funding

Auto Added by WPeMatico

Auto Added by WPeMatico

The second wave of Internet-era travel companies has captured the attention of venture capitalists.

In the last five years, travel companies have raised more than $1 billion in venture capital funding. That includes short-term rental startups, travel and tourism apps, marketplaces for “experiences” and other travel or hospitality tech platforms. Airbnb, a $38 billion company and an anomaly in the category, has raised $3 billion in that same time frame, according to PitchBook.

In the last few months alone, aspiring Concur-competitor TripActions and travel activities platform Klook entered the “unicorn” club with large venture rounds that valued both of the businesses at more than $1 billion. Meanwhile, luggage maker Away raised $50 million at a $400 million valuation and smaller startups in the space like Freebirds, IfOnly, KKDay, Duffel and RedDoorz all closed modest funding rounds.

“Something is really happening in the industry; something bigger than us,” TripActions co-founder Ariel Cohen said in a recent conversation with TechCrunch about his company’s $154 million Series C financing. “Different startups are identifying the opportunity here and the fact that companies want to make sure their employees are happy while they are on the go. That’s why you see investments in companies like Brex and like TripActions.”

Brex, though not classified as a travel startup, lets startup employees earn extra points on business travel with its corporate credit card for startups. It recently raised a $125 million Series C at a $1.1 billion valuation.

Global travel and tourism is one of the most valuable industries worth some $7 trillion. The online travel market, in particular, is expected to grow to $817 billion by 2020. VCs are hunting for tech-enabled startups poised to dominate that slice.

“You have a new wave of businesses where all of that digital infrastructure is set up, so the focus can be on things like efficiency, improved customer service, scale and growth — you have a ton of companies popping up catering to those needs,” Defy Partners co-founder Neil Sequeira told TechCrunch. Sequeira was a managing director at General Catalyst when the firm made its first investment in Airbnb.

On the other hand, you have a whole cohort of travel business founded amid the dot-com boom that are looking to technology startups for a much-needed infusion of innovation. Many of those larger companies have become active acquirers, fueling VC interest in the space. SAP Concur, for example, acquired the formerly VC-backed travel-booking startup Hipmunk in 2016. Before that, it bought travel planning company TripIt for $120 million, among others.

Expedia has gobbled up a number of travel brands too, like travel photography community Trover; Airbnb-competitor HomeAway, which it paid a whopping $3.9 billion for in 2015; and most recently, both Pillow and ApartmentJet.

Many of these acquisitions are for peanuts, which is far from ideal for a venture-funded company. And building a travel business is cash intensive, hence the $4.4 billion Airbnb has raised to date or even TripActions’ $236 million in total VC funding. To keep momentum in the space, companies need to be striking larger M&A deals.

It doesn’t help that many in and around the venture capital industry are predicting an imminent turn in the market. Travel companies, which are reliant upon a consumer’s tendency to spend excess cash, will be among the first sectors to be impacted by hostile economic conditions.

“If the market turns, people aren’t going to spend $10,000 on a trip to Zimbabwe,” Sequeira said, referencing companies like IfOnly, which sells curated experiences.

Travel startups should raise now while the market is hot. The conditions may not remain favorable for long.

Powered by WPeMatico

Datacoral aims to make it easier for enterprises to build data products by abstracting away all of the complex infrastructure to organize and process data. The company today announced that it has raised a $10 million Series A financing round led by Madrona Venture Group, with participation from Social Capital, which also led its $4 million seed round in 2017.

Datacoral CEO Raghu Murthy tells me that the company plans to use the new funding to grow its business team in order to be able to reach more potential customers and to expand its engineering team.

The promise of Datacoral is to offer enterprises an end-to-end data infrastructure that will allow businesses and their data scientists to focus on generating insights over having to manage and integrate their data sources. Because nobody wants to move large amounts of data between clouds — and take the performance hit that comes with that — Datacoral sits right inside a company’s AWS systems. It’s still a fully managed service, though, but the data is encrypted and never leaves a customer’s virtual private cloud.

“As companies look to their data to deliver value – data practitioners are finding that configuring and managing their own data infrastructure is a time-consuming job that is expensive and fraught with errors,” said Murthy. “We have built a platform that easily and automatically brings together data from different applications and databases, organizes that data in any query engine and acts on insights that are critical to running their business. A crucial component is that it works securely and privately within the customer’s cloud, instead of us ingesting data from their systems.”

Murthy was an early engineer at Facebook and part of the team that was in charge of scaling that company’s data infrastructure and ran a part of the engineering team at Bebop, Diane Greene’s startup that was later acquired by Google.

To scale Datacoral, the team is betting on a serverless platform itself. It’s making extensive use of AWS Lambda and other PaaS solutions on Amazon’s cloud computing platform. That doesn’t mean Datacoral plans to only support AWS, though. Murthy tells me that Azure support is next. “We plan to work across all of the top cloud providers by leveraging their unique services and provide a consistent ‘data-centric interface’ to our customers — essentially be ‘cloud best’ instead of ‘cloud agnostic.’”

Current Datacoral users include Greenhouse, Front, Ezetap, Swing Education, mPharma and Mason Finance.

Powered by WPeMatico

Every day, there are around 650,000 emergency service callouts via 911 for medical, police and fire assistance in the U.S.; and by their nature these are some of the most urgent communications that we will ever make.

But ironically for the age of smartphones, connected things and the internet, these 911 calls are also some of the most antiquated — with a typical emergency response center still relying on humans making the calls to tell them the most basic of information about their predicaments before anything can be actioned.

