funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Local advertising startup ZypMedia is announcing that it has raised $5.6 million in Series C funding.

That’s a relatively small amount of money for a Series C (the company had previously raised $6.9 million total, according to Crunchbase), but co-founder Aman Sareen said, “We had the opportunity to raise a lot more, but we chose not to.” In fact, Sareen said ZypMedia became profitable last year.

So the new funding round should allow the company to continue expanding its product lineup and its team — it has plans to double its headcount in the United States and India over the next year — while still leaving room for organic growth.

“We didn’t want to be a cautionary tale [like] other previous adtech companies,” Sareen said. “We are buckling down for the long haul … We didn’t want to necessarily raise money just for the sake of it.”

Sareen founded ZypMedia with his former college roommate Ramandeep Ahuja, as well as former Current TV executive Mark Goldman, with the aim of helping local broadcasters move into programmatic advertising.

The idea is to help those media companies offer campaigns that can reach advertisers’ desired audiences across traditional and digital channels, such as display, video (including over-the-top), social media and native advertising.

“Local digital advertising has been very neglected,” Sareen said. “It’s a huge market, and our goal was to be one of the leaders. I’ll be honest, it wasn’t an easy to task, but we have been decently successful in our mission.”

“Decently successful” means signing up partners like Sinclair Broadcast Group and Univision. It also means enlisting Archer Venture Capital as the lead investor in the new round. (Existing investors US Venture Partners and Sinclair also participated.)

“Not only have Aman and Ramandeep created a superior tech stack for delivering local advertising, they’ve also developed a really smart and defensible business model, partnering with local media companies to act as their direct sales force,” said Archer Managing Director John Hadl in the funding announcement.

And ultimately, the vision goes beyond bringing incremental revenue to traditional media companies. Sareen argued that ZypMedia’s model positions it right at the intersection of traditional and digital advertising.

“Within the next two-to-five years, digital or linear, over-the-top or over-the-air, it will jump through one platform,” he said. “Everything will use the same technology and currency.”

Powered by WPeMatico

There are few things more irritating than a canceled flight, whether it’s on your way to a friend’s wedding, a conference or to celebrate a holiday back home. Wouldn’t it be nifty if technology could put an end to our travel woes? Freebird, a travel rebooking service, has raised an $8 million Series A to do just that.

The startup charges a minimum of $19 per flight — more depending on distance, time of year, location and more — to independent travelers and companies that partner with the service to help travelers rebook flights after cancellations or other “disruption events.” Most of the time, flights are on-time and without issue, which means that most of the time, Freebird pockets all of its customer’s cash. But if there is a disruption event, Freebird guarantees it will rebook you with just three taps of your phone and without any additional charge.

American Express Ventures has led the round, with support from Citi Ventures, PAR Capital Ventures, General Catalyst and Accomplice. Freebird is currently in discussions with Amex and Citi, as well as other banks, to roll its travel benefits into their corporate card services. To date, the startup works with 100 corporate clients and 10 corporate travel agency partners, including BCD Travel. Freebird says it expects to support 250,000 travelers this year.

Founded in 2015 by Ethan Bernstein, Cambridge, Mass.-based Freebird aggregates data on flight patterns to predict the probability of a flight disruption. If the probability is high, Freebird charges more for access to its mobile rebooking tool.

“If you’re flying out of Buffalo in the winter, it’s going to be a higher-risk flight,” Freebird chief executive officer Bernstein told TechCrunch. “If you’re flying out of Phoenix in the summer, you’re at a very low risk of being disrupted. We understand those risks and we are able to price our product differently based on those factors.”

Freebird has raised a total of $16.5 million in funding to date. It’s one of many travel technology startups to bring in venture capital this year. IfOnly, a marketplace for experiences, secured $20 million in April; luggage startup Away brought in a $50 million in June; and travel activities platform Klook raised $200 million in August, to name a few.

Freebird, though focused specifically on flights, says its experiences are at the forefront of its business model.

“There are a million different products that will help you automate your life but one of the things we are focused on is transforming personal experiences,” Bernstein said. “Do they go through these disruption events tearing their hair out or do they go through it knowing that they have control, agency, support and information? It’s funny what happens when people deal with uncertainty; uncertainty is the worst. As soon you give people information, human support and technology to help them solve their problems, they experience the event so much differently.”

