funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Fortnite, the free multi-player survival game, has earned an astonishing $1 billion from in-game virtual purchases alone. Now, others in the gaming industry are experimenting with how they too can capitalize on new trends in gaming.

Mythical Games, a startup out of stealth today with $16 million in Series A funding, is embracing a future in gaming where user-generated content and intimate ties between players, content creators, brands and developers is the norm. Mythical is using its infusion of venture capital to develop a line of PC, mobile and console games on the EOSIO blockchain, which will also be open to developers to build games with “player-owned economies.”

The company says an announcement regarding its initial lineup of games is on the way.

Mythical is led by a group of gaming industry veterans. Its chief executive officer is John Linden, a former studio head at Activision and president of the Niantic-acquired Seismic Games. The rest of its C-suite includes chief compliance officer Jamie Jackson, another former studio head at Activision; chief product officer Stephan Cunningham, a former director of product management at Yahoo; and head of blockchain Rudy Kock, a former senior producer at Blizzard — the Activision subsidiary known for World of Warcraft. Together, the team has worked on games including Call of Duty, Guitar Hero, Marvel Strike Force and Skylanders.

Galaxy Digital’s EOS VC Fund has led the round for Mythical. The $325 million fund, launched earlier this year, is focused on expanding the EOSIO ecosystem via strategic investments in startups building on EOSIO blockchain software. Javelin Venture Partners, Divergence Digital Currency, cryptocurrency exchange OKCoin and others also participated in the round.

It’s no surprise investors are getting excited about the booming gaming business given the success of Epic Games, Twitch, Discord and others in the space.

Epic Games raised a $1.25 billion round late last month thanks to the cultural phenomenon that its game, Fortnite, has become. KKR, Iconiq Capital, Smash Ventures,Vulcan Capital, Kleiner Perkins, Lightspeed Venture Partners and others participated in that round. Discord, a chat application for gamers, raised a $50 million financing in April at a $1.65 billion valuation from Benchmark Capital, Greylock Partners, IVP, Spark Capital and Tencent. And Dapper Labs, best known for the blockchain-based game CryptoKitties, even raised a VC round this year — a $15 million financing led by Venrock, with participation from GV and Samsung NEXT.

In total, VCs have invested $1.8 billion in gaming startups this year, per PitchBook.

Powered by WPeMatico

It’s been 14 years since Mark Shuttleworth first founded and funded Canonical and the Ubuntu project. At the time, it was mostly a Linux distribution. Today, it’s a major enterprise player that offers a variety of products and services. Throughout the years, Shuttleworth self-funded the project and never showed much interest in taking outside money. Now, however, that’s changing.

As Shuttleworth told me, he’s now looking for investors as he looks to get the company on track to an IPO. It’s no secret that the company’s recent re-focusing on the enterprise — and shutting down projects like the Ubuntu phone and the Unity desktop environment — was all about that, after all. Shuttleworth sees raising money as a step in this direction — and as a way of getting the company in shape for going public.

“The first step would be private equity,” he told me. “And really, that’s because having outside investors with outside members of the board essentially starts to get you to have to report and be part of that program. I’ve got a set of things that I think we need to get right. That’s what we’re working towards now. Then there’s a set of things that private investors are looking for and the next set of things is when you’re doing a public offering, there’s a different level of discipline required.”

It’s no secret that Shuttleworth, who sports an impressive beard these days, was previously resistant to this, and he acknowledged as much. “I think that’s a fair characterization,” he said. “I enjoy my independence and I enjoy being able to make long-term calls. I still feel like I’ll have the ability to do that, but I do appreciate keenly the responsibility of taking other people’s money. When it’s your money, it’s slightly different.”

Refocusing Canonical on the enterprise business seems to be paying off already. “The numbers are looking good. The business is looking healthy. It’s not a charity. It’s not philanthropy,” he said. “There are some key metrics that I’m watching, which are the gate for me to take the next step, which would be growth equity.” Those metrics, he told me, are the size of the business and how diversified it is.

Shuttleworth likens this program of getting the company ready to IPO to getting fit. “There’s no point in saying: I haven’t done any exercise in the last 10 years but I’m going to sign up for tomorrow’s marathon,” he said.