Now a new generation of startups has been emerging to tackle that gap to make emergency responses more accurate and faster; and one of them today is announcing a significant round of funding on the back of very strong growth. RapidSOS, a New York-based startup that helps increase the funnel of information that is transmitted to emergency services alongside a call for help, has raised another $30 million in funding — money that it’s going to use to continue enhancing its product, and also to start pushing into more international markets.

The opportunity internationally is greater than the U.S. alone: while the U.S. sees 240 million calls per year to 911 numbers, globally the figure is 2 billion.

The funding — which comes only about six months after RapidSOS’s href=”https://www.prnewswire.com/news-releases/rapidsos-raises-16m-to-provide-life-saving-data-to-first-responders-300631998.html”>last round of $16 million — is being led by Playground Global, the VC firm and “startup studio” co-founded by Android co-creator Andy Rubin.

Others in the round include a mix of previous and new investors (and a lot of illustrious names): Highland Capital Partners, M12 (Microsoft’s Venture Fund), Two Sigma Ventures, Forte Ventures, The Westly Group, CSAA IG, three former FCC chairmen and Ralph de la Vega, the former AT&T vice chairman and CEO of AT&T Business Solutions and International. It brings the total raised by the startup to $65 million.

Michael Martin, CEO and co-founder of RapidSOS, said the startup is not disclosing its valuation, but he did point me to the company’s stunning growth over the last year. “We went from 10,000 users to 250 million,” he said, noting the range of agencies and other partners the startup is integrating with to provide more detailed information across the emergency services ecosystem.

Partners on the two sides of RapidSOS’s marketplace include, on one side, Apple, Google, Uber, car companies and others making connected devices and apps — which integrate RapidSOS’s technology to provide 911 response centers with more data such as a user’s location and diagnostic details that can help determine what kind of response is needed, where to go, and so on. And on the other side, you have the emergency services that need that information to do their work and organize assistance.

RapidSOS offers a few different products to the market. Its most popular, the RapidSOS NG911 Clearinghouse, works either with a response center’s existing software, or by way of a web application. This product now covers some 180 million people in the U.S. in terms of the number of people touched by those different emergency response services, the company says.

The RapidSOS API, meanwhile, is used by a number of device makers and apps to be able to channel that information into the RapidSOS system, so that when a response center is using RapidSOS and a caller is using a device or app with the API integrated with it, that information gets conveyed.

The startup also offers a rescue and recovery app called Haven, and found its profile getting a huge boost after Haven went viral in the wake of a succession of natural disasters in the U.S.

The company generates revenue in different ways across that range of services. On mobile, the service is free to consumers, with licensing for the integrations paid for by large tech partners like Apple, Google, etc. In the areas of safety and security (including integrations with home security, digital health, medical alert, personal emergency response (PERS) and vehicle crash response providers), RapidSOS is “typically bundled in with the service offering,” Martin said.

Martin — who co-founded the company with now-CTO Nicholas Horelik (respectively Harvard and MIT grads) after Martin said he was mugged in New York City — said that he sees a big opportunity for RapidSOS, and indeed emergency services in general, once we start to join up the dots better between the trove of data that we can now pick up with connected objects, and conveying what’s important in that trove in order to make emergency calls more effective.

“Most emergency communication today uses infrastructure established between the 1960s and the 1980s, and it means that if you need 911 but can’t have a conversation you are in trouble. 911 doesn’t even know your name when you call,” he said in an interview. “But there is all this rich information today, and so our job is to help make that available when you really need it.”

(I should note he spoke to me while driving on a freeway, but he noted that the car he was in was part of a RapidSOS pilot, and so if he did have an accident, at least the responders would be more aware of what happened… Not a huge comfort, but interesting.)

When you consider the number of connected wearables, connected cars and other inanimate objects that are now becoming “smart” through internet-based, wireless controls, sensors and operating systems, you can see the strong potential of harnessing that for this particular use case.

RapidSOS is not the only company that’s addressing this gap in the market. Carbyne out of Israel raised a growth round earlier this year led by Founders Fund in its first investment in an Israeli startup, also to build systems to provide more data for emergency services responders.

(Carbyne, by coincidence, was also borne out of the CEO getting mugged: necessity really is the mother of invention.)

“We are completely different from Carbyne,” Martin said of the other startup. “They are trying to provide more modern software to the industry” — where companies like Motorola have long dominated — “and it’s great to see new innovation on that front. But when we looked at industry, we found the challenge was not software but the data that was being provided. There is a lot of information out there, but no data flow, which is limited by the typical emergency response system to 512 bytes of data.”

He says that RapidSOS, in that regard, works with multiple vendors, including Carbyne, to transmit that data.

And it’s that platform-agnostic approach that interestingly caught the eye of Playground.

“RapidSOS is on the forefront of emergency technology, working with companies like Apple, Google, Uber, and Microsoft to transform emergency communication,” said Bruce Leak, co-founder of Playground Global, in a statement. “We see endless opportunities for connected device data to enhance emergency response and are eager to work with RapidSOS to expand their life-saving platform.”

Powered by WPeMatico

Seemingly every industry is finding ways to use drones in some way or another, but deep underground it’s a different story. In the confines of a mine or pipeline, with no GPS and little or no light, off-the-shelf drones are helpless — but an Australian startup called Emesent is giving them the spatial awareness and intelligence to navigate and map those spaces autonomously.

