funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Three U.S. companies raised more than $1 billion in just one funding round in 2018, a year in which total deal value for U.S. startups is expected to surpass $100 billion for the first time.

For the most part, it was the usual suspects, and yes, SoftBank was an accessory in many of these rounds. Here’s a look at the 10 largest venture rounds of 2018.

The video game Fortnite Battle Royale was the star of the year 2018; more than 200 million players worldwide are registered online. (Photo Illustration by Chesnot/Getty Images)

Given the absolute phenomenon Fortnite became in just one year from its original release, it was no surprise private investors wanted to put money into Epic Games, the company behind it. In October, Epic Games announced a whopping $1.25 billion round at $15 billion valuation from KKR, Iconiq Capital, Smash Ventures, Vulcan Capital, Kleiner Perkins and Lightspeed Venture Partners to continue growing its Fortnite empire. That game alone is expected to bring in $2 billion in revenue in 2018 and reports 200 million registered players — not too shabby.

Cary, N.C.-based Epic Games’ monstrous fundraise was a standout in a year when funding for gaming and esports startups really took off. According to Crunchbase, global venture investment in the industry increased nearly 75 percent, to $701 million in the first half of 2018. Given Epic’s round, Discord’s $150 million infusion of capital this week and several others since June, the second half of 2018 undoubtedly set major records in the space.

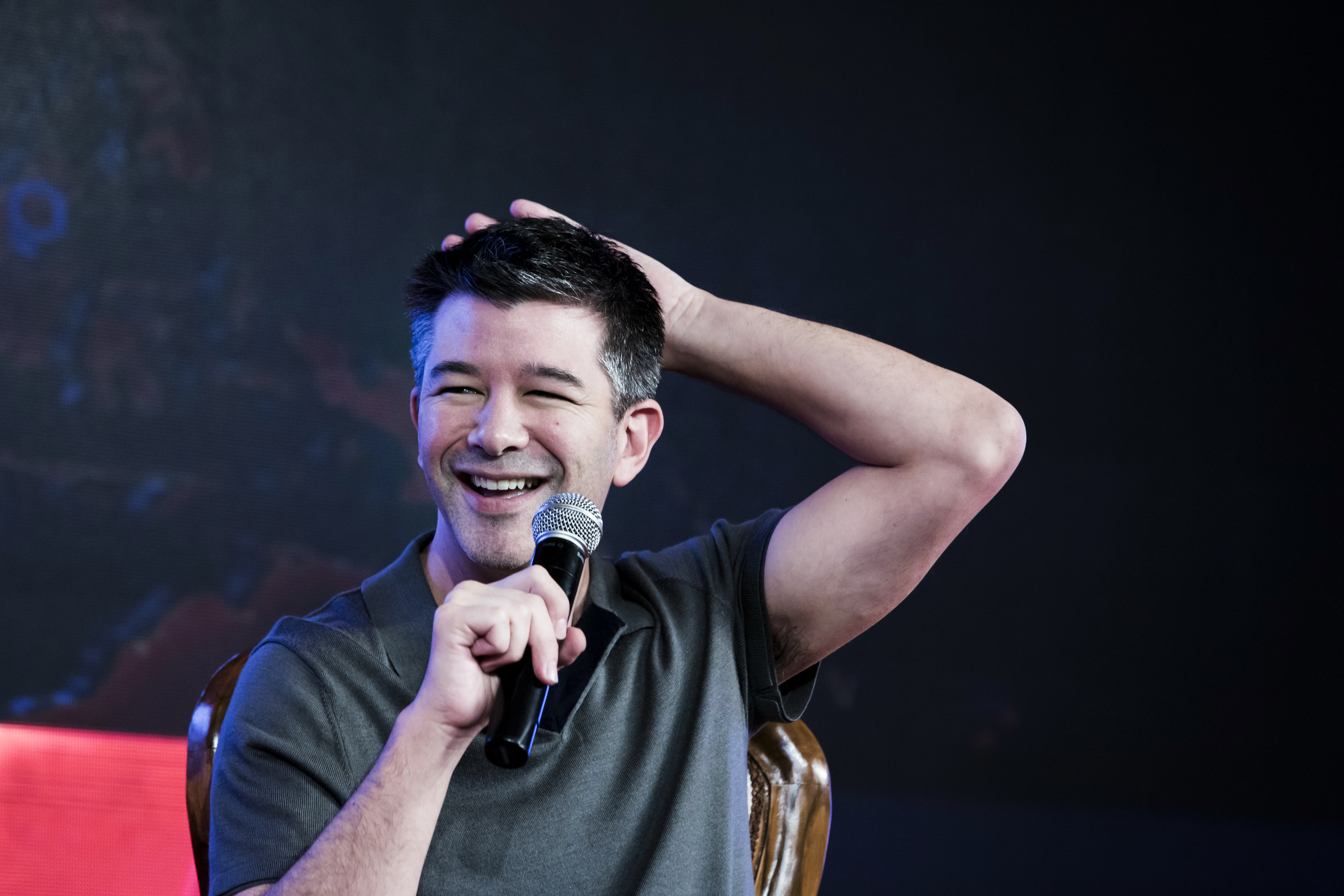

Travis Kalanick, co-founder and former chief executive officer of Uber Technologies Inc., speaks during the TiE Global Entrepreneurs Summit in New Delhi, India, on Friday, December 16, 2016. Kalanick said the company will introduce Uber Moto across India. Photographer: Udit Kulshrestha/Bloomberg via Getty Images

One of the largest rounds of 2018 was also one of the first big financings of the year. To be fair, the negotiations behind Uber’s $1.2 billion SoftBank investment and much of the press coverage surrounding it came in 2017, but the deal officially closed in January. This deal was monumental for many reasons. First of all, it made Uber founder and former chief executive officer Travis Kalanick a billionaire — not just on paper — and it cemented SoftBank’s position as the ride-hailing giant’s largest shareholder.

The financing brought San Francisco-based Uber’s total raised to date to just over $20 billion at a valuation said to be around $72 billion. Of course, Uber has since privately filed for an initial public offering slated for the first quarter of 2019.