Powered by WPeMatico

HeadSpin has closed a $20 million Series B, valuing the provider of mobile application performance software at $500 million. New investors ICONIQ Capital, Battery Ventures and EQT Ventures participated in the funding round. Existing backers GV, Telstra Ventures, Danhua Capital, Nexus Ventures Partners and NextWorld Capital did not participate.

The company emerged from stealth last year with Manish Lachwani at the helm. Lachwani was the former principal architect of the Amazon Kindle, chief technology officer of mobile gaming company Zynga and co-founder and chief technology officer of Google-acquired Appurify, which helped developers automate testing and optimization of their mobile apps and websites.

He’s been in the application performance management business for a long time; under his leadership, Palo Alto-based HeadSpin has quickly grown into one of the fastest growing, though relatively unknown, startups in Silicon Valley.

“What HeadSpin has been able to achieve in its first three years is remarkable, and it has already attracted dozens of major clients across the mobile ecosystem,” ICONIQ partner Will Griffith said in a statement. “The company is quickly becoming the new standard of record for all mobile ecosystem players going forward. It’s one of the fastest-scaling software companies we’ve seen.”

HeadSpin works with Tinder, DocuSign and some 200 other app providers, allowing the companies to test and monitor their apps in real-time and on real devices before, during and after an app is released. The AI-enabled platform gives developers the ability to experience their app just as any regular user would and highlights high priority issues so companies can quickly resolve customer’s problems at scale.

Founded in 2015, HeadSpin says it expects to double revenue in 2018 but did not disclose any financial metrics.

Chief technology officer Brien Colwell is the other half of the company’s founding team. Colwell is the founder and former CEO of Nextop.io, a Y Combinator graduate and app optimization startup. Colwell and Lachwani are joined by HeadSpin’s head of product Sriram Krishnan, Tinder’s former head of international growth. Krishnan joined HeadSpin in October 2017 after working with HeadSpin’s toolset in his role at the app-based dating company.

“When I signed up for HeadSpin, I found out how phenomenal the product was,” Krishnan told TechCrunch .

“A lot of what we built was predicated on the fact that the mobile ecosystem is still very new,” he added. “If you think about the apps world, it’s only been around 10 years … It’s the Wild West out there when it comes to understanding performance.”

Powered by WPeMatico

After four months “on the beach,” per his LinkedIn profile, Uber’s former global head of business and corporate development has a new gig. Lime has hired David Richter (pictured) as its first-ever chief business officer and interim chief financial officer.

Based in San Francisco, Richter will be overseeing the bike- and e-scooter-sharing startup’s business operations. Richter spent more than four years at Uber leading the ride-hailing giant’s global business development, corporate development, experiential marketing, autonomous vehicle alliances and brand relevance teams. He left in May after expressing frustrations with a series of departures in his group, according to The Information.

“As Lime continues to grow, David will bring in unparalleled expertise, particularly in the realm of business development and corporate partnerships, as well as in managing our overall business strategy and deal flow,” Lime co-founder and chief executive officer Toby Sun said in a statement. “His leadership experience, coupled with his keen understanding of the fast-moving shared mobility industry will be a huge advantage to our company as we continue to expand our global footprint.”

Lime is said to be completing the fundraising circuit right now, asking investors for a valuation north of $3 billion. The company, which entered the unicorn club in June, has raised a total of $467 million to date from GV, Andreessen Horowitz, IVP, Section 32, GGV Capital and more.

The company is using the buckets of capital to expand beyond bikes and scooters. Last Monday, rumors emerged that it was planning a brick-and-mortar push. The company confirmed that it would indeed build scooter “lifestyle stores” in major U.S. and international markets, starting with Santa Monica, Calif.

The next day on stage at the JD Power Automotive Roundtable, Lime announced its official foray into car-sharing. The company has since applied for a car-sharing permit in Seattle and plans to rent out small electric vehicles, which it’s calling “transit pods,” by the end of the year.

According to Axios, Lime plans to spend $50 million on the pods, which will cost $1 for consumers to start, plus an additional 40 cents per minute.

“You can expect electric vehicles to be an additional micro-mobility option for Lime riders to choose from within the Lime app soon,” a spokesperson for Lime said in a statement provided to TechCrunch. “More details on timing, specs of the vehicle, locations for the first rollout, etc. will be announced in the coming weeks.”

Lime launched in 2017 and has since recorded 11.5 million scooter and bike rides.

