funding

Auto Added by WPeMatico

Auto Added by WPeMatico

What if instead of just accepting Uber rides, gig workers could pick from higher-paying skilled tasks around town like stocking shelves, checking inventory or driving a forklift at a local grocer? When they work quickly and accurately or learn new trades, they get to choose between more complex jobs. That’s the idea that’s racked up $400 million in staffing contracts for Jyve, an on-demand labor platform that’s coming out of stealth today after 3.5 years. It already has 6,000 workers doing tasks for 4,000 stores across the country.

“I believe the skill economy is way bigger than the gig economy,” says Jyve CEO and founder Brad Oberwager. He sees Uber driving as just the low-expertise beginning of a massive new job type where people with specializations or experience are efficiently matched to retail work. Jyve’s secret sauce is the work quality review system built into its app for managers and stores that lets it know who got the job done right and deserves even better opportunities.

Jyve’s potential to become the skilled labor marketplace has quietly attracted $35 million in funding across a seed and Series A round raised over the past few years, led by SignalFire and joined by Crosscut Ventures and Ridge Ventures. “Jyve is one of the fastest-growing companies we’ve seen, having already reached $400 million in bookings in three short years,” writes Chris Farmer, CEO of SignalFire. “They are creating a new economic class.”

It’s all because Safeway hasn’t touched a bag of Doritos in 50 years, Oberwager tells me. Grocery stores have long outsourced the shelving and arrangement of products to the big brands that make them, which is why the retail consumer packaged good industry employs 10 million people in the U.S., or more than 10 percent of the country’s workforce. But instead of relying on one person to drive goods to the store, load them in and shelve them, Jyve can cut costs and divide those tasks and match them to nearby people with sufficient skills.

“Retail isn’t dying, it’s changing, and brands that are thriving are the ones investing in their in-store experience as well as owning their e-commerce initiatives,” observed Oberwager. “The question we must ask then is how do we fill this labor shortage and also enable people to refine special skills that are multi-dimensional and rewarding.”

Oberwager knows the tribulations of grocery shelving well. He built online drugstore More.com before the dot-com boom, then started making his own food products. He created True Fruit Cups, one of the country’s largest importer of grapefruit, and founded and sold his Bare apple chips company. Competing for shelf space with big brands paying workers to set up elaborate displays in grocery stores, he saw a chance to reimagine retail labor.

But it was when his daughter got sick and he realized the surgeon who performed the operation was essentially a high-skilled mercenary that he seized on the opportunity beyond grocers. “He walks in, does the surgery, walks out. He’s a gig worker, but it’s a skill I’m willing to pay a lot for,” says Oberwager.

He created Jyve to aggregate the demand from different stores and the skills from different workers. When someone signs up for Jyve, they start with easier tasks like moving boxes in the backroom. If they do that well, they could unlock higher-paying shelf stocking and display arrangement, then product ordering and brand ambassadorship. At each step, they take photos and leave comments about their work that are reviewed by a combination of store and brand managers, as well as Jyve’s machine vision algorithms and human quality-control team. It can quickly tell if someone puts the Cheerios box on the shelf the wrong way, and won’t give them public-facing tasks if they don’t improve

“Seventy percent of our market managers were originally drivers, and they become W-2 workers,” Oberwager says proudly. Jyve even makes it easy for brands and retailers to hire its top giggers for full-time jobs. Why would the startup allow that? “I want to put it on a billboard, ‘Work hard, get promoted,’ ” he tells me. The fact that Oberwager’s last name could be interpreted as “higher wages” in German makes Jyve seem like his destiny.

“Seventy percent of our market managers were originally drivers, and they become W-2 workers,” Oberwager says proudly. Jyve even makes it easy for brands and retailers to hire its top giggers for full-time jobs. Why would the startup allow that? “I want to put it on a billboard, ‘Work hard, get promoted,’ ” he tells me. The fact that Oberwager’s last name could be interpreted as “higher wages” in German makes Jyve seem like his destiny.

But to fulfill that prophecy, Jyve will have to out-tech old-school staffing firms like Acosta, Advantage and Crossmark. It’s also hoping to ween grocers off of Instacart by bringing shopping for online orders back to stores’ in-house staff — provided by Jyve. A worker could be stocking shelves, then use that knowledge to quickly pick up all the items for an online order and give them to a curbside driver, then return to their task.

