funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Thirty Madison, the healthcare startup behind the hair loss brand Keeps, has brought in a $15.25 million Series A co-led by Maveron and Northzone.

The company provides a subscription-based online marketplace for men’s hair loss prevention medications Finasteride and Minoxidil. Keeps sells these drugs direct-to-consumer, working with manufacturers to keep the costs low.

On Keeps, a subscription of Minoxidil, an over-the-counter topical treatment often referred to by the brand name Rogaine, is $10 monthly. A subscription to Finasteride, a prescription drug taken daily, is $25 per month.

“It’s an end-to-end platform that is the single best place for guys who are looking to keep their hair,” Thirty Madison co-founder Steven Gutentag told TechCrunch.

Keeps is tapping into a big market. According to the American Hair Loss Association, two-thirds of American men experience some hair loss by the age of 35.

You may have heard of Hims, a venture-backed men’s healthcare company that similarly sells subscriptions to hair loss treatments, as well as oral care, skin care and treatments for erectile dysfunction. Keeps is its smaller competitor. For now, the company is focused solely on haircare, though with the new funds, Thirty Madison plans to launch Cove, a sister brand to Keeps that will provide treatments to migraine sufferers.

The company was founded last year by Gutentag and Demetri Karagas with a plan to develop several digital healthcare brands under the Thirty Madison umbrella.

“Going through this process myself of starting to experience hair loss, I was not sure where to turn,” Gutentag said. “I went online and looked up ‘why am I losing my hair,’ and if you search on Google, really for any medical condition, you usually walk away thinking you’re going to die … I was so fortunate that I got access to this high-quality specialist who could help me with my problem and I was in the position to afford those treatments, but most people don’t get that access.”

Keeps also provide digital access to a network of doctors at a cost of roughly $30 per visit.

TechCrunch’s Connie Loizos wrote last year that “it’s never been a better time to be a man who privately suffers from erectile dysfunction, premature ejaculation or hair loss” because of advances and investments in telemedicine. Since then, even more money has been funneled into the space.

Hims has raised nearly $100 million to date and is rumored to be working on a line of women’s products. Roman, a cloud pharmacy for erectile dysfunction, raised an $88 million Series A last month and is launching a “quit smoking kit.” And Lemonaid Health, which also provides prescriptions to erectile dysfunction medications and more, secured $11 million last year.

Greycroft, Steadfast Venture Capital, First Round, ERA, HillCour and Two River also participated in Thirty Madison’s fundraise, which brings its total raised to date to $22.75 million.

Powered by WPeMatico

Devoted Health, a Waltham, Mass.-based insurance startup, has raised a $300 million Series B and is enrolling to its Medicare Advantage plan members in eight Florida counties.

The company, which helps Medicare beneficiaries access care through its network of physicians and tech-enabled healthcare platform, has raised the funds from lead investor Andreessen Horowitz, Premji Invest and Uprising.

The company declined to disclose its valuation.

Devoted’s founders are brothers Todd and Ed Park — the company’s executive chairman and chief executive officer, respectively. Todd co-founded a pair of now publicly traded companies, Athenahealth, a provider of electronic health record systems, and health benefits platform Castlight Health. He also served as the U.S. chief technology officer during the Obama administration. Ed, for his part, was the chief operating officer of Athenahealth until 2016 and a member of Castlight’s board of directors for several years.

Venrock partners Bryan Roberts — Devoted’s founding investor — and Bob Kocher — its chief medical officer — are also part of the company’s founding team.

The Park brothers have tapped Jeremy Delinsky, the former CTO at Wayfair and Athenahealth, as COO; DJ Patil, a former data scientist at the White House, as its head of technology; and Adam Thackery, the former CFO of Universal American, as its chief financial officer.

Its board includes former Health and Human Services Secretary Kathleen Sebelius and former Senate Majority Leader Bill Frist. As part of the latest round, a16z’s Vijay Pande will join its board, too.

The company says it’s committed to treating its customers as if they were members of its employees’ own families. For Patil, the startup’s head of tech, that’s made the entire process of building Devoted a very emotional one.