Powered by WPeMatico

RevenueCat, a startup that helps developers manage their in-app subscriptions, has raised $1.5 million in new funding.

The company was part of the most recent batch at Y Combinator, and CEO Jacob Eiting said growth has been “a rocket ship” for the past few months. As of this week, RevenueCat is working with 100 live apps, and it’s crossing $1 million in tracked revenue.

The startup offers an API to address what sounds like a straightforward task, supporting in-app subscriptions in iOS and Android. As Eiting put it when I first interviewed him a few months ago, it’s “boring work” solving a “boring problem” — but that’s one of the reasons why developers don’t want to deal with it. It also means they don’t have to spend time dealing with bugs and updates on the subscription side of either platform.

And RevenueCat continues to add new features, like allowing developers to bring their revenue data into analytics and attribution services. That, in turn, makes it easier for them to see which ads are driving real revenue.

The long-term goal is to build what Eiting (who’s pictured above with his co-founder Miguel Carranza) calls a “revenue management platform.”

“Our mission as a company is to help developers make more money,” he said. “I think we do become this one-stop shop, a service that you integrate with all the payment touch points in your app to help you track your revenue and help you understand how customers are spending.”

The new funding (which is on top of the $120,000 RevenueCat received from YC) was led by Jason Lemkin of SaaStr. Eiting said it’s “an obvious fit,” since the software-as-a-service entrepreneurs who read SaaStr articles, listen to its podcasts and attend its events form “this huge community of companies that are potential customers for us.”

Powered by WPeMatico

Teamable, a provider of hiring software that leverages employees’ social networks, has brought in $5 million from new investor Foundation Capital and existing backers True Ventures and SaaStr Fund.

The startup also announced its acquisition of Simppler‘s referral recommendation engine and matchmaking recruiting software. Teamable’s co-founder and chief executive officer Laura Bilazarian declined to disclose the terms of the deal but said none of the $5 million investment was used to finance the transaction.

According to Crunchbase, Simppler had raised $3.2 million in equity funding from Foundation Capital, Greylock, Vertex Ventures and others. The company, which is akin to Teamable, creates a referral platform using existing employee networks; it was founded by Vipul Sharma in 2013. Sharma previously ran machine learning at Eventbrite and, according to his LinkedIn profile, he’s been an engineering director at Indeed for the past year.

Sharma and the Simppler team will not be joining Teamable .

Using Gmail, Facebook, GitHub and other social media platforms, Teamable aggregates its employees’ contacts to connect recruiters with a more focused set of potential candidates. Companies using Teamable, including Spotify and Lyft, then facilitate a warm introduction between a candidate and the employee in their network. The startup says its social recruiting algorithms lead to more efficient and diverse hiring practices.

“I don’t think candidates love the way recruiting is done,” Bilazarian told TechCrunch. “They are throwing applications over a wall and not hearing back. And I don’t think companies love the way recruiting is done because people are just making guesses based off a job description and they aren’t getting the right applicants.”

“Instead of few people at a company spamming the entire world, you have people who really understand the company reaching out to you,” she added. “Teamable is very precise. It’s reach out to five people to get a hire versus reach out to 200 just to get one response.”

The Foundation-led investment brings Teamable’s total equity funding to date to $10 million, including last year’s $5 million Series A. Bilazarian says the 50-person company is cash flow positive with 200 customers. With offices in San Francisco and Yerevan, Armenia, Teamable will use the capital to expand its team and recruiting platform.

Powered by WPeMatico

Robotics has had a role in manufacturing since the 1970s, but even today they are aren’t often driven by the latest software. Bright Machines, a San Francisco startup wants to change that and it got a whopping $179 million Series A today to get this thing going. While it was at it, it also officially launched the company.

The startup wants to bring a software-driven approach to robotics, one that would let you take dumb robotics and program it in a more automated fashion to perform a set of tasks, taking advantage of artificial intelligence and machine learning in ways that they say most manufacturing companies simply aren’t equipped to handle right now.

This is clearly not your typical Series A and Bright Machines does not appear to be a typical Series A company, feeling its way trying to get a product to market. Perhaps that’s because the company began life as incubated project inside Flex, a customized manufacturing company. It was then spun out as a startup called AutoLab AI and changed the name to Bright Machines today for the big company unveiling.

It already boast over 300 employees and brought in CEO, Armar Hanspal, who was most recently co-CEO at Autodesk to run the show. Former Autodesk CEO Carl Bass is a board member. Other board members include Mike McNamara, CEO of Flex and Steve Luszo, CEO of Seagate. Eclipse led the round.