The move from being a private company to taking outside investment and going public — especially after all these years of being self-funded — is treacherous, though, and Shuttleworth admitted as much, especially in terms of being forced to setting short-term goals to satisfy investors that aren’t necessarily in the best interest of the company in the long term. Shuttleworth thinks he can negotiate those issues, though.

Interestingly, he thinks the real danger is quite a different one. “I think the most dangerous thing in making that shift is the kind of shallowness of the unreasonably big impact that stock price has on people’s mood,” he said. “Today, at Canonical, it’s 600 people. You might have some that are having a really great day and some that are having a shitty day. And they have to figure out what’s real about both of those scenarios. But they can kind of support each other. […] But when you have a stock ticker, everybody thinks they’re having a great day, or everybody thinks they’re having a shitty day in a way that may be completely uncorrelated to how well they’re actually doing.”

Shuttleworth does not believe that IBM’s acquisition of its competitor Red Hat will have any immediate effect on its business, though. What he does think, however, is that this move is making a lot of people rethink for the first time in years the investment they’ve been making in Red Hat and its enterprise Linux distribution. Canonical’s promise is that Ubuntu, as well as its OpenStack tools and services, are not just competitive but also more cost-effective in the long run, and offer enterprises an added degree of agility. And if more businesses start looking at Canonical and Ubuntu, that can only speed up Shuttleworth’s (and his bankers’) schedule for hitting Canonical’s metrics for raising money and going public.

Powered by WPeMatico

We hear so much about managing the customer relationship, but companies have to manage the products they sell, too. Propel, a Santa Clara startup, is taking a modern cloud approach to the problem, and today it landed an $18 million Series B investment.

The round was led by Norwest Venture Partners. Previous investors Cloud Apps Capital Partners, Salesforce Ventures and SignalFire also participated. Today’s investment brings the total raised to more than $28 million.

“We are focused on helping companies design and launch products, based on how you go through the life cycle of a product from concept to design to make, model, sell, service where everybody in a company gets involved in product processes at different points in time,” company co-founder and CEO Ray Hein told TechCrunch.

Hein says the company has three core products to help customers track products through their life. For starters, there is the product life cycle management tool (PLM), used by engineering and manufacturing. Next, they have product information management for sales and marketing. Finally, they have service personnel using the quality management component.

The company is built on top of the Salesforce platform, which could account for Salesforce Ventures’ interest in the startup. While Propel looks purely at the product, Salesforce is more interested in the customer, whether from a sales, service or marketing perspective.

These same employees need to understand the products they are developing and selling and that is where Propel comes into play. For instance, when sales people are filling out an order, they need access to the product catalog to get the right numbers or marketing needs to understand the products they are adding to an online store in an e-commerce environment.

Traditional PLM tools from companies like SAP and Oracle are on-prem or have been converted from on-prem to cloud services. Propel was born in the cloud and Sean Jacobsohn, partner at Norwest Venture Partners, who will be joining the Propel board, sees this as a key differentiator for the startup.

“With Propel’s solution, companies can get up and running faster than with on-premise alternatives and pivot products in a matter of seconds based on real-time feedback gathered from marketing, engineering, sales, customers and the entire supply chain,” Jacobsohn said in a statement.

The company was founded in 2015. It currently has 35 employees; flush with these new funds, Hein intends to boost to 50 in the coming months.

Powered by WPeMatico

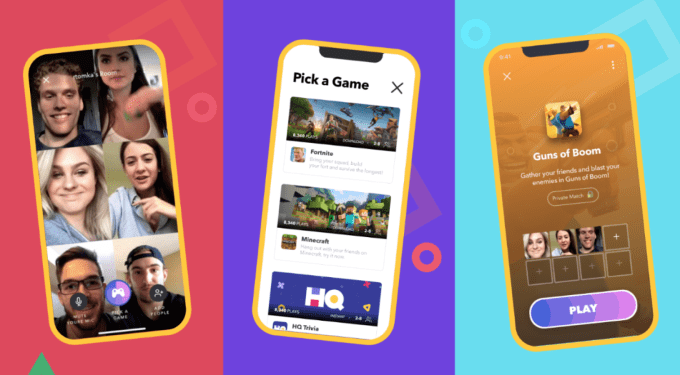

The best parts of gaming are the jokes and trash talk with friends. Whether it was four-player Goldeneye or linking up PCs for Quake battles in the basement, the social element keeps video games exciting. Yet on mobile we’ve lost a lot of that, playing silently by ourselves even if we’re in a squad with friends somewhere else. Bunch wants to bring the laughter back to mobile gaming by letting you sync up with friends and video chat while you play. It already works with hits like Fortnite and Roblox, and developers of titles like Spaceteam are integrating Bunch’s SDK to inspire longer game sessions.

