funding

Auto Added by WPeMatico

Auto Added by WPeMatico

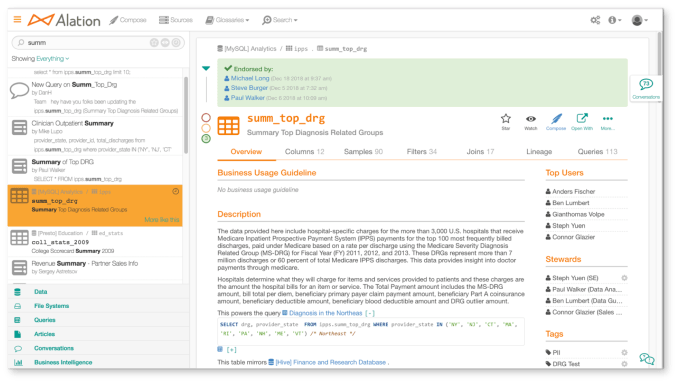

Alation, a startup that helps crawl a company’s databases in order to build a data search catalog, announced a $50 million Series C investment today.

The round was led by Sapphire Ventures and Salesforce Ventures. Existing investors Costanoa Ventures, DCVC (Data Collective), Harmony Partners and Icon Ventures also participated. Today’s investment brings the total raised to $82 million, according to Crunchbase data.

The participation of Sapphire Ventures, originally launched by SAP, and Salesforce Ventures, the venture arm of Salesforce, is particularly telling. One of the issues these enterprise software companies face when they go inside large enterprises is helping customer’s access and understand data wherever it lives. It’s one of the reasons that Salesforce bought MuleSoft for $6.5 billion last year.

This is a problem that employees face, as well. It’s simply inefficient to query multiple databases manually, or to even know what databases exist inside a large organization. Alation uses out-of-the-box connectors to connect to common data sources like Oracle, Redshift, Teradata, Spark and Tableau to create a centralized data catalog.

With that catalog in place, employees can search just as they would with any enterprise search engine, with the notable difference that this tool is focused strictly on structured data inside of supported data sources.

The company goes beyond pure matching to find the data an employee is searching for. Company CEO and co-founder Satyen Sangani says they also use a method to analyze usage to display the most likely result. “What differentiates us in particular is that we look at the logs of how people are using that information,” he explained. This is analogous to how Google uses the PageRank algorithm to measure the popularity of a page based on the number of times people link to a page.

Alation catalog page. Screenshot: Alation

It is certainly not alone in the space, with competitors like Alteryx and Informatica, but Alation’s approach seems to be resonating. Sangani reports triple-digit growth four years running. The company has soared from 89 employees at the end of last year to around 200 today. It boasts 100 large enterprise customers in production, including names like BMW, Hilton, American Express and Salesforce (whose investment arm, Salesforce Ventures also helped lead today’s round).

As the company grows rapidly, Sangani says he wants the capital in place to help fuel the increasing interest. The size and scope of his customers means that he will need to hire not just engineers to keep developing the product and building new connectors, but customer support and sales and marketing. In all, he expects to add between 100 and 200 employees in the next year.

He also wants to continue building out partnerships. As an example, Teradata is an authorized reseller, and has helped sell the product in global markets where a startup like Alation might lack the resources to enter.

Based in Redwood City, Calif., the company launched in 2012 and released the first version of the product in 2014. Its most recent round prior to today was a $23 million Series B in 2017.

Powered by WPeMatico

We’ve known since around December that Niantic (the company behind Pokémon GO and the soon to be released Harry Potter Wizards Unite) was in the middle of raising a ton of money for its Series C round. At the time, it looked like it’d come in around $200 million.

The company has just officially announced the round, disclosing the final amount: $245 million.

Niantic says that the round was led by IVP, and backed by aXiomatic Gaming, Battery Ventures, Causeway Media Partners, CRV and Samsung Ventures. They also confirmed that the company’s current valuation is “nearly” $4 billion, as rumored when word of the round was first floating around.

This raise comes just as Niantic is plotting its next steps, post overwhelming Pokémon success. It’s just about to launch another game based on massively nostalgic IP with Wizards Unite, all while working on slowly opening up its armory of AR frameworks (and its massive database of locational points of interest) for third-party developers to build upon.

Powered by WPeMatico

Infor, a NYC-based enterprise software company, announced a massive $1.5 billion investment today that could be the precursor to an IPO in the next 12-24 months. One analyst is estimating that the valuation could be at least $60 billion.