What is attracting all of this money and talent to such a young company? Bright Machines is trying to solve a hard and expensive manufacturing problem. “We’re putting together the people, the tech stack and funding and other resources to go really go tackle this big under-served environment by bringing more automation and software to the factory floor,” CEO Hanspal told TechCrunch.

While he acknowledges we have seen a move toward automating the factor floor for decades, they are attacking an area that up until now has been underserved by robotics because the technology simply wasn’t ready to handle it. “What we’re doing that’s different is going from dumb, blind and costly robots to ones that are sensor rich, have computer vision, machine learning and are adaptable,” he said.

What’s more, they are bringing a subscription model to this approach, allowing customers to set up custom manufacturing lines on the fly with what they claim is much lower cost and fuss they faced with more traditional approaches.

They are taking on this sum of money so early because they believe it is a huge market and if they can attract the right talent, they can bring a substantive change to manufacturing that is lacking today. Time will tell if the bet pays off.

Powered by WPeMatico

Silicon Valley is in the midst of a health craze, and it is being driven by “Eastern” medicine.

It’s been a record year for US medical investing, but investors in Beijing and Shanghai are now increasingly leading the largest deals for US life science and biotech companies. In fact, Chinese venture firms have invested more this year into life science and biotech in the US than they have back home, providing financing for over 300 US-based companies, per Pitchbook. That’s the story at Viela Bio, a Maryland-based company exploring treatments for inflammation and autoimmune diseases, which raised a $250 million Series A led by three Chinese firms.

Chinese capital’s newfound appetite also flows into the mainland. Business is booming for Chinese medical startups, who are also seeing the strongest year of venture investment ever, with over one hundred companies receiving $4 billion in investment.

As Chinese investors continue to shift their strategies towards life science and biotech, China is emphatically positioning itself to be a leader in medical investing with a growing influence on the world’s future major health institutions.

We like to talk about things we can interact with or be entertained by. And so as nine-figure checks flow in and out of China with stunning regularity, we fixate on the internet giants, the gaming leaders or the latest media platform backed by Tencent or Alibaba.

However, if we follow the money, it’s clear that the top venture firms in China have actually been turning their focus towards the country’s deficient health system.

A clear leader in China’s strategy shift has been Sequoia Capital China, one of the country’s most heralded venture firms tied to multiple billion-dollar IPOs just this year.

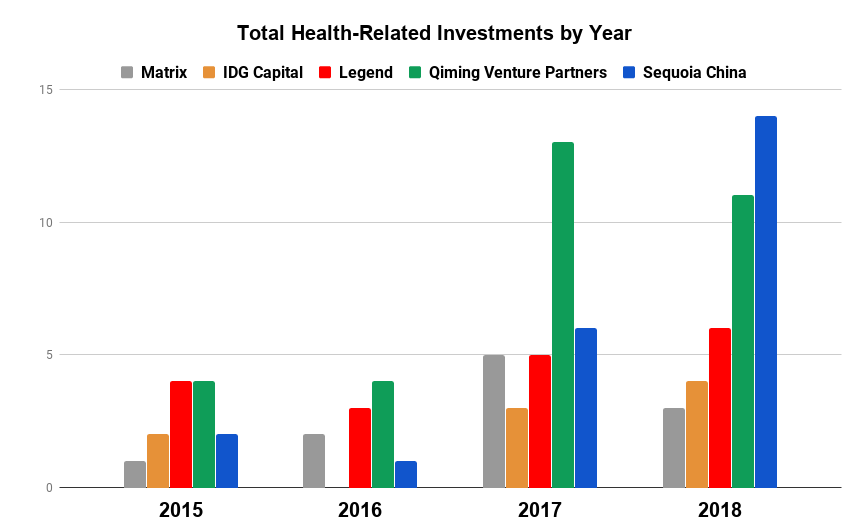

Historically, Sequoia didn’t have much interest in the medical sector. Health was one of the firm’s smallest investment categories, and it participated in only three health-related deals from 2015-16, making up just 4% of its total investing activity.

Recently, however, life sciences have piqued Sequoia’s fascination, confirms a spokesperson with the firm. Sequoia dove into six health-related deals in 2017 and has already participated in 14 in 2018 so far. The firm now sits among the most active health investors in China and the medical sector has become its second biggest investment area, with life science and biotech companies accounting for nearly 30% of its investing activity in recent years.