Juul Labs, the maker of the popular e-cigarette brand that has recently come under fire from health officials over its popularity with young adults, plans to introduce a line of lower-nicotine pods. Photographer: Gabby Jones/Bloomberg via Getty Images

Juul, one of the buzziest companies of 2018, raised $1.2 billion from private investors Tiger Global, Fidelity and more in mid-2018. Then, this month, the developer of e-cigarettes popular among teenagers accepted a $12.8 billion investment from the makers of Marlboro that valued it at $38 billion. Not only has Juul created significant controversy surrounding the ethics, or lack thereof, of its core product and its marketing to the younger generation in a short time, but it has also accumulated value at a clip rarely seen before. Juul, for context, surpassed a $10 billion valuation just seven months after its first round of VC backing — that’s four times faster than Facebook.

2019 is poised to be an interesting year for San Francisco-based Juul as it navigates public scrutiny, regulations and the completion of its partnership with Altria Group, which, according to Juul’s CEO Kevin Burns, will “help accelerate [Juul’s] success switching adult smokers.”

Magic Leap’s flagship product, the Magic Leap One AR headset, began shipping to consumers this year.

It wouldn’t be an end of the year round-up of the largest VC deals without any mention of Magic Leap, the extremely well-funded virtual reality company. Tucked away in Plantation, Fla., 8-year-old Magic Leap has closed round after round, raising more than $2 billion to develop its hardware and software. The key investors in this year’s big round, which valued the company at $6.3 billion, were Temasek and AT&T, which announced it would become the exclusive “wireless distributor” of Magic Leap products in the U.S. starting this summer. Magic Leap is also backed by Google, Alibaba and Axel Springer.

Not only did Magic Leap land one of the largest VC deals this year, but it also finally began shipping to consumers its flagship product, the Magic Leap One AR headset. That was a long time coming — years, in fact. So long, many doubted whether the buzzy headsets would ever see the light of day. Now, the headsets are available to buyers in 48 states, though it’s worth mentioning they cost more than two grand.

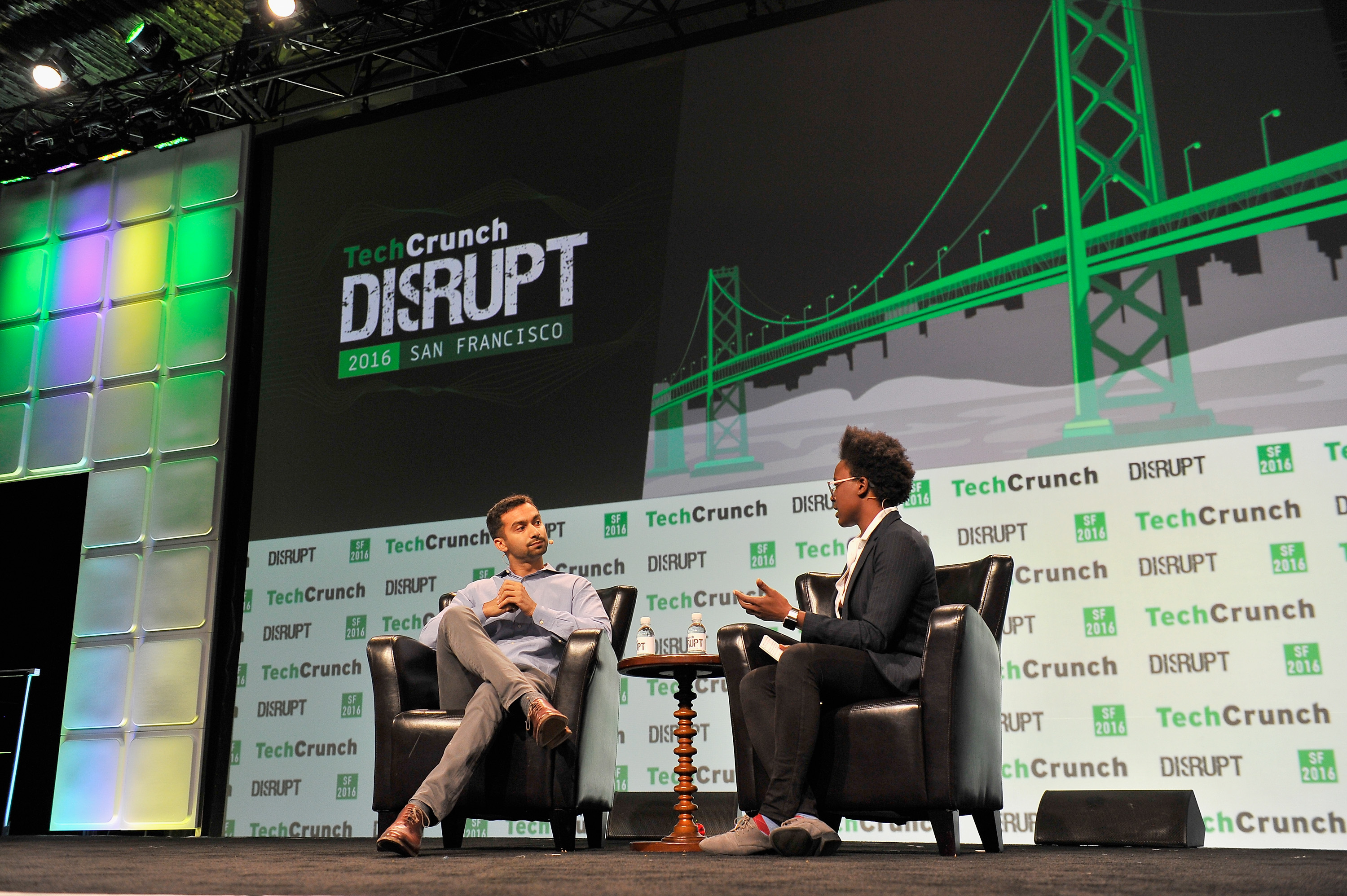

Founder and CEO of Instacart Apoorva Mehta and moderator Megan Rose Dickey speak onstage during TechCrunch Disrupt SF 2016 at Pier 48 on September 14, 2016 in San Francisco, California. (Photo by Steve Jennings/Getty Images for TechCrunch)

Instacart has a lofty goal of delivering groceries to every household in the U.S., and it needs a lot of cash to get there. The company has raised VC every year since it completed the Y Combinator startup accelerator in 2012, and 2018 was no different. In October, the service brought in $600 million at a $7.6 billion valuation in a round led by D1 Capital Partners. Headquartered in San Francisco, the company has raised $1.6 billion to date from Coatue Management, Thrive Capital, Canaan Partners, Andreessen Horowitz and several others.