Keeping work quality up to snuff will be a challenge, but by dangling higher wages, Jyve aligns its incentives with its workers. The bigger hurdle may be convincing big brands and retail institutions to change the way they’ve done staffing forever. Oberwager professes that it takes a long time to onboard, but also a long time to offboard, so it could build a solid moat if it’s the first to win this market. Jyve is now in more than 1,200 cities across the U.S.., and a real-time map showed a plethora of gigs available around San Francisco during the demo.

Oberwager admits the unskilled gig economy is “a little dehumanizing. It makes people a cog in a machine.” But he hopes each “Jyver,” as he calls them, can become more like a circuit — a complex machine of its own that powers something bigger.

Powered by WPeMatico

Just this morning, robotic process automation (RPA) firm Blue Prism announced enhancements to its platform. A little later, the company, which went public on the London Stock Exchange in 2016, announced it was raising £100 million (approximately $130 million) by issuing new stock. The announcement comes after reporting significant losses in its most recent fiscal year, which ended in October.

The company indicated it plans to sell the new shares on the public market, and that they will be made available to new and existing shareholders, including company managers and directors.

CEO Alastair Bathgate attempted to put the announcement in the best possible light. “The outcome of this placing, which builds on another year of significant progress for the company, highlights the meteoric growth opportunity with RPA and intelligent automation,” he said in a statement.

While the company’s revenue more than doubled last fiscal year, from £24.5 million (approximately $32 million) in 2017 to £55.2 million (approximately $72 million) in 2018, losses also increased dramatically, from £10.1 million (approximately $13 million) in 2017 to £26.0 million (approximately $34 million), according to reports.

The move, which requires shareholder approval, will be used to push the company’s plans, outlined in a TechCrunch article earlier this morning, to begin enhancing the platform with help from partners, a move the company hopes will propel it into the future.

Today’s announcement included a new AI engine, an updated marketplace where companies can share Blue Prism extensions and a new lab, where the company plans to work on AI innovation in-house.

Bathgate isn’t wrong about the market opportunity. Investors have been pouring big bucks into this market for the last couple of years. As we noted, in this morning’s article, “UIPath, a NYC RPA company has raised almost $450 million. Its most recent round in September was for $225 million on a $3 billion valuation. Automation Anywhere, a San Jose RPA startup, has raised $550 million including an enormous $300 million investment from SoftBank in November on a valuation of $2.6 billion.”

Powered by WPeMatico

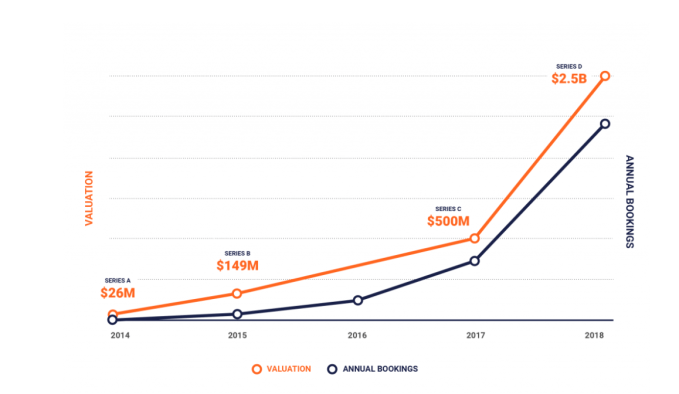

Confluent, the commercial company built on top of the open-source Apache Kafka project, announced a $125 million Series D round this morning on an enormous $2.5 billion valuation.

The round was led by existing investor Sequoia Capital, with participation from Index Ventures and Benchmark, which also participated in previous rounds. Today’s investment brings the total raised to $206 million, according to the company.

The valuation soared from the previous round when the company was valued at $500 million. What’s more, the company’s bookings have scaled along with the valuation.

Graph: Confluent

While CEO Jay Kreps wouldn’t comment directly on a future IPO, he hinted that it is something the company is looking to do at some point. “With our growth and momentum so far, and with the latest funding, we are in a very good position to and have a desire to build a strong, independent company,” Kreps told TechCrunch.

