funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Juniper Square, a four-year-old startup at the intersection of enterprise software, real estate and financial technology, has brought in an additional $25 million in Series B funding to fuel the growth of its commercial real estate investment platform. Ribbit Capital led the round, with participation from Felicis Ventures.

Founded in 2014 by Alex Robinson, Yonas Fisseha and Adam Ginsburg, the startup’s chief executive officer, vice president of engineering and VP of product, respectively, Juniper has raised a total of $33 million to date.

The company operates a software platform for commercial real estate investment firms — an industry that has been slower to adopt the latest and greatest technology. Robinson tells TechCrunch those firms raise money from pension funds, endowments and elsewhere to purchase and then manage commercial real estate, using Juniper’s software as a tool throughout that process. Juniper supports fundraising and capital management with a suite of customer relationship management (CRM) and productivity tools for its users.

The San Francisco-based company says it currently has hundreds of customers and manages half a trillion dollars in real estate.

“The private markets are just as big as the public markets … but the private markets have typically not been accessible to everyday investors, and that’s part of what we are trying to do with Juniper Square,” Robinson told TechCrunch. “It’s a tremendously large market that almost nobody knows anything about.”

Juniper will use its latest investment to double headcount from 60 to 120 in the year ahead, with plans to beef up its engineering, product and sales teams specifically as the company expects to continue experiencing massive growth. Robinson said it’s grown between 3x and 4x every year for the last three years.

Felicis Ventures managing director Sundeep Peechu said in a statement that Juniper “is one of the fastest growing real estate tech companies” the firm has ever seen: “They are building technology for an industry that touches nearly every human and every corner of the economy. It’s a hard problem that takes time to solve, but the benefits of making these huge markets work better are tremendous.”

Existing in a relatively niche intersection, Juniper’s job now is to prove itself more efficient and user-friendly than Microsoft Excel spreadsheets, which, Robinson says, are still its biggest competitor.

“Our goal is to be the de facto platform for real estate investment and we are well on our way to becoming that.”

Powered by WPeMatico

As companies compete for talent, a startup that has built a platform to help ensure that the talent — once it’s working for you — doesn’t get bogged down by IT frustration, has raised a significant round of funding.

Lausanne, Switzerland-based Nexthink has nailed down $85 million in funding led by Index Ventures (which has a base in nearby Geneva), with participation also from Highland Europe, Forestay Capital, Galéo Capital and TOP Funds and Olivier Pomel (co-founder and CEO of Datadog).

Nexthink’s CEO Pedro Bados said in an interview that the company will be using this round to expand its business globally and specifically in the US.

It will be doing this from a healthy base. The company already has 900 enterprise customers, covering no less than 7 million endpoints, using its platform to improve employees’ interaction and satisfaction with the IT tools that they are required to use for work. Customers include Adobe, Advocate Healthcare, BlackRock, Commerzbank, Safran, Sega HARDlight, Tiffany & Co., Vitality, Wipro and Western Union.

Network monitoring is a big and established area in the world of IT, where tech companies provide a wide array of solutions to identify and potentially fix network glitches across on-premise, cloud and hybrid environments.

What is only becoming more apparent now to organizations is that problems with the dozens of apps and other software that employees need to use can be just as much, if not more, of an issue, when it comes to getting work done — for example, because something is not working in the app, the worker is unsure how to do something, or there is a configuration issue.

That is the issue that Nexthink is tackling. The company installs a widget — it calls it a Collector — on a worker’s phone, tablet, laptop, desktop computer, or whatever device is being used. That Collector in turn monitors hundreds of metrics around how you are using your device, ranging from performance issues and policy breaches through to examining what software is being used, and what is not.

Nexthink’s algorithms both identify and even can anticipate when a problem is happening, and either provide a quick suggestion to fix it, or provide the right data to the IT team to help solve the problem.

In the “marketplace” created in an IT network, you might think of Nexthink as solving problems at two ends: for the IT team, reduces the number of calls it gets by helping solve problems and providing useful information in cases where they will really be needed. For the employees, it gives them a quick and hopefully helpful response so that they can get on with their work.

“Not only are employees happy and more productive, but costs go down on support,” Bados says.