Instacart CEO Apoorva Mehta told TechCrunch at the time that the startup didn’t really need the capital and that this was more of an “opportunistic” battle. The market is hot, after all, and Instacart has ambitious plans to scale and it has a fierce competitor in Amazon to take on. As for an IPO, Mehta said “it will be on the horizon.”

SoftBank-backed Katerra says it’s brought in more than $1.3 billion in bookings for new construction ranging from residential to hospitality and student housing.

One of SoftBank’s first major bets of 2018 was on construction technology, with an $865 million investment in Katerra at a $3 billion valuation out of its Vision Fund. Katerra, a tech startup based out of Menlo Park, develops, designs and constructs buildings. At the time of its January fundraise, Katerra told TechCrunch it had brought in more than $1.3 billion in bookings for new construction ranging from residential to hospitality and student housing. Founded in 2015 by three former private equity barons, the company has raised a total of $1.1 billion to date from SoftBank, Foxconn, Greenoaks Capital and others.

In June, Katerra announced it would merge with KEF Infra, an offsite manufacturing technology specialist, and would begin operating in India and the Middle East markets.

Yet another SoftBank investment, San Francisco-based Opendoor is also backed by Fifth Wall Ventures, GV, Andreessen Horowitz and more.

Opendoor’s two big SoftBank-backed investments this year totaled $725 million, valuing the company at $2.5 billion. The deal gave SoftBank a minority stake in Opendoor, an online real estate marketplace, and put one of its five managing directors, Jeff Housenbold, on the company’s board of directors. The round brought Opendoor’s total funding to slightly more than $1 billion — most of which it acquired in 2018, a major year for the company. Founded in 2014, the San Francisco-based startup is also backed by Fifth Wall Ventures, GV, Andreessen Horowitz and more.

According to TechCrunch’s Connie Loizos, Housenbold had hoped to work with Opendoor co-founder and CEO Eric Wu for some time. “The minute he joined [SoftBank] he reached out to me and let me know … saying if there was an opportunity to work together, to reach out to him,” Wu said.

Uber competitor Lyft expanded aggressively in 2018, raised hundreds of millions in additional venture capital funding, and filed confidentially to go public.

Lyft managed to stay quite busy this year. Not only did the ridesharing company raise a $600 million round at a $15.1 billion valuation, it also acquired bike-share operator Motivate and filed confidentially to go public. Founded in 2012 by Logan Green and John Zimmer, the company has long competed with Uber, and will continue to do so as the pair race to the public markets in early-2019. Lyft, much smaller than Uber and only active in the U.S. and Canada, has raised nearly $5 billion in venture backing from KKR, Mayfield, Didi Chuxing, Floodgate and others.

San Francisco-based Lyft has spent much of the last two years expanding rapidly across the U.S. market, as well as pursuing its autonomous vehicle ambitions.

Automation Anywhere raised a monstrous $550 million Series A in 2018, with support from the SoftBank Vision Fund.

The only surprise to make this list is Automation Anywhere, a 15-year-old provider of robotic process automation. The company raised a total of $550 million in Series A funding, a large chunk of which came from the SoftBank Vision Fund, as well as NEA, General Atlantic and Goldman Sachs. The round valued Automation Anywhere at $2.6 billion. According to PitchBook, this was the first round of institutional backing for the San Jose, Calif.-based company.

In a conversation with TechCrunch, Automation Anywhere CEO Mihir Shukla said they were attracted to SoftBank because of Masayoshi So — the CEO and founder of SoftBank: “[He} has a vision and he is investing in foundational platforms that will change how we work and travel. We share that vision.”

SAN FRANCISCO, CA – SEPTEMBER 06: Peloton Co-Founder/CEO John Foley speaks onstage during Day 2 of TechCrunch Disrupt SF 2018 at Moscone Center on September 6, 2018 in San Francisco, California. (Photo by Kimberly White/Getty Images for TechCrunch)

Peloton’s growth exploded in 2018 as it launched its $4,000 treadmill, doubled down on original fitness streaming content and raised an additional $500 million in equity funding at a $5 billion valuation. The New York-based startup, often referred to as the “Netflix of fitness,” has raised nearly $1 billion in venture capital funding in the six years since it was founded by John Foley. It’s backed by L Catterton, True Ventures, Tiger Global and others.

It’s likely Peloton will take the public markets plunge in 2019 much like Uber and Lyft. Foley earlier this year told The Wall Street Journal that though he doesn’t have any concrete plans, 2019 “makes a lot of sense” for its stock market debut.

Powered by WPeMatico

Malta, the renewable energy storage project born in Alphabet’s moonshot factory X, is now on its own and flush with $26 million from a Series A funding round led by Breakthrough Energy Ventures .

Concord New Energy Group and Alfa Laval also invested in the round.

Project Malta launched last year in Alphabet’s X (formerly Google X) with an aim to build energy storage facilities that can support full-scale power grids. The independent company spun out of Alphabet is now called Malta Inc.

Malta Inc. has developed a system designed to keep power generated from renewable energy or fossil fuels in reserve for longer than lithium-ion batteries. The electro-thermal storage system first captures energy generated from wind, solar or fossil generators on the grid. The collected electricity drives a heat pump, which converts the electrical energy into thermal energy. The heat is stored in molten salt, while the cold is stored in a chilled antifreeze liquid. A heat engine is used to convert the energy back to electricity for the grid when it’s needed.

The system can store electricity for days or even weeks, Malta says.

Malta is going to use the funds to work with industry partners to turn the detailed designs developed and refined at X into industrial-grade machinery for its first pilot system.

BEV, the lead investor in Malta’s Series A round, was created in 2016 by the Breakthrough Energy Coalition, an investor group that includes Microsoft co-founder Bill Gates, John Doerr, chairman of venture firm Kleiner Perkins Caufield & Byers, Alibaba founder Jack Ma, Amazon founder and CEO Jeff Bezos, and SAP co-founder Hasso Plattner.

