical professional users of its app are who they say they are.

Siilo says every user gets vetted. Though not prior to being able to use the messaging functions. But users that have passed verification unlock greater functionality — such as being able to search among other (verified) users to find peers or specialists to expand their professional network. Siilo says verification status is displayed on profiles.

“At Siilo, we coin this phenomenon ‘network medicine’, which is in contrast to the current old-fashioned, siloed medicine,” says CEO and co-founder Joost Bruggeman in a statement. “The goal is to improve patient care overall, and patients have a network of doctors providing input into their treatment.”

While Bruggeman brings the all-important medical background to the startup, another co-founder, Onno Bakker, has been in the mobile messaging game for a long time — having been one of the entrepreneurs behind the veteran web and mobile messaging platform, eBuddy.

A third co-founder, CFO Arvind Rao, tells us Siilo transplanted eBuddy’s messaging dev team — couching this ported in-house expertise as an advantage over some of the smaller rivals also chasing the healthcare messaging opportunity.

It is also of course having to compete technically with the very well-resourced and smoothly operating WhatsApp behemoth.

“Our main competitor is always WhatsApp,” Rao tells TechCrunch. “Obviously there are also other players trying to move in this space. TigerText is the largest in the US. In the UK we come across local players like Hospify and Forward.

“A major difference we have very experienced in-house dev team… The experience of this team has helped to build a messenger that really can compete in usability with WhatsApp that is reflected in our rapid adoption and usage numbers.”

“Having worked in the trenches as a surgery resident, I’ve experienced the challenges that healthcare professionals face firsthand,” adds Bruggeman. “With Siilo, we’re connecting all healthcare professionals to make them more efficient, enable them to share patient information securely and continue learning and share their knowledge. The directory of vetted healthcare professionals helps ensure they’re successful teamplayers within a wider healthcare network that takes care of the same patient.”

Siilo launched its app in May 2016 and has since grown to ~100,000 users, with more than 7.5 million messages currently being processed monthly and 6,000+ clinical chat groups active monthly.

“We haven’t come across any other secure messenger for healthcare in Europe with these figures in the App Store/Google Play rankings and therefore believe we are the largest in Europe,” adds Rao. “We have multiple large institutions across Western-Europe where doctors are using Siilo.”

On the security front, as well flagging the ISO 27001 certification the company has gained, he notes that it obtained “the highest NHS IG Toolkit level 3” — aka the now replaced system for organizations to self-assess their compliance with the UK’s National Health Service’s information governance processes, claiming “we haven’t seen [that] with any other messaging company”.

Siilo’s toolkit assessment was finalized at the end of Febuary 2018, and is valid for a year — so will be up for re-assessment under the replacement system (which was introduced this April) in Q1 2019. (Rao confirms they will be doing this “new (re-)assessment” at the end of the year.)

As well as being in active use in European hospitals such as St. George’s Hospital, London, and Charité Berlin, Germany, Siilo says its app has had some organic adoption by medical pros further afield — including among smaller home healthcare teams in California, and “entire transplantation teams” from Astana, Kazakhstan.

It also cites British Medical Journal research that found that of the 98.9% of U.K. hospital clinicians who now have smartphones, around a third are using consumer messaging apps in the clinical workplace. Persuading those healthcare workers to ditch WhatsApp at work is Siilo’s mission and challenge.

The team has just announced a €4.5 million (~$5.1M) seed to help it get onto the radar of more doctors. The round is led by EQT Ventures, with participation from existing investors. It says it will be using the funding to scale up its user base across Europe, with a particular focus on the UK and Germany.

Commenting on the funding in a statement, EQT Ventures’ Ashley Lundström, a venture lead and investment advisor at the VC firm, said: “The team was impressed with Siilo’s vision of creating a secure global network of healthcare professionals and the organic traction it has already achieved thanks to the team’s focus on building a product that’s easy to use. The healthcare industry has long been stuck using jurassic technologies and Siilo’s realtime messaging app can significantly improve efficiency

and patient care without putting patients’ data at risk.”

While the messaging app itself is free for healthcare professions to use, Siilo also offers a subscription service to monetize the freemium product.

This service, called Siilo Connect offers organisations and professional associations what it bills as “extensive management, administration, networking and software integration tools”, or just data regulation compliance services if they want the basic flavor of the paid tier.