Confluent and Kafka have developed a streaming data technology that processes massive amounts of information in real time, something that comes in handy in today’s data-intensive environment. The base streaming database technology was developed at LinkedIn as a means of moving massive amounts of messages. The company decided to open-source that technology in 2011, and Confluent launched as the commercial arm in 2014.

Kreps, writing in a company blog post announcing the funding, said that the events concept encompasses the basic building blocks of businesses. “These events are the orders, sales and customer experiences, that constitute the operation of the business. Databases have long helped to store the current state of the world, but we think this is only half of the story. What is missing are the continually flowing stream of events that represents everything happening in a company, and that can act as the lifeblood of its operation,” he wrote.

Kreps pointed out that as an open-source project, Confluent depends on the community. “This is not something we’re doing alone. Apache Kafka has a massive community of contributors of which we’re just one part,” he wrote.

While the base open-source component remains available for free download, it doesn’t include the additional tooling the company has built to make it easier for enterprises to use Kafka. Recent additions include a managed cloud version of the product and a marketplace, Confluent Hub, for sharing extensions to the platform.

As we watch the company’s valuation soar, it does so against a backdrop of other companies based on open source selling for big bucks in 2018, including IBM buying Red Hat for $34 billion in October and Salesforce acquiring MuleSoft in June for $6.5 billion.

The company’s most recent round was $50 million in March, 2017.

Powered by WPeMatico

Healthy oceans are on the minds of Marc and Lynne Benioff, and they showed it today with a $1.5 million donation to the Sustainable Ocean Alliance (SOA), a new nonprofit attempting to promote and incubate conservation-focused startups. The money will considerably expand the organization’s upcoming Ocean Solutions accelerator.

Benioff appeared Wednesday on a panel at Davos about the “ocean economy,” at which he mentioned the donation and SOA. He joined rather a powerhouse lineup to address the issues of environmental dangers threatening wallets as well as whales: Michelle Bachelet (U.N. High Commissioner for Human Rights), Enric Sala (an Explorer-in-Residence at National Geographic), Nina Jensen of REV Ocean and indefatigable environmental crusader Al Gore. I certainly wish I could have attended.

It’s clear that the Salesforce founder is as concerned about environmental issues as he is about social ones, and as ready to write a check when there’s a compelling reason to do so.

“Our oceans are in grave danger, due to the many consequences of climate change and pollution,” he said in a press release announcing the donation. “These challenges can be solved with investment and innovation. Lynne and I are proud to support [SOA founder] Daniela Fernandez and the Sustainable Ocean Alliance’s bold vision to create 100 new startups by 2021 to help heal the ocean.”

The SOA started its accelerator last year with a handful of interesting ocean- and conservation-focused startups: a device to keep fish from getting tangled in nets, wave-harvesting energy tech, materials for oil cleanups, that sort of thing. It’s got another batch planned and the Benioff’s donation will allow it to triple the number of startups included. Several will be going to the “Accelerator at Sea,” an eight-day event aboard a Lindblad Expeditions ship sailing from Alaska this summer.

Last year the organization also got a sudden cash infusion from a motivated donor: the mysterious Pine, who distributed some $86 million to charity (and nonprofits like SOA) after making a tremendous amount of money on Bitcoin. These are one-off donations, naturally — so of course financial sustainability, as well as ecological, is on Fernandez’s mind.

“We realize that we cannot simply depend on individual donors or anonymous cryptocurrency gifts. We have had difficulty finding traditional forms of funding for SOA due to the limited amount of funds that are allocated to such a niche sector,” Fernandez, who is at Davos but unfortunately not on the aforementioned panel, told me.

“Instead of only having to fundraise, we have had to create new funders by educating them about the importance of protecting the ocean. It is the typical entrepreneurial scenario of building the plane while flying it. However, in our case, we had to build the plane while simultaneously developing the aircraft market.”