Powered by WPeMatico

A Juul is not a cigarette. It’s much easier than that. Through devilishly slick product design I’ll discuss here, the startup has massively lowered the barrier to getting hooked on nicotine. Juul has dismantled every deterrent to taking a puff.

The result is both a new $38 billion valuation thanks to a $12.8 billion investment from Marlboro Cigarettes-maker Altria this week, and an explosion in popularity of vaping amongst teenagers and the rest of the population. Game recognize game, and Altria’s game is nicotine addiction. It knows it’s been one-upped by Juul’s tactics, so it’s hedged its own success by handing the startup over a tenth of the public corporation’s market cap in cash.

Juul argues it can help people switch from obviously dangerous smoking to supposedly healthier vaping. But in reality, the tiny aluminum device helps people switch from nothing to vaping…which can lead some to start smoking the real thing. A study found it causes more people to pick up cigarettes than put them down.

Photographer: Gabby Jones/Bloomberg via Getty Images

How fast has Juul swept the nation? Nielsen says it controls 75 percent of the U.S. e-cigarette market up from 27 percent in September last year. In the year since then, the CDC says the percentage of high school students who’ve used an e-cigarette in the last 30 days has grown 75 percent. That’s 3 million teens or roughly 20 percent of all high school kids. CNBC reports that Juul 2018 revenue could be around $1.5 billion.

The health consequences aside, Juul makes it radically simple to pick up a lifelong vice. Parents, regulators, and potential vapers need to understand why Juul works so well if they’ll have any hope of suppressing its temptations.

It’s tough to try a cigarette for the first time. The heat and smoke burn your throat. The taste is harsh and overwhelming. The smell coats your fingers and clothes, marking you as smoker. There’s pressure to smoke a whole one lest you waste the tobacco. Even if you want to try a friend’s, they have to ignite one first. And unlike bigger box mod vaporizers where you customize the temperature and e-juice, Juul doesn’t make you look like some dorky hardcore vapelord.

Juul is much more gentle on your throat. The taste is more mild and can be masked with flavors. The vapor doesn’t stain you with a smell as quickly. You can try just a single puff from a friend’s at a bar or during a smoking break with no pressure to inhale more. The elegant, discrete form factor doesn’t brand you as a serious vape users. It’s casual. Yet the public gesture and clouds people exhale are still eye catching enough to trigger the questions, “What’s that? Can I try?” There’s a whole other article to be written about how Juul memes and Instagram Stories that glamorized the nicotine dispensers contributed to the device’s spread.

And perhaps most insidiously, vaping seems healthier. A lifetime of anti-smoking ads and warning labels drilled the dangers into our heads. But how much harm could a little vapor do?

A friend who had never smoked tells me they burn through a full Juul pod per day now. Someone got him to try a single puff at a nightclub. Soon he was asking for drag off of strangers’ Juuls. Then he bought one and never looked back. He’d been around cigarettes at parties his whole life but never got into them. Juul made it too effortless to resist.

Lighting up a cigarette is a garish activity prohibited in many places. Not so with discretely sipping from a Juul.

Cigarettes often aren’t allowed to be smoked inside. Hiding it is no easy feat and can get you kicked out. You need to have a lighter and play with fire to get one started. They can get crushed or damp in your pocket. The burning tip makes them unruly in tight quarters, and the bud or falling ash can damage clothing and make a mess. You smoke a cigarette because you really want to smoke a cigarette.

Public establishments are still figuring out how to handle Juuls and other vaporizers. Many places that ban smoking don’t explicitly do the same for vaping. The less stinky vapor and more discrete motion makes it easy to hide. Beyond airplanes, you could probably play dumb and say you didn’t know the rules if you did get caught. The metal stick is hard to break. You won’t singe anyone. There’s no mess, need for an ashtray, or holes in your jackets or couches.

As long as your battery is charged, there’s no need for extra equipment and you won’t draw attention like with a lighter. Battery life is a major concern for heavy Juulers that smokers don’t have worry about, but I know people who now carry a giant portable charger just to keep their Juul alive. But there’s also a network effect that’s developing. Similar to iPhone cords, Juuls are becoming common enough that you can often conveniently borrow a battery stick or charger from another user.

And again, the modular ability to take as few or as many puffs as you want lets you absent-mindedly Juul at any moment. At your desk, on the dance floor, as you drive, or even in bed. A friend’s nieces and nephews say that they see fellow teens Juul in class by concealing it in the cuff of their sleeve. No kid would be so brazen as to try smoke in cigarette in the middle of a math lesson.

Gillette pioneered the brilliant razor and blade business model. Buy the sometimes-discounted razor, and you’re compelled to keep buying the expensive proprietary blades. Dollar Shave Club leveled up the strategy by offering a subscription that delivers the consumable blades to your door. Juul combines both with a product that’s physically addictive.

When you finish a pack of cigarettes, you could be done smoking. There’s nothing left. But with Juul you’ve still got the $35 battery pack when you finish vaping a pod. There’s a sunk cost fallacy goading you to keep buying the pods to get the most out of your investment and stay locked into the Juul ecosystem.

(Photo by Scott Olson/Getty Images)

One of Juul’s sole virality disadvantages compared to cigarettes is that they’re not as ubiquitously available. Some stores that sells cigs just don’t carry them yet. But more and more shops are picking them up, which will continue with Altria’s help. And Juul offers an “auto-ship” delivery option that knocks $2 off the $16 pack of four pods so you don’t even have to think about buying more. Catch the urge to quit? Well you’ve got pods on the way so you might as well use them. Whether due to regulation or a lack of innovation, I couldn’t find subscription delivery options for traditional cigarettes.

And for minors that want to buy Juuls or Juul pods illegally, their tiny size makes them easy to smuggle and resell. A recent South Park episode featured warring syndicates of fourth-graders selling Juul pods to even younger kids.

Juul co-founder James Monsees told the San Jose Mercury News that “The first phase is proving the value and creating a product that makes cigarettes obsolete.” But notice he didn’t say Juul wants to make nicotine obsolete or reduce the number of people addicted to it.

Juul co-founder James Monsees

If Juul actually cared about fighting addiction, it’d offer a regimen for weaning yourself off of nicotine. Yet it doesn’t sell low-dose or no-dose pods that could help people quit entirely. In the US it only sells 5% and 3% nicotine versions. It does make 1.7% pods for foreign markets like Israel where that’s the maximum legal strengths, though refuses to sell them in the States. Along with taking over $12 billion from one of the largest cigarette companies, that makes the mission statement ring hollow.