Nexthink has actually been around for 14 years — Bados co-founded Nexthink with Patrick Hertzog and Vincent Bieri not long after he finished his graduate research work in artificial intelligence at the polytechnic in Lausanne — and this latest round is larger than all the funding that the company had raised up to now, which had been $69 million.

That in itself is a sign of how VCs and the industry are waking up to the opportunity to address the challenge of software usability and experience and how that might affect employee satisfaction and productivity.

“We’ve known the company for a while and have a lot of respect for Pedro as a CEO,” said Neil Rimer of Index Ventures in an interview. “We’ve been watching what they have been building focusing on user experience and management, and it’s an area that we find compelling.” Plus the customer caliber and loyalty helped, he said. “The retention and lack of churn are all very impressive.”

Unsurprisingly, there are a number of others also moving into the same space as Nexthink, including Microsoft, VMware and Riverbed, as well as others like New Relic around the same neighborhood of services. For now, Bados says he sees these more as potential partners than rivals.

Powered by WPeMatico

“The screen is becoming the most important place in the world,” says InVision CEO and founder Clark Valberg . In fact, it’s hard to get through a conversation with him without hearing it. And, considering that his company has grown to $100 million in annual recurring revenue, he has reason to believe his own affirmation.

InVision, the startup looking to be the Salesforce of design, has officially achieved unicorn status with the close of a $115 million Series F round, bringing the company’s total funding to $350 million. This deal values InVision at $1.9 billion, which is nearly double its valuation as of mid-2017 on the heels of its $100 million Series E financing.

Spark Capital led the round, with participation from Goldman Sachs, as well as existing investors Battery Ventures, ICONIQ Capital, Tiger Global Management, FirstMark and Geodesic Capital. Atlassian also participated in the round. Earlier this year, Atlassian and InVision built out much deeper integrations, allowing Jira, Confluence and Trello users to instantly collaborate via InVision.

As part of the deal, Spark Capital’s Megan Quinn will be joining the board alongside existing board members and observers Amish Jani, Lee Fixel, Matthew Jacobson, Mike Kourey, Neeraj Agrawal, Vas Natarajan and Daniel Wolfson.

InVision started in 2011 as a simple prototyping tool. It let designers build out their experience without asking the engineering/dev team to actually build it, to then send to the engineering and product and marketing and executive teams for collaboration and/or approval.

Over the years, the company has stretched its efforts both up and downstream in the process, building out a full collaboration suite called InVision Cloud, so that every member of the organization can be involved in the design process; Studio, a design platform meant to take on the likes of Adobe and Sketch; and InVision Design System Manager, where design teams can manage their assets and best practices from one place.

But perhaps more impressive than InVision’s ability to build design products for designers is its ability to attract users that aren’t designers.

“Originally, I don’t think we appreciated how much the freemium model acted as a flywheel internally within an organization,” said Quinn. “Those designers weren’t just inviting designers from their own team or other teams, but PMs and Marketing and Customer Service and executives to collaborate and approve the designs. From the outside, InVision looks like a design company. But really, they start with the designer as a core customer and spread virally within an organization to serve a multitude.”

InVision has simply dominated prototyping and collaboration, today announcing it has surpassed 5 million users. What’s more, InVision has a wide variety of customers. The startup has a long and impressive list of digital-first customers — including Netflix, Uber, Airbnb and Twitter — but also serves 97 percent of the Fortune 100, with customers like Adidas, General Electric, NASA, IKEA, Starbucks and Toyota.

Part of that can be attributed to the quality of the products, but the fundamental shift to digital (as predicted by Valberg) is most certainly under way. Whether brands like it or not, customers are interacting with them more and more from behind a screen, and digital customer experience is becoming more and more important to all companies.

In fact, a McKinsey study showed that companies that are in the top quartile scores of the McKinsey Design Index outperformed their counterparts in both revenues and total returns to shareholders by as much as a factor of two.

But as with any transition, some folks are averse to change. Valberg identifies industry education and evangelism as two big challenges for InVision.

“Organizations are not quick to change on things like design, which is why we’ve built out a Design Transformation Team,” said Valberg. “The team goes in and gets hands on with brands to help them with new practices and to achieve design maturity within the organization.”

With a fresh $115 million and 5 million users, InVision has just about everything it needs to step into a new tier of competition. Even amongst behemoths like Adobe, which pulled in $2.29 billion in revenue in Q3 alone, InVision has provided products that can both complement and compete.