As part of that the nonprofit now plans to release a yearly “State of Our Ocean” report — the first came out today. It’s not so much a scholarly or analytical report like you might have from NOAA or national fisheries or wildlife concerns. Fernandez says this one “takes into account the perspective of young people who are on the ground working to solve the issues at hand. SOA interviewed 3,000 young ocean leaders from around the world who gave their input as to what the ocean priorities should be in 2019 and graded our current world leaders on their efforts to restore the health of the ocean.”

It’s good to ask the un-jaded youngs about things like this, and SOA specifically aims to find and promote young entrepreneurs and activists, so it’s on brand. I’ve read through it and there’s a lot of info about impending disasters, many of which have to do with climate change, but plenty are caused by people as well (or rather, caused by people more recently). It’s a bit depressing, but what isn’t?

Hopefully the cash infusion will help scoop up more of those motivated young folks into the program. We’ll probably hear more from the SOA when it finds some more startups to load into the accelerator.

Powered by WPeMatico

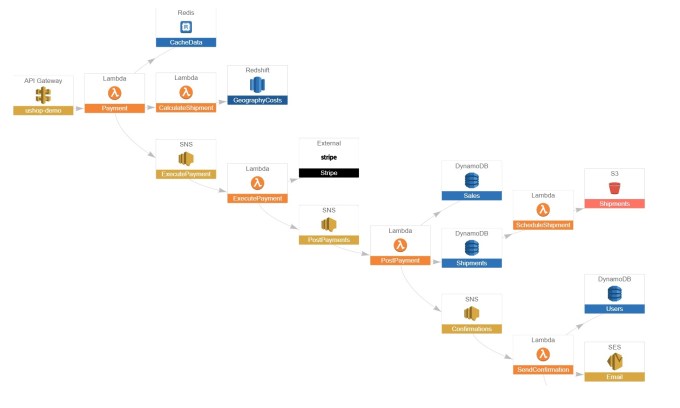

Lumigo, an Israeli startup, announced a healthy $8 million seed round today, as it emerged from stealth to help companies monitor serverless architecture. Investors include Pitango Venture Capital, Grove Ventures and Meron Capital.

The company was started by a couple of ex-Checkpoint execs, Erez Berkner and Aviad Mor. They decided to head out on their own to solve a problem they were seeing around monitoring as developers moved to serverless environments.

Serverless computing lets developers code applications without worrying about the underlying infrastructure. That’s because services like AWS Lambda, Azure Functions and Google Cloud Functions provide the exact amount of infrastructure resources required to run the application at any given moment. It is incredibly convenient for developers trying to move more quickly, but it poses challenges for the operations team trying to manage and monitor the application.

To help solve this, the company uses a visual map to show operations exactly what’s happening inside the application. The map enables operations teams to see and understand every request and get to the root cause of a problem. It can trace the path not only from the serverless infrastructure, but also to adjacent services like database and storage.

Lumigo serverless monitoring map

For starters, the company is working with AWS, but plans to add support for other cloud platforms down the road. Moving forward, the founders’ vision is more than just serverless. They plan to expand to monitor containers and API services like Twilio and Stripe.

For now, it’s still early days, but the company has eight employees and a dozen customers using the product. The money should allow them to hire more engineers and begin building out the product further.

Powered by WPeMatico

I’m not allowed to tell you exactly how Anchorage keeps rich institutions from being robbed of their cryptocurrency, but the off-the-record demo was damn impressive. Judging by the $17 million Series A this security startup raised last year led by Andreessen Horowitz and joined by Khosla Ventures, #Angels, Max Levchin, Elad Gil, Mark McCombe of Blackrock and AngelList’s Naval Ravikant, I’m not the only one who thinks so. In fact, crypto funds like Andreessen’s a16z crypto, Paradigm and Electric Capital are already using it.

They’re trusting in the guys who engineered Square’s first encrypted card reader and Docker’s security protocols. “It’s less about us choosing this space and more about this space choosing us. If you look at our backgrounds and you look at the problem, it’s like the universe handed us on a silver platter the Venn diagram of our skill set,” co-founder Diogo Monica tells me.