Bunch is like Discord for mobile, and the chance to challenge that gaming social network unicorn has attracted a $3.8 million seed round led by London Venture Partners and joined by Founders Fund, Betaworks, Shrug Capital, North Zone, Streamlined Ventures, 500 Startups and more. With Bunch already cracking the top 100 social iOS app chart, it’s planning a launch on Android. The cash will go to adding features like meeting new people to game with or sharing replays, plus ramping up user acquisition and developer partnerships.

“I and my co-founders grew up with LAN parties, playing games like Starcraft and Counter Strike — where a lot of the fun is the live banter you have with friends,” Bunch co-founder and CEO Selcuk Atli tells me. “We wanted to bring this kind of experience to mobile; where players could play with friends anytime, anywhere.”

Bunch team

Atli was a venture partner at 500 Startups after co-founding and selling two adtech companies: Manifest Commerce to Rakuten, and Boostable to Metric Collective. But before he got into startups, he co-founded a gaming magazine called Aftercala in Turkey at age 12, editing writers twice his age because “on the internet, nobody knows you’re a dog,” he tells me. Atli teamed up with Google senior mobile developer Jason Liang and a senior developer from startups like MUSE and Mox named Jordan Howlett to create Bunch.

“Over a year ago, we built our first prototype. The moment we tried it ourselves, we saw it was nothing like what we’ve experienced on our phones before,” Atli tells me. The team raised a $500,000 pre-seed round and launched its app in March. “Popular mobile games are becoming live, and live games are coming to mobile devices,” says David Lau-Kee, general partner at London Venture Partners. “With this massive shift happening, players need better experiences to connect with friends and play together.”

“Over a year ago, we built our first prototype. The moment we tried it ourselves, we saw it was nothing like what we’ve experienced on our phones before,” Atli tells me. The team raised a $500,000 pre-seed round and launched its app in March. “Popular mobile games are becoming live, and live games are coming to mobile devices,” says David Lau-Kee, general partner at London Venture Partners. “With this massive shift happening, players need better experiences to connect with friends and play together.”

When you log on to Bunch’s iOS app you’ll see which friends are online and what they’re playing, plus a selection of games you can fire up. Bunch overlays group voice or video chat on the screen so you can strategize or satirize with up to eight pals. And if developers build in Bunch’s SDK, they can do more advanced things with video chat, like pinning friends’ faces to their in-game characters. It’s a bit like OpenFeint or iOS Game Center mixed with Houseparty.

For now, Bunch isn’t monetizing, as it hopes to reach massive scale first, but Atli thinks they could sell expression tools like emotes, voice and video filters, and more. Growing large will require beating Discord at its own game. The social giant now has over 130 million users across PCs, consoles and mobile. But it’s also a bit too hardcore for some of today’s casual mobile gamers, requiring you to configure your own servers. “I find that execution speed will be most critical for our success or failure,” Atli says. Bunch’s sole focus on making mobile game chat as easy as possible could win it a mainstream audience seduced by Fortnite, HQ Trivia and other phenomena.

Research increasingly shows that online experiences can be isolating, and gaming is a big culprit. Hours spent playing alone can leave you feeling more exhausted than fulfilled. But through video chat, gaming can transcend the digital and become a new way to make memories with friends — no matter where they are.

Powered by WPeMatico

Imagine coating an expensive part with a layer of diamond dust the width of a human hair, capturing its light pattern as a unique identifier, then storing that identifier in a traditional database or on the blockchain. That’s precisely what Dust Identity, a Boston-based startup, is trying to do, and today it got $2.3 million in seed money led by Kleiner Perkins with participation from New Science Ventures, Angular Ventures and Castle Island Ventures.

The science behind Dust Identity was nurtured inside MIT, but the company has been at work for two years trying to build a solution based on that idea after receiving early support from DARPA. What these folks do is manufacture extremely tiny diamonds. They dust an object such as a circuit board with a coating of this and capture the diamonds in a polymer, company CEO and co-founder Ophir Gaathon explained.