Powered by WPeMatico

You may recall Rylo from this time last year, when the imaging startup launched a creative take on the 360 camera. The company’s been fairly quiet in the six months since it launched some new software tricks, but a new round of funding should help the company take some key steps toward spreading the gospel.

This week, Rylo announced that it has secured a $20 million Series B, led by Icon Ventures. That brings its total up to $35 million, with help from Accel Partners and Sequoia Capital. Plans for the funding are pretty much what you’d expect.

“Securing Series B funding from this excellent group of investors will allow us to maximize our potential for growth and earn significantly more market share,” CEO Alex Karpenko said in a release tied to the news. “We have come a long way since our launch one year ago, and I’m excited to continue to drive Rylo’s growth through investments in marketing, sales and retail partnerships in the coming year.”

Rylo’s camera represents an interesting piece of tech that utilizes 360 videos to create some unorthodox camera tricks, like stabilizing images, following subjects and creating a number of interesting effects. The product also has solid distribution with more than 500 retail locations in the U.S., including Best Buy.

Marketing, however, is going to be key for the success of the $499 camera, whose initial appeal is not as immediately apparent as the likes of GoPro.

Powered by WPeMatico

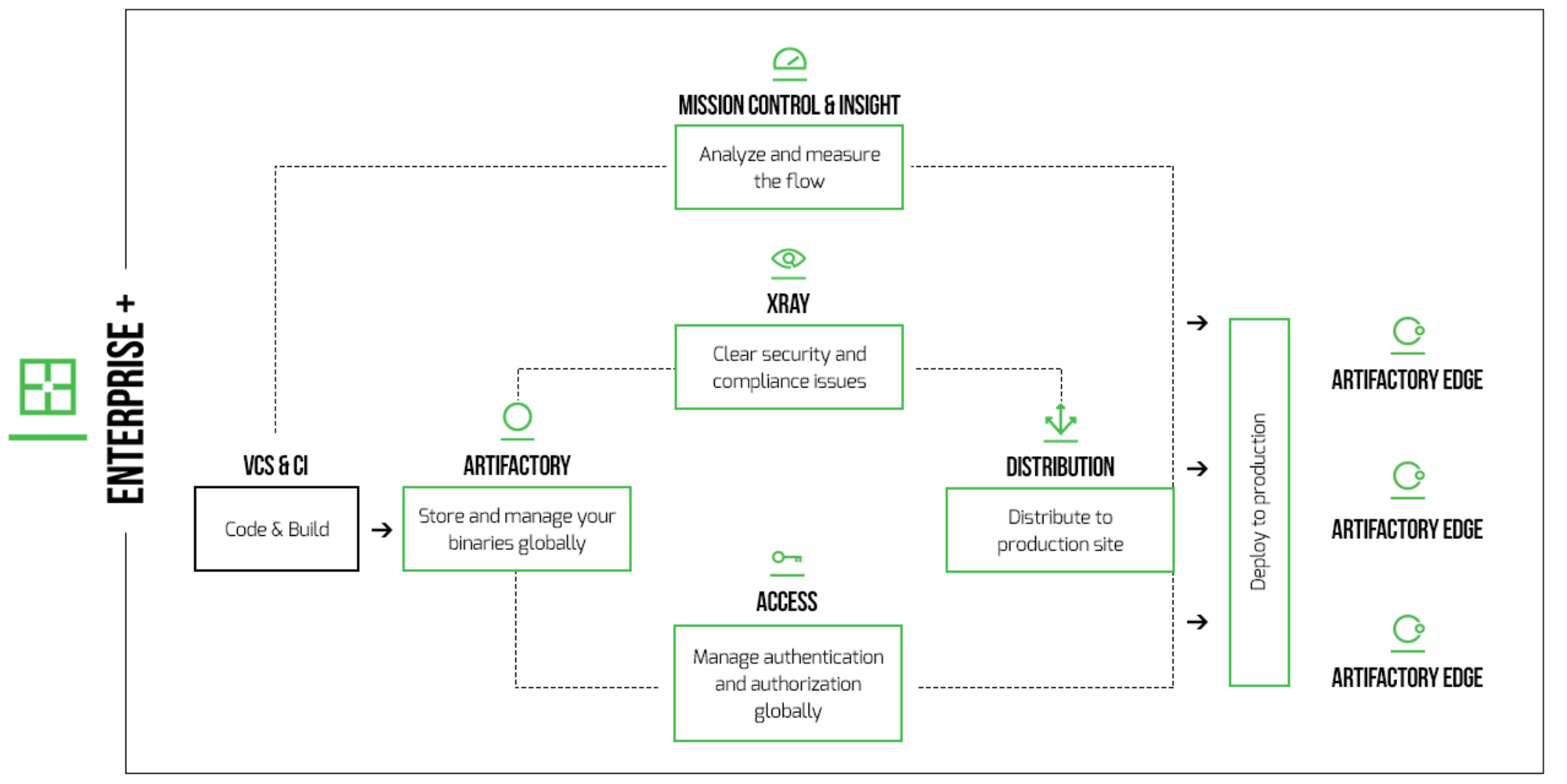

JFrog wants to change the way we deal with software updates. Instead of large numbered updates you have to manually download, it sees a future of continuous delivery where software is delivered as binaries and updated in the background. Investors must like that vision very much because they showered the company with a $165 million Series D investment today, which it says pushes its valuation past the billion-dollar mark.

The round was led by Insight Venture Partners, and as part of the deal Insight’s co-founder and managing director, Jeff Horing will be joining the JFrog board. Other investors joining the round included new investors and Silicon Valley Funds, Spark Capital and Geodesic Capital, as well as existing investors Battery Ventures, Sapphire Ventures, Scale Venture Partners, Dell Technologies Capital and Vintage Investment Partners. Today’s investment pushes the total invested to-date to over $226 million.

What the company has done to justify this kind of investment is offer a series of products that enable customers to deliver code in the form of binaries. That in turn allows them to deliver updates on a regular basis in the background without disturbing the user experience. In a world of continuous delivery, this approach is essential. You couldn’t deliver multiple updates a day if you had to take down your service every time you did it.

The JFrog platform is actually made up of multiple products, but the main one is JFrog Artifactory where companies can add the latest binaries (updates) and deliver them to customers in the background. It’s not unlike, GitHub, but whereas GitHub is a repository for downloading software and updates, the Artifactory is a place to deliver these updates automatically without user involvement. It also handles other DevOps functions like security, access control and distribution.