The investment is being led by Koch Industries’ investment arm, Koch Equity Development, and Golden Gate Capital. Today’s investment comes on top of a $2 billion+ cash infusion from Koch in 2017, bringing the total raised to at least more than $3.5 billion along with a hefty $6.1 billion in debt. That’s a lot of cash.

In fact, the company plans to use a large portion of today’s investment to pay down part of that debt, including $500 million in senior secured notes due in 2020, which it plans to pay off next month, and $750 million in HoldCo senior contingent cash pay notes due in 2021, which it plans to pay off in May. The thinking is that the company wants to reduce its debt load ahead of its IPO.

“We expect this paydown, in combination with cash flows and estimated IPO proceeds, will provide Infor with leverage levels consistent with other successful IPOs over the past few years,” Infor CFO Kevin Samuelson explained during an investor call today.

The company wouldn’t rule out additional investments before going public, but it was looking firmly toward an IPO. “We’ve spoken for some time about the many advantages that we believe Infor will receive if the company goes public, including improved brand recognition, a broader employee equity program, additional currency for M&A and more financial clarity for our customers and prospects,” Samuelson said.

Infor may be the largest company you never heard of, with more than 17,000 employees and 68,000 customers in more than 100 countries worldwide. All of those customers generated $3 billion in revenue in 2018. That’s a significant presence.

Ray Wang, founder and principal analyst at Constellation Research, told TechCrunch that based on that revenue, he believes the valuation could be in the neighborhood of $60 billion. He based that on $3 billion in revenue, while using Oracle and SAP as similar industry comparisons. These companies have a 20X price/earnings ratio. He adds, that would make it the largest tech IPO ever for a NYC tech company if that comes to pass. Infor would not confirm this number with a spokesperson telling TechCrunch, “We cannot comment on value at this time.”

What does this company do to achieve this size and scope? It’s not unlike many other large enterprise companies, says Wang. It produces cloud software solutions around typical enterprise needs such as CRM, ERP and supply chain asset management.

Daniel Newman, principal analyst at Futurum Research, says that Infor has grown rapidly through a series of acquisitions and an unusual approach to enterprise software. “What makes its approach to enterprise software unique is that rather than building software and then attempting to customize it for the unique [customer] needs, Infor takes an industry-based approach that incorporates both subtle and material capabilities to address specific industry needs that more generic ERP tools aren’t capable of out of the box,” Newman told TechCrunch.

He adds that this difference is attractive to many companies seeking ERP and enterprise asset management tools that are built with their business in mind, rather than completely customizing a software designed for any business in any industry.

As it turns out, Koch isn’t just an investor, it’s an Infor customer. “Koch was a customer of Infor before we became an investor in the company, and Koch Industries’ companies continue to move their most mission critical applications to Infor CloudSuites,” Jim Hannan, executive vice president and CEO for Enterprises at Koch Industries said in a statement.

The company, which was founded way back in 2002, has been shifting to the cloud over the last five years. It reports that more than 70 percent of its revenue is now derived from cloud products, fueled in part by an aggressive acquisition strategy.

Powered by WPeMatico

HyperScience, the machine learning company that turns human readable data into machine readable data, has today announced the close of a $30 million Series B funding round led by Stripes Group, with participation from existing investors FirstMark Capital and Felicis Ventures, as well as new investors Battery Ventures, Global Founders Capital, TD Ameritrade and QBE.

HyperScience launched out of stealth in 2016 with a suite of enterprise products focused on the healthcare, insurance, finance and government industries. The original products were HSForms (which handled data-entry by converting hand-written forms to digital), HSFreeForm (which did a similar function for hand-written emails or other non-form content) and HSEvaluate (which could parse through complex data on a form to help insurance companies approve or deny claims by pulling out all the relevant info).

Now, the company has combined all three of those products into a single product called HyperScience. The product is meant to help companies and organizations reduce their data-entry backlog and better serve their customers, saving money and resources.

The idea is that many of the forms we use in life or in the workplace are in an arbitrary format. My bank statements don’t look the same as your bank statements, and invoices from your company might look different than invoices from my company.

HyperScience is able to take those forms and pipe them into the system quickly and easily, without help from humans.

Instead of charging by seat, HyperScience charges by documents, as the mere use of HyperScience should mean that fewer humans are actually “using” the product.

The latest round brings HyperScience’s total funding to $50 million, and the company plans to use a good deal of that funding to grow the team.