“Once the diamonds fall on the surface of a polymer epoxy, and that polymer cures, the diamonds are fixed in their position, fixed in their orientation, and it’s actually the orientation of those diamonds that we developed a technology that allows us to read those angles very quickly,” Gaathon told TechCrunch.

For all the advanced technology at play here, Dust Identity is truly an identity company, but instead of identifying an individual, its purpose is to provide a trusted identity for an object using a physical anchor — in this case, diamond dust. You may be thinking that diamonds are kind of an expensive way to achieve this, but as it turns out, the company is actually creating the coating materials from low-cost diamond industrial waste.

“We start with diamond waste (for example, [from] the abrasive industry), but we developed a proprietary process (that’s of course highly scalable and economical) to purify and engineer the diamond waste into dust,” a company spokesperson explained.

The idea behind all of this is to prove that an object is valid and hasn’t been tampered with. The dust is applied at some point during the manufacturing process. The unique identifier is captured with some kind of commercial scanner and stored in the database. It provides a physical anchor for blockchain supply chain solutions that’s currently lacking. When the part makes its way to the buyer, they can run the part under a scanner and make sure it matches. If the dust pattern has been disturbed, there’s a good chance the piece was tampered with.

Finding a way to create uncopyable tags for physical objects is a kind of supply chain Holy Grail. Ilya Fushman, a partner at Kleiner Perkins, says his firm recognized the potential of this solution. “We have a pretty strong hard tech practice. We understand the value of supply chain and supply chain integrity,” he said.

The company is not alone in trying to find a way to attach a physical anchor to items in the supply chain. In fact, you can go back to RFID tags and QR codes, but Gaathon says the security of these approaches has degraded over time as hackers figure out how to copy them. IBM and others are working on tiny chips to attach to objects, but the diamond dust approach could be the most secure if it can scale because it works with an entirely random light pattern that can never be reproduced.

The startup intends to take the money and try to prove this idea can be commercialized for government and manufacturing use cases. It certainly gets points for creativity here and it could be onto something that could transform how we track the integrity of items as they move through a supply chain.

Powered by WPeMatico

Heyday, a startup aiming to make facials more affordable and personalized, announced today that it has raised $8 million in Series A funding.

I first wrote about the company a year ago, when it raised its $3 million seed round. At the time, co-founder and CEO Adam Ross said his goal was to offer something that sits between expensive, high-end facials and “random little places that are generally cheap in a bad way.” (Heyday pricing starts at $65 for a 30-minute session.)

The company currently operates six brick-and-mortar locations — it started in New York City but recently opened its first Los Angeles store. At the same time, Ross said the website was recently redesigned to offer a more “frictionless” booking experience, and the company also says it can use its “Facial Record” of customers to personalize the treatment and products.

Moving forward, the goal is to both open new physical locations (particularly in LA), but also to continue investing in the technology.

“It’s not an either/or — we see mutual growth and expansion across both channels,” Ross said. “The physical footprint is always going to be a key pillar of our brand strategy, but to win and service customers’ needs in this space, you need to be online.”

Ross also suggested that Heyday is changing the way customers look at facials. For one thing, 30 percent of its customers say they’ve never had a facial before. In addition, Ross said they’re starting to see facials not as an occasional luxury, but as a regular part of their wellness routine: “Most of our clients think about us like an Equinox membership.” And they should, he argued, especially since “your skin is your largest organ.”

The new funding was led by Fifth Wall Ventures, with participation from Lerer Hippeau, Brainchild Funding, M3 Ventures and CircleUp. Fifth Wall partner Kevin Campos is joining Heyday’s board of directors.

“We are in the midst of a significant shift in the retail industry, where marquee brands are moving from digitally native to an omnichannel model,” Campos said in the funding announcement. “We believe the team at Heyday is offering the best experience across both digital and physical touchpoints, and we are thrilled to partner with them to help navigate this complex process and position them for success.”

Powered by WPeMatico

Approximately 90 percent of people in need of rehabilitation services for drug and alcohol abuse don’t have access to them, according to a Substance Abuse and Mental Health Services Administration survey. Why? Often, because they don’t know where to look.