Drones that work underground or in areas otherwise inaccessible by GPS and other common navigation techniques are being made possible by a confluence of technology and computing power, explained Emesent CEO and co-founder Stefan Hrabar. The work they would take over from people is the epitome of “dull, dirty, and dangerous” — the trifecta for automation.

The mining industry is undoubtedly the most interested in this sort of thing; mining is necessarily a very systematic process and one that involves repeated measurements of areas being blasted, cleared, and so on. Frequently these measurements must be made manually and painstakingly in dangerous circumstances.

One mining technique has ore being blasted from the vertical space between two tunnels; the resulting cavities, called “stopes,” have to be inspected regularly to watch for problems and note progress.

“The way they scan these stopes is pretty archaic,” said Hrabar. “These voids can be huge, like 40-50 meters horizontally. They have to go to the edge of this dangerous underground cliff and sort of poke this stick out into it and try to get a scan. It’s very sparse information and from only one point of view, there’s a lot of missing data.”

Emesent’s solution, Hovermap, involves equipping a standard DJI drone with a powerful lidar sensor and a powerful onboard computing rig that performs simultaneous location and mapping (SLAM) work fast enough that the craft can fly using it. You put it down near the stope and it takes off and does its thing.

“The surveyors aren’t at risk and the data is orders of magnitude better. Everything is running onboard the drone in real time for path planning — that’s our core IP,” Hrabar said. “The dev team’s background is in drone autonomy, collision avoidance, terrain following — basically the drone sensing its environment and doing the right thing.”

As you can see in the video below, the drone can pilot itself through horizontal tunnels (imagine cave systems or transportation infrastructure) or vertical ones (stopes and sinkholes), slowly working its way along and returning minutes later with the data necessary to build a highly detailed map. I don’t know about you, but if I could send a drone ahead into the inky darkness to check for pits and other scary features, I wouldn’t think twice.

The idea is to sell the whole stack to mining companies as a plug-and-play solution, but work on commercializing the SLAM software separately for those who want to license and customize it. A data play is also in the works, naturally:

“At the end of the day, mining companies don’t want a point cloud, they want a report. So it’s not just collecting the data but doing the analytics as well,” said Hrabar.

Emesent emerged from Data61, the tech arm of Commonwealth Scientific and Industrial Research Organisation, or CSIRO, an Australian agency not unlike our national lab system. Hrabar worked there for over a decade on various autonomy projects, and three years ago started on what would become this company, eventually passing through the agency’s “ON” internal business accelerator.

“Just last week, actually, is when we left the building,” Hrabar noted. “We’ve raised the funding we need for 18 months of runway with no revenue. We really are already generating revenue, though.”

The $3.5 million (Australian) round comes largely from a new $200M CSIRO Innovation fund managed by Main Sequence Ventures. Hrabar suggested that another round might be warranted in a year or two when the company decides to scale and expand into other verticals.

DARPA will be making its own contribution after a fashion through its Subterranean Challenge, should (as seemly likely) Emesent achieve success in it (they’re already an approved participant). Hrabar was confident. “It’s pretty fortuitous,” he said. “We’ve been doing underground autonomy for years, and then DARPA announces this challenge on exactly what we’re doing.”

We’ll be covering the challenge and its participants separately. You can read more about Emesent at its website.

Powered by WPeMatico

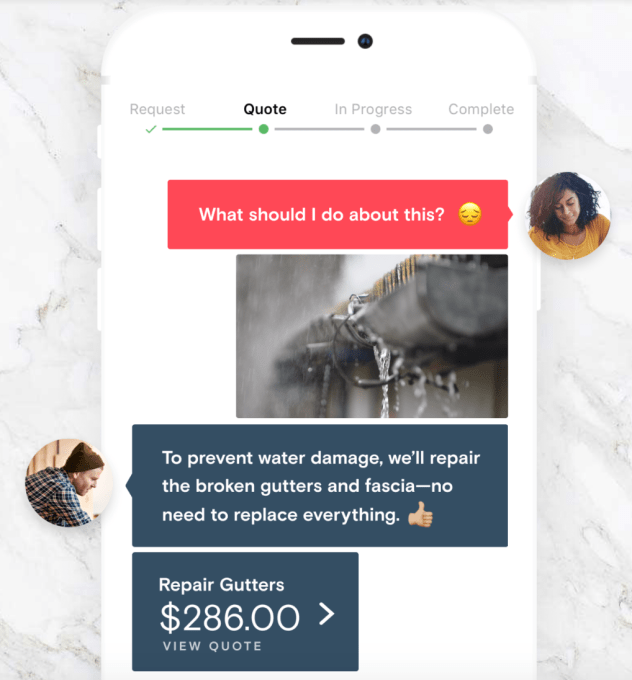

You probably don’t know how much it should cost to get your home’s windows washed, yard landscaped or countertops replaced. But Setter does. The startup pairs you with a home improvement concierge familiar with all the vendors, prices and common screwups that plague these jobs. Setter finds the best contractors across handiwork, plumbing, electrical, carpentry and more. It researches options, negotiates a bulk rate and, with its added markup, you pay a competitive price with none of the hassle.

One of the most reliable startup investing strategies is looking at where people spend a ton of money but hate the experience. That makes home improvement a prime target for disruption, and attracted a $10 million Series A round for Setter co-led by Sequoia Capital and NFX. “The main issue is that contractors and homeowners speak different languages,” Setter co-founder and CEO Guillaume Laliberté tells me, “which results in unclear scopes of work, frustrated homeowners who don’t know enough to set up the contractors for success, and frustrated contractors who have to come back multiple times.”