Today, Anchorage is coming out of stealth and launching its cryptocurrency custody service to the public. Anchorage holds and safeguards crypto assets for institutions like hedge funds and venture firms, and only allows transactions verified by an array of biometrics, behavioral analysis and human reviewers. And because it doesn’t use “buried in the backyard” cold storage, asset holders can actually earn rewards and advantages for participating in coin-holder votes without fear of getting their Bitcoin, Ethereum or other coins stolen.

The result is a crypto custody service that could finally lure big-time commercial banks, endowments, pensions, mutual funds and hedgies into the blockchain world. Whether they seek short-term gains off of crypto volatility or want to HODL long-term while participating in coin governance, Anchorage promises to protect them.

Anchorage’s story starts eight years ago when Monica and his co-founder Nathan McCauley met after joining Square the same week. Monica had been getting a PhD in distributed systems while McCauley designed anti-reverse engineering tech to keep U.S. military data from being extracted from abandoned tanks or jets. After four years of building systems that would eventually move more than $80 billion per year in credit card transactions, they packaged themselves as a “pre-product acqui-hire” Monica tells me, and they were snapped up by Docker.

As their reputation grew from work and conference keynotes, cryptocurrency funds started reaching out for help with custody of their private keys. One had lost a passphrase and the $1 million in currency it was protecting in a display of jaw-dropping ignorance. The pair realized there were no true standards in crypto custody, so they got to work on Anchorage.

“You look at the status quo and it was and still is cold storage. It’s the same technology used by pirates in the 1700s,” Monica explains. “You bury your crypto in a treasure chest and then you make a treasure map of where those gold coins are,” except with USB keys, security deposit boxes and checklists. “We started calling it Pirate Custody.” Anchorage set out to develop something better — a replacement for usernames and passwords or even phone numbers and two-factor authentication that could be misplaced or hijacked.

This led them to Andreessen Horowitz partner and a16z crypto leader Chris Dixon, who’s now on their board. “We’ve been buying crypto assets running back to Bitcoin for years now here at a16z crypto. [Once you’re holding crypto,] it’s hard to do it in a way that’s secure, regulatory compliant, and lets you access it. We felt this pain point directly.”

Andreessen Horowitz partner and Anchorage board member Chris Dixon

It’s at this point in the conversation when Monica and McCauley give me their off-the-record demo. While there are no screenshots to share, the enterprise security suite they’ve built has the polish of a consumer app like Robinhood. What I can say is that Anchorage works with clients to whitelist employees’ devices. It then uses multiple types of biometric signals and behavioral analytics about the person and device trying to log in to verify their identity.

But even once they have access, Anchorage is built around quorum-based approvals. Withdrawals, other transactions and even changing employee permissions requires approval from multiple users inside the client company. They could set up Anchorage so it requires five of seven executives’ approval to pull out assets. And finally, outlier detection algorithms and a human review the transaction to make sure it looks legit. A hacker or rogue employee can’t steal the funds even if they’re logged in because they need consensus of approval.

That kind of assurance means institutional investors can confidently start to invest in crypto assets. That swell of capital could help replace the retreating consumer investors who’ve fled the market this year, leading to massive price drops. The liquidity provided by these asset managers could keep the whole blockchain industry moving. “Institutional investing has had centuries to build up a set of market infrastructure. Custody was something that for other asset classes was solved hundreds of years ago, so it’s just now catching up [for crypto],” says McCauley. “We’re creating a bigger market in and of itself,” Monica adds.

With Anchorage steadfastly handling custody, the risk these co-founders admit worries them lies in the smart contracts that govern the cryptocurrencies themselves. “We need to be extremely wide in our level of support and extremely deep because each blockchain has details of implementation. This is inherently a very difficult problem,” McCauley explains. It doesn’t matter if the coins are safe in Anchorage’s custody if a janky smart contract can botch their transfer.

There are plenty of startups vying to offer crypto custody, ranging from Bitgo and Ledger to well-known names like Coinbase and Gemini. Yet Anchorage offers a rare combination of institutional-since-day-one security rigor with the ability to participate in votes and governance of crypto assets that’s impossible if they’re in cold storage. Down the line, Anchorage hints that it might serve clients recommendations for how to vote to maximize their yield and preserve the sanctity of their coin.