“We have a product that works and a phenomenally good product market fit,” said CEO Peter Brodsky. “What will determine our success is our ability to build and scale the team.”

Powered by WPeMatico

The government shutdown entered its 21st day on Friday, upping concerns of potentially long-lasting impacts on the U.S. stock market. Private market investors around the country applauded when Uber finally filed documents with the SEC to go public. Others were giddy to hear Lyft, Pinterest, Postmates and Slack (via a direct listing, according to the latest reports) were likely to IPO in 2019, too.

Unfortunately, floats that seemed imminent may not actually surface until the second half of 2019 — that is unless President Donald Trump and other political leaders are able to reach an agreement on the federal budget ASAP. This week, we explored the government’s shutdown’s connection to tech IPOs, recounted the demise of a well-funded AR project and introduced readers to an AI-enabled self-checkout shopping cart.

1. Postmates gets pre-IPO cash

The company, an early entrant to the billion-dollar food delivery wars, raised what will likely be its last round of private capital. The $100 million cash infusion was led by BlackRock and valued Postmates at $1.85 billion, up from the $1.2 billion valuation it garnered with its unicorn round in 2018.

2. Uber’s IPO may not be as eye-popping as we expected

To be fair, I don’t think many of us really believed the ride-hailing giant could debut with a $120 billion initial market cap. And can speculate on Uber’s valuation for days (the latest reports estimate a $90 billion IPO), but ultimately Wall Street will determine just how high Uber will fly. For now, all we can do is sit and wait for the company to relinquish its S-1 to the masses.

N26, a German fintech startup, raised $300 million in a round led by Insight Venture Partners at a $2.7 billion valuation. TechCrunch’s Romain Dillet spoke with co-founder and CEO Valentin Stalf about the company’s global investors, financials and what the future holds for N26.

Bird is in the process of raising an additional $300 million on a flat pre-money valuation of $2 billion. The e-scooter startup has already raised a ton of capital in a very short time and a fresh financing would come at a time when many investors are losing faith in scooter startups’ claims to be the solution to the problem of last-mile transportation, as companies in the space display poor unit economics, faulty batteries and a general air of undependability. Plus, Aurora, the developer of a full-stack self-driving software system for automobile manufacturers, is raising at least $500 million in equity funding at more than a $2 billion valuation in a round expected to be led by new investor Sequoia Capital.

WeWork, a co-working giant backed with billions, had planned on securing a $16 billion investment from existing backer SoftBank . Well, that’s not exactly what happened. And, oh yeah, they rebranded.

After 20 long years, augmented reality glasses pioneer ODG has been left with just a skeleton crew after acquisition deals from Facebook and Magic Leap fell through. Here’s a story of a startup with $58 million in venture capital backing that failed to deliver on its promises.

7. Data point

Seed activity for U.S. startups has declined for the fourth straight year, as median deal sizes increased at every stage of venture capital.

Key takeaways:

1. Seed activity for U.S. startups declined for the fourth straight year

2. Median U.S. seed deal was the highest on record in Q4 at $2.1M

3. Seed activity as a % of deals shrunk to 25%

4. Companies securing seed deals are older than ever https://t.co/exr8DRQRAF— Kate Clark (@KateClarkTweets) January 9, 2019

8. Meanwhile, in startup land…

This week edtech startup Emeritus, a U.S.-Indian company that partners with universities to offer digital courses, landed a $40 million Series C round led by Sequoia India. Badi, which uses an algorithm to help millennials find roommates, brought in a $30 million Series B led by Goodwater Capital. And Mr Jeff, an on-demand laundry service startup, bagged a $12 million Series A.

9. Finally, Meet Caper, the AI self-checkout shopping cart

The startup, which makes a shopping cart with a built-in barcode scanner and credit card swiper, has revealed a total of $3 million, including a $2.15 million seed round led by First Round Capital .

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

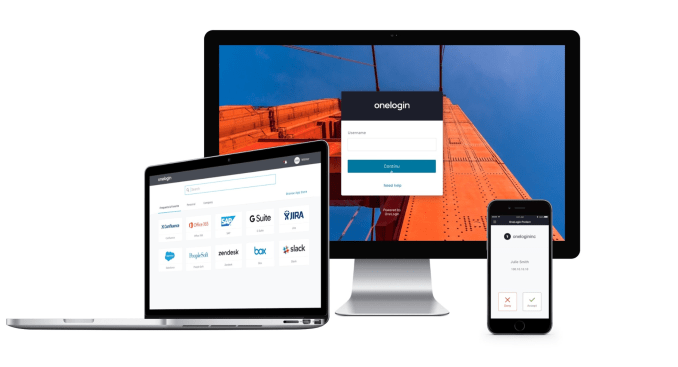

OneLogin is not a young startup by any means. The identity access management company was founded in 2009 and has watched while companies like Ping Identity, Duo Security and Okta had tidy exits. But as CEOs are fond of pointing out, the total addressable market is large and where investors see a chance, they take it. Today, the company announced a $100 million investment.