Juul is the death stick business as usual, but strengthened by the product design and virality typically reserved for Apple and Facebook.

Powered by WPeMatico

The story of the game Star Citizen and Cloud Imperium, the company developing it, is almost too ludicrous to believe: a crowdfunding effort to create a space sim of unparalleled size and realism, raising hundreds of millions, with backers paying thousands for ships and gear in a game that’s years from release. Yet it’s real enough that it just pulled in $42 million in private funding to help bring it closer to release.

Star Citizen began as the brainchild of Chris Roberts, architect of the Wing Commander series and other well-received space games. His idea was to crowdfund the team’s next game, and did so in 2012; the money started rolling in, and it never really stopped. Nor has the game ceased to grow in its ambitions, adding things like entire planets to the lineup that seem, on their face, somewhat insane.

There’s no shortage of histories of the game and its developers out there, so for our purposes let it suffice to say that over the last six years the company has raised $211 million, the vast majority of which comes from gamers “pledging” anywhere from a few bucks to thousands of dollars for all manner of things related to the title. Early access to builds, exclusive ships, testing new content, etc.

A huge amount of work has been done on the game, so this isn’t just a colossal con, though there are plenty who think the game, and its first-person shooter counterpart Squadron 42, can’t possibly ever fulfill its ambitions and justify the money people have put into it.

That doesn’t seem to be the opinion of Clive Calder, founder of Zomba and producer in a variety of entertainment formats, whom Roberts met during a clandestine campaign to solicit funding.

Roberts, who writes the story in one of his candid messages to the project’s fanbase, had decided a while back that he didn’t want to use pledged funds for marketing purposes — at least not the kind of marketing blitz AAA games tend to require for a successful global release. So he went looking for investment, and found Calder, with whom he “got on like a house on fire.”

Calder’s family office agreed to invest $46 million for a 10 percent stake in Cloud Imperium, which all told puts it near a half-billion valuation. One may very well question the sanity of such a valuation for a company that has not yet shipped an actual product — working prototypes, sure, but not a completed game — but hell, at least they’re making something people are excited about. That’s got to be worth a couple bucks.

Cloud Imperium gains two new board members from outside, though Roberts, who commands the kind of loyalty that only decades in an industry can create, was quick to point out that “control of the company and the board still firmly stays with myself as chairman, CEO and majority shareholder.”

In another act of not exactly radical but not legally required transparency, the company also posted an outline of the company’s financials over the last six years. Unsurprisingly, the company has been investing most of its cash into game development in the form of salaries, contracts and overhead; a non-trivial amount has gone toward “publishing operations, community, events and marketing,” which with a game as community-focused as Star Citizen is not surprising.

The company has grown steadily, adding a hundred people a year or so to a present size of 464 — which is the kind of size you’d expect on a AAA game like Assassin’s Creed or Red Dead Redemption. Even more would be added on as temporary artists, actors and so on.

I’m sure it has escaped no one that pledges appear to have peaked, though if they remain steady the company clearly will have enough to continue operations if it doesn’t expand. But one does also see perhaps a secondary motive in seeking investment from outside the community. At some point people are going to want a game.

To that end, Squadron 42, at least, is scheduled for release in Q2 2020 — though backers and critics will both chuckle a little at the idea that Cloud Imperium will be able to hit those goals. The games, infamously, were originally slated for release long ago. But the scope of the project has grown since its conception and although some no doubt would rather be playing the completed game today, they may very well find that good things come to those who wait. And wait. And wait…

Powered by WPeMatico

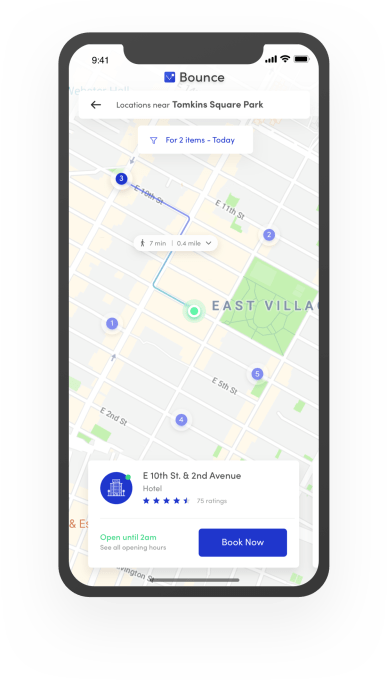

If you’ve ever found yourself lugging a big suitcase from meeting to meeting, a startup called Bounce could make your life easier. Using Bounce, you’ll be able to pay for short-term storage at hotels, dry cleaners and other local businesses.

The San Francisco-based startup is announcing that it has raised $1.2 million in seed funding from investors including Structured Capital managing partner Jillian Manus, Seabed VC, Airbnb general counsel Rob Chesnut and Canadian entrepreneur Michael Hyatt.

CEO Cody Candee (pictured above with his co-founder and CTO Aleksander Rendtslev) said he’s actually not someone who owns a lot of stuff himself, but he realized that “people are constantly planning their days and planning their lives around the things that they own,” whether that’s running home to drop something off or heading straight to your hotel from the airport because you need to get rid of your luggage.

So Bounce has already signed up more than 100 locations across New York, San Francisco, Washington, DC and Chicago, and it says they’ve been used to store tens of thousands of bags. You currently browse these locations through the Bounce website, but Candee said an iOS app launch is imminent. Apparently Bounce vets its locations, partly to ensure that they have secure storage areas and that their posted store hours are accurate — so that you don’t rush to the store to pick something up before closing, only to discover that everyone left early. Candee added that the most common use cases include travelers who have checked out of their hotels, people attending events (I once tried to carry my gym bag into Madison Square Garden and I will never do that again) and salespeople who are hopping from meeting to meeting.

Apparently Bounce vets its locations, partly to ensure that they have secure storage areas and that their posted store hours are accurate — so that you don’t rush to the store to pick something up before closing, only to discover that everyone left early. Candee added that the most common use cases include travelers who have checked out of their hotels, people attending events (I once tried to carry my gym bag into Madison Square Garden and I will never do that again) and salespeople who are hopping from meeting to meeting.