Setter is now available in Toronto and San Francisco, with seven-plus jobs booked per customer per year costing an average of over $500 each, with 70 percent repeat customers. With the fresh cash, it can grow into a household name in those cities, expand to new markets and hire up to build new products for clients and contractors.

I asked Laliberté why he cared to start Setter, and he told me “because human lives are made better when you can make essential human activities invisible.” Growing up, his mom wouldn’t let him buy video games or watch TV so he taught himself to code his own games and build his own toys. “I’d saved money to fix consoles and resell them, make beautiful foam swords for real live-action games, buy and resell headphones — anything that people around me wanted really!” he recalls, teaching him the value of taking the work out of other people’s lives.

I asked Laliberté why he cared to start Setter, and he told me “because human lives are made better when you can make essential human activities invisible.” Growing up, his mom wouldn’t let him buy video games or watch TV so he taught himself to code his own games and build his own toys. “I’d saved money to fix consoles and resell them, make beautiful foam swords for real live-action games, buy and resell headphones — anything that people around me wanted really!” he recalls, teaching him the value of taking the work out of other people’s lives.

Meanwhile, his co-founder David Steckel was building high-end homes for the wealthy when he discovered they often had ‘home managers’ that everyone would want but couldn’t afford. What if a startup let multiple homeowners share a manager? Laliberté says Steckel describes it as “I kid you not, the clouds parted, rays of sunlight began to shine through and angels started to sing.” Four days after getting the pitch from Steckel, Laliberté was moving to Toronto to co-found Setter.

Users fire up the app, browse a list of common services, get connected to a concierge over chat and tell them about their home maintenance needs while sending photos if necessary. The concierge then scours the best vendors and communicates the job in detail so things get done right the first time, on time. They come back in a few minutes with either a full price quote, or a diagnostic quote that gets refined after an in-home visit. Customers can schedule visits through the app, and stay in touch with their concierge to make sure everything is completed to their specifications.

The follow-through is what sets Setter apart from directory-style services like Yelp or Thumbtack . “Other companies either take your request and assign it to the next available contractor or simply share a list of available contractors and you need to complete everything yourself,” a Setter spokesperson tells me. They might start the job quicker, but you don’t always get exactly what you want. Everyone in the space will have to compete to source the best pros.

Though potentially less scalable than Thumbtack’s leaner approach, Setter is hoping for better retention as customers shift off of the Yellow Pages and random web searches. Thumbtack rocketed to a $1.2 billion valuation and had raised $273 million by 2015, some from Sequoia (presenting a curious potential conflict of interest). That same ascent may have lined up the investors behind Setter’s $2 million seed round from Sequoia, Hustle Fund and Avichal Garg last year. Today’s $10 million Series A also included Hustle Fund and Maple VC.

The toughest challenge for Setter will be changing the status quo for how people shop for home improvement away from ruthless bargain hunting. It will have to educate users about the pitfalls and potential long-term costs of getting slapdash service. If Laliberté wants to fulfill his childhood mission, he’ll have to figure out how to make homeowners value satisfaction over the lowest sticker price.

Powered by WPeMatico

The past decade in retail has been the golden age of direct-to-consumer (D2C) and digitally native vertical brands (DNVBs) that use the internet to communicate with customers, execute transactions, handle distribution and offer better economics.

But as small independent startups have scaled into unicorn territory and as countless brands have saturated digital channels, customer acquisition has gotten harder and costlier. Companies are now trying to meet customers with different purchase habits by developing physical stores.

However, building an effective brick-and-mortar presence can be expensive and risky for DNVBs, requiring resources outside their core competencies. Chicago-based startup Leap is hoping to make it easier for digital brands to grow physical retail footprints without the typical risks of store development by taking care of the entire process for them.

Leap offers a full-service platform covering the complete life cycle of a brand’s brick-and-mortar launch. In addition to owning the lease and the financial commitments that come with it, Leap covers everything from staffing, experiential design, tech integration and even day-to-day operations.

(Photo by Alexander Scheuber/Getty Images)

Less than a year since its founding, Leap announced today the launch of its first store and the close of a $3 million seed round, led by Costanoa Ventures, with participation from Equal Ventures and Brand Foundry Ventures.

The debut store will act as the first Chicago location for Koio, the high-end D2C sneaker brand backed by headline-grabbing names like the Winklevoss twins, director Simon Kinberg and actor Miles Teller.

Instead of paying a monthly lease fee, along with all the other variable costs associated with operating a physical store, companies like Koio pay Leap on a percent of sales basis, effectively minimizing risk and incentivizing performance.

On top of minimizing development expense for brands, Leap believes its customer insights and intelligent logistics platform can help improve shopper engagement, increase customer traffic and drive brand lift. If the startup’s thesis proves true, brands can improve both sides of their brick-and-mortar unit economics by reducing customer acquisition costs and amplifying customer value.

At its core, Leap simplifies a DNVB’s physical retail operations into a single line item on its P&L, allowing the company to focus on brand building and supply chain rather than retail strategy, while also allowing them to scale faster.

With the latest fundraise, the company hopes to build out its team and continue new location expansion. Longer-term, Leap’s co-founders hope to build a vast network of sites that can help provide intelligence around new store development and shopper preference.

“We want to be the platform to help brands go to market in the offline space”, said co-founder Amish Tolia. “We want to help brands build direct-to-consumer relationships in local neighborhoods across the country and enable them to focus on what they’re best at. Enable them to focus on product innovation, supply chain management, great marketing and brand building.”