The latest round was led by new investors Greenspring Associates and Silver Lake Waterman, the late-stage investing arm of Silver Lake. Existing investors CRV and Scale Venture Partners also contributed to the round. Today’s investment brings the total raised since inception to more than $170 million, according to the company.

It is referring to this as a “growth round,” but indicated that actually means Series D plus “flexible capital.” Whatever you call it, it would appear to give OneLogin some runway to grow large enough to find a way to exit.

CEO Brad Brooks says his company is well-positioned to compete with the likes of Okta and Microsoft in this market by offering a multi-faceted authentication solution that works both on-prem and in the cloud. He swept aside questions of revenue, valuation or IPO plans, only indicating that the company was growing and they had big expansion plans.

Photo: OneLoginThat would include building on its success in Europe, while expanding to Asia and creating more specific solutions in the U.S., such as focusing on FedRamp federal government compliance. The company currently has more than 260 employees, and with the new money, Brooks wants to put the pedal to the metal.

He plans to double that number in the next 18 months, as he fuels that expansion plan, bringing in new engineers along with sales, marketing and support. He wouldn’t rule out acquisitions to expand the company’s capabilities, but said his preference is building in-house over buying. He believes that building provides an internal goal of innovation and offers the kind of challenges that attract engineering talent.

Brooks came on board in 2017, replacing co-founder Thomas Pedersen, who moved into the role of chairman of the board and chief technology Officer. Its most recent round prior to today was a $22.5 million Series C last June.

Powered by WPeMatico

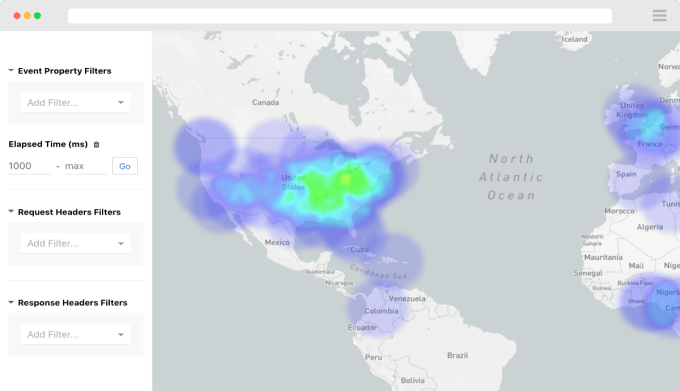

Today, many companies provide developer access to their services via APIs. Moesif, a San Francisco startup, wants to help these companies gain insight into their customer’s API usage patterns. Today, the company announced a $3.5 million seed round.

The investment was led by Merus Capital, with participation by Heavybit, Fresco Capital and Zach Coelius, whose investments include Cruise Automation, which was sold to GM in 2016 for $1 billion.

Moesif co-founder and CEO Derric Gilling says Moesif is akin to Mixpanel or Google Analytics, except instead of tracking web or mobile analytics, it looks at API usage. “As more and more companies are using and creating these APIs, there comes a point where you need to understand how your customers are using them, any problems they are running into and how do you actually decrease developer churn.”

Heat map showing API usage by region. Screenshot: Moesif

The company is aiming at two primary types of users. First of all, there are developers who can use the monitoring features to understand when there are issues with the API. These folks have access to the free tier.

Moesif also targets business units like product management, sales and marketing, which use the tool to understand who’s using the API, how often and, with machine learning, understand who is likely to stop using the product based on how they are using it. The tool can tie into other business systems like Mailchimp or a CRM tool to get a more complete picture of customers as they use the API.

The product was released last year, and Gilling says his company already has 2,000 customers, which includes both the free and paid tiers. He said they have had particular success with SaaS and fintech companies, both of which make heavy use of APIs. Customers include PowerSchool, Schwab and DHL.

While the company currently consists of two founders and one employee, flush with the seed investment, it intends to hire around 10 people in the next six months, including a VP of engineering, additional developers and sales and marketing folks.