But Quinn believes the future of InVision rests on execution.

“As with most companies, the biggest challenge will be continued excellence in execution,” said Quinn. “InVision has all the right tail winds with the right team, a great product and excellent customers. It’s all about building and executing ahead of where the pack is going.”

Powered by WPeMatico

Contentful, a Berlin- and San Francisco-based startup that provides content management infrastructure for companies like Spotify, Nike, Lyft and others, today announced that it has raised a $33.5 million Series D funding round led by Sapphire Ventures, with participation from OMERS Ventures and Salesforce Ventures, as well as existing investors General Catalyst, Benchmark, Balderton Capital and Hercules. In total, the company has now raised $78.3 million.

It’s been less than a year since the company raised its Series C round and, as Contentful co-founder and CEO Sascha Konietzke told me, the company didn’t really need to raise right now. “We had just raised our last round about a year ago. We still had plenty of cash in our bank account and we didn’t need to raise as of now,” said Konietzke. “But we saw a lot of economic uncertainty, so we thought it might be a good moment in time to recharge. And at the same time, we already had some interesting conversations ongoing with Sapphire [formerly SAP Ventures] and Salesforce. So we saw the opportunity to add more funding and also start getting into a tight relationship with both of these players.”

It’s been less than a year since the company raised its Series C round and, as Contentful co-founder and CEO Sascha Konietzke told me, the company didn’t really need to raise right now. “We had just raised our last round about a year ago. We still had plenty of cash in our bank account and we didn’t need to raise as of now,” said Konietzke. “But we saw a lot of economic uncertainty, so we thought it might be a good moment in time to recharge. And at the same time, we already had some interesting conversations ongoing with Sapphire [formerly SAP Ventures] and Salesforce. So we saw the opportunity to add more funding and also start getting into a tight relationship with both of these players.”

The original plan for Contentful was to focus almost explicitly on mobile. As it turns out, though, the company’s customers also wanted to use the service to handle its web-based applications and these days, Contentful happily supports both. “What we’re seeing is that everything is becoming an application,” he told me. “We started with native mobile application, but even the websites nowadays are often an application.”

In its early days, Contentful focused only on developers. Now, however, that’s changing, and having these connections to large enterprise players like SAP and Salesforce surely isn’t going to hurt the company as it looks to bring on larger enterprise accounts.

Currently, the company’s focus is very much on Europe and North America, which account for about 80 percent of its customers. For now, Contentful plans to continue to focus on these regions, though it obviously supports customers anywhere in the world.

Contentful only exists as a hosted platform. As of now, the company doesn’t have any plans for offering a self-hosted version, though Konietzke noted that he does occasionally get requests for this.

What the company is planning to do in the near future, though, is to enable more integrations with existing enterprise tools. “Customers are asking for deeper integrations into their enterprise stack,” Konietzke said. “And that’s what we’re beginning to focus on and where we’re building a lot of capabilities around that.” In addition, support for GraphQL and an expanded rich text editing experience is coming up. The company also recently launched a new editing experience.

Powered by WPeMatico

Looker has been helping customers visualize and understand their data for seven years, and today it got a big reward, a $103 million Series E investment on a $1.6 billion valuation.

The round was led by Premji Invest, with new investment from Cross Creek Advisors and participation from the company’s existing investors. With today’s investment, Looker has raised $280.5 million, according the company.

In spite of the large valuation, Looker CEO Frank Bien really wasn’t in the mood to focus on that particular number, which he said was arbitrary, based on the economic conditions at the time of the funding round. He said having an executive team old enough to remember the dot-com bubble from the late 1990s and the crash of 2008 keeps them grounded when it comes to those kinds of figures.

Instead, he preferred to concentrate on other numbers. He reported that the company has 1,600 customers now and just crossed the $100 million revenue run rate, a significant milestone for any enterprise SaaS company. What’s more, Bien reports revenue is still growing 70 percent year over year, so there’s plenty of room to keep this going.

He said he took such a large round because there was interest and he believed that it was prudent to take the investment as they move deeper into enterprise markets. “To grow effectively into enterprise customers, you have to build more product, and you have to hire sales teams that take longer to activate. So you look to grow into that, and that’s what we’re going to use this financing for,” Bien told TechCrunch.