“I’ve cried a lot at this company,” Patil told TechCrunch. “You meet these seniors and they’ve done everything right. They’ve worked so incredibly hard their entire lives. They’ve given it their all for the American dream. They’ve paid into this model of healthcare and they deserve better.”

Devoted, which previously raised $69 million across two financing rounds in 2017 from Oak HC/FT, Venrock, F-Prime Capital Partners, Maverick Ventures and Obvious Ventures, has begun enrolling to its Medicare Advantage plan seniors located in Broward, Hillsborough, Miami-Dade, Osceola, Palm Beach, Pinellas, Polk and Seminole counties. It will begin providing care January 1, 2019.

Its long-term goal is to offer insurance plans to seniors nationwide.

“We are responsible for these people’s healthcare, so we need to get it right,” Patil said.

Powered by WPeMatico

Paperspace wants to help developers build artificial intelligence and machine learning applications with a software/hardware development platform powered by GPUs and other powerful chips. Today, the Winter 2015 Y Combinator grads announced a $13 million Series A.

Battery Ventures led the round with participation from SineWave Ventures, Intel Capital and Sorenson Ventures. Existing investor Initialized Capital also participated. Today’s investment brings the total amount to $19 million raised.

Dharmesh Thakker, a general partner with Battery Ventures sees Paperspace as being in the right place at the time. As AI and machine learning take off, developers need a set of tools and GPU-fueled hardware to process it all. “Major silicon, systems and Web-scale computing providers need a cloud-based solution and software ‘glue’ to make deep learning truly consumable by data-driven organizations, and Paperspace is helping to provide that,” Thakker said in a statement.

Paperspace provides its own GPU-powered servers to help in this regard, but co-founder and CEO Dillon Erb says they aren’t trying to compete with the big cloud vendors. They offer more than a hardware solution to customers. Last spring, the company released Gradient, a serverless tool to make it easier to deploy and manage AI and machine learning workloads.

By making Gradient a serverless management tool, customers don’t have to think about the underlying infrastructure. Instead, Paperspace handles all of that for them providing the resources as needed. “We do a lot of GPU compute, but the big focus right now and really where the investors are buying into with this fundraise, is the idea that we are in a really unique position to build out a software layer and abstract a lot of that infrastructure away [for our customers],” Erb told TechCrunch.

He says that building some of the infrastructure was an important early step, but they aren’t trying to compete with the cloud vendors. They are trying to provide a set of tools to help developers build complex AI and machine learning/deep learning applications, whether it’s on their own infrastructure or on the mainstream cloud providers like Amazon, Google and Microsoft.

What’s more, they have moved beyond GPUs to support a range of powerful chips being developed to support AI and machine learning workloads. It’s probably one of the reasons that Intel joined as an investor in this round.

He says the funding is definitely a validation of something they set out to work on when they first started this in 2014 and launched out of Y Combinator in 2015. Back then he had to explain what a GPU was in his pitch decks. He doesn’t have to do that anymore, but there is still plenty of room to grow in this space.

“It’s really a greenfield opportunity, and we want to be the go-to platform that you can start building out into intelligent applications without thinking about infrastructure.” With $13 million in hand, it’s safe to say that they are on their way.

Powered by WPeMatico

Instacart chief executive officer Apoorva Mehta wants every household in the U.S. to use Instacart, a grocery delivery service that allows shoppers to order from more than 300 retailers, including Kroger, Costco, Walmart and Sam’s Club, using its mobile app.

Today, the company is taking a big leap toward that goal.

San Francisco-based Instacart has raised $600 million at a $7.6 billion valuation, just six months after it brought in a $150 million round and roughly eight months after a $200 million financing that valued the business at $4.2 billion.

D1 Capital Partners, a relatively new fund led by Daniel Sundheim, the former chief investment officer of Viking Global Investors, led the round.

Instacart is raking in cash aggressively but spending it cautiously. The company still has all of its Series E, which ultimately totaled $350 million, and the majority of its $413 million Series D in the bank, a source close to the company told TechCrunch. That means, in total, Instacart has $1.2 billion at its fingertips. Currently, according to the same source, the company is only profitable on a contribution margin basis, meaning it’s earning a profit on each individual Instacart order.