Moesif was founded in late 2016, and the founders went through the Alchemist Accelerator last year.

Powered by WPeMatico

The Intercontinental Exchange’s (ICE) cryptocurrency project Bakkt celebrated New Year’s Eve with the announcement of a $182.5 million equity round from a slew of notable institutional investors. ICE, the operator of several global exchanges, including the New York Stock Exchange, established Bakkt to build a trading platform that enables consumers and institutions to buy, sell, store and spend digital assets.

This is Bakkt’s first institutional funding round; it was not a token sale. Participating in the round are Horizons Ventures, Microsoft’s venture capital arm (M12), Pantera Capital, Naspers’ fintech arm (PayU), Protocol Ventures, Boston Consulting Group, CMT Digital, Eagle Seven, Galaxy Digital, Goldfinch Partners and more.

Bakkt is currently seeking regulatory approval to launch a one-day physically delivered Bitcoin futures contract along with physical warehousing. The startup initially planned for a November 2018 launch, but confirmed this morning an earlier CoinDesk report that it was delaying the launch to “early 2019” as it awaits permission from the Commodity Futures Trading Commission. Along with the funding, crypto news blog The Block Crypto also reports Bakkt has hired Balaji Devarasetty, a former vice president at Vantiv, as its head technology.

ICE’s crypto project was first announced in August and is led by chief executive officer Kelly Loeffler, ICE’s long-time chief communications and marketing officer. Bakkt quickly inked partnerships with Microsoft, which provides cloud infrastructure to the service, and Starbucks, to develop “practical, trusted and regulated applications for consumers to convert their digital assets into U.S. dollars for use at Starbucks,” Starbucks vice president of payments Maria Smith said in a statement at the time.

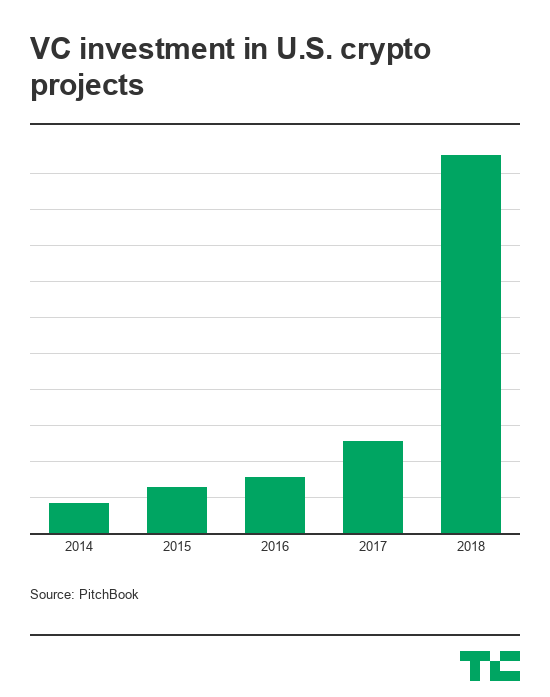

Many Bitcoin startups floundered in 2018, despite record amounts of venture capital invested in the industry. This was as a result of failed initial coin offerings, an inability to scale following periods of rapid growth and the falling price of Bitcoin. Still, VCs remained bullish on Bitcoin and blockchain technology in 2018, funneling a total of $2.2 billion in U.S.-based crypto projects — a nearly 4x increase year-over-year. Around the globe, investment hit a high of $4.6 billion — a more than 4x increase from last year, according to PitchBook.

“Notably, 2018 was the most active year for crypto in its brief ten-year history,” Loeffler wrote. “This was evidenced by rising investment in distributed ledger technology and digital assets, as well as by blockchain network metrics such as daily bitcoin transaction value and active addresses. Yet, these milestones tend to be overshadowed by the more narrow focus on bitcoin’s price, which has been seen by some, as a proxy for the potential of the technology.”

Today, the price of Bitcoin is hovering around $3,700 one year after a historic run valued the cryptocurrency at roughly $20,000. The crash caused many to dismiss Bitcoin and its underlying technology, while others remained committed to the tech and its potential for complete financial disruption. A project like Bakkt, created in-house at a respected financial institution with support from noteworthy businesses, is a logical bet for crypto and traditional private investors alike.