He said it’s highly likely that this is the last private fundraising the company will undertake as it heads toward an IPO at some point in the future. “We would absolutely view this as our last round unless something drastic changed,” Bien said.

For now, he’s looking to build a mature company that is ready for the public markets whenever the time is right. That involves building internal processes of a public company even if they’re not there yet. “You create that maturity either way, and I think that’s what we’re doing. So when those markets look okay, you could look at that as another funding source,” he explained.

The company currently has around 600 employees. Bien indicated that they added 200 this year alone and expect to add additional headcount in 2019 as the business continues to grow and they can take advantage of this substantial cash infusion.

Powered by WPeMatico

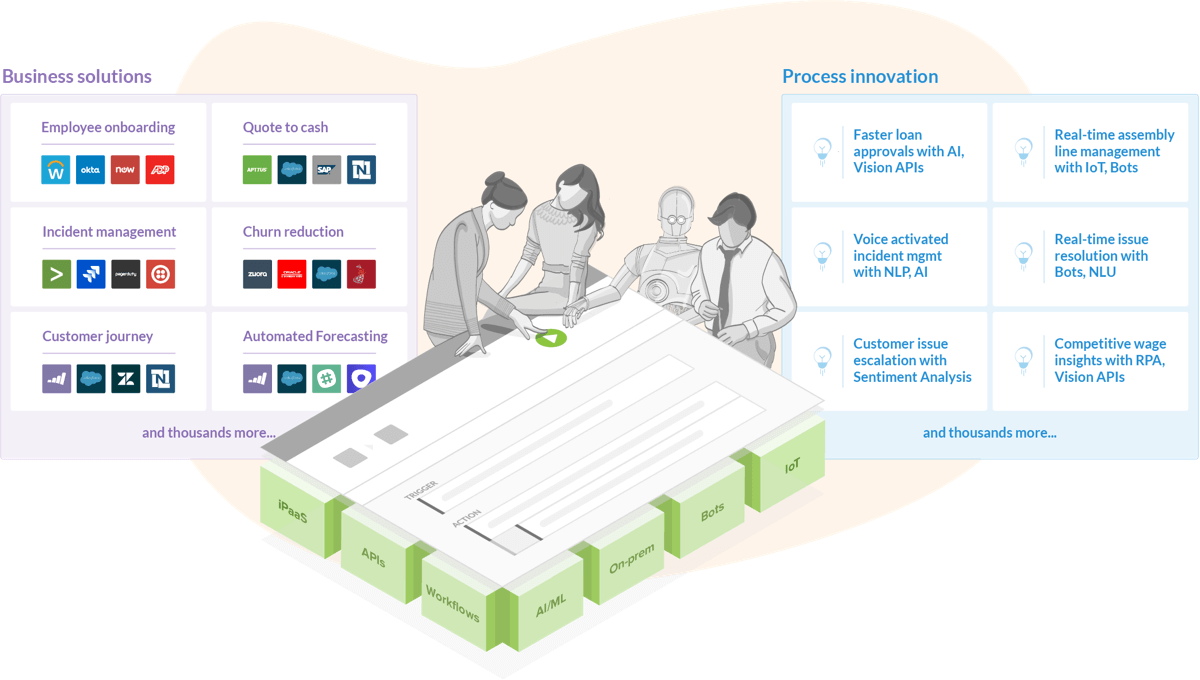

Workato, a startup that offers an integration and automation platform for businesses that competes with the likes of MuleSoft, SnapLogic and Microsoft’s Logic Apps, today announced that it has raised a $25 million Series B funding round from Battery Ventures, Storm Ventures, ServiceNow and Workday Ventures. Combined with its previous rounds, the company has now received investments from some of the largest SaaS players, including Salesforce, which participated in an earlier round.

At its core, Workato’s service isn’t that different from other integration services (you can think of them as IFTTT for the enterprise), in that it helps you to connect disparate systems and services, set up triggers to kick off certain actions (if somebody signs a contract on DocuSign, send a message to Slack and create an invoice). Like its competitors, it connects to virtually any SaaS tool that a company would use, no matter whether that’s Marketo and Salesforce, or Slack and Twitter. And like some of its competitors, all of this can be done with a drag-and-drop interface.