While Leap’s value proposition is straightforward, its business model points to a bigger trend in the world of retail.

By opting to sell its software and brick-and-mortar services rather than creating its own brands, Leap effectively acts as a “retail-as-a-service” platform. The as-a-service strategy is already quietly growing in popularity in the retail space, with companies like b8ta, the Internet of Things gadget retailer, launching its hardware-oriented “Built by b8ta” platform earlier this year.

Though likely heavy in upfront capital costs, retail-as-a-service businesses don’t have the same constant concern around supply chain, manufacturing, consumer acquisition and marketing spend. And in certain pricing models based on a monthly fee or percent of square footage basis, platforms can see more stable revenues relative to pure retail startups.

From a brand perspective, DNVBs have been looking for ways to extend growth runways while minimizing the cost and uncertainty that deterred them from physical stores in the first place. The as-a-service model can make brick-and-mortar retail a much more scalable engine, possibly even cooling rising concern around bubbling consumer valuations.

As more of the young digitally born D2C giants resort to as-a-service companies to find marginal customers, we may see the rise of a new set of startups fighting to establish themselves as the platform on which brands operate.

If the last decade was defined by retail online, it’s possible that the next decade will be defined by retail-as-a-service.

And if you find yourself in Chicago, feel free to check out the Leap-enabled Koio Store at 924 W Armitage in Lincoln Park.

Powered by WPeMatico

As car and tech companies continue to make inroads on vehicles and services to build autonomous driving systems, a startup that is creating high-definition maps to help these vehicles move around has quietly picked up a significant round of funding.

DeepMap — a Palo Alto startup co-founded by James Wu and Mark Wheeler, who previously helped build maps and more at Google, Apple and Baidu — has raised a significant round of growth funding at a valuation of at least $475 million to expand its technology stack and its reach into more markets beyond its current footprint of the U.S. and China.

Founded in 2016, DeepMap has been relatively quiet since raising $25 million in 2017, but news about this round has been trickling out for the last few months. In July, the company filed papers for a $60 million Series B round. In August, it noted that Nvidia had joined the round, which by that point was “oversubscribed” but still not closed.

And today, Generation Investment Management — the VC firm that counts former Vice President Al Gore and others among its co-founders — also confirmed that it is part of that Series B, along with previous investors Andreessen Horowitz, Accel Partners and GSR Ventures, and new investor Robert Bosch Venture Capital. PitchBook notes that the round puts the valuation of DeepMap at $450 million post-money. However, with Generation added to the mix, both the size of the Series B and the valuation might be higher.

We’ve asked and Generation and DeepMap are not disclosing those details, but they have said that the investment is being made because the interests of the startup are in line with that of the VC.

“DeepMap and Generation share the deeply-held belief that autonomous vehicles will lead to environmental and social benefits,” said Wu, who is the CEO of DeepMap (Wheeler is the CTO), in a statement. “We are delighted to work with the talented team at Generation. We consider Generation to be a value-added investor, whose insights and mission-aligned network will be of great advantage as we scale, especially in Europe.”

DeepMap is not exactly in stealth mode, but it also doesn’t disclose much about what it is working on specifically, nor how the funding will be used. (But it is hiring, mostly in engineering roles, in Palo Alto and Beijing.)

Companies like Waymo are expanding their autonomous driving tests, Lyft is buying companies to help ingest more driving data more easily and just this week Baidu announced new car plans with Volvo and Ford, but there are still some crucial pieces that need to be put in place for self-driving to become a wide-scale reality, and one of them is building systems that have an accurate reading of the roads they are driving on.

HD mapping will play a key role in that regard, helping make systems more accurate with real-time localization features that respond to road types and driving conditions. DeepMap says that it provides centimeter-specific accuracy using “real-world data, not models” and the ability to incorporate 3D landmark features and full 3D environments using “true LiDAR intensity and RGB values data” for simulation tools.

While DeepMap does not detail its products on its site, one report describes its offering as including hardware tools, software solutions, field data collection services, and a service that is able to translate the self-driving fleet data that companies are now in the process of collecting “into their own personalized HD maps.” The same report claimed that DeepMap charges about $5,000 per kilometer for mapping services in the U.S.

DeepMap is also not the only company working on addressing this need for better and more accurate mapping: mapping startup Camera is also raising money to build its service; DeepMap’s investor Nvidia is also working on this problem; and lvl5 is another name we’ve also seen mentioned in this context.

The funding, and these partnerships, will likely help DeepMap cement its position on the map, so to speak, as all of these continue to grow.

“DeepMap is perfectly placed to address the imminent needs of autonomous vehicles. These vehicles will require HD maps and localization modules which are real-time, scalable, economically-viable, and machine-readable, something which DeepMap can deliver through its unique approach,” said Lilly Wollman, co-head of Generation’s Growth Equity team, in a statement. “We are very excited to partner with one of the most technically impressive and experienced teams in the industry.”

Powered by WPeMatico

Mavrck has raised another $5.8 million in funding, bringing its total raised to $13.8 million.

When the company raised its Series A back in 2015, it was focused on helping brands work with “micro-influencers” who were already using their products. Now it describes itself as an “all-in-one” influencer marketing platform, offering a number of tools to automate and measure the process.

Last month, Mavrck announced new features for Pinterest, where it’s now an official marketing partner. It also says it’s been doing more to improve measurement and detect fraud — on the fraud side, it promises to analyze a “statistically significant sample” of an Instagram account’s followers, and of the accounts that engage with their content, to determine if they’re bots.