In a conversation with TechCrunch, Mehta said the company didn’t need the capital and that it was an “opportunistic” round, i.e. the capital was readily available and Instacart has ambitious plans to scale, so why not fundraise. Instacart plans to use the enormous pool of capital to double its engineering team by 2019, which will include filling 300 open engineering roles in its recently announced Toronto office, he said.

As far as an initial public offering, it will happen — eventually.

“It will be on the horizon,” Mehta told TechCrunch.

“2018 has been a really big year for us,” he added. “The reason why we are so excited is because the opportunity ahead of us is enormous. The U.S. is a $1 trillion grocery market and less than 5 percent of that is bought online. It’s an enormous category that’s highly under-penetrated.”

In the last six months, Instacart has announced a few notable accomplishments.

As of August, the service has been available to 70 percent of U.S. households. That’s due to the expansion of existing partnerships and new deals entirely, like a recently announced pilot program between Instacart and Walmart Canada that gives Canadian Instacart users access to 17 different Walmart locations across Winnipeg and Toronto, Ontario.

The company has also completed several executive hires. Most recently, it tapped former Thumbtack chief technology officer Mark Schaaf as CTO. Before that, Instacart brought on David Hahn as chief product officer and Dani Dudeck as its first chief communications officer.

In early September, the company confirmed its chief growth officer Elliot Shmukler would be leaving the company.

The six-year-old Y Combinator graduate has raised more than $1.6 billion in venture capital funding from Coatue Management, Thrive Capital, Canaan Partners, Andreessen Horowitz and several others.

Powered by WPeMatico

Truphone — a UK startup that provides global mobile voice and data services by way of an eSIM model for phones, tablets and IoT devices — said that it has raised another £18 million ($23.7 million) in funding; plus it said it has secured £36 million ($47 million) more “on a conditional basis” to expand its business after signing “a number of high-value deals.”

It doesn’t specify which deals these are, but Truphone was an early partner of Apple’s to provide eSIM-based connectivity to the iPad — that is, a way to access a mobile carrier without having to swap in a physical SIM card, which has up to now been the standard for GMSA-based networks. Truphone is expanding on this by offering a service for new iPhone XS and XR models, taking advantage of the dual SIM capability in these devicews. Truphone says that strategic partners of the company include Apple (“which chose Truphone as the only carrier to offer global data, voice and text plans on the iPad and iPhone digital eSIM”); Synopsys, which has integrated Truphone’s eSIM technology into its chipset designs; and Workz Group, a SIM manufacturer, which has a license from Truphone for its GSMA-accredited remote SIM provisioning platform and SIM operating system.

The company said that this funding, which was made by way of a rights issue, values Truphone at £386 million ($507 million at today’s rates) post-money. Truphone told TechCrunch that the funding came from Vollin Holdings and Minden Worldwide — two investment firms with ties to Roman Abramovich, the Russian oligarch who also owns the Chelsea football club, among other things — along with unspecified minority shareholders. Collectively, Abramovich-connected entities control more than 80 percent of the company.

We have asked the company for more detail on what the conditions are for the additional £36 million in funding to be released and all it is willing to say is that “it’s KPI-driven and related to the speed of growth in the business.” It’s unclear what the state of the business is at the moment because Truphone has not updated its accounts at Companies House (they are overdue). We have asked about that, too.

For some context, Truphone most recently raised money almost exactly a year ago, when it picked up £255 million also by way of a rights issue, and also from the same two big investors. The large amount that time was partly being raised to retire debt. That deal was done at a valuation of £370 million ($491 million at the time of the deal). Going just on sterling values, this is a slight down-round.

Truphone, however, says that business is strong right now:

“The appetite for our technology has been enormous and we are thrilled that our investors have given us the opportunity to accelerate and scale these groundbreaking products to market,” said Ralph Steffens, CEO, Truphone, in a statement. “We recognised early on that the more integrated the supply chain, the smoother the customer experience. That recognition paid off—not just for our customers, but for our business. Because we have this capability, we can move at a speed and proficiency that has never before seen in our industry. This investment is particularly important because it is testament not just to our investors’ confidence in our ambitions, but pride in our accomplishments and enthusiasm to see more of what we can do.”