What’s different, Workato founder and CEO Vijay Tella tells me, is that the service was built for business users, not IT admins. “Other enterprise integration platforms require people who are technical to build and manage them,” he said. “With the explosion in SaaS with lines of business buying them — the IT team gets backlogged with the various integration needs. Further, they are not able to handle all the workflow automation needs that businesses require to streamline and innovate on the operations.”

Battery Ventures’ general partner Neeraj Agrawal also echoed this. “As we’ve all seen, the number of SaaS applications run by companies is growing at a very rapid clip,” he said. “This has created a huge need to engage team members with less technical skill-sets in integrating all these applications. These types of users are closer to the actual business workflows that are ripe for automation, and we found Workato’s ability to empower everyday business users super compelling.”

Tella also stressed that Workato makes extensive use of AI/ML to make building integrations and automations easier. The company calls this Recipe Q. “Leveraging the tens of billions of events processed, hundreds of millions of metadata elements inspected and hundreds of thousands of automations that people have built on our platform — we leverage ML to guide users to build the most effective integration/automation by recommending next steps as they build these automations,” he explained. “It recommends the next set of actions to take, fields to map, auto-validates mappings, etc. The great thing with this is that as people build more automations — it learns from them and continues to make the automation smarter.”

The AI/ML system also handles errors and offers features like sentiment analysis to analyze emails and detect their intent, with the ability to route them depending on the results of that analysis.

As part of today’s announcement, the company is also launching a new AI-enabled feature: Automation Editions for sales, marketing and HR (with editions for finance and support coming in the future). The idea here is to give those departments a kit with pre-built workflows that helps them to get started with the service without having to bring in IT.

Powered by WPeMatico

Camunda, a Berlin-based company that builds open-source workflow automation software, announced a €25 million (approximately $28 million) investment from Highland Europe today.

This is the company’s first investment in its 10-year history. CEO and co-founder Jakob Freund says the company has been profitable since Day One, but decided to bring in outside capital now to take on a more aggressive international expansion.

The company launched in 2008 and for the first five years offered business process management consulting services, but they found traditional offerings from companies like Oracle, IBM and Pega weren’t encouraging software developers to really embrace BPM and build new applications.

In 2013 the company decided to solve that problem and began a shift from consulting to software. “We launched our own open-source project, Camunda BPM, in 2013. We also offered a commercial distribution, obviously, because that’s where the revenue came from,” Freund explained.

The project took off and they flipped their revenue sources from 80 percent consulting/20 percent software to 90 percent software/10 percent consulting in the five years since first creating the product. They boast 200 paying customers and have built out an entire stack of products since their initial product launch.

The company expanded from 13 employees in 2013 to 100 today, with offices in Berlin and San Francisco. Freund wants to open more offices and to expand the head count. To do that, he felt the time was right to go out and get some outside money. He said they continue to be profitable and more than doubled their ARR (annual recurring revenue) in the last 12 months, but knowing they wanted to expand quickly, they wanted the investment as a hedge in case revenue slowed down during the expansion.

“However, we also want to invest heavily right now and build up the team very quickly over the next couple of years. And we want to do that in such a quick way that we want to make sure that if the revenue growth doesn’t happen as quickly as the headcount building, we’re not getting any situation where we would then need to go look funding,” he explained. Instead, they struck while the company and the overall workflow automation space is hot.

He says they want to open more sales and support offices on the east coast of the U.S. and move into Asia, as well. Further, they want to keep investing in the open-source products, and the new money gives them room to do all of this.

Powered by WPeMatico

When it comes to how humans communicate with each other or with machines, voice is a major interface, with growth in the latter fuelled by the rise of artificial intelligence, faster computing technology and an explosion of new devices — some of which only, or primarily, work with voice commands. But the supreme reign of voice has also opened a window of opportunity for malicious hackers — specifically, in the area of voice fraud.

Now, a security startup called Pindrop is announcing that it has raised $90 million to tackle this with a platform that it says can identify even the most sophisticated impersonations and hacking attempts, by analysing nearly 1,400 acoustic attributes to verify if a caller or a voice command is legit.

“We live in a brave new world where everything you thought you knew about security needs to be challenged,” said Vijay Balasubramaniyan, co-founder, CEO and CTO of Pindrop, who built the company (with co-founders Ahamad Mustaque and Paul Judge) originally out of his PhD thesis.