Customers include P&G, Godiva and PepsiCo, and the company says recurring revenue has grown 400 percent year-over-year.

“Everything that we have done at Mavrck this year has been done with the intention to drive the influencer industry forward,” said co-founder and CEO Lyle Stevens in the funding announcement. “Every new capability that we’ve introduced, every partner that we’ve started working with, every influencer behavior that we’ve tracked was part of our mission to help marketers harness the power of content that people trust to drive tangible business value for their brands.”

The new funding comes from GrandBanks Capital and Kepha Partners. A spokesperson said this isn’t a Series B, but rather additional capital raised to support increased demand and channel partnerships.

Powered by WPeMatico

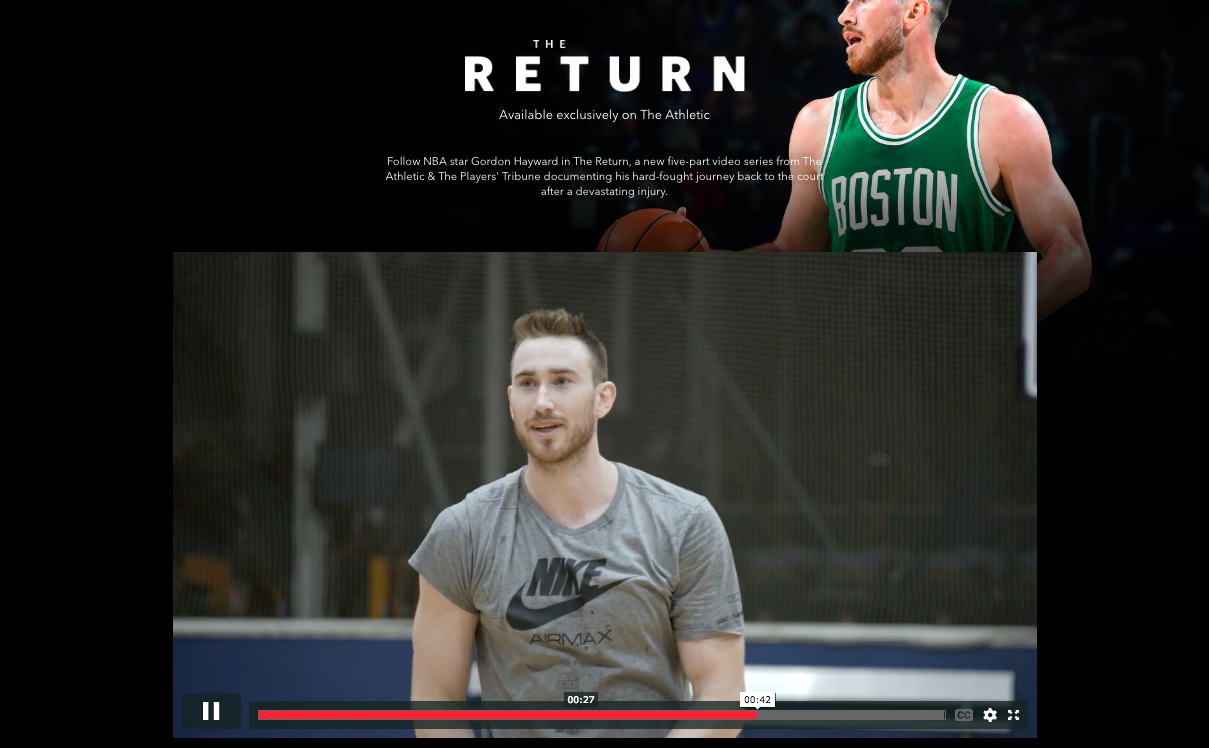

Local newspapers may be shuttering and people may be consuming most news on social media, but don’t tell Alex Mather that a subscription news publication can’t grow like a unicorn startup. His 2-year-old sports publisher The Athletic has gained over 100,000 paid subscribers (60 percent under age 34) and has a 90 percent retention rate.

Having already raised $30 million in its short life, the company announced a new $40 million Series C yesterday, led by Founders Fund and Bedrock Capital. It reportedly values The Athletic around $200 million.

I interviewed Alex Mather (The Athletic’s CEO) and Eric Stomberg (partner at Bedrock Capital) to understand what’s behind the breakout success, and why they think this publishing startup can scale to become a multi-billion dollar company.

EP: Bedrock makes concentrated, contrarian bets. Explain how The Athletic fits that.

ES: I first met Alex and Adam in 2016 during Y Combinator. The popular view then, as it remains now, was that people just aren’t willing to pay for content online and that to win in media you have to put out a high volume of free articles on social.

The Athletic took the opposite approach. It’s a narrative violation. Everything is part of a paid subscription, with the belief that instead of writers needing to post 3-4 pieces per day, they should focus on deeper stories that add value to paid subscribers over time. That worldview resonated with us. If you can create content at scale that people are willing to pay for, that’s a powerful economic engine.

There’s so much sports coverage already out there, by professionals and amateurs alike, so why are people willing to pay for The Athletic?

AM: While there appears to be an abundance of content, most of it is aggregated, shallow content for a broad audience. We produce fewer stories and target a diehard fan. Our subscribers consistently tell us that no one else produces the same depth on a daily basis.

How did you determine the $60/year price point?