Santa Monica-based WeRecover wants to fill that information gap with its Kayak-like online booking engine for rehab centers. The startup’s matching algorithm pairs people with an accredited rehab center with open beds, tailored to that person’s budget, insurance, clinical needs and location. The goal is to make it easier for anyone seeking treatment for themselves or otherwise to quickly discover and secure a spot at a facility, streamlining what can be a daunting and logistically complicated process that prevents people from receiving the care they need.

Today, WeRecover is announcing another $2 million fundraise led by Crosslink Capital, bringing its total venture capital backing to $4.5 million. Box Group, Wonder Ventures, Struck Capital and others also participated in the round.

“It’s a really obvious idea … but truly no entrepreneurs anywhere were working to build a marketplace for addiction recovery centers,” WeRecover co-founder and chief executive officer Stephen Estes told TechCrunch. “There’s an overwhelming need for a simpler way to connect with patients.”

WeRecover co-founder and chief executive officer Stephen Estes.

Founded in 2016 by Estes and Max Jaffe, WeRecover has rapidly grown from connecting a few hundred people seeking treatment per month to roughly 4,000 users last month. The startup now provides information on 11,000 treatment centers in 29 states. The goal is to have at least 1 program listed in every state by the end of 2018. Currently, most of the programs the company tracks are located in California, Florida, Arizona and Colorado.

Estes said the WeRecover database is the most comprehensive database of free, nonprofit and state-funded treatment programs in existence, simply because no one had set out to aggregate this particular set of information until now.

The startup plans to use the latest round of venture financing to continue hunting down treatment centers to add to its database, expand its 16-person team and, eventually, Estes said, WeRecover would like to craft and integrate content into the experience.

“We play a really important role in somebody’s journey,” he said. “They find treatment through us and we are part of one of the most important decisions they make in their life, so we should keep them engaged. We do think there’s room to build an app to help people sustain their sobriety and connect them with their peers.”

Powered by WPeMatico

Cognigo, a startup that aims to use AI and machine learning to help enterprises protect their data and stay in compliance with regulations like GDPR, today announced that it has raised an $8.5 million Series A round. The round was led by Israel-based crowdfunding platform OurCrowd, with participation from privacy company Prosegur and State of Mind Ventures.

The company promises that it can help businesses protect their critical data assets and prevent personally identifiable information from leaking outside of the company’s network. And it says it can do so without the kind of hands-on management that’s often required in setting up these kinds of systems and managing them over time. Indeed, Cognigo says that it can help businesses achieve GDPR compliance in days instead of months.

To do this, the company tells me, it’s using pre-trained language models for data classification. That model has been trained to detect common categories like payslips, patents, NDAs and contracts. Organizations can also provide their own data samples to further train the model and customize it for their own needs. “The only human intervention required is during the systems configuration process, which would take no longer than a single day’s work,” a company spokesperson told me. “Apart from that, the system is completely human-free.”

To do this, the company tells me, it’s using pre-trained language models for data classification. That model has been trained to detect common categories like payslips, patents, NDAs and contracts. Organizations can also provide their own data samples to further train the model and customize it for their own needs. “The only human intervention required is during the systems configuration process, which would take no longer than a single day’s work,” a company spokesperson told me. “Apart from that, the system is completely human-free.”

The company tells me that it plans to use the new funding to expand its R&D, marketing and sales teams, all with the goal of expanding its market presence and enhancing awareness of its product. “Our vision is to ensure our customers can use their data to make smart business decisions while making sure that the data is continuously protected and in compliance,” the company tells me.

Powered by WPeMatico

Today, Real Estate Technology Ventures (RET Ventures) announced the final close of $108 million for its first fund. RET focuses on early-stage investments in companies that are primarily looking to disrupt the North American multifamily rental industry, with the firm boasting a roster of LPs made up of some of the largest property owners and operators in the multifamily space.

RET is one of the latest in a rising number of venture firms focused on the real estate sector, which by many accounts has yet to experience significant innovation or technological disruption.

The firm was founded in 2017 by managing director John Helm, who possesses an extensive background as an operator and investor in both real estate and real estate technology. Helm’s real estate journey began with a position right out of college and eventually led him to the commercial brokerage giant Marcus & Millichap, where he worked as CFO before leaving to build two venture-backed real estate technology companies. After successfully selling both companies, Helm worked as a venture partner at Germany-based DN Capital, where he invested in companies such as PurpleBricks and Auto1.