There are other companies that appear to have a similar idea — for example, Vertoe was part of winter class at Techstars NYC — but Candee said that competitors are mostly “attacking just the luggage storage space,” which he suggested is “relatively easy to build.”

In contrast, he said, “The way we see it is, we’re really building a tech platform and basically thinking about these broader use cases.” In fact, he said Bounce is already testing out a system where items are transported by local couriers between different storage locations.

“We’re thinking about what could be built on top of that platform,” Candee said. “A drycleaner could come on our platform and they could basically say, ‘Hey, drop your clothes off’ and then Bounce it back to wherever that user is.”

Powered by WPeMatico

Before Ram Palaniappan founded Earnin, he developed a system for employees at a payments company called UniRush, where he spent eight years as president. If you needed money before payday, he would write you a check from his checking account and when payday rolled around, employees would reimburse him.

Despite being paid what Palaniappan thought were fair wages, his workers often found themselves in a bind, needing access to wages they couldn’t expect to see in their own bank accounts for days.

“This is such a core pain point,” Palaniappan told TechCrunch. “Over three-fourths of the country live paycheck to paycheck … It’s an issue of fairness. We all have gotten used to getting paid every two weeks, but most employees would rather be paid before they work.”

Palaniappan decided to transform what he had been doing as a favor to employees into a real business with Earnin (formerly known as Activehours), a startup that helps hourly, gig and salary workers track their earnings and transfer them to their checking accounts in real time using a mobile application. Today, the company is announcing a $125 million Series C funding from top-tier investors DST Global, Andreessen Horowitz, Spark Capital, Matrix Partners, March Capital Partners, Coatue Management and Ribbit Capital. Palaniappan declined to disclose the valuation.

Earnin founder and chief executive officer Ram Palaniappan

Here’s how it works: An employee signs up on the Earnin app and connects their bank account. Earnin infers the person’s pay cycle and debits their account the amount they’ve borrowed on their payday. Earnin charges no fees or interest; instead, it operates on a pay it forward revenue model some would balk at. Earnin users have the option to “tip” the app after each transaction and that tip, in turn, is used to fund the next user’s withdrawal. If a user tips more than Earnin thinks is reasonable for the given withdrawal, it will notify the user and give them the option to dial back the tip amount.

What the company has found is that users are usually more than happy to contribute to the Earnin community of workers.

“So often, people are trying to help each other out,” Palaniappan said. “That’s the most powerful piece — how much support the community is providing to each other.”

Earnin was launched in 2014 and has previously raised $65 million in venture capital funding. With the latest investment, it will expand its engineering and product teams across its offices in Palo Alto — where it’s headquartered — as well as in Cincinnati and Vancouver.

The app, often among the App Store’s top 10 financial apps, has more than 1 million downloads, the company says, and is used by employees at more than 50,000 companies — many of which check the app every day. Palaniappan says its users are working more than 15 million hours per week. If each user works an estimated 40 hours per week, that means the app has roughly 375,000 weekly active users.

He added that the startup’s growth in the last four years has been “quite remarkable.” Given the investor support it’s received, it’s likely to step into “unicorn” territory soon. Ribbit Capital, for example, is a leading fintech investing firm with capital invested in Coinbase, Revolut, Gusto, Wealthfront, NuBank, Brex and more.

Powered by WPeMatico

After a long year fighting underage use of its products, Juul Labs has today struck a deal with Altria Group, the owners of Philip Morris USA and makers of Marlboro cigarettes.

The deal values Juul at $38 billion, according to Bloomberg, and injects the company with a fresh $12.8 billion in exchange for a 35 percent stake in Juul Labs.

Here’s what Juul Labs CEO Kevin Burns had to say in a prepared statement:

We understand the controversy and skepticism that comes with an affiliation and partnership with the largest tobacco company in the US. We were skeptical as well. But over the course of the last several months we were convinced by actions, not words, that in fact this partnership could help accelerate our success switching adult smokers. We understand the doubt. We doubted as well.

He goes on to explain the strict criteria Juul Labs had for a potential investor, particularly one from the Big Tobacco space. For one, Altria entered into a standstill agreement that limits to 35 percent the company’s ownership in Juul. Altria also must use its database and its distribution network to get out to current smokers the message of Juul.

For the past year, many have seen Juul as a dangerous toy for teenagers. In November, FDA Commissioner Scott Gottlieb announced new measures for the e-cig industry meant to keep the products out of the hands of teens. One of those measures includes restricting the sale of flavored non-combustible tobacco products beyond the usual cigarette flavors of tobacco and menthol.

But after nearly a year of playing defense, this new deal marks a bit of an offensive push from Juul Labs. The company has always stressed that its main goal is to give smokers a meaningful alternative to combustible cigarettes. Partnering with Big Tobacco may not seem like the best way to do that, optically speaking. But Altria has agreed to a few measures that would get into the hands of actual smokers information about Juul, including:

In the release, Altria said that part of the reason for the investment is simply that the organization understands change is coming to the tobacco industry.

Howard Willard, Altria’s chairman and chief executive officer, had this to say in a prepared statement:

We are taking significant action to prepare for a future where adult smokers overwhelmingly choose non-combustible products over cigarettes by investing $12.8 billion in JUUL, a world leader in switching adult smokers. We have long said that providing adult smokers with superior, satisfying products with the potential to reduce harm is the best way to achieve tobacco harm reduction. Through JUUL, we are making the biggest investment in our history to achieve that goal. We strongly believe that working with JUUL to accelerate its mission will have long-term benefits for adult smokers and our shareholders.

Altria has made a few big moves lately, including acquiring a 45 percent stake in cannabis company Cronos earlier this month. The company also announced this month that it would discontinue its own e-cig products, including all MarkTen and Green Smoke e-vapor products, and VERVE oral nicotine products.

“This decision is based upon the current and expected financial performance of these products, coupled with regulatory restrictions that burden Altria’s ability to quickly improve these products,” read the press release. “The company will refocus its resources on more compelling reduced-risk tobacco product opportunities.”

Now we know that those opportunities look like an extra-long thumb drive called Juul.