AM: We think of $60/year ($5/month) as less than the average NBA ticket. It’s a meaningful price but not prohibitive, especially when we do discounts in the first year. Like all subscription companies, whether we like it or not, we have to consider how our pricing stacks up against Netflix. For $10/month, you can subscribe to Netflix which is spending $8 billion per year in content.

Is The Athletic profitable?

AM: We expand by launching in local markets. We are in 47 thus far. The operational focus is on building a local team and becoming profitable in each local market. I can tell you that most markets are profitable in the first year — currently all of our markets over one year old are profitable and most of those over 6 months old are profitable.

(Photo by Thearon W. Henderson/Getty Images)

Explain your growth strategy in terms of coverage: Which sports did you start with and at which level (local versus national)?

AM: Direct-to-consumer businesses have to really work to earn their subscribers’ hard-earned money. We have to obsess over where we can be different. In the beginning, that was with hockey and baseball, because those have been de-prioritized by the bigger players. That shifted as we gained more subscribers: we needed to become comprehensive. We hired folks to cover the NBA, to cover the NFL, to cover soccer.

Do subscribers usually come just for one local sport or for the broader bundle?

AM: We’ve built a powerful bundle. A local newspaper has local politics, local restaurants, and then local sports. We have just the sports, but add a national perspective and a nationwide bundle. Most of our subscribers are “super bundlers,” meaning they subscribe to content from multiple cities plus at least one national product and usually a college product that’s not local. We provide all that for significantly less than competitors.

Eric — as a VC looking for multi-billion-dollar exits, how are you analyzing the potential scale of a subscription publication like this? Even most people who are bullish on subscriptions believe it’s a choice of going for a niche audience and staying small.

ES: There are two things we look for in a subscription business: retention and a positive flywheel.

Retention. In any subscription business, the key question is: can they maintain their subscribers over time? Most of them don’t. Spotify does, Netflix does, and The Athletic does as well. The Athletic is off the charts, which sets it up for scale. You want to see deep engagement over a very, very long period of time — years.

A positive flywheel. The more you build your subscriber base, the more you build your revenue base. That allows you to get better content, to hire unique writers, to build greater depth. In doing so, you attract people who weren’t ready to subscribe in the early days but now you have writers they follow and content they want. Technology is important here too: as you build a bigger platform with more content, serving the right content at the right time to each user is a key advantage. When this flywheel is working it’s actually quite hard to put a ceiling on the business.

Most publishers did a so-called “pivot to video” over the last couple of years. You’re anchored in writing. Why not more video at the start?

AM: We’re obsessed with the consumer and all our research in the beginning said that people still like to read books and articles. Advertising with text may not be as good as with video, which may be why so many other companies “pivoted to video,” but we think the written word is still the best way to convey certain types of stories. It’s straightforward, it doesn’t require headphones.

There’s an incredible amount of talent out there that can produce these stories and that has been cast aside by many entities. We saw it as an opportunity to give them great jobs and bring value to our subscribers. That has paid off for us.

What are your plans for video or other content formats in the future?

AM: We raised this Series C with audio and video in mind. We can tell even more stories when we add in audio and video possibilities. Our goal is to serve the subscriber: some love to read, some love to listen, others prefer to watch. We look up to things like The Ringer, Andre the Giant on HBO, VICE News, Gimlet, and The Daily by The New York Times all as incredible storytelling, and we ask ourselves “how can we do sports versions of those?”

Why focus on hiring experienced, full-time writers rather than a stable of contributors or curating from the vast pool of content by fans? Lots of amateurs pay close attention to sports.

AM: What’s really important to us is a growth mentality — that by Day 100 on our team a writer is thinking very differently. We’re providing lots of data, lots of feedback. We invest in great people who will figure this out with us over time. Also, scaling so quickly from 0 to 300 editorial staff was possible because we recruited experienced talent who know what to do already.

We do have about 400 contributors as well. These are folks who may be lawyers or accountants but are passionate about the teams they cover. We are a way for them to reach a premium audience. We can pay them really well and give them world-class editors formerly with Sports Illustrated and ESPN.

How are you acquiring your subscribers?

AM: When we expand into a new market, we gain new subscribers by hiring writers who have a following already and by word of mouth from existing subscribers. Then like any direct-to-consumer brand, we are acquiring subscribers through Google, Facebook and Twitter.

You financially incentivize your writers based on them acquiring new subscribers through their articles or by promoting The Athletic with their followers online. That is very uncommon in publishing. Explain that strategy.

AM: It ties back to our focus on building for the long term and investing in talent that will grow with us. We like to assign incentives that give us the best chance of building a sustainable business and we think about compensation in that way. We give our team equity in the company and for many, we tie a portion of their comp to the performance of their team, sport, city. It’s a great way to share in the responsibility and success of the business.

At the bottom of articles, you ask readers to rate each story as “Meh,” “Solid,” or “Awesome.” I wish every publisher did this. How do you use this data? How do a writer’s scores impact them?

AM: It’s about feedback loops. Our writers gauge feedback when they share on Twitter. This is another data point. It helps paint a more complete picture. NPS alone isn’t enough of course though. We look at whether articles drive new subscribers, drive deep engagement, drive comments, etc. We don’t use pageviews, but we certainly use metrics. Usually, this results in a writer producing very different work on Day 100 than they were on Day 0.

Explain the interaction between subscribers. It’s not unique to have a comments section: there are bad comments sections, good comments sections and comments sections that go unused. At a tactical level, how do you think about building community?