Health-related investment data for 2015-18 compiled from Pitchbook, Crunchbase, and SEC Edgar

There’s no shortage of areas in need of transformation within Chinese medical care, and a wide range of strategies are being employed by China’s VCs. While some investors hope to address influenza, others are focused on innovative treatments for hypertension, diabetes and other chronic diseases.

For instance, according to the Chinese Journal of Cancer, in 2015, 36% of world’s lung cancer diagnoses came from China, yet the country’s cancer survival rate was 17% below the global average. Sequoia has set its sights on tackling China’s high rate of cancer and its low survival rate, with roughly 70% of its deals in the past two years focusing on cancer detection and treatment.

That is driven in part by investments like the firm’s $90 million Series A investment into Shanghai-based JW Therapeutics, a company developing innovative immunotherapy cancer treatments. The company is a quintessential example of how Chinese VCs are building the country’s next set of health startups using their international footprints and learnings from across the globe.

Founded as a joint-venture offshoot between US-based Juno Therapeutics and China’s WuXi AppTec, JW benefits from Juno’s experience as a top developer of cancer immunotherapy drugs, as well as WuXi’s expertise as one of the world’s leading contract research organizations, focusing on all aspects of the drug R&D and development cycle.

Specifically, JW is focused on the next-generation of cell-based immunotherapy cancer treatments using chimeric antigen receptor T-cell (CAR-T) technologies. (Yeah…I know…) For the WebMD warriors and the rest of us with a medical background that stopped at tenth-grade chemistry, CAR-T essentially looks to attack cancer cells by utilizing the body’s own immune system.

Past waves of biotech startups often focused on other immunologic treatments that used genetically-modified antibodies created in animals. The antibodies would effectively act as “police,” identifying and attaching to “bad guy” targets in order to turn off or quiet down malignant cells. CAR-T looks instead to modify the body’s native immune cells to attack and kill the bad guys directly.

Chinese VCs are investing in a wide range of innovative life science and biotech startups. (Photo by Eugeneonline via Getty Images)

The international and interdisciplinary pedigree of China’s new medical leaders not only applies to the organizations themselves but also to those running the show.

At the helm of JW sits James Li. In a past life, the co-founder and CEO held stints as an executive heading up operations in China for the world’s biggest biopharmaceutical companies including Amgen and Merck. Li was also once a partner at the Silicon Valley brand-name investor, Kleiner Perkins.

JW embodies the benefits that can come from importing insights and expertise, a practice that will come to define the companies leading the medical future as the country’s smartest capital increasingly finds its way overseas.

Despite heavy investment by China’s leading VCs, Silicon Valley is doubling down in the US health sector. (AFP PHOTO / POOL / JASON LEE)

Innovation in medicine transcends borders. Sickness and death are unfortunately universal, and groundbreaking discoveries in one country can save lives in the rest.

The boom in China’s life science industry has left valuations lofty and cross-border investment and import regulations in China have improved.

As such, Chinese venture firms are now increasingly searching for innovation abroad, looking to capitalize on expanding opportunities in the more mature US medical industry that can offer innovative technologies and advanced processes that can be brought back to the East.

In April, Qiming Venture Partners, another Chinese venture titan, closed a $120 million fund focused on early-stage US healthcare. Qiming has been ramping up its participation in the medical space, investing in 24 companies over the 2017-18 period.

New firms diving into the space hasn’t frightened the Bay Area’s notable investors, who have doubled down in the US medical space alongside their Chinese counterparts.

Partner directories for America’s most influential firms are increasingly populated with former doctors and medically-versed VCs who can find the best medical startups and have a growing influence on the flow of venture dollars in the US.

At the top of the list is Krishna Yeshwant, the GV (formerly Google Ventures) general partner leading the firm’s aggressive push into the medical industry.

Krishna Yeshwant (GV) at TechCrunch Disrupt NY 2017

A doctor by trade, Yeshwant’s interest runs the gamut of the medical spectrum, leading investments focusing on anything from real-time patient care insights to antibody and therapeutic technologies for cancer and neurodegenerative disorders.

Per data from Pitchbook and Crunchbase, Krishna has been GV’s most active partner over the past two years, participating in deals that total over a billion dollars in aggregate funding.