They’ll have crypto investment legend Chris Dixon on their board to guide them. “What you’ll see is in the same way that institutional investors want to buy stock in Facebook and Google and Netflix, they’ll want to buy the equivalent in the world 10 years from now and do that safely,” Dixon tells me. “Anchorage will be that layer for them.”

But why do the Anchorage founders care so much about the problem? McCauley concludes that, “When we look at what’s potentially possible with crypto, there a fundamentally more accessible economy. We view ourselves as a key component of bringing that future forward.”

Powered by WPeMatico

Communications satellites are multiplying year by year as more companies vie to create an orbital network that brings high-speed internet to the globe. Ubiquitilink, a new company headed by Nanoracks co-founder Charles Miller, is taking a different tack: reinventing the Earthbound side of the technology stack.

Miller’s intuition, backed by approval and funding from a number of investors and communications giants, is that people are competing to solve the wrong problem in the comsat world. Driving down the cost of satellites isn’t going to create the revolution they hope. Instead, he thinks the way forward lies in completely rebuilding the “user terminal,” usually a ground station or large antenna.

“If you’re focused on bridging the digital divide, say you have to build a thousand satellites and a hundred million user terminals,” he said, “which should you optimize for cost?”

Of course, dropping the price of satellites has plenty of benefits on its own, but he does have a point. What happens when a satellite network is in place to cover most of the planet but the only devices that can access it cost thousands of dollars or have to be in proximity to some subsidized high-tech hub?

There are billions of phones on the planet, he points out, yet only 10 percent of the world has anything like a mobile connection. Serving the hundreds of millions who at any given moment have no signal, he suggests, is a no-brainer. And you’re not going to do it by adding more towers; if that was a valid business proposition, telecoms would have done it years ago.

Instead, Miller’s plan is to outfit phones with a new hardware-software stack that will offer a baseline level of communication whenever a phone would otherwise lapse into “no service.” And he claims it’ll be possible for less than $5 per person.

He was coy about the exact nature of this tech, but I didn’t get the sense that it’s vaporware or anything like that. Miller and his team are seasoned space and telecoms people, and of course you don’t generally launch a satellite to test vaporware.

But Ubiquitilink does have a bird in the air, with testing of their tech set to start next month and two more launches planned. The stack has already been proven on the ground, Miller said, and has garnered serious interest.

“We’ve been in stealth for several years and have signed up 22 partners — 20 are multi-billion-dollar companies,” he said, adding that the latter are mainly communications companies, though he declined to name them. The company has also gotten regulatory clearance to test in five countries, including the U.S.

Miller self-funded the company at the outset, but soon raised a pre-seed round led by Blazar Ventures (and indirectly, telecoms infrastructure standby Neustar). Unshackled Ventures led the seed round, along with RRE Ventures, Rise of the Rest, and One Way Ventures. All told, the company is working with a total $6.5 million, which it will use to finance its launches and tests; once they’ve taken place, it will be safer to dispel a bit of the mystery around the tech.

“Ubiquitilink represents one of the largest opportunities in telecommunications,” Unshackled founding partner Manan Mehta said, calling the company’s team “maniacally focused.”

I’m more than a little interested to find out more about this stealth attempt, three years in the making so far, to rebuild satellite communications from the ground up. Some skepticism is warranted, but the pedigree here is difficult to doubt; we’ll know more once orbital testing commences in the next few months.

Powered by WPeMatico

Most founders don’t walk away from their startup after raising $32 million and reaching 1000 clients. But Roger Dickey’s heart is in consumer tech, and his company Gigster had pivoted to doing outsourced app development for enterprises instead of scrappy entrepreneurs.

So today Dickey announced that he’d left his role as Gigster CEO, with former VMware VP Christopher Keane who’d sold it his startup WaveMaker coming in to lead Gigster in October. Now, Dickey is launching Untitled Labs, a “search lab” designed to test multiple consumer tech ideas in “social and professional networking, mobility, personal finance, premium services, health & wellness, travel, photography, and dating” before building out one

Untitled Labs is starting off with $2.8 million in seed funding from early Gigster investors and other angels including Founders Fund, Felicis Ventures, Caffeinated Capital, Joe Montana’s Liquid Ventures, Ashton Kutcher, Nikita Bier of TBH (acquired by Facebook), and Zynga co-founder Justin Waldron.