The funding is a growth round aimed specifically at two areas. First, taking US-based Pindrop into more international markets, starting with Europe — Vijay spoke to me in London — and coming soon to Asia. And second, to expand from customer service scenarios — the vast majority of its business today — into any applications that use voice interfaces, such as connected car platforms, home security devices, smart offices and smart home speakers.

To that end, this Series D includes a mix of strategic and financial investors: led by London’s Vitruvian Partners, it also includes Allegion Ventures (the corporate venture arm of the security giant), Cross Creek, systems integrator Dimension Data (“As you grow you want to be able to sell through partners,” Balasubramaniyan says), Singapore-based EDBI (to help with its push into Asia), and Goldman Sachs. Google’s CapitalG, IVP, Andreessen Horowitz, GV and Citi Ventures — all previous investors — were also in this round.

(The latter group of investors also has at least one strategic name in it: Pindrop is already working with Google, the CEO said.)

Valuation is not being disclosed, but in Pindrop’s Series C round in 2017, the company was valued at $600 million post-mioney, according to PitchBook, and the valuation now is “much higher,” Balasubramaniyan said with a laugh. The company’s raised $212 million to date.

The crux of what Pindrop has built is a platform that makes a voice “fingerprint” that identifies not just the specific tone you emit, but how you speak, where you are typically calling from and the sounds of that space, and even your regular device — something we can do now with the rise of smartphones that we typically don’t share with others — with each handset having a unique acoustic profile. Matching all these against what is determined to be your “normal” circumstances helps to start to build verification, Balasubramaniyan explained.

Founded in 2011 in Atlanta, GA, most of Pindrop’s business today has been built around helping to prevent voice fraud in customer service engagements. That business, Balasubramaniyan said, is on the path to profitability by the first quarter of 2019 and continues to grow well, with a voice fraud problem in the space that costs the industry $22 billion ($14 billion in fraud, $8 billion in time and systems wasted on security questions). (Pindrop claims it has stopped over $350 million in voice-based fraud and attacks so far in 2018.)

Current customers include eight of the 10 largest banks and five largest insurance companies in the U.S., with more than 200 million consumer accounts protected at the moment.

“There are 3.6 million agents in customer service jobs in the UK, with one in every 89 people in the US in this role,” he noted. “But last year, there there were 4.4 million new assistants added to the market,” referring to all the devices, apps and services that have hit us, “and that’s where we realised that it’s about expansion for us.”

In cases like connected home or office scenarios, some of the ways that these might get hacked are only starting to become apparent.

Balasubramaniyan noted that it can be something as innocent as a little girl ordering an expensive doll house while playing with Alexa (Pindrop is also now starting to work with Amazon, too, as it happens), or something more nefarious like a fraudster calling your answering machine to command your smart home hub to unlock your front door.

But we are unlikely to turn away from voice interfaces, and that is where a company like Pindrop (as well as competitors like Verint) come in.

“Voice-enabled interfaces are expanding how consumers interact with IoT devices in their everyday lives – as well as IoT manufacturers’ ability to offer smarter and stronger solutions,” said Allegion Ventures President Rob Martens, in a statement. “We’re excited about the future of voice technology and see Pindrop as a pioneer in the space. We look forward to working with Vijay and his team to accelerate the adoption of voice technology into new markets.”

More generally, as we see the rise of more voice services it’s only natural that we will start to see more ways of trying to hack them. Pindrop puts an interesting focus on the aural details of an experience as a way of helping to fight that. It’s detail that we often overlook in today’s very visual culture, but it’s also in a way a return to more analogue days.

Balasubramaniyan said one of his inspirations for the startup was a story he read as a child in 2600, the Hacker publication, that stuck with him, about Bell Labs. There, they had a team of blind engineers who could identify problems on a phone line by listening to the dial tone. “They had golden hearing,” he said.

Powered by WPeMatico

As the fight against climate change heats up, Cove.Tool is looking to help tackle carbon emissions one building at a time.

The Atlanta-based startup provides an automated big-data platform that helps architects, engineers and contractors identify the most cost-effective ways to make buildings compliant with energy efficiency requirements. After raising an initial round earlier this year, the company completed the final close of a $750,000 seed round. Since the initial announcement of the round earlier this month, Urban Us, the early-stage fund focused on companies transforming city life, has joined the syndicate comprised of Tech Square Labs and Knoll Ventures.