Backed by the efforts of Yeshwant and select others, the medical industry has become one of the most prominent investment areas for Google’s venture capital arm, driving roughly 30% of its investments in 2017 compared to just under 15% in 2015.

GV’s affinity for medical-investing has found renewed life, but life science is also part of the firm’s DNA. Like many brand-name Valley investors, GV founder Bill Maris has long held a passion for the health startups. After leaving GV in 2016, Maris launched his own fund, Section 32, focused specifically on biotech, healthcare and life sciences.

In the same vein, life science and health investing has been part of the lifeblood for some major US funds including Founders Fund, which has consistently dedicated over 25% of its deployed capital to the space since at least 2015.

The tides may be changing, however, as the recent expansion of oversight for the Committee on Foreign Investment in the United States (CFIUS) may severely impact the flow of Chinese capital into areas of the US health sector.

Under its extended purview, CFIUS will review – and possibly block – any investment or transaction involving a foreign entity related to the production, design or testing of technology that falls under a list of 27 critical industries, including biotech research and development.

The true implications of the expanded rules will depend on how aggressively and how often CFIUS exercises its power. But a lengthy review process and the threat of regulatory blocks may significantly increase the burden on Chinese investors, effectively shutting off the Chinese money spigot.

Regardless of CFIUS, while China’s active presence in the US health markets hasn’t deterred Valley mainstays, with a severely broken health system and an improved investment environment backed by government support, China’s commitment to medical innovation is only getting stronger.

Deficiencies in China’s health sector has historically led to troublesome outcomes. Now the government is jump-starting investment through supportive policy. (Photo by Alexander Tessmer / EyeEm via Getty Images)

They say successful startups identify real problems that need solving. Marred with inefficiencies, poor results, and compounding consumer frustration, China’s health industry has many.

Outside of a wealthy few, citizens are forced to make often lengthy treks to overcrowded and understaffed hospitals in urban centers. Reception areas exist only in concept, as any open space is quickly filled by hordes of the concerned, sick, and fearful settling in for wait times that can last multiple days.

If and when patients are finally seen, they are frequently met by overworked or inexperienced medical staff, rushing to get people in and out in hopes of servicing the endless line behind them.

Historically, when patients were diagnosed, treatment options were limited and ineffective, as import laws and affordability issues made many globally approved drugs unavailable.

As one would assume, poor detection and treatment have led to problematic outcomes. Heart disease, stroke, diabetes and chronic lung disease accounts for 80% of deaths in China, according to a recent report from the World Bank.

Recurring issues of misconduct, deception and dishonesty have amplified the population’s mounting frustration.

After past cases of widespread sickness caused by improperly handled vaccinations, China’s vaccine crisis reached a breaking point earlier this year. It was revealed that 250,000 children had been given defective and fallacious rabies vaccinations, a fact that inspectors had discovered months prior and swept under the rug.

Fracturing public trust around medical treatment has serious, potentially destabilizing effects. And with deficiencies permeating nearly all aspects of China’s health and medical infrastructure, there is a gaping set of opportunities for disruptive change.

In response to these issues, China’s government placed more emphasis on the search for medical innovation by rolling out policies that improve the chances of success for health startups, while reducing costs and risk for investors.

Billions of public investment flooded into the life science sector, and easier approval processes for patents, research grants, and generic drugs, suddenly made the prospect of building a life science or biotech company in China less daunting.

For Chinese venture capitalists, on top of financial incentives and a higher-growth local medical sector, loosening of drug import laws opened up opportunities to improve China’s medical system through innovation abroad.

Liquidity has also improved due to swelling global interest in healthcare. Plus, the Hong Kong Stock Exchange recently announced changes to allow the listing of pre-revenue biotech companies.

The changes implemented across China’s major institutions have effectively provided Chinese health investors with a much broader opportunity set, faster growth companies, faster liquidity, and increased certainty, all at lower cost.

However, while the structural and regulatory changes in China’s healthcare system has led to more medical startups with more growth, it hasn’t necessarily driven quality.

US and Western investors haven’t taken the same cross-border approach as their peers in Beijing. From talking with those in the industry, the laxity of the Chinese system, and others, have made many US investors weary of investing in life science companies overseas.

And with the Valley similarly stepping up its focus on startups that sprout from the strong American university system, bubbling valuations have started to raise concern.