Truphone is one of a handful of providers that is working with Apple to provide plans for the digital eSIM by way of the MyTruphone app. Essentially this will give users an option for international data plans while travelling — Truphone’s network covers 80 countries — without having to swap out the SIMs for their home netw orks.

orks.

The eSIM technology is bigger than the iPhone itself, of course: some believe it could be the future of how we connect on mobile networks. On phones and tablets, it does away with users ordering, and inserting or swapping small, fiddly chips into their devices (that ironically is also one reason that carriers have been resistant to eSIMs traditionally: it makes it much easier for their customers to churn away). And in IoT networks where you might have thousands of connected, unmanned devices, this becomes one way of scaling those networks.

“eSIM technology is the next big thing in telecommunications and the impact will be felt by everyone involved, from consumers to chipset manufacturers and all those in-between,” said Steve Alder, chief business development officer at Truphone. “We’re one of only a handful of network operators that work with the iPhone digital eSIM. Choosing Truphone means that your new iPhone works across the world—just as it was intended.” Of note, Alder was the person who brokered the first iPhone carrier deal in the UK, when he was with O2.

However, one thing to consider when sizing up the eSIM market is that rollout has been slow so far: there are around 10 countries where there are carriers that support eSIM for handsets. Combining that with machine-to-machine deployments, the market is projected to be worth $254 million this year. However, forecasts put that the market size at $978 million by 2023, possibly pushed along by hardware companies like Apple making it an increasingly central part of the proposition, initially as a complement to a “home carrier.”

Truphone has not released numbers detailing how many devices are using its eSIM services at the moment — either among enterprises or consumers — but it has said that customers include more than 3,500 multinational enterprises in 196 countries. We have asked for more detail and will update this post as we learn more.

Powered by WPeMatico

When Snowflake, the cloud data warehouse, landed a $263 million investment earlier this year, CEO Bob Muglia speculated that it would be the last money his company would need before an eventual IPO. But just 9 months after that statement, the company announced a second even larger round. This time it’s getting $450 million, as an unexpected level of growth led them to seek additional cash.

Sequoia Capital led the round, joined by new investor Meritech Capital and existing investors Altimeter Capital, Capital One Growth Ventures, Madrona Venture Group, Redpoint Ventures, Sutter Hill Ventures Iconiq Capital and Wing Ventures. Today’s round brings the total raised to over $928 million with $713 million coming just this year. That’s a lot of dough.

Oh and the valuation has skyrocketed too from $1.5 billion in January to $3.5 billion with today’s investment. “We are increasing the valuation from the prior round substantially, and it’s driven by the growth numbers of almost quadrupling the revenue, and tripling the customer base,” company CFO Thomas Tuchscherer told TechCrunch.

At the time of the $263 million round, Muglia was convinced the company had enough funds and that the next fundraise would be an IPO. “We have put ourselves on the path to IPO. That’s our mid- to long-term plan. This funding allows us to go directly to IPO and gives us sufficient capital, that if we choose, IPO would be our next funding step,” he said in January.

Tuchscherer said in fact that was the plan at the time of the first batch of funding. He joined the company, partly because of his experience bringing Talend public in 2016, but he said the growth has been so phenomenal, that they felt it was necessary to change course.

“When we raised $263 million earlier in the year, we raised based on a plan that was ambitious in terms of growth and investment. We are exceeding and beating that, and it prompted us to explore how do we accelerate investment to continue driving the company’s growth,” he said.

Running on both Amazon Web Services and Microsoft Azure, which they added as a supported platform earlier this year, certainly contributed to the increased sales, and forced them to rethink the amount of money it would take to fuel their growth spurt.

“I think it’s very important as a distinction that we view the funding as being customer driven in the sense that in order to meet the demand that we’re seeing in the market for Snowflake, we have to invest in our infrastructure, as well as in our R&D capacity. So the funding that we’re raising now is meant to finance those two core investments,” he stressed

The number of employees is skyrocketing as the company adds customers. Just eight months ago the company had around 350 employees. Today it has close to 650. Tuchscherer expects that to grow to between 900 and 1000 by the end of January, not that far off.