Untitled Labs is starting off with $2.8 million in seed funding from early Gigster investors and other angels including Founders Fund, Felicis Ventures, Caffeinated Capital, Joe Montana’s Liquid Ventures, Ashton Kutcher, Nikita Bier of TBH (acquired by Facebook), and Zynga co-founder Justin Waldron.

Investors lined up after seeing the success of Dickey’s last two search labs. In 2007, his Curiosoft lab revamped classic DOS game Drugwars as a Facebook game called Dopewars and sold it to Zynga where it became the wildly popular Mafia Wars. He did it again in 2014, building Gigster out of Liquid Labs and eventually raising $32 million for it in rounds led by Andreessen Horowitz and Redpoint. Dickey had proven he wasn’t just dicking around and his search labs could experiment their way to an A-grade startup.

“I loved learning about B2B but over the years I realized my true passions were in consumer and I kinda got the itch to try something new” Dickey tells me. “These things happen in the life-cycle of a company. The person who starts it isn’t always the same person to take it to an IPO. Gigster’s doing incredibly well. It was just a really vanilla separation in the best interest of all parties.”

Gigster co-founders (from left): Debo Olaosebikan and Roger Dickey

Gigster’s remaining co-founder and CTO Debo Olaosebikan will stay with the startup, but tells me he’ll be “moving away from a lot of the day-to-day management.” He’ll be in a more public facing role, evangelizing the vision of digital transformation to big clients hoping Gigster can equip them with the apps their customers demand. “We’ve gotten to a really good place on the backs of the founders and to get it to the next level inside of enterprise, having people who’ve done this, lived this, worked in enterprise for a long time makes sense for the company.”

Olaosebikan and Dickey both confirm there was no misconduct or other funny business that triggered the CEO’s departure, and he’ll stay on the Gigster board. Dickey tells me that Gigster’s business managing teams of freelance product managers, engineers, and designers to handle product development for big clients has grown revenue every quarter. It now has 1200 clients including almost 10% of Fortune 500 companies. Olaosebikan says “We have a great repeatable sales model. We can grow profitably and then we can figure out financing. We’re not in a hurry to raise money.”

Since leaving Gigster, Dickey has been meeting with investors and entrepreneurs to noodle on what’s in their “idea shelf” — the product and company concepts these techies imagine but are too busy to implement themselves. Meanwhile, he’s seeking a few elite engineers and designers to work through Untitled’s prospects.

Dickey said he came up with the “search labs” definition since he and others had found success with the strategy that no one had formalized. The search labs model contrasts with three other ways people typically form startups:

Dickey tells me that after 80 angel investments, going to every recent Y Combinator Demo Day, and talking with key players across the industry, the search lab method was the best way to hone in on his best idea rather than just going on a hunch. Given that approach, he went with “Untitled” so he could save the branding work for when the right product emerges. Dickey concludes “We’re trying to keep it really barebones. We don’t have an office, don’t have a logo, and we’re not going to make swag. We’re just going to find the next business as efficiently as possible.”

Powered by WPeMatico

Pro.com is basically a general contractor for the age of Uber and Prime Now. While the company started as a marketplace for hiring home improvement professionals, it has now morphed into a general contractor and serves Denver, Phoenix, San Francisco, San Jose and Seattle. Today, Pro.com announced that it has raised a $33 million Series B round led by WestRiver Group, Goldman Sachs and Redfin. Previous investors DFJ, Madrona Venture Group, Maveron and Two Sigma Ventures also participated.

WestRiver founder Erik Anderson, Redfin CEO Glenn Kelman and former Microsoft exec Charlotte Guyman are joining the Pro.com board.

“Many of Redfin’s customers struggle to get professional renovation services, so we know firsthand that Pro.com’s market opportunity is massive,” writes Redfin’s Kelman. “Pro.com and Redfin share a commitment to combining technology and local, direct services to best take care of customers.”

The company tells me that the round caps off a successful 2018, where Pro.com saw its job bookings grow by 275 percent over 2017, a number that was also driven by its expansion beyond the Seattle market (as well as the good economic climate that surely helped in driving homeowners to tackle more home improvement projects). The company now has 125 employees.