But with China dedicating more and more billions across the globe, the country is determined to patch the massive holes in its medical system and establish itself as the next leader in international health innovation.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we had the Three Excellent Friends (Connie Loizos, Danny Chrichton, and Alex Wilhelm) on hand to kick things about with Scale Venture Partner’s own Rory O’Driscoll.

As I’ve written the last few weeks, what a pile of news we’ve had recently. And like the last few episodes, we had to pick and choose what to drill into. This week: Twilio-Sendgrid, Palantir, Uber, Lyft, and Tencent Music IPOs, Instacart, and Saudi Arabia.

In order, I think? First, we tackled the week’s biggest venture-themed M&A: Twilio buying SendGrid. Keep in mind that they are both recent IPOs; Twilio went out in 2016, and SendGrid in 2017.

The $2 billion-ish all-stock transaction is effectively Twilio using its rich market cap (rich in terms of its revenue and profit multiples) to snag an obvious (though intelligent) extension of API-powered communications toolset.

Next up we dug into the chance that Palantir is worth $41 billion. Spoiler: It isn’t. Then we chatted the two other recently-floated IPO valuations for Uber ($120 billion) and Lyft ($15 billion). They probably make more sense, depending a little on how you add and then divide.

All that and we also touched on the recent delay in the Tencent Music IPO, a profitable company.

Then we riffed through the Instacart round ($600 million more at a $7.6 billion valuation; wow), and re-touched on Silicon Valley’s currently least popular dinner party topic: how much Saudi money has recently gone to work powering tech startups.

A big thanks to you for not only sticking with Equity for so long, but also for making it quite literally as popular as it has ever been. It’s super fun to have the biggest crew with us every week that we’ve ever had.

You, yes you, are a delight.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

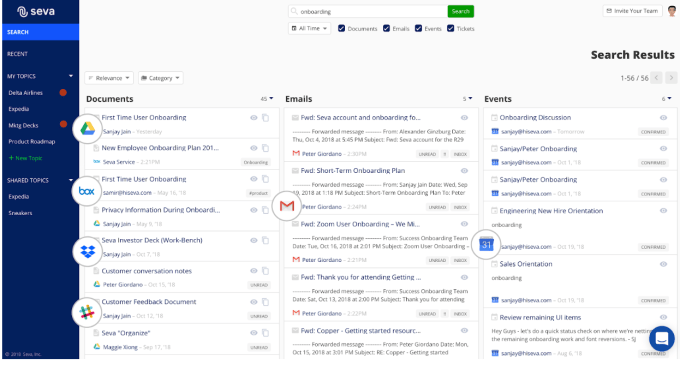

Seva, a New York City startup, that wants to help customers find content wherever it lives across SaaS products, announced a $2.4 million seed round today. Avalon Ventures led the round with participation from Studio VC and Datadog founder and CEO Olivier Pomel.

Company founder and CEO Sanjay Jain says that he started this company because he felt the frustration personally of having to hunt across different cloud services to find the information he was looking for. When he began researching the idea for the company, he found others who also complained about this fragmentation.

“Our fundamental vision is to change the way that knowledge workers acquire the information they need to do their jobs from one where they have to spend a ton of time actually seeking it out to one where the Seva platform can prescribe the right information at the right time when and where the knowledge worker actually needs it, regardless of where it lives.”

Seva, which is currently in Beta, certainly isn’t the first company to try to solve this issue. Jain believes that with a modern application of AI and machine learning and single sign-on, Seva can provide a much more user-centric approach than past solutions simply because the technology wasn’t there yet.

The way they do this is by looking across the different information types. Today they support a range of products including Gmail, Google Calendar, Google Drive,, Box, Dropbox, Slack and JIRA, Confluence. Jain says they will be adding additional services over time.

Screenshot: Seva

Customers can link Seva to these products by simply selecting one and entering the user credentials. Seva inherits all of the security and permissioning applied to each of the services, so when it begins pulling information from different sources, it doesn’t violate any internal permissioning in the process.

Jain says once connected to these services, Seva can then start making logical connections between information wherever it lives. A salesperson might have an appointment with a customer in his or her calendar, information about the customer in a CRM and a training video related to the customer visit. It can deliver all of this information as a package, which users can share with one another within the platform, giving it a collaborative element.

Seva currently has 6 employees, but with the new funding is looking to hire a couple of more engineers to add to the team. Jain hopes the money will be a bridge to a Series A round at the end of next year by which time the product will be generally available.

Powered by WPeMatico