As for that IPO, surely that is still a goal, but the growth simply got in the way. “We are building the company to be autonomous and to be a large independent company. It’s definitely on the horizon,” he said.

While Tuchscherer wouldn’t definitively say that the company is looking to support at least one more cloud platform in addition to Amazon and Microsoft, he strongly hinted that such a prospect could happen.

The company also plans to plunge a lot of money into the sales team, building out new sales offices in the US and doubling their presence around the world, while also enhancing the engineering and R&D teams to expand their product offerings.

Just this year alone the company has added Netflix, Office Depot, DoorDash, Netgear, Ebates and Yamaha as customers. Other customers include Capital One, Lionsgate and Hubspot.

Powered by WPeMatico

Egnyte launched in 2007 just two years after Box, but unlike its enterprise counterpart, which went all-cloud and raised hundreds of millions of dollars, Egnyte saw a different path with a slow and steady growth strategy and a hybrid niche, recognizing that companies were going to keep some content in the cloud and some on prem. Up until today it had raised a rather modest $62.5 million, and hadn’t taken a dime since 2013, but that all changed when the company announced a whopping $75 million investment.

The entire round came from a single investor, Goldman Sachs’ Private Capital Investing arm, a part of Goldman’s Special Situations group. Holger Staude, vice president of Goldman Sachs Private Capital Investing will join Egnyte’s board under the terms of the deal. He says Goldman liked what it saw, a steady company poised for bigger growth with the right influx of capital. In fact, the company has had more than eight straight quarters of growth and have been cash flow positive since Q4 in 2016.

“We were impressed by the strong management team and the company’s fiscal discipline, having grown their top line rapidly without requiring significant outside capital for the past several years. They have created a strong business model that we believe can be replicated with success at a much larger scale,” Staude explained.

Company CEO Vineet Jain helped start the company as a way to store and share files in a business context, but over the years, he has built that into a platform that includes security and governance components. Jain also saw a market poised for growth with companies moving increasing amounts of data to the cloud. He felt the time was right to take on more significant outside investment. He said his first step was to build a list of investors, but Goldman shined through, he said.

“Goldman had reached out to us before we even started the fundraising process. There was inbound interest. They were more aggressive compared to others. Given there was prior conversations, the path to closing was shorter,” he said.

He wouldn’t discuss a specific valuation, but did say they have grown 6x since the 2013 round and he got what he described as “a decent valuation.” As for an IPO, he predicted this would be the final round before the company eventually goes public. “This is our last fund raise. At this level of funding, we have more than enough funding to support a growth trajectory to IPO,” he said.

Philosophically, Jain has always believed that it wasn’t necessary to hit the gas until he felt the market was really there. “I started off from a point of view to say, keep building a phenomenal product. Keep focusing on a post sales experience, which is phenomenal to the end user. Everything else will happen. So this is where we are,” he said.

Jain indicated the round isn’t about taking on money for money’s sake. He believes that this is going to fuel a huge growth stage for the company. He doesn’t plan to focus these new resources strictly on the sales and marketing department, as you might expect. He wants to scale every department in the company including engineering, posts-sales and customer success.

Today the company has 450 employees and more than 14,000 customers across a range of sizes and sectors including Nasdaq, Thoma Bravo, AppDynamics and Red Bull. The deal closed at the end of last month.

Powered by WPeMatico

SoftBank may soon own up to 50 percent of WeWork, a well-funded provider of co-working spaces headquartered in New York, according to a new report from The Wall Street Journal.

SoftBank is reportedly weighing an investment between $15 billion and $20 billion, which would come from its $92 billion Vision Fund, a super-sized venture fund led by Japanese entrepreneur and investor Masayoshi Son.

WeWork declined to comment.

SoftBank already owns some 20 percent of WeWork. The firm invested $4.4 billion in the company in August 2017, $1.4 billion of which was set aside to help WeWork expand in China, Japan and Southeast Asia.

This August, WeWork raised another $1 billion from SoftBank in convertible debt. At the same time, WeWork disclosed financials to a handful of media outlets, sharing that its revenue had doubled to $763.8 million in the first half of 2018 as losses increased to $723 million.