JFrog platform. Diagram: JFrog

CEO and co-founder Shlomi Ben Haim was happy to reveal that the company’s valuation had entered unicorn territory, but he wasn’t willing to share an exact number. “I don’t want to get into details, but we exceeded the billion dollar valuation. We are north of $1 billion already and we are building the company to generate the revenue to justify it,” he told TechCrunch.

He wasn’t discussing specific revenue numbers, but reports the company has a goal of a billion dollars in revenue by 2025, and he says they are working toward that. He did say they have had 500 percent revenue growth since the $50 million round in 2016, and that they tripled the number of employees to 400, while doubling the number of products they offer. They currently have 4500 customers including 70 percent of the Fortune 100.

So fair to say things are going well for the company. Ben Haim says the ultimate goal for the company is to deliver software in the background for scenarios like your operating system or your Tesla. Instead of shutting down your car or computer for the next software update, it will just happen over the air in the background. We are obviously a ways from fulfilling that vision, but investors are clearly betting on that potential.

Powered by WPeMatico

Foursquare has today announced the partial close of a $33 million Series F financing, with $25 million already closed out and another $8 million inbound, according to the blog post.

The round was co-led by Simon Ventures and Naver Corp, with participation from Union Square Ventures, an existing investor.

Over the past four years, Foursquare has pivoted from a consumer-facing social application to an enterprise platform, giving brands, retailers and ad platforms a way to get accurate, location-based data about their customers and their conversion rates.

Foursquare CEO Jeff Glueck told TechCrunch that more than 90 percent of Foursquare’s revenue comes from the enterprise side of the business. Two of the company’s most popular products are Attribution and the Pilgrim SDK.

With Attribution, Foursquare allows retailers and publishers to effectively track the impact their media has on conversion at offline locations. Using a panel of 25 million, non-incentivized users, these brands and retailers can track their own impact, as well as make more informed campaign decisions using insights around foot traffic and visit history of certain demographics.

The Pilgrim SDK, on the other hand, allows brands and partners to deliver highly relevant notifications and other experiences to their own users by leveraging Foursquare’s troves of location data.

Foursquare customers include Tinder, AccuWeather, Spotify, Hilton and iHeartMedia, and that doesn’t include the long list of brands — Uber, Apple, Microsoft, Samsung and Twitter — whose platforms are powered by Foursquare location.