AM: My co-founder and I met at Strava, the social network for endurance athletes. I ran the product team and we were obsessed with community. We see an incredible connection between community engagement and subscriber retention. The question that drives us is how can we connect users in an authentic way, how can we connect users to our staff in an authentic way, how can we connect users to athletes in an authentic way. We’re doing a lot of experimentation here. We have a distinct opportunity because of our paywall: most of the comments on The Athletic are saying substantive things.

Powered by WPeMatico

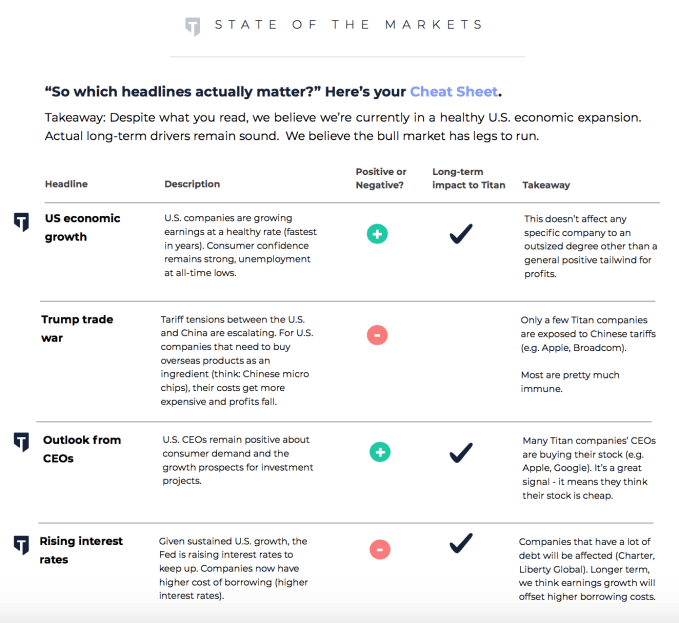

Titan could put an end to stock market FOMO. The app chooses the best 20 stocks by scraping top hedge fund data, adds some shorts based on your personal risk profile and puts your money to work. No worrying about market fluctuations or constantly rebalancing your portfolio. You don’t have to do anything, but can get smarter about stocks thanks to its in-app explanations and research reports. Titan wants to be the easiest way to invest in stocks for a mobile generation that wants an affordable coach to guide them through the market themselves.

“Our goal is to take things that aren’t accessible [in wealth management] and make them accessible, starting with hedge funds,” says Titan co-founder Joe Percoco. That potential to democratize one of the keys to financial mobility has won Titan a $2.5 million seed round from Y Combinator’s co-founder Paul Graham, president Sam Altman and partners including Gmail creator Paul Bucheit. The rest of the capital comes from Maverick Ventures, BoxGroup and Liquid2 Ventures.

“Titan is where investing meets virality,” says Graham. “Those are two very powerful forces.” Since TechCrunch broke the news of Titan’s launch in August, it’s doubled its assets under management to $20 million and hired its first non-founder engineer.

Now it’s launching in-app educational videos so stock market dummies can get up to speed if they want to understand where their money’s going amidst a swirling see of financial news. “There are so many different headlines telling so many different narratives,” Percoco tells me. “Everyone is searching for explanations in a voice they trust. An ‘ETF’ can’t talk back. Sometimes a human face is better than writing. A video can really help people make choices.” Here’s its two-minute video about Facebook’s Q2 earnings a few months ago, explaining why the share price crashed 25 percent:

Percoco and Clayton Gardner met on their first day of Wharton business school, while their third co-founder was earning a hedge fund patent and studying computer science at Stanford. They went on to work at hedge funds and private equity firms like Goldman Sachs, but got fed up just growing the fortunes of the already rich.

So they started Titan to invent a modern, mobile version of BlackRock, the investment giant founded in the 1980s. Titan uses the public disclosures of hedge funds to find consensus around the 20 best performing stocks. With as little as $1,000, users can let Titan robo-manage their investments for a 1 percent fee on assets. Users provide some info on how big they want to gamble, and Titan personalizes their portfolio with more or less conservative shorts to hedge their bets.

Titan’s simplicity combined with the sense of participation could help it grow quickly. It sits between do-it-yourself options like Robinhood or E*Trade, where you’re basically left to fend for yourself, and totally passive options like Wealthfront and Betterment, where you’re so divorced from your portfolio that you’re not learning. Managed hedge funds and fellow active investment vehicles like BlackRock with a human advisor can require a $100,000 minimum investment that’s too steep for millennials.

“Even the best hedge fund in the world is only going to send you a PDF every 90 days,” Percoco explains. But Titan doesn’t want you nervously checking your portfolio non-stop. “Our median user checks the app once per day.” That seems like a healthy balance between awareness and sanity. It thinks its education and informative push notifications make it worth a higher required investment and fees than Wealthfront charges.

“Even the best hedge fund in the world is only going to send you a PDF every 90 days,” Percoco explains. But Titan doesn’t want you nervously checking your portfolio non-stop. “Our median user checks the app once per day.” That seems like a healthy balance between awareness and sanity. It thinks its education and informative push notifications make it worth a higher required investment and fees than Wealthfront charges.

Essentially, Titan is a stock trading auto-pilot merged with a flight simulator so you improve your finance skills without having to fear a crash. Percoco tells me the sense of accomplishment that engenders is why clients say they’re telling friends about Titan. “When I invest, I look for companies that are growing quickly and making a huge positive impact on the world. Titan is one of those companies,” investor Altman says. “I think they could improve the financial well-being of an entire generation.”

Powered by WPeMatico