Speaking with investors and past customers, John realized there was a need for a venture fund specifically focused on the multifamily rental sector. RET points out that while multifamily properties have traditionally fallen under the commercial real estate umbrella, operators are forced to deal with a wide set of idiosyncratic dynamics unique to the vertical. In fact, outside of a select group, most of the companies and real estate investment trusts that invest in multifamily tend to invest strictly within the sector.

Now, RET has partnered with leading multifamily owners to help identify innovative startups that can help the LPs better run their portfolios, which account for nearly a million units across the country in aggregate. With its deep sector expertise and its impressive LP list, RET believes it can bring tremendous value to entrepreneurs by providing access to some of the largest property owners in the U.S., effectively shortening a notoriously lengthy sales cycle and making it much easier to scale.

Photo: Alexander Kirch/Shutterstock

One of the first companies reaping the benefits of RET’s deep ties to the real estate industry is SmartRent, the startup providing a property analytics and automation platform for multifamily property managers and renters. Today, SmartRent announced it had closed $5 million in series A financing, with seed investor RET providing the entire round.

SmartRent essentially provides property managers with many of the smart home capabilities that have primarily been offered to consumers to date, making it easier for them to monitor units remotely, avoid costly damages and streamline operations, all while hopefully enhancing the resident experience through all-in-one home controls.

By combining connected devices with its web and mobile platform, SmartRent hopes to provide tools that can help identify leaks or faulty equipment, eliminate energy waste and provide remote access control for door locks. The functions provided by SmartRent are particularly valuable when managing vacant units, in which leaks or unnecessary energy consumption can often go unnoticed, leading to multimillion-dollar damage claims or inflated utility bills. SmartRent also attempts to enhance the leasing process for vacant units by pre-screening potential renters that apply online and allowing qualified applicants to view the unit on their own without a third-party sales agent.

Just like RET, SmartRent is the brainchild of accomplished real estate industry vets. Founder and CEO Lucas Haldeman was still the CTO of Colony Starwood’s single-family portfolio when he first rolled out an early version of the platform in around 26,000 homes. Haldeman quickly realized how powerful the software was for property managers and decided to leave his C-suite position at the publicly traded REIT to found SmartRent.

According to RET, the strong industry pedigree of the founding team was one of the main drivers behind its initial investment in SmartRent and is one of the main differentiators between the company and its competitors.

With RET providing access to its leading multifamily owner LPs, SmartRent has been able to execute on a strong growth trajectory so far, with the company on pace to complete 15,000 installations by the end of the year and an additional 35,000 apartments committed for 2019. And SmartRent seems to have a long runway ahead. The platform can be implemented in any type of rental property, from retrofit homes to high rises, and has only penetrated a small portion of the nearly one million units owned by RET’s LPs alone.

SmartRent has now raised $10 million to date and hopes to use this latest round of funding to ramp growth by broadening its sales and marketing efforts. Longer-term, SmartRent hopes to permeate throughout the entire multifamily industry while continuing to improve and iterate on its platform.

“We’re so early on and we’ve made great progress, but we want to make deep penetration into this industry,” said Haldeman. “There are millions of apartment units and we want to be over 100,000 by year one, and over a million units by year three. At the same time, we’re continuing to enhance our offering and we’re focused on growing and expanding.”

As for RET Ventures, the firm hopes the compelling value proposition of its deep LP and industry network can help RET become the go-to venture firm startups looking to disrupt the real estate rental sector.

Powered by WPeMatico

Selling equity to buy Facebook and Google ads is a bad deal for startups. Clearbanc offers a fundraising alternative. For fast-growing businesses reliably earning sales from their marketing spend, Clearbanc offers funding from $5,000 to $10 million in exchange for a steady revenue share of their earnings until it’s paid back plus a 6 percent fee. Clearbanc picks which merchants qualify by developing tech that scans their Stripe, Facebook ads and other accounts to assess financial health and momentum. It’s already doled out $100 million this year.

“As a business successfully scales, we continue to provide them ongoing capital,” co-founder and CEO Andrew D’Souza tells me. “Our goal is to be the first and last backer of a successful business and save the entrepreneur from having to take hundreds of pitch meetings to keep their company funded.”