Powered by WPeMatico

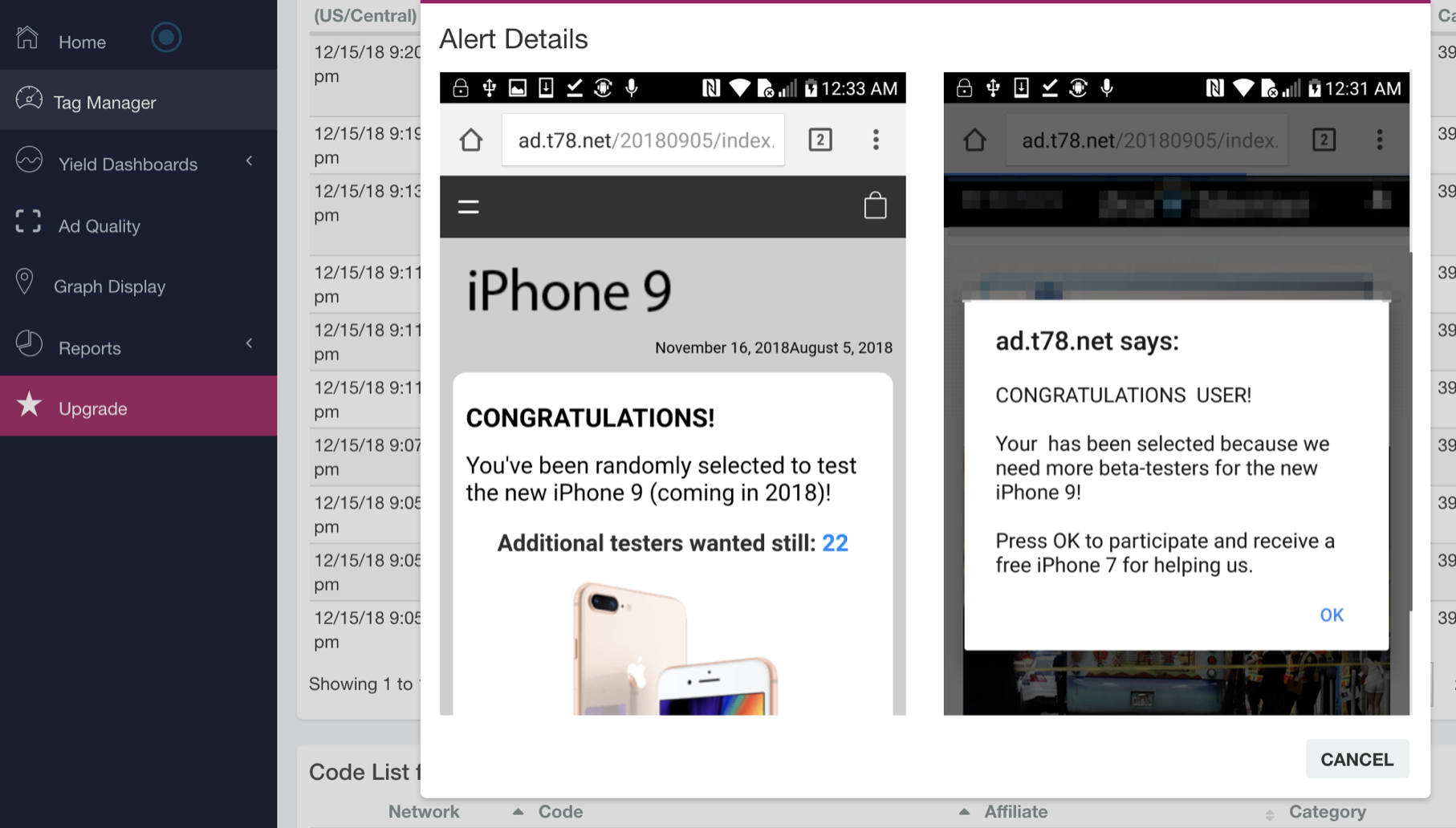

Adtech cybersecurity company Devcon announced today that it has raised $4.5 million in seed funding.

Over the past couple of years, ad fraud has become a bigger concern in the industry, but Devcon co-founder and CEO Maggie Louie said most existing solutions focus on things like verifying ad quality and confirming that impressions aren’t coming from bots. Devcon, in contrast, functions more like “a Norton AntiVirus of adtech,” preventing attempts by bad actors who are “using adtech as a catalyst to attack consumers and companies.”

In other words, Louie said Devcon works with ad networks and publishers to “eliminate 99 percent of the nefarious things that are making their way through the system.” It says it can block malicious ads on an individual basis, whether they include pop-ups and redirects or unauthorized tag injectors. Customers can then view the individually blocked ads and see where they came from, and there’s also a dashboard that shows how much money is being lost to fraud.

Louie pointed to the recent DOJ indictment of eight individuals allegedly involved in a digital ad fraud scheme as a sign that the issue is becoming more serious.

“Some of these attacks have some very concerning potential outcomes [for consumers], so being able to stop those before they get out is akin to stopping a water contamination at the source level,” she added.

At the same time, she argued that this is a particularly challenging area for security, because there’s been “a lack of crossover between cybersecurity and ad ops,” leading to a dearth of “security people or cybersecurity people who understand adtech.”

In contrast, the Devcon team combines media veterans like Louie (who was recently vice president of audience at the Athens Banner-Herald and also worked at the Los Angeles Times) with “white hat” hackers like co-founder and CTO Josh Summitt (who was previously on the ethical hacking team at Bank of America). It’s also hired former FBI Cyber Squad Supervisor Michael F. D. Anaya as its head of global cyber investigations and government relations.

In fact, Devcon says it assisted law enforcement in the first-ever conviction for online ad theft and money laundering, which resulted in a four-year prison sentence.

Devcon was founded in Memphis, Tenn., but has since expanded its headquarters to Atlanta, and it was part of this year’s Techstars Barclay accelerator in London. The seed funding was led by Las Olas VC — among other things, Louie said it will allow Devcon to further develop its machine learning technology to automatically identify emerging threats.

Powered by WPeMatico

Our distinct skill sets and shortcomings mean people and robots will join forces for the next few decades. Robots are tireless, efficient and reliable, but in a millisecond through intuition and situational awareness, humans can make decisions machine can’t. Until workplace robots are truly autonomous and don’t require any human thinking, we’ll need software to supervise them at scale. Formant comes out of stealth today to “help people speak robot,” says co-founder and CEO Jeff Linnell. “What’s really going to move the needle in the innovation economy is using humans as an empowering element in automation.”