With this funding round, Pro.com has now raised a total of $60 million. It’ll use the funding to enter more markets, with Portland, Oregon being next on the list, and expand its team as it goes along.

It’s no secret that the home improvement market could use a bit of a jolt. The market is extremely local and fragmented — and finding the right contractor for any major project is a long and difficult process, where the outcome is never quite guaranteed. The process has enough vagaries that many people never get around to actually commissioning their projects. Pro.com wants to change that with a focus on transparency and technology. That’s a startup that’s harder to scale than the marketplace the company started out with, but it also gives the company a chance to establish itself as one of the few well-known brands in this space.

Powered by WPeMatico

In 2016, Serkan Piantino packed up his desk at Facebook with hopes to move on to something new. The former director of Engineering for Facebook AI Research had every intention to keep working on AI, but quickly realized a huge issue.

Unless you’re under the umbrella of one of these big tech companies like Facebook, it can be very difficult and incredibly expensive to get your hands on the hardware necessary to run machine learning experiments.

So he built Spell, which today received $15 million in Series A funding led by Eclipse Ventures and Two Sigma Ventures.

Spell is a collaborative platform that lets anyone run machine learning experiments. The company connects clients with the best, newest hardware hosted by Google, AWS and Microsoft Azure and gives them the software interface they need to run, collaborate and build with AI.

“We spent decades getting to a laptop powerful enough to develop a mobile app or a website, but we’re struggling with things we develop in AI that we haven’t struggled with since the 70s,” said Piantino. “Before PCs existed, the computers filled the whole room at a university or NASA and people used terminals to log into a single main frame. It’s why Unix was invented, and that’s kind of what AI needs right now.”

In a meeting with Piantino this week, TechCrunch got a peek at the product. First, Piantino pulled out his MacBook and opened up Terminal. He began to run his own code against MNIST, which is a database of handwritten digits commonly used to train image detection algorithms.

He started the program and then moved over to the Spell platform. While the original program was just getting started, Spell’s cloud computing platform had completed the test in less than a minute.

The advantage here is obvious. Engineers who want to work on AI, either on their own or for a company, have a huge task in front of them. They essentially have to build their own computer, complete with the high-powered GPUs necessary to run their tests.

With Spell, the newest GPUs from Nvidia and Google are virtually available for anyone to run their tests.

Individual users can get on for free, specify the type of GPU they need to compute their experiment and simply let it run. Corporate users, on the other hand, are able to view the runs taking place on Spell and compare experiments, allowing users to collaborate on their projects from within the platform.

Enterprise clients can set up their own cluster, and keep all of their programs private on the Spell platform, rather than running tests on the public cluster.

Spell also offers enterprise customers a “spell hyper” command that offers built-in support for hyperparameter optimization. Folks can track their models and results and deploy them to Kubernetes/Kubeflow in a single click.

But perhaps most importantly, Spell allows an organization to instantly transform their model into an API that can be used more broadly throughout the organization, or used directly within an app or website.

The implications here are huge. Small companies and startups looking to get into AI now have a much lower barrier to entry, whereas large traditional companies can build out their own proprietary machine learning algorithms for use within the organization without an outrageous upfront investment.

Individual users can get on the platform for free, whereas enterprise clients can get started for $99/month per host you use over the course of a month. Piantino explains that Spell charges based on concurrent usage, so if the customer has 10 concurrent things running, the company considers that the “size” of the Spell cluster and charges based on that.

Piantino sees Spell’s model as the key to defensibility. Whereas many cloud platforms try to lock customers in to their entire suite of products, Spell works with any language framework and lets users plug and play on the platforms of their choice by simply commodifying the hardware. In fact, Spell doesn’t even share with clients which cloud cluster (Microsoft Azure, Google or AWS) they’re on.

So, on the one hand the speed of the tests themselves goes up based on access to new hardware, but, because Spell is an agnostic platform, there is also a huge advantage in how quickly one can get set up and start working.

The company plans to use the funding to further grow the team and the product, and Piantino says he has his eye out for top-tier engineering talent, as well as a designer.

Powered by WPeMatico