“As a business successfully scales, we continue to provide them ongoing capital,” co-founder and CEO Andrew D’Souza tells me. “Our goal is to be the first and last backer of a successful business and save the entrepreneur from having to take hundreds of pitch meetings to keep their company funded.”

After largely flying under the radar since being found in 2015, now Clearbanc has some big funding news of its own. It’s now raised $70 million from a seed and new Series A round from Emergence Capital, Social Capital, CoVenture, Founders Fund, 8VC and more, with Emergence’s Santi Subotovsky joining the board.

“Venture capital has shifted. Instead of funding true research and development, today 40 percent of venture capital goes directly to buying Google and Facebook ads,” D’Souza claims (that may be true for some e-commerce startups, but TechCrunch could not verify that stat for all startups). “Equity is the most expensive way to fund digital ad spend and repeatable growth. So we created something new.”

Clearbanc emerged from an angel investing alliance between two serial entrepreneurs. D’Souza built Andreessen Horowitz-funded social recruiting site Top Prospect, USV-backed education tech company Top Hat and Mastercard portfolio biometric authentication wearable startup Nymi. He helped raise more than $300 million in venture after a stint at McKinsey, when he began co-investing with Michele Romanow, a VC from Canada’s version of the TV show Shark Tank called Dragons’ Den. She’d bootstrapped shopping hub Buytopia that acquired 10 other e-commerce companies, and discount-finder SnapSaves that she sold to Groupon in 2014.

“We started investing together in some of the deals we would see from Dragons’ Den and often found that an equity investment wasn’t the right structure for these consumer product companies. They had great economics and had found a niche of customers, but often didn’t want to exit the business at any point,” D’Souza recalls. “They needed money to acquire more customers, scale up their marketing efforts and online ad spend. So we started to do these revenue share deals.”

Both engineers, they built tech to automate the due diligence and find companies with healthy unit economics and customer acquisition costs. The partnership blossomed into Clearbanc, and romance. “We’re also a couple, so we spend a lot of time together,” D’Souza writes. Inter-startup dating can be problematic, but so far seems to be working for Clearbanc.

Clearbanc’s team

Now Clearbanc has poured over $100 million into 500 companies in 2018, like Vinebox. The subscription wine box company used Clearbanc to grow its membership numbers while raising a Series A for developing new products. Clearbanc’s companies pay out 5 percent in revenue share until the investment plus 6 percent is paid back. That’s a great deal for companies that are already proven moneymakers, like Hunt A Killer, a murder mystery game subscription box that had raised $10,000 and was selling swiftly. Derisked, it didn’t need venture, and has now taken $8 million from Clearbanc to ramp its business.

Clearbanc co-founders Andrew D’Souza and Michele Romanow

Clearbanc is rising up at a time when organic growth channels are shutting down. The ruthless optimization of algorithmic feeds by Facebook, Instagram and Twitter suppress marketing content unless businesses are willing to pay. Without free virality opportunities, companies must rely on venture funding or loans just to turn around and pay that money to big ad platforms. With the new cash, which also comes from iNovia Capital, Real Ventures, Portag3, Precursor, WTI, Berggruen and FJ Labs, Clearbanc plans to expand abroad after doing deals in the U.S. and Canada. It’s also going to invest in building awareness as well as its data science capabilities.

D’Souza and Romanow must have confidence in their tech, as a wrong investment means they might never get their cash back. “We pay a lot of attention to our underwriting and decision-making process because if we make a mistake, we can lose a lot of money. Unlike a VC, we don’t expect the majority of our companies to fail and have the winners make up for the losses,” says D’Souza. One big misstep could wipe out the gains from a bunch of other investments.

Meanwhile, it has to break the norms of how businesses find funding. Startups immediately seek traditional venture or debt financing that can depend on the flashy names already on their cap table, while merchants turn to exploitative online lenders that require a personal guarantee and base their decisions on the founders’ own credit history instead of the business.

While riskier hard-tech startups that will take years to get to market will still need venture, a new crop of direct-to-consumer products and other fast-monetizing startups that are already humming can avoid diluting their team and investors by using Clearbanc. D’Souza concludes, “We’ve spent our entire careers as entrepreneurs and wanted to build a new asset class to help entrepreneurs grow.”

Powered by WPeMatico