Linnell learned the grace of uniting flesh and steel while working on the movie Gravity. “We put cameras and Sandra Bullock on dollies,” he bluntly recalls. Artistic vision and robotic precision combined to create gorgeous zero-gravity scenes that made audiences feel weightless. Google bought his startup Bot & Dolly, and Linnell spent four years there as a director of robotics while forming his thesis.

Now with Formant, he wants to make hybrid workforce cooperation feel frictionless.

The company has raised a $6 million seed round from SignalFire, a data-driven VC fund with software for recruiting engineers. Formant is launching its closed beta that equips businesses with cloud infrastructure for collecting, making sense of and acting on data from fleets of robots. It allows a single human to oversee 10, 20 or 100 machines, stepping in to clear confusion when they aren’t sure what to do.

“The tooling is 10 years behind the web,” Linnell explains. “If you build a data company today, you’ll use AWS or Google Cloud, but that simply doesn’t exist for robotics. We’re building that layer.”

“This is going to sound completely bizarre,” Formant CTO Anthony Jules warns me. “I had a recurring dream [as a child] in which I was a ship captain and I had a little mechanical parrot on my should that would look at situations and help me decide what to do as we’d sail the seas trying to avoid this octopus. Since then I knew that building intelligent machines is what I would do in this world.”

So he went to MIT, left a robotics PhD program to build a startup called Sapient Corporation that he built into a 4,000-employee public company, and worked on the Tony Hawk video games. He too joined Google through an acquisition, meeting Linnell after Redwood Robotics, where he was COO, got acquired. “We came up with some similar beliefs. There are a few places where full autonomy will actually work, but it’s really about creating a beautiful marriage of what machines are good at and what humans are good at,” Jules tells me.

Formant now has SaaS pilots running with businesses in several verticals to make their “robot-shaped data” usable. They range from food manufacturing to heavy infrastructure inspection to construction, and even training animals. Linnell also foresees retail increasingly employing fleets of robots not just in the warehouse but on the showroom floor, and they’ll require precise coordination.

What’s different about Formant is it doesn’t build the bots. Instead, it builds the reins for people to deftly control them.

First, Formant connects to sensors to fill up a cloud with LiDAR, depth imagery, video, photos, log files, metrics, motor torques and scalar values. The software parses that data and when something goes wrong or the system isn’t sure how to move forward, Formant alerts the human “foreman” that they need to intervene. It can monitor the fleet, sniff out the source of errors, and suggest options for what to do next.

For example, “when an autonomous digger encounters an obstacle in the foundation of a construction site, an operator is necessary to evaluate whether it is safe for the robot to proceed or stop,” Linnell writes. “This decision is made in tandem: the rich data gathered by the robot is easily interpreted by a human but difficult or legally questionable for a machine. This choice still depends on the value judgment of the human, and will change depending on if the obstacle is a gas main, a boulder, or an electrical wire.”

Any single data stream alone can’t reveal the mysteries that arise, and people would struggle to juggle the different feeds in their minds. But not only can Formant align the data for humans to act on, it also can turn their choices into valuable training data for artificial intelligence. Formant learns, so next time the machine won’t need assistance.

With rock-star talent poached from Google and tides lifting all automated boats, Formant’s biggest threat is competition from tech giants. Old engineering companies like SAP could try to adapt to the new real-time data type, yet Formant hopes to out-code them. Google itself has built reliable cloud scaffolding and has robotics experience from Boston Dynamics, plus buying Linnell’s and Jules’ companies. But the enterprise customization necessary to connect with different clients isn’t typical for the search juggernaut.

Linnell fears that companies that try to build their own robot management software could get hacked. “I worry about people who do homegrown solutions or don’t have the experience we have from being at a place like Google. Putting robots online in an insecure way is a pretty bad problem.” Formant is looking to squash any bugs before it opens its platform to customers in 2019.

Linnell fears that companies that try to build their own robot management software could get hacked. “I worry about people who do homegrown solutions or don’t have the experience we have from being at a place like Google. Putting robots online in an insecure way is a pretty bad problem.” Formant is looking to squash any bugs before it opens its platform to customers in 2019.

With time, humans will become less and less necessary, and that will surface enormous societal challenges for employment and welfare. “It’s in some ways a continuation of the industrial revolution,” Jules opines. “We take some of this for granted but it’s been happening for 100 years. Photographer — that’s a profession that doesn’t exist without the machine that they use. We think that transformation will continue to happen across the workforce.”

Powered by WPeMatico

Seismic has been helping companies create and manage their sales and marketing collateral since 2010. Today the company announced a $100 million Series E investment on a $1 billion valuation.

The round was led by Lightspeed Venture Partners and T. Rowe Price. Existing investors General Atlantic, JMI Equity and Jackson Square Ventures also participated in the round. The company has now raised $179 million since inception.

What is attracting this level of investment is Seismic’s sales enablement tools, a kind of content management for sales and marketing. “What we’re trying to do with our technology is to help marketers who are striving to create the right content to help the sellers, and help sellers navigate all of the content out there and put together the right pieces and the right materials that are going to help them move the sales cycle along,” Seismic CEO and co-founder Doug Winter explained.

The inclusion of an investor like T. Rowe Price often is a signal of IPO ambitions, and Winter acknowledged the connection, while pointing out that T. Rowe Price is also a customer. “We do have a goal to be public-ready as a company that we are aiming for. We are the leader of the space, and we do feel like striving to be a public company and to be the first one in our space to go public. It’s a goal we are going to push for,” Winter told TechCrunch.

But he says taking this investment is more about taking advantage of market opportunity. The money gives Seismic the ability to expand to meet growing sales. Today, the company has more than 600 customers averaging more than $200,000 in spending, according to Winter.

The company acquired the Savo Group in May to help expand its market position. Seismic is based in San Diego with offices in Boston and Chicago (from the acquisition). It also opened offices in the U.K. and Australia earlier this year and plans further international expansion with the new investment. The company currently has more than 600 employees, including 185 engineers and project managers, and plans to keep hiring as it puts this money to work.

Powered by WPeMatico