SoftBank, for its part, seems to have a hankering for real estate tech. Not only has it become a key stakeholder in WeWork, but it has deployed significant amounts of capital to Opendoor, Compass, Katerra and others.

Last month, the Vision Fund backed Opendoor, a platform for buying and selling homes, with $400 million. The same day, it led a $400 million round for Compass, valuing the real estate brokerage startup at $4.4 billion. As for Katerra, SoftBank poured $865 million into the construction tech business in January.

WeWork, founded in 2010 by Adam Neumann and Miguel McKelvey, has raised nearly $5 billion in a combination of debt and equity funding to date. It was valued at $20 billion in 2017, though reports earlier this summer estimated its valuation would fall somewhere between $35 billion and $40 billion with additional capital from SoftBank. A $40 billion valuation would make it the second most valuable VC-backed company in the U.S. behind only Uber.

WeWork has more than 268,000 members across 287 locations in 23 countries.

Powered by WPeMatico

CAVU Venture Partners has led the $20 million Series B for Once Upon a Farm, which sells organic, cold-pressed baby food in 8,500 grocery stores in the U.S.

The Berkeley-based startup was originally founded in 2015 by serial entrepreneurs Cassandra Curtis and Ari Raz. Today, it lists actress Jennifer Garner and former General Mills president John Foraker as co-founders, too.

Both Garner and Foraker — who was the chief executive officer of the popular organic mac & cheese brand Annie’s Homegrown for more than a decade — joined the company in September 2017. Foraker had been an angel investor in Once Upon a Farm and, after conversations with Garner, decided to accept the role of CEO. Garner, widely known for her roles in Alias, 13 Going on 30 and the upcoming HBO original series Camping, was already somewhat of a Once Upon a Farm evangelist when she signed on as chief brand officer a little over a year ago.

“I am proud of the innovative business that we have built,” Garner said in a statement. “It is incredibly exciting to see so many families embracing our products. This latest round of funding allows us to continue to help busy parents give their children the most nutritious foods possible and make life a little bit easier for families across the country.”

Foraker told TechCrunch that since he and Garner joined, the business has grown 10x. Last fall, the company’s products were for sale in 300 stores; today, as mentioned, they are available in more than 8,000.

“Because she has global celebrity, the power of that, she can really help us get the message out and help lots of moms and dads find [Once Upon a Farm],” Foraker said.

Once Upon a Farm sells smoothies and applesauce for kids up to age 12 directly to consumers through its online marketplace and in stores. Pouches of its signature baby food, smoothies and applesauce are $2.99 each.

As part of the deal, CAVU’s co-founder and managing partner Brett Thomas, along with CAVU investor Jared Jacobs, will join the company’s board. S2G Ventures and Beechwood Capital also participated in the round for the startup, which raised a $4 million Series A in June 2017.

The company plans to use the funds to expand its direct to consumer business, partner with more U.S. grocers and build out a wider assortment of baby products.

“You can buy fresh pet food now in almost 20,000 stores in the U.S.,” Foraker said. “We think fresh baby food has a long way to go.”