“The path to developing new markets is rarely linear: progress tends to modulate between innovation, dismissal, reinvention, and, finally, acceptance,” Loeffler added. “Each step, whether part of discovery or adversity, ultimately strengthens the product. Twenty years ago, it was controversial to suggest that commodities or bonds could trade electronically on a screen, and many steps were required for that evolution to play out.”

Powered by WPeMatico

Sensor data platform Samsara confirmed this morning that it had closed a new round of funding from existing investors Andreessen Horowitz and General Catalyst that values the startup at $3.6 billion.

The news was first reported by Cheddar, which spotted a filing with the state of Delaware on December 21 disclosing Samsara’s intent to raise a $100 million round at more than double the valuation it garnered upon its $50 million Series D this March.

“Our growth comes from bringing transformational new technologies to solve the problems of operational businesses, a massive segment of the economy that has long been underserved by the technology industry,” wrote Kiren Sekar, Samsara’s vice president of marketing and products, in the funding announcement. “Today, the advent of inexpensive sensors, high-bandwidth wireless connectivity, smartphones, and cloud computing enable these businesses to fully reap the benefits of 21st century technology.”

Founded in 2015, Samsara supports the transportation, logistics, construction, food production, energy and manufacturing industries with its internet-connected sensor systems, which helps businesses collect data and derive insights to improve the efficiency of physical operations.

The company’s co-founders are Sanjit Biswas and John Bicket, who previously launched Meraki, an enterprise Wi-Fi startup acquired by Cisco in an all-cash $1.2 billion deal in 2012.

Samsara’s latest financing brings the company’s total raised to $230 million. According to PitchBook, Andreessen Howoritz and General Catalyst are the only two private investors in the company, with Marc Andreessen and Hemant Taneja of General Catalyst representing the venture capital firms as lead investors on several Samsara deals.

San Francisco-based Samsara says revenue grew 250 percent in 2018 as its customer base swelled to 5,000. As for how it will deploy the new capital, the company plans to hire 1,000 employees, double down on AI and computer vision technology and open its first East Coast office in Atlanta.

The startup has yet to spend a dime of its last financing round, evidence it, like many other venture-funded startups, is pulling in capital before a market downturn strikes the industry and makes it increasingly difficult to raise hefty sums at impressive valuations.

“While the company already had a healthy balance sheet – we hadn’t dipped into our previous round of funding – the new capital enables us to accelerate long-term product investments and expand into new markets while continuing to maintain a strong balance sheet over the long term,” wrote Sekar.

Powered by WPeMatico

Startups supporting startups are blazing a new trail with support from venture capitalists.

Co-working spaces like The Wing and The Riveter raked in funding rounds this year, as did Brex, the provider of a corporate card built specifically for startups. Now Carta, which helps companies manage their cap tables, valuations, portfolio investments and equity plans, has announced an $80 million Series D at a valuation of $800 million. The company, formerly known as eShares, raised the capital from lead investors Meritech and Tribe Capital, with support from existing investors.

The round brings Carta’s total funding to $147.8 million. Its existing investors include Spark Capital, Menlo Ventures, Union Square Ventures and Social Capital, though the latter didn’t participate in the Series D funding. Tribe Capital, however, is a new venture capital firm launched by Arjun Sethi, who previously led Social Capital’s investment in Carta, Jonathan Hsu and Ted Maidenberg, a trio of former Social Capital partners who exited the VC firm amid its transition from a traditional VC fund to a technology holding company. Tribe is said to be in the process of raising its own $200 million debut fund.

Founded in 2012 by Henry Ward (pictured), the Palo Alto-based company plans to use the latest investment to develop their transfer agent and equity administration products and services to better support startups transitioning into public companies. It also will launch additional products for investors to collect data from their portfolio companies and to manage their back office.

“We’ve come this far by changing how ownership management works for private companies—popularizing electronic securities and cap table software, combined with audit-ready 409As,” Ward wrote in an announcement. “But our ambitions go far beyond supporting privately-held, venture-backed companies.”

Carta, which counts Robinhood, Slack, Wealthfront, Squarespace, Coinbase and more as customers, currently manages $500 billion in equity. This year, Carta expanded its headcount from 310 employees to 450 employees, launched board management and portfolio insights products and completed a study in partnership with #Angels that highlighted the major equity gap female startup employees are victim to.

The study, released in September, revealed that women own just 9 percent of founder and employee startup equity, despite making up 35 percent of startup equity-holding employees. On top of that, women account for 13 percent of startup founders, but just 6 percent of founder equity — or $0.39 on the dollar.

Powered by WPeMatico