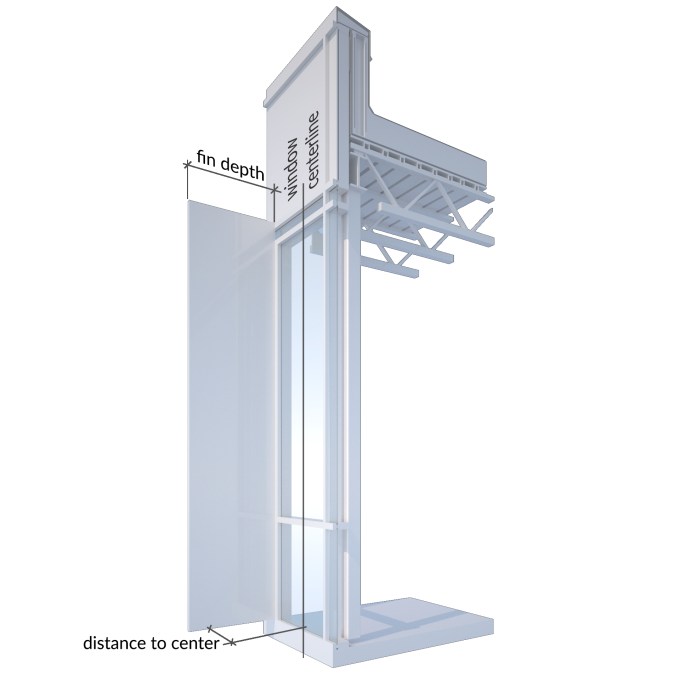

Cove.Tool software allows building designers and managers to plug in a variety of building conditions, energy options, and zoning specifications to get to the most cost-effective method of hitting building energy efficiency requirements (Cove.Tool Press Image / Cove.Tool / https://covetool.com).

In the US, the buildings we live and work in contribute more carbon emissions than any other sector. Governments across the country are now looking to improve energy consumption habits by implementing new building codes that set higher energy efficiency requirements for buildings.

However, figuring out the best ways to meet changing energy standards has become an increasingly difficult task for designers. For one, buildings are subject to differing federal, state and city codes that are all frequently updated and overlaid on one another. Therefore, the specific efficiency requirements for a building can be hard to understand, geographically unique and immensely variable from project to project.

Architects, engineers and contractors also have more options for managing energy consumption than ever before – equipped with tools like connected devices, real-time energy-management software and more-affordable renewable energy resources. And the effectiveness and cost of each resource are also impacted by variables distinct to each project and each location, such as local conditions, resource placement, and factors as specific as the amount of shade a building sees.

With designers and contractors facing countless resource combinations and weightings, Cove.Tool looks to make it easier to identify and implement the most cost-effective and efficient resource bundles that can be used to hit a building’s energy efficiency requirements.

Cove.Tool users begin by specifying a variety of project-specific inputs, which can include a vast amount of extremely granular detail around a building’s use, location, dimensions or otherwise. The software runs the inputs through a set of parametric energy models before spitting out the optimal resource combination under the set parameters.

For example, if a project is located on a site with heavy wind flow in a cold city, the platform might tell you to increase window size and spend on energy efficient wall installations, while reducing spending on HVAC systems. Along with its recommendations, Cove.Tool provides in-depth but fairly easy-to-understand graphical analyses that illustrate various aspects of a building’s energy performance under different scenarios and sensitivities.

Cove.Tool users can input granular project-specifics, such as shading from particular beams and facades, to get precise analyses around a building’s energy performance under different scenarios and sensitivities.

Traditionally, the design process for a building’s energy system can be quite painful for architecture and engineering firms.

An architect would send initial building designs to engineers, who then test out a variety of energy system scenarios over the course a few weeks. By the time the engineers are able to come back with an analysis, the architects have often made significant design changes, which then gets sent back to the engineers, forcing the energy plan to constantly be 1-to-3 months behind the rest of the building. This process can not only lead to less-efficient and more-expensive energy infrastructure, but the hectic back-and-forth can lead to longer project timelines, unexpected construction issues, delays and budget overruns.