Powered by WPeMatico

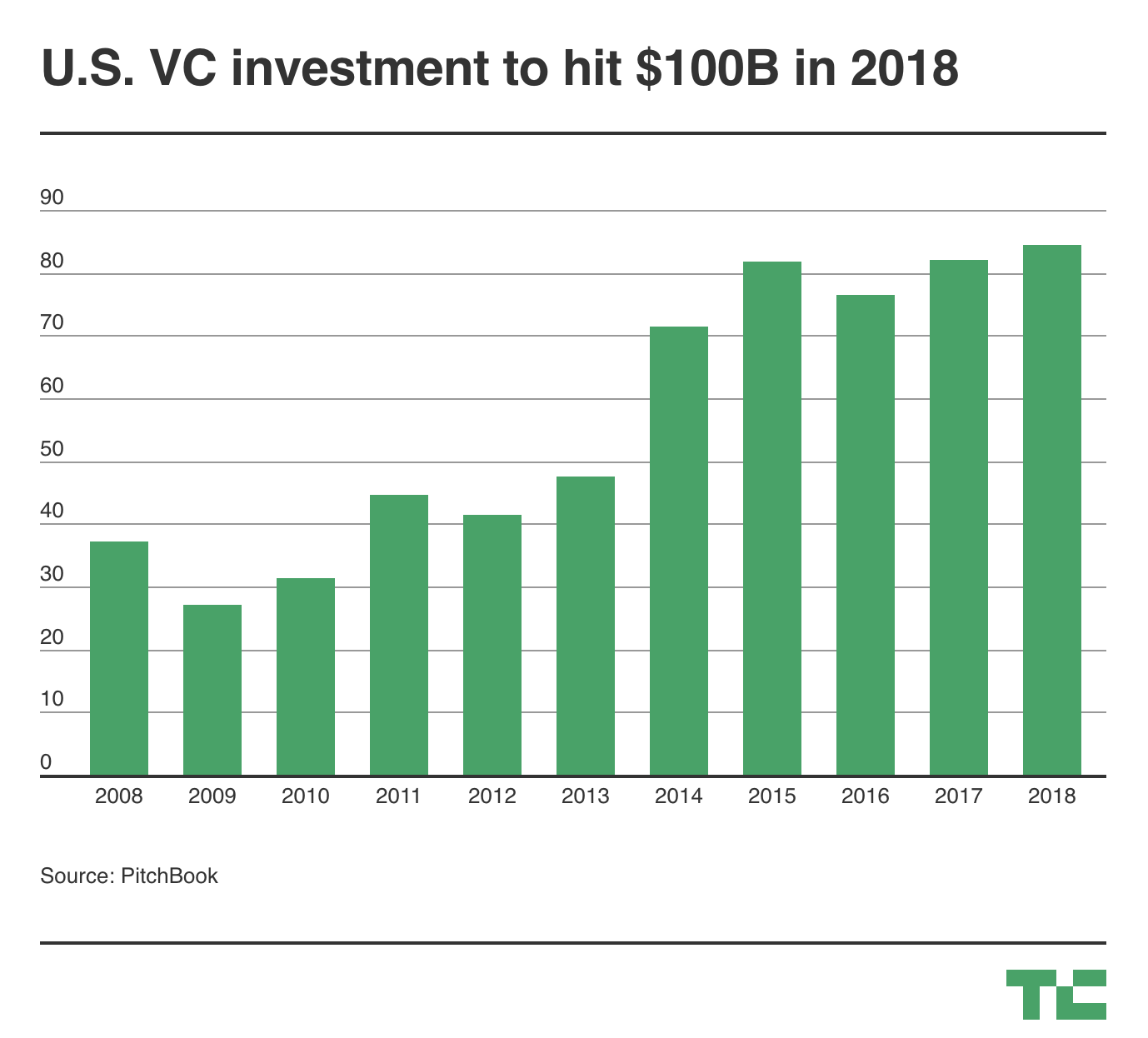

So many new unicorns valued at $1 billion-plus, countless $100 million venture financings, an explosion of giant funds — it’s no surprise 2018 is shaping up to be a banner year for venture capital investment in U.S.-based companies.

There are more than 2.5 months remaining in 2018 and already U.S. companies have raised $84.1 billion — more than all of 2017 — across 6,583 VC deals as of Sept. 30, 2018, according to data from PitchBook’s 3Q Venture Monitor.

Last year, companies raised $82 billion across more than 9,000 deals in what was similarly an impressive year for the industry. Many questioned whether the trend would — or could — continue this year, and oh, boy has it. VC investment has sprinted past decade-highs and shows no signs of slowing down.

Why the uptick? Fewer companies are raising money, but round sizes are swelling. Unicorns, for example, were responsible for about 25 percent of the capital dispersed in 2018. Those companies, which include Slack, Stripe and Lyft, have raised $19.2 billion so far this year — a record amount — up from $17.4 billion in 2017. There were 39 deals for unicorn companies valuing $7.96 billion in the third quarter of 2018 alone.

Some other interesting takeaways from PitchBook’s report on the U.S. venture ecosystem:

Powered by WPeMatico