According to Glueck, one of Foursquare’s greatest advantages is that they can offer the same high-level capabilities as their competitors, such as Facebook and Google, while focusing solely on the value they’re delivering to partners.

“The success of Google or Facebook or Amazon makes them great companies but unreliable partners,” said Glueck. “The truth about these walled gardens is that they can change their terms and conditions on a whim. They’re not partner-oriented. They’re seeking domination. It’s important for an independent developer community to be able to partner with a company that has the same capabilities.”

Foursquare currently includes more than 100 million places in more than 150 countries on their platform, which powers apps that collectively serve more than 1 billion consumers.

This latest round, which increased the company’s valuation, brings Foursquare’s total funding to $240 million.

Powered by WPeMatico

To keep up with the growing sizes of early-stage funding rounds, Y Combinator announced this morning that it will increase the size of its investments to $150,000 for 7 percent equity starting with its winter 2019 batch.

Based in Mountain View, Calif., YC funds and mentors hundreds of startups per year through its 12-week program that culminates in a demo day, where founders pitch their companies to an audience of Silicon Valley’s top investors. Airbnb, Dropbox and Instacart are among its greatest successes.

Since 2014, YC has invested $120,000 for 7 percent equity in its companies. It has increased the size of its investment before — in 2007, a YC “standard deal” was just $20,000 — but the amount of equity the accelerator takes in exchange for the capital has been consistent.

“We thought a $30K increase was necessary to help companies stay focused on building their product without worrying about fundraising too soon,” Y Combinator chief executive officer Michael Seibel wrote in a blog post this morning. “Capital for startups has never been more abundant, and we’ll continue to focus on the things that remain hard to come by — community, simplicity, advice that’s systematic and personal, and above all, a great founder experience.”

Seibel was named CEO in 2016. Co-founder Sam Altman serves as YC’s president.

YC is also changing the way it crafts its investments. It will now invest in startups on a post-money safe basis rather than on a pre-money safe. YC invented the fundraising mechanism, safe, in 2013. A safe, or a simple agreement for future equity, means an investor makes an investment in a company and receives the company stock at a later date — an alternative to a convertible note. A safe is a quicker and simpler way to get early money into a company and the idea was, according to YC, that holders of those safes would be early investors in the startup’s Series A or later priced equity rounds.

In recent years, YC noticed that startups were raising much larger seed rounds than before and those safes were “really better considered as wholly separate financings, rather than ‘bridges’ into later priced rounds.” Founders, in the meantime, were struggling to determine how much they were being diluted.

YC’s latest change, in short, will make it easier for founders to know exactly how much of their company they are selling off and will make capitalization table math, which can be extremely grueling for founders, a whole lot easier.

The pre-money safe has been criticized by founders and investors alike.

Last year, a pair of venture capitalists who’d worked with YC companies, Dolby Family Partners’ Pascal Levensohn and Andrew Krowne, wrote that the safe method was screwing over founders.

“Entrepreneurs who don’t do the capitalization table math end up owning less of their company’s equity than they thought they did. And when an equity round is inevitably priced, entrepreneurs don’t like the founder dilution numbers at all. But they can’t blame the VC, they can’t blame the angels, so that means they can only blame… oops!”

A transition to a post-money safe will eliminate that cap table math headache while still being simple and efficient. The trade-off, YC says, “is that each incremental dollar raised on post-money safes dilutes just the current stockholders, which is often the founders and early employees.” So it’s not perfect, but it’s an improvement.

Recent YC grad Deepak Chhugani, the founder of The Lobby, which announced a $1.2 million investment this week, had a positive response to the changes and said either way, most of the resources provided by YC are priceless to a first-time founder, like himself.

YC is also tweaking its policy around pro-rata follow-ons. You can read about that here.

Powered by WPeMatico

WndrCo, the consumer tech investment and holding company founded by longtime Hollywood executive Jeffrey Katzenberg, has invested $30 million in The Infatuation, a restaurant discovery platform.

The Infatuation made waves earlier this year when it purchased Zagat from Google, which had paid $151 million for the 40-year-old company in 2011. Despite efforts to makeover the Zagat app, the search giant ultimately decided to unload the perennial restaurant review and recommendation service and focus on expanding its database of restaurant recommendations organically.

New York-based The Infatuation was founded by music industry vets Chris Stang and Andrew Steinthal in 2009. It has previously raised $3.5 million for its mobile app, events, newsletter and personalized SMS-based recommendation tool.