Cove.Tool effectively looks to automate the process of “energy modeling.” The energy modeling looks to ease the pains of energy design in the same ways Building Information Modeling (BIM) has transformed architectural design and construction. Just as BIM creates predictive digital simulations that test all the design attributes of a project, energy modeling uses building specs, environmental conditions, and various other parameters to simulate a building’s energy efficiency, costs and footprint.

By using energy modeling, developers can optimize the design of the building’s energy system, adjust plans in real-time, and more effectively manage the construction of a building’s energy infrastructure. However, the expertise needed for energy modeling falls outside the comfort zones of many firms, who often have to outsource the task to expensive consultants.

The frustrations of energy system design and the complexities of energy modeling are ones the Cove.Tool team knows well. Patrick Chopson and Sandeep Ajuha, two of the company’s three co-founders, are former architects that worked as energy modeling consultants when they first began building out the Cove.Tool software.

After seeing their clients’ initial excitement over the ability to quickly analyze millions of combinations and instantly identify the ones that produce cost and energy savings, Patrick and Sandeep teamed up with CTO Daniel Chopson and focused full-time on building out a comprehensive automated solution that would allow firms to run energy modeling analysis without costly consultants, more quickly, and through an interface that would be easy enough for an architectural intern to use.

So far there seems to be serious demand for the product, with the company already boasting an impressive roster of customers that includes several of the country’s largest architecture firms, such as HGA, HKS and Cooper Carry. And the platform has delivered compelling results – for example, one residential developer was able to identify energy solutions that cost $2 million less than the building’s original model. With the funds from its seed round, Cove.Tool plans further enhance its sales effort while continuing to develop additional features for the platform.

The value proposition Cove.Tool hopes to offer is clear – the company wants to make it easier, faster and cheaper for firms to use innovative design processes that help identify the most cost-effective and energy-efficient solutions for their buildings, all while reducing the risks of redesign, delay and budget overruns.

Longer-term, the company hopes that it can help the building industry move towards more innovative project processes and more informed decision-making while making a serious dent in the fight against emissions.

“We want to change the way decisions are made. We want decisions to move away from being just intuition to become more data-driven.” The co-founders told TechCrunch.

“Ultimately we want to help stop climate change one building at a time. Stopping climate change is such a huge undertaking but if we can change the behavior of buildings it can be a bit easier. Architects and engineers are working hard but they need help and we need to change.”

Powered by WPeMatico

FortressIQ, a startup that wants to bring a new kind of artificial intelligence to process automation called imitation learning, emerged from stealth this morning and announced it has raised $12 million.

The Series A investment came entirely from a single venture capital firm, Light Speed Venture Partners. Today’s funding comes on top of $4 million in seed capital the company raised previously from Boldstart Ventures, Comcast Ventures and Eniac Ventures.

Pankaj Chowdhry, founder and CEO of FortressIQ, says that his company basically replaces high-cost consultants who are paid to do time and motion studies and automates that process in a fairly creative way. It’s a bit like Robotics Process Automation (RPA), a space that is attracting a lot of investment right now, but instead of simply recording what’s happening on the desktop, and reproducing that digitally, it takes it a step further in a process called “imitation learning.”

“We want to be able to replicate human behavior through observation. We’re targeting this idea of how can we help people understand their processes. But imitation learning is I think the most interesting area of artificial intelligence because it focuses not on what AI can do, but how can AI learn and adapt,” he explained

They start by capturing a low-bandwidth movie of the process. “So we build virtual processors. And basically the idea is we have an agent that gets deployed by your enterprise IT group, and it integrates into the video card,” Chowdhry explained.

He points out that it’s not actually using a camera, but it captures everything going on, as a person interacts with a Windows desktop. In that regard it’s similar to RPA. “The next component is our AI models and computer vision. And we build these models that can literally watch the movie and transcribe the movie into what we call a series of software interactions,” he said.

Another key differentiator here is that they have built a data mining component on top of this, so if the person in the movie is doing something like booking an invoice, and stops to check email or Slack, FortressIQ can understand when an activity isn’t part of the process and filters that out automatically.

The product will be offered as a cloud service. Chowdhry’s previous company, Third Pillar Systems, was acquired by Genpact in 2013.

Powered by WPeMatico