Stang told TechCrunch this morning that they plan to use a good chunk of the funds to develop the new Zagat platform, which will be kept separate from The Infatuation.

“The first thing we want to do before we build anything is spend a lot of time researching how people have used Zagat in the past, how they want to use it in the future, what a community-driven platform could look like and how to apply community reviews and ratings to the brand,” said Stang, The Infatuation’s chief executive officer. “Zagat’s roots are in user-generated content. … What we are doing now is thinking through what that looks like with new tech applied to it. What it looks like in the digital age. How [we can] take our domain expertise and that legendary brand and make something new with it.”

The Infatuation will also expand to new cities beginning this fall with launches in Boston and Philadelphia. It’s already active in a dozen or so U.S. cities including Los Angeles, Seattle and San Francisco. The startup’s first and only international location is London.

Katzenberg, who began his Hollywood career at Paramount Pictures, began raising up to $2 billion for WndrCo about a year ago. Since then, he’s unveiled WndrCo’s new mobile video startup NewTV, which has raised $1 billion and hired Meg Whitman, the former president and CEO of Hewlett Packard, as CEO.

On top of that, WndrCo has invested in Mixcloud, Axios, Node, Flowspace, Whistle Sports, TYT Network and others.

Given The Infatuation founders’ experience in the entertainment industry, a partnership with Katzenberg was natural.

“We really felt like between content and technology they had … expertise on both sides,” Stang said. “The Infatuation is at its best when great content intersects with great technology, to find a fund that was perfectly suited to that was exciting.”

Powered by WPeMatico

What happens when you bring together an entrepreneur, a product designer and an investment banker who all really love collector vehicles? You get Rally Rd., an app for buying and selling equity shares in classic cars.

Launched in 2016, the company’s SEC-compliant platform lets users purchase shares in Ferraris, Porsches, Lamborghinis and other classic models for as little as $50 per share. The company says it has 50,000 members that have invested millions. Currently, there are just 10 cars available to purchase stakes in, though Rally Rd. expects to have 100 available on the app by the end of 2019.

The New York-based startup has just closed its second round of funding, a $7 million Series A led by Upfront Ventures, with participation from Anthemis Group, Social Leverage, WndrCo, Nas, Betterment co-founder Eli Broverman and Acorns co-founder Jeff Cruttenden. Earlier this year, it announced a $3 million seed round led by Columbus Nova.

Rally Rd.’s co-founders Chris Bruno and Rob Petrozzo told TechCrunch the crypto boom and bust really put digital asset investing in the mainstream, helping to bolster business that would have seemed pretty odd just a few years ago.

The pair plan to use the investment to open what they call a “live investing ecosystem,” a vehicle showroom where users can go to participate in initial car offerings in-person. The first will be in New York’s SoHo neighborhood, with other locations to follow in Los Angeles, South Florida and possibly Texas, where they have a strong user base.

“We want to create that Apple Store atmosphere where anyone can come in and learn about equity investing on the spot,” said Petrozzo, Rally Rd.’s chief product officer.

Through a subsidiary company, Rally Rd. purchases collector vehicles and holds the cars’ titles. The startup then hosts SEC-registered offerings, essentially an IPO for a car, where investors can buy one or more of 2,000 equity shares. The vehicles are registered for sale through a registered broker-dealer available in 32 states; the company is still working on obtaining licenses for the remaining 18 states.

Just like the regular stock market, after the initial offering, Rally Rd. holds regular trading windows for each vehicle where users can buy or sell their shares in an app-based secondary marketplace.

“They’ve literally recreated the NASDAQ or NYSE experience for these assets on the Rally Rd. platform,” Upfront partner Greg Bettinelli, who has joined Rally Rd.’s board of directors, told TechCrunch.

Bettinelli added that the reaction he has seen from Rally Rd. customers is similar to what he saw in the early days of the Amazon-acquired smart doorbell company Ring, mobile sneaker marketplace GOAT and ThredUp, an online consignment store that’s raised more than $125 million to date.

For now, Rally Rd. isn’t making money. They don’t take any management fees or share of the offering. Bruno says their plan to generate revenue is to adopt the Robinhood model and are building out a subscription service for those interested in premium access.

In early 2019, Rally Rd. expects to announce expansions into other verticals, including art and sports memorabilia. At some point, they plan to make the app available around the globe, beginning with Australia, Europe and Canada.

Powered by WPeMatico